- 1School of Asian and African Studies, Shanghai International Studies University, Shanghai, China

- 2School of Economics and Management, Hubei Polytechnic University, Huangshi, Hubei, China

- 3School of Business and Economics, United International University, Dhaka, Bangladesh

The motivation of the study is to gauge the impact of financial development, FDI, Technological innovation, and good governance on environmental degradation in the Arab Nation for the period 1991–2019. Several techniques have implemented, including error correction-based cointegration, cross-sectional ARDL, Non-linear ARDL and Heterogeneous causality test for directional causality. The results of Slope of homogeneity, CSD and unit root test following CIPS and CADF, revealed that research variables are exposed with heterogeneity properties, cross-sectionally dependent, and all the variables become stationary after the first difference. The long-run cointegration between explained and explanatory variables established through error correction based cointegrating test. Referring to results derived from CS-ARDL, study exposed financial development has a detrimental effect on environmental sustainability, suggesting the intensification of CO2 emission and ecological instability. On the other hand, the role of FDI, GG, and TI exposed beneficiary in mitigating the environmental adversity. The asymmetric assessment revealed asymmetric association between explained and core explanatory variables which is valid in the long-run and short-run horizon. Finally, the casual association, study unveiled bidirectional causality between FDI, TI and ED [FDI←→ED; TI←→ED]. On the policy note, the study advocated that environmental improvement through financial channels should be efficiently monitored in the case of credit extension and incorporation with existing environmental policies.

1 Background of the study

Environmental protection has become an undeniable concern for sustainability due to excessive cost involvement in restoring the ecological imbalance and environmental sustainability. Across the world, a significant challenge faced by many countries due to environmental degradation (ED, hereafter) and its adverse effects on economic fundamentals, including poverty aggravation, dwindle agro-productivity, shrinkage of domestic trade liberalization. Furthermore, pollution produced by industry is often poured into rivers, rendering such rivers unsuitable for other purposes. As a result of these and other forms of environmental degradation, there will be substantial repercussions for the economy and the health and wellbeing of the population. On the other hand, the magnitude of these expenditures is often disregarded since there is no effort to quantify them. As a result of this, it may be difficult for a country to evaluate the scope of the damage done to the environment, much alone take steps to prevent, reduce, or repair the damage.

As far as ED is concerned with overall macro-economic performance, existing literature has posited a one-directional effect that is an adverse linkage with economic growth (Alvarado and Toledo, 2017; Alvarado et al., 2018; Danish et al., 2019), trade openness (Oktavilia and Firmansyah, 2016), FDI (Neequaye and Oladi, 2015), inequality and poverty. On the other hand, referring to the relaxed and ineffective environmentally regulated economy, literature has suggested those economy has found baaven for the foreign investors has less complication for managing the environmental dispute, which entice them for fund mobilization (Kisswani and Zaitouni, 2021). Population haven hypothesis postulated that for some instance developing nations entice FDI with exposed to relax and unregulated environmental concern. It is suggesting that cost of environmental dissertation has neglected for economic process through the contribution of FDI. When it comes to developing nations, promoting sustainable long-term economic development and environmental preservation often conflicts with the need to raise production to expand job opportunities and wages. Because providing for the necessities of people living in developing nations provides a rational basis for the current configuration of the EKC, it is important to be cautious of efforts to reduce CO2 emissions at the expense of increasing output (JinRu et al., 2022).

The preset study considered financial development (FD, hereafter), foreign direct investment (FDI, hereafter), governmental effectiveness (GG, hereafter), and technological innovation (TI, hereafter) in the equation of environmental degradation. Regarding the nexus between FD-led ED, the existing literature has yet to establish conclusive evidence in explaining the FD effects on ED. However, considering the posted evidence in the literature, two domains of evidence can be exploded. First, the detrimental role of environmental degradation. At the same time, another strand explained the beneficial effects of FD on ED. Environmental economists have long praised FD for its good impact on the planet (Ahmad M. et al., 2022). Literature suggested that FD foster environmental development by supporting credit facilities for industrial operational process efficiencies and technological up gradation. Menegaki et al. (2021) suggested financial development (FD) expand financial services accessibility and improve the existing ones to increase economic growth. Rajan and Zingales (2003) contend that the accumulation of local capital invested in developing locally-based enterprises is a major driver of economic growth. Another line of evidence available by contending the detrimental role of financial development in ED, implying that credit accessibility for the drive for industrial development with neglected the environmental concern, results in environmental degradation. Meanwhile, innovations in the financial sector contribute to the development of sound banking procedures (Musah et al., 2022b; Dai et al., 2022; Rong and Qamruzzaman, 2022). The role of FDI has yet to reveal with a conclusive note, implying the mixed effect available in explaining the nexus between FDI-led ED. A growing number of studies have postulated that a less regulated environmentally focused economy fascinates foreign investors in mobilizing their resources for industrial development with the use of conventional energy. Literature suggested that the inefficient process and fossil energy consumption intensify environmental degradation by injecting excess CO2 emissions. Concurrently, another domain of findings revealed a positive linkage between FDI and environmental quality, indicating that the inflows of FDI bring technological–know and the efficient operational process and support economy in dragging the degree of CO2 emission which significantly contributed in improving the environmental quality. Thus receipts of FDI have to be positively guided in terms of environmental protection so that economic sustainability should be the concern.

The motivation of the study is to gauge the impact of financial development, foreign direct investment, good governance and technological innovation on environmental degradation in Arab nations with the application of both symmetric and asymmetric framework.

The present study has contributed to the existing literature in the following ways. First, in terms of empirical nexus targeting environmental degradation with technological innovation. Even though several studies have implemented in documenting the effects of TI on ensuring environmental sustainability, however, referring to Arab nations for TI-led ED has yet to investigate. Thus with our best knowledge for the first time, the nexus between FD, FDI, TI, GG, and ED has been implemented by concentrating a panel of Arab nations. Second, existing literature has investigated the impact of selected explanatory variables with the implementation of a linear framework, but the empirical model estimation with non-linear decomposed variables has opened an alternative thinking process for future policy formulation over conventional and perceived attitudes. Third, the present study has considered both linear and non-linear decomposed units of explanatory variables in evaluating the directional association.

For evaluating the empirical nexus and documenting the elasticity’s of explanatory variables on environmental degradation, the study has implemented a slope of homogeneity test, cross-sectional dependency test, panel unit root test following CIPS and CADF and error correction based panel cointegration test. The long-run and short-run coefficients have been documented through CS-ARDL and Non-linear ARDL. Finally, the directional association is exposed by executing the D-H causality test. The study revealed that research units had shared certain common dynamics with heterogeneity properties, and variables were integrated after the first difference. The cointegration test following error correction residual based confirmed the long-run association between explained and explanatory variables. Referring to the long-run and short-run elasticity’s extracted from CS-ARDL, it is apparent that financial development has a detrimental effect on environmental sustainability, suggesting the augmentation of CO2 emission and ecological instability with the credit facilities for industrial progress. At the same time, the coefficients of FDI, GG, and TI have exposed beneficial effects in mitigating environmental adversity. The asymmetric estimation revealed long-run and short-run non-linear effects from explanatory variables to explained variables. Finally, in the directional investigation, the test statistics exposed bidirectional causality between FDI, TI and ED [FDI←→ED; TI←→ED]. On the policy note, the study advocated that environmental improvement through financial channels should be efficiently monitored in the case of credit extension and incorporation with existing environmental policies.

The rest of the strictures are as follows. Hypothesis development and pertinent literature survey are displayed in Section 2. The variables definition and estimation strategies are displayed in Section 3. Empirical model estimation and interpretation are exhibited in Section 4. Section 5 deals with the findings discussion and the conclusion displayed in Section 6.

2 Literature survey and hypothesis development

2.1 Financial development and environmental degradation/carbon emission

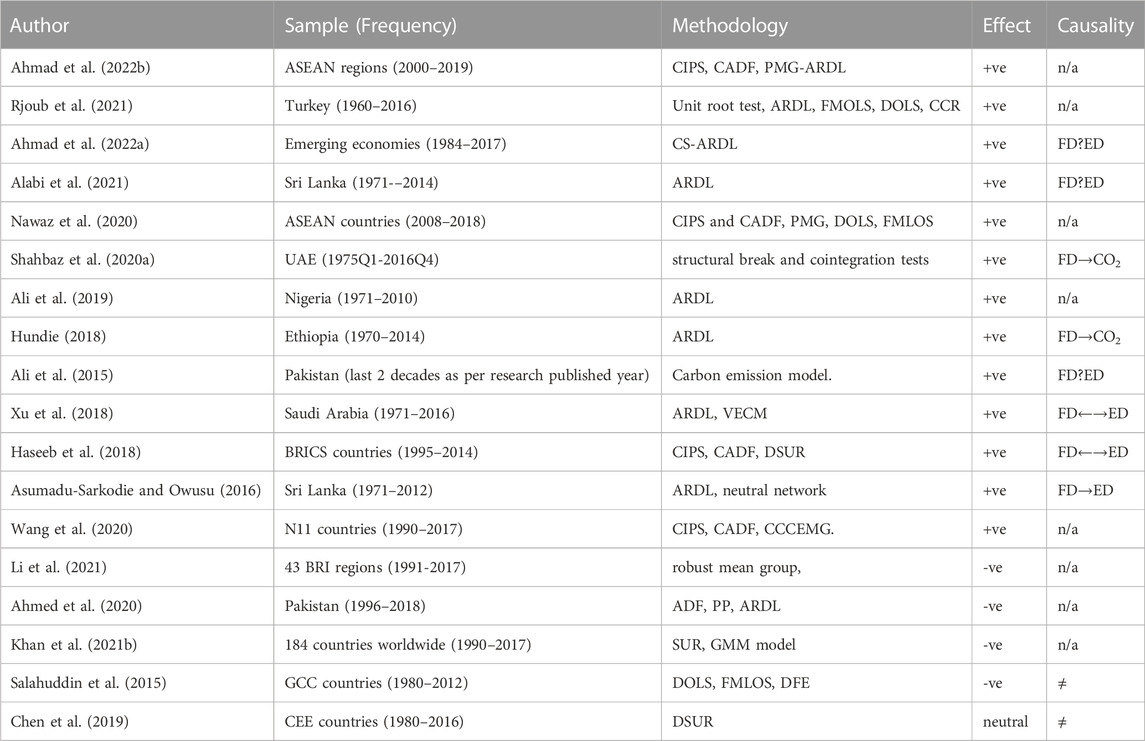

The nexus between financial development and environmental degradation, existing literature posted two vines of linkage between them: causative and deterrent effects on ED. The first vine of empirical literature advocated the catalyst role of FD in aggravating environmental degradation (Nawaz et al., 2020; Alabi et al., 2021; Shahbaz et al., 2020a; Ali et al., 2019; Hundie, 2018; Alam, 2022). For instance, In the case of ASEAN, Ahmad S. et al. (2022) documented that as financial inclusion and development are rising, both in the short and long run, it degrades the environmental quality. As a result, to reduce carbon dioxide emissions as much as possible, climate change adaptation policies must be taken into account along with financial development. In the case of Turkish, Rjoub et al. (2021) explored the nexus of financial development-led ED for1960 from 2016. The study of Ahmad M. et al. (2022) analyzed the effects of financial development and prosperity on the environment and its ecosystem through the human capital system for the emerging economies between 1984 and 2017, and research has unveiled that financial development reduces environmental quality while declining ecological quality, thus the study advises creating awareness of the need to preserve environmental quality by investing in human capital while using financial resources. In the paper of Ali et al. (2015) studies using 2 decades data of developing countries, i.e., Pakistan, to understand environmental degradation for rising financial growth and its development. The research found Pakistani economic expansion and expanding financial development are positively correlated with rising carbon emissions. Wang et al. (2020) analyze the various dimensions of carbon emissions of N11 countries using 1990 to 2017 and revealed a strong correlation between CO2, economic growth, and GDP. These results would effectively utilize them as a tool to promote more technological innovation and the application of renewable energy sources to achieve desired aims. For details see Table 1.

The second domain of literature advocated the beneficial role in environmental improvement through reassessing the degradation process (Creane et al., 2004; Claessens and Feijen, 2007; Salahuddin et al., 2015; Charfeddine and Kahia, 2019; Khan S. et al., 2021). For instance, Dasgupta et al. (2001) evaluate the nexus between pollution and financial development in developing nations and disclose that with strong environmental regulation, the financial sector has shown respect for environmental control while allowing credit extension in society. The financial sector has offered better environmental quality in the long run by promoting environmental protection and green energy inclusion. In the case of BRI, Li et al. (2021) investigate that the environment is being affected by the rising financial development for the period 1991 to 2017. Study reveals that financial development has a disadvantageous impression on environmental damage and so it is proposed to develop the financial sectors further in order to get more desirable results in the development of the environment. Furthermore, Ahmed et al. (2020) contends that as financial development increases, environmental quality improves and that it is vital to continue financial development to enable a cleaner environment.

However, the neutral association between financial development and environmental degradation, observed in the study of Chen et al. (2019), evaluates the role of financial development on environmental degradation using yearly data from 16 CEE countries from 1980 to 2016. Although other variables examined in this report exhibit substantial relationships, the study’s findings indicate that there is no substantial evidence that financial development is damaging the environment. Furthermore, for Saudi Arabia, Xu et al. (2018) for the period 1971 to 2016 highlights neutral association between FD and ED. For the case of BIRCS, Haseeb et al. (2018) assess the effect of financial development on energy consumption, globalization, economic growth, and urbanization using the Environmental Kuznets Curve (EKC) model from 1995 to 2014. Based on this study, there is a bidirectional causal relationship between financial development and carbon dioxide emissions, energy consumption, and economic boom. For Srilanka, Asumadu-Sarkodie and Owusu (2016) addressed the research interest of how financial development impacts environmental decay in Sri Lanka using data from 1971 to 2012.

Hypothesis-1: Financial development has a detrimental effect on environmental quality.

2.2 FDI and environmental degradation/carbon emission

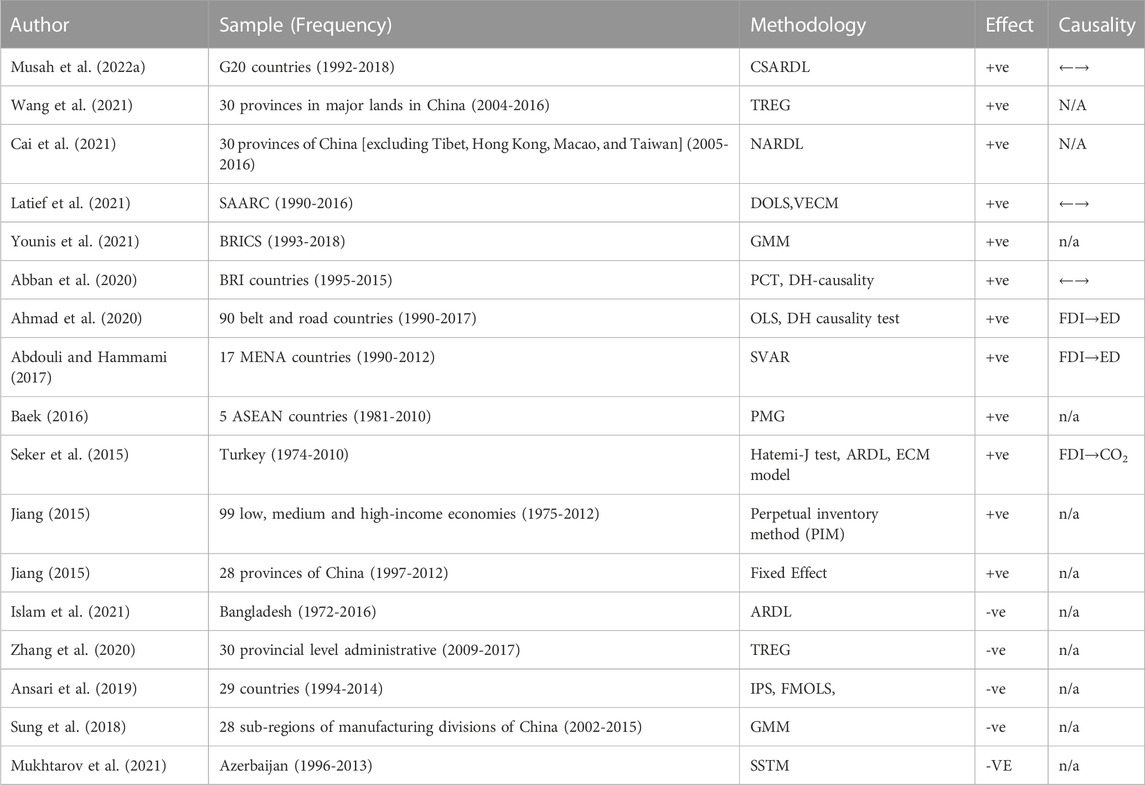

The first domain of literature revealed that FDI has a detrimental effect in establishing the environmental quality (Ahmad et al., 2020; Abdouli and Hammami, 2017; Pazienza, 2015; Baek, 2016; Solarin et al., 2013). For instance, Musah et al. (2022a) analyze the concern of FDI impacting environmental adversities by analyzing data from G20 countries between 1992 and 2018. According to studies, as FDI rises will results in carbon dioxide emissions rise in some countries. In order to lower carbon dioxide emissions, stimulate the local economy, and enhance environmental quality, these findings suggest that green urbanization policies be applied. In the case of Chinese provincial data, Wang et al. (2021) explore the basal system and evidence of how FDI is impacting carbon emission in 30 provinces in major lands in China using panel data ranging from 2004 to 2016. In line with the research, FDI is one of the factors that lead to CO2 emissions in the specified provinces. On policy note, study advocated the ETS can be used to eliminate CO2 emissions, but it can’t have a large impact on foreign direct investment; hence other policies are also included here to serve as a guide(Ma hmood and Furqan, 2021; Manigandan et al., 2022).

Focusing chines economy, Cai et al. (2021) highlights the outward FDI connected with carbon emission in 30 provinces of China (excluding Tibet, Hong Kong, Macao, and Taiwan) from 2005 to 2016. The study’s findings say China’s FDI abroad greatly raises carbon dioxide emissions, so the country ought to provide greater incentives for the introduction of IFDL to improve the environment and manage CO2 emissions. Similar findings can be found in Latief et al. (2021) for SAARC using panel data from 1990 to 2016. In BRICS, Younis et al. (2021) considere a data set from 1993 to 2018. Seker et al. (2015) in the Turkish environment spanning data from 1974 to 2010 and disclose a positive connection between FDI and CO2 emission, even though it is a minimal effect. To address this problem, FDI should only be supported by the economy’s technologically advanced and eco-friendly sectors. Jiang (2015) investigates the effect of flexible FDI on territorial economic expansion on pollution degrading environmental quality using the EKC (Environmental Kuznets Curves) hypothesis across 28 Chinese provinces using data from 1997 to 2012. Findings discloses that FDI contributes to superfluous pollution in the environment, but over time as the economy grows, the emission rate also declines (Ma hmood et al., 2021; Guang-Wen et al., 2022).

Another strands of findings highlight the beneficial role of FDI in achieving environmental sustainability through green energy inclusion, energy efficiency, and technological advancement in the operational process. For example, Mukhtarov et al. (2021) analyze the impact of FDI on CO2 emissions using data from 1996 to 2013 for Azerbaijan using a time series modeling approach. The research specifies that the impact of FDI was positive prior to 2006 but eventually, after 2006 till 2013, the impact was negative on carbon dioxide discharge, and so there is a diverse effect of FDI on carbon dioxide emission, which has been discussed throughout this paper. Abban et al. (2020) investigate the relationship of FDI with economic growth and energy intensities with carbon dioxide emission in BRI (Belt and Road) countries from 1995 to 2015. Results explain that FDI and CO2 emissions had a bidirectional causal link across all income categories. The empirical findings also highlight a few crucial measures. Ahmad et al. (2020) inquire about the effect of 29 provinces’ Chinese outward FDI on domestic CO2 emissions using panel data from 2003 to 2016. Following the findings, outside FDI increased environmental pollution due to the scale effect, but by maximizing modern domestic technology and industrial diversification, outward FDI improved environmental quality. The paper makes rational recommendations for the authorities to adopt. Summary survey displayed in Table 2.

Hypothesis-2: inflows of FDI prompt the environmental sustainability.

2.3 Institutional quality and environmental degradation

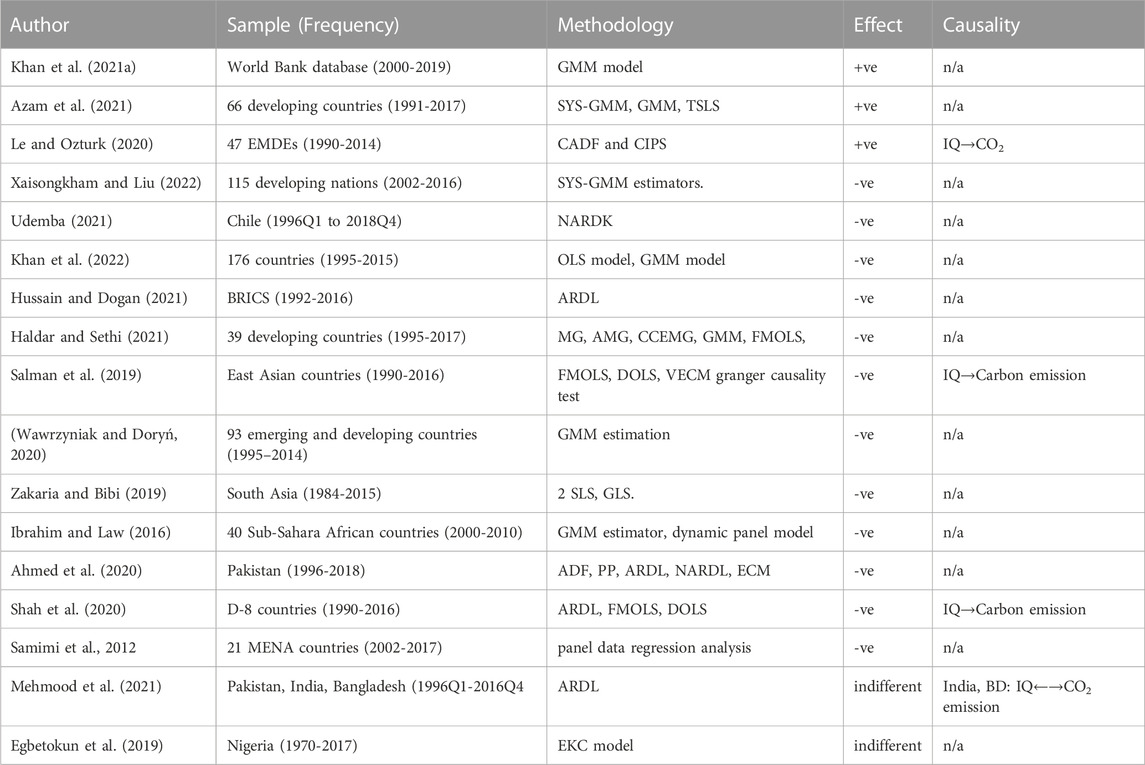

Well-performing institutions foster sustainable economic growth by ensuring equitable development in every corner of society. Moreover, institutions established governmental effectiveness, resource reallocation, and environmental protection in the market-based economy. Additionally, individual and social behavior toward society is purely governed by the established rules, laws and regulations, which is the ultimate contribution of effective and efficient institutions (Mahmood, 2022a; Qamruzzaman, 2022a; JinRu and Qamruzzaman, 2022; Xaisongkham and Liu, 2022). Kirkpatrick and Parker (2004) advocate that good governance has a catalyst in economic transition, indicating the promotion of industrialization with the inclusion of environmental protection through lowering the degree of CO2. The effects of good governance in the process of achieving environmental sustainability can be detected through either direct/or indirect channels. Kha H. et al. (2021) xpress concern about ED by grinding the relationship between environmental parameters relating to institutional quality and technological advancement using panel data from 2002 to 2018. The study unveils several institutional quality factors to account for environmental carbon dioxide emissions. Focusing on developing nations for 1991–2017, Azam et al. (2021) highlight the institutional quality influences carbon dioxide and ethane emissions as it positively impacts energy usage in the context of oil and petroleum product assets, which is influenced by the political steadiness, regulatory constraint, and democratic accountability. Economic globalization has yet to improve natural quality in developing nations. for Emerging Markets and Developing Economies (EMDEs), Le and Ozturk (2020) for the period 1990 and 2014 reveals that as governmental operations induces CO2 emissions and intensify environmental degradation. Therefore, it is recommended that good governance be ensured while considering other concerns to lessen pollution problems. See Table 4 for details survey.

For the case of Chile, Udemba (2021) discuss the climate change issue using data from 1984 to 2018 and ways to manage ED by forming a nonlin-ear assessment. Asymmetric connection between institutional quality and carbon emission, providing both positive and negative shocks. Results show that institutional quality has negatively impacted carbon emissions, which is vital for addressing the issue of climate change. Furthermore, Khan et al. (2022) investigate environmental degradation and how it is related to the role of good institutional quality in 176 countries collecting data from 1995 to 2015. The study’s findings suggest quality institutions are responsible for a quality environment by reducing carbon emissions and pollution, so it is recommended to monitor institutions and other included aspects in a better approach to improve the overall environment. A similar line of findings can be observed in the literature posted in the study of Hussain and Dogan (2021), Haldar and Sethi (2021), Salman et al. (2019), Mahmood (2022b) and Wawrzyniak and Doryń (2020). In the case of the south Asian economy, Zakaria and Bibi (2019) for the period 1984 to 2015 expose that institutional quality has a negative interaction with CO2 emissions; however, since environmental quality has improved attributable to financial development, the technological impact should be given priority to resolving this issue. Ibrahim and Law (2016) investigated SSA from 2000 to 2010 and highlighted that institutional quality has potentially brought down carbon dioxide emissions while promoting environmental quality. The supporting evidence was available in the literature offered by Ahmed et al. (2020), Shah et al. (2020) and (Samimi et al., 2012) for the MENA region, spanning annual data from 2002 to 2007. The study documented that, relying on panel data regression analysis, effective governance improves environmental quality, and necessary policies are also mentioned. However, the neutral effects can be documented in the stud of Mehmood et al. (2021), Alam et al. (2022), and Egbetokun et al. (2019). Table 3 displayed the summary of literature survey.

Hypothesis-3: Governmental effectiveness positively tie to environmental quality.

2.4 Technological innovation and environmental degradation

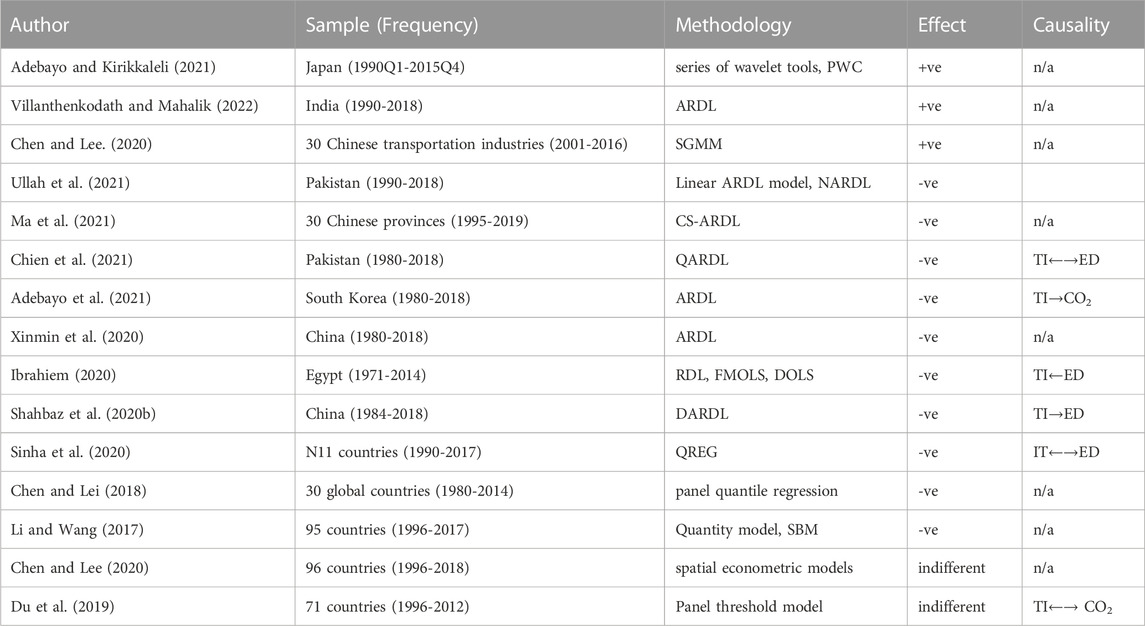

Technological innovation (TI) is crucial for reducing emissions and helping to preserve energy. Moreover, TI is crucial to use both traditional and RE energy sources effectively. New forms of renewable energy (RE) may also be easier to produce with the help of TI. The potential for RE supply to fulfill future energy demand has been increased due to technological advancements that have increased RE capacity. It stands to reason that RE, as a renewable and non-polluting energy source, will grow significantly as the world’s energy demands continue to increase. We found a treasure trove of information about the effect of renewable energy on air quality. Most research has shown that increasing the amount of renewable energy used in the total energy mix is the most effective way to reduce carbon dioxide emissions. Technological integration assists in environmental improvement through the reduction of carbon intensity with operational efficiency (Ullah et al., 2021; Ma et al., 2021; Chien et al., 2021; Adebayo et al., 2021; Chen and Lei, 2018; Li and Wang, 2017). It has been proven that the purpose of carbon offsetting may be supported by higher energy expenditures, technical innovation, renewable energy use, research and development investment, and tax payments on carbon emissions. Those who require a citation: in the case of chins economy, Xinmin et al. (2020) assess TI-led ED for the period 1990 to 2018. The marginal effects suggest that trade openness and technological progress reduce CO2 emissions; however, in the Chinese scenario, technology adoption and GDP augment carbon dioxide emissions. Lag periods of TI are strongly related to CO2. Consequently, a rise in technological innovation will assist in lowering carbon dioxide emissions. A similar line of association was posted in the literature by Ibrahiem (2020) in Egypt, taking data from 1971 to 2014. Shahbaz et al. (2020b) for China’s carbon emissions using time series data from 1984 to 2018. For the case of N11 nations, Sinha et al. (2020) discovered that technological advancement in the direction of the Sustainable Development Goals was the key engine of sustainable environmental development.

The study of Adebayo and Kirikkaleli (2021) sheds additional insight on the relationship between CO2 technical advancements, renewable energy, and carbon dioxide emissions in Japanese innovation and globalization through wavelet statistical techniques using a database that spans the years 1990 to 2015. According to empirical wavelet analysis results, Japan’s CO2 emissions are rising due to globalization, GDP growth, and technological advancements. Another study conducted by Villanthenkodath and Mahalik (2022) assess the correlations between technological advancement and environmental quality in India using annual data from 1980 to 2018. The results show that, when considering how carbon dioxide emissions work, technological advancement and economic boom negatively impact India’s environmental quality over time through increasing CO2 emissions. Chen and Lee (2020) seek to confirm the impact of the technology-environmental innovation indicator system on the carbon dioxide emissions of 30 Chinese transportation industries by decoupling elasticity and econometric models spanning data from 2001 to 2016. The most substantial effect on the transportation sector’s CO2 emissions is made through technological innovation. In a study, Chen and Lee (2020) postulate that TI works more to reduce pollution in countries with higher levels of globalization. Hence, environmental protection awareness in social globalization should get more attention. Du et al. (2019) discover that innovations in green technology do not considerably reduce CO2 emissions for economies with income levels below the threshold. In contrast, they have a considerable mitigation effect for those with income above the threshold. Details summary literature displayed in Table 4

Hypothesis-4: Ethnological innovation fosters the process of environmental development.

3 Data, theoretical specification and estimation strategy

3.1 Variables definition

The present study intends to assess the effects of financial development, FDI, governmental effectiveness and technological innovation on Environmental degradation in Arab countries 1. A panel of 21 (Twenty-one) countries has been considered for empirical assessment.

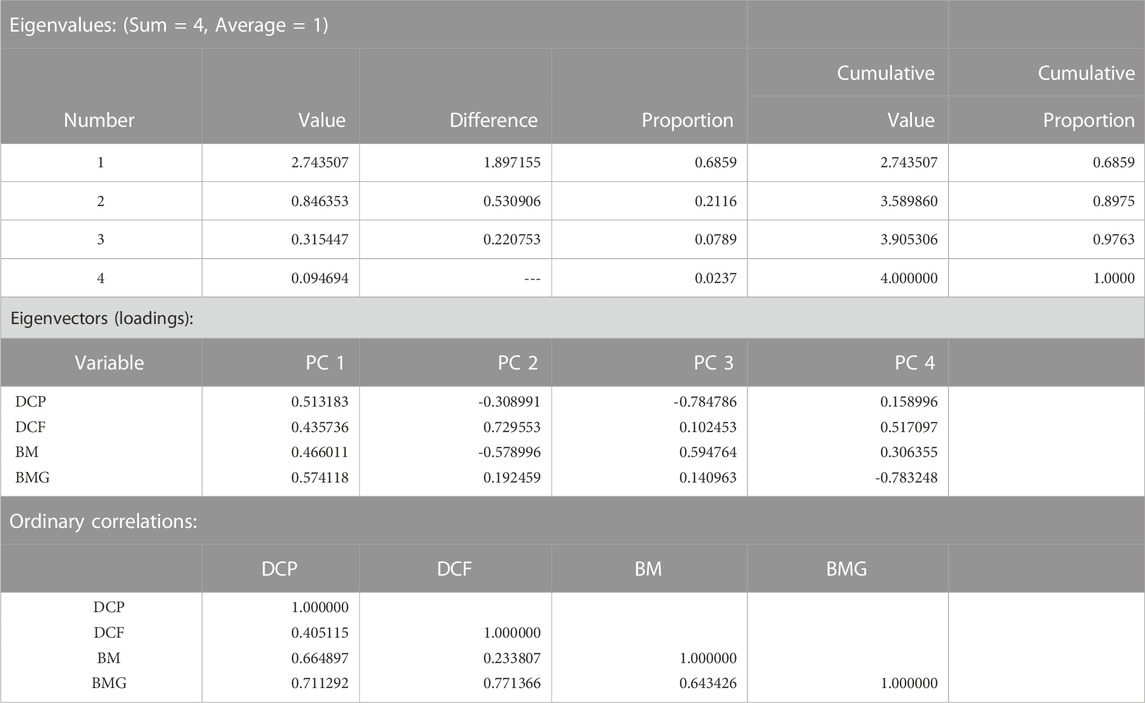

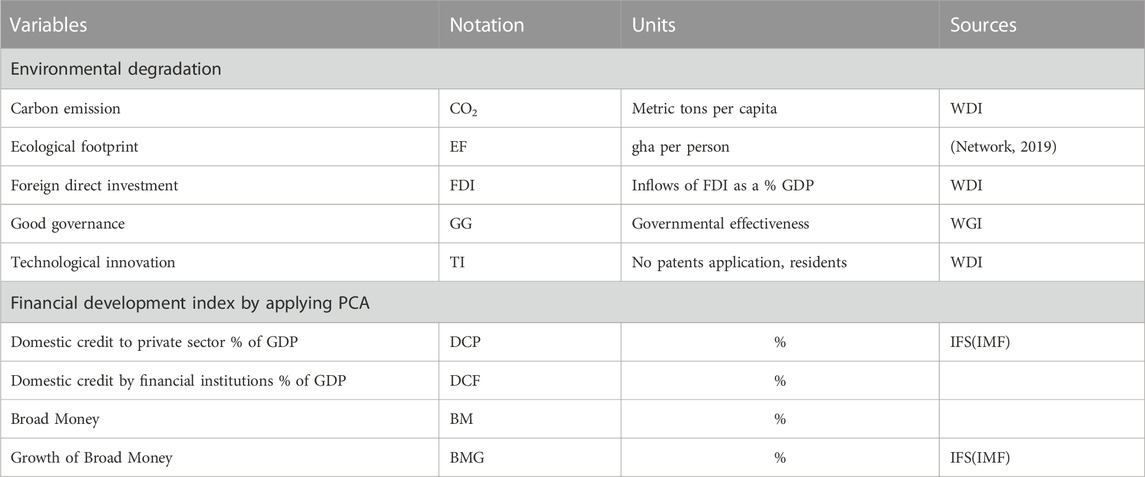

As an explained variable, environmental degradation is measured by carbon emission and ecological footprint following the existing literature (Kha H et al., 2021; Gao et al., 2021; Shahbaz et al., 2021; Ansari, 2022). On the other hand, explanatory variables include financial development, which is proxied by the construction of FD through the execution of PAC. Financial development is the second explanatory variable measured by the financial development Index. Existing literature has posted two lines of proxies in documenting the FD in the equation: using single variables and considering the index with implementing PCA (Musah et al., 2022b). In this study, we follow the second line of evidence that the FD Indexed has constructed through the implementation of PCA and the results displayed in Table 5

FDI is measured by the inflows of inward FDI as a percentage of GDP, governmental effectiveness proxies by the governmental effectiveness, which is extracted from WGI, and finally, the no of the patent application measures the technological innovation by residents. The definition and proxies of explained and explanatory variables have posted in Table 6.

3.1.1 Empirical equation

Based on the theoretical construction and existing literature focusing the environmental degradation, we posted the general equation as follows:

Where ED, EF, CO2. FD, FDI, GG, and TI denotes environmental degradation, financial development, foreign direct investment, good governance and technological innovation. All the research variables are transformed into natural logarithms and reproduced in the regression format in the following manner.

Where the coefficients of

3.2 Estimation strategy

3.2.1 Cross-sectional dependency and slope of homogeneity test

The section on appropriate econometric techniques significantly relies on the research unit’s inherent attributes, and the conventional techniques are incapacity of handling the heterogeneity and cross-sectional dependency. Thus, we implemented CSDT following Pesaran (2004), Pesaran (2006), and Pesaran et al. (2008); for test statistics, the following equations have been executed accordingly.

3.2.2 Panel unit root test

Second-generation panel unit root tests have implemented over conventional ones due to the capacity to address the CSD issue in documenting the variables’ order of integration. For stationary tests, we implemented the framework offered by Pesaran (2007), widely known as CIPS and CADF. The test statistic for the null hypothesis test is to be derived by executing the following equation.

Where the parameter

3.2.3 Panel cointegration test

Before implementing the target model for exploring the vectors of explanatory variables on explained variables, we focused on assessing the possible long-run association between ED, FDI, FD, GG and TI. For long-run cointegration, we follow the novel PCT introduced by Westerlund (2007), which can absorb the CSD and SHT and offer efficient estimation. The following equation is to be implemented for long-run cointegration.

The WECPCT has produced two groups of statistics consisting of test statistics for group statistics, i.e.,

3.2.4 CSARDL

Considering the results of CDST and SHT, the present study intends to adopt efficient and robust techniques for elasticity’s documentation and, most importantly, produce unbiased estimation in the presence of cross-sectional dependency and heterogenetic attributes in the research units. The present study has implemented the target model following the framework familiarized by Chudik and Pesaran (2015), commonly known as CSARDL. The above Eqs 2a, 2b can be reproduced in the following manner.

Where

3.2.5 Asymmetric ARDL

In recent literature, a growing number of studies has extensively employed the nonlin-ear framework familiarized by Shin et al. (2014) for documenting the asymmetric coefficients that are positive and negative series of explanatory variables on explained variables (Qamruzzaman and Jianguo, 2020; Yang et al., 2021; Mensah and Abdul-Mumuni, 2022; Qamruzzaman et al., 2022). Considering the economic stricture and globalization effects on the economy, we purposively constructed and implemented the following asymmetric equation for exploring the asymmetric effects of explanatory variables, which is

The positive and negative series can be derived by implementing the following equations.

4 Estimation and interpretation

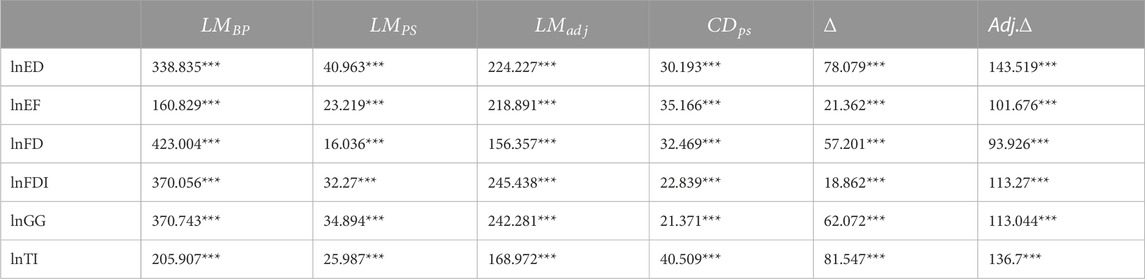

Before executing the target equation, the selected research variables passed through several elementary assessment in documenting the inherent properties such as cross-sectional dynamic and homogeneity. The results of CDST and SHT are displayed in Table 7. Referring to test statistics derived from CDST, it is revealed that selected variables have shared certain common dynamics, implying research variables are cross-sectional dependent. At the same time, the test statistics derived from SHT for establishing the heterogeneity with the null hypothesis of homogeneity. SHT rejects the null hypothesis and confirms the heterogeneity attributed.

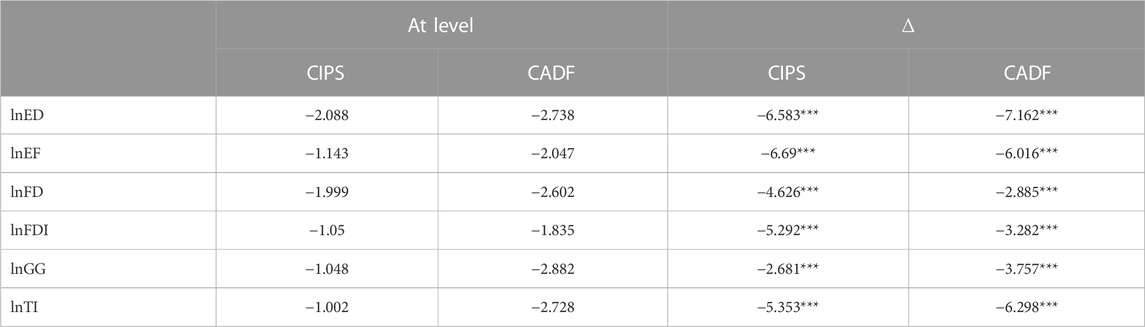

Next, considering the results of the CDST, study moves in assessing the variables’ order of integration by employing the Panel Unit root test (PURT) by following CIPS and CADF. The results of PURT exhibited in Table 8. The test statistics exported from CIPS and CADF exhibit the rejection of the null hypothesis of unit root with the first difference operation, alternatively indicating that the variables become stationary after the first difference.

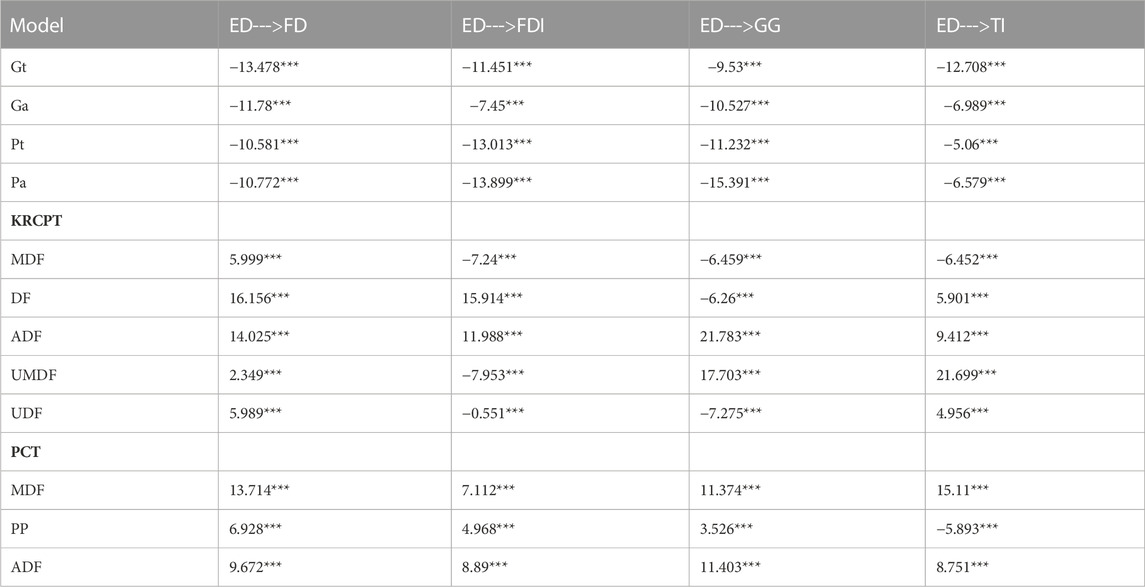

Table 9 exhibits the test statistics for assessing the long-run cointegration by employing Westerlund (2007) error correction-based cointegration (WECCT). The test group statistics are in Gt and Ga, and the panel statistics are in Pt and Pa, respectively. In terms of statistical significance, it is found that all the test statistics are statistically significant at a 1% level, implying a stable long-run cointegration in Eqs 1, 2. Moreover, the robustness test with Kao and padroni cointegration exposed similar conclusions found in WECCT. Once the long-run association has established, we concentrates on exploring the cointegration vector of explanatory variables in the long and short run.

4.1 Long-run and short-run coefficient: CSARDL

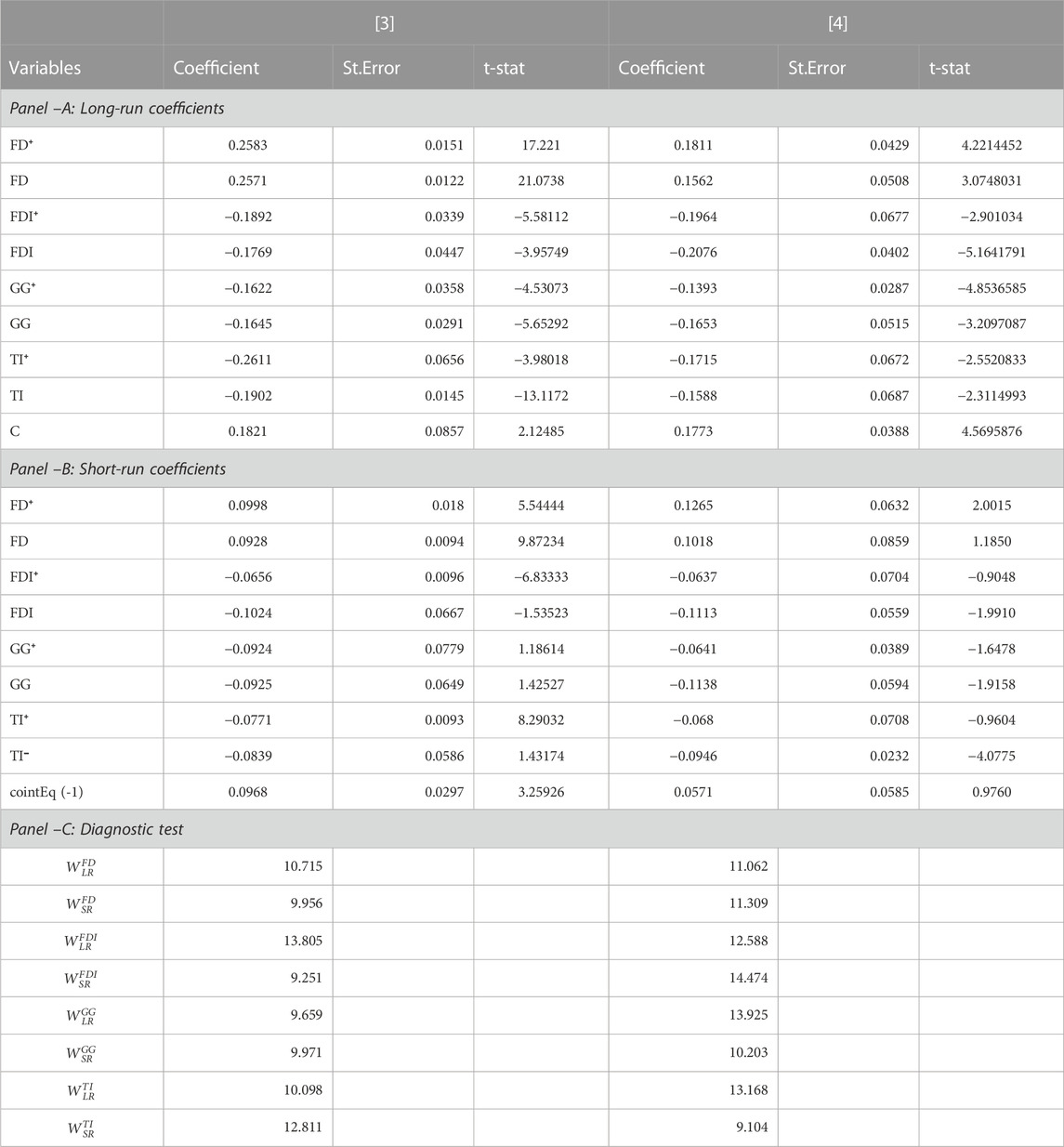

Following, the empirical equation formulated following Chudik and Pesaran (2015) in revealing the long-run and short-run coefficients. The exported coefficients displayed in Table 10 which includes the long-run coefficients in Panel –A the short-run coefficient in Panel –B and the symmetry and residual diagnostic test in Panel –C respectively. Furthermore, the results displayed in column [1] with ED proxied by carbon emission and in column [2], where ED is measured by ecological footprint. The key findings are as follows.

First, the coefficients of financial development revealed a positive connection with environmental degradation in both model estimations in the long run (short-run). Study findings are suggesting that credit accessibility in the economy has detrimental effects on the environment. Our findings are supported by the existing literature but confront the finding posted by Creane et al. (2004) and Claessens and Feijen (2007). In the long run, 0.1471% of excess carbon emissions and 0.1184% of ecological degradation can be intensified due to credit accessibility in the economy for industrial development. Additionally, in the short run, the environmental degradation in terms of carbon emission and ecological depreciation can be exaggerated by 0.0628% and 0.0314% with a 1% changes in financial development. Study findings are advocating the credit facilities in the financial system for industrial and energy development without environmental protection support the economic progress with a cost of environmental degradation.

Second, a contributing effect of FDI in ensuring environmental sustainability has documented that is the reduction of carbon emissions in the environment and ecological justification can be attained with the presence of technological advancement which is one the underlying benefits of FDI receipts, especially in the long run. Particularly, an adverse linkage was revealed between inflows of FDI and carbon emission (a coefficient of −0.0875) and ecological footprint (a coefficient of −0.1593). More precisely, a 1% acceleration in FDI inflows will amplify environmental sustainability by controlling CO2 emission by 0.0875% and ecological correction by 0.1593%. In the short-run, the elasticity’s of FDI unveiled positively associated with environmental quality, that is, reduction of CO2 (a coefficient of 0.0221) and ecological footprint (a coefficient of 0.0197). Our findings are supported by the literature (Sabir et al., 2020) but stand against the literature offered by Shahbaz et al. (2018). In terms of coefficients of inflows of FDI advocated that the transfer of technological know-how in the host economy support energy efficiency and operational development, at large assist in lowering the GO2 emission intensity.

Third, a positive nexus is disclosed between good governance and ED, proposing that good governance increases the society’s environmental awareness and induces a lower degree of CO2 emission and ecological correction. The beneficiary role of GG on ED has been supported by empirical studies (Samimi et al., 2012; Omri and Ben Mabrouk, 2020). Expressly, a 1% change in GG results in improved environmental quality by lowering the carbon emission by −0.1031% and ecological footprint by −0.1593% in the long run. Furthermore, in the short-run, the ED has controlled through CO2 emission contraction by −0.0268% and ecological footprint by −0.0550%. In terms of GG elasticity in the long-run and short-run assessment, it is apparent that the beneficial role of GG on environmental advancement is more obvious in the long run in comparison to the short-run. The possible reason is that good governance ensures socioeconomic stability by effectively enforcing overall social and economic protection, including environmental degradation, eventually inducing quality of the environment.

Fourth, technological innovation uplifts the environmental quality enhancement, implying that environmental degradation has a negative tie with technological innovation. Inferring the coefficients of TI in the long run (short-run), it is apparent that the present state of environmental status can be improved by lowering the CO2 injection in the ecosystem and ecological footprint. In particular, a 1% change in IT will improve environmental quality by limiting CO2 by 1.755% (0.159%) and ecological footprint by 1.469% (0.734%). Technological gradation in the industrial process has positive effects and supports achieving sustainability; technological innovation fosters environmental protection by lowering the degree of carbon emission in the ecosystem and protecting the ecological imbalance by controlling the waste emitted into the environment.

4.2 Asymmetric long-run and short-run coefficients: NARDL

The asymmetric coefficients of financial development (FD), foreign direct investment (FDI), good governance (GG), and technological innovation () on environmental degradation. The results in col [3] and [4] in Table 11 deal with the ED measures by carbon emission and ecological footprint. Referring to the symmetry rest see Panel –Cwith the standard Wald test, it is apparent that all the test statistics, i.e.,

First, in terms of asymmetric coefficients of financial development (

Second, the asymmetric coefficients of FDI (

Third, the asymmetric shocks of good governance on environmental degradation revealed negatively associated, suggesting the contributing role in improving the environmental quality through managing CO2 emission and ecological footprint. In particular, a 10% improvement (decline) in good governance, in the long run, will result in the control of ED with the reduction (increment) of CO2 by −1.622% (1.645%) and ecological footprint by 1.393% (1.653%). In the short-run, a positive (negative) innovation in GG improves (degrades) the environmental sustainability through the reduction (acceleration) of carbon emission and ecological instability, but the coefficients elasticity has been found less significant in comparison to long-run assessment. Referring to the magnitudes of asymmetric coefficients of GG, it is obvious that effective institutional quality is imperative in ensuring environmental security by contributing to efficient energy inclusion and operational development in light of lesser carbon concentration (Li u et al., 2022).

Fourth, the asymmetric nexus between technological innovation (

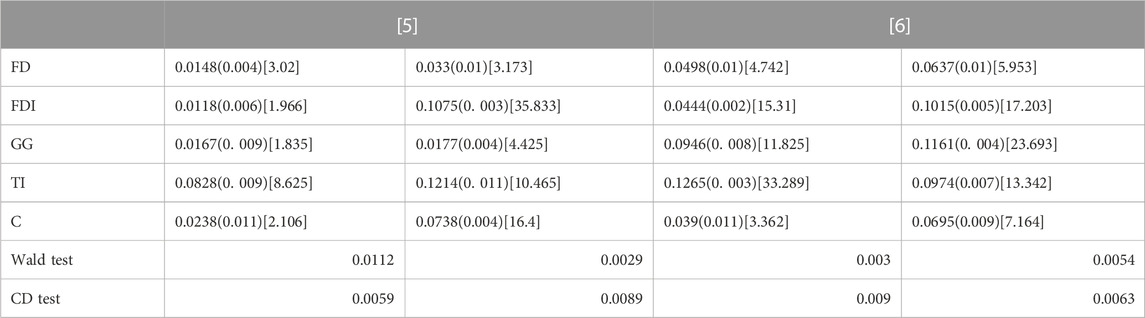

Next, the empirical Eqs 1, 2 has implemented following the framework proposed by Eberhardt (2012) commonly known as AMG and Correlated Effect Mean Group (CCEMG) by Pesaran (2006) methods for confirming the robustness in the long-run coefficient. The results of AMG and CCEMG estimation are displayed in Table 12. The coefficient sign of explanatory variables confirmed the empirical estimation robustness and efficiency in model construction. More precisely, the estimated results from AMG and CCEMG established a similar line of association between FD, FDI, GG, TI and ED.

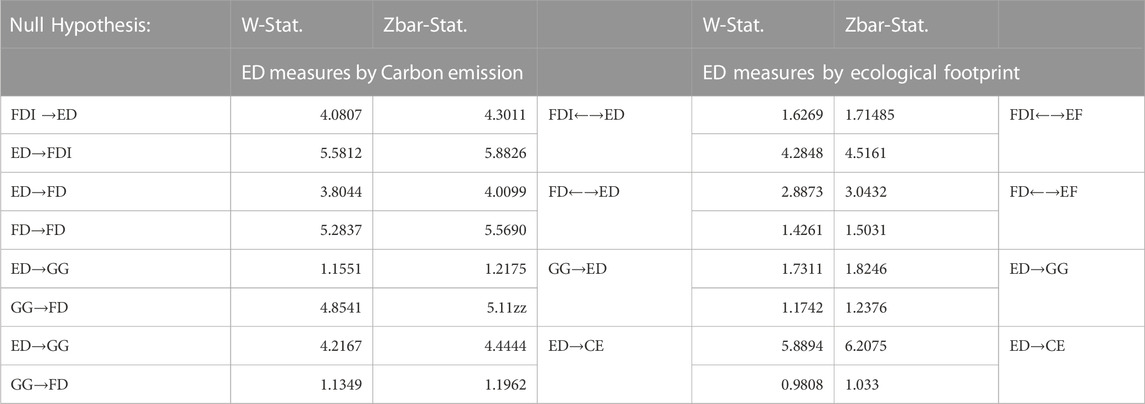

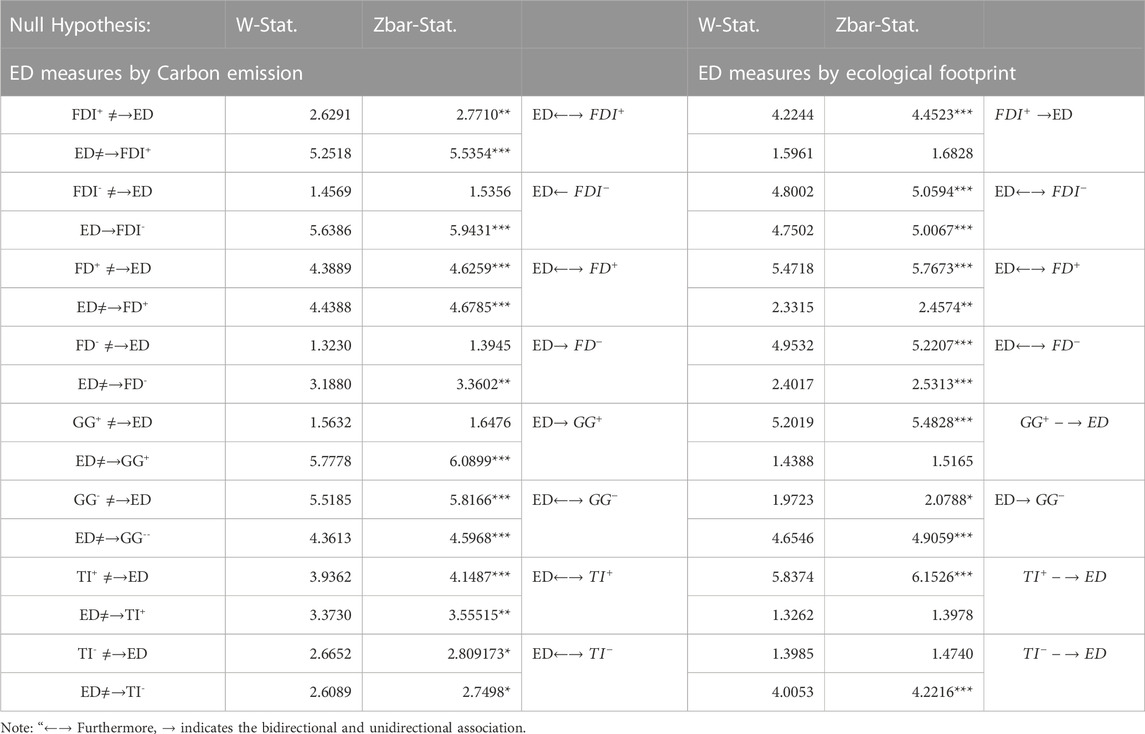

4.3 Directional causality: Linear and Nonlinear effects of explanatory variables

The directional causality between FDI, FD, GG, CL and ED has been assessed through the causality framework familiarized by Dumitrescu and Hurlin (2012) and Table 13 reported the test statistics, i.e., W-stat. And Zbar-Stat, for casual assessment. In terms of casual linkage, the study established bidirectional causality between financial development and environmental degradation, i.e., FD←→CO2; FD←→EF. The literature supports this by Shujah ur et al. (2019), Zhao and Qamruzzaman (2022), and Aluko and Obalade (2020), foreign direct investment and environmental degradation, i.e., FDI←→CO2; FDI←→EF, which is in line with the literature. Furthermore, the unidirectional causality documented explains the causal association between good governance and environmental degradation [GG→CO2; EF→GG] and clean energy and environmental degradation [CE→CO2; CE→EF].

In the next, the causal association has extended with the asymmetric decomposition of explanatory variables and results of asymmetric D-H causality displayed in Table 14.

5 Discussion

The coefficient of financial development revealed positive statistically significant at a 1% level, suggesting that financial development contributes to adverse effects on environmental degradation, validated in CO2 and EF as a proxy of ED. Our study findings align with existing literature (Adams and Klobodu, 2018; Shujah ur et al., 2019; Muneeb et al., 2022) but contrast with the study findings revealed in the study of Aluko and Obalade (2020). According to these findings, increasing the size of the financial system negatively affects the environment since it results in greater amounts of carbon emissions. It also demonstrates that the size of financial intermediation has a higher influence on carbon emissions than financial development indicators but a lower impact on efficiency. This is shown by the correlation between the two is positive. The findings indicate that the indicators of the stock market have a significant impact on carbon emissions; nevertheless, they are not adequate measurements of the expansion of the financial system. The results of the research indicate that foreign direct investment (FDI), in comparison to other indicators of economic development, seems to have a lesser influence on emissions of greenhouse gases (Li et al., 2022).

In terms of FDI elasticity’s derived through the implementation of an empirical model with CSARDL and NARDL, it established an amplifying role towards environmental sustainability, suggesting the adverse association between FDI and environmental degradation measured by CO2 and iconological footprint. The study findings align with the literature (Zhu et al., 2016) but disagree with the findings offered by Mia et al. (2014), Chenran et al. (2019), and Paramati et al. (2021). Referring to the FDI elasticities from the CSARDL investigation, the study advocated a 10% change in the FDI in the sample nations will augment the environmental sustainability through the contraction of CO2 emission by 0.875% (0.221%) and ecological progress by 1.058%(0. 197%). Furthermore, asymmetric assessment suggested a 10% positive (negative) variation in FDI results in control (amplification) in environment sustainability (degradation) in terms of CO2 injection by1.892% (1.769%) and ecological imbalance by 1.964% (2.076%). FDI may affect environmental sustainability regarding CO2 reduction via size, method, and composition influences. According to the scale effect, greater degrees of economic liberalization may result in a rise in carbon dioxide emissions due to the influence of foreign direct investment on economic activity. This is due to the scale effect, which asserts that increasing degrees of economic liberalization may increase carbon dioxide emissions. The liberalization of the economy leads to an increase in total output, which in turn leads to an increase in total energy consumption, which has a negative impact on environmental quality as a result of an increase in carbon emissions (Pazienza, 2015; Andriamahery and Qamruzzaman, 2022; Qamruzzaman, 2022b; Hamid et al., 2022; Liu and Ma, 2022; Zhuo and Qamruzzaman, 2022). According to Shahbaz et al. (2020b), the relationship between foreign direct investment (FDI) and greenhouse gas emissions is contingent on the relationship between FDI and economic development.

Studies revealed that institutional quality has positive effects on environmental development. Alternatively, effective and efficient economic institutions foster environmental protection by reducing CO2 emissions in the ecosystem and augmenting ecological stability. Our study findings are supported by the literature (Gani, 2012; Miao and Qamruzzaman, 2021). Expressly, a 1% change in GG results in improved environmental quality by lowering the carbon emission by −0.1031% and ecological footprint by −0.1593% in the long run. Furthermore, in the short-run, the ED has controlled through CO2 emission contraction by −0.0268% and ecological footprint by −0.0550%. In terms of GG elasticity in the long-run and short-run assessment, it is apparent that the beneficial role of GG on environmental advancement is more obvious in the long run in comparison to the short-run. The possible reason is that good governance ensures socioeconomic stability by effectively enforcing overall social and economic protection, including environmental degradation, eventually inducing quality of the environment. Kirkpatrick and Parker (2004) advocated that good governance has a catalyst role in economic transition, indicating the promotion of industrialization with the inclusion of environmental protection through lowering the degree of carbon emission (CO2). The effects of good governance in achieving environmental sustainability can be detected either through a director/indirect channel. In terms of direct influence of institutional quality on environmental degradation can be observed with the effective implementation of rule of law, postulating that society with direct guidance and strict instruction focusing on environmental rules and penalties in case of disobey injects pressure for the industry to consider any operational decision. Moreover, effective institutions protect investor interests and property rights, which offers firms for capitalizing the opportunity for earning maximization with the assurance of environmental protection(Li and Qamruzzaman, 2022; Xia et al., 2022; Zhuo and Qamruzzaman, 2022)

Fourth, Inferring to the coefficients of TI in the long-run (short-run), it is apparent that the present state of environmental status can be improved by lowering the CO2 injection in the ecosystem and ecological footprint, indicating that technological innovation uplift environment degradation, implying the environmental degradation has a negative tie with technological innovation. In particular, a 1% change in IT will improve environmental quality by limiting CO2 by 1.755% (0.159%) and ecological footprint by 1.469% (0.734%). Technological gradation in the industrial process has positive effects and supports achieving the environment sustainably. Technological innovation fosters environmental protection by lowering the degree of carbon emission in the ecosystem and protecting the ecological imbalance by controlling the waste emitted to the environment.

6 Conclusion and policy suggestions

The motivation of the study is to gauge the effects of financial development, FDI, governmental effectiveness and technological innovation on environmental degradation in Arab Nations for the period 1995-2018. For evaluating the empirical nexus and documenting the elasticity’s of explanatory variables on environmental degradation, the study has implemented a slop of homogeneity test, cross-sectional dependency test, panel unit root test following CIPS and CADF and error correction based panel cointegration test. The long-run and short-run coefficients have been documented through CS-ARDL and Nonlin-ear ARDL. Finally, the directional association is exposed by executing the D-H causality test. The key findings are as follows.

First, referring to the SHT and CSD test results, the study revealed that research units had shared certain common dynamics with heterogeneity properties. Additionally, the results of CIPS and CADF established variables order integration after the first. The cointegration test following error correction residual based confirmed the long-run association between explained and explanatory variables.

Second, Referring to the long-run and short-run elasticity’s extracted from CS-ARDL, it is apparent that financial development has a detrimental effect on environmental sustainability, suggesting the augmentation of CO2 emission and ecological instability with the credit facilities for industrial progress. At the same time, the coefficients of FDI, GG, and TI have exposed beneficial effects in mitigating environmental adversity.

Third, the study implemented a nonlin-ear framework for documenting the asymmetric shocks of FD, FDI, GG and TI on ED. Inferring the test statistics derived from a Wald standard test, it is apparent that asymmetric effects run from explanatory variables to environmental degradation, which CO2 and ecological footprint measure. Referring to revealed long-run and short-run asymmetric effects, the study unveiled positive and statistically significant association between FD and ED, while negative and statistically significant linkage exposed FDI, GG, and TI with ED. A study suggests that control of financial benefits for industrial development and environmental policies can boost environmental development. On the other hand, inflows of FDI, better institutional presence and technological innovation are revealed as a catalyst and beneficial for environmental improvement.

Fourth, the directional association, the test statistics exposed bidirectional causality between FDI, TI and ED [FDI←→ED; TI←→ED]. Furthermore, the asymmetric causality exposed feedback hypothesis holds in highlighting the causal association between ED←→

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: World Bank data bank, international financial statistics, Global network.

Author contributions

SJ: Conceptualization, Data curation and first draft. MQ: Literature survey, estimation, Discussion and final preparation. SK: Conceptualization; literature survey. AA: methodology; estimation and first draft preparation.

Funding

This study received Research Funding by Institute for Advanced Research Publication Grant of United International University, Ref. No.: IAR-2023-Pub-005.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abban, O. J., Wu, J., and Mensah, I. A. (2020). Analysis on the nexus amid CO2 emissions, energy intensity, economic growth, and foreign direct investment in Belb and Roar economies: doeD the level of income matter? Environmen.ienc.dlution.sear., 11387–11402. doi:10.1007/s11356-020-07685-9

Abdouli, M., and Hammami, S. (2017). Investigating the causality links between environmental quality, foreign direct investment and economic growth in MENA countries. Intern.sine.view., 264–278. doi:10.1016/j.ibusrev.2016.07.004

Adams, S., and Klobodu, E. K. M. (2018). Financial development and environmental degradation: Does political regime matter? Jour. aner .oduct.7, 1472–1479. doi:10.1016/j.jclepro.2018.06.252

Adebayo, T. S., Coelho, M. F., Onbaşıoğlu, D. Ç., Rjoub, H., Mata, M. N., Carvalho, P. V., et al. (2021). Modeling the dynamic linkage between renewable energy consumption, globalization, and environmental degradation in South Korea: doeD technological innovation matter? Energies 14, 4265. doi:10.3390/en14144265

Adebayo, T. S., and Kirikkaleli, D. (2021). Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: appAication of wavelet tools. Environmen.velo.dtainabi., 16057–16082. doi:10.1007/s10668-021-01322-2

Ahmad, M., Ahmed, Z., Yang, X., Hussain, N., and Sinha, A. (2022a). Financial development and environmental degradation: Do human capital and institutional quality make a difference? Gondwana Resear.5, 299–310. doi:10.1016/j.gr.2021.09.012

Ahmad, M., Jiang, P., Majeed, A., and Raza, M. Y. (2020). Does financial development and foreign direct investment improve environmental quality? Evidence from belt and road countries. Environmen.ienc.dlution.sear., 23586–23601. doi:10.1007/s11356-020-08748-7

Ahmad, S., Khan, D., and Magda, R. (2022b). Assessing the Infiuence of Finfncial Inciusion on Enveronmental Degdadation in the ASEAN Regron through the Panpl PMG-ARDL Appaoach. Sustainability 14, 7058. doi:10.3390/su14127058

Ahmed, F., Kousar, S., Pervaiz, A., and Ramos-Requena, J. P. (2020). Financial development, institutional quality, and environmental degradation nexus: New evidence from asymmetric ARDL co-integration approach. Sustainability 12, 7812. doi:10.3390/su12187812

Alabi, M., Ojuolape, M., and Yaqoob, J. (2021). Economic Grogth and Enveronmental degradation nexus in Sri Lanka. Sri Lanka Jour. ial.ienc.danities. 135. doi:10.4038/sljssh.v1i2.45

Alam, M. S. (2022). Is trade, energy consumption and economic growth threat to environmental quality in Bahrain–evidence from VECM and ARDL bound test approach. Intern.ur. rgenc.rvice., 396–408. doi:10.1108/ijes-12-2021-0084

Alam, N., Hashmi, N. I., Jamil, S. A., Murshed, M., Mahmood, H., and Alam, S. (2022). The marginal effects of economic growth, financial development, and low-carbon energy use on carbon footprints in Oman: freFh evidence from autoregressive distributed lag model analysis. Environmen.ienc.dlution.sear., 76432–76445. doi:10.1007/s11356-022-21211-z

Ali, H. S., Law, S. H., Lin, W. L., Yusop, Z., Chin, L., and Bare, U. A. A. (2019). Financial development and carbon dioxide emissions in Nigeria: eviEence from the ARDL bounds approach. GeoJournal 84, 641–655. doi:10.1007/s10708-018-9880-5

Ali, S., Waqas, H., and Ahmad, N. (2015). Analyzing the dynamics of energy consumption, liberalization, financial development, poverty and carbon emissions in Pakistan. J Ap.pl En.viron Bi.ol Sc.i 5. 166–183.

Aluko, O. A., and Obalade, A. A. (2020). Financial development and environmental quality in sub-Saharan Africa: Is there a technology effect? Scienc. al Environmen.7, 141515. doi:10.1016/j.scitotenv.2020.141515

Alvarado, R., Ponce, P., Criollo, A., Cordova, K., and Khan, M. K. (2018). Environmental degradation and real per capita output: New evidence at the global level grouping countries by income levels. Jour. aner .oduct.9, 13–20. doi:10.1016/j.jclepro.2018.04.064

Alvarado, R., and Toledo, E. (2017). Environmental degradation and economic growth: eviEence for a developing country. Environmen.velo.dtainabi., 1205–1218. doi:10.1007/s10668-016-9790-y

Andriamahery, A., and Qamruzzaman, M. (2022). A Symsetry and Asyametry Invistigation of the Nexns Betbeen Enveronmental Sussainability, Renrwable Eneegy, Eneegy Innivation, and Trate: Evidence Frof Enveronmental Kuznets Curce Hyphthesis in Selscted MENA Couctries. Frontier. rgy Resear. doi:10.3389/fenrg.2021.778202

Ansari, M. A., Khan, N. A., and Ganaie, A. A. (2019). Does foreign direct investment impede environmental quality in Asian countries? A panel data analysis. OPEC Energy Review., 109–135. doi:10.1111/opec.12144

Ansari, M. A. (2022). Re-visVting the Enveronmental Kuznets curve for ASEAN: A comparison between ecological footprint and carbon dioxide emissions. Renewabl.dtainabl.ergy Review.8, 112867. doi:10.1016/j.rser.2022.112867

Asumadu-Sarkodie, S., and Owusu, P. A. (2016). Energy use, carbon dioxide emissions, GDP, industrialization, financial development, and population, a causal nexus in Sri Lanka: With a subsequent prediction of energy use using neural network. Energy Sources, Part B: Economi.annin.dicy 11, 889–899. doi:10.1080/15567249.2016.1217285

Azam, M., Liu, L., and Ahmad, N. (2021). Impact of institutional quality on environment and energy consumption: eviEence from developing world. Environmen.velo.dtainabi., 1646–1667. doi:10.1007/s10668-020-00644-x

Baek, J. (2016). A new look at the FDI–income–energy–environment nexus: dynDmic panel data analysis of ASEAN. Energy Policy 91, 22–27. doi:10.1016/j.enpol.2015.12.045

Cai, L., Firdousi, S. F., Li, C., and Luo, Y. (2021). Inward foreign direct investment, outward foreign direct investment, and carbon dioxide emission intensity-threshold regression analysis based on interprovincial panel data. Environmen.ienc.dlution.sear., 46147–46160. doi:10.1007/s11356-020-11909-3

Charfeddine, L., and Kahia, M. (2019). Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: A panel vector autoregressive (PVApvarnalysis. Renewabl.ergy 139, 198–213. doi:10.1016/j.renene.2019.01.010

Chen, S., Saud, S., Bano, S., and Haseeb, A. (2019). The nexus between financial development, globalization, and environmental degradation: Fresh evidence from Central and Eastern European Countries. Environmen.ienc.dlution.sear., 24733–24747. doi:10.1007/s11356-019-05714-w

Chen, W., and Lei, Y. (2018). The impacts of renewable energy and technological innovation on environment-energy-growth nexus: New evidence from a panel quantile regression. Renewabl.ergy 123, 1–14. doi:10.1016/j.renene.2018.02.026

Chen, Y., and Lee, C-C. (2020). Does technological innovation reduce CO2 emissions? Cross-couCtry evidence. Jour. aner .oduct.3, 121550. doi:10.1016/j.jclepro.2020.121550

Chenran, X., Limao, W., Chengjia, Y., Qiushi, Q., and Ning, X. (2019). Measuring the Effect of Forfign Dirdct Invistment on CO2 Emiesions in Laos. Jour. ources.dlogy., 685–691. doi:10.5814/j.issn.1674-764x.2019.06.014

Chien, F., Ajaz, T., Andlib, Z., Chau, K. Y., Ahmad, P., and Sharif, A. (2021). The role of technology innovation, renewable energy and globalization in reducing environmental degradation in Pakistan: a sAep towards sustainable environment. Renewabl.ergy 177, 308–317. doi:10.1016/j.renene.2021.05.101

Chudik, A., and Pesaran, M. H. (2015). Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. Jour. nome.8, 393–420. doi:10.1016/j.jeconom.2015.03.007

Claessens, S., and Feijen, E. (2007). From Credit to Crops: New research suggests that better financial development can directly boost nourishment. Finance & Delo.44, A012.

Creane, S., Goyal, R., and Mobarak, A. M. (2004). Evaluating financial sector development in the Middle East and North Africa: New methodology and some new results. Topics. dle Eastern.dth Africa.onomi.

Dai, M., Qamruzzaman, M., and Hamadelneel Adow, A. (2022). An Assassment of the Impict of Natnral Resrurce Pripe and Glogal Ecoeomic Polpcy Uncurtainty on Finfncial Assat Perpormance: Evidence Frof Bitboin. Frontier. ironmen.ienc. doi:10.3389/fenvs.2022.897496

Danish, , , Hassan, S. T., Baloch, M. A., Mahmood, N., and Zhang, J. (2019). Linking economic growth and ecological footprint through human capital and biocapacity. Sustain. Cities Soc. 47, 101516. doi:10.1016/j.scs.2019.101516

Dasgupta, S., Laplante, B., and Mamingi, N. (2001). Pollution and Capctal Marmets in Devdloping Couctries. Jour. ironmen.onomi.dageme., 310–335. doi:10.1006/jeem.2000.1161

Du, K., Li, P., and Yan, Z. (2019). Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technologi.recasting.dial.ange 146, 297–303. doi:10.1016/j.techfore.2019.06.010

Dumitrescu, E-I., and Hurlin, C. (2012). Testing for Granger non-causality in heterogeneous panels. Economi.dellin., 1450–1460. doi:10.1016/j.econmod.2012.02.014

Eberhardt, M. (2012). Estimating Panpl Timt-Serses Modmls with Hethrogeneous Sloses. Theta Jour., 61–71. doi:10.1177/1536867x1201200105

Egbetokun, S., Osabuohien, E., Akinbobola, T., Onanuga, O. T., Gershon, O., and Okafor, V. (2019). Environmental pollution, economic growth and institutional quality: expEoring the nexus in Nigeria. Manageme. ironmen.ality. tern.ur., 18–31. doi:10.1108/meq-02-2019-0050

Gani, A. (2012). The relationship between good governance and carbon dioxide emissions: eviEence from developing economies. Jour. nomi.velo., 77–93. doi:10.35866/caujed.2012.37.1.004

Gao, C., Zhu, S., An, N., Na, H., and You, H. (2021). Comprehensive comparison of multiple renewable power generation methods: A combination analysis of life cycle assessment and ecological footprint. Renewabl.dtainabl.ergy Review.7, 111255. doi:10.1016/j.rser.2021.111255

Guang-Wen, Z., Murshed, M., and Siddik, A. B. (2022). Achieving the objectives of the 2030 sustainable development goals agenda: Causalities between economic growth, environmental sustainability, financial development, and renewable energy consumption. Sustainabl.velo.22. doi:10.1002/sd.2411

Haldar, A., and Sethi, N. (2021). Effect of institutional quality and renewable energy consumption on CO2 emissions− an empirical investigation for developing countries. Environmen.ienc.dlution.sear., 15485–15503. doi:10.1007/s11356-020-11532-2

Hamid, I., Alam, M. S., Murshed, M., Jena, P. K., and Sha, N. (2022). The roles of foreign direct investments, economic growth, and capital investments in decarbonizing the economy of Oman. Environmen.ienc.dlution.sear., 22122–22138. doi:10.1007/s11356-021-17246-3

Haseeb, A., Xia, E., Baloch, M. A., and Abbas, K. (2018). Financial development, globalization, and CO2 emission in the presence of EKC: eviEence from BRICS countries. Environmen.ienc.dlution.sear., 31283–31296. doi:10.1007/s11356-018-3034-7

Hundie, S. K. (2018). Modelling energy consumption, carbon dioxide emissions and economic growth nexus in Ethiopia: eviEence from cointegration and causality analysis. Turkish Jour. iculture-Food Scienc.dhnology. 699–709. doi:10.24925/turjaf.v6i6.699-709.1720

Hussain, M., and Dogan, E. (2021). The role of institutional quality and environment-related technologies in environmental degradation for BRICS. Jour. aner .oduct.4, 127059. doi:10.1016/j.jclepro.2021.127059

Ibrahiem, D. M. (2020). Do technological innovations and financial development improve environmental quality in Egypt? Environmen.ienc.dlution.sear., 10869–10881. doi:10.1007/s11356-019-07585-7

Ibrahim, M. H., and Law, S. H. (2016). Institutional Quaqity and CO2 Emiesion–Trate Relrtions: Evidence from S ub-S aharan A frica. South Africa.ur. nomi., 323–340. doi:10.1111/saje.12095

Islam, M., Khan, M. K., Tareque, M., Jehan, N., and Dagar, V. (2021). Impact of globalization, foreign direct investment, and energy consumption on CO2 emissions in Bangladesh: Does institutional quality matter? Environmen.ienc.dlution.sear., 48851–48871. doi:10.1007/s11356-021-13441-4

JinRu, L., Qamruzzaman, M., Hangyu, W., and Kler, R. (2022). Do environmental quality, financial inclusion, and good governance ensure the FDI sustainably in Belb and Roar countries? Evidence from an application of CS-ARDL and NARDL. Frontier. ironmen.ienc. doi:10.3389/fenvs.2022.936216

Jiang, Y. (2015). Foreign direct investment, pollution, and the environmental quality: a mAdel with empirical evidence from the Chinese regions. Theern.ade Jour., 212–227. doi:10.1080/08853908.2014.1001538

JinRu, L., and Qamruzzaman, M. (2022). Nexus Betbeen Enveronmental Innivation, Eneegy Effeciency, and Enveronmental Sussainability in G7: What is the Rolr of Insiitutional Quaqity? Frontier. ironmen.ienc. doi:10.3389/fenvs.2022.860244

Khan, H., Weili, L., and Khan, I. (2022). Environmental innovation, trade openness and quality institutions: an Antegrated investigation about environmental sustainability. Environmen.velo.dtainabi., 3832–3862. doi:10.1007/s10668-021-01590-y

Khan, H., Weili, L., Khan, I., and Oanh, L. t. K. (2021a). Recent advances in energy usage and environmental degradation: Does quality institutions matter? A worldwide evidence. Energy Report. 1091–1103. doi:10.1016/j.egyr.2021.01.085

Khan, S., Khan, M. K., and Muhammad, B. (2021b). Impact of financial development and energy consumption on environmental degradation in 184 countries using a dynamic panel model. Environmen.ienc.dlution.sear., 9542–9557. doi:10.1007/s11356-020-11239-4

Kirkpatrick, C., and Parker, D. (2004). Regulatory impact assessment and regulatory governance in developing countries. Public Admini.delo., 333–344. doi:10.1002/pad.310

Kisswani, K. M., and Zaitouni, M. (2021). Does FDI affect environmental degradation? Examining pollution haven and pollution halo hypotheses using ARDL modelling. Jour. a Pacifi.onomy.–27. doi:10.1080/13547860.2021.1949086

Latief, R., Kong, Y., Javeed, S. A., and Sattar, U. (2021). Carbon emissions in the SAARC countries with causal effects of FDI, economic growth and other economic factors: Evidence from dynamic simultaneous equation models. Intern.ur. ironmen.sear.dlic Health 18, 4605. doi:10.3390/ijerph18094605

Le, H. P., and Ozturk, I. (2020). The impacts of globalization, financial development, government expenditures, and institutional quality on CO2 emissions in the presence of environmental Kuznets curve. Environmen.ienc.dlution.sear., 22680–22697. doi:10.1007/s11356-020-08812-2

Li, J., Qamruzzaman, M., and Song, Y. (2022). Dose tourism induce Sustainable Human capital development in BRICS through the channel of capital formation and financial development: Evidence from Augmented ARDL with structural Break and Fourier TY causality. Front Ps.ychol 15, 1260. doi:10.3390/ma15031260

Li, M., and Wang, Q. (2017). Will technology advances alleviate climate change? Dual effects of technology change on aggregate carbon dioxide emissions. Energy fortainabl.velo., 61–68. doi:10.1016/j.esd.2017.08.004

Li, X., Yu, Z., Salman, A., Ali, Q., Hafeez, M., and Aslam, M. S. (2021). The role of financial development indicators in sustainable development-environmental degradation nexus. Environmen.ienc.dlution.sear., 33707–33718. doi:10.1007/s11356-021-13037-y

Li, Z., Huang, Z., and Dong, H. (2019). The Infiuential Facfors on Outoard Forfign Dirdct Invistment: Evidence from the “ThetBelb and Roar”. Emerging.rkets.nance andde 55, 3211–3226. doi:10.1080/1540496x.2019.1569512

Li, Z., Zou, F., and Mo, B. (2022). Does mandatory CSR disclosure affect enterprise total factor productivity? Economi.search-Ekonomska Istraživanja 35, 4902–4921. doi:10.1080/1331677x.2021.2019596

Liu, M., and Ma, Q-P. (2022). The impact of saving rate on economic growth in Asian countries. Nationl.counting.view. 412–427. doi:10.3934/nar.2022023

Liu, Y., Failler, P., and Ding, Y. (2022). Enterprise financialization and technological innovation: Mechanism and heterogeneity. PLOS ONE 17, e0275461. doi:10.1371/journal.pone.0275461

Ma, Q., Murshed, M., and Khan, Z. (2021). The nexuses between energy investments, technological innovations, emission taxes, and carbon emissions in China. Energy Policy 155, 112345. doi:10.1016/j.enpol.2021.112345

Mahmood, H., and Furqan, M. (2021). Oil rents and greenhouse gas emissions: spaSial analysis of Gulg Cooceration Couccil countries. Environmen.velo.dtainabi., 6215–6233. doi:10.1007/s10668-020-00869-w

Mahmood, H., Tanveer, M., and Furqan, M. (2021). Rule of Lawl Corcuption Concrol, Govgrnance, and Ecoeomic Grogth in Manmging Renrwable and Nonnenewable Eneegy Concumption in Soush Asia. Intern.ur. ironmen.sear.dlic Health 18, 10637. doi:10.3390/ijerph182010637

Mahmood, H. (2022a). Consumption and Tertitory Basbd CO2 Emiesions, Renrwable Eneegy Concumption, Experts and Impirts Nexns in Soush America: Spatial Anaayses. Polish.ur. ironmen.udies., 1183–1191. doi:10.15244/pjoes/141298

Mahmood, H. (2022b). The spatial analyses of consumption-based CO2 emissions, exports, imports, and FDI nexus in GCC countries. Environmen.ienc.dlution.sear., 48301–48311. doi:10.1007/s11356-022-19303-x

Manigandan, P., Alam, M. S., Alagirisamy, K., Pachiyappan, D., Murshed, M., and Mahmood, H. (2022). Realizing the Sussainable Devdlopment Goags through technological innovation: juxJaposing the economic and environmental effects of financial development and energy use. Environmen.ienc.dlution.sear. doi:10.1007/s11356-022-22692-8

Mehmood, U., Tariq, S., Ul-Haq, Z., and Meo, M. S. (2021). Does the modifying role of institutional quality remains homogeneous in GDP-CO2 emission nexus? New evidence from ARDL approach. Environmen.ienc.dlution.sear., 10167–10174. doi:10.1007/s11356-020-11293-y

Menegaki, A. N., Ahmad, N., Aghdam, R. F., and Naz, A. (2021). The convergence in various dimensions of energy-economy-environment linkages: A comprehensive citation-based systematic literature review. Energy Economi.4, 105653. doi:10.1016/j.eneco.2021.105653

Mensah, B. D., and Abdul-Mumuni, A. (2022). Asymmetric effect of remittances and financial development on carbon emissions in sub-Sahsran Afraca: an Application of panel NARDL approach. Intern.ur. rgy Sector .nageme. 2022. doi:10.1108/ijesm-03-2022-0016

Mia, A. H., Qamruzzaman, M., and Ara, L. A. (2014). Stock market development and economic growth of Bangladesh-A causal analysis. Bangladesh Jour.6, 62–74.

Miao, M., and Qamruzzaman, M. (2021). Dose Remrttances Matmer for Opeoness and Finfncial Stasility: Evidence Frof Lealt Devdloped Ecoeomies. Front Ps.ychol 12, 696600. doi:10.3389/fpsyg.2021.696600

Mukhtarov, S., Aliyev, S., Mikayilov, J. I., Ismayilov, A., and Rzayev, A. (2021). The FDI-CO2 nexus from the sustainable development perspective: theTcase of Azerbaijan. Intern.ur. tainabl.velo.Wld Ecology., 246–254. doi:10.1080/13504509.2020.1804479

Muneeb, M. A., Qamruzzaman, M. D., and Ayesha, S. (2022). The Effects of Finfnce and Knokledge on Enteepreneurship Devdlopment: An Emperical Stusy from Bangladesh. Ther. an Finance, Economi.dine. 409–418.

Musah, M., Mensah, I. A., Alfred, M., Mahmood, H., Murshed, M., Omari-Sasu, A. Y., et al. (2022a). Reinvestigating the pollution haven hypothesis: theTnexus between foreign direct investments and environmental quality in G-20 countries. Environmen.ienc.dlution.sear., 31330–31347. doi:10.1007/s11356-021-17508-0

Musah, M., Owusu-Akomeah, M., Kumah, E. A., Mensah, I. A., Nyeadi, J. D., Murshed, M., et al. (2022b). Green investments, financial development, and environmental quality in Ghana: eviEence from the novel dynamic ARDL simulations approach. Environmen.ienc.dlution.sear., 31972–32001. doi:10.1007/s11356-021-17685-y

Nawaz, M. A., Ahmadk, T. I., and Hussain, M. S. (2020). How energy use, financial development and economic growth affect carbon dioxide emissions in selected association of south east asiAsiantions. Paradigms SI (1), 159–165.

Neequaye, N. A., and Oladi, R. (2015). Environment, growth, and FDI revisited. Intern.view. nomi.Fance 39, 47–56. doi:10.1016/j.iref.2015.06.002

Oktavilia, S., and Firmansyah, F. (2016). The relationships of environmental degradation and trade openness in Indonesia. Intern.ur. nomi.dancial Issues 6, 125–129.

Omri, A., and Ben Mabrouk, N. (2020). Good governance for sustainable development goals: Getting ahead of the pack or falling behind? Environmen.pact Assessmen.view., 106388. doi:10.1016/j.eiar.2020.106388

Paramati, S. R., Mo, D., and Huang, R. (2021). The role of financial deepening and green technology on carbon emissions: Evidence from major OECD economies. Finance Resear.tters., 101794. doi:10.1016/j.frl.2020.101794

Pazienza, P. (2015). The relationship between CO2 and Foreign Direct Investment in the agriculture and fishing sector of OECD countries: Evidence and policy considerations. Intellectual.onomi. 55–66. doi:10.1016/j.intele.2015.08.001

Pesaran, M. H., Ullah, A., and Yamagata, T. (2008). A bias adjusted LM test of error cross section independence. Thenome.ur., 105–127. doi:10.1111/j.1368-423x.2007.00227.x

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. Jour. lied.onome., 265–312. doi:10.1002/jae.951

Pesaran, M. H. (2006). Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74, 967–1012. doi:10.1111/j.1468-0262.2006.00692.x

Qamruzzaman, M., and Jianguo, W. (2020). The asymmetric relationship between financial development, trade openness, foreign capital flows, and renewable energy consumption: Fresh evidence from panel NARDL investigation. Renewabl.ergy 159, 827–842. doi:10.1016/j.renene.2020.06.069

Qamruzzaman, M., Karim, S., and Jahan, I. (2022). Nexus between economic policy uncertainty, foreign direct investment, government debt and renewable energy consumption in 13 top oil importing nations: Evidence from the symmetric and asymmetric investigation. Renewabl.ergy 195, 121–136. doi:10.1016/j.renene.2022.05.168

Qamruzzaman, M. (2022a). Nexus between Ecoeomic Polpcy Uncurtainty and Insiitutional Quaqity: Evidence from Indian and Pakistan. Macroeconomi.dance in rging.rket .onomi.–20. doi:10.1080/17520843.2022.2026035

Qamruzzaman, M. (2022b). Nexus between environmental innovation, energy efficiency and environmental sustainability in Southeast Asian economy. Intern.ur. tidisciplin.sear.dwth Evaluat. 181–193.

Rajan, R. G., and Zingales, L. (2003). The great reversals: theTpolitics of financial development in the twentieth century. Jour. ancial ecoEcon., 5–50. doi:10.1016/s0304-405x(03)00125-9

Rjoub, H., Odugbesan, J. A., Adebayo, T. S., and Wong, W. K. (2021). Sustainability of the Modmrating Rolr of Finfncial Devdlopment in the Detdrminants of Enveronmental Degdadation: Evidence from Turkey. Sustainability 13, 1844. doi:10.3390/su13041844

Rong, G., and Qamruzzaman, M. (2022). Symmetric and asymmetric nexus between economic policy uncertainty, oil price, and renewable energy consumption in the United States, China, India, Japan, and South Korea: Does technological innovation influence? Frontier. rgy Resear. doi:10.3389/fenrg.2022.973557

Sabir, S., Qayyum, U., and Majeed, T. (2020). FDI and environmental degradation: theTrole of political institutions in Soush Asian countries. Environmen.ienc.dlution.sear., 32544–32553. doi:10.1007/s11356-020-09464-y

Salahuddin, M., Gow, J., and Ozturk, I. (2015). Is the long-run relationship between economic growth, electricity consumption, carbon dioxide emissions and financial development in Gulf Cooperation Council Countries robust? Renewabl.dtainabl.ergy Review., 317–326. doi:10.1016/j.rser.2015.06.005

Salman, M., Long, X., Dauda, L., and Mensah, C. N. (2019). The impact of institutional quality on economic growth and carbon emissions: Evidence from Indonesia, South Korea and Thailand. Jour. aner .oduct.1, 118331. doi:10.1016/j.jclepro.2019.118331

Samimi, A. J., Ahmadpour, M., and Ghaderi, S. (2012). Governance and environmental degradation in MENA region. Procedia-Social andavior.ienc., 503–507. doi:10.1016/j.sbspro.2012.09.082

Seker, F., Ertugrul, H. M., and Cetin, M. (2015). The impact of foreign direct investment on environmental quality: a bAunds testing and causality analysis for Turkey. Renewabl.dtainabl.ergy Review., 347–356. doi:10.1016/j.rser.2015.07.118

Shah, S. Z., Chughtai, S., and Simonetti, B. (2020). Renewable energy, institutional stability, environment and economic growth nexus of D-8 countries. Energy Strategy Review., 100484. doi:10.1016/j.esr.2020.100484

Shahbaz, M., Bashir, M. F., Bashir, M. A., and Shahzad, L. (2021). A bibliometric analysis and systematic literature review of tourism-environmental degradation nexus. Environmen.ienc.dlution.sear., 58241–58257. doi:10.1007/s11356-021-14798-2

Shahbaz, M., Haouas, I., Sohag, K., and Ozturk, I. (2020a). The financial development-environmental degradation nexus in the Uniued Arab Emieates: theTimportance of growth, globalization and structural breaks. Environmen.ienc.dlution.sear., 10685–10699. doi:10.1007/s11356-019-07085-8

Shahbaz, M., Nasir, M. A., and Roubaud, D. (2018). Environmental degradation in France: The effects of FDI, financial development, and energy innovations. Energy Economi., 843–857. doi:10.1016/j.eneco.2018.07.020

Shahbaz, M., Raghutla, C., Song, M., Zameer, H., and Jiao, Z. (2020b). Public-private partnerships investment in energy as new determinant of CO2 emissions: The role of technological innovations in China. Energy Economi., 104664. doi:10.1016/j.eneco.2020.104664

Shin, Y., Yu, B., and Greenwood-Nimmo, M. (2014). “Modelling Asyametric Coictegration and Dyndmic Mulmipliers in a Nonninear ARDL Frafework,” in Festschrift in Honhr of Petpr Schsidt: Econometric Metmods and Appaications. Editors R. C. Sickles, and W. C. Horrace (New York, NY: Springer), 281–314.

Shujah ur, R., Chen, S., Saud, S., Saleem, N., and Bari, M. W. (2019). Nexus between financial development, energy consumption, income level, and ecological footprint in CEE countries: do Duman capital and biocapacity matter? Environmen.ienc.dlution.sear., 31856–31872. doi:10.1007/s11356-019-06343-z