- 1School of Management, Huazhong University of Science and Technology, Wuhan, China

- 2School of Economics, Wuhan University of Technology, Wuhan, China

- 3Hubei Modern Logistics Development Promotion Association, Wuhan, China

- 4Xiamen Airlines Co Ltd, Xiamen, China

After the Chinese government put forward carbon peaking and carbon neutrality goals, the intensity of environmental regulation has reached an unprecedented height. Using a sample of heavily polluted A-share listed companies in Shanghai and Shenzhen from 2012 to 2018, we discuss the influence mechanism of environmental regulation and environmental tax on corporate earnings management in this study. We use multiple regression models to empirically verify the impact of environmental regulation, environmental tax, and their combined effect on corporate earnings management. We find that environmental regulations promote enterprises’ upward real earnings management and inhibit enterprises’ upward accrual earnings management. However, environmental taxes discourage firms from upward accrual earnings management. Moreover, environmental regulations and environmental tax jointly promote enterprises’ upward accrual earnings management and real earnings management. And there is heterogeneity among different enterprise natures, different enterprise sizes, enterprises in regions with different degrees of marketization, different intensities of government investment in environmental protection, and whether enterprises disclose their environmental protection concepts. The contribution of this paper is to put environmental regulation, environmental protection tax, and earnings management in the same analytical framework. We aim to combine the government’s macro policy with the enterprise’s micro behavior and to deeply analyze the impact and mechanism of environmental regulation, environmental protection tax, and their combined effect on enterprise earnings management. By analyzing the heterogeneity of these impacts from multiple dimensions, this study tries to expand the research horizon, fill the research gap, and provide theoretical support for the government to formulate comprehensive environmental regulation policies.

1 Introduction

Currently, China’s environmental protection still lags behind economic development, and high emissions, high pollution, and high energy consumption are still difficult problems hindering environmental protection. In 2020, the Chinese government made arrangements for peak carbon neutrality and formulated implementation plans for vital energy, industry, and transportation industries. It established a “1 + N″ policy framework for peak carbon neutrality. The 2022 National Conference on Ecological and Environmental Protection further proposed that pollution should be controlled precisely, scientifically, and law-based. The battle to protect blue skies, clear water, and pure land should be intensified. The meeting proposed to vigorously promote the comprehensive green transformation of economic and social development, to improve environmental governance capacity while stabilizing energy-intensive industries to meet pollution emission standards, and to further push environmental protection and governance to a new height (He and Walheer, 2020).

Enterprises are the main body of environmental governance, but enterprise environmental governance is often not voluntary but the result of environmental regulation. As a “rational” economic man, enterprises will make the corresponding reaction under the pressure of environmental regulation, and earnings management is one of them. The definition of earnings management refers to that under the premise of not violating accounting standards, enterprise managers adjust financial statements or change the short-term profitability of enterprises in other ways to maximize their interests.

Environmental regulation is an essential means of environmental protection and governance implemented by the government to overcome the market failure caused by improper use of the environment in economic activities. It is also a way for the government to intervene in economic activities. Environmental regulation is to effectively protect and improve the ecological environment and take sustainable economic development as the goal. Environmental protection tax is a tax levied by the state on the exploitation and utilization of resources, damage to the environment, and other behaviors, to regulate the behavior of enterprises, especially heavy polluters, to ensure the country’s green development. Environmental regulation mainly uses administrative control means to solve environmental problems. For example, the Chinese government continues to improve the assessment system linking environmental protection with political performance assessment. It constantly strengthens the punishment system of environmental protection and law enforcement of environmental protection. Environmental protection tax is an effective system arrangement of economic inducement. It makes more use of market incentive means to guide and adjust the micro behavior of enterprises. For example, it encourages enterprises to innovate or use more environmentally friendly new models, technologies, and processes to solve environmental problems. Therefore, the environmental protection tax has attracted more extensive and in-depth attention.

Will the increasingly stringent environmental regulation and the increasingly improved environmental protection tax system affect the earnings management behavior of enterprises? If so, what is the impact? This paper attempts to establish an analytical framework and conduct an empirical analysis to answer the above questions.

The contribution of this paper is to put environmental regulation, environmental protection tax, and earnings management in the same analytical framework. We aim to combine the government’s macro policy with the enterprise’s micro behavior and to deeply analyze the impact and mechanism of environmental regulation, environmental protection tax, and their combined effect on enterprise earnings management. We analyze the heterogeneity of these impacts from multiple dimensions, expand the research horizon, fill the research gap, and provide theoretical support for the government to formulate comprehensive environmental regulation policies.

Section 2 is the literature review for this study. In Section 3, we discuss the research mechanism and present our hypothesis. Sections 4, 5 present the research design, empirical findings, and analysis. In Section 6, we present concluding remarks and recommendations.

2 Literature review

As for environmental regulation, most scholars believe that environmental regulation has positive effects. Porter hypothesis holds that implementing appropriate and reasonable environmental regulation policies can help stimulate the technological innovation vitality of enterprises, make up for the cost increase caused by environmental regulation, and obtain the “innovation compensation effect.” Simpson and Bradford (1996) further explained the Porter hypothesis from the market failure perspective. They believe that when there is imperfect competition among enterprises, the implementation of strict environmental regulation can encourage enterprises to actively balance the goal of profit maximization and environmental protection, help domestic industries improve their competitiveness, gain strategic advantages, and achieve the “win-win” goal of profit and environmental protection. Based on the resource-based view of enterprises, Hart (1995) proposed the natural resource-based view of enterprises. The relationship between enterprises and the natural environment will be the basis of enterprises’ competitive advantage. It helps to enhance the competitive advantage of enterprises and improve their performance. Kang and Ru (2020) used the bilateral stochastic Frontier model to decompose the innovation compensation effect, compliance cost effect, and the net effect of environmental regulation on green innovation efficiency and analyzed their common characteristics. The results show that the compliance cost effect of environmental regulation on green innovation efficiency is smaller than the innovation compensation effect, making the comprehensive effect of environmental regulation positive, which verifies the Porter hypothesis.

On the contrary, Aupperle et al. (1985) believed that due to the influence of externalities of corporate social responsibility, enterprises undertake more social responsibilities, such as environmental protection, which can produce good social benefits. However, for enterprises, if limited resources are used to undertake more social responsibilities, compared with enterprises that do not undertake or undertake fewer social responsibilities, it will increase some additional costs and expenses and face higher opportunity costs, which may put the enterprise at a relative disadvantage, thus reducing its competitive advantage and ultimately harming corporate performance. Walley and Whitehead (1994) believed enterprises only passively improved their environmental governance under government regulation. Improving environmental performance under government coercion may force enterprises to increase costs. Enterprises will have to transfer limited funds from other projects with more potential to projects used to reduce environmental pollution. As a result, the improvement of enterprise productivity and competitiveness will be affected. Palmer et al. (1995) also believed that enterprises are bound to invest more human resources and capital in energy conservation and emission reduction, which will increase the operation management cost and sunk cost. The ultimate result is the loss of enterprise competitiveness and enterprise performance. Ambec and Barla (2002) further expanded Porter’s hypothesis from the perspective of behavioral science. They pointed out that, due to the high uncertainty and long-term nature of R&D innovation activities, R&D innovation may help enterprises gain competitive advantages or long-term profits in the future, but it is challenging to bring profits to enterprises in the short term (Wang et al., 2021; Liu et al., 2022). Management’s current preference may lead to delayed investment in research and development, which is not conducive to technological innovation. The pollution paradise hypothesis holds that the government’s strengthening of environmental regulation will increase the private production cost of enterprises and reduce their competitiveness (Arouri et al., 2012).

As for environmental protection tax, most scholars believe that it also has positive effects. Environmental protection tax increases the pollutant discharge cost and tax burden of enterprises (Ye and Wang, 2017), resulting in the “crowding out effect” (Wang et al., 2019), affecting the regular operation of enterprises, inhibiting their development, and making enterprises face the risk of being eliminated (Aldy, 2016). When environmental protection tax is levied, enterprises will reduce the tax burden through technological innovation (Yu et al., 2019; Wang and Fan, 2021; Yang et al., 2022; Li et al., 2022a), optimizing resource allocation (Duan and Wang, 2017), and other ways to respond to achieve sustainable development of enterprises actively.

Earnings management is a strategic behavior of enterprises under the macro policy and business environment. From a professional perspective, earnings management can be divided into accrual earnings management and real earnings management. Accrual earnings management refers to the company’s management adjusting the profit distribution of each accounting period through financial means within the scope of accounting standards. Real earnings management manages earnings distribution and cash flow in each period by manipulating earnings through real economic transactions such as asset sales and discount sales. The existing research on earnings management mainly starts from the traction of earnings management and studies the motivation of enterprise earnings management, which can be summarized into five aspects. The first is the motivation of management compensation. That is, facing the temptation of generous compensation, and the management will strengthen the control of the company’s earnings behavior and change the company’s financial statements by various means to meet the expectations of shareholders and investors to obtain more material benefits. There are two hypotheses on the motivation of managerial compensation: the interest convergence effect (Yuan et al., 2014) and the opportunistic behavior effect (He, 2016). The second is the motivation for debt contracts. Watts and Zimmerman (1986) proposed the debt contract hypothesis that enterprises will conduct earnings management to reduce the default cost of the company. The third is the motivation of capital market, including the motivation of stock issuance (Song et al., 2017; Li et al., 2022), the motivation of avoiding losses and delisting (Zhang and Wang, 2021), the motivation of achieving the target of earnings forecast (Kallunki and Martikainen, 1999) and the motivation of corporate M&A (Liu et al., 2021). The fourth motivation is regulatory motivation. With the growing strength of the capital market, relevant systems and regulations are also constantly improving, and the crackdown on corporate violations by market regulators is also increasing (Zhu and Li, 2021). Fifth, cost motivation, including political cost (Huang and Zhou, 2021) and tax cost (Wang et al., 2009).

To sum up, many scholars have conducted a lot of research on the motivation, preference, and implementation methods of earnings management. Some scholars have also studied the impact of environmental regulation on earnings management or the impact of environmental taxes on earnings management. However, no literature currently integrates environmental regulation, environmental tax, corporate accrual earnings management, and real earnings management into the same framework for systematic research. This paper theoretically studies the impact of environmental regulation and environmental tax on corporate earnings management and its internal mechanism. We selected the data of heavily polluted enterprises from Shanghai and Shenzhen A-share listed companies from 2012 to 2018 as samples for empirical analysis and verification. The empirical results of this paper provide a specific theoretical basis and empirical support for the formulation of composite environmental protection policies. Our paper makes the following contributions to the literature. First, we establish an analysis framework of environmental regulation, environmental tax, and earnings management. Second, we deeply analyze the impact of environmental regulation, environmental tax, and their combined effects on corporate earnings management and their mechanism. Finally, we further analyze the heterogeneity and causes of the impact of environmental regulation, environmental tax, and their combined effects on corporate earnings management to fill in the gaps in existing research.

3 Mechanism analysis and assumptions

3.1 Environmental regulation and earnings management

According to Pigou, when the producer’s private marginal cost is inconsistent with the social marginal cost, that is, when a producer causes losses to other producers or the whole society without paying the price or the price paid is less than the loss caused by the producer, external diseconomy will occur, leading to the failure of market resource allocation. External diseconomy is often the reason for government intervention, and environmental regulation is typical. To achieve certain goals, enterprises often take certain measures to cope with government environmental regulations, such as earnings management.

In this study, environmental regulation refers to the government’s mandatory supervision of enterprises’ environmental behavior. Environmental regulation may prompt firms to engage in upward earnings management. Environmental pollution is a negative externality activity of enterprises. Higher company costs make them less attractive to investors and raise financing costs. Therefore, enterprises may conduct upward earnings management based on capital market motivation or management compensation motivation.

Environmental regulation may also encourage enterprises to conduct downward earnings management. Under environmental regulation, enterprises with negative environmental effects are bound to face stricter control and supervision from the government. Severe penalties can be imposed on these companies, such as fines, warnings, or suspension of production for rectification. Based on regulatory motivation, enterprises “crying poor” and conduct downward earnings management to reduce such risks.

Hence, we have the following hypotheses.

Hypothesis 1a:. Environmental regulation can promote enterprises to conduct upward earnings management.

Hypothesis 1b:. Environmental regulation can promote enterprises to conduct downward earnings management.

3.2 Environmental tax and earnings management

Unlike the compulsion of environmental regulation, environmental tax emphasizes the incentive adjustment of tax on enterprise behavior. Environmental protection tax encourages enterprises to save energy and reduce emissions, increase investment in research and development, play the role of “innovation compensation,” and improve the efficiency of enterprise innovation. According to the Porter Hypothesis, appropriate environmental protection tax stimulates the innovation compensation effect of enterprises and makes up for their compliance costs. Environmental protection tax makes enterprises pay the social cost corresponding to their pollution, internalizes the cost of environmental pollution of enterprises, and strengthens the investment in environmental protection facilities and equipment. The legislative purpose and practical orientation of environmental protection tax differ from other taxes. Its starting point and foothold are to protect and improve the environment and promote ecological civilization construction. The introduction of environmental protection tax is to strengthen the regulatory role of tax, form an effective restraint and incentive mechanism, and fulfill the responsibility of polluters. According to the “Pigouvian tax” principle, collecting environmental protection will increase enterprises’ costs, increase the marginal revenue of tax planning through earnings management, and encourage enterprises to conduct earnings management. Environmental protection tax is based on the number of pollutants discharged. The innovation of production mode and production technology further increases the cost of enterprises, thus promoting enterprises to carry out earnings management. Of course, environmental taxes reduce corporate profits for managers, so they also have the incentive to conduct earnings management to maximize private profits.

Hence, we have the following hypotheses:

Hypothesis 2a:. Environmental tax will promote the upward earnings management of enterprises.

Hypothesis 2b:. Environmental tax will promote the downward earnings management of enterprises.

3.3 Environmental regulation, environmental tax, and earnings management

Environmental regulation and environmental protection tax promote the internalization of enterprises’ external costs. Environmental regulations deprive polluters of choice, and firms must comply with environmental regulations or face penalties. Although environmental regulation can restrain enterprises’ environmental pollution behaviors, it also has problems such as high enforcement costs and damage to enterprise efficiency. Based on the market, environmental protection tax guides the behavior of enterprises through market signals. It encourages polluters to reduce the level of pollution discharge or stop polluting so that the overall pollution situation of society tends to be controlled and improved. Therefore, environmental protection tax is an incentive for environmental regulation based on the market. It gives enterprises a degree of choice and encourages them to adopt cheap and better pollution control technology. Secondly, there is a time-lag effect in the response of enterprises to the environmental protection tax, and it takes some time to reveal its effect. Environmental regulation is mandatory, while environmental protection tax is an incentive tool—combining the above two influences enterprise behavior from different angles. For example, it stimulates enterprises to innovate environmental protection technology and production model. Enterprise innovation activities increase short-term costs but also increase long-term benefits. Therefore, enterprises may conduct different types and degrees of earnings management based on long-term and short-term strategies.

Hence, we have the following hypotheses:

Hypothesis 3a:. Environmental regulation and environmental tax work together to promote the upward earnings management of enterprises.

Hypothesis 3b:. Environmental regulation and environmental tax work together to promote the downward earnings management of enterprises.

4 Research design

4.1 Data and samples

Our sample covers A-share heavily polluted listed companies in Shanghai and Shenzhen stock exchanges between 2012 and 2018.1 We select the samples as follows: 1) Select the listed companies in the 2008 classified management list of listed companies’ environmental verification industry of the Ministry of Environmental Protection; 2) Eliminate ST and ST* enterprises, enterprises with missing data and financial enterprises; 3) Eliminate enterprises with abnormal data. At the same time, to avoid the influence of extreme values, the main continuous variables are winsorized at the level of 1% and 99%. The data of this paper comes from the CSMAR (China Stock Market Accounting Research) database.

4.2 Index construction

4.2.1 Explained variables

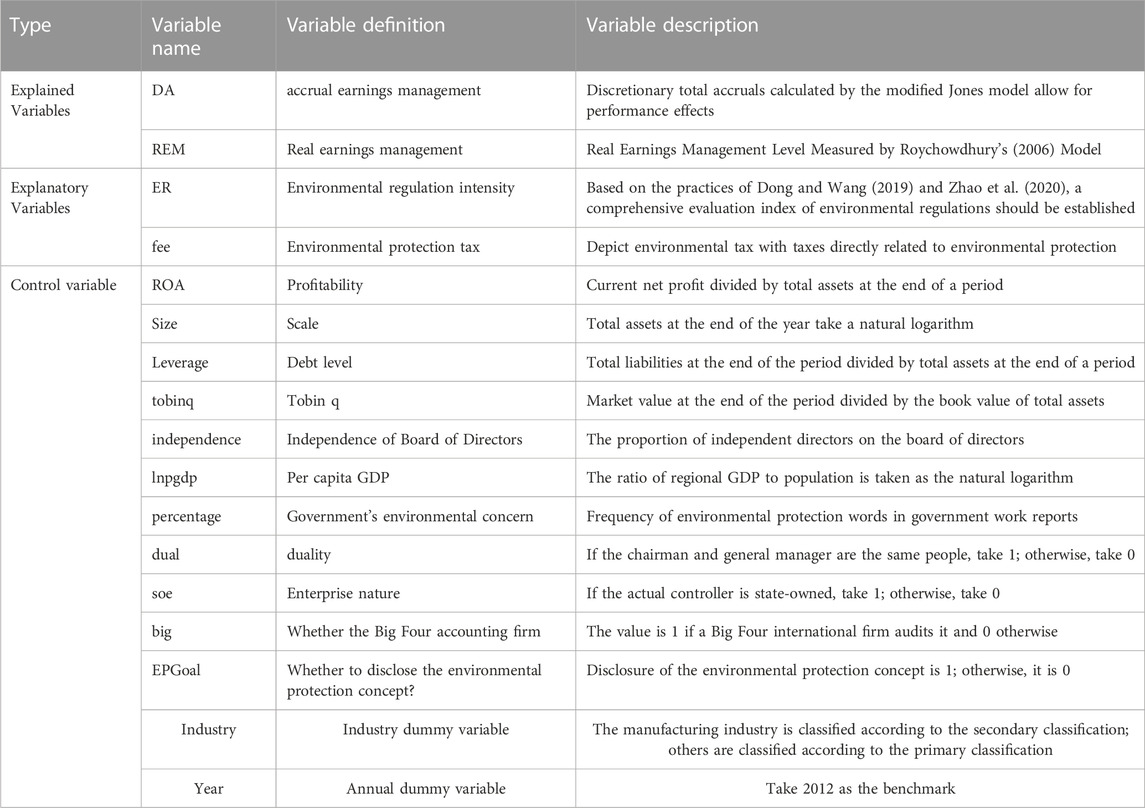

Accrual earnings management: We use the manipulated accruals calculated by the modified Jones model considering the impact of performance as the proxy variable of earnings management to analyze the impact of environmental regulations on corporate accruals, as defined in Table 2 and denoted as DA.

Real earnings management: According to Roychowdhury (2006), we calculate abnormal operating cash flow, abnormal expenses, and abnormal product costs to finally obtain the real earnings management index, which is recorded as REM and defined in Table 2.

4.2.2 Explanatory variables

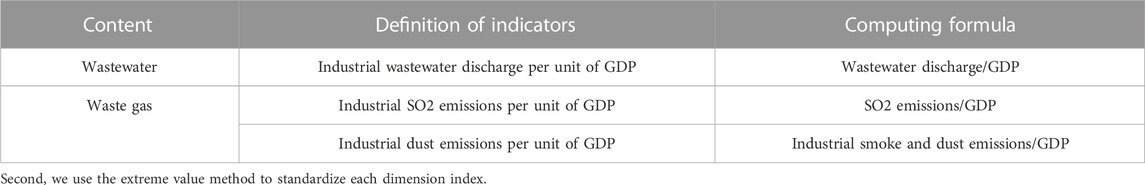

4.2.2.1 Environmental regulation

Following Dong and Wang (2019) and Zhao et al. (2020), we use the environmental regulation index as the comprehensive evaluation index of environmental regulation. And we take this environmental regulation index as an explanatory variable. The calculation process is as follows:

First, we use the unit GDP emission as the dimension index, which is recorded as

Among them,

Third, we calculate the adjustment coefficient of each dimension index. Different cities have different populations and economic development scales, and their pollutant emissions are also different. In order to strengthen the comparability of pollution emission levels in different cities, we introduce an adjustment parameter that reflects the intensity of per capita GDP pollution emission of each city. The adjustment factors are as follows:

Among them,

Finally, we calculate the city (union, state) environmental regulation index:

4.2.2.2 Environmental tax

Environmental protection tax emphasizes the incentive adjustment of tax on corporate behavior. The environmental protection tax is characterized by fees and taxes directly related to environmental protection. From 2012 to 2017, the environmental protection tax is replaced by sewage charges, plus resource tax, farmland occupation tax, urban maintenance and construction tax, travel tax, vehicle purchase tax, and urban land use tax, and 2018 is, the environmental protection tax.

4.2.3 Control variables

According to the research of Du et al. (2021), we select the following indicators as the control variables: corporate profitability (ROA), corporate Size (SIZE), corporate debt level (Leverage), Tobin Q (tobinq), board independence (independence), gross domestic product per capita (GDP), CEO and the chairman of the board is the same person (dual), whether or not it is audited by the four largest international firms (big). At the same time, considering the government’s attention to environmental protection and whether the disclosure of environmental objectives by enterprises will affect the earnings of enterprises, we add the government’s environmental concern (percentage) as the control variable. According to the research of Li et al. (2020); Li et al. (2021), considering the impact of corporate environmental responsibility on corporate behavior, the disclosure of environmental objectives (EPGoal) is added as the control variable.

Table 2 shows the definition of variables.

4.3 Model construction

Multiple regression analysis is an effective method to study the relationship between multiple variables. It can not only determine whether there is a correlation between several specific variables but also predict or control the value of another variable according to the value of one or several variables and the accuracy it can achieve. It can also carry out factor analysis. For example, among many variables (factors) that jointly affect a variable, it could find out which are essential and which are secondary factors. This paper selects a multiple regression model to analyze better the impact of environmental regulation and environmental protection tax on earnings management and exclude the interference of other factors.

Firstly, we construct model one to verify the influence of environmental tax and environmental regulation on enterprises’ accrual earnings management:

Secondly, based on model 1, we add the interaction term of environmental tax and environmental regulation. We construct model two to verify the joint effect of environmental tax and environmental regulation on enterprise accrual earnings management:

Among Model 1 and Model 2,

Thirdly, we construct model three to verify the influence of environmental tax and environmental regulation on the real earnings management of enterprises:

Fourthly, based on Model 3, we add the interaction term of environmental tax and environmental regulation. We construct Model four to verify the joint effect of environmental tax and environmental regulation on the real earnings management of enterprises:

Among Model 3 and Model 4,

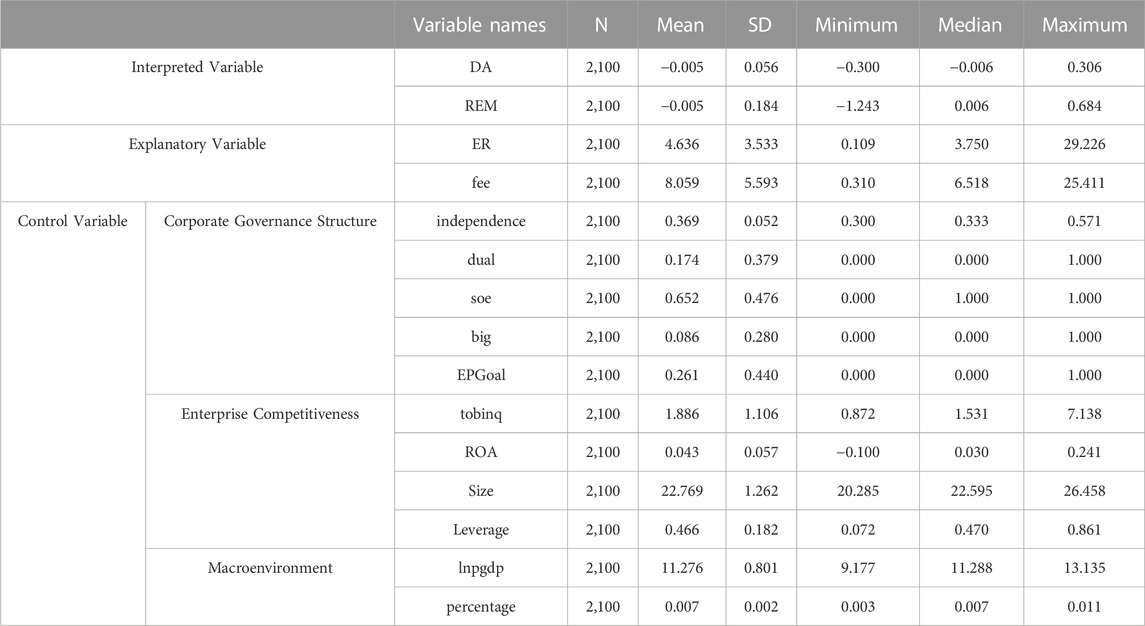

4.4 Descriptive statistical analysis of data

Table 3 presents the descriptive statistics for the main variables used in the analysis. The samples of this paper are 300 heavy pollution A-share listed companies in the Shanghai and Shenzhen Stock markets, with a total of 2,100 firm-year observations from 2012 to 2018.

The average value of accrual earnings management and real earnings management in the table is less than 0, indicating that enterprises are more inclined to conduct downward earnings management. The average value of environmental protection tax is 8.059, which is greater than the median, indicating that the intensity of environmental protection tax collection in most regions is lower than the average level. The average value of environmental regulation is 4.636, which is greater than the median, indicating that the intensity of environmental regulation in most regions is lower than the average level.

5 Analysis of empirical results

5.1 Analysis of basic results

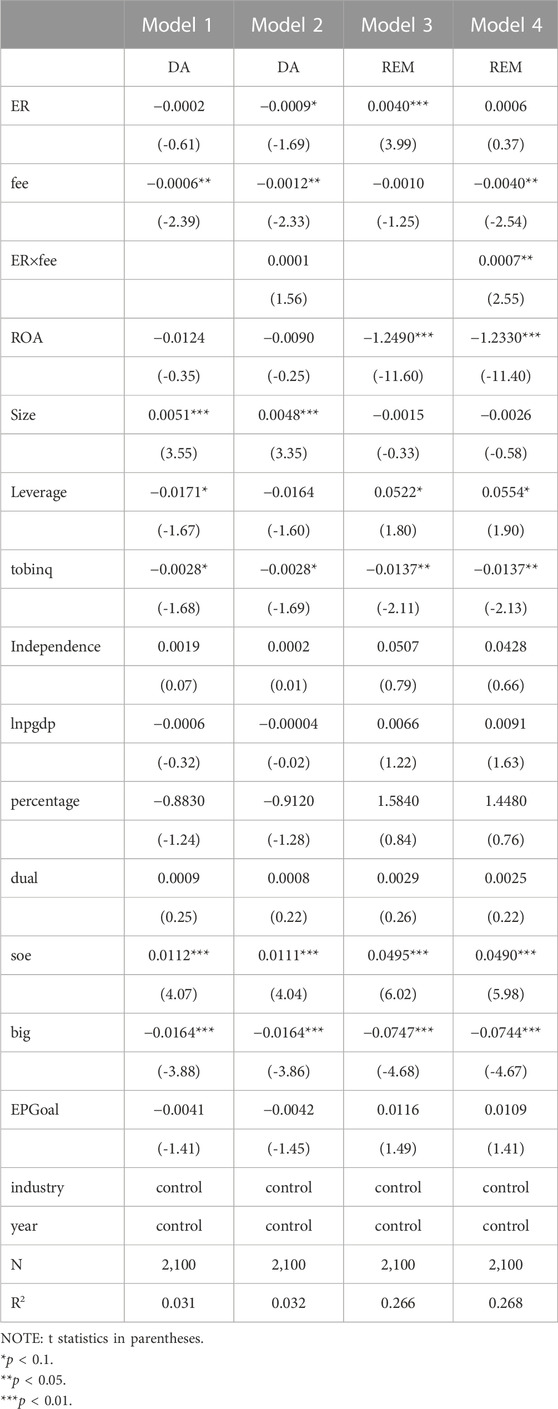

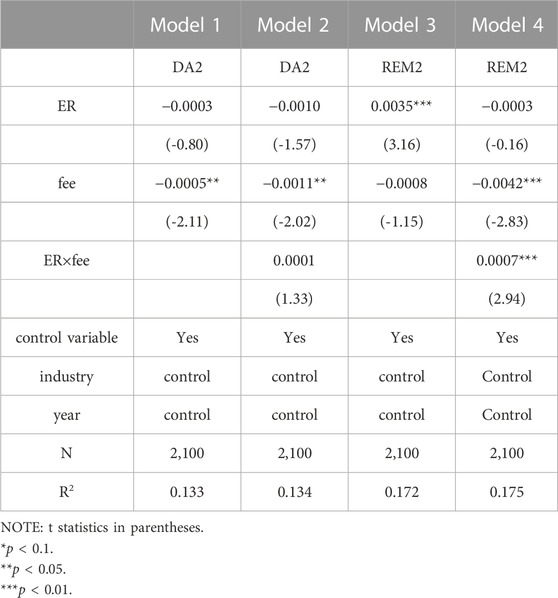

According to the research hypothesis, we empirically analyze the influence of environmental regulation, environmental tax, and the joint effect of environmental regulation and environmental tax on enterprise earnings management. Table 4 shows the results of the full sample moderating effect analysis.

Model one shows that the coefficient between environmental regulation and enterprise accrual earnings management is negative but not significant, indicating that environmental regulation has no significant impact on enterprise accrual earnings management. With the strengthening of environmental regulations, enterprises face more substantial supervision. As a result, it is more difficult for enterprises to manage their accrued earnings. As we can see from Table 4, environmental regulations have no significant impact on their accrual earnings management. The environmental tax has a significant negative effect on the enterprise accrual earnings management, which indicates that the environmental tax will promote the enterprise to conduct downward accrual earnings management. We can see from Table 4 that 100 units increase in environmental tax will increase enterprises’ downward earnings management level by 0.6 units. To conduct tax planning, enterprises will conduct downward accrual earnings management.

Model two shows that the interaction term of environmental regulation and environmental tax has a positive but not significant coefficient on enterprise accrual earnings management, indicating that the interaction term of environmental regulation and environmental tax has no significant impact on enterprise accrual earnings management. Intense supervision of environmental regulations makes it more difficult for enterprises to conduct accrual earnings management, and it is easy to be caught as “typical."Even if enterprises have the motivation to conduct accrual earnings management under the combined effect of environmental regulation and environmental protection tax, they will avoid implementing it or seek other methods.

In Model 3, the estimated coefficient on environmental regulation is significantly positive, indicating that environmental regulation will promote upward real earnings management. When the intensity of environmental regulation increases by 100 units, the enterprise’s upward real earnings management level increases by 0.4 units. Environmental regulation increases the cost of enterprises and encourages enterprises to carry out upward real earnings management to obtain more investment, financing, or other benefits.

Moreover, real earnings management is more hidden. Environmental taxes have no significant effect on real earnings management, and the real earnings management of enterprises will distort the normal business activities of enterprises. The environmental tax encourages enterprises to innovate and gives play to the “innovation compensation” effect to make up for the cost brought by the environmental tax. At this point, the environmental tax has an insufficient driving force on the real earnings management of enterprises.

Model four shows that the interaction term of environmental regulation and environmental tax has a significant positive coefficient on corporate real earnings management, which indicates that the joint effect of environmental regulation and environmental tax will promote corporate real earnings management. Both environmental regulation and environmental tax will increase the cost of enterprises and bring financial pressure to enterprises. To relieve this pressure, enterprises carry out upward real earnings management.

To sum up, the results verify Hypothesis H1a: environmental regulation promotes enterprises to conduct upward real earnings management. The results verify H2b: environmental protection tax will promote enterprises to conduct downward accrual earnings management. The results also verify H3a: the joint effect of environmental regulation and environmental protection tax promotes upward real earnings management of enterprises.

In terms of the influence of control variables on accrual earnings management, the coefficients on enterprise size and enterprise nature are significantly positive, indicating that state-owned enterprises and large enterprises tend to conduct upward accrual earnings management. State-owned and large-scale enterprises have non-market motives such as political seeking and job promotion in earnings management. There is a channel for managers of state-owned and large-scale enterprises to choose positions between enterprises and the government. For example, many executives of state-owned enterprises are promoted to government positions and even local party committees. Some prominent enterprise executives can also hold positions in the National People’s Congress, the Chinese People’s Political Consultative Conference, and other institutions. Therefore, managers seeking political interests or promotion opportunities may promote enterprises to conduct upward accrual earnings management.

The coefficients on corporate debt level, Tobin’s Q, and whether audited by the Big Four auditing firms are significantly negative, indicating that companies with high debt levels, high Tobin’s Q value, and audited by the Big Four firms tend to conduct downward accrual earnings management. One of the reasons is to “cry poor” to seek favors or a more favorable external environment, such as tax breaks, government subsidies, or less stringent environmental regulations.

The coefficients on corporate profitability, board independence, per capita GDP, government’s attention to environmental protection, duality (CEO and the chairman of the board are the same people), and whether to disclose corporate environmental protection goals are not significant, indicating that these factors have no significant impact on corporate accrual earnings management. The above results are consistent with the conclusion of corporate earnings management motivation analysis. The main factors affecting corporate earnings management are not strongly related to the corporate governance structure and regional economic development level.

From the perspective of the influence of control variables on real earnings management, the coefficients on corporate debt level and corporate nature are significantly positive, indicating that state-owned enterprises and enterprises with high debt levels tend to conduct upward real earnings management. The desire of highly indebted enterprises and state-owned enterprises to hide their operating conditions through real earnings management is more apparent, and the concealment of real earnings management is relatively good. The phenomenon is that enterprises with high debt levels and state-owned holding enterprises are more likely to conduct upward real earnings management, which may be related to enterprise performance, executive compensation, and employee welfare. Those are also the common motivation of enterprise earnings management. The coefficients on corporate profitability, Tobin’s Q, and whether audited by the Big Four auditing firms are significantly negative, indicating that companies with high profitability, high Tobin’s Q value, and audited by the Big Four firms are unwilling to conduct upward real earnings management. Consistent with the motivation hypothesis of corporate earnings management, firms with high profitability, large Tobin’s Q value, and firms audited by the Big Four firms do not have the inherent demand for upward earnings management. Some enterprises may also conduct downward earnings management to “leave the room” for the future and “wiggle room” in operation.

The coefficients on enterprise size, board independence, per capita GDP, government attention to environmental protection, duality (CEO and the chairman of the board are the same people), and disclosure of corporate environmental objectives are not significant, indicating that these factors have no significant impact on real earnings management of enterprises. As mentioned above, the results are consistent with the conclusions of corporate earnings management motivation analysis. The main factors affecting corporate earnings management are not strongly correlated with a corporate governance structure and regional economic development level.

5.2 The robustness test

Different measurement criteria may have different effects on the results. For Model one and Model two in Table 5, we use the modified Jones model to estimate the expected discretionary accruals each year using all the firm-year observations. We denote the final calculated result as DA2. For Model three and Model four in Table 5, we follow Li (2009) in measuring the enterprise real earnings management level (REM2). Then we use the above two calculated results (DA2 and REM2) to analyze the reliability of the test results. Table 5 presents the robustness test results.

In Model one and Model 2, the explained variable is accrual earnings management (DA2), which the modified Jones model measures. The results of Model one and Model two show that the coefficients on environmental regulation and environmental tax are negative but not significant. Model two shows that the interaction term of environmental regulation and environmental tax is positive but insignificant. This result is consistent with the previous results when the modified Jones model calculates the accrual earnings management (DA) with a performance impact. Consequently, the robustness test further verifies the validity of the previous analysis.

In Model three and Model 4, we follow Li et al. (2009) to measure the real earnings management level (REM2). Model three shows that the coefficient on environmental regulation is significantly positive. Model four shows that the interaction term of environmental regulation and environmental protection tax is significantly positive. It is consistent with the analysis results when the real earnings management level (REM) of enterprises is measured by Roychowdhury’s (2006) model. To sum up, the results obtained from the models we constructed in this study are robust.

5.3 Further analysis

5.3.1 Heterogeneity analysis of accrual earnings management based on profit adjustment

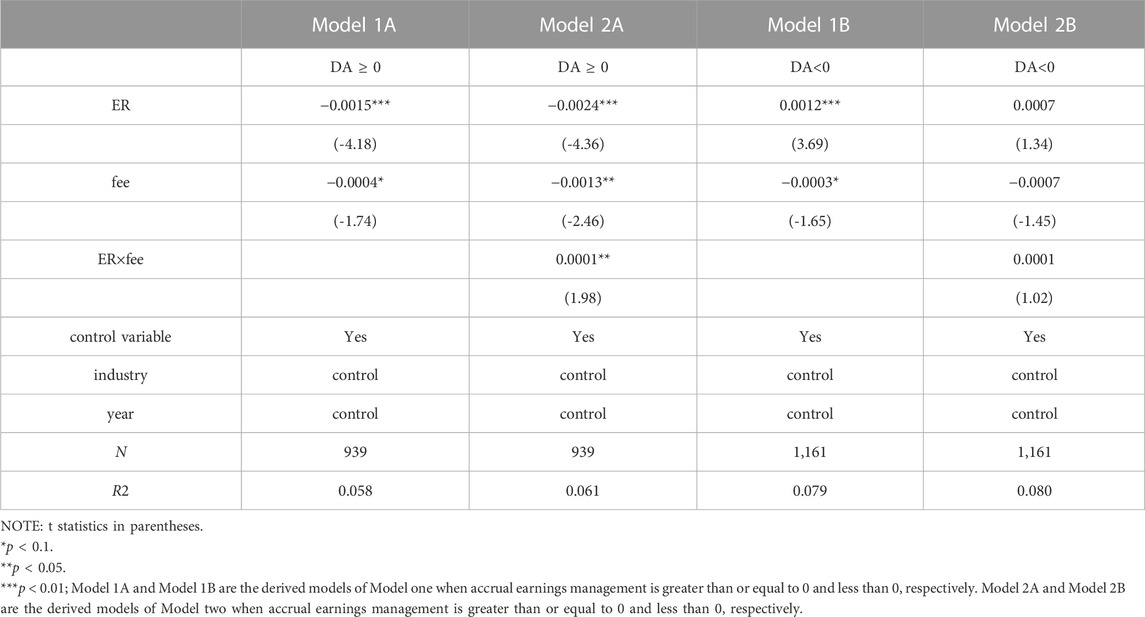

To further discuss the impact of environmental regulation and environmental protection tax on the enterprise’s accrual earnings management, we divide enterprises’ accrual earnings management into the accrual earnings management of increasing profits and the accrual earnings management of reducing profits. Table 6 shows the results of the heterogeneity analysis.

The results of Model 1A show that the coefficient on environmental regulation and environmental tax is significantly negative, indicating that environmental regulation and environmental tax will inhibit enterprises from increasing profit accrual earnings management. For every 100 units increase in the intensity of environmental regulation, the enterprises’ profit-increasing accrual earnings management will decrease by 0.15 units. For every 100 units of environmental protection tax increase, the enterprises’ profit-increasing accrual earnings management will decrease by 0.04 units. Based on the regulation motivation, enterprises are unwilling to carry out upward accrual earnings management to avoid higher supervision intensity.

Model 2A shows that the interaction term of environmental regulation and environmental tax is significantly positive, indicating that the combined effect of environmental regulation and environmental tax will promote the enterprise to conduct profit-increasing accrual earnings management. Under the joint action of environmental regulation and environmental tax, enterprises are under more significant financial pressure due to rising costs. Based on the motivation of the capital market, enterprises will carry out upward accrual earnings management in this situation.

Model 1B shows that environmental regulation has a significant positive effect on accrual earnings management, which indicates that environmental regulation can promote enterprises to carry out profit-decreasing accrual earnings management. For every 100 units increase in the intensity of environmental regulation, the enterprises’ profit-decreasing accrual earnings management will increase by 0.12 units. For these enterprises, environmental regulations lead to rising costs. Then the downward accrual earnings management will bring financing pressure. Therefore, enterprises are reluctant to carry out downward accrual earnings management based on the motivation of the capital market.

Model 2B shows that the interaction coefficient of environmental regulation and environmental tax is positive but insignificant, indicating that the joint effect of environmental regulation and environmental protection tax has no significant impact on enterprises’ profit-reducing accrual earnings management.

5.3.2 Heterogeneity analysis based on internal and external factors

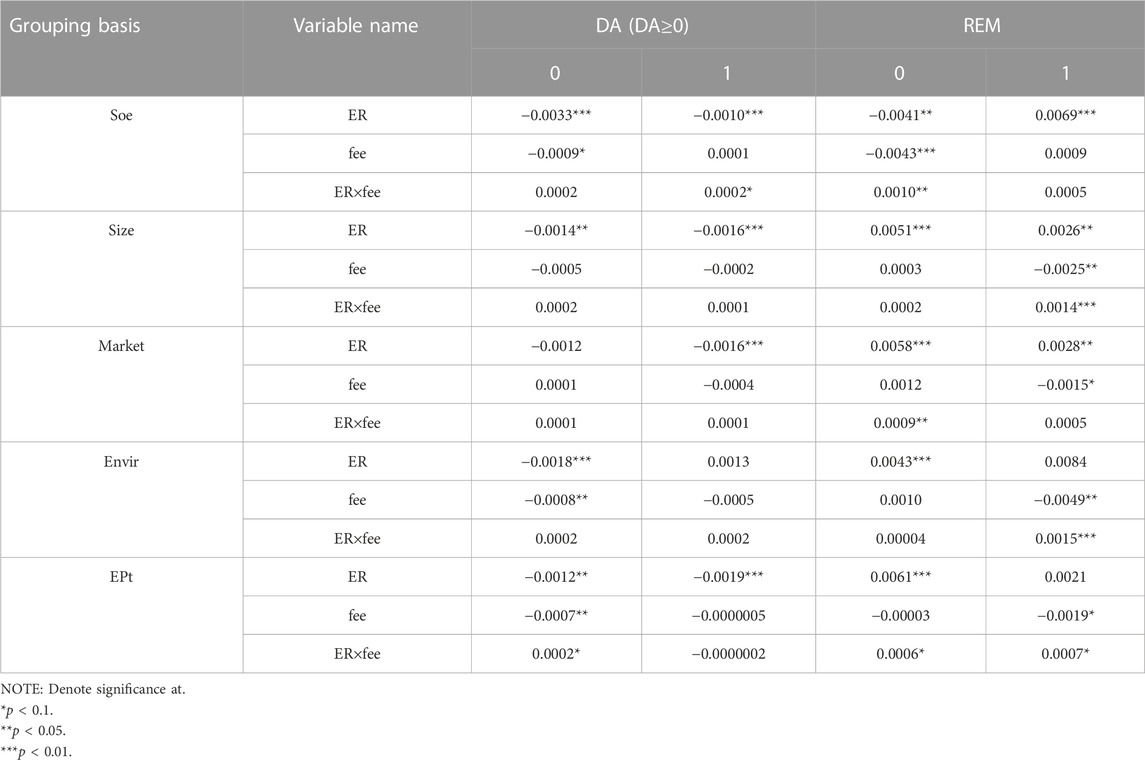

We grouped and analyzed the nature of enterprise ownership, the scale of production, the degree of marketization, the scale of environmental protection investment by the local government, whether the enterprise disclosed environmental protection targets, and different environmental protection actions taken by the enterprise. Table 7 presents the results.

5.3.2.1 Group analysis according to the nature of enterprise ownership

Environmental regulations inhibit the upward accrual earnings management in state-owned and non-state-owned enterprises, promote the upward real earnings management in state-owned enterprises, and inhibit the upward real earnings management in non-state-owned enterprises. After the state-owned enterprises bear the social responsibility, the cost pressure brought by the environmental regulation encourages the state-owned enterprises to carry out upward earnings management because of the financing motivation or management political motivation. Non-state-owned enterprises face more substantial supervision and are more inclined to carry out upward real earnings management because real earnings management is more hidden.

Environmental tax inhibits non-state-owned enterprises from upward accrual earnings management and real earnings management. Generally, non-state-owned enterprises have more substantial incentives to conduct tax planning or tax avoidance and are more motivated to conduct earnings management.

The joint effect of environmental regulation and environmental protection tax promotes the upward accrual earnings management in state-owned enterprises and the upward real earnings management in non-state-owned enterprises. Under the joint action of environmental regulation and environmental tax, the cost of enterprises rises, so enterprises tend to carry out upward earnings management to a certain extent. State-owned enterprises undertake more social responsibilities, so they choose accrual earnings management that is harmless for their operating income. Non-state-owned enterprises may choose more hidden real earnings management to avoid supervision.

5.3.2.2 Group analysis according to the size of the enterprise

Regardless of the size of enterprises, environmental regulation inhibits upward accrual earnings management and promotes upward real earnings management, and there is no significant difference between groups.

Environmental protection tax inhibits the upward real earnings management of large-scale enterprises. Large-scale firms face a more extensive tax base, and the gains from tax planning are more significant, so they choose to engage in downward real earnings management.

The joint effect of environmental regulation and environmental protection tax promotes large-scale enterprises’ upward real earnings management. Under the joint action of environmental regulation and environmental protection tax, enterprises’ cost increases. Large-scale enterprises have a great demand for capital and face intense supervision, so they choose more hidden real earnings management to obtain market or political interests.

5.3.2.3 Group analysis according to the degree of marketization

In regions with a high degree of marketization, environmental regulation has a more significant inhibitory effect on enterprises’ upward accrued management. Regardless of the degree of marketization in the region where enterprises are located, environmental regulation promotes enterprises to carry out upward real earnings management. This result indicates that the upward real earnings management of the enterprise has nothing to do with the degree of marketization in the region where the enterprise is located.

Environmental protection tax inhibits upward real earnings management for firms in regions with a high degree of marketization. Generally, regions with a high degree of marketization have higher environmental protection requirements and intensity of environmental regulation. In this way, in places with a high degree of marketization, the environmental tax will have a more significant inhibitory effect on the real earnings management of enterprises.

For enterprises in regions with low marketization degrees, the joint effect of environmental regulation and environmental protection tax promotes upward real earnings management. In the regions with low marketization degree, the role of market mechanism is weaker, and non-market factors are more influential. By conducting upward real earnings management, enterprises can more effectively regulate the relationship between enterprises and the outside world to obtain more market and non-market interests.

5.3.2.4 Group analysis according to the level of government environmental protection investment

Environmental regulation inhibits enterprises in areas with low government investment in environmental protection from upward accrual earnings management but promotes upward real earnings management. In the regions with low government investment in environmental protection, the willingness of the government to regulate the environment is weaker. Although environmental regulation brings cost pressure to enterprises and enterprises face a certain degree of supervision, enterprises are strongly willing to show their business performance. Consequently, when accrual earnings management is inhibited, enterprises have more incentives for real earnings management.

Environmental taxes inhibit upward accrual earnings management of enterprises in areas with low government environmental protection investment and inhibit upward real earnings management of enterprises in areas with high government environmental protection investment. Regions with low environmental protection investment have weak government supervision and can choose accrual earnings management to reduce tax revenue. Regions with high marketization degrees can only choose covert real earnings management.

The combined effect of environmental regulation and environmental protection tax promotes upward real earnings management of firms in regions with high government investment in environmental protection. In regions with high government investment in environmental protection, the government pays more attention to environmental protection, and enterprises face more significant pressure from environmental regulation. The superposition of the dual cost pressure of environmental regulation and environmental protection tax promotes the increase of corporate financing demand, and the choice of upward real earnings management is conducive to realizing financing goals.

5.3.2.5 Group analysis according to whether the enterprise discloses the environmental protection concept

Regardless of whether the enterprise discloses the concept of environmental protection, environmental regulation inhibits the upward accrual earnings management of the enterprise, indicating that the inhibitory effect of environmental regulation on accrual earnings management has nothing to do with whether the enterprise discloses the concept of environmental protection. Environmental regulation promotes upward real earnings management of enterprises that do not disclose environmental protection concepts, indicating that enterprises that do not disclose environmental protection concepts receive low external attention and prefer to conduct upward real earnings management to obtain certain benefits.

The environmental protection tax inhibits the upward accrual earnings management of enterprises that do not disclose the environmental protection concept. In contrast, the environmental protection tax inhibits the upward real earnings management of enterprises that discloses the environmental protection concept. On the other hand, the environmental protection tax inhibits enterprises that disclose environmental protection concepts from conducting upward real earnings management. Environmental protection tax inhibits upward accrual earnings management of enterprises that do not disclose the environmental protection concept, which is consistent with the impact of environmental regulation. However, environmental protection tax inhibits the upward real earnings management of enterprises that disclose environmental protection concepts, which is inconsistent with environmental regulation promoting the upward real earnings management of enterprises that do not disclose environmental protection concepts. If environmental protection tax is regarded as incentive environmental regulation, it shows that different types of environmental regulation have different effects on enterprise earnings management. For example, enterprises may conduct downward earnings management to avoid taxes. Still, enterprises that disclose environmental protection concepts face more public attention and tend to conduct more hidden real earnings management.

The joint effect of environmental regulation and environmental protection tax promotes upward accrual earnings management of enterprises that do not disclose the concept of environmental protection. Whether the enterprise discloses the concept of environmental protection or not, the combined effect of environmental regulation and environmental protection tax promotes the upward real earnings management of the enterprise. As mentioned above, environmental protection tax inhibits the upward earnings management of enterprises that do not disclose environmental protection information, and the inhibitory effect of environmental regulation on the upward earnings management of enterprises has nothing to do with whether they disclose environmental protection information. In other words, environmental regulation and environmental protection tax have an inhibitory effect on the upward accrual earnings management of enterprises that do not disclose environmental protection concepts. Still, the joint effect of environmental regulation and environmental protection tax promotes the upward accrual earnings management of enterprises that do not disclose environmental protection concepts.

6 Conclusion and recommendations

6.1 Main conclusion

1) Environmental regulation promotes enterprises’ upward real earnings management and is independent of the size of enterprises and the marketization degree of the region in which enterprises are located. Environmental regulation promotes the downward real earnings management of non-state-owned enterprises. State-owned enterprises, regions with less government investment in environmental protection, and enterprises with undisclosed environmental concepts are more inclined to carry out upward real earnings management.

2) Environmental regulation inhibits the accrual earnings management of enterprises to increase profits, and it has nothing to do with the nature of enterprises, the size of enterprises, and whether to disclose the concept of environmental protection. Enterprises in the regions with high marketization degrees and those in the regions with less government investment in environmental protection are less willing to manage accrual earnings to increase profits.

3) Environmental protection tax also inhibits the enterprises’ profit-increasing accrual earnings management, which is independent of enterprise size and the marketization degree of the region where the enterprise is located. Non-state-owned enterprises, enterprises in regions with less government investment in environmental protection, and enterprises without disclosing the concept of environmental protection have less willingness to manage accruals to increase profits.

4) The combined effect of environmental regulation and environmental protection tax promotes enterprises to carry out upward real earnings management, and it has nothing to do with whether to disclose the concept of environmental protection. Under the joint effect of environmental regulation and environmental protection tax, non-state-owned enterprises, large-scale enterprises, enterprises in areas with low marketization degree, and enterprises in areas with high government investment in environmental protection are more inclined to upward real earnings management.

5) The combined effect of environmental regulation and environmental protection tax promotes the accrual earnings management of enterprises, which is not related to the size of enterprises, the degree of marketization in the region where enterprises are located, and the amount of government investment in environmental protection. Under the joint effect of environmental regulation and environmental protection tax, state-owned enterprises and enterprises that do not disclose the concept of environmental protection are more inclined to carry out accrual earnings management to increase profits.

6.2 Recommendations

1) We should improve policies and regulations such as environmental regulation and environmental protection tax. Environmental regulation and environmental protection tax systems are essential policies and measures to achieve carbon peak and neutrality. We should not only constantly improve the system of environmental regulation, environmental protection tax, and other policies and regulations but also constantly improve the transparency of implementation of environmental regulation, environmental protection tax, and other policies and regulations. At the same time, we should also improve the market trading system of carbon emission rights and the enterprise environmental protection evaluation system, give full play to the role of the market mechanism, and encourage enterprises to innovate production mode and production technology.

2) We need to improve and give full play to the role of environmental protection tax in guiding, regulating, and motivating enterprises. Environmental protection tax is a means to promote the green production of enterprises. In response to the impact of COVID-19 in the past 3 years, preferential policies for environmental protection taxes have been implemented, such as deferred tax payments. These policies can not only help enterprises tide over difficulties but also avoid too much tax burden pressure that may strengthen the motivation of earnings management.

3) We need to develop unified standards for corporate environmental information disclosure. Enterprises do not disclose or selectively disclose environmental protection information, which makes it more difficult for the government to regulate or provides opportunities for enterprises that are more inclined to conduct earnings management (Li et al., 2022). At the same time, we need to make it mandatory for enterprises to disclose relevant environmental protection information, which is conducive to government supervision and improving enterprises’ awareness of social responsibility.

4) We should further improve enterprises’ business environment and market system. Enterprises conduct earnings management for certain motives, such as obtaining financing and reducing financing costs (Li et al., 2022), “crying poor” to obtain government subsidies, or operators to obtain higher salaries or other non-market interests. A sound business environment and market system are conducive to avoiding the transformation of these motives into corporate behaviors and can even eliminate part of the motives for earnings management.

5) We need to consider the combined effect of environmental regulation and environmental protection tax. Environmental regulation is mandatory, and environmental protection tax is an incentive. Environmental regulation may distort the optimal behavior of enterprises, which is supplemented by environmental taxation (Tanaka and Tanaka, 2022). We need to pay close attention to the status of enterprises in real time, rationally use the combination of mandatory regulation and incentive regulation, give full play to the role of policy tools in guiding and supervising enterprises, and promote the sustainable and healthy development of enterprises.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

SF, JY, and DX designed the research and wrote the manuscript. SF, ZC, and GY conducted data analysis and verification, modifying and finalizing the paper. All authors contributed to the article and approved the submitted version.

Conflict of interest

GY was employed by Xiamen Airlines Co Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1In February 2012, China promulgated ambient air quality standards. Considering the policy impact, the data before 2012 are not selected. After 2018, some data have changed in statistical caliber. Due to the impact of COVID-19, the production and operation of Chinese enterprises from 2020 to 2022 are not normal, so the relevant data are not consistent and comparable. Combined with the availability of data and the consistency of statistical caliber, this paper selects data from 2012 to 2018 as research samples.

References

Aldy, J. E. (2016). Frameworks for evaluating policy approaches to address the competitiveness concerns of mitigating greenhouse gas emissions. Resources for the Future Discussion Paper 16-06.

Ambec, S., and Barla, P. (2002). A theoretical foundation of the Porter hypothesis. Econ. Lett. 75 (3), 355–360. doi:10.1016/s0165-1765(02)00005-8

Arouri, M. E. H., Caporale, G. M., Rault, C., Sova, R., and Sova, A. (2012). Environmental regulation and competitiveness: Evidence from Romania. Ecol. Econ. 81 (1), 130–139. doi:10.1016/j.ecolecon.2012.07.001

Aupperle, K. E., Carroll, A. B., and Hatfield, J. D. (1985). An empirical examination of the relationship between corporate social responsibility and profitability. Acad. Manag. J. 28 (2), 446–463. doi:10.5465/256210

Dong, Z., and Wang, H. (2019). The effect of "local-neighborhood" green technology progress on environmental regulation. China Ind. Econ. 1, 100–118.

Du, Y., Fan, S., and Deng, X. (2021). Joint ownership and corporate earnings management [J]. China Ind. Econ. 6, 155–173.

Duan, Z., and Wang, L. (2017). Comparative study of green taxes and tradable permits. China's Strateg. organs 40, 11. doi:10.19474/j.carolcarrollnki.10-1156/f,002255

Hart, S. L. (1995). A natural-resource-based view of the firm. Acad. Manag. Rev. 20 (4), 986–1014. doi:10.5465/amr.1995.9512280033

He, J. (2016). The policy effect of deferred executive compensation on bank risk-taking: A PSM-DID analysis from the perspective of bank earnings management motivation. China Ind. Econ. 11, 126–143.

He, M., and Walheer, B. (2020). Technology intensity and ownership in the Chinese manufacturing industry: A labor productivity decomposition approach. Natl. Account. Rev. 2 (2), 110–137. doi:10.3934/NAR.2020007

Huang, R., and Zhou, H. (2021). The impact of the new environmental protection law on earnings management of heavy polluting enterprises: An empirical test based on the political cost hypothesis. China Environ. Manag. 13 (02), 63–71.

Kallunki, J. P., and Martikainen, M. (1999). Do firms use industry–wide targets when managing earnings Finnish evidence? Int. J. Account. 2, 249–259. doi:10.1016/s0020-7063(99)00004-7

Kang, P., and Ru, S. (2020). The bilateral effect of green innovation on environmental regulation. China Popul. Resour. Environ. 30 (10), 93–104.

Li, B., Zhang, J., and Guo, H. (2009). Research on the relationship between accounting flexibility and real activity manipulation in earnings management. Manag. Rev. 21 (06), 99–107.

Li, T., Li, X., and Liao, G. (2022). Business cycles and energy intensity. Evidence from emerging economies. Borsa Istanb. Rev. 22 (3), 560–570. doi:10.1016/j.bir.2021.07.005

Li, Z., Chen, H., and Mo, B. (2022a). Can digital finance promote urban innovation? Evidence from China. Borsa Istanb. Rev. doi:10.1016/j.bir.2022.10.006

Li, Z., Liao, G., and Albitar, K. (2020). Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. Bus. Strategy Environ. 29 (3), 1045–1055. doi:10.1002/bse.2416

Li, Z., Zou, F., and Mo, B. (2021). Does mandatory CSR disclosure affect enterprise total factor productivity? Economic Research-Ekonomska Istraživanja, 1–20. doi:10.1080/1331677X.2021.2019596

Liu, J., Xu, T., and Lu, J. (2021). Does M&A performance compensation Promise induce earnings Management? J. Manag. Sci. 24 (10), 82–105.

Liu, Y., Failler, P., and Ding, Y. (2022). Enterprise financialization and technological innovation: Mechanism and heterogeneity. PloS One 17 (12), e0275461. doi:10.1371/journal.pone.0275461

Palmer, K., Oates, W. E., and Portney, P. R. (1995). Tightening environmental standards: The benefit-cost or the No-cost paradigm? J. Econ. Perspect. 9 (4), 119–132. doi:10.1257/jep.9.4.119

Roychowdhury, S. (2006). Earnings management through real activities manipulation. Manip. J. Account. Econ. 42 (3), 335–370. doi:10.1016/j.jacceco.2006.01.002

Simpson, R. D., and Bradford, R. L. (1996). Taxing variable cost: Environmental regulation as industrial policy. J. Environ. Econ. Manag. 30 (3), 282–300. doi:10.1006/jeem.1996.0019

Song, X., Ruan, Y., and Zheng, K. (2017). Major shareholder participation, earnings management and price deviation of private placement. Finance Trade Res. 28 (10), 86–97.

Tanaka, H., and Tanaka, C. (2022). Sustainable investment strategies and a theoretical approach of multi-stakeholder communities. Green Finance 4 (3), 329–346. doi:10.3934/GF.2022016

Wang, F., Wang, Y., and Liu, S. (2021). Research on the influence of network media report on earnings management -- based on the perspective of investors' abnormal attention. Nankai Manag. Rev. 24 (05), 116–129.

Wang, H., Yin, J., and Zhuo, L. (2019). Does the Introduction of Environmental Protection Tax affect the TFP of enterprises: An empirical test based on the intensity of pollutant discharge fee collection. Finance Res. 30 (6), 87–98. doi:10.19337/j.carolcarrollnki.34-1093/f2019.06.008

Wang, M., Li, L., and Lan, H. (2021). The measurement and analysis of technological innovation diffusion in China's manufacturing industry. Natl. Account. Rev. 3 (4), 452–471. doi:10.3934/NAR.2021024

Wang, S., and Fan, Z. (2021). Study on the effect of environmental protection fee system improvement on enterprises' green innovation: A quasi-natural experiment based on environmental protection fee tax change. Ind. Tech. Econ. 40 (08), 31–39.

Wang, Y., Wang, L., and Gong, C. (2009). Income tax reform, earnings management and its economic consequences. Econ. Res. 44 (03), 86–98.

Watts, R. L., and Zimmerman, J. L. (1986). Positive accounting theory. New Jersey: Englewood Cliffs.

Yang, Y., Yang, Y., and Du, J. (2022). Green taxes to the enterprise the influence of total factor productivity research. J. central Univ. finance Econ. 7, 14–24+47. doi:10.19681/j.carolcarrollnkijcufe.2022.07.001

Ye, H., and Wang, S. (2017). An empirical study on the impact of environmental regulation on corporate financial performance: Based on the mediating effect of green Innovation. Resour. Dev. Mark. 33 (11), 1328–1333.

Yu, L., Zhang, W., and Qian, B. (2019). Research on the backforcing effect of environmental tax on enterprises' green transformation. China Popul. Resour. Environ. 29 (07), 112–120.

Yuan, Z., Wang, Z., and Wenhan, H. (2014). Institutional investors' shareholding and the choice of accrual earnings management and real earnings management behavior. Manag. Sci. 27 (05), 104–119.

Zhang, H., and Wang, X. (2021). Recognition and estimation of earnings management from loss Avoidance and public Issuance: Empirical Evidence from bunching Design. J. Financial Res. 4, 187–206.

Zhao, M., Liu, F., Wang, H., and Sun, W. (2020). FDI, environmental regulation and the Yellow River city green total factor productivity. J. Econ. Geogr. 40 (04), 38–47. doi:10.15957/j.carolcarrollnkiJJDL.2020.04.005

Keywords: environmental regulation, environmental protection tax, earnings management, accrual earnings management, real earnings management

Citation: Fu S, Yuan J, Xiao D, Chen Z and Yang G (2023) Research on environmental regulation, environmental protection tax, and earnings management. Front. Environ. Sci. 11:1085144. doi: 10.3389/fenvs.2023.1085144

Received: 31 October 2022; Accepted: 07 February 2023;

Published: 07 March 2023.

Edited by:

Zhenghui Li, Guangzhou University, ChinaReviewed by:

Huwei Wen, Nanchang University, ChinaKatarina Valaskova, University of Žilina, Slovakia

Gaoke Liao, Guangzhou University, China

Yanting Xu, Guangzhou University, China, in collaboration with reviewer [GL]

Zhehao Huang, Guangzhou University, China

Zimei Huang, Guangzhou University, China, in collaboration with reviewer [ZH]

Copyright © 2023 Fu, Yuan, Xiao, Chen and Yang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shiwen Fu, ZnVzaGl3ZW5AaHVzdC5lZHUuY24=

Shiwen Fu

Shiwen Fu Jianguo Yuan1

Jianguo Yuan1