- 1College of Economics and Management, Hebei Agricultural University, Baoding, China

- 2School of Accounting, Tianjin University of Finance and Economics, Tianjin, China

The existing theoretical research on environmental liability insurance mainly focuses on system construction, development status and other aspects, and mainly consists of normative research, with relatively little empirical research. This paper uses empirical research methods to explore the impact of environmental liability insurance on the green innovation of enterprises and examines the driving role of environmental liability insurance in green innovation from the perspective of green governance. This paper, based on the list of enterprises purchasing environmental pollution liability insurance (EPLI) as published by the Ministry of Ecology and Environment, explores the impact of EPLI on the green innovation of enterprises. It is found that purchasing EPLI can significantly improve the green innovation of enterprises. The effect path test shows that EPLI can promote the green innovation of enterprises by relaxing financing constraints and reducing agency costs. The heterogeneity scenario test shows that compared with non-state-owned enterprises, non-heavily polluting enterprises, and enterprises in regions with a lower intensity of environmental regulation, EPLI plays a stronger role in the promotion of green innovation of state-owned enterprises, heavily polluting enterprises and enterprises in regions with a higher intensity of environmental regulation. In addition, it is found that the promotion effect of EPLI on green innovation is mainly reflected in the significant improvement of high-quality green innovation and the optimization of the structure of the green patent output. This paper affirms the positive role of EPLI on the green operations of enterprises and provides empirical evidence that green insurance serves the development of the green innovation of enterprises.

1 Introduction

Extensive economic development has led to the continuous deterioration of the ecological environment and the frequent occurrence of environmental pollution problems in China. Faced with a serious threat to their lives from environmental pollution, the affected people usually seek civil compensation from the enterprises involved by means of litigation. As the main producers of environmental pollution, enterprises are often required to bear huge numbers of litigation claims, pollution compensation, and environmental remediation costs, and their daily production and business activities will also be extremely adversely affected. Taizhou Environmental Protection Federation in Jiangsu Province sued six chemical enterprises for polluting the environment in 2014, and the cost of compensation was up to RMB 160 million. Such a heavy economic burden may cause the enterprises to go bankrupt and out of business, which undoubtedly slows down the process of high-quality development of China’s economy (Yin et al., 2022).

In order to address this problem, the State Council issued “Several Opinions on the Reform and Development of the Insurance Industry” in 2006, which, for the first time, proposed measures “to develop insurance business such as environmental pollution liability insurance through market operation and policy guidance”. In 2007, the Ministry of Ecology and Environment and China Banking and Insurance Regulatory Commission jointly issued the “Guidance on Environmental Pollution Liability Insurance”, emphasizing that environmental pollution liability insurance, as an important innovation in the environmental management system, is an important means for insured enterprises to use the liability insurance mechanism to protect themselves against the operational risks brought about by pollution accidents and to actively assume social responsibility. In 2013, the Ministry of Ecology and Environment and China Banking and Insurance Regulatory Commission further issued the “Guidance on the Pilot Work of Compulsory Environmental Pollution Liability Insurance”, stating that “compulsory environmental pollution liability insurance takes advantage of insurance instruments to deal with environmental pollution damage in a market-oriented and socialized way, which is of positive significance for enterprises to strengthen their business management”. In 2015, the State Council issued the “Overall Plan for the Reform of the Ecological Civilization System”, emphasizing “the establishment of a compulsory environmental pollution liability insurance system in areas with high environmental risk”. In 2016, seven ministries and commissions such as the People’s Bank of China and the Ministry of Finance jointly issued the “Guidance on Establishing a Green Financial System”, emphasizing the need to vigorously promote the construction of a green financial system that includes compulsory environmental pollution liability insurance, facilitate green innovation and transformation of enterprises in an all-round manner, and promote the green development of China’s economy. It is obvious that the Chinese government attaches great importance to the development of this new type of insurance, namely environmental pollution liability insurance.

Environmental pollution liability insurance (hereinafter referred to as “EPLI”) usually refers to commercial insurance that takes on the insured party’s liability for damages caused to third parties due to the occurrence of environmental pollution accidents as the subject matter (Bie, 2008; Yan, 2009; Li, 2010), which not only has the basic function of insurance but a special function of promoting the green innovation and transformation of the industrial structure (Yin et al., 2022). In theory, EPLI uses market-based means to realize the internalization of the premium expenditure of insured enterprises for operations, directly link insurance premiums to the risk status of enterprises and their risk management level, force enterprises to transform their production processes and upgrade their production processes through economic means, and promote the transformation and upgrade of green innovation (Yin et al., 2022). However, as a special financial system arrangement in China, can environmental liability insurance really promote the green innovation of enterprises? This conclusion is not supported by relevant empirical evidence. Based on this, this paper explores the impact of EPLI on the green innovation of enterprises and its mechanism of action using the method of the multiple linear regression test, in order to understand more comprehensively how green finance supports the high-quality innovative development and the green business of enterprises.

This paper makes the following contributions. Firstly, it enriches the research on the economic consequences of EPLI. The existing research on EPLI mainly consists of normative research, with a focus on system construction, development status, etc. This paper uses an empirical research approach to examine the green innovation-driving role of EPLI from a green governance perspective, providing a theoretical basis for a deeper understanding of the role of EPLI in micro-finance behavior. Secondly, it expands the research on the factors influencing the green innovation of enterprises. There are abundant studies on the factors influencing the green innovation of enterprises, but little research has focused on the relationship between EPLI and the green innovation of enterprises. This paper examines the impact of enterprises purchasing EPLI on green innovation and expands the research on the factors influencing green innovation. Thirdly, it deeply explores the mechanism of action of EPLI in influencing the green innovation of enterprises. The findings of this paper suggest that EPLI acts on the green innovation of enterprises by relaxing financing constraints and reducing agency costs, thus deepening the understanding of how EPLI affects the green innovation of enterprises. Fourthly, it further provides empirical evidence for the specific context in which EPLI affects the green innovation of enterprises. This paper explores whether there are differences in the impact of EPLI on the green innovation of enterprises under different economic scenarios, such as the nature of property rights, the attributes of heavily polluting industries, and the intensity of environmental regulation, clarifies the specific contexts in which EPLI affects green innovation, and provides evidence, support and empirical references for regulators to formulate differentiated green insurance policies and strengthen the green governance effect of EPLI.

2 Literature review

At present, as far as the existing literature on the basic EPLI theory is concerned, scholars at home and abroad have conducted relevant studies mainly from the perspectives of system construction and development status.

2.1 System construction

Wang (2009) pointed out that China should implement strategies to improve environmental protection laws, provide financial support, improve the original insurance and reinsurance markets and form mutual insurance companies; Liu et al. (2019) believed that the design of scientific and reasonable insurance clauses and improvement of the reinsurance mechanism are the keys to the improvement of marine engineering environmental liability insurance. Zheng and Yao (2015) found by comparison that the system of adjusting rates based on the payout ratio has a higher degree of risk differentiation, and therefore recommended that this reward and punishment system be used for EPLI. Fang (2016) pointed out that the innovation of EPLI types and the establishment of a compulsory and voluntary insurance system can promote EPLI development in China. Sun and Gu (2015) argued that the key to the EPLI system lies in the establishment of a mode of “voluntary insurance-based, supported by compulsory insurance".

2.2 Development status

Zhang (2011) pointed out that legislative deficiencies were the main reason for hindering EPLI development; Li (2009)] found that China’s EPLI faced problems such as low motivation of enterprises to take out insurance, insufficient capacity of insurers, and difficulties in implementation by relevant government departments; Yu et al. (2017) identified narrow coverage areas, unreasonable insurance liabilities, high insurance premium rates, and high insurance payout rates as the main problems in China’s EPLI practice; Guo and Zhou (2017) pointed out that the inability to effectively quantify the environmental pollution losses and to set insurance premium rates is the bottleneck in the operation of the EPLI compensation mechanism; Wang et al. (2011); Liu (2015); Chen and Lin (2015),; Li et al. (2015) conducted field research on the EPLI pilot work in different provinces, cities, and regions, and found that there was a general lack of EPLI demand from enterprises and lack of supply from insurers in China (Wang et al., 2011; Chen and Lin, 2015; Li et al., 2015; Liu, 2015). Misheva (2016) analyzed the changing demand among industrial enterprises for EPLI. In combination with the operational mode of highly polluting enterprises, Misheva (2017) analyzed their environmental and risk factors in an integrated manner and pointed out the impact of EPLI on the risk management of industrial enterprises.

In summary, most studies on the EPLI theory are normative studies, with a focus on system construction, development status, etc., while there are relatively few empirical studies. In addition, few of these studies have analyzed the relationship between EPLI and the green innovation of enterprises, which provides an opportunity for innovative study in this paper.

3 Theoretical analysis and research hypothesis

As a high-risk investment, enterprise innovation is often affected by both financing constraints due to imperfect external capital markets and agency costs resulting from poor internal corporate governance (Bai et al., 2018; Yin and Yu, 2022), as is the case with green innovation. EPLI may have a positive impact on the green innovation of enterprises in the following two ways. On the one hand, EPLI can improve the green innovation of enterprises by relaxing financing constraints. As a component of green finance, EPLI has shown two effects in relaxing financing constraints: first, the China Banking Regulatory Commission issued the “Green Credit Guideline” in 2012, so the fulfillment of environmental liability became a necessary access condition for commercial banks to implement green credit (Cai et al., 2019). By taking out EPLI, enterprises transfer their environmental liability to insurance institutions, reducing compensation losses and business risks caused by environmental pollution, reducing the bank lending risk, prompting banks to relax their lending conditions and making it easier to obtain support from green credit, thus relaxing corporate financing constraints. Second, as a manifestation of enterprises’ active fulfillment of environmental liability, purchasing EPLI can satisfy investors’ preference for social responsibility through a signal mechanism. The fundamental impediment for enterprises to obtain financing in the capital market is information asymmetry (Fazzari et al., 1988), while the fulfillment of social responsibility sends positive financial signals to the outside world, which is conducive to alleviating information asymmetry and reducing the perceived risk of the outside world and cost of capital (Dhaliwal et al., 2011). Through the fulfillment of social responsibility, enterprises can also build a good reputation and credibility, accumulate moral capital for themselves, and improve the level of corporate credit, thus reducing the identified risks of creditors and obtaining recognition in the capital market (Brammer and Pavelin, 2006). It can be seen that purchasing EPLI can help enterprises to alleviate their financing difficulties and improve their green innovation ability.

On the other hand, purchasing EPLI can improve the green innovation of enterprises by reducing agency costs. First, EPLI creates effective incentives for officers. Unlike conventional investment projects, enterprise innovation is characterized by high uncertainty, high possibility of failure, and long investment cycles. Therefore, fostering green innovation requires a stable business environment and green innovation investment (Holmstrom, 1989; Manso, 2011; Ferreira et al., 2014; Dong et al., 2023). Purchasing EPLI can transfer compensation premiums and governance costs to insurers, creating a relatively stable decision-making environment for green innovation and helping to increase officers’ tolerance for the risk of failure of green innovation and incentivizing them to boldly pursue green innovation. Second, as an emerging governance mechanism, EPLI can play an external supervising role. Enterprises bring insurance institutions into corporate governance by purchasing EPLI, and the insurance institutions supervise the environmental behavior of enterprises through insurance contracts. According to the insurance underwriting risk theory, insurers, as rational economic actors, will perform an active external governance function through pre-underwriting screening and continuous post-underwriting supervision. In order to reduce their payout risk, insurance institutions will reduce the likelihood of environmental pollution incidents by directing and urging enterprises to implement technological innovations to achieve intensive development. Third, the duty of disclosure and the inquiry mechanism of EPLI can effectively alleviate information asymmetry. The model clauses of EPLI of the Insurance Association of China clearly stipulate that the policyholder should fulfill the duty of disclosure and fill out the insurance policy truthfully. The duty of disclosure and the inquiry mechanism of EPLI strengthen the communication between insurance institutions and insured enterprises, alleviating the information asymmetry within and outside enterprises, thus reducing principal-agent problems such as moral hazard and adverse selection, and promoting green innovation decision-making of enterprises. In summary, EPLI restrains the management’s self-interest through incentive, monitoring, and information effects, reduces agency costs, and stimulates management to reduce the probability of environmental incidents through green innovation. Based on the above analysis, this paper proposes the following hypothesis:

Hypothesis 1. Purchasing EPLI can improve the green innovation of enterprises.

4 Research design

4.1 Sample selection and data source

Since the existing regulatory system does not compel listed companies to publicly disclose information related to EPLI, this paper manually collected information on listed companies’ purchase of EPLI through the list of enterprises purchasing EPLI as released on the official website of the Ministry of Ecology and Environment. Based on this, this paper used all A-share listed companies on the Shanghai and Shenzhen Stock Exchanges as the initial research samples and screened the initial samples as follows: excluding ST and *ST companies, financial and insurance listed companies, companies with abnormal data and incomplete indicators. The observations of 5222 samples were finally obtained. In this paper, the basic information relating to green patent applications by listed companies was manually collected from the official website of the China National Intellectual Property Administration. The financial data of listed companies and their corporate governance data were obtained from CSMAR, WIND, and RESSET databases. Data related to environmental regulation were taken from the China Environment Yearbook. In order to control the effect of anomalous observations, each continuous variable was Winsorized by ±1% in this paper.

4.2 Definition of variables

4.2.1 Green innovation of enterprises

With reference to Qi et al. (2018), this paper used the natural logarithm of the number of green patent applications plus 1 to measure the green innovation of enterprises. The identification of green patents followed the international common identification method, and seven categories of patents (such as energy conservation, nuclear power, alternative energy, transportation, administrative regulations or design, waste management, and agriculture and forestry) were classified as the patents related to environmentally friendly technologies according to the Green List of the International Patent Classification.

4.2.2 EPLI

With reference to Hu and Wang (2019), a dummy variable (Ins) was set as a proxy variable for EPLI based on whether the enterprise had purchased such insurance. If the listed company or its subsidiary was on the list of enterprises purchasing EPLI as published by the Ministry of Ecology and Environment in 2014 and 2015 and was within the validity of the insurance contract, Ins was 1; otherwise, it was 0. That is, if the enterprise was insured with environmental liability insurance, the assigned value was 1; otherwise, it was 0.

4.2.3 Control variables

With reference to Li and Zheng (2016), the following control variables were selected: enterprise size (Size), enterprise age (Age), capital structure (Lev), solvency (Liquidity), growth (Growth), cash flow (CF), return on equity (Roe), shareholding ratio of the biggest shareholder (Big1), shareholding ratio of institutional investors (Insti), board size (Board), independent director size (Indep), and duality (Dual). In order to control the influence of factors that did not change with individuals at the time level and industry level on the regression results, this paper further controlled the time-fixed effect and industry-fixed effect.

4.3 Model design

To examine the impact of EPLI on the green innovation of enterprises, the following Model (1) was developed:

where GI is the natural logarithm of the total number of green patent applications by listed companies in the current year plus 1. Ins is set equal to one if a listed company or its subsidiary is included in the list of insured enterprises published by the Ministry of Ecology and Environment, and zero otherwise. Size is the natural logarithm of total assets of the company. Age is the natural logarithm of the number of years since the company was founded. Lev equals total liabilities divided by total assets. Liquidity equals liquid assets divided by liquid liabilities. Growth equals the increase in operating revenue for the period divided by operating revenue for the previous period. CF equals the net cash flow from operating activities divided by total assets. Roe equals the net profit divided by the owner’s equity. Big1 equals the number of shares held by the biggest shareholder divided by the total share capital. Insti equals the number of shares held by institutional investors divided by the total share capital. Board equals the natural logarithm of the number of members of the board of directors plus 1. Indep equals the number of independent directors divided by the number of members of the board of directors. Dual is set as equal to one if the posts of chairman and general manager are held by the same person, and zero otherwise. Ind is the dummy variable for an industry. Year is the dummy variable for a year.

5 Empirical results and analysis

5.1 Descriptive statistics

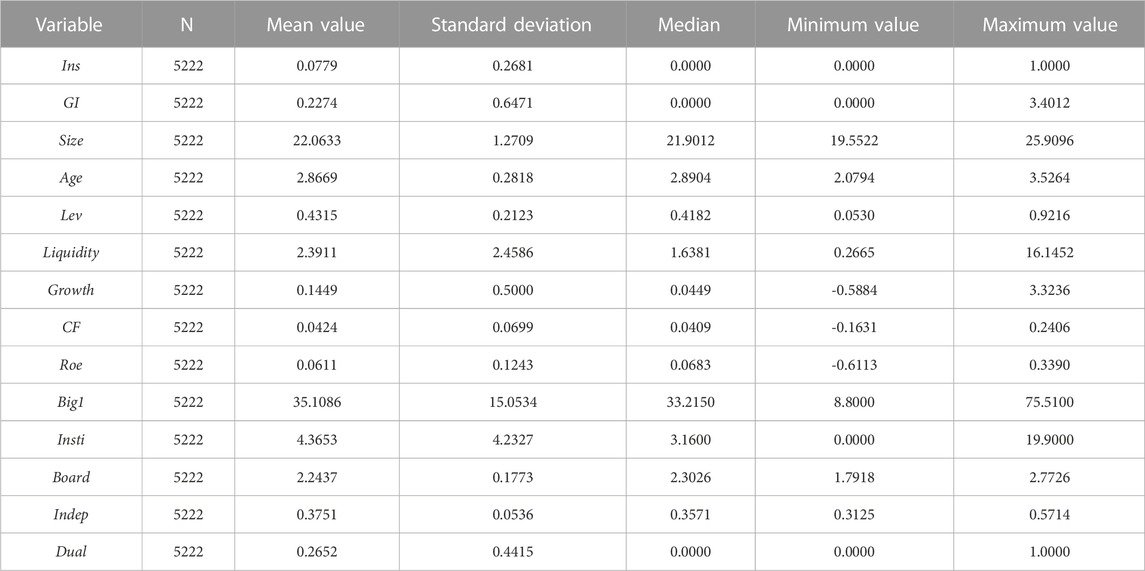

The descriptive statistical results of the main variables are presented in Table 1. The mean value of EPLI (Ins) is 0.0779, and the observations of purchasing EPLI only account for 7.79% of all samples, indicating that the coverage of EPLI is generally low for listed companies in China. The mean value of green innovation (GI) is 0.2274 and the median value is 0.0000, which indicates that the level of green innovation is generally low among listed companies in China. The minimum value of green innovation (GI) is 0.0000, and the maximum value is 3.4012, with a standard deviation of 0.6471, which implies that there is a large individual difference in the green innovation of the samples. In addition, the statistical results of the control variables show that most of the enterprises perform normal production and operation.

5.2 Pearson correlation coefficient

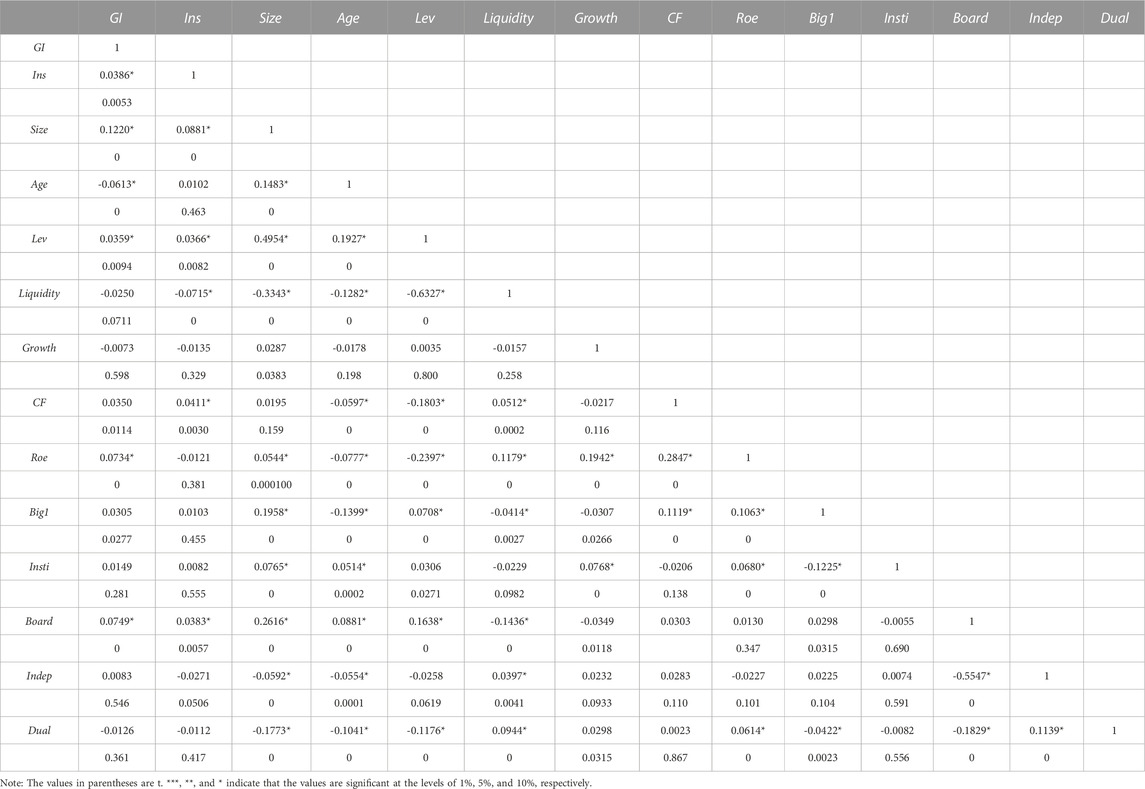

Table 2 shows the Pearson correlation coefficients among the variables. It can be seen from the table that the correlation coefficient between the explanatory variable Ins and the explained variable GI is significantly positive, indicating that EPLI is helpful to promote the green innovation of enterprises. In addition, the size, age and other factors of the enterprise are also significantly related to GI, so we control these variables in the model. In addition, the correlation coefficient between each variable is less than 0.5, indicating that there is no multicollinearity problem in this model.

5.3 Estimated results of impact of EPLI on green innovation of enterprises

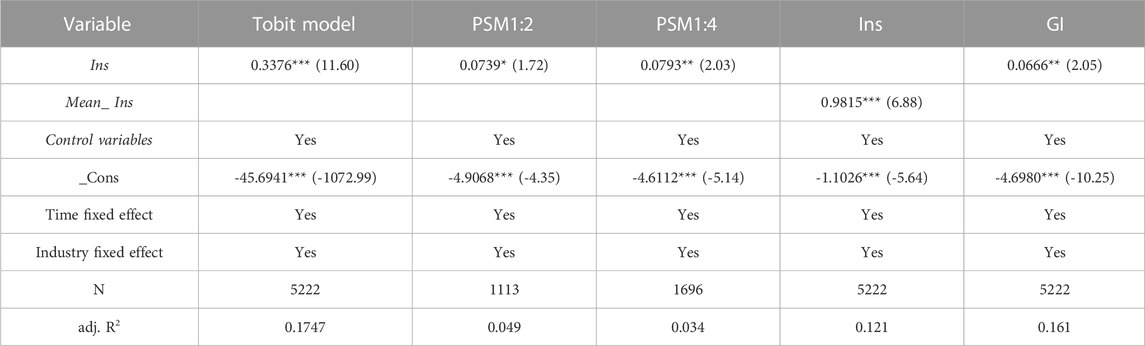

The test results of the main regression are shown in Table 3. It can be seen that the regression coefficient for EPLI is significantly positive with or without controlling the control variables, time effects, and industry effects. After the effect of other factors is considered, the estimated coefficient of Ins in Column (3) is 0.0666, which is significantly positive at the level of 5%, indicating that purchasing EPLI can improve the green innovation of enterprises. Hence, Hypothesis 1 is verified. In addition, our research conclusion is also supported by the recent literature on the relationship between environmental regulations, environmental practices and green innovation. Like the research conclusion of Ali et al. (2019), Ali et al. (2022a) and Ali et al. (2022b), our research conclusion demonstrates that governance mechanisms such as environmental laws and regulations and environmental practices can help to improve the environmental performance of enterprises.

5.4 Robustness test

5.4.1 Tobit model

Considering that the explained variable “green patent of enterprise” is censored data with a left-truncated distribution, there is a problem of censoring at zero. Therefore, a Tobit model is built in this paper to re-run the regression with reference to Lin et al. (2011) and Zhang et al. (2017). The regression results are shown in Table 4, consistent with the above.

5.4.2 Propensity score matching

With reference to Ning et al. (2019) and Hao et al. (2016), propensity score matching is carried out, and the enterprise size, enterprise age, capital structure, solvency, growth, cash flow, profitability, shareholding ratio of the biggest shareholder, shareholding ratio of institutional investors, board size, proportion of independent directors, and duality are selected as covariates to establish a Probit model of whether to purchase EPLI, and the enterprises without EPLI are taken as the control group, with the 1:2 and 1:4 closest matching modes for matching. The matched samples are used to perform regression on Model (1) and the results are shown in Table 4, consistent with the main regression.

5.4.3 Instrumental variable method

EPLI may affect the green innovation of enterprises in a significantly positive manner, but green innovation may also affect enterprises’ purchasing of EPLI. In other words, the results in this paper may be affected by reciprocal causality. To this end, with reference to Yuan et al. (2018), the mean value of EPLI (Mean_ Ins) purchased by other listed companies in the same industry in the same year is selected as the instrumental variable for EPLI (Ins) for a two-stage regression in this paper. The regression results are shown in Table 4, and the regression coefficients remain significantly positive.

6 Further analysis

6.1 Test of the mechanism of action of impact of EPLI on green innovation of enterprises

As mentioned earlier, enterprises purchase EPLI to improve green innovation mainly by relaxing financing constraints and reducing agency costs. In this paper, the mediation model proposed by Wen and Ye (2014) is used to test whether EPLI can promote green innovation by relaxing enterprises’ financing constraints and reducing agency costs.

6.1.1 Test of mediating effect based on relaxation of financing constraints

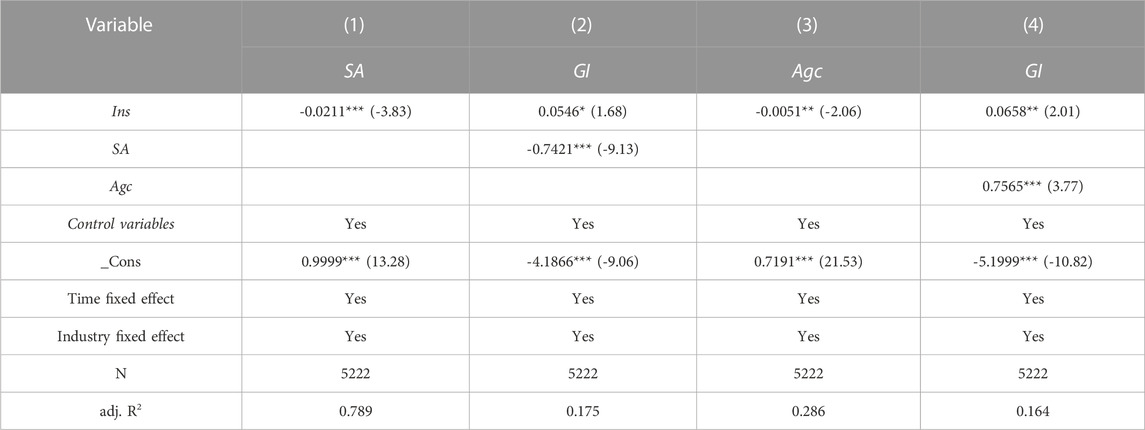

For the measurement of financing constraints, the SA index constructed by Hadlock and Pierce (2010) consists of two completely exogenous variables (enterprise size, and enterprise age), and contains no endogenous variables, which can avoid the subjectivity of other measurement methods and their measurement bias (Hadlock and Pierce, 2010), and has been widely recognized in China. Therefore, the SA index is used to measure the financing constraints in this paper, SA = -0.737×Size+0.043×Size2-0.04×Age. A negative SA index with a higher absolute value indicates a more severe degree of financing constraints on the enterprise. According to the mediation model, the regression results of green innovation of enterprises (GI) and EPLI (Ins) are shown in Table 3—that is, EPLI promotes the green innovation of enterprises; the regression results of EPLI (Ins) to financing constraints (SA) are shown in Column (1) of Table 5, and the coefficient of Ins is significantly negative at the level of 1%, which indicates that EPLI is conducive to relaxing the financing constraints of enterprises; after the mediating variable of financing constraints (SA) is added on the basis of the baseline regression, both Ins and SA are significant, which indicates that financing constraints have some mediating effects. Thus, EPLI improves the green innovation of enterprises by relaxing financing constraints.

6.1.2 Test of mediating effect based on the reduction in agency costs

Based on the practice of Ang et al. (2000) and Zhou et al. (2019), the administrative expense rate (the proportion of the administrative expenses to the operating revenue) is used in this paper as a measure of agency costs. The steps for testing the mediating effect are similar to those described above and will not be repeated. The regression results in Table 5 show that agency costs are incomplete mediators for the impact of EPLI on the green innovation of enterprises. Thus, EPLI improves the green innovation of enterprises by reducing agency costs.

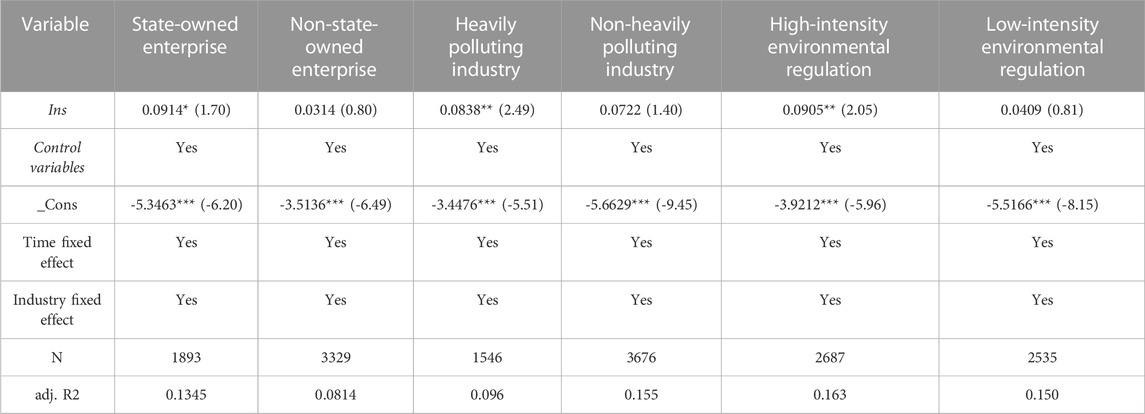

6.2 Impact of heterogeneous scenarios on the relationship between EPLI and green innovation of enterprises

6.2.1 Test of the impact of EPLI on green innovation of enterprises under different natures of property rights

The nature of property rights is an important institutional context for the study of finance in China, which provides a new perspective for this paper to further study the relationship between EPLI and the green innovation of enterprises. In the face of the deteriorating ecological environment, China’s performance appraisal system has gradually realized diversification and greenization, and the government has paid more attention to the innovation performance and environmental performance of officers of state-owned enterprises when selecting and promoting officers. For example, the Business Performance Appraisal Method for Heads of Central Enterprises incorporates the transformation and upgrade, innovation driving, and social responsibility into the appraisal index system. The officers of state-owned enterprises have an incentive to focus on innovation research and development (R&D) and environmental governance for performance appraisal and position promotion (Liu et al., 2015). In this paper, the samples are divided into two groups according to the nature of the ultimate controller, and the regression of Model (1) is conducted separately. In addition, since the R&D and innovation capability factors of state-owned enterprises and non-state-owned enterprises may affect the regression results of Ins and GI under different property rights, we additionally control the R&D capability of enterprises in Model (1) (where Rd is equal to the R&D investment of enterprises divided by operating income). As shown in Table 6, the results indicate that EPLI plays a more important role in promoting the green innovation of state-owned enterprises.

6.2.2 Test of the impact of EPLI on green innovation of enterprises under different attributes of heavily polluting industries

As the main producers of environmental pollution in China and the industries with high environmental risk, heavily polluting industries are bound to be the key targets of supervision by insurance institutions. In 2013, the Ministry of Ecology and Environment and the China Banking and Insurance Regulatory Commission jointly issued the “Opinions on the Pilot Work of Compulsory Environmental Pollution Liability Insurance”, which clearly advises the launch of compulsory environmental pollution liability insurance in heavily polluting industries with high environmental risk, such as the heavy metal and petrochemical industries. Considering that the relationship between EPLI and the green innovation of enterprises may differ in different industries, in this paper, all of the samples are divided into sample groups of heavily polluting industries and non-heavily polluting industries for separate regression. With reference to the study of Shen and Ma (2014), the categories of industries specified as heavily polluting industries in the List of Environmental Verification Sector Classification and Management about Listed Companies published by the Ministry of Ecology and Environment in 2008 are compared in accordance with the Guidelines on Industry Classification of Listed Companies revised by the China Securities Regulatory Commission in 2012. As shown in Table 6, the regression results indicate that EPLI plays a more important role in promoting the green innovation of enterprises in heavily polluting industries.

6.2.3 Test of the impact of EPLI on green innovation of enterprises under different intensities of environmental regulation

Environmental regulation is a necessary measure to protect China’s ecological environment. The Porter Hypothesis suggests that environmental regulation can force enterprises to carry out technological innovation, and so environmental regulation may have a positive impact on green innovation. In addition, environmental regulation itself can curb the management’s opportunism and exert a governance effect on green innovation. With reference to the study of Yang et al. (2008), the “total amount of pollution discharge fees collected/number of pollution discharge fee-paying units” is selected in this paper to measure the intensity of environmental regulation. According to the median value of each industry company each year, the total sample is divided into a group with high environmental regulation and a group with low environmental regulation, and the regression is performed on the model separately. As shown in Table 6, the results indicate that EPLI plays a more important role in promoting the green innovation of enterprises in areas with a high intensity of environmental regulation.

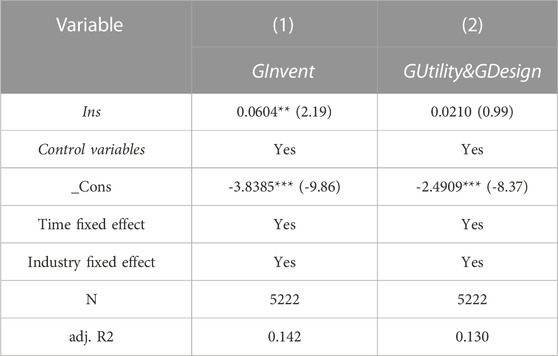

6.3 Further analysis of promotion effect of EPLI on green innovation of enterprises

Compared to utility models and industrial designs, inventions have a higher technical content and newer methods, which can best reflect the quality of innovation (Liu and Zhao, 2019). Therefore, this paper further explores the impact of EPLI on the quality and structure of green innovation outputs. This paper selects green invention patents to measure qualitative green innovation (GInvent), the sum of the green utility model and industrial design patents to measure non-qualitative green innovation (GUtility&GDesign), and builds Model (3) to test the effect of EPLI on the promotion of different types of green patents:

The regression results are shown in Table 7. The coefficient of Ins in Column (1) has a significantly positive correlation at the level of 5%, and the coefficient of Ins in Column (2) does not pass the significance test, which implies that qualitative green invention patents significantly increase after enterprises take out EPLI, while non-qualitative green innovation output does not change significantly. This shows that purchasing EPLI is conducive to promoting high-quality green innovation and optimizing the output structure of green patents.

7 Research conclusions and recommendations

This paper examines the impact of EPLI on the green innovation of listed companies by taking the listed companies in Shanghai and Shenzhen cities as the research samples. It is found that (1) EPLI can significantly improve the green innovation of enterprises; (2) EPLI plays a role in promoting the green innovation of enterprises by relaxing financing constraints and reducing agency costs; (3) compared with non-state-owned enterprises, non-heavily polluting enterprises, and enterprises in regions with a lower intensity of environmental regulation, EPLI plays a stronger role in the promotion of green innovation of state-owned enterprises, heavily polluting enterprises and enterprises in regions with higher intensity of environmental regulation; (4) EPLI plays a role in promoting the green innovation of enterprises, which is mainly reflected in the significant promotion of high-quality green innovation and the optimization of the structure of green patent outputs. This paper demonstrates that EPLI, as a special green financial institutional arrangement, can play a role in the external governance of China’s listed companies and exert a positive effect on the green operation and management of enterprises.

Based on the above conclusions, the following recommendations are made in this paper. Firstly, the regulatory authorities should actively improve the system design of environmental liability insurance. Insurance companies should develop a variety of green insurance products to meet the insurance needs of different entities based on the actual needs of insurance companies. Third party assessment agencies should also be introduced to conduct risk assessment to ensure the rationality and scientificity of insurance rates and premiums. At the same time, insurance companies prevent the occurrence of moral hazards and adverse selection by formulating environmental liability insurance contract clauses. Secondly, the research conclusions show that environmental liability insurance has a stronger role in promoting the green innovation of state-owned enterprises, heavily polluting enterprises, and enterprises in regions with higher environmental regulation intensity. Regulators should pay more attention to the environmental liability insurance coverage of non-state-owned enterprises, non-heavily polluting enterprises and enterprises in areas with low environmental regulation intensity. Thirdly, in addition to selecting environmental liability insurance products that are suitable for the enterprise, the enterprise should also improve its environmental risk awareness and risk response ability, and use the governance effect of environmental liability insurance to achieve a win–win situation regarding environmental benefits and economic benefits.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

Conceptualization, JN; methodology, SY and JN; software, ZY; validation, FS and JN; formal analysis, SY; investigation, JN; resources, SY and ZY; data curation, FS; writing—original draft preparation, JN; writing—review and editing, SY and JN; supervision, ZY; project administration, FS; funding acquisition, SY. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Hebei Provincial Department of Education Humanities and Social Sciences Research Project of Higher Education Institutions "Evaluation of Green Governance Effect of Environmental Pollution Liability Insurance of Listed Companies under the Double-Carbon Target" (Project No.: BJS2022003); General Projects of the National Social Science Fund "On the Bubble Risk Identification and Prevention of Local Governments' Competition in Green Innovation Under the Goal of Carbon Neutrality" (Project No.: 22BGL218); Tianjin Graduate Research and Innovation Project "Research on the Impact of Carbon Information Disclosure on Enterprise Green Technology Innovation and Its Mechanism under the Double Carbon Target" (Project No.: 2021YJSB353).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ali, S., Jiang, J., Ahmad, M., Usman, O., and Ahmed, Z. (2022a). A path towards carbon mitigation amidst economic policy uncertainty in BRICS: An advanced panel analysis. Environ. Sci. Pollut. Res. 29 (41), 62579–62591. doi:10.1007/s11356-022-20004-8

Ali, S., Jiang, J., Rehman, R., and Khan, M. K. (2022b). Tournament incentives and environmental performance: The role of green innovation. Environ. Sci. Pollut. Res. 1-11. doi:10.1007/s11356-022-23406-w

Ali, S., Zhang, J., Usman, M., Khan, F. U., Ikram, A., and Anwar, B. (2019). Sub-national institutional contingencies and corporate social responsibility performance: Evidence from China. Sustainability 11 (19), 5478. doi:10.3390/su11195478

Ang, J. S., Cole, R. A., and Lin, J. W. (2000). Agency costs and ownership structure. J. Finance. 55 (1), 81–106. doi:10.1111/0022-1082.00201

Bai, J., Meng, Q., and Shen, Y. (2018). Does foreign bank entry affect domestic enterprise innovation? Account. Res. 6 (11), 63–83. doi:10.1080/21697213.2018.1483589

Bie, T. (2008). Environmental pollution liability insurance in foreign countries. Account. Rev. 5, 60–62. doi:10.2308/accr.200856062

Brammer, S. J., and Pavelin, S. (2006). Corporate reputation and social performance: The importance of fit. J. Manag. Stud. 43 (3), 435–455. doi:10.1111/j.1467-6486.2006.00597.x

Cai, H., Wang, X., and Tan, C. (2019). Green credit policy, incremental bank loans and environmental protection effect. Account. Res. 3, 88–95. doi:10.2308/accr.201938895

Chen, J., and Lin, Q. (2015). A study of the current status and improvement of the pilot environmental pollution liability insurance in the yangtze river delta region. Shanghai. insura. Mon. 3, 38–43. doi:10.3271/inmo.201533843

Dhaliwal, D. S., Li, O. Z., Tsang, A., and Yang, Y. G. (2011). Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. Account. Rev. 86 (1), 59–100. doi:10.2308/accr.00000005

Dong, T., Yin, S., and Zhang, N. (2023). New energy-driven construction industry: Digital green innovation investment project selection of photovoltaic building materials enterprises using an integrated fuzzy decision approach. Systems 11, 11. doi:10.3390/systems11010011

Fang, Y. (2016). Countermeasures for improving China's environmental pollution liability insurance system. Econ. Rev. J. 3, 97–100. doi:10.16528/j.cnki.22-1054/f.201603097

Fazzari, S. M., Hubbard, R. G., Petersen, B. C., Blinder, A. S., and Poterba, J. M. (1988). Financing constraints and corporate investment. Brookings. Pap. Econ. Act. 1, 141–206. doi:10.3386/w2387

Ferreira, D., Manso, G., and SilvaAndré, C. (2014). Incentives to innovate and the decision to go public or private. Rev. Financ. Stud. 27 (1), 256–300. doi:10.1093/rfs/hhs070

Guo, J., and Zhou, X. (2017). Thinking on the compensation mechanism of environmental pollution liability insurance. Environ. Prot. 45 (10), 18–21. doi:10.14026/j.cnki.0253-9705.2017.10.003

Hadlock, C. J., and Pierce, J. R. (2010). New evidence on measuring financial constraints: Moving beyond the KZ index. Rev. Financ. Stud. 23 (5), 1909–1940. doi:10.1093/rfs/hhq009

Hao, Z., Hu, G., and Hu, J. (2016). A study on the relationship among D&O liability insurance, corporate governance and private benefits of executives. Insura. Stud. 5, 94–108. doi:10.13497/j.cnki.is.2016.05.009

Holmstrom, B. (1989). Agency costs and innovation. J. Econ. Behav. Organ. 12 (3), 305–327. doi:10.1016/0167-2681(89)90025-5

Hu, G., and Wang, Y. (2019). Directors' and officers' liability insurance and enterprise differentiation strategy. J. Bus. Econ. (11), 55–69. doi:10.14134/j.cnki.cn33-1336/f.2019.11.005

Li, H. (2010). Choice of strategy and construction of system with regard to the development of environmental pollution liability insurance in China. Nanjing J. Soc. Sci. 2, 105–110. doi:10.3969/j.issn.1001-8263.2010.02.016

Li, H. (2009). Dilemma and development strategy of the environmental pollution liability insurance system. Environ. Prot. 18, 36–38. doi:10.3969/j.issn.0253-9705.2009.18.012

Li, W., and Zheng, M. (2016). Is it substantive innovation or strategic innovation? - impact of macroeconomic policies on micro-enterprises' innovation. Econ. Res. J. 51 (04), 60–73. doi:10.2746/ecrej.201646073

Li, X., Shen, X., Huang, B., and Cai, F. (2015). Environmental impairment liability insurance pilot program in China: Current status and policy recommendations. Environ. Sustain. Devel. 40 (01), 47–51. doi:10.19758/j.cnki.issn1673-288x.2015.01.012

Lin, C., Lin, P., and Song, F. M. (2011). Managerial incentives, CEO characteristics and corporate innovation in China’s private sector. J. Comp. Econ. 39 (2), 176–190. doi:10.1016/j.jce.2009.12.001

Liu, H., Ivanov, K., Wang, Y., and Wang, L. (2015). A novel method based on two cameras for accurate estimation of arterial oxygen saturation. Environ. Sustain. Devel. 40 (01), 52–54. doi:10.1186/s12938-015-0045-1

Liu, H., Zheng, S., and Wang, Y. (2015). Ownership types, technological innovation, and enterprise performance. China. Soft. Sci. Magaz. 3, 28–40. doi:10.3969/j.issn.1002-9753.2015.03.004

Liu, W., Liu, D., Xing, W., Wang, C., and Wang, Q. (2019). Identification and assessment index of direct losses caused by marine environmental pollution. Marine. Environ. Sci. 38 (01), 120–128. doi:10.13634/j.cnki.mes.2019.01.042

Liu, X., and Zhao, J. (2019). Tax incentives and enterprise innovation - a "Quasi-Natural experiment" based on vat Reform. Account. Res. 9, 43–49. doi:10.2308/accr.201994349

Manso, G. (2011). Motivating innovation. J. Finance. 66 (5), 1823–1860. doi:10.1111/j.1540-6261.2011.01688.x

Misheva, I. (2016). Environmental insurance: A part of risk of management in enterprises utilising hazardous production. Econ. 21/Iko. 21 (2-ENG), 60–84.

Misheva, I. (2017). Expert assessment of the environmental risk of technogenic nature: An element of the environmental pollution liability insurance of the industrial enterprises. Bus. Management/Biznes. Upr. 23 (3), 83–108. hdl.handle.net/10610/3353.

Ning, J., Jin, Y., and Zhang, Y. (2019). Environmental pollution liability insurance and enterprise innovation: Promote or suppress? Sci. Techno. Progre. Policy. 36 (17), 90–97. doi:10.6049/kjjbydc.2019010455

Qi, S., Lin, S., and Cui, J. (2018). Do environmental rights trading schemes induce green innovation? Evidence from listed firms in China. Econ. Res. J. 53 (12), 129–143. doi:10.2746/ecrej.201812129143

Shen, H., and Ma, Z. (2014). Local economic development pressure, firm environmental performance and debt financing. J. Financ. Res. 2, 153–166. doi:10.1284/jfire.20142153166

Sun, W., and Gu, J. (2015). International reference of the environmental pollution liability insurance system. Econ. Rev. J. 6, 121–124. doi:10.16528/j.cnki.22-1054/f.2015.06.005

Wang, C., Wu, J., Zhu, N., Huang, L., and Xu, X. (2011). The need of innovation and breakthrough in environmental liability insurance - an analysis based on the trial implementation of environmental liability insurance in hunan, hubei and Hebei. Environ. Econ. 8, 31–36. doi:10.3969/j.issn.1672-724X.2011.08.010

Wang, Z. (2009). Causes and solutions to insufficient supply and demand for environmental pollution liability insurance. Insura. Stud. 5, 89–94. doi:10.1622/inst.2009-05-018

Wen, Z., and Ye, B. (2014). Analyses of mediating effects: The development of methods and models. Adv. Psychol. Sci. 22 (05), 731–745. doi:10.3724/SP.J.1042.2014.00731

Yan, X. (2009). Discussion on the establishment of a "green insurance" system in China. Insura. Stud. 10, 51–55. doi:10.1622/inst.2009-10-009

Yang, H., Chen, S., and Zhou, Y. (2008). Local government competition and environmental policy - empirical evidence from province's governments in China. South. China. J. Econ. 6, 15–30. doi:10.3969/j.issn.1000-6249.2008.06.002

Yin, S., and Yu, Y. (2022). An adoption-implementation framework of digital green knowledge to improve the performance of digital green innovation practices for industry 5.0. J. Clean. Prod. 363, 132608. doi:10.1016/j.jclepro.2022.132608

Yin, S., Zhang, N., Ullah, K., and Gao, S. (2022). Enhancing digital innovation for the sustainable transformation of manufacturing industry: A pressure-state-response system framework to perceptions of digital green innovation and its performance for green and intelligent manufacturing. Systems 10 (3), 72. doi:10.3390/systems10030072

Yu, F., Niu, K., and Jia, Q. (2017). Discussion on the environmental risks and environmental damage assessment in environmental liability insurance. Environ. Prot. 45 (14), 51–55. doi:10.14026/j.cnki.0253-9705.2017.14.024

Yuan, R., Wen, W., and Xie, Z. (2018). Directors' and officers' liability insurance and financial restatements. Account. Res. 5, 21–27. doi:10.2308/accr.20182127

Zhang, W., Wang, L., Zhou, D., Cui, Q., Zhao, D., and Wu, Y. (2011). Expression of tumor-associated macrophages and vascular endothelial growth factor correlates with poor prognosis of peripheral T-cell lymphoma, not otherwise specified. J. Financ. Econ. 26 (03), 46–52. doi:10.3109/10428194.2010.529204

Zhang, X., Liu, B., Wang, T., and Li, C. (2017). Credit rent-seeking, financing constraint and corporate innovation. Econ. Res. J. 52 (05), 161–174. doi:10.2746/ecrej.20145161174

Zheng, S., and Yao, D. (2015). Comparison of China’s environmental pollution liability insurance premium rate reward and punishment system. J. Insura. Res. 8, 98–108. doi:10.13497/j.cnki.is.2015.08.009

Keywords: environmental pollution liability insurance, green innovation, financing constraints, agency problems, sustainable development

Citation: Ning J, Yuan Z, Shi F and Yin S (2023) Environmental pollution liability insurance and green innovation of enterprises: Incentive tools or self-interest means?. Front. Environ. Sci. 11:1077128. doi: 10.3389/fenvs.2023.1077128

Received: 22 October 2022; Accepted: 05 January 2023;

Published: 18 January 2023.

Edited by:

Shigeyuki Hamori, Kobe University, JapanReviewed by:

Hanxi Wang, Harbin Normal University, ChinaMiaochun Fan, Northwest A&F University, China

Shahid Ali, Nanjing University of Information Science and Technology, China

Copyright © 2023 Ning, Yuan, Shi and Yin. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jinhui Ning, bmluZ2ppbmh1aTExMjBAMTYzLmNvbQ==; Shi Yin, c2h5c2hpMDMxNEAxNjMuY29t

Jinhui Ning1*

Jinhui Ning1* Shi Yin

Shi Yin