- 1School of Economics, Bahauddin Zakariya University, Multan, Pakistan

- 2Department of Economics, The Women University, Multan, Pakistan

- 3Institute of Management Sciences, The Women University, Multan, Pakistan

- 4Department of Political Science and IR, The Women University, Multan, Pakistan

Controlling environmental contamination requires the use of environmental regulation. The growth of green finance depends on digital finance. The objectives of the study are threefold: first, to explore the impact of digital financial inclusion in deriving climate change; second, to trace the shape of the financial inclusion-based environmental Kuznets curve; and third, to investigate the intersecting effect of digital financial inclusion and institutional quality on environmental quality. Using panel data from 48 Asian economies between 1996 and 2020, heterogeneity, non-stationarity, and cross-sectional dependence are addressed using an econometric method called “dynamic common correlated effects (DCCE).” The empirical evidence confirms a significant relationship between environmental performance and financial inclusiveness. Furthermore, the findings also validated the inverted U-shape environmental Kuznets curve based on financial inclusiveness. Our research suggests that a strong institutional framework has the potential to mitigate the long-term negative consequences of financial inclusion on the environment. To establish coordinated control of environmental quality, the government fully utilizes the environmental regulation and digital inclusive finance environmental governance. Consequently, to achieve environmental sustainability, policymakers in Asian countries should develop policies that enhance financial inclusion and institutional quality.

Introduction

The growing economies of Asia have been carrying the weight of global growth since the global financial crisis (GFC) of 2008, which is the primary expression of the 21st century’s designation as the Asian Century. The Asian economies currently have a market of over US$ 41.78 trillion and a population of over 59.76% of the world’s population. In the second and third quarters of 2019, it experienced a remarkable growth rate of between 5.4% and 5.2% (Focus Economics, 2022). Although the economic and social progress in Asia is to be applauded, it is vital to take the ecological and environmental effects into account. There is a mixed body of research on the relationship between the environmental consequences of economic growth, and many of these studies have compared the short- and long-term effects of economic growth. In particular, the idea is that despite short-term environmental degradation, long-term economic expansion can improve the environmental quality. The environmental Kuznets curve (EKC) is a phenomenon that frequently occurs. However, there are conflicting results in the empirical evidence regarding this element of economic growth and environment (Chen H et al., 2022; Chen J et al., 2022; Dai et al., 2022; Jahanger et al., 2022; 2023; Korkut Pata et al., 2022; Kostakis et al., 2023; Pata and Samour, 2022; Voumik et al., 2022; Wang et al., 2023). The effects of the qualitative degradation of environmental circumstances have made global warming one of the most critical issues currently affecting rising and industrial Asian nations. As a result, the problem attracted a great deal of attention and became the environmental economists’ main concern. As a result, the literature on environmental economy was extended, and substantial research was carried out on the relationship between environmental attributes and economic growth (Kostakis et al., 2023). Similarly, financial sector performance was considered to be crucial for economic growth (Nasir et al., 2019). Over time, it has become clear that changes in the financial sector have a ripple impact on the overall economy. The financial crisis of 2007–2008 is a prime example of how developments in the financial sector can trigger an international economic crisis. This demonstrates how important a role the financial sector has in influencing the state of the whole economy. The financial market is responsible for making money available to economic agents so they can seize chances in the real estate sector, which in turn, promotes growth and development. Financial market reforms are implemented during economic downturns to address these economic oddities (Fakher, 2019; Nasir et al., 2019; Ntow-Gyamfi et al., 2020; Fakher et al., 2021). Global temperatures have increased due to increased levels of ozone-depleting gases, particularly carbon dioxide emissions, in the atmosphere brought on by the human activity (Nasir et al., 2019; Shahbaz et al., 2022; Wang et al., 2022; Yang et al., 2022). According to the State of the Global Climate 2021 report1, the 2021 surface temperature was 0.84°C warmer than the 13.9°C average temperature for the 20th century, measured as an average over the land and ocean. Compared to the pre-industrial era of 1880–1900, it was 1.04°C warmer. According to NOAA’s temperature data2, 2021 was the sixth warmest year ever. It has resulted in a string of extreme weather occurrences that are increasingly frequent and intense, such as cold and heat waves, floods, droughts, wildfires, and storms (Wang et al., 2022). Every nation is attempting to create a financial system that aids in achieving a sustainable environment to address this challenge. The environment is degraded in this conflict. The purpose of this study is to investigate environmental consequences of financial inclusiveness and propose insights that might be useful for the policymakers in Asian economies. With this aim, this study has three objectives: to explore direct, U-shaped, and interaction term effect (with institutional quality) of digital financial inclusion on environmental quality.

Researchers and environmental scientists from all over the world are attempting to classify each factor that affects environmental performance. In this situation, high production and processing are needed to achieve high financial and economic growth, which puts pressure on the environment and creates an ecological deficit (Aydin et al., 2019; Destek and Sarkodie, 2019; Dogan and Inglesi-Lotz, 2020; Charfeddine and Zaouali, 2022; Hussain et al., 2022). The literature on the relationship between finance and the environment is extensive yet ambiguous. Numerous studies have indicated that financial development promotes economic growth by improving the environmental quality (Nasir et al., 2019; Yang et al., 2021; Liu N et al., 2022). Financial markets have been shown to stimulate economic growth, according to Frankel and Romer (1999)3. Moreover, financial development significantly influences economic growth (Amjed and Shah, 2021). Analogous to the empirical evidence on environmental consequences of economic growth, the existing literature on the ecological consequences of financial sector performance reported the mixed and contrasting evidence (Ahmad et al., 2019; Nasir et al., 2019; Ntow-Gyamfi et al., 2020; Fakher et al., 2021; Khan et al., 2021; Ashraf et al., 2022; Ehigiamusoe et al., 2022; Trinh et al., 2022; Qalati et al., 2023). Therefore, it is important to consider the environmental consequences of financial inclusiveness.

There is a growing body of empirical research in the finance environment literature on the question of whether financial inclusion leads to a decline or improvement in environmental quality (Nasir et al., 2019; Ntow-Gyamfi et al., 2020; Fakher et al., 2021; Charfeddine and Zaouali, 2022; Liu N et al., 2022; Shahbaz et al., 2022). Additionally, Lenka (2021) considered financial inclusion as a crucial component of financial development. As an example, some earlier research studies investigating the relationship between financial inclusion and environmental degradation looked at how it affected environmental quality and found that financial inclusion worsened it (Liu et al., 2022a; Liu et al., 2022b; Ozturk and Ullah, 2022; Wang et al., 2022; Yang et al., 2022). On the other hand, a positive association between financial inclusion and environmental quality was discovered by Ding et al. (2022), Liu N et al. (2022), Shahbaz et al. (2022), and Xue and Zhang (2022). The role of institutional quality is also crucial for achieving the required level of financial inclusion and a sustainable environment (Ntow-Gyamfi et al., 2020). It includes government effectiveness (GEF), political stability (PS), regulatory quality (RQ), rule of law (ROL), and voice and accountability (VAC). Therefore, the better institutional quality can help improve the environmental quality and to attain the Sustainable Development Goals4 (Ntow-Gyamfi et al., 2020).

According to Zhang (2011) and Xue and Zhang (2022), there are three pathways that may be used to explain the connection between financial development and environmental quality. These are the economic growth channel, credit creation channel, and foreign direct investment inflow channel. The argument over the relationship between financial development and economic growth is still going strong, drawing both theoretical and empirical research into its many levels of causality. They agreed that the discussion has not stopped (Ntow-Gyamfi et al., 2020; Fakher et al., 2021). Therefore, it is important to comprehend how financial inclusion and institutional quality affects environmental sustainability of nations. The remaining paper is organized as the following section provides the theoretical and empirical literature on finance and environmental quality. The Data and methodology section offers the data and methodological framework. The Results section offers the results of the study. The final section of the study reserves discussion and policy recommendations.

Theoretical and empirical review

Academicians have recently emphasized the crucial importance of identifying factors that affect environmental performance. By presenting new potential factors that could influence environmental performance, this study broadens the scope of this discussion. The authors study the effects of financial inclusion on ecological issues. In the framework of sustainable development, the main goal of this study is to present some fresh findings and conclusion about the environmental effects of financial inclusion. Protecting the environment and fostering sustainable economic growth are two of the most important concerns facing nations today (Pata and Samour, 2022; Jahanger et al., 2023; Kostakis et al., 2023). Policymakers and researchers have tried to identify each determining element or victim of environmental degradation against the backdrop of rising greenhouse gas emissions around the world. Financial inclusion is frequently seen as a driver for economic progress in the 2030 Sustainable Development Goals (SDGs) (Chatterjee, 2020; Afonso and Blanco-Arana, 2022; Ayenew Mossie, 2022; Batrancea et al., 2022). Financial inclusion is a crucial element of financial development in terms of supporting the financial sector and institutions. It is also thought to be extremely important for fostering economic growth (Ali et al., 2021). Thus, a nation’s high rate of financial inclusion can also be viewed as a measure of its economic stability. It may be possible to achieve synergy between development and climate change policies if financial inclusion turns out to be a workable mitigation method (Ullah et al., 2022). In general, the process of financial inclusion draws more research funding, which lessens environmental damage brought on by economic growth and expansion (Chaudhry et al., 2022; Hussain et al., 2022; Anu et al., 2023; Khan et al., 2023).

To establish the relationship between financial inclusiveness and environmental performance, we take the aid of the STIRPAT model. The IPAT model was first presented by Ehrlich and Holdren (1971) to evaluate how population (P), economic (A), and technical (T) elements affect the environment. The IPAT model runs into an issue when it analyses a circumstance, making it impossible to generalize. The model captures an unbiased impact on the dependent variable by allowing only one factor to vary, while all other factors are maintained constant (Chikaraishi et al., 2015). To solve this problem, a stochastic IPAT equation was designed by Dietz and Rosa (1997) known as STIRPAT (STochastic Impacts by Regression on Population, Affluence, and Technology). They transformed the IPAT model into a stochastic model called the STIRPAT model, where the statistical causes of environmental degradation are evaluated (Chikaraishi et al., 2015). Meng et al. (2012) improved upon and broadened the STIRPAT model by adding other elements such as quadratic terms or various P, A, or T. Currently, the STIRPAT model has been successfully used to analyze the effects of various dynamic forces on the diversity of environmental degradation (Ma et al., 2022; Usman et al., 2022; Xue et al., 2022; Zhao et al., 2022; Zhu et al., 2022; Li et al., 2023; Yang et al., 2023; Yu et al., 2023). The STIRPAT model can be expressed as the following equation in its exponential form:

where

After taking the logarithms, the model has the following linear form:

where

a and b → logarithms of

The STIRPAT model is altered by the addition of PAT decomposition variables, and the effects of these components on the environment are examined. “T” is also decomposable in the STIRPAT model, much like P and A (Xue et al., 2022; Li et al., 2023). In this study, CEPI is used to quantify pollutant emission (I); and GDP per capita captures the affluence of an economy (A) (Poumanyvong and Kaneko, 2010; Hao et al., 2016; Qayyum Khan et al., 2018; Kusumawardani and Dewi, 2020). Income inequality is used as a replacement of the population (P) and technology (T), representing financial inclusiveness and institutional quality introduced in the STIRPAT model. The enhanced model is expressed as follows:

Ntow-Gyamfi et al. (2020) and Xue et al. (2022) included the quadratic terms’ digital financial inclusion to test the modified Kuznets curve hypothesis based on the financial market (FM_EKC). The easiest and most widely used tool for examining how one variable affects an outcome that also depends on the status of another variable is the interaction approach. This approach has been frequently employed to investigate the aforementioned nexuses between financial growth and institutional quality-finance nexus. Using African country’s data to show, for instance, that higher financial sector advancement lessens the detrimental effects of institutional quality on environmental quality (Ntow-Gyamfi et al., 2020) by examining how financial markets affect the consequences of financial market performance and economic growth on environmental performance in selected OPEC countries from 2010 to 2019 (Fakher et al., 2021), they discover that when the level of banking sector development rises, the financial development would weaken the economic growth and institutional quality harmful effect on environmental quality. Therefore, the aforementioned equation can be rewritten as follows (Fakher et al., 2021) to account for the environmental indicators’ response to the marginal effect of institutional quality and financial inclusion and to validate the financial market-based EKC:

where we use CEPI (comprehensive environmental performance index) as our indicator of environmental performance and FII (financial inclusion index) for measuring financial inclusiveness. The term IQI stands for the institutional quality index derived by using six components, namely, control of corruption, government effectiveness, political stability, regulatory quality, rule of law, and voice of accountability. The data for IQI are extracted from the world governance indicator, the World Bank5. The term PCI and GINI stand for the measure of per capita income and income inequality, respectively. The data are taken from different sources. The data on CEPI are derived from Latif (2022)6. The data on FII are extracted from Cámara and Tuesta (2017)7. The data for the indicators of IQI are taken from the Worldwide Governance Indicators8. Furthermore, the data for CPI, PCI, and GINI are taken from the World Development Indicators9. By combining these data sources, we can obtain an annual dataset for 48 Asian economies for the period of 1996–2020.

Eqs 3, 4 indicate that the impact of financial inclusion on environmental performance can be represented by FII itself, its quadratic term, and its interaction with the institutional quality index alongside other explanatory variables, such as per capita income and income inequality. The marginal effect can be calculated by using the average, minimum, and maximum levels of both FII and IQI. All the variables are expressed in a logarithmic form.

Data and methodology

Performance in the financial sector is a key factor in the economic development of the technology. Its impact on the environmental change has not received enough attention. We aim to investigate the non-linear impacts of financial inclusion on the environment in Asian economies. Therefore, the study uses a dynamic common correlated effect (DCCE) estimator to analyze the impact of financial inclusion on environmental performance across Asian nations from 1996 to 2020. The list of 48 Asian economies is given in Table A1 in Appendix. The outcomes are then contrasted and examined from an economic and environmental standpoint.

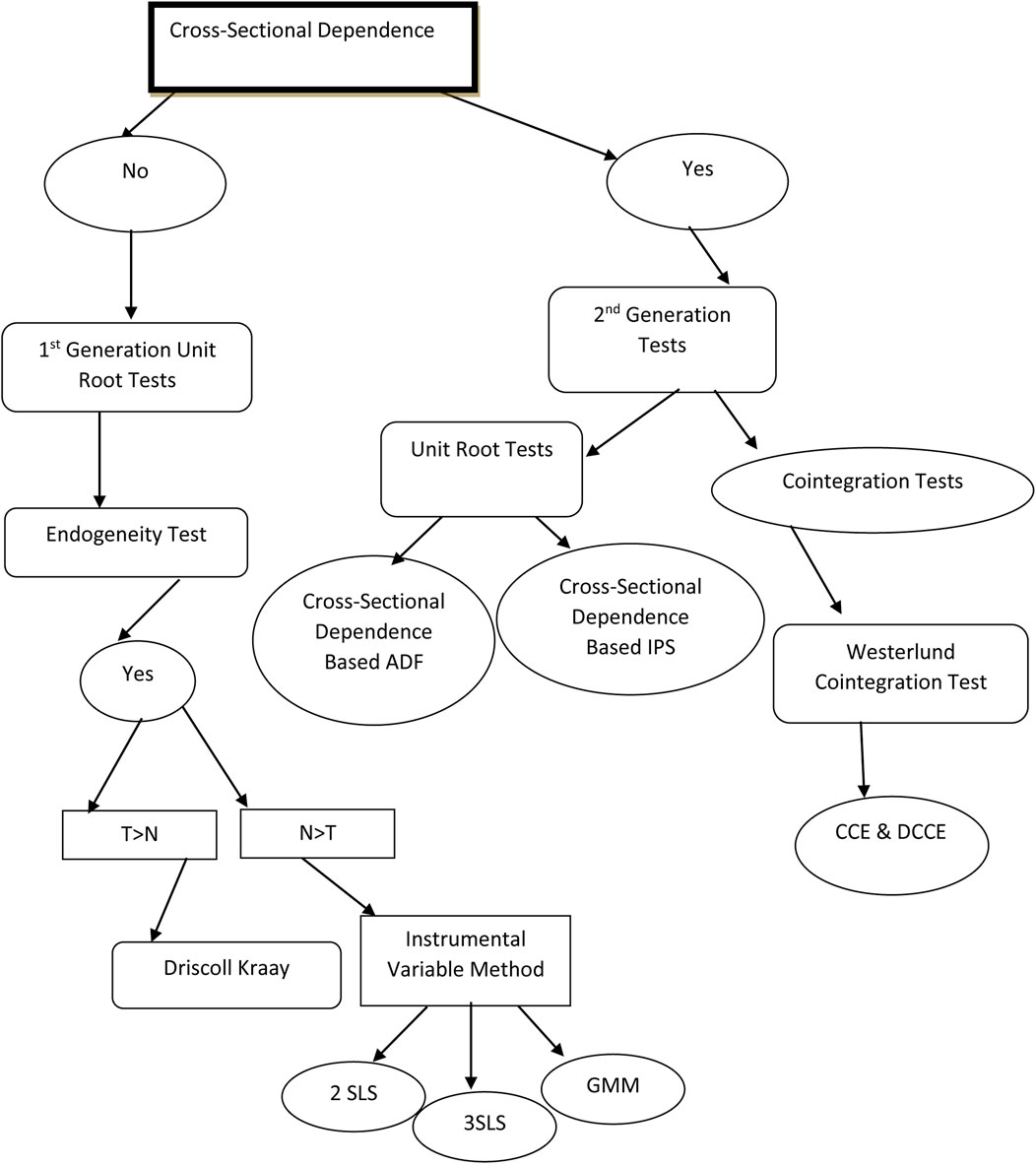

The methodological roadmap is summarized in a schematic framework in Figure 1.

Numerous researchers contend that globalization, economic shocks, and numerous other unobserved factors are to blame for the presence of CSD in many economies (Ma et al., 2021; Riti et al., 2021; Korkut Pata et al., 2022). Each nation in this era of modernization is impacted by the developments occurring in other economies (Edwards et al., 2022). Chudik and Pesaran, (2015) created a novel method called “dynamic common correlated effects (DCCE)” that makes it simple to address this CSD problem. According to this methodology, CSD occurs between cross-sectional units because of a few unnoticed common factors. The PMG10 (Pesaran et al., 1999), MG11, and CCE12 methodologies’ guiding concepts are also used to construct the DCCE approach. The CCE technique uses cross-sectional averages for both independent and dependent variables to identify unobserved common causes. The CCE approach can handle serial correlation, non-stationarity, and structural breakdowns; however, because its dependent variable is not entirely exogenous, it is ineffective for dynamic panel data (Ditzen, 2021). On the other hand, the estimators in the DCCE methodology become more persistent by utilizing more lags of cross-sectional averages. Ditzen (2021) adapted the DCCE technique for heterogeneous panel data to get both short-run and long-run dynamic results. The DCCE technique addresses several significant issues that other conventional methodologies are unable to handle. This technique first addresses the CSD issue by extracting the lags and averages of all cross-sectional units. The mean group (MG) attributes, which are a component of the DCCE approach, can be used to address the second issue, parameter heterogeneity. Third, it determines dynamic common correlated effects for heterogeneous data under the assumption that each regression variable can be explained by a single component. Fourth, the DCCE method takes non-stationarity in data into account and gets rid of asymptotic distortion brought on by the endogeneity of the independent variables (Chudik and Pesaran, 2015). Additionally, in both static and dynamic models using panel data, the DCCE technique develops an instrument set utilizing the lagged form of the variables and becomes robust to endogenous regressors. In dynamic panel models, regardless of whether the regressors are strictly exogenous, weakly exogenous, or endogenous, they significantly improve the estimator’s small sample features (Chaudhry et al., 2022; Liddle and Hasanov, 2022).

Results

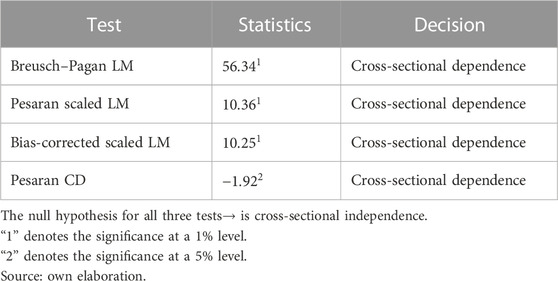

Analyses start with diagnostic procedures. To begin, we check for cross-sectional dependence (CSD)13 between the model’s panels (De Hoyos and Sarafidis, 2006). We use the Breusch–Pagan LM test, Pesaran scaled LM test, bias-corrected scaled LM test, and Pesaran CSD test to test for the CSD problem. The results of the CSD test are reported in Table 1.

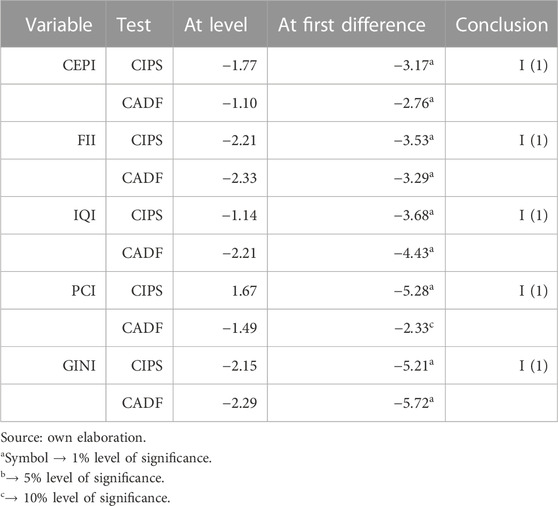

The results of the CSD test confirm the existence of cross-sectional dependence among the panel prescribing to apply for the second-generation unit root tests (CIPS and CADF). The results of CIPS and CADF are reported in Table 2.

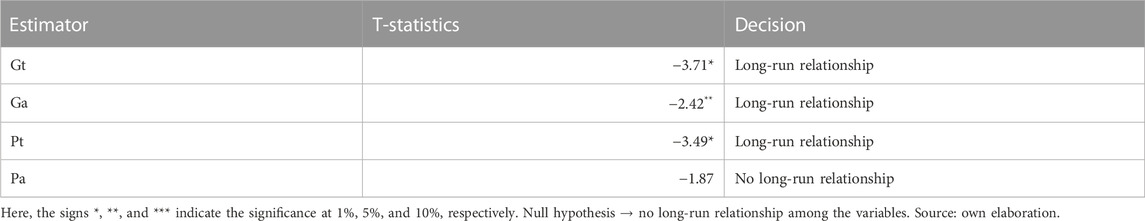

The second-generation unit-root test findings are shown in Table 2, and they show that all the variables are non-stationary at their level, and their first differences are stationary. This means that the variables are integrated order of one process, i.e., they are I (1). We use the Westerlund and Edgerton (2008)14 cointegration test to examine the existence of a long-run, that is, cointegrated relationship among financial inclusivity, institutional quality, and environmental performance, given that the level of the variables is non-stationary. The results of the Westerlund co-integration test are reported in Table 3.

The results of Westerlund cointegration indicated that three out of four tests confirmed the existence of the long-run relationship between financial inclusiveness, institutional quality, per capita income, income inequality, and environmental performance.

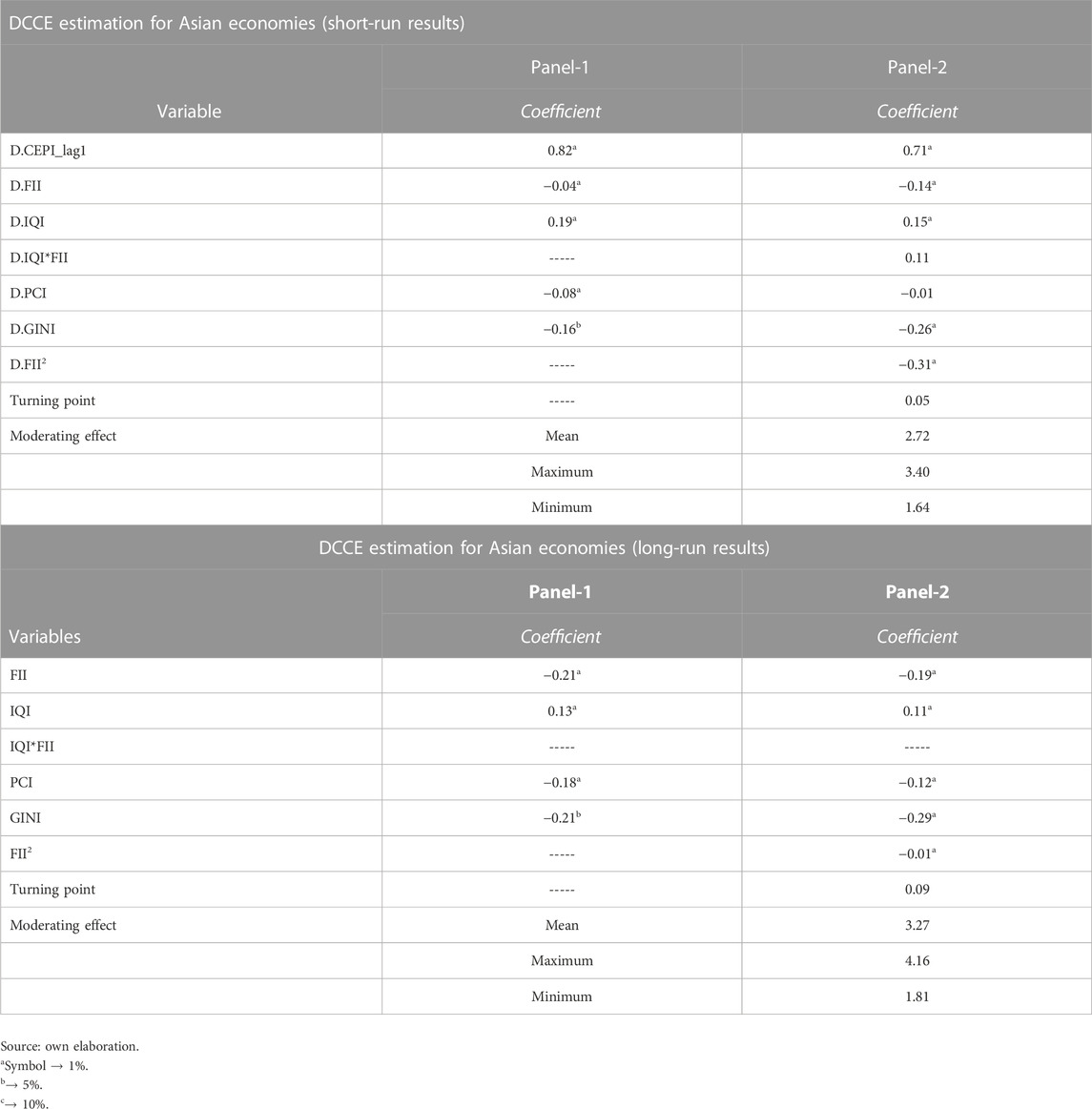

Since variables are cointegrated, we would be interested in estimating parameters/coefficients of this long-run relationship. As previously mentioned, we use the DCCE estimator for this purpose as it accounts not only for non-stationarity but also for the cross-sectional dependency and heterogeneity. Table 4 presents the outcomes of DCCE, where the upper part of the table presents the short-run results and the lower part of the table documents the long-run results. Table 4 tabulates short- and long-run results for Eqs 3, 4 through Panel-1 and Panel-2, respectively. To be precise, Panel-1 indicated the estimation results of Eq. 3, where the environmental performance is dependent upon its own lag, financial inclusiveness, institutional quality, per capita income, and income inequality, while Panel-2 presents the estimation results for the interaction term model, checking the validation of financial inclusion-based EKC, i.e., Eq. 4.

Results of short and long run given in Table 4 show that financial inclusion has a significant impact on the environmental performance. In this part, we start by looking at the empirical findings from the dynamic panel model that are presented in the lower part of Table 4. With the coefficients of −0.21 and −0.19, respectively, the association between financial inclusion and environmental performance is significant at the one percent level in each panel. Because there is a negative correlation between financial inclusion and environmental performance, financial inclusiveness that is primarily encouraged by access to credit may be able to assist households in starting businesses that will boost the household income. Households with higher incomes can now afford energy-intensive things that they previously could not. Due to increased industrialization and economic activity, the environment may be harmed by the production of industrial waste (Ullah et al., 2021; Liu et al., 2022a; Liu et al., 2022b; Charfeddine and Zaouali, 2022; Ding et al., 2022; Hussain et al., 2022; Wang et al., 2022). The findings are opposite of the findings by Liu N et al. (2022), Shahbaz et al. (2022), and Xue and Zhang (2022). Similar negative relationships between growth (PCI) and environmental performance occur in the original EKC argument, where the relationship between growth and environmental performance has been explored. The results of Ntow-Gyamfi et al. (2020) are confirmed by the fact that an increase in IQI, on the other hand, enhances the environmental performance in all panels. The interactive relationship between financial inclusion and institutional quality is then included. Panel-2 of Table 4 presents the findings. We find that institutional quality and our environmental performance metrics are generally positively correlated (M. Usman and Jahanger, 2021). Our findings imply that having a solid institutional foundation aid in controlling economic agents’ behavior in the direction of a greener environment (Tamazian and Bhaskara Rao, 2010; Ntow-Gyamfi et al., 2020). Financial inclusion has a favorable effect on environmental performance as we found when we mediated the association between financial inclusion and institutional quality in the short run. Our findings imply that even with the negative effects of financial inclusion on environmental performance, environmental performance still rises with financial inclusion since there is a substantial positive association between institutional quality and environmental performance. This shows that authorities can reduce the negative consequences of financial inclusion on the environment. Although institutional strength might contribute to the creation of a sustainable environment, the existence of financial inclusion strengthens institutional efforts (Usman and Jahanger, 2021). It was found that inequality had a negative significant impact on environmental performance. The results are consistent with the findings of Qayyum Khan et al. (2018). Additionally, the squared term of FII is introduced in Panel-2 of Table 4 to check for the shape of EKC. The findings validated the inverted U-shape hypothesis of EKC even based on FII (Nasir et al., 2019; Ntow-Gyamfi et al., 2020; Fakher et al., 2021). Although the detrimental impact of financial inclusion on the environment may be reversed in later phases of growth, the turning points are moderate, according to the turning points computed and provided in Table 4 (above 60 percent). This indicates that until financial inclusion reaches a level above 60 percent, it will continue to have a negative influence on environmental performance. The next important step was to find the marginal impact of financial inclusion on environmental performance by evaluating at the maximum, minimum, and average levels of financial inclusion and institutional quality. The results are reported in the second last row of Table 4. Results suggested that the marginal impact of financial inclusion is primarily favorable from the minimum level to the maximum level (Ntow-Gyamfi et al., 2020). It is important to briefly discuss the estimation outcomes of Eq. 4. First, if the FII and its relationship to CEPI are considered, it may be said that Eq. 4 is the best depiction of the finance–environment relationship. The relationship between financial inclusion and environmental sustainability is non-linear, as shown by Eq. 4. The association between financial inclusion and environmental performance is an inverted U-shape. Furthermore, the intersecting effect of financial inclusiveness and institutional quality on environmental performance declares that strong institutional quality plays a significant role in mitigating the adverse effects of the financial sector on environmental quality at least in the short run. We think that this connection goes beyond the established link between financial inclusion and growth. Additionally, the data support the idea that the quadratic term of FII mitigates the harmful effects of climate change. This shows that authorities can reduce the negative consequences of financial inclusion on the environment.

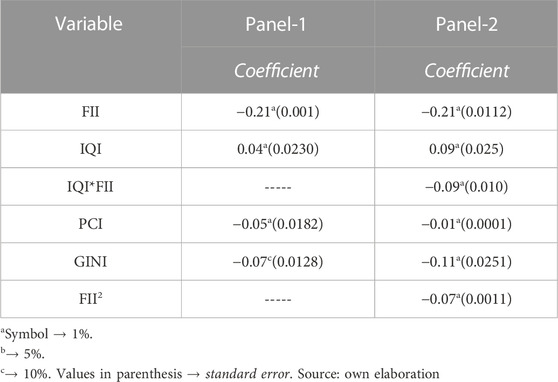

To guarantee the reliability of the findings, Table 5 presents the Driscoll–Kraay estimation results. The primary outcomes are still the same, as can be observed.

Conclusion and policy recommendations

The study’s goal is to investigate the relationship between financial inclusion and environmental sustainability in 48 Asian economies. The study used a dynamic common correlated effect estimator and data collection from 1996 to 2020 for the empirical analysis. The financial inclusion index calculates the level of financial inclusion. Environmental performance is measured using the Comprehensive Environmental Performance Index. In addition, the study included the investigation of several control factors, including per capita income and income inequality. The study employed two separate panels to trace the interactive association to simplify the analysis, where Panel-1 was designed to examine how financial inclusion and institutional strength directly affect the environmental performance. Although Panel-2 was created to examine the moderating impact of institutional quality and to support the structure of EKC, the second panel introduced the squared term of financial inclusion in characterizing the link between financial inclusion and the environment. It is crucial to quickly go over equation’s estimation results (4). First, it may be claimed that Eq. 4 is the best representation of the interaction between finance and the environment, when the FII and its relationship to CEPI are considered. The equation illustrates the non-linear nature of the relationship between financial inclusion and environmental sustainability (4). An inverted U-shape represents the relationship between financial inclusion and environmental performance. Furthermore, the intersecting effect of financial inclusiveness and institutional quality on environmental performance declares that strong institutional quality plays a significant role in mitigating the adverse effects of the financial sector on environmental quality. According to us, there is more of a correlation between financial inclusion and growth than has previously been recognized. Furthermore, the data are consistent with the hypothesis that the quadratic term of FII attenuates the negative consequences of the climate change. This demonstrates the institutional quality may reduce the damaging effects of financial inclusion on the environment. The results of the DCCE analysis for each of the two panels show that financial inclusion has a negative and significant impact on environmental performance, leading to the conclusion that rising levels of digital financial inclusion tend to significantly increase pollution emissions, which worsen environmental performance in Asian economies. Our findings imply that even with the negative effects of financial inclusion on environmental performance, environmental performance still rises with financial inclusion since there is a substantial positive association between institutional quality and environmental performance. This shows that authorities can reduce the negative consequences of financial inclusion on the environment. Although institutional strength might contribute to the creation of a sustainable environment, the existence of financial inclusion strengthens institutional efforts. Although the detrimental impact of financial inclusion on the environment may be reversed in later phases of growth, the turning points are moderate, which indicates that until financial inclusion reaches a level above 60 percent, it will continue to have a negative influence on environmental performance. The next important step was to find the marginal impact of financial inclusion on environmental performance by evaluating at the maximum, minimum, and average levels of financial inclusion and institutional quality. Results suggested that the marginal impact of financial inclusion is primarily favorable from the minimum level to the maximum level. The developments of digital inclusive finance and institutional quality can both greatly enhance environmental quality, according to the independent effect test. Additionally, the development of institutional quality at this level has made the environmental quality in the surrounding areas worse. This is due to the intensity of digital financial inclusion increasing in this region. The junction of institutional quality and digital financial inclusion can greatly improve environmental quality, according to the joint effect test. This demonstrates how digital inclusive finance and institutional regulation work together to manage environmental quality.

The study presented several significant policy implications for Asian economies based on these findings. First, through enhancing their infrastructure for digital financial facilities, the governments of Asian economies should promote cooperation in financial inclusion online. Second, by improving access to mobile and the internet, governments should concentrate on the technical foundation of digital financial inclusion. Third, the government should improve the accuracy of digital financial inclusion and take seriously the connections between carbon emissions, energy use, and financial inclusion when formulating policies. Finally, the government should promote financial sector and institutional policy reforms that support the increased use of banking services, which have a direct impact on economic development.

Environmental pollution can be efficiently reduced through environmental regulation. To simultaneously control corporate polluting behaviors from the perspectives of the government, the market, and the public, a variety of environmental regulation measures should be devised. Businesses will be compelled to develop technology and raise environmental standards if environmental legislation is strengthened. Second, depending on local objective situations and requests from locals, local governments should create more focused evaluation targets for environmental governance in distinct locations. Local governments can coordinate regional governance and come to an agreement on coordinated regulation on environmental governance objectives in this fashion. Local governments should also decide on and set the level and mode of environmental regulation in accordance with regional conditions. The government should simultaneously encourage the central and western provinces to draw lessons from their experiences with environmental governance and boost their investments in environmental protection in a way that makes sense. Finally, relevant environmental protection departments should step up local environmental education and publicity, which can raise residents’ awareness of environmental protection, convince them of the importance of reducing pollution, and motivate them to take an active role in environmental protection. Finally, it is important to note the diverse characteristics of environmental governance led by digital finance, enhancing interregional collaboration, and the “flexible” supervision of digital finance in the process of the regional layout of the digital finance. A digital financial governance system that involves consultation, co-governance, and sharing can be established at the same time as a regulatory model that incorporates a variety of government, market, and societal concerns. This system will eliminate digital financial dangers.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1https://www.climate.gov/news-features/understanding-climate/climate-change-global-temperature.

2https://www.ncei.noaa.gov/cdo-web/.

3https://doi.org/10.1257/aer.89.3.379.

4https://populationmatters.org/sdgs.

5https://info.worldbank.org/governance/wgi/.

6https://doi.org/10.1088/2515-7620/ac8338.

7https://databank.worldbank.org/source/global-financial-inclusion.

8https://databank.worldbank.org/source/worldwide-governance-indicators.

9https://databank.worldbank.org/source/world-development-indicators.

10https://www.tandfonline.com/doi/abs/10.1080/01621459.1999.10474156.

11https://www.sciencedirect.com/science/article/abs/pii/030440769401644F.

12https://onlinelibrary.wiley.com/doi/pdfdirect/10.1111/j.1468-0262.2006.00692.x.

13https://journals.sagepub.com/doi/pdf/10.1177/1536867X0600600403.

14https://doi.org/10.1111/j.1468-0084.2008.00513.x.

References

Afonso, A., and Blanco-Arana, M. C. (2022). Financial and economic development in the context of the global 2008-09 financial crisis. Int. Econ. 169, 30–42. doi:10.1016/J.INTECO.2021.11.006

Ahmad, M., Zhao, Z. Y., Irfan, M., and Mukeshimana, M. C. (2019). Empirics on influencing mechanisms among energy, finance, trade, environment, and economic growth: A heterogeneous dynamic panel data analysis of China. Environ. Sci. Pollut. Res. 26, 14148–14170. doi:10.1007/s11356-019-04673-6

Ali, M., Nazir, M. I., Hashmi, S. H., and Ullah, W. (2021). Financial inclusion, institutional quality and financial development: Empirical evidence from oic countries. Singap. Econ. Rev. 67 (1), 161–188. doi:10.1142/S0217590820420084

Amjed, S., and Shah, I. A. (2021). Does financial system development, capital formation and economic growth induces trade diversification? J. Econ. Dev. 23 (3), 222–237. doi:10.1108/jed-06-2020-0073

Anu Singh, A. K., Raza, S. A., Nakonieczny, J., and Shahzad, U. (2023). Role of financial inclusion, green innovation, and energy efficiency for environmental performance? Evidence from developed and emerging economies in the lens of sustainable development. Struct. Change Econ. Dyn. 64, 213–224. doi:10.1016/J.STRUECO.2022.12.008

Ashraf, A., Nguyen, C. P., and Doytch, N. (2022). The impact of financial development on ecological footprints of nations. J. Environ. Manag. 322, 116062. doi:10.1016/J.JENVMAN.2022.116062

Aydin, C., Esen, O., and Aydin, R. (2019). Is the ecological footprint related to the Kuznets curve a real process or rationalizing the ecological consequences of the affluence? Evidence from PSTR approach. Ecol. Indic. 98, 543–555. doi:10.1016/j.ecolind.2018.11.034

Ayenew Mossie, W. (2022). Understanding financial inclusion in Ethiopia. Cogent Econ. Finance 10.1, 2071385. doi:10.1080/23322039.2022.2071385

Batrancea, L., Rathnaswamy, M. K., and Batrancea, I. (2022). A panel data analysis on determinants of economic growth in seven non-BCBS countries. J. Knowl. Econ. 13 (2), 1651–1665. doi:10.1007/s13132-021-00785-y

Cámara, N., and Tuesta, D. (2017). Cámara and Tuesta, 2017. Bank of Morocco – CEMLA – IFC satellite seminar at the ISI world statistics congress on “financial inclusion” marrakech, Morocco. 14 July 2017, July.

Charfeddine, L., and Zaouali, S. (2022). The effects of financial inclusion and the business environment in spurring the creation of early-stage firms and supporting established firms. J. Bus. Res. 143, 1–15. doi:10.1016/j.jbusres.2022.01.014

Chatterjee, A. (2020). Financial inclusion, information and communication technology diffusion, and economic growth: A panel data analysis. Inf. Technol. Dev. 26 (3), 607–635. doi:10.1080/02681102.2020.1734770

Chaudhry, I. S., Yusop, Z., and Habibullah, M. S. (2022). Financial inclusion-environmental degradation nexus in OIC countries: New evidence from environmental Kuznets curve using DCCE approach. Environ. Sci. Pollut. Res. 29, 5360–5377. doi:10.1007/s11356-021-15941-9

Chen, H., Rehman, M. A., Luo, J., and Ali, M. (2022). Dynamic influence of natural resources, financial integration and eco-innovation on ecological sustainability in EKC framework: Fresh insights from China. Resour. Policy 79, 103043. doi:10.1016/J.RESOURPOL.2022.103043

Chen, J., Huang, S., and Ajaz, T. (2022). Natural resources management and technological innovation under EKC framework: A glimmer of hope for sustainable environment in newly industrialized countries. Resour. Policy 79, 103016. doi:10.1016/J.RESOURPOL.2022.103016

Chikaraishi, M., Fujiwara, A., Kaneko, S., Poumanyvong, P., Komatsu, S., and Kalugin, A. (2015). The moderating effects of urbanization on carbon dioxide emissions: A latent class modeling approach. Technol. Forecast. Soc. Change 90 (PA), 302–317. doi:10.1016/J.TECHFORE.2013.12.025

Chudik, A., and Pesaran, M. H. (2015). Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J. Econ. 188 (2), 393–420. doi:10.1016/J.JECONOM.2015.03.007

Dai, Y., Zhang, H., Cheng, J., Jiang, X., Ji, X., and Zhu, D. (2022). Whether ecological measures have influenced the environmental Kuznets curve (EKC)? An analysis using land footprint in the weihe river basin, China. Ecol. Indic. 139, 108891. doi:10.1016/J.ECOLIND.2022.108891

De Hoyos, R. E., and Sarafidis, V. (2006). Testing for cross-sectional dependence in panel-data models. Stata J. 6 (4), 482–496. doi:10.1177/1536867x0600600403

Destek, M. A., and Sarkodie, S. A. (2019). Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total Environ. 650, 2483–2489. doi:10.1016/j.scitotenv.2018.10.017

Ding, R., Shi, F., and Hao, S. (2022). Digital inclusive finance, environmental regulation, and regional economic growth: An empirical study based on spatial spillover effect and panel threshold effect. Sustain. Switz. 14 (7), 4340. doi:10.3390/su14074340

Ditzen, J. (2021). Estimating long-run effects and the exponent of cross-sectional dependence: An update to xtdcce2. Stata J. 21 (3), 687–707. doi:10.1177/1536867X211045560

Dogan, E., and Inglesi-Lotz, R. (2020). The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: Evidence from European countries. Environ. Sci. Pollut. Res. 27 (11), 12717–12724. doi:10.1007/s11356-020-07878-2

Edwards, P., Brukas, V., Brukas, A., Hoogstra-Klein, M., Secco, L., and Kleinschmit, D. (2022). Development of forest discourses across europe: A longitudinal perspective. For. Policy Econ. 135, 102641. doi:10.1016/J.FORPOL.2021.102641

Ehigiamusoe, K. U., Lean, H. H., Babalola, S. J., and Poon, W. C. (2022). The roles of financial development and urbanization in degrading environment in Africa: Unravelling non-linear and moderating impacts. Energy Rep. 8, 1665–1677. doi:10.1016/J.EGYR.2021.12.048

Ehrlich, P. R., and Holdren, J. P. (1971). Impact of population growth. Science 171 (3977), 1212–1217. doi:10.1126/SCIENCE.171.3977.1212

Fakher, H. A. (2019). Investigating the determinant factors of environmental quality (based on ecological carbon footprint index). Environ. Sci. Pollut. Res. 26 (10), 10276–10291. doi:10.1007/s11356-019-04452-3

Fakher, H. A., Panahi, M., Emami, K., Peykarjou, K., and Zeraatkish, S. Y. (2021). Investigating marginal effect of economic growth on environmental quality based on six environmental indicators: Does financial development have a determinative role in strengthening or weakening this effect? Environ. Sci. Pollut. Res. 28 (38), 53679–53699. doi:10.1007/s11356-021-14470-9

Hao, Y., Chen, H., and Zhang, Q. (2016). Will income inequality affect environmental quality? Analysis based on China’s provincial panel data. Ecol. Indic. 67, 533–542. doi:10.1016/J.ECOLIND.2016.03.025

Hussain, M., Ye, C., Ye, C., and Wang, Y. (2022). Impact of financial inclusion and infrastructure on ecological footprint in OECD economies. Environ. Sci. Pollut. Res. 29 (15), 21891–21898. doi:10.1007/s11356-021-17429-y

Jahanger, A., Razib Hossain, M., Joshua Chukwuma, O., Stephen Obinozie, O., Awan, A., and Balsalobre-Lorente, D. (2023). Analyzing the N-shaped EKC among top nuclear energy generating nations: A novel dynamic common correlated effects approach. Gondwana Res. 116, 73–88. doi:10.1016/J.GR.2022.12.012

Jahanger, A., Yu, Y., Hossain, M. R., Murshed, M., Balsalobre-Lorente, D., and Khan, U. (2022). Going away or going green in NAFTA nations? Linking natural resources, energy utilization, and environmental sustainability through the lens of the EKC hypothesis. Resour. Policy 79, 103091. doi:10.1016/J.RESOURPOL.2022.103091

Khan, A., Chenggang, Y., Hussain, J., and Kui, Z. (2021). Impact of technological innovation, financial development and foreign direct investment on renewable energy, non-renewable energy and the environment in belt and Road Initiative countries. Renew. Energy 171, 479–491. doi:10.1016/J.RENENE.2021.02.075

Khan, Z., Haouas, I., Trinh, H. H., Badeeb, R. A., and Zhang, C. (2023). Financial inclusion and energy poverty nexus in the era of globalization: Role of composite risk index and energy investment in emerging economies. Renew. Energy 204, 382–399. doi:10.1016/J.RENENE.2022.12.122

Korkut Pata, U., Yilanci, V., Hussain, B., and Asif Ali Naqvi, S. (2022). Analyzing the role of income inequality and political stability in environmental degradation: Evidence from South Asia. Gondwana Res. 107, 13–29. doi:10.1016/J.GR.2022.02.009

Kostakis, I., Armaos, S., Abeliotis, K., and Theodoropoulou, E. (2023). The investigation of EKC within CO2 emissions framework: Empirical evidence from selected cross-correlated countries. Sustain. Anal. Model. 3, 100015. doi:10.1016/J.SAMOD.2023.100015

Kusumawardani, D., and Dewi, A. K. (2020). The effect of income inequality on carbon dioxide emissions: A case study of Indonesia. Heliyon 6 (8), e04772. doi:10.1016/J.HELIYON.2020.E04772

Latif, N. (2022). Comprehensive environmental performance index (CEPI): An intuitive indicator to evaluate the environmental quality over time. Environ. Res. Commun. 1, 075016. doi:10.1088/2515-7620/ac8338

Lenka, S. K. (2021). Relationship between financial inclusion and financial development in India: Is there any link? J. Public Aff. 22, 1–10. doi:10.1002/pa.2722

Li, Z., Murshed, M., and Yan, P. (2023). Driving force analysis and prediction of ecological footprint in urban agglomeration based on extended STIRPAT model and shared socioeconomic pathways (SSPs). J. Clean. Prod. 383, 135424. doi:10.1016/J.JCLEPRO.2022.135424

Liddle, B., and Hasanov, F. (2022). Industry electricity price and output elasticities for high-income and middle-income countries. Empir. Econ. 62 (3), 1293–1319. doi:10.1007/s00181-021-02053-z

Liu, D., Xie, Y., Hafeez, M., and Usman, A. (2022a). The trade-off between economic performance and environmental quality: Does financial inclusion matter for emerging asian economies? Environ. Sci. Pollut. Res. 29 (20), 29746–29755. doi:10.1007/s11356-021-17755-1

Liu, D., Zhang, Y., Hafeez, M., and Ullah, S. (2022b). Financial inclusion and its influence on economic-environmental performance: Demand and supply perspectives. Environ. Sci. Pollut. Res. 29, 58212–58221. doi:10.1007/s11356-022-18856-1

Liu, N., Hong, C., and Sohail, M. T. (2022). Does financial inclusion and education limit CO2 emissions in China? A new perspective. Environ. Sci. Pollut. Res. 29 (13), 18452–18459. doi:10.1007/s11356-021-17032-1

Ma, H., Liu, Y., Li, Z., and Wang, Q. (2022). Influencing factors and multi-scenario prediction of China’s ecological footprint based on the STIRPAT model. Ecol. Inf. 69, 101664. doi:10.1016/J.ECOINF.2022.101664

Ma, Q., Murshed, M., and Khan, Z. (2021). The nexuses between energy investments, technological innovations, emission taxes, and carbon emissions in China. Energy Policy 155, 112345. doi:10.1016/J.ENPOL.2021.112345

Meng, M., Niu, D., and Shang, W. (2012). CO2 emissions and economic development: China’s 12th five-year plan. Energy Policy 42, 468–475. doi:10.1016/J.ENPOL.2011.12.013

Nasir, M. A., Duc Huynh, T. L., and Xuan Tram, H. T. (2019). Role of financial development, economic growth and foreign direct investment in driving climate change: A case of emerging asean. J. Environ. Manag. 242, 131–141. doi:10.1016/j.jenvman.2019.03.112

Ntow-Gyamfi, M., Bokpin, G. A., Aboagye, A. Q. Q., and Ackah, C. G. (2020). Environmental sustainability and financial development in Africa; does institutional quality play any role? Dev. Stud. Res. 7 (1), 93–118. doi:10.1080/21665095.2020.1798261

Ozturk, I., and Ullah, S. (2022). Does digital financial inclusion matter for economic growth and environmental sustainability in OBRI economies? An empirical analysis. Resour. Conservation Recycl. 185, 106489. doi:10.1016/J.RESCONREC.2022.106489

Pata, U. K., and Samour, A. (2022). Do renewable and nuclear energy enhance environmental quality in France? A new EKC approach with the load capacity factor. Prog. Nucl. Energy 149, 104249. doi:10.1016/J.PNUCENE.2022.104249

Pesaran, M. H., Shin, Y., and Smith, R. P. (1999). Pooled mean group estimation of dynamic heterogeneous panels. J. Am. Stat. Assoc. 94 (446), 621–634. doi:10.1080/01621459.1999.10474156

Poumanyvong, P., and Kaneko, S. (2010). Does urbanization lead to less energy use and lower CO2 emissions? A cross-country analysis. Ecol. Econ. 70 (2), 434–444. doi:10.1016/J.ECOLECON.2010.09.029

Qalati, S. A., Kumari, S., Tajeddini, K., Bajaj, N. K., and Ali, R. (2023). Innocent devils: The varying impacts of trade, renewable energy and financial development on environmental damage: Nonlinearly exploring the disparity between developed and developing nations. J. Clean. Prod. 386, 135729. doi:10.1016/J.JCLEPRO.2022.135729

Qayyum Khan, A., Saleem, N., and Tamkeen Fatima, S. (2018). Financial development, income inequality, and CO 2 emissions in Asian countries using STIRPAT model. Environ. Sci. Pollut. Res. 25, 6308–6319. doi:10.1007/s11356-017-0719-2

Riti, J. S., Shu, Y., and Kamah, M. (2021). Institutional quality and environmental sustainability: The role of freedom of press in most freedom of press countries. Environ. Impact Assess. Rev. 91, 106656. doi:10.1016/J.EIAR.2021.106656

Shahbaz, M., Li, J., Dong, X., and Dong, K. (2022). How financial inclusion affects the collaborative reduction of pollutant and carbon emissions: The case of China. Energy Econ. 107, 105847. doi:10.1016/j.eneco.2022.105847

Tamazian, A., and Bhaskara Rao, B. (2010). Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ. 32 (1), 137–145. doi:10.1016/j.eneco.2009.04.004

Trinh, H. H., Sharma, G. D., Tiwari, A. K., and Vo, D. T. H. (2022). Examining the heterogeneity of financial development in the energy-environment nexus in the era of climate change: Novel evidence around the world. Energy Econ. 116, 106415. doi:10.1016/J.ENECO.2022.106415

Ullah, S., Ali, K., Shah, S. A., and Ehsan, M. (2022). Environmental concerns of financial inclusion and economic policy uncertainty in the era of globalization: Evidence from low and high globalized OECD economies. Environ. Sci. Pollut. Res. 29 (24), 36773–36787. doi:10.1007/s11356-022-18758-2

Ullah, S., Ozturk, I., Majeed, M. T., and Ahmad, W. (2021). Do technological innovations have symmetric or asymmetric effects on environmental quality? Evidence from Pakistan. J. Clean. Prod. 316, 128239. doi:10.1016/j.jclepro.2021.128239

Usman, A., Ozturk, I., Naqvi, S. M. M. A., Ullah, S., and Javed, M. I. (2022). Revealing the nexus between nuclear energy and ecological footprint in STIRPAT model of advanced economies: Fresh evidence from novel CS-ARDL model. Prog. Nucl. Energy 148, 104220. doi:10.1016/J.PNUCENE.2022.104220

Usman, M., and Jahanger, A. (2021). Correction to: Heterogeneous effects of remittances and institutional quality in reducing environmental deficit in the presence of EKC hypothesis: A global study with the application of panel quantile regression. Environ. Sci. Pollut. Res. 28 (28), 37311. doi:10.1007/s11356-021-13791-z

Voumik, L. C., Rahman, M., and Akter, S. (2022). Investigating the EKC hypothesis with renewable energy, nuclear energy, and RandD for EU: Fresh panel evidence. Heliyon 8 (12), e12447. doi:10.1016/J.HELIYON.2022.E12447

Wang, Q., Yang, T., and Li, R. (2023). Does income inequality reshape the environmental Kuznets curve (EKC) hypothesis? A nonlinear panel data analysis. Environ. Res. 216, 114575. doi:10.1016/J.ENVRES.2022.114575

Wang, X., Wang, X., Ren, X., and Wen, F. (2022). Can digital financial inclusion affect CO2 emissions of China at the prefecture level? Evidence from a spatial econometric approach. Energy Econ. 109, 105966. doi:10.1016/j.eneco.2022.105966

Xue, L., Li, H., Xu, C., Zhao, X., Zheng, Z., Li, Y., et al. (2022). Impacts of industrial structure adjustment, upgrade and coordination on energy efficiency: Empirical research based on the extended STIRPAT model. Energy Strategy Rev. 43, 100911. doi:10.1016/J.ESR.2022.100911

Xue, L., and Zhang, X. (2022). Can digital financial inclusion promote green innovation in heavily polluting companies? Int. J. Environ. Res. Public Health 19 (12), 7323. doi:10.3390/ijerph19127323

Yang, F., Shi, L., and Gao, L. (2023). Probing CO2 emission in Chengdu based on STRIPAT model and Tapio decoupling. Sustain. Cities Soc. 89, 104309. doi:10.1016/J.SCS.2022.104309

Yang, L., Wang, L., and Ren, X. (2022). Assessing the impact of digital financial inclusion on PM2.5 concentration: Evidence from China. Environ. Sci. Pollut. Res. 29 (15), 22547–22554. doi:10.1007/s11356-021-17030-3

Yang, X., Li, N., Mu, H., Pang, J., Zhao, H., and Ahmad, M. (2021). Study on the long-term impact of economic globalization and population aging on CO2 emissions in OECD countries. Sci. Total Environ. 787, 147625. doi:10.1016/j.scitotenv.2021.147625

Yu, S., Zhang, Q., Hao, J. L., Ma, W., Sun, Y., Wang, X., et al. (2023). Development of an extended STIRPAT model to assess the driving factors of household carbon dioxide emissions in China. J. Environ. Manag. 325, 116502. doi:10.1016/J.JENVMAN.2022.116502

Zhang, Y. J. (2011). The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 39 (4), 2197–2203. doi:10.1016/j.enpol.2011.02.026

Zhao, L., Zhao, T., and Yuan, R. (2022). Scenario simulations for the peak of provincial household CO2 emissions in China based on the STIRPAT model. Sci. Total Environ. 809, 151098. doi:10.1016/J.SCITOTENV.2021.151098

Appendix

Keywords: financial inclusion, institutional quality, environmental sustainability, Asian countries interaction effect model, DCCE

Citation: Latif N, Safdar N, Liaquat M, Younas K, Nazeer N and Rafeeq R (2023) The role of institutional quality in assessing the environmental externality of financial inclusion: A DCCE approach. Front. Environ. Sci. 11:1071149. doi: 10.3389/fenvs.2023.1071149

Received: 15 October 2022; Accepted: 12 January 2023;

Published: 24 January 2023.

Edited by:

Fakhri J. Hasanov, King Abdullah Petroleum Studies and Research Center (KAPSARC), Saudi ArabiaReviewed by:

Sa’D. Shannak, Hamad bin Khalifa University, QatarDavid Mhlanga, University of Johannesburg, South Africa

Tinuade Adekunbi Ojo, University of Johannesburg, South Africa

Copyright © 2023 Latif, Safdar, Liaquat, Younas, Nazeer and Rafeeq. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Nazia Latif, bmF6aWFsYXRpZjIyMkBnbWFpbC5jb20=

†These authors have contributed equally to this work

Nazia Latif

Nazia Latif Noreen Safdar2†

Noreen Safdar2†