- 1College of Business, Shanghai University of Finance and Economics, Shanghai, China

- 2Management College, Ocean University of China, Qingdao, China

The Environmental, social, and governance (ESG) disclosure is an important aspect of firms’ strategies. Therefore, exploring how to facilitate the firms’ ESG disclosure is necessary. This paper examines the role of multiple large shareholders (MLS, hereafter) in facilitating a firm’s ESG disclosure. Using a sample of Chinese listed firms during 2011–2020, we compare the ESG disclosure of firms having MLS with that of firms having a single large shareholder (SLS, hereafter) and find that having MLS associated with significantly higher ESG disclosure. After addressing endogeneity and altering the measurement of MLS, the benchmark results still hold after. Additional analysis shows that MLS exerts a more prominent positive effect on ESG disclosure in SOEs. We also examine the role of the other large shareholders in facilitating firms’ ESG disclosure. Our findings reveal a bright side of MLS: it facilitates ESG disclosure by monitoring. Therefore, this paper’s conclusion sheds new light on the bright side of MLS from the perspective of firms’ ESG disclosure and provides insights into how to improve ESG disclosure.

1 Introduction

Since the United Nations integrated environmental, social, and governance (ESG) in the Principles for Responsible Investment (PRI) in 2006, the ESG (Environment, Social, and Government) has drawn a lot of scholars’ attention and become a hot topic in academia and practice (Siew et al., 2016; Li et al., 2020; Zhang et al., 2020; Li et al., 2021; Kolsi et al., 2022; Lu et al., 2022; Yoo and Managi, 2022). A growing strand of literature has examined the influence factors of ESG disclosure, such as corporate virtue (Christensen et al., 2022), board gender diversity (Manita et al., 2018), external natural disasters (Huang et al., 2022), and board structure (Husted and de Sousa-Filho, 2019). However, multiple large shareholders (MLS, hereafter) play a vital role in corporate governance through their intervention or “voice” on manager conducts and firm decision-making (Shleifer and Vishny, 1986; Dou et al., 2018). It is puzzling that there are a few scholars exploring the relationship between MLS and firms’ ESG disclosure.

However, there have two strands that have emphasized the significant effects of MLS on firm behavior and have controversial conclusions. The first strand have investigated benefits of MLS extensively, such as the governance role in firms’ investment decisions (Jiang et al., 2018), improving firm values by monitoring the insiders (Basu et al., 2016), improving financial reporting quality through their exit threat as informed investors (Dou et al., 2018). Boubaker et al. (2016) highlight the important governance role played by MLS in family firms. Boubaker et al. (2017) hold that MLS reduce the controlling owner’s incentive to avoid bank monitoring, leading to greater reliance on bank debt. Boubaker et al. (2021) point that MLS play a governance role that neutralizes the effect of excess control on productive efficiency. The second strand have examined the cost sides of MLS. For instance, Jiang et al. (2020) hold that MLS is positively related to earnings management due to collusion and cost-sharing, which highlights a potential dark side of MLS. Moreover, MLS tend to collude and form an alliance to increase controllable profits when firms’ behaviors are inconsistent with their interests (Zhang and Li, 2022). Therefore, whether MLS can facilitate firms’ ESG disclosure still need to be further examined.

In China, on the one hand, MLS is a common ownership structure among listed firms and more than 30% of Chinese listed firms have at least large major shareholders that hold >10% of the shares (Cai et al., 2016). On the other hand, firms’ ESG disclosure has been vigorously promoted and developed in China. In 2018, the Asset Management Association of China (AMAC) issued “the Green Investment Guidelines (For Trial Implementation)”, which proposed the ESG disclosure framework for listed firms, thus requiring Chinese listed firms to disclose ESG information. The ESG disclosure system has accelerated the green transformation and development speed of Chinese listed firms, improved market transparency, and alleviated the problem of information asymmetry. Due to Chinese listed companies not only represent the driving force in ESG disclosure but also play a leading role in the Chinese ownership reform (Guo and Liang, 2016; Siew et al., 2016; Deng et al., 2022). This paper selected Chinese-listed firms as research samples for this study. Therefore, the context of China that provides an ideal environment for our research.

To further examine the impact of MLS on firms’ ESG disclosure and explore its mechanism, we propose a hypothesis that firms with MLS may play a monitoring role in affecting their ESG disclosure based on the stakeholder theory and agent theory (Freeman, 1999; Esposito De Falco et al., 2021; Bhandari et al., 2022). Then, we collect Chinese listed firms’ ESG disclosure scores during 2011–2020 from Bloomberg and manually identify whether a listed firm has more than one large shareholders or not each year during 2011–2020 based on the CSMAR database. Employing the variation between firms with MLS and firms with a single major shareholder (SLS, hereafter), this paper empirically estimates the impact of MLS on ESG disclosure based on the two-way fixed effect regression model. Baseline regression results show that having MLS increases ESG disclosure. To prove the robustness of the above finding, we also construct a difference-in-difference (DID, hereafter) model and find that our benchmark regression results still hold after considering the potential endogeneity problem. Our benchmark regression results are robust after altering the measurement of the MLS variable. Finally, we also explore mechanisms of firm ownership and the impacts of other large shareholders through additional analysis.

The main contributions of this study can be concluded in two aspects. First, this paper extend the studies on the influencing factors of ESG disclosure. Previous scholars focus on the impacts of ESG disclosure caused by managers’ traits (Velte, 2019), board structure (Husted and de Sousa-Filho, 2019), and external environment shocks (Huang et al., 2022). We add to this strand of literature through solidly demonstrating the positive effects of MLS on ESG disclosure, which serve as a vital feature of corporate governance structure. Second, this paper deepen the understanding of the benefits of MLS, especially on firms’ ESG disclosure, which unravels the bright side of MLS from the perspective of ESG disclosure. Previous studies have extensively emphasized the positive consequence of MLS, including alleviating agency problems (Edmans and Manso, 2011; Hope et al., 2017; Lin et al., 2020), and reducing managers’ misconduct (Dou et al., 2018).

The remainder of this paper is: Section 2 is the theoretical analysis and hypothesis development. Section 3 provides the empirical design, including empirical models, sample selection, and variables. Section 4 provides baseline regression results and discussion. Section 5 conducts a series of robustness checks. Section 6 provides additional analysis. Section 7 provides conclusions and discussion.

2 Theoretical analysis and hypothesis development

Information asymmetry theory and stakeholder theory are the main theories employed in analyzing firms’ ESG disclosure behavior (Mervelskemper and Streit, 2017; Billio et al., 2021). According to the information asymmetry theory, the firms’ insiders generally hold more information than the external investors, which causes serious stock market information friction (Huang, 2021). ESG information disclosure can solve the information asymmetry problem between firms and investors so that investors can have a clearer perception of firm strategy from three dimensions: environment, society, and corporate governance (Duque-Grisales and Aguilera-Caracuel, 2021).

Meanwhile, the mainstream literature explains the driving force of ESG disclosure stakeholder theory (Freeman, 2001; 1999), which emphasizes that the purpose of ESG disclosure is simultaneously improving social and economic performance as well as fulfilling stakeholders’ interests, such as customers, supplier, investors, employees, governments, and clients, which is not limited in chasing the maximum realization of shareholders’ benefits (Esposito De Falco et al., 2021). Therefore, firms’ ESG disclosure is conducive to demonstrating that firms actively prioritize social responsibility to stakeholders other than shareholders and create shared value for both parties while dealing with pressing social issues with creative solutions (Broadstock et al., 2021). In addition, firms’ ESG disclosure exerts a significant impact on both their own value enhancement (Mervelskemper and Streit, 2017).

The shareholding structure is the logical starting point of corporate governance. The effect of major shareholders, as the key force in the internal governance of Chinese listed companies, on corporate information disclosure is currently dominated by two typical views in academia. On the one hand, some believe that MLS may have a “Collusion effect” on ESG disclosure. The controlling shareholders may conspire with management to make strategic disclosures to satisfy their interests, which has been revealed by the agency theory (Newton and Paeglis, 2019). Based on the tunnel effect theory, MLS may also conspire to exacerbate rather than mitigate agency problems (Guthrie and Sokolowsky, 2010). Cai et al. (2016) find that MLS also conspire to maximize their interests rather than monitor them if their interests are aligned, which harms firm value. Thus, MLS also tends to conspire to reduce ESG disclosure.

However, most existing literature considers the “effective monitoring effect” of MLS as the main role in corporate governance. At the theoretical level, the threshold effect of equity checks and balances is a common basis of analysis. The theory points out that MLS can not only guarantee the concentration of the company’s equity, but also use the role of mutual supervision, checks, and balances, and competition between them to check the decision-making behavior of controlling shareholders, so as to reduce the encroachment of interests of controlling shareholders on listed companies. At the practical level, existing studies using empirical tests with data from several countries show that multiple majority shareholder shareholding structures can play a “monitoring effect”. That is to say, the shareholding structure of MLS restrains management decisions, reduces corporate agency costs, and mitigates corporate information asymmetry. When a firm with MLS, collusion between controlling shareholders and manager is more costly because MLS not only monitor and check controlling shareholders and manager, but also improve internal control quality (Zhang and Li, 2022). Thus, MLS reduces the possibility of collusion and improves the efficiency of corporate governance (He et al., 2022).

Most of the existing studies have proved the view of the monitoring hypothesis. Based on the above analysis, this paper argues that the role of the monitoring effect of MLS is the main influence on the degree of corporate ESG disclosure. Specifically, multiple major shareholders, as the shareholder of corporate interests, have sufficient motivation to maintain the development of the company. The existence of MLS can monitor and check each other, thus effectively curbing managers’ manipulation of corporate information for their own selfish interests and thus positively promoting corporate ESG information disclosure. Thereupon, this paper proposes the following hypothesis.

H1 (Monitoring effect): Firms with MLS increase their ESG disclosure, ceteris paribus.

3 Empirical research and methodology design

3.1 Sample selection and data sources

We choose the Chinese listed firms during 2011–2020 as the sample and conduct the following processes: (1) because the leverage of financial listed firms is abnormal, we exclude firms belonging to the financial industry; (2) because the operation and financial situation of ST* and ST listed firms is abnormal, we drop firms belonging to ST*, ST. The ESG disclosure of Chinese listed firms collected from Bloomberg, and other firms’ financial and governance information are obtained from the CSMAR database. In addition, we also report industry sector distribution of Sample in Supplementary Table SA1 in Supplementary Appendix SA.

3.2 Variables construction

3.2.1 ESG disclosure

ESG disclosure published by Bloomberg has been broadly used in ESG disclosure literature recently (Siew et al., 2016; Minutolo et al., 2019). The ESG disclosure score of Chinese listed firms published by Bloomberg was employed to measure ESG disclosure. A higher score indicates a better ESG disclosure.

3.2.2 Multiple large shareholders

Following related literature (Jiang et al., 2020; Zhang and Li, 2022), we define Multi as a dummy variable measured by whether a firm has more than two large shareholders. The Multi dummy variable is equal to one if the firm has more than one shareholder and 0 otherwise. We consider that shareholders who individually or collectively hold >10% of the firm’s shares have the right to request that the board of directors hold an extraordinary general meeting according to the Company Law of the People’s Republic of China. Therefore, we define shareholders holding >10% of the shares as large shareholders.

3.3 Model specification

To empirically explored the impacts of MLS on ESG disclosure, we construct our baseline regression model based on related literature as follows (Jiang et al., 2020; Zhang and Li, 2022).

Where

3.4 Summary statistics

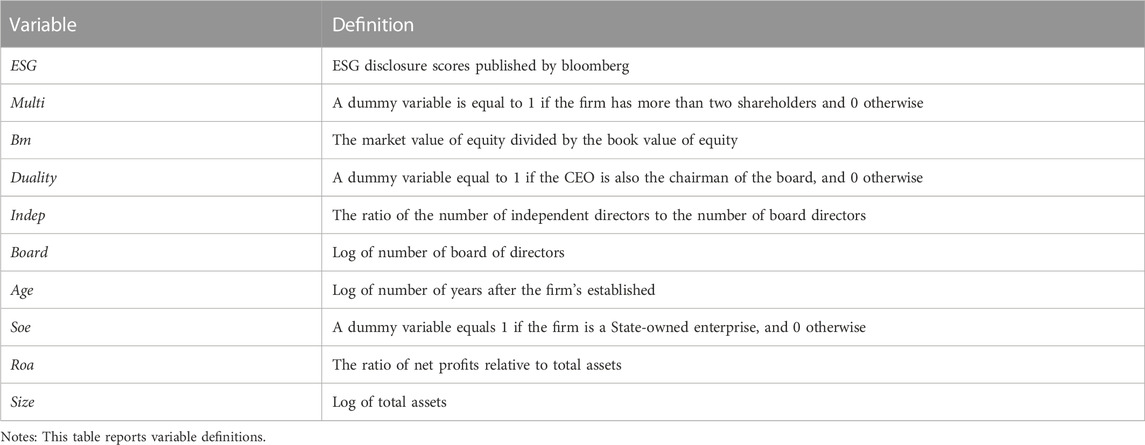

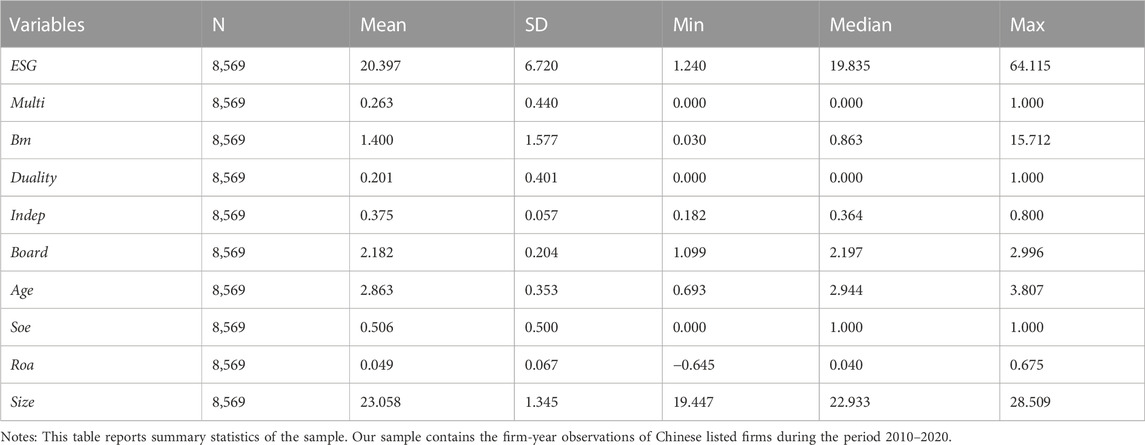

Table 2 reports summary statistics of the main variables. We find that the proportion of listed firms with more than two shareholders is 26.4%, according to Table 1. The standard deviation of ESG is 6.977, the minimum value is 1.240, and the maximum value is 64.115, indicating a large variation in ESG disclosure among Chinese listed firms. The mean of Duality is 0.2, indicating that 20% of the sample firms have a CEO who is also the chairman. The mean of Soe is 0.504, indicating that 50.4% of the sample firms are state-owned. In addition, all sample distributions are consistent with extant research (He et al., 2022; Zhang and Li, 2022). In addition, we also report Correlation coeffcient matrix in Supplementary Table SB1 in Supplementary Appendix SB.

4 Benchmark regression results

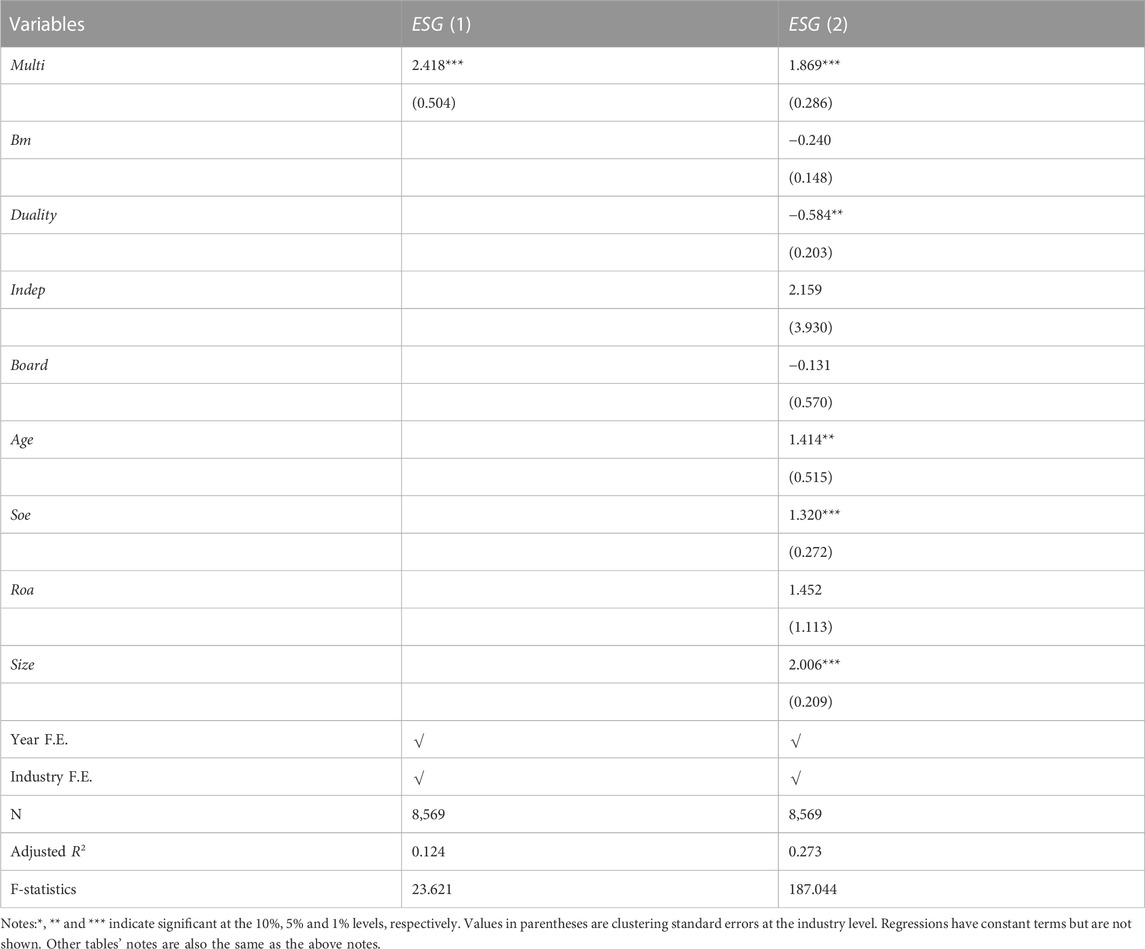

Table 3 reported the regression results of baseline models (1). Columns (1)–(2) show that the variable of MLS (Multi) is 1% significantly positively associated with corporate ESG disclosure (ESG) and with estimate coefficients of 2.418 and 1.869, respectively. Therefore, the above baseline empirical finding proved the H1a, which indicates that having MLS increases corporate ESG disclosure (monitoring effect). Based on the estimation result in Column (2) of Table 3, we find that a one-standard-deviation increase in MLS raises a firm’s ESG disclosure score by 0.822 points, which is obtained by multiplying the standard deviation of the MLS measure by the estimated coefficient. Considering that the mean of ESG disclosure is 20.397, this effect is also economically significant.

In addition, we also find that the estimated coefficient of power concentration (Duality) is negative at the 5% siginificance level, which reflects that the power concentration (Duality) exerts a negative effect on ESG disclosure. We also find that the estimated coefficient of stated-owned enterprise (Soe) is positive at the 1% siginificance level, which indicates that the stated-owned enterprise (Soe) exerts a positive effect on ESG disclosure. We also find that the estimated coefficient of firms’ age (Age) is positive at the 5% siginificance level, which indicates that the firms’ age (Age) exerts a positive effect on ESG disclosure. We also find that the estimated coefficient of firms’ size (Size) is positive at the 1% siginificance level, which indicates that the firms’ size (Size) exerts a positive effect on ESG disclosure. In addition, we also find that the above finding still robust after controlling firm fixed effect in the benchmark model. The related results are reported in Supplementary Table SC1 in Supplementary Appendix SC.

5 Robustness checks

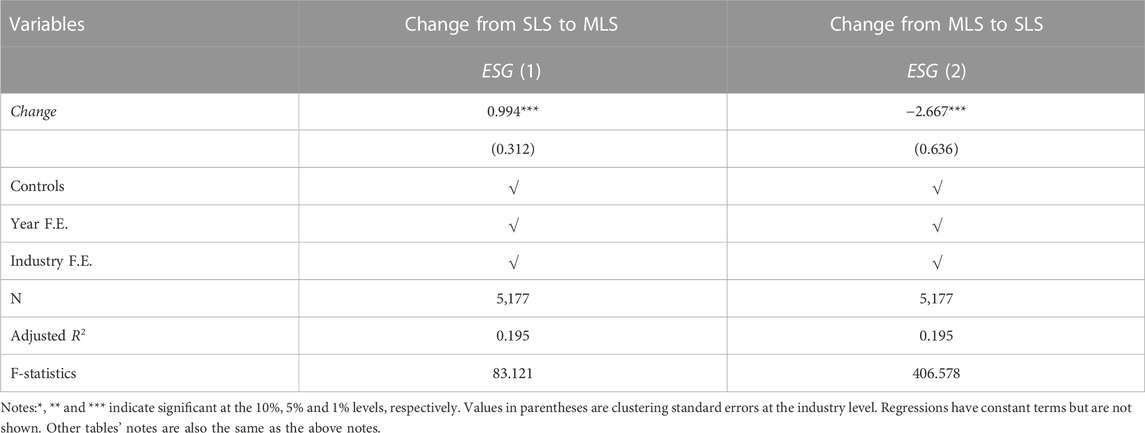

5.1 Mitigating potential endogeneity problem: DID estimations

Considering higher ESG disclosure is potentially related to the urgent need of MLS aiming at reducing agency cost and exerting a monitoring role in facilitating ESG disclosure. To solve the above potential endogeneity concern, following related literature (Slaughter, 2001; Zhang and Li, 2022), we define the treatment group as firms whose ownership structure once changed in sample period and the control group as firms whose ownership structure remained unchanged in sample period. Specifically, if firms whose ownership structure changed from an SLS to MLS in sample period are used as the treatment group, we define firms whose ownership structure has been an SLS all time in sample period as the control group. If firms whose ownership structure changed from MLS to an SLS in sample period are defined as the treatment group, we define the firms whose ownership structure has been MLS all time in sample period as the control group. We construct DID model (2) as follows:

In model (2),

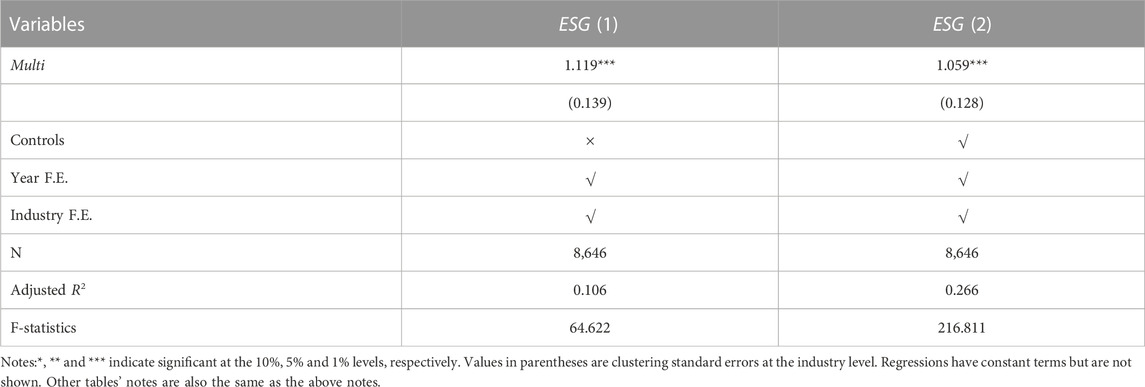

5.2 Alternative measurements of multiple large shareholders

Furthermore, we follow related literature (Zhang and Li, 2022) and define shareholders holding >5% of the shares as large shareholders and reconstruct Multi variable for the robustness test. The robustness regression results reported in Table 5 are still consistent with our baseline regression results.

5.3 Propensity score match (PSM)

Following the related literature (Jiang et al., 2020), to compare ESG disclosure of firms with MLS to that of a (propensity score) matched sample of firms with a SLS that have similar firm-level observable characteristics, we first use a logit model to estimate the probability (i.e., the propensity score) that a firm has MLS as a function of all of the firm characteristic variables in our baseline regression, with firm fixed effects and year fixed effects included as well. Next, we match each firm with MLS to a firm with a SLS based on a predicted probability difference within 0.0001 (in absolute value) from the probability of the MLS firm. The regression result of PSM is reported in Supplementary Table SD1 in Supplementary Appendix SD and shows that MLS exert a significant negative effect on firms’ ESG disclosure. Our benchmark results still hold.

6 Mechanism analysis

6.1 The role of other large shareholders

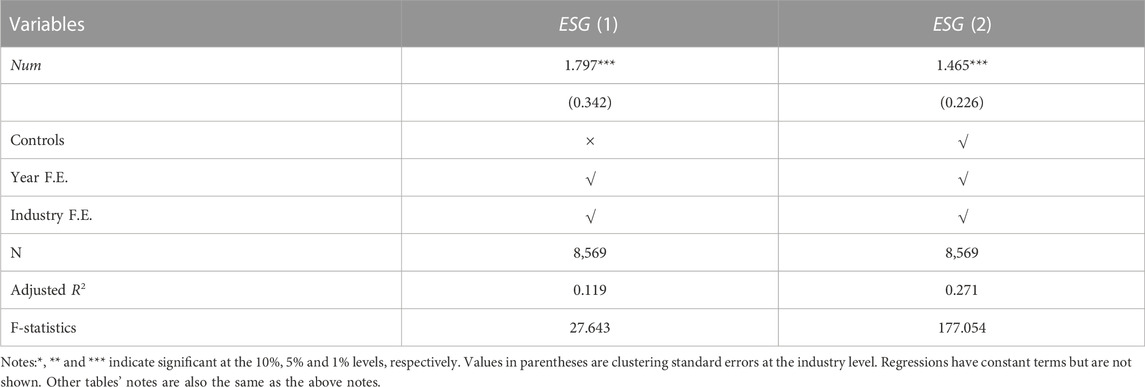

Following related literature (Jiang et al., 2018), we use the number of large shareholders other than the first largest shareholder (Num), which aims to further analyze the effect of MLS.

In column (1) of Table 6, the coefficient of Num is 1.797 and significant at the 1% level, revealing that the number of other major shareholders positively affects firms’ ESG disclosure; In column (2), the coefficient of Num is 1.465 and significant at the 1% level, also implying the above finding.

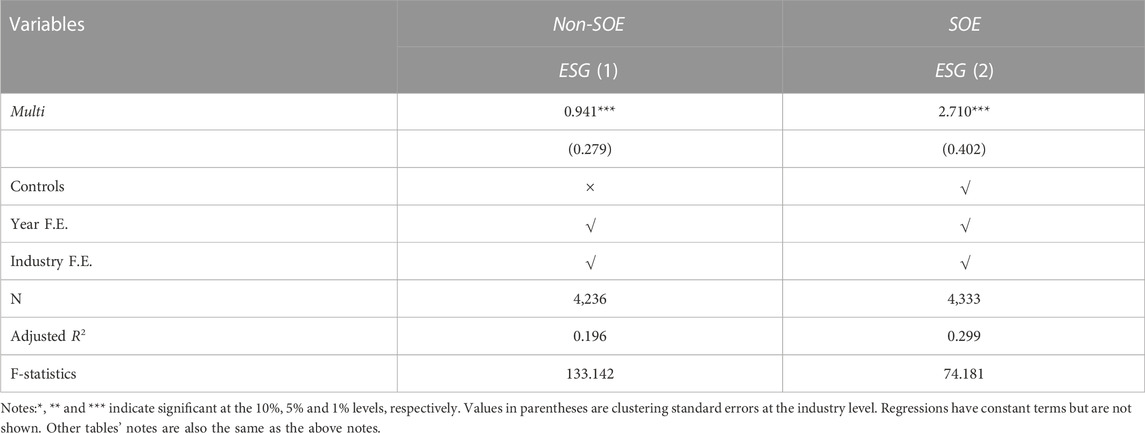

6.2 The role of agency cost

The State-owned enterprises (SOEs) are an important determinant of agency cost (Ding et al., 2018). Due to the lack of shareholders’ supervision of managers, agency cost is higher in SOEs than Non-SOEs (Khuong et al., 2022). Therefore, we re-estimate baseline model (1) based on the subsample of “SOE” and “Non-SOE”. Table 7 reports related results as follows. As shown in Table 7, the effect of MLS on ESG disclosure varies across ownership and MLS play a more positive role in facilitating ESG disclosure in SOEs. The reason is that for SOEs, MLS alleviate agency problem in SOEs more prominently by play a monitoring role, which facilitate firms’ ESG activities disclosure.

7 Conclusion and discussion

Now, corporate ESG disclosure has been a worldwide concern, especially in developing countries like China. At the same time, MLS are important to firms’ decision-making and strategy behaviors. This paper seeks to investigate whether a firm with MLS may form monitoring (collusion) and will increase (decrease) its ESG disclosure. Then, we find that having MLS increases corporate ESG disclosure. The above finding is robust to a series of robustness checks such as difference-in-difference (DID) estimation and altering the measurement of the variable of MLS. Finally, we also find that baseline results also vary across firm ownership and explore its mechanism of the role of other large shareholders. Therefore, this paper’s conclusion sheds new light on the bright side of MLS from the aspect of ESG disclosure and provides insights into how to improve corporate ESG disclosure.

First, firms should notice the ownership structure and rational reform the ownership structure of listed firms. Specifically, firms should pay attention to the issue of equity concentration and strengthen the constraints on the first large shareholder. Besides, the firm should allow other large shareholders and minority shareholders to reflect the role of supervision and checks and balances, which can be done by enabling like-minded minority shareholders to participate in corporate decision-making through concerted action. Firms should actively undertake social responsibility and take the initiative to disclose ESG information to show the capital market the firms’ good corporate image and attract green investment.

Second, the government should be aware of the supervisory role played by the MLS in corporate governance. Moreover, it can guide enterprises through policy formulation to actively attract strategic investment and improve corporate equity allocation and structure. Related government departments should gradually improve the ESG disclosure efficiency of listed firms and guide the ESG disclosure of Chinese listed firms to change from voluntary to mandatory disclosure gradually. The government should guide enterprises to make a smooth transition and gradually realize mandatory disclosure of ESG information under the guidance of laws and regulations.

Finally, this paper did not assess the impact of MLS on firms’ ESG disclosure in different regions. In the future, we could take various regional heterogeneity into consideration and re-examine the influence of MLS on firms’ ESG disclosure.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2023.1063501/full#supplementary-material

References

Basu, N., Paeglis, I., and Rahnamaei, M. (2016). Multiple blockholders, power, and firm value. J. Bank. Finance 66, 66–78. doi:10.1016/j.jbankfin.2016.01.001

Bhandari, K. R., Ranta, M., and Salo, J. (2022). The resource-based view, stakeholder capitalism, ESG, and sustainable competitive advantage: The firm’s embeddedness into ecology, society, and governance. Bus. Strategy Environ. 31, 1525–1537. doi:10.1002/bse.2967

Billio, M., Costola, M., Hristova, I., Latino, C., and Pelizzon, L. (2021). Inside the ESG Ratings:(Dis) agreement and performance. Corp. Soc. Responsib. Environ. Manag. 28, 1426–1445. doi:10.1002/csr.2177

Boubaker, S., Manita, R., and Rouatbi, W. (2021). Large shareholders, control contestability and firm productive efficiency. Ann. Operations Res. 296, 591–614. doi:10.1007/s10479-019-03402-z

Boubaker, S., Nguyen, P., and Rouatbi, W. (2016). Multiple large shareholders and corporate risk-taking: Evidence from French family firms. Eur. Financ. Manag. 22, 697–745. doi:10.1111/eufm.12086

Boubaker, S., Rouatbi, W., and Saffar, W. (2017). The role of multiple large shareholders in the choice of debt source. Financ. Manag. 46, 241–274. doi:10.1111/fima.12148

Broadstock, D. C., Chan, K., Cheng, L. T., and Wang, X. (2021). The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Finance Res. Lett. 38, 101716. doi:10.1016/j.frl.2020.101716

Cai, C. X., Hillier, D., and Wang, J. (2016). The cost of multiple large shareholders. Financ. Manag. 45, 401–430. doi:10.1111/fima.12090

Christensen, D. M., Serafeim, G., and Sikochi, A. (2022). Why is corporate virtue in the eye of the beholder? The case of ESG ratings. Account. Rev. 97, 147–175. doi:10.2308/TAR-2019-0506

Deng, N., Shi, Y., Wang, J., and Gaur, J. (2022). Testing the adoption of blockchain technology in supply chain management among MSMEs in China. Ann. Oper. Res. 2022. doi:10.1007/s10479-022-04856-4

Ding, H., Fan, H., and Lin, S. (2018). Connect to trade. J. Int. Econ. 110, 50–62. doi:10.1016/j.jinteco.2017.10.004

Dou, Y., Hope, O.-K., Thomas, W. B., and Zou, Y. (2018). Blockholder exit threats and financial reporting quality. Contemp. Account. Res. 35, 1004–1028. doi:10.1111/1911-3846.12404

Duque-Grisales, E., and Aguilera-Caracuel, J. (2021). Environmental, social and governance (ESG) scores and financial performance of multilatinas: Moderating effects of geographic international diversification and financial slack. J. Bus. Ethics 168, 315–334. doi:10.1007/s10551-019-04177-w

Edmans, A., and Manso, G. (2011). Governance through trading and intervention: A theory of multiple blockholders. Rev. Financial Stud. 24, 2395–2428. doi:10.1093/rfs/hhq145

Esposito De Falco, S., Scandurra, G., and Thomas, A. (2021). How stakeholders affect the pursuit of the Environmental, Social, and Governance. Evidence from innovative small and medium enterprises. Corp. Soc. Responsib. Environ. Manag. 28, 1528–1539. doi:10.1002/csr.2183

Freeman, R. E. (2001). A stakeholder theory of the modern corporation. Perspect. Bus. Ethics Sie 3, 38–48.

Freeman, R. E. (1999). Divergent stakeholder theory. Acad. Manag. Rev. 24, 233–236. doi:10.5465/amr.1999.1893932

Guo, Y., and Liang, C. (2016). Blockchain application and outlook in the banking industry. Financ. Innov. 2, 24–12. doi:10.1186/s40854-016-0034-9

Guthrie, K., and Sokolowsky, J. (2010). Large shareholders and the pressure to manage earnings. J. Corp. Finance 16, 302–319. doi:10.1016/j.jcorpfin.2010.01.004

He, F., Du, H., and Yu, B. (2022). Corporate ESG performance and manager misconduct: Evidence from China. Int. Rev. Financial Analysis 82, 102201. doi:10.1016/j.irfa.2022.102201

Hope, O.-K., Wu, H., and Zhao, W. (2017). Blockholder exit threats in the presence of private benefits of control. Rev. Account. Stud. 22, 873–902. doi:10.1007/s11142-017-9394-2

Huang, D. Z. (2021). Environmental, social and governance (ESG) activity and firm performance: A review and consolidation. Account. finance 61, 335–360. doi:10.1111/acfi.12569

Huang, Q., Li, Y., Lin, M., and McBrayer, G. A. (2022). Natural disasters, risk salience, and corporate ESG disclosure. J. Corp. Finance 72, 102152. doi:10.1016/j.jcorpfin.2021.102152

Husted, B. W., and de Sousa-Filho, J. M. (2019). Board structure and environmental, social, and governance disclosure in Latin America. J. Bus. Res. 102, 220–227. doi:10.1016/j.jbusres.2018.01.017

Jiang, F., Cai, W., Wang, X., and Zhu, B. (2018). Multiple large shareholders and corporate investment: Evidence from China. J. Corp. Finance 50, 66–83. doi:10.1016/j.jcorpfin.2018.02.001

Jiang, F., Ma, Y., and Wang, X. (2020). Multiple blockholders and earnings management. J. Corp. Finance 64, 101689. doi:10.1016/j.jcorpfin.2020.101689

Khuong, N. V., Anh, L. H. T., Quyen, P. N., and Thao, N. T. T. (2022). Agency cost: A missing link between female on board and firm performance. Bus. Strategy & Dev. 5 (3), 286–302. doi:10.1002/bsd2.199

Kolsi, M. C., Al-Hiyari, A., and Hussainey, K. (2022). Does environmental, social and governance performance score mitigate earnings management practices? Evidence from the US commercial banks. Europe PubMed Central. 10.21203/rs.3.rs-1585001/v1.

Li, Z., Liao, G., and Albitar, K. (2020). Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. Bus. Strategy Environ. 29, 1045–1055. doi:10.1002/bse.2416

Li, Z., Zou, F., and Mo, B. (2021). Does mandatory CSR disclosure affect enterprise total factor productivity? Econ. Research-Ekonomska Istraživanja 35, 4902–4921. doi:10.1080/1331677x.2021.2019596

Lin, S., Chen, F., and Wang, L. (2020). Identity of multiple large shareholders and corporate governance: Are state-owned entities efficient MLS? Rev. Quantitative Finance Account. 55, 1305–1340. doi:10.1007/s11156-020-00875-z

Lu, Y., Wang, L., and Zhang, Y. (2022). Does digital financial inclusion matter for firms’ ESG disclosure? Evidence from China. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.1029975

Manita, R., Bruna, M. G., Dang, R., and Houanti, L. (2018). Board gender diversity and ESG disclosure: Evidence from the USA. J. Appl. Account. Res. 19, 206–224. doi:10.1108/JAAR-01-2017-0024

Mervelskemper, L., and Streit, D. (2017). Enhancing market valuation of ESG performance: Is integrated reporting keeping its promise? Bus. Strategy Environ. 26, 536–549. doi:10.1002/bse.1935

Minutolo, M. C., Kristjanpoller, W. D., and Stakeley, J. (2019). Exploring environmental, social, and governance disclosure effects on the S&P 500 financial performance. Bus. Strategy Environ. 28, 1083–1095. doi:10.1002/bse.2303

Newton, D., and Paeglis, I. (2019). Do large blockholders reduce risk? J. Appl. Corp. Finance 31, 95–112. doi:10.1111/jacf.12332

Shleifer, A., and Vishny, R. W. (1986). Large shareholders and corporate control. J. political Econ. 94, 461–488. doi:10.1086/261385

Siew, R. Y., Balatbat, M. C., and Carmichael, D. G. (2016). The impact of ESG disclosures and institutional ownership on market information asymmetry. Asia-Pacific J. Account. Econ. 23, 432–448. doi:10.1080/16081625.2016.1170100

Slaughter, M. J. (2001). Trade liberalization and per capita income convergence: A difference-in-differences analysis. J. Int. Econ. Intranational Int. Econ. 55, 203–228. doi:10.1016/S0022-1996(00)00087-8

Velte, P. (2019). Does CEO power moderate the link between ESG performance and financial performance? A focus on the German two-tier system. Manag. Res. Rev. 43, 497–520. doi:10.1108/MRR-04-2019-0182

Yoo, S., and Managi, S. (2022). Disclosure or action: Evaluating ESG behavior towards financial performance. Finance Res. Lett. 44, 102108. doi:10.1016/j.frl.2021.102108

Zhang, L., and Li, B. (2022). Mutual supervision or conspiracy? The incentive effect of multiple large shareholders on audit quality requirements. Int. Rev. Financial Analysis 83, 102274. doi:10.1016/j.irfa.2022.102274

Keywords: ESG disclosure, multiple large shareholders, agency cost, ownership structure, monitoring effect, collusion effect, China

Citation: Wang L, Fan X and Zhuang H (2023) ESG disclosure facilitator: How do the multiple large shareholders affect firms’ ESG disclosure? evidence from China. Front. Environ. Sci. 11:1063501. doi: 10.3389/fenvs.2023.1063501

Received: 07 October 2022; Accepted: 16 January 2023;

Published: 25 January 2023.

Edited by:

Mohamed Chakib Kolsi, Emirates College of Technology, United Arab EmiratesReviewed by:

Achraf Guidara, Majan College, OmanSabri Boubaker, Ecole de Management de Normandie, France

Copyright © 2023 Wang, Fan and Zhuang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xuchang Fan, ZmFueHVjaGFuZ0BzdHUub3VjLmVkdS5jbg==

†These authors have contributed equally to this work

Liang Wang

Liang Wang Xuchang Fan

Xuchang Fan Hongyu Zhuang1†

Hongyu Zhuang1†