- 1School of Accounting, Jiangxi University of Finance and Economics, Nanchang, Jiangxi, China

- 2School of Business, Jishou University, Jishou, Hunan, China

In recent years, whether the mixed-ownership reform system of introducing state-owned participation shareholders into private enterprises helps to improve the environmental governance of private enterprises has been a matter of much attention and discussion. Based on data from 2007 to 2019 for Chinese A-share privately listed companies, this paper examines how the state-owned participation shareholders affect the environmental governance level of private enterprises. The results show that state-owned participating shareholder participation can improve the environmental governance level of private enterprises, and this phenomenon is more significant among industrial enterprises and enterprises in regions with a higher degree of marketization. Furthermore, there is a substitution effect between the state-owned participation shareholders, the executive team’s participation in politics, and the Party organization establishment in improving the environmental governance level of private enterprises, and the state-owned participation shareholders play a relatively larger role. In addition, the supervision effect is better when state-owned participation shareholders are from the local area and have a higher level of participation.

1 Introduction

Environmental governance is an important way to promote the construction of ecological civilization. In 2022, China’s “Government Work Report” clearly states that the focus should be on “strengthening pollution prevention and ecological construction and continuously improving environmental quality”, emphasizing that the government and enterprises should continue to strengthen the governance of the ecological environment and continuously promote the construction of ecological civilization. However, under the high pressure of environmental protection, the problem of environmental pollution still exists in China (Luo and Lai, 2016). According to the China State of the Environment Bulletin, although the quality of the ecological environment has generally improved, the construction of ecological civilization is still facing the grim situation of tightening resource constraints, serious environmental pollution, and ecosystem degradation. The current environmental pollution problem in China is mainly manifested by the lack of enterprise awareness and action on environmental governance and the generally low investment in environmental governance (Li et al., 2020). Although 80% of environmental pollution in China comes from enterprises, more than 70% of the investment in environmental governance comes from the government (Feng and Sun, 2020). As the main source of environmental pollution, enterprises are supposed to be an important subject of environmental governance, and the improvement of environmental quality relies heavily on the enthusiasm for enterprises’ environmental governance. However, the negative externalities of the environment make enterprises pursuing economic benefits lack the motivation of environmental governance (Orsato, 2006; Tang et al., 2013). Especially for private enterprises, their business activities are less subject to government intervention than state-owned enterprises, and they are more sensitive to the cost of environmental governance, thus taking less responsibility for environmental protection and causing more serious environmental pollution problems. It has been shown that government-led administrative means are the main factor driving the environmental governance of private enterprises (Gao and Zheng, 2017; Xie et al., 2017; Zhou and Shen, 2019; Liu et al., 2020). While the measures taken by private enterprises in environmental governance due to the government’s administrative measures are still essentially a “reactive” response to environmental problems. Therefore, to solve the long-term environmental pollution problems of private enterprises, the most fundamental thing is to strengthen the supervision and governance of enterprises, and to increase their motivation to carry out environmental governance, so that they can participate in environmental governance “actively".

State-owned equity participation in private enterprises is a crucial method to strengthen the supervision and management of enterprises (Li et al., 2017). Since the third plenary session of the 18th CPC central committee proposed “actively developing mixed-ownership economy”, mixed-ownership reform has rapidly become a hot topic in all sectors of society. The main purpose of the mixed ownership reform is to achieve common development and effective checks and balances among different ownership capital, and the form of reform includes not only the participation of non-state capital in state-owned enterprises but also the participation of state-owned capital in non-state-owned enterprises. Chinese State Council issued the document “Opinions of the State Council on the Development of Mixed Ownership Economy in State-owned Enterprises” in 2015, which points out that “encouraging state-owned capital to participate in non-state-owned enterprises in various ways and actively develop a mixed-ownership economy”. This provides new guidance for the reform of private enterprises in the new era of socialism with Chinese characteristics and proposes a new way of supervising and managing enterprises. With the continuous reform and improvement of the mixed-ownership system, the “complementarity” of heterogeneous shareholders enables private enterprises to take advantage of different ownership capital (Wei and Song, 2020; Li et al., 2021). Numerous studies have found that state-owned participation shareholders have a dual economic and supervisory role in the enterprise. On the one hand, the introduction of state-owned participation shareholders makes private enterprises form a political association with the government (Deng and Wang, 2020), which brings more economic resources and development opportunities for private enterprises (Khwaja and Mian, 2005; Yu et al., 2017). On the other hand, the equity check and balance structure formed by the state-owned participation shareholders and the private controlling shareholders can effectively supervise the controlling shareholders and management, which improves the efficiency of private enterprises’ investment and financing (Li et al., 2021). More importantly, because of the social responsibility of state-owned participation shareholders, they tend to pay more attention to environmental protection than private enterprises (Tang et al., 2013). So, when state-owned equity participates in private enterprises, can it exercise the right to supervise environmental protection on behalf of the state and government, implement the environmental protection responsibilities of private enterprises, and hence promote private enterprises to actively engage in environmental governance? In the context of the current mixed-system reform, it is of great theoretical and practical significance to answer this question.

Environmental governance for enterprises is most notably reflected in environmental investment (Hu et al., 2017). The State Environmental Protection Administration defines environmental investment as the funds used by enterprises to prevent pollution and protect and improve the ecological environment, and (Patten, 2005) states that corporate environmental investment is a relatively accurate and representative objective indicator of the environmental governance level. Based on this, we use Chinese A-share listed private enterprises from 2007 to 2019 as a research sample and employ corporate environmental investment as a proxy variable for the environmental governance level, to examine the impact of state-owned participation shareholders on the environmental governance level of private enterprises. The empirical result shows that state-owned participation shareholders have significantly promoted the environmental governance level of private enterprises, and the promotion effect is more significant among industrial enterprises and enterprises in regions with a higher degree of marketization. Further study finds that there is a substitution effect between state-owned participation shareholders, executive team’s participation in politics, and party organization establishment on the environmental governance level of private enterprises, and the state-owned participation shareholders play a relatively larger role; when state-owned participation shareholders are from the local area and have a higher degree of participation, they can play a better supervision effect.

In contrast with the existing literature, our study makes several contributions. First, we expand the research in the area of economic consequences for state-owned participation shareholders from the perspective of corporate environmental governance. Studies on state-owned participation shareholders have mainly focused on enterprise investment and financing (Li et al., 2021), cash flow level (Wei and Song, 2020), TFP(Yin et al., 2018), enterprise transparency (Zhao and Mao, 2022), enterprise innovation (Luo and Qin, 2019) and performance (Yu et al., 2017)aspects. For example, Li et al. (2021) found that state-owned shares within private firms, which act as political affiliations, help them to obtain more bank loans and longer loan terms. Luo and Qin (2019) noted that state-owned equity participation significantly contributed to the innovation investment of family private enterprises. Yu et al. (2017) found that state-owned equity participation in private enterprises acted as a reputational guarantee at the institutional level and helped private enterprises to access more economic resources and development space, thus improving the financial performance. These studies have mainly focused on the impact of the equity structure of state-owned shareholders’ checks and balances on firm-level economic performance in private enterprises, and there is a lack of exploration in terms of enterprise environmental governance. In contrast to existing studies, we explore the mechanism of the impact of state-owned participation shareholders on enterprise environmental governance from the purpose and supervision effect of state-owned equity participation in private enterprises, combining the two influential pathways of exercising voting rights and supervision management, which can be a useful supplement to the existing studies.

Second, we enrich the literature on enterprise environmental governance from the perspective of shareholder heterogeneity. The existing literature mainly focuses on administrative instruments of government departments (Xie et al., 2017; Zhou and Shen, 2019; Liu et al., 2020), executive characteristics (Hu et al., 2017; Schaltenbrand et al., 2018; Xu and Yan, 2020) and other perspectives to explore the factors driving environmental governance, studies involving the shareholder heterogeneity affecting environmental governance have mainly focused on two aspects: institutional shareholders and foreign investors. For example, (Zhao et al., 2019) and (Dyck et al., 2019) found that field visits by green institutional investors can motivate companies to actively take responsibility for environmental governance and thus improve environmental governance performance. Gulzar et al. (2019) pointed out that foreign shareholders can improve companies by improving environmental governance techniques and actively participating in enterprise governance to enhance the environmental governance level. However, so far, there are few discussions combining the perspective of state-owned participation shareholders. Compared to external supervision, state-owned participation shareholders have a broader scope and stronger enforcement power and usually have more say in the supervision of enterprise environmental governance. Therefore, we explore the driving mechanism of enterprise environmental governance based on the research perspective of state-owned participation shareholders, further expanding the research related to the relationship between shareholder heterogeneity and environmental governance.

Third, our analysis of state-owned participation shareholders and the enterprise environmental governance level helps government departments to develop a comprehensive understanding of the relationship between mixed-ownership reform and corporate environmental governance. The importance of environmental governance at the national strategic level and the leading role of mixed-ownership reform as a top-level design for China to promote subsequent economic reforms, make the issue of environmental governance of private enterprises in mixed-ownership reform particularly important. In this context, discussing the impact of state-owned participation shareholders on the enterprise environmental governance helps government departments and state-owned participation shareholders to adjust the target and proportion of participation in a more targeted manner, and implement differentiated participation for enterprises in different industries and regions to improve their environmental governance level, provides an empirical basis for private enterprises to further deepen the mixed-ownership reform at this stage. It is significant to achieve the policy goal of ecological civilization construction.

2 Hypothesis development

Under governmental pressure to protect the environment, enterprise environmental governance practices often act on enterprise environmental investment behavior decisions through effective internal supervision mechanisms. Therefore, effective internal supervision is an important driver of enterprise environmental governance. As a participant of the company, the state-owned participation shareholders need to fulfill the supervisory and management authority of the funders while achieving the goal of preserving and increasing the value of state-owned capital (Li et al., 2021). Specifically, state-owned participation shareholders can exert supervisory effects to promote the environmental governance of private enterprises (Li et al., 2017).

First, state-owned participation shareholders can exercise their voting rights to express their views on basic business management decisions of the company, etc., and exert a supervisory effect, thus improving the enterprise’s environmental governance level. Enterprise environmental governance is a public affairs activity with high investment costs, long lead time, and high risks, which makes private enterprises pursuing economic interests less motivated to participate in environmental governance. State-owned participation shareholders, as social responsibility bearers, not only consider the economic benefits of the enterprise but also expect the enterprise to have good performance in environmental and other social responsibilities. When state-owned equity participates in private enterprises, they may take relevant measures to influence the business management decisions to a certain extent (Yu et al., 2017), and improve the enthusiasm for enterprise environmental governance. On the one hand, state-owned participation shareholders have more advanced social responsibility undertaking concepts and practical experience and can integrate their social responsibility preferences in the supervision process of enterprise decision-making, and guide enterprises to make more decisions that are conducive to environmental responsibility undertaking and environmental governance participation through the exercise of voting rights. On the other hand, the increase in enterprise environmental governance participation brought about by the effective guidance of state-owned participation shareholders on enterprise management decisions can further improve the social reputation of the company and improve its sustainable development (Deng and Wang, 2020). The resulting competitive advantage will be able to gain the recognition of other small and medium-sized shareholders and other stakeholders in private enterprises, increasing the possibility of their active participation in environmental governance, which in turn can improve the overall environmental governance level of the enterprise.

Second, state-owned participation shareholders can effectively curb the self-interest and short-sightedness of managers, reduce the opportunity for managers to misappropriate company resources, and exert a supervisory effect on them, thereby improving the environmental governance level of the enterprise. According to agency theory, in the absence of effective supervision, managers may act shortsightedly out of their interests, choosing the economic projects that are most beneficial to themselves at the expense of shareholders and abandoning environmental governance projects with high investment and low returns (Carl et al., 2012). At the same time, managers are likely to use information asymmetry to appropriate company resources and reduce the investment funds available for enterprise environmental governance. State-owned participation shareholders have a wide range of supervision and strong enforcement power and can implement effective internal supervision of managers (Zhong et al., 2020). On the one hand, state-owned participation shareholders exert pressure on managers by submitting proposals to the general meeting, negotiating, and replacing management members, and transferring environmental responsibilities to the managers of their participating private enterprises at each level, thus effectively curbing the self-interest and short-sightedness of managers and making them pay more attention to the long-term interests of private enterprises (Bradshaw et al., 2019) and undertake environmental governance projects, thus improving the enterprises’ environmental governance level. On the other hand, the state-owned participation shareholders increase the resources of private enterprises to conduct environmental governance by investigating and punishing managers’ misappropriation of interests in internal control management, thus reducing the opportunity for managers to misappropriate the company’s resources. Based on the above analysis, Hypothesis 1 is proposed.

Hypothesis 1: Ceteris paribus, state-owned participation shareholders can improve the environmental governance level of private enterprises.The role of state-owned participation shareholders in improving the environmental governance level of private enterprises is influenced by industry heterogeneity. Different industries generally face different market environments and government regulations, resulting in large differences in the level of market competition and financial performance between industries, which affects the environmental responsibility and environmental governance level of enterprises (Tang et al., 2013). Given that industrial enterprises are the main source of current environmental pollution in China, they face stricter environmental and industry regulations and greater pressure to reduce emissions than enterprises in other industries and are also closely watched by the government, society, and the public (Du and Li, 2020). According to the theory of environmental fiduciary responsibility, the industrial sector should perform more responsibilities of environmental protection and strengthen environmental responsibility. Therefore, when state-owned participation shareholders are introduced to industrial private enterprises, the state-owned participation shareholders urge the enterprises to give increasing weight to environmental pollution problems by exercising their supervisory power, and prompt them to invest more environmental protection funds for the purchase of environmental protection facilities, the improvement of environmental protection technologies and systems, and the treatment of pollution emissions, to increase the treatment of industrial pollution and improve the efficiency of pollution treatment. Based on the above analysis, Hypothesis 2 is proposed.

Hypothesis 2: Ceteris paribus, the positive effect of state-owned participation shareholders on the environmental governance level of private enterprises is more significant in industrial enterprises.The role of state-owned participation shareholders in improving the environmental governance level of private enterprises is influenced by the degree of regional marketization. Uneven economic development across regions in China has led to large differences in the degree of marketization among regions. When located in regions with a lower degree of marketization, where there is more government intervention and a relatively lagging economic development and governance environment, information asymmetries may exacerbate agency conflicts and may also face higher government agency costs resulting from government intervention (John et al., 2011). In this environment, private enterprises will be more likely to choose projects with greater investment benefits rather than environmental governance to achieve local economic development goals. Conversely, when the degree of regional marketization is relatively high, the external economic and legal environment is better, there is less government intervention, and the local government pays more attention to the protection of the ecological environment (Zhang et al., 2022). At this time, the introduction of state-owned participation shareholders by private enterprises will not only improve the governance structure and supervision mechanism of the enterprises but also their business objectives and development strategies will be improved with the entry of state-owned participation shareholders with environmental protection obligations, prompting them to make more environmental investments. Therefore, compared to regions with a lower degree of marketization, the introduction of state-owned equity in private enterprises in regions with a higher degree of marketization can better play a supervisory effect, promote private enterprises to make environmental investments, and improve environmental governance levels. Based on the above analysis, Hypothesis 3 is proposed.

Hypothesis 3: Ceteris paribus, the positive effect of state-owned participation shareholders on the environmental governance level of private enterprises is more significant in regions with higher levels of marketization.

3 Research design

3.1 Sample selection and data sources

We take 2007–2019 Chinese A-share listed private companies as the initial sample, considering that companies implement new accounting standards from 2007, to avoid research errors caused by changes in accounting standards. On this basis, the initial sample is screened as follows: 1) excluding samples with missing data on relevant variables; 2) excluding samples of ST, *ST, and PT. According to the Company Law and the Securities Law, the Stock Exchange will impose “Special Treatment” (ST) on the trading of shares of listed companies with abnormal financial and other financial conditions for two consecutive years. When a listed company has losses for three consecutive years, it will become a delisting risk warning “*ST”, its shares will be suspended, and the stock exchange will implement “Particular Transfer” (PT) for such suspended stocks. Such companies have abnormal financial and operational conditions, and their enterprise environmental governance levels are not representative; 3) excluding samples of financial companies, because the financial industry is subject to special regulation and accounting data have different meanings; 4) excluding samples with changes like enterprise ownership during the sample period, to exclude the impact of frequent changes in the nature of enterprise ownership on the study findings during the sample period; 5) referring to the method of (Li et al., 2021), the scope of state-owned participation shareholders is defined as the State-owned Assets Supervision and Administration Commission and other relevant government departments, state-owned enterprises, four major state-owned asset management companies, etc., excluding financial shareholders such as social security funds and investment accounts, and finally obtaining 10,436 observations. The state-owned equity data is collected from the top ten shareholders’ “ownership property” in the company’s annual report and websites such as QiChacha Enterprise Search, and the financial data is obtained from the CSMAR database. In addition, to mitigate the effect of extreme values on the results, the continuous variables are Winsorized at the 1% and 99% quartiles.

3.2 Variable selection

Independent variable: State-owned participation shareholders (State). Drawing on the study of Yu et al. (2017), we use two measures: 1) The shareholding of state-owned participation shareholders (State1), which takes the value of 1 if the top ten shareholders of private enterprises contain state-owned participation shareholders and 0 otherwise; 2) The shareholding ratio of state-owned participation shareholders (State2), the sum of the shareholding proportion of state-owned participation shareholders in the top ten shareholders of private enterprises.

Dependent variable: environmental governance level (EI). Drawing on Tang et al. (2013), environmental investment, which is the ratio of enterprise environmental protection investment to total enterprise assets at the end of the year, is used to measure the environmental governance level of enterprises. In particular, data on environmental investment are obtained from the increase in capital expenditures related to environmental protection disclosed by listed companies in the construction-in-progress account in the notes to their annual reports. In addition, to improve the readability of the regression coefficients, the test treats the environmental governance level variable by multiplying it by 100 according to the basis of the values taken.

Regulated variables:

1) The industry in which the enterprise is located (Industr), a dummy variable that is assigned a value of 1 if the enterprise is located in an industrial enterprise and 0 otherwise, according to the document “Industry Classification of National Economy” issued by the SEC in 2012.

2) The degree of marketization (Market), using the marketization index value of each province (city, district) constructed by Fan and Wang (2018). The higher the index, the higher the degree of marketization.

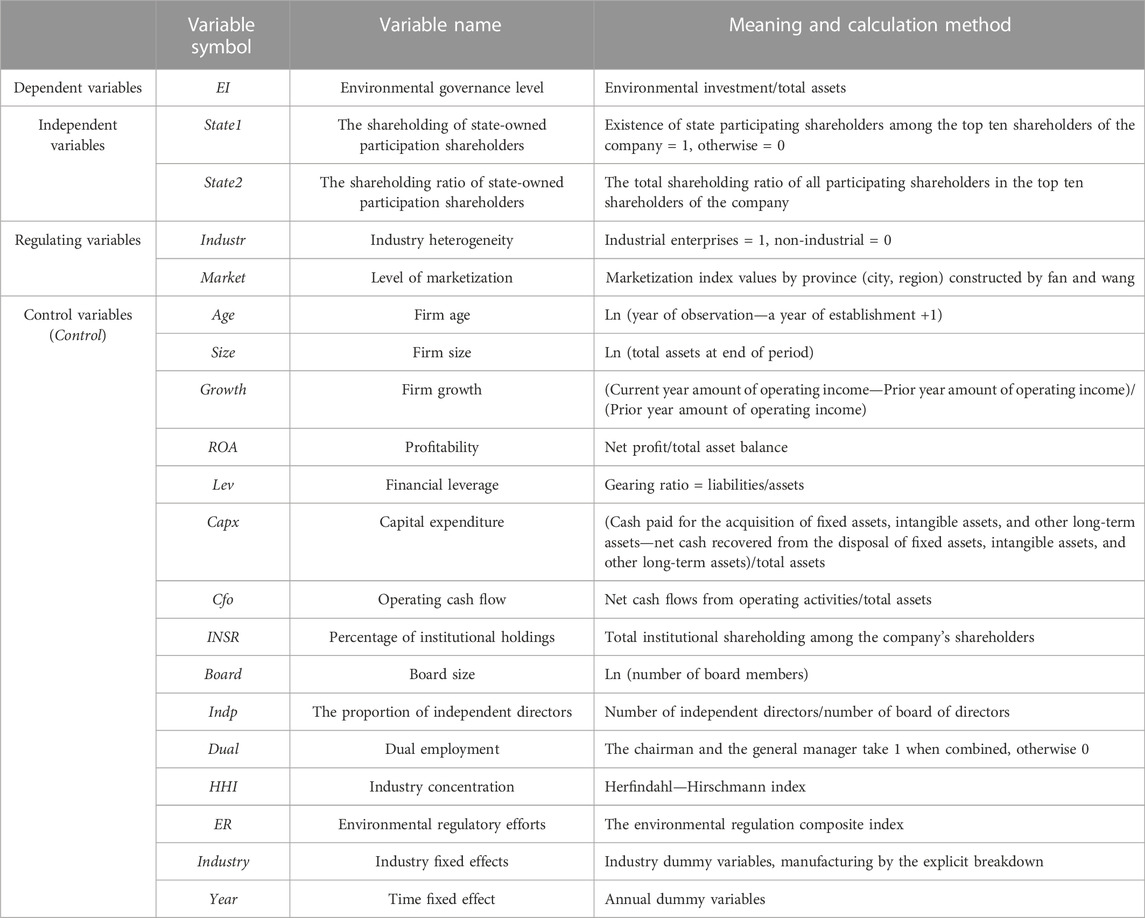

The choice of control variables is based on three main considerations: First, at the level of firm characteristics, environmental investment is an investment behavior of firms and is necessarily influenced by firm fundamentals, so with reference to previous literature (Porter and Linde, 1995; Tang et al., 2013; Hu et al., 2017; Feng and Sun, 2020), we control for variables such as firm age (Age), firm size (Size), firm growth (Growth), profitability (ROA), financial leverage (Lev), capital expenditure (Capx) and operating cash flow (Cfo). Second, at the level of internal corporate governance, factors such as shareholding structure, board structure, and executive characteristics can indirectly affect the environmental governance level by influencing firms’ investment decisions (Carl et al., 2012; Tao and Liu, 2013; Schaltenbrand et al., 2018; Dyck et al., 2019; Zhao and Mao, 2022), so we also control for the proportion of institutional shareholding (INSR), board size (Board), the proportion of independent directors (Indp), and dual employment (Dual) variables. Third, at the level of the firm’s external environment, according to previous literature (Orsato, 2006; Gao and Zheng, 2017; Zhou and Shen, 2019), the degree of market competition of the enterprise and the strength of government environmental regulation also have an impact on the environmental governance of a firm at a certain period, so we also control for the variables of industry concentration (HHI) and the environmental regulation effects (ER). In addition, we control for industry and year in the model to minimize the impact of industry characteristics and time trends on enterprise environmental governance. The specific variables are defined as shown in Table 1.

3.3 Empirical model

To test the effect of state-owned participation shareholders on the environmental governance level of private enterprises, we construct a regression model (1).

In model (1), the subscript i denotes different firms in the sample and t denotes different years, and we are mainly concerned with the direction and significance of the estimated coefficient α1 of Statei,t. According to the previous analysis, if the hypothesis holds, α1 will be significantly larger than zero. Since we used panel data, to determine whether the regression model uses a fixed-effects model or a random-effects model, we first conducted a Hausman-test, and the test result p-value was .0000, so the original hypothesis was rejected and the fixed-effects model was used. To test Hypothese 2 and 3, we group the entire sample according to the industry heterogeneity of private enterprises, and the median value of the marketability index, respectively, and compares the differences in the role of state-owned participation shareholders in improving the environmental governance level of private enterprises.

4 Empirical results and analysis

4.1 Descriptive statistical analysis

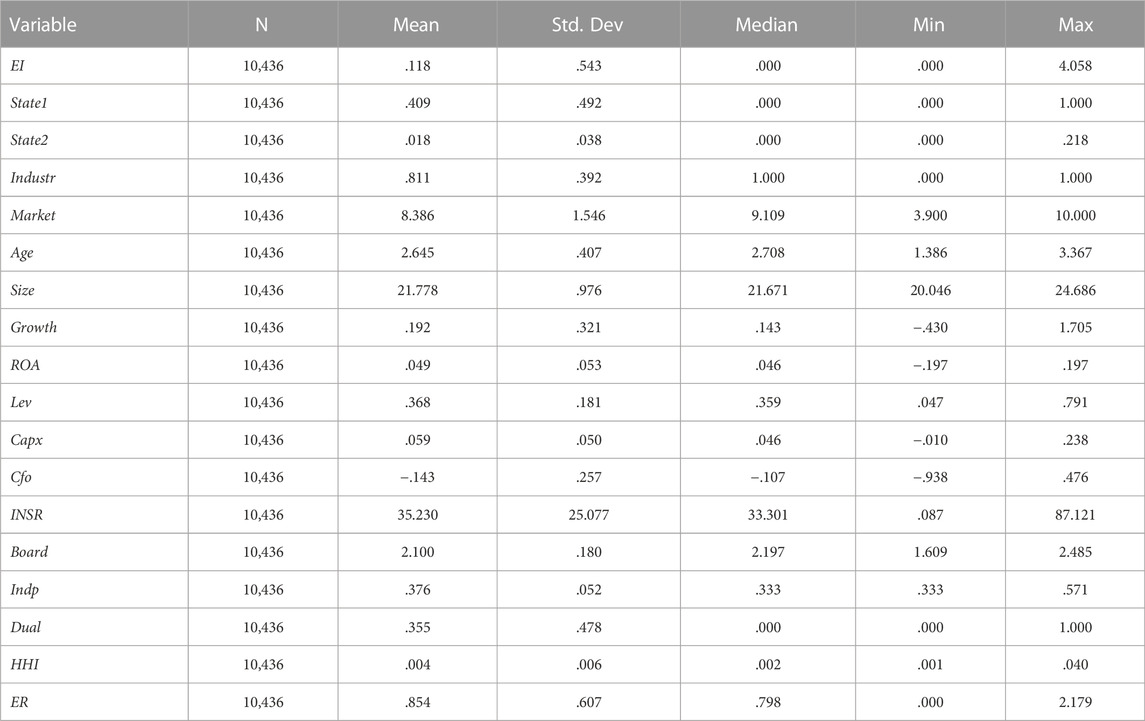

The descriptive statistics of the main variables are shown in Table 2. As can be seen from Table 2, the total sample size is 10,436, the mean value of the environmental governance level (EI) is .118 and the median value is 0, indicating that the amount of enterprise environmental management investment is about .12% of total assets and the sample as a whole has a right-skewed distribution. The maximum value is 4.058 and the minimum value is 0, indicating that there is a large difference in the environmental governance level between different private enterprises. At the same time, only 17% of all the companies in the sample carried out environmental governance, and the motivation for environmental governance of privately listed companies is low. Among the independent variables, the mean value of the shareholding of state-owned participation shareholders (State1) is .409, i.e. 40.9% of private enterprises have state-owned participation shareholders, indicating that the introduction of state-owned participation shareholders in private enterprises is a relatively common phenomenon. The mean value of the shareholding ratio of state-owned participation shareholders (State2) is .018 and the maximum value is .218, indicating that the shareholding ratio of state-owned participation shareholders varies considerably across private enterprises. Among the control variables, the mean and median of indicators such as enterprise age (Age), enterprise size (Size), and enterprise growth (Growth) are the same, indicating that the variables generally conform to a normal distribution; the median and minimum value of the proportion of independent directors (Indp) is .333, the mean is .376, and the standard deviation is .052. It indicates that the number of independent directors in the sample accounts for 37.6% of the board of directors, and the differences between companies are small. According to the Guidance on Establishing Independent Director System in Listed Companies issued by CSRC, the board of directors of listed companies should include at least one-third of independent directors, which indicates that most companies comply with the regulation.

4.2 Univariate mean test

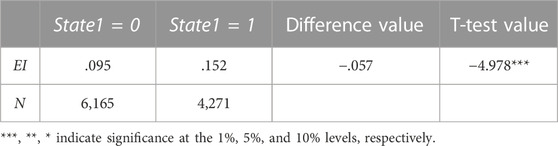

To analyze how state-owned participation shareholders affect the enterprise environmental governance level, we grouped private enterprises according to the shareholding of state-owned participation shareholders and conducted t-tests on the main dependent variables, and the results are shown in Table 3. Where State1 = 0 indicates the sample of companies without the shareholding of state-owned participation shareholders and State1 = 1 indicates the sample of companies with the shareholding of state-owned participation shareholders. The mean value of environmental governance level is .152 in the sample with state-owned participation shareholders, and .095 in the sample without state-owned participation shareholders, the t-test values of both are significant at the 1% level. This indicates that there is a significant difference between the two, with a higher average level of environmental governance in the sample of companies with the existence of state-owned participation shareholders. The above results indicate that the existence of state-owned participation shareholders can improve the environmental governance level of private enterprises, which tentatively supports Hypothesis 1.

4.3 Regression results and analysis

4.3.1 Main regression results

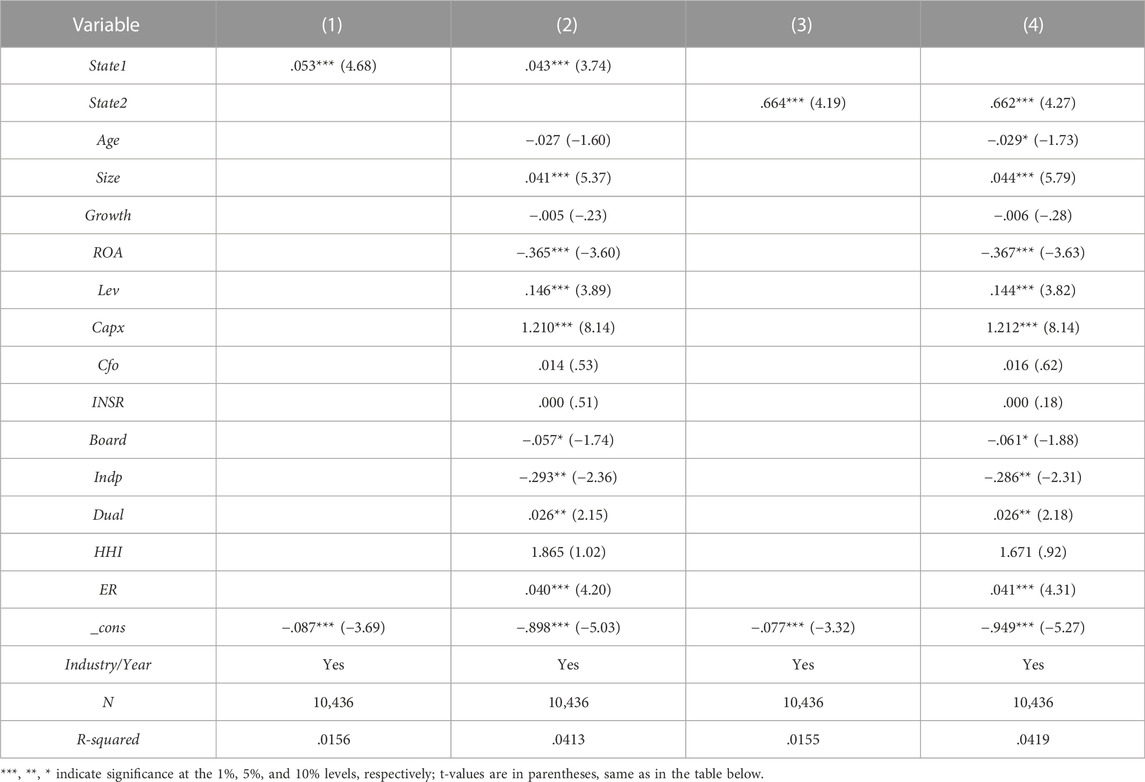

To examine the effect of state-owned participation shareholders on the environmental governance level of private enterprises, we regress the full sample according to model (1), and Table 4 provides the regression results of the relationship between state-owned participation shareholders and the environmental governance level of private enterprises. Among them, no control variables are included in columns 1) and 3), and only industry-level and time-level fixed effects are controlled for; in columns 2) and 4), to examine the robustness of the regression results, control variables, and industry-level and time-level fixed effects are further included. The results in columns 2) and 4) realize that the coefficient estimates of .043 for the shareholding of state-owned participation shareholders (State1) and .662 for the shareholding ratio of state-owned participation shareholders (State2) are significant at the 1% level and are not significantly different from the coefficient estimates in columns 1) and 3). The above regression results indicate that the state-owned equity participation in private enterprises has played its due supervisory effect and prompted private enterprises to increase their environmental investment. In terms of economic significance, private enterprises with the existence of state-owned participation shareholders have a higher environmental governance level compared to private enterprises without state-owned equity participation; the environmental governance level of private enterprises increases by .662% on average when the shareholding of state-owned participation shareholders increases by one unit. Overall, the results in Table 4 are consistent with the theoretical derivation and support Hypothesis 1.

4.3.2 Group test results

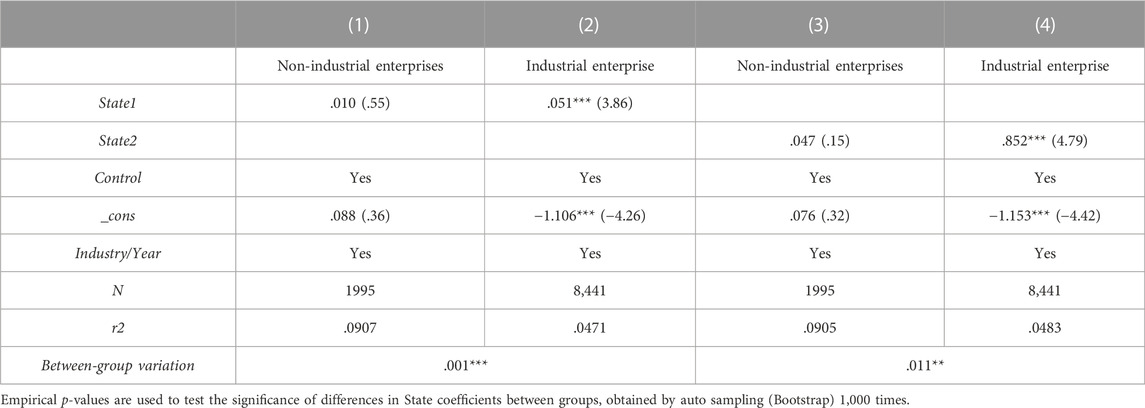

1) Group tests of the enterprise’s industry heterogeneity. Table 5 reports the effect of the industry heterogeneity of private enterprises on the relationship between the state-owned participation shareholders and the environmental governance level of private enterprises. The results show that when private enterprises belong to non-industrial enterprises, state-owned participation shareholders (State1 and State2) do not play a role in the environmental governance level of private enterprises. While, when the private enterprises belong to industrial enterprises, the coefficients of state-owned participation shareholders (State1 and State2) are significantly positive at the 1% level, while comparing the group differences of the coefficients reveals that the coefficients are restrictively different between the two groups. The above results indicate that the environmental pollution caused by the industrial enterprises themselves is serious, and when state-owned participation shareholders are introduced, the state-owned participation shareholders will pay more attention to the environmental issues of the enterprises and exert a supervision effect, which makes the private enterprises to make environmental investments and have a more significant effect on the environmental governance level, which supports Hypothesis 2.

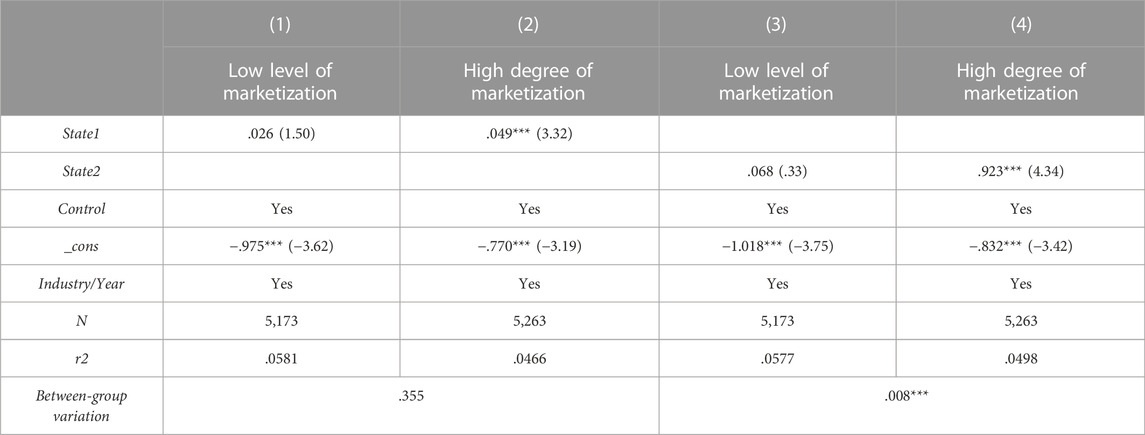

2) Group tests of regional marketization levels. Table 6 reports the difference in the effect of state shareholders on the environmental governance level when private enterprises are located in different regions with different levels of marketization. The regression results show that the coefficients of state-owned participation shareholders (State1 and State2) are positive in different subgroups, but only in the group with a high degree of marketization is significant at the 1% level. This indicates that when the location of private enterprises is in a region with a high degree of marketization, the introduction of state-owned participation shareholders can supervision the environmental governance of enterprises and intervene in their business and investment activities from the perspective of internal enterprise governance, which greatly increases the willingness of private enterprises to protect the environment and forces them to invest in environmental governance. Hypothesis 3 was verified.

TABLE 6. Group test of the degree of marketization of the region in which private enterprises are located.

5 Robustness tests

To ensure the reliability of the study findings, we conducted the following robustness tests.

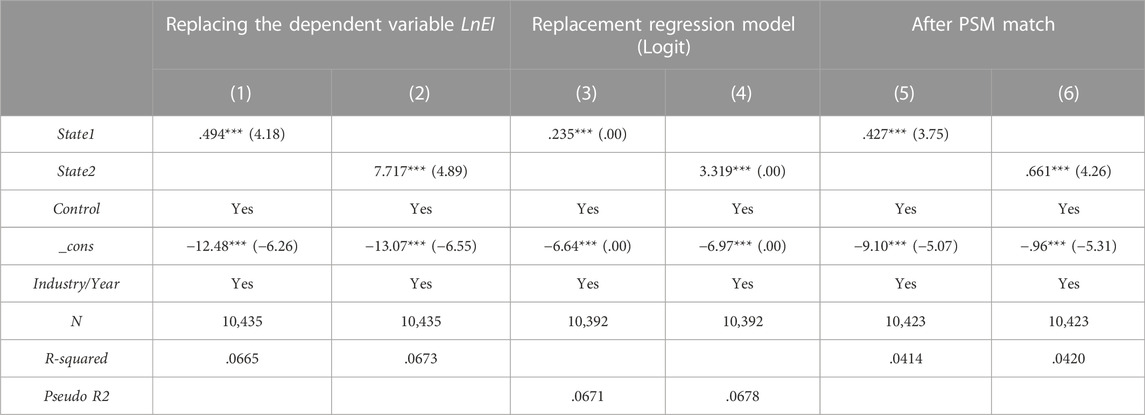

1) Replacement of the measure of the dependent variable. In the above regressions, the explanatory variable environmental governance level (EI) is measured by the relative amount of environmental protection investment after deflating total assets. To maintain the robustness of the results, referring to (Zhou and Shen, 2019), we use the natural logarithm of environmental protection investment to measure the environmental governance level again. The empirical results are shown in columns 1) and 2) of Table 7, and the main findings still hold after replacing the measure of the environmental governance level.

2) Replace the regression model and use the Logit model to test the sample again. In our research sample, there are still many private companies that have not made environmental investments. Therefore, we construct dummy variables based on whether the enterprise environmental investment is zero or not and use the Logit model to test again. The empirical results are shown in columns 3) and 4) of Table 7, and the main findings still hold after replacing the regression model.

3) Propensity score matching (PSM). We use the propensity score matching method to find paired samples for the sample with state-participating shareholders and retest the basic hypothesis using propensity score matched samples. The empirical results of the nuclear-matched screened samples show that the standardized deviations of the variables are all less than 10%, indicating that they pass the balance test. The results for the regression-matched sample are presented in columns 5) and 6) of Table 7 and it can be found that the main findings still hold.

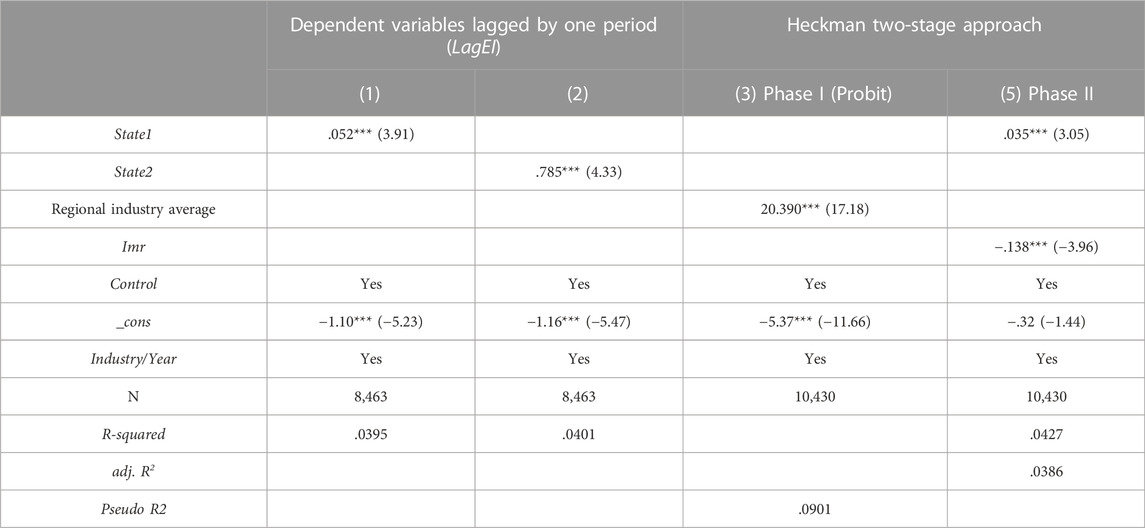

4) The dependent variables are treated with a one-period lag. Since environmental governance takes a long time and therefore has the characteristic of lagging, the regression results are observed after lagging the dependent variable environmental governance level by one period. The results in columns 1) and 2) of Table 8 show that the main findings still hold.

5) Heckman’s two-stage approach. Considering the potential sample selection bias problem, not all private enterprises in the sample have state-owned participation shareholders, and for enterprises that do not have state-owned participation shareholders, the effect of state-owned participation shareholders on their environmental governance level cannot be observed. To address this issue, we use the Heckman two-stage method to test the sample again. In the first stage process, the average of the shareholding ratios of state-owned participation shareholders in different industries in each region is chosen as the instrumental variable to build the Probit model. In the second stage, the inverse Mills ratio (Imr) is brought into the equation for regression. As the results in columns 3) and 4) in Table 8 show, the coefficients of the instrumental variables in the first stage are significantly positive. After accounting for the sample selection bias issue, the coefficient of the regression on the presence of state-owned participation shareholders (State1) in the second stage is significantly positive, indicating that the original regression results are still robust and plausible after accounting for the sample selection bias issue.

6 Further research

6.1 The substitution effect of state-owned participation shareholders, executive team’s participation in politics, and party organization establishment

State-owned participation shareholders (government-owned equity), executive team’s participation in politics (private entrepreneurs have certain political status and identity) and Party organization establishment are the same explicit political association of private enterprises, and there is a substitution relationship among them (Zhang and Guo, 2010; Deng and Wang, 2020). State-owned participating shareholders are the shares formed by relevant departments or institutions that have the right to invest on behalf of the state with state-owned assets in the entity company, including shares converted from the company’s existing state-owned assets; the political participation of the executive team is mainly reflected in the political identity of private entrepreneurs including the political identity of the chairman or CEO and their background as government officials, which can enable the company to maintain direct or indirect relations with the government; According to Article 19 of the Company Law, private enterprises should establish party organizations with reference to the Communist Party’s constitution to supervise and guide the enterprises’ business activities and facilitate communication with the government (Zhang and Jiang, 2019). In terms of environmental governance, relevant studies have shown that private enterprises with executive teams participating in politics have relatively more environmental governance levels (Lin et al., 2015; Xu and Yan, 2020), and Party organization establishment plays an effective supervisory role, which makes private enterprises’ activities more guided and restricted by the government and more actively respond to the national green development strategy, invests more resources in pollution control and environmental protection (Yan and Xu, 2022). The executive team’s participation in politics and Party organization establishment is a kind of proactive behavior of enterprises, which try to establish relationships with government departments or officials through these means to pursue their interests. In contrast, political affiliation at the equity level of state-owned participation shareholders can more directly and effectively improve the environmental governance of the enterprise. The introduction of state-owned participation shareholders into private enterprises is based on existing laws and institutions, and state-owned equity shareholders are both passive and active. In this case, government departments form a community of interest with private enterprises, forming a more stable and close institutional link with private enterprises at the equity level, and a more direct political association (Li et al., 2021). In practice, government departments, as external stakeholders and capital market participants of private enterprises, often play a crucial role (Yu et al., 2017). Therefore, when state-owned participation shareholders are introduced, government departments are more effective in supervising private enterprises, thus improving enterprise environmental governance.

To explore the above issue, referring to Deng and Wang (2020), the State variable is put into the regression model in a model (2) and two interaction terms PC × State and PC × (1- State), Party × State and Party × (1- State) are added for regression, respectively, to create the following model.

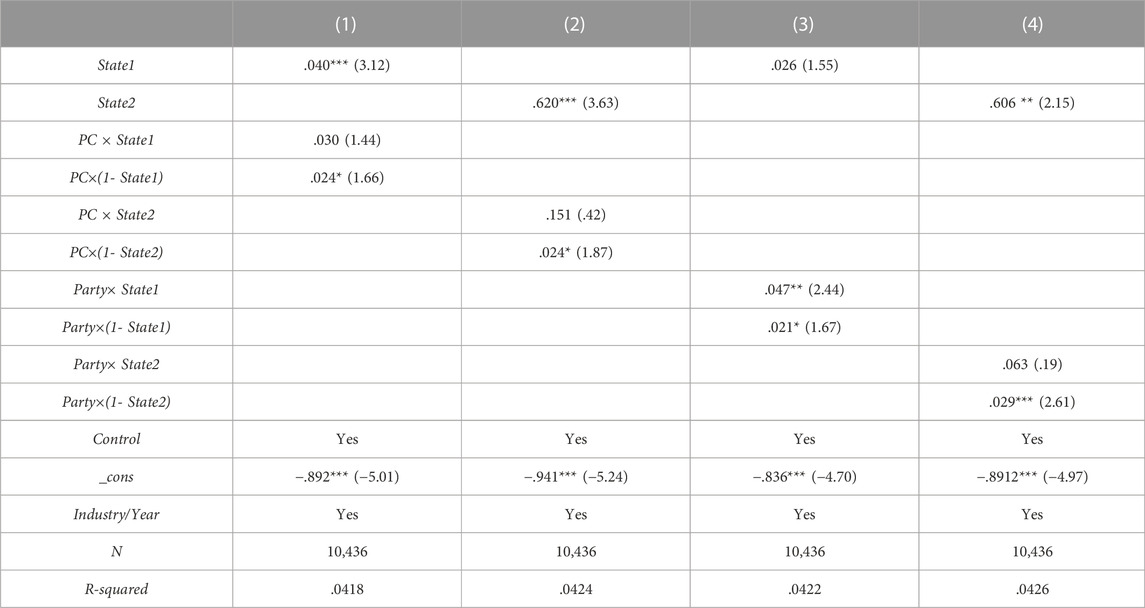

Among them, The subscripts i and t represent the firm and year, respectively, and ε is the model residual. PC is a dummy variable indicating whether there is an executive team’s participation in politics, which is defined by (Yu and Pan, 2008) and is considered to exist if the general manager or chairman of a privately listed company is or has been serving in a government department, elected as a deputy to the National People’s Congress and a member of the Chinese People’s Political Consultative Conference, and is assigned a value of 1, otherwise 0. Party organization establishment, using the approach of (Zhang and Jiang, 2019), takes the value of 1 if the private enterprise has established a grassroots Party organization in the current year, and 0 otherwise. In models (2) and (3), we focus on the coefficient values α3 for PC × (1- State) and β3 for Party × (1- State). If both α3 and β3 are significantly greater than 0, it indicates that in terms of improving the environmental governance level of private enterprises, there is a substitution relationship between the state-owned participation shareholders and the executive team’s participation in politics and the Party organizations establishment.

Table 9 shows the regression results of the alternative relationship between state-owned participation shareholders and the executive team’s participation in politics and Party organization establishment, where columns 1) and 2) are the regression results of the alternative relationship between state-owned participation shareholders and executive team’s participation in politics and model (2), and columns 3) and 4) are the regression results of the alternative relationship between state-owned participation shareholders and Party organization establishment and model (3). The test results show that in columns 1), 2), and 4) the coefficients of the cross-product terms PC×State and Party×State2 are positive but insignificant, and the regression coefficients of the cross-product terms PC×(1- State) and Party×(1- State2) are positive and all pass the significance test. In column 3), the coefficients of the cross-products Party×State1 and Party×(1- State1) are positive and pass the significance test. In addition, the effects of control variables in models (2) and (3) are approximately the same as in model (1). This result indicates that when state-owned equity shareholders participate in private enterprises, they can promote environmental investment and improve environmental governance. In this case, enterprises significantly reduce their reliance on the executive team’s participation in politics and Party organization establishment. However, in the absence of state-owned participation shareholders in private enterprises, the role of the executive team’s participation in politics and Party organization establishment in improving the environmental governance level is greater, i.e., there is a substitution effect between state-owned participation shareholders and executive team’s participation in politics and Party organization establishment in promoting the environmental governance of enterprises. At the same time, the political affiliation effect brought by state-owned participation shareholders plays a much larger role than the executive team’s participation in politics and Party organization establishment.

TABLE 9. Test for the substitution effect of state-owned participation shareholders, executive team’s participation in politics, and Party organization establishment.

6.2 The relationship between the origin of state-owned participation shareholders, the degree of participation, and the environmental governance level

According to the previous arguments and analysis, state-owned equity shareholders can improve the level of enterprise environmental governance. Then, what type of state-owned participation shareholders has a more significant effect on the environmental governance level of private enterprises? (Luo and Qin, 2019)? Find that the impact of state-owned participation shareholders on private enterprises depends not only on the number of state-owned participation shareholders’ shareholdings in private enterprises but also on the place of origin of state-owned participation shareholders and their level of participation in private enterprises.

In terms of the origin of the participating shareholders, when the state-owned participation shareholders and the private enterprises come from the same region, the closer the geographical distance between them, the lower the communication cost and the greater the influence on the private enterprises. When the state-owned participation shareholders originate from the local area, private enterprises will meet government needs, respond positively to government policy guidelines, improve the ecological environment of the enterprise, and make environmental investments, thus obtaining the key resources allocated by the local government. From the perspective of shareholder participation, the “formal” participation of state-owned equity shareholders in private enterprises can have a limited impact, but only “substantive” participation in the daily business activities of the enterprise can have a real impact. Therefore, when there are strong representatives of state-owned participation shareholders in private enterprises, it is often more conducive to the supervision effect, alleviating the internal agency conflict of the controlling private enterprises, and the connection between enterprises and government departments is also closer (Li et al., 2017). Therefore, local state-owned participation shareholders are more likely to improve the environmental governance of private enterprises than off-site state-owned participation shareholders; compared with the low participation in private enterprises, the higher participation of state-owned shareholders has a more significant effect on the improvement of the environmental governance level of private enterprises.

Based on the above analysis, we further explore the benchmark results by distinguishing the characteristics of the origin and degree of participation of state-owned participation shareholders. Specifically, we restrict the sample to private enterprises with state-owned participation shareholders and construct the following regression model.

where i and t represent the enterprise and year, respectively, and ε is the model residual. Referring to (Luo and Qin, 2019), when the number of shares held by local state-owned participation shareholders is more among state-owned participation shareholders, the state-owned participation shareholders are considered to be of local origin and Local takes the value of 1, otherwise, it takes the value of 0. When state-owned participation shareholders send directors to private enterprises, the state-owned participation shareholders are considered to have a high degree of participation in private enterprises and Part takes the value of 1, otherwise, it takes the value of 0. In models (4) and (5), we focus on coefficient value α1 for Locali,t, and coefficient value β1 for Parti,t, which respectively measure the impact of the origin and participation degree of state-owned shareholders on the environmental governance level of private enterprises.

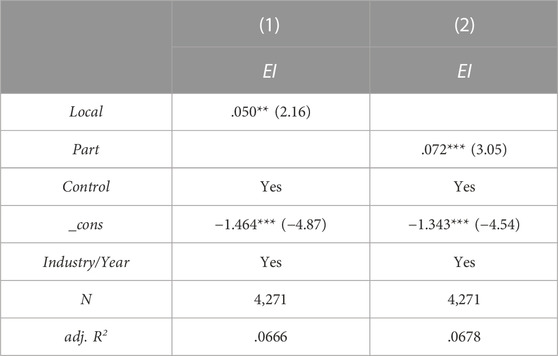

Table 10 reports the differences in the impact of the origin of state-owned participation shareholders and the participation degree of state-owned participation shareholders on the environmental governance level among private enterprises with state-owned participation shareholders. Among them, column 1) shows the difference in the impact of the participation of state-owned participation shareholders on the environmental governance level of private enterprises when the origin of the shareholders is different. The results show that the coefficient of whether the state-owned participation shareholders are from local (Local) is .050 and significant at the 5% level, which means that when the state-owned equity participation is from local, it has a stronger effect on the environmental governance level of private enterprises; column 2) shows the difference in the effect of its participation on the environmental governance level of private enterprises when the state-owned participation shareholders have different degrees of participation. The coefficient of the degree of participation (Part) is .072, which is also significant at the 1% level, indicating that when the participation degree of state-owned participation shareholders in private enterprises is high, their participation has a stronger effect on the improvement of the environmental governance level of private enterprises.

7 Conclusion and recommendations

The introduction of state-owned participation shareholders in private enterprises gives them significant resource acquisition advantages but also gives them more social functions. We examine the impact of state-owned participation shareholders on the environmental governance level of private enterprises from the supervision effect hypothesis. The results show that state-owned participation shareholders can improve the environmental governance level of private enterprises, and the improvement effect is more significant when the enterprise is an industrial enterprise and registered in regions with a higher degree of marketization. Further analysis reveals that there is a substitution effect between the state-owned participation shareholders, the executive team’s participation in politics, and the Party organization establishment in improving the environmental governance level of private enterprises, and the state-owned participation shareholders play a relatively larger role; from the characteristics of state-owned participation shareholders, when the state-owned participation shareholders are of local origin and have a high participation degree, the role of state-owned participation shareholders in improving the environmental governance level of private enterprises is more significant. Our study expands the research in the area of economic consequences for state-owned participation shareholders from the perspective of corporate environmental governance, enriches the literature on the factors influencing enterprise environmental governance, and provides an empirical basis for private enterprises to further deepen the mixed-ownership reform at this stage, which is of great significance for achieving the policy goal of ecological civilization construction.

Based on the above research findings, we propose the following policy recommendations: 1) Actively promote state-owned equity shareholders’ participation in private enterprises. The unique sense of environmental responsibility of state-owned participation shareholders helps to urge private enterprises to make environmental investments, so the supervisory effect of state-owned participation shareholders should be given full play to promote the company to improve its governance structure and optimize its environmental governance decision-making mechanism. 2) State-owned equity should participate in private enterprises for different industries and regions. By tilting limited resources to industrial enterprises and enterprises in regions with a high degree of marketization and improving the supervision efficiency of state-owned participation shareholders, it will help to better realize the effective integration of different mixed economies and improve the environmental governance level of private enterprises. 3) State-owned participation shareholders should not only participate in private enterprises but also participate in the management decisions of private enterprises. Only when the state-owned participation shareholders have a real influence on private enterprises can they effectively play their role in the governance of private enterprises. Therefore, state-owned participation shareholders should pay attention to the “form” and “substance” of equity participation, and participate in the “substance” of the private enterprise’s business management decisions.

The shortcomings of this paper and the corresponding research directions are mainly reflected in the following three aspects: First, due to the availability of data, our samples are all listed companies in the private sector. However, state-owned participation shareholders also exist in a large number of unlisted companies, which are also the main force of environmental governance. Therefore, in future research, we can obtain data from non-listed companies through various channels, such as field research, to study the influence of state-owned participation shareholders on the environmental governance level in non-listed private companies. Second, there is no unified standard for measuring the environmental governance level in the existing literature, and only environmental investment data are used to measure it in our study. Environmental investment belongs to the perspective of input, and the data are manually collected and compiled by us through reviewing the company’s financial statements and social responsibility reports, which have some errors. In the follow-up study, we can consider how to better measure the enterprise environmental governance level from both input and output perspectives. Finally, we have only examined the effect of the shareholding of state-owned participation shareholders and the shareholding ratio of state-owned participation shareholders on the environmental governance level of private enterprises, and have not yet examined the effect of different types of state-owned participation shareholders on the environmental governance level of private enterprises. In future research, we can further distinguish between national-level participation shareholders, provincial-level participation shareholders, and investment-type platform participation shareholders to explore in depth the impact of state-owned participation shareholders on the environmental governance level of private enterprises.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

Conceptualization, LZ and JM; methodology, LZ and JM; software, JM; validation, LZ and JM; formal analysis, LZ and JM; investigation, LZ and JM; resources, JM; data curation, JM; writing—original draft preparation, JM; writing—review and editing, LZ and JM; visualization, LZ and JM; supervision, LZ; project administration, LZ and JM. All authors have read and agreed to the published version of the manuscript.

Funding

The research project is supported by the Postgraduate Innovation Special Fund Project of Jiangxi Province, China (YC2021-B108).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bradshaw, M., Liao, G., and Ma, M. (2019). Agency costs and tax planning when the government is a major Shareholder. J. Account. Econ. 67, 255–277. doi:10.1016/j.jacceco.2018.10.002

Carl, J. K., Juan, S., and Luis, D. (2012). Corporate governance and the environment: What type of governance creates greener companies? J. Manag. Stud. 49, 492–514. doi:10.1111/j.1467-6486.2010.00993.x

Deng, Y., and Wang, J. (2020). Do state non-controlling shareholders in private firms promote corporate innovation. Sci. Technol. Prog. Policy 37, 81–89. doi:10.6049/kjjbydc.2019040774

Du, W., and Li, M. (2020). Assessing the impact of environmental regulation on pollution abatement and collaborative emissions reduction: Micro-evidence from Chinese industrial enterprises. Environ. Impact Assess. Rev. 82, 106382. doi:10.1016/j.eiar.2020.106382

Dyck, A., Lins, K. V., Roth, L., and Wagner, H. F. (2019). Do institutional investors drive corporate social responsibility? International evidence. J. Financial Econ. 131, 693–714. doi:10.1016/j.jfineco.2018.08.013

Fan, G., and Wang, X. (2018). Marketization Index of China’s Provinces: NERI Report 2018. Beijing: Social Science Academic Press.

Feng, Q., and Sun, T. (2020). Comprehensive evaluation of benefits from environmental investment: Take China as an example. Environ. Sci. Pollut. Res. 27, 15292–15304. doi:10.1007/s11356-020-08033-7

Gao, X., and Zheng, H. (2017). Environmental concerns, environmental policy and green investment. Int. J. Environ. Res. public health 14, 1570. doi:10.3390/ijerph14121570

Gulzar, M. A., Cherian, J., and Hwang, J. (2019). The impact of board gender diversity and foreign institutional investors on the corporate social responsibility (CSR) engagement of Chinese listed companies [J]. Sustainability 11 (2), 307. doi:10.3390/su11020307

Hu, J., Song, X., and Wang, H. (2017). Informal institution, hometown identity and corporate environmental governance. Manag. World 3, 76–94. doi:10.3969/j.issn.1002-5502.2017.03.006

John, K., Knyazeva, A., and Knyazeva, D. (2011). Does geography matter? Firm location and corporate payout policy. J. financial Econ. 101, 533–551. doi:10.1016/j.jfineco.2011.03.014

Khwaja, A. I., and Mian, A. (2005). Do lenders favor politically connected firms? Rent provision in an emerging financial market. Q. J. Econ. 120, 1371–1411. doi:10.1162/003355305775097524

Li, M., Li, B., and Hui, X. (2017). Governance effect of the participation of state-owned equity on overinvestment of private enterprises. Commer. Res. 59, 42–47. doi:10.13902/j.cnki.syyj.2017.12.006

Li, W., Zheng, M., Zhang, Y., and Cui, G. (2020). Green governance structure, ownership characteristics, and corporate financing constraints. J. Clean. Prod. 260, 121008. doi:10.1016/j.jclepro.2020.121008

Li, Z., Yun, F., Huang, J., and Lian, Y. (2021). Research on the influence of state-owned capital's shares on the investment efficiency of non-state-owned enterprises. Economist. 03, 71–81. doi:10.16158/j.cnki.51-1312/f.2021.03.008

Lin, H., Zeng, S. X., Ma, H. Y., and Chen, H. Q. (2015). How political connections affect corporate environmental performance: The mediating role of green subsidies. Hum. Ecol. Risk Assess. Int. J. 21, 2192–2212. doi:10.1080/10807039.2015.1044937

Liu, T., Liu, M., Hu, X., and Xie, B. (2020). The effect of environmental regulations on innovation in heavy-polluting and resource-based enterprises: Quasi-natural experimental evidence from China. PLoS ONE 15, 02395499–e239618. doi:10.1371/journal.pone.0239549

Luo, D., and Lai, Z. (2016). Investment of heavily polluting enterprises and promotion of local officials–based on the practical investigation of data for prefectural cities during 1999-2010. Account. Res. 4, 42–48. doi:10.3969/j.issn.1003-2886.2016.04.006

Luo, H., and Qin, J. (2019). Research on the influence of state-owned equity participation on family firms’ innovation investment. China Ind. Econ. 36, 174–192. doi:10.19581/j.cnki.ciejournal.2019.07.010

Orsato, R. J. (2006). Competitive environmental strategies: When does it pay to be green? Calif. Manag. Rev. 48, 127–143. doi:10.2307/41166341

Patten, D. M. (2005). The accuracy of financial report projections of future environmental capital expenditures: A research note. Account. Organ. Soc. 30, 457–468. doi:10.1016/j.aos.2004.06.001

Porter, M. E., and Linde, V. d. (1995). Green and competitive: Ending the stalemate[J]. Harvard business review, 73 (5), 120–134. doi:10.1016/0024-6301(95)99997-E

Schaltenbrand, B., Foerstl, K., Azadegan, A., and Lindeman, K. (2018). See what we want to see? The effects of managerial experience on corporate green investments. J. Bus. ethics 150, 1129–1150. doi:10.1007/s10551-016-3191-x

Tang, G., Li, L., and Wu, D. (2013). Environmental regulation, industry attributes and corporate environmental investment. Acc. Res. 6, 83–96. doi:10.3969/j.issn.1003-2886.2013.06.012

Tao, L., and Liu, B. (2013). Driving factors of corporate environment inputs: Based on neo-institution theory: Evidence from Chinese listed companies. J. China Univ. Geosciences(Social Sci. Ed. 13, 46–53+133. doi:10.16493/j.cnki.42-1627/c.2013.06.007

Wei, L., and Song, H. (2020). Research on the influence of state-owned equity participation on private enterprises’ cash holdings. Finance Econ. 28–39. doi:10.3969/j.issn.1000-8306.2020.09.004

Xie, R., Yuan, Y., and Huang, J. (2017). Different types of environmental regulations and heterogeneous influence on “green” productivity: Evidence from China. Ecol. Econ. 132, 104–112. doi:10.1016/j.ecolecon.2016.10.019

Xu, X., and Yan, Y. (2020). Effect of political connection on corporate environmental investment: Evidence from Chinese private firms. Appl. Econ. Lett. 27, 1515–1521. doi:10.1080/13504851.2019.1693692

Yan, Y., and Xu, X. (2022). Does entrepreneur invest more in environmental protection when joining the communist party? Evidence from Chinese private firms. Emerg. Mark. Finance Trade 58, 754–775. doi:10.1080/1540496X.2020.1848814

Yin, Z., Liu, L., Wang, H., and Wen, F. (2018). Study on the ownership balance and the efficiency of mixed ownership enterprises from the perspective of heterogeneous shareholders. PLoS ONE 13, 01944333–e194515. doi:10.1371/journal.pone.0194433

Yu, H., Yang, Z., and Song, Z. (2017). State ownership, political connections, and corporate performance:A research based on Chinese private-controlled listed firms. Manag. Rev. 29, 196–212. doi:10.14120/j.cnki.cn11-5057/f.2017.04.018

Yu, M., and Pan, H. (2008). The relationship between politics, institutional environments and private enterprises’ access to bank loans. Manag. World 8, 9–21+39+187. doi:10.19744/j.cnki.11-1235/f.2008.08.002

Zhang, R., and Jiang, X. (2019). Party organization governance, marketization process and social responsibility information disclosure. Contemp. Finance Econ. 0, 130–139. doi:10.13676/j.cnki.cn36-1030/f.2019.03.012

Zhang, R., Lin, Y., and Kuang, Y. (2022). Will the governance of non-state shareholders inhibit corporate social responsibility performance? Evidence from the mixed-ownership reform of China's state-owned enterprises. Sustainability 14, 527. doi:10.3390/su14010527

Zhang, X., and Guo, L. (2010). Mechanism, channel and strategy of political connection: A study based on Chinese private enterprises. Finance Trade Econ. 99–104. doi:10.19795/j.cnki.cn11-1166/f.2010.09.015

Zhao, Y., and Mao, J. (2022). Mixed ownership reforms and the transparency of nonstate-owned enterprises: Evidence from China. Manag. Decis. Econ. 44, 271–284. doi:10.1002/mde.3679

Zhao, Y., Shen, H., and Zhou, Y. (2019). Environmental information asymmetry, institutional investors’ corporate site visits and corporate environmental governance. Stat. Res. 36, 104–118. doi:10.19343/j.cnki.11-1302/c.2019.07.009

Zhong, T., Sun, F., Zhou, H., and Lee, J. Y. (2020). Business strategy, state-owned equity and cost stickiness: Evidence from Chinese firms. Sustainability 12, 1850. doi:10.3390/su12051850

Keywords: state-owned participation shareholders, mixed-ownership reform, private enterprises, environmental governance level, industrial enterprises, marketization degree

Citation: Zou L and Ma J (2023) Do state-owned participation shareholders improve the environmental governance level of private enterprises? Evidence from Chinese listed firms. Front. Environ. Sci. 11:1053200. doi: 10.3389/fenvs.2023.1053200

Received: 25 September 2022; Accepted: 04 January 2023;

Published: 12 January 2023.

Edited by:

Zhenghui Li, Guangzhou University, ChinaReviewed by:

Lina Zhang, Hohai University, ChinaIsac De Freitas Brandão, Instituto Federal de Educação, Brazil

Copyright © 2023 Zou and Ma. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jiejing Ma, MjIwMTkxMDAyNUBzdHUuanh1ZmUuZWR1LmNu

Ling Zou1

Ling Zou1 Jiejing Ma

Jiejing Ma