94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 09 February 2023

Sec. Environmental Citizen Science

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1042436

Clarifying the evolution of international competitiveness for strategic and critical mineral articles is of great significance for promoting new energy development and achieving carbon neutrality in China. This study, therefore, calculates the series of indicators based on product space theory, for instance, international import & export shares, revealed comparative advantage (RCA) and product density, to analyze the competitiveness evolution. Results show that: the international competitiveness of China’s strategic and critical mineral articles demonstrated a declining tendency, and the rising percentage of imports was much larger than the decreasing export percentage. The evolution of the international competitiveness of 11 strategic and critical minerals is different. Among them, the international competitiveness of two articles is very strong, that of four articles is relatively weak, and that of three products is decreasing trend. From the perspectives of industrial sectors and trade, we analyze the underlying reasons for the competitiveness evolution of 11 strategic and critical mineral articles in detail and discuss the industry transformation and upgrade feasibility for strategic and critical mineral articles. Our work aims to provide strong support for the upgrading and high-quality development of the strategic and critical mineral products industry by providing corresponding policy suggestions.

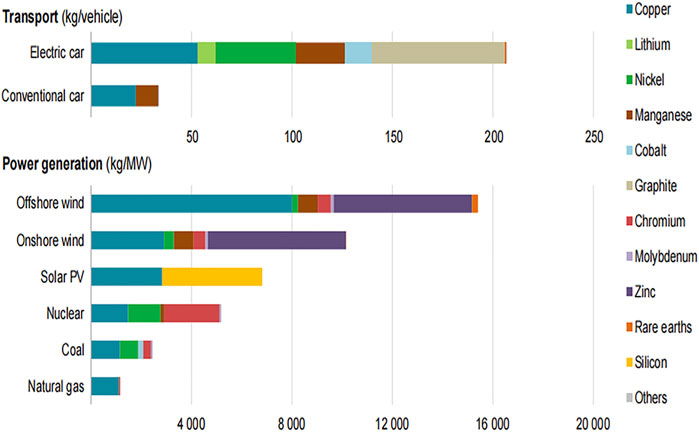

Strategic emerging industries, with their important status in China’s economic system, lead the future development of China. World Energy Outlook Special Report 2021 states that Strategic and critical minerals are widely used in the energy transition, for instance, electric car, conventional car, offshore wind, onshore wind, nuclear and so on (Figure 1). Especially in the impact of the Coronavirus pandemic, global energy is changing from fuel-intensive to material-intensive, the reasonable development and utilization of strategic and critical mineral resources can effectively accelerate the pace of energy transition and lay the foundation for achieving carbon peaking and carbon neutrality. Thus, strategic and critical minerals are of great significance to socio-economic development and environmental protection.

FIGURE 1. Mineral resources used in clean energy transformation1.

In accordance with the State Planning of Mineral Resources (2016–2020) issued by the Ministry of Land and Resources of China, 24 minerals, including oil and natural gas, were included in the catalog of strategic minerals. The development quality and profit of these mineral resources were designated as a priority. However, the government decree did not specifically list a catalog of critical minerals. On the basis of the criticality and scarcity of minerals, 11 strategic key minerals are classified and defined as indispensable minerals or playing a key role in emerging strategic industries (Wang, 2019). Since the 2008 global economic crisis, countries throughout the world resort to strategic emerging industries for the solution to economic recovery. The supporting and leading role of strategic emerging industries in the national economy has continued to increase. The 2021 Development Report on the Strategic Emerging Industry of China concluded that the strategic position of the new material industry has been further enhanced with the resultant intensified monopoly of the sector. The competition for critical materials has become a new battleground among world industrial powers due to the accelerated development of high-performance new materials. The main distribution of China’s strategic and critical minerals is shown in Figure 2. They are mainly distributed in provinces with relatively remote geographical locations and less development, while there have rich mineral reserves as shown in Table 1. As a province/autonomous region rich in mineral reserves, how to drive industrial development and promote GDP with the help of factor advantages has become the focus of this paper.

In 2020, China proposed that carbon dioxide emissions strive to peak by 2030 and achieve carbon neutrality by 2060, making it urgent for China to explore pathways for high-quality development of strategic key mineral resources in the context of carbon neutrality. As one of the important stages for the strategic and critical mineral smelting and processing industries, strategic and critical mineral articles are located in the middle of the industrial chain. For some rare mineral resources of China, the strong competitiveness in the upper industrial chain contrasts strongly with the poor competitive capacity in the middle and lower industrial chains. Some researchers (Xu and Yang, 2019) have raised concerns about the phenomenon. By measuring the competitiveness of strategic and critical mineral articles, this paper analyzes their competitiveness evolution trend and the underlying reasons on the basis of product space theory. Product space is a new perspective to visualize and study industrial evolution and more scientifically predict upgrading routes. In traditional trade networks, scholars mainly discuss trade relations between economies under trade agreements (Furusawa and Konishi, 2007). Taking the economies as the object and depicting the international trade network by building a trade economic model. In trade networks, nodes represent countries and lines represent trade agreements (Li et al., 2021). Different from the above theory, product space theory does not take enterprises, economies and countries as research objects. The research on micro products focuses on the specific trade products in the trade market and the strategic position and competitiveness of the economy in global trade. Qi et al. (2020) focuses on a specific product, defines the potential evolutionary trend of blue product based on product space theory, draws and analyze export strengths and the evolution of different countries with respect to a list of blue products. Oyyum et al., 2021 clarify the export network of hydrogen products based on its similarities and product characteristics. Jiang et al. (2022) focus on fruit product and analyze the path-dependence characteristics of fruit production and export in China. Product space has made breakthroughs in micro research and empirical methods of industrial upgrading, which has pushed the industrial evolution to a new stage. At the same time, this paper puts forward some policy suggestions, for example, optimizing the future industrial development path and direction, improving the industrial chain of strategic and critical mineral articles, and enhancing the competitiveness of China’s strategic emerging industries in the global industrial chain. These provide theoretical and practical basis for the development of China’s strategic and critical mineral industries and emerging industries in the new era.

The previous publications have the following categories: The first category is research about industrial competitiveness measurement, which abounds in number. The “Five Forces Model” proposed by Porter (1990) laid the foundation for the theoretical research of industrial competitiveness. Later, scholars developed indicators, for instance, revealed comparative advantage (RCA), to quantify global industry competitiveness (Yu et al., 2020). Li and Liu (2012) investigated the tendency of China’s international industrial competitiveness since China’s WTO membership from static and dynamic perspectives. They concluded that China’s global industrial competitiveness has been greatly enhanced. After quantitatively contrasting China’s strategic emerging industries and non-strategic sectors with the global competitiveness indicators system developed by International Institute for Management Development (IMD), Zhang and Zhao (2014) expressed the opinion that the competitiveness gap between strategic emerging industries and non-strategic sectors remained basically unchanged from 2005 to 2011. With analytic hierarchy process (AHP) and grey correlation analysis, Song and Li (2017) concluded that the competitiveness of China’s aluminum industry lagged far behind that of developed countries. With the continuous development of the economy and society, scholars began to apply the theory of product space to their investigations into international industrial competitiveness. For example, Jin et al. (2013) analyzed the competitiveness evolution trend of 35 types of export articles of China with product space analysis approach and found that the international competitiveness of manufactured articles roughly showed a U-shaped distribution. Based on the product spatial structure theory, Liu and Qiao, 2016 concluded that the medium-tech manufactured articles of Japan are expected to become the development priority due to the strong global competitiveness of the country. With an integral framework of product space analysis, Xu and Yang (2019) analyzed the competitiveness of China’s rare minerals. Based on technology complexity and product density, Ding and Song (2022) studied the accumulation of resources endowment and the improvement of export competitiveness from product space theory.

The previous publications of the second category are investigations into strategic and critical minerals. With the emergence of a new round of scientific revolution, the competition for strategic and critical minerals becomes fiercer. At the same time, the research of strategic and critical minerals has become a hot topic in China. From the perspectives of supply safety and global governance, Wu et al. (2020) and Zhou et al. (2020) defined the strategic and critical minerals and elaborated the implications of their supply safety. After their investigations into the impact of price fluctuation of strategic metal minerals on the output of metal industry, Zhong and Song, 2020 discovered the remarkably negative impact of supply shock on the upper and middle chains of strategic minerals industry during the Sino-US trade war. Wang et al. (2019) analyzed the inherent problems in the development of strategic minerals industry of China, including the shortage of mineral resources, and deficiency of competitiveness in the downstream application sectors.

Previous publications on the international competitiveness of strategic and critical mineral articles have the following deficiencies: First, focusing only on the current competitiveness status, the traditional approaches for industrial competitiveness, including indicators method (Zhou, 2020), and multi-level grey correlation method (Song and Li, 2017), etc., lack the industrial transformation and upgrading paths from the perspective of dynamic spatial evolution. Second, the researches on the international competitiveness of commonly-used minerals abound, while strategic and critical minerals have rarely been touched upon. Third, publications on the competitiveness evolution trend of strategic and critical mineral from the aspect of product space are scarce. The investigations into strategic and critical mineral have been rarely extended to the stage of mineral articles. The researches on the competitiveness of midstream mineral articles are absent.

The innovations of this paper can be summarized into the following: The first is the integration of product space theory into the research of industrial competitiveness. The measurement of industrial competitiveness from the aspect of product space breaks through the barriers of traditional comparative static research. Upon analyzing the evolution of industrial competitiveness from a dynamic level, and clarifying the evolution process and upgrade path of a specific industry, this paper expands the research approaches and direction of industrial competitiveness. The second innovation is our investigations into the competitiveness of strategic and critical mineral articles. As midstream products, strategic and critical mineral articles are an important part of strategic and critical minerals industry chain. Expanding the research methods and approaches for the competitiveness evolution of strategic and critical mineral articles, this research is of great significance to the optimization of industrial chain layout.

To sum up, most researches related to strategic and critical mineral resources focus on their sourcing and high-tech applications. Investigations into the competitiveness of China’s strategic and critical mineral articles from the perspective of product space are scarce. An in-depth analysis of the competitiveness evolution of midstream applications clarifies the development status of China’s strategic and critical mineral articles. Thus, the development of the strategic and critical minerals industry can be more accurately positioned in the national economy. Using the variations of import and export shares, RCA value and product density from 2000 to 2018, this paper conducts a longitudinal analysis of China’s development of strategic and critical mineral industry from the perspective of product space.

The product trade data in this paper is retrieved from the United Nation COMTRADE database, which has a detailed record of the import and export trade of various countries and subdivides the global commodities into several categories according to different classification standards, is an authoritative and comprehensive database. Sample data are classified according to The Harmonized Commodity Description and Coding System (hereinafter referred to as HS Code) formulated by the World Customs Organization (WCO). China’s accession to the WTO in 2001 has further expanded its export trade. After joining the WTO, China’s products have more favorable competitive conditions than in the past, which can promote the development of China’s export trade, especially the trade of industries in which China has comparative advantages. The data selected after 2000 can well describe the competitiveness evolution of strategic and critical mineral resources. At the same time, after 2018, China’s foreign trade was affected by the China-U.S. trade war and the coronavirus pandemic, and trade was tightened. Therefore, we chose the sample data for the period 2000–2018 (Table 2).

The product space theory adopted in this paper was proposed by Hausmann and Klinger (2006), Hidalgo et al., 2007, which has become the main method to explore product evolution from the complex network perspective in economic research. The theory can be understood from the following aspects: By analyzing the characteristics of a particular product and the relationship with its neighboring products, it predicts the possibility of industrial transformation and upgrading of this product and the future evolution path with the entire product network as the starting point; From the perspective of industrial output, the product space theory believes that if a country has the capacity to produce a certain product, it is more likely to have the ability to produce neighboring products of that product. That is to say, if a product has a large variety of adjacent products, it will have a great capacity of industrial transformation and upgrading. If a given product is extremely approximate to the adjacent products, it has large possibility of industrial upgrading; The transformation and upgrading of a particular product often depend on its original endowments (capital, technology, etc.). The competitiveness of a specific industry and the possibility of industrial transformation and upgrading can be measured from factors like RCA, proximity and density.

Balassa (1965) proposed the Revealed Comparative Advantage Indicators (RCA) to measure whether a country or region has a significant advantage in the trade of a product. An important indicator for studying the international competitiveness of an industry, the RCA is also the basis for constructing a theory of product space structure (Chen and Tan, 2004). In Formula (1),

Proximity is utilized to measure the degree of proximity between two products produced by a certain country (Deng and Cao, 2016). The proximity value is inversely proportional to the similarity extent between articles A and B. Thus, the manufacturing of product A is more likely to be transferred to the production of B. This indicator is expressed by calculating the minimum value of the probability that two products are simultaneously competitive. In Formula (2),

Density is used to measure the correlation extent between a particular product and the other product with comparative advantage (Jin et al., 2013). The high density of a product demonstrates that a large number of products with RCA are associated with the product. As a result, the more approaches with which the product can be transformed into a product with RCA, the higher possibility of industrial transformation and upgrading. Where

With the above three indicators, the RCA and density values of the 11 strategic and critical mineral articles are measured respectively. On the basis of product space theory, this paper analyzed the international competitiveness of a specific product and the possibility of its industrial transformation and upgrading.

Since the 2008 global economic crisis, countries throughout the world, in particular industrial powers, have been trying to seek remedies for economic recovery, the development of strategic and emerging industries being one of the solutions imbued with high expectation. The development of strategic and critical mineral articles industry is one of the most important solutions to economic recovery. With the three indicators, including international market share, density and RCA, this paper analyzes the international competitiveness evolution trend of China’s strategic and critical mineral articles from the perspective of product space. On the basis of analyzing these indicators, this paper further discusses the competitiveness evolution of the strategic and critical mineral articles from the perspective of industrial sectors.

Figure 3 shows the market shares of China’s strategic and critical mineral articles (Supplementary Table S1). In general, the trends in the market share of the 11 mineral products vary relatively little and the evolution of their export shares is relatively stable. In terms of market shares, the export volumes of antimony and rare Earth articles account for a large proportion of world exports. Exceeding 70% in the years 2000, 2003, 2004 and 2005, the market share of antimony articles during 2000–2019 was higher than that of other mineral articles. The export shares of most mineral articles are lower than 30%. Among them, those of chromium, tungsten, lithium, tin and fluorite articles range between 10%–30%, and those of zirconium, cobalt, nickel and uranium articles are even lower (less than 10%). The market shares of antimony, rare Earth, fluorite and lithium articles have witnessed a significant change. Among them, the market shares of fluorite, rare Earth and antimony articles dropped by 20%, while those of lithium articles demonstrated an upward trend, with a rise from 13.96% in 2000% to 27.80% in 2018. The export shares of rare Earth articles in 2010 and 2011 increased to 58.01% and 57.56%, nearly 20% higher than those of previous years. After 2012, their export rate dropped to 30%. Figure 3 reflects the fact that the declining trend in market share for most products over the period 2000–2018, with antimony, tin and rare earths in particular trending downwards, and others trending more moderately.

Figure 4 shows the import shares of China’s strategic and critical mineral articles (Supplementary Table S2). On the whole, the import shares of the 11 mineral articles included in this study showed an increasing trend. The import shares of cobalt, nickel, zirconium, uranium and rare Earth articles witnessed a significant increase. With a large increase since 2009, the import share of cobalt articles reached 40%. With small fluctuations from 2000 to 2014, the import share of rare Earth articles saw a significant rise after 2015, reaching 16.79% in 2018. Showing an upward trend as a whole, the import shares of zirconium and nickel articles experienced a significant change from 2009 to 2014. Compared with the international market share, the proportion of imports in the world market is even smaller. The phenomenon of imports exceeding exports in recent years shows a decreased exports and increased imports in China’s trade of strategic and critical mineral articles. Moreover, the increase in imports was much larger than the decrease in exports. The import shares of fluorite and antimony articles experienced small changes while those of rare Earth articles saw a significant increase since 2015. As Figure 4 can be concluded that China’s mineral products imports have increased, with demand for cobalt, nickel and uranium increasing year by year, especially the increasing trend of cobalt imports, which may bring import dependency problems.

The statistical data during 2000–2018 are applied to calculate the RCA value and product density of the 11 strategic and critical mineral articles. On the basis of the contrastive results of these two indicators, this paper discusses the international competitiveness variation trend of the 11 mineral articles. The changing trend of RCA value corresponds to the product density value. In other words, if the density value of a particular product decreases, the number of the products with revealed comparative advantages around this product and transformation and upgrading ability also decreases, and the RCA value of the product is curtailed. Conversely, if the value of product density rises, thanks to the facilitation of favorable factors, the RCA value of the product increases accordingly. On the basis of the variation trend demonstrated in Figures 5, 6, the RCA value and product density of China’s strategic and critical mineral articles demonstrated an overall downward trend from 2000 to 2018. The time span from 2000 to 2008 witnessed a fast-reducing rate. After 2008, the decline slowed down. Among the 11 strategic and critical mineral articles, the international competitiveness of chromium, antimony, tungsten, rare Earth, tin and fluorite articles changed from very strong to weak; that of zirconium, cobalt, lithium, nickel and uranium articles remained weak.

Figure 5 shows the RCA changes in China’s strategic and critical mineral articles (Supplementary Table S3). Generally speaking, the RCA values of these 11 mineral articles are within the ranges of [0, 0.8] and [0.8, 1.25], respectively demonstrating a weak and strong competitiveness. The variation of RCA values of rare Earth, chromium articles are strikingly different from that of other minerals. With the largest declining scope among the 11 strategic minerals, the RCA value of rare Earth articles dropped from over 6.5 to less than 0.5. Decreasing at a constant rate before 2010, the RCA value of chromium articles surpassed that of rare Earth articles in 2011. After becoming a mineral article with the most competitive capacity, chromium remained to be a highly competitive mineral in spite of its declining RCA value thereafter.

Figure 6 demonstrates the changes in industrial density for the 11 mineral articles (Supplementary Table S4). In general, the period of 2000–2008 experienced the largest declining scope of industrial densities, basically falling within the strong or very strong ranges. The densities of chromium, antimony, tungsten, rare Earth, tin and fluorite articles changed greatly, with the fluctuation span of chromium reaching up to 1. With slight changes from 2008 to 2018, the densities of the 11 strategic and critical mineral articles remained within [0, 0.25] and [0, 0.5], the ranges of weak and ordinary density. Significant declines appeared in 2010, 2016 and 2018. By calculating the average density values of these strategic and critical mineral articles from 2000 to 2018, it is found that the value of fluorite articles is the highest, which is in the strong range. The average density values of chromium, antimony, tungsten, rare Earth and tin articles are in the strong range, while those of zirconium, cobalt, lithium, nickel and uranium articles are in the weak range. From 2000 to 2018, fluorite articles had the most favorable development environment, followed by chromium, antimony, tungsten, rare Earth tin articles, and finally came zirconium, cobalt, lithium, nickel and uranium articles.

The above indicators revealed the weak overall competitiveness of China’s strategic and critical mineral articles. Except for a gradual rising share of imports, the other indicators for the 11 strategic and critical mineral articles, including share of exports, RCA value, and product density, showed a downward trend. Thus, the international competitiveness for these articles and their ability of industrial upgrading have transformed from strong to weak. For in-depth investigation into the competitiveness evolution of strategic and critical mineral articles, we further analyze the competitive capacity of each of the 11 mineral articles from the perspective of industrial sectors.

The demand for strategic and critical mineral articles, as indispensable raw material for the development of emerging strategic industries, is much greater than their actual supply. However, the above-mentioned analysis told us that the international competitiveness of China’s strategic and critical mineral articles as a whole experienced a downward trend. Of course, there exist large differences among the competitiveness of these 11 strategic and critical mineral articles. The following are the underlying reasons for the competitiveness evolution of the 11 strategic and critical mineral articles.

Rare Earth articles. With its rich rare Earth resources, China is the world’s largest exporter of rare Earth articles. Accounting for about 43% of the world’s total proven reserves, China’s rare Earth stock is ranked first in the world. The shares of rare Earth articles exported accounted for over 50% in 2008, 2010 and 2011. In the last 5 years, the export proportions have seen a significant decline, with a percentage of around 30%. In the past, China exported a large quantity of rough-processed rare Earth articles, which kept the RCA above 2.5 for a long time from 2000 to 2010, showing a trend of “taking the lead”. Between 2000 and 2004 and in 2008, the RCA values were up to 3, showing a very strong international competitiveness. The RCA value for rare Earth articles have seen a declining tendency in recent years. The resultant weakened competitiveness was mainly caused by China’s industrial policies. In 2005, The Chinese government released a series of policies, for instance, the Notice on Adjusting the Export Tax Rebate Rate of Some Articles and the Catalogue for Industrial Structure Adjustment, to regulate the export volume of rare Earth. It led to a rise of 80,000 Yuan in rare Earth prices between 2004 and 2006, an increase of nearly three folds. In 2011, the Chinese State Council issued Several Opinions on Promoting the Sustainable and Healthy Development of Rare Earth Industry. In the same year, the Ministry of Land and Resources amended the relevant policies on rare Earth exploration and mining, resulting in a significant reduction in the number of rare Earth mining enterprises, output and export volume. The RCA value, which measures the international competitiveness of strategic and critical mineral articles, is mainly determined according to export data. Accordingly, the international competitiveness of rare Earth articles has decreased. The establishment of Guangdong Rare Earth Industry Group in 2012 heralded the industrial reconstruction of China’s rare Earth sector. For the intensive management of rare Earth industry and formation of RE industrial cluster, similar measures were taken in the major rare Earth producing provinces of China, such as Fujian, Inner Mongolia and Jiangxi. The restructuring of domestic rare Earth sector encourages RE manufacturers to increase their investment on the R & D of high-end application industries. The preliminary effects brought by these policies led to a decline in the international competitiveness of domestic rare Earth articles.

Chromium articles. Accounting for around 10% of the world’s exports from 2000 to 2018, China’s chromium articles had strong international competitiveness. The RCA value for chromium articles between 2000 and 2010 remained around 1. With its RCA value exceeding four in 2011, it became the most competitive industry among the 11 strategic and critical mineral articles. After 2011, the RCA value of chromium articles, which remained to be higher than 1 except in 2016 and 2018, showed a downward trend. It can be concluded that chromium articles had strong international competitiveness in the large part of 2000–2018. The underlying reasons for the competitiveness evolution can be accounted from the following two aspects: The first is the military intervention of the European Union and the United States in Libya, which raised global demand for the mineral and pushed up its price. The second is the formation of industrial clusters. Chromium is mainly used in stainless steel industry. Recent years have seen the formation of stainless-steel industrial clusters in some provinces of China, for instance, Shanxi, Shandong and Guangdong, with their respective development focus and characteristics. The output of China’s chromium articles industry in 2017, in particular stainless-steel industry, exceeded half of the world output of the same year. In terms of industrial distribution and output, the large-sized chromium industry of China has strong international competitiveness.

Tungsten articles. As one of the few countries with a complete tungsten industrial chain, China has been in a dominant position in tungsten mining and primary processing for a long time. Widely used in strategic emerging industries, including aerospace and automobile sectors, tungsten articles are an important support for downstream high-end industries. The tungsten exports of China increased from 12.18% in 2000% to 23.49% in 2018, with a two-fold increase. In 2007, China surpassed the United States in tungsten exports, becoming the largest tungsten exporter in the world. The competitiveness evolution for China’s tungsten articles is generally stable. The rising proportion of China’s tungsten exports is mainly due to the gradual decrease in developed economies, in particular, the United States and Japan. The recent years have seen a downward trend in the RCA value of tungsten articles in spite of its relatively stable evolution of within [0.8, 2]. This corresponded to the declining product density and significant fluctuations after 2002.It demonstrated that the development environment of China’s tungsten manufacturing industry had been affected by adverse factors. Currently, tungsten mines are confronted with problems like resource depletion and soaring costs. Focusing on the manufacturing of low- or medium-end tungsten articles, the existing tungsten enterprises are short of industrial competitiveness. Lack of sophisticated sewage treatment technology complicated the statement of China’s tungsten manufacturing industry.

Antimony articles. With the largest antimony reserves in the world, China has a dominant advantage in the export of antimony articles. The evolution of RCA value for antimony articles shows the declining competitiveness of China’s antimony industry. The following are the major reasons: The first is the industrial policy of China. In accordance with The Total Export Quota of Agricultural and Industrial Articles, the Ministry of Commerce imposed quota restrictions on the export of antimony articles. A high export tariff resulted in a high export cost. The second is weak market regulation. The lax supervision led to the rampant smuggling of antimony articles, which in turn caused chaos in the domestic antimony articles market (Yuan and Liu, 2017). The third is the backward antimony smelting and processing technology. The industry of antimony articles is facing the challenge of industrial transformation and upgrading.

Fluorite articles. China has long been a leader in its fluorite output. The fluorite output of the country in 2019 reached 3.65 million tons, accounting for 54% of the world. As an important raw material for the development of emerging industries, fluorite articles have wide applications in the industries of steel and construction materials. The changing tendency of RCA value showed a downward competitiveness of China’s fluorite articles, in particular, in the early stage of the development of fluorite product industry. Loose regulation of fluorite mining resulted in over-exploitation. As a consequence, a large number of fluorite resources have not been fully mined and utilized. Due to unsophisticated R&D and processing technology, the price for fluorite articles has long been low. In recent years, China tightened the policy of exporting fluorite articles for a sustainable development of fluorite industry and efficient supply side order. As a result, the competitiveness of fluorite articles decreased year by year.

Tin articles. China is one of the countries with abundant tin resources in the world. With the rapid development of emerging science and technology, tin-related raw materials have found ever-wider applications in economic development. The supply of tin resources can hardly keep pace with the demand due to the fast economic growth. On the basis of the RCA variation tendency of tin articles, we know that the international competitiveness of China’s tin articles showed an obvious downward trend. The underlying reasons include: The first is the high demand for tin resources facilitated by the fast development of domestic aerospace industry. As a consequence, the imports of tin and its articles soared. The second reason was rooted in the tin industry itself. Large tin enterprises in China, in spite of their strong international competitiveness, have not played an active role in driving the industry. Currently, most of domestic tin enterprises can be described to be “small-size, extensive operation and chaotic management”. The third reason rested with the regulation policy. The Tin Industry Standard Conditions document clearly stipulates the size of tin mines and their environmental requirements and restricts the export and output of tin resources from the supply side.

Zirconium articles. As a country short of zirconium resources, China is the largest consumer and importer of zirconium resources. Over 85% of its zirconium is imported from other countries. From the RCA change trend of zirconium articles, we can that the international competitiveness of zirconium articles in China is weak. The weak competitiveness of zirconium articles is mainly affected by trade and industry. The monopoly of zirconium in the international market restricted the development of zirconium-related industries in China. Recent years have seen a drastic decrease of zirconium output in China. China is short of sophisticated zirconium-related technology, which led to the weak competitiveness of China’s zirconium articles industry.

Cobalt articles. Cobalt materials are widely used in the fields of metallurgical industry and new energy. The demand for cobalt has increased dramatically in China, a country with scarce cobalt resources. With the rise of new energy industries, the cobalt industry has developed rapidly. The RCA of cobalt articles between 2000 and 2018 was lower than 0.8. The weak competitiveness of cobalt articles can be explained from the aspects of industry and trade. China’s cobalt industry has been confronted with the following challenges: The first is the scarcity of cobalt resources in China. In accordance with the report released by the United States Geological Survey (USGS), the proven cobalt resources in China are less than 0.5% of the world. The rapid economic development of China has a huge demand for cobalt resources. Moreover, it is extremely difficult to outsource cobalt in other countries. The second was rooted in the structural deficiencies of cobalt enterprises. The industrial structure was short of integration. The third rested with the trade monopoly of cobalt resource by a small number of transnational enterprises. The cobalt enterprises of China are up against insufficient technological innovation and low production efficiency.

Lithium articles. As a “new material in the 21st century”, lithium has found wide application in the industries of battery and aerospace. In spite of its large reserve in lithium resources, China has weak international competitiveness in lithium industry. China’s lithium industry is faced with a lot of difficulties: small production scale, high cost, outdated mining and beneficiation technology. 74% of the lithium raw materials are imported from other countries. The integration of lithium resource industry chain in the upstream and downstream as well as across regions is not high.

Nickel articles. Nickel is an important material for economic development. The nickel reserve of China accounts for around 3.1% of the world. The weak international competitiveness of nickel articles is mainly affected by trade and industrial factors. In January 2020, Indonesia issued a policy to restrict its nickel export, and China as a nickel-mine imported country, this policy has caused an increase in nickel articles cost; in terms of industry, in response to the reduction of the export tax rebate rate of nickel articles, most nickel articles enterprises in China reduced the export price of nickel articles. The consumption of nickel resources in China is much faster than the output growth, resulting in a high dependence on imports, Even the import of nickel has reached 80% in recent years, increasing the cost of nickel articles in China.

Uranium articles. The total amount of uranium discovered in China is relatively small and highly dependent on importing from foreign. As a strategic and critical mineral in China, Uranium mine plays an important role in the nuclear industry. From 2000 to 2018, the RCA of uranium articles is lower than 0.8. It can be concluded that the international competitiveness of China’s uranium articles is weak. To explain this phenomenon from the industrial point of view, China is short of uranium resources and highly dependent on importing uranium from abroad. Since 2001, it has almost been in the net import state and the production cost of uranium articles is high. China’s industry is in quality improvement transition period. With the escalation of Sino-US trade conflict, the strategic and critical mineral articles industry is greatly affected by the pre-policy effects.

On the basis of the above analysis of the 11 minerals, we have the following findings: The international competitiveness of rare Earth articles is strong, but the overall competitiveness evolution trend is declining; The performance of chromium articles is strong; The performance of tungsten articles is strong, but there is still a steady downward trend; Antimony, fluorite and tin articles continue to decline to a weak state. Zirconium, cobalt, lithium, nickel and uranium have been in a weak state.

Product space theory believes that RCA value is directly proportionate to the possibility of industrial transformation and upgrading. The RCA value and density are applied as two indicators to measure the possibility of transformation and upgrading of the industry. RCA indicator is an important indicator to measure the international competitiveness of an industry. The larger the RCA indicators, the stronger the international competitiveness of the industry. The industries with RCA >2.5 are classified as very competitive; those with 1.25 < RCA <2.5 are classified as competitive; those with 0.8 < RCA <1.25 are classified as weak; and those with RCA <0.8 are very weak (Liu, 2002). The density shows the similarity between a particular industry and its adjacent sectors. The higher the density, the closer the specific product is to the adjacent articles with comparative advantage, which is conducive to the transformation and upgrading of the industry. A density of 0.75–1 shows the product has very strong transformation and upgrading capability; A density of 0.5–0.75 shows the product has strong transformation and upgrading capability; A density of 0.25–0.5 shows that the product has weak transformation and upgrading capability; a density of lower than 0.25 shows that the product has very weak transformation and upgrading capability (Chen and Huang, 2020).

This paper selects the data of strategic and critical mineral articles in 2017 and discusses the possibility of transformation and upgrading on the basis of their values of RCA and density. As shown in Table 3, Chromium articles have strong international competitiveness and density is very low, which proves that chromium articles will maintain a competitive advantage in the future, but their product transformation and upgrading ability will be limited; the international competitiveness of antimony and tin articles is very weak and the density is low. It can be seen that these two articles are less likely to be transformed and upgraded into articles with international competitive advantages; tungsten and rare Earth articles have weak international competitiveness and low density. It can be obtained that these two articles have good prospects for industrial upgrading, transformation and development, which is conducive to maintaining the existing international competitive advantage; fluorite articles have very weak international competitiveness and high density, it is likely to be transformed and upgraded into articles with international competitive advantages in the future; zirconium, cobalt, lithium, nickel and uranium articles have very weak international competitiveness and density is zero. It can be concluded that the transformation and upgrading ability of these five products in the future is very weak.

On the basis of the data of strategic and critical mineral articles (by courtesy of the UN commodity trade statistics 2000–2018 database), this paper investigates the international competitiveness of 11 strategic and critical mineral articles and their possibility of industrial transformation and upgrading by calculating RCA, density, import and export shares with the product space theory. The major conclusions are as follows: The international competitiveness of China’s 11 strategic and critical mineral articles declined as a whole from 2000 to 2018. Among them, the competitiveness of cobalt, nickel, zirconium, uranium and lithium articles was weak while that of tin, fluorite, antimony and rare Earth articles decreased significantly. In spite of a downward trend, the international competitiveness of tungsten and chromium articles was strong; Strategic and critical mineral articles are located in the midstream of the industry. The research of Xu and Yang (2019) proves the presence of weak competitiveness in the middle industrial chain of rare mineral industry. The competitiveness evolution trend of strategic and critical mineral articles conforms to this conclusion. From the perspective of product space, this paper verifies that the international competitiveness of strategic and critical mineral articles is affected by factors of policy, trade, industry and market; On the whole, China’s dependence on foreign countries’ supply of strategic and critical mineral articles has increased year by year. With rising imports and decreasing exports, China has become a major importer of strategic and critical mineral articles in the world. The overall international competitiveness shows a downward trend. Among the 11 strategic and critical mineral articles, the weak competitiveness of cobalt, nickel, zirconium, uranium, fluorite and antimony is mainly due to the shortage or depletion of relevant mineral resources. Thanks to the complete industrial chain and relatively sophisticated industrial clusters in China, tungsten and chromium articles demonstrate strong competitiveness. The declining competitiveness of rare Earth articles is mainly affected by China’s domestic policies.

The international competitiveness of China’s strategic and critical mineral articles experienced a downward trend from 2000 to 2018. Some mineral articles' international competitiveness, industrial transformation and upgrading ability have poor performance. As the basis for the development of strategic and critical mineral industry, strategic and critical mineral articles need to have strong international competitiveness before high-tech articles. Otherwise, the layout of the strategic and critical mineral industry would rely heavily on the global industrial chain of multinational corporations. For the formation of sustainable and strong competitiveness in the international market, it is important to take targeted measures to tackle the problems faced by mineral industries. On the basis of the above analysis, we put forward the following policy suggestions to improve the international competitiveness of mineral articles and enhance their ability of industrial transformation and upgrading:

Relaxing policy restrictions and expanding the development space of strategic and critical mineral articles. Since the 1990s, Chinese government has issued a series of import and export quota policies for strategic and critical minerals, such as rare Earth and tungsten, to realize the sustainable development of mineral resources and regulate the development mode of mineral enterprises. In spite of their immediate results, these policies limited the international competitiveness of mineral enterprises. When formulating industrial development policies, the government is advised to give a certain buffer space for industrial adjustment and development. For example, the government delays the implementation of policies for specific mineral industries, issues an import and export or production quota policy, and gives the industry a certain buffer time, which is conducive to the mineral enterprises to timely adjust the production scale and production plan and reduce the negative impact of the policy; Due to the gradually declining added values of the upstream, midstream, and downstream sectors of strategic and critical mining industries, downstream industries with higher added value are often encouraged to develop. While giving priority to the development of high-tech industries, the macro-control policies of the government should reserve enough development space for midstream industries, such as mineral articles. The financing restrictions of strategic and critical mineral articles enterprises should be relaxed, which is conducive to promoting the production enthusiasm of domestic small and medium-sized enterprises and encouraging competition in the mineral industry.

Encouraging corporate innovation for the rising competitiveness of strategic and critical mineral articles. China’s strategic and critical mineral articles faces the problems of unsophisticated technology and low efficiency, which leads to their declining competitiveness. Moreover, they increase the difficulty of industrial transformation and upgrading. Only by taking innovation as the development orientation of mineral enterprises, can the product industry seize the development opportunity and enhance its international competitiveness. These policies include: encouraging technological innovation of enterprises, strengthening product R and D, introducing high-tech talents, and increasing government support for innovative enterprises; promoting international cooperation between China’s strategic and critical mining enterprises and global mining enterprises. With the help of foreign rich mineral resources and advanced technology, develop domestic strategic and critical mineral industry, so as to realize the transformation and upgrading of mineral articles; large enterprises, which have strong innovation capacity, plenty of capital and information, should be encouraged to lead the development of small- and medium-sized enterprises. It is conducive to the healthy and innovative development of the strategic mineral industry.

Formation of industrial clusters to increase the economic benefits of the strategic and critical mineral articles industry. In terms of their geographical distribution, the rich mineral resources of China are unevenly distributed. The formation of industrial cluster of mineral enterprises can greatly strengthen the division of labor, cooperation and production efficiency of the upstream, middle and downstream industries. The specific policies can be: By reducing the cost of transportation and communication, industrial clusters can effectively improve the production and cooperation efficiency of mineral enterprises, Industrial clusters lead to the pooling of information, which increases the possibility of industrial transformation and upgrading. The pooling of information, talents and capital encourages the concentration of expertise and technology. With an important role in enhancing the international competitiveness of the industry, the integration of mineral resources improves the development efficiency of the mineral articles industry. At the same time, the role of carbon pricing mechanisms as an economic incentive in the economic transformation of the energy industry is used to contribute to the achievement of carbon neutrality by 2060 and international climate change.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

WZ: manuscript concept. TH, YX, JL, and WX: additional review and editing. All authors have read and agreed to the published version of the manuscript.

This work was supported by The National Social Science Foundation of China (20XGL016).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2023.1042436/full#supplementary-material

1Figure 1 is from the role of critical minerals in clean energy, World Energy Outlook Special Report , May 5, 2021 by International Energy Agency.

Balassa, B. (1965). Trade liberalisation and “revealed” comparative advantage. Manch. Sch. 33, 9–123. doi:10.1111/j.1467-9957.1965.tb00050.x

Chen, L., and Huang, X. L. (2020). Research on product spatial structure and dynamic comparative advantages--based on product data analysis of China and countries along the belt and road. Mod. Econ. Res., 62–70.

Chen, L. M., and Tan, L. W. (2004). Research on empirical method of valuing international competitiveness of Chinese manufacturing--comparing with porter’s index and industry taxonomy. China Ind. Econ. 5, 30–37. doi:10.19581/j.cnki.ciejournal.2004.05.004

Deng, X. R., and Cao, H. (2016). Industrial upgrading path: Conform or defy comparative advantage—an empirical analysis based on product space structure. China Ind. Econ. 335, 52–67. doi:10.19581/j.cnki.ciejournal.2016.02.005

Ding, Y. B., and Song, C. (2022). Would the transformation of processing trade build China into a manufacturer of quality? Based on the technical structure of product space. Collect. Essays Finance Econ. 287, 3–14. doi:10.13762/j.cnki.cjlc.20211009.002

Furusawa, T., and Konishi, H. (2007). Free trade networks. J. Int. Econ. 72, 310–335. doi:10.1016/j.jinteco.2006.08.003

Hausmann, R., and Klinger, B. (2006). The evolution of comparative advantage: The impact of the structure of the product space. Cambridge, MA: CID Working Paper, 106.

Hidalgo, C. A., Klinger, B., Barabási, A. L., and Hausmann, R. (2007). The product space conditions the development of nations. Science 317, 482–487. doi:10.1126/science.1144581

Jiang, G. Z., Wu, B. B., and Rao, Q. J. (2022). The policies for China's fruit products to enhance the international competitiveness based on the product space analysis. Humanities & Social Sciences Journal of Hainan University, 1–8.

Jin, B., Li, P. F., and Liao, J. H. (2013). The current situation and trend of international competitiveness of industries in China——an analysis based on export commodities. China Ind. Econ., 5–17.

Li, G., and Liu, J. C. (2012). Empirical analysis of international competitiveness of China's industries after a decade of WTO accession. Finance Trade Econ. 369, 88–96.

Li, S., Li, X., Lang, W., Chen, H. H., and Huang, X. G. (2021). The spatial and mechanism difference in the export evolution of product space in global countries. Sustainability 13, 2255. doi:10.3390/SU13042255

Liu, R. X. (2002). A comparative study of the export competitiveness of east asia' economy. Nankai Economic Research, 40–46+51.

Liu, Z. G., and Qiao, L. (2016). The current situation and trend of Japanese manufacturing industries’ international competitiveness: A reappraisal based on the product space theory. Contemporary Economy of Japan, 1–13.

Oyyum, M. A., Dickson, R., Shah, S. F. A., Niaz, H., Khan, A., Liu, J. J., et al. (2021). Availability, versatility, and viability of feedstocks for hydrogen production: Product space perspective. Renew. Sustain. Energy Rev. 145, 110843. doi:10.1016/j.rser.2021.110843

Qi, X. F., Zhao, B. X., Zhang, J. H., and Xiao, W. W. (2020). The drawing of a national blue product space and its evolution. Mar. Policy 112, 103773. doi:10.1016/j.marpol.2019.103773

Song, Y. K., and Li, Y. (2017). Comparison of competitiveness aluminum industry: In Chinese, American and Australian’s based on AHP and grey relational analysis. China Min. Mag. 26, 61–66.

Wang, A, J., Wang, G. S., and Deng, X. Z. (2019). etcSecurity and management of China’s mineral resources in the new era. Bull. Natl. Nat. Sci. Found. China 33, 133–140.

Wang, D. H. (2019). Discussion on issues related to strategic and critical minerals resource. Geol. Chem. Mineral 41 (2), 65–72.

Wu, Q. S., Zhou, N., and Cheng, J. H. (2020). A review and prospects of the supply security of strategic key minerals. Resour. Sci. 42, 1439–1451. doi:10.18402/resci.2020.08.01

Xu, M., and Yang, D. H. (2019). An analysis of international competitiveness of China's rare mineral resources industry. Southeast Acad. Res. 269 (1), 111–122.

Yu, W., Cai, Z. F., and Liu, L. Q. (2020). New measurement and interpretation of the vulnerability of Chinese manufacturing international competitiveness: In-depth perspective based on firm level micro-data. J. Finance Econ. 46, 124–139.

Yuan, L. Y., and Liu, X. Y. (2017). Analysis of China's export trade in its articles. Co-Operative Economy & Science, 115–117.

Zhang, R. F., and Zhao, Y. Y. (2014). China's strategic emerging industry competitiveness measurement research. Mod. Manag. Sci., 33–35.

Zhong, M. R., and Song, W. T. (2020). Impact of strategic metal price shocks on industrial output: Time-varying analysis based on the TVP-FAVAR model. Resour. Sci. 42, 1580–1591. doi:10.18402/resci.2020.08.12

Zhou, J. K. (2020). An analysis of Sino-US trade imbalance from the perspective of industrial competitiveness. Economist, 61–70.

Keywords: strategic and critical mineral articles, product space, international competitiveness, industrial transformation, upgrading

Citation: Zhu W, Hu T, Xiao W, Liao J and Xu Y (2023) The product space and evolution of international competitiveness—evidence from China’s strategic and critical mineral articles. Front. Environ. Sci. 11:1042436. doi: 10.3389/fenvs.2023.1042436

Received: 14 December 2022; Accepted: 30 January 2023;

Published: 09 February 2023.

Edited by:

Xuefeng Shao, The University of Newcastle, AustraliaReviewed by:

Chuan Qin, University of California, Riverside, United StatesCopyright © 2023 Zhu, Hu, Xiao, Liao and Xu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yue Xu, amF5NXh1MDA3QDE2My5jb20=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.