- 1School of Finance, Shandong University of Finance and Economics, Jinan, China

- 2College of Business, Framingham State University, Framingham, MA, United States

Corporate social responsibility (CSR) disclosure has gained more attention from both practitioners and scholars. Company executives are starting to seek competitive differentiation from their sustainability strategies (McKinsey & Company, 2020). This study explores the link between CSR disclosure and investment efficiency using a sample of Chinese-listed firms from 2010 to 2019. The findings suggest that CSR disclosure improves investment efficiency through reducing information asymmetry and agency cost. Also, mandatory CSR disclosure has a more significant effect on investment efficiency than voluntary CSR disclosure. In addition, this study finds that the nature of ownership (state-owned vs. non-state-owned), CSR performance, institutional ownership, and the level of industry competition all affect this relationship. The study provides meaningful implications for future CSR disclosure policy development.

1 Introduction

Growing global concern about economic and environmental sustainability has sparked a trend toward requiring companies to disclose their corporate social responsibility (CSR) activities. Companies start to benefit from moving CSR from the sidelines into mainstream value creation. And CSR related investment strategies increased approximately 150% in 2019 according to the 2021 CSR white paper.

CSR disclosure may be defined as information that a firm makes public, typically within a stand-alone report, that relates to its performance, standards, or activities under the CSR umbrella (Brooks and Oikonomou, 2018). CSR disclosure may be mandatory—firms are legally required to deliver CSR information—or voluntary, where the extent of reporting may vary substantially among firms. CSR disclosure guidelines issued by different countries show considerable variance regarding information required to be disclosed in CSR reports (Brooks and Oikonomou, 2018). The China Securities Regulatory Commission (CSRC) began mandating certain firms to issue stand-alone CSR reports in response to emerging environmental and social issues while encouraging other firms to publish CSR reports voluntarily at the same time (Brooks and Oikonomou, 2018; Makosa et al., 2020; Liu and Tian, 2021; Zhang, 2022). For example, the Shanghai Stock Exchange announced on 30 December 2008 that firms listed in the “Corporate Governance Sector”, firms with shares listed overseas, and firms in the financial industry were henceforth required to issue a CSR report with their annual report beginning with the 2008 report. The Shenzhen Stock Exchange released a similar announcement pertaining to all firms on its “Shenzhen 100 Index”. From 2001 to 2019, the number of firms disclosing CSR reports increased dramatically (for both mandatory and voluntary disclosures).

The economic consequences of CSR disclosure have aroused much attention in academia in recent years (Krüger, 2015; Chen et al., 2018; Pham and Tran, 2020; Bae et al., 2021; Qin and Yang, 2022). Many scholars have investigated the role of CSR disclosure in decreasing profitability (Chen et al., 2018), lowering financing costs (Ni and Zhang, 2019), adding value to firms (Xu et al., 2020), improving consumer loyalty (Contini et al., 2020), improving firm performance (Pham and Tran, 2020), curtailing excessive payouts (Liu and Tian, 2021), and lowering the idiosyncratic risk (He et al., 2022).

More importantly, previous research has shown that a company’s CSR disclosure impacts its investment behavior. However, previous studies in this field all contain various imperfections. For example, Liu and Tian (2021), Makosa et al. (2020) study the impact of CSR disclosure on investment efficiency, but their sample is limited to the year 2008 and could not reflect the long-term effects of the policy changes. Cao et al. (2012) use Rankins CSR ratings (RKS) as a proxy for CSR disclosure quality and analyze the relationship between CSR disclosure and investment efficiency. It is worth noting that RKS only covers listed firms that publish CSR reports. In other words, their study is limited to all listed firms who disclosed CSR information but does not show the difference between disclosed and undisclosed firms. The most relevant study is Zhong and Gao (2017), which studies whether Chinese firms that issue CSR reports exhibit a higher level of investment efficiency than firms that do not issue CSR reports. However, Zhong and Gao’s study mainly focuses on the role of CSR disclosure in reducing information asymmetry, neglecting other potential mechanisms.

The study makes the following contributions. First, the study differs from previous studies in that it focuses on the long-term economic benefits generated by CSR disclosure rather than the short-term impact of the mandatory CSR disclosure policy implemented in December of 2008. The empirical findings in this study provide new insights to the long-term impact of CSR disclosure on economic implications using ten-year data from 2010 to 2019. This research shows that CSR disclosure has a favorable influence on investment efficiency by reducing underinvestment, not overinvestment.

Also, this article investigates the different effects of mandatory vs. voluntary CSR disclosure on investment efficiency. Previous studies show voluntary CSR disclosure increases firm investment (Bouquet and Deutsch, 2008; Tan et al., 2020), but do not shed light on its effect on investment efficiency. Makosa et al. (2020) find mandatory CSR disclosure decreases firm investment but enhances investment efficiency using difference-in-difference design around 2008 when China mandated certain firms to disclose CSR information. This paper analyzes the different effects of mandatory versus voluntary CSR disclosure on investment efficiency in China using a longer sample period.

Second, this study complements and extends previous research by demonstrating that CSR disclosure improves investment efficiency, and more importantly, by investigating the underlying mechanisms. Accounting studies show that a decrease in information asymmetry and agency cost could increase investment efficiency (Jensen, 1986; Biddle and Hilary, 2006; Chen F. et al., 2011). This article adds to this line of research by providing direct empirical evidence that CSR disclosure improves investment efficiency by reducing both information asymmetry and agency cost.

Third, this paper examines the effects of CSR disclosure on investment efficiency across multiple dimensions and explores related policy implications. The study analyzes the impact of state ownership, CSR performance, institutional ownership, and industry competition on the relationship between CSR disclosure and investment efficiency. With such multi-dimensional analysis, this study tries to explain why companies’ CSR disclosure could benefit their corporate governance. The findings help enhance companies’ understanding of the two-fold mechanisms and encourage companies to implement CSR disclosure strategies to improve their long-term business performance. At the same time, the discussion of the economic consequences of mandatory vs voluntary CSR disclosure will also help policymakers develop and promote the implementation of CSR disclosure related policies.

In summary, many studies use the DID model to investigate the positive governance effects of CSR disclosure on corporate investment efficiency, but the specific mechanisms by which CSR disclosure affects investment efficiency remain unknown. Also, most CSR studies focus on the impact of policy shocks in 2008, ignoring the long-term effects of CSR disclosure on companies. Very little research has been conducted on the impact of mandatory vs. voluntary CSR disclosure on investment efficiency. In China’s long-standing, fast-growing economy, the impact of different industry contexts and companies’ characters on CSR disclosure has not been sufficiently researched and explored. The study intends to complement and extend the line of literature from above mentioned aspects.

The rest of the paper is organized as follows. Section 2 reviews related literature. Section 3 presents the development of the hypotheses. Section 4 describes the data, variables definition, and empirical models. Section 5 presents the empirical results and Section 6 is the robustness check. Section 7 reports the additional analysis and Section 8 presents the main conclusions of the paper.

2 Literature review

CSR disclosure has been shown to affect various firms’ economic outcomes, such as decreasing profitability (Chen et al., 2018), lowering financing costs (Ni and Zhang, 2019), improving consumer loyalty (Contini et al., 2020), improving firm performance (Pham and Tran, 2020), adding value to firms (Xu et al., 2020), curtailing excessive payouts (Liu and Tian, 2021), promoting long-term growth and substantial innovation (Zhang, 2022), and lowering the idiosyncratic risk (Wang et al., 2018; He et al., 2022), etc. These studies all demonstrate the important roles CSR disclosure plays in corporate governance and keep inspiring more related studies.

A key question in corporate finance is: What motivates a firm’s investment? In an ideal world, a firm’s investment efficiency should be determined only by its investment opportunities (Stein, 2003; Cheng et al., 2014). Numerous studies have conclusively established that information asymmetry and agency issues impact the efficiency of business investment (Biddle et al., 2009; Chen F. et al., 2011; Shahzad et al., 2018; Wu et al., 2022). But only a few studies shed light on the relationship between CSR disclosure and investment efficiency. Cao et al. (2012) uses Rankins ESG Ratings from RKS to proxy for CSR disclosure quality and studies its impact on investment efficiency with a sample of listed companies in China. The problem with their study is that it only covers listed firms who publish CSR reports and does not differentiate between mandatory and voluntary disclosures. Zhong and Gao (2017) also use RKS’s ranking as a proxy for CSR disclosure quality and analyze its influence on investment efficiency. But their study mainly focuses on CSR disclosure’s role in reducing information asymmetry and ignores the role CSR disclosure plays in reducing agency cost. Liu and Tian (2021), Makosa et al. (2020) and Zhang (2022) all study the impact of CSR disclosure on investment efficiency, but they only focus on the milestone year 2008 when China mandates CSR disclosure among certain companies. These studies do not examine the long-term effect of the CSR disclosure mandate or consider the more recent changes. The aim of this study is to complement and extend this line of research by examining the impact of CSR disclosure on investment efficiency within a longer time period and analyze the two-fold underlying mechanisms: information asymmetry and the agency problem.

Jensen and Meckling (1976) and Myers and Majluf (1984) propose a paradigm to explain the role of information asymmetry in investment decisions, which includes adverse selection and moral hazard. According to Mikkelson and Partch (1986), non-public information from management may cause investors to conclude that the capital market is overvalued, raising firms’ cost of capital, and excluding otherwise suitable investment prospects. On the other hand, companies with high-quality financial information have fewer opportunities to depart from optimal investment levels (Biddle et al., 2009; Chen S. et al., 2011; Gomariz and Ballesta, 2014). By releasing environmental and other certain internal information, CSR disclosure should act as a bridge between stakeholders and company management, mitigating information asymmetry. As a result, CSR disclosure should enable managers to make more informed investment decisions and facilitates more efficient resource allocation.

Agency problems arise when managers or controlling shareholders use corporate resources for personal benefit at the expense of minority shareholders (Jensen and Meckling, 1976; Denis et al., 1997; Djankov et al., 2008). It has been argued that agency conflicts between management and shareholders, as well as between controlling and minority shareholders, significantly impact the company’s investment decisions (Jensen, 1986; Fazzari et al., 1988; Jiang et al., 2010; Luo et al., 2015). Since investments are cash-flow sensitive and thus often suffer from agency problems (Pawlina and Renneboog, 2005), companies with more severe agency problems tend to spend the free cash flow on negative net present value projects rather than distribute dividends to shareholders (Jiang et al., 2010; Andrén and Jankensgård, 2015; Luo et al., 2015). For example, if stakeholders are not aware of the financial and non-financial information of the company, there would be a lack of effective communication between shareholders and managers and thus a lack of effective monitoring of managers’ behavior. In such cases, management, driven by their self-interest, tends to manipulate information, such as mislead investors by reducing the readability of reports (Lo et al., 2017), make investment decisions which benefit their personal interest rather than shareholders’ interest, and finally result in firms’ inefficient investment (Jensen and Meckling, 1976).

The empirical evidence in this area seems to be mixed. Using a sample of US firms, Lopatta et al. (2016) discover that better corporate CSR performance reduces insider trading, mitigates information asymmetry, and mitigates agency problems. But they focus on firm CSR performance rather than CSR disclosure. Lu et al. (2017) study the effect of CSR reports on the value of cash holding and find that the voluntary issuance of a standalone CSR report substantially increases the value of cash holdings by providing incremental information. Their findings suggest that CSR disclosure reduces information asymmetry related to managerial investment decisions, which may reduce managers’ opportunistic behavior when investing in excess cash holdings. On the contrary, Guo et al. (2022) find that stock price informativeness decreases after China’s 2008 CSR disclosure mandate and information asymmetry between investors and managers increased significantly. They also point out that the reduction applies mainly to firms under a mandatory CSR program rather than firms that voluntarily disclosed CSR before 2008. The mixed evidence calls for more empirical studies in this field.

More importantly, existing studies do not compare the different impact of mandatory CSR disclosure versus voluntary CSR disclosure on investment efficiency. This addresses the importance of this study which intends to fill this vacuum in the literature. Previous studies on mandatory CSR disclosure have only examined its economic consequences using a natural or quasi-natural experiment and the DID model around 2008. For example, Liu and Tian (2021) find that firms subject to the mandatory CSR regulation have lower investment inefficiency using a natural experiment. Zhang (2022) discovers that mandatory CSR disclosure increases corporate innovation using quasi-natural experimentation.

On the other hand, studies show voluntary CSR disclosure also has significant economic consequences but might suffer from credibility concerns. For example, Cho et al. (2013) argue that voluntary CSR disclosure mitigates the impact of poor environmental performance on firms’ reputation, but stakeholders must use filters to assess the credibility of voluntarily disclosed CSR information. Sethi et al. (2017) find that voluntary CSR disclosure has made it challenging to implement robust measures to evaluate the quality and accuracy of the reports. Nekhili et al. (2017) point out that the voluntary nature of CSR disclosure has resulted in several irregularities in reporting formats which largely affect the information value added by voluntary CSR disclosure. These studies further show the importance of research into the economic consequences of voluntary disclosure. This study analyzes how mandatory and voluntary CSR disclosure affect information asymmetry separately and differently during a ten-year period after the milestone year 2008 when China mandated certain companies to disclose CSR information.

3 Hypotheses development

3.1 CSR disclosure and investment efficiency

The goal of an enterprise is to create value and to pursue all projects with positive net present value (Luo et al., 2015). An enterprise must make investments to maximize value until its income and expenditure reaches an equilibrium (Harjoto and Jo, 2011). The volatility of the capital market as well as other pitfalls may prevent managers from accepting all profitable projects, resulting in deviations from an optimal investment level. As a result, firms with more severe capital constraints may suffer from more severe investment inefficiencies (Hubbard, 1990; Campello et al., 2010). Since managers are better informed than external investors, they are more incentivized to issue capital when companies are overvalued. Rational investors who can anticipate such managerial behavior tend to retain their capital or raise interest rates they charge, resulting in firms’ higher financial constraints and underinvestment (Stiglitz and Weiss, 1981; Biddle et al., 2009). CSR disclosure often contains vital important information and could mitigate firms’ financial constraints and improve corporate investment efficiency by reducing information asymmetries. Dhaliwal et al. (2011) find that companies which initiate voluntary CSR disclosure not only benefit from a lower cost of equity capital but also appear more appealing to private investment firms and financial analysts. Similarly, Nandy and Lodh (2012) reveal that eco-friendly firms with higher environmental CSR disclosure scores can obtain more favorable and suitable loan deals than their non-eco-friendly counterparts. Furthermore, Samet and Jarboui, (2017) provide confirmatory evidence of CSR disclosure’s positive impact on firm investment efficiency.

According to Freeman (1984) stakeholder theory, employees, consumers, suppliers, and investors who control resources, can affect the implementation of corporate decisions. Paying attention to stakeholders’ concerns and expectations could help firms prevent stakeholders from undermining or thwarting firm’s goals (Wang et al., 2016). CSR disclosure can be viewed as a response of management to shareholders’ information inquiries and regulatory needs. Increasing CSR disclosure may increase the amount of information available to stakeholders and allow external stakeholders to observe and monitor firm behavior (Yusoff et al., 2013; Zhang, 2022), which further encourages companies to improve their corporate governance and investment efficiency. CSR disclosure enhances the mutual trust between managers and other stakeholders by providing more information (Cheng et al., 2014). With less short-term performance pressure, managers may pay more attention to the company’s long-term interests, do more rational resource allocation, and improve investment efficiency. As a result, the first hypothesis is stated as follows.

H1:. CSR disclosure improves investment efficiency.

3.2 CSR disclosure, information asymmetry, and investment efficiency

As introduced in the literature review session, information asymmetry and agency cost are the two well-established reasons behind inefficient investments. CSR disclosure could reveal information managers attempt to conceal and helps to eliminate information asymmetry (Cho et al., 2013; Lopatta et al., 2016; Cui et al., 2018). The additional information in CSR disclosure shows a more complete picture of the company’s operations (Lopatta et al., 2016).

CSR disclosure could reduce the level of information asymmetry by assisting external investors to better understand the company’s strategies, enhancing the efficiency of information transmission. Previous studies show that CSR disclosure could provide investors with an information edge and allows them to make better investment decisions (Cho et al., 2013), lower insider trading, and lessen information asymmetry (Lopattaet al., 2016). Capital markets are shown to be extremely sensitive to company-released CSR information, and stock markets even react directly to the positive and poor performance of CSR events (Krüger, 2015; Kölbel et al., 2017). Attig et al. (2014) show that CSR disclosure conveys critical environmental information and could potentially lower the financial cost. The most related study to ours is (Samet and Jarboui, 2017) which show the mediation function of information asymmetry between CSR activities and investment efficiency with a sample of firms listed on the Tehran Stock Exchange during 2012–2017 using content analysis. They focus on the mediating role of information efficiency in the relationship between CSR disclosure and underinvestment but not between CSR disclosure and overinvestment or the overall investment efficiency. Based on above discussion, this article states the second hypothesis as follows.

H2:. Information asymmetry plays a mediating role in the relationship between CSR disclosure and overall investment efficiency.

3.3 CSR disclosure, agency cost, and investment efficiency

Agency problems have been shown to cause inefficient investment (Jensen, 1986; Biddle and Hilary, 2006). CSR disclosure could mitigate the conflicts of interest among various stakeholders and maximize shareholders’ wealth (Calton and Payne, 2003; Jensen, 2010). CSR disclosure helps stakeholders perform better monitoring and governance functions, discourages opportunistic management behavior, urges managers to choose projects that are in the companies’ long-term interests, and ultimately reduces inefficient investments. Harjoto and Jo (2011) find that CSR involvement reduces conflicts of interest between managers and non-investing stakeholders and increases firm value. Eccles et al. (2014) study the effect of firms’ integrating social and environmental issues into corporate strategy and reveal that highly sustainable firms are more likely to have established processes for shareholders engagement, which limits short-term opportunistic behavior.

CSR disclosure could also send positive signals to market participants and enhance firm reputation, form stronger mutual trust between managers and other stakeholders within the company, and stabilize contractual relationships in the long run (Cheng et al., 2014). This enhanced stakeholder engagement will further reduce supervision costs, alleviate agency problems, and ultimately discourage inefficient investment. For example, Jo and Harjoto (2011) find that CSR is positively associated with internal and external monitoring mechanisms. CSR disclosure brings rising risks to managers by strengthening external supervision and monitoring mechanisms and impedes managers from making investments out of self-interest (Lu et al., 2017). Samet and Jarboui, (2017) also study the mediating role of agency problems in the relationship between CSR disclosure and investment efficiency, but again their study is limited to overinvestment, rather than overall investment efficiency. And their sample is from the Tehran Stock Exchange while ours is from the Chinese stock exchanges. This study proposes the following hypothesis.

H3:. Reduced agency problems play a mediating role in the relationship between CSR disclosure and investment efficiency.

3.4 Mandatory vs. voluntary: The impact of CSR disclosure on investment efficiency

The Shenzhen Stock Exchange and the Shanghai Stock Exchange mandate certain listed firms to issue CSR reports at the end of 2008 while encouraging other listed companies to do so voluntarily. Previous studies show differences in the economic impact of mandatory and voluntary CSR disclosures (Dong and Xu, 2016; Chen et al., 2018). Voluntary CSR disclosure may differ largely in their focus and scope, which are mainly determined by firms’ willingness to disclose. In contrast, mandatory disclosure is more standard about format, disclosing scope, and elements following the directive document issued by the government. As a result, mandatory and voluntary CSR disclosure should have different economic implications for investment efficiency. Corporations under the CSR disclosure mandate are subject to more stringent government control and, as a result, less likely to engage in irresponsible investment activities (Christensen et al., 2017). On the other hand, companies mandated to provide CSR reports are backed by the government’s credibility and possess a more solid financial position. Accordingly, they should take less unproductive investments.

This study proposes the following hypothesis based on above discussion.

H4:. Mandatory CSR disclosures are more effective in improving corporate investment than voluntary CSR disclosures.

4 Research design

4.1 Sample and data collection

Since 2009 was the first year the mandatory CSR disclosure policy became effective in China, the initial sample consists of all Chinese A-shares firms listed on the Shanghai and Shenzhen stock exchanges from 2010 to 2019 with 21,085 observations. This research obtains financial data from the China Stock Market and Accounting Research (CSMAR) database, and the CSR disclosure data from the RKS database (Rankins ESG Ratings database1). Then, the study cleans the sample according to the following procedures: First, this research excludes firms in the financial industry based on the CSRC classification criteria. The research also excludes ST/PT firms (ST: Special treatment2; PT: Particular Transfer3) This step leaves the research 19,702 observations. Second, the study winsorizes continuous variables at the top and bottom one percent to avoid the impact of outliers and get 18,714 observations. The final sample contains 18,431 observations with no missing dependent or control variables.

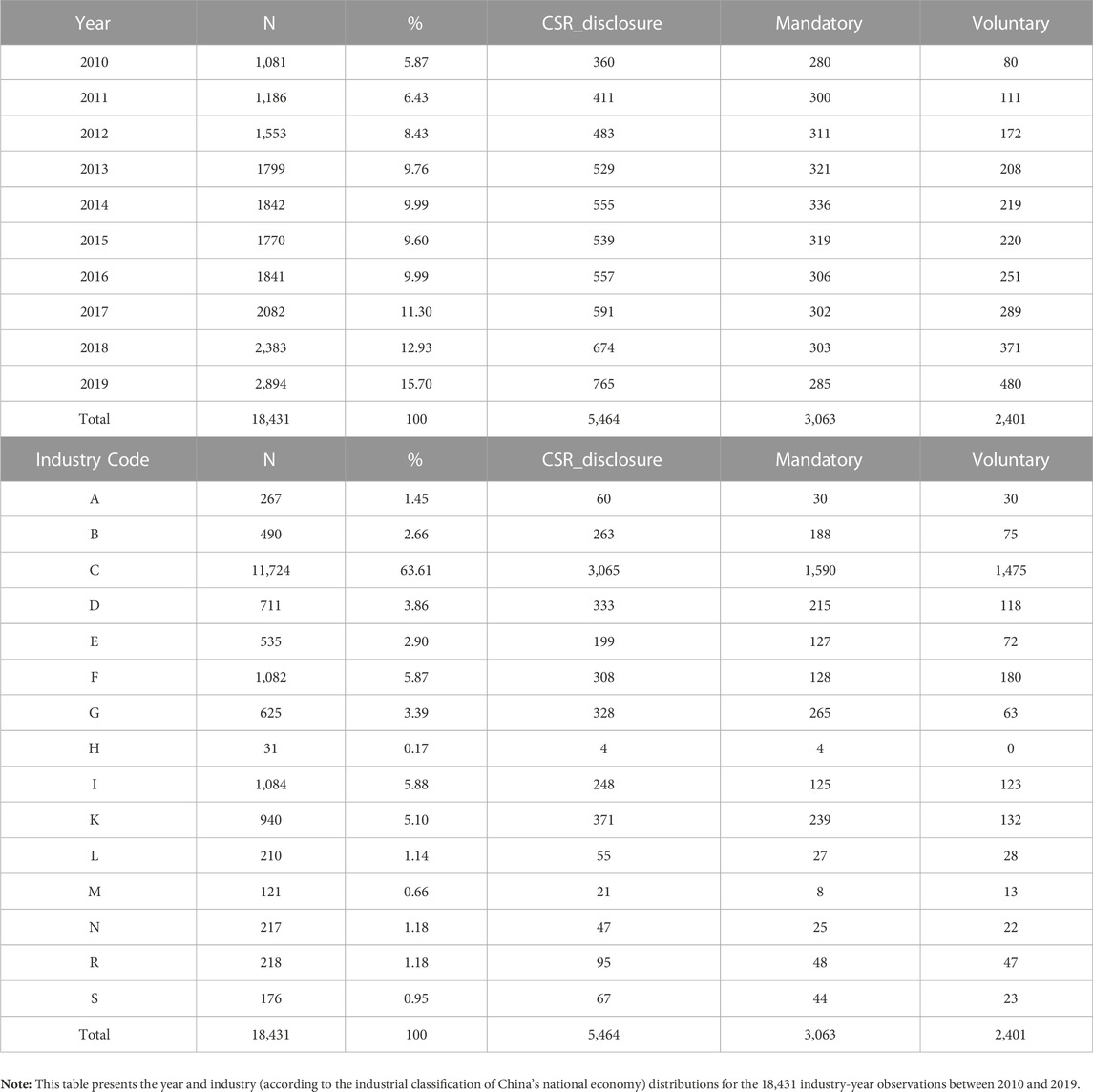

Table 1 shows the sample distribution by year and industry (please refer to Appendix 1 for the industry classification code). The sample distribution by year from 2010 to 2019 shows that CSR disclosures among Chinese listed companies increased over time, with mandated disclosure outnumbering voluntary disclosure until 2018. The sample distribution by industry shows that the manufacturing industry (Industry Code “C”) dominates other industries with 11,724 observations which account for 63.61% of the whole sample. Other industries, such as retail and information transmission, software, and information technology services, also have a considerable number of observations.

4.2 Variable measures

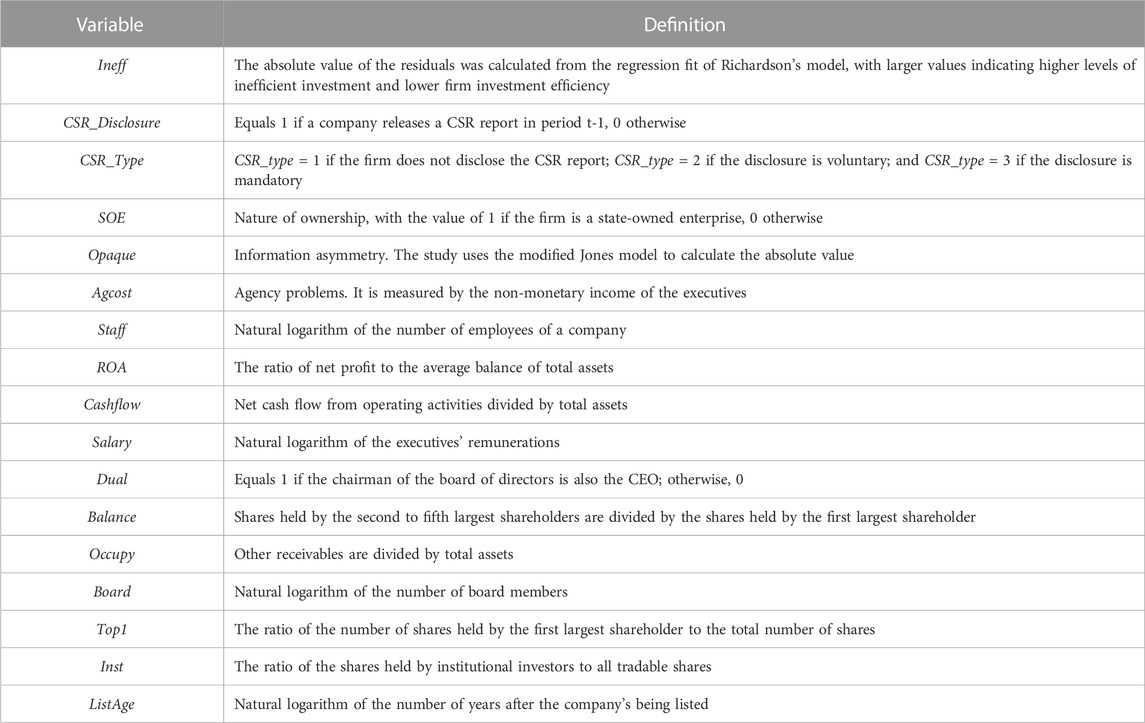

4.2.1 Dependent variable: Investment efficiency

This article defines investment efficiency

4.2.2 Independent variable: CSR disclosure

Following prior CSR studies (e.g., Michelon et al., 2013; Zhong and Gao, 2017; Liu and Tian, 2021), the research uses the disclosure of stand-alone CSR reports in period t-1 as a dummy variable (CSR_Disclosure) which equals to 1 if there is disclosure and 0 otherwise.

4.2.3 Mediating variables: Information asymmetry and agency problems

Following Dechow et al. (1995) and Hu (2021), this study applies the modified Jones model to calculate firms’ information asymmetry. The modified Jones model (Dechow et al., 1995; Hu, 2021) is estimated by industry and year, and then the γ estimated in Eq. 2 are substituted into Eq. 3 to calculate the discretionary accruals (DA). This study uses the absolute value of DA to get Opaque which measures the information asymmetry. The larger Opaque, the lower the information transparency and higher information asymmetry; TA stands for total accruals, which is equal to operating profit minus net cash flow from operating activities; Asset is total assets; PPE is the value of fixed assets at the end of the period; ΔREV is the difference between the company’s operating income in the current period and the previous period; and ΔREC is the increase in accounts receivable in the current period from last period.

The study uses the difference between the actual and expected expenditures of a firm’s executives to measure agency costs (Luo et al., 2011). The larger the difference, the more severe the agency problem. This is measured by the abnormal executive on-the-job consumption, expressed as the difference between management on-the-job consumption and the expected normal on-the-job consumption of executives as determined by economic factors (Luo et al., 2011). The following model measures the expected normal level of executive on-the-job consumption:

Perks is the amount of in-service consumption of executives, which is derived from administrative expenses after deducting the remuneration of directors, officers, and supervisory board members, provision for bad debts, provision for the decline in value of inventories1, and amortization of intangible assets for the year, which is clearly not in-service consumption; Asset is the total assets at the end of the previous period; Δsale is the change in revenue from primary business for the period; PPE is the net value of fixed assets such as plant, property, and equipment for the period; Inventoryit is total inventory for the period, and LnEmployee is the natural logarithm of the total number of employees in the business. The predicted value of the dependent variable obtained from the model is the normal on-the-job consumption, and the difference between the actual on-the-job consumption and the normal on-the-job consumption is the abnormal on-the-job consumption, represented by the variable Agcost. The higher the Agcost, the more serious the agency problem.

4.3 Model specification

To investigate the effects of CSR disclosure on investment efficiency, this research estimates the following model:

Ineff represents investment inefficiency. The larger Ineff, the less efficient the investment. As explained earlier, CSR_Disclosure indicates whether the company discloses CSR. It takes the value of 1 if the firm publishes a stand-alone CSR report and 0 otherwise. A negative coefficient indicates a reducing effect of CSR disclosure on investment inefficiency and wise versus. Controls include a set of control variables as listed in Table 2. ε is an error term. The quality of corporate financial information is also affected by inefficient corporate investments, so the research uses lagged CSR disclosure and financial data to avoid contemporary endogeneity issues.

Following previous studies, the study chooses several firm characteristics associated with CSR disclosure and investment efficiency as control variables (Biddle et al., 2009; Chen S. et al., 2011; Zhong and Gao, 2017; Makosa et al., 2020; Liu and Tian, 2021). All control variables are lagged by one period.

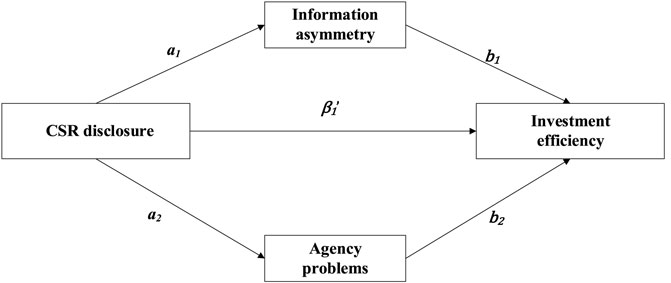

To test hypotheses H2 and H3 with regard to the impact of the mediating variables on the relationship between CSR disclosure and firm investment efficiency, the research follows Baron and Kenny (1986), Hayes (2009), Hayes and Scharkow (2013), Wen and Ye (2014) and apply the mediated model test method for empirical testing. In the relationship between the independent variable X and the dependent variable Y, if X affects Y through the intermediate variable M, then M is said to be the mediating variable. If more than one mediating variable Mi is present at the same time, the effect is said to be the multiple mediating effect.

As the two mediating variables in this study, which measure the information asymmetry and the agency problem, have very different meanings, focusing, and calculations. There is no influence relationship or specific sequence between the two mediating variables selected in this study, so the mediating effect in this article is a parallel multiple mediating effect rather than chain mediation. The model equations and are as follows:

The approaches proceed as follows. First, the study estimates Eq. 5 and get the total effect of CSR disclosure on investment efficiency, β1. Second, analyze the regression of CSR_Disclosure to Opaque in Eq. 6 and Agcost in Eq. 7 to test the significance of the regression coefficient, a1 and a2. Third, the coefficient b1 and b2 is the effect of Opaque and Agcost on Ineff after controlling for the effect of CSR_Disclosure in Eq. 8. The coefficient β1' is the direct effect of CSR_Disclosure on Ineff after controlling for the effect of Opaque and Agcost. The model diagram is shown in Figure 1.

Please note, the indirect effect of information asymmetry (Opaque) and agency problems (Agcost) on the relationship between CSR disclosure and investment efficiency is measured by aibi, while the direct effect of CSR disclosure on investment efficiency is equal to β1'.

The study includes industry dummy variables to control for industry fixed effects, which may affect the relationship between firms’ investment efficiency and their CSR disclosure decisions. Industry dummy variables are based on the industry code classified in Appendix 1. This research also includes dummy variables for each year in the sample period (i.e., year fixed effects) to control for changing economic conditions.

4.4 Methods

To test the hypotheses discussed here, this paper uses STATA to conduct multiple regressions to explore the impact of CSR disclosure on investment efficiency, with year and industry-fixed effects included which control for characteristics that vary over time and across industries. Given that all variables are collected at the firm level, data quality is analyzed prior to the regressions to ensure normal distribution. This study also tests the role of mediating effects.

5 Results

5.1 Descriptive statistics

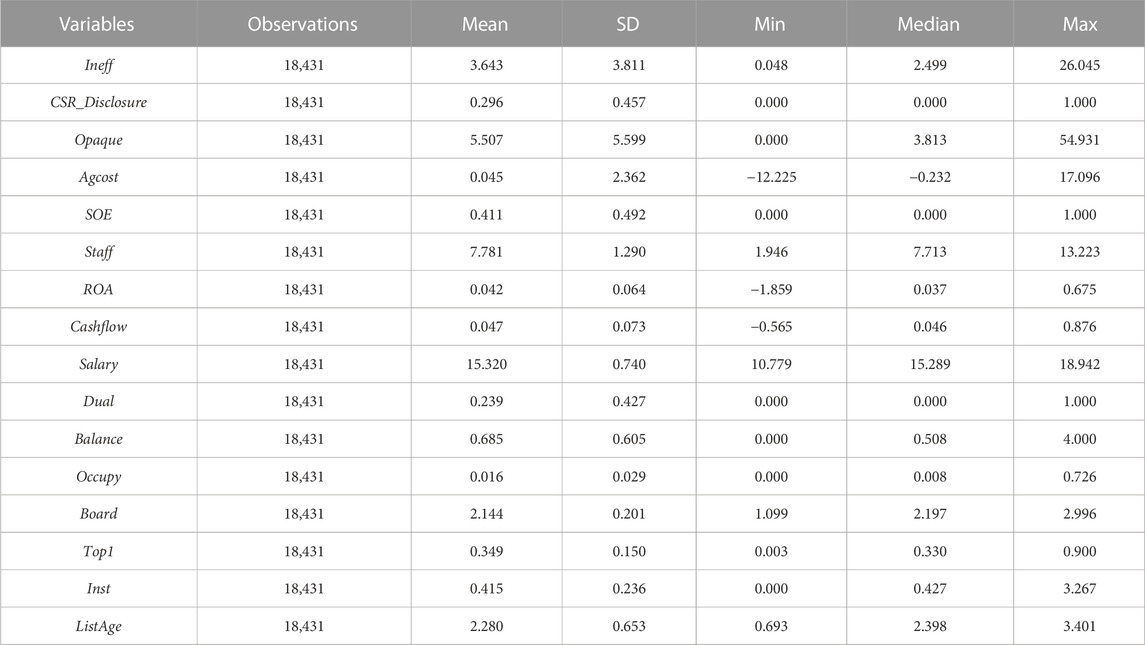

Table 3 shows the descriptive statistics. The mean value of Ineff is 3.643%, which indicates that the average inefficient investment in the sample is 3.643%. The minimum value of Ineff is 0.048% and the maximum value is 26.045%, indicating that there is a relatively large difference in investment efficiency among companies in the sample. The mean value of CSR_Disclosure is 0.29, indicating that the percentage of companies disclosing stand-alone CSR reports in China is 29%, approximately one-third of the sample which is not high. Apart from the above variables, the means and medians of the other control variables are relatively close to each other, implying the sample is relatively balanced. Opaque has a mean (median) of 5.507 (3.813) and a standard deviation of 5.599, indicating a wide variation in information asymmetry among the sample companies.

5.2 Base results

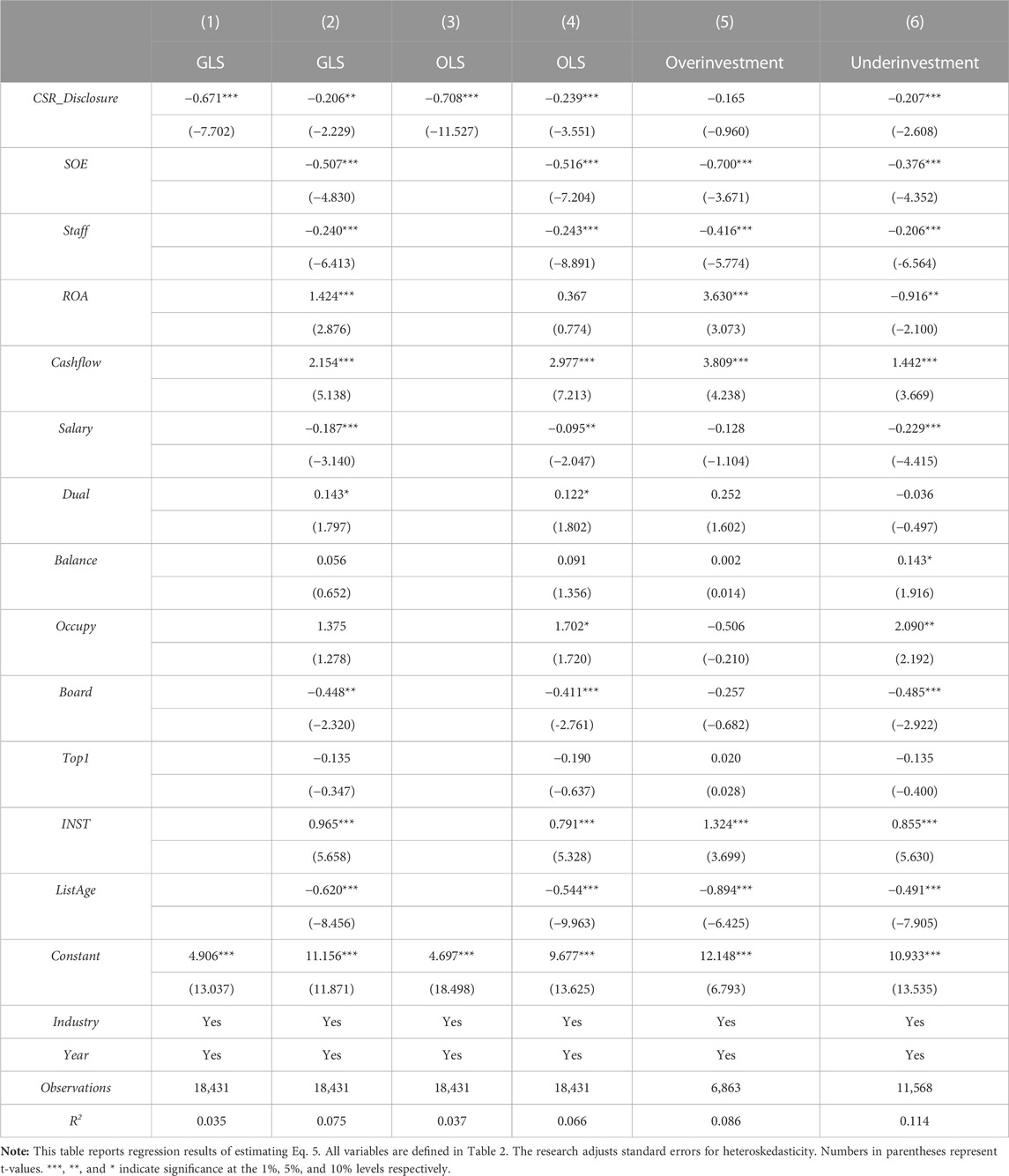

In Table 4, we report the results regression models with different settings on the impact on CSR disclosure on investment efficiency based on Eq. 5. The dependent variable is investment inefficiency (Ineff)—the proxy for investment efficiency, and the main variable of interest is CSR_Disclosure. Columns (1) and (2) show GLS regression results, and columns (3) and (4) show OLS regression results. As observed in columns (1) and (3), where all control variables are excluded, we find that the coefficients on CSR_Disclosure are significantly negative (−0.671 with t-value = −7.702 and −0.708 with t-value = −11.527). In columns (2) and (4), when all control variables are included, the negative relationship is still existing and relatively significant (−0.206 with t-value = −2.229 and −0.239 with t-value = −3.551). The coefficients of CSR disclosure (CSR_Disclosure) are significantly negative which suggest that CSR disclosure significantly reduces inefficient investment. This is consistent with the hypothesis H1.

Column (5) and (6) presents the regression results with two subsamples: Overinvestment and underinvestment. According to Richardson (2006), both overinvestment and underinvestment are inefficient investments although they have different economic implications. Zamir et al. (2020) find CSR disclosures reduce underinvestment for large firms but do not constrain overinvestment in emerging Asian markets. Their findings indicate the potential different impact CSR disclosure has on underinvestment and overinvestment. Thus, it is helpful to study the impact of CSR disclosure on overinvestment and underinvestment separately.

The study defines overinvestment as the positive deviations (positive residual) from the expected investment and underinvestment as the negative deviations (negative residual) from the expected investment level. The coefficient of CSR_Disclosure is only significantly negative (−0.207 at 1% significance level) with the underinvestment subsample which suggests that CSR disclosure only reduces underinvestment, not overinvestment.

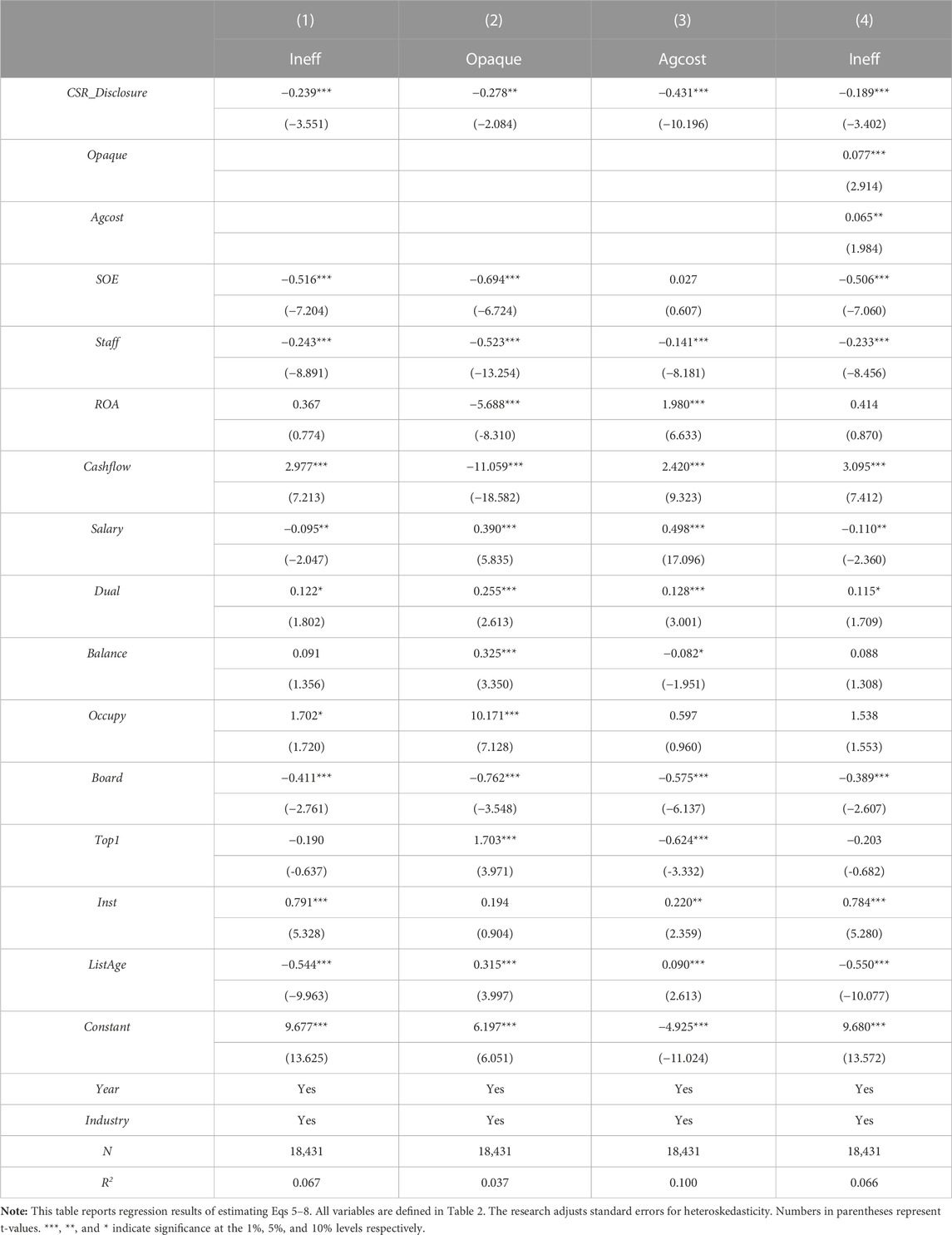

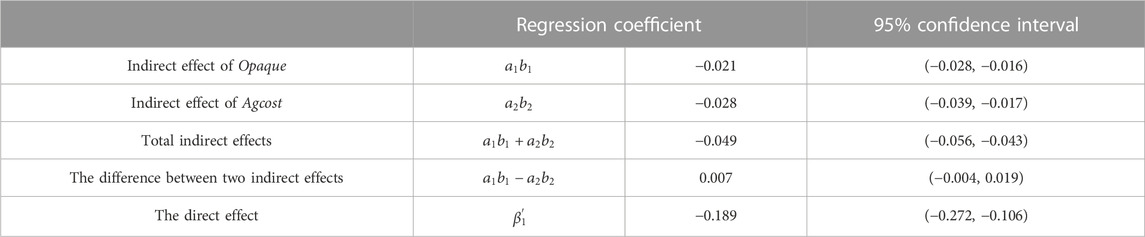

The results of the mediating effect tests in Table 5 show that the coefficient of the total effect of CSR_Disclosure on firms’ inefficient investment is −0.239, which passes the test at the 1% significance level. After controlling for the effects of information asymmetry and agency problems, the direct effect of CSR disclosure on investment efficiency is −0.189. According to the Bootstrap test results for mediation effects in Table 6, the indirect effect of Opaque is −0.021, and 95% confidence interval is (−0.028, −0.016) and does not include 0; similarly, the indirect effect of Agcost is −0.028, and 95% confidence interval is (−0.039, −0.017) and also does not include 0, indicating that CSR_Disclosure will indirectly affect investment efficiency through Opaque and Agcost. The Bootstrap test results in Table 6 also show that the total mediating effects of information asymmetry and agency cost are also significant, but the difference between the two specific mediating effects is not significant. Hypothesis H2 and H3 are verified.

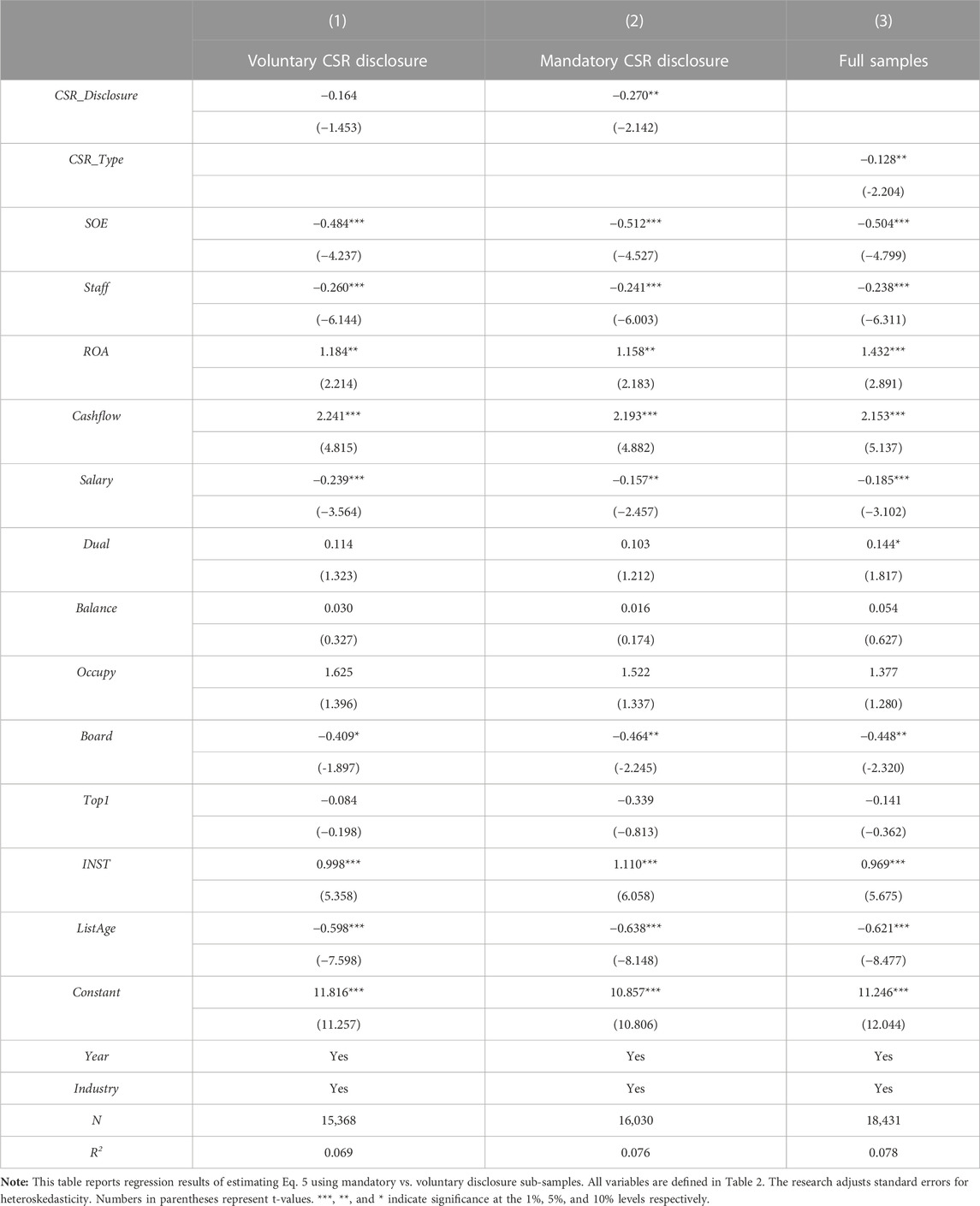

Table 7 reports regression results of estimating Eq. 5 using mandatory and voluntary disclosure subsamples respectively. Since CSR_Disclosure is defined as a dummy variable which equals 1 if the listed company discloses a stand-alone CSR report and 0 otherwise, the coefficients of CSR_Disclosure in Columns (1) and (2) capture the investment inefficiency difference between disclosed group and undisclosed group within voluntary and mandatory CSR sub-samples respectively. Specifically, there are 15,368 total observations in Column (1), 2,401 observations with voluntary CSR disclosure and 12,967 observations without stand-alone CSR report. There are 16,030 total observations in Column (2), 3,063 observations with mandatory CSR disclosure and 12,967 observations without stand-alone CSR report.

For example, Column (1) compares the difference in investment inefficiency between firms that made voluntary CSR disclosures and those that did not disclose stand-alone CSR reports. The coefficient of CSR_Disclosure is −0.164 which is insignificant statistically. This means the investment inefficiency is lower but insignificant for firms that made voluntary CSR disclosure compared to firms that did not issue stand-alone reports. Similarly, Column (2) compares the difference in investment efficiency between firms that made mandatory CSR disclosures and those that did not disclose stand-alone CSR reports. The coefficient of CSR_Disclosure is −0.27 which is significant at 5% significance level. This means the investment inefficiency is significantly lower for firms that made mandatory CSR disclosure compared to firms that did not issue stand-alone reports. These results indicate that mandatory CSR disclosure is more effective in improving corporate investment efficiency, which is consistent with the hypothesis H4.

In Column (3), this article adds another discrete variable CSR_type which equals to 1 if the firm does not issue any CSR report; equals to 2 if the firm issues voluntary disclosure; and equals to 3 if the firm issues mandatory disclosure. The coefficient of CSR_type in column (3) is significantly negative, suggesting that the degree of inefficient investment decreases as CSR_type increases, which is also consistent with the hypothesis H4.

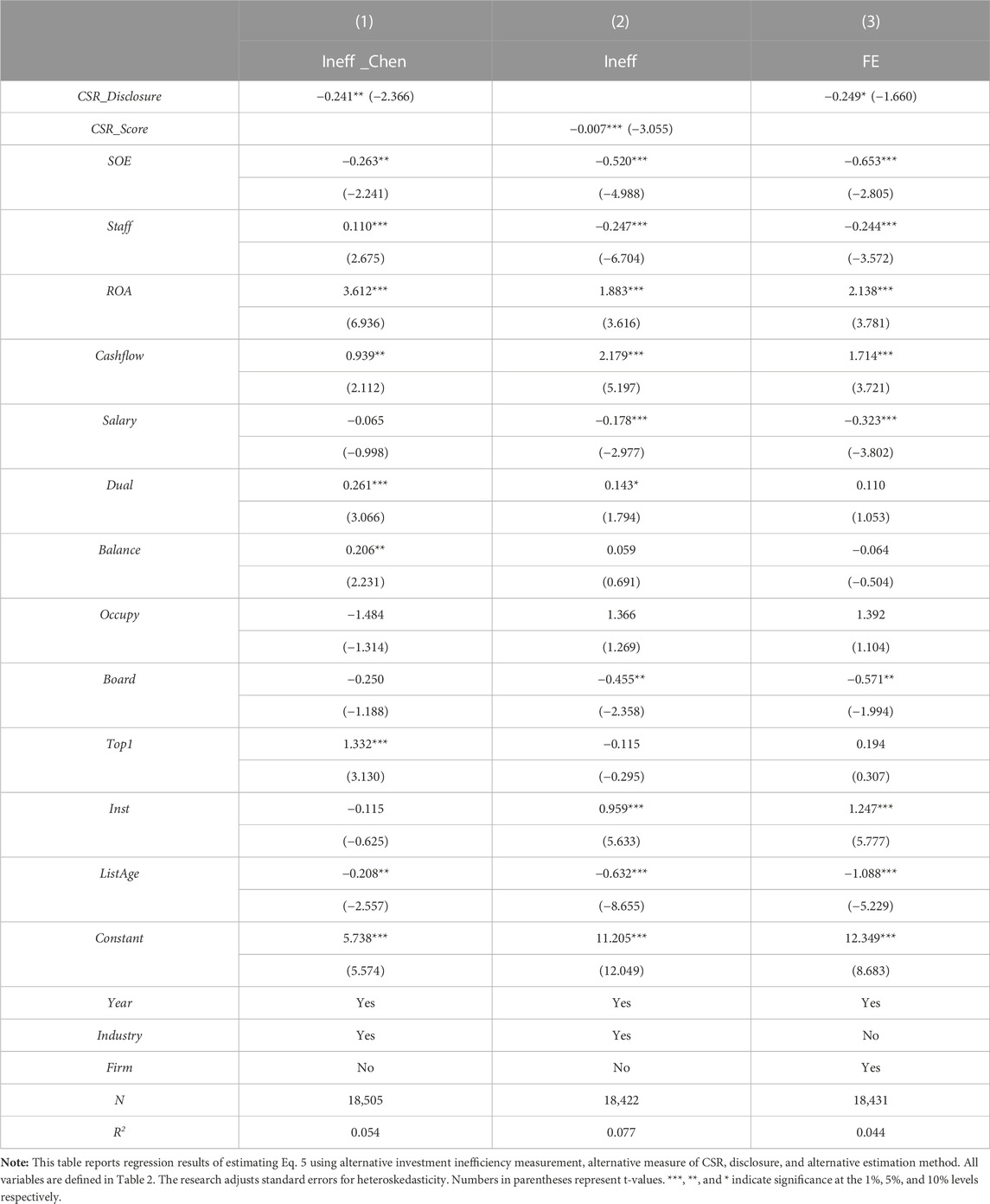

6 Robustness check

To examine the validity of the results which indicate CSR disclosure improves investment efficiency, it runs a battery of additional tests. The study uses alternative measures of investment efficiency, alternative measures of CSR disclosure, alternative estimation methods, and several approaches to address endogeneity and self-selection bias.

6.1 Alternative measure of investment efficiency

This article uses Chen’s model to calculate investment efficiency as a robustness test. Chen S. et al. (2011) propose the following model (Eq. 8) to calculate investment efficiency, and several scholars demonstrate that the model is equally applicable to the Chinese capital market (Dai and Kong, 2017).

In the model, Inv represents the proportion of new investment, and its definition is consistent with Eq. 1, and SalesGrowth is the growth rate of operating income for the company. NEG is a dummy variable that takes the value of 1 if SalesGrowth is negative and 0 otherwise. This research also introduces an interaction term between NEG and SalesGrowth in Eq. 8. All control variables are lagged by one period. Eq. 8 is estimated by year-industry, and the absolute value of the estimated residuals are used as a proxy for investment efficiency (Ineff _Chen). Table 8 reports the regression results. The coefficients of CSR_Disclosure in column (1) are all significantly negative, with the estimates of remaining control variables consistent with the previous results.

6.2 Alternative measure of CSR disclosure

In Table 8, the study analyzes the effect of an alternative measure of CSR disclosure on investment efficiency. This research uses CSR scores from the Hexun database4 as a proxy for CSR disclosure to test its effect on investment efficiency. The study needs to point out that compared to RKS, Hexun is more suitable for measuring the CSR performance, rather than CSR disclosure (Zhong et al., 2019). The results using the Hexun database in the research is just for robustness check purposes.

The coefficients of CSR_Disclosure in column (2) are significantly negative, with the estimates of remaining control variables consistent with previous results.

6.3 Alternative estimation methods

Table 8 also reports the regression results using firm fixed effects. The main results control for industry and year fixed effects. As a robustness test, the study further controls for firm fixed effects. The results remain robust. The coefficients of CSR_Disclosure in Table 8 are significantly negative, with the estimates of remaining control variables consistent with previous results.

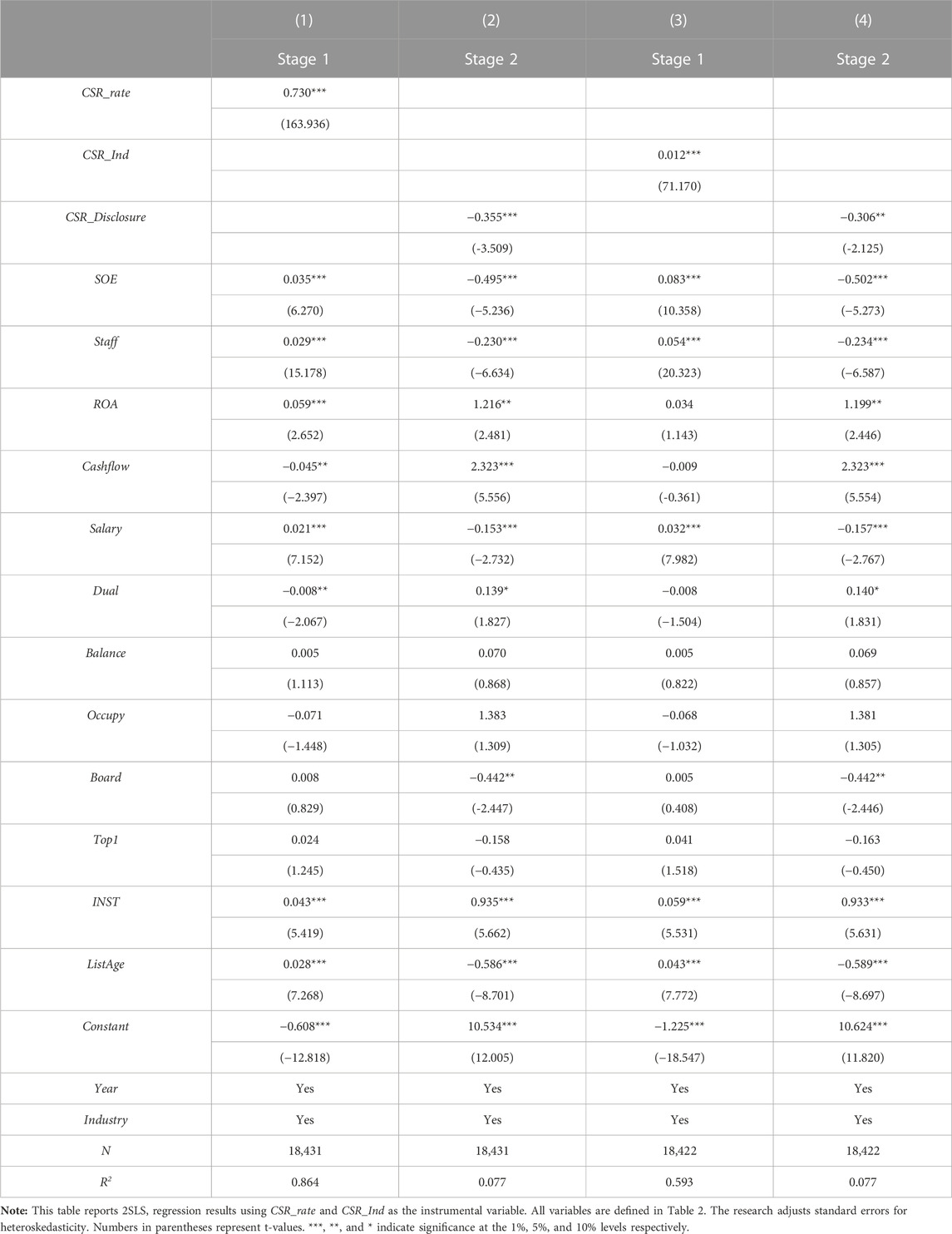

6.4 Robustness check—2SLS regression

Investment efficiency might also influence CSR disclosure which causes a reverse causality problem. For example, firms with high overall investment efficiency and good financial functioning are more likely to issue CSR reports. To rule out such reverse causality from interfering with the estimation results, this study looks for exogenous instrumental variables and re-estimates the model using the 2-step least square method (2SLS). Following Song et al. (2017), this research calculates the ratio of the number of CSR disclosures over the total number of firms in the same industry-year (CSR_rate) as the first instrumental variable. Following Benlemlih and Bitar (2018), the study calculates the industry-year average of overall CSR scores (CSR_Ind) from the Hexun database as the second variable.

On one hand, CSR_rate and CSR_Ind both satisfy the relevance requirement of instrumental variables as companies in the same year and industry share similar characteristics and information environments. On the other hand, CSR_rate and CSR_Ind do not directly affect firms’ investment efficiency, which also satisfies the exogeneity requirement.

Table 9 reports 2SLS regression results. Column (1) and column (3) show the results of the first stage regression using CSR_rate and CSR_Ind as instrumental variables respectively. The coefficients of both instruments are significant at the 1% significance level, which is consistent with the findings of Song et al. (2017); Benlemlih and Bitar (2018). Column (2) and column (4) show the second stage regression results using CSR_rate and CSR_Ind as instrumental variables respectively. The coefficient of CSR_Disclosure on inefficient investment remains significantly negative at the 1% and 5% significance level respectively, indicating CSR_Disclosure improves investment efficiency after considering the interference of reverse causality. These results corroborate the reliability of the main findings.

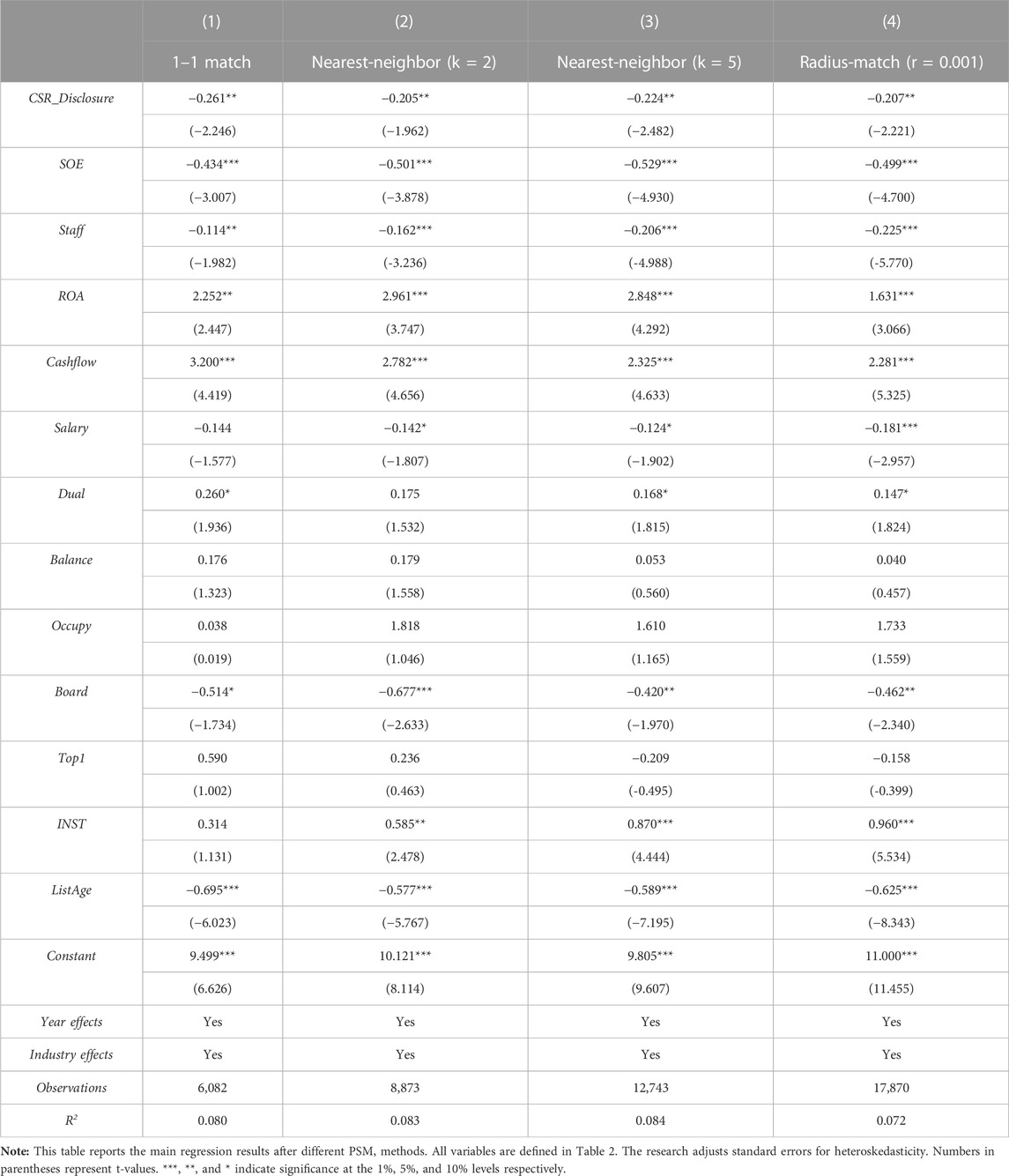

6.5 Robustness test—Propensity score matching test

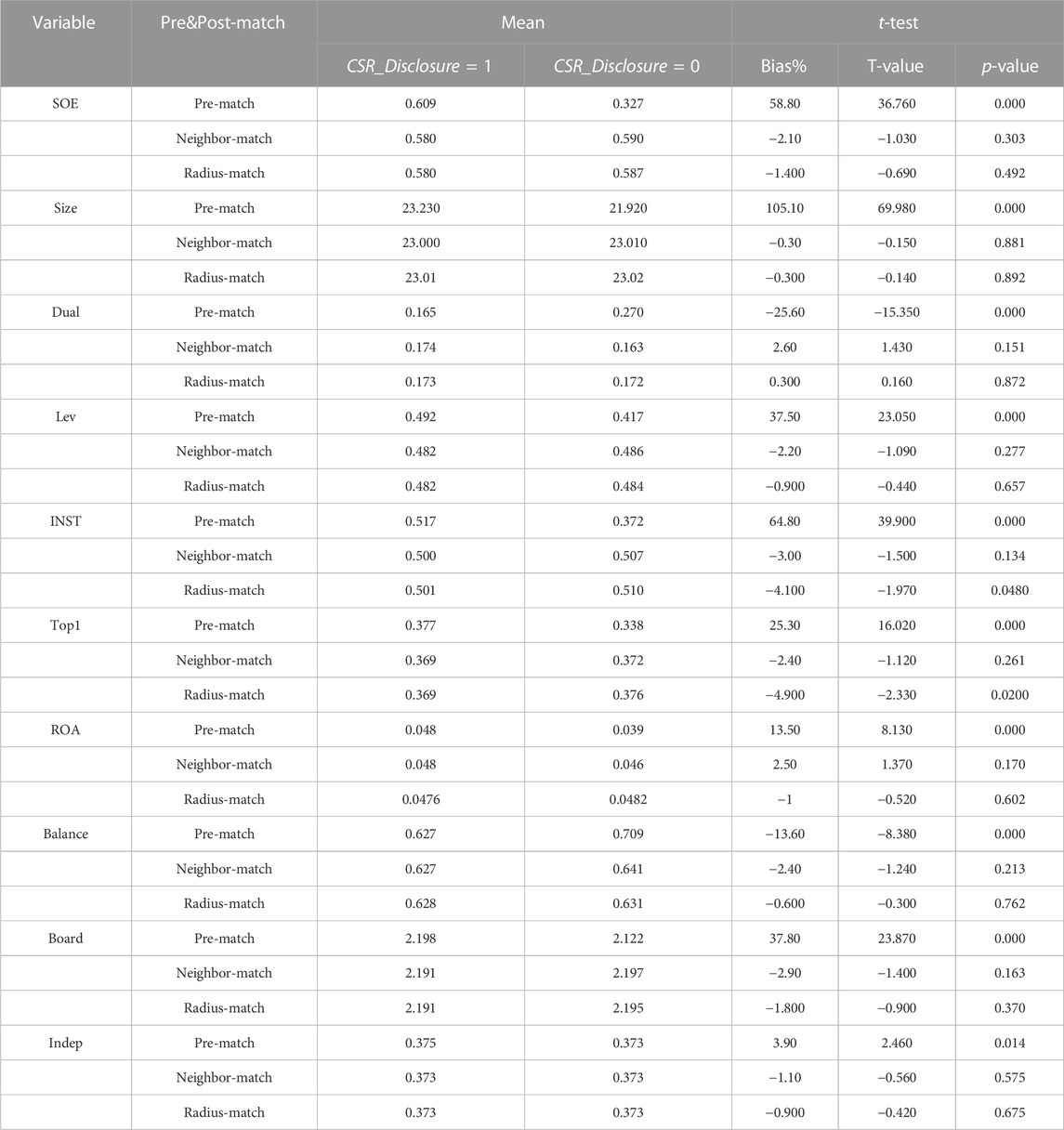

The results might also be subject to self-selection bias. So, this article follows Wang and Chang (2021) and adopt propensity score matching (PSM) with different matching methods: k-nearest neighbor matching (k = 1, k = 2, k = 5) and radius matching (r = 0.001). The 1-1 nearest neighbor PSM matching is all with put-back sampling. As shown in Table 10, CSR_Disclosure remains significantly negatively related to investment efficiency under different PSM methods. The balance test results of PSM in Appendix 2.

7 Additional analysis

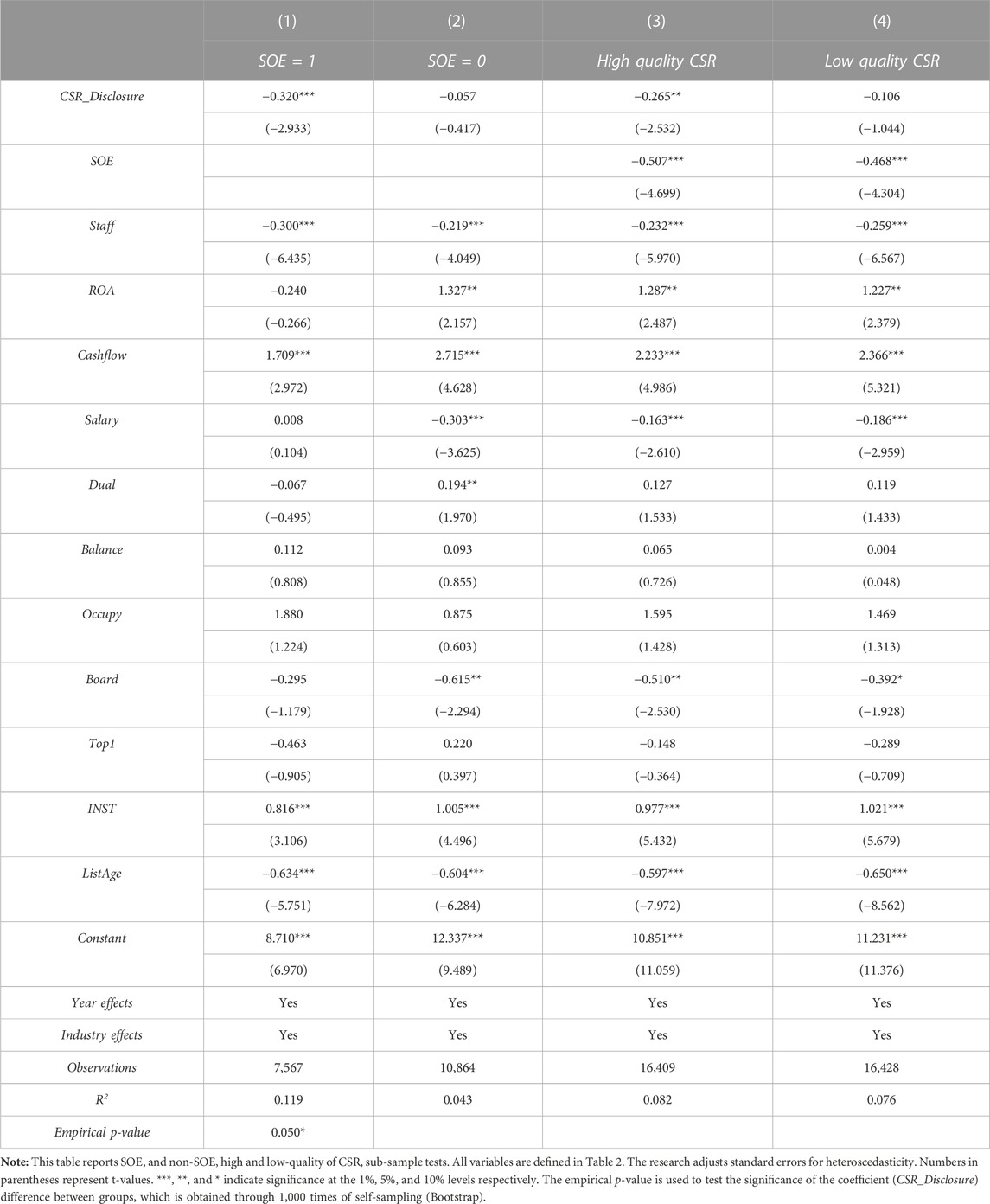

7.1 CSR disclosure and investment efficiency: Nature of ownership

State-owned enterprises (SOE) remain dominant in the Chinese capital market5 and pressured by the State-Owned Assets Supervision and Administration Commission of the State Council (SASAC) to issue CSR reports (Zhao, 2012). SOE take more state and society-assigned responsibilities and SOE executives, who are politically motivated, are more enthusiastic to respond to CSR disclosure requirements and implement them effectively (Song et al., 2017). Consequently, compared to non-SOE, the investment behavior of SOE firms might be more influenced by CSR disclosure. In this part, this study separates firms according to their different ownership background to explore whether there is a difference in the role of CSR disclosure on investment efficiency between SOE and non-SOE.

Table 11 shows the regression results with SOEs and non-SOEs subsamples respectively. In Column (1) with the SOE subsample, the coefficient of CSR_Disclosure is −0.32 and significant at the 1% significance level. While In Column (2) with the non-SOE subsample, the coefficient of CSR_Disclosure is −0.057 and insignificant. The results suggest that CSR disclosure’s role in improving investment efficiency is only significant with state-owned enterprises. This might be caused by SOEs’ unique business objectives which are more social-focused than economic gains-focused. SOEs’ primary business indicator is not pure profit generating, but rather the preservation of corporate assets and images. Accordingly, they are more likely to have “moral motives” for CSR disclosure. In contrast, non-SOEs’ business objective is profit maximization, with CSR a mere incidental part of the business process. As a result, CSR disclosure is of limited use to non-SEOs and might contain limited information.

7.2 CSR disclosure and investment efficiency: CSR performance

Table 11 also presents the effect of CSR disclosure on investment efficiency for different CSR performance subsamples. Firms with good CSR performance are more likely to send positive signals of “good citizenship” through the publication of CSR reports (“signaling effect”). This article posits that such reports are more likely to trigger a significant impact of CSR disclosure on investment efficiency. Previous studies have found a positive impact of CSR performance on investment efficiency (Benlemlih and Bitar, 2018; Lin et al., 2021). The question naturally rises that whether CSR performance will affect the impact of CSR disclosure on investment efficiency and awaits us to answer.

Based on the CSR rating data published by RKS, this study divides the sample into two groups: high CSR performance and low CSR performance based on each industry’s median score. The coefficient of CSR_Disclosure is −0.265 and significant at the 5% significance level for better CSR performance subsample and −0.106 and insignificant for poor CSR performance subsample. This study can conclude that CSR disclosure’s effect on investment efficiency is more pronounced for companies with higher-quality CSR practices.

7.3 CSR disclosure and investment efficiency: Institutional holdings

Previous literature recognizes that stock ownership plays a vital role in limiting agency conflicts and enhancing firm value (Bathala et al., 1994). Institutional shareholding has been widely used as a proxy for external regulation. Empirical studies show that institutional holdings may influence managers’ planning horizons and investment behavior (Eng and Shackell, 2001). Specifically, the higher the institutional shareholding, the stricter the external regulation and the lower the probability that firms engage in irresponsible activities (Christensen. et al., 2017). Therefore, this research investigates the impact of CSR disclosure on investment efficiency in different shareholding conditions.

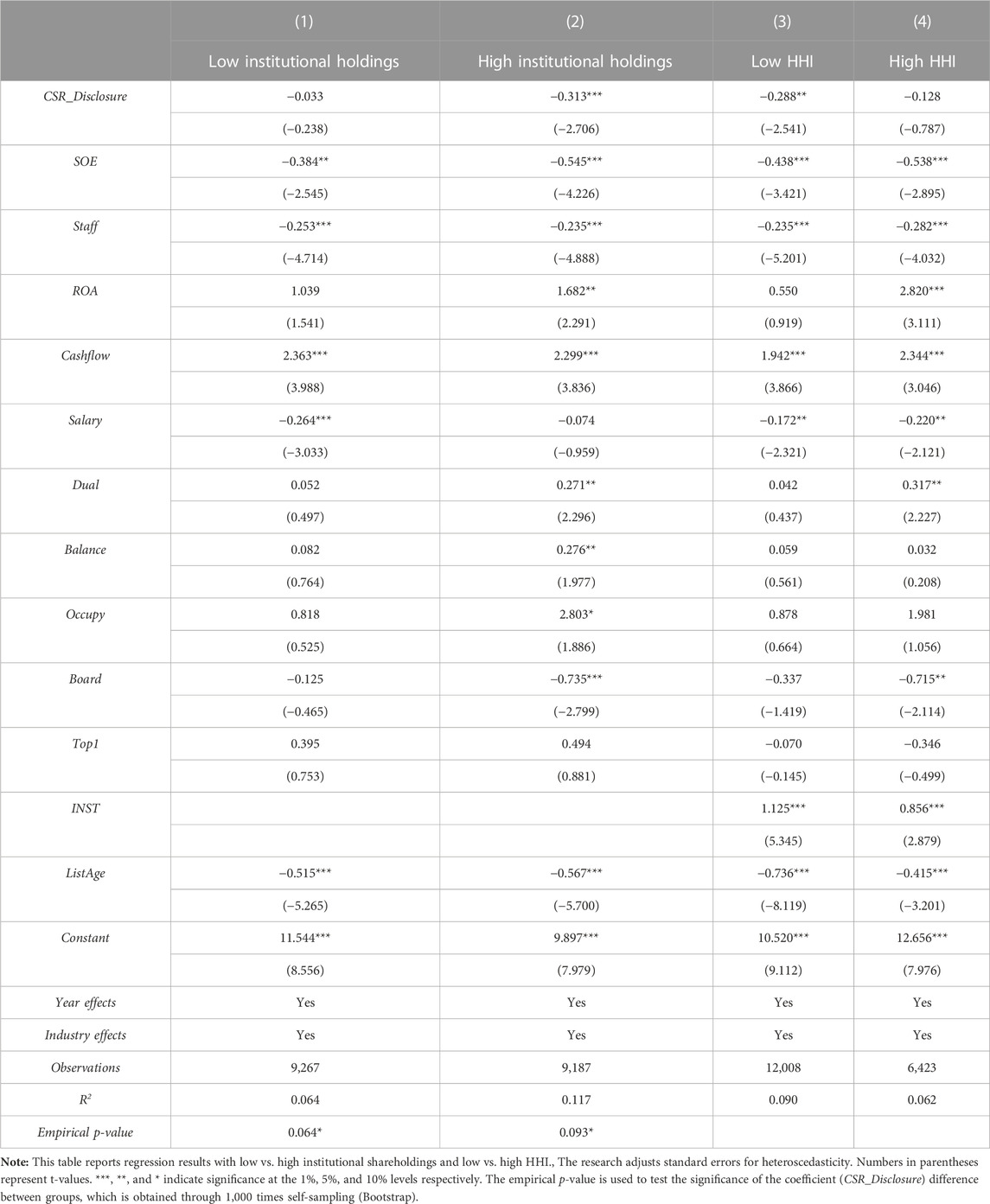

This study separates the sample based on the criteria whether the institutional investors’ shareholding is higher than the annual industry median. A higher than industry median institutional investors’ shareholding suggests a higher level of external regulation. Table 12 reports the subsample test results. In Column (1), the coefficient of CSR_Disclosure for low institutional holdings subsample is −0.033 and insignificant. In Column (2), the coefficient of CSR_Disclosure for high institutional ownership subsample is −0.313 and significant at the 1% significance level. The results indicate that the effect of CSR disclosure on investment efficiency is more pronounced for firms with higher institutional holdings or more strict external regulation.

7.4 CSR disclosure and investment efficiency: Industry competition

Earlier studies demonstrate that industry competition determines a company’s external living environment and critically influences its internal business decisions (Nickell, 1996; Karuna, 2007; Fosu, 2013; Lyu et al., 2022). When a company belongs to a more competitive industry, it usually takes a series of actions to differentiate itself from other competitors in order to be favored by investors and other stakeholders. CSR is widely considered a competitive strategy that allows companies to differentiate themselves from tier rivals (Flammer, 2015; Jia, 2020; Long et al., 2020). According to strategic management theories, implementing CSR practices and making CSR disclosure are both effective strategies companies could use to send positive signals to the market (Porter and Kramer, 2006). In other words, industry competition level is an important factor influencing firms’ internal motivation for CSR disclosure.

This research predicts that industry competition strengthens the relationship between CSR disclosure and investment efficiency. The article uses Herfindahl–Hirschman Index (HHI) to measure industry competition. HHI is a commonly accepted measure of industry competition. It measures competition by squaring the market share of each firm competing in the same market and then summing the resulting numbers. The higher the HHI, the less competitive the industry is and the lower the HHI, the more competitive the industry is.

Table 12 report the regression results. In Column (3), the coefficient of CSR_Disclosure for Low HHI (high competition) subsample is −0.288 and significant at 5% significance level. While in Column (4), the coefficient of CSR_Disclosure for High HHI (low competition) subsample is only −0.128 and insignificant. The results indicate that the effect of CSR disclosure on investment efficiency is more pronounced among companies in highly competitive industries.

This might be explained by the stronger desire of firms from those fiercely competitive industries to gain favor and recognition from investors and shareholder. The more competitive the industry in which a company operates, the greater the pressure to survive, and the more likely the company will regulate their business practices through CSR disclosure and actively fulfill their obligations.

8 Conclusion

This study investigates the influence of CSR disclosure on investment efficiency and the underlying mechanisms. The findings suggest that CSR disclosure improves investment efficiency with a sample of Chinese listed firms. Specifically, the results show CSR disclosure has a significant impact on underinvestment, but no significant effect on overinvestment. This finding is in harmony with Benlemlih and Bitar (2018) which find that CSR has a significant effect on underinvestment, but not overinvestment. The study also shows evidence that mandatory CSR disclosure is more effective in improving corporate investment efficiency than voluntary CSR disclosure, possibly due to a lack of uniform format and content regulation for voluntary disclosure. The findings suggest that information asymmetry and agency cost act as mediating roles in this process. This study uses various tests to demonstrate the robustness of the empirical results. Furthermore, CSR disclosure by state-owned equities (SOEs) is more effective in increasing investment efficiency. And CSR disclosure by enterprises with better CSR performance, higher institutional holdings, and enterprises in more competitive industries also increases investment efficiency more effectively.

Based on the findings, the following policy recommendations are made: First, the positive impact of CSR disclosure on investment efficiency suggests that CSR disclosure could improve company reputation and increase company value as an information medium. Companies’ CSR disclosure can boost market confidence and attract more potential investors, lowering financing costs, improving investment efficiency, and increasing company value. Government should continue to actively implement CSR disclosure policies through tax incentives or mandatory legislation to encourage more companies to join the ranks of disclosing CSR information. In the long run, companies would be more likely to engage in social responsibility activities and develop a steady and healthy growth.

Second, currently, not all publicly traded companies are required to publish CSR reports and there is a lack of guidance for CSR reports’ formats, contents, and elements. This will hinder investors’ appropriate understanding of CSR reports and increases the opportunity of managerial misbehavior. Regulators are recommended to provide more detailed guidance on the format, content, and elements of the CSR disclosure report. Furthermore, government, external institutions, consumers, and other relevant stakeholders should strengthen external monitoring to prevent firms from using CSR disclosure as a “greenwash” or “show”.

This study does have several limitations which mainly stem from its failure to conduct detailed analysis of the content of CSR reports. Future research could dive into the tone, mood, content, and readability of firms’ CSR disclosure using textual analysis and sentiment analysis, investigate their impact on corporate governance, and link to different stakeholder groups and audiences. Given the lack of evaluation metrics for CSR disclosure, it also calls for future studies to address the measurement and evaluation of firms’ CSR disclosure quality.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

FH and MC contributed to the conceptualization and design of the study. MC wrote the original draft and contributed to analyzing it. RL contributed to the review and editing of the manuscript. All authors contributed to the article and approved the submitted version.

Acknowledgments

We gratefully acknowledge the financial support of the National Social Science Foundation Key Project of China “The Promotion of the Integration of the Digital Economy and the Real Economy” (21AZD022).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1RKS is a third-party rating agency of public interest and the authority for CSR in China. It was established in 2007 and independently developed the first rating system for social responsibility reports of listed companies in China. This database has been widely used in academic research.

2Firms that received delisting risk warnings for two consecutive years of operating losses.

3Firms with three consecutive years of losses and suspended from trading.

4Hexun database was founded in 1996, standing out from the early financial and securities information services in China and establishing the first financial information vertical website. After 26 years of dedicated cultivation, Hexun.com has gradually established its dominant position and brand influence.

5SOE accounted for over 60% of China’s market capitalization in 2019 according to Hissey (2019) “Investing in Chinese State-Owned Enterprises”.

References

Andrén, N., and Jankensgård, H. (2015). Wall of cash: The investment-cash flow sensitivity when capital becomes abundant. J. Bank. Financ. 50, 204–213. doi:10.1016/j.jbankfin.2014.10.010

Attig, N., Cleary, S. W., El Ghoul, S., and Guedhami, O. (2014). Corporate legitimacy and investment–cash flow sensitivity. J. Bus. Ethics 121 (2), 297–314. doi:10.1007/s10551-013-1693-3

Bae, K. H., El Ghoul, S., Gong, Z. J., and Guedhami, O. (2021). Does CSR matter in times of crisis? Evidence from the COVID-19 pandemic. J. Corp. Financ. 67, 101876. doi:10.1016/j.jcorpfin.2020.101876

Baron, R. M., and Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Bathala, C. T., Moon, K. P., and Rao, R. P. (1994). Managerial ownership, debt policy, and the impact of institutional holdings: An agency perspective. Financ. Manage. 38, 38–50. doi:10.2307/3665620

Benlemlih, M., and Bitar, M. (2018). Corporate social responsibility and investment efficiency. J. Bus. Ethics 148 (3), 647–671. doi:10.1007/s10551-016-3020-2

Biddle, G. C., and Hilary, G. (2006). Accounting quality and firm-level capital investment. Acc. Rev. 81 (5), 963–982. doi:10.2308/accr.2006.81.5.963

Biddle, G. C., Hilary, G., and Verdi, R. S. (2009). How does financial reporting quality relate to investment efficiency? J. Acc. Econ. 48 (2-3), 112–131. doi:10.1016/j.jacceco.2009.09.001

Bouquet, C., and Deutsch, Y. (2008). The impact of corporate social performance on a firm’s multinationality. J. Bus. Ethics 80 (4), 755–769. doi:10.1007/s10551-007-9467-4

Brooks, C., and Oikonomou, I. (2018). The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. Brit. Acc. Rev. 50 (1), 1–15. doi:10.1016/j.bar.2017.11.005

Calton, J. M., and Payne, S. L. (2003). Coping with paradox: Multistakeholder learning dialogue as a pluralist sensemaking process for addressing messy problems. Bus. Soc. 42 (1), 7–42. doi:10.1177/0007650302250505

Campello, M., Graham, J. R., and Harvey, C. R. (2010). The real effects of financial constraints: Evidence from a financial crisis. J. Financ. Econ. 97 (3), 470–487. doi:10.1016/j.jfineco.2010.02.009

Cao, Y. Y., Wang, J. Q., and Yu, L. L. (2012). An empirical study of corporate social responsibility disclosure and investment efficiency (in Chinese). J. Manag. World 32, 48–61. doi:10.19744/j.cnki.11-1235/f.2012.12.022

Chen, F., Hope, O. K., Li, Q., and Wang, X. (2011). Financial reporting quality and investment efficiency of private firms in emerging markets. Acc. Rev. 86 (4), 1255–1288. doi:10.2308/accr-10040

Chen, S., Sun, Z., Tang, S., and Wu, D. (2011). Government intervention and investment efficiency: Evidence from China. J. Corp. Financ. 17 (2), 259–271. doi:10.1016/j.jcorpfin.2010.08.004

Chen, Y. C., Hung, M., and Wang, Y. (2018). The effect of mandatory CSR disclosure on firm profitability and social externalities: Evidence from China. J. Acc. Econ. 65 (1), 169–190. doi:10.1016/j.jacceco.2017.11.009

Cheng, B., Ioannou, I., and Serafeim, G. (2014). Corporate social responsibility and access to finance. Strateg. Manage. J. 35 (1), 1–23. doi:10.1002/smj.2131

Cho, S. Y., Lee, C., and Pfeiffer, R. J. (2013). Corporate social responsibility performance and information asymmetry. J. Acc. Public. Pol. 32 (1), 71–83. doi:10.1016/j.jaccpubpol.2012.10.005

Christensen, H. B., Floyd, E., Liu, L. Y., and Maffett, M. (2017). The real effects of mandated information on social responsibility in financial reports: Evidence from mine-safety records. J. Acc. Econ. 64 (2-3), 284–304. doi:10.1016/j.jacceco.2017.08.001

Contini, M., Annunziata, E., Rizzi, F., and Frey, M. (2020). Exploring the influence of corporate social responsibility (CSR) domains on consumers’ loyalty: An experiment in BRICS countries. J. Clean. Prod. 247, 119158. doi:10.1016/j.jclepro.2019.119158

Cui, J., Jo, H., and Na, H. (2018). Does corporate social responsibility affect information asymmetry? J. Bus. Ethics 148 (3), 549–572. doi:10.1007/s10551-015-3003-8

Dai, Y., and Kong, D. M. (2017). Can executives with overseas experience improve corporate investment efficiency (In Chinese). J. World Econ. 1, 168–192. doi:10.19985/j.cnki.cassjwe.2017.01.009

Dechow, P. M., Sloan, R. G., and Sweeney, A. P. (1995). Detecting earnings management. Acc. Rev., 193–225.

Denis, D. J., Denis, D. K., and Sarin, A. (1997). Agency problems, equity ownership, and corporate diversification. J. Financ. 52 (1), 135–160. doi:10.1111/j.1540-6261.1997.tb03811.x

Dhaliwal, D. S., Li, O. Z., Tsang, A., and Yang, Y. G. (2011). Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. Acc. Rev. 86 (1), 59–100. doi:10.2308/accr.00000005

Djankov, S., La Porta, R., Lopez-de-Silanes, F., and Shleifer, A. (2008). The law and economics of self-dealing. J. Financ. Econ. 88 (3), 430–465. doi:10.1016/j.jfineco.2007.02.007

Dong, S., and Xu, L. (2016). The impact of explicit CSR regulation: Evidence from China’s mining firms. J. Appl. Acc. Res. 17, 237–258. doi:10.1108/JAAR-03-2014-0030

Eccles, R. G., Ioannou, I., and Serafeim, G. (2014). The impact of corporate sustainability on organizational processes and performance. Manage. Sci. 60 (11), 2835–2857. doi:10.1287/mnsc.2014.1984

Eng, L. L., and Shackell, M. (2001). The implications of long-term performance plans and institutional ownership for firms' research and development (R&D) investments. J. Acc. Audit. Fina. 16 (2), 117–139. doi:10.1177/0148558X0101600204

Fazzari, S. M., Glenn Hubbard, R., and Petersen, B. C. (1988), Financing constraints and corporate investment. Brookings papers on economic activity, 1, 141–195.

Flammer, C. (2015). Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach. Manage. Sci. 61 (11), 2549–2568. doi:10.1287/mnsc.2014.2038

Fosu, S. (2013). Capital structure, product market competition and firm performance: Evidence from South Africa. Q. Rev. Econ. Financ. 53 (2), 140–151. doi:10.1016/j.qref.2013.02.004

Freeman, R. (1984). Strategic management: A stakeholder perspective. Cambridge: Cambridge University Press.

Gomariz, M. F. C., and Ballesta, J. P. S. (2014). Financial reporting quality, debt maturity and investment efficiency. J. Bank. Financ. 40, 494–506. doi:10.1016/j.jbankfin.2013.07.013

Guo, C., Yang, B., and Fan, Y. (2022). Does mandatory CSR disclosure improve stock price informativeness? Evidence from China. Res. Int. Bus. Financ. 62, 101733. doi:10.1016/j.ribaf.2022.101733

Harjoto, M. A., and Jo, H. (2011). Corporate governance and CSR nexus. J. Bus. Ethics 100 (1), 45–67. doi:10.1007/s10551-011-0772-6

Hayes, A. F. (2009). Beyond Baron and Kenny: Statistical mediation analysis in the new millennium. Commun. Monogr. 76 (4), 408–420. doi:10.1080/03637750903310360

Hayes, A. F., and Scharkow, M. (2013). The relative trustworthiness of inferential tests of the indirect effect in statistical mediation analysis: Does method really matter? Psychol. Sci. 24 (10), 1918–1927. doi:10.1177/0956797613480187

He, F., Qin, S., Liu, Y., and Wu, J. G. (2022). CSR and idiosyncratic risk: Evidence from ESG information disclosure. Financ. Res. Lett. 49, 102936. doi:10.1016/j.frl.2022.102936

Hu, J. (2021). Do facilitation payments affect earnings management? Evidence from China. J. Corp. Financ. 68, 101936. doi:10.1016/j.jcorpfin.2021.101936

R. G. Hubbard (Editor) (1990). Asymmetric information, corporate finance, and investment (Chicago: University of Chicago Press).

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. Am. Econ. Rev. 76 (2), 323–329.

Inc. F. R. S. (n.d.). Investing in Chinese State-Owned Enterprises. Available at: https://insight.factset.com/investing-in-chinese-state-owned-enterprises (Accessed February 9, 2023).

Jensen, M. C., and Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 3, 305–360. doi:10.1016/0304-405x(76)90026-x

Jensen, M. C. (2010). Value maximization, stakeholder theory, and the corporate objective function. J. Appl. Corp. Financ. 22 (1), 32–42. doi:10.1111/j.1745-6622.2010.00259.x

Jia, X. (2020). Corporate social responsibility activities and firm performance: The moderating role of strategic emphasis and industry competition. Corp. Soc. Resp. Env. Ma. 27 (1), 65–73. doi:10.1002/csr.1774

Jiang, G., Lee, C. M., and Yue, H. (2010). Tunneling through intercorporate loans: The China experience. J. Financ. Econ. 98 (1), 1–20. doi:10.1016/j.jfineco.2010.05.002

Jo, H., and Harjoto, M. A. (2011). Corporate governance and firm value: The impact of corporate social responsibility. J. Bus. Ethics 103 (3), 351–383. doi:10.1007/s10551-011-0869-y

Karuna, C. (2007). Industry product market competition and managerial incentives. J. Acc. Econ. 43 (2-3), 275–297. doi:10.1016/j.jacceco.2007.02.004

Kölbel, J. F., Busch, T., and Jancso, L. M. (2017). How media coverage of corporate social irresponsibility increases financial risk. Strateg. Manage. J. 38 (11), 2266–2284. doi:10.1002/smj.2647

Krüger, P. (2015). Corporate goodness and shareholder wealth. J. Financ. Econ. 115 (2), 304–329. doi:10.1016/j.jfineco.2014.09.008

Lin, Y. E., Li, Y. W., Cheng, T. Y., and Lam, K. (2021). Corporate social responsibility and investment efficiency: Does business strategy matter? Int. Rev. Financ. Anal. 73, 101585. doi:10.1016/j.irfa.2020.101585

Liu, L., and Tian, G. G. (2021). Mandatory CSR disclosure, monitoring and investment efficiency: Evidence from China. Acc. Financ. 61 (1), 595–644. doi:10.1111/acfi.12588

Lo, K., Ramos, F., and Rogo, R. (2017). Earnings management and annual report readability. J. Acc. Econ. 63 (1), 1–25. doi:10.1016/j.jacceco.2016.09.002

Long, W., Li, S., Wu, H., and Song, X. (2020). Corporate social responsibility and financial performance: The roles of government intervention and market competition. Corp. Soc. Resp. Env. Ma. 27 (2), 525–541. doi:10.1002/csr.1817

Lopatta, K., Buchholz, F., and Kaspereit, T. (2016). Asymmetric information and corporate social responsibility. Bus. Soc. 55 (3), 458–488. doi:10.1177/0007650315575488

Lu, L. Y., Shailer, G., and Yu, Y. (2017). Corporate social responsibility disclosure and the value of cash holdings. Eur. Acc. Rev. 26 (4), 729–753. doi:10.1080/09638180.2016.1187074

Luo, Q., Li, H., and Zhang, B. (2015). Financing constraints and the cost of equity: Evidence on the moral hazard of the controlling shareholder. Int. Rev. Econ. Financ. 36, 99–106. doi:10.1016/j.iref.2014.11.010

Luo, W., Zhang, Y., and Zhu, N. (2011). Bank ownership and executive perquisites: New evidence from an emerging market. J. Corp. Financ. 17 (2), 352–370. doi:10.1016/j.jcorpfin.2010.09.010

Lyu, C., Zhang, F., Ji, J., Teo, T. S., Wang, T., and Liu, Z. (2022). Competitive intensity and new product development outcomes: The roles of knowledge integration and organizational unlearning. J. Bus. Res. 139, 121–133. doi:10.1016/j.jbusres.2021.09.049

Makosa, L., Yang, J., Sitsha, L., and Jachi, M. (2020). Mandatory CSR disclosure and firm investment behavior: Evidence from a quasi-natural experiment in China. J. Corp. Acc. Finance 31 (4), 33–47. doi:10.1002/jcaf.22467

Michelon, G., Boesso, G., and Kumar, K. (2013). Examining the link between strategic corporate social responsibility and company performance: An analysis of the best corporate citizens. Corp. Soc. Resp. Env. Ma. 20 (2), 81–94. doi:10.1002/csr.1278

Mikkelson, W. H., and Partch, M. M. (1986). Valuation effects of security offerings and the issuance process. J. Financ. Econ. 15 (1-2), 31–60. doi:10.1016/0304-405X(86)90049-8

Myers, S. C., and Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 13 (2), 187–221. doi:10.1016/0304-405X(84)90023-0

Nandy, M., and Lodh, S. (2012). Do banks value the eco-friendliness of firms in their corporate lending decision? Some empirical evidence. Int. Rev. Financ. Anal. 25, 83–93. doi:10.1016/j.irfa.2012.06.008

Nekhili, M., Nagati, H., Chtioui, T., and Rebolledo, C. (2017). Corporate social responsibility disclosure and market value: Family versus nonfamily firms. J. Bus. Res. 77, 41–52. doi:10.1016/j.jbusres.2017.04.001

Ni, X., and Zhang, H. (2019). Mandatory corporate social responsibility disclosure and dividend payouts: Evidence from a quasi-natural experiment. Acc. Financ. 58 (5), 1581–1612. doi:10.1111/acfi.12438

Nickell, S. J. (1996). Competition and corporate performance. J. Polit. Econ. 104 (4), 724–746. doi:10.1086/262040

Pawlina, G., and Renneboog, L. (2005). Is investment-cash flow sensitivity caused by agency costs or asymmetric information? Evidence from the UK. Eur. Financ. Manag. 11 (4), 483–513. doi:10.1111/j.1354-7798.2005.00294.x

Pham, H. S. T., and Tran, H. T. (2020). CSR disclosure and firm performance: The mediating role of corporate reputation and moderating role of CEO integrity. J. Bus. Res. 120, 127–136. doi:10.1016/j.jbusres.2020.08.002

Porter, M. E., and Kramer, M. R. (2006). Strategy and society: The link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 84 (12), 78–92.

Qin, B., and Yang, L. (2022). CSR contracting and performance-induced CEO turnover. J. Corp. Financ. 73, 102173. doi:10.1016/j.jcorpfin.2022.102173

Richardson, S. (2006). Over-investment of free cash flow. Rev. Acc. Stud. 11 (2), 159–189. doi:10.1007/s11142-006-9012-1

Samet, M., and Jarboui, A. (2017). How does corporate social responsibility contribute to investment efficiency? J. Multinatl. Financ. M. 40, 33–46. doi:10.1016/j.mulfin.2017.05.007

Sethi, S. P., Martell, T. F., and Demir, M. (2017). Enhancing the role and effectiveness of corporate social responsibility (CSR) reports: The missing element of content verification and integrity assurance. J. Bus. Ethics 144 (1), 59–82. doi:10.1007/s10551-015-2862-3

Shahzad, F., Rehman, I. U., Nawaz, F., and Nawab, N. (2018). Does family control explain why corporate social responsibility affects investment efficiency? Corp. Soc. Resp. Env. Ma. 25 (5), 880–888. doi:10.1002/csr.1504

Song, X. Z., Hu, J., and Li, S. H. (2017). Corporate social responsibility disclosure and stock price crash risk: Based on information effect and reputation insurance effect. J. Financ. Res. 4, 161–175.

Stiglitz, J. E., and Weiss, A. (1981). Credit rationing in markets with imperfect information. Am. Econ. Rev. 71 (3), 393–410.

Tan, W., Tsang, A., Wang, W., and Zhang, W. (2020). Corporate social responsibility (CSR) disclosure and the choice between bank debt and public debt. Acc. Horiz. 34 (1), 151–173. doi:10.2308/acch-52631

Wang, J., and Chang, Y. (2021). Mandatory corporate social responsibility report and audit fee: Evidence from a quasi-natural experiment (in Chinese). Manag. Rev. 33 (7), 249.

Wang, Q., Dou, J., and Jia, S. (2016). A meta-analytic review of corporate social responsibility and corporate financial performance: The moderating effect of contextual factors. Bus. Soc. 55 (8), 1083–1121. doi:10.1177/0007650315584317

Wang, X., Cao, F., and Ye, K. (2018). Mandatory corporate social responsibility (CSR) reporting and financial reporting quality: Evidence from a quasi-natural experiment. J. Bus. Ethics 152 (1), 253–274. doi:10.1007/s10551-016-3296-2

Wen, Z., and Ye, B. (2014). Analyses of mediating effects: The development of methods and models. Adv. Psychol. Sci. 22 (5), 731. doi:10.3724/SP.J.1042.2014.00731

Wu, Y., Lee, C. C., Lee, C. C., and Peng, D. (2022). Short sales and corporate investment efficiency: Evidence from China. Emerg. Mark. Financ. Tr. 58 (8), 2342–2354. doi:10.1080/1540496X.2021.1977122

Xu, S., Chen, X., Li, A., and Xia, X. (2020). Disclosure for whom? Government involvement, CSR disclosure and firm value. Emerg. Mark. Rev. 44, 100717. doi:10.1016/j.ememar.2020.100717

Yusoff, H., Mohamad, S. S., and Darus, F. (2013). The influence of CSR disclosure structure on corporate financial performance: Evidence from stakeholders’ perspectives. Procedia Econ. Finance 7, 213–220. doi:10.1016/S2212-5671(13)00237-2

Zamir, F., Shailer, G., and Saeed, A. (2020). Do corporate social responsibility disclosures influence investment efficiency in the emerging markets of Asia? Int. J. Manag. Financ. 18, 28–48. doi:10.1108/IJMF-02-2020-0084

Zhang, H. (2022). Mandatory corporate social responsibility disclosure and firm innovation: Evidence from a quasi-natural experiment. Financ. Res. Lett. 47, 102819. doi:10.1016/j.frl.2022.102819

Zhao, M. (2012). CSR-based political legitimacy strategy: Managing the state by doing good in China and Russia. J. Bus. Ethics 111 (4), 439–460. doi:10.1007/s10551-012-1209-6

Zhong, M., and Gao, L. (2017). Does corporate social responsibility disclosure improve firm investment efficiency? Evidence from China. Rev. Acc. Financ. 16, 348–365. doi:10.1108/RAF-06-2016-0095

Appendix 1

Appendix 2

This study used four matching measures: k-nearest neighbor matching (k = 1, k = 2, k = 5) and radius matching (r = 0.001). Before matching, the study conducted a balance test and found that the control variables between the treatment and control groups were significantly different. After matching, the standardized deviations of most variables are decreased to less than 10%. And the t-test is not significant. The results show that there is no significant difference in the matching variables between the two groups after the matching. The balance test results are shown in Appendix 1. Here the study only gives the balance test results for k-nearest Neighbor-match (k = 1) and Radius-match (r = 0.001). The 1-1 nearest neighbor PSM matching is all with put-back sampling.

Keywords: corporate social responsibility, investment efficiency, information asymmetry, agency problems, mandatory disclosure VS. voluntary disclosure

Citation: Huang F, Chen M and Liu R (2023) The nature of corporate social responsibility disclosure and investment efficiency: Evidence from China. Front. Environ. Sci. 11:1028745. doi: 10.3389/fenvs.2023.1028745

Received: 26 August 2022; Accepted: 20 January 2023;

Published: 17 February 2023.

Edited by:

Yuantao Xie, University of International Business and Economics, ChinaReviewed by:

Hanmin Dong, Huazhong University of Science and Technology, ChinaJuan Li, Shandong First Medical University, China

Copyright © 2023 Huang, Chen and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Meng Chen, Y2hlbm1lbmc3MjEyQDE2My5jb20=

Fangliang Huang1

Fangliang Huang1 Meng Chen

Meng Chen Rongbing Liu

Rongbing Liu