94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 23 September 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.997865

This article is part of the Research TopicGlobal Excellence: Environmental Issues and Global Value Chain in AsiaView all 24 articles

During the 14th Five Year Plan period, the green transformation of China’s economic growth mode has become the top priority under the carbon peak and carbon neutrality goal. As an important focus of green transformation and development, manufacturing enterprises need to carry out green innovation to cope with the dual pressure of resource and environmental constraints and supply side structural contradictions. Based on the perspective of business ecosystem theory, this study uses fsQCA method to analyze the A-share listed manufacturing enterprise clusters in China’s Yangtze River Delta economic belt and the middle reaches of the Yellow River economic belt. The research found that: 1) Manufacturing enterprises engaged in green innovation has the characteristics of multi causality and concurrence, and there are mainly four driving paths of high performance level. 2) The vision of management and investment is the core supporting factor of green innovation performance. The business ecosystem structure, which combines environmental supervision and competitors’ green innovation concerns, is the core driving structure of enterprise green innovation. 3) Compared with the academic experience of senior executives, the driving effect of environmental investment plays a greater role in improving the level of innovation performance. The innovation of this study is to introduce the green investment vision of managers and the green innovation concerns of stakeholders into the research framework of green innovation driving paths of manufacturing enterprises, explore different green innovation paths across case sets, and discuss the heterogeneity of the impact of each path on the level of green innovation performance, providing a practical plan of green innovation for managers of manufacturing enterprises, and help them understand which business ecosystem elements can promote efficient green innovation.

Since the reform and opening up, China’s economy has continued to develop at a high rate and has become one of the world’s economic powerhouses. The rapid development of the primary industry also means that China’s economy is facing the problem of resource and environmental pollution. The report of the 19th National Congress of the Communist Party of China states that the construction of an ecological civilisation cannot be ignored, and the 14th Five-Year Plan also lists “double carbon” as a key target for pollution prevention and control. Based on this, implementing the concept of sustainable development and promoting green development-oriented economic and social transformation is an important development task for China at present. Under the definition of the United Nations Environment Programme (UNEP), green transformation is considered to be based on circular economy, with the construction of ecological civilisation as the main guide, and green development as the banner to change the development mode to sustainable development, so as to achieve resource conservation, environmental friendliness, ecological balance, and harmonious development of man, nature and society. The manufacturing industry, as the main body of China’s real economy, promotes the efficient and green development of the manufacturing industry, which is the key path to achieve China’s economic and social transformation (Zhai and An, 2020). In view of this, to promote the green transformation of China’s economy and develop a green economy, manufacturing enterprises must be the key entry point to promote the green innovation. At the same time, Manufacturing also affects emissions from other sectors by participating in the supply chain. At present, it is developing in the direction of high technology, and the relationship between industries is becoming more and more complex (Li, 2018). Therefore, studying green innovation from the perspective of product supply chain and exploring specific green innovation paths are very important steps in the process of reducing carbon emissions in China’s manufacturing industry (Tian et al., 2018). This paper focuses on the manufacturing industry and examines the key factors driving the green innovation of the manufacturing industry, aiming to provide effective suggestions for enterprises to build a sustainable business ecosystem and accelerate the green innovation, so as to help China’s economic green transformation and upgrading.

Previous studies on green innovation in the literature have mainly focused on the macro level, but there are few analyses based on the micro perspective. The existing literature on the factors influencing green innovation can be summarised into two dimensions: external constraints and internal management, such as environmental regulation, media supervision and corporate governance, but the research on management’s investment vision and stakeholders’ concern for “green upgrading” is not deep enough. This paper innovatively examines the incentive effects of environmental regulation, management’s investment vision and stakeholders’ green concerns on the enterprise green innovation from three dimensions, which is an enrichment and deepening of the existing theories. Secondly, from an internal perspective, the enterprise green innovation performance is a concrete measure to achieve sustainable development, and from an external perspective, it is a necessary path for the construction of ecological civilisation in China. By searching for a business ecosystem that promotes the enterprise green innovation performance, this paper can provide effective strategic suggestions to enterprise managers and point the way for enterprises to accelerate their innovation and upgrading.

The organization for economic cooperation and development (OECD) defines green innovation as the creation and implementation of products and services, production processes, marketing methods, organizational structures and institutional arrangements that can improve the environment. Green economic growth emphasizes the coordinated development of economy and environment under the constraints of resource-carrying and environmental capacities (Wang et al., 2022). Only by harmonising the relationship between the enterprise and nature, the enterprise and the external environment and the enterprise itself can the green innovation of the enterprise be promoted, which means that the green innovation of the enterprise is inextricably linked to the business ecosystem in which it operates and that its promotion is a complex and dynamic process.

In recent years, scholars at home and abroad have conducted a series of studies on the driving factors affecting the enterprise green innovation. On the one hand, many scholars believe that enterprises are driven to adopt green innovation strategies by internal and external synergies. Delmas and Montiel (2009) suggest that energy saving and emission reduction by firms is mainly driven by internal pressure. Yang (2018) argues that external institutional pressures drive organisations to green management. Ribeiro et al. (2022) suggests that organisational structure affects the efficiency of a firm’s green behaviour. Cuerva et al. (2014) found that the resource commitment of corporate management influences whether a company is actively engaged in environmental management change. Wang and Song (2017) studied the impact of reverse outsourcing on green technology progress. Kimata and Itakura (2021) studied the impact of technological capabilities on corporate responsibility for environmental protection. On the other hand, Cheba et al. (2022) found that some scholars also start their research from the necessary paths for enterprises to implement the innovation, mainly in terms of information technology, government regulation, academic innovation and industrial chain to suggest the path of green innovation for enterprises, and that the way and performance level of enterprises to carry out green innovation depends on the level of their R&D and innovation capability. However, the innovation and upgrading of companies requires not only the optimisation of production and operational processes, but also top-down changes in organisational structures, and these initiatives are predicated on significant green investments by management.

Based on this, Osagie et al. (2016) suggest that under environmental pressure from the external environment and internal strategies, companies are more reactive in implementing green innovation measures. These initiatives include not only the development of green products, but also the introduction of the concept of ‘cleaner production’. At the same time, the negative externalities of the environment make it difficult for competing micro-enterprises to make the green transition through market mechanisms alone, while government environmental regulation can act as an external driver of the green transition by exerting cost pressures on enterprises from the outside (Du et al., 2021). Chan (2010) found that the preference orientation of management within a company towards environmental protection will significantly drive the adoption of environmentally friendly strategies. In a subsequent study, Chan et al. (2012) also found that management’s environmental orientation not only promotes green cooperative interactions between firms and suppliers, but even enhances the green transition orientation of industry competitors. While exploring the factors influencing the green innovation of a company from within the company, scholars usually look at it from the perspective of management governance, for example. Homroy and Slechten (2019) indicate that there is a significant correlation between the environmental experience and academic competence of corporate executives and corporate environmental performance, with executives taking decisions to enhance environmental investments for corporate reputation reasons. At the same time, some scholars, taking into account the voluntary nature of environmental information disclosure, found that senior managers, affected by their educational background and age, have strong discretion in green innovation decision-making and environmental information disclosure, which will affect the green innovation performance of enterprises (Ma et al., 2019). Therefore, the enterprise green innovation performance is not only quite relevant to external environmental regulations, but also inextricably linked to the managerial awareness and social responsibility of the internal management of enterprises.

In addition, if a firm has operational problems during capital expansion, such as high adjustment costs, it will not be able to make timely and sound decisions on green investments based on the external environment, and may be discouraged from making green investments. Wang et al. (2018) found that in actual production, if technological progress is divided into production technological progress and green technological progress, enterprises' R&D investment in green technology will inevitably reduce the progress rate of production technology. So as to affect the production and operation decision-making and business performance of enterprises. This is a key element in the process of implementing a green innovation strategy for companies.

To sum up, most of the existing relevant studies on the driving factors of green innovation in enterprises only focus on the single value of many potential influencing factors of green innovation, that is, the marginal net effect in regression analysis, but ignore the complex synergy among many important factors. In addition, the research on the characteristics of managers at the enterprise level is limited, and it also ignores the heterogeneous effects brought by different stakeholders. In this paper, we also discuss the compound driving path of enterprise green innovation performance from the four dimensions of manufacturing enterprises, governments, competitors and consumers, and explore the dynamic mechanism of enterprises' implementation of open green innovation under the collaborative driving effect of government supervision, top managers' green investment vision and stakeholders' green innovation concerns. At the same time, taking the A-share listed manufacturing enterprises in the Yangtze River Delta and the middle reaches of the Yellow River as cases, the fsQCA method is used to reveal the diversified paths and driving mechanisms that lead to the differences in the performance of green innovation of manufacturing enterprises, so as to provide managers with the core driving path and action reference of enterprise green innovation, and help managers of manufacturing enterprises deeply understand the underlying logic of green innovation, It can be used for reference to promote the high-quality development of manufacturing enterprises.

As defined by the United Nations Environment Programme, green innovation is an economic model of sustainable long-term development based on improving human well-being and social equity, and minimizing environmental hazards and ecological scarcity (Beckers et al., 2012). For China, to realize the green transformation of the whole economy, enterprises are the landing point and the way to break the ice. Eiadat et al. (2008) believe that the green innovation of companies is related to many factors, such as government environmental regulation, the importance of managers and the pressure of stakeholders. Therefore, based on the business ecosystem theory, this paper examines the incentive effect of environmental regulation, management’s investment vision and stakeholders’ green attention on enterprise green innovation from three dimensions, and constructs a research framework of enterprise green innovation ecosystem, in order to further clarify the driving mechanism to promote the performance of enterprise green innovation.

Moore (1996) was the first to introduce biological principles into the field of organisational strategy research, arguing that in an era of dissolving industry boundaries, the business ecosystem is the main source of competition faced by firms, i.e. a firm’s competitive advantage depends on the importance of the business ecosystem in which it operates. And to achieve a change in the economic development model, it is necessary to take enterprises as the landing point for change. Only through green innovation can manufacturing enterprises gain a competitive advantage. However, due to the fickleness of the external business ecosystem, enterprises are no longer in the original static system, and the process of blindly and spontaneously seeking innovation is subject to a series of internal and external constraints such as capital, technology and policy, and the cost of trial and error is too high. This means that companies have to be part of the entire business ecosystem, strengthen their ties with external governments and internal stakeholders, optimise their own organisational structure, integrate resources through the ecosystem, and form a symbiotic coupling between the company and all parties. At the same time, the business ecosystem in which an enterprise is located is the operational vehicle for the green innovation of manufacturing enterprises. Green innovation is not only a strategic change to the traditional economic model, but also a strategic innovation to address the contradiction between negative externalities and the external environment. By promoting the coupling between government, internal management, competitors and consumers in the business ecosystem, green innovation can accelerate the efficient recycling of technology, talent and capital based on green concepts in the entire business ecosystem, thus improving the green performance of the entire business ecosystem and the innovation performance of other enterprises in the system, and stabilising the resource allocation pattern in the system.

Thus, there is not just a unilateral orientation between corporate green innovation and the business ecosystem, but a circular network formed through organic integration, as shown in Figure 1:

On this basis, this paper suggests that the main factors that facilitate the green innovation of companies can be grouped into three dimensions: environmental regulation, management’s investment horizon, and stakeholders’ green concerns.

The concept of green innovation is guided by the concepts of “green economy” and “green development”, and is seen as an idea for transforming development in response to natural resource constraints. Green innovation is an innovation composed of new or improved products, processes, services and management. It can not only add value to customers and enterprises, but also significantly reduce the adverse impact on the environment. In recent years the concept has matured and improved through continuous development and change, and green innovation has become a key path for companies to gain a sustainable advantage in the blue ocean competition. The green innovation of an enterprise is essentially a strategic transformation that can match the external development environment and pursue its own sustainable growth, and is also an all-round change that covers all aspects of the green development concept and economic development model, and is a policy measure for the synergistic development of the economic and environmental management of the enterprise (He et al., 2021). From a micro perspective, the green innovation is a process of “strategic change”, focusing on the behaviour of the various organisational structures of the company under a green philosophy. Green innovation requires institutional, cognitive and environmental support to achieve. Therefore, this paper argues that corporate green innovation refers to a strategic change in the economic model that is driven by the concept of green development and driven by policies, strategies and stakeholders to promote sustainable development.

For the government, environmental regulation is an efficient policy tool for environmental governance, which will have a certain degree of impact on the green innovation of manufacturing enterprises, but this impact is also multi-faceted as there are differences in the time dimension of measurement. In the short term, companies need to upgrade their equipment and processes in order to meet the requirements of environmental management and change their high pollution and energy consumption production patterns, thus incurring significant green investment costs and weakening their short-term competitiveness. However, as environmental regulations become more stringent, the cost of green innovation can reduce the cost of environmental penalties in the long term and increase the efficiency of resource use and productivity, bringing sustainable economic and environmental benefits to the company. The theory of organisational legitimacy is often used to explain the motivations for corporate behavior, with organisational legitimacy usually referring to the degree to which social activities are regulated by laws, regulations, values, customs and so on (Suchman, 1995). Environmental legitimacy refers to the desired level of performance of a company’s environmental behaviour (Mahadeo et al., 2011). In terms of organisational legitimacy theory, environmental legitimacy mainly comes from government regulatory pressure, stakeholder pressure and media public opinion pressure, etc. Depending on the source, it can be divided into two levels: formal and informal. Wang et al. (2021) found that environmental regulation will affect the resource allocation and legitimacy of enterprises, and then affect productivity and innovation performance. Environmental legitimacy is one of the key influencing factors in the enterprise green innovation. This is reflected in the fact that companies often make additional environmental-related investments to improve their green transition performance in order to maintain their legitimacy.

Formal environmental legality (government regulation). Li et al. (2022) found that external pressures stemming from government regulation can prompt firms to adopt green management practices. Government regulation is an important form of formal environmental legitimacy, whereby the government puts external pressure on companies to make a positive green transition by setting relevant environmental regulations and policies. It has been shown that the legitimacy pressure from the government level is a significant positive driver for companies to make the green transition. On the one hand, in the face of external political pressure exerted by governments, companies will take the initiative to engage in green innovation activities in order to increase their own environmental legitimacy. Of these, manufacturing companies, which tend to prevent pollution, will pay more attention to the impact of government environmental regulations (Buysse and Verbeke, 2003). On the other hand, in addition to green innovation and research activities, companies also adopt strategies such as energy saving and emission reduction to minimise their pollution efforts. In other words, government regulation contributes significantly to the green performance of companies in the context of green innovation as a strategy to cope with external pressures. Under the pressure of formal environmental legitimacy, companies will spend more on environmental protection in their production processes and actively adopt green innovation strategies, thereby gaining legitimacy and thus the “innovation compensation effect” (Porter and Linde, 1995). Therefore, this paper argues that with increased government regulation, companies will be subject to greater formal environmental legitimacy, meaning that they will make significant investments in green technology innovation, i.e. a positive driver for enterprise green innovation.

The negative externalities of pollution and the uncertainty of business operations expose companies to unknown economic risks, which in turn has a deterrent effect on the promotion of green innovation. Capital support is therefore also an important driver of enterprise green innovation. When external investors consider a company’s green performance through its annual report, the investment in environmental protection is often used as a measure of the cost to management of adopting a green transition versus the fines incurred as a result of the company’s polluting behaviour, thus driving the extent of green research and development. At the same time, the choice of key decisions for corporate management is mostly the result of behavioural factors and is not an economically optimal rational choice. Shnayder and Van Rijnsoever (2018) conclude from management research that the choice of corporate strategy is influenced from the top due to the often heterogeneous mental models of managers. In the cognitive school of strategic management, Hambrick and Mason (1984) developed a higher-order theory of strategic decision making, the core of which is that executives react in a highly personal way according to the decision moment they are in, and from this they derive highly personal actions, i.e. their decisions contain many of their own inherent characteristics of personality, experience and values. Furthermore, higher order theory is respected in academic circles because it is essentially an information processing theory and because it can systematically explain how executives make decisions with limited rationality. It can be argued that the green investment behaviour adopted by firms depends heavily on the expertise of corporate executives and the goals they focus on when assessing strategic issues, so the academic background of corporate executives can be used as a focus for studying their influence on corporate green investment. Therefore, this paper selects the driving effect of corporate environmental investment and the academic experience of executives as a reflection of management’s green investment vision to promote enterprise green innovation.

Based on a resource-based view perspective, it is argued that an important driver influencing corporate innovation is capital resources. It is found that under the pressure of informal environmental regulations such as media public attention, significant capital investment can propel firms to undertake green technology research and development. Given this, the size of the environmental capital invested by firms will be directly linked to their level of innovation performance. However, while the impact of environmental investment has a direct effect on green transition performance, it also has an indirect effect, based on a signalling theory perspective. The media’s attention to the potential pollution behaviour of companies not only exposes them to a siege of negative public opinion, but may also lead them to passively induce punitive mechanisms in the market, or even administrative penalties (Zhao et al., 2022). Under such pressure, companies often have to resort to public relations to deal with a greater degree of reputational crisis, but this approach does not address the root causes of the negative effects. Instead, for a more sustainable approach, companies will signal to the media public that they are proactive in environmental protection through internal environmental investments, creating an image of active environmental responsibility (Berman and Bui, 2001). In particular, companies’ investments in environmental protection are often used to develop green technologies such as clean energy or energy-efficient products, which can effectively influence public perception and evaluation of the company, thus allowing the company to turn the tide of public opinion (Mohr, 2002; Brunnermeier and Cohen, 2003). With environmental protection in the minds of the people, public awareness of environmental protection has increased like never before this year, so that manufacturing companies pay high attention to environmental protection public opinion. Not only that, but the media public will even take the initiative to monitor companies involved in pollution, based on the principle of interest-orientation (Makdissi and Wodon, 2006). The increased investment in environmental protection by companies under pressure can therefore effectively deal with the “negative effects” of public opinion in the media, creating a “compensatory effect” on innovation and increasing the incentive for companies to innovate green through a negative feedback mechanism (Arouri et al., 2012). This shows that there is a positive effect between the environmental investment decisions taken by the management of a company and its green innovation performance. When companies make relatively high levels of investment in environmental protection, the consequent increase in environmental reputation makes the “compensatory effect” outweigh the “crowding-out effect” and provides an incentive for further green research and development. Thus, management’s choice of environmental investment decisions, i.e. management’s green investment horizon, has a significant contribution to the green innovation of the company.

The academic experience of executives refers to the track record of executives who have taught at universities, conducted research at research institutes or scientific societies. Bamber et al. (2010) define the executive team as the executives who are directly involved in making decisions for the company, such as the chief executive officer, general manager and chief financial officer. Executives with academic experience have the right qualities in terms of education, practical experience, social resources and values that are necessary for top management, which can significantly contribute to the development of green investment activities. Managers’ personal capabilities are often associated with their ability to act on innovation activities, and their risk tolerance is positively correlated with their personal capabilities, so that more capable executives are better at making more rational choices when making decisions, suggesting that managerial capabilities have an impact on the level and efficiency of corporate innovation. It is therefore of theoretical importance to explore the relationship between executives’ academic experience and corporate green innovation, and this paper argues that having executives’ academic experience is also one of the important drivers of corporate green innovation.

Stakeholder theory has been around since 1960 and was first introduced to management and economics by the American scholar Ansoff (1964), who suggested that companies must weigh up the relationships between their many stakeholders and their conflicting claims in order to develop a more rational corporate strategy, including insiders, suppliers and distributors. Companies that fail to gain the support of their stakeholders in a competitive business environment will not be able to achieve sustainable and smooth growth, suggesting that not only the direct investors in the company, but also other stakeholder groups outside the company have an impact on the operation of the business. Freeman (1984) extended stakeholder theory by arguing that the scope of stakeholders could be extended to groups that are influenced in the process of realising the vision of the firm. Quintelier et al. (2021) found that stakeholders not only have an influence on business strategy, but also have certain legal or ethical constraints on the business and their claims will be brought to the attention of the business management. In the process of resource allocation, companies can only achieve win-win results if they form a balance of interests with their stakeholders. In a context of unprecedented social awareness of environmental protection, companies cannot ignore the growing environmental sentiment of consumers and competitors. Therefore, companies must be aware of the role played by stakeholders in their development and establish good links with them in order to achieve long-term green and sustainable development. Based on this, this paper deconstructs stakeholder green concerns into consumer green innovation concerns and competitor green innovation concerns, and analyses them in detail in the following paragraphs.

Consumer green innovation concern refers to the fact that consumers attach great importance to environmental issues and use a company’s environmental green innovation performance as an important indicator to evaluate the legitimacy or reputation of the company concerned. Annunziata et al. (2019) argue that companies’ promotion of their own environmental advice can increase the depth of consumers’ understanding of environmental protection and thus have a positive impact on consumers’ green consumption transition. His study found that the carbon emissions of manufacturing firms decreased as consumers’ low-carbon preferences increased, and that increased consumer awareness of environmental protection would facilitate the achievement of firms’ environmental goals in the supply chain. In addition, consumer activity also has a countervailing effect on the production activities of companies. Consumers’ interest in green innovation increases their demand for green products, which generates external normative pressure on companies to innovate green. Normative pressure is the legitimisation of behaviour based on commonly understood and defined norms (Larson, 1991). Regulatory pressures are spread mainly through the network of channels in the business ecosystem, i.e. “supplier-business-consumer” (Li and Ding, 2013). In practical terms, however, consumers are often more dominant than suppliers. The above consumer demand for green products is in fact a normative pressure for companies to adopt green innovation activities, and driven by this normative pressure, companies will further promote enterprise green innovation in order to secure their dominant position in the market mechanism and their own reputation. This paper therefore argues that the normative pressure for environmental protection can be transmitted to the companies concerned through consumers’ concern for green innovation, which in turn influences enterprise green innovation.

Competitor green innovation concern refers to the fact that a firm’s competitors in the industry take environmental issues very seriously and use a firm’s green innovation performance as an important indicator to evaluate the legitimacy or reputation of peer firms. Competitors’ concern for green innovation can create imitative pressure on manufacturing firms (Hofer et al., 2012). That is, firms will imitate their more legitimate and reputable counterparts in order to gain an advantageous position in the competitive market mechanism (Li and Ding, 2013). On the one hand, the increased attention of competitors to green innovation will increase their own legitimacy and bring a corresponding threat to the enterprises themselves, so that enterprises will strengthen their innovation and research and development of green technologies in order to gain a higher legitimacy. On the other hand, competitor green innovation concerns have a greater impact on the effectiveness of government regulation and consumer green innovation concerns, and firms will be favoured by the resource and opportunity advantages brought about by institutional homogeneity to further adopt green innovation behaviours. Therefore, this paper argues that competitor green innovation concern will bring imitative pressure on enterprises, which will in turn lead them to practice green concepts and increase environmental protection investment, so as to achieve enterprise green innovation performance.

In summary, this paper proposes an analytical framework to promote the green innovation factors of enterprises, as shown in Figure 2 Analytical framework of factors driving enterprise green innovation performance.

Qualitative Comparative Analysis (QCA) is a case-oriented approach that was developed by the American sociologist Ragin in 1980. This paper uses a hybrid approach of fuzzy set Qualitative Comparative Analysis (fsQCA) and Necessary Condition Analysis (NCA) to explore the elements of the business ecosystem that influence the green innovation of companies. fsQCA method is based on algebraic and Boolean logic to compare and analyse cases. Given the small sample size and complexity of the companies selected for this paper, the fsQCA approach can reveal the complex causal relationships between the occurrence of a given outcome and the combination of conditions at play. The NCA method can test whether a condition is necessary for a particular outcome, while compensating for the inability of the fsQCA method to analyse the amount of necessary condition effects (Dul, 2016).

The aim of this paper is to explore the effective path of enterprise green innovation performance based on a group perspective under the combined effect of multiple factors. The reasons for choosing a mixed approach of fsQCA and NCA are as follows: First, the enterprise green innovation performance is a process influenced by many complex antecedents, and there are multiple causal relationships. Unlike traditional regression analyses, which explore the “net effect” of specific factors from a single perspective and do not consider the linkage effects of multiple factors, the fsQCA approach can take into account multiple interacting variables, allowing the asymmetric causality problem to be resolved. Secondly, there is a diversity of pathways through which green innovation occurs. Different sets of variables may lead to the same outcome. The fsQCA method can effectively analyse the impact of multiple factor combinations on the outcome in a holistic perspective through a two-way analysis (Fiss, 2011). Thirdly, the NCA approach can test the necessity of the purpose of this paper’s research, i.e. that none of the antecedent variables can produce the necessary drivers of corporate green innovation, but rather the interaction forms a grouping that has an impact on corporate green innovation.

This paper focuses on A-share listed manufacturing companies in the Yangtze River Delta Economic Zone and the Middle Yellow River Economic Zone. This is mainly because the Yangtze River Delta has become the manufacturing center of the world, the advanced manufacturing industry in the central cities of the economic zone in the middle reaches of the Yellow River has begun to take shape, and the innovation ability of emerging manufacturing cities has significantly increased, which has important practical significance and research value. Firstly, due to the unavailability of data on the industry as a whole, this paper focuses on the more representative manufacturing industry as the target industry for the study. Secondly, in order to ensure the availability of data for subsequent research, A-share listed manufacturing companies in the Yangtze River Delta Economic Zone and the Middle reaches of the Yellow River Economic Zone were selected based on the 2012 industry classification standards of the China Securities Regulatory Commission, and companies with financial abnormalities such as ST and PT, as well as those with missing or incomplete data on key variables, were excluded.

The data in this paper were obtained by searching professional databases and hand-screening. Specifically, the proxy variable for formal environmental legitimacy (government regulation) was the China Pollution Source Regulation Information Disclosure Index (PITI) published on the website of the Public Environmental Research Centre. Corporate patent data was obtained from the website of the State Intellectual Property Office (SIPO), and green patent data was obtained by hand-searching the IPC classification numbers of green patents according to the names and stock codes of A-share listed manufacturing companies of the Securities Regulatory Commission. The data on the academic experience of executives, the ratio of current environmental protection investment to net fixed assets and the fixed asset ratio of enterprises were obtained from the database of Cathay United (CSMAR), the data on the total regional industrial output value and the total industry output value were mainly obtained from the China Industrial Statistics Yearbook, the Baidu index was mainly obtained from the Baidu index website, and the total enterprise output value was manually collated through the annual reports of listed companies. The above data were eventually matched and the 39 sample enterprises with the highest data availability were used as research cases.

1) Enterprise green innovation performance.

Based on the previous definition of the concept of “enterprise green innovation performance”, six dimensions emerged: 1) Level of green innovation (number of green patent applications/(all patent applications+1)); 2) Green R&D intensity (R&D investment/main business revenue); 3) Fixed asset ratio (net fixed assets to gross fixed assets); 4) Non-production expense ratio (selling, administrative and general expenses/main operating revenue); 5) Financial leverage (rate of change in earnings per ordinary share/rate of change in EBITDA); 6) Inventory ratio (inventory/main operating revenue). This paper refers to Wu et al. (2020) and Du et al. (2021) for the methodology, At the same time, taking into account the fact that it takes a certain period of time for companies to make the green innovation, the variance of 4 years is used to indicate the degree of green transition. Specifically, this paper takes 2017 as the base period and calculates the variance of the six indicators over [t−1, t+2] 4 years, and then standardises the variance of the six indicators based on industry and takes the average value to obtain the degree of enterprise green innovation.

2) Formal environmental legality (government regulation).

The pressure for formal environmental legitimacy comes mainly from the environmental policies set by the government, which, as the main body of environmental regulation, mainly monitors whether enterprises fulfil their environmental responsibilities. The Public Environmental Research Centre (PERC), a public interest environmental research institute, and the Natural Resources Defense Council (NRDC), an international public interest environmental organisation, have jointly designed and launched the Pollutant Information Disclosure Index (PITI), which is the most objective and comprehensive indicator of the strength of local government regulation of corporate environmental practices in China. The PITI index reflects the strength of environmental information disclosure by cities and the importance that local governments attach to environmental protection. Therefore, this paper refers to the research methods of Tu et al. (2019) and Ding et al. (2022), the PITI index of the city where the sample companies are registered is used as a measure of government regulation to gauge the external legitimacy pressures faced by companies in making the green transition and upgrading.

3) The driving effect of environmental investment.

Companies that undergo green innovation based on the green concept usually invest heavily in environmental protection, so for the measurement of this variable, this paper draws on Yang et al. (2021) and Lu (2021), at the same time, according to the ISO14001 definition of environmental protection investment, this paper mainly selects new environmental protection-related engineering projects, green-related facilities (such as sewage treatment equipment, etc.), technology research and development and other related expenditures as accounting objects, and calculates the amount of environmental protection investment of the sample enterprises. Specifically, this paper uses the intensity of an enterprise’s investment in environmental protection to reflect the enterprise’s investment in environmental protection, i.e. the proportion of the enterprise’s current investment in environmental protection to the net value of fixed assets as a proxy variable to measure.

4) Executive Academic Experience.

Academic experience leads to a greater emphasis on reputation in the process of self-perception of value, which will make academic business executives pay more attention to the performance of their companies in practicing green responsibility in order to avoid adverse effects on their personal reputation, and can therefore be considered as an intrinsic motivation to promote green innovation. This paper refers to the calculations in the research results of Cho et al. (2017), measured by the proportion of executives with academic experience to the total number of executives in the executive team.

5) Consumer’s “green innovation concern”.

According to the previous section, external pressure from consumers’ concerns about green innovation is an important factor influencing the adoption of green technologies by companies. This paper refers to Li et al. (2021), which used “environmental pollution” as a keyword in the “Baidu index” to obtain the Baidu index values of the sample companies’ regions at different times, and logarithmically processed them to measure the variable of consumer green concern. Given that the study was conducted on manufacturing companies, the following transformations were made to the data

Accordingly, the public concern index in 2020 is calculated, where: i, t and r denote the sample enterprises, the selected year and the region in which they are located respectively; s denotes the total industrial output value of the region in year t in region r; c denotes the total output value of the industry to which enterprise i belongs in year t in region r; z denotes the total output value of enterprise i in year t in region r; and erim denotes the value of the public Baidu index on environmental pollution in year t in region r.

6) Competitor’s “green innovation concern”.

According to the previous section, this paper argues that imitation pressure arising from competitors’ green innovation concerns is an important factor influencing firms’ green innovation. This paper therefore follows the methodology of Losacker (2022) and identifies and measures the number of green patents of the sample companies’ competitors based on the online search tool “Green List of the International Patent Classification” launched by the World Intellectual Property Organization (WIPO), and uses the number of green patents obtained by the target companies as a measure of the competitors’ green innovation focus.

In fsQCA analysis, the variables need to be calibrated to fuzzy set affiliation scores in the range (0, 1) to characterise the affiliation of a case on a particular variable (Kumbure et al., 2020). This is done by determining fully affiliated anchor points, maximum fuzzy intersection points and fully unaffiliated anchor points. Based on knowledge of the existing literature and the specific metrics covered in this paper, a direct calibration method is used to ensure objective accuracy of the calibration process and to weaken the effect of extreme data on the histological results. The fuzzy set affiliation scores of the dataset were converted by setting the threshold values for each anchor point, i.e. using the 25, 50 and 75% quantile values as the fully unaffiliated, cross-affiliated and fully affiliated anchor points for each variable. The original values of the variables were standardised and then fuzzy sets were calibrated using the “Calibrate” function using fsqca 3.0 software for the sample study data according to the above criteria.

In this chapter, 39 listed companies are analysed as typical cases, and the results of the univariate necessity analysis and the grouping results of variable adjustment are obtained by combining the five conditional variables and one outcome variable from the previous section, using a fuzzy qualitative comparative analysis to clarify the capabilities of listed companies under each model for successful green innovation.

First, this paper draws on the NCA necessity analysis approach proposed by Dul (2016) to examine the necessity analysis of conditional variables (government regulation (

In this paper, both upper bound regression and upper bound envelopment analysis are used to estimate and analyse the necessary condition effect sizes. The combined results are shown in the table above for government regulation (p = 0.852), environmental investment intensity (p = 0.312), executive academic experience (p = 1.000), consumer concern for green innovation (p = 1.000) and competitor concern for green innovation (p = 0.863), and most of the effect sizes are small, indicating that none of these five factors constitute necessary for the enterprise green innovation performance.

In addition, the paper further analyses the bottleneck results between each conditional variable. As can be seen from Table 2, when the enterprise green innovation performance (

Following the main steps of the QCA study, the paper concludes with a necessity test for individual condition variables in turn. The analysis is carried out using the single variable necessity testing function in the QCA software and should focus on consistency and coverage. The single condition necessity test focuses on these two indicators to determine whether there is a certain necessity relationship between the condition variable and the outcome variable. Where consistency refers to the extent to which a condition can be jointly explained by the occurrence of an outcome, and coverage refers to the reliability of each condition variable in explaining the occurrence of the outcome variable. It is generally accepted that when a condition variable is a necessary condition for an outcome variable, then the consistency value between that condition variable and the outcome variable is greater than 0.9; if the consistency value is below 0.9 then this condition variable does not act as a necessary condition leading to the outcome. The specific data are shown in Table 3.

According to the data in the above table, it can be seen that the coverage of all the conditions is almost above 0.7, indicating that all the conditional variables are more reliable in explaining the outcome variables. According to the consistency results of the above table, the consistency data of all five conditional variables are less than 0.9, indicating that a single variable alone cannot independently explain the enterprise green innovation performance, and that government regulation, environmental investment intensity, executive academic experience, consumer attention to green innovation and competitor attention to green innovation do not constitute a single condition necessary to influence the overall ability of a business firm to innovate efficiently.

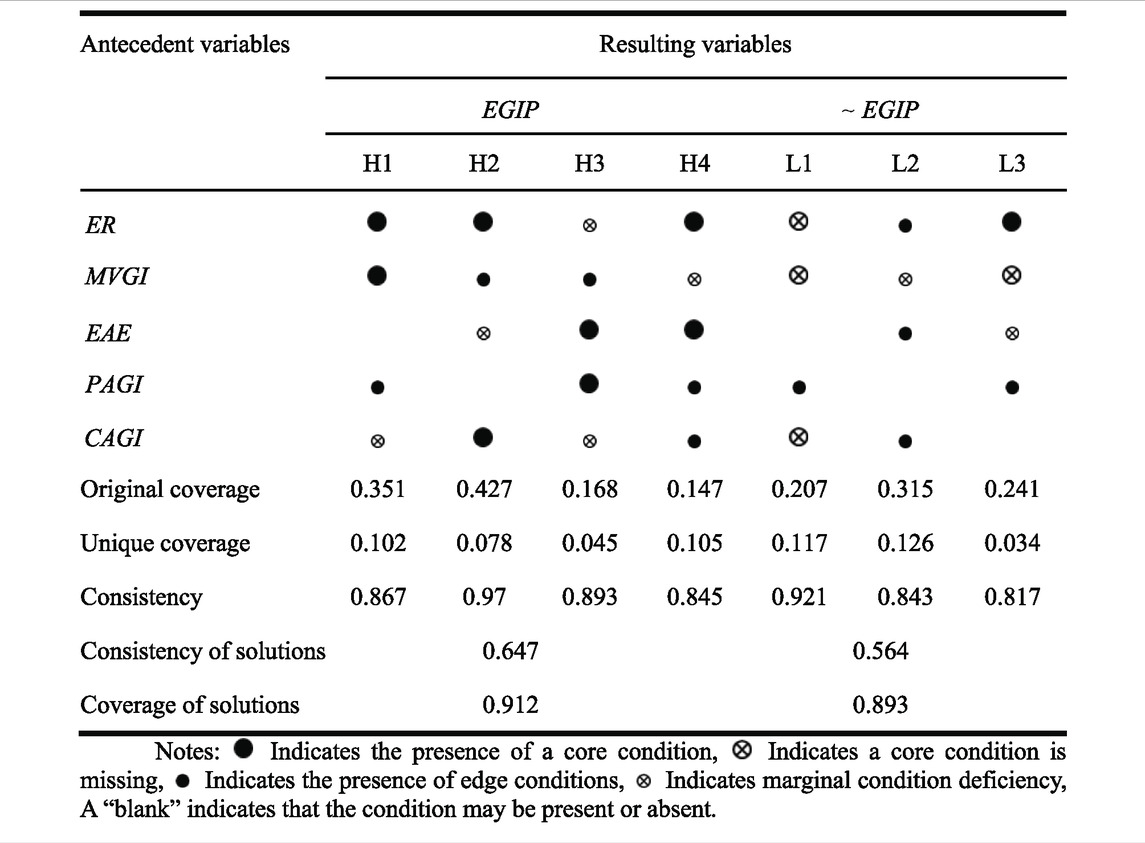

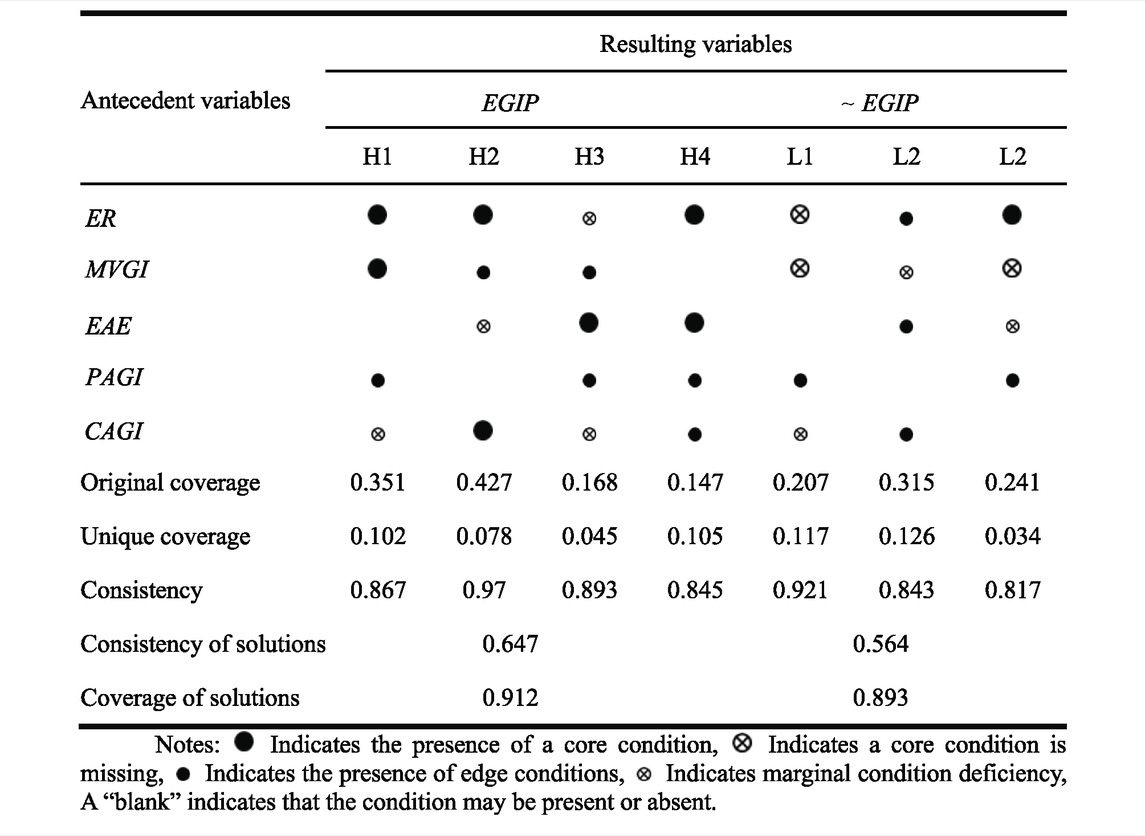

The results of the univariate necessity analysis have demonstrated that the five antecedent variables selected for the thesis have some explanatory power in influencing the role of enterprise green innovation performance, but none of them are necessary to constitute their outcome variables. Therefore, it can be judged that the enterprise green innovation performance is influenced by a combination of factors. The results of the conditional combination analysis of all the variables are shown in Table 4 below.

The cross-sectional analysis in the table shows that there are four paths that can achieve the result of green innovation of positive enterprises, and the consistency of each combination is close to 1, which indicates that this combination of conditions is significant and has a high explanatory power for the outcome variable. The coverage of the combined solution is 0.912, which indicates that all four paths are highly representative, covering 91.2% of all results, and have some research value. The four paths are grouped into “regulation + competition” external pressure driven (

(1) External Pressure Driven.

External pressure driven, which is mainly driven by the synergy of “regulation + competition”, with a sufficiency value of 0.427, indicating that the combination of “government regulation * environmental investment intensity * competitors’ green innovation concern” is a sufficient condition for the enterprise green innovation performance at high and low In this path, the combination of “government regulation*environmental investment intensity*competitor green innovation concern” is a sufficient condition for the enterprise green innovation performance at high and low performance levels. In this path, government regulation and competitors’ concern for green innovation play a central driving role as core conditions, while the intensity of environmental investment plays a supporting role. This suggests that in this model, the emergence of orientation through government regulation and corporate competitors can act as the main direction for green innovation of firms, thus better facilitating their innovation.

(2) Internal Strategic Driven.

The green strategy driven approach reveals the dominant role of “executives + consumers” in driving green innovation, with a sufficiency value of 0.168, indicating that the combination of “environmental investment intensity * executive academic experience * consumer interest in green innovation” is a sufficient condition for green innovation at high and low performance levels. The combination of these factors is a sufficient condition for green innovation at high and low performance levels. In this model, although there is a lack of government regulation and competitors’ attention to green innovation, the other factors can substitute and compensate for each other, and still achieve the same result. This pathway has a central driving role with executive academic experience and consumer orientation as core conditions of existence, with environmental investment intensity playing a supporting role. It suggests that under this pathway, the focus should be on setting up mechanisms for the hiring of executive talent.

(3) Internal and External Driven.

The internal and external two-way drive model, mainly manifested in the internal and external two-way drive model of “investment + regulation” and “top + regulation”, has sufficiency values of 0.351 and 0.147 for the two paths respectively, indicating that The combination of “government regulation*investment in environmental protection” and “government regulation*academic experience of executives” is a sufficient condition for the green innovation of companies at high and low performance levels. These two combinations can be used to promote the green innovation of business enterprises through the substitution and compensation effects between the factors. In this model, government regulation and management investment vision play a central driving role as the core conditions of existence, while consumer orientation plays a supporting role. The key to this model is the complementarity of government and environmental sector investment, which improves the efficiency of capital flows in the business ecosystem, thus enabling listed companies to achieve a better green innovation of their businesses. At the same time, the driving effect of the academic experience of executives should also be emphasised, resulting in the sharing and flow of talent within the business ecosystem and the synergy of internal and external efforts, complemented by the complementary effect of green concerns of stakeholders, to promote better green innovation of business enterprises.

On the basis of the above grouping model, in order to further identify and reflect the differential configuration of enterprises’ green innovation at different performance levels, this study split the overall sample into two sub-samples based on the 50% quantile of enterprises’ green innovation, corresponding to the cases of enterprises with high level of green innovation performance and the cases of enterprises with low level of green innovation performance respectively, still according to the aforementioned quantile The sub-samples were analysed using the qca3.0 calibration method, and the output results are shown in Tables 5.

TABLE 5. Configuration for enterprise green innovation performance at high and low performance levels.

Comparing the results of different performance levels, it can be seen that green innovation driven by a combination of government regulation and competitors’ green innovation concerns can show higher performance levels, for example, the consistency of the group H2 (

The robustness test chosen for this paper is to adjust the variable calibration thresholds, a method of adjusting consistency levels, which is also frequently used in QCA (Laux, 2013). That is, the results can be considered robust if clear subset relationships are still maintained between the groupings by different consistency levels or fuzzy set calibration threshold selections. That is, the results of this paper are considered to pass the robustness test if the differences between the output groupings and the original grouping composition after adjusting the thresholds are not significant, or if there are some differences but have clear subset relationships.

This article refers to the method of Lewellyn and Muller-Kahle (2021), and appropriately adjusts the consistency threshold to 0.81, and the grouping analysis was conducted again using fsqca3.0 software, and the specific results are shown in Table 6. The newly generated groupings of H1, H2 as well as H3 are basically consistent with the original groupings, and only H4 has changed slightly, but it is still of the government regulation and executive academic training type, which is not sufficient to draw new conclusions. As can be seen from the table, the level of consistency between the individual solutions and the overall solution is basically similar, the study results basically pass the robustness test and the study data are true and valid.

TABLE 6. Green innovation grouping of enterprises after adjusting the consistency threshold to 0.81.

With the introduction of the “Double Carbon” target in the 14th Five-Year Plan, “green development” has become the basic colour of China’s economy for a long time to come. To achieve changes in economic growth, the transformation and upgrading of industries is the key path, which means that the point of change lies in the innovation and upgrading of enterprises. Due to the supply-side structural reform, manufacturing enterprises will have to face resource and environmental constraints and structural contradictions on the supply side, therefore, the enterprise green innovation performance is the core initiative for enterprises to build competitive advantages. The innovation and upgrading of enterprises is inextricably linked to the business ecological environment in which they operate, not only in terms of external government regulations, but also in terms of the causality of their management’s environmental behaviour and the symbiosis with internal stakeholders such as competitors and consumers. Based on this, this paper takes manufacturing enterprises as a research sample, focuses on the goal of “green innovation”, and uses the fsQCA method to explore the mechanisms of environmental regulation, environmental investment intensity, executive academic experience and consumer and competitor green innovation concerns on the enterprise green innovation performance, to clarify the evolution of the multiple driving paths for green innovation of manufacturing enterprises, and to explore the evolution of the multiple driving paths for green innovation of manufacturing enterprises. It also explores the internal and external drivers necessary for efficient green innovation of manufacturing enterprises, and attempts to find out the answer to the question “What kind of business ecosystem can promote enterprise green innovation performance?”. and then provide effective suggestions for green innovation for enterprise managers.

Based on 39 cases of A-share listed manufacturing enterprises in the Yangtze River Delta economic zone and the middle reaches of the Yellow River economic zone that have undergone green innovation as the main research objects, this paper adopts a fuzzy set of qualitative comparative analysis to find the factors influencing the enterprise green innovation performance, explore the multiple driving paths and their mechanisms of action to promote green innovation based on a histological perspective, and identify the core elements necessary for the efficient enterprise green innovation in the business The core elements necessary for an efficient green innovation are identified. The main findings are as follows.

First, the green innovation of manufacturing firms is characterised by multiple concurrent factors. The analysis of the fsQCA and NCA hybrid approach shows that the single elements of the business ecosystem, such as environmental regulation, environmental investment, executive academic experience and consumer and competitor green innovation concerns, cannot exist independently as the necessary conditions to drive green innovation of manufacturing enterprises, and their mechanisms of action are in the form of organic combinations to form groups to drive green innovation. This shows that green innovation is not a static phenomenon, but a dynamic strategic phenomenon with complexity in the whole business ecosystem. Based on the analysis from the perspective of the group state, the driving factors for the enterprise green innovation performance mainly come from the internal management of enterprises and external pressure. There are four driving paths: government regulation and environmental investment complementary, government and competition-oriented, talent-driven, and government regulation and academic training of executives.

Secondly, the external pressure-driven path of “regulation + competition” is the key path to green innovation. In other words, a business ecosystem in which external government pressure to regulate and internal pressure to imitate competitors coexist organically is an important guarantee for green innovation. A comparison of the levels of green innovation performance across the different paths shows that this path has the highest consistency, indicating that firms are more inclined to adopt green innovation strategies under the pressure of external institutional legitimacy and internal competitor imitation. However, among the four paths that lead to high levels of green innovation, there are no paths that are driven solely by government environmental regulation and competitor focus on green innovation, and even low levels of green innovation are found in the combination of these two sets of variables, suggesting that external legitimacy and internal competitor pressure alone cannot lead to high levels of green innovation, as the elements in this suggests that external legitimacy and internal competitor pressure alone cannot lead to a high level of green innovation, as the elements in the combined business ecosystem cannot be recycled efficiently.

Thirdly, the business ecosystem under a combination of environmental regulation and competitor green innovation concerns is the core driving structure for green innovation, while corporate environmental investment is the core supporting driver for high performance levels of green innovation. The above findings suggest that although environmental regulation and competitor green innovation concerns are core driving structures, they can only manifest themselves in high performance level green innovation when firms strengthen their environmental investments. This suggests that the environmental reputation gained by firms when making high environmental investments allows for a ‘compensating effect’ over a ‘crowding out effect’, which is incentivised to complement external legitimacy and competitive pressures, creating a coupling within the business ecosystem This is the only incentive that complements external legitimacy and competitive pressures, creating a coupling within the business ecosystem and increasing the level of performance of companies in green innovation. In addition, the driving effect of environmental investment plays a greater role in innovation performance than the contribution of executive academic experience.

As a necessary path for manufacturing enterprises to achieve sustainable development, the diversified realisation path of enterprise Green Innovation has become a strategic focus for enterprises. In the innovation process, enterprises do not only act as independent individuals, but also need to combine the external business ecological environment with internal decision-making to give full play to their institutional and internal technological advantages, forming a virtuous cycle of efficient green innovation. Based on the findings of this paper, the following management insights are proposed.

Firstly, enterprises need to improve their own ability to cope with the legitimacy pressure brought about by environmental regulation, based on improvements to the way internal resources are allocated, and to achieve a backward push on enterprises from an endogenous dynamic level in order to develop their competitive advantage. The green innovation promotes the upgrading of the manufacturing industry and minimises the negative effects of the initial green innovation blockage brought about by environmental regulation. At the same time, from the perspective of competitive and reputational mechanisms, companies should not only actively engage in environmental behaviour under the policies of environmental regulation, but also proactively fulfil their environmental responsibilities, build up their environmental image and improve their influence in the business ecosystem, thereby motivating them to promote green innovation.

Second, enhance the ability to perceive green investment projects, focus on the green market orientation of the general environment and make timely investment decisions on environmental projects. Under the external pressure of increasing rigidity of environmental regulations, the media public and consumer demand has become a breakthrough for companies to gain a competitive advantage under the market mechanism. Therefore, companies should take relevant academic experience into account in their employment to improve their business decisions, thereby broadening management’s investment horizons and urging them to strengthen their environmental investments and improve their green innovation.

Third, optimise the allocation of resources for green innovation and improve the synergy effect of the main body of the green innovation system. While strengthening green investment, enterprises should also establish a sense of competition and cooperation in green innovation, correctly treat the competitive relationship in the industry, strengthen the communication link with stakeholders and create a good business ecological environment. By building an organisational structure that adapts to knowledge sharing and broadening the way in which technology is shared in the industry, a multi-win situation of value co-creation can be achieved. A sound trust mechanism can be established between the subjects implementing green innovation as a means of guaranteeing cooperation to access complementary and heterogeneous resources and maximise benefits.

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

XW contributed to the conception and design of the study. XY organized the database and performed the statistical analysis. YW wrote the first draft of the manuscript. XW, LQ, and KZ wrote sections of the manuscript. JZ draft the work and revised it critically for important intellectual content. All authors contributed to manuscript revision, read, and approve the submitted version.

This study is supported by Supported by National Natural Science Foundation of China (No. 71901199); the China Postdoctoral Science Foundation Funded Project (No. 2019M660170); the Postdoctoral Innovation Project of Shandong Province (No. 201902019); the Special Program for Rural Revitalization Research of OUC(No. ZX2022002); the Special Funds for Fundamental Scientific Research Operation of Central Universities (202113011); Guangxi Key Laboratory of Marine Environmental Science, Guangxi Academy of Sciences (GXKLHY21-04).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Annunziata, A., Mariani, A., and Vecchio, R. (2019). Effectiveness of sustainability labels in guiding food choices: Analysis of visibility and understanding among young adults. Sustain. Prod. Consum. 17, 108–115. doi:10.1016/j.spc.2018.09.005

Ansoff, H. I. (1964). A quasi-analytic approach to the business strategy problem. Manage. Sci. 1, 67–77. doi:10.1287/mantech.4.1.67

Arouri, M., Caporale, G. M., Rault, C., Sova, R., and Sova, A. (2012). Environmental regulation and competitiveness: Evidence from Romania. Ecol. Econ. 81, 130–139. doi:10.1016/j.ecolecon.2012.07.001

Brunnermeier, S. B., and Cohen, M. A. (2003). Determinants of environmental innovation in US manufacturing industries. J. Environ. Econ. Manage. 45 (2), 278–293. doi:10.1016/S0095-0696(02)00058-X

Bamber, L. S., Jiang, J., and Wang, I. Y. (2010). What's my style? The influence of top managers on voluntary corporate financial disclosure. Acc. Rev. (854), 1131–1162. doi:10.2308/accr.2010.85.4.1131

Beckers, T., Lu, Y., Ishwaran, N., and Alcamo, J. (2012). Environmental development: A new voice for science and policy. Environ. Dev. 1 (1), 1–2. doi:10.1016/j.envdev.2011.12.001

Berman, E., and Bui, L. T. M. (2001). Environmental regulation and productivity: Evidence from oil refineries. Rev. Econ. Stat. 83 (3), 498–510. doi:10.1162/00346530152480144

Buysse, K., and Verbeke, A. (2003). Proactive environmental strategies: A stakeholder management perspective. Strateg. Manag. J. 24 (5), 453–470. doi:10.1002/smj.299

Chan, R. (2010). Corporate environmentalism pursuit by foreign firms competing in China. J. World Bus. 45 (1), 80–92. doi:10.1016/j.jwb.2009.04.010

Chan, R., He, H. W., Chan, H. K., and Wang, W. (2012). Environmental orientation and corporate performance: The mediation mechanism of green supply chain management and moderating effect of competitive intensity. Ind. Mark. Manag. 41 (4), 621–630. doi:10.1016/j.indmarman.2012.04.009

Cheba, K., Bak, I., Szopik-Depczynska, K., and Ioppolo, G. (2022). Directions of green transformation of the European Union countries. Ecol. Indic. 136, 108601. doi:10.1016/j.ecolind.2022.108601

Cho, C. H., Jung, J. H., Kwak, B., Lee, J., and Yoo, C. (2017). Professors on the board: Do they contribute to society outside the classroom? J. Bus. Ethics 141 (2), 393–409. doi:10.1007/s10551-015-2718-x

Cuerva, M. C., Triguero-Cano, A., and Corcoles, D. (2014). Drivers of green and non-green innovation: Empirical evidence in low-tech SMEs. J. Clean. Prod. 68, 104–113. doi:10.1016/j.jclepro.2013.10.049

Delmas, M., and Montiel, I. (2009). Greening the supply chain: When is customer pressure effective? J. Econ. Manag. Strategy 18 (1), 171–201. doi:10.1111/j.1530-9134.2009.00211.x

Ding, J. X., Lu, Z., and Yu, C. H. (2022). Environmental information disclosure and firms? Green innovation: Evidence from China. Int. Rev. Econ. Finance 81, 147–159. doi:10.1016/j.iref.2022.05.007

Du, K., Cheng, Y., and Yao, X. (2021). Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Econ. 98, 105247. doi:10.1016/j.eneco.2021.105247

Dul, J. (2016). Necessary condition analysis (NCA): Logic and methodology of "necessary but not sufficient" causality. Organ. Res. Methods 19 (1), 10–52. doi:10.1177/1094428115584005

Eiadat, Y., Kelly, A., Roche, F., and Eyadat, H. (2008). Green and competitive? An empirical test of the mediating role of environmental innovation strategy. J. World Bus. 43 (2), 131–145. doi:10.1016/j.jwb.2007.11.012

Fiss, P. C. (2011). Building better causal theories: A fuzzy set approach to typologies in organization research. Acad. Manage. J. 54 (2), 393–420. doi:10.5465/AMJ.2011.60263120

Freeman, R. (1984). Strategic management: A stakholder approach. J. Manage. Stud. 29, 131–154. doi:10.1017/CBO9781139192675

Hambrick, D. C., and Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Acad. Manage. Rev. 9 (2), 193–206. doi:10.5465/amr.1984.4277628

He, L. Y., Sun, Y. M., Xia, Y. F., and Zhong, Z. Q. (2021). Construction of a green development performance index of industrial enterprises: Based on the empirical study of 458 listed industrial enterprises in China. Ecol. Indic. 132, 108239. doi:10.1016/j.ecolind.2021.108239

Hofer, C., Cantor, D. E., and Dai, J. (2012). The competitive determinants of a firm's environmental management activities: Evidence from US manufacturing industries. J. Operations Manag. 30 (1-2), 69–84. doi:10.1016/j.jom.2011.06.002

Homroy, S., and Slechten, A. (2019). Do board expertise and networked boards affect environmental performance? J. Bus. Ethics 158 (1), 269–292. doi:10.1007/s10551-017-3769-y

Kimata, A., and Itakura, H. (2021). Interactions between organizational culture, capability, and performance in the technological aspect of society: Empirical research into the Japanese service industry. Technol. Soc. 64. doi:10.1016/j.techsoc.2020.101458

Kumbure, M. M., Tarkiainen, A., Luukka, P., Stoklasa, J., and Jantunen, A. (2020). Relation between managerial cognition and industrial performance: An assessment with strategic cognitive maps using fuzzy-set qualitative comparative analysis. J. Bus. Res. 114, 160–172. doi:10.1016/j.jbusres.2020.04.001

Larson, A. (1991). Partner networks: Leveraging external ties to improve entrepreneurial performance. J. Bus. Ventur. 6 (3), 173–188. doi:10.1016/0883-9026(91)90008-2

Laux, T. (2013). Set-theoretic methods for the social Sciences - a guide to qualitative comparative analysis. Kolner Z. Soziol. Soz. 65 (1), 168–170.

Li, C., Firdousi, S. F., and Afzal, A. (2022). China's Jinshan Yinshan sustainability evolutionary game equilibrium research under government and enterprises resource constraint dilemma. Environ. Sci. Pollut. Res. 29 (27), 41012–41036. doi:10.1007/s11356-022-18786-y

Li, F. R., and Ding, D. Z. (2013). The effect of institutional isomorphic pressure on the internationalization of firms in an emerging economy: Evidence from China. Asia Pac. Bus. Rev. 19 (4), 506–525. doi:10.1080/13602381.2013.807602

Li, L. (2018). China's manufacturing locus in 2025: With a comparison of “Made-in-China 2025” and “Industry 4.0”. Technol. Forecast. Soc. Change 135, 66–74. doi:10.1016/j.techfore.2017.05.028

Li, W. L., Yang, G. F., and Li, X. N. (2021). Correlation between PM2.5 pollution and its public concern in China: Evidence from Baidu index. J. Clean. Prod. 293, 126091. doi:10.1016/j.jclepro.2021.126091

Losacker, S. (2022). 'License to green': Regional patent licensing networks and green technology diffusion in China. Technol. Forecast. Soc. 175. doi:10.1016/j.techfore.2021.121336

Lu, J. (2021). Can the green merger and acquisition strategy improve the environmental protection investment of listed company? Environ. Impact Assess. Rev. 86, 106470. doi:10.1016/j.eiar.2020.106470

Ma, Y., Zhang, Q., Yin, Q. Y., and Wang, B. C. (2019). The influence of top managers on environmental information disclosure: The moderating effect of company's environmental performance. Int. J. Environ. Res. Public Health 16, 1167. doi:10.3390/ijerph16071167

Mahadeo, J. D., Oogarah-Hanuman, V., and Soobaroyen, T. (2011). Changes in social and environmental reporting practices in an emerging economy (2004–2007): Exploring the relevance of stakeholder and legitimacy theories. Account. Forum 35 (3), 158–175. doi:10.1016/j.accfor.2011.06.005

Makdissi, P., and Wodon, Q. (2006). Environmental regulation and economic growth under education externalities. J. Econ. Dev. 31 (1), 45–52.

Mohr, R. D. (2002). Technical change, external economies, and the porter hypothesis. J. Environ. Econ. Manage. 43 (1), 158–168. doi:10.1006/jeem.2000.1166

Osagie, E. R., Wesselink, R., Blok, V., Lans, T., and Mulder, M. (2016). Individual competencies for corporate social responsibility: A literature and practice perspective. J. Bus. Ethics 135 (2), 233–252. doi:10.1007/s10551-014-2469-0

Porter, M., and Linde, C. (1995). Toward A new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9, 97–118. doi:10.1257/jep.9.4.97

Quintelier, K., van Hugten, J., Parmar, B. L., and Brokerhof, I. M. (2021). Humanizing stakeholders by rethinking business. Front. Psychol. 12, 687067. doi:10.3389/fpsyg.2021.687067

Ribeiro, N., Gomes, D. R., Ortega, E., Gomes, G. P., and Semedo, A. S. (2022). The impact of green HRM on employees' eco-friendly behavior: The mediator role of organizational identification. Sustainability 14, 2897. doi:10.3390/su14052897

Shnayder, L., and Van Rijnsoever, F. J. (2018). How expected outcomes, stakeholders, and institutions influence corporate social responsibility at different levels of large basic needs firms. Bus. Strategy Environ. 27 (8), 1689–1707. doi:10.1002/bse.2235

Suchman, M. (1995). Managing legitimacy: Strategic and institutional approaches. Acad. Manage. Rev. 20, 571–610. doi:10.5465/AMR.1995.9508080331

Tian, Y., Xiong, S., Ma, X., and Ji, J. (2018). Structural path decomposition of carbon emission: A study of China's manufacturing industry. J. Clean. Prod. 193, 563–574. doi:10.1016/j.jclepro.2018.05.047

Tu, Z. G., Hu, T. Y., and Shen, R. J. (2019). Evaluating public participation impact on environmental protection and ecological efficiency in China: Evidence from PITI disclosure. China Econ. Rev. 55, 111–123. doi:10.1016/j.chieco.2019.03.010

Wang, S. H., Chen, M., and Song, M. L. (2018). Energy constraints, green technological progress and business profit ratios: Evidence from big data of Chinese enterprises. Int. J. Prod. Res. 56 (8), 2963–2974. doi:10.1080/00207543.2018.1454613

Wang, S. H., and Song, M. L. (2017). Influences of reverse outsourcing on green technological progress from the perspective of a global supply chain. Sci. Total Environ. 595, 201–208. doi:10.1016/j.scitotenv.2017.03.243

Wang, S. H., Sun, X. L., and Song, M. L. (2021). Environmental regulation, resource misallocation, and ecological efficiency. Emerg. Mark. Finance Trade 57 (3), 410–429. doi:10.1080/1540496X.2018.1529560

Wang, S., Wang, X., and Lu, B. (2022). Is resource abundance a curse for green economic growth? Evidence from developing countries. Resour. Policy 75, 102533. doi:10.1016/j.resourpol.2021.102533

Wu, H. T., Hao, Y., and Ren, S. Y. (2020). How do environmental regulation and environmental decentralization affect green total factor energy efficiency: Evidence from China. Energy Econ. 91, 104880. doi:10.1016/j.eneco.2020.104880

Yang, C. (2018). An analysis of institutional pressures, green supply chain management, and green performance in the container shipping context. Transp. Res. Part D Transp. Environ. 61, 246–260. doi:10.1016/j.trd.2017.07.005

Yang, L., Qin, H., Xia, W. Y., Gan, Q. X., Li, L., Su, J. F., et al. (2021). Resource slack, environmental management maturity and enterprise environmental protection investment: An enterprise life cycle adjustment perspective. J. Clean. Prod. 309, 127339. doi:10.1016/j.jclepro.2021.127339

Zhai, X. Q., and An, Y. F. (2020). Analyzing influencing factors of green transformation in China's manufacturing industry under environmental regulation: A structural equation model. J. Clean. Prod. 251, 119760. doi:10.1016/j.jclepro.2019.119760

Keywords: enterprise green innovation performance, fuzzy set comparison, environmental regulation, business ecosystem, green innovation concerns

Citation: Wan X, Wang Y, Qiu L, Zhang K and Zuo J (2022) Executive green investment vision, stakeholders’ green innovation concerns and enterprise green innovation performance. Front. Environ. Sci. 10:997865. doi: 10.3389/fenvs.2022.997865