- 1Department of Finance, School of Economics and Business Administration, Chongqing University, Chongqing, China

- 2Department of Finance, Chongqing College of Finance and Economics, Chongqing, China

- 3School of Management, Zhejiang Shuren University, Hangzhou, China

This paper takes the inter-provincial panel data of China from 1999 to 2015 as the research sample and uses the GMM estimation method to empirically test the relationship among education input, social security expenditure, and urban-rural income gap. The results show that education input and social security expenditure have a significant impact on the urban-rural income gap, and there are regional differences. Specifically, the augments of education input and social security expenditure widens the urban-rural income gap in the western region, and narrows the urban-rural income gap of the eastern and central regions but has less impact on the eastern region. The paper provides a new perspective for understanding the urban-rural income gap in China, and has a significance meaning for further increasing the educational investment in the western rural areas, and improving the redistribution efficiency of social security expenditure.

1 Introduction

Investment in education is an essential factor that massively influences a country’s economic growth and distribution of income. In the view of the economic model, education refers to investment in a country’s resources (e.g., human capital) on equity grounds. According to modern economic growth theory, investment in education can improve the level of human capital and then enhance labor productivity and boost economic growth. With the influx of a large number of rural surplus labor forces into cities at present, human capital is likely to widen the income gap between urban and rural residents while promoting economic development in cities.

In recent years, the People’s Republic of China has massively invested in education. However, the situation in China still demands economists to manage and eradicate the existing urban-rural income inequality. Over the years, the high level of income disparity in China has curbed the country’s economic activities, demanding an improved redistribution process. Indeed, as per this requirement, China needs to effectively focus on the existing urban-rural income disparities that may cause serious harm to the country’s economic efficiency and social equality. In China, the increasing urban-rural income gap increases poverty, thus boosting the need for economic prosperity (Guo and Zhang, 2019). Considering such a background, it has become necessary to mitigate the growing economic disparities to help stabilize China’s long-term economic development (Khan, et al., 2022a; Yu et al., 2022).

At the same time, at the present stage, a socialized and multi-level social security system, in which the government dominates with shared responsibilities, has been formed in China. In particular, launching sustainable economic reforms has made China the fastest growing country (Khan, et al., 2022b). However, the regions of China have not shared the fruits of economic development equally. Consequently, China has experienced a rise in unequal income distribution. With the increasing trend in urban-rural income inequality, the conventional systems have failed to identify the root cause of the growing disparities. As such, the literature states that accelerating income inequality has potentially hurt China’s economic and social development, thereby signaling the need to resolve the imbalance in urban-rural income (Wang et al., 2019).

After a long period of negligence, researchers have focused on the subject of urban-rural economic disparities. Over the years, several factors have contributed to accelerating the widespread income distribution. But, today, the desire to minimize the income disparities has liberalized education and social security expenditure to stop the progressing effect of resource inequalities. Social security is a primary source that provides financial support to the world economies. Therefore, the research shows that China has reduced urban-rural income inequality through social assistance provisions. Social security expenditure has an impact on the income distribution of residents by affecting the accumulation of human capital elements, wage distribution, and the accumulation of material capital. When the initial distribution pattern is determined, the government re-distributes the income by transfer payment, thereby narrowing the income distribution gap arising from the initial distribution (Xiao and Yu, 2017). From the empirical aspect, the literature shows that lower expenditures on social policies unfavorably influence the urban-rural residents’ disposable income. The decrease in social security reforms led to a decline in fiscal expenses. In explaining this notion, the research states that the transfer payment in education reduces the urban-rural income gap by significantly contributing to the country’s economic prosperity (Beneke et al., 2017; Sarfraz et al., 2020). Thus, it is evident that both education investment and social security expenditure can impact the income distribution and hence the income gap between urban and rural areas.

Altogether, during the last few years, growing income disparity has caused the Chinese government to experience an imbalance in resource allocation, thus elevating numerous problems such as the urban-rural income gap. China, as the trend-setter of regional economic welfare, has marginalized the need to accelerate the effect of economic equality on the surrounding regions by reducing the urban-rural income gap. However, to address this research gap, this paper empirically investigates the impact of education input level on the income gap of China’s circular economy. As China comprises a large population, managing the increasing disparity issue has become a significant issue for the Chinese government.

Therefore, in response to the research gap, this study examines the effect of urban-rural income inequality. It aims to investigate the answer to the following research questions. Does the government’s education investment and social security expenditure help narrow the income gap between urban and rural areas? Is there any difference in this impact between different regions? Also, this study enriches the literature on Chinese economics. It substantially improves the research content on unequal income distribution. Fundamentally, this forms the new basis for promoting urban-rural income equality. The literature help boost world economics by showing how to significantly narrow the income gap among the different regions (Taleb Da Costa, 2021). In particular, this study provides suggestions to formulate redistribution policies to reduce the growing income gap in the People’s Republic of China.

This study includes five sections. The first section briefly provides an overview of the research objective and significance. Then, Section 2 (i.e., the literature review) presents a comprehensive view of the subject. Next, Section 3 suggests the study methodology, and Section 4 describes the study outcomes. Lastly, Section 5 concludes the article by providing policy implications and future directions.

2 Literature review

The widening of the urban-rural income gap has given rise to a number of economic and social issues as the structural problems in China’s economic development process have gradually become apparent. Education investment is closely related to human capital. Suppose the education investment is unevenly distributed in a region. In that case, it will directly affect the development of human capital in the region and the income gap between urban and rural areas. Xue and Wang (2009) show that the investment in educational resources in China is unevenly distributed. Samuelson & Solow (1956) contend that the difference in human capital is the real cause of the income gap between regions.

Many scholars have studied the income gap between urban and rural areas. Lin (2003) has found that the income gap between urban and rural areas in China shows a rapid growth trend. Wang (2009) analyzed the significant income gap between urban and rural residents in China from the perspective of the mobility of residents’ income. Wang and Fan (2004) put forward that the varying degrees of productivity and capital flow disparities are the significant causes of the income gap between regions in China from the allocation and flow of production factors in the different areas. Yang (2009) analyzed the relationship between the income gap of residents and the income redistribution system. The results showed that the income gap of residents is significantly affected by the income redistribution policy. Chen and Feng (2000) finds that the main reason for the income gap of residents in different regions in China is the unbalanced development of private enterprises. Chen and Li (2017) calculated the equalization effect of financial expenditure at all levels of subsistence allowance in cities in China, arguing that the provincial financial departments of the urban subsistence allowances failed to play a positive role and even offset the equalization effect to a certain extent. Guo and Fu (2017) analyzed the relationship between the fiscal expenditure on the social protection floor, urban bias, and the income gap between urban and rural residents according to the provincial panel data from 1999 to 2013. They proposed that the fiscal expenditure on the social protection floor has a reverse relationship with the income gap between urban and rural residents.

In particular, the impact of education input on the urban-rural income distribution is heterogeneous. At present, China is facing considerable challenges concerning income distribution. In this regard, researchers have stated that improvements in the educational input can guide the country to reduce urban and rural disparity. Indeed, this call to manage the country’s resource allocation has made economists keen to reduce the urban-rural income gap. The comprehensive view of academic literature on the circular economy suggests the country should embrace effective business models and approaches to optimizing the country’s efficiency by marginally reducing the unequal resource allocation. As such, the study states that equal distribution of educational input reduces income inequality in the circular economy (Arshed et al., 2018; Sarfraz et al., n. d.; Shah et al., 2019).

Recently, increasing urbanization has significantly contributed to China’s economic development. However, in this regard, social security plays a fundamental role in influencing the income gap. The social security expenditure in China tends to be urbanized. At the same time, the transfer income of urban residents is higher than that of rural residents, and there is a substantial income gap between urban and rural residents. In recent years, scholars have mainly studied the relationship between social security expenditure and the income gap between urban and rural areas from the following three perspectives. Firstly, the specific ways that social security expenditure affects the income gap between urban and rural areas.

Wang and He. (2014) argue that social security mainly narrows the income gap between urban and rural areas from the link of redistribution. Still, the function of redistribution fails to be exerted effectively. Secondly, the empirical analysis of the impact of the social security expenditure in urban and rural areas on the income gap between urban and rural areas. Tao (2008) conducted a comparative analysis of the items and level of social security in urban and rural areas in China and proposed that the social security expenditure in urban and rural areas has a significant impact on the income gap between urban and rural areas. Thirdly, the relationship between social security expenditure and the income gap between urban and rural areas.

Hu et al. (2011) contend that the regional differences in social security expenditure do not significantly narrow the income gap between urban and rural areas.

Over the years, multiple studies have explored the relationship between educational level and urban-rural income distribution (Marginson, 2019). The prior literature showed that several factors widen the urban-rural income disparities. This new trend has made the government adopt development strategies to accelerate the country’s fiscal development (Wang et al., 2019). The objective of the social security expenditure is to promote the country’s economic freedom by significantly decreasing the income gap. Social security provides financial assistance to rectify the increasing inequalities. However, various studies show that social security positively impacts urban-rural income equality. One study claims that social security expenditure contributes to the residents’ long-term happiness and the country’s economic stability (Zhang et al., 2019). The social security expenditure reforms progressively work towards reducing income inequality. As such, another study states that social security expenditure decreases the effect of the income gap in urban-rural areas (Yu & Li, 2021).

Significantly, the effect of the social security expenditure has become a worthy topic for today’s researchers and economists. By bridging the income gap among the varied regions, China has made remarkable achievements in the global economy. In contrast, over the past decades, the urban-rural disparity has impaired resource efficiencies, thus influencing the economic prosperity of the world’s countries. However, in this regard, the socio-economic problems caused by the increasing income inequality pose risks to high-economic countries. As an impact of social security policies, the government should reduce the resource differences among the regions. For example, the social security system in India works to improve human wellbeing (Drèze & Khera, 2017). In Vietnam and Southern Africa, social security assistance has significantly reduced poverty. Hence, similar results have been found in other areas. Indeed, the impact of social security expenditure policies has helped countries to minimize resource inequality. The research finds that the global economies should focus on decomposing income inequality among various regions (Azam & Bhatt, 2018).

Educational investment and social security expenditure mainly derive from the government’s tax revenue, and there is intergenerational transfer. Kaganovich & Zilcha (1999) analyzed the relationship between public education investment and social security expenditure and conducted an empirical test on the role of government tax revenue in economic growth with the aid of the overlapping generations model. Pecchenino & Utendorf (1999) found that social security expenditure reduced economic growth and social welfare. Pecchenino & Pollard (2002) pointed out that, to ensure the quality of education, an increase in educational investment and a decrease in social security expenditure could boost economic growth.

Glomm & Kaganovich (2003) argue that increasing public educational investment may lead to unfair income distribution. Glomm & Kaganovich (2008) found that social security expenditure is inversely proportional to the income gap. Still, the impacts of educational investment and social security expenditure on economic growth are both non-monotonicity.

Rojas (2004) analyzed the relationship between education investment and social security expenditure. Qiu (2009) demonstrated that social security could narrow the income gap by means of numerical simulation. However, from this viewpoint, social security has emerged as the most profound tool stimulating the country’s urban-rural income gap. The social security system is a mechanism that helps countries manage their economic resources (i.e., wealth inequality) (Catherine et al., 2020).

This system narrows down the effect of the income gap on human civilization. It reduces future uncertainty, thus stimulating the country’s economic freedom. In explaining this notion, the study states that the social security system reduces future socio-economic variability, thus substantially narrowing the income gap (Deng et al., 2019). In terms of the security reforms, China has been successful in ceaselessly advancing its economic activity. Similarly, these reforms have also been initiated in other countries, thus making the influence of social security expenditure meaningful. (Liu & Chen, 2012) study showed that public education investment and social security significantly impact the income gap between urban and rural areas.

Taking Hubei Province as an example, Wang (2017) conducted an empirical analysis on the impact of years, quality, and structure of education on the income of the poor in rural areas. Zeng and Jiang (2020) examined the effects of population age structure and social security level on the urban-rural income gap using provincial panel data from 2000 to 2017 in China, integrating systematic GMM estimation methods and panel threshold regression models.

A significant negative effect of the child dependency ratio on the urban-rural income gap was found, and that an increase in social security expenditure strengthens the impact of the child dependency ratio on reducing the urban-rural income gap. The significant positive effect exerted by social security expenditure on the urban-rural income gap was apparent. No significant linear relationship exists between the old-age dependency ratio and the urban-rural income gap, but there is a significant threshold effect.

Li (2020) analyzed the moderating effect of social security expenditure on the income gap between urban and rural residents through the regional panel data of Xinjiang from 2007 to 2018. The results indicated that there was a significant threshold effect on the regulation of social security expenditure on the income gap between urban and rural residents in Xinjiang, and the increase in social security expenditure showed a change from non-significant “inverse regulation” to significant “positive regulation”. According to Song and Gao (2022) believe that education investment and service sector development narrow the urban-rural income gap. Meanwhile, education investment has an inverted “U” shape on the urban-rural income gap, while service sector development has a positive “U” shape. This non-linear relationship is mainly reflected in the existence of a threshold effect.

By reviewing the existing literature, it is evident that scholars have reached a consistent conclusion on the impact of social security expenditure on the income gap between rural and urban areas. Social security expenditure significantly impacts the income gap between rural and urban areas. At the same time, some scholars believe that the main reason for the income gap between urban and rural areas is the increase in educational investment. At present, there is extensive literature on the influence of educational investment on income and social security expenditure on the urban-rural income gap. However, there is little research on the interaction between educational investment and social security expenditure on the urban-rural income gap. This paper intends to conduct an empirical analysis of the influence of educational investment and social security expenditure on the income gap between urban and rural areas to provide a reference for the government to make budget decisions.

3 Model setting, data sources, and estimation method

3.1 Model setting

The Theil index, which is an index to measure the income gap between urban and rural areas of groups, individuals, or regions, is sensitive to the changes in income of different classes and conforms to the current situation of the income gap between rural and urban areas in China (Long et al., 2015). Therefore, this paper uses the Theil index to measure the income gap between urban and rural areas in China.

To examine the level of educational investment and the influence of social security expenditure of different provinces and cities on the income gap between urban and rural areas in this region, this paper constructs the following inter-provincial panel data model:

In the formula,

3.2 Selection of control variables and data declaration

This paper refers to the article by Lv. (2017) on the method of selecting control variables that affect the income gap between urban and rural areas to select the control variables. The degree of opening to the outside world is expressed by the proportion of the total import and export volume of each province to the GDP of the region. The urbanization rate is expressed by the proportion of urban population to the total population of each province. The capital formation rate is expressed by the proportion of the total capital formation of each province to the GDP. Human capital is expressed by the proportion of the number of college students in each province to the total population. Population aging is expressed by the proportion of the population aged 65 years and over to the total population of each province.

3.3 Data sources and declarations

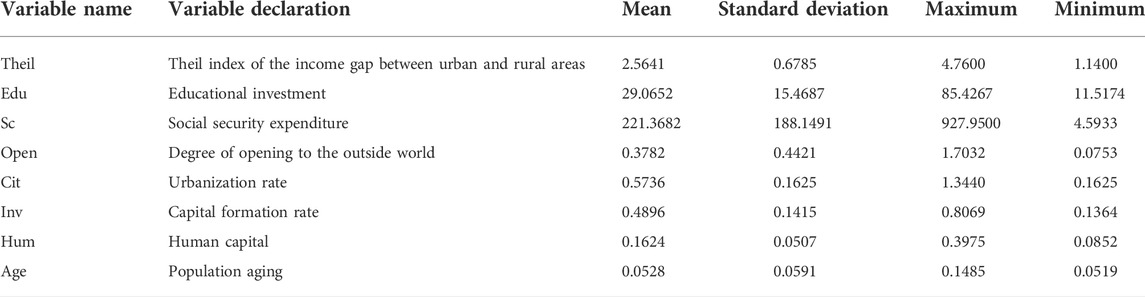

In light of the starting time of statistics on medical and health expenditure, pension and social welfare expenditure, retirement expenditure of administrative institutions and social security subsidy expenditure, and major changes in the field of education in China, the sample interval of this paper is defined as the period from 1999 to 2015. Based on the panel data of 30 provinces, autonomous regions, and municipalities directly under the Central Government (excluding the Tibet Autonomous Region with missing data), this paper divides 30 provinces, autonomous regions, and municipalities directly under the Central Government into eastern, central, and western regions by referring to the sample division method of (Xin Liu, 2013). Among them, the eastern region includes Beijing, Tianjin, Hebei, Liaoning, Shandong, Jiangsu, Zhejiang, Shanghai, Guangdong, Fujian, and Hainan; the central region includes Inner Mongolia, Heilongjiang, Jilin, Shanxi, Henan, Anhui, Hubei, Hunan, and Jiangxi; and the western region includes Guangxi, Shaanxi, Gansu, Sichuan, Guizhou, Chongqing, Yunnan, Xinjiang, Ningxia, and Qinghai1. The data in this paper comes from the China Statistical Yearbook, China Population Statistics Yearbook, and provincial statistical yearbooks. The statistical declarations of the variables are shown in Table 1.

3.3.1 Estimation method

In this paper, the Generalized Method of Moments (GMM) is used to analyze the relationship between education investment, social security expenditure, and the income gap between urban and rural areas, which involves a panel unit root test, panel cointegration test, and GMM estimation.

3.3.2 Panel unit root test

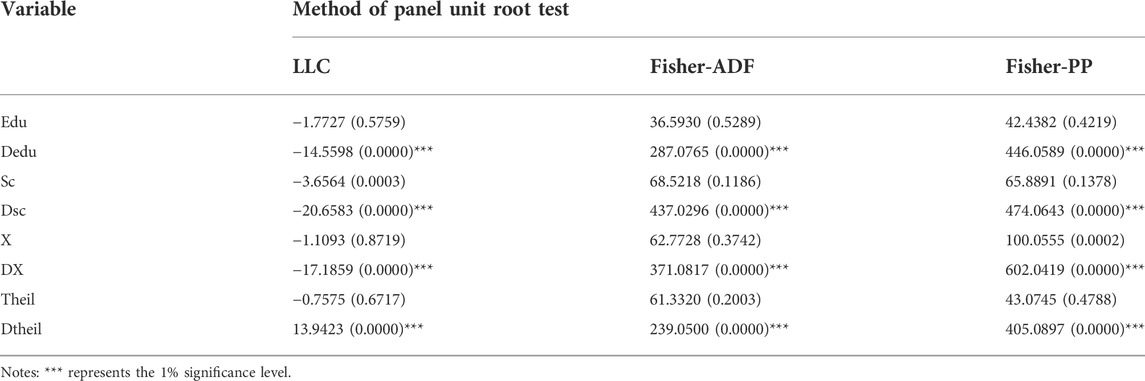

The LLC test and Breitung test are applicable If it is assumed that each cross-section sequence in the panel data has the same unit root. The IPS, Fisher-ADF, and Fisher-PP tests are also applicable. To make the test results more robust, this paper uses LLC, Fisher-ADF, and Fisher-PP tests.

3.3.3 Panel cointegration test

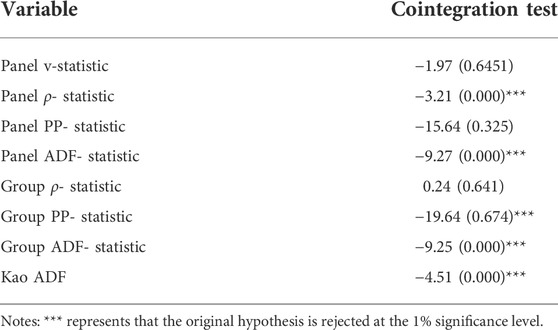

The cointegration test is composed of seven test statistics proposed by Pedroni et al. (1999) and ADF statistics proposed by Kao (1999), among which Panel v, Panel

3.3.4 Generalized Method of Moments

Since the least square method cannot eliminate the endogenous nature of variables, this paper uses the GMM proposed by Marino-Buslje et al. (1998) to solve the endogenous problem.

4 Empirical results

4.1 Stability of variables

The LLC, Fisher-ADF, and Fisher-PP methods were used to test the unit root of each variable. As can be seen from Table 2, the original sequence of each variable is non-stationary. Still, the sequence after the first-order difference is stationary, and thus there may be a cointegration relationship between variables.

According to the foregoing estimation method, panel co-integration tests were carried out for eight variables, such as Panel v-Statistic. As can be seen from Table 3, the Panel ADF and Group ADF statistics of all variables reject the original hypothesis at the 1% significance level. As a result, it is believed that there is a long-term co-integration relationship between educational investment, social security expenditure, and the income gap between urban and rural areas in China.

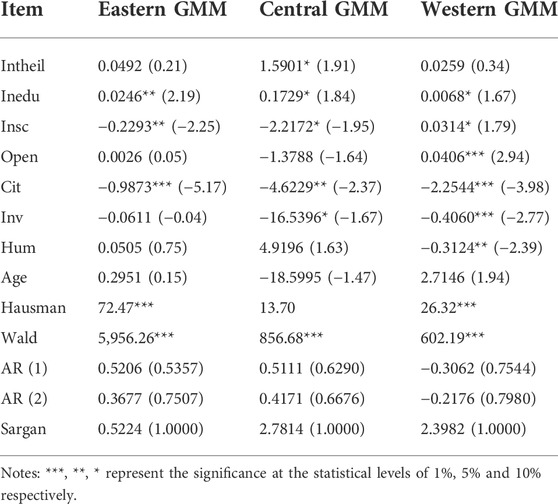

Due to the superiority of GMM estimation in solving endogenous problems, this paper adopts the GMM to conduct an empirical analysis of the impact of education investment and social security expenditure on the income gap between urban and rural areas in the eastern, central, and western regions. The results are shown in Table 4.

TABLE 4. Empirical results among educational investment, social security expenditure, and the income gap between urban and rural areas.

The logarithm of the Theil index in the eastern region did not pass the significance level test, indicating that the income gap between urban and rural areas in the previous period did not affect the income gap between urban and rural areas in the current period. The logarithms of educational investment and social security expenditure significantly affected the income gap between urban and rural areas. Except for the urbanization rate, other control variables did not pass the significance level test, which shows that the urbanization rate is an important factor affecting the income gap between urban and rural areas in the eastern region.

The logarithm of the Theil index in the central region passed the significance level test, indicating that the income gap in the current period was significantly affected by that of the previous period. The income gap between urban and rural areas was significantly affected by the logarithms of educational investment and social security expenditure. Among the control variables, the urbanization and capital formation rates passed the significance level test. The coefficients were negative, indicating that the urbanization capital formation rate reduced the income gap between urban and rural areas in the central region.

The logarithms of educational investment and social security expenditure in the western region passed the significance level test, which shows that education investment and social security expenditure widened the income gap between urban and rural areas in the western region to a certain extent. The control variables of the degree of opening to the outside world, urbanization rate, capital formation rate, and human capital all passed the significant level test, among which the degree of opening to the outside world enlarged the income gap between urban and rural areas in the western region. In contrast, urbanization rate, capital formation rate, and human capital narrowed the income gap between urban and rural areas.

5 Conclusion

Based on the GMM and the inter-provincial panel data of China from 1999 to 2015 as samples, this paper conducted an empirical analysis of the relationship between educational investment, social security expenditure, and the income gap between urban and rural areas.

Educational investment greatly impacts the income gap between urban and rural areas because the main source of income for urban residents in China is wages, and human capital is the main factor affecting employment. In China, the long-term implementation of the policy of preferential investment in education funds in cities is not conducive to the accumulation of human capital for residents in rural areas, thus eventually widening the income gap between urban and rural residents (Chen et al., 2010). The income gap between urban and rural areas was significantly affected by educational investment and social security expenditure, mainly because families had to undertake the educational expenditure of their children. Even if the government does not increase social security expenditure, the urban residents will invest in their children’s education. However, due to the lack of social security, low family income, and the lack of the concept of poverty alleviation through education, the residents in rural areas spend less on their children’s education, which, to some extent, restricts the accumulation of human capital in rural areas. The income gap between urban and rural areas in the eastern and central regions was significantly narrowed due to educational investment, but that in the western region was still enlarged. The main reason for this is that a majority of students from the western region choose to stay in the eastern or central regions after graduating from university, which leads to a lack of talent in the western region and enlarges the income gap between urban and rural areas. The income gap between urban and rural areas in the western region was not narrowed as in the eastern region due to the impact of social security expenditure since the funds were less invested in social security expenditure in rural areas of the western region.

5.1 Policy recommendations

Based on the above conclusions, the following recommendations should be implemented to narrow the income gap between urban and rural residents in China:

First, the government should strengthen education investment in poverty-stricken areas. Efforts should be made to improve the quality of education and the conditions for running schools in poverty-stricken areas, enabling poor students to access compulsory education in a comprehensive way. At the same time, the government should cooperate with enterprises, institutions, and social organizations to build a diversified educational investment mechanism.

Second, the government should optimize the rational allocation of educational resources. Expenditures on various types of education funds at all levels in various regions must be refined and implemented, supervised, and managed by special personnel to effectively solve the problem of uneven distribution of educational resources.

Third, the government should establish a growth mechanism for social security expenditure. According to the level of economic development, it is necessary to devise a growth mechanism of social security expenditure to meet the living needs of residents to realize the full coverage of social security in poverty-stricken areas.

Fourth, the government should improve the social security systems in urban and rural areas. The equalization of social security expenditure between urban and rural residents should be gradually realized at multiple levels and through multiple channels. Efforts should be made to eliminate the differences between urban and rural residents in social security expenditure.

Data availability statement

The original contributions presented in the study are included in the article/supplementary materials, further inquiries can be directed to the corresponding author/s.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Liu Xin, Liu Wei. Combined Effects on the Income Gap of Eastern, Central and Western Education Investment and Social Security Spending (J).Northwest Population Journal. 2013, (7).

References

Arshed, N., Anwar, A., Kousar, N., and Bukhari, S. (2018). Education enrollment level and income inequality: A case of saarc economies. Soc. Indic. Res. 140 (3), 1211–1224. doi:10.1007/s11205-017-1824-9

Azam, M., and Bhatt, V. (2018). Spatial income inequality in India, 1993–2011: A decomposition analysis. Soc. Indic. Res. 138 (2), 505–522. doi:10.1007/s11205-017-1683-4

Beneke, M., Lustig, N., and Oliva, J. A. (2017). “The impact of taxes and social spending on inequality and poverty in El Salvador. Commitment to equity handbook. A guide to estimating the impact of fiscal policy on inequality and poverty,” in Brookings institution press and CEQ institute. (2016) (New Orleans, LA: Center for Global Development Working Paper), 447.

Catherine, S., Miller, M., and Sarin, N. (2020). Social security and trends in inequality. Available at SSRN.

Chen, B., and Feng, Y. (2000). Determinants of economic growth in China: Private enterprise, education, and openness. China Econ. Rev. 11 (1), 1–15. doi:10.1016/S1043-951X(99)00014-0

Chen, B., Zhang, P., and Yang, N. D. (2010). Government investment in education/human capital investment and income gap between urban and rural areas in China. Manag. World 1, 36–43. doi:10.19744/j.cnki.11-1235/f.2010.01.006

Chen, W., and Li, C. (2017). A study of fiscal expenditure levels equalization effect about the urban minimum subsistence scheme based on the decomposition test Theil. Soc. Secur. Stud. 1 (01), 40–48. doi:10.3969/j.issn.1674-4802.2017.01.005

Deng, X., Tian, J., and Chen, R. (2019). Effect of social security system on consumption through income and uncertainty: Evidence from China. Sustainability 11 (7), 1828. doi:10.3390/su11071828

Drèze, J., and Khera, R. (2017). Recent social security initiatives in India. World Dev. 98, 555–572. doi:10.1016/j.worlddev.2017.05.035

Glomm, G., and Kaganovich, M. (2003). Distributional effects of public education in an economy with public pensions. Int. Econ. Rev. Phila. 44 (3), 917–937. doi:10.1111/1468-2354.t01-1-00094

Glomm, G., and Kaganovich, M. (2008). Social security, public education and the growth–inequality relationship. Eur. Econ. Rev. 52 (6), 1009–1034. doi:10.1016/j.euroecorev.2007.10.002

Guo, J., and Zhang, Y. (2019). Can the internet block the widening income gap between urban and rural residents? an empirical study based on China's provincial panel data. Shanghai Econ. (6), 57–73. doi:10.3969/j.issn.1000-4211.2019.06.005

Guo, X., and Fu, S. (2017). Fiscal expenditure on social protection floor, urban bias and urban-rural income gap. Soc. Secur. Stud. (02), 95–105. doi:10.3969/j.issn.1674-4802.2017.02.012

Hu, B.-D., Liu, W., and Liu, X. (2011). Social security expenditure and urban-rural income gap: Empirical evidences from China (1978-2008). J. Jiangxi Univ. Finance Econ. 3 (2), 49–54.

Kaganovich, M., and Zilcha, I. (1999). Education, social security, and growth. J. Public Econ. 71 (2), 289–309. doi:10.1016/s0047-2727(98)00073-5

Kao, C. (1999). Spurious regression and residual-based tests for cointegration in panel data. J. Econ. 90 (1), 1–44. doi:10.1016/s0304-4076(98)00023-2

Khan, S. A. R., Godil, D. I., Yu, Z., Abbas, F., and Shamim, M. A. (2022a). Adoption of renewable energy sources, low‐carbon initiatives, and advanced logistical infrastructure—An step toward integrated global progress. Sustain. Dev. 30 (1), 275–288. doi:10.1002/sd.2243

Khan, S. A. R., Ponce, P., Yu, Z., and Ponce, K. (2022b). Investigating economic growth and natural resource dependence: An asymmetric approach in developed and developing economies. Resour. Policy 77, 102672. doi:10.1016/j.resourpol.2022.102672

Li, C. Y. (2020). Research on the adjustment effect of xinjiang social security expenditure on the income gap between urban and rural residents. Soc. Sci. Xinjiang (3), 141–149. doi:10.3969/j.issn.1009-5330.2020.03.018

Lin, J. Y. (2003). Development strategy, viability, and economic convergence. Econ. Dev. Cult. Change 51 (2), 277–308. doi:10.1086/367535

Liu, X., Liu, X., Lu, J. P., Zhang, L., Min, H., and Lin, F. C. (2010). The cysteine protease MoAtg4 interacts with MoAtg8 and is required for differentiation and pathogenesis in Magnaporthe oryzae.∼2008. Autophagy 6 (10), 74–85. doi:10.4161/auto.6.1.10438

Liu, Y., and Chen, L. (2012). Effects of educational investment and social security on urbanÀrural income gap. Popul. J. 2, 10–20.

Long, H. M., Ling, L., Tan, C., and Wang, Z. (2015). Research on the regional differences of income gap between China’s urban and rural areas: Based on regional data. J. Financial Res. 3, 83–95.

Lv, C. (2017). Has China's social security expenditure narrowed the urban-rural income gap A dynamic panel model analysis based on scale and structure. J. Agrotechnical Econ. 1 (5), 98–110. doi:10.13246/j.cnki.jae.2017.05.010

Marginson, S. (2019). Limitations of human capital theory. Stud. High. Educ. 44 (2), 287–301. doi:10.1080/03075079.2017.1359823

Marino-Buslje, C., Mizuguchi, K., Siddle, K., and Blundell, T. L. (1998). A third fibronectin type III domain in the extracellular region of the insulin receptor family. FEBS Lett. 441 (2), 331–336. doi:10.1016/s0014-5793(98)01509-9

Pecchenino, R. A., and Pollard, P. S. (2002). Dependent children and aged parents: Funding education and social security in an aging economy. J. Macroecon. 24 (2), 145–169. doi:10.1016/s0164-0704(02)00024-1

Pecchenino, R. A., and Utendorf, K. R. (1999). Social security, social welfare and the aging population. J. Popul. Econ. 12 (4), 607–623. doi:10.1007/s001480050116

Pedroni, A., Hammerschmidt, K., and Friedrichsen, H. (1999). He, Ne, Ar, and C isotope systematics of geothermal emanations in the Lesser Antilles Islands Arc. Geochimica Cosmochimica Acta 63 (3–4), 515–532. doi:10.1016/s0016-7037(99)00018-6

Rojas, J. A. (2004). On the interaction between education and social security. Rev. Econ. Dyn. 7 (4), 932–957. doi:10.1016/j.red.2004.04.003

Samuelson, P. A., and Solow, R. M. (1956). A complete capital model involving heterogeneous capital goods. Q. J. Econ. 70 (4), 537–562. doi:10.2307/1881864

Sarfraz, M., Ozturk, I., Shah, S. G. M., and Maqbool, A. (2020). Contemplating the impact of the moderators agency cost and number of supervisors on corporate sustainability under the aegis of a cognitive CEO. Front. Psychol. 11, 965. doi:10.3389/fpsyg.2020.00965

Sarfraz, M., Shah, S. G., Fareed, Z., and Shahzad, F. (2020). Demonstrating the interconnection of hierarchical order disturbances in CEO succession with corporate social responsibility and environmental sustainability. Corp. Soc. Responsib. Environ. Manag. 27 (6), 2956–2971.

Shah, S. G. M., Tang, M., Sarfraz, M., and Fareed, Z. (2019). The aftermath of CEO succession via hierarchical jumps on firm performance and agency cost: Evidence from Chinese firms. Appl. Econ. Lett. 1, 1744–1748. –5. doi:10.1080/13504851.2019.1593932

Song, J. Y., and Gao, C. S. (2022). Education investment, service industry development and income gap between urban and rural areas: Mechanism analysis based on Chinese provincial panel data. J. Nanjing Audit Univ. 19 (3), 102–111. doi:10.3969/j.issn.1672-8750.2022.03.011

Taleb Da Costa, M. (2021). An econometric study of the impact of education on the economic development of low-income countries.

Tao, J. (2008). Social security system and urban–rural income gap. Lanzhou Acad. J. 12, 54–57. doi:10.3969/j.issn.1005-3492.2008.12.019

Wang, H. (2009). A case study on the mobility of income of residents in China. Manag. World 1 (3), 36–44. doi:10.19744/j.cnki.11-1235/f.2009.03.005

Wang, X., Shao, S., and Li, L. (2019). Agricultural inputs, urbanization, and urban-rural income disparity: Evidence from China. China Econ. Rev. 55, 67–84. doi:10.1016/j.chieco.2019.03.009

Wang, X. (2017). The influence of education on poverty in rural areas—empirical analysis based on the panel data of 13 cities in Hubei province. Soc. Secur. Stud. (04), 82–89.

Wang, Z.-w., and He, D.-m. (2014). The impact mechanism of social security expenditure on residents' income——a convergence analysis based on the panel data of 13 cities in Jiangsu province. East China Econ. Manag. 28 (12), 64–68. doi:10.3969/j.issn.1007-5097.2014.12.013

Xiao, Y., and Yu, Z. (2017). A study on the impact of social security expenditure on income gap between urban and rural areas. East China Econ. Manag. 31 (03), 32–41. doi:10.39.69/j.issn.1007-5097.2017.03.005

Xin Liu, W. L. (2013). Combined effects on the income gap of eastern, central and western education investment and social security spending. Northwest Popul. J. 4 (1), 78–82.

Xue, H., and Wang, R. (2009). An empirical study on the equity of the compulsory education in China from the perspective of education production function. Educ. Econ. 03, 1–9. doi:10.3969/j.issn.1003-4870.2009.03.001

Yang, T., Simmons, A. N., Matthews, S. C., Tapert, S. F., Frank, G. K., Bischoff-Grethe, A., et al. (2009). Adolescent subgenual anterior cingulate activity is related to harm avoidance. Neuroreport 26 (04), 19–23. doi:10.1097/WNR.0b013e328317f3cb

Yu, L., and Li, X. (2021). The effects of social security expenditure on reducing income inequality and rural poverty in China. J. Integr. Agric. 20 (4), 1060–1067. doi:10.1016/s2095-3119(20)63404-9

Yu, Z., Khan, S. A. R., Ponce, P., de Sousa Jabbour, A. B. L., and Jabbour, C. J. C. (2022). Factors affecting carbon emissions in emerging economies in the context of a green recovery: Implications for sustainable development goals. Technol. Forecast. Soc. Change 176, 121417. doi:10.1016/j.techfore.2021.121417

Zeng, L., and Jiang, W.-G. (2020). Age structure of population, social security level and the income gap between urban and rural areas: Based on GMM estimation method and panel threshold regression. Northwest Popul. J. 41 (5), 46–58. doi:10.15884/j.cnki.issn.1007-0672.2020.05.004

Keywords: educational input, social security expenditure, urban-rural income gap, GMM estimation, circular economy, sustainable practices

Citation: Wang Y, Huang Y and Sarfraz M (2022) Signifying the relationship between education input, social security expenditure, and urban-rural income gap in the circular economy. Front. Environ. Sci. 10:989159. doi: 10.3389/fenvs.2022.989159

Received: 08 July 2022; Accepted: 20 July 2022;

Published: 11 August 2022.

Edited by:

Syed Abdul Rehman Khan, Xuzhou University of Technology, ChinaReviewed by:

Raveenthiran Vivekanantharasa, Open University of Sri Lanka, Sri LankaNing Ma, Lanzhou University, China

Copyright © 2022 Wang, Huang and Sarfraz. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuan Wang, OTUxMTQ0MTA2QHFxLmNvbQ==; Muddassar Sarfraz, bXVkZGFzc2FyLnNhcmZyYXpAZ21haWwuY29t

Yuan Wang

Yuan Wang Yingjun Huang1

Yingjun Huang1 Muddassar Sarfraz

Muddassar Sarfraz