95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 02 September 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.989070

This article is part of the Research Topic The Role of Energy Efficiency and Transition Towards Clean Energy in Achieving the COP26 Commitments View all 22 articles

This study tries to investigate the development in the banking sector by considering the correlation values before and after March 2020 including the COVID-19 pandemic period in the case of Turkey. However, the full influence of the pandemic will take place in the long term. The number of banks in Turkey, the number of domestic/foreign branches, the number of deposit/participation banks, the volume of the financial sector in gross domestic product (GDP), the number of personnel working in banks, the total number of savings deposits of banks, the total amount of savings deposits of banks, the total number of automatic teller machines (ATMs)/point of sale (POS) owned by the banks, and their relations with the data of the number of establishments are the members of the bank. In Spearman’s correlation, these will be reviewed in the course of correlations. As a result of the analysis, a high level of positive correlation was detected in most of the variables, while an admirable level of positive correlation was determined between the two variables.

Financial markets are to transfer the savings of domestic or foreign investors to the actors who want to invest in return for interest. Banks are one of the most critical actors in fulfilling this function. The fact that banking activities are affected by speculation and external events more than other markets increases its breakable structure. In addition, the risk of not paying the loan taken by its customers is shaped according to the events in the market. For these reasons, the banking sector is more exposed to fragile structures and instability. In addition, when the concern of appealing to more customers is added, there will be practices that lead to unfair competition. Because the sector is so vulnerable, governments are making strict policies and providing support to ensure stability in the financial sector. However, the implementations are not long term due to the apprehension that they will adversely affect the competition among market actors in the long run (Usman et al., 2021).

The main field of activity is to take the excess funds from the investor and give them to the investors in need of funds. Apart from this basic function, different transactions are also carried out according to the needs of the customers. The fact that banks have multiple functions makes them indispensable in terms of customers and makes them vulnerable in the market in which they operate. When the banking system is not managed well, it causes serious problems. In addition, the government should strictly control the entrepreneurs entering this field. If these are not carried out, it will cause the withdrawal of banks from the market on a micro-scale and the deterioration of the country’s economy at a macro-level. Because of this importance, the central authorities always prioritize controlling the banking system.

The banks’ ability to respond to the needs of their customers and to meet the demands of those who want to make transactions for profit causes their investments as an institution to focus on more profitable transactions or activities with a minimum risk of loss. However, as in the COVID-19 pandemic period in March 2020, it is sometimes very difficult to predict global problems. Within the framework of prudence, predetermined savings should be saved in order to be used in the solution of such problems. On the other hand, it can be said that the sector will be positively affected by this disaster due to factors such as the pandemic affecting the banking sector positively and allowing remote working, which is a cheaper method in business life to be tried. For example, it causes a change in the way the industry works (Usman and Radulescu, 2022). Despite the fact that at the end of the pandemic bans, some banks have decided to continue due to the effective performance they have received from remote working. Particularly, in the banking sector, it is observed that all departments that perform customer service duties have started to work remotely. In the study, first, information about the conceptual terminology and historical development of banking will be given. In the second part, studies on the subject will be mentioned. Finally, the increase or decrease in the determined variables will be determined and interpreted. In this direction, effective policy recommendations will be designed so that this sector can function better.

When the stockholders look at the elements necessary for the realization of a production process in an economic market, it is seen that there are labor, natural resources, capital, and entrepreneurship. Especially when these elements are not included, the most important function that gives purchasing power to other elements is capital (the corresponding fund in the financial sector). The financial sector is the unit in which entrepreneurs and investors who want to invest in the market but cannot afford it financially will request funds (Usman and Balsalobre-Lorente 2022). In the financial sector, the unit that acts as a bridge between those who demand funds and those who supply them is the bank. This function of banks causes the growth of both the economy and the institutions demanding funds (Afşar, 2007).

The term “bank” appears for the first time historically in Italy. It is seen that Lombardian bankers perform their banking transactions by placing tables (bancos) in the market places. It is accepted that it is derived from “banco,” which (Parasız, 2000) means table, chair, or bench in Italian, which is accepted in the literature. In addition, there are also opinions that the city of Venice, which was under the rule of the Roman–Germanic Empire, was qualified for compulsory debt bonds (Öçal et al., 1997) “Banchi,” which is a combination of the words “Monti” in Italian and “Banck” in German.

There is no common definition of the bank in the international literature. It is defined in different sizes. A general definition will be made after a few definitions are given here. A bank is defined as a commercial enterprise that accepts the savings of individuals in the society who do not want to spend their money in a certain (Öcal and Çolak, 1997) period and gives loans by creating an account on their behalf, acts as an intermediary in payments, transfers money, collects promissory notes and checks, and accepts precious metals as escrow in their safes. Furthermore, it is defined as a financial intermediary that accepts funds according to money and capital needs and creates deposits related to them, transfers the funds it collects to those who request funds and the government (treasury bills and bonds) in short- or long-term forms, and generates income in return (Tunay et al., 1997). In some sources, the bank is expressed as a business. It is defined as a business that has certain equity and is organized according to the objectives determined by the law, generates income in return for the banking services it performs, and has partners, customers, and creditors–debtors (Geylan, 1985).

As it can be understood from the definitions made from different angles previously, each characterization changes according to the change of perspective or the new function that the technological developments in the market impose on the financial sector. Bank, in general, acts as an intermediary between those who demand and supply funds, lends itself with its own capital and funds collected from the market and their respective institutes, lends to the state and market actors in short or long term, performs the collection of foreign exchanges such as promissory notes and cheques, and fulfills newly attributed duties in the light of technological developments. It can be defined as a commercial enterprise aiming to generate income in return for transactions (Usman and Makhdum 2021).

Banks have many functions. Fulfilling these functions is very important for the development of the economy. The steady growth and deepening of the economy are directly related to the increase in transactions in the banking sector (Bildirici, 2016).

In the past, it is found that the first banking activity was performed by Babylon and Sumerians. The first bank, called the model, emerged among the Sumerians around 3500 BC. In models, they provide financial support to the priests of the period in return for money. It provides loans to those who are engaged in agriculture on the condition that they give them back when they harvest. In addition, due to the long journeys made to different settlements under the conditions of the period, they give their precious metals as entrusted to the priests, who are regarded as respectable in society, against the risk of being stolen during the journey (Intisar et al., 2020). Priests receiving a certain fee from those who benefit from these transactions formed the basis of banking activities. In later periods, it was started to be made by wealthy people engaged in trade. In this way, it came to today’s banking system (Pehlivan, 2021).

The first bank suitable for today’s financial system was established by the Dutch Bank in 1609. This was followed by the Bank of Venice in 1637. In 1668, the Bank of Sweden, which was the first central bank, was established. Since this date, all nation-states have started to establish a central bank system that controls their banking activities in their own countries. Since the 19th century, countries have started to engage in economic struggles with each other. Countries have now entered into a goal of putting each other in a difficult situation or making them dependent on each other (Yetiz, 2016). Even in today’s world, this aim still continues. For example, in the Russia–Ukraine War that broke out in 2022, it is seen that the great powers are in a race to put the actors in a difficult situation economically or to sell arms to countries.

Considering the banking activities in Turkey, it is seen that it came a little later than other Western countries. Historically, many wars and the long duration of wars in Turkey have caused the country to focus more on military and defense expenditures (Konak and Ergeneoğlu, 2020). In the Ottoman Empire, for the first time in the 16th century, it is not seen as a banking activity in Turkey. We come across Eytam Funds established by the Janissaries in order to provide financial support to orphans (Güneş and Manav, 2019). Two French bankers of Galata, namely, Manolaki Baltazzi and Jacques Alleon, founded the first bank in the Ottoman Empire in 1847. The Ottoman Empire, which was left behind by the developments in the field of industry, was allowed to establish a bank under the control of the Ottomans in order to provide the essential financial support for technological developments from the outside. In addition, the function of keeping the value of (Mikayilov, 2015) Kaime issued in the country under control has been undertaken.

In the Crimean War, which took place between Russia and the Ottoman Empire in 1854, the country was in a difficult situation economically. It hindered the development of the Ottoman Bank, which was established for two main purposes: 1) maintaining the country’s borrowing-payment balance and 2) establishing an environment of trust in payments. In 1856, with the participation of British capital in the Ottoman Bank, the establishment of a French–British partnership was realized. Thus, there is no problem in terms of capital. The name of the bank was changed to “Bank-ı Osmanı-i Şahane,” and it had the monopoly of printing banknotes (Apak and Tay, 2012). Homeland Funds were established in 1863 based on voluntary donations. Afterward, it was converted into a benefit fund under the circumstance of paying a premium in proportion to the income of those engaged in agricultural activities. In 1888, Ziraat Bank, which was the first bank, was established, and the ballot box was transferred. The main purpose of the bank has been determined as supporting agricultural activities (Yetiz, 2016). Many policies have been followed to change the banking system under foreign monopoly and to dominate the national banking system. Today’s banking system has been put forward by going through various stages.

The review of literature is summarized below in chronological order in Table 1, including the surname of the author, the date, the purpose, and the result of the study.

The analysis part of the present studies was carried out to determine the effect of COVID-19 on the banking system in the world and in Turkey. The empirical analysis was performed over several variables in general. However, in this study, the effect of COVID-19 on the Turkish banking system was statistically analyzed based on 10 time series variables. The empirical finding of a significant relationship between the variables as a result of the analysis offers the opportunity to make an inclusive evaluation in determining the COVID-19 effect on the Turkish banking sector.

Another point that distinguishes this study from previous studies is that in other studies, a specific analysis was made in general and the COVID-19 association was determined. In this article, unlike other studies, the data during 1998–2021 and 2010–2021 of the variables used in the analysis were tabulated separately, and it was clearly determined in which years they decreased and in which years they increased. This comprehensive article is expected to provide an opportunity to evaluate the literature from a different perspective on these aspects.

Within the scope and purpose of the study, Table 2 explores the number of banks, the number of domestic/foreign branches, the number of deposit banks, and participation banks according to their qualifications, in the context of the current outlook in the banking system. It is found that there are 51 banks in Turkey. All banks have 9,710 domestic and 71 foreign branches. As a deposit bank, there are 21 banks with foreign capital, three public, eight private, and three transferred to the Savings Deposit Insurance Fund (SDIF). In addition, six participation banks operate within the system.

The COVID-19 pandemic on the sustainability of the financial sector and the volumetric change of the financial sector in GDP during 1998–2020 is shown in Table 3. These findings show that there was a decrease of 3.5 and 3.9% in 2002 and 2003 due to the 2001 economic crisis; however, there was an increase in other years. The highest increase was realized in 2009 with 30.2% in the region. It can be said that the measures taken by the government against the international economic depression experienced in 2008 had a massive effect. The effect of the COVID-19 pandemic, which took place in March 2020, was not seen negatively. This can be attributed to two reasons. First, during the period of COVID-19, especially the fact that countries meet their food shortage and medical needs from each other affect international trade positively, and this affects the banking system accordingly, which are payment instruments. Second, since the full effect of the pandemic will be seen in long term, it is not reflected in the variables in short term.

As the third variable, the number of personnel working in banks between 1998 and 2021 is given in Table 4. Accordingly, it is seen that there was a contraction in the number of personnel in 2000, 2001, 2002, and 2003. It can be observed that this decrease is due to the effects of the economic crisis in 2001. There was a continuous decrease between the years 2016 and 2021. It can be observed that the pandemic has an effect on the decrease in 2020 and 2021, respectively.

The variable number of bank branches during 1998–2021 is provided in Table 5. Accordingly, there has been a decrease in the number of personnel in approximately the same direction over the years. There was a decrease in 2001–2003. Especially, the 2001 economic crisis had an effect on this. The biggest decrease was in 2001 with 11.8%, and the highest increase was in 2008 with 15.4%. Since 2019, the effect of digitalization and the COVID-19 pandemic that has occurred worldwide and the number of branches have decreased, as people turn to online transactions instead of physical contact.

The changes in the total deposit amount of banks during 1998–2020 are given in Table 6. According to the findings, there was a decrease in the total deposit amount during 2001–2002, 2007, and 2019. The highest increase was experienced between the years 1999, 2000, and 2010.

The data regarding the total number of savings deposits of banks are given in Table 7. Accordingly, this shows the increasing trend continuously. The highest increase rate was realized in 2011 with 12.2% and in 2020 with 11.5%.

The total savings deposit amounts of banks between 1998 and 2020 are given in Table 8. According to the table, a positive trend in the total amount of savings deposits of banks has been found continuously. On the other hand, the highest increase was realized in 1999 with 107.8%, and the least increase was realized in 2012 with 8.5%.

The total number of ATMs owned by banks during 2010–2021 is given in Table 9. Accordingly, it has increased continuously, except for the years 2020–2021. The highest increase was realized in 2013 with 25.9%.

The number of POS devices of the banks for the years 2010–2020 is given in Table 10. When we look at the rate of change in the variables over the years, it has increased continuously except for the years 2015 and 2017. The highest increase rate was realized in 2018.

The number of workplaces that became members of banks during the years 2010–2020 is provided in Table 11. This shows that the total number of workplaces that are members of banks decreased in 2016–2017, while it increased in other years. The highest increase was realized in 2020 with 19.3%.

COVID-19 pandemic data on the Turkish banking sector were collected from the Central Bank of the Republic of Turkey (CBRT), the Banking Regulation and Supervision Agency (BRSA), and the Banks Association of Turkey (BAT). In this context, data on the sector’s volume, number of personnel, number of branches, bank deposit amount, non-conventional loan amount, savings deposit amount, number of ATMs, amount of POS devices, and number of savings deposits were collected for the years 1998–2021. The created data set was transferred to the SPSS Statistics 20 program. Since the data set created within the scope of the study did not show a normal distribution, Spearman correlation analysis was used by the program to determine the relationship among them.

It is the analysis method used to determine the relationship between variables. It is used when the data do not show a normal distribution. It is used to explain the linear relationship between two variables by using the values obtained sequentially. The relations of the variables with each other have been determined. In order to calculate the rank correlation coefficient (r_s) within the scope of the analysis, the variable values are ordered from the largest to the smallest. Grading is carried out according to the order formed. The rank correlation coefficient is calculated using Eq. 1 as given below (Terzi, 2018):

Di: difference between ordinal numbers between two variables.

N = number of variables.

A dependent/same-direction relationship between variable values and Spearman’s rank correlation (

Using Spearman’s rank correlation (

The sign +1 is interpreted as the existence of a perfectly linear positive relationship. In this case, when one variable increases, the value of the other variable also increases linearly. On the contrary, when the value is -1, it is evaluated as the existence of a perfectly linear negative relationship. In this case, as the value of one variable increases, the value of the other variable decreases in a fully linear framework. Furthermore, Table 12 explores the interpretation of Spearman rank correlation (r_s) value for showing the linear association between candidate variables. The Spearman rank correlation value ranges between +1 to −1. The +1 shows the perfect positive linear association while −1 shows the perfect negative linear association between variables.

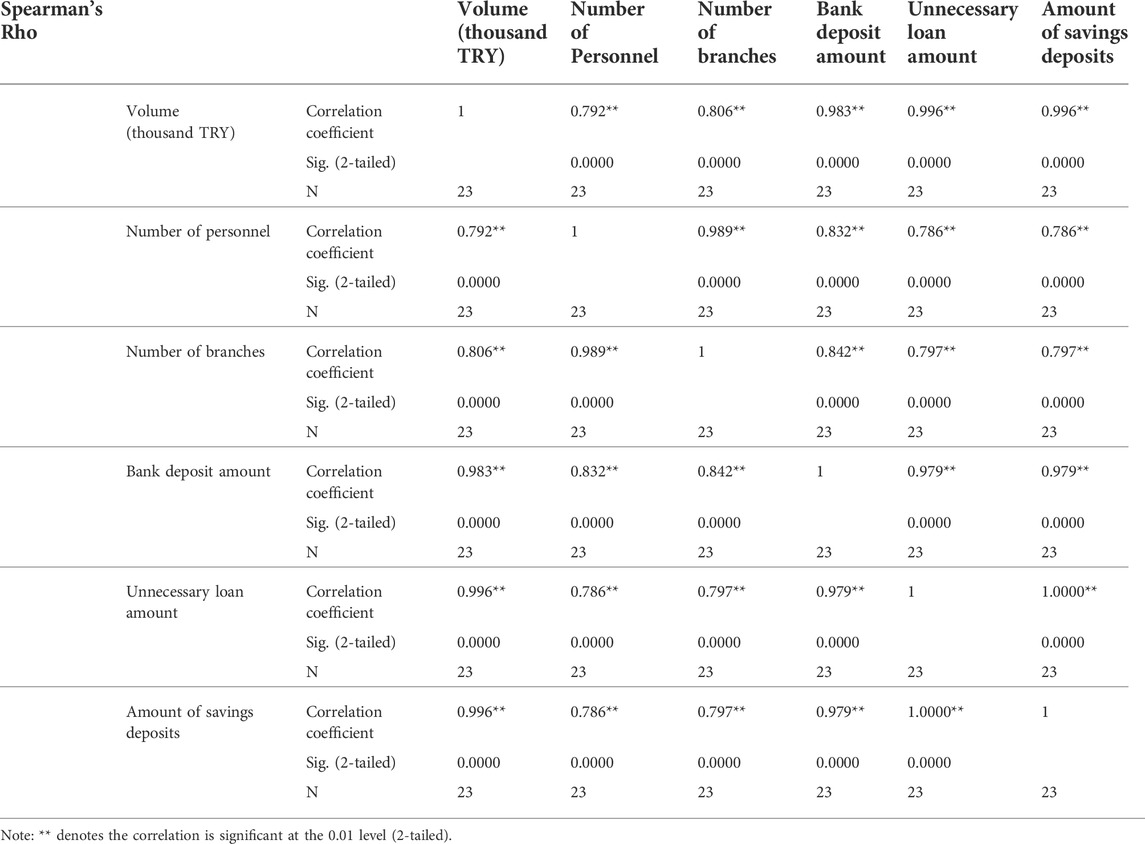

In order to determine the direction and degree of the relationship between the data obtained within the scope of the study, the volume, the number of personnel, the number of branches, the deposit amount of the bank, the amount of non-conventional loans, and the savings deposit amount, including the data for the years 1998–2020, are incorporated into the data for the period 2010–2020. A data analysis on the number of ATMs, the amount of POS, the number of member businesses, and the number of savings deposits belonging to Spearman’s correlation analysis was performed. Analysis results are given in Table 13.

TABLE 13. Spearman’s correlation analysis on volume, number of personnel, number of branches, amount of deposits of banks, amount of extra-useless loans, and amount of savings deposits.

Table 13 explores the results of Spearman’s correlation analysis of the variables. It has been determined that there is a strong positive association between the volume and the number of personnel, the number of branches, the deposit amount of the bank, the amount of non-conventional loans, and the amount of savings deposits, with Spearman’s Correlation coefficients taking the values of 0.792, 0.806, 0.983, 0.996, and 0.996, respectively. It has been determined that there is a strong positive relationship between the volume of the variable and the number of personnel, the number of branches, the deposit amount of the bank, the amount of non-conventional loans, and the amount of savings deposits, with Spearman’s correlation coefficients taking the values of 0.792, 0.989, 0.832, 0.786, and 0.786, respectively. Spearman’s correlation coefficients between the number of branches, the number of personnel, the deposit amount of the bank, the amount of non-conventional loans, and the amount of savings deposits were 0.806, 0.989, 0.842, 0.797, and 0.797, respectively. According to these values, there is a strong positive relationship between the candidate variables.

Spearman’s correlation coefficients between the volume of bank deposits, the number of personnel, the number of branches, the amount of non-conventional loans, and the amount of savings deposits were found to be 0.983, 0.832, 0.842, 0.979, and 0.979, respectively. In this context, it is concluded that there is a strong positive relationship between the variables. Spearman’s correlation coefficients between the amount of non-necessary loans and volume, number of personnel, number of branches, bank deposit amount, and savings deposit amount were 0.996, 0.786, 0.797, 0.979, and 1, respectively. According to the value of the coefficient, there is a strong positive relationship between the amount of non-conventional loans and the volume, the number of personnel, the number of branches, and the deposit amount of the bank, while there is a perfect positive relationship between the amounts of savings deposits. As for the last variable, Spearman’s correlation coefficients between bank deposit amount and volume, number of personnel, number of branches, bank deposit amount, and non-conventional loan amount were 0.996, 0.786, 0.797, 0.979, and 1, respectively. When there is a strong positive relationship between the directions of the relations according to the values, the amount of savings deposits, the volume, the number of personnel, the number of branches, and the deposit amount of the bank, there is an excellent positive relationship between the amounts of non-conventional loans. When the level and direction of the relations are evaluated in general, it is seen that there is a positive and strong level. In particular, it has been determined that the data generally tend to increase and go in coordination with each other.

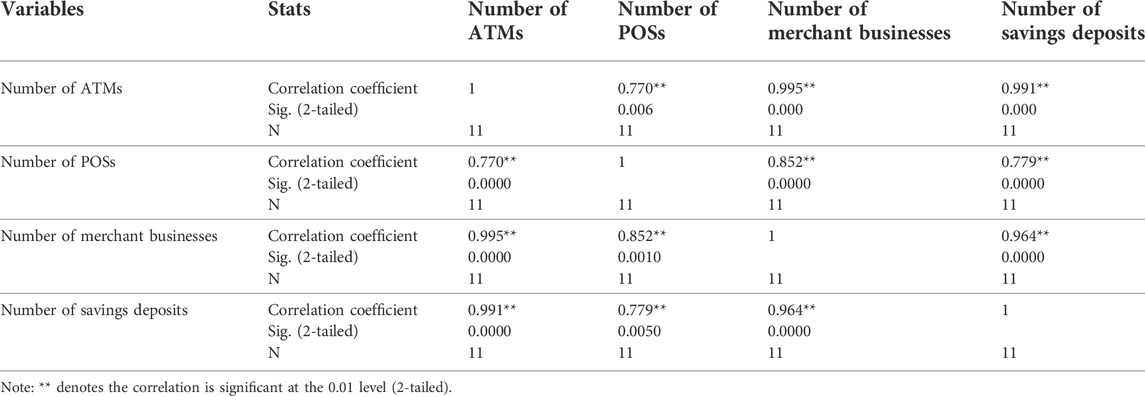

In Table 14, Spearman’s correlation analysis results are given to determine the relationship between the number of ATM/POS, the number of member businesses, and the number of savings deposits for the years 2010–2020.

TABLE 14. Spearman’s correlation analysis by number of ATM-POS, number of merchant businesses, and number of savings deposits.

Spearman’s correlation coefficients between the number of ATMs, the number of POS, the number of member businesses, and the number of savings deposits were 0.770, 0.955, and 0.991, respectively. For that reason, it can be said that there is a strong positive connection between the variables. Spearman’s correlation coefficients between the number of POS and the number of ATMs, the number of member businesses, and the number of savings deposits were 0.770, 0.852, and 0.779, respectively. In this direction, there is a strong positive relationship between the variables. Spearman’s correlation coefficients between the number of merchants and the number of ATMs/POS and the number of savings deposits were determined as 0.955, 0.852, and 0.964, respectively. It is concluded that there is a strong positive relationship between the variables. Lastly, Spearman’s correlation coefficients between the number of savings deposits and the number of ATMs/POS, and the number of member businesses were determined as 0.991, 0.779, and 0.964, respectively. Similarly, it is concluded that there is a strong positive relationship between the variables.

This study aims to determine the sustainability of the Turkish banking sector in March 2020 when the COVID-19 virus started to appear in Turkey. In this context, data on the volume, number of personnel, number of branches, bank deposit amount, non-conventional loans, savings deposits of the Turkish banking sector between 1998–2020, the number of ATMs/POS, member workplaces, and savings deposits during 2010–2020 are presented. The values of the CBRT, BRSA, and BAT were obtained from institutions. Spearman’s correlation analysis was performed in order to determine the direction and degree of the relationship between the obtained data. As a result of the findings, it was resolute that there was a strong positive relationship in almost all of the variables. It has been determined that there is a perfect positive relationship only between the amount of non-conventional loans and the amount of savings deposits. When these results are evaluated in general, it is concluded that the COVID-19 pandemic did not adversely affect the Turkish banking sector. In addition, the positive relationship between the variables indicates that the Turkish banking sector has sustainable growth. In order to maintain this aspect of the Turkish banking sector, the following measures can be taken:

• In short term, the pandemic did not have any negative impact on the Turkish banking sector. On the contrary, this sector continued its steady growth. However, since it is difficult to predict the long-term results from today, it is necessary to take protective measures, such as institutions and organizations that have the duty of supervising banks, such as the Central Bank, BRSA, SDIF, and BAT, should keep the sector under strict control and direct the government to take preventive measures against possible bad courses.

During the pandemic period, the export volumes of most countries have increased, as countries attach importance to foreign trade, especially in order to meet the needs in the field of health. Incentives given in this direction should be increased to enable companies in Turkey to turn exports. The increase in exports will ensure the development of the banking sector, which is one of the only payment institutions in international trade. In the coming years, together with the increasing number of exports, the possible problems that may arise due to the pandemic will be eliminated. Providing interest-free loans to exporting companies and offering advantages such as the exchange of foreign currency obtained by these companies by the Central Bank at high exchange rates will encourage companies to export.

• In order to ensure the continuation of the sustainable growth of the banking sector, measures should be taken to increase the saving volume and the inflationary environment experienced throughout the world. In this context, the Turkish government takes these measures at certain rates, with currency-protected deposit accounts and income-indexed promissory notes.

• The inflation rate in Turkey has been 73.5% in the last year. In this market, where the national currency is devaluating every day, the CBRT should take precautions regarding the rediscount interest rates, which is one of the monetary policy tools. It should follow a contractionary monetary policy in order to reduce the amount of money in the market. It does this through banks that supply funds to the market. By increasing the rediscount interest rate, the amount of money in the market should be reduced.

• In order to prevent the inflation that will occur as a result of the companies that panicked as a result of the increase in foreign exchange, they try to buy foreign currency today in order to meet the payments to be made in the following months, and the Central Bank should give these companies a guarantee of fixing the exchange rate for the future periods.

• In addition, government bonds and treasury bills should be issued with cheaper interest rates to prevent savings from diverting to foreign currency (dollarization process) as a result of high inflation in Turkey. By withdrawing the Turkish lira from the market, efforts should be made to reduce the depreciation of the Turkish lira against foreign currency.

The banking sector, which is seen as the most important income source of the Turkish economy, needs to have strict controls, especially to ensure sustainable development. In this period, when it is not known how the pandemic will affect the sector in the long run, it is vital to take the necessary measures in order not to disrupt the strong banking system in Turkey and not be affected by the inflationary environment.

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Conceptualization, BE; methodology, ÖA; data analysis, ÖA; investigation, BE; data curation, ÖA; writing—original draft preparation, BE; writing—review and editing, BE and ÖA. All authors have read and agreed to the published version of the manuscript.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Afşar, A. (2007). The relationship between financial development and economic growth. J. Account. Finance 36, 188–198.

Apak, S., and Tay, A. (2012). The place and importance of the Ottoman Bank in the financial system of the ottoman Empire in the 19th century. J. Account. Financial Hist. Stud. 3, 63–103.

Arabacı, H., and Yücel, D. (2020). Impact of COVID-19 pandemic on Turkish banking sector. Soc. Sci. Res. J. 9, 196–208.

Banks Association of Turkey (2022). Number of banks and branches of banks in Turkey. Available at: https://www.tbb.org.tr/modules/banka-bilgileri/banka_sube_bilgileri.asp.

Banks Association of Turkey (2022). Number of personnel working in banks between 1998-2021. http://verisistemi.tbb.org.tr/ (Accessed May 7, 2022).

Banks Association of Turkey (2021). Total amount of savings deposits of banks between the years of 7.1998-2020. https://verisistemi.tbb.org.tr/index.php?/tbb/report_bolgeler (Accessed May 7, 2022).

Banks Association of Turkey (2022). Total number of ATMs owned by banks between 2010-2021. https://verisistemi.tbb.org.tr/index.php?/tbb/report_bolgeler (Accessed May 6, 2022).

Banks Association of Turkey (2021). Total number of businesses joining banks between 2010-2020. Avaialble at: https://verisistemi.tbb.org.tr/index.php?/tbb/report_bolgeler (Accessed May 6, 2022).

Banks Association of Turkey (2021). Total number of savings deposits of banks between 2010-2020. https://verisistemi.tbb.org.tr/index.php?/tbb/report_bolgeler (Accessed May 6, 2022).

Banks Association of Turkey (2021). Total pos number of banks between 2010-2020. https://verisistemi.tbb.org.tr/index.php?/tbb/report_bolgeler (Accessed May 6, 2022).

Bicil, İ. M. (2021). Changes in total factor efficiency of deposit banks in the Turkish banking system during the covid-19 pandemic process. J. Manag. Econ. Res. 19, 349–361.

Bildirici, Ç., and Van, Ç. (2016). Comparison of financial performance of traditional and participation banks in terms of basel III. Türkiye: Yüzüncü Yıl University. [Unpublished Master's Thesis].

Çakmaklı, C., Demiralp, S., Yeşiltaş, S., and Yıldırım, M. A. (2021). An evaluation of the Turkish economy during covid-19. Berlin: Center for Applied Turkey Studies. Available online: https://www.swp-berlin.org/publications/products/arbeitspapiere/CATS__Working_Paper_Nr_ 1_2021_Cakmakli_Demiralp_Yesiltas_Yildirim.pdf.

Geylan, R. (1985). Commercial bank management and basic problems of Turkish commercial banks. Türkiye: EskişehirAnadolu University Publications No: 86İİBF Publications No, 22.

Güneş, M., and Manav, N. (2019). Pension and aid funds as internal borrowing resources of the ottoman state. Selçuk Univ. J. Turkic Stud. 47, 313–334.

Intisar, R. A., Yaseen, M. R., Kousar, R., Usman, M., and Makhdum, M. S. A. (2020). Impact of trade openness and human capital on economic growth: A comparative investigation of asian countries. Sustainability 12 (7), 2930. doi:10.3390/su12072930

Kantur, Z., and Özcan, G. (2021). Card spending dynamics in Turkey during the covid-19 pandemic. Cent. Bank. Rev. 21, 71–86. doi:10.1016/j.cbrev.2021.07.002

Koç, P., İzgi, Ş. K., Kalaycı, R., and İnce, T. (2021). Analysis of the effects of the covid-19 outbreak on the Turkish banking sector. Ankara, Türkiye: İksad-Publishing House.

Konak, F., and Ergenoğlu, S. (2020). Performance Evaluation of the Turkish Banking Sector After the 2008 Global Financial Crisis, 13. Corum: Hitit University Journal of Social Sciences Institute, 242–263.

Mikayilov, G. (2015). The relationship between advertising expenditures and banking performance in the Turkish commercial banking sector. Türkiye]: Dumlupınar University. [Unpublished PhD Thesis].

Ngoc, B. H., and Awan, A. (2022). Does financial development reinforce ecological footprint in Singapore? Evidence from ARDL and bayesian analysis. Environ. Sci. Pollut. Res. 29, 24219–24233. doi:10.1007/s11356-021-17565-5

Öçal, T., Çolak, Ö. F., Togay, S., and Esen, K. (1997). Money, bank, theory and politics. Ankara, Türkiye: Gazi Publishing.

Pehlivan, P. (2021). “Banking,” in Macroeconomics theories-politics-applications. Editor O. F. Aslan. 1st ed. (Türkiye: Efeakademi Publications), 235–256.

Ratner, B. (2022). The correlation coefficient: Definition. Avaialble at: http://www.dmstat1.com/res/The CorrelationCoefficientDefined.html#:∼:text=Bruce%20Ratner%2C%20Ph.,between%20%2B1%20and%20%2D1. (Accessed June 14, 2022). [

Sarı, S. (2021). The effects of the covid-19 outbreak on the Turkish banking sector. newera. 6, 89–106. doi:10.51296/newera.43

Terzi, Y. (2018). Basic statictics II lesson notes. Avaialble at: https://ist-fef.omu.edu.tr/tr/hakkimizda/ders-notlari/TEMEL%20%C4%B0ST%20II-2018.pdf.

Tuna, K. (2021). Effects of covid-19 pandemic on banking sector employment in türkiye. ije. 71, 191–230. doi:10.26650/istjecon2021-933821

Tunay, K. B., Uzuner, M., and Yiğit, A. (1997). Public banking in Turkey and its effects on the sector. Ankara, Türkiye: Economic Research Center Publication No, 7.

Turkish Statistical İnstitute (2021). Number of bank branches between 1998-2021. https://data.tuik.gov.tr/ (Accessed May 7, 2022).

Turkish Statistical İnstitute (2021). Total deposit amount of banks between the years of 5.1998-2020. https://data.tuik.gov.tr/ (Accessed May 7, 2022).

Turkish Statistical İnstitute (2021). Volume of the finance sector in GDP between 1998-2020. Available at: https://data.tuik.gov.tr/Bulten/Index?p=Yillik-Gayrisafi-Yurt-Ici-Hasila-2020-37184.

Usman, M., and Balsalobre-Lorente, D. (2022). Environmental concern in the era of industrialization: Can financial development, renewable energy and natural resources alleviate some load? Energy Policy 162, 112780. doi:10.1016/j.enpol.2022.112780

Usman, M., Makhdum, M. S. A., and Kousar, R. (2021). Does financial inclusion, renewable and non-renewable energy utilization accelerate ecological footprints and economic growth? Fresh evidence from 15 highest emitting countries. Sustain. Cities Soc. 65, 102590. doi:10.1016/j.scs.2020.102590

Usman, M., and Makhdum, M. S. A. (2021). What abates ecological footprint in BRICS-T region? Exploring the influence of renewable energy, non-renewable energy, agriculture, forest area and financial development. Renew. Energy 179, 12–28. doi:10.1016/j.renene.2021.07.014

Usman, M., and Radulescu, M. (2022). Examining the role of nuclear and renewable energy in reducing carbon footprint: Does the role of technological innovation really create some difference? Sci. Total Environ. 841, 156662. doi:10.1016/j.scitotenv.2022.156662

Yan, J., and Jia, P. (2022). The impact of COVID-19 on bank sector traditional business model sustainability in China: Bank branch versus fintech. Front. Phys. 10, 1–10. doi:10.3389/fphy.2022.820646

Yetiz, F. (2016). The birth of banking and the Turkish banking system. J. Niğde Univ. Fac. Econ. Adm. Sci. 9, 107–117.

Yetiz, F. (2016). The birth of banking and the Turkish banking system. J. Niğde Univ. Fac. Econ. Adm. Sci. 9, 107–117.

Keywords: sustainability, banking sector, COVID-19, economic growth, Sperman’s correlation analysis

Citation: Erden B and Aslan ÖF (2022) The impact of the COVID-19 pandemic outbreak on the sustainable development of the Turkish banking sector. Front. Environ. Sci. 10:989070. doi: 10.3389/fenvs.2022.989070

Received: 08 July 2022; Accepted: 26 July 2022;

Published: 02 September 2022.

Edited by:

Magdalena Radulescu, University of Pitesti, RomaniaCopyright © 2022 Erden and Aslan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Bahattin Erden, YmVyZGVuQGF0YXVuaS5lZHUudHI=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.