- 1School of Economics and Management, China University of Geosciences, Beijing, China

- 2Key Laboratory of Carrying Capacity Assessment for Resource and Environment, Ministry of Land and Resources, Beijing, China

- 3Key Laboratory of Strategic Studies, Ministry of Land and Resources, Beijing, China

At this stage, the air pollution problem represented by climate warming has become very serious, and it is important to establish a carbon emission trading system as an innovative policy tool to promote energy savings and emission reduction. China’s carbon trading market is currently in its initial stage, and only power generation enterprises are included in the market. When faced with changes in the carbon trading market mechanism, enterprises are often unable to make rapid adjustments, making it difficult to reflect the carbon market’s role in reducing emissions. Current research on the design of carbon trading mechanisms of enterprises has lacked investigation into the influence of the design of carbon trading mechanisms on the willingness of enterprises to participate from the perspective of enterprises. In this paper, we use choice experiments, a conditional logit model and a multinomial logit model to explore the impacts of changes in the design of enterprise carbon trading mechanisms on enterprise willingness to participate in carbon trading. The impacts of all attributes on the willingness to participate in national carbon trading is ranked from largest to smallest: offset mechanism > carbon product trading > government penalty > carbon quota allocation. Based on the research results, relevant policy recommendations and corporate countermeasures are proposed to improve corporate willingness to participate in carbon trading and encourage active cooperation in energy saving and emission reduction activities.

1 Introduction

In recent years, dramatic changes in production methods have brought wealth to humankind while also causing serious environmental pollution problems, and the problem of atmospheric pollution from climate warming has taken on a very serious shape. Studies have shown that climate warming is mainly due to the excessive consumption of non-clean fuels that produce greenhouse gases, and CO2 emissions are mainly too high. In terms of CO2 emission reduction, scholars have studied the impact of renewable energy on CO2 emission reduction at different levels (Dong et al., 2018, Dong et al.2020). At the same time, the international community has taken certain measures to control global carbon emissions from the enterprise level, among which the establishment of a carbon emission trading system is important as a tool to help energy savings and emission reduction.

China began preparations for carbon trading in 2011 and officially launched a national carbon trading market on 16 July 2021. The current national corporate carbon trading market has just started to operate and is government-led and is achieved through a policy-enforced approach. The successful operation of the carbon market needs to coordinate the interests of many related entities, and a policy that is too aggressive is likely to cause opposition from emitting enterprises, which is inevitably detrimental to the successful operation of the carbon market; a policy that is too lenient cannot form pressure on enterprises to reduce emissions (Liu and Song, 2019). The enterprise side, as the direct audience of carbon trading policy, is more sensitive to the policy response, and this will directly affect the enterprise’s willingness to participate in carbon trading. It may be counterproductive to enact a policy from the government’s perspective without paying enough attention to enterprise willingness to participate. Feedback on the enterprise willingness to participate is an important indicator of whether the policy is reasonable, feasible and effective. Therefore, effectively improving the effectiveness of policy regulation may be considered from the standpoint of increasing the willingness of enterprises to participate and further positive feedback on the enactment of the policy to positively stimulate the increase in enterprise willingness to participate in carbon trading and promote two-way cooperation between enterprises and the government to accomplish the task of carbon emission reduction.

Considering that China’s national carbon trading market is still in its preliminary stage, this study takes the power industry that has participated in national carbon trading as the research sample, based on which the relationship between two variables, carbon trading market mechanism changes and enterprise willingness to participate in carbon trading, is explored, and reasonable suggestions are given from the perspective of policy-makers and enterprise responses to enhance the purpose of enterprise willingness to participate in carbon emissions and promote the achievement of carbon emission reduction goals.

In terms of research content, this study combines the original carbon trading mechanism model and the actual carbon trading operation of enterprises to construct a carbon trading model for enterprises based on Chinese national conditions. Previous studies have focused more on carbon trading itself, but there have been fewer studies from the perspective of enterprises, the main actors in carbon trading. This study explores the relationship between changes in the carbon trading market mechanism and the willingness of enterprises to participate in carbon trading from the perspective of enterprises to fill the gap in academic research in this area. At the same time, policy-makers can use the research results as a reference basis to issue policy bills that are conducive to increasing enterprise willingness to participate in carbon trading and to promote enterprise active cooperation in carrying out energy conservation and emission reduction activities and to ensure their own benefits to a certain extent while cooperating with the national carbon trading requirements.

In terms of research methodology, this paper quantifies the degree of enterprise understanding of carbon trading. The second part of the questionnaire, based on the literature on the concept of carbon trading and its realization path, combined with the ten steps of the enterprise carbon trading system, asks six single and multiple choice questions, covering the principle of carbon trading, trading subjects, trading objects, allocation methods, etc. All six questions have standard answers, and the scores are used to quantify the degree of enterprise understanding of carbon emissions. In addition, this paper is the first to apply the choice experiment method to the study of enterprise willingness to participate in carbon trading. The choice experiment has two core advantages: first, a complete economic theoretical foundation and empirical methodological system; and second, a high information load that coincides with real market scenarios. In terms of model selection, this study adopted a conditional logit model and multinomial logit model in turn. The advantage of the conditional logit model is that it can analyze which attribute levels influence the choice of scheme to a large extent while ignoring the heterogeneity of consumer preferences; the multinomial logit model can perform heterogeneity analysis and help to understand the influence of heterogeneous attributes of many firms on the choice of carbon trading scheme.

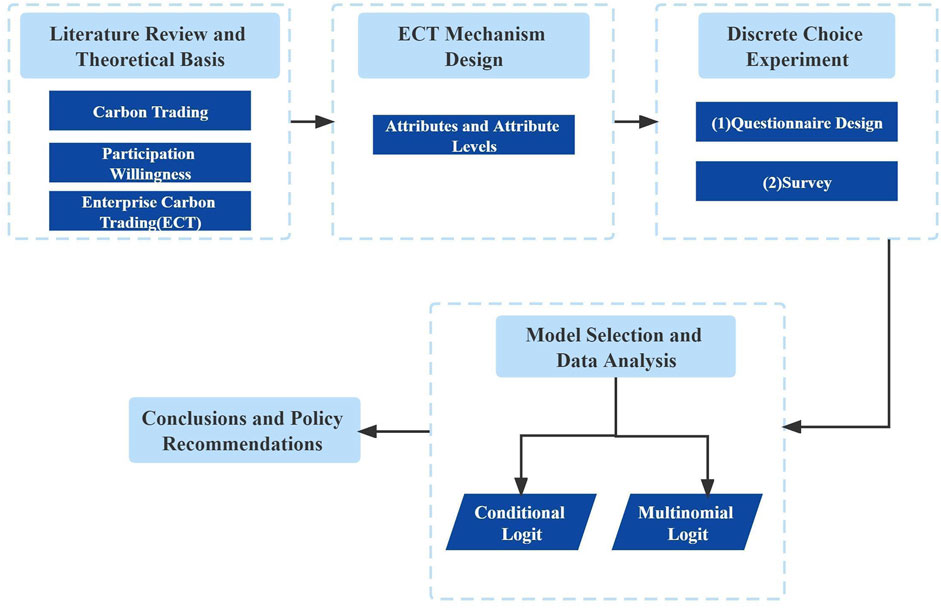

The logical framework of this study is shown in Figure 1, and the specific research ideas are divided into the following five steps. In the first step, the theoretical basis of corporate carbon trading and the elements related to the design of the corporate carbon trading mechanism are analyzed by using the literature review method. In the second step, the enterprise carbon trading market model is designed, the key attributes of the possible changes in the design of the corporate carbon trading market and the different levels of each attribute are defined, and the choice set is set based on the choice experiment method. In the third step, based on the choice set determined by the choice experiment method, a questionnaire is prepared, a discrete choice experiment is conducted, and the data are collected. In the fourth step, a discrete choice model is used to quantify the public preferences based on the experimental data. In the fifth step, the results are discussed and analyzed based on the data, conclusions are drawn, and reference suggestions are made for policy-makers to improve the willingness of enterprises to participate in carbon emissions, taking into account the main problems that they may face.

2 Literature review

Current domestic and international research on enterprise carbon trading mechanisms mainly focuses on the design of enterprise carbon trading mechanisms. For example, Liu and Liu (2015) analyzed the carbon emission reduction cost and carbon emission reduction revenue under the current carbon quota trading mechanism from the perspective of management accounting, constructed a principal-volume-benefit analysis model for enterprise emission reduction decisions, explored the quantitative dependence relationship among variables, and proposed a simple and easy-to-implement carbon emission reduction decision method (Liu and Liu, 2015). Focusing on the supply chain dominated by manufacturers and retailers, Meng applied the supply chain contract and game theory to provide insights into the two-stage supply chain cooperative carbon emission reduction strategy under the free carbon quota and carbon emission rights trading mechanism by considering carbon trading, carbon emission reduction and consumer low-carbon awareness (Meng 2015). Ma et al. (2019) analyzed the impact of the CET system on the carbon emissions of electric power enterprises, defined the roles and functions of each trader agent in the electric power market and carbon emission rights trading market, and constructed an agent-based CET model to carry out research on the carbon emission reduction trading mechanism of electric power enterprises from three aspects: power generation technology transformation, carbon emission rights trading and related market simulation. Lu (2019) compared the carbon management level of pilot enterprises participating in the carbon market with that of non-pilot enterprises not participating to verify whether the carbon trading mechanism can encourage enterprises to actively manage carbon emissions and achieve emission reduction. An and Tang (2012) analyzed the inherent facilitation and constraint relationship between quota-based emission trading and project-based emission trading (CDM) by adding a new objective function, redefining parameters, and modifying constraints based on the AIM-Enduse model to construct a single-stage optimal decision model for corporate emission reduction under the emission trading mechanism. Tian and Xu (2020) took an aviation service enterprise as an example to explore the composition of enterprise compliance cost and its influencing factors under the carbon trading mechanism and to construct a measurement model of enterprise compliance cost.

For the study of carbon trading mechanisms incorporating government variables, Wu et al. (2021) established a differential game model to explore the interactive strategies between the government and supply chain enterprises under the carbon trading mechanism and subsidies and obtained the optimal solutions for the government and supply chain participants under different scenarios by applying the optimal control principle. Hu and Ding (2020) using the intermediary and moderating effect approach; examined the mediating effect of carbon trading and total factor productivity; investigated the moderating mediating effect under the influence of green innovation, marketization and government subsidies; and explored whether carbon trading can balance corporate effectiveness and green efficiency and the optimization strategy of corporate carbon reduction. Lu and Cang (2018) constructed a dynamic game model between the government and enterprises under the carbon trading mechanism and studied the effects of changes in different parameters on the probability of non-compliant emissions and government verification based on their respective expected utilities. Xu and Dong (2017) constructed an evolutionary game model between local governments and power generation enterprises, theoretically investigated the evolutionary laws and conditions for the existence of evolutionary stabilization strategies under the carbon emission trading mechanism, analyzed the factors affecting the direction of the evolutionary equilibrium of the system, and provided some policy suggestions for the government to guide power generation enterprises to reduce emissions consciously. Studies from other perspectives have also been designed, such as the aspects of enterprise carbon trading operation benefits and enterprise carbon trading operation improvement measures (Chen 2016; Chen and Yu 2018; Liao et al., 2018; Song et al., 2018; Zhang 2018; Wang et al., 2019; Yang and Yang 2019; Ren et al., 2020; Yu et al., 2020; Yu and Liu 2020; Zhou et al., 2020; Sun et al., 2021; Yu et al., 2021; Zhang 2021; Zhang et al., 2021; Lin and Wu 2022).

Willingness to participate is a psychological decision of the decision-making subject before the actual participation behavior, which reflects the action tendency of the decision-maker before the participation behavior and is a typical representative of behavioral willingness. There are many methods to study willingness to participate at home and abroad, mainly including the scale method, behavioral observation method and physiological response method. Among them, the scale method has a large number of questions and is prone to halo error and tendency error, while the behavioral observation method and the physiological response method are difficult to implement. As a widely used method to evaluate the non-use value of ecosystem services and environmental goods, the stated preference method can construct hypothetical scenarios and present them to the respondents and is often used to study consumer preferences with a small number of questions and is easy to implement, which can make up for the shortcomings of the above three methods. The choice experiment (CE) method, as a typical stated preference (SP) method, is applicable to the case of simultaneous changes in multiple elements and can be useful in measuring the relative value and relative importance among the elements (Lv 2013), with the significant advantage of observing individual choices in different hypothetical contexts (Li et al., 2019). This method is well suited for this study because enterprise carbon trading is not yet fully used widely and public familiarity is not yet high.

There are few typical studies in China and abroad on the relationship between carbon trading and enterprise willingness to participate. For example, Zhao et al. (2018) designed a discrete choice format questionnaire with multiple constraints and studied the impact of carbon trading schemes in China by analyzing 555 valid questionnaires and identified the factors that influence enterprise willingness to pay for carbon emissions. Based on the theoretical framework of planned behavior and the natural resource-based view of enterprises, Zou et al. (2020) investigated the three dimensions of the willingness to participate in carbon trading of emission control enterprises in the context of carbon trading: behavioral attitude, subjective norms, and perceived behavioral control. They constructed a theoretical model of emission control enterprise willingness to demand forestry carbon sinks and empirically tested the influence of each factor on the willingness and demand of emission control enterprise forestry carbon sinks using 396 emission control enterprise actual research data using the Heckman two-stage model. Zhou et al. (2020) considered enterprise active participation in carbon trading as a form of corporate eco-innovation and integrated resource-based theory and managerial cognitive theory with this premise. Using a combination of qualitative and quantitative analysis methods, he investigated enterprise heterogeneity—the relationship between resources, capabilities, managerial interpretation, and enterprise willingness to participate in carbon trading—from the perspective of enterprises. Based on resource base theory and managerial cognitive theory, Yan and Liu (2021) used research data from 222 manufacturing enterprises to investigate the mechanisms of the role of resource base and managerial explanation on enterprise willingness to participate in carbon trading. Gao (2017) examined the firm choice preferences of closely related key design elements of firms and to examine the design elements that significantly affect firm choice preferences by conducting a hypothetical scenario experiment of key design elements of firms and to give the policy options that firms prefer under these design elements, to test and revise the three scenario recommendations proposed by the preassessment and to propose a complete scenario recommendation for the industry market mechanism.

In summary, the current research on the design of enterprise carbon trading mechanisms mainly focuses on the design of enterprise carbon trading mechanisms, and there is a lack of research from the perspective of enterprises, the main body of carbon trading. When the carbon trading mechanism changes, it is bound to have an impact on the economic benefits of enterprises, and enterprises need to respond quickly. By investigating the changes in enterprise willingness to participate when the carbon trading mechanism changes, we can provide an effective reference for policy-makers. The current research literature related to enterprise willingness to participate in carbon trading is relatively small and does not focus on power generation enterprises but on the three dimensions of forestry carbon sink demand willingness and demand willingness, enterprise heterogeneity and willingness to participate, manager interpretation and willingness to participate, and key design elements of enterprises and enterprise preferences. Research that explores the relationships between two variables—carbon trading mechanism changes and changes in power generation enterprise willingness to participate—is lacking.

3 Present situation and mode analysis of enterprise carbon trading

3.1 Concept and steps of carbon trading

Carbon trading is based on trading carbon dioxide emission rights as a commodity, which has the advantage of controlling carbon emissions in aggregate. According to the experience of the operation of the international carbon market, there are two types of carbon trading: quota-based trading and project-based trading. Quota-based trading is a type of aggregate trading in which emission quotas are bought and sold between trading entities due to limited supply under the premise of controlling the total amount of carbon traded. Project-based trading is acquiring certified emission reductions (CERs) by implementing emission reduction projects based on the clean development mechanism, the voluntary emission reduction mechanism, and the joint implementation emission reduction mechanism.

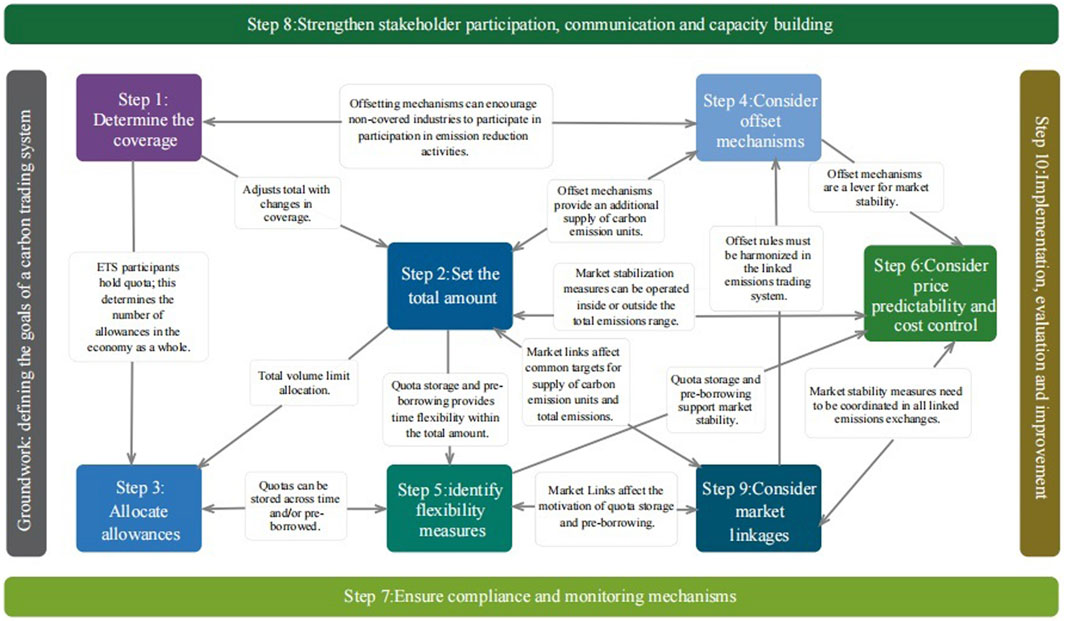

Typically, a carbon trading system design consists of ten steps1, as shown in Figure 2. The first step is to determine the coverage, i.e., the geographic areas, sectors, sources, and types of greenhouse gases to which the relevant entities must contribute quotas. The second step is to set the total amount, which limits the total amount of quotas available for issuance over a specified period of time, and thus the total amount of emissions generated by regulated entities in the carbon market. The third step is to allocate quotas, which defines the matching allocation methodology and policy objectives, defines the eligibility and methodology for the free allocation of quotas and balances them over time through auctions. The fourth step is to consider offset mechanisms, help expand the supply of carbon quotas and reduce compliance costs in the carbon trading system by considering whether to accept offsets from sources and industries not covered within and/or outside the jurisdiction. The fifth step is to identify flexibility measures, i.e., setting rules on quota storage, determining rules on quota preborrowing and early allocation and setting the length of the reporting and compliance cycles. The sixth step is to consider price predictability and cost control, select appropriate instruments to intervene in the market and define the regulatory framework. The seventh step is to ensure compliance and monitoring mechanisms, i.e., identifying control units, approving and managing verification agencies, establishing and monitoring the carbon trading system registry, designing and implementing penalty mechanisms and enforcement mechanisms and regulating and supervising the market for trading carbon quotas. The eighth step is to strengthen stakeholder participation, communication and capacity building. Stakeholders and their respective positions, interests and concerns should be clarified, and transparent decision-making processes should be coordinated in a cross-sectoral way to avoid policy dissonance. The ninth step is to consider market linkages, i.e., through market linkages. Carbon 2trading systems allow control units to use carbon emission units (quotas or credits) issued by a carbon trading system in another jurisdiction to complete compliance tasks. The tenth step is implementation, evaluation and improvement. This includes determining the timing and process for implementation of the carbon trading system, determining the process and scope of the review and evaluating the carbon trading system to support the review.

FIGURE 2. Ten steps in the design of a carbon trading system2.

3.2 Present situation and problems of enterprise carbon trading

The development of China’s carbon trading market is mainly divided into two stages: the first stage is the carbon trading pilot stage from 2011 to 2020, and the second stage is the national carbon trading market stage from 2021 to the present.

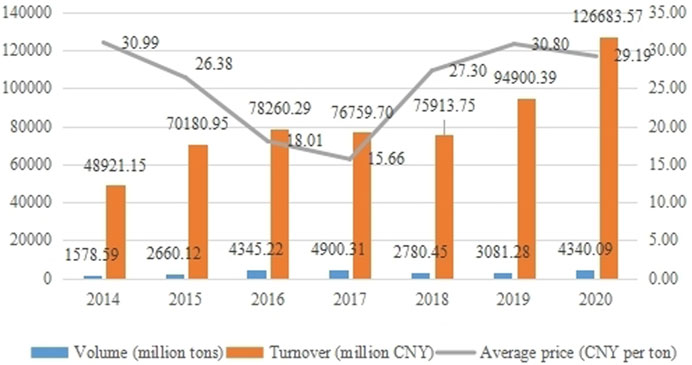

Since 2011, China has launched local pilot carbon trading in eight provinces and cities, including Shenzhen, Shanghai, and Beijing, and officially launched the carbon trading pilot in 2013. In terms of industries, the eight high-energy-consuming industries, including power generation, petrochemicals, chemicals, building materials, iron and steel, non-ferrous metals, paper, and domestic civil aviation, are the main industries. In terms of quota allocation, most regions adopt a combination of free allocation and paid bidding. As shown in Figure 3, from 2014 to 2020, the overall volume of the pilot carbon trading market shows a fluctuating trend of first increasing and then decreasing and then increasing, the overall turnover of the pilot carbon trading market shows a growing trend, and the overall average price of the pilot carbon trading transaction shows a trend of first decreasing and then increasing.

FIGURE 3. China’s pilot carbon trading market volume, turnover and average price (2014–2020) (unit: million tons, million CNY, CNY per ton). Data source: Shanghai Energy and Environment Exchange https://www.cneeex.com/.

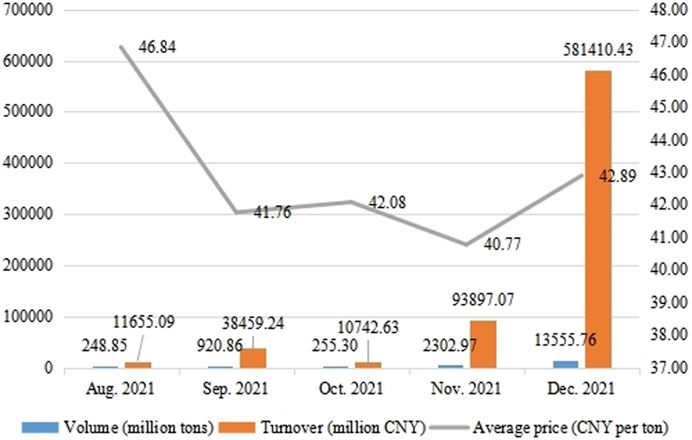

On 16 July 2021, the national carbon market opened for trading, China’s carbon trading market entered the second phase, and the carbon market formally moved from the pilot to the national level. On 31 December 2021, the first compliance period of the national carbon trading market ended successfully. As shown in Figure 4, the carbon trading volume and turnover of each month in the first compliance period of the national carbon trading market showed an overall growth trend and increased significantly in November and December, the average transaction price showed an overall trend of first decreasing and then increasing, and the difference between the months did not exceed 6 CNY per ton. In terms of compliance, the compliance completion rate of the first compliance cycle of the national carbon market was 99.5%, which was a good compliance situation overall. In terms of enterprise participation, 2,162 key emission units in the power generation industry were included in the first compliance cycle, and the willingness of key emission enterprises to trade rose, with a number of energy enterprises completing compliance ahead of schedule, increasing trading activity and rising awareness of emission reduction among enterprises. Overall, the role of the national carbon market as an important policy tool to control and reduce greenhouse gas emissions and promote the achievement of carbon peaking and carbon neutrality was initially reflected.

FIGURE 4. Volume, turnover and average price by month in the first compliance period of the national carbon trading market (unit: million tons, CNY, and CNY per ton). Data source: Shanghai Energy and Environment Exchange https://www.cneeex.com/.

Since the launch of the national carbon market, the market has been active, with prices rising steadily and running smoothly. However, some experts expressed their views on the theme of “Promoting the Construction of a High-Quality National Carbon Market” at the online Carbon Neutral Summit Forum, saying that one of the main reasons for the low scale of market transactions at this stage is the enterprise willingness to participate in market transactions3. The enterprise willingness to participate in the market is still to be improved. The reasons for the low willingness of enterprises to participate in carbon trading are probably the following. First, most enterprises have difficulty in grasping the essence of carbon trading within a short period of time, and lack talents with the knowledge and ability to participate in carbon market trading. Second, the current penalty measures are light, which leads to the lack of high restraint on enterprise carbon emissions. Third, the instability of the policy makes enterprises think that it is risky to participate, thus favoring a risk-averse strategy to hold a wait-and-see attitude. Fourth, the trading product is single, currently there are only quotas and CCER spot, not involving futures and other carbon quota derivatives, and the market is not liquid enough. Fifth, some enterprises have low awareness of carbon emission reduction, and while the overall performance is good, some enterprises have insufficient compliance. Therefore, there is an urgent need for in-depth research to explore the impact of the design of enterprise carbon trading mechanism on enterprise willingness to participate from the perspective of enterprises, so as to improve enterprise willingness to participate in carbon trading and actively complete their carbon emission reduction tasks.

3.3 Enterprise carbon trading system design

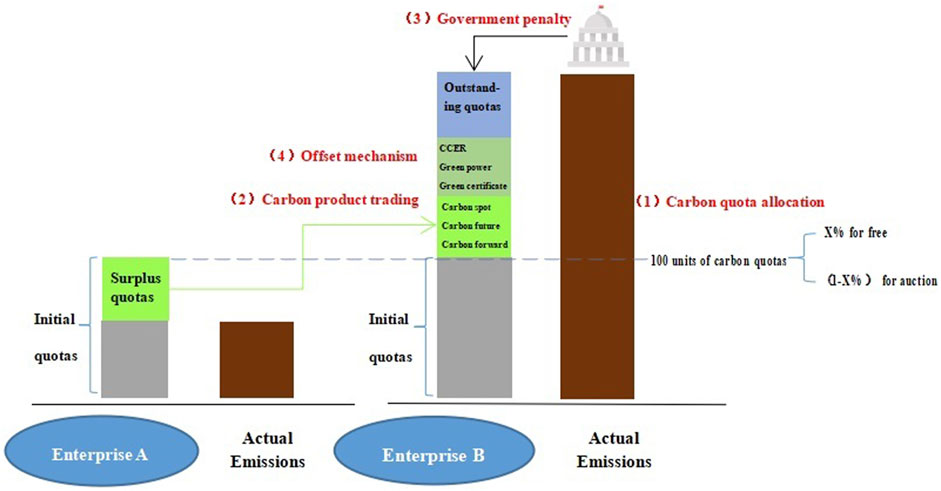

Combined with the introduction of carbon trading system design in Section 3.1, the key factors affecting the effectiveness of enterprises are considered from the perspective of enterprises. At first, enterprises need to make a judgment on the tendency of the required auction ratio in carbon quota acquisition based on their own financial situation and carbon emission estimation. To meet the different degrees of auction demand of enterprises, this study sets up different auction ratios of carbon quota allocation. After enterprises determine carbon quotas, they may need to purchase carbon quotas to meet their carbon emission demand when the actual operation situation deviates from expectations. As a carbon asset, it is theoretically possible to either purchase a spot directly or exercise its commercial attributes as futures. Therefore, this study selects three types of carbon products traded: carbon spots, which are currently implemented, and carbon futures and carbon forward, which may be added in the future. In addition to purchasing carbon quotas, enterprises can offset a portion of their carbon quotas in the form of offsets. In addition to the already implemented CCER offsets, green power offsets and green certificate offsets also have greater potential for the current exploration of offset mechanisms. The current penalty of a 10,000–30,000 CNY fine is considered by some scholars to be relatively light; therefore, this study designed two stronger penalty schemes on this basis. Figure 5 presents the current corporate carbon trading model and the four key factors.

Considering that the experiment should be as close to the real situation as possible so that respondent choice results are closer to the actual behavior, this paper sets up the operational context of enterprise carbon trading. The state allocates the allowed carbon emissions (i.e., initial carbon quotas) to emission-controlling enterprises at the beginning of each year according to the total carbon emission target so that the emission-controlling enterprises have certain carbon emission rights in their daily operations. If the actual carbon emissions of the enterprise in the current year are greater than the allocated carbon quotas, it can buy carbon quotas through the carbon trading market, and vice versa, it can sell carbon quotas for profit. Suppose an enterprise has 100 units of initial carbon quotas per year, which can be freely bought, sold or traded in the middle of the year and will be zeroed out at the end of the year.

3.3.1 The four key attributes of an enterprise carbon trading system

3.3.1.1 Carbon quota allocation

① Free acquisition, which means that the government allocates a certain amount of initial carbon quotas to enterprises for free (each enterprise receives the same amount of initial quotas when they are distributed for free).

② Obtained by auction, which means that the government sells the initial carbon quotas to enterprises in the form of an auction, and the auction price is usually approximately half of the market price (under the auction approach, enterprises can purchase more initial quotas from the government at a lower price and sell them in the future at the market price to earn the difference).

Whether the quotas are obtained for free or by auction, they can be traded in the future market. The current quota auction mechanism adopted by the EU carbon trading market is as follows: ① Since 2013, all quotas in the electricity production sector will be auctioned and will no longer have free quotas; for the modernization and renewal of power generation facilities, free quotas can continue to be granted. ② Other sectors adopt a step-by-step transition, specifically: 80% of the total quota for these sectors in 2013 will be free quotas, and 20% will be auctioned; thereafter, the proportion of free quotas will be reduced annually on average to 30% in 2020.

Referring to the auction ratio of the EU carbon trading market and considering the actual situation of China’s fledgling national carbon trading market, this study sets two attribute levels: “80% for free and 20% for auction” and “60% for free and 40% for auction”. In addition, a scenario of increasing auction ratio is developed (Xue 2011).

3.3.1.2 Carbon product trading

According to the current policy and market mechanisms in China, the current carbon market trading instruments mainly focus on carbon spots. Since carbon futures and carbon forward are two trading instruments that are expected to be utilized to some extent in the future, they are also designed to be included. Carbon futures are the underlying material for buying and selling CO2 but for delivery or settlement in the future, and the carbon forward is the agreement between two parties to buy or sell a certain amount of carbon credits or carbon units at a certain price at a certain time in the future.

3.3.1.3 Government penalty

Under the carbon trading mechanism, there is a constant dynamic evolution between the government and power generation enterprises, and the size of government penalties is directly linked to the motivation of enterprises to reduce emissions based on their own initiative. The current commonly implemented penalties are fines of 10,000–30,000 CNY. However, in early 2021, when the State collected comments on the Interim Regulations on Carbon Emission Trading Management (Draft Revision), many scholars proposed more severe penalties and selected two measures with a certain degree of distinction among many measures, including a fine of 30,000–100,000 CNY and a fine of 2–5 times the value of carbon emission quotas calculated by the average market price of that year.

3.3.1.4 Offset mechanisms

Offset mechanisms allow emission reductions and/or decarbonization from sources not covered by the carbon trading system to have an offsetting effect. Once accepted, they are equivalent to carbon trading system allowances and can be used to meet compliance obligations in the carbon market. Current offset types mainly include CCER offsets, considering other offset methods that may be tested in the future, among which green certificate offsets can advance the process of China’s power system reform, alleviate the current cash flow problems of renewable energy enterprises, accelerate the consumption of scenic power, and enhance the penetration of non-water renewable energy generation. Green power offsets help energy-using enterprises broaden their emission reduction paths, promote the optimization and adjustment of the energy consumption structure on the power user side, enhance the comprehensive regulation capacity of the power system, and highlight the green environmental value attributes of new energy generation. Therefore, two offset mechanisms are added: green power offset and green certificate offset.

3.3.2 Trading process design of the enterprise carbon trading system

As shown in Figure 5, Firm A and Firm B have the same 100 units of carbon quotas (gray dashed line), and if compliance is set on an annual basis, the carbon emissions of A and B cannot exceed the carbon quotas they have at the end of the year. If the emissions exceed the carbon quota, enterprises will face a penalty in the form of a fine.

Enterprise A, whose actual carbon emissions for the year are less than 100 units (its brown part does not reach the gray dashed line), can sell its surplus quotas (light green part) to Enterprise B. Enterprise B, whose actual carbon emissions for the year exceed 100 units, needs to offset its excess through the offset mechanism (dark green part) or buy it from A to complete compliance and avoid fines.

The above process is carried out in the unified platform, and the relevant government departments verify the carbon transactions of enterprises annually according to the standards set by the Ministry of Ecology and Environment and incorporate the carbon transactions of enterprises into the management scope of the credit system to ensure the authenticity, integrity and accuracy of the transactions.

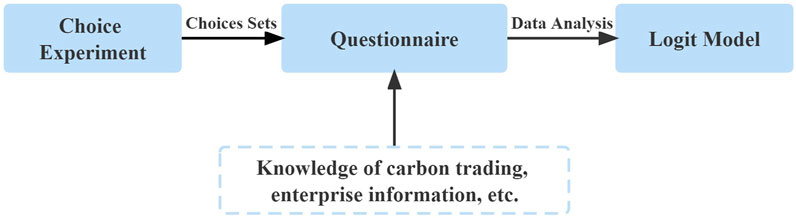

4 Statistics and methods

There are three main research methods in this paper, as shown in Figure 6: the choice experiment method, the questionnaire survey method, and the logit model. Among them, the choice experiment method is realized by a questionnaire survey, and the logit model is used to analyze the data of the choice experimental method.

First, the choice set is derived by the choice experiment method. Second, it is included in the questionnaire survey (which has aspects other than the choice set) to collect data. Finally, the questionnaire data are analyzed, and the factors influencing the willingness to participate and their degree of influence are obtained by the logit model.

4.1 Choice experiment

The choice experiment method requires subjects to make a choice between a set of virtual products or options in a particular context, each option being defined by multiple attributes, with differences in the values of the attributes determining the differences in the options. Based on subject decision information, the researcher is able to analyze subject preferences for each option attribute and further assess the value of the different attributes to provide a basis for public policy formulation. Usually, the basic steps of the choice experiment method are as follows: ① setting the context of the experiment; ② selecting the experimental attributes and their levels; ③ designing the experimental task; ④ conducting research to collect data; and ⑤ modeling and analysis (Quan 2016).

4.1.1 Setting up the context

The context for the implementation of the experimental approach chosen in this paper is the enterprise carbon trading system created in Part 2, and this study is conducted on emission-controlled power generation companies that have participated in the national carbon trading. To facilitate respondent understanding of how corporate carbon trading works, we inserted an explanation of the corporate carbon trading model into the electronic questionnaire at the same time.

4.1.2 Attributes and attribute levels

Setting attributes and attribute levels are key factors in selecting experimental methods, which generally follow the following principles. First, the selected attributes should reflect the main characteristics of the research subjects. Second, since too many attributes will lead to an increase in experimental complexity and may confuse participants and reduce the accuracy of experimental results, the number of selected attributes should generally not exceed 10. Finally, the selected attributes should be closely integrated with the research content.

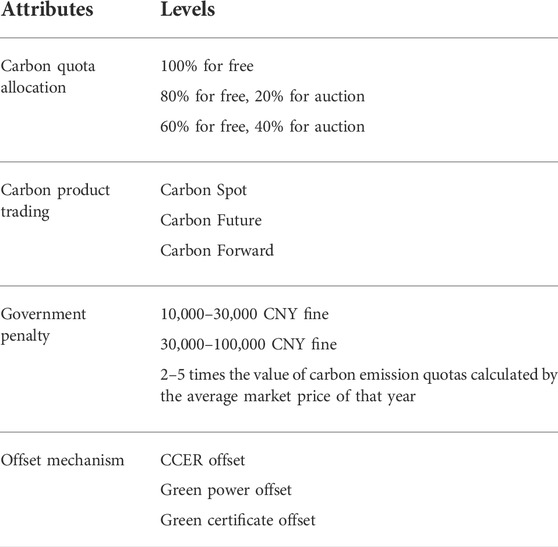

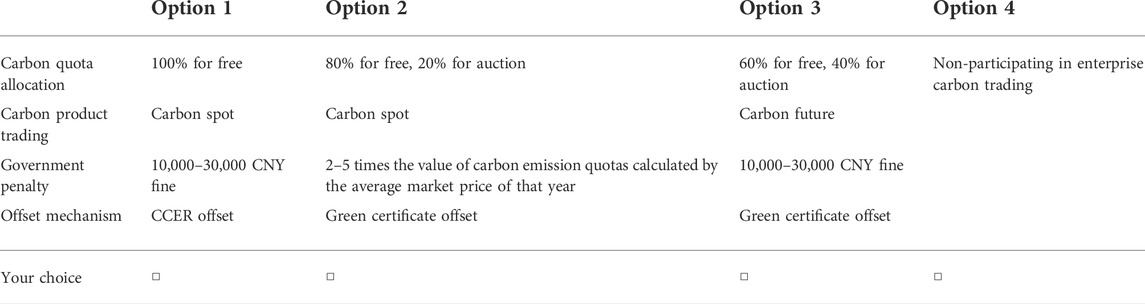

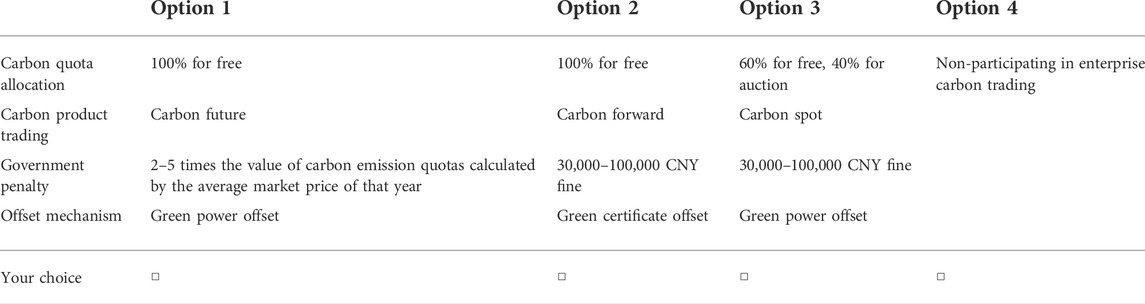

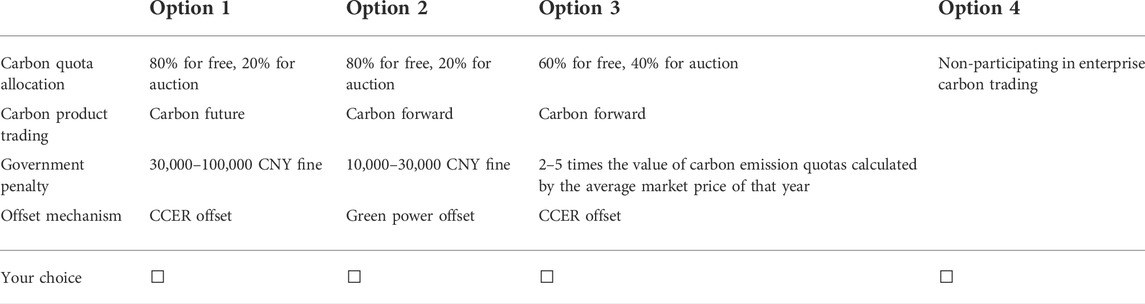

Combined with the design of the carbon trading mechanism of enterprises in the previous paper, this study assumes four major attributes: carbon quota allocation, carbon product trading, government penalty, and offset mechanism. Considering the actual national conditions and acceptance, the level of each attribute is shown in Table 1.

4.1.3 Experimental design

According to the number and level of attributes listed in Table 1, a total of 81 different combinations can be obtained (3 × 3×3 × 3 = 81). Based on the operability and measurement efficiency, the SPSS orthogonal experiment method was used to further derive 9 representative individual carbon trading schemes. Using random numbers from 1 to 9, they were randomly grouped to form 3 choice sets (see Tables 1–4), and each choice set contained 3 scenarios, each of which was composed of four major attributes. It should be noted that considering that some respondents might not want to participate in corporate carbon trading, the option of “not participating in corporate carbon trading” (i.e., option 4) was added to each choice set.

4.2 Questionnaire design

The subject of this study is the influence of carbon trading market mechanism design on the willingness of power generation enterprises to participate in carbon trading; therefore, it is reasonable to propose an hypothesis that in which the different degrees of understanding of carbon trading will affect the willingness of enterprises to participate in carbon trading.

The first part is a survey on the basic situation of enterprises, including nine basic questions, such as the city where the enterprise is located, the type of enterprise, the installed capacity of the enterprise, and the power generation mode that accounts for the largest proportion of the enterprise power generation structure.

To quantify the degree of enterprise understanding of carbon trading, the second part of the questionnaire was set up: the degree of understanding of the carbon trading mechanism. Based on the literature on the concept of carbon trading and its realization path and combined with the ten steps of the carbon trading system for enterprises, six single- and multiple-choice questions were set, covering the principles of carbon trading, trading subjects, trading objects, allocation methods, etc. These six questions have standard answers, and the scores are used to quantify the degree of enterprise understanding of carbon emissions.

In the third part of the survey, we set up a feedback survey after participating in carbon trading, which was conducted from the external factors of the enterprise, the internal factors of the enterprise carbon trading mechanism design and the external policy factors, to understand as much as possible all the possible influencing factors inside and outside the enterprise in the process of carbon trading.

The fourth part is a survey on enterprise willingness to participate in carbon trading, including 3 choice sets (based on the experimental design in Part 4.1, each respondent is randomly assigned to one choice set). The 3 choice sets can be used to explore enterprise willingness and tendency to participate and combined with the feedback survey after participating in carbon trading in Part 3 to better optimize the design of the enterprise carbon trading mechanism to improve the willingness of emission control enterprises to participate and enhance the emission reduction effect.

4.3 Logit model

The logit model is one of the discrete choice method models, which is often used in data analysis of the choice experiment method, and it is able to study the key attributes that affect the willingness of enterprises to participate in carbon trading and the degree of their influence. When using the logit model, it is necessary to first determine the explained variables (dependent variables) and the explanatory variables (independent variables). Second, we process the data and set the appropriate dummy variables. Finally, we interpret the coefficients of the logit regression results.

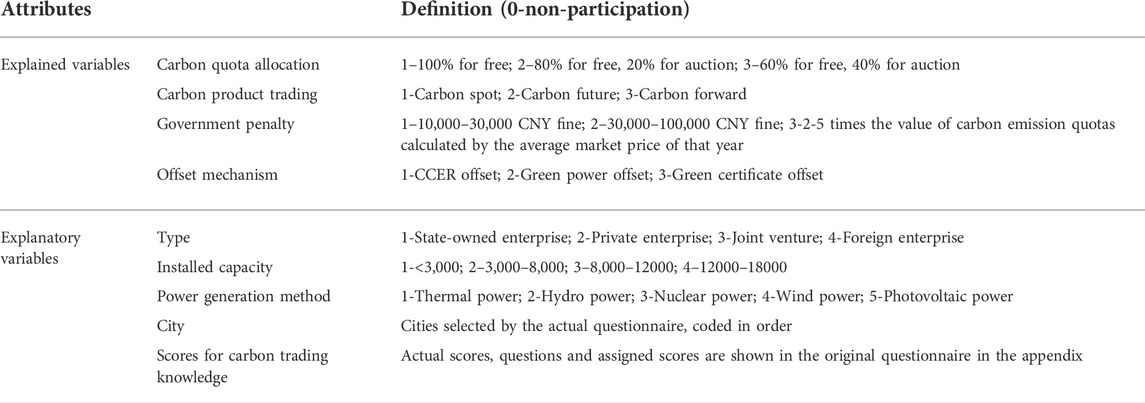

Therefore, to make the data convenient for statistical analysis in the logit model, the variables need to be coded first, as shown in Table 5. The explained variables are the four major attributes and their levels, and the explanatory variables are those related to the enterprises.

5 Results and analysis

The research objects were power generation enterprises that have participated in national carbon trading. To ensure the validity of the questionnaire and reduce errors, two questions were set at the beginning of the questionnaire: whether the company is a power generation company and whether it has participated in the national carbon trading. The platform was set up to screen when it was distributed; that is, when the questionnaire was completed, if the answer to either of the above two questions was no, the platform automatically determined that the questionnaire was invalid. A total of 300 valid questionnaires were collected. Based on these 300 valid questionnaires, the following analysis was conducted.

5.1 Basic situation analysis of enterprises

Four basic questions were set in the first part of the questionnaire: the city where the enterprise is located, the type of enterprise, the installed capacity of the enterprise, and the power generation method that accounts for the largest proportion of the enterprise power generation structure. The results are as follows:

For the city where the enterprise is located, a total of 22 provinces were involved, as shown in Figure 7, where the three provinces with the largest share were Beijing (26%), Hebei (14%), and Tianjin (11%). The diversity of provinces also ensured the richness of the questionnaire to a certain extent and reduced the impact caused by the variability of the degree of carbon trading implementation among enterprises in different cities.

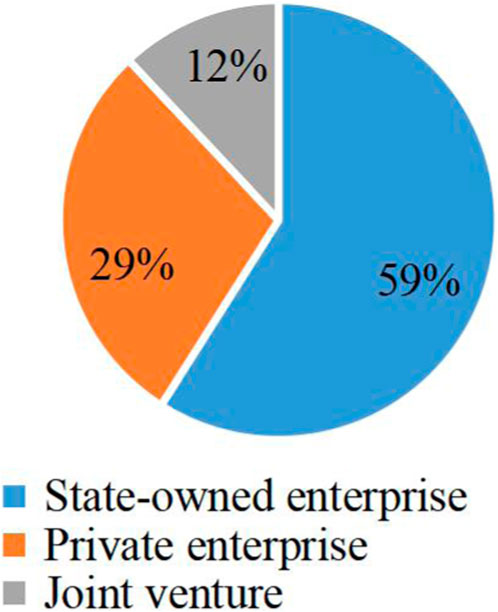

For the types of enterprises, as shown in Figure 8, the proportion of state-owned and non-state-owned enterprises in the sample was not very different, which could avoid the situation in which the research results were only applicable to state-owned enterprises and could not be useful for all power generation enterprises to a certain extent.

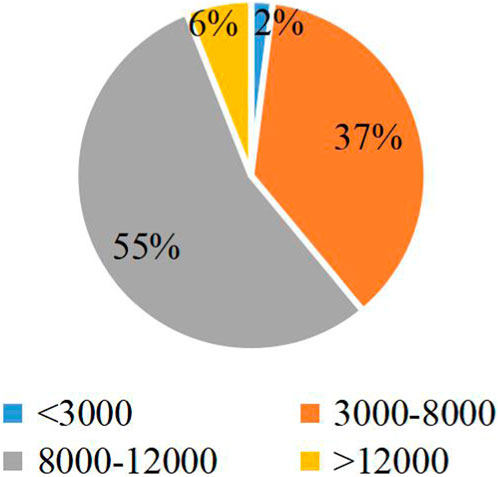

For the enterprise installed capacity, the 2021 China Electricity Map of the country’s total installed electricity capacity layout released by the National Energy Administration shows an installed capacity span of 0–18,000 million kilowatts. Based on this layout map, 3,000, 8,000, and 12,000 three split lines were set (in million kilowatts). The results are shown in Figure 9, which shows that the vast majority of the installed capacity range was focused on a range of 3,000–12000 million kilowatts, accounting for a total of 92%. The data span well.

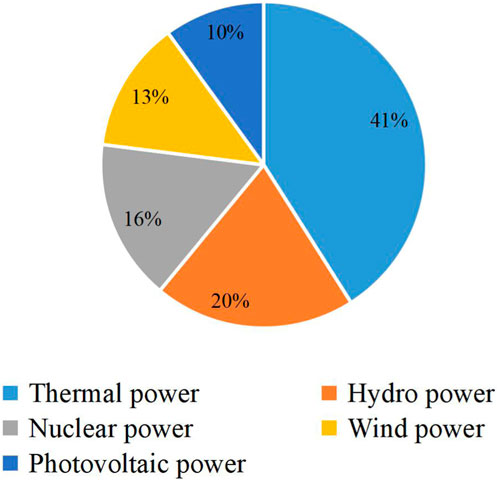

The generation method that accounts for the largest share of the enterprise power generation structure is shown in Figure 10. Although thermal power generates carbon emissions, it is still inevitable that it was the largest power generation method in the corporate power generation structure. On the other hand, various clean energy sources other than thermal power accounted for a total of 59%, and the most used among the various clean energy sources was hydro power, which showed that enterprises are also attempting to shift to clean energy.

5.2 Analysis of the level of knowledge about carbon trading of enterprises

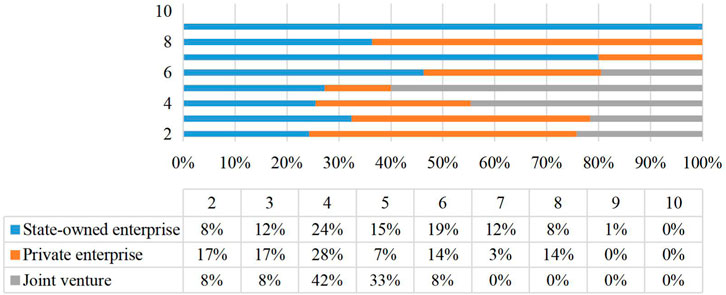

In the second part of the questionnaire, six questions related to the carbon trading mechanism of enterprises were included, each with a unique correct answer, providing 1 point for a correct single choice question and 1 point for each correct choice of a multiple choice question, for a total score of 10 points. The results were as follows: 2 points (11%), 3 points (13%), 4 points (27%), 5 points (15%), 6 points (16%), 7 points (8%), 8 points (9%), and 9 points (1%). Overall, the majority of the scores were 4–6, and the specific calculation showed that the average score was 4.77, which did not reach half of the total score, indicating that most enterprises are still in a relatively elementary understanding of the carbon trading mechanism, i.e., the degree of understanding is not high. This also indicates that the power generation enterprises participating in the national carbon trading still need to further learn the relevant knowledge and understand the carbon trading mechanism more deeply.

A further cross-tabulation analysis was performed with the type of enterprise, as shown in Figure 11. State-owned enterprises scored from 2 to 9 points, private enterprises scored from 2 to 8 points, and joint ventures scored from 2 to 6 points. At the same time, the calculation yielded an average score of 5 for state-owned enterprises, 4.48 for privately owned enterprises, and 4.25 for joint ventures. On the one hand, there was a large difference in the scores of the same type of enterprises. On the other hand, the overall level of understanding of joint ventures was lower, while the level of understanding of state-owned enterprises was relatively high compared to that of private enterprises and joint ventures.

FIGURE 11. Cross-tabulation analysis of enterprise type and carbon trading mechanism knowledge score.

5.3 Analysis of external carbon trading policy factors of enterprises

Considering the current implementation of national carbon trading and policy support, three policy factors were designed to improve the efficiency of enterprises, and the questions were also included as ranking questions without restricting the number of rankings. The results show that the first choice of “allow preborrowing between compliance periods” was 29%, the first choice of “allow storage between performance periods” was 55%, and the first choice of “allow flexible adjustment of the length of the performance period” was 16%. More than half of the enterprises preferred “allow storage between performance periods.” If we disregard the ranking and only consider whether or not to choose, the results still indicate that the largest number of enterprises (85%) chose the option “allow storage between performance periods.” By implementing storage, it is possible to achieve emission reductions in the present in exchange for increased emissions in the future. Storage can facilitate cost-effective emission reductions by providing the flexibility needed for those wishing to reduce emissions earlier, thereby preparing for more stringent total controls in the future.

5.4 Research analysis of enterprise willingness to participate in carbon trading

5.4.1 Analysis of the impact of enterprise carbon trading attributes on willingness to participate

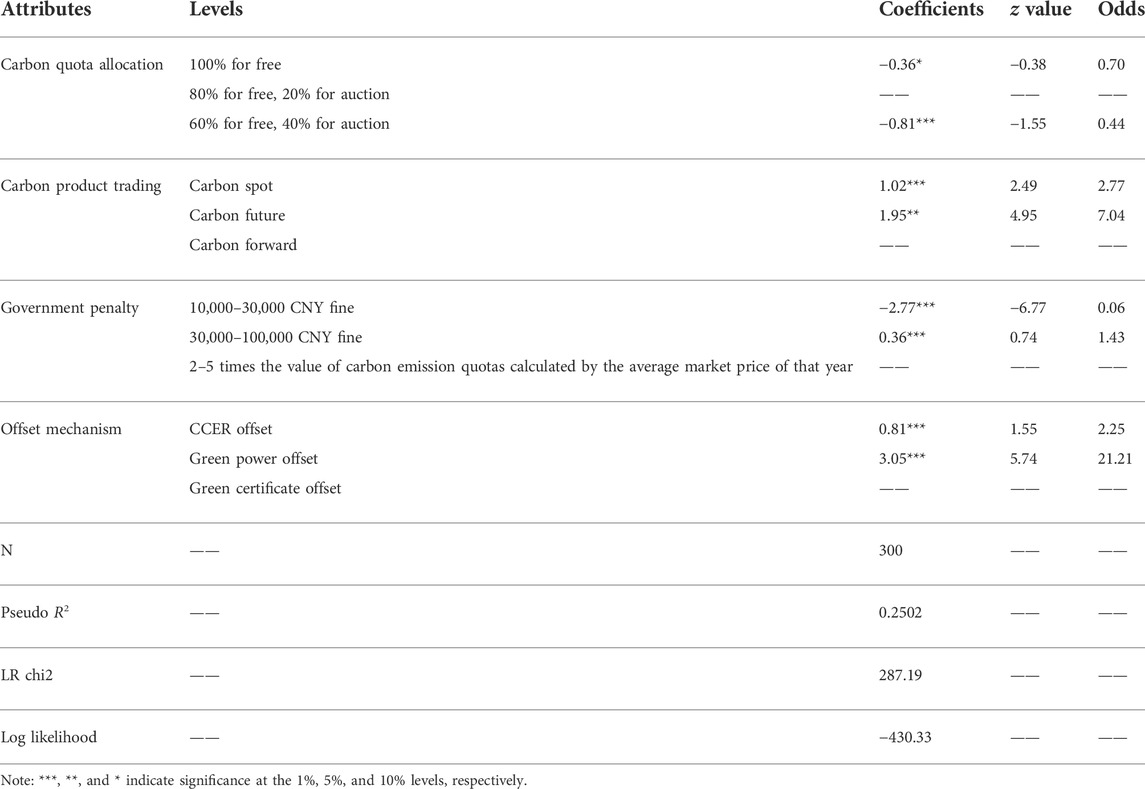

In this section, the impact of the four main attributes of the enterprise carbon trading system (carbon quota allocation, carbon product trading, government penalty, and offset mechanism) on enterprise willingness to participate in carbon trading is investigated. Using econometric Stata 16.0 software, a conditional logit model was applied in the analysis, and the results are shown in Table 6.

In Table 6, the coefficients are the original values of the regression results, which indicate the utility of the attribute level to influence the willingness of firms to participate in carbon trading; the z value is used to measure the variance multiple of the deviation of the sample mean from the overall mean, i.e., the degree of deviation from the variance. As a non-linear model, the regression coefficients of the conditional logit model are not directly interpreted as the marginal impact of each attribute level on decision-making, but the impact of the respective variables on individual program choice can be intuitively reflected by calculating the chance ratio (odds ratios) of each attribute level. In this study, the variables with relatively low levels under each attribute were selected as the reference group.

In the bottom part of Table 6, pseudo R2 values indicate the explanatory power of independent variables in the model on the variance of the dependent variables, which ranges from 0 to 1. The larger the value is, the stronger the explanatory power. In this study, pseudo R2 = 0.2502, indicating that the model analytical results can be accepted. LR chi2 is used to test the independence or determine the association between the categorical variables. The log-likelihood value indicates the value of the log-likelihood function that maximizes it, and usually it is negative.

Table 6 shows that only the “100% for free” of carbon quota allocation is significant at the 10% confidence level, and carbon futures of carbon product trading attributes is significant at the 5% confidence level, while all the remaining levels are significant at the 1% confidence level, which has a significant impact on enterprise willingness to participate in carbon trading. The magnitude of the coefficients in the table reflects the relative importance of the impact of the corresponding level variables of the set attributes on the willingness of enterprises to participate in carbon trading. Combining the coefficients and chance ratios in the table, it can be concluded that the influence of all attribute levels on the willingness to participate in the national carbon trading power generation enterprises is ranked from largest to smallest: offset mechanism > carbon product trading > government penalty > carbon quota allocation.

(1) The offsetting mechanism has the greatest impact on enterprise willingness to participate in carbon trading, and the utilities are all positive. Among them, CCER offset can increase surveyed enterprise willingness to participate in carbon trading by 0.81 times compared to green certificate offset, while green power offset can increase surveyed enterprise willingness to participate in carbon trading by 3.05 times. An ideal situation is that, although purchasing green power may cost more, enterprises can use green power certificates to convert a certain amount of carbon emission reduction, saving their own carbon emission quotas, which can be used as an important basis for carbon emission reduction when verifying carbon emissions, which is also the future development trend. In addition, enterprises can also use the “green certificate” as a basis for carbon tariff reductions for export products, and if there is a balance of carbon quotas, they can also be listed and traded in the future. By purchasing green power, power enterprises not only meet the demand of clean energy production but can also obtain authoritative green environmental value certification, achieving a high degree of unity of economic, social, and environmental benefits.

(2) The degree of influence of carbon product trading on the willingness to participate is in second place. Compared with carbon forward, choosing carbon spots and carbon futures as carbon products can increase the willingness of enterprises to participate in carbon trading by 1.02 times and 1.9 times, respectively. While both carbon futures and carbon forward involve delivery and payment in the future, the major difference between the two is that futures are standardized and traded on an exchange, while forward is privately negotiated and executed by several parties. For example, certified emission reductions (CERs) generated from clean development mechanism (CDM) projects are often traded in the form of carbon forward. The parties enter into a contract, specifying the future price, quantity, and timing of the carbon credits or units to be traded, before initiating a project. They are non-standardized contracts that are not generally traded on an exchange, and the price, timing, and location of the product are negotiated through the over-the-counter market, but they are susceptible to project default risk due to the looser regulatory structure. Therefore, carbon futures have less market risk than carbon forward.

(3) Among the government penalties, different penalty schemes present different impact effects. A fine of 10,000–30,000 CNY will decrease enterprise willingness in participating in carbon trading by 2.77 times, while a fine of 30,000–100,000 CNY will increase enterprise willingness in participating in carbon trading by 0.36 times. Compared to the current measure of a 10,000–30,000 CNY fine already in place, the option of a 30,000–100,000 CNY fine only has an increase in quantity but is not affected by the carbon price in the real-time carbon market. In contrast, a fine of 2–5 times the value of carbon emission quotas calculated by the average market price of that year is much higher than the first two options in terms of risk, and the degree of penalty may become the largest. According to the above analysis, it can be seen that for enterprises, although most of them think that the current penalties are not obvious for promoting their business, they do not want to take too much risk themselves.

(4) Among the attributes studied, carbon quota allocation is the last one in terms of relative importance for enterprise willingness in participating in carbon trading. In the carbon quota allocation, taking “80% for free, 20% for auction” as the reference, choosing “100% for free” will reduce the willingness to participate by 0.36 times, and choosing “60% for free, 40% for auction” will reduce the willingness to participate by 0.81 times. This may indicate that auctioning a certain percentage of carbon quotas helps enterprises make flexible arrangements to make judgments to obtain as much corporate benefits as possible, while auctioning more than a certain percentage of carbon quotas may play a counterproductive role; therefore, the 20% auction ratio is more moderate for enterprises.

The last column in Table 6 shows the chance ratio of each attribute level, which indicates the value of the relative probability change of the chosen option caused by a certain attribute level when the interaction of each attribute is held constant for other attribute levels. Depending on the sign and magnitude of the model parameter estimates, the relative value of the change in the probability of the chosen option can reflect the influence of each attribute level on people’s choice decision. In the offset mechanism, the probability of being selected will increase by 225% if changing from the reference scheme green certificate offset to the CCER offset and by 2,121% if changing to the green power offset. In the case of carbon product trading, the probability of being selected increases by 277% if the reference option is changed from carbon forward to carbon spots and by 704% if the reference option is changed to carbon futures. In terms of the government penalty, if the reference option is changed from “2–5 times the value of carbon emission quotas calculated by the average market price of that year” to “10,000–30,000 CNY fine,” the probability of being selected for this option will decrease by 94%, and if it is changed to “30,000–100,000 CNY fine,” the probability of being selected will increase by 43%.

5.4.2 Heterogeneity analysis of enterprise willingness to participate in carbon trading

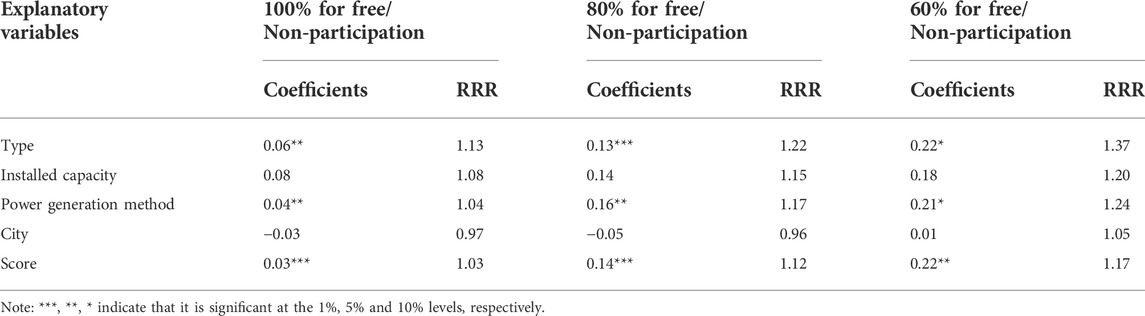

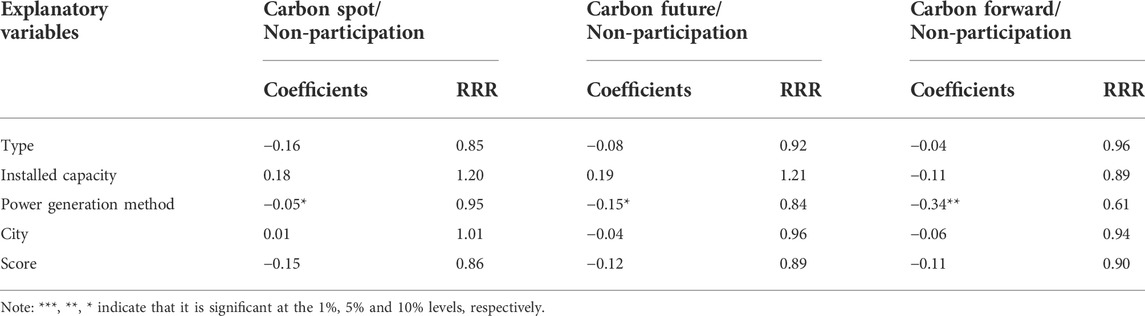

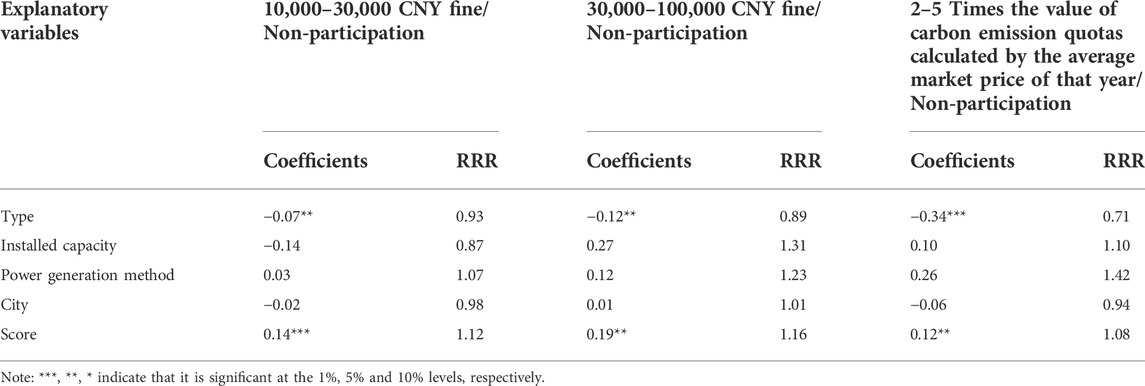

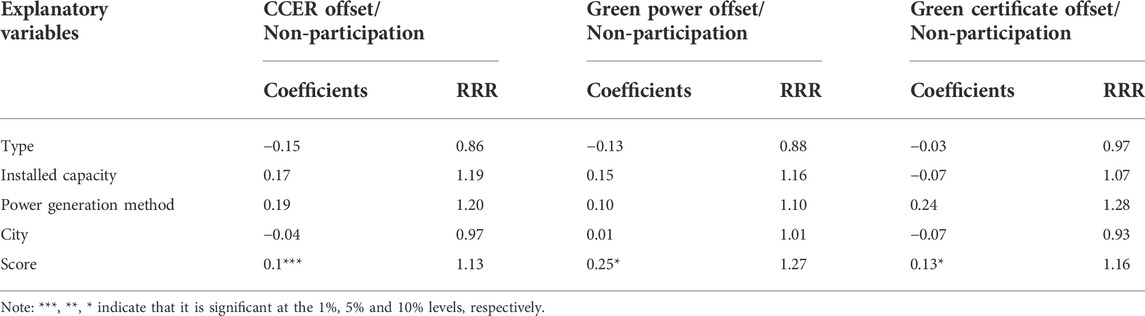

To further analyze the magnitude and direction of the influence of enterprise characteristic factors on the willingness of enterprises to participate in carbon trading, this paper adopts a multinomial logit regression model (mlogit) and incorporates five factors, which are enterprise type, enterprise installed capacity, enterprise power generation method, enterprise city, and carbon trading knowledge score, into the analysis from the four attributes that constitute enterprise carbon trading: carbon quota allocation, carbon product trading, government penalty, and offset mechanism.

n the mlogit models of the five attributes, the significance of the model likelihood ratio test is less than 0.001, and the significance of the goodness of fit is greater than 0.05, indicating that the original hypothesis can be accepted; that is, the model using the mlogit model to analyze the influence of the basic characteristics of enterprises and the degree of knowledge of carbon trading on enterprise willingness to participate in carbon trading is valid. The regression results of the parameters of the model are shown in Tables 7–10. The coefficients in the tables are the original values of the regression results, which indicate the degree of influence of enterprise characteristic factors on the tendency to choose the four major attributes; RRR (relative risk ratio) is the ratio of two probabilities; the explained variables are the four major attributes of carbon quota allocation, carbon product trading, government penalty and offset mechanism; and the explanatory variables are enterprise type, installed capacity, power generation method, city, and knowledge of carbon trading.

TABLE 7. Influence of enterprise characteristics on the choice of carbon quota allocation when participating in carbon trading.

From the model results, it can be seen that the carbon trading knowledge score, generation method and type all have significant effects on enterprise willingness to participate in carbon trading.

The carbon trading knowledge score affects three aspects of carbon trading, namely, the carbon quota allocation, government penalty and offset mechanism. As shown in Table 7, the willingness of enterprises to purchase a larger proportion of carbon quotas increases with the level of knowledge about carbon trading. The coefficients of “100% for free,” “80% for free, 20% for auction,” and “60% for free, 40% for auction” are 0.03, 0.03, and 0.03, respectively, indicating that the three scores have a positive effect on enterprise willingness to participate in carbon trading. The relative risk ratios are 1.03, 1.12, and 1.17, respectively, indicating that for every 1 point increase in the knowledge score of carbon trading, the probability of choosing the three levels of quotas will increase by 3%, 12%, and 17%, respectively, compared to the group that is unwilling to participate in enterprise carbon trading. The cross-sectional comparison also shows that the more people that know about carbon trading, the more willing they are to reduce enterprise carbon emissions by purchasing carbon quotas. Similarly, it can be seen from Tables 9, 10 that, all other things being equal, the probability of choosing the CCER offset, green power offset and green certificate offset increases by 13%, 27%, and 16%, respectively, for every 1-point increase in the knowledge score of carbon trading compared to not participating in enterprise carbon trading. Compared to not participating in carbon trading, the probability of a fine of 10,000–30,000 CNY, a fine of 30,000–100,000 CNY, and a fine of 2–5 times the value of carbon emission quotas calculated at the average market price for that year increases by 12%, 16%, and 8%, respectively. It can be seen that the offset mechanism and government penalties for green power offset and the fines of 30,000–100,000 CNY are more favorable.

The power generation method affects two aspects of enterprise carbon trading, namely, carbon quota allocation and carbon product trading. As shown in Table 7, with the transition from non-clean energy to clean energy, for carbon quota allocation, the probability of choosing “100% for free,” “80% for free, 20% for auction,” and “60% for free, 40% for auction” increases by 4%, 17%, and 21%, respectively, compared to not participating in carbon trading. As seen from Table 8, the probability of choosing carbon spots, carbon futures, and carbon forward decreases by 5%, 16%, and 39%, respectively, for carbon product trading. Specifically, the reasons for this are as follows: for carbon quota allocation, as power generation transitions from non-clean to clean energy, carbon emissions are relatively decreasing, which in turn leads to a lower demand for purchasing carbon credits to reduce enterprise carbon emissions; then, the demand for the auction ratio decreases. For carbon product trading, it can be seen that carbon spots to carbon futures and then to carbon forward is transformed to allow the price of buying or selling to be determined in the present, and the requirement for delivery and payment will be reflected in the contract as a specific date in the future. As power generation methods transition to clean energy and carbon emissions are relatively lower, the need for carbon credits and the timing of delivery are gradually decreasing, and often the carbon spot trading method will meet the current needs of enterprises.

TABLE 8. Influence of enterprise characteristics on the choice of carbon product trading when participating in carbon trading.

The type of enterprise affects two aspects of enterprise carbon trading, namely, carbon quota allocation and government penalties. As seen from Table 7, with the change in enterprise type from state-owned enterprises to non-state-owned enterprises, the probability of choosing “100% for free,” “80% for free, 20% for auction,” and “60% for free, 40% for auction” for carbon quota allocation decreases by 13%, 22%, and 37%, respectively. As shown in Table 9, the probability of choosing a fine of 10,000–30,000 CNY, a fine of 30,000–100,000 CNY, and a fine of 2–5 times the value of carbon emission quotas calculated by the average market price of that year decreases by 7%, 11%, and 29%, respectively, for the government penalty. This may be explained by the fact that non-state-owned enterprises are less capable of regulating carbon emissions and less flexible in adjusting them compared to state-owned enterprises and have a higher probability of actual carbon emissions higher than expected or the initial allocated value of carbon quotas. Thus, non-state-owned enterprises may purchase a larger percentage of carbon quotas to reduce carbon emissions on the one hand and may hope the penalties will be skewed to a lesser degree when there is overdue clearance of carbon quotas on the other hand.

TABLE 9. Influence of enterprise characteristics on the choice of government penalty when participating in carbon trading.

From Table 7 to Table 10 it can be seen that there is no significant effect of installed capacity and city on each attribute of enterprise carbon trading. The reason for this phenomenon is that the installed capacity is not sensitive to the enterprise willingness to participate in carbon trading, and most of the surveyed enterprises are located in the first and second tier cities with more developed and modernized economies, and the enterprises in these cities have the practical foundation and certain theoretical knowledge of enterprise carbon trading, so there is not much difference in the willingness of the surveyed enterprises to participate.

TABLE 10. Influence of enterprise characteristics on the choice of offset mechanism when participating in carbon trading.

6 Policy recommendations

On the basis of exploring the basic situation of power generation enterprise participation in carbon trading and their understanding of carbon trading, this paper focuses on measuring the impacts of changes in the design of the carbon trading mechanism on enterprise willingness to participate in carbon trading and the impact of enterprise heterogeneity factors on enterprise willingness to participate in carbon trading. Based on the research results, the following policy recommendations are proposed to help improve the construction of the carbon trading market, increase enterprise willingness to participate in carbon trading, and actively complete carbon emission reduction tasks.

First, carbon quotas should be allowed to be stored between different compliance periods. The results of the questionnaire show that for different policy support options, the highest number of enterprises chose the option “allowing storage between compliance periods,” with a preference of 85%. By implementing storage, emission reductions can be achieved in the present in exchange for increased emissions in the future. Storage can facilitate cost-effective emission reductions by providing the flexibility needed for those wishing to reduce emissions earlier, thereby preparing for more stringent total controls in the future.

Second, there should be a focus on training professional talent. Research shows that the degree of understanding of carbon trading has a significant positive correlation with the enterprise willingness to participate in carbon trading. Therefore, cultivating a group of high-level talents who are familiar with the carbon trading mechanism and carbon trading instruments will not only lay a solid foundation for the construction of the national carbon market, but also effectively increase the enterprise willingness to participate in carbon trading and achieve the task of carbon emission reduction.

Third, relevant policy tendencies should be adjusted based on the influence of enterprise carbon trading attributes on willingness to participate. In regard to carbon quota allocation, the scenario results simulated in this study can be used as a reference, i.e., increasing the appropriate proportion of auctioned carbon quotas can help increase enterprise willingness to participate. In regard to carbon product trading, carbon spots still play an important and irreplaceable role, and if we want to increase the types of carbon product trading, we may consider carbon futures, which has the greatest impact on enterprise willingness to participate. In regard to offset mechanisms, although there are advantages and disadvantages for each of the three offset mechanisms, this study shows that green power trading is preferred by enterprises in the current situation, which also indicates that this offset mechanism may have greater potential. In regard to government penalties, this study shows that most companies believe that the current penalties, while light, need to be moderately increased.

Fourth, the response measures on the enterprise side of carbon trading should be improved. When the proportion of auction options available for carbon quota acquisition increases in the future, research shows that the willingness to participate will show a trend of rising first and then falling; therefore, power generation enterprises, after considering their own financial situation and development plans, can appropriately consider raising the budget for purchasing carbon quotas in the auction session based on the carbon quotas issued by the state for free. In terms of carbon quota trading, carbon futures and carbon forward are expected to enter the carbon market with the increasing number of carbon products in the future. Based on the results of this study, it can be seen that if companies want to try new types of carbon product trading, carbon futures will be a good choice, based on the fact that they are proficient in trading with carbon spots. In addition to purchasing carbon quotas, companies can also use offset mechanisms to offset a portion of their carbon quotas. As offset mechanisms become increasingly abundant, enterprises can selectively prefer to expand green power offsets to achieve carbon quota reductions. The purchase of green power by power companies not only meets the demand for clean energy for production but also obtains authoritative green environmental value certification, achieving a high degree of unity in regard to economic, social and environmental benefits. At the same time, with the trend of increasing penalties, companies need to be more cautious in thinking about the larger corporate costs of not completing carbon emissions and should shift from thinking about offsetting government penalties with corporate benefits generated by carbon emissions to thinking about how to maximize corporate benefits based on completing carbon emissions on time.

Ffth, the system construction should be improved to promote the stable development of the carbon market. On the one hand, research shows that the existing carbon spot trading does not fully meet the needs of enterprises, and the current trading single product is relatively single. Therefore, the national level needs to improve the construction of the carbon market as soon as possible, so as to prepare for the introduction of new trading products in the future. On the other hand, the impact of offset mechanism on enterprise willingness to participate in carbon trading shows that both green power offset and green certificate offset play a certain degree of role in promoting carbon trading compared with CCER offset. Therefore, we can consider the introduction of both green power and green certificate markets, vigorously develop the integration market, and establish a nationwide unified carbon emission trading system with a large market.

7 Conclusion

This study applied the choice experiment method, combined with a conditional logit model and multinomial logit model, to explore the study of the impact of carbon trading market mechanism design on power generation enterprise willingness to participate and came to the following conclusions:

First, this study shows that the influence of four key attributes of the existing enterprise carbon trading model on the willingness of power generation enterprises that have participated in national carbon trading to participate is ranked from largest to smallest: offset mechanism > carbon product trading > government penalty > carbon quota allocation. Among the different attribute levels of each key attribute, enterprises are most inclined at an attribute level of “80% for free, 20% for auction” for the carbon quota allocation attribute, an attribute level of carbon futures for the carbon product trading attribute, an attribute level of “30,000–100,000 CNY fine” for the government penalty attribute, and an attribute level of green power offset regarding the offset mechanism.

Second, this study shows that three heterogeneous factors, enterprise type, enterprise generation method and enterprise carbon trading knowledge score, all affect enterprise willingness to participate in carbon trading. Among them, enterprise type affects the carbon quota allocation factor and government penalty factor; the enterprise generation method affects the carbon quota allocation factor and carbon product trading factor; and the enterprise carbon trading knowledge score affects the carbon quota allocation, government penalty and offset mechanism of enterprise carbon trading.

Third, relevant policy recommendations are proposed to promote the construction of enterprise carbon trading mechanisms and enhance enterprise willingness to participate in carbon trading. According to the degree of influence of the four attributes on enterprise willingness to participate in carbon trading, the policy implementation tendency of carbon quota allocation, carbon product trading, offset mechanism and government penalty is appropriately adjusted. The construction of storage between different compliance periods, the construction of professional talent, the enterprise response measures and the construction of overall carbon market system should also be promoted.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Ethics statement

The study does not require approval because it is an anonymous survey of willingness to participate in a particular policy and is not related to the human body. The research was conducted in accordance with the principles embodied in the Declaration of Helsinki and in accordance with local statutory requirements. All participants gave written informed consent to participate in the study and agreed to publication.

Author contributions

D-SZ: conceptualization, methodology, writing-original draft preparation, and writing. T-TF: conceptualization, reviewing and editing, collecting related information, and supervision. J-JK:writing.

Funding

This paper is supported by the National Natural Science Foundation of China (Grant No. 42171278), the National Natural Science Foundation of China (Grant Nos. 71991481 and 71991480), the Fundamental Research Funds for the Central Universities (Grant No. 2652019083), the Beijing Municipal Social Science Foundation (17YJC029), and the National Natural Science Foundation of China (Grant No. 51978443).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Ref: Market Readiness Partnership (PMR) and International Carbon Action Partnership (ICAP), 2016,Carbon emissions trading practice manual: design and implementation of carbon markets. World Bank, Washington. License: Creative Commons Citation License CC BY 3.0 IGO.

2Ref: Market Readiness Partnership (PMR) and International Carbon Action Partnership (ICAP), 2016, Carbon emissions trading practice manual: design and implementation of carbon markets. World Bank, Washington. License: Creative Commons Citation License CC BY 3.0 IGO.

3Source: CSCN. [EB/OL]. http://field.10jqka.com.cn/20210813/c631838280.shtml.

References

An, C. Y., and Tang, Y. J. (2012). Research on the decision model of carbon emission reduction of enterprises under the emission trading mechanism. Econ. Res. 47, 45–58.

Chen, K., and Yu, W-Y. (2018). Research on the response strategies of thermal power generation enterprises in the context of carbon trading. Guangdong, China: Guangdong R&D Center for Technological Economy, 34–35+37.

Chen, T. (2016). Research on the response strategies of Chinese enterprises under the national carbon trading situation. Environ. Sci. Manag. 41, 73–76.

Dong, K. Y., Dong, X. C., and Jiang, Q. Z. (2020). How renewable energy consumption lower global CO2 emissions? Evidence from countries with different income levels. World Econ. 43 (6), 1665–1698. doi:10.1111/twec.12898

Dong, K. Y., Sun, R. J., and Dong, X. C. (2018). CO2 emissions, natural gas and renewables, economic growth: Assessing the evidence from China. Sci. Total Environ. 640-641, 293–302. doi:10.1016/j.scitotenv.2018.05.322

Gao, S. (2017). Experimental study on the design of new market mechanism and corporate behavior scenarios for international carbon trading. Beijing, China: Tsinghua University.

Hu, Y. F., and Ding, Y. Q. (2020). Can a carbon trading mechanism balance corporate efficiency and green efficiency? China Popul. Resour. Environ. 30, 56–64.

Li, W. B., Li, W. B., Long, R. Y., Chen, H., Yang, M. Y., Chen, F. Y., et al. (2019). Would personal carbon trading enhance individual adopting intention of battery electric vehicles more effectively than a carbon tax? Resour. Conservation Recycl.

Liao, N., Zhao, Y. L., He, Y., and Zhou, Y. (2018). Simulation analysis of the impact of carbon trading policy on profit and carbon emission of electricity and coal supply chain. China Manag. Sci. 26, 154–163. doi:10.16381/j.cnki.issn1003-207x.2018.08.016

Lin, B. Q., and Wu, N. (2022). Will the China's carbon emissions market increase the risk-taking of its enterprises? Int. Rev. Econ. Finance 77, 413–434. doi:10.1016/j.iref.2021.10.005

Liu, C., Song, Y., Guo, Y., Pi, F., Yao, W., Xie, Y., et al. (2019). Determination of the effects of torularhodin against alcoholic liver diseases by transcriptome analysis. Free Radic. Biol. Med. 27, 47–54. doi:10.1016/j.freeradbiomed.2019.07.033

Liu, C. Z., and Liu, B. L. (2015). Principal-volume-benefit analysis of enterprises' emission reduction decisions under carbon quota trading mechanism. Finance Account. Mon., 40–41.

Lu, M., and Cang, Y. Q. (2018). The game study of government regulation and enterprise emissions under carbon trading mechanism. Contemp. Econ., 78–80.

Lu, Y. J. (2019). An empirical study on the impact of carbon emission trading mechanism on the carbon management level of enterprises. Shanghai, China: Shanghai Jiaotong University.

Lv, H. H. (2013). Research on the evaluation of national forest park recreational resources value based on choice experiment method. Dalian, China: Dalian University of Technology.

Ma, M. J., Li, Q., and Han, Q. (2019). Research on carbon emission reduction trading mechanism of electric power enterprises based on Agent-CET model. Ind. Eng. 22, 87–92.

Meng, A. L. (2015). Research on the cooperative emission reduction strategy of supply chain enterprises based on carbon emission trading mechanism. Chongqing, China: Chongqing Jiaotong University.

Ren, X. S., Ma, X., Liu, Y. J., and Zhao, G. H. (2020). Impact of carbon trading policy on economic performance of high pollution industrial enterprises: an empirical analysis based on multiple mediating effects model. Resour. Sci. 42, 1750–1763. doi:10.18402/resci.2020.09.10

Song, X., Jiang, X., Zhang, X., and Liu, J. (2018). Analysis, evaluation and optimization strategy of China thermal power enterprises’ business performance considering environmental costs under the background of carbon trading. Sustainability 10, 2006. doi:10.3390/su10062006