- 1Graduate Institute for Taiwan Studies, Xiamen University, Xiamen, China

- 2School of Economics and Management, Henan Agricultural University, Zhengzhou, China

- 3School of Digital Economics, University of Sanya, Sanya, China

- 4School of Economics, Xiamen University, Xiamen, China

Energy conservation and emission reduction of the manufacturing industry are of great significance for promoting China’s high-quality economic development. In this paper, the Luenberger productivity index based on the data envelopment analysis (DEA) method is used to measure the green total factor productivity (GTFP). The regression results show that, on one hand, environmental regulation on Taiwan-funded enterprises has a negative impact on the GTFP, which implies that these enterprises need to pay “compliance costs” due to the implementation of environmental regulation policies of Chinese local governments. On the other hand, Taiwan-funded enterprises who can create a large number of jobs have strong bargaining power with the local governments, hence have more opportunities to be exempted from environmental regulations to a certain extent. Therefore, in order to prevent local governments from failing to strictly implementing environmental regulations on Taiwan-funded enterprises, it is suggested that environmental protection achievements be included in the performance appraisal system for the local governments. Chinese local governments should start with a weaker enforcement of environmental regulation, by giving Taiwan-funded enterprises a certain buffer period to gradually adjust the policies intensity. Production characteristics and pollution density of Taiwan-funded enterprises should be considered when enforcing environmental regulation. It is also suggested that environmental, social and governance (ESG) scores of Taiwan-funded enterprises should be taken as a part of their credit qualifications, so as to enhance the internal motivation of energy conservation and emission reduction of these enterprises. In this way, environmental regulation will play a full role in promoting the GTFP of Taiwan-funded enterprises, and help the high-quality development of Chinese economy.

1 Introduction

In the past century, the development of science and technology has led to continuous economic growth. However, the huge consumption of the energy and the damage of the environment have made the conflict between human and nature increasingly acute. It is imminent to establish a resource-saving and environment-friendly society, to develop a low-carbon and circular economy. As the world’s second largest economy, China has to undertake the responsibility of energy conservation, emission reduction and environmental protection. At the 75th Session of the United Nations General Assembly in 2020, Chinese President announced that China would achieve the goal of peaking carbon dioxide and other greenhouse gas emissions by 2030 and achieving carbon neutrality by 2060. Energy conservation and emission reduction as well as green transformation and upgrading of the manufacturing industry are of great significance for promoting China’s high-quality economic development and achieving the goal of carbon neutrality, and promoting the GTFP of manufacturing enterprises.

Since the Chinese government put forward the “double carbon” target in 2020, emissions reduction has become the focus of the Chinese government’s work (Jiang et al., 2022), a series of environmental regulations has been enacted. Scholars also pay more and more attention to the issue about energy conservation, emission reduction and environmental protection, there are many related studies in the existing literature. However, there is almost no research on the environmental performance of Taiwan-funded enterprises. When scholars study the impact of environmental regulation on the GTFP of enterprises, most of them focus on domestic-funded or foreign-funded enterprises. Compared with other types of enterprises, Taiwan-funded enterprises have specific characteristics. Since the recovery of cross-strait economic and trade relations in the late 1980s, Taiwan-funded enterprises have played an important role in providing employment, promoting industrial upgrading, and helping Chinese mainland deeply enter the international market. According to the statistics of “Taiwan’s Investment Board of Ministry of Economic Affairs”, Taiwan’s cumulative investment in Chinese mainland reached 192.42 billion US dollars during the period from 1991 to 2020; According to the Ranking of China’s Top 500 Foreign Trade Enterprises in 2020 released by the Statistical Society for Foreign Economic Relations and Trade of China, Taiwan-funded enterprises occupied 3 seats among the top 10. However, as the environmental regulation implemented strictly, Taiwan-funded enterprises with high energy consumption, high pollution are facing the pressure of energy conservation, emission reduction and green transformation (Wu and Deng, 2019). In addition, Taiwan-funded enterprises in the mainland had advantages in technology, management and capital in the early stage of reform and opening up, and the mainland have implemented preferential policies for them to attract them to invest in the mainland, which gave them certain advantages in bargaining. Therefore, this paper focuses on Taiwan-funded enterprises in Chinese mainland and aims to answer two questions: first, how do environmental regulation policies in Chinese mainland affect Taiwan-funded enterprises’ GTFP? Second, whether Taiwan-funded enterprises have bargaining power on the environmental regulation policies with local governments of the Chinese mainland? If Taiwan-funded enterprises have, how does bargaining power affect the relationship between local government environmental regulation policies and enterprises’ green total factor productivity? To answer these questions, we conduct an empirical analysis, and the main findings are: the Chinese mainland environmental regulation will reduce the GTFP of Taiwan-funded enterprises; the more jobs opportunities the Taiwan-funded enterprises creates, the higher the bargaining power with the local governments, and the greater the possibility being exempted from environmental regulation to a certain extent.

This paper is different from the previous literature in several aspects. First, in China, it is of special significance to study the bargaining power, especially the bargaining power of Taiwan-funded enterprises in Chinese mainland, because of the particularity of Taiwan-funded enterprises and the great flexibility of Chinese local governments in implementing environmental regulations. At present, research on the bargaining power of Taiwan’s enterprises in Chinese mainland is almost blank. Most researches focus on the role of policies on enterprises, and this paper also examines on the reaction of enterprises to policy implementation; Second, different from the previous literature that mainly uses output value or tax to measure enterprises’ bargaining power, this paper finds it is more reasonable to use employment to measure bargaining power for Taiwan-funded enterprises; Third, unlike the existing literature, this paper uses the green TFP to measure the productivity of enterprises, rather than the traditional TFP. It is generally believed that the traditional TFP overestimate true productivity; Fourth, many of current literatures focus on carbon emissions, while this paper applies to various forms of pollutants, mainly waste gas pollution, waste water pollution and industrial soot pollution; Last but not least, the existing literature often analyze a group of countries within one framework, ignoring the lack of uniform environmental regulations across countries. This paper focuses on different enterprises inside one country, so there is no such a problem of legal heterogeneity. Based on these, we believe that, studying the impact of environmental regulation policies on the GTFP of Taiwan-funded enterprises in Chinese mainland will add micro-evidence to relevant theories, and discussing the distortion of environmental regulation policies by bargaining power of Taiwan-funded enterprises will provide a useful reference for policy makers or enforcers.

The rest of this paper is arranged as follows: Section 2 proposes two theoretical hypotheses, that is, the environmental regulation will reduce the GTFP of Taiwan-funded enterprises, and the bargaining power of Taiwan-funded enterprises has a negative effect on the implementation of the environmental regulation policies in Chinese mainland; Section 3 explains the processing of variables, focusing on calculating the GTFP index of Taiwan-funded enterprises and the urban environmental regulation index; Section 4 conducts empirical analysis using panel data of Taiwan-funded enterprises, to verify the two theoretical hypotheses proposed, to reveal the impact of environmental regulation on the GTFP of Taiwan-funded enterprises and the negative effect of the bargaining power of Taiwan-funded enterprises with the local governments; Section 5 are the conclusions and policy recommendations.

2 Theoretical hypotheses

2.1 The impact of environmental regulation on the green total factor productivity

With the increasing amount of attention given to ecological protection, the balance between environmental regulation and economic development is at the center of academic and policy debates. Environmental regulation, such as collecting the pollution discharge fees, is the main mean for the government to realize the green transformation of enterprises. In China, the relationship between environmental regulation and green total factor productivity of enterprises is so important that it cannot be overemphasized, but the conclusions remain controversial. The impact of environmental regulation on the GTFP of enterprises is mainly summarized as “Porter Hypothesis” and “Compliance Cost Hypothesis”. The “Porter Hypothesis” believes that reasonable environmental regulation can stimulate the “innovation compensation effect,” which can not only compensate the “compliance cost,” but also improve the productivity and competitiveness of enterprises (Porter and Linde, 1995). Jaffe and Palmer (1997) also believe that the mechanism of environmental regulation is to internalize the externalities generated in the production activities into the production costs of enterprises, and then force enterprises to carry out technological innovation. Fan et al. (2022) show that environmental regulation indirectly promotes GTFP by enhancing green technological innovation level. Jin et al. (2022) constructs a GTFP evaluation index system and analyzes the impact of environmental regulation on GTFP in the context of increasing innovative labor force. Guan and Wu (2020), Liu et al. (2020), Xiao et al. (2020) all support the “Porter Hypothesis”. The “Compliance Cost Hypothesis” believes that environmental regulation will lead to a “distortion effect of resource allocation” and hinder the improvement of GTFP. Xie et al. (2017), Yuan and Xiang (2018) show that environmental regulation will increase the cost of enterprises and squeeze out R&D investment, which is not conducive to the improvement of GTFP of enterprises.

However, more and more studies have found that the impact of environmental regulation on the GTFP of enterprises cannot be simply attributed to “Porter Hypothesis” or “Compliance Cost Hypothesis.” Shen and Liu (2012) show that there is a U-shaped relationship between the intensity of environmental regulation and technological innovation, and the “Porter hypothesis” can only be realized when the intensity of environmental regulation exceeds a certain threshold; Li and Tao (2012) show that the intensity of environmental regulation in heavily polluted industries is relatively reasonable, which may promote the GTFP, improve technological innovation and efficiency. The relationship between environmental regulation and GTFP, technological innovation or technological efficiency is U-shaped in moderately and mildly polluted industries. Yu and Hu (2016) show that environmental regulation always has a negative impact on the technological innovation in the heavily polluted industries, an impact with the U-shaped relationship in the mildly polluted industries. Yin and Wu (2021) show that the impact of government-controll environmental regulation follows the “Compliance Cost Hypothesis” with a lag of two periods, and the impact of public participation environmental regulation follows the “Porter hypothesis” with a lag of two periods, and the impact has regional differences. Cheng and Kong (2022) show that command-and-control (management) environmental regulations will boost the expansion of GTFP. This is mainly achieved by improving technological efficiency and narrowing the technological gap. Market-based environmental regulations can also accelerate the growth of GTFP, principally through improvements in the advancement of technology and a narrowing of the technological gap. Zou and Zhang (2022) show that the effect of command-and-control environmental regulation on GTFP is a significant inverted U-shape curve, which is currently the primary driving role in green development, but it is too strict and increasingly less effective. Both market incentive and voluntary environmental regulations appear as positive U-shape curves, and their proper enhancement is breakthrough for future green development. Besides, market incentive environmental regulation is more effective in pollution-intensive industries with relatively low pollution, while voluntary environmental regulation is sensitive to pollution-intensive industries with relatively serious pollution. Li and Chen (2019) show that environmental regulation reduces the GTFP of enterprises in the short-term, and promotes the GTFP in the long-term.

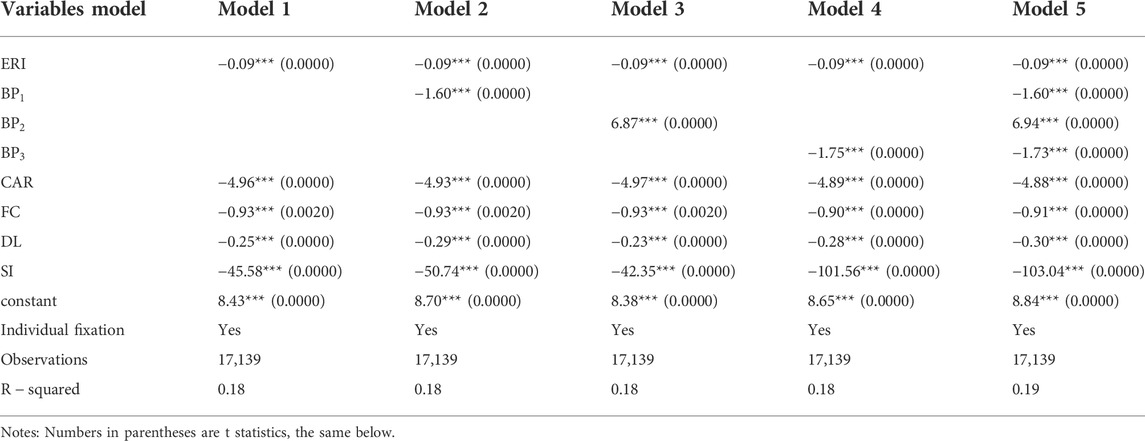

Therefore, the net impact of environmental regulation on the GTFP of enterprises depends on the balance between the innovation compensation effect and the resource distortion effect produced by the policies. In fact, in the past 30 years, many industries invested by Taiwanese in Chinese mainland were the sunset industries in Taiwan, with heavy pollution and high energy consumption. The data in Figure 1 supports this: during 1991 and 2021, about 50% of Taiwanese investment in Chinese mainland was concentrated in heavily polluting industries. In 2021, the proportion of Taiwanese investment in heavily polluting industries in Chinese mainland reached 64%. In terms of environmental management, the Ministry of Environmental Protection said that Taiwan-funded enterprises would be treated equally with mainland enterprises.1 This means that Taiwan-funded enterprises have to pay more than before for the environmental treatment costs, such as pollution discharge fees, which may reduce their GTFP. Based on this, this paper presents the first hypothesis: Chinese mainland environmental regulation policies will reduce the GTFP of Taiwan-funded enterprises.

FIGURE 1. The proportion of Taiwanese funded enterprises investing in heavily polluting industries in Chinese mainland during 1991 and 2021. Note: Figure is based on the data from “Taiwan’s Investment Board of Ministry of Economic Affairs”. According to the Guidelines for Environmental Information Disclosure of Listed Companies issued by the Ministry of Ecology and Environmental of the People’s Republic of China in 2010, mining industry, chemical manufacturing, chemical materials, plastic products, metal products, electronic components, computers, electronic products, and optical products, textile industry, leather, fur and their products, and pulp, paper, and paper products are regarded as heavy pollution industries.

2.2 The negative effect of the bargaining power of enterprises on environmental regulation

In China, environmental regulatory policies are generally formulated by the central government and implemented by the local governments. Due to the performance appraisal system of local governments and the promotion system of officials, local governments tend to pay more attention to economic development rather than environmental performance. Therefore, it is not unusual that local governments pursue a single economic goal and fail to accommodate long-term and overall interests by choosing to relax environmental controls, so enterprises may use their greater contribution to the performance appraisal of the local governments as a “bargaining chip” to obtain exemption or loose enforcement of environmental regulation. Xi (2017) point out that large taxpayers who make greater contribution to the performance appraisal of the local governments have strong bargaining power with the local governments which can weaken the effect of environmental regulation. In the view of Li and Chen (2019), to reflect the bargaining power of enterprises, regional GDP and stable employment are also important tasks for the local governments. The higher the industrial output value or more employees of the enterprises, the greater the contribution to the local governments, and then the enterprise will obtain greater bargaining power. When constructing the indexes of the bargaining power of Taiwan-funded enterprises, this paper uses Li and Chen (2019) as the main reference.

Employment, value-added tax and industrial output value are the three major contributions of Taiwan-funded enterprises to the local governments. Among the three, the highest contribution is employment, rather than value-added tax or industrial output value. First, the value-added tax payment of Taiwan-funded enterprises is relatively limited, which is not enough to form a strong bargaining power. For example, in 2007, the actual value-added tax rate of Taiwan-funded enterprises was 10.2%, far lower than the statutory rate of 17% (Yang et al., 2017); Second, the industrial output value of Taiwan-funded enterprises is also relatively limited. Most of the Taiwan-funded enterprises “put both ends abroad” (put the raw material market and sale market in the international market). According to the 2020 Factual Survey on Overseas Production of Export Orders, Taiwan’s manufacturing export orders accounted for 45.5% of its production in the mainland, of which 72.1% were exported to the United States or other countries. Therefore, the actual contribution of the industrial output value of Taiwan-funded enterprises to the local governments has been discounted. Third, most importantly, Taiwan-funded enterprises have created a large number of employment opportunities in the past decades. The minister of the Ministry of Commerce of the People’s Republic of China, pointed out in 2020: “Foreign trade and foreign investment directly and indirectly created more than 200 million jobs.” Taiwan-funded enterprises have created more than 12 million jobs in the mainland (Bai and Liu, 2020). Therefore, the bargaining power of Taiwan-funded enterprises with the local governments is mainly reflected in employment. Based on this, this paper presents the second hypothesis: the more the jobs created, the stronger the bargaining power of Taiwan-funded enterprises with the local governments and the greater they can weaken the implementation of environmental regulation.

3 Variables and data

3.1 Variable description and data processing

According to the two hypotheses put forward above, this paper will use the panel data of Taiwan-funded enterprises to examine the impact of environmental regulation or bargaining power on the GTFP. Therefore, the theoretic regression model is set up as follows:

In Eq. 1, GTFP is the green total factor productivity of Taiwan-funded enterprises, ERI is the environmental regulation intensity of the city where the enterprises are located, BP is the bargaining power of Taiwan-funded enterprises with the local government, vector X contains the control variables at the enterprise level, and vector Y contains the control variables at the city level, and Ɛ is the error term. In general,

There are two types of core explanatory variables in Eq. 1. First, the urban environmental regulation index (ERI) is calculated referring to the research of Fu and Li (2010). Three indexes (industrial wastewater discharge standard rate, industrial sulfur dioxide removal rate and industrial soot removal rate) are selected to measure the level of environmental regulation of a city. The data source used to calculate these indexes is the China City Statistical Yearbook over the years. Second, the bargaining power (BP) of Taiwan-funded enterprises is calculated referring to the research of Li and Chen (2019). This paper calculates three variables to indicate bargaining power, represented by BP1, BP2, and BP3, respectively. Mathematically, the three variables are defined as follows:

The data sources used to calculate the above three variables are the Chinese Industrial Enterprise Database and the China Urban Statistical Yearbook.

Two control variables are selected at the enterprise level: The first is regarded to the current asset ratio (CAR), measured by the proportion of current asset as the sum of current asset and fixed asset; The second is the financing constraint (FC), which is expressed as the ratio of interest expense to fixed asset. The data source used to calculate these two firm-level control variables is the Chinese Industrial Enterprise Database.

Two control variables are also selected at the city level: The first is the development level (DL), expressed by per capita GDP; The second is the scientific importance (SI), measured by the proportion of scientific expenditure in GDP in a city. The data source used to calculate these two city-level control variables is the China Urban Statistical Yearbook.

The explained variable, GTFP in Eq. 1, is calculated using the Luenberger Productivity Index of the SBM (Slack-Based Measure) directional distance function, see below for details.

From the description of the above variables, it can be seen that the data at the enterprise level are all derived from the Chinese Industrial Enterprise Database. To accurately select the Taiwan-funded enterprises from the Chinese Industrial Enterprise Database is an extreme difficult task because the database is huge with over 4 million enterprises, and there are many errors, omissions and changes of the enterprise names. Before matching the enterprise names of Taiwan-funded enterprises with the database, this paper first excludes the invalid observations of key variables that do not meet the requirements according to the accounting standards, retains the manufacturing enterprises with industry code between 13 and 42 in the Chinese Industrial Enterprise Database. The names of provinces and cities and the area-codes of enterprises are also repaired in accordance with documents of the Ministry of Civil Affairs and the Ministry of Industry and Information Technology. Then, this research begins to match the names of the Taiwan-funded enterprise in the Directory of Taiwan Enterprises in the Mainland (six volumes), the Directory of Investment Undertakings of Listed Companies in Chinese mainland and the Top 1,000 Taiwan Business Companies with the Chinese Industrial Enterprise Database. Due to enterprise restructure, reorganization or expansion, the enterprise names may change over years, so the common words such as “limited company,” “group,” and “factory” are crossed out for matching purpose. Based on the sequential matching logic of Brandt et al. (2012), this paper uses the following variables and variable combinations to match the data of two or three years: “legal person code,” “enterprise name,” “area code + phone number,” “legal person + zip code + product2,” “opening time + phone number + city.” The use of variable combination helps to improve the matching accuracy. Limited by the availability of data from Taiwan-funded enterprises and the “typos” in the Chinese Industrial Enterprise Database, this paper finally selects 2005–2007 as the sample with a total of 17,139 observations.

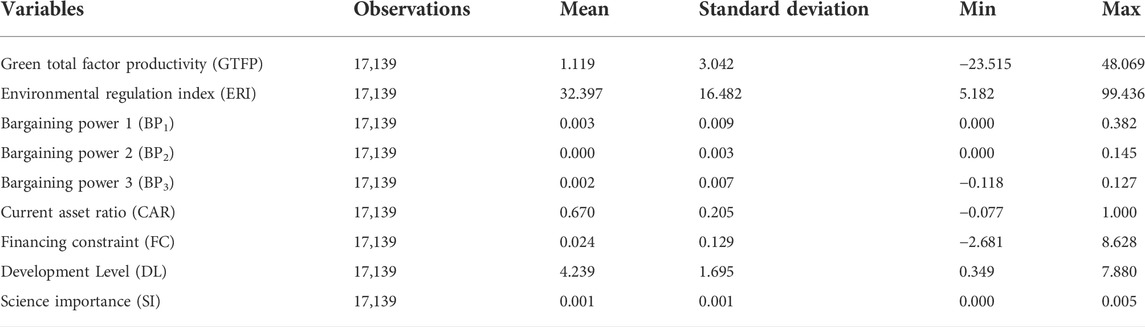

The summary statistics of the main variables is shown in Table 1.

3.2 Measuring the green total factor productivity of Taiwan-funded enterprises

Total factor productivity (TFP) is an important guarantee for economic growth in long-term, but traditional TFP does not take into account the damage to environmental resources caused by economic growth, thus distorting the evaluation of social welfare and economic performance (Hailu and Veeman, 2000). With the current rapid economic development and unearthed environmental problems, we cannot ignore environmental factors when considering total factor productivity (Li et al., 2019). Compared with traditional TFP, GTFP can take the undesired outputs such as industrial wastewater, industrial sulfur dioxide, and industrial soot produced by the industrial enterprises, into account, which is an important guarantee for sustainable economic growth (Li and Liao, 2020).

In the empirical analysis, the green total factor productivity index will be represented by the Luenberger productivity index calculated by Data Envelopment Analysis (DEA) method. The DEA proposed by Charnes et al. (1978) does not require parameter assumptions, can solve the problem of multiple inputs and multiple outputs, and can simultaneously incorporate capital input and pollutant emissions into the analysis framework. It takes into account undesired output and is currently a widely applicable method for calculating GTFP (Wang et al., 2010). Therefore, this paper chooses this method to calculate GTFP. The calculation process is specified as follows:

First, according to the research of Fukuyama and Weber (2010), the SBM directional distance function is defined:

where x represents input,

If the technological progress of the enterprise is denoted by TP and the technological efficiency of the enterprise is denoted by TE, then the GTFP index between the period t and period t + 1 is:

In the empirical analysis, the input factor is the fixed asset of the enterprises, and the desired output is the industrial output value of the enterprises; The undesired outputs are the industrial emissions of wastewater, sulfur dioxide and industrial soot. This paper uses the methods of Cui and Lin (2019) to calculate the three undesired outputs: first, calculate the weight of each pollution index in the city, using the equation

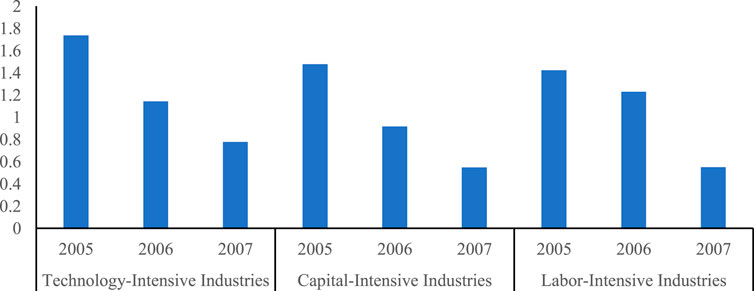

According to the above input-output data, this paper uses MAXDEA software to calculate GTFP of Taiwan-funded enterprises. The results show that the average GTFP of technology-intensive enterprises is the highest, which is 1.192; the average GTFP of labor-intensive enterprises is the second highest, which is 1.036; the average GTFP of capital-intensive enterprises is the lowest, which is 0.966. Observing Figure 2, it can be seen that the GTFP of Taiwan-funded enterprises in different industries showed a downward trend from 2005 to 2007. It may be that the increasingly stringent environmental regulation had a negative impact on the GTFP.

FIGURE 2. Changes in GTFP of Taiwan-funded enterprises of different industrial types from 2005 to 2007. Note: The criteria for the classification of the types of Taiwan-funded enterprises refer to Yang et al. (2018).

4 Emprical analysis

4.1 Multicollinearity test

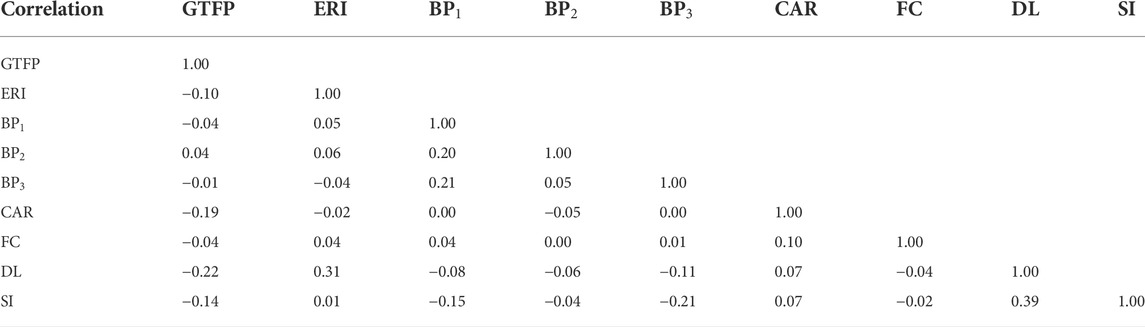

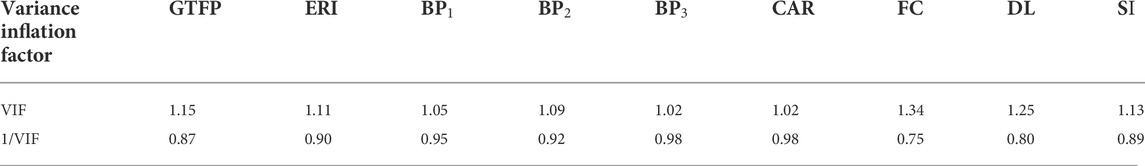

In Tables 2, 3, except for the positive correlation between BP2 and GTFP, all other variables are negatively correlated. The maximum value of VIF is 1.34, which is much less than 10. It can be preliminarily determined that there is no multicollinearity among variables.

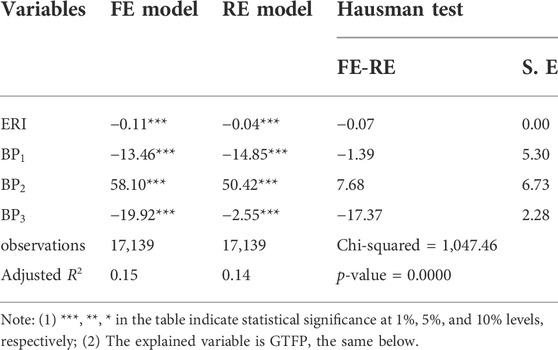

The Hausman test results in Table 4 show that the p-value is less than 0.01, which means that the null hypothesis is rejected, so this paper chooses individual fixed effect model to run the regressions.

4.2 Regression results

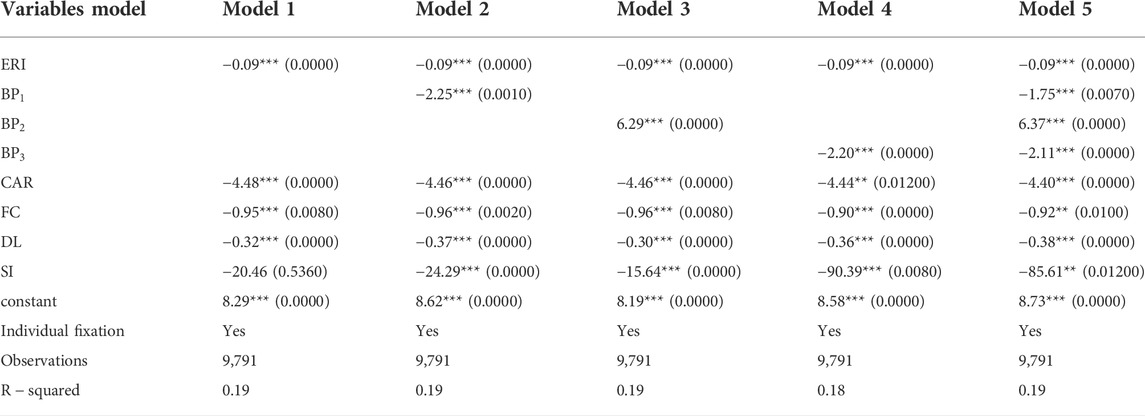

First, Table 5 shows the regression results of five models with regard to the Taiwan-funded enterprises. Model 1 is the basic regression without considering the bargaining power (BP) of enterprises. The results of model 1 show that the environmental regulation index (ERI) of the city has a significant negative impact on GTFP, which rejects the “Porter Hypothesis” and supports the “Compliance Cost Hypothesis.” This paper argues that the time period selected by the sample from 2005 to 2007 coincided with the third wave of boom of Taiwanese investment in the Chinese mainland. A large number of enterprises with large energy consumption and serious environmental pollution moved from Taiwan to the Chinese mainland. The Department of Environmental Protection begun to treat all enterprises equally on pollution control with no more preferential policies for foreign and overseas enterprises during that period. Theoretically, the investment of enterprises in pollution prevention and control tends to crowd out the investment in R&D and technology innovation, which will have a negative impact on green total factor productivity (Qi et al., 2016). With the strict implementation of environmental regulation, Taiwan-funded enterprises have increased investment in pollution control, decreased investment in technology research, distorted resource allocation, and decreased GTFP. This conclusion confirms the first hypothesis proposed in this paper.

Second, Table 5 also shows the regression results of model 2, model 3, model 4, model 5. In order to investigate the reaction of the bargaining power of enterprises on the environmental regulation policies, the variables BP1, BP2, and BP3 enter the regression sequentially. It can be seen that the signs of all explanatory variables have not changed, and they are all statistically significant at the 1% level, indicating reliability of the results to a certain degree. The signs of the coefficients of BP1 and BP3 are significantly negative, −1.6 and −1.75, respectively, indicating that the industrial output value and VAT tax payment of Taiwan-funded enterprises cannot become the effective bargaining power, and Taiwan-funded enterprises still have to pay “compliance costs” for the pollution caused by them. The reason is that, on one hand, the business model of Taiwan-funded enterprises in the Chinese mainland is “put both ends abroad” (put the raw material market and sale market in the international market). Although the import and export amounts are high, the actual net amount is relatively small, so the contribution to the local gross output value is discounted; On the other hand, Chinese mainland has provided favorable tax policies for Taiwan-funded enterprises. During the sample period, zero value-added tax rate was applied to the export products of Taiwan-funded enterprises, that is, all taxes will be refunded after the products are declared for export. On the contrary, the coefficient of BP2 is always significantly positive, indicating that the more jobs created, the greater the contribution to the local governments, the higher the bargaining power, and the greater the possibility of obtaining exemptions or loose implementation of environmental regulation. Thereby, the greater the contribution to the local employment, the stronger force to counteract environmental regulation. This conclusion confirms the second hypothesis proposed in this paper.

The coefficients of CAR and FC are both significantly negative, indicating that the higher the proportion of current asset or the stronger the financing constraint, the lower the GTFP. Enterprises with a high proportion of current asset or strong short-term liquidity may crowd out R&D or other long-term expenditures. Enterprises have strong financing constraint may hinder energy conservation and emission reduction, and then may increase the undesired output. The coefficients of DL and SI are also significantly negative, indicating that the increasing in per capita income or the increasing government’s emphasis on scientific research in cities have a negative impact on the GTFP in short run. The higher the level of economic development of a city, the higher the cost of sacrificing the natural environment, and the lower the green total factor productivity of enterprises in the city (Li et al., 2021). With the improvement of people’s living standards, or with the greater the city’s expenditure on scientific research, the city has higher requirements on achieving green transformation and upgrading, which force enterprises to pay high environmental costs.

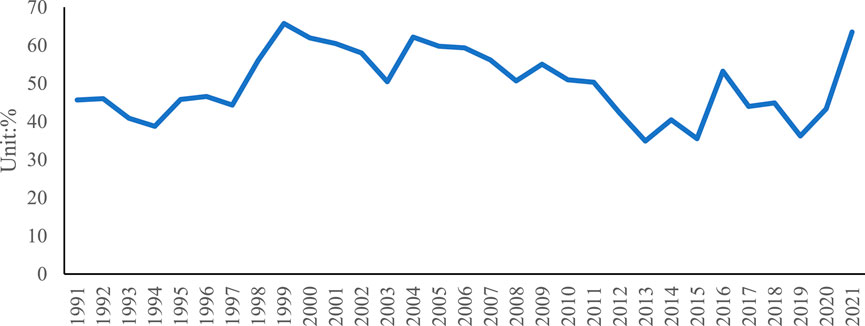

4.3 Reliability checking with different samples

In order to further test the reliability of the regression results, this paper selects technology-intensive enterprises to run regression again. The number of observations of Taiwan-funded technology-intensive enterprises is 9,791, accounting for 57.13% of the total sample. According to Table 6, after changing the sample, the signs of the regression coefficients of the explanatory variables have not changed, and they are still significant, which shows that the model setting and regression results in this paper are reliable to some extent. The two hypotheses proposed in this paper are still valid. With strict implementation of environmental regulation, the technology-intensive enterprises will make some adjustments. First, these enterprises may reduce production to cope with the impact of short-term environmental regulation. Second, these enterprises may increase environmental governance expenditures by reducing investment in technological innovation. Therefore, the environmental regulation also has a negative impact on the GTFP of Taiwan-funded technology-intensive enterprises. In comparison, Taiwan-funded technology-intensive enterprises enjoy greater tax incentives. Since 1 October 1999, after the mainland levied the statutory tax rate of 17% on computer software products, the value-added tax rate has been reduced to 6%, and the value-added tax rate of exported products is zero. Most of the Taiwan-funded technology-intensive enterprises also “put both ends abroad.” The abundant and cheap labor resources in Chinese mainland are still the key to attracting Taiwanese to invest. Therefore, job creation is still the bargaining power of Taiwan-funded technology-intensive enterprises to obtain exemptions or loose implementation of environmental regulation.

In addition, the research also collapses the panel data into a cross-sectional data to run an OLS regression, and the main results do not change significantly. The regression results are not reported to save space. Therefore, the regression results of Table 5 is very likely to be reliable.

5 Conclusions and policy recommendations

Using the matching results of the Chinese Industrial Enterprise Database, the Taiwanese Enterprise Directory and the China Urban Statistical Yearbook, this paper constructs the panel data of Taiwan-funded enterprises in Chinese mainland, uses the data envelopment analysis method to calculate the green total factor productivity index of Taiwan-funded enterprises, examines the impact of the environmental regulation on GTFP of Taiwan-funded enterprises, and discusses the reaction of the bargaining power of these enterprises with the local governments. The findings of this study are: first, the Chinese mainland environmental regulation will reduce the GTFP of Taiwan-funded enterprises; second, the more jobs opportunities the Taiwan-funded enterprises creates, the greater the contribution to the local economy, the higher the bargaining power with the local governments, and the greater the possibility being exempted from environmental regulation to a certain extent. However, in term of industrial output value or value-added tax, Taiwan-funded enterprises have low bargaining power with the local governments. Compared with previous studies, Taiwan-funded enterprises have prominent ability to increase the employment, which is greater contribution to local government achievements, and hence they can obtain strong bargaining power.

In view of this, in order to truly achieve the goals of energy conservation and emission reduction and sustainable high-quality economic development in Chinese mainland, this paper makes the following suggestions.

First, to reduce the reaction force of Taiwan-funded enterprises to the environmental regulation, the central government should consider environmental protection as important as economic development, supervise the implementation of environmental protection policies in a timely manner, reduce the adverse effect of bargaining power of Taiwan-funded enterprises in Chinese mainland, by incorporating environmental achievements into the local government performance appraisal framework, formulating long-term environmental regulation policies, and forming an institutionalized, systematic and normalized environmental supervision mechanism.

Second, China should adjust the pace of enforcement of environmental regulation. One of the reasons why environmental regulation policies have a negative impact on Taiwan-funded enterprises is that the policies are relatively tough, and some are even “one size fits all.” Polluting enterprises do not have enough time to adjust their production or improve technology or increase investment in pollution prevention and control equipment, and have to adopt stress strategies to deal with it. Local governments should start with weaker enforcement of environmental regulation, by giving Taiwan-funded enterprises a certain buffer period to gradually adjust the policy intensity, to improve environmental protection standards, and then to achieve the green transformation and upgrading of the manufacturing industry.

Third, the pollution degree of Taiwan-funded enterprises is different, and the impact on the environment is different. 1. Therefore, when implementing environmental regulation policies, local governments should first distinguish the types and characteristics of Taiwan-funded enterprises, and pollution density of targeted industries (Zou and Zhang, 2022), then carry out differentiated environmental regulation means on polluting enterprises.

Fourth, China should build and improve the Environmental, Social and Governance (ESG) scoring standards of Taiwan-funded enterprises, take ESG scoring as part of credit, and encourage financial institutions to provide Taiwan-funded enterprises with high ESG scores the lower-cost and higher-amount loans2. This way will enhance the internal motivation of Taiwan-funded enterprises in energy conservation, emission reduction and green transformation.

Due to the extremely difficult availability the of data of Taiwan-funded enterprises in Chinese mainland, the sample interval of this paper is selected from 2005 to 2007. Since 2007, Chinese mainland has introduced a series of macro-control measures, including new land and environmental protection policies, tax reform, and the new labor contract law. These macro-control measures have further increased the cost of Taiwan-funded enterprises. In recent years, energy, environment and climate change have posed important challenges to Chinese mainland, and Taiwan-funded enterprises are also facing more severe pressure from green transformation. Therefore, the follow-up research will expand the sample with more years, analyze Taiwan-funded enterprises based on different industry types, and further examine the impact of different types of environmental regulation policies on the green total factor productivity.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

YH is mainly responsible for model construction, regression analysis and full-text writing. XL is responsible for the collection and collation of literature and data; YL is responsible for data processing.

Funding

This work was Supported by National Social Science Foundation of China (Grant No. 20BJL019). The remaining errors are our own.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Taiwan, China.com: Ministry of Environmental Protection: Chinese Mainland Treats Environmental Management of Taiwan-Funded Enterprises Equally, last visited on 8 June 2022, website: http://www.taiwan.cn/xwzx/bwkx/201303/t20130315_3909820.htm.

2The “product” here is referred to a product category in the Chinese Industrial Enterprise Database.

References

Bai, G. Y., and Liu, X. Q. (2020). Study on the effects of cross-strait economic and trade cooperation on the tenth anniversary of the ECFA. Asia-pacific Econ. Rev. 05, 132–141+152. doi:10.16407/j.cnki.1000-6052.2020.05.015

Brandt, L., Van, B. J., and Zhang, Y. F. (2012). Creative accounting or creative destruction? Firm-level productivity growth in Chinese manufacturing. J. Dev. Econ. 97 (02), 339–351. doi:10.1016/j.jdeveco.2011.02.002

Charnes, A., Cooper, W. W., and Rhodes, E. (1978). Measuring the efficiency of decision making units. Eur. J. Operational Res. 2, 429–444. doi:10.1016/0377-2217(78)90138-8

Cheng, Z. H., and Kong, S. Y. (2022). The effect of environmental regulation on green total factor productivity in China's industry. Environ. Impact Assess. Rev. 94, 106757. doi:10.1016/j.eiar.2022.106757

Cui, X. H., and Lin, M. Y. (2019). How does foreign direct investment affect the green total factor productivity of enterprises? Empirical analysis based on malmquist-luenberger index and PSM-DID model. Bus. Manag. J. 3, 38–55. doi:10.19616/j.cnki.bmj.2019.03.003

Fan, M., Yang, P., and Li, Q. (2022). Impact of environmental regulation on green total factor productivity: A new perspective of green technological innovation. Environ. Sci. Pollut. Res. 29, 53785–53800. doi:10.1007/s11356-022-19576-2

Fu, J. Y., and Li, L. S. (2010). A case study on the environmental regulation, the factor endowment and international competitiveness in industries. Manag. World 10, 87–98+187. doi:10.19744/j.cnki.11-1235/f.2010.10.008

Fukuyama, H., and Weber, W. L. (2010). A directional slacks-based measure of technical inefficiency. Socioecon. Plann. Sci. 4, 274–287. doi:10.1016/j.seps.2008.12.001

Guan, H. L., and Wu, Z. N. (2020). Spatial correlation and spillover effects of rural finance development. Econ. Problems 2, 118–229. cnki: sun: jjwt.0.2020-02-016.

Hailu, A., and Veeman, T. S. (2000). Environmentally sensitive productivity analysis of the Canadian pulp and paper industry, 1959-1994: An input distance function approach. J. Environ. Econ. Manag. 3, 251–274. doi:10.1006/jeem.2000.1124

Jaffe, A. B., and Palmer, K. (1997). Environmental regulation and innovation: A panel data study. Rev. Econ. Stat. 4, 610–619. doi:10.1162/003465397557196

Jiang, T., Yu, Y., Jahanger, A., and Balsalobre-Lorente, D. (2022). Structural emissions reduction of China’s power and heating industry under the goal of “double carbon”: A perspective from input-output analysis. Sustain. Prod. Consum. 31, 346–356. doi:10.1016/j.spc.2022.03.003

Jin, W., Gao, S. H., and Pan, S. F. (2022). Research on the impact mechanism of environmental regulation on green total factor productivity from the perspective of innovative human capital. Environ. Sci. Pollut. Res. Int. (28), 1–19. doi:10.1007/s11356-022-22120-x

Li, J. J., Zhang, J., Zhang, D. Y., and Ji, Q. (2019). Does gender inequality affect household green consumption behaviour in China? Energy Policy 135, 111071. doi:10.1016/j.enpol.2019.111071

Li, L., and Tao, F. (2012). Selection of optimal environmental regulation intensity for Chinese manufacturing industry—based on the green TFP perspective. China Ind. Econ. 5, 70–82. doi:10.19581/j.cnki.ciejournal.2012.05.006

Li, P. S., and Chen, Y. Y. (2019). Environmental regulation, bargaining power of enterprises and green total factor productivity. Finance Trade Econ. 11, 100–117. doi:10.19795/j.cnki.cn11-1166/f.20191111.006

Li, T. H., and Liao, G. K. (2020). The heterogeneous impact of financial development on green total factor productivity. Front. Energy Res. 8, 1–9. doi:10.3389/fenrg.2020.00029

Li, Z. G., Che, S., and Wang, J. (2021). Research on the green development effect of national central city construction: Quasi natural experiments based on 285 cities. Sci. Technol. Prog. Policy 16, 29–36. doi:10.6049/kjjbydc.2021010380

Liu, Y., Yang, X., and Huang, M. X. (2020). Environmental regulation and green total factor productivity—analysis of the mediating effect based on different technological progress path. Contemp. Econ. Manag. 6, 16–27. doi:10.13253/j.cnki.ddjjgl.2020.06.003

Porter, M. E., and Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 4, 97–118. doi:10.1257/jep.9.4.97

Qi, Y., Lu, H. Y., and Zhang, N. C. (2016). Can environmental regulation achieve win-win of "reducing pollution" and "increasing performance"? —evidence from key environmental protection cities with "compliance" and "Non-Compliance" quasi-experimental. Finance Trade Econ. 9, 126–143. doi:10.19795/j.cnki.cn11-1166/f.2016.09.010

Shen, N., and Liu, F. C. (2012). Can intensive environmental regulation promote technological innovation? Porter hypothesis reexamined. China Soft Sci. 5, 108–112. doi:10.19795/j.cnki.cn11-1166/f.20191111.006

Wang, B., Wu, Y. R., and Yan, P. F. (2010). Environmental efficiency and environmental total factor productivity growth in China’s regional economies. Econ. Res. J. 5, 95–109. cnki: sun: jjyj. 0.2010-05-008.

Wu, X. L., and Deng, Q. M. (2019). The research on risk of transformation and upgrading of Taiwanese enterprises in Chinese mainland. Taiwan Stud. 2, 33–40. doi:10.13818/j.cnki.twyj.2019.02.005

Xi, P. H. (2017). Fiscal incentives, environmental preference and the horizontal environmental management—from the perspective of bargaining power of major tax payers. China Ind. Econ. 11, 100–117. doi:10.19581/j.cnki.ciejournal.2017.11.009

Xiao, Y. F., Zhou, B. Y., and Li, Q. (2020). Environmental regulation affects the realization mechanism of green total factor productivity:an empirical study based on China’s resource-based industries. East China Econ. Manag. 3, 69–74. doi:10.19629/j.cnki.34-1014/f.190822001

Xie, R., Yuan, Y., and Huang, J. (2017). Different types of environmental regulations and heterogeneous influence on “green” productivity: Evidence from China. Ecol. Econ. 2, 104–112. doi:10.1016/j.ecolecon.2016.10.019

Yang, H., Jiang, X., and Li, F. (2017). Research on the influence of foreign tax policy on technology innovation and FDI quality. J. Shandong Univ. (Philosophy Soc. Sci. 3, 138–145. doi:10.3969/j.issn.1001-9839.2017.03.019

Yang, L. G., Gong, S. H., Wang, B., and Chao, Z. S. (2018). Human capital, technology progress and manufacturing upgrading. China Soft Sci. 1, 138–148. cnki: sun: zgrk.0.2018-01-013.

Yin, L. H., and Wu, C. Q. (2021). Environmental regulation and ecological efficiency of pollution-intensive industries in the yangtze river economic belt. China Soft Sci. 8, 181–192. doi:10.3969/j.issn.1002-9753.2021.08.018

Yu, D. H., and Hu, Y. N. (2016). Does tightening environmental regulation impede technological innovation upgrading of manufacturing industries in China? — an empirical Re-examination on porter hypothesis. Industrial Econ. Res. 2, 11–20. doi:10.3269/j.cnkiier.2016.02.002

Yuan, B., and Xiang, Q. (2018). Environmental regulation, industrial innovation and green development of Chinese manufacturing: Based on an extended CDM model. J. Clean. Prod. 176, 895–908. doi:10.1016/j.jclepro.2017.12.034

Keywords: Taiwan-funded enterprises, green total factor productivity (GTFP), environmental regulation, bargaining power, high-quality development of Chinese economy

Citation: Huang Y, Li X and Liu Y (2022) The impact of environmental regulation or bargaining power on green total factor productivity: Evidence from Taiwan-funded enterprises in Chinese mainland. Front. Environ. Sci. 10:982430. doi: 10.3389/fenvs.2022.982430

Received: 30 June 2022; Accepted: 31 August 2022;

Published: 20 September 2022.

Edited by:

Lu Yang, Shenzhen University, ChinaCopyright © 2022 Huang, Li and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiapei Li, aGFpeXVseHBAMTYzLmNvbQ==

Yanping Huang

Yanping Huang Xiapei Li2*

Xiapei Li2*