94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 16 September 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.980267

We show that innovative activities exacerbate environmental degradation based on data covering 52 countries between 1990 and 2014. Yet, innovative activities carried out in countries with greater financial development pose less environmental harm. Additionally, we show the equity market is more effective concerning dampening effect of innovation on carbon emissions. With a dynamic panel threshold method, we find that innovation is significantly associated with improvements in environmental quality when the private sector credit and market capitalization of listed domestic companies exceed threshold levels of about 65 and 16% as a share of GDP respectively. We also look into the relationship between financial structure and the innovation-pollution nexus. We show that innovation promotes environmental quality in countries that have a relatively more equity-based financial system. Our empirical evidence calls for policymakers to identify the optimal level of finance to mitigate pollution resulting from innovative activities and realign the financial structure in accordance with the innovation-pollution nexus.

Human-induced climate change is causing widespread adverse effects and damage to the environment and human life across sectors and regions (IPCC, 2022). As a result of economic activities, burning fossil fuels over the past century has increased atmospheric carbon dioxide (CO2). It is widely acknowledged that CO2 emissions are the principal cause of global warming since they are responsible for about half of the Earth’s net radiative forcing (net solar retention). Global warming is expected to cause widespread extinction due to rising temperatures and more extreme weather events. It is undoubtedly true that initiatives aimed at the reduction of greenhouse gas emissions contributed spur global action and prompted international protocol adoption. While only a few countries are involved, hundreds of international environmental agreements already exist, contributing to the development of the international environmental regime. According to the Climate Transparency Report (2020), evidence from G20 countries indicates that developing countries suffer the greatest vulnerability to climate change, yet they also exhibit the least level of readiness and are most challenged. Developed countries are obligated to boost climate financing to support developing countries in their efforts to combat climate change. While the level of financial development in developed and developing countries differs greatly, we believe that this key factor will have an impact on the relationship between innovation and pollution. Therefore, the goal of this study is to investigate the effect of innovation on carbon emissions over a global panel of countries and to analyze how financial development might affect the innovation-pollution nexus.

With the goal of reducing pollution and improving the environment, efforts have been conducted to pinpoint factors that influence emissions. In this regard, numerous studies have identified a number of factors as significant contributors to pollution, including economic growth (Saboori et al., 2012; Cai et al., 2018; Dong et al., 2018; Mardani et al., 2019); renewable energy consumption (Shahbaz et al., 2013; Cai et al., 2018; Mahmood et al., 2019); urbanization (Lin et al., 2017; Fang et al., 2020); population (Ara et al., 2015; Zhang et al., 2018); and international trade (Ren et al., 2014; Muhammad et al., 2020). Recently, innovations and countries’ levels of development in the financial sector have come under the spotlight for their impact on the environment. The innovation process has been identified as a critical driver of economic development. On one hand, it promotes the use of clean energy, which directly lowers carbon emissions. On the other hand, innovation might lead to a rise in carbon emissions even while energy efficiency technology has advanced. Recent studies discovered innovation practice tends to exert different impacts on sustainable development across different national contexts and historical periods (Ibrahim and Vo, 2021; Zhao et al., 2021; Latif et al., 2022; Tze San et al., 2022Yu et al., 2022). Likewise, the development of the financial sector has also been firmly placed at the center of the debate over environmental quality. Nonetheless, existing studies downplays the significance of the interaction between financial development and innovation which are required to be seen in conjunction with the environment. This study seeks to obtain a more comprehensive picture of financial development not only by incorporating the credit market as well as the equity market but also demonstrate its specific mechanism through which act on innovation via different financial markets, thereby influencing the environmental sector.

Based on the theory of economic development, Schumpeter (1911) argued that financial intermediaries mobilize savings, evaluate projects, manage risk, monitor managers, and facilitate transactions, which makes external financing more affordable for firms, contributing to technological innovation and economic growth, thereby supporting environmental sector activities through this channel. Theoretically, equity markets and credit markets are seen to play different roles in the development of innovation. Regarding the equity market, since firms’ equity financing is not subject to strict collateral requirements, it provides a set of risk management options for investments in riskier, yet innovative projects (Levine, 2005). This makes equity financing particularly suitable for startups, high-tech, and innovative companies (Carpenter et al., 2020). In this sense, the development of equity markets provides countries with greater access to cutting-edge technologies and channel funds to environmentally friendly firms, enabling them to improve energy efficiency and create sustainable innovations, thereby reducing CO2 emissions (Paramati et al., 2017; Bardos et al., 2020). On the other hand, some literature suggests that the development of equity markets may stifle innovation. In advanced countries, fully functioning markets could lead to a market for corporate control, which might encourage firms to acquire other companies instead of expanding organically, which could be detrimental to the innovation in the real economy and cause environmental problems (Singh, 1991).

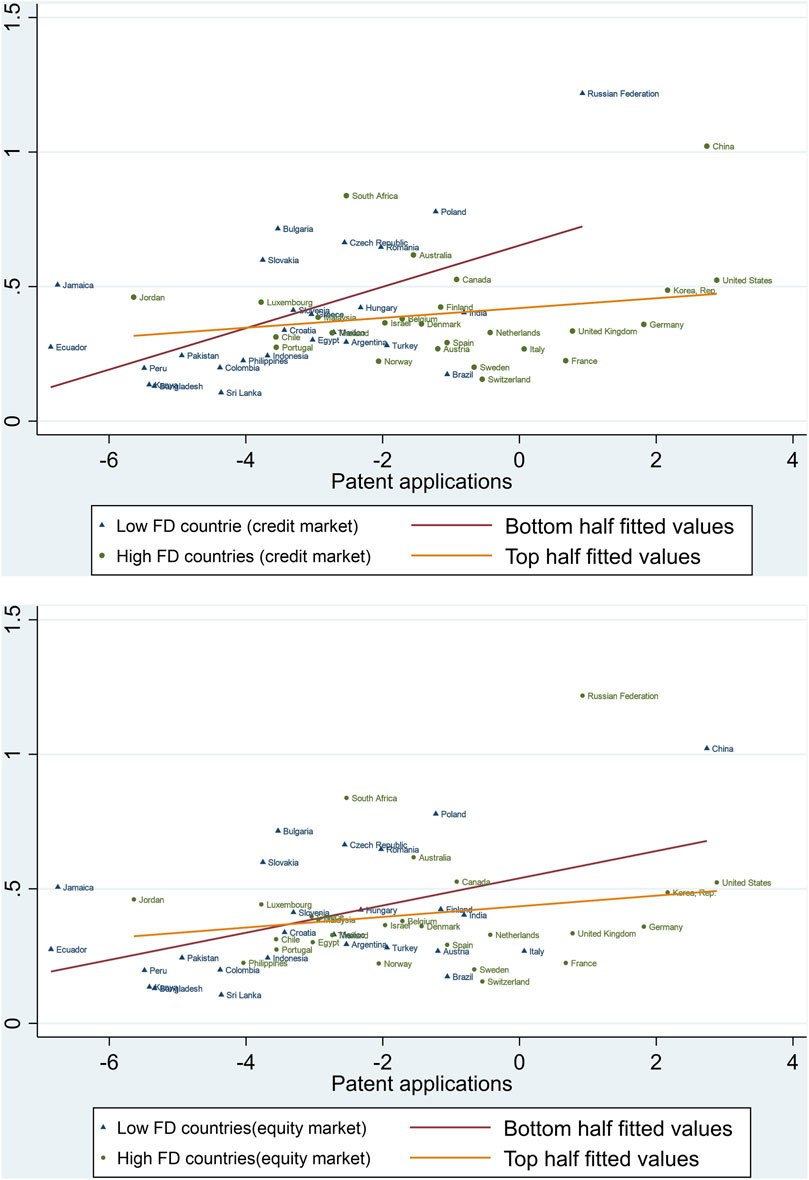

Given that credit financing is pledgeable, the credit market tends to favor conservative investments, which deters businesses from launching significant and innovative enterprises (Morck and Nakamura, 1999). In the absence of price signals, the development of credit markets is unable to gather crucial data about companies’ investment prospects to guide their real investment strategies (Allen and Gale, 1999). This could also lead to uncertain impacts on the environment. The different effects of credit and equity markets on the innovation-pollution nexus are illustrated in Figure 1. The figure illustrates that illustrate that the slope between innovation and CO2 emissions appears steeper for countries of lower financial development. The scatterplot implies that the negative effect on environmental quality from innovation could be stronger for low financial development countries. Moreover, when financial developments are proxied by the equity market, innovation has a milder impact on CO2 emissions.

FIGURE 1. Financial development and innovation-pollution nexus. The countries are categorized by the level of credit market development and equity market development specifically. The countries are divided into two categories, low and high FD countries.

Three implications may be derived from the above discussion. First, we would find evidence that innovation increases carbon emissions if energy consumption from expanded innovative activities exceeds the energy consumption savings gained through enhanced green innovative technology. Conversely, innovation decreases carbon emissions. Second, financial development may affect the speed of how innovation is transferred to energy consumption, thus influencing pollution. Third, financial development may also impact innovations per se in promoting environmental quality. Finally, the credit market and equity market affect innovation as well as the innovation-pollution nexus through different underlying mechanisms.

In light of the research gaps outlined above, the contribution of this study lies in four ways. First, this study offers cross-country evidence to show how innovation impacts environmental quality by utilizing data from a large number of countries from 1990 to 2014. Second, we employ a comprehensive financial development proxy that includes the credit and equity markets to examine how their varying effect on innovation will impact environment quality individually. Third, this study examines whether the relationship between innovation and CO2 emission exhibits threshold effects such that innovation’s contribution to environmental quality is related to the level of financial development of countries. By adopting a novel dynamic panel threshold model that accounts for the endogeneity issue, the study unearths the role of financial development in innovation–pollution nexus. Fourth, we also examine how innovation activities affect environmental quality under different structures of financial systems, namely bank-based and equity-based financial systems, which have seldom been investigated in previous studies before.

By relying on 52 countries, we show that innovative activities exacerbate environmental degradation between 1990 and 2014. Nevertheless, beyond a certain level of financial development, higher innovation exhibits a weaker negative impact on environmental degradation. Furthermore, by utilizing a dynamic threshold model, we find that innovation is significantly associated with improvements in environmental quality when the private sector credit and market capitalization of listed domestic companies exceed threshold levels of about 65 and 16% as a share of GDP respectively. We also document the impact of different structures of financial systems on the innovation-pollution nexus. We show that innovation promotes environmental quality in economies that are relatively more equity-funded.

The remainder of the paper is structured as follows. Section 2 reviews the literature. Section 3 specifies methodology and data. Section 4 discusses the empirical results. Section 5 concludes.

It is undoubtedly true that initiatives aimed at the reduction of greenhouse gas emissions have sparked a global movement to explore ways of improving environmental quality. On the one hand, innovation encourages the use of clean energy, which directly lower carbon emissions. On the other hand, innovation, which is a critical driver of economic development, can result in higher overall energy consumption, which would lead to higher carbon emissions despite the advancements in energy efficiency technologies. In this regard, the findings on the innovation-pollution nexus are mixed across different national contexts and historical periods.

Using panel data from 1990 to 2016, Dauda et al. (2021) found, in line with EKC’s assumption, that innovation and CO2 emissions were negatively correlated in a number of African countries. Dauda et al. (2021) discovered a negative relationship between innovation and CO2 emissions in selected African countries by using the panel data from 1990 to 2016. Töbelmann and Wendler (2020) investigated how environmental innovation affected CO2 emissions in the EU-27 countries from 1992 to 2014. Using GMM in a dynamic panel, they note that the impact of innovation varies across countries, where less developed countries tend to exhibit a higher degree of heterogeneity. Additionally, they find that general innovative activity does not influence the reduction of carbon dioxide emissions, but only environmental innovation does. Similarly, using a panel data set over the period 1996 to 2012, Du et al. (2019) observe that green innovations have a modest impact on carbon dioxide reduction in economies that have income levels below the threshold, whereas the reduction is substantial in economies with income levels above the threshold. Fernández Fernández et al. (2018) used data from 1990 to 2013 to investigate the impact of innovation on CO2 emissions in the European Union, the United States, and China. Studies have shown that research and development expenditures have contributed substantially to reducing CO2 emissions for developed countries but not for developing countries. Accordingly, innovations in various national contexts should have different environmental effects. Similarly, other studies show that innovation in different forms will also exert different outcomes on CO2 emissions. According to Yan et al. (2017), who investigated the effects of low-carbon innovations for 15 major economies between 1992 and 2012, clean innovations considerably reduced CO2 emissions while grey innovations (which are not carbon-free) had little of an effect.

Usually, literature relates financial development and innovation to growth and supports the idea that they are positive as well as strongly related to one another. It has been argued by King and Levine, (1993) that more efficient and effective financial systems can significantly enhance innovation and, as a result, accelerate economic growth. Benfratello et al. (2008) examined a range of Italian firms from the 1990s and found that financial development was associated with process innovation.

In recent years, some scholars have demonstrated that finance and innovation may not have a monotonic relationship. Zhu et al. (2020) found that higher levels of financial development are correlated with lower levels of innovation based on a dynamic panel threshold model. Trinugroho et al. (2021) also revealed an inverted U-shaped non-linear relationship between finance and innovation by utilizing panel data from 68 developed and developing countries during 1995–2018. Further studies have shed light on what role equity markets and credit markets play in the development of innovation. Regarding the equity market, there are two opposing viewpoints regarding its development, both positive and negative. On the one hand, since firms’ equity financing is not subject to strict collateral requirements, it provides a set of risk management options for investments in riskier, yet innovative projects (Levine, 2005). This makes equity financing particularly suitable for young, high-tech companies (Carpenter and Petersen, 2002). Le et al. (2019) demonstrate that stock market-based financial development is positively correlated with patent applications, which is considered a proxy for innovation. On the other hand, some literature suggests that the development of equity markets may hinder innovation. In advanced countries, fully functioning markets could lead to a market for corporate control, which might encourage firms to acquire other companies instead of expanding organically, which could be detrimental to the real economy (Singh, 1991).

Concerning the credit market, two implications relating to its role in innovation may also be considered. Given the pledgeable nature of credit financing, credit markets tend to favor conservative investments, which discourage firms from undertaking innovative and valuable projects (Morck and Nakamura, 1999). Xiao and Zhao (2012) have shown that bank credit promotes innovation in countries with low levels of government ownership of banks; however, in countries with a higher level of government ownership of banks, it can sometimes be detrimental. Hsu et al. (2014) examine the effect of the equity market versus the credit market in their study, demonstrating that the development of the credit market seems to inhibit innovation as a result of the lack of price signals.

Nonetheless, existing studies neglect the importance of the interactive effect of financial development and innovation which are required to be seen in conjunction with the environment.

An effective and functional financial sector contributes to economic growth (Schumpeter, 1911; King and Levine, 1993). According to Levine (2005), the development of financial systems (banks, capital markets, laws and regulations about banks, and capital markets) is geared towards reducing barriers to financing, monitoring, and gaining access to financial information at a lower cost, thereby supporting environmental sector activities through this channel. However, its precise impact on environmental quality remains unclear. One strand of the literature suggests that well-developed financial sectors may lead to environmental degradation. For example, Park et al. (2018) reported that environmental quality is adversely affected by financial development in selected European Union (EU) countries because domestic credit to the private sector is invested in non-environmentally friendly projects. In addition, private credit growth has been associated with an increase in CO2 emissions as a result of higher energy consumption. Further, based on a comparison of developed and developing countries, Shoaib et al. (2020) investigated the impact of financial development on CO2 emission over the period 1999 to 2013. The study shows that financial development has a more significant and positive impact on carbon emissions in developing countries. Sunday Adebayo et al. (2022) demonstrate that the effects of financial development vary between countries owing to differences in political, social, and economic shocks. Moreover, studies by Al-Silefanee et al. (2022) on Islamic countries, Haug and Ucal (2019) on Turkey, Nasir et al. (2019) on ASEAN-5, Fang et al. (2020) on China, and Yang et al. (2021) on BRICS countries, Abid et al. (2022) on G8 countries, documented negative effects of financial development on the environment.

Another strand of literature reported that in fact financial development positively affects the environment by decreasing carbon emissions. Specifically, Paramati et al. (2017) reported stock market growth reduces CO2 emissions in developed economies since it provides investors with access to additional funding sources and can therefore result in higher levels of investment in clean energy projects instead of conventional energy. Likewise, Anees et al. (2019) hold that higher financial development decreases environmental degradation since greater financial sector development contributes to the development of energy-efficient technologies. Kirikkaleli and Adebayo (2021) document that within a global context, financial development contributes to environmental sustainability over the long run. Apart from that, a surplus of empirical studies has also reported a negative relationship between financial development and CO2 emissions. (see, e.g., Abid, 2017; Shahbaz et al., 2018; Umar et al., 2020; Kirikkaleli et al., 2021; He et al., 2021; Brown et al., 2022).

Indeed, as evidenced by the literature, studies on the linkage are mixed and not yet conclusive. Despite this, it also indicates some limitations in the existing body of knowledge. This study intends to get a more comprehensive picture of financial development not only by incorporating the credit creation as well as equity market but also demonstrate its specific mechanism through which act on innovation via different financial markets, thereby influencing the environmental sector.

Accordingly, from the foregoing, studies of these links are mixed and far from being conclusive. To reiterate, existing studies neglect the importance of the interactive effect of financial development and innovation which are required to be seen in conjunction with the environment. Currently, no existing research efforts have been conducted on the specific mechanism through which acts on innovation via different financial markets, thereby influencing the environmental sector. Thus, the present study expands on previous research by systematically analyzing the relationship between innovation and environmental quality under different levels of financial development, both in the credit market and equity market.

The research draws on a balanced panel of 52 countries covering the period 1990–2014. We used 5-year non-overlapping average data for all the variables. To be specific, the period is averaged over 5-year intervals, and each variable is covered by a maximum of five observations per country. The empirical investigation is divided into two parts. Firstly, we explore the relationship between innovation and CO2 emissions. Secondly, we assess the influence of financial development on the relationship between innovation and pollution. To achieve this, two methods are employed: a linear system GMM and a dynamic panel threshold.

Given the aim of this study, we use CO2 emissions to measure environmental quality. The higher the emissions, the greater the environmental degradation. In terms of innovation, this study will adopt patent-based measures of innovation, due to the lack of R&D expenditure data accessibility for some developing countries. Patent-based measures which are broadly used in prior studies (Jaffe, 1986; Pradhan et al., 2016; Law et al., 2018; Zhu et al., 2020), can better reflect the effective innovation output compared with the R&D expenditure indicator. Specifically, the total patent application and total patent grants extracted from the World Intellectual Property Organization (WIPO) will be employed as measurements of innovation. Turning to financial development, we employ a comprehensive financial development proxy that contains both credit and equity markets. Following the previous studies (Nasir et al., 2019; Nguyen et al., 2020), the proxy for two forms of markets are presented below:

Where

We follow the existing studies to include other covariates GDP (Zhang and Zhang, 2018), Trade (Park et al., 2018), Energy (Destek and Sarkodie, 2019), Human capital (Mahmood et al., 2019), Population (Dong et al., 2018) and Urbanization (Lin et al., 2017; Fang et al., 2020) as shown in Table 1. Data sources and descriptive statistics for all variables are summarized in Table 1 and Table 2, respectively.

Based on Table 2, we find an average value of CO2 emissions per capita is 0.397 while the averages of patent applications and grants are 1.198 and 0.471, respectively. Credit market development (FD1) and equity market development (FD2) have mean values of 3.797 and 3.562. Besides, they differ greatly across countries with standard deviations of 1.530 and 1.247, respectively.

As the first objective of this research is to investigate the effect of innovation on environmental quality, the baseline model is as follows. Next, we categorized the sample into two categories according to the level of financial development. Initially, the countries are sorted by level of financial development. Following this, we designate the 26 top countries as those with high financial development, while the 26 bottom countries are considered to have low financial development. By following this strategy, we can gain an understanding of how financial development may moderate the relationship between innovation and CO2 emissions. Within each group, the following equation is considered:

Where

Thus, from Equation 1, innovation is supposed to increase pollution if the estimated coefficient (

Where

The coefficient for the interactive term--

To give a precise estimated threshold value where the effects of innovation on the environment under the impact of financial development begin to change, this study adopts a novel GMM method proposed by Hansen (1999), created by Seo and Shin (2016), and Seo, Kim, and Kim (2019), where the transitional variable and other covariates are allowed to be endogenous and were extended from prior panel model (Caner and Hansen, 2004; Kremer et al., 2013).

Financial development is considered a threshold indicator in the study, whereas innovation is a regime-dependent variable that varies based on the estimated threshold of financial development. Our notation here is similar to that used in Eq. 1. Accordingly, the model given in Eq. 2 follows:

Where

In Table 3, the basic results of Eq. 1 are presented. We use patent applications and grants as proxies for innovation, and CO2 emissions as the proxy for environmental quality. We propose a two-step GMM approach for estimating Eq. 1. Considering the downward bias in the computation of the standard errors by two-step estimation, we apply the Windmeijer correction.

Starting with an analysis of how innovation impacts CO2 emissions, As shown by the full sample results, the overall impact of innovation on CO2 emissions is positive and significant. GDP/capita and energy exhibit significant negative and positive effects on CO2 emissions respectively. Moreover, human capital, population, and urbanization exhibit a positive but insignificant effect on CO2 emissions. Specifically, based on Table 3, we find a positive effect of innovation on CO2 emissions where a 1% rise in innovation increases CO2 emissions by 0.001468%. Consistent with another recent cross-country study by Chen and Lee (2020), innovation didn’t show a mitigation effect on environment quality globally. Our finding indicates that higher innovation increases environmental degradation. Despite the fact that innovation can enhance the efficiency of resource use, their marginal importance is diminishing, and the expansion of economic scale may still necessitate using a greater amount of natural resources, which will adversely impact the environment (Newell, 2009).

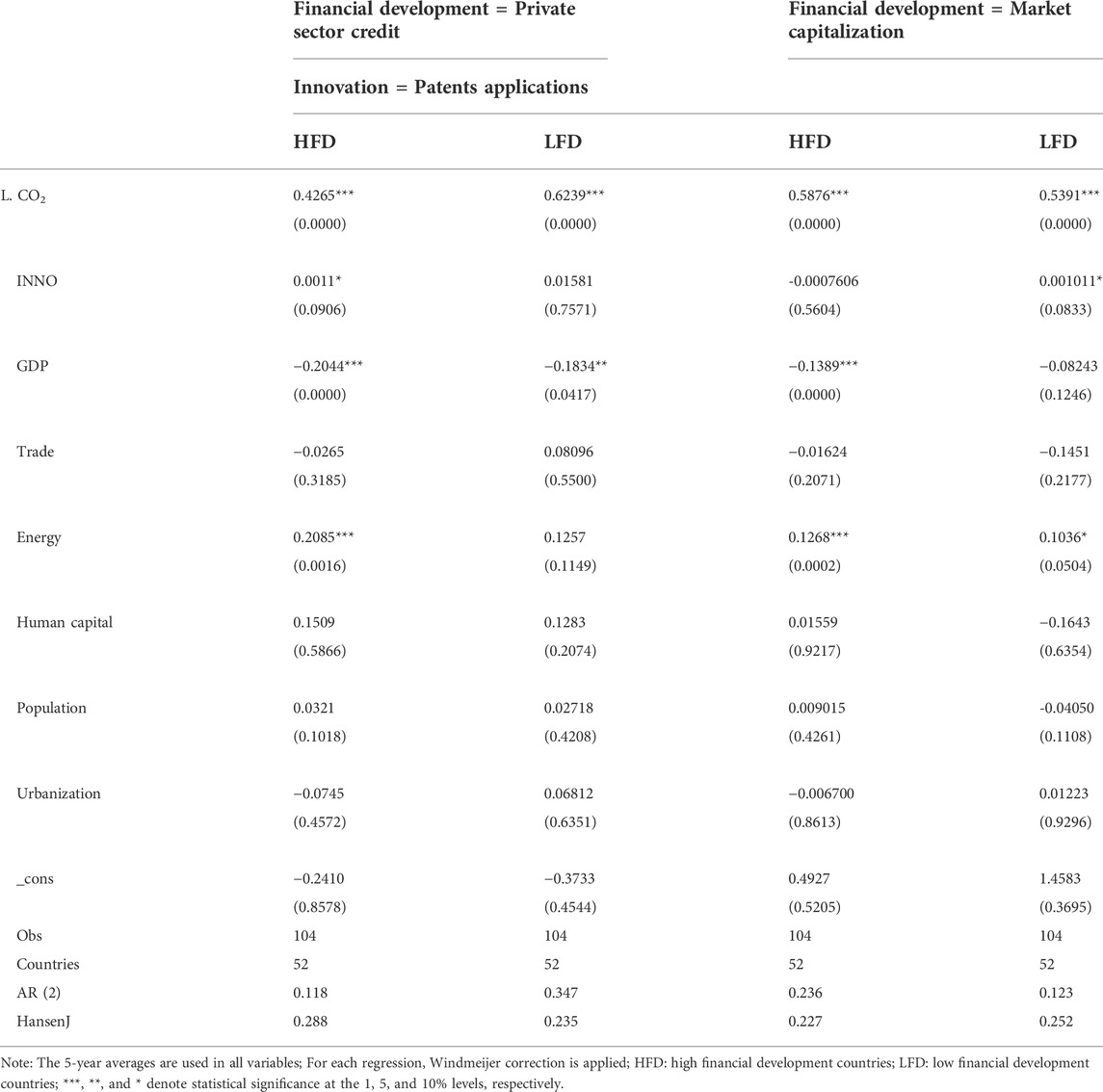

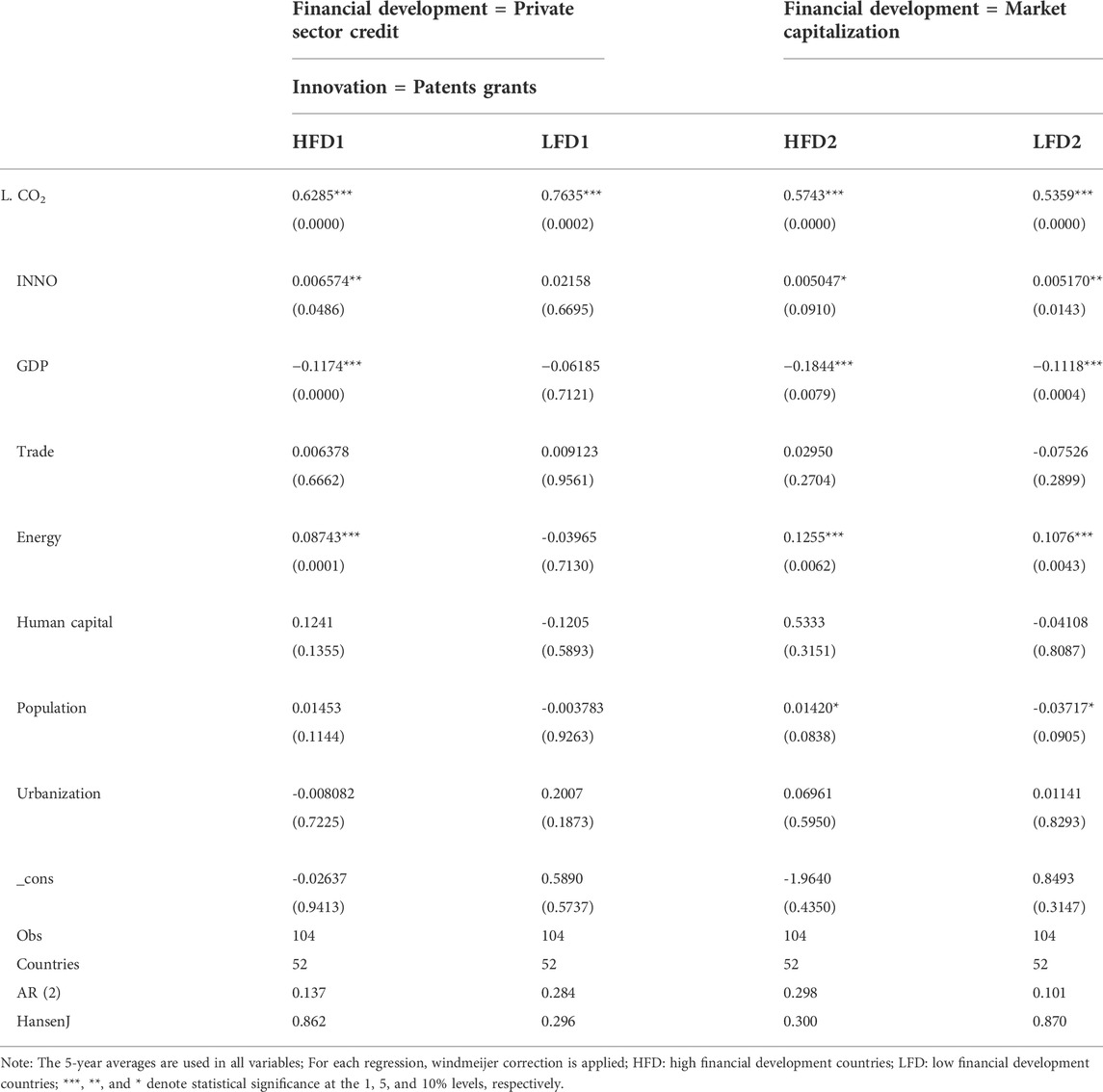

Next, we examine how innovation impacts CO2 emissions under different samples. We split the full sample into the low and high levels of credit market and equity market development countries. As shown in Table 4 and Table 5, the effect of innovation on CO2 emissions for low financial development countries is higher than that of high financial development countries. Throughout subsamples, we find that the coefficient estimate of innovation (INNO) is of greater magnitude and statistically more significant among countries with a low level of financial development (LFD). Additionally, we observe that for credit market development groups there is a greater dampening effect of innovation than for equity market development groups, given the coefficients of innovation. Below the Tables, we record the p-values for the AR (2) and Hansen J-tests. It is apparent from the AR (2) test that there is no significant correlation between the error term and the lagged dependent variable, indicating the use of two lags as a valid instrument. The Hansen test indicates that the specifications are not over-identified. This is in accordance with Figure 1.

TABLE 4. Financial development, Innovation, and environment quality: 1990–2014. (Innovation = Patents applications).

TABLE 5. Financial development, Innovation, and environment quality: 1990–2014. (Innovation = Patents grants).

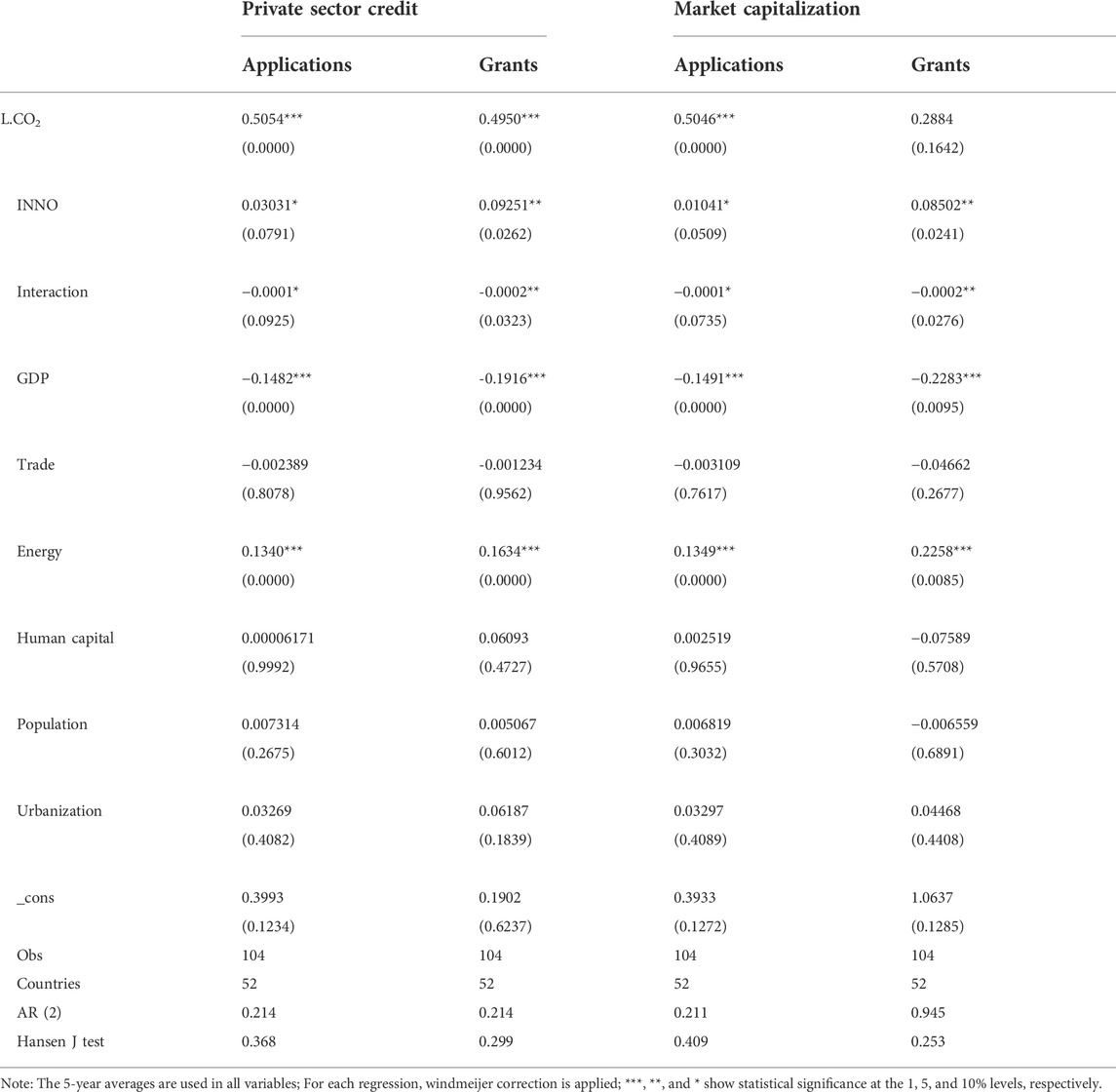

The interaction analysis is summarized in Table 6. For both credit market development and equity market development, there is consistent evidence that the interaction coefficient is negative, and that the coefficient of innovation (INNO) is positive and significant. As shown in Eq. 2, the average marginal effect of innovation on CO2 emission is

TABLE 6. The effect of innovation on environment quality with level of financial development: 1990–2014.

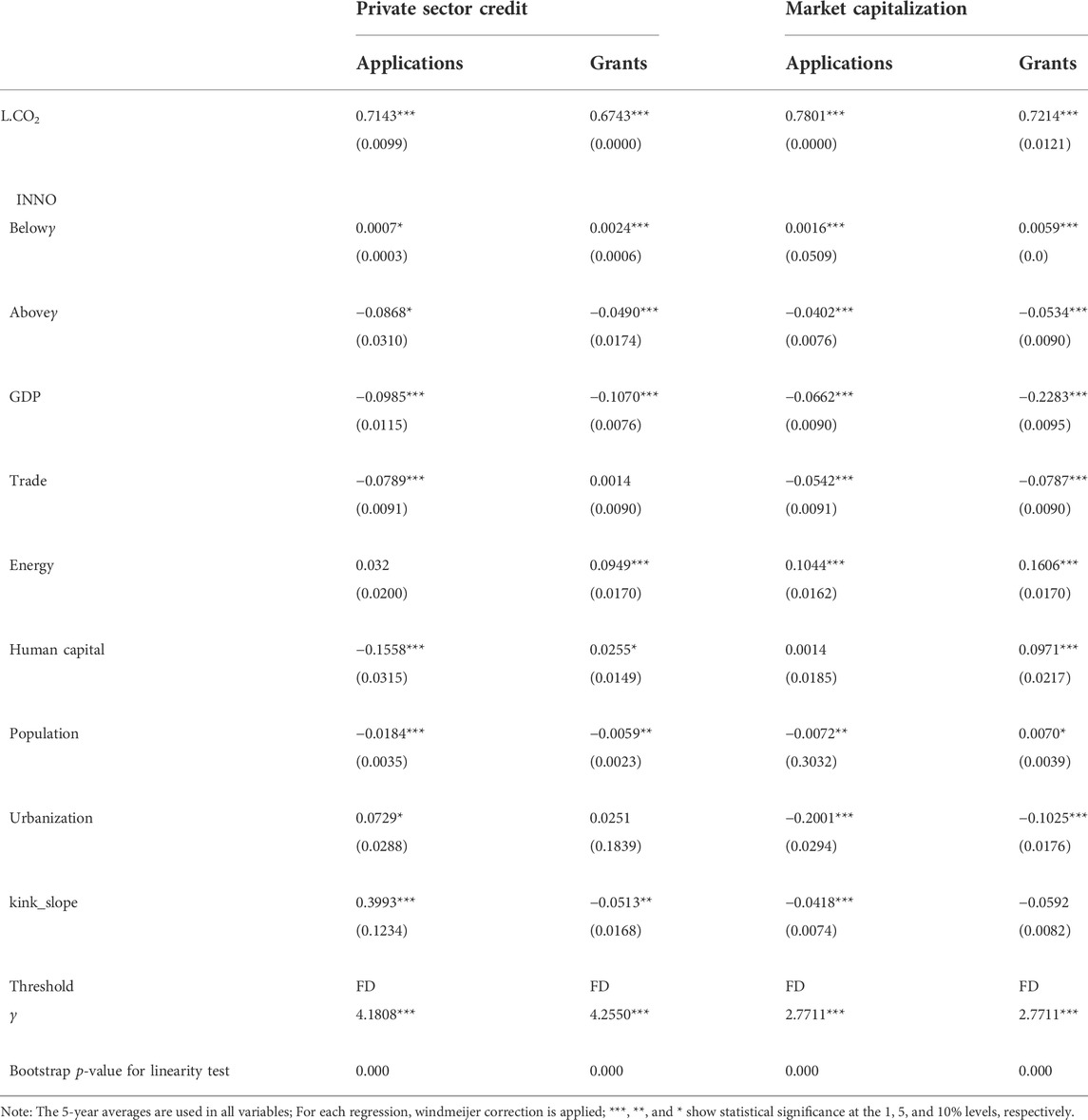

We can observe from Table 7 that a threshold is identified where γ (financial development) equals 4.181 and the bootstrap linearity test confirms the existence of the threshold effect. In simple terms, it is evident that innovation has a significantly different impact on CO2 emissions in the two regimes. In more detail, as shown in Figure 1 and Figure 2, innovation has a statistically significant and stronger positive effect on CO2 emissions in the lower financial development regime but is less correlated with CO2 emissions in the higher financial development regime. Therefore, it can be concluded that, with the growth of countries’ level of financial development, the CO2 emissions will increase at first and then reduce more slowly once the financial development exceeds the threshold value. The estimated threshold value of financial development is 65 and 16% as a share of GDP for the credit market and equity market respectively. The threshold value doesn’t show much difference when we use patent applications and grants as two indicators.

TABLE 7. Dynamic Panel Threshold Analysis: The effect of innovation on environment quality with level of financial development, 1990–2014.

As discussed above, equity markets and credit banks appear to exert different influences on the innovation-pollution nexus. Inspired by the work of Yao and Tang (2021), we introduce the financial structure to further investigate whether more equity-funded countries have more stringent pollution controls on innovative activities. We define Financial Structure (FS) as the proportion of stock market financing in total financing through credit and stock markets (De Haas and Popov, 2019):

The countries are divided into two groups by value of Financial Structure on an ascending scale. In our sample of countries, the top half is defined as more equity-based, while the bottom half is defined as more bank-based. We examine the structure of financial systems because the potential effect of innovation on pollution may be shaped by the financing mechanism of innovative activities in a country.

Table 8 provides the effect of financial structure on the innovation-pollution nexus. The results show that INNO has the expected signs. Specifically, innovation has a significant and positive effect on CO2 emissions in countries that are relatively more bank-based while in equity-based countries, innovation is found to have a significant and negative impact on CO2 emissions. This suggests that stock markets are better at funding innovation in an environmentally friendly way than banks.

We show that innovative activities exacerbate environmental degradation based on data covering 52 countries between 1990 and 2014. Yet, in countries with higher levels of financial development, their innovative activities are found to be less harmful to the environment. Additionally, the dampening effect of innovation on environmental quality is greater for credit market development groups than for equity market development groups. With a dynamic panel threshold method, we investigate the relationship among financial development, innovation, and environmental quality. We find that innovation is significantly associated with improvements in environmental quality when the private sector credit and market capitalization of listed domestic companies exceeds a threshold level of about 65 and 16% as a share of GDP respectively. Further, we also examine the relationship between financial structure and the innovation-pollution nexus. We show that innovation promotes environmental quality in countries that have a relatively more equity-based financial system.

From a policy perspective, the study highlights the importance of channeling funds to environmentally friendly and innovative activities for pollution reduction. We believe that identifying the direction of funds flow, as well as the sufficient level of finance, are both essential for maximizing mitigation pollution in response to innovations. Regarding credit markets, given the mean level of financial development (% of GDP) across different countries, the majority of the countries in this study have not reached the estimated threshold levels under which innovations do not lead to pollution. Accordingly, it is imperative for policymakers to incorporate green indicators as one of the conditions for providing credit. Concerning the equity market, our study shows that in the equity market, performance is better than in the credit market, with a lower threshold point based on the estimated innovation-pollution relationship. Thus, equity markets demonstrate a greater potential to contribute to the innovation-pollution nexus. Based on our findings, we recommend that in addition to monitoring and overseeing green actions in the real sector, countries should realign the financial structure in accordance with the innovation-pollution nexus, which is essential to green growth, by promoting innovation that leads to green transition.

The study has several limitations that can be addressed by future research. Firstly, this study provides cross-country evidence, but the results may vary in countries. Therefore, this framework can be used by future researchers to split the countries into different groups to examine if comparable results can be achieved. We believe it is valuable to see the results from various locations. Secondly, the environmental quality can be measured in other ways such as ecological footprint which includes more comprehensive indicators of anthropogenic actions, thus it could be considered in further research. Thirdly, apart from financial development, more factors should be taken into account in the innovation-pollution nexus, such as institutional quality, financial inclusion, green innovation, and circular economy principles. Finally, our study collected general patent data as the indicator of innovation in each country, but future studies can utilize patent applications and grants in environment-related technologies to focus on green innovation instead of general innovation.

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

DY: conceptualization, validation, investigation, writing-original draft, visualization. WS: writing review and editing, conceptualization, validation. AN and MH: analysis, corrections, and revisions. BL: revisions, editing, and proofreading.

This work was supported by Universiti Putra Malaysia under Grant 9696800.

We are sincerely grateful to the editor and anonymous referees for their constructive remarks and suggestions.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.980267/full#supplementary-material

Abid, A., Mehmood, U., Tariq, S., and Haq, Z. U. (2022). The effect of technological innovation, FDI, and financial development on CO2 emission: Evidence from the G8 countries. Environ. Sci. Pollut. Res. 29 (8), 11654–11662. doi:10.1007/s11356-021-15993-x

Abid, M. (2017). Does economic, financial and institutional developments matter for environmental quality? A comparative analysis of EU and mea countries. J. Environ. Manag. 188 (2), 183–194. doi:10.1016/j.jenvman.2016.12.007

Al-Silefanee, R. R., Mamkhezri, J., Khezri, M., Karimi, M. S., and Khan, Y. A. (2022). Effect of islamic financial development on carbon emissions: A spatial econometric analysis. Front. Environ. Sci. 10, 1–13. doi:10.3389/fenvs.2022.850273

Allen, F., and Gale, D. (1999). Diversity of opinion and financing of new technologies. J. Financial Intermediation 8 (1–2), 68–89. doi:10.1006/jfin.1999.0261

Anees, S., Zaidi, H., Wasif, M., and Hou, F. (2019). Dynamic linkages between globalization, financial development and carbon emissions: Evidence from Asia Pacific Economic Cooperation countries. J. Clean. Prod. 228, 533–543. doi:10.1016/j.jclepro.2019.04.210

Ara, R., Sohag, K., Mastura, S., and Jaafar, M. (2015). CO 2 emissions , energy consumption , economic and population growth in Malaysia. Renew. Sustain. Energy Rev. 41, 594–601. doi:10.1016/j.rser.2014.07.205

Bardos, K. S., Ertugrul, M., and Gao, L. S. (2020). Corporate social responsibility, product market perception, and firm value. J. Corp. Finance 62, 101588. doi:10.1016/j.jcorpfin.2020.101588

Benfratello, L., Schiantarelli, F., and Sembenelli, A. (2008). Banks and innovation: Microeconometric evidence on Italian firms. J. Financial Econ. 90 (2), 197–217. doi:10.1016/j.jfineco.2008.01.001

Brown, L., McFarlane, A., Das, A., and Campbell, K. (2022). The impact of financial development on carbon dioxide emissions in Jamaica. Environ. Sci. Pollut. Res. 29 (17), 25902–25915. doi:10.1007/s11356-021-17519-x

Cai, Y., Sam, C. Y., and Chang, T. (2018). Nexus between clean energy consumption, economic growth and CO2 emissions. J. Clean. Prod. 182, 1001–1011. doi:10.1016/j.jclepro.2018.02.035

Caner, M., and Hansen, B. E. (2004). Variable instrumental estimation of a threshold University of Pittsburgh. Econ. Theory 20 (5), 813–843. doi:10.1017/S026646660420501

Carpenter, J. N., Lu, F., and Whitelaw, R. F. (2020). The real value of China’s stock market. J. Financial Econ. 139, 679–696. doi:10.1016/j.jfineco.2020.08.012

Carpenter, R. E., and Petersen, B. C. (2002). Capital market imperfections, high-tech investment, and new equity financing. Econ. J. 112 (477), 54–72. doi:10.1111/1468-0297.00683

Chen, Y., and Lee, C. C. (2020). Does technological innovation reduce CO2 emissions?Cross-country evidence. J. Clean. Prod. 263, 121550. doi:10.1016/j.jclepro.2020.121550

Climate Transparency Report (2020). Comparing G20 climate action towards net zero the highlights. Available at: http://1p5ndc-pathways.climateanalytics.org/about/.

Dauda, L., Long, X., Mensah, C. N., Salman, M., Boamah, K. B., Ampon-Wireko, S., et al. (2021). Innovation, trade openness and CO2 emissions in selected countries in Africa. J. Clean. Prod. 281, 125143. doi:10.1016/j.jclepro.2020.125143

De Haas, R., and Popov, A. A. (2019). Finance and carbon emissions. ECB Work. Pap. Ser. doi:10.2139/ssrn.3459987

Destek, M. A., and Sarkodie, S. A. (2019). Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total Environ. 650, 2483–2489. doi:10.1016/j.scitotenv.2018.10.017

Dogan, E., and Seker, F. (2016). The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew. Sustain. Energy Rev. 60, 1074–1085. doi:10.1016/j.rser.2016.02.006

Dong, K., Hochman, G., Zhang, Y., Sun, R., Li, H., and Liao, H. (2018). CO2 emissions, economic and population growth, and renewable energy: Empirical evidence across regions. Energy Econ. 75, 180–192. doi:10.1016/j.eneco.2018.08.017

Du, K., Li, P., and Yan, Z. (2019). Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol. Forecast. Soc. Change 146, 297–303. doi:10.1016/j.techfore.2019.06.010

Fang, Z., Gao, X., and Sun, C. (2020). Do financial development, urbanization and trade affect environmental quality? Evidence from China. J. Clean. Prod. 259, 120892. doi:10.1016/j.jclepro.2020.120892

Fernández Fernández, Y., Fernández López, M. A., and Olmedillas Blanco, B. (2018). Innovation for sustainability: The impact of R&D spending on CO2 emissions. J. Clean. Prod. 172, 3459–3467. doi:10.1016/j.jclepro.2017.11.001

Hansen, B. E. (1999). Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econ. 93, 345–368. doi:10.1016/S0304-4076(99)00025-1

Haug, A. A., and Ucal, M. (2019). The role of trade and FDI for CO2 emissions in Turkey: Nonlinear relationships. Energy Econ. 81, 297–307. doi:10.1016/j.eneco.2019.04.006

He, X., Adebayo, T. S., Kirikkaleli, D., and Umar, M. (2021). Consumption-based carbon emissions in Mexico: An analysis using the dual adjustment approach. Sustain. Prod. Consum. 27, 947–957. doi:10.1016/j.spc.2021.02.020

Hsu, P. H., Tian, X., and Xu, Y. (2014). Financial development and innovation: Cross-country evidence. J. Financial Econ. 112 (1), 116–135. doi:10.1016/j.jfineco.2013.12.002

Ibrahim, M., and Vo, X. V. (2021). Exploring the relationships among innovation, financial sector development and environmental pollution in selected industrialized countries. J. Environ. Manag. 284, 112057. doi:10.1016/j.jenvman.2021.112057

IPCC (2022) Climate change 2022 impacts, adaptation and vulnerability summary for Policymakers.Contribution of working group II to the sixth assessment Report of the intergovernmental panel on climate change.

Jaffe, A. B. (1986). Technological opportunities and spillovers of R&D: Evidence from firm’s patents, profits and market value. Am. Econ. Rev. 76 (5), 984–1001.

King, R. G., and Levine, R. (1993). Finance, entrepreneurship and growth. J. Monetary Econ. 32 (3), 513–542. doi:10.1016/0304-3932(93)90028-E

Kirikkaleli, D., and Adebayo, T. S. (2021). Do renewable energy consumption and financial development matter for environmental sustainability? New global evidence. Sustain. Dev. 29 (4), 583–594. doi:10.1002/sd.2159

Kirikkaleli, D., Güngör, H., and Adebayo, T. S. (2021). Consumption‐based carbon emissions, renewable energy consumption, financial development and economic growth in Chile. Bus. Strategy Environ. 31 (3), 1123–1137. doi:10.1002/bse.2945

Kremer, S., Bick, A., and Nautz, D. (2013). Inflation and growth: New evidence from a dynamic panel threshold analysis. Empir. Econ. 44 (2), 861–878. doi:10.1007/s00181-012-0553-9

Latif, B., Gunarathne, N., Gaskin, D., San, T., and Ali, M. (2022). Resources, Conservation and Recycling Environmental corporate social responsibility and pro-environmental behavior: The effect of green shared vision and personal ties. Resources, Conservation and Recycling 186, 106572. doi:10.1016/j.resconrec.2022.106572

Law, S. H., Lee, W. C., and Singh, N. (2018). Revisiting the finance-innovation nexus: Evidence from a non-linear approach. J. Innovation Knowl. 3 (3), 143–153. doi:10.1016/j.jik.2017.02.001

Le, T. D., Pham, D. P. T., and Le, T. B. (2019). The relationship between financial development and innovation: Empirical evidence from selected Asian countries. Acta Univ. Agric. Silvic. Mendel. Brun. 67 (1), 287–298. doi:10.11118/actaun201967010287

Levine, R. (2005). Chapter 12 finance and growth: Theory and evidence. FINANCE GROWTH THEORY Evid. 1 (05), 865–934. doi:10.1016/S1574-0684(05)01012-9

Lin, S., Wang, S., Marinova, D., Zhao, D., and Hong, J. (2017). Impacts of urbanization and real economic development on CO2 emissions in non-high income countries: Empirical research based on the extended STIRPAT model. J. Clean. Prod. 166, 952–966. doi:10.1016/j.jclepro.2017.08.107

Mahmood, N., Wang, Z., and Hassan, S. T. (2019). Renewable energy, economic growth, human capital, and CO2 emission: An empirical analysis. Environ. Sci. Pollut. Res. 26 (20), 20619–20630. doi:10.1007/s11356-019-05387-5

Mardani, A., Streimikiene, D., Cavallaro, F., Loganathan, N., and Khoshnoudi, M. (2019). Carbon dioxide (CO2) emissions and economic growth: A systematic review of two decades of research from 1995 to 2017. Sci. Total Environ. 649, 31–49. doi:10.1016/j.scitotenv.2018.08.229

Morck, R., and Nakamura, M. (1999). Banks and corporate control in Japan. J. Finance 54 (1), 319–339. doi:10.1111/0022-1082.00106

Muhammad, S., Long, X., Salman, M., and Dauda, L. (2020). Effect of urbanization and international trade on CO2 emissions across 65 belt and road initiative countries. Energy 196, 117102. doi:10.1016/j.energy.2020.117102

Nasir, M. A., Duc Huynh, T. L., and Xuan Tram, H. T. (2019). Role of financial development, economic growth & foreign direct investment in driving climate change: A case of emerging asean. J. Environ. Manag. 242, 131–141. doi:10.1016/j.jenvman.2019.03.112

Newell, R. G. (2009). Literature review of recent trends and future prospects for innovation in climate change mitigation, 9. Paris: OECD Environment Working Papers.

Nguyen, T. T., Pham, T. A. T., and Tram, H. T. X. (2020). Role of information and communication technologies and innovation in driving carbon emissions and economic growth in selected G-20 countries. J. Environ. Manag. 261, 110162. doi:10.1016/j.jenvman.2020.110162

Paramati, S. R., Mo, D., and Gupta, R. (2017). The effects of stock market growth and renewable energy use on CO2 emissions: Evidence from G20 countries. Energy Econ. 66, 360–371. doi:10.1016/j.eneco.2017.06.025

Park, Y., Meng, F., and Baloch, M. A. (2018). The effect of ICT , financial development, growth, and trade openness on CO2 emissions: An empirical analysis. Environ. Sci. Pollut. Res. 25, 30708–30719. doi:10.1007/s11356-018-3108-6

Pradhan, R. P., Arvin, M. B., Hall, J. H., and Nair, M. (2016). Innovation, financial development and economic growth in Eurozone countries. Appl. Econ. Lett. 23 (16), 1141–1144. doi:10.1080/13504851.2016.1139668

Ren, S., Yuan, B., Ma, X., and Chen, X. (2014). International trade, fdi (foreign direct investment) and embodied CO2 emissions: A case study of chinas industrial sectors. China Econ. Rev. 28, 123–134. doi:10.1016/j.chieco.2014.01.003

Saboori, B., Sulaiman, J., and Mohd, S. (2012). Economic growth and CO2 emissions in Malaysia: A cointegration analysis of the environmental kuznets curve. Energy Policy 51, 184–191. doi:10.1016/j.enpol.2012.08.065

Seo, M. H., Kim, S., and Kim, Y. J. (2019). Estimation of dynamic panel threshold model using Stata. Stata J. 19 (3), 685–697. doi:10.1177/1536867X19874243

Seo, M. H., and Shin, Y. (2016). Dynamic panels with threshold effect and endogeneity. J. Econ. 195 (2), 169–186. doi:10.1016/j.jeconom.2016.03.005

Shahbaz, M., Hye, Q. M. A., Tiwari, A. K., and Leitao, N. C. (2013). Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 25, 109–121. doi:10.1016/j.rser.2013.04.009

Shahbaz, M., Nasir, M. A., and Roubaud, D. (2018). Environmental degradation in France: The effects of FDI, financial development, and energy innovations. Energy Econ. 74, 843–857. doi:10.1016/j.eneco.2018.07.020

Shoaib, H. M., Rafique, M. Z., Nadeem, A. M., and Huang, S. (2020). Impact of financial development on CO2 emissions: A comparative analysis of developing countries (D8) and developed countries (G8) hafiz. Environ. Sci. Pollut. Res. 27 (11), 12461–12475. doi:10.1007/s11356-019-06680-z

Singh, A. (1991) The stock market and economic development: Should developing countries encourage stock markets? MPRA Paper 53881.

Sunday Adebayo, T., Saint Akadiri, S., Haouas, I., and Rjoub, H. (2022). A time-varying analysis between financial development and carbon emissions: Evidence from the MINT countries. Energy Environ., 0958305X2210820. doi:10.1177/0958305X221082092

Töbelmann, D., and Wendler, T. (2020). The impact of environmental innovation on carbon dioxide emissions. J. Clean. Prod. 244, 118787. doi:10.1016/j.jclepro.2019.118787

Trinugroho, I., Hook, S., Chang, W., Wiwoho, J., and Sergi, B. S. (2021) ‘Effect of financial development on innovation: Roles of market institutions ☆’, Econ. Model., 103(), p. 105598. doi:10.1016/j.econmod.2021.105598

Tze San, O., Badar, L., and Vaio, A. Di. (2022) GEO and sustainable performance: The moderating role of GTD and environmental consciousness, J. Intellect. Cap., 23 (7), 38–67. doi:10.1108/JIC-10-2021-0290

Umar, M., Ji, X., Kirikkaleli, D., and Xu, Q. (2020). COP21 Roadmap: Do innovation, financial development, and transportation infrastructure matter for environmental sustainability in China? J. Environ. Manag. 271 (2019), 111026. doi:10.1016/j.jenvman.2020.111026

Xiao, S., and Zhao, S. (2012). Financial development, government ownership of banks and firm innovation. J. Int. Money Finance 31 (4), 880–906. doi:10.1016/j.jimonfin.2012.01.006

Yan, Z., Yi, L., Du, K., and Yang, Z. (2017). Impacts of low-carbon innovation and its heterogeneous components on CO2 emissions. Sustain. Switz. 9 (4). doi:10.3390/su9040548

Yang, B., Jahanger, A., and Ali, M. (2021). Remittance inflows affect the ecological footprint in BICS countries: Do technological innovation and financial development matter? Environ. Sci. Pollut. Res. 28 (18), 23482–23500. doi:10.1007/s11356-021-12400-3

Yao, X., and Tang, X. (2021). Does financial structure affect CO2 emissions? Evidence from G20 countries. Finance Res. Lett. 41 (2), 101791. doi:10.1016/j.frl.2020.101791

Yu, D., Tao, S., Hanan, A., Ong, T. S., Latif, B., and Ali, M. (2022). Fostering green innovation adoption through Green Dynamic Capability: The Moderating Role of Environmental Dynamism and Big Data Analytic Capability. Int. J. Environ. Res. Public Health 19, 10336. doi:10.3390/ijerph191610336

Zhang, G., Zhang, N., and Liao, W. (2018). How do population and land urbanization affect CO2 emissions under gravity center change? A spatial econometric analysis. J. Clean. Prod. 202, 510–523. doi:10.1016/j.jclepro.2018.08.146

Zhang, Y., and Zhang, S. (2018). The impacts of GDP, trade structure, exchange rate and FDI inflows on China’s carbon emissions. Energy Policy 120 (2), 347–353. doi:10.1016/j.enpol.2018.05.056

Zhao, J., Shahbaz, M., Dong, X., and Dong, F. (2021). How does financial risk affect global CO2 emissions? The role of technological innovation. Technol. Forecast. Soc. Change 168, 120751. doi:10.1016/j.techfore.2021.120751

Keywords: financial development, innovation, CO2 emission, financial structure, threshold effect

Citation: Yu D, Soh W, Amin Noordin BA, Dato Haji Yahya MH and Latif B (2022) The impact of innovation on CO2 emissions: The threshold effect of financial development. Front. Environ. Sci. 10:980267. doi: 10.3389/fenvs.2022.980267

Received: 28 June 2022; Accepted: 22 August 2022;

Published: 16 September 2022.

Edited by:

Mobeen Ur Rehman, Shaheed Zulfikar Ali Bhutto Institute of Science and Technology (SZABIST), United Arab EmiratesReviewed by:

Tomiwa Sunday Adebayo, Cyprus International University, TurkeyCopyright © 2022 Yu, Soh, Amin Noordin, Dato Haji Yahya and Latif. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Weini Soh, c29od2VpbmlAdXBtLmVkdS5teQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.