- 1School of Economics and Management, China Three Gorges University, Yichang, Hubei, China

- 2School of Economics and Management, Wuhan University, Wuhan, Hubei, China

Based on climate change data of local cities and cash holding data of Chinese listed companies from 2011 to 2019, this article studies the impact of climate change on the level of corporate cash holdings and analyzes the path of climate change on the corporate cash holding level. The results show that under the influence of climate change, enterprises hold a high level of cash holdings to cope with risks and change variables to carry out robustness tests; meanwhile, the results remain consistent. By analyzing the source channels of enterprise cash, it is found that climate change increases the cash received from selling goods, providing services, and tax refund, but decreases the cash received from borrowing. The mechanism of action shows that climate change has increased the operating risk of enterprises and thus the level of cash holdings of enterprises, but climate change has not increased the financial risk of enterprises. The main reason is that under the influence of climate change, enterprises have reduced the debt level and thus reduced the financial risk. Heterogeneity analysis shows that the impact of climate change on corporate cash holdings is more obvious in state-owned enterprises, enterprises with high degree of financing constraints, and ecologically fragile regions. This study provides a new explanation for the influencing factors and approaches of corporate cash management strategies, which helps to better understand the cash holding strategies of listed companies in China. It also indicates that climate change is likely to be a macro incentive to aggravate the risks of real economy.

1 Introduction

Climate change is one of the important challenges facing the world today. In recent years, social problems caused by climate change have become increasingly prominent. Climate change has not only been concerned by meteorologists and economists but also generally received the attention of governments of various countries around the world (Pankratz et al., 2019). For example, the signing of the Paris Agreement shows the efforts to deal with climate change on a global scale, while the proposal of the dual carbon goals of “carbon neutrality and carbon peak” is an important strategy for China to reduce climate change and deal with climate risks.

Existing studies on the economic consequences of climate change mainly focus on macroeconomic effects, such as average temperature rise on agriculture (Schlenker et al., 2005; Schlenker and Roberts, 2009; Zhang et al., 2017), industrial output or economic growth (Dell et al., 2012), international trade (Jones and Olken, 2010), and labor productivity or total factor productivity (Letta and Tol, 2019; Patle et al., 2020) all had negative effects. Climate change also brings uncertainty to the production and operation of enterprises and affects the economic activities of microenterprisesenterprises, mainly embodied in the multiple risks caused by climate change such as the physical risk (flood, severe storms, droughts, and extreme temperature) of fixed assets of enterprises, the government policy’s uncertainty risk associated with climate change and local governments (in order to complete the “double carbon” target of electricity measures), as well as the regulatory risk (strict environmental regulation).The main climate risks faced by enterprises and investors in the next 5 years come from climate policy changes, and the actual impact of climate change on physical assets is the biggest risk in the next 3 decades (Stroebel and Wurgler, 2021). The current crisis continues to pose great challenges for both politicians and central banks to find more sustainable solutions and win the trust of the population (Sinkovic et al., 2021).

Since climate change has brought risks to enterprises’ production and operation, will enterprises take measures to deal with these risks? The level of cash holding is related to the long-term prospect of enterprise operation. Companies tend to reserve a certain amount of cash to cope with market uncertainty and economic crisis (Myers and Majluf, 1984; Bates et al., 2009; Song and Lee, 2012). Cash is one of the important ways for enterprises to control the overall risk. Will enterprises keep a high level of cash holdings to cope with climate risks? In addition, given the opportunity cost of cash holding, companies must balance and dynamically adjust the benefits and costs of cash holding to keep it at an “optimal” level. However, from the perspective of investment opportunities, physical risks, policy risks, and regulatory risks of enterprises in regions with large climate change increase, and enterprises reduce investment opportunities and investment intentions, thus reducing cash holdings. Will climate change have an impact on corporate cash holdings at all? This study will investigate the impact of climate change on corporate cash holdings and explore its internal mechanism and transmission path.

The reasons for choosing Chinese companies as research objects are mainly based on the following considerations: 1) China has a large land area, and there are huge climate differences between different regions. Therefore, the research on climate risks in China can cover more types of climate and enterprises which is more applicable and reliable. 2) China is a large economy facing a greater threat from climate change with a high climate risk index, and the climate problem is relatively serious. 3) In recent years, extreme climate events in China, such as floods and high temperatures, have caused negative impacts on residents’ daily life. Therefore, studying the impact of climate change on Chinese enterprises has an important practical significance and practical value.

The occurrence of climate change is a naturalenvironmental phenomenon, and for enterprises, it is an external emergency. It is almost impossible for enterprises to influence the time and place of climate change, so as to avoid the endogeneity problem caused by reverse causation; secondly, the occurrence of climate change and extreme climate events is obviously random and highly complex, so it is very difficult for enterprises to predict it. Therefore, enterprises cannot change the production address in anticipation of climate change, and the cost of changing the production address is high, which makes most enterprises passively accept the climate shock and reduces the underestimation of climate change impacts caused by corporate relocation. Therefore, based on climate change data of local cities and cash holding data of Chinese listed companies from 2011 to 2019, this article studies the impact of climate change on the corporate cash holding level from the perspective of cash prevention motivation and analyzes the path and heterogeneity of climate change on the corporate cash holding level. The results show that under the influence of climate change, enterprises respond to risks by holding high levels of cash holdings, and the results remain consistent after robustness tests by using alternative variables and eliminating special samples. By analyzing the source channels of corporate cash, it is found that climate change increases the cash received from selling goods, providing services, and the cash returned from taxes and fees, but it decreases the cash received from borrowing. The mechanism of action shows that climate change has increased the operating risk of enterprises and thus the level of cash holdings of enterprises, but it has not increased the financial risk of enterprises. The main reason is that under the influence of climate change, enterprises have reduced the debt level and thus the financial risk. A heterogeneity analysis shows that the impact of climate change on corporate cash holdings is more obvious in state-owned enterprises, enterprises with high degree of financing constraints, and ecologically fragile regions.

The contributions of this study are mainly reflected in the following aspects:

First, this study examines the choice of enterprise cash holding decision from the perspective of climate change. Previous studies focused on the macroeconomic impact of climate change, and few studies focused on the impact of climate change on the level of enterprises. This study combines climate change with the enterprise cash holding level for the first time, which not only helps to fully understand the relationship between macro climate change and enterprise behavior at the micro level but also enriches the relevant research in the field of influencing factors of the enterprise cash holding level.

Second, extreme climatic events have occurred frequently in recent years, and enterprises are likely to respond to the impact of climate change and extreme climate events by adjusting the cash holding level. Therefore, it is of high research value to analyze the mechanism of climate change affecting the cash holding level of enterprises. The increasingly severe climate change is bound to affect the micro business behavior of enterprises. It is particularly important to study the internal mechanism of climate change affecting the micro business behavior of enterprises at the moment of the threat of climate change. The disclosure of the mechanism in this study can show the transmission channel of climate change to the cash holding level of enterprises and further expand the research scope of climate risk and the cash holding level.

Finally, this study analyzes the differences of the impact of climate change on the cash holding level of enterprises with different property rights, financing constraints, and regional ecological vulnerability. Enterprises can make more reasonable cash holding decisions by analyzing the impact of climate change in combination with their own property rights and financing constraints. Local governments can judge the level of climate risk according to the regional ecological vulnerability, which will help the government to improve the climate change response system and formulate flexible and effective carbon emission reduction policies. It can also provide a theoretical basis and empirical evidence for enterprises to make reasonable cash holding decisions according to their own conditions to deal with climate change in the face of a high climate risk.

The other parts of this article are arranged as follows: the second part is the theoretical analysis and research hypothesis. The third part is the research design. The fourth part is the empirical results and analysis. The fifth part is the mechanism research. The sixth part is heterogeneity analysis. The seventh part is the research conclusion and policy suggestion.

2 Theoretical analysis and research hypothesis

2.1 Literature review

Existing studies have extensively discussed the economic effects of climate change, and average temperature rise has an impact on agriculture (Schlenker et al., 2005; Schlenker and Roberts, 2009; Zhang et al., 2017), industrial output or economic growth (Dell et al., 2012), health or mortality (Heutel et al., 2021), international trade (Jones and Olken, 2010), and labor productivity or total factor productivity (Letta and Tol, 2019; Patle et al., 2020) have had a negative impact. Moreover, carbon emission has a negative but significant nexus with the sustainable economic development of the ASEAN countries (Nguyen and Ngo, 2022). However, few scholars have studied how climate change affects the economic activities of microenterprises. Stroebel and Wurgler’s (2021) survey of 861 relevant individuals found that most people believe that the main climate risks faced by companies and investors in the next 5 years come from changes in climate policy, and the actual impact of climate change on physical assets is the future biggest risk in 30 years. Climate change has had a negative impact on the macroeconomic level, but the research on its impact on the micro-management behavior of listed companies still needs to be expanded. The current research has different conclusion on this: Addoum et al. (2020) used the factory-level data of American companies and did not find that extreme high temperature is significantly related to the productivity and sales revenue of the factory. We obtained sufficient resources to withstand temperature changes. Pankratz et al. (2019) research based on data from 93 countries found that an extreme high-temperature environment will reduce company’s sales revenue.

For the studying corporate cash holding strategies, after Keynes (1936) first proposed the three major motives for corporate cash holdings, Opler et al. (1999) studied the determinants of cash holdings in the US listed companies from 1971 to 1994 and found that management people will hold extra cash for their own goals such as risk aversion, investment arbitrage, and reduction of dividend payments. How to maintain a reasonable and stable level of cash holdings is of great significance to reduce the total cost of cash holdings and improve the efficiency of business management. Baum et al. (2004) studied the impact of macroeconomic fluctuations on the cash holding behavior of non-financial companies. The increase in macroeconomic fluctuations will lead to an unreasonable distribution of cash holdings in various companies. Rizwan (2012) believes that when the macroeconomic environment is uncertain, because external financing becomes difficult to obtain, the company’s demand for cash increases. Song and Lee (2012) studied how the Asian financial crisis affected the cash management policies of Asian companies by examining the cash holdings of Asian companies before and after the crisis. Pinkowitz et al. (2013) investigated whether there were unusually high changes in the cash holdings of the US listed companies before and after the financial crisis. They found that after the financial crisis, US companies held more cash than companies with similar characteristics in the late 1990s. In the research on the internal characteristics of companies and the influence of company size on cash holdings, one view is that company size has a negative impact on cash holdings (Faulkender, 2002). Another hypothesis is that cash holdings are positively correlated with firm size, and large companies are in a better position to accumulate cash because they may be more profitable (Ozkan and Ozkan, 2004). Other scholars have studied the impact of company-level characteristics such as financial leverage, cash flow, investment opportunities, ownership, and governance factors on cash holdings (Ferreira and Vilela, 2004; Kusnadi, 2011; Shah, 2011). However, most of the aforementioned studies explore the impact of economic factors and internal factors on corporate cash holding strategies based on the economic environment and corporate-level characteristics. There is still a lack of research on how climate change affects corporate cash holdings. The impact of climate change on companies’ production and operation activities has brought great certainty. Cash holding is one of the important ways for companies to control overall risks. How will climate risks affect companies’ cash holding behavior? This study will examine the impact of climate change on corporate cash holdings.

By analyzing and combing the existing literature, it can be seen that today’s academic circles have done relevant research on the macroeconomic impact of climate change and the influencing factors of corporate cash holdings. The research found that the influencing factors of listed companies’ cash holdings are mainly concentrated in internal factors such as corporate characteristics and corporate governance, as well as external factors such as macroeconomic and institutional environment. There is no research on the impact of climate change on corporate cash holdings from the perspective of the natural environment, especially the climate risk. The external natural environment affects the survival of enterprises all the time. Enterprises are also facing dual challenges of the impact of external climate change and the requirements of green and low-carbon development. How should enterprises turn challenges into opportunities and how to promote the external pressure of environmental governance into the internal driving force of the transformation of their own development mode, so as to achieve green and high-quality development while maintaining economic stability and progress, creating enterprises with a win-win situation between the government and residents? We have to deeply explore the impact of climate change on the business behavior at the micro enterprise level. Therefore, based on China’s unique natural environment and institutional background, this study uses previous studies to examine the impact of climate change on corporate cash holding behavior.

2.2 Climate change and corporate cash holdings

Cash is an indispensable asset for companies to maintain production, operation, and growth. Cash flow can reflect the true operating conditions of the company. In order to deal with financing constraints, product market competition, and uncertainty of future investment opportunities, companies need to maintain a certain amount of cash holding level. First, according to the theory of financing priority, because of the difference in the cost of capital caused by information asymmetry, companies will give priority to endogenous financing, and companies will maintain the ability to pay for cash in order to cope with unexpected situations, that is, hold cash based on preventive motives. To deal with the pressure of product market competition, it is necessary to maintain normal production and operation, that is, to hold a certain amount of cash for transaction motivation. Third, when the company has already met the existing investment needs, it needs to hold additional cash to seize future investment opportunities. This article examines how climate change affects corporate cash holding strategies based on three aspects: prevention motivation, transaction motivation, and investment motivation.

Climate change will increase the business risk of enterprises. First, climate change will reduce employee productivity and working hours (Sepannen et al., 2006; Graff Zivin and Neidell, 2014). Compared with the production level of enterprises under normal climatic conditions, climate change will decrease the production capacity of the company. Insufficient production will affect the normal operation of the company and damage the company’s own operating capacity. Second, climate change will increase the uncertainty of the external operating environment, and the willingness of customers to purchase and pay will be negatively affected. In addition to the possibility of unrecoverable payments, it also reduces operating income. In severe cases, it may even cause companies to suspend work and production. Therefore, companies need to increase cash holdings to deal with higher operating risks. At the same time, climate change will also cause uncertainty in corporate earnings, a significant increase in cash flow volatility, and weaker corporate solvency. At the same time, banks tend to issue short-term loans, which in turn increase corporate financial risks. Therefore, companies, in order to enhance their own debt servicing ability, will hold more cash. Climate change will also inhibit the production of inventories and investment in fixed assets by enterprises. Because inventories and fixed assets are easily damaged in extreme climates, enterprises are likely to be unable to perform the contract and need to postpone the execution of the contract or assume compensation obligations and reduce production of inventory and of purchase fixed assets. Assets, in order to satisfy the trading motives of normal production and operation and the speculative companies that make additional investments, will hold more cash. In summary, companies hold more cash based on stronger preventive motives, speculation, and trading opportunities, and climate change will increase the level of cash holdings of companies.

Based on the aforementioned analysis, this study proposes Hypothesis 1:

Hypothesis 1:. Climate change will increase the level of corporate cash holdings; compared with companies facing smaller financing constraints, climate change has a greater impact on the cash holdings of companies with greater financing constraints because when companies face greater financing constraints, it is more difficult for companies to raise all funds in response to extreme climates. Funds are needed, so when climate changes, on the one hand, banks increasingly regard climate change as a related risk factor when issuing loans. When climate changes, the business and financial risks of companies increase. Banks consider the increase in the possibility that loans cannot be recovered and will reduce the number of loans issued to enterprises, increase loan approval standards, or increase loan interest rates, and the financing constraints of enterprises will be further tightened, which will encourage enterprises to use more endogenous financing and hold more According to a study by Javadi and Al Masum (2021), in areas with higher climate change risks, the spread of bank loans paid by companies is significantly higher, and the company’s customers exposure to climate risks will also have an impact on the company’s borrowing costs. Adverse effects; on the other hand, climate change makes companies with greater financing constraints hold more cash than usual, and compared with companies with less financing constraints, managers face greater financing constraints based on previous experience. Compared with peers, in order to avoid the higher operating and financial risks of climate change and serious negative impacts on companies, the increase in cash holdings will be greater. Therefore, the higher the degree of corporate financing constraints, the greater the impact of climate change on corporate cash, and the positive impact of holding is more significant.Based on the aforementioned analysis, this study proposes Hypothesis 2:

Hypothesis 2:. The higher the degree of corporate financing constraints, the more significant the positive impact of climate change on corporate cash holdings.During climate change, state-owned companies tend to hold more cash than private companies. First, private enterprise groups operating in a collectivized mode can effectively alleviate capital constraints and deal with external risks through the allocation of resources in the internal capital market (Carney et al., 2011). However, state-owned enterprise groups often have more serious agency problems due to the absence of owners, and the internal capital market is likely to become a tool for major shareholders to “empty” the company (Li et al., 2004). Compared with private member companies, state-owned member companies generally hold more cash (Haley and Haley, 2013). Climate risks may be exaggerated to encourage companies to hold excess cash and become a means for large shareholders of state-owned enterprises to embezzle state-owned assets. Second, state-owned enterprises tend to reduce working hours or give more subsidies during climate change. The risk compensation provided by state-owned enterprises is generally higher than that of private enterprises, and the basic compensation of private enterprises is higher (Jiang Tao and Xu Yu et al., 2008). Climate risk is increasingly being considered in the overall corporate risk. Since private companies provide more basic salaries, climate change will have less impact on the total compensation of employees. Moreover, state-owned enterprises will more strictly implement relevant laws and regulations to issue high-temperature allowances when the temperature is high because the goal of state-owned enterprises is to maximize social benefits. Compared with the goal of private enterprises to maximize shareholder’s wealth, they will pay more attention to the personal health of employees. Therefore, state-owned enterprises may hold more cash due to more serious agency problems and higher management fees during climate change.Based on this, this article proposes Hypothesis 3:

Hypothesis 3:. Compared with non–state-owned enterprises, the positive impact of climate change on the cash holdings of state-owned enterprises is more significant.

3 Research design

3.1 Sample selection and data sources

The research sample of this study is the sample of Chinese A-share listed companies from 2011 to 2019, and the sample is treated as follows: first, financial companies and ST and PT companies are excluded; second, 1% Winsorization was applied to both ends of the continuous variable, and the clustering adjustment of the standard error was carried out at the company level in the regression analysis. The financial data of this study comes from CSMAR, and the climatic data comes from The Daily Data Set of China Surface Climatic Data collected from 842 benchmark and general surface meteorological observation stations of the State Meteorological Administration. The temperature data of prefectural cities adopts the data of the nearest meteorological station.

3.2 Research model and variable definition

In order to test the aforementioned research hypothesis, this study constructed the following empirical model by referring to Huang et al. (2018):

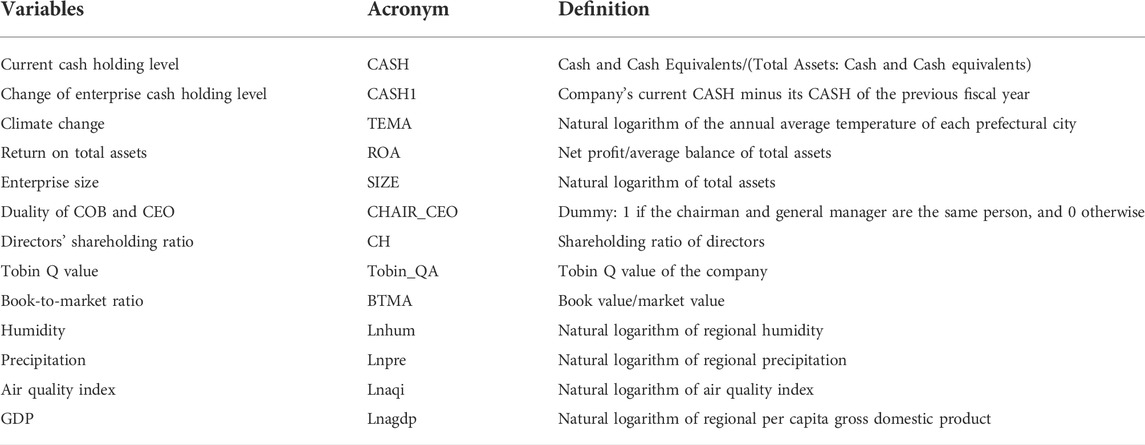

In the model, by referring to Almeida et al. (2004) and Harford et al. (2008), this study uses the current cash holding level (CASH) and the change of enterprise cash holding level (CASH1) as dependent variables to investigate how climate change affects the enterprise cash holding level. Independent variable climate change (TEMA): Climate warming is the biggest impact faced by natural ecosystems, and climate change is measured by climate warming (Montzka et al., 2011). In this study, using Huang et al. (2018) as a reference, the annual average temperature of each prefectural city is taken as the natural logarithm (TEMA) as the measure of climate variable. Control variables at the enterprise level include return on total assets (ROA); enterprise size (SIZE) is measured by the natural logarithm of total assets; CHAIR_CEO is set to 1 if the chairman and general manager are the same person, otherwise it is set to 0; directors’ shareholding ratio (CH); Tobin_QA indicates the Tobin Q value of the company; the book-to-market ratio (BTMA). Regional control variables include natural logarithm of regional humidity (Lnhum); natural logarithm of regional precipitation (Lnpre); natural logarithm of air quality index (Lnaqi); and regional per capita gross domestic product (Lnagdp). In addition, Year, Industry and Firm represent fixed effects at the year, industry, and firm levels, respectively.

4 Empirical results

4.1 Descriptive statistics of variables

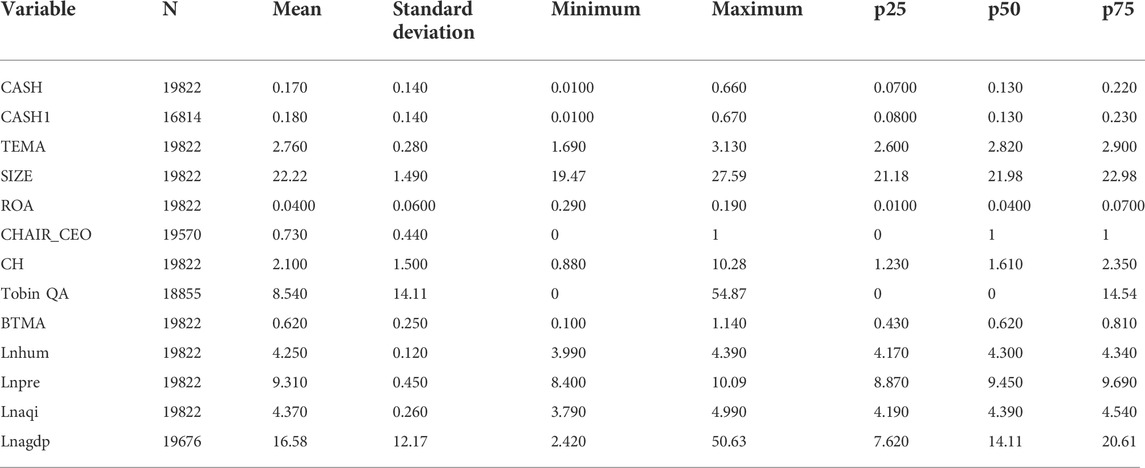

Table 1 shows the descriptive statistical results of the main variables. Table 1 shows that the mean value of CASH is 0.17, median is 0.13, maximum value is 0.66, and minimum value is 0.01, indicating that there is a great difference in the cash holding level of sample enterprises. The mean value of CASH1 is 0.18, median is 0.13, maximum value is 0.67, and minimum value is 0.01, indicating that the change of the cash holding level of sample enterprises fluctuates greatly. The mean value of climate change (TEMA) is 2.76, maximum value is 3.13, and minimum value is 1.69, indicating that the sample enterprises also have great differences in climate change. The mean value of CHAIR_CEO is 0.73, indicating that most CEOs of listed companies in China also serve as chairman of the board. The average CH of directors is 2.1%, indicating that directors of listed companies in China generally hold shares. The average book-to-market ratio (BTMA) is 0.61, indicating that the book value of listed companies in China is generally less than the market value. The results of control variables are consistent with the research conclusion of Yu et al. (2019).

4.2 Correlation analysis of variables

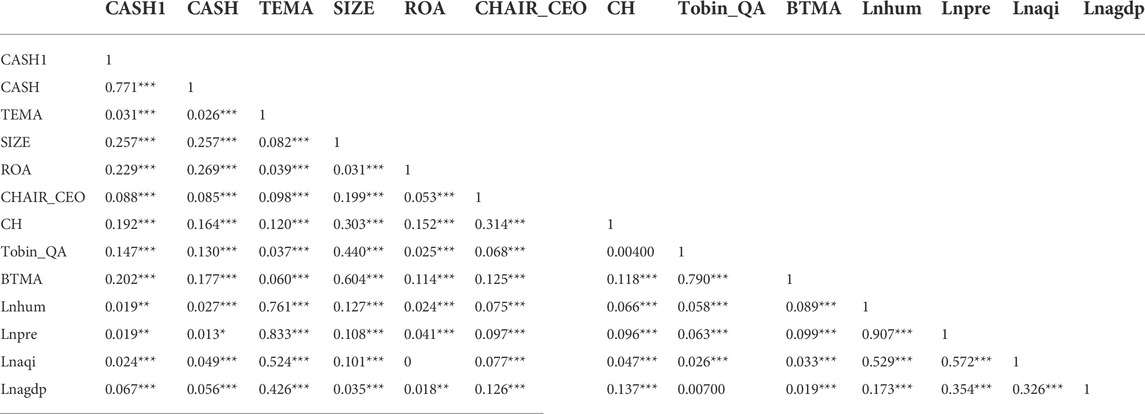

Table 2 shows the correlation analysis results among variables. As can be seen from Table 2, the Pearson test results show that climate change is positively correlated with the change value of cash holding level and the cash holding level. Among them, the correlation coefficient between TEMA (climate change) and CASH1 (change in the corporate cash holding level) is significantly positive at 1% level. The correlation coefficient between TEMA (climate change) and CASH (current CASH holdings of enterprises) is significantly positive at the level of 1%. The correlation coefficient between ROA (profitability), CASH1 (change in corporate CASH holding level), and CASH(current CASH holding level) is significantly positive at the 1% level, indicating that corporate profitability is closely related to corporate CASH holding, which is consistent with the hypothesis of previous studies and this study. The aforementioned results preliminarily indicate that climate change will significantly affect the change of corporate cash holdings.

4.3 Empirical analysis

4.3.1 Climate change and corporate cash holdings

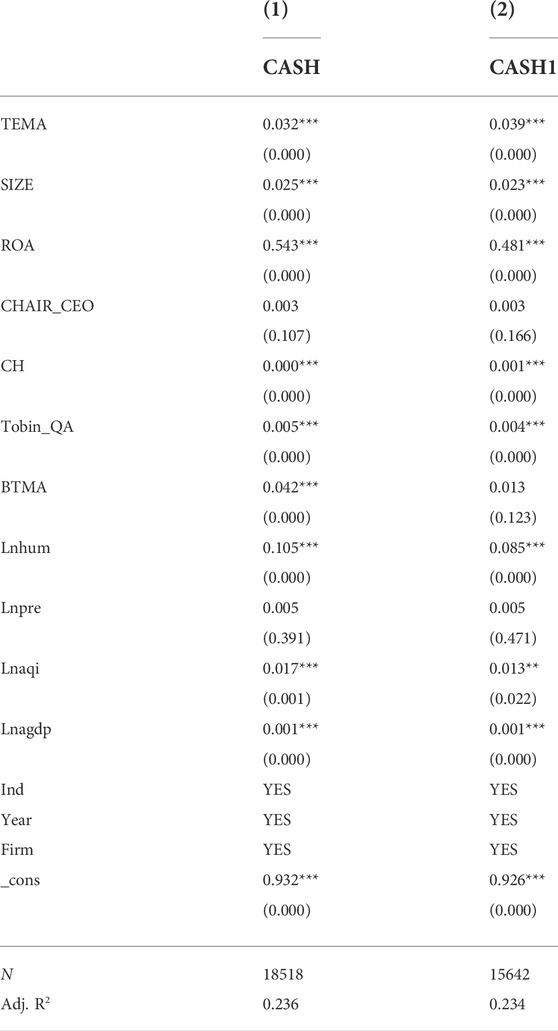

Table 3 examines the relationship between climate change and corporate cash holdings through multiple regression analyses. The explained variables of the two columns are different, but both control related control variables and annual and industry fixed effects. The column (1) adopts CASH (current CASH holdings of enterprises) as the explained variable, which controls related control variables as well as annual and industry fixed effects. The estimated coefficient of the explanatory variable TEMA (climate risk) was 0.032 and significant above 1%. In column (2), CASH1 (change in the corporate cash holding level) is used as the explained variable, and the estimated coefficients of TEMA (climate change) are 0.039, which are still significant at the level above 1%. The column (1) and (2) results of the column joint show that under the control of the factors that influence the enterprise facing climate change, the corporate cash holdings level is higher when the climate risk relation with the corporate cash holdings level was significantly positively related, and climate change really changed the corporate cash holdings behavior decision-making and support the hypothesis H1a.

4.3.2 Further analysis

4.3.2.1 Robustness test

4.3.2.1.1 Climate change and excess cash holdings

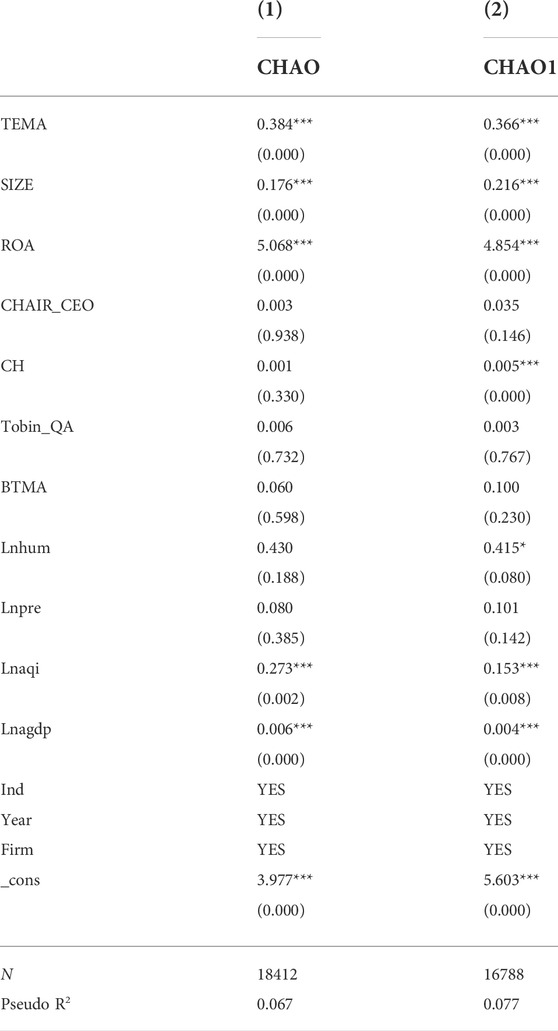

In the aforementioned empirical tests, this study measures cash holdings from the perspectives of cash holdings and changes respectively. In the following study, the level of excess cash holdings will be used as a surrogate indicator to make the measurement results more robust. Excess cash holding (CHAO) is the cash holding level adjusted by the industry median. Dummy variable CHAO (CHAO1) is constructed in this study, and the enterprises whose holding level each year is higher than the industry median value within the sample range are defined as persistent high holding enterprises with a value of 1, or 0 otherwise. The regression results are shown in Table 4.

Table 5 shows that, whether for persistent high holding enterprises now, climate change influences enterprise’s cash levels positively, at 1% significant level, and the relationship is more obvious in the persistent high holding enterprise now that is persistently high due to climate change as enterprises enhance the level of cash holdings more significantly. Climate change raises the level of excess cash holdings.

4.3.2.1.2 Climate change metrics

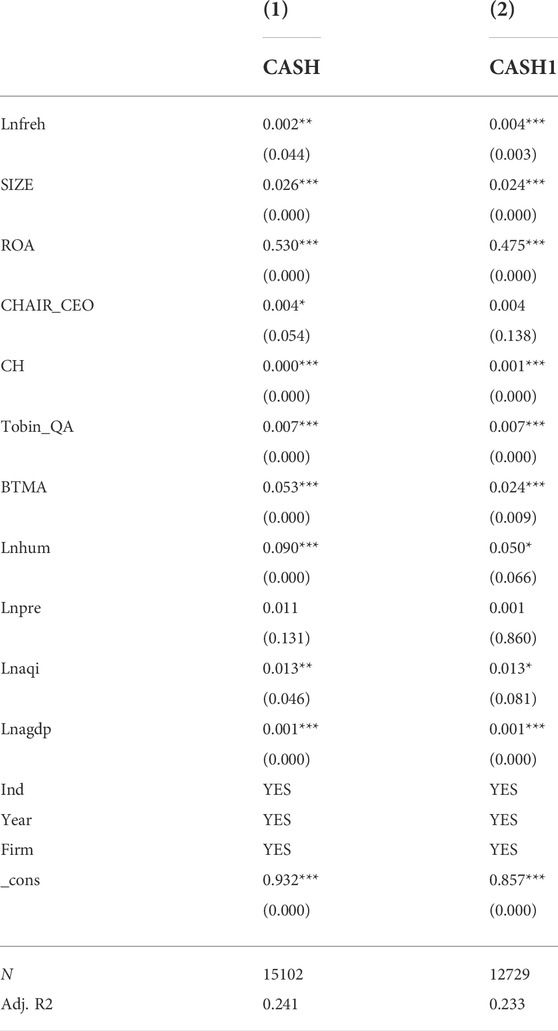

From the perspective of probability distribution, extreme climate events are small probability events that occur outside the statistical distribution in a particular period, usually distributed within 10% of each side of the statistical distribution curve (IPCC). Taking more stringent measures, this study will be the same date each year climate base period (e.g., every year January 1) day by day the heat in ascending order; the first 95% quantile is defined as the extremely high temperature, the highest temperature when a certain level more than the days of high-temperature threshold is considered in the cities as the day appeared to be a very high temperature, In this study, the natural logarithm of extremely high-temperature days in a prefectural city was used as a substitute variable of climate change (Lnfreh).

The regression results in Table 5 show that when the explained variable is CASH (current CASH holding of enterprises), Lnfreh (extremely hot days) is significantly positive at the level of 5%; when the explained variable is CASH1 (change of CASH holding level of enterprises), Lnfreh (extremely hot days) is significantly positive at the level of 1%. The column (1) and (2) results of the column joint show that the replacement of temperature measure do not change the basic model of regression results when the enterprise is located cities where appear the natural logarithm (base e) of extremely hot days as the substitution variable of climate change; climate change and the corporate cash holding level is still significant and robust positive correlation.

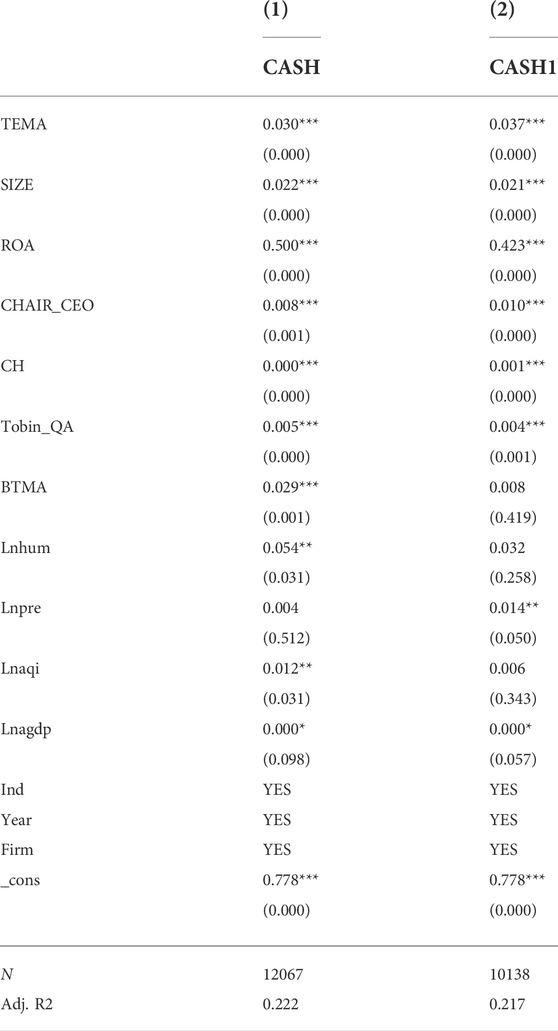

4.3.2.1.3 Delete the sample

The headquarters of the listed company and the engaged actual production department may be not in the same city, and the production department may spread throughout the country, especially large state headquarters in Beijing, to reduce the headquarters which are inconsistent with the local situation. This article includes headquarter in Beijing, Shanghai, Shenzhen, and other cities with large out again to return samples and robustness inspection. The results in Table 6 show that after removing the cluster of cities of headquarters, the coefficient of TEMA (climate change) is significantly positive at 1% regardless of the explained variable being CASH (current CASH holding of enterprises) or CASH1 (change of CASH holding level of enterprises), which further verifies the robustness of the regression results of the basic model in this study.

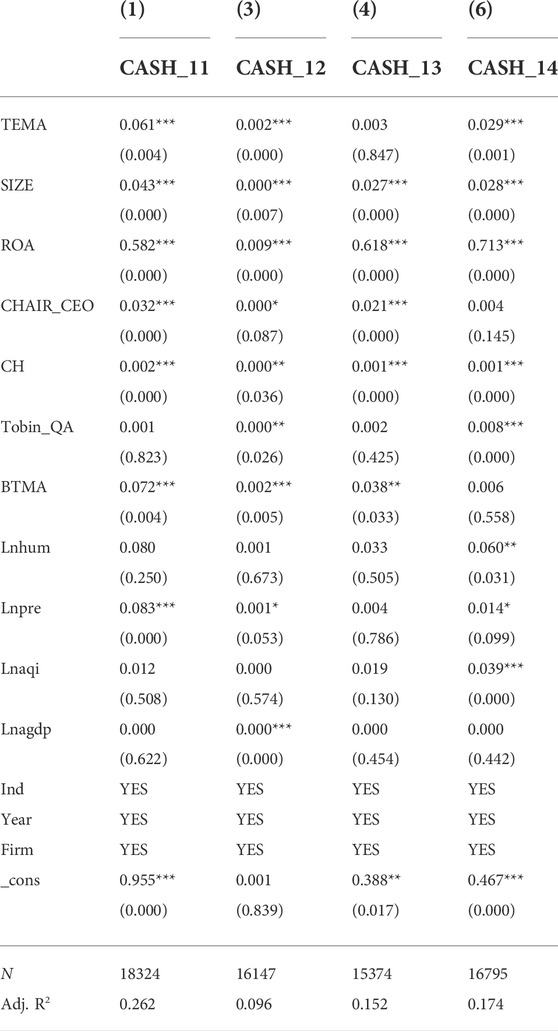

4.3.2.2 Analysis of enterprise cash sources

Generally speaking, there are three main sources of cash: cash flow generated by operating activities, cash flow generated by investment activities, and cash flow generated by financing activities. Among them, the business activities of enterprises are mainly selling goods and providing services to obtain cash inflow. In investment activities, enterprises mainly recover investment or dispose of fixed assets and intangible assets. Financing activities refer to the activities in which the scale and composition of equity capital and debt capital of an enterprise change. In this study, the possible channels of cash increase are used to explore the sources of enterprises’ increasing cash holdings, and the robustness of the correlation between climate risk and corporate cash holdings is tested by changing the measurement index of cash holdings. Here, CashFrom refers to the possible sources of increasing cash, and CASH_11, CASH_12, CASH_13, and CASH_14, respectively, refer to “cash received from selling goods and providing services,” “tax rebate received,” “cash received from investment recovery,” and “cash received from borrowing” in the cash flow statement. The aforementioned variables are divided by the total assets at the end of the year for standardized treatment, and the control variables remain consistent. The regression results are shown in Table 7. In Table 7, according to the results of the column (1) and (2) column, the TEMA (climate change) coefficient in 1% significance level is positive; in column (3) the coefficient was not significant; and the coefficient of the column (4) was significantly negative. Selling goods and providing labor services received cash, and the refund of the two operating cash increase sources are affected by climate change. Climate change has no significant impact on the capital needed for investment, but it reduces the capital from financing sources, indicating that climate change will reduce the asset–liability ratio and thus reduce the financial risk of enterprises.

5 Mechanism analysis

5.1 Mechanism test: Enhance business risk

According to the aforementioned theoretical analysis, this study believes that the higher operational and financial risks caused by climate change will simultaneously enhance the precautionary motivation, transaction motivation, and speculative motivation of enterprises to hold cash, thus leading to the improvement of the cash holding level of enterprises. Next, it focuses on examining the two possible impact paths of climate change on the level of corporate cash holdings by increasing business risk and financial risk, so as to reveal its internal mechanism of action.

In order to test whether climate change improves the level of corporate cash holdings by increasing business risks, this study constructed the following model:

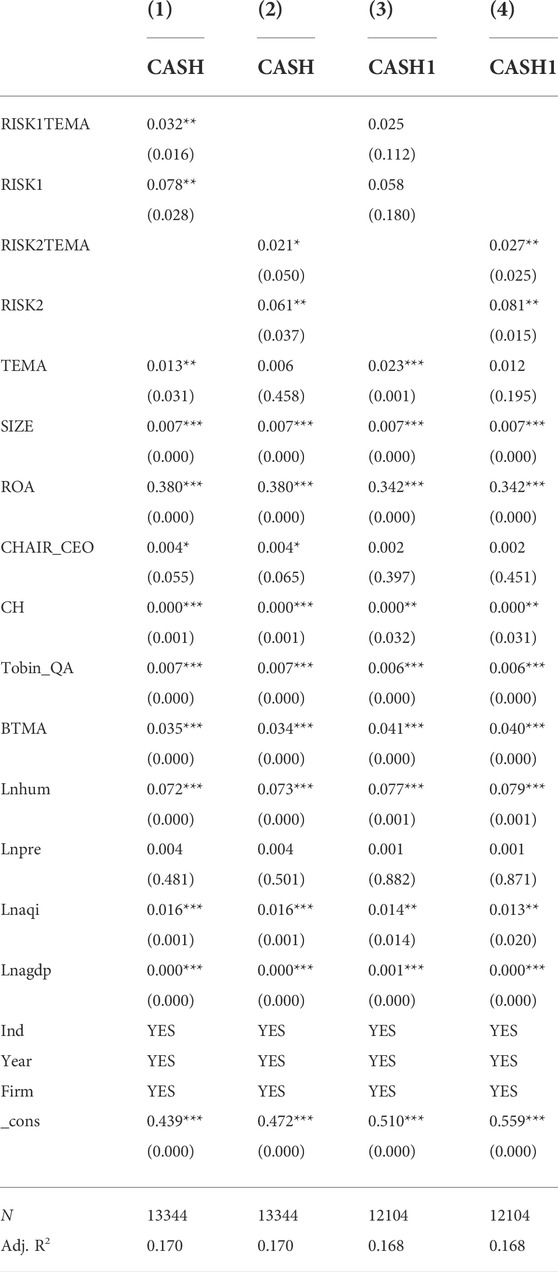

Referring to the methods of John et al. (2008) and Boubakri et al. (2013), this study adopts the standard deviation of a company’s industry-adjusted ROA over a period of time to measure the operating risk of an enterprise. ROA is measured by “EBIT divided by ending total assets”; then, the return on equity of the company for each year is adjusted by the industry average. Adj_ROA refers to the ROA adjusted by the industry. The calculation period used in this study is 5 years (T−3, T +1). Then we calculated the standard deviation of the company Adj_ROA over time to get RISK1. At the same time, for the sake of robustness, the standard deviation of ROA without industry adjustment is used to calculate RISK2. The greater the RISK1 and RISK2, the greater the business risk. RISK1TEMA and RISK2TEMA represent the cross term of RISK1 with RISK2 and TEMA. Other control variables remain unchanged, and the regression results are shown in Table 9.

In column (1) of Table 9, RISK1 is used as the estimated variable of operating risk, and the explained variables are CASH. The estimated coefficient of RISK1 and TEMA is significantly positive at the level of 5%. In column (2), RISK2 is used as the explanatory variable, and the explanatory variable is CASH. The estimated coefficient of the cross term between RISK2 and TEMA (RISK2TEMA) is significantly positive at 10%. The explained variables in column (3) and column (4) are CASH1, and the estimated coefficient of the cross term between RISK2 and TEMA is significantly positive at 5% when RISK2 is used as the explanatory variable. It can be found that both RISK1 and RISK2 are used to estimate business risk, and the estimated coefficients of the cross term of business risk and climate risk are significantly positive. The empirical results from columns (1) and (4) show that when business risk is high, the sensitivity of “climate change-cash holding” is increased. In other words, climate change increases the operating risk of enterprises and thus improves their cash holding levels, which proves that the operating risk is the intermediary channel of climate change to improve their cash holding levels.

5.2 Mechanism test: Improve financial risk

In order to test whether climate change can improve the level of corporate cash holdings by increasing financial risks, this study constructed the following model:

Referring to the practice of Thomson et al. (2008) and Zhai et al. (2014), this study uses Z-Score to measure the financial risk of enterprises, and the calculation formula is as follows:

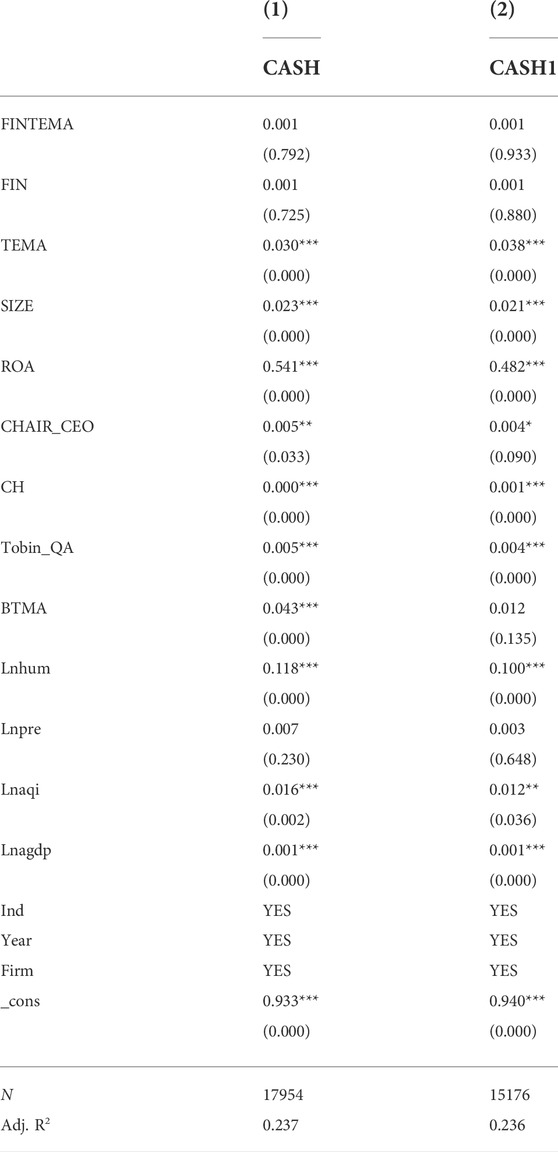

Netcp represents working capital; Asset represents total assets; Retearning represents undistributed profit; Ev represents total market value of shares; and Income represents net profit before tax. To facilitate the explanation, FIN is obtained by taking the negative of the aforementioned Z index. The larger the FIN, the greater the financial risk of the enterprise. The regression results are shown in Table 10.

The results in Table 10 show that no matter CASH (current CASH holding of enterprises) or CASH1 (change of CASH holding level of enterprises) is taken as the explained variable, the cross term of financial risk and climate change (FINTEMA) is not significant, indicating that the financial risk mechanism is not established, mainly because of the following reasons: first, according to the cash sources, it can be seen that climate risk reduces the borrowing funds of enterprises’ financing activities, indicating that enterprises will raise less funds from outside when facing climate change and reduce the debt level—“deleveraging”, reducing the financial risk of enterprises. Second, there are fewer climate disasters that cause devastating losses to enterprises in China because the probability of bankruptcy risk caused by climate change is low.

6 Heterogeneity analysis

6.1 Climate change, financing constraints, and corporate cash holdings

There was a positive relationship between social capital and corporate value, during the last global financial crisis (Jucá and Fishlow, 2022). Compared to financing constraints of smaller companies, larger companies’ cash holdings level influence is bigger because when large companies face financing constraints, the company when dealing with extreme climate tries harder to raise the required capital. So, when the climate changes, on the one hand, bank loans increasingly change as an associated risk factor. Excess cash holding is less valuable for unconstrained companies (Hendrawaty, 2019). When climate change increases the management risk of the enterprise, the possibility of a given bank loans cannot take back, which will improve the loan approval standards or improve loan interest rates. Enterprise financing constraints will tighten further, and this will lead to greater use of internal finance business and holding more cash. Javadi and Al Masum (2021) showed that in regions with a high climate change risk, the spread of bank loans paid by enterprises is significantly higher, and the exposure of corporate customers to climate risk will also have a negative impact on corporate borrowing costs. On the other hand, climate change makes enterprises with larger financing constraints hold more cash than usual; compared with enterprises with smaller financing constraints, managers with larger financing constraints are less able to adjust to climate change with external capital based on previous experience and comparison with peers. In order to avoid high operational risks caused by climate change and serious negative impacts on enterprises, the increase of cash holdings will be larger. Therefore, the higher the degree of financing constraints of enterprises, the more significant the positive impact of climate change on cash holdings of enterprises.

In order to test the difference between climate risk and the corporate cash holding level in different degree of financing constraint, this study uses Hadlock and Pierce (2010) to construct financing constraint variable (SA): SA = −0.737 * Size + 0.043 * Size2−0.040 * Age, where Size is the natural logarithm of enterprise’s size (unit: million yuan); Age refers to the establishment time of the enterprise. If SA index is negative and the absolute value is larger, it indicates that the enterprise is subjected to more serious financing constraints. On this basis, the following model is established:

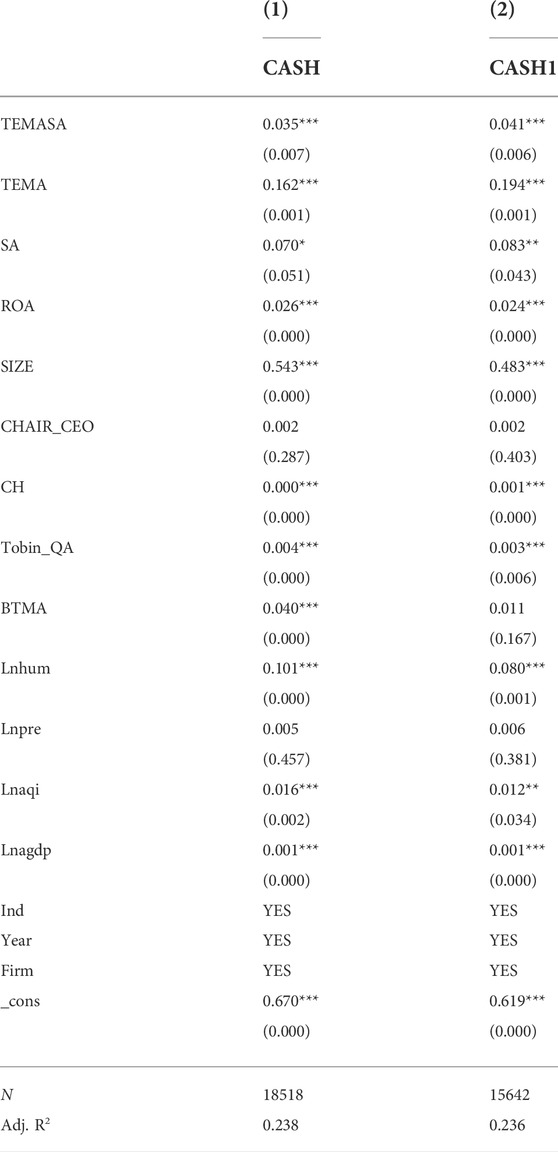

The explained variable in column (1) of Table 10 is CASH (current CASH holdings of enterprises), from which it can be seen that the influence coefficient of the cross term of TEMA (climate risk) and SA (financing constraint) is 0.035, which is significant at the level of 1%. The explained variable in column (2) is CASH1 (change in the corporate cash holding level), from which it can be seen that the influence coefficient of the cross term of TEMA (climate risk) and SA (financing constraint) is 0.041, which is significant at the level of 1%. The regression results show that the higher the degree of financing constraints, the stronger the impact of climate risk on corporate cash holdings and changes.

6.2 Climate change, property rights, and corporate cash holdings

State-owned enterprises tend to hold more cash than private enterprises under climate change. Compared with private enterprises, state-owned enterprises have different social responsibilities and also bear special political responsibilities (Xu and Zou, 2011). CSR have significant and positive nexus with financial performance of the banks in ASEAN countries (Dat et al., 2022). In the face of climate change, state-owned enterprises should not only consider the preservation and increase of state-owned assets but also the maintenance of people’s livelihood and social stability. Especially when threatened by natural disasters, state-owned enterprises often need to participate in the social emergency response system to ensure the safety of people’s lives and property as much as possible. This behavior is different from that of private enterprises, which may require more cash holdings, which will enhance the prevention motivation of state-owned enterprises to hold cash. At the same time, state-owned enterprises are more likely to receive attention from local governments than private enterprises when they face higher climate risks. According to the report to the 19th CPC National Congress, we will “make state capital stronger, better, and bigger”. When climate risks rise or even natural disasters occur, state-owned enterprises, as a force that cannot be ignored in emergency rescue and social stability, may be given preferential resources or even subsidies for state-owned enterprises to shoulder more social responsibilities. Therefore, state-owned listed companies may hold more cash during climate change due to stronger prevention motivation or more government subsidies due to shouldering more social responsibilities.

In order to test the difference between climate risk and corporate cash holdings under different property rights, the following model is constructed in this study:

In the model, IFSOE is 1 if the enterprise is a state-owned enterprise, and 0 if it is not, and the specific results are shown in Table 11. Table 12 shows the regression results of climate change, property rights and corporate cash holdings. The property right variable (IFSOE) is constructed. If the enterprise is a state-owned enterprise, it is set to 1; if it is a private enterprise, it is set to 0. The explained variable in column (1) is the corporate CASH holding level, from which it can be seen that the influence coefficient of the cross term of climate risk (TEMA) and property right (IFSOE) is 0.023, which is significant at the level of 1%. The explained variable in column (2) is the change in the level of corporate cash holdings (CASH1), from which it can be seen that the influence coefficient of the cross term of climate risk (TEMA) and property right (IFSOE) is 0.026, which is significant at the level of 5%. The regression results show that compared with private enterprises, climate change has a stronger positive effect on the cash holdings of state-owned enterprises.

6.3 Climate change, ecological vulnerability zoning, and corporate cash holdings

The severely vulnerable areas of natural disasters in China are scattered in the eastern region and concentrated in the central and western regions, and most of the central and western regions are medium–high vulnerable regions. The ecological vulnerability regions are in the order of western > central > eastern regions from high to low (Liu et al., 2010). Businesses in ecologically fragile regions such as the Midwest may choose to hold more cash in times of climate change than those in the East. In the context of the increasingly frequent climate change in China and the serious negative impact of abnormal climate events on people’s lives, how to adapt to climate change and what reasonable measures to take to deal with climate risks have long been the focus of local governments. At present, the ecological environment in the central and western regions of China is relatively fragile, facing great pressure of environmental protection and governance, and the ability to cope with climate change is relatively weak, especially in the western region. The ecological environment in western China has a weak innate foundation, strong external interference, high vulnerability of the urban ecological environment, and is more vulnerable to adverse hazards (Zhang, 2018). On the one hand, the ecological environment in the central and western regions is relatively fragile, and the uncertainty of natural climate change is also increasing significantly, mainly reflected in the increase of frequent extreme climate events and their frequency and duration. On the other hand, local governments in the central and western regions have limited understanding and countermeasures to climate change and its impacts, which will lead them to takethe initiative to formulate countermeasures and policies to reduce the harm. The untimely and inappropriate response of local governments to climate change will further amplifyclimate risks, causing greater uncertainty to the daily lives of residents and the production and operation of enterprises. Therefore, enterprises in ecologically fragile regions such as the central and western regions will face greater climate risks and may hold more cash to cope with adverse climate change than enterprises in the eastern regions.

In order to test the regional differences between climate change and corporate cash holdings, this study constructed the following model:

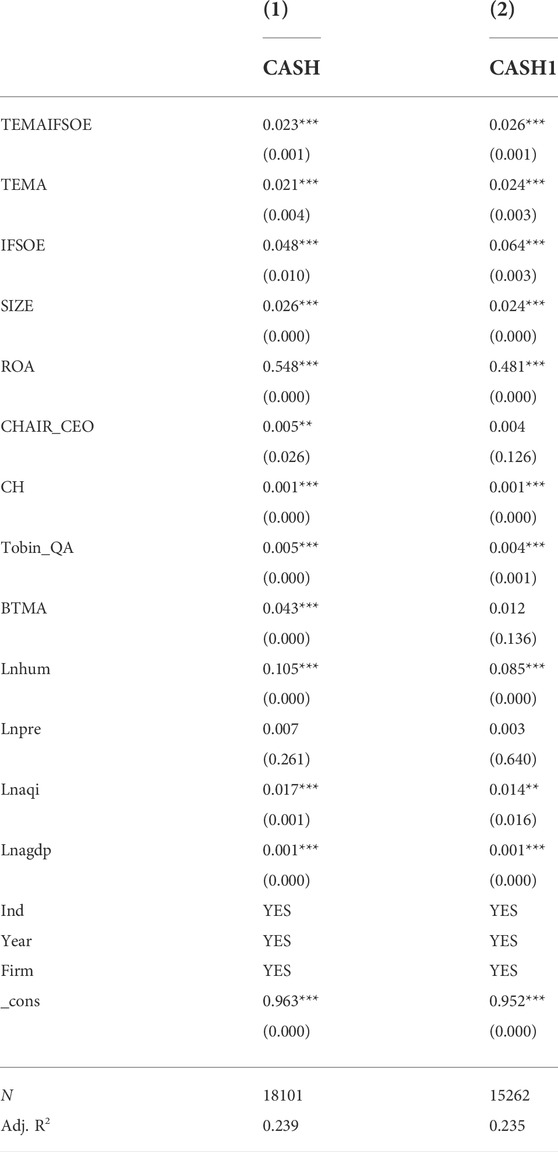

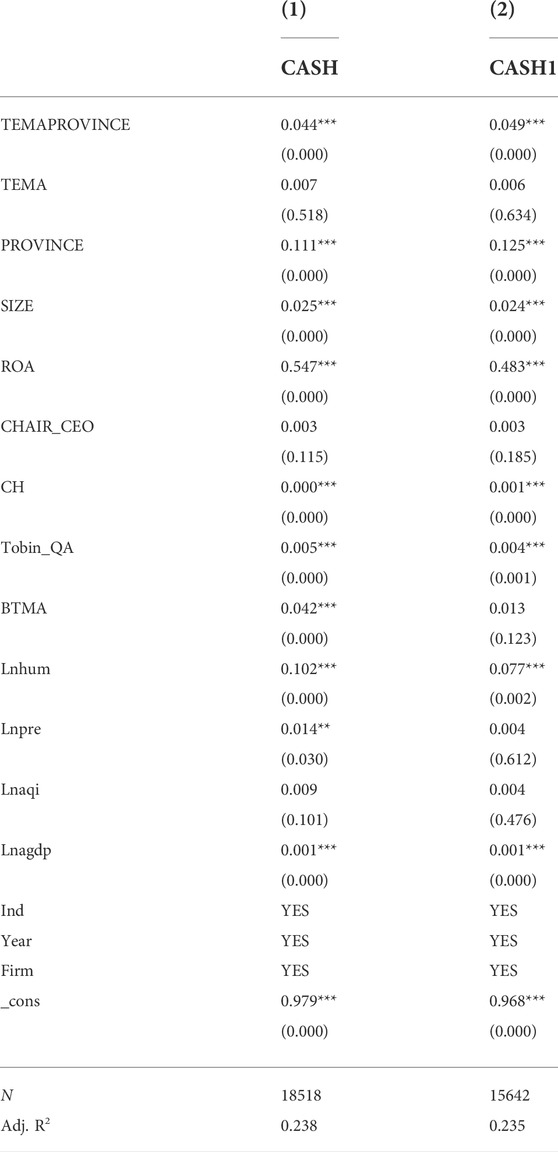

The dummy variable of ecologically fragile region (PROVINCE) is set to 1 if the enterprise is located in ecologically fragile regions, such as central and western regions, and 0 if the enterprise is located in non-ecologically fragile regions. Table 13 shows the regression results of climate change, different climate regions, and corporate cash holdings. The explained variable in column (1) is the corporate CASH holding level, from which it can be seen that the cross term of climate risk (TEMA) and ecologically fragile region (PROVINCE) has an impact coefficient of 0.044, which is significant at 1% level. The explained variable in column (2) is the change in the corporate cash holding level (CASH1), from which it can be seen that the cross term of climate risk (TEMA) and the ecologically fragile region (PROVINCE) has an impact coefficient of 0.049, which is significant at the level of 1%. The regression results show that climate change has a more significant positive effect on the cash holding level of enterprises in ecologically fragile areas than those in non-ecologically fragile areas.

7 Conclusion

On the basis of combing the literature on climate risk and corporate cash holding, trade-off theory, financing order theory, information asymmetry theory, principal-agent theory, and resource dependence theory, this study takes China’s A-share non-financial insurance listed companies from 2011 to 2019 as the research object and starts from the preventive motivation of cash holding. From the perspective of climate environment, the effects and transmission mechanism of climate risk on corporate cash holding behavior are investigated, and the effects of property rights, financing constraints, and ecological vulnerability on the aforementioned relationship are considered. The findings of this study are as follows:

(1) There is a significant positive correlation between climate risk and the corporate cash holding level, that is, the greater the impact of climate change, the higher the corporate cash holding level.

(2) Climate risk reflects the impact of high current performance of enterprises by increasing business risk, excluding the hypothesis that increasing corporate financial risk is the impact path;

(3) From the source analysis of corporate cash channels, it is found that climate risk increases the cash received from selling goods and providing services and the cash returned from taxes and fees and reduces the cash received from borrowing;

(4) The higher the degree of financing constraints, the more significant the relationship; compared with private enterprises, climate risk has a stronger impact on cash holding level of state-owned enterprises. The positive impact of climate risk on the cash holding level of enterprises in ecologically fragile areas is more significant than that in non-ecologically fragile areas.

The aforementioned results show that the risks caused by climate change have been attached great importance to and actively responded to by enterprises. The current high ownership of enterprises is an important strategic measure for enterprises to avoid the impact of external climate environment and consolidate market competitive advantage, rather than a means for managers to seek personal gains and harm the interests of shareholders.

The conclusion of this study has an important practical significance and policy reference value. On the one hand, in the face of the increasingly complex and dynamic external climate environment, business operators should always have a high sense of vigilance to deal with the risk of uncertain climate change. Especially in the context of severe social and economic losses caused by natural disasters, Chinese enterprises are faced with negative impact on their operating capacity, highly uncertain market environment, and squeezed financing channels. Therefore, high current holding is of more practical guiding significance for enterprises with higher climate risks to achieve stable and long-term development and high-quality development. At the macro level in society, on the other hand, enterprises can maintain normal operation, which is very important to maintain social stability and safeguard national economy and people’s livelihood; since the 18th congress of the CPC Central Committee stressed several times to “prevent resolving major risks”, climate change daily operation and future development of the enterprise cannot be ignored and the influence of the high hold current to helping companies cope with the climate risks. When facing the possibility of major climate emergencies, enterprise managers should timely adjust their business decision-making behaviors to prevent risk spillover and take all effective measures to minimize the adverse effects caused by climate risks, so as to benefit the overall social situation of people living and working in peace and stability and economic operation.

Due to the availability of data, the analysis of the internal mechanism of climate change involved in the theoretical analysis is relatively poor in this study. With the enrichment of data and improvement of research methods, the analysis of the impact mechanism will be supported by more evidence. In the future, researchers can pay attention to the impact of climate factors such as emission reduction policies, employee health, and extreme weather events on business behavior at the enterprise level, and further reveal its transmission mechanism.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material; further inquiries can be directed to the corresponding author.

Author contributions

SY wrote the manuscript. LW conceived and designed the analysis. SZ collected the data.

Funding

This study was supported by the National Social Science Fund of China Research on the Causes and Effects of Fluctuation in Global Value Chain Participation and Chinas Control Countermeasures (21CJY015).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Addoum, J. M., Ng, D. T., and Ortiz-Bobea, A. (2020). Temperature shocks and establishment sales. Rev. Financial Stud. 33 (3), 1331–1366. doi:10.1093/rfs/hhz126

Al-Amarneh, A. (2013). Why do Jordanian firms hold cash? An empirical examination of the industrial companies listed in ASE. Ijar 5 (1), 103–111. doi:10.7813/2075-4124.2013/5-1/b.18

Almeida, H., Campello, M., and Weisbach, M. S. (2004). The cash flow sensitivity of cash. J. Finance 59, 1777–1804. doi:10.1111/j.1540-6261.2004.00679.x

Bates, T. W., Kahle, K. M., and Stulz, R. M. (2009). Why do US firms hold so much more cash than they used to?. The journal of finance 64 (5), 1985–2021.

Baum, C. F., Caglayan, M. O., Ozkan, N., and Talavera, C. (2004). The impact of macroeconomic uncertainty on cash holdings for non-financial firms. SSRN J. 15 (4), 289–304. doi:10.2139/ssrn.555952

Boubakri, N., Cosset, J., and Saffar, W. (2013). The role of state and foreign owners in corporate risk-taking: Evidence from privatization. J. Financial Econ. 108 (3), 641–658. doi:10.1016/j.jfineco.2012.12.007

Carney, M., Gedajlovic, E. R., Heugens, P. P., Van Essen, M., and Van Oosterhout, J. (2011). Business group affiliation, performance, context, and strategy: A metaanalysis. Academy of Management Journal 54 (3), 437–460.

Dat, N. M., Dai, N. Q., and Ngoc, P. B. (2022). The impact of corporate social responsibilities (CSR), entrepreneurship, and financial factors on the financial performance of the banks in ASEAN countries. Ce 16 (2), 227–240. doi:10.5709/ce.1897-9254.479

Dell, M., Jones, B. F., and Olken, B. A. (2012). Temperature shocks and economic growth: Evidence from the last half century. Am. Econ. J. Macroecon. 4 (3), 66–95. doi:10.1257/mac.4.3.66

Denis, D. J., and Sibilkov, V. (2010). Financial constraints, investment, and the value of cash holdings. Rev. Financ. Stud. 23 (1), 247–269. doi:10.1093/rfs/hhp031

Ferreira, M. A., and Vilela, A. S. (2004). Why do firms hold cash? Evidence from EMU countries. Eur. Financ. Manag. 10 (2), 295–319. doi:10.1111/j.1354-7798.2004.00251.x

Fritz Foley, C. F., Hartzell, J. C., Titman, S., and Twite, C. (2007). Why do firms hold so much cash? A tax-based explanation. J. financial Econ. 86 (3), 579–607. doi:10.1016/j.jfineco.2006.11.006

Graff Zivin, J., and Neidell, M. (2014). Temperature and the allocation of time: Implications for climate change. J. Labor Econ. 32 (1), 1–26. doi:10.1086/671766

Hadlock, C. J., and Pierce, J. R. (2010). New evidence on measuring financial constraints: Moving beyond the KZ index. The review of financial studies 23 (5), 1909–1940.

Haley, U. C. V., and Haley, G. T. (2013). Subsidies to Chinese industry: State capitalism, business strategy, and trade policy[M]. New York: Oxford University Press.

Harford, J., Mansi, S. A., and Maxwell, W. F. (2008). Corporate governance and firm cash holdings in the US. J. financial Econ. 87 (3), 535–555. doi:10.1016/j.jfineco.2007.04.002

Hendrawaty, E. (2019). Value of excess cash holdings of financially unconstrained companies. Contemp. Econ. 13 (3), 293–304.

Heutel, G., Miller, N. H., and Molitor, D. (2021). Adaptation and the mortality effects of temperature across U.S. Climate regions. Rev. Econ. Stat. 103 (4), 1–14. doi:10.1162/rest_a_00936

Hoberg, G., Phillips, G., and Prabhala, N. (2014). Product market threats, payouts, and financial flexibility. J. Finance 69 (1), 293–324. doi:10.1111/jofi.12050

Huang, H. H., Kerstein, J., and Wang, C. (2018). The impact of climate risk on firm performance and financing choices: An international comparison. J. Int. Bus. Stud. 49 (5), 633–656. doi:10.1057/s41267-017-0125-5

Javadi, S., and Masum, A. (2021). The impact of climate change on the cost of bank loans. J. Corp. Finance 69, 102019–102119. doi:10.1016/j.jcorpfin.2021.102019

John, K., Litov, L., and Yeung, B. (2008). Corporate governance and risk-taking. J. Finance 63 (4), 1679–1728. doi:10.1111/j.1540-6261.2008.01372.x

Jones, B. F., and Olken, B. A. (2010). Climate shocks and exports. Am. Econ. Rev. 100 (2), 454–459. doi:10.1257/aer.100.2.454

Jucá, M. N., and Fishlow, A. (2022). The impact of social capital on firm value. Ce 16 (2), 182–194. doi:10.5709/ce.1897-9254.476

Kusnadi, Y. (2011). Do corporate governance mechanisms matter for cash holdings and firm value? Pacific-Basin Finance J. 19 (5), 554–570. doi:10.1016/j.pacfin.2011.04.002

Lei, X. X., Wang, X., and Wang, M. (2019). Temperature effects on mortality and household adaptation: Evidence from China. J. Environ. Econ. Manag. 96, 195–212. doi:10.1016/j.jeem.2019.05.004

Letta, M., and Tol, R. S. J. (2019). Weather, climate and total factor productivity. Environ. Resour. Econ. 73 (1), 283–305. doi:10.1007/s10640-018-0262-8

Li, Z. Q., Sun, Z., and Wang, Z. W. (2004). Tunneling" and ownership arrangement: Empirical evidence from the capital occupancy of major shareholders of Listed companies in China [J]. Account. Res. 12.

Liu, Y., Huang, J., and Ma, L. (2010). Regional vulnerability assessment of natural disasters in China based on DEA model. Geogr. Res. 29 (007), 1153–1162.

Myers, S. C., and Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of financial economics 13 (2), 187–221.

Montzka, S. A., Dlugokencky, E. J., and Butler, J. H. (2011). Non-CO2 greenhouse gases and climate change. Nature 476, 43–50. doi:10.1038/nature10322(7358)

Nguyen, T. D., and Ngo, Q. T. (2022). The impact of corporate social responsibility, energy consumption, energy import and usages and carbon emission on sustainable economic development: Evidence from ASEAN countries. Ce 16 (2), 241–256. doi:10.5709/ce.1897-9254.480

Opler, T., Pinkowitz, L., Stulz, R., and Williamson, R. (1999). The determinants and implications of corporate cash holdings. J. Financial Econ. 52, 3–46. doi:10.1016/s0304-405x(99)00003-3

Ozkan, A., and Ozkan, N. (2004). Corporate cash holdings: An empirical investigation of UK companies. J. Bank. Finance 28 (9), 2103–2134. doi:10.1016/j.jbankfin.2003.08.003

Pankratz, N., Bauer, R., and Derwall, J. (2019). Climate change, firm performance, and investor surprises. SSRN J. doi:10.2139/ssrn.3443146

Patle, G. T., Kumar, M., and Khanna, M. (2020). Climate-smart water technologies for sustainable agriculture: A review. J. Water Clim. Change 11 (4), 1455–1466. doi:10.2166/wcc.2019.257

Peng, H., and Ji, F. (2022). Can informal environmental regulation promote green innovation? - a quasi-natural experiment based on environmental information disclosure policy. Pol. J. Environ. Stud. 31, 2795–2809. doi:10.15244/pjoes/145189

Pinkowitz, L., Stulz, R. M., and Williamson, R. (2013). Is there a US high cash holdings puzzle after the financial crisis?[J]. Fish. Coll. Bus. Work. Pap. 2013, 07.

Rizwan, M. F. (2012). Evidence from Pakistan's corporate sector [J]. Entrepreneurial Strategies Policies Econ. Growth 2012, 361–369.

Schlenker, W., Michael Hanemann, W. M., and Fisher, A. C. (2005). Will U.S. Agriculture really benefit from global warming? Accounting for irrigation in the hedonic approach. Am. Econ. Rev. 95 (1), 395–406. doi:10.1257/0002828053828455

Schlenker, W., and Roberts, M. J. (2009). Nonlinear temperature effects indicate severe damages to U.S. crop yields under climate change. Proc. Natl. Acad. Sci. U.S.A. 106 (37), 15594–15598. doi:10.1073/pnas.0906865106

Seppanen, O., Fisk, W. J., and Lei, Q. H. (2006). Effect of temperature on task performance in office environment. Alexandria: Office of Scientific & Technical Information Technical Reports.

Shah, A. (2011). The corporate cash holdings: Determinants and implications[J]. Afr. J. Bus. Manag. 5 (34), 12939–12950.

Sinković, D., Zemla, S., and Zemla, N. (2021). Monitoring of economic indicators in the context of financial and economic crises. Ce 16 (1), 61–87. doi:10.5709/ce.1897-9254.469

Song, K. R., and Lee, Y. (2012). Long-term effects of a financial crisis: Evidence from cash holdings of east asian firms. J. Financ. Quant. Anal. 47 (3), 617–641. doi:10.1017/s0022109012000142

Stroebel, J., and Wurgler, J. (2021). What do you think about climate finance? J. Financial Econ. 142, 487–498. doi:10.1016/j.jfineco.2021.08.004

Xu, C., and Zou, J. (2011). A comparative study on social responsibility of State-owned enterprises and private enterprises [J]. Econ. Rev. 000 (010), 23–26.

Yu, F., Zhang, M., and Jiang, F. (2008). Does corporate governance affect corporate financial risk? [J]. Account. Res. 8 (10), 27–49. doi:10.5539/ibr.v8n8p27

Zhai, S., Zhang, S., and Lu, X. (2014). Energy management and energy crisis in textile finishing. Manag. World 000 (004), 53–59.

Zhang, Y. M. (2018). Ecological vulnerability assessment in western China: An exploratory study of 45 cities in western China [J]. Statistics Inf. Forum 33 (8), 11. doi:10.1016/j.proenv.2010.10.051

Keywords: climate change, corporate cash holding level, financial risk, operational risk, source channels

Citation: Yu S, Wang L and Zhang S (2022) Climate risk and corporate cash holdings: Mechanism and path analysis. Front. Environ. Sci. 10:979616. doi: 10.3389/fenvs.2022.979616

Received: 27 June 2022; Accepted: 22 July 2022;

Published: 02 September 2022.

Edited by:

Zahoor Ahmed, Cyprus International University, CyprusReviewed by:

Elchin Suleymanov, Baku Engineering University, AzerbaijanMuhammad Saeed Meo, Superior University Lahore Pakistan, Pakistan

Copyright © 2022 Yu, Wang and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lei Wang, eWFuMTk4OXZzQDE2My5jb20=

Siming Yu

Siming Yu Lei Wang

Lei Wang Shuocheng Zhang

Shuocheng Zhang