- 1Business School, China University of Political Science and Law, Beijing, China

- 2Research Center of Finance, Shanghai Business School, Shanghai, China

- 3Graduate School of Humanities and Social Sciences, Okayama University, Okayama, Japan

- 4Graduate School of Economics, Kobe University, Kobe, Japan

This study explores the relationship between ESG investments and carbon emissions in China. Our results show that 1% increase in environmental investments would cause 0.246% decrease in CO2 emissions and 0.558% decrease in carbon emission intensity. The impact of ESG investment is heterogeneous across the developed and underdeveloped regions. Environmental investments in the advanced eastern region have significantly improved carbon productivity. In contrast, environmental investments in the central and western regions significantly reduced carbon emissions, but they have little impact on carbon productivity.

1 Introduction

Rapid economic development over the past century has led to a series of environmental problems. The “high carbon, high development” model is not sustainable because of the threat of impending climate change. According to Raggad (2020), the greenhouse effect is particularly severe due to the large volume of carbon emissions, which not only adversely affects the ecological balance but also diminishes the health of the economy. In August 2021, the Intergovernmental Panel on Climate Change stated, in its Sixth Assessment Report Group I Working Paper, that global temperatures will rise by 1.5°C–2°C, which will affect agricultural activities and exceed critical the tolerance thresholds of human health, unless carbon dioxide and other greenhouse gas emissions are significantly reduced in the coming decades1.

To fight against climate change, the European Union has established the world’s largest and most mature carbon emissions trading system, assigning a certain amount of carbon emission permits to enterprises (Åihman and Zetterberg, 2005). In the United States, energy security policies have been put forward; the feasibility of carbon tax is under progressive discussion, and a net zero-carbon emission plan has been formulated (Brown and Li, 2019). Japan has made great efforts to improve environmental protection technology, successfully reducing carbon emissions through material recycling. In India, biomass energy, a kind of renewable energy, has been utilized by the government to deal with their energy crisis and minimize their carbon footprint. Although there are technological, economic and infrastructure barriers to developing biomass energy, this can be improved through research and development (Irfan et al., 2022). Thailand also faces environmental challenges, as it relies on non-renewable energy consumption to develop its economy, leading to carbon emissions (Yue et al., 2021). China launched carbon emissions trading pilots in seven provinces in 2013, and it set up a national carbon emissions trading market in 2017. The establishment of carbon emission trading markets in China is crucial to boost ecological conservation and to stay committed to its goal of carbon emission reduction (Wang et al., 2020). As China is currently the world’s largest carbon emitter, the ability of domestic companies to effectively reduce carbon emissions is one of the most important factors in achieving global climate goals (Ding et al., 2021). The world needs to consider the energy trilemma: accessible energy affordability, energy security and environmental sustainability. If the world only invests in energy use, the resulting growth will eventually become unsustainable (Khan et al., 2022a). Xie et al. (2022) shows that there is a relationship between natural resources and economic performance. Achieving carbon neutrality and peak emission targets is widely recognized as the only way to achieve sustainable economic development. Furthermore, governments should focus more on sustainable resources since it is crucial to development.

As the concept of ESG has been developed in recent years, increasing research attention focused on ESG development. Rustam et al. (2019) found that higher financial leverage limits the company’s ability to disclose ESG information. Baldini et al. (2018) found that country-level characteristics such as political system (legal framework and corruption), labor system (labor protection and unemployment rate), and cultural system (social cohesion and equal opportunities) significantly influence companies s corporate ESG disclosure. In addition, the role of the market also affects the disclosure of comprehensive ESG information. Zhang et al. (2020) studied the interactive effect of three dimensions of ESG information of listed companies on firm value, and concluded that green innovation, environment and ESG information disclosure can positively affect firm value, and its substitution effect on firm value gradually decreases with the increase of firm value.

In this study, we investigated the impact of listed companies’ ESG investments on carbon emissions in China. Some studies have focused on the impact of ESG investments on climate change and environmental performance (Jinga, 2021; Peng et al., 2021). Li and Xue (2020) has stated that the implementation of carbon reduction goals relies heavily on the participation by enterprises. A combination of the external political environment, internal development motivation, and the requirement for good community relations prompted companies to focus on green transition. Dong et al. (2021) points out that, to follow the carbon emission restrictions, companies resort to short-term solutions with output control and slower production, which does not conform to the real intention of government policies. The long-term adjustment is what really matters in achieving carbon neutrality. The country should strive to have a low-carbon mechanism by implementing carbon tax, continuous financial aid to lower carbon production, commercializing low-carbon emission technology, etc., (Khan et al., 2022b). Fukushima (2013) documents that reducing carbon emissions is an integral part of corporate ESG investments, regardless of company type. Addressing environmental issues is necessary for conducting business activities. Using the Dumitrescu-Hurlin technique, Ahmad et al. (2021) found that the causality between energy-industry investment and economic performance differs across the regional development levels.

Since China is currently the world’s largest carbon emitter, domestic companies’ ability of carbon emissions reduction is one of the most important factors in achieving global climate goals2. The Hong Kong Exchange required listed companies to disclose ESG reports in 2015, indicating that addressing environmental concerns have become an obligation for enterprises.

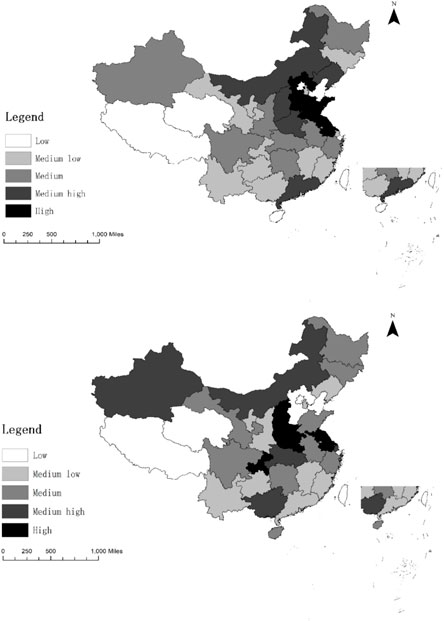

Figure 1 shows the distribution of carbon emissions in China in 2014 and 2019. The total carbon emissions remained relatively stable, but their distribution changed significantly. Thus, it is necessary to conduct an in-depth analysis of China’s efforts towards the green transition of industries.

This paper contributes to the literatures by investigating the relationship between the ESG investment and the reduction of carbon emissions in China. We focus on the role of regional differences in the relationship between ESG investments and carbon emissions. Regional differences, including both natural resource distribution and economic differences, have significant influence on carbon emissions. The distribution of coal, which is the major fossil fuel used in China, is extremely uneven. However, the reduction in carbon emissions in China is mainly achieved by reducing coal consumption. Richer coal resources allow for a lower cost of resource consumption attributable to local extraction, leading to a weaker incentive for enterprises to develop new technology, to use clear energy, and to improve energy consumption efficiency. Additionally, the unbalanced and inadequate development of regional economies has reduced incentives of local governments for the green transition. Therefore, it is important to analyze the impact of regional differences on carbon emissions. We divide the whole sample into three parts—Eastern, Central, and Western regions, and study the effect of ESG investments on carbon emissions of listed companies in each region, which increases the credibility and applicability of the results. This study provides relevant reference in the implementation of the policy, which is in line with the current goal of green transformation and sustainable economic growth.

The rest of the paper is structured as follows: Section 2 provides the data description and analysis; Section 3 introduces the proposed model; Section 4 presents the empirical results; and Section 5 discusses the results and conclusions of the study.

2 Data

2.1 Dependent variables

Based on a study by Wang et al. (2017) and Li and Xue (2020), we selected carbon dioxide emission amount, carbon productivity, and carbon emission intensity as dependent variables. Because carbon emissions cannot be observed, we focused on 14 types of energy: coal, coke, coke oven gas, natural gas, crude oil, gasoline, kerosene, diesel oil, fuel oil, liquefied petroleum gas, blast furnace gas, converter gas, liquefied natural gas, and other natural gas. We then calculated their carbon dioxide emission indices according to Liang et al. (2021). Specifically, we collected 180 balance sheets from 2014 to 2019 and used the coal discount coefficient to estimate carbon dioxide emission index. Data were obtained from the China Energy Statistics Yearbook (2015–2020). Carbon emissions were estimated as follows:

where

2.2 Independent variables

Our key independent variable is the ESG investment score. ESG scores are estimated based on the announcement of ESG investment and performance of listed firms. These scores can be used to evaluate corporate investment behavior and their contribution to promoting sustainable economic development and fulfilling social responsibilities. We also used environmental, social, and governance scores as independent variables to examine their impact on carbon emissions. We calculate our provincial ESG data as the average ESG investment score of listed firms in each province. The scores were obtained from the SynTao database.

2.3 Control variables

We selected the scientific and technological level, economic development level, primary energy consumption, and degree of openness as control variables. Progress in science and technology plays a vital role in the development of new energy sources, and improvement in new energy processing and conversion efficiency changes the energy consumption structure. The data were obtained from the official website of the State Intellectual Property Office.

We used GDP per capita to represent the level of regional economic development. The Kuznets curve shows the inverted “U” relationship between GDP per capita and environmental degradation (Spangenberg, 2001). China’s regional economic development level is unbalanced, which leads to a difference in the time required to cross the turning point among regions. These data were obtained from the China City Statistical Yearbooks.

The consumption of primary energy directly affects carbon emissions (Bertinelli et al., 2007). The lower the energy processing conversion rate (i.e., the greater the proportion of primary energy), the greater the impact on environmental damage and carbon emissions. The data were obtained from the China Energy Statistics Yearbook.

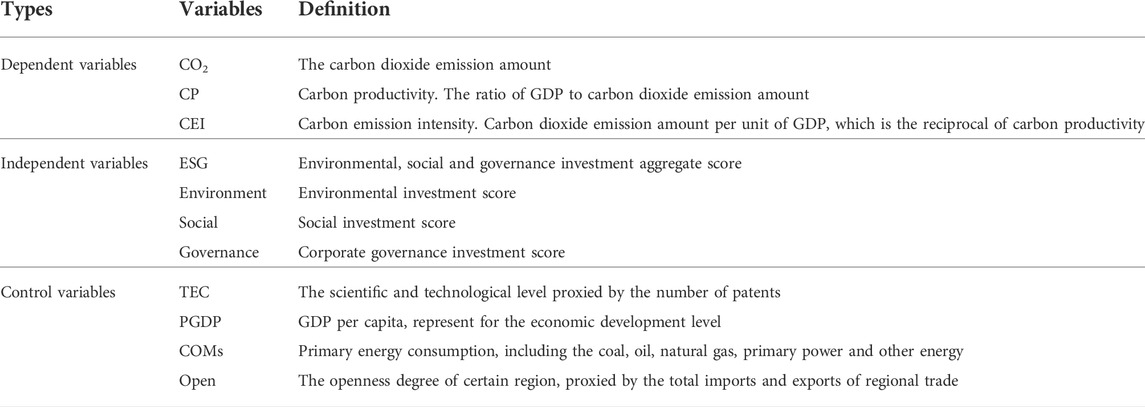

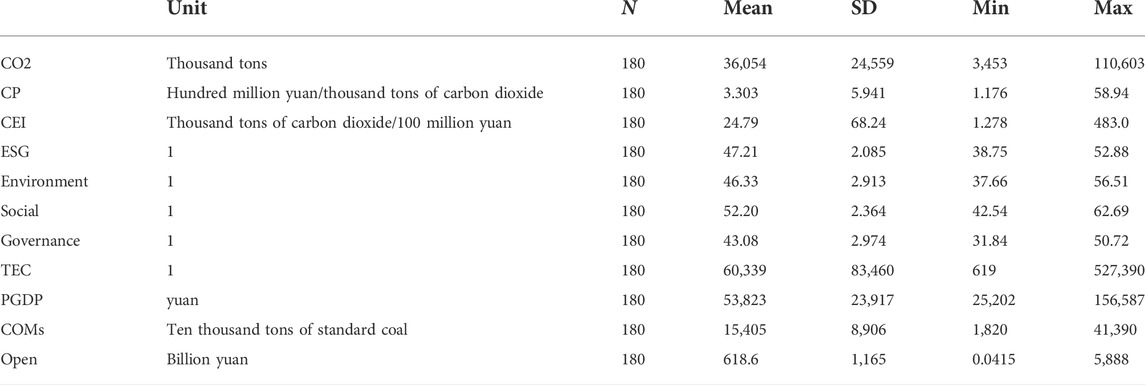

Developed and developing countries are deeply involved in the global value chain and profoundly affect the international carbon transfer network through the trade-clustering effect (Wang et al., 2021). To retain the competitive advantage, some countries relax environmental regulations and the behavior of “race to the bottom line” appears (Revesz, 1997). These results show that the degree of openness significantly affects a country’s carbon emissions. We collect these data coms from China Statistical Yearbook. The definitions of the variables are listed in Table 1 and the summary statistics are shown in Table 2.

3 Methodology

We employ a panel regression model for the empirical analysis. We used the logarithm form of the variables to alleviate the effects of heteroscedasticity. As mentioned above, we chose carbon dioxide emission amount, carbon productivity, and carbon emission intensity as dependent variables. Since the provincial and time effect could hardly be considered as random experiment, we conducted a two-way fixed effect model to evaluate the relationship. The result of Hausman test also support this selection. The model is constructed as follows:

where

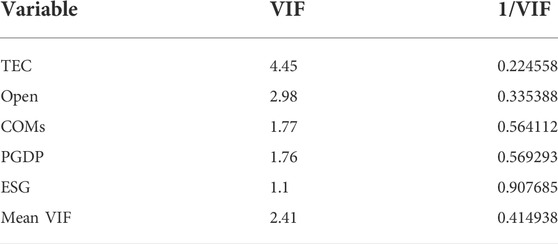

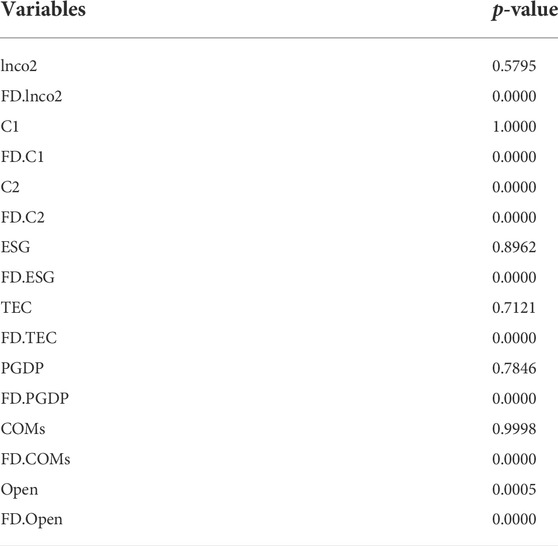

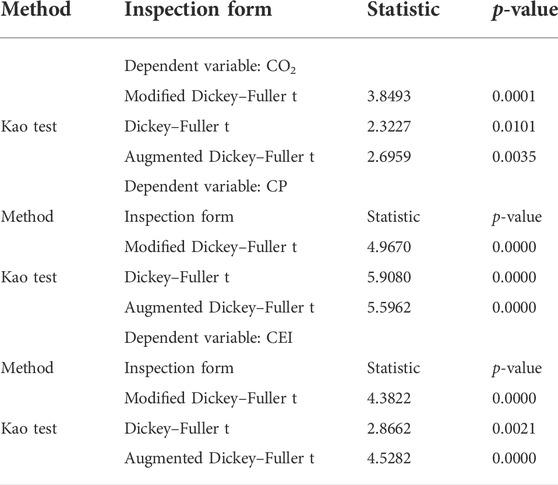

Firstly, we test multicollinearity and stationary of the variables. According to Table 3, the VIF values of the explanatory variables are all less than 5, suggesting that there is no serious multicollinearity problems. Table 4 provide the results of unit root test for logarithmic and log first-order difference of the variables. It is clear that most of the variables are first-order stationary. Consequently, the cointegration test should be performed to determine whether there is a stable relationship between the variables. We employ the Kao test to investigate panel cointegration on the variables. Table 5 shows that the cointegration relationships stand in all cases, indicating that our model is not misspecifie.

4 Empirical results

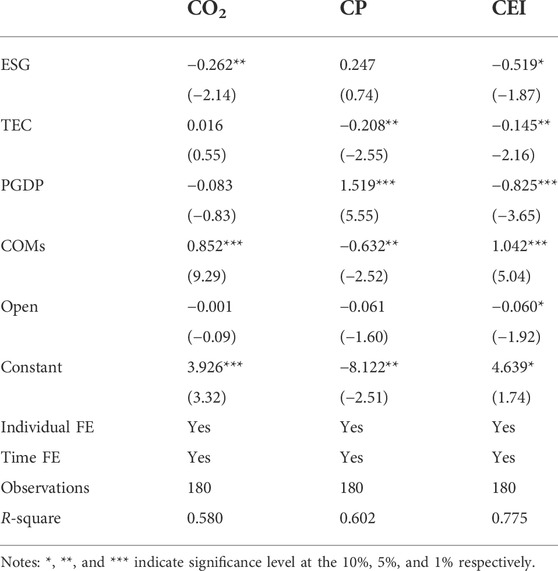

Table 6 reports the primary results of Eq. 2. In case 1, the primary energy consumption is significant at the 1% significance level because the energy consumption is directly related to carbon emissions. After controlling for the effect of energy consumption, we observe that ESG investment has a significantly negative impact on carbon dioxide emissions. A 1% increase in ESG investment reduces carbon emissions by 0.262%, indicating that ESG investment significantly contributes to alleviating climate change in China.

In Case 2, we adopt carbon productivity as the dependent variable. GDP per capita is highly significant and positive, indicating that carbon productivity is much better in well-developed regions. As energy consumption is significantly negative, suggesting that the under developed regions have not achieved the balance of economic development and environmental protection. However, we observe that ESG investment is positive but not significant, indicating that ESG investments by Chinese enterprises have not achieved progress in relevant green technologies at the current stage. In Case 3, we adopt carbon emission intensity as the dependent variable and obtained similar results. ESG investment is significant and negative, indicating that an increase in ESG investment tends to reduce or inhibit carbon emissions intensity.

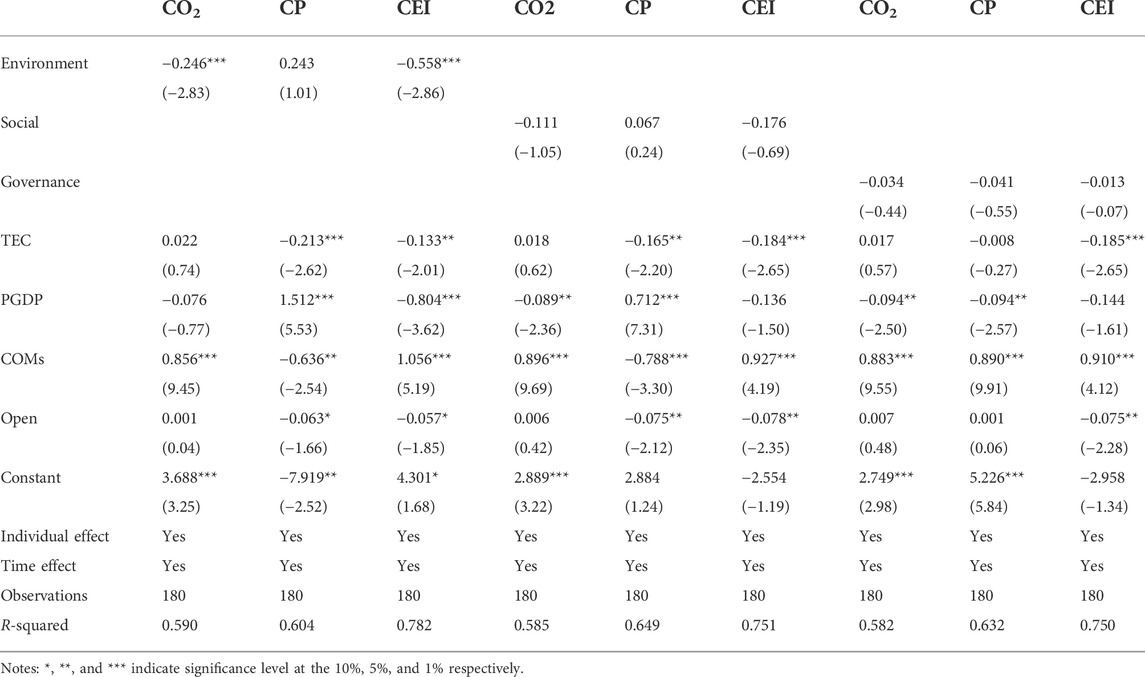

We then distinguish between environmental, social, and governance investments and investigate their impact on carbon emissions. The empirical results are presented in Table 7. Clearly, environmental investment significantly reduced carbon emissions but had no significant impact on carbon productivity. These results are similar to those in Table 6. However, social and governance investments had no significant impact on carbon emissions.

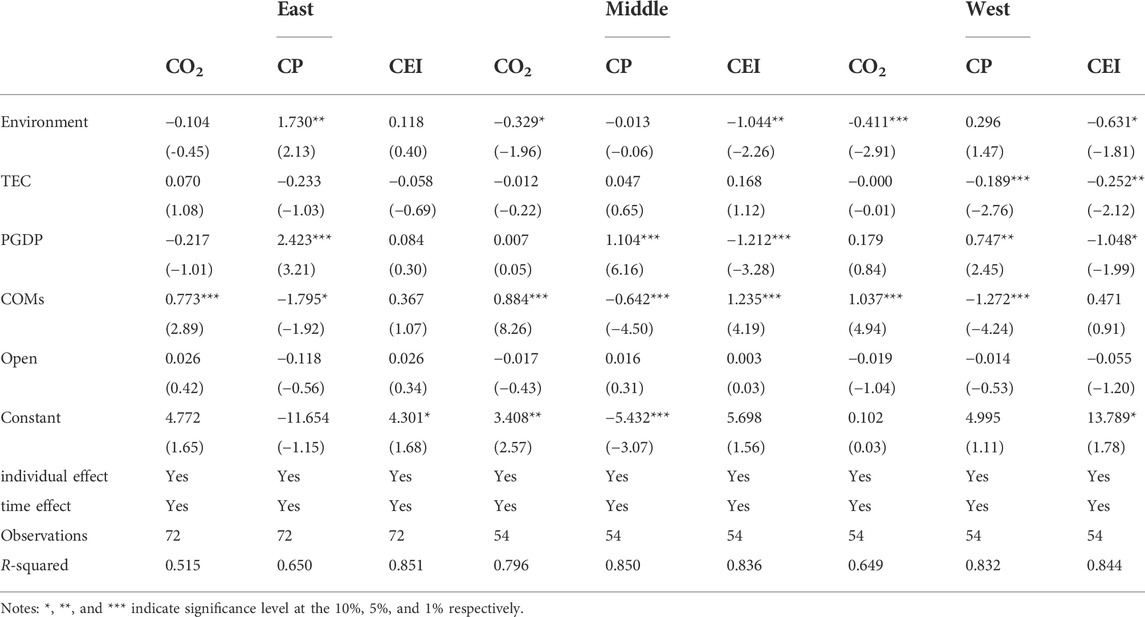

To further analyze the impact of environmental investment on carbon emissions in different regions of China, we refer to the regional division method of the National Bureau of Statistics and divide the sample into three sub-samples: the eastern, central, and western regions3. The results are presented in Table 8.

TABLE 8. The effect of regional environmental investments on carbon emission in the East, Middle, and West regions.

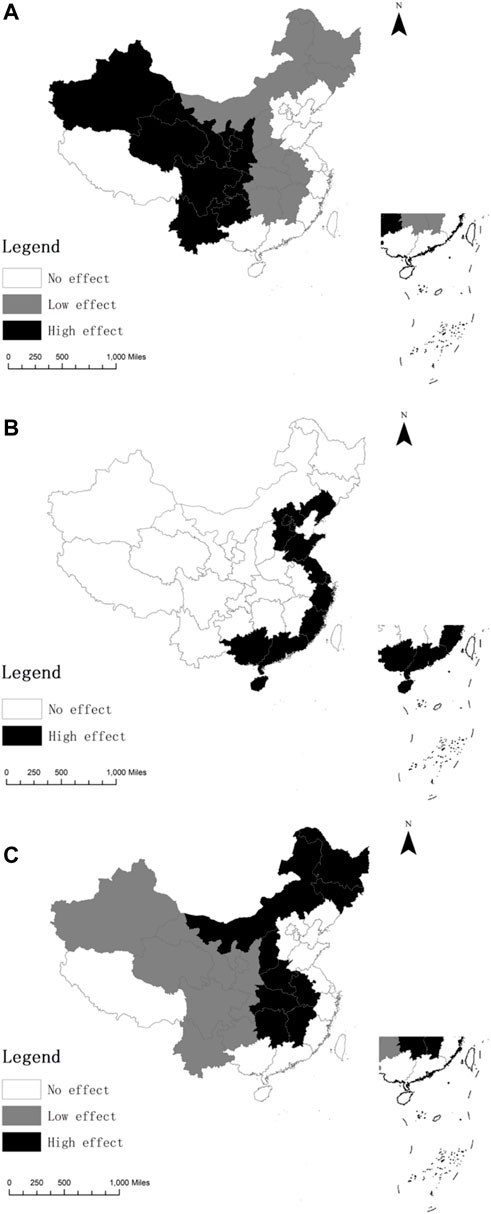

According to Table 8, environmental investments have significant impact on carbon emissions in each region. Specifically, environmental investments significantly increase carbon productivity in the eastern region, and decrease the CO2 emissions and carbon emission intensity in the western and central region. For better understanding, the results of Table 8 are visualized in Figure 2. Clearly, the impact of environmental investments on carbon emissions differs across regions. These results suggest that environmental investments by enterprises in eastern regions mainly focus on improving carbon productivity, and companies in western and central regions concentrate on reducing carbon emissions.

FIGURE 2. (A). The impact of Environmental investments on carbon emissions (B). The impact of Environmental investments on carbon productivity (C). The impact of Environmental investments on carbon emission intensity.

As the eastern region is the most advanced economy in China, we can conclude that enterprises in the eastern region focus on green innovations in the production process. Compared to the eastern region, the environmental investments of enterprises in the central and west regions significantly reduce carbon emissions. However, such investments do not improve carbon productivity. These results suggest that advanced provinces in China have achieved balance between economic development and environmental protection. China is undergoing a green transition in its industries, and it has obtained substantial positive results from ESG investment. Since the effect of ESG investments is different across regions, environmental economic policies should take into account the levels of economic development.

5 Conclusion

In 2021, the Chinese government put forward the goal of “achieving carbon peak by 2030 and carbon neutrality by 2060”. The requirements of sustainable development have changed the idea of “high pollution, high economic development”, and have been forcing green transition to enterprises.

This study investigates the impact of ESG investments by Chinese listed firms on carbon emissions. We find that Chinese enterprises’ ESG investments significantly reduce carbon emissions, but the effect differs across regions. Enterprises in the eastern region focus on improving their carbon productivity. In the central and western regions, firms concentrate on reducing the amount of carbon emissions.

Overall, China still has a long way to go to meet its climate change targets. The responsibility for reducing carbon emissions requires technological progress in the production process, which has not been realized in the current stage. Future research could focus on specific industries, and investigate the mechanism of how ESG investments can reduce carbon emissions.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

YC: Methodology, data collection, empirical analysis, writing, and conceptualization. CZ: Methodology, and empirical analysis. YH: Methodology, and writing. ST: Conceptualization, writing, formal analysis, and supervision. XC: Writing, supervision, and funding.

Funding

This work was supported by JSPS KAKENHI Grant Number 19K1373801 and 19K1373821.

Acknowledgments

Thanks to Tianyang Wang for his help in checking the paper.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1See details at https://www.ipcc.ch/report/ar6/wg1/#SPM

2See more details in Wu et al., 2018.

3China National Bureau of Statistics Information Disclosure (stats.gov.cn)

References

Ahmad, M., Jan, I., Jabeen, G., and Alvarado, R. (2021). Does energy-industry investment drive economic performance in regional China: Implications for sustainable development. Sustain. Prod. Consum. 27, 176–192. doi:10.1016/j.spc.2020.10.033

Åihman, M., and Zetterberg, L. (2005). Options for emission allowance allocation under the EU emissions trading directive. Mitig. Adapt. Strateg. Glob. Chang. 10 (4), 597–645. doi:10.1007/s11027-005-6156-4

Baldini, M., Maso, L. D., Liberatore, G., Mazzi, F., and Terzani, S. (2018). Role of country-and firm-level determinants in environmental, social, and governance disclosure. J. Bus. Ethics 150, 79–98. doi:10.1007/s10551-016-3139-1

Bertinelli, L., Strobl, E., and Zou, B. (2007). Economic development and environmental quality: A reassessment in light of nature's self-regeneration capacity. Ecol. Econ. 66 (2), 371–378. doi:10.1016/j.ecolecon.2007.09.013

Brown, M. A., and Li, Y. (2019). Carbon pricing and energy efficiency: Pathways to deep decarbonization of the US electric sector. Energy Effic. 12 (2), 463–481. doi:10.1007/s12053-018-9686-9

Ding, J., Chen, W., and Fu, S. (2021). Optimal policy for remanufacturing firms with carbon options under service requirements. J. Syst. Sci. Syst. Eng. 31 (1), 34–63. doi:10.1007/s11518-021-5512-6

Dong, F., Gao, Y., Li, Y., Zhu, J., Hu, M., and Zhang, X. (2021). Exploring volatility of carbon price in European union due to COVID-19 pandemic. Environ. Sci. Pollut. Res. 29 (6), 8269–8280. doi:10.1007/s11356-021-16052-1

Fukushima, T. (2013). The significance of CSR in A/R CDM promotion from the case study of Japan: A focus on corporate forest-related activities and emission trading. J. For. Res. 18 (4), 293–304. doi:10.1007/s10310-012-0351-4

Irfan, M., Elavarasan, R. M., Ahmad, M., Mohsin, M., Dagar, V., and Hao, Y. (2022). Prioritizing and overcoming biomass energy barriers: Application of AHP and G-TOPSIS approaches. Technol. Forecast. Soc. Change 177, 121524. doi:10.1016/j.techfore.2022.121524

Jinga, P. (2021). The increasing importance of environmental, social and governance (ESG) investing in combating climate change. Vienna: InTechopen. doi:10.5772/intechopen.98345

Khan, I., Zakari, A., Dagar, V., and Singh, S. (2022a). World energy trilemma and transformative energy developments as determinants of economic growth amid environmental sustainability. Energy Econ. 108, 105884. doi:10.1016/j.eneco.2022.105884

Khan, I., Zakari, A., Zhang, J., Dagar, V., and Singh, S. (2022b). A study of trilemma energy balance, clean energy transitions, and economic expansion in the midst of environmental sustainability: New insights from three trilemma leadership. Energy (Oxford) 248, 123619. doi:10.1016/j.energy.2022.123619

Li, L., and Xue, W. (2020). Carbon emissions influence factors and peak forecast study of China. IOP Conf. Ser. Earth Environ. Sci. 450 (1), 012095. doi:10.1088/1755-1315/450/1/012095

Liang, C., Liu, Z., and Geng, Z. (2021). Assessing E-commerce impacts on China's CO2 emissions: Testing the CKC hypothesis. Environ. Sci. Pollut. Res. 28 (40), 56966–56983. doi:10.1007/s11356-021-14257-y

Peng, B., Chen, S., Elahi, E., and Wan, A. (2021). Can corporate environmental responsibility improve environmental performance? An inter-temporal analysis of Chinese chemical companies. Environ. Sci. Pollut. Res. 28 (10), 12190–12201. doi:10.1007/s11356-020-11636-9

Raggad, B. (2020). Economic development, energy consumption, financial development, and carbon dioxide emissions in Saudi arabia: New evidence from A nonlinear and asymmetric analysis. Environ. Sci. Pollut. Res. 27 (17), 21872–21891. doi:10.1007/s11356-020-08390-3

Revesz, R. L. (1997). The race to the bottom and federal environmental regulation: A response to critics. Minn. Law Rev. 82 (2), 535.

Rustam, A., Wang, Y., and Zameer, H. (2019). Does foreign ownership affect corporate sustainability disclosure in Pakistan? A sequential mixed methods approach. Environ. Sci. Pollut. Res. Int. 26, 31178–31197. doi:10.1007/s11356-019-06250-3

Spangenberg, J. H. (2001). The environmental kuznets curve: A methodological artefact? Popul. Environ. 23 (2), 175–191. doi:10.1023/a:1012827703885

Wang, F., Wang, C., Su, Y., Jin, L., Wang, Y., and Zhang, X. (2017). Decomposition analysis of carbon emission factors from energy consumption in guangdong province from 1990 to 2014. Sustainability 9 (2), 274. doi:10.3390/su9020274

Wang, Y., Gu, J., and Wu, J. (2020). Explaining local residents’ acceptance of rebuilding nuclear power plants: The roles of perceived general benefit and perceived local benefit. Energy Policy 140, 111410. doi:10.1016/j.enpol.2020.111410

Wang, Y., Wang, Z., and Zameer, H. (2021). Structural characteristics and evolution of the “international trade-carbon emissions” network in equipment manufacturing industry: International evidence in the perspective of global value chains. Environ. Sci. Pollut. Res. 28 (20), 25886–25905. doi:10.1007/s11356-021-12407-w

Wu, L., Chen, Y., Feylizadeh, M. R., and Liu, W. (2018). Estimation of China's macro-carbon rebound effect: Method of integrating data envelopment analysis production model and sequential malmquist-luenberger index. J. Clean. Prod. 198, 1431–1442. doi:10.1016/j.jclepro.2018.07.034

Xie, M., Irfan, M., Razzaq, A., and Dagar, V. (2022). Forest and mineral volatility and economic performance: Evidence from frequency domain causality approach for global data. Resour. Policy 76, 102685. doi:10.1016/j.resourpol.2022.102685

Yue, X.-G., Liao, Y., Zheng, S., Shao, X., and Gao, J. (2021). The role of green innovation and tourism towards carbon neutrality in Thailand: Evidence from bootstrap ADRL approach. J. Environ. Manag. 292, 112778. doi:10.1016/j.jenvman.2021.112778

Keywords: ESG investment, carbon emission, carbon productivity, regional effect, green transition

Citation: Cong Y, Zhu C, Hou Y, Tian S and Cai X (2022) Does ESG investment reduce carbon emissions in China?. Front. Environ. Sci. 10:977049. doi: 10.3389/fenvs.2022.977049

Received: 24 June 2022; Accepted: 21 September 2022;

Published: 12 October 2022.

Edited by:

Xiao-Guang Yue, European University Cyprus, CyprusCopyright © 2022 Cong, Zhu, Hou, Tian and Cai. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shuairu Tian, dGlhbnNyQHNicy5lZHUuY24=; Xiaojing Cai, Y2FpY2FpQG9rYXlhbWEtdS5hYy5qcA==

Yingnan Cong1

Yingnan Cong1 Shuairu Tian

Shuairu Tian Xiaojing Cai

Xiaojing Cai