- Business School, Yangzhou University, Yangzhou, China

ESG is a brand-new concept about how environmental, social and corporate governance supports sustainable development in enterprises. However, little research is done on how to reshape the internal mechanism by which data element embedding drives enterprise performance based on the brand-new sustainable concept. From the perspective of contingency theory and organizational agility, a conceptual model including ESG investment, data element embedding, organizational agility and environmental uncertainty is constructed to study the internal mechanism by which data element embedding affects enterprise performance. The model is empirically researched through the data obtained from the survey of 287 manufacturing enterprises in China. The results show that, ESG investment and external data element embedding impose no direct impact on enterprise performance, but create an indirect impact through organizational agility; environmental uncertainty negatively moderates the effect of ESG investment on organizational agility. Through the hierarchical analysis of ESG investment and data elements embedded in enterprise performance, the value creation mechanism of data elements is revealed, which enriches and expands the theory of data elements and organizational agility, and provides enlightenment for ESG investment to drive the value creation of data elements.

Introduction

Under the background of “Internet + manufacturing”, enterprises are faced with fierce market competition and changing consumer demands. Consumers hope that enterprises can respond to their individual needs through different channels, and change from the original pursuit of product quality to pursuit of consumer experience. This change makes the large-scale mass production model in the industrial economy era no longer appropriate, and enterprises need timely and accurate data to coordinate internal and external business activities of the organization, which makes data one of the basic elements in business success (Moyano-Fuentes and Martínez-Jurado, 2016). An enterprise is an organizational form linked with the effective allocation of resources. In essence, the competition among enterprises is a battle over the resource allocation efficiency. The accuracy, timeliness and effectiveness of resource allocation by enterprises is based on the correct data transmission inside and outside the organization, and the full mining and effective use of data increases the allocation and use efficiency of economic resources. Like traditional production factors, data factors can directly improve the enterprise production efficiency, but the difference between data factors and other factors is that when data factors are embedded in any factor such as labor, capital, and technology, it will produce a value multiplication effect. Seen from long-term development trends, data elements will eventually be embedded in production links on a large scale, thus increasing total factor productivity and creating an important impact on the resource allocation efficiency, which results in increased labor productivity, shortened production time, reduced production costs and circulation costs. In this way, it increases the final product value, accelerates the reproduction cycle of the industrial chain, thereby bringing about huge value creation under the condition of equal costs.

ESG is a new sustainable development concept about the integration and coordinated development of environment, society and corporate governance. It provides enterprises and investors with a comprehensive framework that integrates environmental, social and corporate governance, and conveys a development view of pursuing integration of economic and social values (Atan et al., 2018; Huang, 2021). Data element embedding is an enterprise information sharing infrastructure that runs through business functions and information exchange and coordination among business partners. Despite its importance, data element embedding is also affected by the relationship between the organization and external subjects (Closs and Savitskie, 2003). These findings suggest that the value creation of data elements is highly dependent on other antecedent processes. Therefore, it is very necessary to conduct empirical research on the value creation process of ESG investment-driven data elements. The research results will help enterprises better understand the mechanism by which data element embedding affects enterprise performance, so that we can effectively use data element embedding to achieve enterprise performance and actively enhance the strategic competitiveness of enterprises.

Although the academic and business circles have noticed the impact of environmental characteristics and organizational agility on the value creation of data elements, there is no unified understanding and definition of how to describe and reflect environmental characteristics and organizational agility. Hence, from the perspective that ESG drives data element embedding, this paper defines and measures enterprise environmental characteristics and organizational agility, analyzes the impact of environmental characteristics and organizational agility on the action process of data elements, establishes a theoretical model by which data element embedding affects enterprise performance based on contingency theory, and puts forward research hypotheses, trying to analyze the composition of data elements, the role of organizational agility and environmental characteristics. Moreover, it tests the theoretical model through empirical research methods to reveal the mechanism by which data element embedding affects enterprise performance.

1 Value of data elements based on contingency theory

The contingency theory shows that an enterprise organization is a subsystem in an open social macro system that is affected by the internal and external environment. The internal elements and external environmental background and conditions of each organization are rather different. Enterprises should maintain the best adaptation to the environment by taking effective organizational management models and measures. The effect of management is highlighted in the interaction between the management model and the various elements of the organization, and enterprise performance is a result of the matching between its organizational strategic behavior and internal and external environmental conditions (Drazin and Van de Ven, 1985). This process requires enterprises to adopt effective organizational strategies and processes to handle the specific external conditions in front of them. The most important core of contingency theory is to enable organizations to adapt to the environment. When the organizational environment changes complexly, enterprises need to explore new markets, discover changes in consumer needs, and develop new products or services in a targeted manner. In this process, enterprises need to integrate new market information, perform differentiated restructuring of the organization, and even expand new subsystems or new production processes to adapt to changes in the environment.

Contingency theory regards the organization as an open system that continuously exchanges information and follows a factor-process-performance path (Schoonhoven, 1981). Factors refer to the pre-factors and environments in the context. For instance, market demand fluctuations cause uncertainty and opportunities for enterprises, and then affect the organization operation process. Process means the organization and management of these pre-factors or adaptation to these pre-factors, such as information sharing, organizational operation adjustment and so on. Performance refers to the result of this series of actions and processes.

According to contingency theory, this paper argues that data element embedding is a strategic behavior of an organization to improve its coordinated operation process and benefit enterprise performance (Wong C W Y et al., 2011). The productivity of data elements lies in the fact that they can essentially drive and stimulate the enterprise potential, achieve self-reform, self-transformation, and self-control of enterprises, and cope with various internal and external uncertainties through the agility in efficient coordination, so that the technology chain, product chain, value chain and even the space chain of enterprises can be effectively expanded and reconstructed, making the enterprise production and operation process more closely coupled with the consumer market, thus enabling agile and flexible management, forming information aggregation in the virtual space, thereby driving enterprise organization and market innovation. Therefore, enterprises cannot ignore the impact of environmental factors on the relationship between organizational agility and organizational performance driven by data elements. Contingency theory provides appropriate theoretical guidance for studying the factors influencing the process in which data element embedding leads to enterprise performance.

2 Theoretical models and hypotheses

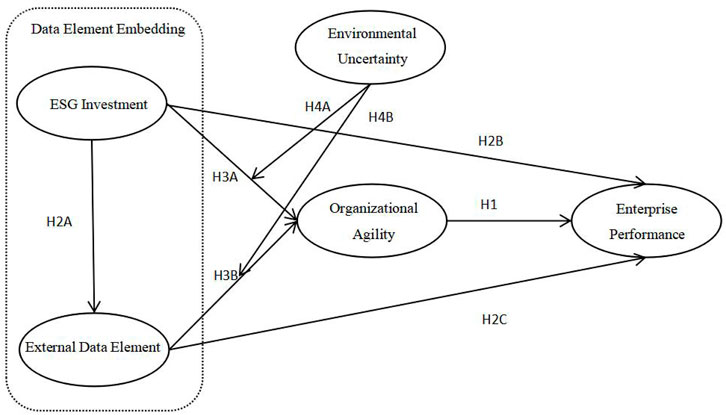

Based on the contingency theory, this paper establishes a mechanism model regarding the impact of ESG investment on enterprise performance, analyzes the composition of data elements and the main characteristics of organizational agility, and investigates the mechanism by which ESG investment affects enterprise performance through data element embedding and organizational agility. Where, according to the relevant theories, the intervening effect of enterprise environmental factors on the value creation process of data elements is proposed, the characteristics of environmental factors are measured by environmental uncertainty, and the effect of data element embedding on organizational agility is analyzed. The theoretical model is shown in Figure 1.

2.1 Organizational agility

Economic globalization and intensified corporate competition have put pressure on enterprises in their efforts to maintain a competitive advantage in such an unstable environment. In the face of fierce competition and dynamic environment, enterprises need to take competitive behaviors (such as constantly developing new products or improving service accuracy, etc.), integrate limited resources and organizational capabilities to drive organizational agility. Organizational agility is the ability to innovate and respond quickly to capitalize on opportunities for growth and prosperity in the face of uncertainty in the business environment, which is an extension of the concept of strategic flexibility in response to unstructural change (Zhang and Sharifi, 2000). Existing literature generally explains organizational agility from two perspectives: market agility and operational adjustment agility (Lu and Ramamurthy, 2011). Market agility refers to an enterprise’s ability to respond proactively and exploit opportunities through continuous monitoring and rapid delivery of products or services to meet consumer needs. Market agility emphasizes dynamic, proactive growth-oriented corporate thinking about decision-making and judgment under conditions of change or uncertainty (Sambamurthy et al., 2003). Operational adjustment agility is the ability to adjust business processes and resources at the internal level of an enterprise to meet changes in the market or demand. Operational agility emphasizes the flexibility and rapid response capability of an enterprise’s internal operating processes in the face of changes. Enterprises with high organizational agility have the skills to take competitive actions and respond flexibly to changes in the environment, and provide consumers with new product or service needs, thereby effectively reducing operating costs, increasing product-market fit and market share, thus acquiring higher profit and value (Chen and Wang, 2014). Therefore, the following hypothesis is made:

H1: Organizational agility is positively correlated with enterprise performance.

2.2 ESG investment and data element embedding

In 1997, the relevant United Nations agencies proposed that environmental, social and corporate governance factors must be incorporated in the corporate decision-making process. Many financial institutions and non-governmental third-party institutions then began to pay attention to and promote ESG concepts, information disclosure and ESG evaluation (Wong C W Y et al., 2011). At the same time, social rating agencies have gradually established a comprehensive multi-dimensional evaluation system, which further strengthens enterprises’ emphasis on ESG concepts. ESG investment can not only enhance the external signal of the enterprise, reduce the enterprise financing cost by alleviating information asymmetry and agency problems, but also can establish a good social image of the enterprise and strengthen the relationship between the enterprise and its stakeholders (Yoon et al., 2018). ESG investment helps to win the trust and support of various stakeholders, strengthens the long-term cooperative relationship between enterprises and all parties in the supply chain, and then helps enterprises gather the data resources required for operation, thereby achieving sustainable development of enterprises. Hence, the following hypotheses are proposed:

H2A: ESG investment positively affects the external data element embedding of enterprises.

H2B: ESG investment positively affects enterprise performance.

Data element embedding means a high-level stage in utilization of enterprise information technology and other electronic resources. Sharing the integrated information between internal departments and external cooperative enterprises through electronic tools will facilitate cross-functional collaboration inside and outside the enterprise, which is represented as interaction and sharing of timely, accurate and standardized data between organizational functions within and outside the enterprise (Yoon et al., 2018). Previous research proposed multiple levels of data element embedding to support business coordination (Wong C W Y et al., 2011). Data element embedding, on the one hand, can drive enterprises to accurately identify consumer needs and dynamic changes, and then provide precise marketing, targeted advertising, a price system beneficial to users, high-quality personalized services, and faster product and service iterations, thereby gaining market competitiveness and increasing profits. On the other hand, it can drive the reduction of organizational operating costs, the improvement of operating efficiency, and the improvement of production quality, so that higher operating performance is possible. As one of the key factors in enterprise success, data element embedding also provides an open communication and information sharing mechanism between enterprise functional entities and supply chain partners to support enterprises to take appropriate performance improvement actions (Wong C W Y et al., 2011). For example, Dell continuously adjusts its production plan according to the market demand and makes suppliers adjust the production plan continuously, so that the production gradually approaches the real market needs in the process of continuous adjustment. Dell and its suppliers share so much information in the process that they work in close coordination as a unit. Integration of enterprise production plans and dealer procurement plans can help enterprises adapt to market demand changes and produce customized products. At the same time, order plans can be updated in time before market activities, so that enterprises and partners can jointly achieve the goal of improving performance. It can be said that data element embedding provides a collaborative mechanism to support the completion of intra and inter-enterprise tasks and reduce operating costs, thus bringing obvious first-mover advantages to enterprises. In the future, to some extent, enterprises will rely on digital element embedding to achieve competitiveness and sustainable growth (Sambamurthy et al., 2003). Hence, the following hypothesis is proposed:

H2C: External data element embedding positively affects enterprise performance.

Enterprises with agile responses can quickly take countermeasures against sudden changes in market demand. How to develop this ability? The first suggestion given is data sharing among supply chain members. Enterprises that actively participate in ESG activities also display higher consumer satisfaction and a sense of identity with supply chain enterprises, which weakens the differences between enterprises and external stakeholders, brings all-round, multi-level effects to the enterprise’s operations and resource allocation, and then subtly increases organizational agility. Data element embedding emphasizes that in the mode of resource sharing, the long tail theory means to meet the ever-changing individual needs of consumers through multi-variety production in small batches, and let enterprises and other enterprises form economic benefits via the division of labor and cooperation. Wherein, the production operation mode, organizational management mode and service system will all be oriented towards rapid response. High data element embedding provides a timely and accurate support platform for enterprise operation adjustment and market response, thus enabling enterprises to conduct real-time dynamic analysis through real-time integration of internal and external data, quickly grasp market dynamics, adjust corresponding strategies and behaviors, adjust enterprise operations, optimize the process, and provide timely and rapid decision-making response (Fink and Neumann, 2007). Hence, the following hypotheses are made:

H3A: ESG investment positively affects organizational agility.

H3B: External data element embedding positively affects organizational agility.

2.3 The moderating effect of environmental uncertainty

The accelerated iteration of technology, the high penetration of the industry and the blurring of boundaries all make many enterprises face uncertainty. Such uncertainty is a result of superposition of various factors. For example, the innovation cycle has gradually shortened from the original long time, the information technology-driven integration of industries makes it difficult to distinguish one industry from another, and the boundaries are becoming more and more blurred. Strong competition does not necessarily come from traditional competitors, but may come from dimensionality reduction strikes from other industries (for instance, the emergence of new energy vehicles affects traditional vehicle industry, etc.). Therefore, enterprises strive to expand the previously unfamiliar market, which further accelerates the environmental instability. At the same time, with the rapid economic development and the constant technological innovation, consumer needs are gradually becoming diverse and personalized, and the business environment also exhibits a non-stationary trend (Newkirk and Lederer, 2006). In the field of business management research, environmental uncertainty is used as one important moderating variable to measure organizational behavior. The so-called environmental uncertainty refers to the unpredictable and non-sustainable unstable state or change of the business environment (Wang et al., 2015). Tallon et al. also suggested using environmental uncertainty as an important contextual variable in the information economy and information management (Tallon, 2008). Regarding the impact of original ESG investment and data element embedding on organizational agility, we ignore the contextual variable of the environment. Therefore, it is difficult to reflect the situational dependence in the realization of value embedded in data elements. Hence, the following hypothesis is made:

H4A: Environmental uncertainty moderates the relationship between ESG investment and enterprise organizational agility.

H4B: Environmental uncertainty moderates the relationship between external data element embedding and enterprise organizational agility.

3 Research methods

The data in each value creation link of data elements of manufacturing enterprises are acquired by questionnaire survey, the impact of organizational agility on enterprise performance is analyzed by structural equation method, the impact of data element embedding on organizational agility and enterprise performance is tested, and the moderating role of environmental uncertainty level in the impact of data element embedding on organizational agility is analyzed.

3.1 Scale development and questionnaire design

The data collection herein adopts the questionnaire survey method, the measurement variables basically come from the existing literature, and there is a certain guarantee on the measurement reliability and validity. Before the official questionnaire came out, a small-scale pre-investigation was carried out. According to the investigation results, the expressions and sentences of the questionnaire items were revised to form the final questionnaire. Except the basic enterprise information, the 5-point Likert scale was used. ESG investment originated from socially responsible investment (SRI), which means the three most important consideration factors in socially responsible investment. From this perspective, we selected the three benchmarking institutions for ESG research: the Sustainability Accounting Standards Board (hereinafter referred to as SASB) as a non-profit organization, Morgan Stanley Capital International (hereinafter referred to as MSCI) as an index research and development enterprise, and Standard & Poor’s (hereinafter referred to as S&P), then compared the similarities and differences in ESG research process. We found that SASB, MSCI and S&P have quite different starting points in designing the ESG evaluation system, but all lead to the same goal. These ESG index systems can provide us with an analysis template for sustainable development and green development, and provide investors with a starting point for analysis framework and index. SASB selected five important aspects for evaluation, including Environment, Social Capital, Human capital, Business Model & Innovation, Leadership and Governance. The data element embedding was measured by the scales of Wong, Moyano-Fuentes, Roberts (Wong C W Y et al., 2011; Roberts and Grover, 2012; Moyano-Fuentes and Martínez-Jurado, 2016), etc., organizational agility was measured by the scales of Lu, Sambamurthy, et al. (Sambamurthy et al., 2003; Lu and Ramamurthy, 2011), environmental uncertainty was measured by the scale of Wong, Newkirk, Wang et al. (Newkirk and Lederer, 2006; Lu and Ramamurthy, 2011; Wang et al., 2015), and enterprise performance was measured by the scales of Wong and Narayanan (Wong C W Y et al., 2011; Narayanan et al., 2015).

3.2 Data collection

The surveyed areas are mainly concentrated in Shanghai, Jiangsu, Zhejiang and other Yangtze River Delta regions in China. In these regions, the manufacturing industry is relatively developed, and the application of information technology is relatively early, which is typical and representative. The survey data mainly comes from two sources. The first way is to distribute 125 questionnaires in college MBAs, and the second way is to conduct field research or postal research through alumni resources. The questionnaire was filled out by the head of the information technology department, ESG management department or marketing department of the enterprise. A total of 400 questionnaires were distributed in this way. A total of 317 questionnaires were recovered from the three research channels, and the questionnaire recovery rate reached 79.25%. The validity of the recovered questionnaires was screened. 21 questionnaires filled in with incomplete information, contradictory information, and almost with the same options, and nine questionnaires by respondents whose positions did not meet the requirements and who did not understand information technology and information management were eliminated. Therefore, a total of 287 questionnaires entered the final data analysis and model fitting stage.

3.3 Common method bias control

In the survey, the questionnaire is often completely filled out by one person, and there may be a problem of common method bias. In data analysis, two main steps are taken to address the problem of common method bias. First, adopt reasonable program control and process control, conduct anonymous survey and adjust the order of questionnaire items to control the questionnaire. Second, conduct Harman single factor test on the final survey data. In factor analysis, the variance of the first principal component factor is explained as 32.7% when there is no rotation, which has a significant statistical advantage, so it can be considered that the common method bias has no significant effect in this study.

4 Empirical analysis

This paper uses SPSS23 and SmartPLS3.0 as tools to conduct data research, tests the reliability and validity of the scale, calculates the influence of various variables, judges the fitness of the model and finally verifies the hypothesis of the model on this basis.

4.1 Evaluation of measurement tools

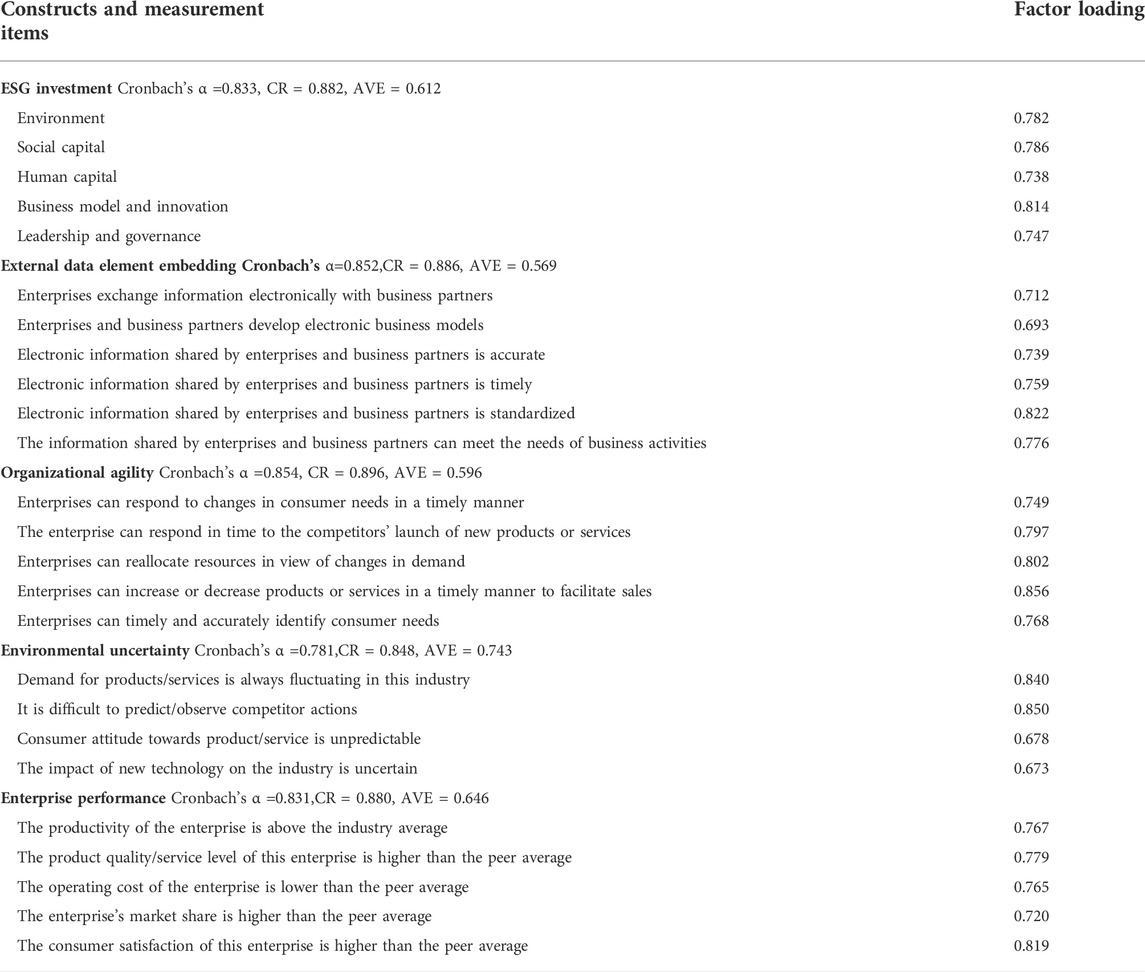

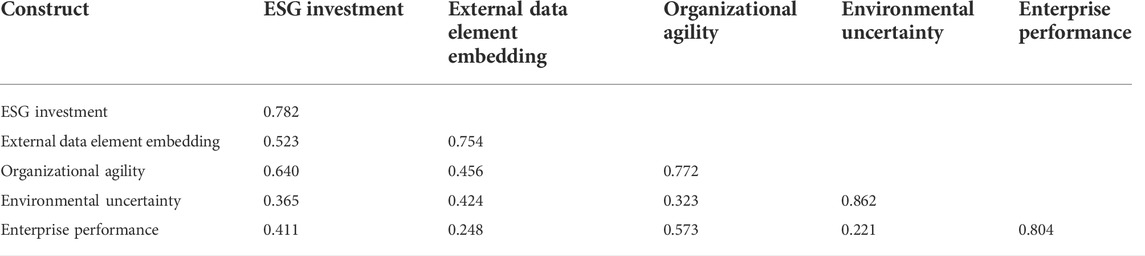

As can be seen from the Table 1, the minimum Cronbach’s value of the construct in this paper is 0.781, and the minimum value of the combined reliability (CR) is 0.848, which far exceeds the critical value of 0.7, so the measurement model of the construct has relatively high reliability. The minimum value of the standardized factor loadings of all measurement items is 0.673, which is higher than the critical value of 0.6, indicating that the measurement model has high convergent validity. The average variance extracted value (AVE) for all constructs is above the critical value of 0.5. Through exploratory factor analysis, the maximum variance method is used for rotation, the Kaiser-Meyer-Olkin measurement test value is 0.854, which approaches 1, and the Bartlett sphericity test value is 4,289.83, with a degree of freedom of 276. The significance is less than 0.001, and the factor variance explained amount reaches 70.8%. The validity test is mainly to check the discriminant validity, which is measured by the square root of the average variance extracted value (AVE) greater than the correlation coefficient of the corresponding construct. As can be seen from the Table 2, the data in this paper meet the requirements, and it can be said that the discriminant validity of the scale is within a reasonable range.

4.2 Model fit

In PLS path analysis, the GoF index is generally used to measure the fitness or goodness of fit of the model. The calculation method of GoF is

4.3 Theoretical hypothesis verification

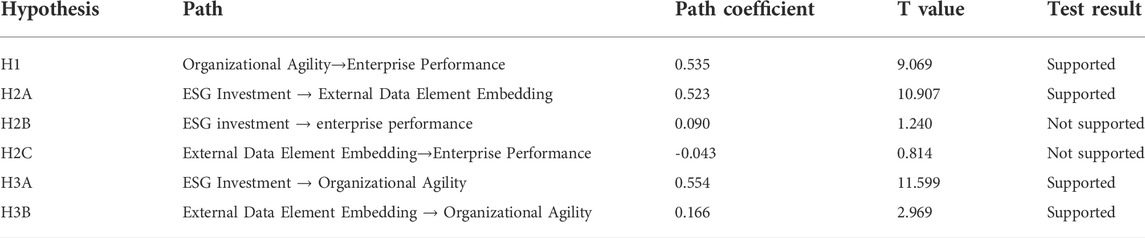

Structural equation based on partial least squares does not require very high data volume and data distribution of survey samples, which is suitable for exploratory research and is widely used in the fields of information technology and strategic management. In this paper, SmartPLS, a typical software in PLS, is used for data fitting and analysis. Table 3 reports the hypothesis testing results without considering moderating effects.

It can be seen from Table 3 that the path coefficient between organizational agility and enterprise performance is 0.535, which is significant at p < 0.001, indicating that there is a strong positive relationship between organizational agility and enterprise performance, so hypothesis H1 is verified. The path coefficient between ESG investment and external data element embedding is 0.523, which is significant at p < 0.001, suggesting that ESG investment has a direct and significant impact on external data element embedding, so hypothesis H2A is verified. The path coefficients between ESG investment, external data element embedding and organizational agility are 0.554 and 0.166, respectively, which are significant at p < 0.001 and p < 0.05, respectively, indicating a certain positive relationship between the variables, so hypotheses H3A and H3B are verified. However, the path coefficient between ESG investment, external data element embedding and enterprise performance does not reach the critical significance level of 0.05, so hypotheses H2B and H2C are not established, that is, data element embedding has no significant direct impact on enterprise performance.

4.4 Analysis of mediating effect

In the path analysis, the path coefficients from ESG investment to enterprise performance, from external data element embedding to enterprise performance, and from organizational agility to enterprise performance are calculated. The test results show that the path coefficients from data element embedding to enterprise performance are insignificant, while organizational agility has a significant positive impact on enterprise performance. Therefore, according to the recommendations of the literature (Tarafdar and Qrunfleh, 2017), there is need to further analyze the mediating role of organizational agility in the impact of data element embedding on organizational agility.

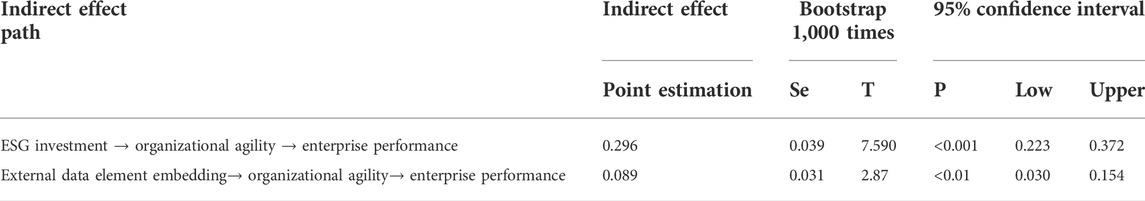

In the past, most mediating effect tests in structural equation models were tested by the Sobel method. Hayes’ research shows that the data parameter distribution in the PLS method may not meet the normality requirement, so the traditional Sobel method is biased in effect test (Andrew F. Hayes, 2009; A. F. Hayes and Scharkow, 2013). According to the research recommendations of Nitzl and Roldan (Nitzl et al., 2016), by using the bootstrapping algorithm in PLS to estimate the relevant parameters, it is possible to effectively test the mediating effect. As shown in Table 4, the T-value test shows that all path coefficients pass the significance test at the 0.05 level, and 95% of the intervals are positive numbers, excluding 0, which verifies that organizational agility plays a mediating role between data element embedding and enterprise performance.

4.5 The moderating effect of environmental uncertainty

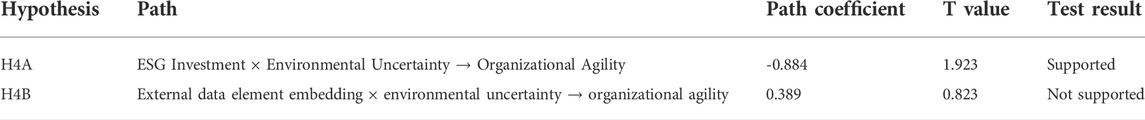

SmartPLS provides a cross-product method for moderating effect verification, but the requirement for the interaction term is that it must be a reflective construct. The constructs studied herein are all reflective and meet the preconditions for application. Before calculation, the data must be normalized to generate new interaction constructs ESG investment × environmental uncertainty, external data element embedding × environmental uncertainty. Then, we calculate the impact of the new interaction construct on organizational agility and use bootstrapping algorithm to estimate the coefficient significance. The calculation results show that environmental uncertainty negatively moderates the relationship between internal data element embedding and enterprise organizational agility, so H4A is confirmed. However, environmental uncertainty has no significant impact on the relationship between external data element embedding and enterprise organizational agility, so H4B is not supported, as shown in Table 5.

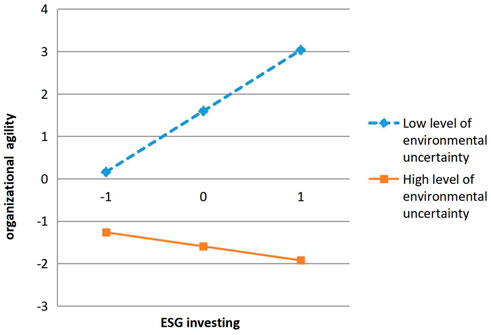

From the results in the above table, it can be seen that the path coefficient of the product terms ESG investment and environmental uncertainty with respect to organizational agility is -0.884, which is significant (p < 0.05, T > 1.923), indicating that environmental uncertainty negatively moderates the impact of ESG investment on organizational agility. For each standard deviation increase in environmental uncertainty, the slope of ESG investment against organizational agility decreases by 0.884 standard deviations. Neither of the other moderation paths passes the significance test, indicating that environmental uncertainty may not play a moderating role in the impact of external data element embedding on organizational agility. In order to make the results of the moderating effect more visible, this paper divides the environmental uncertainty into two groups, one with one standard deviation above the mean and one with one standard deviation below the mean. According to the organizational agility prediction equation after adding the interaction term, the interaction diagram two is plotted.

As can be seen from the Figure 2, when environmental uncertainty is at a lower level, ESG investment has greater impact on organizational agility, which further confirms the conclusion that environmental uncertainty negatively moderates the impact of ESG investment on organizational agility.

FIGURE 2. The interaction effect of environmental uncertainty on ESG investment and organizational agility.

5 Discussion and enlightenment

5.1 Main findings

This paper develops a new scale on data element embedding in manufacturing enterprise, conducts confirmatory factor analysis on corresponding constructs, builds a value creation model for enterprise data elements, and conducts mediation path analysis and moderating effect test. The main findings are as follows:

5.1.1 Hierarchical characteristics and action mechanism of organizational agility driving factor

According to the survey data, two factors are extracted through confirmatory factor analysis, which proves that the driving factors of organizational agility are divided into two constructs: ESG investment and external data element embedding. Different from existing research, this paper verifies the conclusion that ESG investment has a significant direct impact on the external data element embedding of enterprises. This conclusion directly shows that data element embedding by ESG investment is a reasonable path, and a good ESG investment background provides a good guarantee for the external data element embedding of enterprises. Previous studies either blended ESG investment and external data element embedding into one, or regarded them as two separate parts, ignoring the structural and hierarchical effects within ESG investment. In addition, at a practical level, ESG investment is the trigger for enterprise performance improvement, so enterprises should strengthen data sharing channels and data quality construction between internal agencies and with external cooperative enterprises (Lai et al., 2008), thereby strategically preparing for good performance.

5.1.2 Organizational agility is the bridge between enterprise data element embedding and performance

The study found that neither ESG investment nor external data element embedding had a direct impact on enterprise performance, while organizational agility had a direct impact on enterprise performance. Through the mediating effect, it is tested that ESG investment and data element embedding play a positive role through organizational agility. This finding provides some guidance for how to improve enterprise performance. Therefore, when enterprise managers make strategic decision-making on data element embedding, they should timely direct data elements to drive the improvement of organizational agility, thereby ensuring high enterprise performance. At present, the main domestic and foreign literatures still focus on the direct effect of data element embedding on enterprise performance (Zhang and Sharifi, 2000; Junni et al., 2015), and hardly study the mediating effect of organizational agility.

5.1.3 The moderating effect of environmental uncertainty

Through the moderating effect, it is verified that environmental uncertainty plays a negative moderating role in the impact of corporate ESG investment on organizational agility, but environmental uncertainty does not make external data element embedding significantly affect organizational agility. That is to say, lower environmental uncertainty better helps us form corporate organizational adjustment and market responsiveness through corporate ESG investment. In the context of Chinese management, ESG investment is relatively easy for many enterprises, and the effect of ESG investment on organizational agility is effective when the degree of environmental uncertainty is low. However, once the market environment faced by enterprises changes drastically and consumer demands constantly change, corporate ESG investment is far less stable than the external data element embedding, so it is necessary to pay attention to the impact of the environment in ESG investment (Wong C Y et al., 2011).

5.2 Management enlightenment

From the perspective of practical application value, the main management enlightenments are as follows:

First of all, under the circumstance of low environmental uncertainty, enterprises should pay attention to ESG investment. The final purpose is how to combine new consumers, new production models, new products, etc. With data analysis to drive the business process speed and enhance enterprise competitiveness. Enterprises should pay more attention to data elements from a strategic perspective, and realize that enterprises are not making ESG investments to just reach relevant standards, but there is need to transit to data application capabilities. Through the training of IT capabilities among technical and managerial staff (Sun et al., 2020), the introduction of advanced information system software and hardware, and the cultivation of internal information sharing systems, it may be easier to achieve the prerequisite driving conditions for organizational agility. Enterprises should establish a collaborative mechanism in the aspects of human, finance, material, production, supply, and sales to realize the organic integration of internal resources, build an advanced environmental-society-governance framework within the enterprise, effectively utilize the internal data resources of the enterprise, optimize the internal management process, improve the management level and governance efficiency, thus laying a solid foundation for the enterprise to expand the use of external data elements.

Secondly, in the context of high environmental uncertainty, enterprises should not only pay attention to ESG investment, but also strengthen the construction of external data element embedding. Market information is crucial to suppliers, manufacturers and downstream retailers in the entire industry chain, but enterprises in different positions in the entire industry chain have certain differences in the way and ability to access information. Distributors and retailers in the downstream of the industry chain directly face consumers, who possess an incomparable advantage in accessing market information, and can directly predict products and adjust relevant market decisions based on the first-hand data of consumers. However, production enterprises in the upstream cannot directly access market information. Therefore, if they have a good information exchange system with distributors or retailers, through horizontal and vertical information sharing, enterprises can improve their grasp of market information and adjust production and operation processes in a timely manner. In this regard, in order to ensure that all subjects in the industrial chain can effectively share information, core enterprises can build an information sharing system as an information platform for the entire industrial chain to provide effective information services to participating subjects and enable the optimal embedding level of external data. For example, in recent years, the auto retail industry faces fierce competition. Many enterprises integrate supply chain information sharing, connect downstream sales information with information such as the factory’s internal ERP system, and establish an e-commerce platform or implement ERP/MES system extension, so that internal enterprise information is shared with upstream supply chain, which can effectively improve organizational agility in the context of environmental uncertainty. Therefore, in the face of different environments, enterprises should grasp a reasonable “degree” between ESG investment and external data element embedding with a limited budget.

Finally, although different enterprises invest heavily in ESG investment, they must ultimately drive organizational agility through data elements. Seen from the outside of the enterprise, consumer needs are constantly changing, and competitors constantly appear, which puts forward new requirements for enterprises. That is, there is need to abandon the traditional experience management model, adopt digital element embedding to grasp market demand information and competitive information through data analysis. Through fast and accurate strategic and tactical decision-making, they need adjust organizational structure, production mode, product type, etc. To gain a competitive advantage. Organizational agility is a special ability of an organization, which is not a form of an organization, but means the ability of an organization to respond quickly, change flexibly, and empower actions. The difference between agile enterprises and other enterprises is that they are always consumer-oriented and continuously innovate products or services. For example, when developing a new product for consumers, they actively learn the consumer’s attitude towards new product design solutions and continuously seek feedback and comments from consumers. Because the process from production to sales is too complicated for many manufacturing enterprises, although a lot of data has been accumulated for a long time, the data scores separately belong to each department or system and cannot be fully utilized. In addition, in order to better improve agility, the relevant decision-making departments of enterprises impose higher and higher requirements for ESG investment specifications, and the requirements for external data granularity become more and more refined. However, enterprise organizations find it difficult to effectively match the current operation, resulting in certain bottlenecks in the process in which ESG investment and data elements drive organizational agility, so effective value creation is impossible. Therefore, it is necessary to establish a scenario-based data application, use effective digitalization of operations, carry out forward-looking design and strategic planning for the overall goal, time and space of specific operations digitalization to empower organizational agility, and make full use of internal and external resources to create agility-oriented processes, so that the products or services provided by an enterprise are differentiated from those of its competitors, thus creating unique value recognized by consumers, which is the basis for maintaining the sustainable development of the enterprise. This not only reflects the adoption of digital technology, but also involves all-round reform in business strategies, management models, organizational processes, etc., which improves the internal and external information communication capability of the enterprise, breaks down internal and external information barriers by relying on real-time information sharing and increases organizational agility.

6 Conclusion

In the context of Chinese manufacturing enterprises, this paper studies the mechanism by which ESG investment and data element embedding affect enterprise performance, collects data by questionnaire survey, and fits the data using structural equation model. The research results show that corporate ESG investment and data element embedding have no direct and significant impact on enterprise performance, but have indirect effects on enterprise performance through organizational agility. At the same time, the research results also show that under different levels of environmental uncertainty, the impact of data element embedding on organizational agility will change. Specifically, the higher the level of environmental uncertainty, the lower the effect of ESG investment on organizational agility. Of course, this study also has some shortcomings. First, the data collected by the survey are cross-sectional data of enterprises, lacking time series data under dynamic conditions, which may affect the interpretation of the problem. In the future, some enterprises will be followed up for a long time. Secondly, the research model only considers the mediating effect of organizational agility. However, there may be other factors related to enterprise performance in practice (Shuradze et al., 2018). Future research will add other factors to improve the explanatory power and application effect of the model.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

GJ: Conceptualization, methodology, resource, Data curation, supervision, writing-original draft, writing review and editing. LR: investigation, writing review and editing. XJ: writing review and editing.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Atan, R., Alam, M. M., Said, J., and Zamri, M. (2018). The impacts of environmental, social, and governance factors on firm performance. Manag. Environ. Qual. Int. J. 29 (2), 182–194. doi:10.1108/meq-03-2017-0033

Chen, J., and Wang, D. (2014). Understanding organizational agility development for a government: A process model of resource configuration. Front. Bus. Res. China 8 (1), 73–97. doi:10.3868/s070-003-014-0004-5

Closs, D. J., and Savitskie, K. (2003). Internal and external logistics information technology integration. Int. J. Logist. Manag. 14 (1), 63–76. doi:10.1108/09574090310806549

Drazin, R., and Van de Ven, A. (1985). The concept of fit in contingency theory. Res. Organ. Behav. 7, 333–365.

Fink, L., and Neumann, S.Tel Aviv University, Israel (2007). Gaining agility through IT personnel capabilities: The mediating role of IT infrastructure capabilities. J. Assoc. Inf. Syst. 8 (8), 440–462. doi:10.17705/1jais.00135

Hayes, A. F. (2009). Beyond baron and kenny: Statistical mediation analysis in the new millennium. Commun. Monogr. 76 (4), 408–420. doi:10.1080/03637750903310360

Hayes, A. F., and Scharkow, M. (2013). The relative trustworthiness of inferential tests of the indirect effect in statistical mediation analysis: Does method really matter? Psychol. Sci. 24 (10), 1918–1927. doi:10.1177/0956797613480187

Huang, D. Z. (2021). Environmental, social and governance (ESG) activity and firm performance: A review and consolidation. Acc. Finance 61 (1), 335–360. doi:10.1111/acfi.12569

Junni, P., Sarala, R. M., Tarba, S. Y., and Weber, Y. (2015). The role of strategic agility in acquisitions. Brit. J. Manage. 26 (4), 596–616. doi:10.1111/1467-8551.12115

Lai, K.-H., Wong, C. W. Y., and Cheng, T. C. E. (2008). A coordination-theoretic investigation of the impact of electronic integration on logistics performance. Inf. Manag. 45 (1), 10–20. doi:10.1016/j.im.2007.05.007

Lu, Y., and Ramamurthy, K. (2011). Understanding the link between information technology capability and organizational agility: An empirical examination. MIS Q. 35 (4), 931–954. doi:10.2307/41409967

Moyano-Fuentes, J., and Martínez-Jurado, P.-J. (2016). The influence of competitive pressure on manufacturer internal information integration. Int. J. Prod. Res. 54 (22), 6683–6692. doi:10.1080/00207543.2015.1131866

Narayanan, S., Narasimhan, R., and Schoenherr, T. (2015). Assessing the contingent effects of collaboration on agility performance in buyer-supplier relationships. J. Operations Manag. 33-34 (1), 140–154. doi:10.1016/j.jom.2014.11.004

Newkirk, H. E., and Lederer, A. L. (2006). The effectiveness of strategic information systems planning under environmental uncertainty. Inf. Manag. 43 (4), 481–501. doi:10.1016/j.im.2005.12.001

Nitzl, C., Roldan, J. L., and Cepeda, G. (2016). Mediation analysis in partial least squares path modeling: Helping researchers discuss more sophisticated models. Industrial Manag. data Syst. 116 (9), 1849–1864. doi:10.1108/imds-07-2015-0302

Roberts, N., and Grover, V. (2012). Leveraging information technology infrastructure to facilitate a firm's customer agility and competitive activity: An empirical investigation. J. Manag. Inf. Syst. 28 (4), 231–270. doi:10.2753/mis0742-1222280409

Sambamurthy, V., Bharadwaj, A., and Grover, V. (2003). Shaping agility through digital options: Reconceptualizing the role of information technology in contemporary firms. MIS Q. 27 (2), 237. doi:10.2307/30036530

Schoonhoven, C. B. (1981). Problems with contingency theory: Testing assumptions hidden within the language of contingency "theory. Adm. Sci. Q. 26 (3), 349. doi:10.2307/2392512

Shuradze, G., Bogodistov, Y., and Wagner, H.-T. (2018). The role of marketing-enabled data analytics capability and organisational agility for innovation: Empirical evidence from German firms. Int. J. Innov. Mgt. 22 (04), 1850037. doi:10.1142/S1363919618500378

Sun, S., Li, T., Ma, H., Li, R. Y. M., Gouliamos, K., Zheng, J., et al. (2020). Does employee quality affect corporate social responsibility? Evidence from China. Sustainability 12 (7), 2692. doi:10.3390/su12072692

Tallon, P. P. (2008). Inside the adaptive enterprise: An information technology capabilities perspective on business process agility. Inf. Technol. Manage. 9 (1), 21–36. doi:10.1007/s10799-007-0024-8

Tarafdar, M., and Qrunfleh, S. (2017). Agile supply chain strategy and supply chain performance: Complementary roles of supply chain practices and information systems capability for agility. Int. J. Prod. Res. 55 (4), 925–938. doi:10.1080/00207543.2016.1203079

Wang, Y., Shi, S., Nevo, S., Li, S., and Chen, Y. (2015). The interaction effect of it assets and it management on firm performance: A systems perspective. Int. J. Inf. Manag. 35 (5), 580–593. doi:10.1016/j.ijinfomgt.2015.06.006

Wong C W Y, C. W. Y., Lai, K.-h., and Cheng, T. C. E. (2011). Value of information integration to supply chain management: Roles of internal and external contingencies. J. Manag. Inf. Syst. 28 (3), 161–200. doi:10.2753/mis0742-1222280305

Wong C Y, C. Y., Boon-itt, S., and Wong, C. W. Y. (2011). The contingency effects of environmental uncertainty on the relationship between supply chain integration and operational performance. J. Operations Manag. 29 (6), 604–615. doi:10.1016/j.jom.2011.01.003

Yoon, B., Lee, J., and Byun, R. (2018). Does ESG performance enhance firm value? Evidence from korea. Sustainability 1010 (10), 3635. doi:10.3390/su10103635

Keywords: ESG investment, data element, organizational agility, enterprise performance, environmental uncertainty

Citation: Jianqiang G, Rong L and Juan X (2022) Data element embedding and firm performance: The influence of ESG investment. Front. Environ. Sci. 10:974399. doi: 10.3389/fenvs.2022.974399

Received: 21 June 2022; Accepted: 27 June 2022;

Published: 25 July 2022.

Edited by:

Xiao-Guang Yue, European University Cyprus, CyprusReviewed by:

Liurong Zhao, Nanjing Technology University, ChinaXing Gao, Southeast University, China

Qiang Li, Anhui University of Finance and Economics, China

Copyright © 2022 Jianqiang, Rong and Juan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Gu Jianqiang, anFndUB5enUuZWR1LmNu

Gu Jianqiang

Gu Jianqiang Lu Rong

Lu Rong