94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 07 November 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.972354

This article is part of the Research TopicThe Nexus between Innovation and Environmental SustainabilityView all 11 articles

Numerous economies focus on attaining a clean environment by applying environmental policies and green technology. This study examined the impact of GDP growth, non-renewable, technological change, environmental tax, and strict regulations on an ecological footprint for the Organization for Economic Cooperation and Development (OECD) and Non-OECD (not members of OECD) economies from 1990 to 2015. This analysis applied the Cross-Sectionally Augmented Auto-Regressive Distributed Lag (CS-ARDL) to identify the role of GDP, and environmental taxes, with selected control factors on ecological degradation. These CS-ARDL techniques resolve the issues of slope heterogeneity, endogeneity, and cross-sectional dependence. For robustness, this study used Augmented Mean Group (AMG), and Common Correlated Effect Mean Group (CCEMG) tests to check the long-run association between variables. The empirical findings of CS-ARDL have confirmed that environmental taxes, stringent environmental policies, and ecological innovation significantly improve environmental quality in OECD compared to the Non-OECD countries. The D-H panel Granger causality test results show the unidirectional causality moving from environmental tax to ecological footprint, which referred to the “green dividend” hypothesis of minimizing environmental degradation. Using AMG and CCEMG tests for Robustness checks indicates that environmental taxes and tight environmental policy can effectively improve the environment’s quality in both regions. Hence, environmental protection awareness is forcing policymakers to minimize the impact of environmental degradation to achieve sustainable growth.

Over the last 20 years, environmental initiatives have been aimed to promote the transition of the economy into low-carbon economies significantly to minimize the adverse environmental effects (such as global warming, greenhouse gas (GHG) emissions, air pollution, and climate change) (Agbugba and Iheonu 2018). By establishing and executing energy plans like the Kyoto Protocol and the Paris Climate Accord, which regulate the policies related to climate and energy consumption, and the transformation of the economy towards low-carbon industrialization and attaining energy-efficient policies. Eco-technology and Environmental regulations are significant features of the Paris Climate Agreement and Kyoto Protocol policies, including carbon trading, environmental taxes, and energy-efficient and eco-friendly technologies as the primary strategy plans (Alberini and Filippini, 2011; Ang et al., 2015). Additionally, researchers have discussed various determinants that mitigate environmental pollution (He et al., 2019). GHG emissions are considered the most significant global threat to the entire ecosystem, especially human health. The main contributor to anthropogenic GHG is carbon dioxide (CO2 emissions), used as the proxy for environmental degradation in various prior Literature. However, massive criticism is faced by the CO2 emissions as a proxy to identify the environmental degradation caused by GDP growth. On the other hand, the use of CO2 emissions as a proxy for capturing the ecological damage caused by economic expansion has been widely criticised by various studies.

In this context, the ecological footprint proposed by (Rees, 1992) satisfies all of the above characteristics for a comprehensive, progressive, and integrative assessment of environmental degradation. A few empirical works have evaluated the ecological footprint factor (Neagu, 2020). Estimating the sustainability of an economy’s consumption is related to the ecological footprint (EFP), developed by Wackernagel and Rees (1998). According to the Global Footprint Network (2022) definition, the ecological footprint indicates how much water and land is naturally essential to produce different products required by the population. Altintas and Kassouri, 2020 examined that validity of EKC depends on the environmental indicators. Their study used the two other environmental proxies, i.e. CO2 emissions and ecological footprint, for 14 European countries from 1990–2014. They concluded that the proxy of the environmental curve could significantly affect the existence of the EKC hypothesis. Their finding shows that the prediction of EKC is highly sensitive to an appropriate environmental tool; thus, the ecological footprint is a reasonable proxy to detect environmental pollution. Their findings exhibit fossil fuels significantly increase environmental pollution, and clean energy use substantially improves the environment’s quality. Moran et al. (2008) and Shahzad et al. (2020); statistical results found a positive and significant relationship between economic growth and ecological footprint. The importance of environmental regulations and a non-carbon ecological footprint for 87 economies from 2004 to 2010 is highlighted by (Asici and Acar 2016). Their statistical findings indicate that ecological constraints significantly improve environmental quality.

Based on contradicting empirical and theoretical analyses of the previous studies, to resolve the inconsistency in the preliminary analysis thus, we required more investigations in this regard. Most of the existing Literature is just on the connection between toxin outflows, for instance, air quality and Sulfur and CO2 emissions discharges, which is an essential restriction of these investigations (Burnett and Madariaga, 2017). In this regard, we found limited research examining a comprehensive analysis and globally analogous factors, especially those containing the study of environmental taxes and policies and economic growth, under the premises of the environmental Kuznets curve (EKC). This study used the newly announced measure of environmental degradation by ecological footprint (EFP). The EFP contains cropland, forest land, grazing land, fishing grounds, CO2 emission, and infrastructure footprint (Charfeddine, 2017). In addition, the utilization of ecological footprint compared to the traditional measure (CO2) of environmental degradation is the motivation of the current analysis in the context of OECD and Non-OECD countries. These economies are facing environmental challenges. Thus further investigation is required to overcome worse climatic challenges. The ecological footprint directly points to the fact that much land and water are naturally needed to yield all products, considering soil, forestry, mining, and oil reserves. As a result, our research examines whether environmental taxes and regulations can reduce an ecological footprint as a proxy for the destruction of the environment.

The OECD and Non-OECD countries are selected for this study as the consumption of non-renewable is still so high in these economies with a high rate of CO2 emissions. The OECD is accountable for 35% of fossil fuel by-products worldwide. Energy-based industries account for 29% of global emissions outflows in these nations because of natural resources (OECD, 2021). These all selected countries face severe environmental issues regarding unexpected outcomes in the ecological system. Various countries have adopted environment-friendly policies such as environmental taxes, renewable sources, green financing, and innovation. But still, many developed countries are polluting the environment badly; thus, global warming and the destruction of the ecosystem are putting pressure on developed countries to minimize CO2 emissions. Recently, various studies concluded a positive and significant relationship between non-renewable energy consumption and environmental degradation (Huang et al., 2020; Saleem et al., 2020.). The study of Abbasi et al. (2021), focused on efficient energy policies to protect the environment from fossil fuel consumption. Additionally, Shen et al. (2020) highlighted the excess utilization of non-renewable energy sources, which leads to the destruction of the environment in developing and developed countries.

The environmental activist had long imagined that environment-related regulations and taxes must endorse ecological objectives in numerous world regions. Since the start of the 21st century, environmental protection awareness has realized the execution of environmental taxes as a plausible choice, particularly among developed countries. As of late, other developed countries like France, Germany, the UK, and Italy have followed this way. Creating countries like Poland, Estonia, and Hungary have had the option to incorporate ecological regulations (OECD, 2019). Non-OECD modern economies like South Korea, Thailand, Taiwan, Singapore, and Malaysia have endorsed instruments (market-based) with the conventional command and control guidelines (adding environmental regulations) as they try to improve the quality of the environment (Saleem et al., 2020). The results of Shen et al. (2020) highlighted the excess utilization of non-renewable energy sources, which leads to the destruction of the environment in developing and developed countries.

The existing Literature identifies various determinants of environmental degradation. For instance, prior studies concluded that technological innovations were a mediating determinant in improving the quality of the environment. Technological change can enhance environmental quality through energy conservation (Cheng et al., 2021). Technological innovation improves energy efficiency, optimizing production processes (Jin et al., 2017). Numerous Literature claims that the primary sources of environmental degradation are non-renewable energy (Saidi and Hammami, 2015; Saleem et al., 2020). Thus, technological advancement upsurge the use of renewable energy through energy efficiency. This background is advantageous and appropriate for governments and policymakers in OECD economies are related to the great importance of addressing the challenges of environmental degradation. In addition, a large portion of the world accounts for OECD economies, which play a significant role in the world economy and technologically advanced economies.

Based on the statements mentioned earlier, this analysis aims to identify the environmental Kuznets curve with the restriction of environmental taxes and regulations used to highlight environmental degradation issues in the context of OECD and Non-OECD economies. These countries are the world’s leading growth economies with high consumption of global energy, thus significantly increasing the level of CO2 emission. For policy recommendation, numerous variables, e.g., green growth, environmental taxes, and environmental regulation policies, are essential to discuss their influential role and different strategies to minimize the effect of environmental degradation in these economies. Consequently, this research analysis addresses a few significant contributions. Initially, the current study certifies uncovering the determinants of an ecological footprint as an alternate factor for environmental deterioration rather than only single carbon dioxide emissions. This is a significant issue since few studies examined the role of ecological footprint, especially since these developed and transitional economies are more answerable for poorly utilizing natural resources. Second, the current study presents a few plausible variables essential to policy implications. This environmental destruction motivates us to reinvestigate the role of non-renewable energy use with some control variables, e.g., environmental taxes, technological innovation, strict environmental regulations that would impact the quality of the environment, with the latest methodologies to check their impact on the ecological footprint. Third, this study is unique as it has both OECD and Non-OECD economies under the umbrella of a single model. This study provides a new insight that contributes to existing studies to examine the effect of technological change, environmental taxes, economic growth, and environmental regulations on the ecological footprint hypothetically. Fourth, the OECD and Non-OECD nations have been investigated using modern econometric approaches and the latest data set from 1990 to 2016. Thus, to identify the stationarity of ecological footprint, economic growth, non-renewable energy consumption, technological change, environmental tax, and regulation, the second generation panel unit root (augmented cross-sectional IPS (CIPS)) tests are used. The panel data analysis also has a cross-sectional dependence. Thus, the traditional panel unit root test (e.g., IPS, LLC, and Hadri tests) give erroneous and inconsistent results. Cross-section dependence (CSD) is a common issue in panel data analysis (Baltagi and Hashem Pesaran, 2007), and due to this, the validation of the traditional estimation of panel test is not accepted (Gengenbach et al., 2009). This study applied the latest Pesaran LM normal, Friedman chi-square, Pesaran CD normal, and Breusch-Pagan chi-square test to avoid spurious results. This review presents advanced econometrics, for example, a second generation unit root statistical test, Westerlund (2008) co-integration test, CS ARDL, for robustness check the methods of Augmented Mean Group (AMG) and Common Correlated Effect Mean Group (CCEMG), and board Dumitrescu and Hurlin’s (D-H) causality test. The current study provides important policy suggestions for OECD and Non-OECD economies. Finally, this study will identify the following research questions. Firstly, Do technological change, environmental taxes, and regulations significantly improve the ecological footprint in these OECD and Non-OECD countries?

The remaining part of the research is organized as follows. Section 2) is presented the literature review on environmental degradation with its few control variables. Section 3) gives the theoretical background methodology and our technique, including the assessment procedure. Section 4) shows our analysis’s results, discussion, and interpretation. Finally, Section 5) discusses a conclusion and policy suggestions for sustainability.

Based on the theoretical Literature, in the early 1940s, the idea of technological innovation was presented by Josef Schumpeter. Technological innovation should be replaced by old traditional methods in the capitalist economy. According to their theory, temporary monopoly power can be raised in the society, but they benefit from excess profits for a short period, but then the market will be replaced by old products with new ones. Three stages of market transformation are described by Schumpeter, where the latest technologies are introduced in the market to replace the old ones. Schumpeter introduced three steps, i.e., invention, innovation, and diffusion. A newly developed product is called an invention; when the brand new goods are commercialized in the market, are related to innovation, and research and development (R&D) is essential to invention and innovation. Diffusion is the third stage where new technology is used by individuals or firms significantly (Jaffe et al., 2003). Therefore, technological innovation is the mutual environmental and economic influence of the three of these stages. Similarly, the endogenous growth theory also focused on technological change and argued that these changes could significantly improve environmental issues in the long term. Technological innovation can be enhanced through R&D, especially in the energy sector, by introducing renewable and energy-efficient technologies that mitigate ecological destruction (Saleem et al., 2020).

In the early, Josef Schumpeter described the theoretical framework for technological change. However, the theoretical framework for clean energy use is represented by the framework of green Keynesianism. Based on this framework, the analysis could identify the contribution of clean energy use in achieving environmental sustainability and reducing the destruction of the environment. The expansion of the Keynesian theory is described as green Keynesianism; this indicates that sustaining environmental sustainability is highly associated with achieving a high economic growth rate. The key objective of green Keynesianism is to boost economic growth and development by finding solutions to environmental issues. Environmental mitigating goals and active macroeconomic policy are jointly discussed in the green Keynesianism theory. These objectives can be achieved by environmentally friendly technologies, clean energy, and environmental protection policies.

Based on the empirical Literature, this analysis categorized the prior existing Literature that examined the main determinants of environmental destruction into four different strands of Literature. The environment-economic growth nexus is explained in the first strand of the Literature. The Literature on the environment-technological change nexus is defined in the second strand of the review. The Literature on the environmental taxes-environmental degradation nexus is examined in the third strand of the evaluation. The Literature on environmental degradation-environmental policy stringency nexus is discussed in the third strand of the review.

The first strand of the literature review indicates the environmental degradation-income level nexus. This association is well presented by Grossman and Krueger (1995); in their research thereon, the link between income level and environmental degradation is defined in their inverted U-shaped EKC hypothesis. Their hypothesis is explained the inverse relationship between environmental degradation and economic growth. Over the last 20 years, the EKC framework has been used in numerous empirical analyses to identify the relationship between environmental quality and income level (Lapinskiene et al., 2017; Auci and Trovato, 2018), while for the same purpose, this framework is also used with the addition of energy use (Pablo-Romero and Sanchez-Brada, 2017). Many empirical analyses provide evidence for the existence of EKC in European countries (e.g., Auci and Trovato, 2018); their findings confirmed the presence of EKC in 25 European economies from 1997 to 2005. By contrast, some studies did not verify the existence of EKC in European economies (e.g., Mazur et al., 2015); their results could not confirm the existence of EKC for 28 European economies from 1995 to 2006. However, the findings of Pablo-Romero and Sanchez-Brada (2017) confirmed the presence of EKC in the residential sector from 1990 to 2013. Several empirical analyses usually discussed the EKC by utilizing CO2 as a proxy of environmental degradation, but less attention has been given to the ecological footprint and its role in the environmental degradation-economic growth nexus. Al-Mulali et al. (2015) examined the model of EKC for 93-panel countries and confirmed the existence of EKC for middle and upper-income countries, and the ecological footprint was used as the dependent variable. Ozturk et al. (2016) also examined the validity of the EKC framework for upper-middle-income economies by using ecological footprint. Uddin et al. (2017) employed an ecological footprint and confirmed the existence of EKC for Pakistan, India, Nepal and Malaysia. Pata (2021) used the CO2 emission and environmental footprint to identify the validity of EKC premises for the United States of America. Balsalo-bre-Lorente et al. (2019) confirmed the validity of EKC for Mexico, Nigeria, Indonesia, and Turkey economies.

Balsa-Barreiro et al. (2019) analysed the impact of GDP growth on CO2 emissions. Urban population and population for global level from 1960–2016. The world’s human dynamics changes are essential to discuss in the scenario of population growth dynamics, GDP growth, and environmental destruction. All these challenges mentioned above are highly associated with globalisation and measured with the center of gravity (reallocation trends initiated by globalization). The statistical findings concluded that Japan, China, the European Union, and the United States are top emitters and the world’s largest economies. The results also indicate the decoupling effect, when the GDP trace is affected faster than the CO2 trace. Asian countries (especially India and China) and a few African countries are the most populated in the world. Due to the largest megalopolises and cities extended in Europe, southeastern Asia and America significantly increased the urban population. The policies suggested to the policymakers to solve the global challenges primarily related to GDP growth and its influence on the quality of the environment. Wang et al. (2019) examined the coupling/decoupling of GDP growth from energy use in India and China. These countries and other developing nations are trying to achieve sustainable economic growth by using fewer energy sources. This study investigated the GDP growth-energy nexus for China and India from 1990 to 2015 using the Log-Mean Divisia Index and Cobb Douglas function methods. The statistical results concluded that China’s decoupling efforts significantly improve energy efficiency, and by using technological innovation, India is also trying to contribute to the decoupling effort.

The second strand of the Literature is based on the relationship between environmental degradation and technological innovation. Many researchers recommended that CO2 emissions can be significantly reduced by technological innovation, especially in the process of production, without damaging GDP growth. Lin and Zhu (2019) examined the environmental degradation-renewable technology nexus in the context of China. Their statistical findings concluded that technological change through renewable energy sources is improving the environmental quality in China and promoting a low-carbon society. Ahmad et al. (2020) investigated technological innovation and its impact on ecological footprint for twenty-two emerging economies, and their statistical findings concluded that ecological footprint reduction is possible due to technological innovation. Wang et al. (2020) analysed that technological innovation is a critical factor in achieving environmental sustainability in the N-11 economies. Similarly, Guo et al. (2021) examined the impact of technological innovation on the quality of the environment in China, and their findings concluded that sustainable development goals (SDGs) could be achieved through technological innovation. The results of Samargandi (2017) described the relationship between technological change and environmental pollution in Saudi Arabia and could not provide the influential role of technological innovation in minimising environmental degradation. Kassouri et al. (2022) examined the development of renewable energy, oil utilization, and natural capital in the European countries between 1996 and 2016. Their empirical findings concluded that growth in renewable energy consumption is significantly discouraged by the different use of oil utilization by inelastic proportions. Different carbon sequestration techniques can be minimized the use of non-renewable energy sources. Moreover, this region’s energy transitional policy should be enhanced by an adequate supply of renewable energy. Bilgili et al. (2021) investigated the environment-disaggregated energy R&D nexus in 13 developed economies from 2002 to 2018. Their findings exhibit the presence of EKC only in higher carbon-emitting economies. But in the case of lower carbon-emitting economies, the EKC is more predominant. They also found no dynamic association between environmental pollution and economic growth. The impact of research and development on clean energy and technological innovation to curb environmental pollution is a prerequisite in these countries.

The third strand of the Literature is based on the relationship between environmental degradation and environmental taxes. Recently, countries have been trying to attain sustainable economic growth by controlling environmental issues. They are implementing various policies (to increase sustainability) such as environmental taxes, green innovation, and innovative sources of energy (e.g., photovoltaic cells). Ecological destruction and energy consumption are significantly reduced by Environmental tax. Miceikiene et al. (2018) examined the significant role of a carbon tax in the economies and focused on renewable energy innovations.

A comprehensive analysis of Wissema and Dellink (2007) examined the statistical data of Ireland’s economy and concluded that CO2 emissions are reduced by 25% if 15 Euros per ton carbon taxes are imposed. Similarly, Sterner (2007) also explored that use of non-renewable energy can be reduced through the imposition of environmental taxes. Convery et al. (2007) described that environmental taxes collected 13 billion in revenue to the Irish economy in the same line. It is estimated that a 90% decline in CO2 emissions can be possible in this country. Lin and Li (2011) investigated a statistical analysis of Scandinavian economies, found a negative connotation between environment-related taxes and CO2 emissions in Finland, and investigated that the economy of Norway is heavily dependent on petroleum and the rate of CO2 emission is higher in this country. Morley (2012) examined the environmental tax and CO2 emissions nexus in EU member nations, and their statistical findings show the inverse relationship between environmental taxes and CO2 emissions. Borozan (2019) examined the association between energy taxes and residential energy consumption. Their results concluded that energy taxes could efficiently reduce residential energy use in European Union countries. Along the same line, He et al. (2019) also found the influential role of environmental taxes in minimising the CO2 emissions in OECD economies and China.

The fourth strand of the Literature is based on the relationship between environmental degradation and environmental regulations. Stringent environmental laws and policies are being prompted to minimize the worse environmental quality; thus, strict environmental policy is essential for mitigating CO2 emissions. The core purpose of this indicator is to divert the producer and consumer behaviour to environmental-friendly products by making environmental pollution services more expensive. Neves et al. (2020) described that environmental restrictions would increase the cost of polluted (dirty) goods and activities Mulatu (2018) highlighted the importance of environmental outcomes and regulations. They concluded that CO2 emissions could be reduced by implementing environmental policies and eco-friendly technology. According to Cohen and Tubb (2018), environmentally “dirty” technologies should be replaced by eco-friendly technologies as stringent environmental policies and environmental taxes significantly impose positive effects on environmental pollution (Lagreid and Povitkina 2018).

The empirical analyses of the nexus between environmental quality and policy are discussed in the studies of Dechezleprêtre and Sato (2017) and van Leeuwen and Mohnen (2017), but the findings are not conclusive. Shapiro and Walker (2018) examined that between 1990 and 2008, a reduction in CO2 emissions was found in the United States. Similarly, Wolde-Rufael and Mulat-Weldemeskel (2021) analyzed the role of environmental policies for the few emerging economies from 1994 to 2015 and the effectiveness of environmental policies in reducing environmental destruction. In the same vein, de Angelis et al. (2019) examined environmental stringency and its impact on environmental quality for OECD economies. They found a significant reduction in CO2 emissions due to environmental stringency regulations. But Wang and Wei (2020) found that stringency environmental policy does not improve environmental quality by reducing CO2 emissions.

This current topic represents our theoretical framework depending on these preliminary analyses. Additionally, the Literature of literature section discussed a few research analyses that have been done on ecological footprint. Though, limited research studies examine the combined impact of environmental taxes and environmental regulations on environmental quality under the EKC scheme for Non-OECD and OECD nations. The theoretical framework is presented based on the double-dividend hypothesis of environmental taxation and the premises of the environmental Kuznets curve (EKC) (Dinda, 2005). Theoretically, natural resources depletion for consumption purposes will source in higher ecological footprints and more ecological deficit. According to this description, the emerging and developed countries endeavour to implement stringent policy implications and regulations (energy and environmental-related taxes) and governmental controls to regulate non-renewable energy sources and resource consumption. The theoretical framework channel describes energy resource consumption for industrial production as significantly associated with resource consumption and resource generation. Consequently, excess utilization of natural resources causes ecological issues. Following this, ample use of natural resources with environmental destruction motivates the policymakers to implement environmental regulations and taxes to minimize the use of non-renewable.

Thus, identifying the main contribution of this study to the mitigation of environmental issues, this study explores the effects of environmental taxes, strict environmental regulations, and the efficient role of technological innovation on the ecological footprint (EPF) of OECD Non-OECD economies. Thus, in this line, we presume that strict environmental regulations and taxes are efficient indicators of minimizing the deterioration of environmental quality (He et al., 2019; Xiong and Li, 2019). Moreover, the modeling of our study also comprises some plausible control variables based on prior research and Literature. Similarly, other control factors such as non-renewable energy use and GDP growth also increase environmental degradation. The energy use-environmental destruction nexus is well discussed in EKC premises. The contribution of this study is by analyzing the impact of energy on the improvement in ecological footprint, which can significantly improve environmental quality. Many researchers discuss sustainable growth-environment nexus regulations and policies, and their main objective is to achieve less environmental deterioration with sustainable growth (Hao et al., 2021; Saleem 2022). This theory is designed by Grossman and Krueger (1995) as it determines the trade-off between the environment and growth. In this sense, our study incorporated plausible control variables under the umbrella of the EKC framework.

Theoretical description of all the variables mentioned above (Eq. 1) and the ecological footprint-GDP growth nexus with control factors are employed under the scheme of the EKC test in the following equations.

Table 1 represents the list of variables. This study finds the association between ecological footprint (EFP) and growth with other control factors from 1990 to 2016 for twenty-seven OECD and six Non-OECD countries. The data on GDP growth is used as GDP per capita (constant 2010US$). Non-renewable are used as (a percentage of total final energy consumption). The data on GDP growth and non-renewable energy use has been obtained from the World Development Indicator (WDI, 2021).

Initially, the present analysis tries to identify the cross-sectional dependence (CSD) among various model factors. In doing so, the test of CSD is designed by Pesaran (2007). Moreover, numerous indicators are linked with CSD. Spurious results will be attached if the CSD problem is not considered during estimation (Westerlund and Edgerton, 2008; Flores, 2019). The authors used different CSD tests to identify the CSD in the analysis of panel data among the factors, namely, Breusch-Pagan chi-square, Friedman chi-square, Pearson CD normal, and Pearson LM standard test.

The second step of the study tries to identify the data analysis’s slope homogeneity. We used Pesaran and Yamagata’s test (2008) to find out the slope homogeneity of the model. This test can significantly identify the heterogeneity or homogeneity of the data analysis. We used the Pesaran and Yamagata (2008) statistics to determine the slope homogeneity. Thus, the homogeneity and heterogeneity of the panel data would be checked with this test. The importance of the slope homogeneity test cannot be denied in the empirical analysis.

The third step is to check the non-stationarity issue in time series analysis was discussed in various empirical analyses (Cheung et al., 2019; Jiang et al., 2020). The study investigates the unit root problem; thus, the second-generation stationary techniques are used to identify the unit root problem (Pesaran 2007). The test permits the presence of CSD in the study. The augmented cross-sectional IPS (CIPS) test detects the stationary issue of various factors under consideration. This study used Pesaran (2007) (i.e., cross-sectional augmented IPS).

The fourth step of the study is to identify the co-integration between the variables. Co-integration is demarcated as the long-run association between different factors of the model. In this method, various variables can be analysed for long-run relationships. The modern panel co-integration test was designed by Westerlund (2008), and we applied this in our analysis to designate robust revelations. The presence of CSD, non-stationarity of data, and heterogeneity in the panel data analysis can be handled by Westerlund and Edgerton (2008).

The equation of Westerlund co-integration statistics is given below,

The value of group statistics is shown as Ga and Gt, and panel statistics are represented by

The fifth step is to use the CS-ARDL method to identify the association between environmental degradation and its control variables due to the panel data set and the presence of cross-sectional dependency in the variables of this analysis. This CS-ARDL technique resolves the issues of slope heterogeneity, endogeneity, and CSD (Chudik and Pesaran, 2013). This test compresses various descriptive elements with unexplained components and a small sample size that is unpredictable and sensitive sample size. Different explanatory variables with undetected details, unexpected and sensitive small size of the sample are compact by this test. Based on the theoretical framework, this study incorporated the impact of environmental tax, strict environmental regulations, non-renewable energy use, technological change, and GDP growth on environmental degradation. We rewrite the model as follows:

Where

The equation given below defines the model of CSD-ARDL.

Where EDG is related to the dependent variable (environmental degradation), Y represents the average value of dependent variables, and X indicates the importance of main determinants such as GDP, GDP square, GTEC, NREW, EXT, and ERL, l, and m related to the lag values of the dependent variable.

The following equation represents the long-run analysis of CS-ARDL through the mean group estimator as given below,

Meanwhile, the following equation represents the mean group of the study.

Though, the study also presents the short-run coefficients in the following equation,

Eq. 13 represents the short-run co-efficient of CS-ARDL analysis. Where

For robustness check, this study used the tests of applying the Augmented Mean Group (AMG) designed by Eberhardt (2012) Common Correlated Effect Mean Group (CCEMG) designed by Pesaran (2006). These tests significantly deal with the endogeneity, CSD, and heterogeneity concerns. In addition, the correlation among different cross-section units is also controlled by these estimators.

Although, the results of the CS-ARDL estimators confirm the association’s magnitude and direction. However, our final step of the study analyses the causality between variables. Thus, Dumitrescu and Hurlin’s (2012) test is used to scrutinise the causal association between environmental quality (EFP) and other control variables like GDP, non-renewable energy, environmental tax, and strict environmental regulations. By identifying the model of the study, this analysis tests the bivariate causality among different variables by handling the heterogeneity all over the CSD (in the short run). In this test, H0 represents that there is no causality, and H1 represents that there is causality among the factors. Finally, to test the non-causality Granger analysis for each cross-section, the study focused on examining the Wald estimate. The inconsistent non-causal theory recognises that heterogeneous panel causality links to the normal distribution. Figure 1 illustrates the Route of methodology, where different methods are applied in this analysis, e.g., Cross‐sectional dependence test, panel unit test, slope homogeneity test, panel cointegration test, and Causality test Dumitrescu and Hurlin’s (2012).

The empirical findings of the CSD test are presented in Table 2; the presence of CSD is confirmed in the panel data analysis as this study used the Pesaran LM normal, Friedman chi-square, Pesaran CD normal, and Breusch-Pagan chi-square test, respectively, and rejected the null hypothesis (no existence of CSD)/accepted the alternative hypothesis (presence of CSD).

After employing the CSD test, it is essential to use the test of slope homogeneity; thus, we used Pesaran and Yamagata’s (2008) approach. Table 3 shows that this study rejected the null hypothesis and accepted the alternative hypothesis (heterogeneous slope coefficients).

Additionally, the statistical findings of the unit root test are presented in Table 4, identifying the stationarity of the data addressing the heterogeneity and the CSD test. To determine the unit root issue under the observation of alternative or null hypotheses, we concluded that few variables found the stationarity issue in the panel data analysis and rejected the null hypothesis for all the variables.

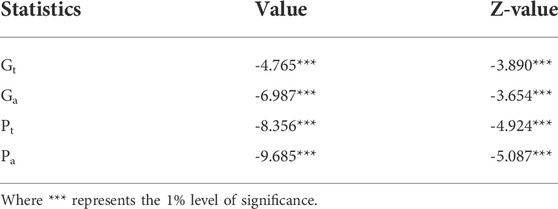

The current analysis applied the method of Westerlund and Edgerton (2008) to identify the existence of cointegration in the research; the statistical findings are reported in Table 5. The results showed that we accepted the alternative hypothesis (presence of cointegration) and rejected the null hypothesis (no cointegration exists). Thus, the study indicates a long-run association between the variables and justifies the study’s arguments. Additionally, the long-run association was found between variables for Westerlund and Edgerton (2008) under the dependent variables EFP.

TABLE 5. Statistical findings of panel cointegration test (Westerlund, 2007).

The present analysis applied the CS-ARDL test to determine the impact of economic growth, non-renewable, technological innovation, environmental tax, and strict environmental regulations on environment quality under the scheme of EKC with dependent variables (EFP). Table 6 indicates the long-run and short-run results for OECD and Non-OECD countries. The GDP growth and GDP square were found to be positively and negatively, respectively, in the context of OECD and Non-OECD countries for environmental quality (EFP); thus, the existence of EKC is confirmed for both OECD and Non-OECD economies. The results are consistent with prior studies (Destek and Sinha, 2020; Saleem et al., 2022). A short-run analysis (OECD countries) shows that a 1 unit change in GDP will increase EFP by 0.52 units. The findings of our study are similar to the results of Ahmed et al. (2020) examined China, Ahmed et al. (2020) for G7 countries, and Shahbaz et al. (2013) for Indonesia. Salahuddin et al. (2016) concluded the contradict findings, and no association was found between environmental quality and GDP growth in OECD countries. On the other side, Ozcan et al. (2020) oppose the result found in their analysis and conclude an inverse association between GDP growth and environmental degradation.

The values of GDP square were negative and significant, which shows that if there is one unit change in GDP square, it will bring a 0.34 unit change in EFP. The long-run estimates also concluded a significant inverse relationship between GDP square and environmental quality, as I unit increase in GDP square will lead to a 0.50 unit decline in EFP. The high rate of GDP growth enriched the excess utilization of resources in these OECD economies. The positive association between GDP growth and ecological footprint in OECD economies suggested that the worse consequences of GDP growth on the quality of the environment can be mitigated through initiatives and effective government policies that consider worse environmental quality. Our findings are consistent with those (Saleem et al., 2021; Wenbo and Yan, 2018), However, the results of Destek and Sarkodie (2020) could not support the EKC’s presence in Pakistan.

Moreover, a significant and positive association was found between NREW energy and environmental degradation in OECD countries; this means ecological footprint destruction is accelerating by using non-renewable energy consumption in the long and short run. The findings can be justified: still developed countries heavily rely on non-renewable energy consumption. The hypothetical testing of the study stated that environmental quality is deteriorating by excess non-renewable energy use. More specifically, the results indicate 0.49 units increase in EFP, as a 1 unit change found in NREW energy use. The long-run estimates also found a positive association between environmental quality and NREW energy, and an I unit increase in NREW will lead to a 0.41 unit upsurge seen in EFP, respectively. This study concluded a positive association between NREW energy use and ecological footprint at a 1% significance level. This hypothesis is justified as higher NREW energy use accelerates the destruction of ecological footprint. Numerous researchers have recently investigated the relationship between environmental quality and NREW energy use (e.g., Sharif et al., 2019, Saleem et al., 2021). Similarly, the findings of Bekun et al. (2019) and Inglesi-Lotz and Dogan (2018) also investigated a positive association between renewable energy use and the quality of the environment. These statistical results are supported by the empirical evidence of Wolde-Rafael and Mulat-Weldemeskel 2021; Adewuyia and Awodumi 2017; Ben Jebli and Kahia 2020).

Technological change through efficient utilization of energy sources and technological change can significantly improve the quality of the environment. A significant negative correlation was found between technological innovation and environmental degradation in OECD countries. More precisely, the results indicate that unit 0.08 unit decreases were seen in EFP, as there was 1 unit change in GTEC. The long-run estimates also found a positive association between environmental quality and GTEC. An I unit increase in GTEC will lead to 0.29 unit decreases in EFP. Moreover, this is comprehensible that environmental quality can be improved through more innovation then fewer resources will be utilized, leading to a lower ecological footprint. Similarly, technological innovation developed the production process of green technology, efficient energy utilization, less utilization of natural resources, and an upsurge of renewable energy sources. These findings align with existing Literature (Saleem et al., 2020; Islam et al., 2022). Various empirical findings (Chen and Lee, 2020; Usman and Hammar, 2021) concluded that technological change exerts a detrimental impact on the quality of the environment. The findings of our study are also endorsed by the studies of (Hao et al., 2021; Saleem et al., 2022). This statement is also vindicated by preliminary analysis, e.g., the study of Tobelmann and Wendler (2020) concluded that technological change could significantly reduce carbon dioxide emissions in European economies. Kassouri et al. (2022) concluded that technological advancement in terms of clean energy in the long run substantially supports the worldwide convergence of energy technology. Their results show that advanced countries should use effective technology-driven energy policies to accelerate clean energy technological innovation.

Environmental effectiveness can be accomplished through the imposition of environmental taxes, and these taxes can decline environmental degradation. The short-run estimation of the study indicates that a 1 unit increase in ETX would lead to a 0.05 unit decline found in EFP. The long-run estimates also found a negative association between ETX and environmental quality. An I unit increase in ETX will lead to 0.32 unit decreases in EFP. The findings of our analysis are endorsed by the studies of (Saleem et al., 2022; Wolde-Rufael and Mulat-Weldemeskel 2021; Ulucak et al., 2020; Andersson 2019; Criqui et al., 2019), and the statistical findings of all these authors found the inverse relationship between environmental tax and environmental degradation.

The short-run estimation of the study indicates that a 1 unit increase in ERL would lead to a 0.05 unit decline found in EFP. The long-run estimates also found a negative association between environmental quality and ERL. An I unit increase in ERL will lead to 0.25 unit decreases found in EFP. Thus, in this line, strict environmental regulations and taxes are efficient factors in abating the deterioration of environmental quality (He et al., 2019; Xiong and Li, 2019). The findings of our analysis are endorsed by the studies of (Wolde-Rufael and Mulat-Weldemeskel 2021); the statistical results of all these authors found the inverse relationship between tight environmental rules and regulations and environmental degradation. The Error of correction technique (ECT) (-1) indicates the speed of adjustment, the findings of ETC (-1) concluded that at a 1% level of significance, 60% modification is required to move towards the equilibrium point of the research study for OECD economies.

Table 6 also designates the long-run and short-run results for Non-OECD economies in model 1 (EFP). The GDP growth and GDP square were positive and negative in Non-OECD economies for environmental quality (EFP). There is a 1 unit change in GDP in the short-run analysis, which will increase EFP by 0.05 units. The values of GDP square were negative and significant, which shows that if one unit change brings in GDP square, it will bring a 0.03 unit change in EFP. The long-run estimates also found the inverse relationship between environmental quality and GDP; an I unit increase in GDP square will lead to a 0.26 unit decline in EFP. The long-run estimates also found the inverse relationship between environmental quality and GDP square, as an I unit increase in GDP square will lead to a 0.49 unit decline in EFP. The findings of our study are consistent with the empirical evidence of (Sharif et al., 2019; Saleem 2020).

Moreover, a significant and positive association was found between NREW energy and environmental degradation in Non-OECD countries. More specifically, the results indicate 0.03 EFP, respectively, as a 1 unit change was found in NREW energy use. The long-run estimates also found a positive association between environmental quality and NREW energy. An I unit increase in NREW will lead to a 0.20 unit upsurge in EFP. These findings can be justified: as most Non-OECD economies are developing economies and heavily depend on non-renewable energy sources. These economies are early stages of economic development and actively moving towards rapid economic growth; thus, the impact of non-renewable energy consumption on environmental quality is worse. The results are consistent with the study of Shafiei and Salim (2014), whose study concluded that excess use of fossil fuels significantly deteriorates the quality of the environment.

Technological change through efficient utilization of energy sources and technological change can significantly improve the quality of the environment. Additionally, a significant negative correlation was found between technological innovation and environmental degradation in Non-OECD countries. The results indicate that unit 0.04 unit decreases were seen in EFP, as a 1 unit change was found in GTEC. The long-run estimates also found a positive association between environmental quality and GTEC. An I unit increase in GTEC will lead to 0.13 unit decreases in EFP. The statistical results of the analysis follow the analyses of Solarin and Bello, (2021), and Usman and Hammar, (2021); these studies concluded that technological innovation via renewable energy use significantly mitigates environmental degradation. These Non-OECD economies are facing the challenges of environmental degradation and putting pressure on ecological footprint due to the negative impact of non-renewable energy use. Thus, the government should encourage investments in technological innovation and provide financial assistance to the firms to promote green technology innovation to combat environmental degradation.

The short-run estimation of the study indicates that a 1 unit increase in ETX would lead to a 0.03 unit decline found in EFP. The long-run estimates also found a negative association between environmental quality and ETX. A 1 unit increase in ETX will lead to 0.18 unit decreases in EFP. The short-run estimation of the study indicates that a 1 unit increase in ERL would lead to a 0.02 unit decline found in EFP. The long-run estimates also found a negative association between environmental quality and ERL An I unit increase in ERL will lead to 0.18 unit decreases in EFP. These results confirmed EXT and ERL’s positive contribution to mitigating environmental degradation. These findings are consistent with the line of Hao et al. (2021) and Zhang et al. (2016); they also analysed that strict environmental regulation can significantly improve the quality of the environment. However, Shahzad et al. (2020) concluded that an environmental degradation-environmental regulation policies nexus finding still requires more research and investigation. The Error of correction technique (ECT) (-1) indicates the speed of adjustment; the results of ETC (-1) concluded that at a 1% significance level, 45% modification is required to move towards the equilibrium point of the research study for Non-OECD economies.

The statistical findings of AMG and CCEMC are reported in Table 7. The GDP and GDP square values under the AMG and CCEMC were positive and negatively associated with EFP and confirmed the existence of EKC in the context of OECD and Non-OECD economies. The results indicate that level of significance and magnitude are changed, but the findings of the estimated co-efficient have the same direction under these two estimation methods (like the former estimation). The panel data consists of slope heterogeneity and cross-section dependence, which can be considered in the CS-ARDL approach. For robustness, this study applied long-run AMG and the CCEMG tests that also considered the slope heterogeneity and cross-section dependence issues. The results of CS-ARDL are endorsed by the findings of AMG and CCEMG tests. The findings of the AMG (CCEMG) tests show that if held all other factors remains constant, if there is 1% change in GDPt, GDPt2,NREWt, GTECt, ETXt, and ERLt, it will bring -0.43 (-0.58),0,28 (-0.38),0,06 (-0.05), 0.08(0.09), 0.06(-0.07),0.05(-0.06) % change in EFP for OECD economies. On the other hand, the findings of the AMG (CCEMG) tests for Non-OECD economies exhibit that if there is one % change in GDPt, GDPt2, NREWt, GTECt, ETXt, and ERLt, it will leads to 0.04 (0.06),0,03 (-0.03), 0.03 (0.03), -0.05(-0.04), -0.04(-0.03),-0.02(-0.03) % change in EFP. Figure 2 represents a graphical illustration of the statistical conclusions; we concluded that the impact of GDP growth, and Nonrenewable energy on Ecological footprint is inverse/accelerating environmental destruction. Moreover, the Environmental tax, strict environmental regulations and technological innovation mitigate ecological destruction.

Table 8 represents the Dumitrescu Hurlin panel test findings to test the causality between the variables. The estimation describes that any policy shock in

This analysis examined the impact of GDP growth, non-renewable, technological change, environmental tax, and tight environmental regulations on an ecological footprint from 1990–2016. The current study applied the method of CS-ARDL to identify the role of GDP on environmental degradation with some control factors under the premises of the environmental Kuznets curve. The findings of this study indicate that an inverted U–shaped EKC was found between GDP growth and environmental quality for OECD and Non-OECD economies (as EFP suggests that GDP growth initially deteriorates the ecological quality, but after the threshold level, GDP growth square leads to less deteriorating environmental quality). The empirical results are robust and consistent in terms of model specification. The analysis explains that the successful implementation of most current policies and work regarding improving environmental quality, such as technological innovation, use of renewable energy, environmental tax, and stringent environmental regulations, significantly contributes to protecting the environment in these economies. The findings of this study concluded that OECD economies are transforming their economies from non-renewable energy to renewable energy use (via technological innovation) faster than Non-OECD economies. Moreover, the impact of environmental tax and regulations impact is more significant for OECD economies than Non-OECD economies. The finding shows that the ecological footprint is significantly deteriorating by increasing GDP growth, especially for OECD economies, compared to the Non-OECD economies.

Based on a comprehensive investigation, this study recommends that environmental taxes discourage fossil fuel energy use and invest in energy-saving and eco-friendly innovations. Environmental protection policies depend on implementing environmental taxes and effective institutional procedures (Implementation of rules) for OECD and Non-OECD economies. Under these checks and balances (by institutions) frameworks confirm preserving the environment through environment-friendly innovation. Additionally, the technological-ecological footprint nexus indicates that bidirectional causality is found between these variables, supporting the feedback hypothesis. This feedback hypothesis shows that economies are moving toward environmental sustainability; these findings align with (Sadorsky 2009a; and Chein et al., 2021). Using fossil fuels could be discouraged by increased technological innovation through efficient and renewable use. Thus, the policymakers and governments in the OECD and Non-OECD economies must adopt energy policies and suitable places that desire marketability and technological change towards accomplishing environmentally sustainable goals. Interestingly, the empirical findings of the current study align with these economies’ recently implemented efficiency and revised transitional energy policies.

Similarly, the statistical findings of this analysis also analyzed that the impact of environmental policies adopted by these economies is working successfully as technological innovation, ecological taxes, and regulation are improving the quality of the environment. However, these economies should reexamine their policies to control the excessive use of nonrenewable energy, and Non-OECD economies require more attention to convert their energy from non-renewable to renewable. This analysis provides practical strategies for regulators to less utilization of non-renewable energy (mitigating environmental degradation) through the development of effective policies. Thus, to overcome the harmful impact of environmental pollution in these selected economies, this study suggested that it is essential to focus on ecological innovation to move towards environmental sustainability and prosperity.

Furthermore, for future research and significant suggestions/policy implications, this current analysis has some limitations that should be addressed. Further research can be done by adding financial inclusion’s role in mitigating environmental degradation by providing financial assistance (green financing) to the firms to produce green products. Scholars can enhance the Literature by scrutinizing the association between research and development (R&D), the role of institutional quality, and ecological footprint. Institutional reforms-environment nexus may bring diverse outcomes, which are not mentioned in the current analysis. Additionally, determinants like human capital, remittance inflows, and economic complexity can be added while investigating the connection between ecological footprint and environmental degradation.

Publicly available datasets were analyzed in this study. This data can be found here: World Bank (2021), World Development Indicators. The World Bank, Accessed on: 28 January2022 from http://data.worldbank.org/ and Global Footprint Network 2021. How the Footprint Works, Ecological Footprint, Global Footprint Network, https://www.footprintnetwork.org/our-work/ecological-footprint/#:∼:text=Ecological%20Footprint%20accounting%20measures%20the%20demand%20on%20and%20supply%20of%20nature.&text=On%20the.

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbasi, K. R., Hussain, K., Redulescu, M., and Ozturk, I. (2021). Does natural resources depletion and economic growth achieve the carbon neutrality target of the UK? A way forward towards sustainable development. Resour. Policy 74, 102341. doi:10.1016/j.resourpol.2021.102341

Adewuyi, A. O., and Awodumi, O. B. (2017). Renewable and non-renewable energy-growth-emissions linkages: Review of emerging trends with policy implications. Renew. Sustain. Energy Rev. 69, 275–291. doi:10.1016/j.rser.2016.11.178

Agbugba, I., Iheonu, C., and Onyeaka, K. (2018). Homogeneous and heterogeneous effect of exchange rate on economic growth in African countries. Int. J. Econ. Commer. Manag. 6 (9), 1–14.

Ahmad, M., Jiang, P., Majeed, A., Umar, M., Khan, Z., and Muhammad, S. (2020). The dynamic impact of natural resources, technological innovations and economic growth on ecological footprint: An advanced panel data estimation. Resour. Policy 69, 101817. doi:10.1016/j.resourpol.2020.101817

Al-Mulali, U., Weng-Wai, C., Sheau-Ting, L., and Mohammed, A. H. (2015). Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol. Indic. 48, 315–323. doi:10.1016/j.ecolind.2014.08.029

Alberini, A., and Filippini, M. (2011). Response of residential electricity demand to price: The effect of measurement error. Energy Econ. 33 (5), 889–895. doi:10.1016/j.eneco.2011.03.009

Altıntaş, H., and Kassouri, Y. (2020). Is the environmental Kuznets Curve in Europe related to the per-capita ecological footprint or CO2 emissions? Ecol. Indic. 113, 106187. doi:10.1016/j.ecolind.2020.106187

Andersson, J. J. (2019). Carbon taxes and CO 2 emissions: Sweden as a case study. Am. Econ. J. Econ. Policy 11 (4), 1–30. doi:10.1257/pol.20170144

Ang, B. W., Choong, W. L., and Ng, T. S. (2015). Energy security: Definitions, dimensions and indexes. Renew. Sustain. energy Rev. 42, 1077–1093. doi:10.1016/j.rser.2014.10.064

Aşıcı, A. A., and Acar, S. (2016). Does income growth relocate ecological footprint? Ecol. Indic. 61, 707–714. doi:10.1016/j.ecolind.2015.10.022

Auci, S., and Trovato, G. (2018). The environmental Kuznets curve within European countries and sectors: Greenhouse emission, production function and technology. Econ. Polit. 35 (3), 895–915. doi:10.1007/s40888-018-0101-y

Balsa-Barreiro, J., Li, Y., Morales, A., and Pentland, A. S. (2019). Globalization and the shifting centers of gravity of world's human dynamics: Implications for sustainability. J. Clean. Prod. 239, 117923. doi:10.1016/j.jclepro.2019.117923

Balsalobre-Lorente, D., Gokmenoglu, K. K., Taspinar, N., and Cantos-Cantos, J. M. (2019). An approach to the pollution haven and pollution halo hypotheses in MINT countries. Environ. Sci. Pollut. Res. 26 (22), 23010–23026. doi:10.1007/s11356-019-05446-x

Baltagi, B. H., and Hashem Pesaran, M. (2007). Heterogeneity and cross section dependence in panel data models: Theory and applications introduction. J. Appl. Econ. Chichester. Engl. 22 (2), 229–232. doi:10.1002/jae.955

Ben Jebli, M., and Kahia, M. (2020). The interdependence between CO2 emissions, economic growth, renewable and non-renewable energies, and service development: Evidence from 65 countries. Clim. Change 162 (2), 193–212. doi:10.1007/s10584-020-02773-8

Bilgili, F., Nathaniel, S. P., Kuşkaya, S., and Kassouri, Y. (2021). Environmental pollution and energy research and development: An environmental Kuznets curve model through quantile simulation approach. Environ. Sci. Pollut. Res. 28 (38), 53712–53727. doi:10.1007/s11356-021-14506-0

Borozan, D. (2019). Unveiling the heterogeneous effect of energy taxes and income on residential energy consumption. Energy Policy 129, 13–22. doi:10.1016/j.enpol.2019.01.069

Burnett, J. W., and Madariaga, J. (2017). The convergence of US state-level energy intensity. Energy Econ. 62, 357–370. doi:10.1016/j.eneco.2016.03.029

Can, M., Ahmed, Z., Mercan, M., and Kalugina, O. A. (2021). The role of trading environment-friendly goods in environmental sustainability: Does green openness matter for OECD countries? J. Environ. Manag. 295, 113038. doi:10.1016/j.jenvman.2021.113038

Charfeddine, L. (2017). The impact of energy consumption and economic development on ecological footprint and CO2 emissions: Evidence from a markov switching equilibrium correction model. Energy Econ. 65, 355–374. doi:10.1016/j.eneco.2017.05.009

Cheng, Y., Awan, U., Ahmad, S., and Tan, Z. (2021). How do technological innovation and fiscal decentralization affect the environment? A story of the fourth industrial revolution and sustainable growth. Technol. Forecast. Soc. Change 162, 120398. doi:10.1016/j.techfore.2020.120398

Cheung, W. C., Simchi-Levi, D., and Zhu, R. (2019). “Learning to optimize under non-stationarity,” in The 22nd International Conference on Artificial Intelligence and Statistics (PMLR), 1079–1087.

Cohen, M. A., and Tubb, A. (2018). The impact of environmental regulation on firm and country competitiveness: A meta-analysis of the porter hypothesis. J. Assoc. Environ. Resour. Econ. 5 (2), 371–399. doi:10.1086/695613

Convery, F., McDonnell, S., and Ferreira, S. (2007). The most popular tax in Europe? Lessons from the Irish plastic bags levy. Environ. Resour. Econ. (Dordr). 38 (1), 1–11. doi:10.1007/s10640-006-9059-2

Criqui, P., Jaccard, M., and Sterner, T. (2019). Carbon taxation: A tale of three countries. Sustainability 11 (22), 6280. doi:10.3390/su11226280

De Angelis, E. M., Di Giacomo, M., and Vannoni, D. (2019). Climate change and economic growth: The role of environmental policy stringency. Sustainability 11 (8), 2273. doi:10.3390/su11082273

Dechezleprêtre, A. (2017). The impacts of environmental regulations on competitiveness antoine Dechezleprêtre and misato Sato review of environmental economics and policy, volume 11, issue 2, 1 july 2017, pages 183–206, https://doi. org/10.1093/reep/rex013 (1) there was an error in the text citations on page 185, lines 34-35, and page 195, line 24. J. Assoc. Environ. Resour. Econ. 1 (4), 521–553.

Destek, M. A., and Sinha, A. (2020). Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: Evidence from organisation for economic Co-operation and development countries. J. Clean. Prod. 242, 118537. doi:10.1016/j.jclepro.2019.118537

Dinda, S. (2005). A theoretical basis for the environmental Kuznets curve. Ecol. Econ. 53 (3), 403–413. doi:10.1016/j.ecolecon.2004.10.007

Dumitrescu, E. I., and Hurlin, C. (2012). Testing for Granger non-causality in heterogeneous panels. Econ. Model. 29 (4), 1450–1460. doi:10.1016/j.econmod.2012.02.014

Eberhardt, M. (2012). Estimating panel time-series models with heterogeneous slopes. Stata J. 12 (1), 61–71. doi:10.1177/1536867x1201200105

Flores, A. (2019). Relationship between transport demand and economic growth: Dynamic analysis using the ARDL model. Cuad. Econ. 43, 105.

Gengenbach, C., Palm, F. C., and Urbain, J. P. (2009). Panel unit root tests in the presence of cross-sectional dependencies: Comparison and implications for modelling. Econ. Rev. 29 (2), 111–145. doi:10.1080/07474930903382125

Global Footprint Network (2020). How the footprint works. California, USA: Ecological Footprint, Global Footprint Network. Availabel at: https://www.footprintnetwork.org/our-work/ecologicalfootprint/#:∼:text=Ecological%20Footprint%20accounting%20measures%20the%20demand%20on%20and%20supply%20of%20nature.&text=On%20the (Accessed April, 2022).

Grossman, G. M., and Krueger, A. B. (1995). Economic growth and the environment. Q. J. Econ. 110 (2), 353–377. doi:10.2307/2118443

Guo, J., Zhou, Y., Ali, S., Shahzad, U., and Cui, L. (2021). Exploring the role of green innovation and investment in energy for environmental quality: An empirical appraisal from provincial data of China. J. Environ. Manag. 292, 112779. doi:10.1016/j.jenvman.2021.112779

Hao, L. N., Umar, M., Khan, Z., and Ali, W. (2021). Green growth and low carbon emission in G7 countries: How critical the network of environmental taxes, renewable energy and human capital is? Sci. Total Environ. 752, 141853. doi:10.1016/j.scitotenv.2020.141853

He, P., Ning, J., Yu, Z., Xiong, H., Shen, H., and Jin, H. (2019). Can environmental tax policy really help to reduce pollutant emissions? An empirical study of a panel ARDL model based on OECD countries and China. Sustainability 11 (16), 4384. doi:10.3390/su11164384

Huang, S. Z., Chau, K. Y., Chien, F., and Shen, H. (2020). The impact of startups' dual learning on their green innovation capability: The effects of business executives' environmental awareness and environmental regulations. Sustainability 12 (16), 6526. doi:10.3390/su12166526

Islam, M., Hossain, M., Khan, M., Rana, M., Ema, N. S., and Bekun, F. V. (2022). Heading towards sustainable environment: Exploring the dynamic linkage among selected macroeconomic variables and ecological footprint using a novel dynamic ARDL simulations approach. Environ. Sci. Pollut. Res. 29 (15), 22260–22279. doi:10.1007/s11356-021-17375-9

Jaffe, A. B., Newell, R. G., and Stavins, R. N. (2003). “Technological change and the environment,” in Handbook of environmental economics (Amsterdam, Netherlands: Elsevier), Vol. 1, 461–516.

Jiang, J., Li, X., and Zhang, J. (2020). Online stochastic optimization with wasserstein based non-stationarity. arXiv preprint arXiv:2012.06961.

Jin, L., Duan, K., Shi, C., and Ju, X. (2017). The impact of technological progress in the energy sector on carbon emissions: An empirical analysis from China. Int. J. Environ. Res. Public Health 14 (12), 1505. doi:10.3390/ijerph14121505

Kassouri, Y., Bilgili, F., and Peter Majok Garang, A. (2022). Are government energy technology research, development, and demonstration budgets converging or diverging? Insights from OECD countries. Technol. Analysis Strategic Manag. 34 (5), 563–577. doi:10.1080/09537325.2021.1914330

Laegreid, O. M., and Povitkina, M. (2018). Do political institutions moderate the GDP-CO2 relationship? Ecol. Econ. 145, 441–450. doi:10.1016/j.ecolecon.2017.11.014

Lapinskienė, G., Peleckis, K., and Slavinskaitė, N. (2017). Energy consumption, economic growth and greenhouse gas emissions in the European Union countries. J. Bus. Econ. Manag. 18 (6), 1082–1097. doi:10.3846/16111699.2017.1393457

Lin, B., and Li, X. (2011). The effect of carbon tax on per capita CO2 emissions. Energy policy 39 (9), 5137–5146. doi:10.1016/j.enpol.2011.05.050

Lin, B., and Zhu, J. (2019). Determinants of renewable energy technological innovation in China under CO2 emissions constraint. J. Environ. Manag. 247, 662–671. doi:10.1016/j.jenvman.2019.06.121

Mazur, C., Contestabile, M., Offer, G. J., and Brandon, N. P. (2015). Assessing and comparing German and UK transition policies for electric mobility. Environ. Innovation Soc. Transitions 14, 84–100. doi:10.1016/j.eist.2014.04.005

Miceikiene, A., Ciuleviciene, V., Rauluskeviciene, J., and Streimikiene, D. (2018). Assessment of the effect of environmental taxes on environmental protection. Ekon. Cas. 66, 286–308.

Moran, D. D., Wackernagel, M., Kitzes, J. A., Goldfinger, S. H., and Boutaud, A. (2008). Measuring sustainable development—nation by nation. Ecol. Econ. 64 (3), 470–474. doi:10.1016/j.ecolecon.2007.08.017

Morawska, L., Thai, P. K., Liu, X., Asumadu-Sakyi, A., Ayoko, G., Bartonova, A., et al. (2018). Applications of low-cost sensing technologies for air quality monitoring and exposure assessment: How far have they gone? Environ. Int. 116, 286–299. doi:10.1016/j.envint.2018.04.018

Morley, B. (2012). Empirical evidence on the effectiveness of environmental taxes. Appl. Econ. Lett. 19 (18), 1817–1820. doi:10.1080/13504851.2011.650324

Mulatu, A. (2018). Environmental regulation and international competitiveness: A critical review. Int. J. Glob. Environ. Issues 17 (1), 41–63. doi:10.1504/ijgenvi.2018.10011732

Neagu, O. (2020). Economic complexity and ecological footprint: Evidence from the most complex economies in the world. Sustainability 12 (21), 9031. doi:10.3390/su12219031

Neves, S. A., Marques, A. C., and Patrício, M. (2020). Determinants of CO2 emissions in European union countries: Does environmental regulation reduce environmental pollution? Econ. Analysis Policy 68, 114–125. doi:10.1016/j.eap.2020.09.005

OECD (2021). Environmental tax (indicator). Available at: https://www.oecd.org/(Accessed April 10, 2022).

Ozturk, I., Al-Mulali, U., and Saboori, B. (2016). Investigating the environmental Kuznets curve hypothesis: The role of tourism and ecological footprint. Environ. Sci. Pollut. Res. 23 (2), 1916–1928. doi:10.1007/s11356-015-5447-x

Pablo-Romero, M., and Sanchez-Brada, A. (2017). Residential energy environmental Kuznets curve in the EU-28. Energy 125, 44–54. doi:10.1016/j.energy.2017.02.091

Pata, U. K., Aydin, M., and Haouas, I. (2021). Are natural resources abundance and human development a solution for environmental pressure? Evidence from top ten countries with the largest ecological footprint. Resour. Policy 70, 101923. doi:10.1016/j.resourpol.2020.101923

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econ. Chichester. Engl. 22 (2), 265–312. doi:10.1002/jae.951

Pesaran, M. H. (2006). Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74 (4), 967–1012. doi:10.1111/j.1468-0262.2006.00692.x

Pesaran, M. H., and Yamagata, T. (2008). Testing slope homogeneity in large panels. J. Econ. 142 (1), 50–93. doi:10.1016/j.jeconom.2007.05.010

Rees, W. E. (1992). Ecological footprints and appropriated carrying capacity: What urban economics leaves out. Environ. Urban. 4 (2), 121–130. doi:10.1177/095624789200400212

Saidi, K., and Hammami, S. (2015). The impact of CO2 emissions and economic growth on energy consumption in 58 countries. Energy Rep. 1, 62–70. doi:10.1016/j.egyr.2015.01.003

Saleem, H., Khan, M. B., and Mahdavian, S. M. (2022). The role of green growth, green financing, and eco-friendly technology in achieving environmental quality: Evidence from selected asian economies. Environ. Sci. Pollut. Res. 29, 57720–57739. doi:10.1007/s11356-022-19799-3

Saleem, H., Khan, M. B., and Shabbir, M. S. (2020). The role of financial development, energy demand, and technological change in environmental sustainability agenda: Evidence from selected asian countries. Environ. Sci. Pollut. Res. 27 (5), 5266–5280. doi:10.1007/s11356-019-07039-0

Shahbaz, M., Ozturk, I., Afza, T., and Ali, A. (2013b). Revisiting the environmental Kuznets curve in a global economy. Renew. Sustain. Energy Rev. 25, 494–502. doi:10.1016/j.rser.2013.05.021

Shahzad, U. (2020). Environmental taxes, energy consumption, and environmental quality: Theoretical survey with policy implications. Environ. Sci. Pollut. Res. 27 (20), 24848–24862. doi:10.1007/s11356-020-08349-4

Shapiro, J. S., and Walker, R. (2018). Why is pollution from US manufacturing declining? The roles of environmental regulation, productivity, and trade. Am. Econ. Rev. 108 (12), 3814–3854. doi:10.1257/aer.20151272

Sharif, A., Raza, S. A., Ozturk, I., and Afshan, S. (2019). The dynamic relationship of renewable and nonrenewable energy consumption with carbon emission: A global study with the application of heterogeneous panel estimations. Renew. Energy 133, 685–691. doi:10.1016/j.renene.2018.10.052

Shen, N., Wang, Y., Peng, H., and Hou, Z. (2020). Renewable energy green innovation, fossil energy consumption, and air pollution—Spatial empirical analysis based on China. Sustainability 12 (16), 6397. doi:10.3390/su12166397

Sterner, T. (2007). Fuel taxes: An important instrument for climate policy. Energy policy 35 (6), 3194–3202. doi:10.1016/j.enpol.2006.10.025

Toebelmann, D., and Wendler, T. (2020). The impact of environmental innovation on carbon dioxide emissions. J. Clean. Prod. 244, 118787. doi:10.1016/j.jclepro.2019.118787

Uddin, G. A., Salahuddin, M., Alam, K., and Gow, J. (2017). Ecological footprint and real income: Panel data evidence from the 27 highest emitting countries. Ecol. Indic. 77, 166–175. doi:10.1016/j.ecolind.2017.01.003

Ulucak, R., and Kassouri, Y. (2020). An assessment of the environmental sustainability corridor: Investigating the non-linear effects of environmental taxation on CO2 emissions. Sustain. Dev. 28 (4), 1010–1018. doi:10.1002/sd.2057

Usman, M., and Makhdum, M. S. A. (2021). What abates ecological footprint in BRICS-T region? Exploring the inuence of renewable energy, nonrenewable energy, agriculture, forest area and financial development. Renew. Energy 179, 12–28. doi:10.1016/j.renene.2021.07.014

Van Leeuwen, G., and Mohnen, P. (2017). Revisiting the porter hypothesis: An empirical analysis of green innovation for The Netherlands. Econ. Innovation New Technol. 26 (1-2), 63–77. doi:10.1080/10438599.2016.1202521

Wackernagel, M., and Rees, W. (1998). Our ecological footprint: Reducing human impact on the earth (vol. 9). Gabriola, BC, Canada: New society publishers.

Wang, H., and Wei, W. (2020). Coordinating technological progress and environmental regulation in CO2 mitigation: The optimal levels for OECD countries & emerging economies. Energy Econ. 87, 104510. doi:10.1016/j.eneco.2019.104510

Wang, Q., Jiang, R., and Zhan, L. (2019). Is decoupling economic growth from fuel consumption possible in developing countries? A comparison of China and India. J. Clean. Prod. 229, 806–817. doi:10.1016/j.jclepro.2019.04.403

Wenbo, G., and Yan, C. (2018). Assessing the efficiency of China's environmental regulation on carbon emissions based on Tapio decoupling models and GMM models. Energy Rep. 4, 713–723. doi:10.1016/j.egyr.2018.10.007

Westerlund, J., and Edgerton, D. L. (2008). A simple test for cointegration in dependent panels with structural breaks. Oxf. Bull. Econ. Statistics 70 (5), 665–704. doi:10.1111/j.1468-0084.2008.00513.x

Wissema, W., and Dellink, R. (2007). AGE analysis of the impact of a carbon energy tax on the Irish economy. Ecol. Econ. 61 (4), 671–683. doi:10.1016/j.ecolecon.2006.07.034

Wolde-Rufael, Y., and Mulat-Weldemeskel, E. (2021). Do environmental taxes and environmental stringency policies reduce CO2 emissions? Evidence from 7 emerging economies. Environ. Sci. Pollut. Res. 28 (18), 22392–22408. doi:10.1007/s11356-020-11475-8

World Bank (2021). World development indicators. Washington, DC, USA: The World Bank. Available at: http://data.worldbank.org/(Accessed January 28, 2022).

Xiong, Z., and Li, H. (2019). Ecological deficit tax: A tax design and simulation of compensation for ecosystem service value based on ecological footprint in China. J. Clean. Prod. 230, 1128–1137. doi:10.1016/j.jclepro.2019.05.172

Zhang, X., Guo, Z., Zheng, Y., Zhu, J., and Yang, J. (2016). A CGE analysis of the impacts of a carbon tax on provincial economy in China. Emerg. Mark. Finance Trade 52 (6), 1372–1384. doi:10.1080/1540496x.2016.1152801

Keywords: CO2 emission, ecological footprint, GDP growth, energy, environmental taxes, environmental policy

Citation: Chen M, Jiandong W and Saleem H (2022) The role of environmental taxes and stringent environmental policies in attaining the environmental quality: Evidence from OECD and non-OECD countries. Front. Environ. Sci. 10:972354. doi: 10.3389/fenvs.2022.972354

Received: 18 June 2022; Accepted: 27 September 2022;

Published: 07 November 2022.

Edited by:

Jose Balsa-Barreiro, Massachusetts Institute of Technology, United StatesReviewed by:

Solomon Prince Nathaniel, University of Lagos, NigeriaCopyright © 2022 Chen, Jiandong and Saleem. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hummera Saleem, aHVtYWlyYXNhbGVlbUBudW1sLmVkdS5waw==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.