- 1Institute of Economic Development and Reform, Huaqiao University, Xiamen, China

- 2School of Economics and Finance, Huaqiao University, Quanzhou, China

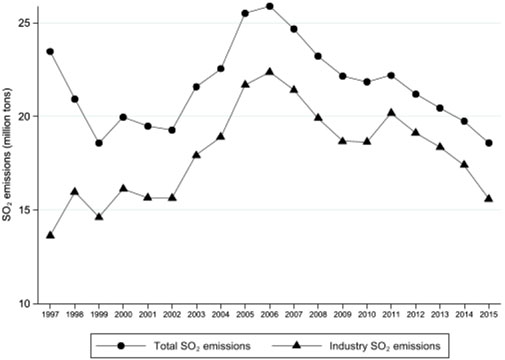

Firms need to adopt abatement strategies and change their modes of production and resource allocation under the strict environmental policy, which affects the labor income share. Based on the firm-level data of China’s Industrial Enterprise Database and Pollution Emission Database from 1998 to 2013, this study uses the difference-in-differences framework to test the effects and mechanisms of environmental policy on labor income share with different abatement strategies. We find that the Two Control Zone policy coupled with Environmental Performance Assessment policy (EPA-TCZ policies) in China, significantly increases the labor income share by 2.6% and reduces sulfur dioxide (

Introduction

Environmental pollution is the negative externality of economic and social activities to the environment. In order to solve this massive, spatio-temporal externality, we must internalize the externality. The implementation of a strict environmental policy is an important method for solving the internalization of externalities, but it will also lead to social problems, such as unemployment and a widening income gap. In particular, China as a developing country in the process of rapid development, the question of how to balance environmental protection and social stability is the key issue of environmental policy-making. Recently, some relevant studies have primarily examined the environmental effects, the output effects, and the trade effects of environmental policy (Chen et al., 2018). Research about the social effect of environmental policy focus on employment and income distribution (Fan, 2019; Liu et al., 2021), and the study on the labor income share effect of environmental policy is becoming an important research topic. In particular, low-income employments and low-skilled workers are more easily affected by environmental regulation, and the widening income gap will cause serious social problems.

The existing literature mainly believes that with the continuous improvement of environmental regulation, the relative changes in labor productivity and average wages are caused by cost effects and innovation compensation effect, and the effect of the labor income share is uncertain from a theoretical point of view (Hu and Yang, 2020; Li and Hu, 2021). To cope with strict environmental policies, profit-maximizing firms will choose differentiated abatement strategies, such as “changes in production processes”, and “end-of-pipe” treatments, to alter the mode of production and resources allocation, leading to relative changes in labor productivity and wages, and thus affect the labor income share. Therefore, the total impact of environmental policy on the labor income share is uncertain and requires empirical analysis. This study attempts to explore the effects and mechanisms of environmental policy on labor income share through the identification of a firm’s abatement strategy, which is helpful in the formulation and evaluation of environmental policies.

Theoretically, the effects of environmental regulation on income distribution are mainly reflected in three components: skill premium, firm scale, and industry characteristics (Qin and Qi, 2019). Environmental regulation changes the firm’s factor structure and affects the income distribution of workers with different skill levels (Fullerton and Monti, 2013). Small firms, polluting firms, and labor-intensive firms are more susceptible to environmental regulation policies (Wang et al., 2019). Empirically, there is no consistent conclusion on the income distribution effect of environmental regulation (Chao et al., 2012; Fan, 2019), and requires sufficient empirical evidence (Pi and Shi, 2018).

In previous empirical studies, three articles were very similar to this study which all considered that environmental rules had a non-linear relationship with labor income share (Hu and Yang, 2020; Liu and Wang, 2020; Li and Hu, 2021). Using industry data, Hu and Yang (2020) found that environmental regulation was an important factor affecting labor income share. More specifically, environmental regulation had a significant U-shaped impact on labor income share through the labor skill structure. Liu and Wang (2020), using provincial panel data from 1997 to 2015, explained the inverted-U-shaped impact of environmental pollution and environmental regulation on labor income share based on the wage compensation theory. Li and Hu (2021) argued that the impact of environmental regulation on labor income share was near the inverted U-shaped inflection point using provincial panel data, with technological innovation, industrial structure adjustment, and foreign direct investment contributing to the improvement of the labor income share. The above literatures use provincial or industry data, however, the research on micro firm-level data is very scarce. How environmental policies affect firms abatement strategies and the heterogeneous impacts on labor income share remain to be explored.

Previous studies had shown that the indicators of environmental regulation were difficult to select. Investments in pollution control, pollutant emissions, and the number of administrative penalty cases were usually used to measure environmental regulation in existing studies, which may lead to estimation bias because of endogenous problems. This study chooses two landmark policies, China’s Two Control Zones (TCZ) policy during the10th Five-Year Plan (FYP) and the Environmental Performance Assessment (EPA) policy of the 11th FYP as quasi-natural experiments, which may overcome the endogenous problem of environmental pollution indicators used in previous studies. According to the TCZ policy in 1998, 64 cities were classified as sulfur dioxide pollution control areas and 109 cities were designated as acid rain control areas depending on the level of regional pollution, which represents a total control policy for key areas of pollution sources. The EPA policy takes the total discharge of major pollutants as a binding indicator for governments at all levels, which is a total control policy for different pollutants. The combination of TCZ and EPA (hereafter, EPA-TCZ) policies promotes the achievement of abatement targets since 2005.

This study considers the impact of the environmental regulations on the labor income share using the EPA-TCZ policies. The effects of the TCZ policy or EPA policy on the environment, trade, employment and infant mortality were respectively analyzed (Hering and Poncet, 2014; Tanaka, 2015; Cai et al., 2016). However, there are few studies about the effects of EPA-TCZ policies. Only Chen et al. (2018) and Zhang et al. (2020) combine the TCZ policy and EPA policy to study their impacts on resource allocation and economic growth.

Unlike existing studies that have paid more attention to the cost effect, innovation compensation effect and wage compensation effect (Hu and Yang, 2020; Liu and Wang, 2020; Li and Hu, 2021), we explore the influence mechanism from the view of the factor-substitute effect. Under the strict environmental policy, firms need to adopt abatement strategies and change their modes of production and resource allocation, such as replacing polluted raw materials with clean raw materials. What’s more, this paper examines the effects and mechanisms of environmental regulation on labor income share with different abatement strategies, which serves as a useful supplement to the existing research from the theoretical and empirical view.

This study enriches the empirical research on the resource allocation effect of firms’ abatement strategies. Abatement strategies discussed in the literature mainly consist of “changes in production process” and “end-of-pipe” treatments (Berman and Bui, 2001; Liu et al., 2021). In practice, firms may use fuel coal with lower sulfur content or replace pollution factors with more labor, and this “source control” strategy has been ignored in existing research. This paper shows that in addition to the above two abatement strategies, firms will also adopt “source control” strategy to cope with environmental policy, and thus influence the labor income share. These results have practical values for making environmental policy.

This study also provides a sample of empirical research about the impact of environmental regulation on labor income share in developing countries. As China’s economy continues to grow, more attention will be paid to environmental protection, and more stringent environmental policies will be implemented, which may create more problems in income distribution. This study matches firm-level data of China’s Industrial Enterprise Database (CIED) and Pollution Emission Database (CPED) to test the effect of the total amount control policy on labor income share. This study provides support for the social effect assessment of China’s environmental policy.

The remainder of this article is arranged as follows. The second section introduces the TCZ policy and EPA policy background. The third section presents a theoretical analysis about the impact of environmental regulation on labor income share under abatement treatments. The fourth section is estimation strategy. The fifth section is the empirical analysis, which estimates the impact of EPA-TCZ policies on labor income share with the robustness test, and presents the mechanism test and heterogeneity analysis. Finally, the sixth section offers the conclusion and presents policy implications.

Policy background

Since the implementation of “Environmental Protection Law” in 1998, the central government has continuously deepened its understanding and protection of the ecological environment, and successively issued a series of environmental policies. These policies are roughly divided into three stages, the exploration stage based on the introduction of laws and regulations, the policy implementation stage based on the government performance assessment and the promotion stage of diversified environmental policies based on the combination of government administrative instructions and marketization (Yu and Yin, 2022). Among them, the most iconic policies are the TZC policy and EPA policy. The former embodies total pollution control at the regional level, and the latter addresses the discharge of various pollutants, which are respectively in the first two stages of environmental policies. During this period, the attributes of emission reduction indicators have changed from anticipatory to binding.

In 1998, the State Council formulated a sulfur dioxide emission reduction plan (that is TCZ policy) to address the increase of

However, the emission reduction effect of the TCZ policy was not remarkable by the end of 2000, which may be related to the anticipation of emission reduction targets and the lack of specific abatement targets (Zhang et al., 2020). In 2002, the central government assigned exact

In 2005, the central government allocated the 10% reduction in major pollutants to governments at all levels as a binding condition, which has been a part of the 11th FYP (2006–2010) for the first time and a close relation to the promotion of local officials. Environmental objectives were incorporated into the environmental performance assessment of local officials, which was EPA policy implemented at the end of 2005.

During the 11th FYP period, total

Theoretical analysis

The existing studies mainly discuss the impact of environmental regulation on labor income share through two mechanisms. The first is the cost effect. Pollution emission is a part of the production function in the form of input or output (Fullerton and Metcalf, 1998; Berman and Bui, 2001; Sanz and Schwartz, 2013). Strict environmental policies make pollution emissions have a “price” and increase the marginal cost, which not only crowds out productive investment, reducing labor productivity (Ferjani, 2011), but also reduces the output and profitability, falling average wages. The impact of environmental regulation on labor income share depends on the relative extent of the decline in labor productivity and wages1. The second is the innovation compensation effect. Firms may adjust production behavior under environmental policies, and turn to increase research to innovate green or production technology (Porter and van der Linde, 1995), which may offset the negative impact of cost effect on output. Meanwhile, the proportion of high-skilled workers is enhanced and the average wage level is increased (Hu and Yang, 2020). Thus, the effect of environmental regulation on labor income share depends on the relative extent of the improvement in wages and labor productivity under the innovation compensation effect.

In addition to the above cost effect and innovation compensation effect, this paper regards that environmental policy may also affect the labor income share by factor-substitute effect. Environmental protection activities may be more labor-intensive than traditional production (Morgenstern et al., 2002; Zhang et al., 2020). For example, cleaner operations may require less polluting fuel and materials, or more labor for inspection, installation and maintenance activities. Firms tend to use labor to replace capital and other polluting factors of production to reduce pollution, and the demand for labor is relatively increasing, which means the labor income share has risen. However, environmental regulation policies may cause firms to adopt advanced technology processes and reduce labor demand (Berman and Bui, 2001), leading to the replacement with labor by capital and a decline in labor income share. From the above, we find that the factor-substitute effect of environmental regulation on labor income share is closely related to abatement strategy.

Abatement activities are mainly divided into two categories: “changes in production processes”, and “end-of-pipe” treatments (Liu et al., 2021). The former, such as the adoption of advanced production technology or green technology, and updating equipment to generate less emission, may require more capital and less labor. The latter refers to technologies used at the end of a production process to reduce emissions by removing produced pollutants, such as the installation of desulfurization devices. This paper regards that in response to stringent environmental policy, firms may reduce pollution emissions from the production source and adopt clean production factors to replace high-emission factors, such as the use of cleaner energy and more labor rather than capital. We refer to this abatement strategy as “source control” strategy.

The impact mechanism of environmental regulation policies on labor income share depends on different abatement strategies. If a “source control” strategy is adopted, on the one hand, the stringent environmental policies make firms use more labor to replace capital and other polluting factors. The demand for labor is relatively increasing with the factor-substitute effect, and the labor income share is rising. On the other hand, firms input cleaner energy, and production costs increase, which makes the impacts of environmental regulation on labor income share depend on the relative decline of labor productivity and wage growth rate through the cost effect. With the strategy of “changes in production processes”, labor productivity and wage level are both improved through the innovation compensation effect, which will cause uncertain changes in the labor income share. In addition, the adoption of advanced production processes may raise the substitution of capital for labor, reducing labor demand and labor income share through the factor-substitute effect. If firms adopt “end-of-pipe” treatments, they not only need to purchase decontamination equipment, but also match the labor for maintenance and operation, which may reduce production investment and result in the decline of labor productivity and wage level with the cost effect. From the above theoretical analysis, it can be seen that the impact of environment regulation on labor income share is uncertain, and further empirical analysis is needed.

Estimation strategy

Estimation framework

To evaluate the labor income share effect of EPA-TCZ policies, we divide TCZ cities into treatment groups and non-TCZ cities into control groups, and then compare the changes in labor income share before and after the implementation of EPA policy using a difference-in-differences (DID) model. Referring to Chen et al. (2018), the regression model is as follows:

where

The coefficient

The coefficient estimation of β with the DID method requires random grouping that if there is no EPA policy in 2005, the labor income share of TCZ cities has the same time trend as that of non-TCZ cities after 2005. Otherwise, there is a systematic difference between the control group and the treatment group before the implementation of the policy in 2005, which may cause the selection bias from the correlation between

The implementation of the TCZ policy may change the characteristics of the treatment group and the control group, making them incomparable when the EPA policy was in place at the end of 2005. Existing studies show that the TCZ policy has affected exports (Hering and Poncet, 2014), GDP growth (Chen et al., 2018), and employment (Zhang et al., 2020). In order to solve this problem, we add a set of variables known in the literature that are affected by TCZ policy, including export and size at the firm level, per-capita GDP and unemployment rate at the city-level. In addition, market structure is added to reflect industry characteristics. The specific models are as follows:

Where

Data sources and descriptive statistics

In order to analyze the effect of the EPA-TCZ policies on labor income share, this study uses combined firm data with CIED and CPED from 1998 to 2013. We also use economic data at the city and industry levels including China’s City Statistical Yearbooks from 1999 to 2014.

China’s Industrial Enterprise Database (CIED) contains rich economic and financial information on industrial firms, such as output, assets and liabilities, and the number of employees, which are self-reported quarterly and annually by the firm and collected in a step-by-step process undertaken by the National Bureau of Statistics. The CIED covers all state-owned and nonstate-owned firms with an annual business income of more than five million, whose total output is accounting for roughly 90% of total industrial output in China, and thus has been widely used in economic literature. In this paper, we use information on the output value, the number of employees, wages, profits, value-added tax, ownership type, city, and industry code.

China’s Pollution Emission Database (CPED) is currently the most comprehensive firm-level pollution emission data in China, covering 85% of the emissions of major pollutants in each region, including

Referring to the research of Brandt et al. (2012), First, CIED and CPED are matched respectively across years according to the firm name, postal code, legal representative, etc. Then, the two databases are matched according to the firms’ organizational code2 in the CIED and CPED. The data from 2008 to 2010 is dropped due to the lack of wage information. In addition, we also delete samples with missing key variables and outliers that do not meet the following accounting standards as follows. 1) the number of employees in the firm is greater than 8; 2) total asset is greater than fixed assets; 3) total asset is greater than the liquid asset; 4) the accumulated depreciation value is greater than the depreciation value in the current year; 5) the output is less than five million; 6) the labor income share is between 0 and 1. The variable of labor income share is winsorized at the 1% level. Finally, we get the unbalanced panel data of 81,735 firms and 313,742 observations.

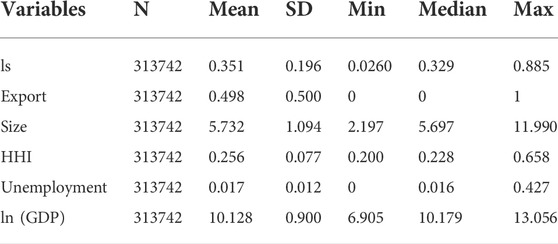

The city-level variables are from the China Statistical Yearbook and the China City Statistical Yearbook, providing some city-level economic variables, such as unemployment rate and per capita GDP. The descriptive statistics of the variables are shown in Table 1.

Main results

Baseline results

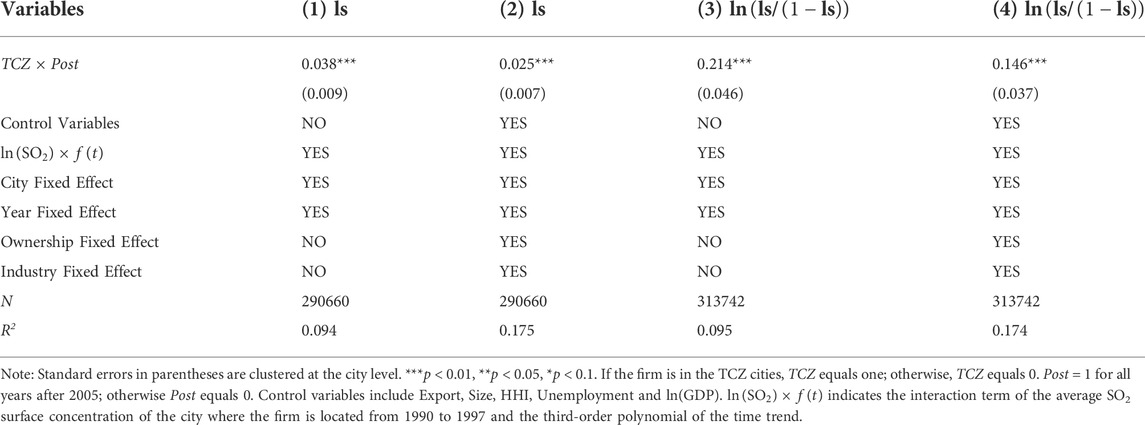

Table 2 reports the baseline results of Equation 1 and 3. Column 1) in Table 2 shows that TCZ

Robustness checks

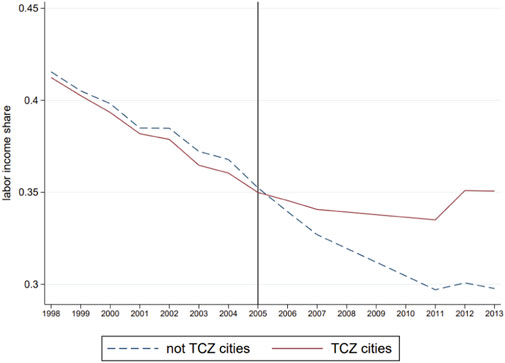

Common trend test. The key assumption of the DID method is the common trend hypothesis, which means that before the implementation of the EPA-TCZ policies, labor income share in TCZ and non-TCZ cities exhibits the same trend. Figure 2 shows the changing trend of the labor income share in TCZ and non-TCZ cities. It can be found that the labor income share declined from 1998 to 2013, which is consistent with the fact that China’s labor income share was reducing at the macro level during the same period. In particular, labor income share in TCZ and non-TCZ cities has the similar declining trend before 2005, but after the implementation of the EPA in 2005, the declining trend of labor income share in TCZ cities is alleviate obviously, which reveals that the treatment group and the control group meet the common trend assumption before the implementation of the policy.

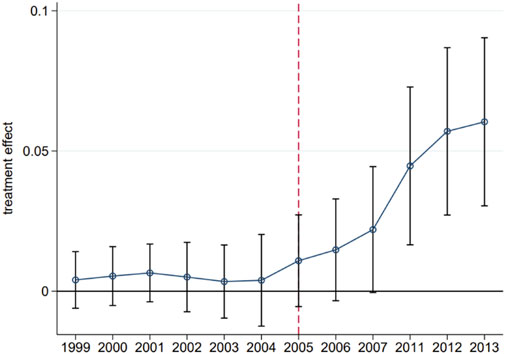

In order to furtherly investigate the common trend and dynamic effect, we use the case study to explore the dynamic effect of the EPA-TCZ policies. The equation is as follows:

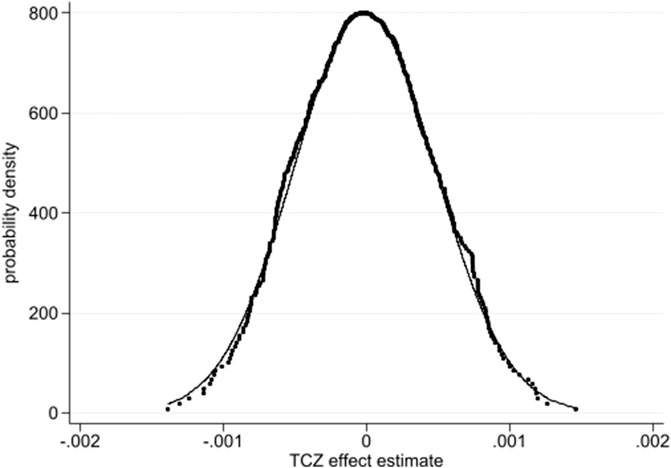

Placebo test. In order to ensure a more robust conclusion, with reference to Chetty et al. (2009)’s method, we undertake a placebo test. First, the treatment firms are randomly selected from the full samples, and the other firms are regarded as the control group. Then, we define and calculate the DID dummy. Finally, the DID effect is estimated. The above processes are repeated 500 times, and the distribution of DID coefficients is shown in Figure 4, where

Alternative samples. Previous studies have shown that after 2005, in order to achieve environmental performance goals, local officials in TCZ cities would rather give up economic growth and take various measures to reduce pollution emissions within their jurisdictions (Chen et al., 2018). Other policies or major events will also affect local governments to make a trade-off between economic growth and pollution emissions after 2005. For example, in order to ensure the air quality during the 2008 summer Olympic Games, local governments may further sacrifice economic growth and require most industrial firms to limit or stop production. The samples of host cities as well as co-host cities are removed to reduce the impact of the major event of the Olympic Games on the results, including Beijing, Shanghai, Tianjin, Shenyang, Qinhuangdao and Qingdao, which are given in columns 1) and 2) of Table 3. We find that

Change the variable definition. Considering that the value of labor income share is between 0 and 1, consistent with the work of Wei et al. (2013), we define the “odds ratio” of

Mechanism analysis

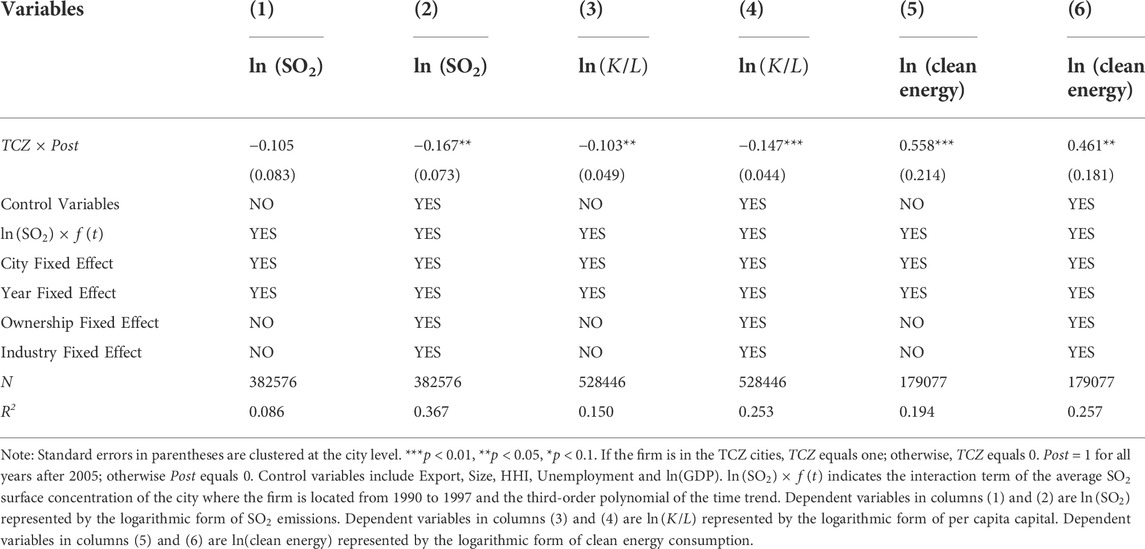

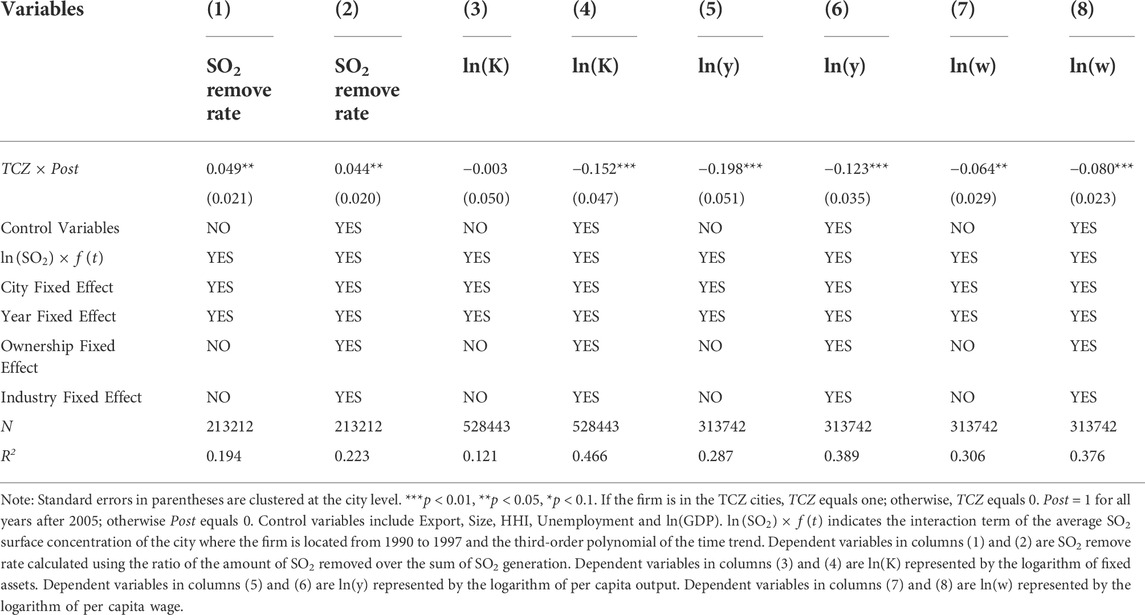

The main purpose of the TCZ policy is to reduce the emissions of major pollutants such as

Firms mainly adopt three abatement strategies: “source control,” “changes in production processes,” and “end-of-pipe”. Under the constraints of environmental policy, if firms adopt “source control” treatments to reduce emissions, they will increase the use of clean energy or use labor instead of capital. Here, we use capital intensity (logarithm of per capita capital,

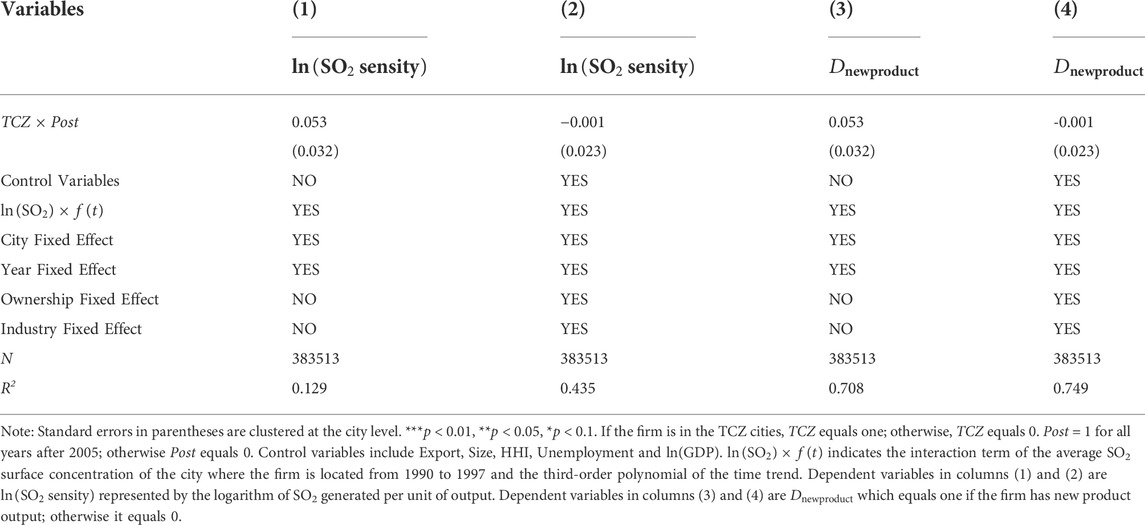

If “changes in production processes” treatments are adopted, firms will increase their R&D investment and improve production technology to reduce generated

If adopting “end-of-pipe” treatments, firms do not change the production process and

“End-of-pipe” treatments require firms to enhance investments in abatement facilities and increase labor for the installation, maintenance, and operation of facilities, which will crowd out the investment in production, resulting in a decline in output and lower profits and wages, and leading to changes in the labor income share. The results in Table 6 provide evidence in support of this point, and are shown that environmental regulation have significantly reduced investment in firm-level fixed assets (columns 3) and (4)) and per capita output (columns 5) and (6)), as well as wages (columns 7) and (8)). The point estimates show that compared with those of non-TCZ cities, firm-level outputs in TCZ cities have decreased by 13% and wages in TCZ cities have decreased by 8.3%, which result in labor income share increasing due to the greater decline in output and the smaller decline in wage rigidity.

To summarize, under strict environmental regulation, firms choose “source control” and “end-of-pipe” abatement strategies and labor income share is increased though factor-substitute effect and cost effect.

Heterogeneous analysis

In addition to policies’ average effects on the labor income share, we are also concerned about which firms are more vulnerable to environmental policies. Therefore, this paper further discusses the heterogeneous impacts of environmental rules on the labor income share from different skill employment structures and ownership.

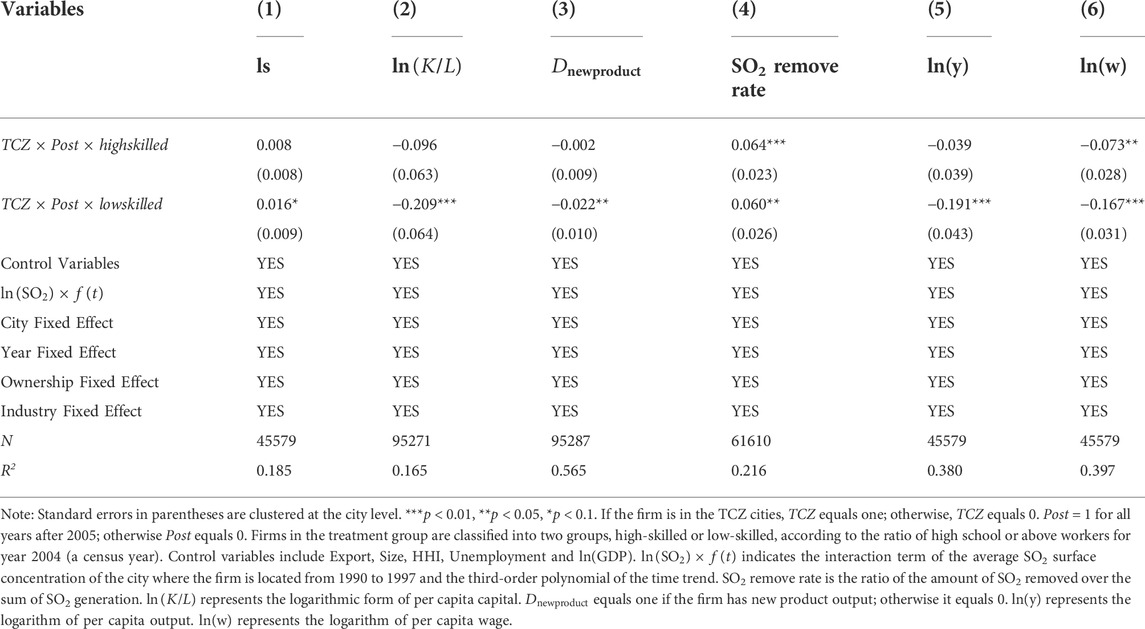

Workforce skill. Compared with low-skilled workers, high-skilled labor has higher labor productivity and wages. Under stringent environmental policies, firms may reduce the demand for low-skilled workers in order to reduce costs or carry out technological innovation (Liu et al., 2021). For this reason, the impact of environmental rules on labor income share is different in firms with different skill structures. There is a survey on the employment structure of labor force in China’s Economic Census in 2004. Therefore, we will retain the firms in 2004 and match them with other years according to their unique identification codes, and divide the firms in the treatment groups into high-skilled and low-skilled firms according to the median of the proportion of the labor force above the high school level. Table 7 shows that the policies have a positive effect on labor income share and

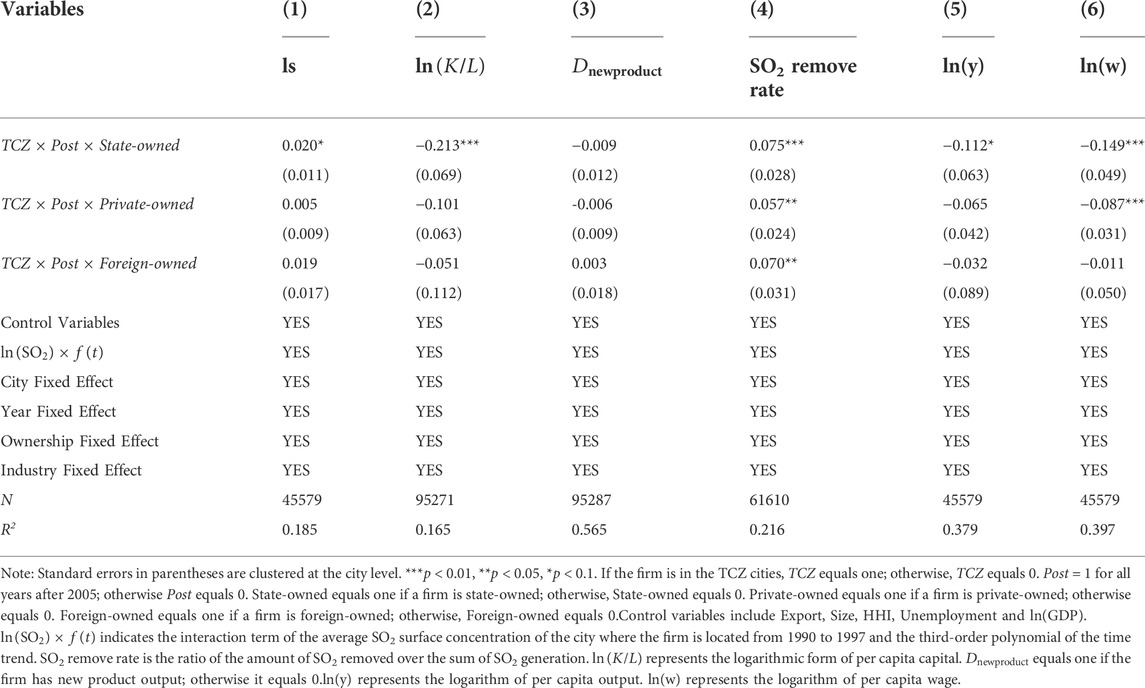

Ownership. Previous studies have shown that the environmental performance in foreign-owned firms is better than that of domestic firms. Therefore, environmental regulations have little impact on pollution emissions and operations of foreign-owned firms (Dean et al., 2009). In domestic firms, environmental regulation policies have a greater impact on the labor demand of state-owned firms than private firms (Liu et al., 2021). Therefore, environmental policy has heterogeneous impacts on the labor income share within different ownership firms. The results in column 1) in Table 8 show that the policies only significantly increases labor income share in state-owned firms, which use more labor instead of capital strategy and “end-of-pipe” treatments (see column 2) and column 4) in Table 8), through factor-substitute effect and cost effect as shown in column 5) and column (6). The possible explanation is two reasons as follows. On the one hand, strict environmental regulation means that the prices of production factors such as raw materials rise faster than those of labor, thus enabling firms to increase labor input (Bezdek et al., 2008), thereby increasing the labor income share. This is in line with the factor-substitute effect of environmental regulation, so that labor resources are allocated to the area with strict policy implementation (Zhang et al., 2020). On the other hand, in the face of local environmental policies, state-owned firms have greater social responsibilities in employment and pollution reduction.

Conclusion

This study theoretically analyzes the impact mechanisms of environmental regulation on labor income share with different abatement strategies and empirically tests the effects and impact mechanisms of the TCZ policy on labor income share after incorporating EPA policy using matching data from the CIED and the CPED. We find that the policies of EPA-TCZ significantly reduces the emission of sulfur dioxide (

Furthermore, we identify the impact mechanisms of environmental regulation on labor income share through firms’ abatement strategies. The results demonstrate that under strict environmental policy constraints, firms primarily adopt “source control” and “end-of-pipe” strategies to achieve emission reduction in the short term. When firms choose “source control” abatement, they use clean production factors such as labor and energy, which make the factor-substitute effect and cost effect of environmental regulation act, to increase the labor income share. When firms choose “end-of-pipe” treatments, it requires the investment in abatement facilities and increases labor for the installation, maintenance, and operation of facilities, which will crowd out the investment in production, resulting in a decline in output and lower profits and wages under the cost effect, and leading to increase in the labor income share due to wage rigidity. Moreover, the heterogeneous effects of environmental regulation on labor income share can been found in low-skilled firms and state-owned firms.

This study supplements the literature on the firm-level resource allocation and income distribution effects of abatement strategies. Existing literature have focused on the impact of firms’ different abatement strategies (“changes in production processes” and “end-of-pipe”) on labor demands (Berman and Bui, 2001; Liu et al., 2021). We find that “source control” treatments are always neglected, which refer that firms reducing emissions at the source of the production process will choose cleaner input factors, such as using labor instead of capital and other polluting factors, which in turn impact the labor income share. In addition, we get that under strict environmental policies, firms tend to select “source control” and “end-of-pipe” treatments, and especially “end-of-pipe” strategy is not a long-term strategy to reduce pollution emissions. Thus, market-oriented environmental policies should be formulated, and may encourage firms to shift to “changes in production processes” treatments that can play an innovative compensation effect in the long term.

This study provides complements to the existing research on the impacts of environmental policies in developed countries. In contract to the policies market-oriented in these countries, the early environmental policies in China are mainly on the form of laws, regulations, and government performance appraisal, which helps to reduce pollution emissions at the cost of reducing production investment and productivity as shown in our results, without fundamentally solving the contradiction between pollution control and growth. This paper provides a new empirical research from developing countries and effective references for the formulation of China’s environmental regulation policy.

Future research can compare the impact of differentiated environmental regulation policies (for example, early environmental policies and market-oriented environmental policies, amount control policies and structural control policies) on firms abatement strategies and labor income share. We can consider internalizing the externality of pollution through coordinated decision-making between local governments (Pan and Chen, 2021). Moreover, we can also consider more heterogeneity analysis, such as different industries and regions.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

YH:Theoretical Analysis, Methodology, Writing-original draft. JZ:Writing-review and editing. JL:Theoretical Analysis, Writing-review and editing. The corresponding author is responsible for ensuring that the statement is correct and agreed by all authors.

Funding

This research is supported by Huaqiao University’s Academic Project Supported by the Fundamental Research Funds for the Central Universities (20SKGC-QT01).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1By definition, labor income share (ls) can be written as wage (w) divided by labor productivity (y),

2Considering there is some deviations in the organizational code when entering data, we remove words that are not helpful in matching the firm name to improve the matching rate

3We also find that the use of average sulfur of coal is decreasing after the implementation of EPA policy

4We also treat the number of abatement facilities as the “end-of-pipe” treatment, and estimate it as the depended variable. The results show that the impact on the number of abatement facilities is not significant, which is consistent with the results obtained by Liu et al. (2021). This may been explained as the demand for abatement equipment and statistics on the number of abatement facilities. Large-scale desulfurization equipment has strong pollutant handling capacity, and firms need a small amount of equipment to meet the abatement requirements. Thus, the amount of equipment needed will not be very significant. In addition, in order to avoid environmental regulation, firms may not report or underreport pollution emissions and abatement treatment

References

Berman, E., and Bui, L. T. M. (2001). Environmental regulation and labor demand: evidence from the south coast air basin. J. Public Econ. 79 (2), 265–295. doi:10.1016/s0047-2727(99)00101-2

Bertrand, M., Duflo, E., and Mullainathan, S. (2004). How much should we trust differences-in-differences estimates? Q. J. Econ. 119 (1), 249–275. doi:10.1162/003355304772839588

Bezdek, R. H., Wendling, R. M., and DiPerna, P. (2008). Environmental protection, the economy, and jobs: national and regional analyses. J. Environ. Manage. 86 (1), 63–79. doi:10.1016/j.jenvman.2006.11.028

Brandt, L., Van Biesebroeck, J., and Zhang, Y. (2012). Creative accounting or creative destruction? firm-level productivity growth in Chinese manufacturing. J. Dev. Econ. 97 (2), 339–351. doi:10.1016/j.jdeveco.2011.02.002

Cai, X., Lu, Y., Wu, M., and Yu, L. (2016). Does environmental regulation drive away inbound foreign direct investment? evidence from a quasi-natural experiment in China. J. Dev. Econ. 123, 73–85. doi:10.1016/j.jdeveco.2016.08.003

Chao, C. C., Laffargue, J. P., and Sgro, P. M. (2012). Environmental control, wage inequality and national welfare in a tourism economy. Int. Rev. Econ. Finance 22 (1), 201–207. doi:10.1016/j.iref.2011.10.013

Chen, Y. J., Li, P., and Lu, Y. (2018). Career concerns and multitasking local bureaucrats: evidence of a target-based performance evaluation system in China. J. Dev. Econ. 133, 84–101. doi:10.1016/j.jdeveco.2018.02.001

Chetty, R., Looney, A., and Kroft, K. (2009). Salience and taxation: theory and evidence. Am. Econ. Rev. 99 (4), 1145–1177. doi:10.1257/aer.99.4.1145

Dean, J. M., Lovely, M. E., and Wang, H. (2009). Are foreign investors attracted to weak environmental regulations? evaluating the evidence from China. J. Dev. Econ. 90 (1), 1–13. doi:10.1016/j.jdeveco.2008.11.007

Fan, J. (2019). Internal geography, labor mobility, and the distributional impacts of trade. Am. Econ. J. Macroecon. 11 (3), 252–288. doi:10.1257/mac.20150055

Ferjani, A. (2011). Environmental regulation and productivity: a data envelopment analysis for Swiss dairy farms. Agric. Econ. Rev. 12 (1), 45–55. doi:10.22004/AG.ECON.178213

Fullerton, D., and Metcalf, G. E. (1998). Environmental taxes and the double-dividend hypothesis: did you really expect something for nothing? Chicago-Kent Law Rev. 73 (1), 221–256.

Fullerton, D., and Monti, H. (2013). Can pollution tax rebates protect low-wage earners? J. Environ. Econ. Manage. 66 (3), 539–553. doi:10.1016/j.jeem.2013.09.001

Han, C., Li, C., and Zhang, S. (2021). The pollution reduction effect of the "two control zones" superimposed environmental performance assessment policy. Res. Financial Econ. Issues 43 (8), 31–39. doi:10.19654/j.cnki.cjwtyj.2021.08.004

Hering, L., and Poncet, S. (2014). Environmental policy and exports: evidence from Chinese cities. J. Environ. Econ. Manag. 68 (2), 296–318. doi:10.1016/j.jeem.2014.06.005

Hu, B., and Yang, J. (2020). Environmental regulation and labor income share: can a win-win situation be achieved. J. Finance Econ. 64 (02), 92–105.

Li, J., and Hu, J. (2021). Research on the impact path of environmental regulation on labor income share: from the direct effect and indirect effect perspective. Ecol. Econ. 37 (11), 174–181.

Liu, M., Tan, R., and Zhang, B. (2021). The costs of “blue sky”: environmental regulation, technology upgrading, and labor demand in China. J. Dev. Econ. 150, 102610. doi:10.1016/j.jdeveco.2020.102610

Liu, Y., and Wang, J. (2020). Environmental pollution, environmental regulation, and labor income share. Environ. Sci. Pollut. Res. 27 (36), 45161–45174. doi:10.1007/s11356-020-10408-9

Lu, X., and Tian, L. (2020). Firm size polarization and labor income share. J. World Econ. 43 (09), 27–48.

Mangin, S., and Sedlacek, P. (2017). Unemployment and the labor share. J. Monet. Econ. 94, 41–59. doi:10.1016/j.jmoneco.2017.10.001

Morgenstern, R. D., Pizer, W. A., and Shih, J. S. (2002). Jobs versus the environment: an industry-level perspective. J. Environ. Econ. Manage. 43 (3), 412–436. doi:10.1006/jeem.2001.1191

Pan, D., and Chen, H. (2021). Border pollution reduction in China: the role of livestock environmental regulations. China Econ. Rev. 69, 101681. doi:10.1016/j.chieco.2021.101681

Pi, J., and Shi, S. (2018). Public pollution abatement and wage inequality. J. Int. Trade Econ. Dev. 28 (2), 257–275. doi:10.1080/09638199.2018.1521464

Porter, M. E., and van der Linde, C. V. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Qin, M., and Qi, Y. (2019). Research on income distribution effect of environmental regulation. J. Res. Econ. Manag. 40 (11), 70–81. doi:10.13502/j.cnki.issn1000-7636.2019.11.006

Sanz, N., and Schwartz, S. (2013). Are pollution permit markets harmful for employment? Econ. Model. 35 (5), 374–383. doi:10.1016/j.econmod.2013.07.009

Tanaka, S. (2015). Environmental regulations on air pollution in China and their impact on infant mortality. J. Health Econ. 42, 90–103. doi:10.1016/j.jhealeco.2015.02.004

Wang, Y., Xie, T., and Hao, C. (2019). How do rising environmental costs affect employment growth: an empirical study based on the revision policy of pollution discharge fees. J. Nankai Econ. Stud. 35 (04), 12–36. doi:10.14116/j.nkes.2019.04.002

Wei, X., Dong, Z., and Liu, Y. (2013). The political relationship, the institutional environment, and the share of the labor income: a case study based on the data collected through the survey of the private firms all over China. J. Manag. World 29(05), 35–46+187. doi:10.19744/j.cnki.11-1235/f.2013.05.003

Yu, Y., and Yin, L. (2022). The evolution of Chinese environmental regulation policy and its economic effects: a summary and prospect. Reform 35 (03), 114–130.

Keywords: environmental regulation, labor income share, air pollution, abatement strategy, China

Citation: Huang Y, Zhao J and Lan J (2022) Environmental regulation, abatement strategy, and labor income share. Front. Environ. Sci. 10:965963. doi: 10.3389/fenvs.2022.965963

Received: 10 June 2022; Accepted: 19 July 2022;

Published: 19 August 2022.

Edited by:

Zeeshan Khan, Curtin University Sarawak, MalaysiaReviewed by:

Umer Shahzad, Anhui University of Finance and Economics, ChinaZahoor Ahmed, Cyprus International University, Cyprus

Copyright © 2022 Huang, Zhao and Lan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yanyan Huang, aHVhbmd5eUBocXUuZWR1LmNu

Yanyan Huang

Yanyan Huang Jun Zhao

Jun Zhao Jiajun Lan2

Jiajun Lan2