- 1Center for International Business and Economy, Sichuan International Studies University, Chongqing, China

- 2School of International Finance and Trade, Sichuan International Studies University, Chongqing, China

- 3School of International Business and Management, Sichuan International Studies University, Chongqing, China

Accelerating the digital transformation of enterprises, enabling enterprise operation and management with digitalization, and driving green transformation are important tasks to further promote the digital construction of a country. Based on the text data mining method, this paper investigates digitalization’s impact on enterprises’ green transformation and its mechanisms, using A-share listed companies in Shanghai and Shenzhen as research samples from 2011 to 2020. The results show that digitalization has the effect of “inhibiting” and then “promoting” on the green transformation of enterprises, i.e., the relationship between the two is U-shaped. The heterogeneity analysis shows that this U-shaped relationship exists among non-heavy polluting enterprises, eastern enterprises, main-board enterprises, GEM enterprises, and enterprises with high digitization speed. As far the influence mechanism, the dynamic capability acts as a partial mediator in the relationship between digitalization and green transformation. This study provides a useful reference for enterprises to drive sustainable development and promote the construction of national ecological civilization.

1 Introduction

China has implemented reform and opening-up policy for more than 40 years, and achieved remarkable economic achievements. However, the extensive growth mode with high energy consumption and high pollution emissions has intensified the ecological load in China, which makes it highly urgent and arduous to solve environmental problems Wu and Li (2022). Nowadays, the severe environmental problems push China to implement the new development concept and promote the comprehensive green transformation, especially the economic green transformation. The report of the 19th National Congress of the Communist Party of China (CPC) pointed out that “it is necessary to establish and practice the concept of Lucid Waters and Lush Mountains are invaluable assets, adhere to the basic national policy of saving resources and protecting the environment,” and increase the supply of beautiful ecological environments such as blue sky, white clouds, green land and clear water, which is not only the aspiration of the public but also the desire of the people’s livelihood. The United Nations Environment Programme (UNEP) defines the green transformation of economy as an economic model that “can improve human welfare and social equity, and greatly reduce the harm to the environment and ecological scarcity”. As the micro subject of economic development and environmental protection, the green transformation of enterprises is not only an effective starting point for a country to promote the green transformation of economy, but also an important object of concern for formulating green economic policies (Dechezleprêtre et al., 2019). Therefore, in order to realize the green transformation of China’s economy, it is necessary to promote the green transformation of enterprises, which is the difficulty and the key.

However, at present, there are two main problems in the green transformation of enterprises. First, insufficient motivation. Economic theory holds that the only purpose pursued by enterprises is to maximize profits. As the main body for profit, enterprises generally believe that environmental protection investment will crowd out productive investment, and thus lack the willingness to take the initiative to invest in environmental protection (Tang et al., 2013). The existing literature has studied on the basis of institutional theory, legitimacy theory, and deterrent theory, and found that environmental supervision (Zhai and An, 2020), compulsory social responsibility disclosure (Wang and Ning, 2020), energy-saving consumption incentive policy (Lei and Sun, 2021) and tax policy (Wu and Li, 2022) are the crucial paths to drive enterprises’ green transformation, that is, to solve the problem of insufficient motivation. Second, insufficient ability. In the green transformation and development of enterprises, there is a lack of technology and talent support, which leads to problems such as difficulty in identifying environmental problems, asymmetric information, and insufficient basis for strategic decision-making. Most scholars think that innovative R&D is the crucial factor in promoting enterprise transformation from the perspective of innovation (Zhai and An, 2020; Wang, 2021), that is, the problem of insufficient green transformation ability can be alleviated by improving innovation ability. Under the background of the accelerated development of the digital economy, a few scholars began to pay attention to the relationship between digitalization and green development. Li J. et al. (2021) concluded that big data strategic planning and analysis ability has significant positive effects on enterprises’ green competitiveness. Song et al. (2022) conducted research using the text analysis method, and found that enterprise digitalization can significantly promote green technology innovation. Ke et al. (2022) found that information and communications technology positively contributes to reducing carbon dioxide emissions. However, few literatures extend the research to green transformation and discuss the influence of digitalization on green transformation of enterprises. In fact, enterprises’ digitalization can help them improve efficiency, save resources and achieve low-carbon development goals while pursuing profits; On the other hand, it can realize the informatization of enterprises’ green behavior and provide data support for their scientific decision-making, that is, digitalization can solve the problem of insufficient green transformation ability of enterprises to a certain extent. So, can digitalization become a new engine and new driving force to promote green transformation of enterprises? Furthermore, how does it promote “transformation”? This paper will carry out in-depth research on these issues.

In order to discuss the relationship between digitalization and green transformation of enterprises, this paper takes the listed companies in Shanghai and Shenzhen A-shares from 2011 to 2020 as the research object and analyzes the influence of digitalization on green transformation of enterprises using text analysis and principal component analysis. The heterogeneity analysis is carried out from four aspects: pollution degree, region, listing board, and digital speed. Further, this paper examines the intermediary role of dynamic capability. The possible contributions of this paper are as follows: At the theoretical level, this paper constructs a micro-level comprehensive index of green transformation to discuss the impact of digitalization on green transformation. We found that digitalization inhibits green transformation when the “risk effect” of digitalization is greater than the “benefit effect.” When the “benefit effect” of digitization is dominant, digitization will have a promoting effect on the green transformation of enterprises. Different from most previous literature, this paper reveals the advantages and disadvantages of digitalization at the same time and innovatively adds the quadratic term of enterprise digitalization to the model to verify the complex linear relationship between digitalization and green transformation. Secondly, this paper studies the mechanism of digitalization and green transformation of enterprises with dynamic capability as the intermediary. A feasible path for digital influence on green transformation is proposed, deepening the relevant theories of green transformation and upgrading of enterprises. Finally, we discuss digitalization’s impact on enterprises’ green transformation under different pollution levels, regions, listing board, and digital speed. It provides an empirical basis for the green transformation and upgrading of different types of enterprises. At the practical level, this study is helpful for enterprises and governments to re-examine the non-economic performance of digitalization. Secondly, this study helps understand the feasible mode of Chinese enterprises’ green transformation under the new normal and the vital role of digitalization in enterprises’ green transformation. At the same time, it provides a valuable reference for developing countries, especially those with serious environmental problems, to digitally drive green transformation at the micro-level.

2 Literature review

2.1 Research on enterprise digitalization

With the rapid development of digital economy recent years, many scholars began to carry out research from the perspective of informatization and digitalization. On the one hand, scholars have focused on how to distinguish enterprises’ digital transformation strategies, so as to provide effective transformation paths for different types of enterprises (Matt et al., 2015; Sebastian et al., 2017; Wang and Wang, 2021). On the other hand, many scholars pay more attention to the impact of digital transformation on enterprises, and draw some meaningful conclusions. First, research on the impact of digital transformation on the internationalization of enterprises, which includes the influence of digitalization on corporate export behavior (Pergelova et al., 2019), firms’ willingness to internationalize (Teruel et al., 2021), and firms’ degree of internationalization (Adomako et al., 2021). Second, research on digitization and innovation, which includes the influence of digitization on innovation factor mismatch (Wang H. et al., 2022) and business model innovation (Yi et al., 2021). Third, research on digitization and green behavior. For example, Fan et al. (2021) found an inverted U-shaped relationship between digitization level and green agricultural development based on inter-provincial panel data. Pang et al. (2021) found that digitalization has a “multiplier” effect and can significantly improve the performance of environmental management based on inter-provincial panel data. At the micro-level, Wang F. et al. (2022), taking A-share listed companies as a sample, found that there is a significant inverted U-shape effect of regional digitization level on green technology innovation of resource-based enterprises. Wang et al. (2020) took industrial listed companies as an example and found that financial digitization promoted the development of green finance. At last, other scholars pay attention to the value created by digitalization for enterprises (Huang et al., 2021; Tan et al., 2022). However (Xiao et al., 2021), holds that in addition to financial value, the value creation effect of enterprise digitalization should also be reflected in non-economic value such as environmental value, which points out the direction for the in-depth study of the impact of digitalization on the green transformation of enterprises.

2.2 Research on green transformation of enterprises

The influencing factors of enterprise green transformation have always been the focus of scholars (Chaiyapa et al., 2018; Ren and Sun, 2020; Ren et al., 2021). Among them, Guo and Zhang (2021) believe that the unique dynamic capability or innovation efficiency of enterprises is an important driving force affecting the green transformation of enterprises, and heterogeneous characteristics such as executives’ environmental protection experience are also indispensable elements of internal governance for enterprises’ green transformation (Bi et al., 2019; Sun and Ren, 2020). Yu et al. (2019b) believed that as a unique governance body of Chinese enterprises, Party organizations can play a very important and positive role in the green transformation of enterprises. Scholars also believe that in addition to the enterprise’s own dynamic capabilities or governance ability, incentive policies, including tax incentives (Yu et al., 2019c; Huang, 2022; Wu and Li, 2022) and energy-saving consumption incentives (Lei and Sun, 2021), are also essential in order to promote the green transformation of enterprises. The improvement of external regulatory mechanisms such as environmental regulation (Gong et al., 2020), social responsibility disclosure (Wang and Ning, 2020), environmental law enforcement supervision (Yu et al., 2019a) can also effectively constrain the behavior of enterprises and promote them to thoroughly implement the concept of green management. Considering that green transformation cannot be separated from a large number of new investments, strengthening green financial support (Chen et al., 2021) can effectively increase enterprise financial support, reduce financing costs, and finally effectively promote enterprise green transformation.

In addition to the research on influencing factors, other scholars believe that the evaluation and measurement of the green transformation is also the focus that the academia should pay attention to. These studies mainly includes four aspects: First, from the contribution perspective, the contribution of green total factor productivity to economic growth, the share of high environmental efficiency industries, etc., is often seen as a measure of the transformation of the development mode (Fu and He, 2021). Second, from the decoupling perspective, when the intensity of environmental pressure and resource consumption is slower than the industrial growth rate, it means that the industry has achieved green transformation and upgrading (Lu et al., 2013). Third, from the perspective of total factor productivity, the degree of transformation is calculated by constructing an efficiency model containing unexpected outputs, which is regarded as the level of the green transformation (Fu and He, 2021). Fourth, from a systemic perspective, the interaction between the scale, structure and efficiency of industry and its environment is the necessary foundation for realizing green transformation. The degree of green transformation can be comprehensively evaluated by constructing an index system. In order to evaluate and measure the macro-level green transformation, many academics are currently using the directional function DDF (directional distance function), the non-radial SBM (Slack Based Model), and the environment RAM (Range Adjusted Measure) model of DEA (Data envelopment analysis) method. However, in terms of micro-level measurement of green transformation, because the Chinese government has not given specific requirements for enterprises to publicly disclose environmental information, and enterprises have a great choice in disclosure content, disclosure form, and disclosure quality (Kong et al., 2021), green productivity and green patent are usually used to approximate the green transformation of enterprises, and the samples are often limited to industrial enterprises. Considering the shortcomings of these methods, Kong et al. (2021) constructs a comprehensive index of enterprise green transformation by selecting indicators from seven dimensions, which is more scientific and reasonable to unify environmental liabilities and environmental performance in one framework.

3 Theoretical analysis and research hypothesis

The information industry, represented by 5G, big data, artificial intelligence, and the Internet of Things, continues to integrate deeply with all aspects of enterprise development. The digital economy, as an advanced form of economic and social development, plays a vital role in adjusting enterprise development strategies, changes in human resources structure, knowledge of technological innovation, and green governance.

According to environmental adaptation theory, drastic changes in the external environment inevitably require enterprises to respond timely. Currently, enterprises are in a brand-new external environment, that is, digital development. However, at present, Chinese enterprises still face problems such as over-reliance on resources, low technology level, and weak innovation foundation, which determines that they must quickly integrate into the new environment to obtain external factors related to the survival and development of the enterprises (Wang F. et al., 2022). Digitalization, as a kind of resource input or even innovation activity, is bound to face certain market risks (Xiao et al., 2021). In the short term, enterprises implementing digitalization need to increase investment in machine learning, and the employment of highly skilled personnel, etc., which would cost a large number of funds, incur high learning costs (Yu et al., 2017), and derive high management costs (Qi and Cai, 2020). Additional investment and cost would crowd out R&D innovation and environmental protection investment to a certain extent (Liu et al., 2022), exerting bad influence on the renewal of environmental protection equipment and the use of environmental materials, which negatively affects corporate efficiency and green governance. Moreover, acquiring knowledge and technology does not happen overnight and depends to some extent on its absorptive capacity. Thus, the early investment in enterprise digitalization may not necessarily produce rapid and significant returns. That is to say, enterprise digitalization would exert bad influence to green transformation due to cost and risk reasons.

However, for the growth and survival of enterprises themselves, digital transformation can bring them lasting vitality. Firstly, from the perspective of economic performance improvement, the unique rhythm and operation track of digital technology will enable enterprises to carry out innovative transformation behavior, and then bring improvement to economic performance (Chen et al., 2019). And the increase in performance can make companies increase their investment in social responsibility and prompt them to engage in green governance. Secondly, from the perspective of environmental performance improvement, on the one hand, digitalization has the potential to improve environmental performance. By using appropriate detection, visualization, and analysis techniques, the energy consumption and pollution in the process of product manufacturing can be effectively reduced (Belhadi et al., 2020), changing from end-management to source-management. On the other hand, digitalization can effectively improve the intelligence of enterprises and promote enterprises to allocate resources efficiently. It can also make the enterprise management more refined, and then optimize the production process, improve the production process and improve the pollution control technology and pollution treatment capacity, so as to reduce the pollution emissions in the production process and help the enterprise realize the green transformation. Thirdly, from the perspective of business model updating, digitalization helps enterprises break the inherent path dependence or traditional business model. For example, we can rely on the operating system in the digital platform to improve work efficiency, and use the e-commerce platform to expand business channels. Through the analysis of consumer behavior data, consumers’ preferences can be known, thus providing conditions for accurately pushing enterprise products information and realizing accurate push and green marketing. In addition, with the support of data value chain and flexible manufacturing system, enterprises can increase the proportion of product customization, reduce delivery cost, reduce inventory and waste, and realize the leap from service-oriented transformation to green transformation (Li and Wang, 2020). Fourthly, from the perspective of information and knowledge acquisition, digitalization can enable enterprises to obtain a large amount of external information and knowledge, significantly improve their information processing capabilities, and promote the flow and sharing of information and knowledge within enterprises (Shen and Yuan, 2020), making the communication and collaboration between enterprises more environmentally friendly. In addition, digitalization also increases the knowledge reserve of green technology innovation of enterprises and promotes green innovation of enterprises. Fifthly, from the perspective of environmental problem identification, enterprises of digitalization can quickly identify their own environmental problems through digital intelligent technology. For example, we can use intelligent algorithms, big data and other technical means to calculate all links of enterprise management, and find a feasible path that takes into account economic development and green governance. That is to say, enterprise digitalization would do good to green transformation due to above benefits it bring to enterprises.

The above analysis shows that enterprise digitalization has both risk and benefit effects on green transformation of enterprises. When the former dominates, it inhibits the green transformation of enterprises due to crowding out resources beneficial to green governance. However, when the latter dominates, it will benefit enterprise green transformation due to the ability to improve economic performance and environmental performance, update business models, improve the efficiency of information and knowledge acquisition, and better identify ecological issues. Generally, because digitalization takes a certain time to produce benefits, the risk effect will be greater than the benefit effect in the early stage of digitalization. As time goes on, the effect of knowledge accumulation and resource integration will gradually appear, and the benefit effect will gradually exceed the risk effect.

Based on the above analysis, hypothesis H1 can be put forward: Digitalization has the effect of inhibiting and then increasing enterprises’ green transformation, i.e., the relationship between the two is U-shaped.

4 Research design

4.1 Sample and data sources

China is the most populous developing country in the world. Its economy is developing rapidly but its environmental problems are serious to some extent, which is typical in developing countries. Thus, this paper takes China’s enterprises listed in Shanghai and Shenzhen A-shares from 2011 to 2020 as the research samples. ST, *ST, PT, and enterprises with missing data are excluded; financial and insurance companies are excluded, and sample data before listing are excluded. The data sources are mainly CSMAR, WIND, and CCER databases. In addition, referring to practice of Song et al. (2018), we obtained the annual reports of enterprises from the Cninfo Information Website. We crawled digital keywords through Python to build the digital transformation index of enterprises. Finally, we obtained 1922 enterprises with 10,024 observations.

4.2 Research model

To empirically examine the impact of enterprise digitalization on green transformation, this paper develops the following model:

Given the possible non-linear relationship between enterprise digitalization and green transformation, this paper draws lessons from the model construction of Chen and Tian (2021) and further adds the squared term of digitalization to Model 1 to establish the Model 2:

4.3 Variable selection

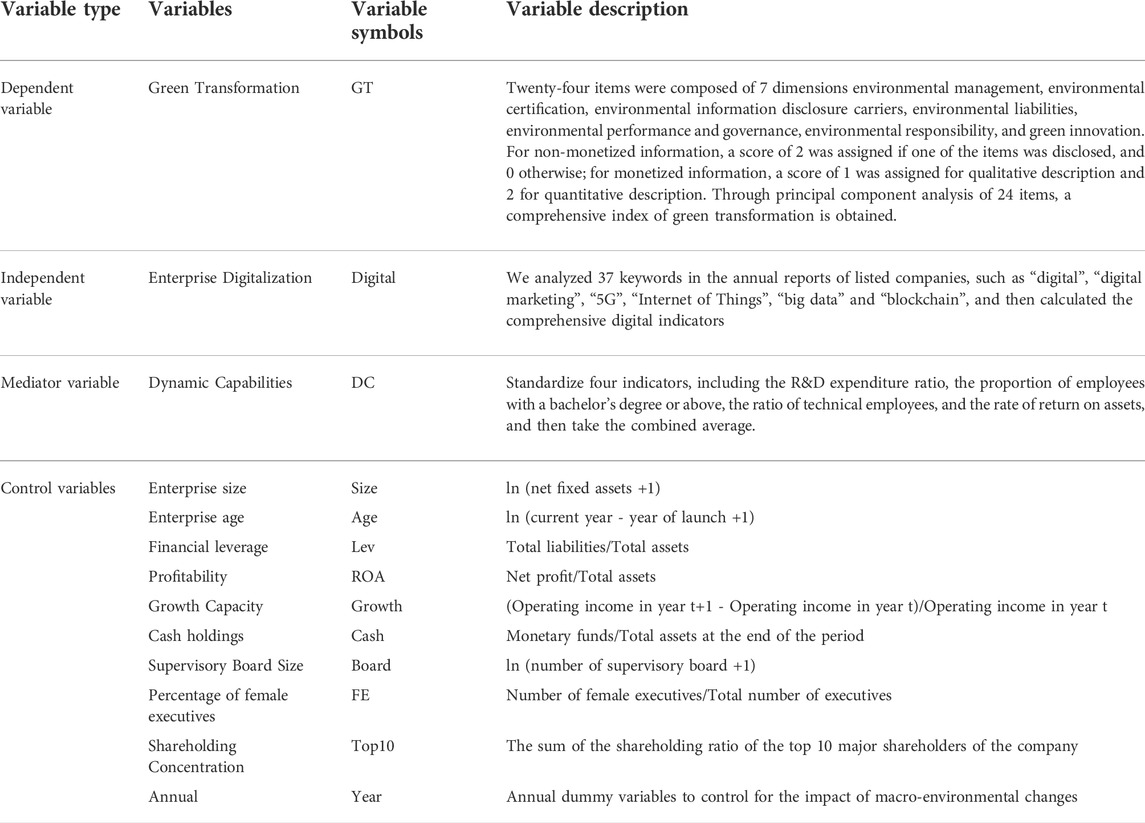

4.3.1 Dependent variable: Green transformation

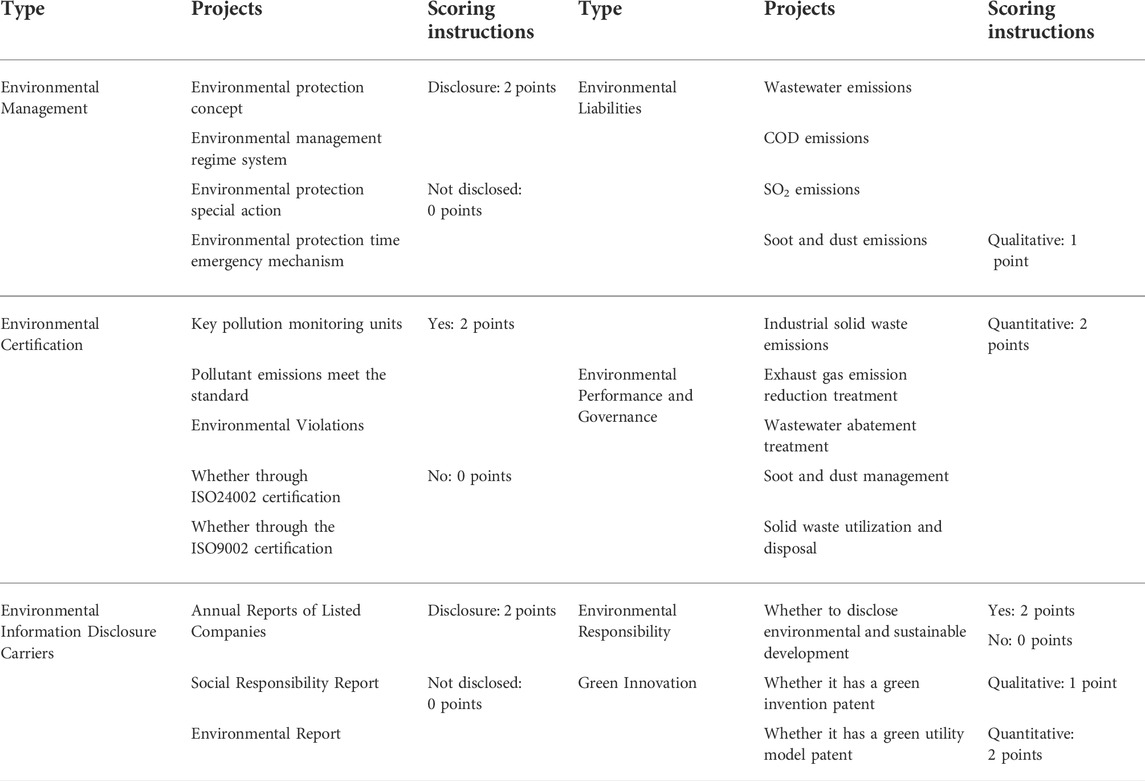

Drawing on the experience of Kong et al. (2021), this paper constructs an index system to measure the green transformation of listed companies from seven dimensions: environmental management, environmental certification, environmental information disclosure carrier, environmental liabilities, environmental performance and governance, environmental responsibility, and green innovation, as shown in Table 1. Firstly, the principal component analysis was conducted on the seven dimensions, and 24 items with a uniqueness of less than 0.55 were screened out from 33 items; secondly, KMO and Bartlett tests are carried out to test its effectiveness: if the KMO value is more significant than 0.8, it means high effectiveness; If the value is between 0.6 and 0.8, the validity can be accepted; If the value is less than 0.6, the effectiveness is poor (Li B. et al., 2021). If the significance level of the Bartlett test of sphericity less than 0.05, the original hypothesis would be rejected, indicating that the principal component analysis model is well constructed as a whole (Huo and Liu, 2017). The KMO value of the comprehensive index of green transformation in this paper is 0.87, which is greater than 0.6, and the p-value of Bartlett’s spherical test is 0.00, which indicates that the index construction method is reasonable. Finally, the comprehensive index of green transformation is obtained through the calculated factor scores.

4.3.2 Independent variable:Enterprise digitalization

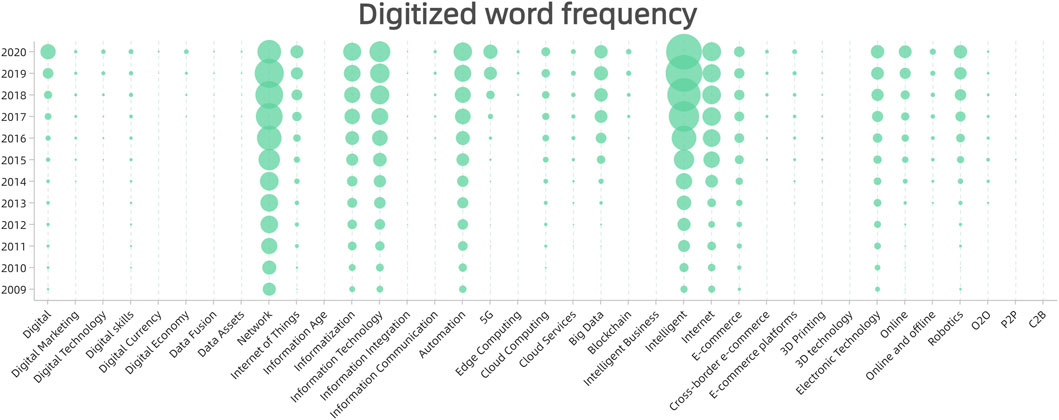

In this paper, the steps to construct the degree of digitization are as follows: first, we use the “word list method” to filter specific texts to construct a digitization word list, including “digital,” “digital marketing,” “5G,” “Internet of Things,” “big data” and “blockchain,” etc. Secondly, Python is used to crawl the annual reports of listed companies on the Cninfo Information Website. The jieba word splitting tool is used to split the text and eliminate the deactivated words to take the frequency of the keywords in the digitized word list in the annual reports. Finally, the 37 keywords with a uniqueness of less than 0.55 were filtered by principal component analysis, and the comprehensive index of enterprise digitalization was calculated. Figure 1 shows the word frequency graph of enterprise digitization. During the sample period, the higher frequency of words appearing in the annual reports of listed companies is intelligence, network, information technology, and the Internet. Over the years, the digital word frequency has been on the rise. It shows that China’s listed companies have paid more attention to all-around digitalization in recent years instead of just staying in conventional technologies such as network and information technology.

4.3.3 Mediator variable: Dynamic capacity

Drawing on the measurement method of Zhao et al. (2012), this paper measures the dynamic capabilities of enterprises in the following four dimensions. (1) The R&D expenditure ratio, this indicator reflects enterprises’ importance to knowledge and innovation. It is an important way to form dynamic capability, which is measured by the ratio of R&D expenditure to total assets of enterprises (Zhao et al., 2012). (2) The proportion of employees with a bachelor’s degree or above, this indicator reflects the quality of the company’s employees to a certain extent and has an essential impact on the company’s ability to perceive, acquire and reconstruct, and is measured using the proportion of employees with bachelor’s degree or above to the total number of employees. (3) The ratio of technical employees, which to some extent reflects the core competitiveness of the enterprise, is measured using the proportion of technical employees to total employees. (4) The return on assets, which reflects the firm’s resource utilization and management level and highlights the firm’s ability to integrate and allocate resources, is measured using the sum of total profits and financial expenses divided by the average total assets. Finally, the score table of the four dimensions is transformed, the mean value is taken, and the score is positively correlated with the dynamic ability of the enterprise.

4.3.4 Control variables

In order to avoid missing variables that may cause errors in the regression results of the model, this paper sets control variables at the company and governance levels. Table 2 shows the definition of each variable.

At the firm level, firm size, age, financial leverage, growth capacity, and cash holdings are selected to control. (1) Enterprise size. The larger an enterprise is, the more attention it receives and the more media reports it (Stanny and Ely, 2008), which leads it to pay more attention to environmental protection. Therefore, the scale may affect the preference of enterprises for green transformation. (2) Age of the enterprise. Generally speaking, the capital and technology accumulated by the long-term operation of enterprises provide technology and capability guarantees for the success of clean technology innovation of enterprises (Dong et al., 2021), which may affect the green transformation of enterprises. (3) Financial leverage. Financial leverage represents an enterprise’s ability to repay debt. Enterprises with high financial leverage are more inclined to disclose carbon emission information, especially the details of the increase in corporate debt caused by the reduction of carbon emissions (Ferguson et al., 2002). (4) Profitability. Enterprises with higher profitability are more inclined to disclose their emission information (Belkaoui, 1976), and green information disclosure is an essential basis for judging the green transformation of enterprises. Therefore, it is controlled. (5) Growth ability. Companies with high growth ability are better able to achieve corporate social responsibility (Ben-Amar et al., 2017), thus promoting the green transformation of enterprises. (6) Cash holdings. We believe that cash holdings may affect the green innovation ability of enterprises and thus the level of green governance of enterprises.

At the governance level, the size of the supervisory board, the percentage of female executives, and shareholding concentration are selected to control. (1) The size of the board of supervisors. Corporate management and supervisory board members, as the core of management, supervision and providing information and advisory services to the company, may influence corporate green transition decisions (Bi et al., 2019), and we control it. (2) The proportion of female executives. We believe that female executives may be more conservative in strategic decision-making and corporate governance, thus affecting the effectiveness of green transformation. (3) Shareholding concentration. Too much equity concentration may be detrimental to developing enterprises’ green innovation capability (Wang F. et al., 2022), so we control it.

5 Empirical results

5.1 Descriptive statistics

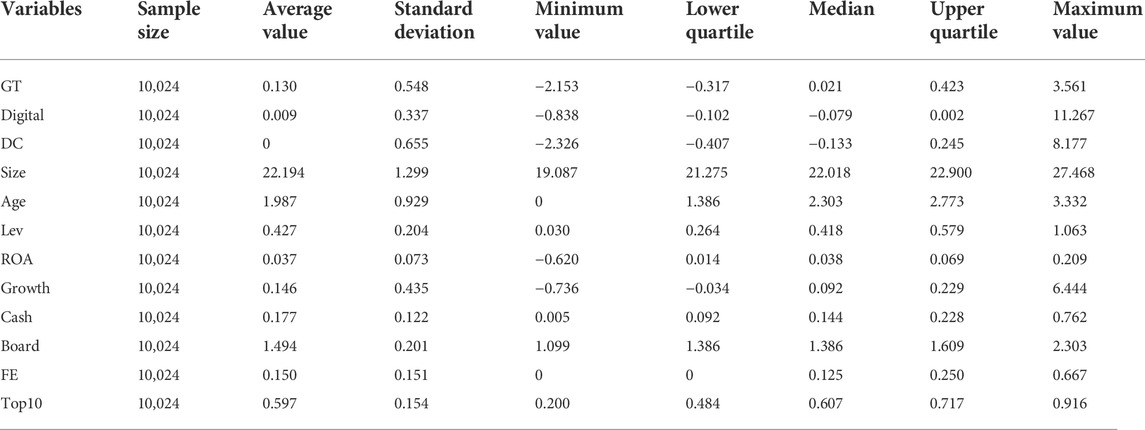

Table 3 shows the results of descriptive statistical analysis of the variables. Among them, the mean value of green transformation (GT) is 0.130, the minimum value is −2.153, the maximum value is 3.561, and the median value is 0.021, which indicates the effectiveness of the current green transformation of each listed company in China varies greatly. The overall degree of green transformation needs to be strengthened. The mean, minimum and maximum values of enterprise digitalization (Digital) are 0.009, −0.838, and 11.267 in order, which also shows that the digitalization level of each listed company and its subsidiaries varies greatly. Other control variables show significant differences in different listed companies, reflecting a good sample distribution.

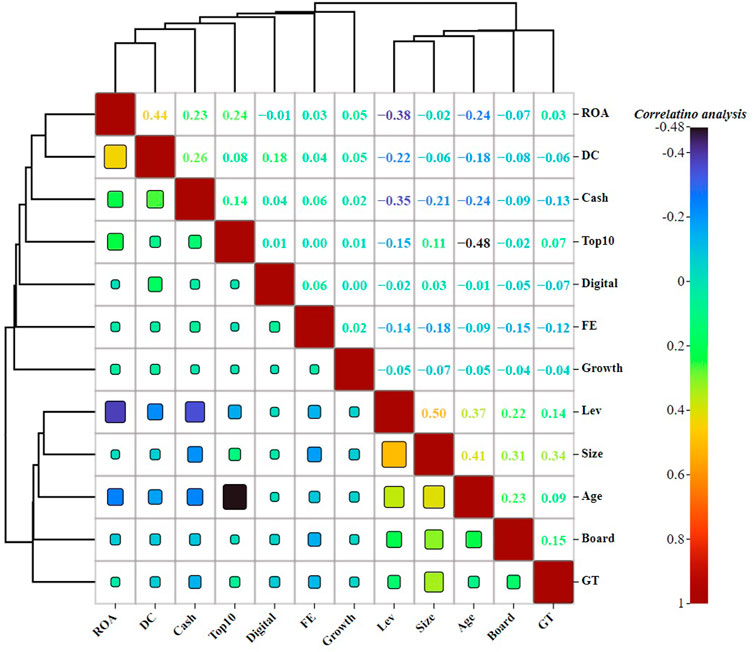

5.2 Correlation analysis

The correlation coefficient matrix is visualized in this paper, and Figure 2 shows the correlation clustering heat map. The higher the correlation in the heat map, the closer the color of the heat point is to dark red. First, the explanatory variables show some correlations among themselves, and the correlations among certain variables are also more significant. For example, enterprise age (Age) has a strong negative correlation with ownership concentration (Top10), and enterprise size (Size) has a strong positive correlation with financial leverage, with correlation coefficients of −0.48 and 0.50, respectively. However, the correlation coefficients of all variables do not exceed 0.6, indicating that the selected variables do not form a multicollinearity problem. Secondly, Digital and Green Transformation show a negative correlation, which means that the digitalization of enterprises may show a weak inhibitory effect on Green Transformation. Further, it is shown that there may be a simple linear relationship between the two. In terms of control variables, enterprise size (Size), age (Age), financial leverage (Lev), profitability (ROA), supervisory board size (Board), and Shareholding concentration (Top10) are all positively correlated with green transformation. It is also important to note that we cluster all indicators, which are broadly divided into two categories as shown by the figure, and these indicators have a relatively consistent trend and good correlation across all firms.

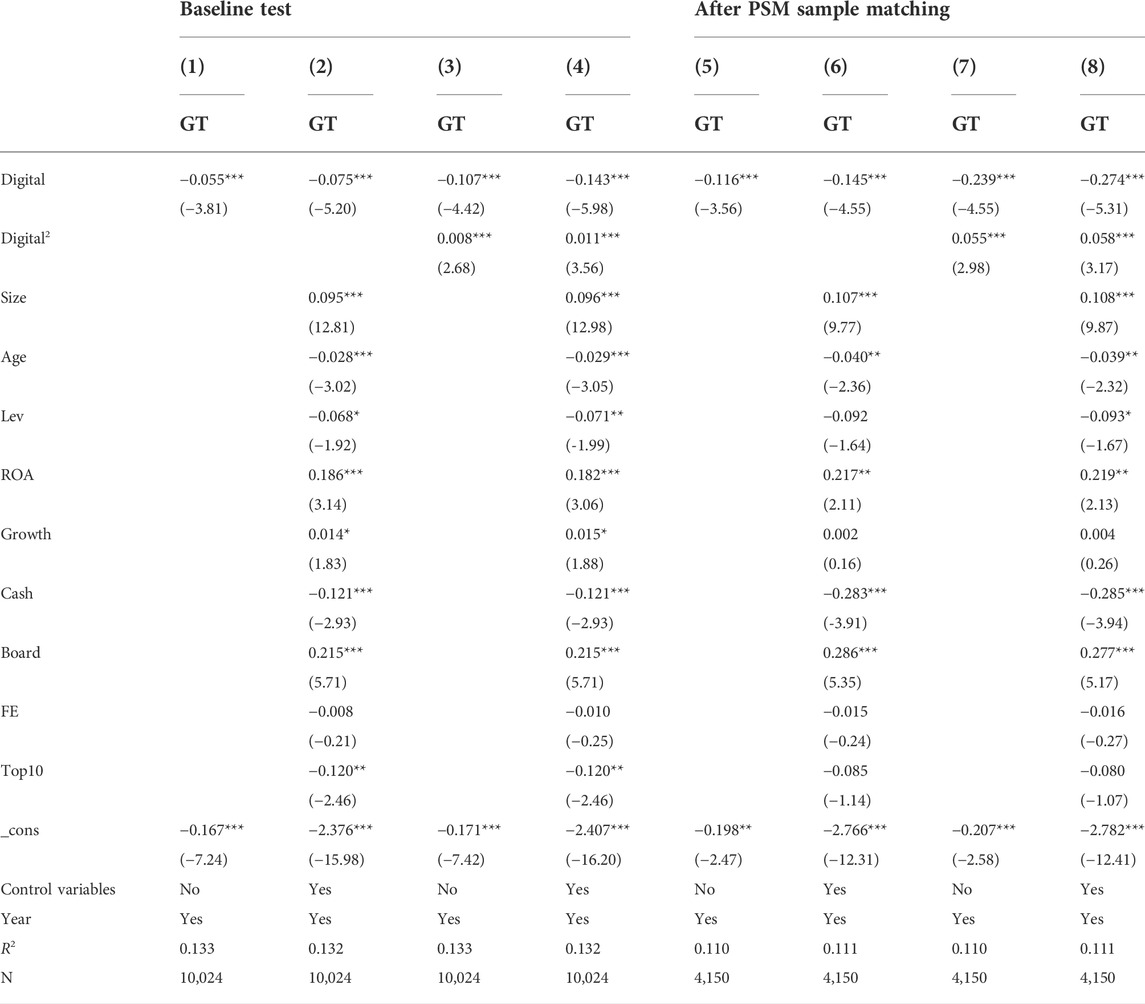

5.3 Baseline regression results

Table 4 shows the regression analysis results of enterprise digitalization on green transformation. Columns (1) (2) are tests of the linear relationship between digitization and green transformation, i.e., Model 1. Regardless of the inclusion of control variables, enterprise digitization has a significant inhibitory effect on green transformation, with significantly negative coefficients at the 1% level. To investigate whether there is a non-linear relationship between the two (i.e., Model 2), columns (3) and (4) show that the coefficient of the primary term is still significantly negative and the coefficient of the second term is significantly positive after adding the squared term of digitalization. It shows that the impact of enterprise digitalization on green transformation is a “U” relationship, which proves hypothesis H1. To some extent, it shows that the digitalization of enterprises needs to reach a certain stage in order to play active role in helping enterprises to make green transformations.

In terms of control variables, firm size (Size), profitability (ROA), and supervisory board size (Board) are significantly and positively associated with enterprise green transformation in columns (1)–(8). It indicates that the larger the overall size, supervisory board size, and higher profitability, the higher the level of green transformation in enterprise. This may be since large enterprises have more good resource advantages and more robust profitability than small enterprises. At the same time, the supervisory board directly influences the management and decision-making of enterprises, which in turn affects the scale of green investment in enterprises. It ultimately has a significant positive effect on the green transformation of enterprises. In contrast, corporate age (Age) and cash holdings (Cash) are significantly and negatively related to corporate green transformation in columns (1)–(8), indicating that the level of green transformation is lower in companies with higher age and higher cash holdings. This may be because older firms have relatively solidified internal management and do not pay enough attention to green. Despite having higher cash holdings, they do not invest enough in green governance, leading to their lower level of green transformation.

For robustness reasons, this paper also performs Propensity score matching (PSM) of the samples year by year to alleviate the sample selection problem. Columns (5)–(8) show the regression results after PSM sample matching, which are consistent with the trend of the benchmark test. Again, hypothesis H1 is proved.

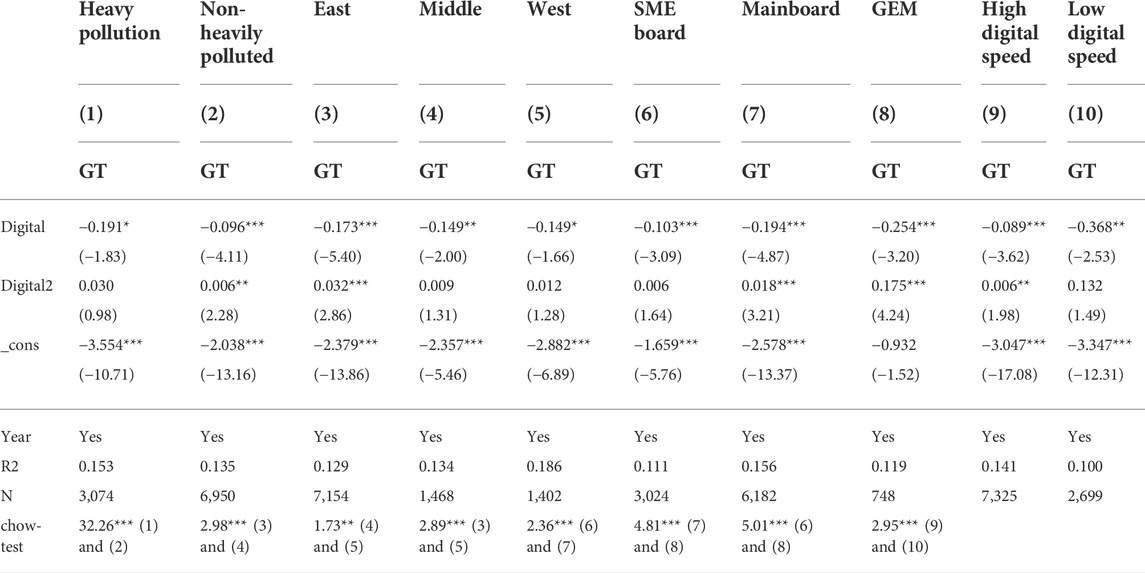

5.4 Heterogeneity test

In order to investigate the asymmetric impact of digitalization on the effect of green transformation at the individual level, this paper explores the impact of digitalization on different types of enterprises by examining heterogeneity in four aspects: pollution level, regional distribution, listed board category, and speed of digitalization.

5.4.1 Differences in the degree of pollution

The implementation of enterprise digitalization needs to consider the differentiated results resulting from different situations within each enterprise. The degree of pollution emission varies significantly from industry to industry due to differences in the process flow, product attributes, and environmental requirements. Heavy polluting industries are often characterized by high pollution, high energy consumption, and high emissions compared with other industries. The listed companies in this industry are more subject to control and supervision by the state and the public. According to the “List of Listed Companies’ Environmental Verification Industry Classification and Management” (Environmental Protection Office Letter [2008] No. 373) and “Guide to Environmental Information Disclosure for Listed Companies” (2020): 16 categories of industries, such as thermal power, iron, and steel, cement, electrolytic aluminum, coal, metallurgy, chemical, petrochemical, building materials, paper, brewing, pharmaceutical, fermentation, textile, tannery, and mining are heavy polluting industries. In this paper, we refer to the study of Tang et al. (2013) and combine the China Securities Regulatory Commission industry classification (2012) to define the corresponding enterprises as the sample of heavy polluters.

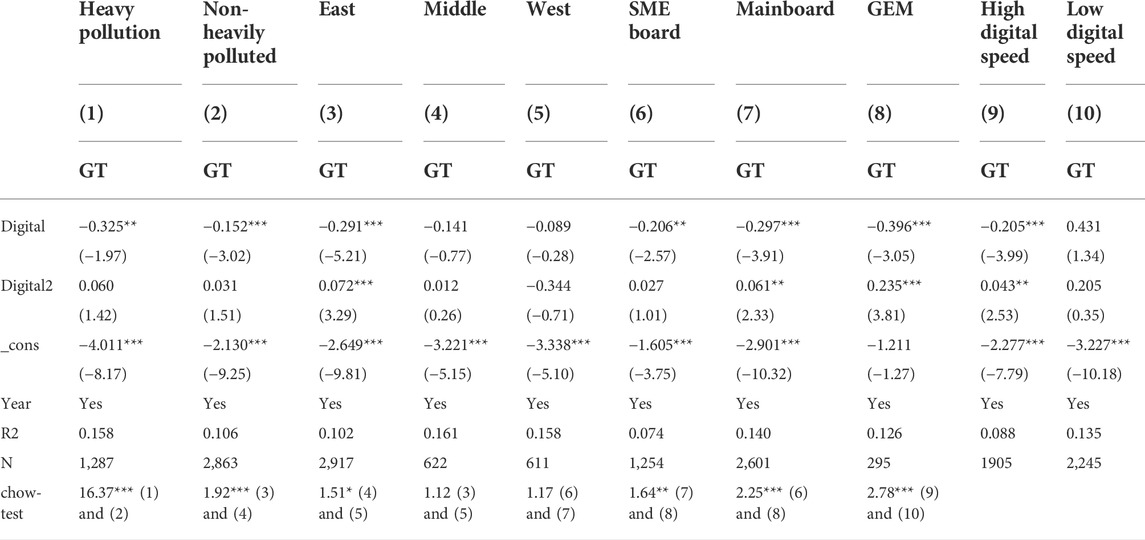

Columns (1) (2) of Table 5 show the regression analysis results for the heavily polluting and non-heavily polluting firms. The regression results show that the squared digital term (Digital2) is significantly positive at the 5% level for the non-heavily polluting firms in column (2). At the same time, Digital2 is not significant for the heavily polluting firms. It indicates that digitalization’s U-shape effect on green transformation only holds in non-heavily polluting firms.

5.4.2 The impact of geographical distribution

China has a diverse regional economic model, and the specificity of the regional economy is more prominent due to the national industrial layout (Kong et al., 2021). Accordingly, the geographical distribution may significantly impact the level of economic development, which affects the digital transformation of enterprises and its effect. In this paper, the country is divided into three regions, namely, the eastern, central, and western regions (only A-share listed companies are considered), based on the differences in geographic location and economic development levels. The specific classification details are as follows: The Eastern region includes Liaoning, Beijing, Tianjin, Shanghai, Shandong, Hebei, Jiangsu, Zhejiang, Fujian, Guangdong, Guangxi, and Hainan, totaling 12 provinces; The Western region includes Chongqing, Sichuan, Yunnan, Guizhou, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang, totaling ten provinces; The Central region includes Heilongjiang, Jilin, Shanxi Inner Mongolia, Anhui, Henan, Hubei, Hunan, Jiangxi, a total of nine provinces.

Columns (3)–(5) of Table 5 show the regression analysis results of the association between digitalization and green transformation of enterprises in different regions. In column (3), the coefficient of the squared term of digitalization (Digital2) for enterprises in the central-eastern region is 0.032 and significant at the 1% level. In contrast, the corresponding Digital2 for enterprises in the central and western regions is not significant. Further, the chow test shows that the differences in the estimated coefficients between regions are significant, indicating that the company’s region strongly influences the relationship between digitalization and green transformation.

5.4.3 Impact of different listing boards

According to the previous baseline regression, firm size significantly positively affects green transformation. This section will further test the association between digitalization and green transformation by sub-sample from the category of listed boards. China has built a multi-level stock market, which mainly includes the main-board market, the SME board market, and the GEM board market. Drawing on the study of Liu (2020), this paper approximates the mainboard market as the main venue for listing large firms, the SME board as the main venue for listing SMEs, and the GEM as the main venue for listing high-tech SMEs based on the characteristics of different stock markets.

Columns (6)–(8) of Table 5 show the regression analysis results of the association between digitalization and green transformation under different listed boards. It can be seen that the regression coefficients of digitalization square term (Digital2) of enterprises in the main-board and GEM samples in columns (7) (8) are 0.018 and 0.175, respectively, both of which are significant at the 1% level. In contrast, the coefficient of Digital2 is not significant in the SME board sample, but the coefficient of the primary term is −0.103, which is significantly negative at the 1% level. This suggests that the digitalization of SMEs inhibits their green transformation.

5.4.4 Impact of digital speed differences

In fact, the speed of digitization will affect enterprises’ access to the knowledge and information needed for the green transformation. Rapid digitization can help companies acquire, develop and exploit strategic resources such as new technologies, knowledge, brands, and marketing channels in the international markets (Dunning, 1994), thus enhancing their green innovation capabilities and market competitiveness. Considering that the speed of digitization may affect the correlation between the degree of digitization and green transformation of enterprises, we divide the digitization speed by the annual industry median in this part. Digitization speed is the number of digitized words in the current year minus the number of digitized words in the previous year after taking the logarithm. If the digitization speed of a company is higher than the annual industry median, it is in the high digitization speed group; otherwise, it is in the low digitization speed group.

Columns (9)–(10) of Table 5 show the regression results of the association between digitization and green transformation of firms at different digitization speeds. In column (9), the digital squared term (Digital2) coefficient for high digital speed firms is 0.006 and significant at the 5% level, while the coefficient of Digital2 for low digital speed firms is not significant. It indicates that the U-shape effect of digitalization on green transformation only holds in high digital speed firms.

5.5 Robustness test

5.5.1 PSM method

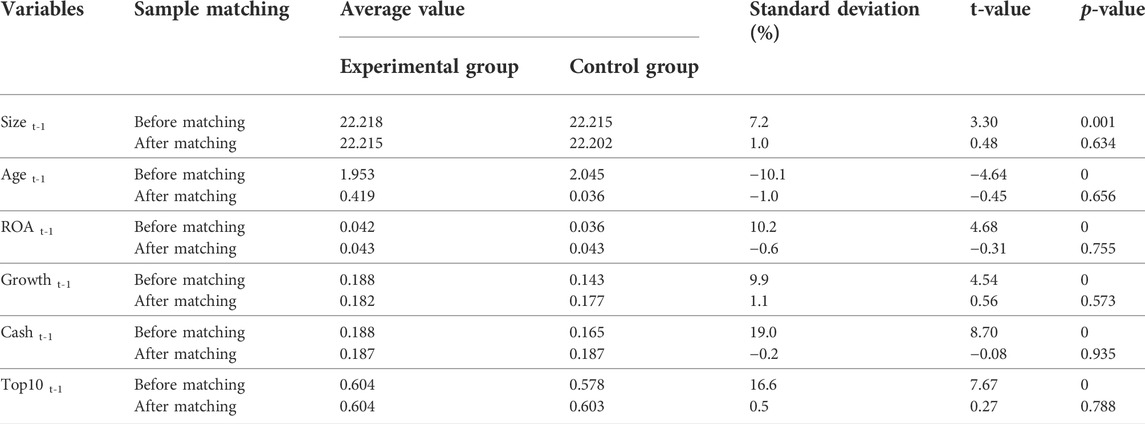

We adopt the PSM method for robustness testing, considering the sample selection bias problem. In this paper, Xie et al. (2021) test is used for reference, and phase-by-phase matching is adopted to alleviate the “time mismatch” problem in traditional PSM matching. We take the digital degree of our enterprise as the median. If the sample is greater than the median, take 1 (that is, the treatment group); otherwise, it is 0 (that is, the control group). The variables of firm size (Size), firm age (Age), and other variables in the previous year were used as covariates to calculate the propensity score, followed by 1:1 nearest neighbor matching, as shown in Table 6. The result meets PSM’s “balance hypothesis.” Figure 3 shows the kernel density function before and after matching. The kernel density functions of the two groups of companies matched by PSM year by year almost overlap. There is no significant difference, so the matching effect is more satisfactory. In this way, the estimation bias caused by the “self-selection problem” of the sample can be better resolved.

Columns (5)–(8) of Table 4 provide robustness validation of the baseline test. Table 7 (1)–(10) reports the regression results of the heterogeneity test after the PSM matched sample, which supports the regression results and corresponding conclusions in Table 5 in terms of regional heterogeneity, listing board heterogeneity, and digitization speed heterogeneity. However, in terms of pollution degree heterogeneity, the digitization of non-heavily polluting firms does not have a non-linear U-shaped relationship with green transformation. The reason is to ensure the accuracy of PSM matching, a 1:1 matching ratio was used in this paper, and the 5,874 unsuccessful matched samples were eliminated. However, the sharp reduction of samples may make the regression results not sufficiently representative of non-heavily polluting enterprises.

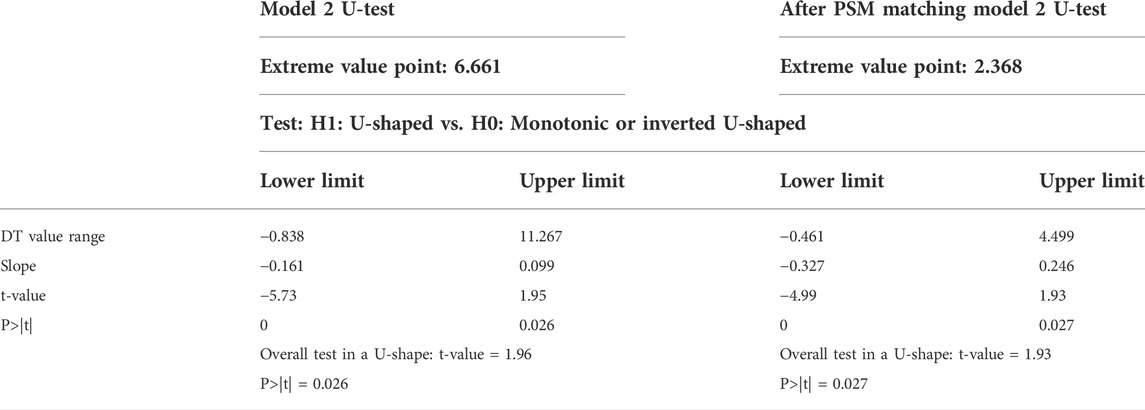

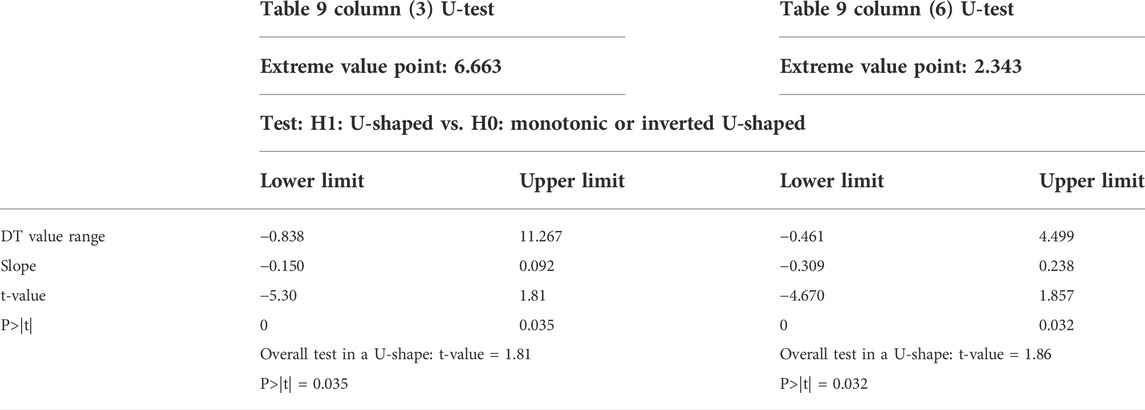

5.5.2 U-test: Digital transformation

Lind and Mehlum (2010) argue that it is too weak to determine the existence of a U-shaped relationship by only putting the squared terms of the explanatory variables in the model and observing whether the coefficients are significant or not. This section draws on Lind and Mehlum (2010), we test whether the U-shaped relationship between Digital and Green Transformation (GT) in Model 2 is true or not. As shown in Table 8, both the baseline test and the test after matching the samples by PSM method, the calculated extreme value points are within the range of Digital, and the original hypothesis is rejected at the 5% statistical level. At the same time, the slope of the test results has a different sign in two intervals, so this paper believes that the U-type relationship between enterprise digitalization and green transformation passes the U-test, and the regression results are reliable which again proves the hypothesis H1.

6 Further analysis

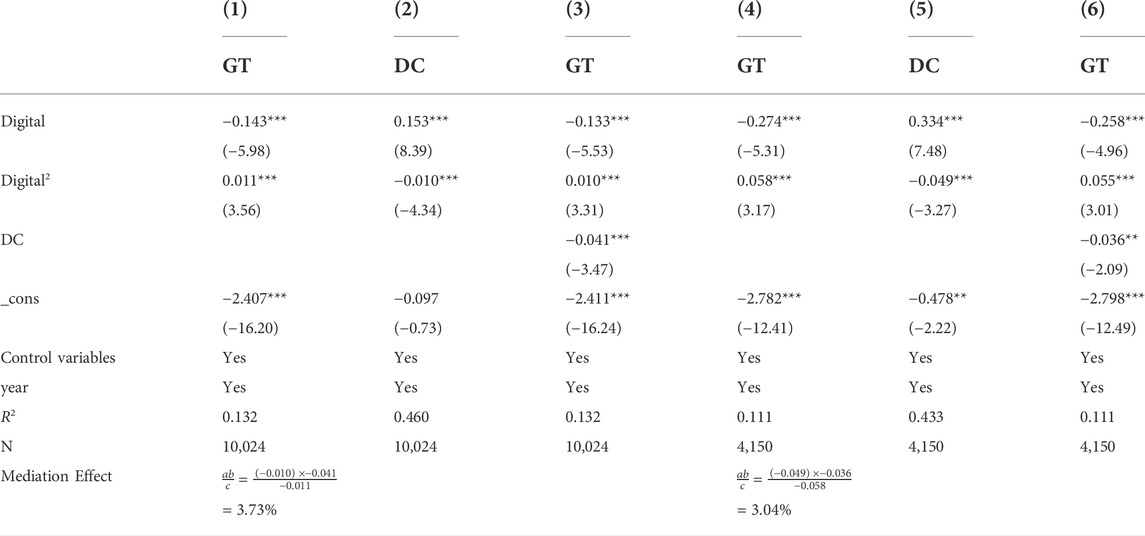

Teece et al. (2009) argue that dynamic capabilities are embedded in the organization and management processes of the enterprise, including perception, acquisition, and reconfiguration capabilities. According to the previous analysis, digitization may affect an enterprise’s environmental problem identification (perception), information knowledge acquisition (acquisition), and organizational management (reconfiguration). Therefore, this paper argues that enterprise digitization can influence its green transformation through the mediating variable of dynamic capabilities. The specific analysis is as follows: In the initial stage, enterprise digitization will spend much money on digital equipment, technology, and talents. The direct effect of these expenditures is to influence the improvement of enterprise perception, acquisition, and reconfiguration capabilities, i.e., to enhance the dynamic capabilities of enterprises. However, the marginal effect of digitalization decreases with the blind increase in digital investment. Excessive digitalization will also expose enterprises to “information overload” and other problems and then inhibit the dynamic capability of enterprises. Therefore, the impact of digitalization on dynamic capabilities is in an inverted U-shape. Furthermore, good ability of perception, acquisition, and reconstruction is helpful for enterprise to tilt their resources toward green governance. It also helps enterprises carry out green product research and development, green process and green technology innovation, helps enterprises realize asset coordination and value-added between internal and external in the business ecosystem, and improve the knowledge sharing and cooperation mechanism between departments (Liang et al., 2022), and finally adapt to the needs of green development and help enterprises realize green transformation. In summary, we believe that dynamic capabilities play a mediating role between digitalization and green transformation.

This paper applies the Wen and Ye (2014) modified mediating effect test to establish three regression equations to verify the mediating effect of dynamic capabilities.

Referring to the method of Dong (2014) for the mediating effect test, if dynamic capabilities have a transmission function in the process of digitalization on the green transformation of enterprises, both

Combining the results of the tests in Tables 9, 10, it can be seen that the squared term coefficient of column (1) digitization on green transformation is 0.011 and significant at the 1% level, which supports the

7 Discussion

Under the background of the accelerated development of digital economy, a few scholars began to pay attention to the relationship between digitalization and green development. However, little literature extends the research to green transformation and explores the impact of digitalization on green transformation. From a practical point of view, when implementing the green transformation strategy, actively digitizing and consciously speeding up digitization can make it across the digital divide and realize green transformation faster. From the theoretical point of view, the conclusion of this paper extends the previous research and clarifies the complex linear relationship between digitalization and green transformation. At the same time, considering the individual characteristics of enterprises, we conducted a heterogeneity test. First, due to the differences in process flow, product attributes, and environmental protection requirements, the pollution emission degree of different industries is also very different. The digitalization of enterprises with different pollution levels may impact their green transformation differently. The reason for this is that, on the one hand, heavily polluting enterprises, as the key targets of the national environmental protection department, disclose more environmental information (Huang and Chen, 2012). Moreover, heavy polluters are more likely to face higher public pressure and media attention than non-heavy polluters, leading them to invest more in green governance and less in digital transformation. On the other hand, heavily polluting enterprises are required to pay regular emission fees or taxes compared to non-heavily polluting enterprises, which also imposes a burden on their operations and crowds out digitalization investments. Therefore, digitalization shows a significant inhibitory effect on corporate green transformation in the sample of heavily polluting enterprises.

Second, China has a diversified regional economic model, and the specificity of the regional economy is prominent due to the influence of the national industrial layout (Kong et al., 2021). Accordingly, the geographical distribution may significantly impact the level of economic development, thus affecting the digital transformation of enterprises and its effect. For enterprises in different regions, the U-shaped relationship between digitalization in the eastern region and green transformation is significant, but the digitalization of enterprises in the central and western regions will inhibit the green transformation. The eastern region of China has a more developed economy, a higher degree of marketization, and intense digital penetration due to its leading development. On the contrary, due to relatively limited traffic conditions, poor natural environment, few high-tech value-added industries, lack of high-level talents and other reasons, the level of economic development, marketization and digitization in the central and western regions are far behind those in the East. The regions with developed economies and a high degree of marketization may have more resources and funds to obtain and spread new things and technologies to cross the digital divides faster and move towards green transformation.

Thirdly, for enterprises with different listed boards, there is a significant U-shaped relationship between digitalization and green transformation of main board and GEM board enterprises, but digitalization of SME board enterprises will inhibit the green transformation of enterprises to a certain extent. Both X inefficiency theory and new institutional economics suggest that the internal management of business organizations is the cause of widespread inefficiencies (Bi, 2008). As firms expand in size, the internal pyramid hierarchy increases, and problems such as information friction arise. As a result, information frictions are more serious in large organizations than in SMEs, internal transaction costs are higher, and resources are more wasted. Initially, digitalization may not promote green transformation or even inhibit it. Nevertheless, reaching a certain level it can play a smooth role in enterprise information, stimulating the flow of information within the enterprise, internal and external, reducing transaction costs, reducing waste and non-environmental behavior, and promoting the green transformation of enterprises. Therefore, the main board of the enterprise digitalization of green transformation has a U-type relationship. As for SMEs, since their profitability is low, their production and operation processes are more in the exploratory stage, and they have not yet formed a mature profit model, and still need to focus much more on their primary business. Consequently, in this case, forced digitalization of them may inhibit its green transformation. The coefficient of GEM enterprises is significantly larger than that of mainboard enterprises, which means that the U-shaped opening is smaller according to the nature of the quadratic function. The possible reason is that GEM is high-tech, mainly SMEs. Despite its digitalization property, its green transformation still depends on the accumulation of digitalization to a certain extent due to its “small and medium” nature.

Fourthly, for enterprises with different digital speeds, the “U” effect of digitalization on green transformation is only established in enterprises with high digital speed, and too slow digital speed may inhibit the green transformation of enterprises. The reason is that digital technology is changing rapidly, and digitalization needs to focus on the impact of speed rather than relying on long-term accumulation. Only with a high speed of digitalization can the inhibitory process be shortened, and the positive promotion effect is generated. Knowledge is enterprises’ most important strategic resource and the primary source of their competitive advantage (Grant, 1996); high digitization speed can help enterprises establish the first advantage quickly. First, it can help firms to acquire R&D resources. Compared with low-digitization speed enterprises, high-digitization speed enterprises can obtain more and faster the R&D resources needed to catch up with or even surpass the technological Frontier, including talents, patented technologies, and capital, and provide technology reserves for green transformation. Second, it can help firms to integrate R&D resources. High digitization speed can help enterprises integrate R&D resources, from R&D networks, cooperate with technologically leading enterprises and upstream and downstream enterprises in the supply chain, establish a green supply chain, and realize green and collaborative development. Third, enterprises with high digitization speed can often establish a first-mover competitive advantage and take the initiative in market competition, thus gaining higher market returns, realizing economies of scale, and providing funds for green governance. Therefore, the high digitization speed of enterprises can get through the initial stage of high investment in human capital and financial investment more quickly, and thus it is more likely to show a U-shaped relationship.

In further research, we use the dynamic ability as a bridge and get more valuable research results. Digitalization can affect the green transformation of enterprises through the intermediary variable of dynamic capability. In the early stage of enterprise digitalization, much more funds would be spent on digital equipment, technology, and talents. The direct effect of these expenditures is to affect the improvement of the enterprise’s perception, acquisition, and reconstruction capabilities, that is, to enhance the dynamic capabilities of enterprises. However, its marginal effect decreases with the blind increase of digital input. For example, excessive digitalization will also cause enterprises to face problems such as “information overload,” which inhibits their dynamic capabilities. The improvement of dynamic capability depends on the massive investment of funds and resources. It also changes the enterprise’s overall development strategy or business model. Only when the dynamic capability is at a high level can it positively impact the green transformation. The results support the transmission path of “digitalization → dynamic capability → green transformation.”

8 Conclusion

Based on text data mining and principal component analysis, this paper takes A-share listed companies in Shanghai and Shenzhen from 2011 to 2020 as research samples to explore the influence of digitalization on green transformation of enterprises and its internal mechanism. The results show that digitalization has a U-shaped effect on the green transformation of enterprises. Secondly, the “U” relationship between digitalization and green transformation of enterprises only exists in non-heavily polluting enterprises, eastern enterprises, main-board enterprises, GEM enterprises, and enterprises with high digital speed. Finally, the dynamic capability plays a partial intermediary role in the U-shaped relationship between digitalization and green transformation. There is an inverted “U” relationship between digitalization and dynamic capability. This study provides a new way of thinking about enterprises’ lack of green transformation capability. In terms of modeling, this paper innovatively includes a quadratic term of digital transformation to verify the complex linear relationship between digitalization and green transformation. This study extends the consequences of digital economy to green transformation based on Ke et al. (2022) and Zhai and An (2020), and provides empirical evidence at the micro-level.

9 Theoretical implications

First of all, most of the literature about digitalization currently studies the economic performance brought by digitalization, and seldom considers the non-economic performance. This study effectively expands the non-economic consequences of digitalization at the micro-level and reveals the advantages and disadvantages of digitalization. Secondly, this paper constructs a comprehensive index of green transformation, taking into account the green technological innovation of enterprises, and promotes the development of quantitative research on green transformation of enterprises. Thirdly, this paper studies digitalization and enterprise green transformation under the unified framework, and carries out a heterogeneity test and intermediary effect test, which enriches the research of influencing factors of green transformation and puts forward an effective transmission path of “digitalization → dynamic capability → green transformation.”

10 Practical implications

Firstly, this paper discusses the U-shaped influence of digitalization on the green transformation of enterprises. The research is helpful to deepen enterprises’ understanding of green transformation, accelerate the pace of digitalization, reduce the “risk effect” of digitalization, and bridge the digital divide, so as to realize “profit” as soon as possible. Second, the study finds that the U-shaped relationship between digitalization and green transformation differs across pollution levels, regions, listing board, and speed of digitalization. It provides an empirical basis for different types of companies to carry out digitalization strategies. It helps enterprises and governments to examine the non-economic performance of digitalization from multiple perspectives. Finally, this study helps to understand the feasible mode of Chinese enterprises’ green transformation under China’s New Normal and the vital role of digitalization in enterprises’ green transformation. At the same time, it provides a new idea for developing countries and countries that pursue an economy but ignored environmental problems to make green transition at the micro-level and provides a basis for their green policy formulation. Therefore, the research conclusion of this paper is helpful for enterprises to rise to the challenge of the digital, actively and quickly digitize to shorten the inhibitory effect of digitalization, so as to improve the ability and effect of green governance and realize the green transformation.

11 Suggestions

This paper makes some contributions to the field of research on digitalization and enterprise green transformation. The findings help enterprises balance digitalization and green transformation to achieve high-quality growth. This paper proves empirically that enterprises can quickly adapt to the era of digital economy through internal digitalization, which helps to smooth their own internal cycle, help them accurately match supply and demand and optimize resource allocation, and finally improve the ability and effect of green governance and realize the green transformation of enterprises. In this regard, this paper proposes the following countermeasures.

For the government. First, the government should increase the investment and construction of 5g base stations, big data centers, artificial intelligence and other digital infrastructure, and provide enterprises with a favorable external environment to help enterprises realize digitalization. Second, we should establish regional big data centers in the East, middle and west regions, strengthen data sharing in various regions, and improve the digitalization ability of enterprises in the central and western regions. Third, the government should formulate relevant policies conducive to the digitalization of enterprises, and implement differentiated incentive policies in combination with the pollution type, scale and region of enterprises, so as to improve the power and effect of digitalization and green transformation of various enterprises. Fourth, encourage financial institutions to provide credit support for enterprises’ digital transformation, especially for small and medium-sized enterprises, so as to reduce the financial pressure of their digital transformation and increase the speed of their digital transformation. Fifth, use tax lever to encourage enterprises to carry out digital upgrading, and provide effective policy guidance while reducing the cost pressure of enterprises. Sixth, the government should encourage and support Internet platforms and industry leading enterprises to open their digital resources, and help heavily polluting enterprises, enterprises in the central and western regions, small and medium-sized enterprises and enterprises with low digital speed realize digital transformation. Seventh, further improve the system of enterprise environmental information disclosure, so as to provide effective external supervision and constraints for the green transformation of enterprises. Eighth, further improve the environmental tax and establish a forced mechanism to promote the green transformation of enterprises.

For the enterprises. First, Enterprises should bravely meet the digital tide, strengthen digital thinking, and actively digitize. They also need to improve employees’ digital skills and data management application ability, and comprehensively and systematically promote the digital transformation of enterprises’ R&D and design, production, processing, operation, management, etc. Digital technology, as a crucial general technology, has significant spillover effects. Enterprises should improve the quality and efficiency of investment and increase investment in digital infrastructure. Second, enterprises should pay attention to the employment and training of digital technology skilled talents. And they should stablish modern industrial colleges, joint laboratories, internship and training bases with vocational colleges and universities, and develop diversified talent training modes such as order system and modern apprenticeship system, and jointly cultivate high-knowledge and high-tech talents. Thirdly, support qualified large enterprises to build integrated digital platforms, and comprehensively integrate the internal information system of the enterprise, and strengthen the data connection of the whole process, and try to form data-driven intelligent decision-making capabilities. At the same time, enterprises should accelerate business collaboration of the whole value chain, and improve the overall operational efficiency of enterprises and upstream and downstream synergy efficiency of the industrial chain, so as to achieve sustainable development and transformation. Finally, enterprises should accelerate the application of online marketing, remote collaboration, digital office, intelligent production line, etc., so as to implement digital transformation in the whole business and whole process as soon as possible.

12 Limitations and future research

There are still some limitations in this paper. First, the study only focuses on the impact of digitalization on green transformation does not subdivide the two. The impact of different types of digitization on corporate green culture transformation and green management transformation can be further explored in the future. Secondly, this paper only examines the mediating role of dynamic capabilities. However, digitalization may also influence green transformation through information transparency, willingness to green innovation, and environmental pressure, which can be further explored in the future. Finally, whether there is a synergistic effect between digitalization and green transformation in the enterprise operation also needs to be studied, which provides a direction for subsequent research.

Data availability statement

The data analyzed in this study is subject to the following licenses/restrictions: ST, *ST, PT, and companies with missing data are excluded; financial and insurance companies are excluded, and sample data before listing are excluded. The data sources are mainly CSMAR, WIND, and CCER databases. In addition, we obtained the annual reports of enterprises from the Juchao Information Website and crawled digital keywords through Python to build the digital transformation index of enterprises. Requests to access these datasets should be directed to https://www.gtarsc.com/, http://www.ccerdata.cn/, http://www.cninfo.com.cn/new/index.

Author contributions

CP: Conceptualization, methodology, resources, validation. XJ: Data curation, Software, writing- original draft preparation, visualization. YZ: Writing- reviewing and editing, supervision.

Funding

This work was supported by National Natural Science Foundation of China (71232004); Social Science Planning Project of Chongqing (2018YBJJ032, 2021NDYB079); Graduate Innovation Project of Chongqing (CYS20322); Scientific research project of Sichuan International Studies University (2022KYQN08).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adomako, S., Amankwah-Amoah, J., Tarba, S. Y., and Khan, Z. (2021). Perceived corruption, business process digitization, and SMEs’ degree of internationalization in sub-Saharan Africa. J. Bus. Res. 123, 196–207. doi:10.1016/j.jbusres.2020.09.065

Belhadi, A., Kamble, S. S., Zkik, K., Cherrafi, A., and Touriki, F. E. (2020). The integrated effect of big data analytics, lean six sigma and green manufacturing on the environmental performance of manufacturing companies: The case of north africa. J. Clean. Prod. 252, 119903. doi:10.1016/j.jclepro.2019.119903

Belkaoui, A. (1976). The impact of the disclosure of the environmental effects of organizational behavior on the market. Financ. Manag., 26–31. doi:10.2307/3665454

Ben-Amar, W., Chang, M., and McIlkenny, P. (2017). Board gender diversity and corporate response to sustainability initiatives: Evidence from the carbon disclosure project. J. Bus. Ethics 142 (2), 369–383. doi:10.1007/s10551-015-2759-1

Bi, Q., li, H., and Yu, L. (2019). The impact and its mechanisms of the executive with environmental experiences on corporate green transformation. J. Guangdong Univ. Finance Econ. 34 (05), 4–21.

Bi, S. (2008). A review of economic efficiency theory research. Econ. Rev. (06), 133–138. doi:10.19361/j.er.2008.06.019

Chaiyapa, W., Esteban, M., and Kameyama, Y. (2018). Why go green? Discourse analysis of motivations for Thailand's oil and gas companies to invest in renewable energy. Energy Policy 120, 448–459. doi:10.1016/j.enpol.2018.05.064

Chen, C., Zhu, L., Zhong, H., Liu, C., Wu, M., and Zeng, H. (2019). Practical innovation of Chinese enterprises from “digital survival” view. J. Manag. Sci. China 22 (10), 1–8.

Chen, G., Ding, S., Zhao, X., and Jiang, X. (2021). China's green finance policy, financing costs and firms' green transition: A central bank collateral framework perspective. J. Financial Res. (12), 75–95.

Chen, Q., and Tian, H. (2021). Impact mechanism of import competition on the development quality of Chinese manufacturing: Based on the mediating effect of innovation. Inq. into Econ. Issues (09), 130–142.

Dechezleprêtre, A., Koźluk, T., Kruse, T., Nachtigall, D., and De Serres, A. (2019). Do environmental and economic performance go together? A review of micro-level empirical evidence from the past decade or so. Int. Rev. Environ. Resour. Econ. 13 (1-2), 1–118. doi:10.1561/101.00000106

Dong, B. (2014). Does risk need to be balanced: The inverted U-shaped relationship between risk taking and performance in new enterprises and the mediating role of entrepreneurial ability. J. Manag. World (01), 120–131. doi:10.19744/j.cnki.11-1235/f.2014.01.013

Dong, Z., Tan, Y., and Cao, Z. (2021). Has green supply chain management encouraged clean technology innovation? An empirical analysis based on identification and classification test. J. East China Normal Univ. Soc. Sci. 53 (04), 136–149+183. doi:10.16382/j.cnki.1000-5579.2021.04.013

Dunning, J. H. (1994). Multinational enterprises and the globalization of innovatory capacity. Res. policy 23 (1), 67–88. doi:10.1016/0048-7333(94)90027-2

Fan, S., Li, Y., Ma, X., and Liu, H. (2021). An empirical study on the impact of digitalization level on agricultural green development——based on panel data of 30 provinces in China. World Agric. (12), 4–16. doi:10.13856/j.cn11-1097/s.2021.12.001

Ferguson, M. J., Lam, K. C., and Lee, G. M. (2002). Voluntary disclosure by state‐owned enterprises listed on the stock exchange of Hong Kong. J. Int. Financial Man. Acc. 13 (2), 125–152. doi:10.1111/1467-646x.00081

Fu, Y., and He, W. (2021). The impact of national high-tech zones on urban green transformation——based on the comparison of resource-based cities and non-resource-based cities. J. Nanjing Univ. Finance Econ. (02), 36–45.

Gong, M., You, Z., Wang, L., and Cheng, J. (2020). Environmental regulation, trade comparative advantage, and the manufacturing industry’s green transformation and upgrading. Int. J. Environ. Res. Public Health 17 (8), 2823. doi:10.3390/ijerph17082823

Grant, R. M. (1996). Prospering in dynamically-competitive environments: Organizational capability as knowledge integration. Organ. Sci. 7 (4), 375–387. doi:10.1287/orsc.7.4.375

Guo, P., and Zhang, A. (2021). Green transformation and upgrading of enterprises in respect of responsible innovation and dynamic capability. Sci. Res. Manag. 42 (07), 31–39. doi:10.19571/j.cnki.1000-2995.2021.07.004

Huang, D., Xie, H., Meng, X., and Zhang, Q. (2021). Digital transformation and enterprise value——empirical evidence based on text analysis methods. Economist 12, 41–51. doi:10.16158/j.cnki.51-1312/f.2021.12.006

Huang, j., and Chen, Y. (2012). The impact of corporate social contribution on environmental information disclosure: Empirical evidence from listed companies in the governance sector of the Shanghai stock exchange. J. Hunan Univ. Sci. 26 (02), 55–58.

Huang, J. (2022). How to reduce the tax burden to help enterprises green transformation and upgrading——empirical study based on polluting industries. Contemp. Econ. Manag. 44 (01), 90–96. doi:10.13253/j.cnki.ddjjgl.2022.01.012

Huo, X., and Liu, L. (2017). A study on China's OFDI influencing factors and the dynamic effect of economic growth: Based on principal component analysis and VAR model. J. Zhejiang Gongshang Univ. (05), 81–94. doi:10.14134/j.cnki.cn33-1337/c.2017.05.009

Ke, J., Jahanger, A., Yang, B., Usman, M., and Ren, F. (2022). Digitalization, financial development, trade, and carbon emissions; implication of pollution haven hypothesis during globalization mode. Front. Environ. Sci. 211. doi:10.3389/fenvs.2022.873880

Kong, D., Wei, y., and Ji, M. (2021). Research on the impact of changing environmental protection fees to taxes on corporate green information disclosure. Secur. Mark. Her. (08), 2–14.

Lei, Y., and Sun, J. (2021). Does the energy-saving consumption incentive policy improve the green transformation of manufacturing enterprises? Industrial Econ. Res. (03), 17–30+56. doi:10.13269/j.cnki.ier.2021.03.002

Li, B., Li, R. Y. M., and Wareewanich, T. (2021). Factors influencing large real estate companies’ competitiveness: A sustainable development perspective. Land 10 (11), 1239. doi:10.3390/land10111239

Li, J., Zhang, R., and Li, B. (2021). Research on the influence mechanism of big data capability on green competitiveness of manufacturing industry from the perspective of environmental dynamics:based on SBM-GML index model. Sci. Technol. Prog. Policy 38 (23), 67–75.

Li, X., and Wang, F. (2020). Data value chain and the mechanism of value creation. Econ. Rev. J. 11, 54–62+52. doi:10.16528/j.cnki.22-1054/f.202011054

Liang, M., Cao, H., and Wang, X. (2022). Senior executives' environmental awareness, dynamic capabilities and corporate green innovation performance: Moderating effect of environmental uncertainty. Sci. Technol. Manag. Res. 42 (04), 209–216.

Lind, J. T., and Mehlum, H. (2010). With or without U? The appropriate test for a U‐shaped relationship. Oxf. Bull. Econ. statistics 72 (1), 109–118. doi:10.1111/j.1468-0084.2009.00569.x

Liu, B., Wang, J., Li, R. Y. M., Peng, L., and Mi, L. (2022). Achieving carbon neutrality–the role of heterogeneous environmental regulations on urban green innovation. Front. Ecol. Evol. 10, 471. doi:10.3389/fevo.2022.923354

Liu, F. (2020). How digital transformation improve manufacturing's productivity: Based on three influencing mechanisms of digital transformation. Finance Econ. 10, 93–107.

Lu, Q., Wu, Q., Zhou, Y., and Zhou, h. (2013). Analysis on the assessment of greenery transformation-upgrading ofIndustry in Guangdong. China Popul. Resour. Environ. 23 (07), 34–41.

Matt, C., Hess, T., and Benlian, A. (2015). Digital transformation strategies. Publications of Darmstadt Technical University, Institute for Business Studies (BWL).

Pang, R., Zhang, S., and Wang, Q. (2021). Can digital improve environmental governance performance?—Empirical evidence from inter-provincial panel data. J. Xi’an Jiaotong Uni. (Soc. Sci.) 41 (05), 1–10. doi:10.15896/j.xjtuskxb.202105001

Pergelova, A., Manolova, T., Simeonova-Ganeva, R., and Yordanova, D. (2019). Democratizing entrepreneurship? Digital technologies and the internationalization of female-led SMEs. J. Small Bus. Manag. 57 (1), 14–39. doi:10.1111/jsbm.12494

Qi, Y., and Cai, C. (2020). Research on the multiple effects of digitalization on the performance of manufacturing enterprises and its mechanism. Study & Explor. (07), 108–119.

Ren, X., and Sun, L. (2020). Research on the causes and paths of green transformation of Chinese enterprises from the perspective of low carbon an exploratory research based on multi-case study and grounded theory. Soft Sci. 34 (12), 111–115+121. doi:10.13956/j.ss.1001-8409.2020.12.17

Ren, X., Sun, L., and Xing, L. (2021). Research on driving factors of Chinese enterprises' green transformation based on root cause analysis: The effective identification and arrangement of primary and secondary factors. J. Nanjing Tech Univ. Soc. Sci. Ed. 20 (04), 99–108+110.

Sebastian, I. M., Moloney, K. G., Ross, J. W., Fonstad, N. O., and Mocker, M. (2017). How big old companies navigate digital transformation. MIS Q. Exec. 16 (3), 197–213.

Shen, G., and Yuan, Z. (2020). The effect of enterprise internetization on the innovationand export of Chinese enterprise. Econ. Res. J. 55 (01), 33–48.

Song, D., Zhu, W., and Ding, H. (2022). Can firm digitalization promote green technological innovation? An examination based on listed companies, 48, 34–48. doi:10.16538/j.cnki.jfe.20211218.304Heavy pollution industriesJ. Finance Econ.04

Song, Y., Wang, H., and Zhu, M. (2018). Sustainable strategy for corporate governance based on the sentiment analysis of financial reports with CSR. Financ. Innov. 4 (1), 2–14. doi:10.1186/s40854-018-0086-0

Stanny, E., and Ely, K. (2008). Corporate environmental disclosures about the effects of climate change. Corp. Soc. Responsib. Environ. Manag. 15 (6), 338–348. doi:10.1002/csr.175

Sun, L., and Ren, X. (2020). Hierarchical network embedding, TMT heterogeneity and the motivation of enterprise green transformation ——an integrated analysis framework of cross-layer interaction factors. Collect. Essays Finance Econ. (07), 93–103. doi:10.13762/j.cnki.cjlc.2020.07.010

Tan, Z., Zhao, X., Pan, J., and Tan, J. (2022). The value of digital transformation: From the perspective of corporate cash holdings. J. Finance Econ. 48 (03), 64–78. doi:10.16538/j.cnki.jfe.20220113.103

Tang, G., Li, L., and Wu, D. (2013). Environmental regulation, industry attributes and corporate environmental investment. Account. Res. (06), 83–89+96.

Teece, D. J., Pisano, G., and Shuen, A. (2009). Dynamic capabilities and strategic management. Strateg. Manag. J. 18, 509–533. doi:10.1002/(sici)1097-0266(199708)18:7<509::aid-smj882>3.0.co;2-z

Teruel, M., Coad, A., Domnick, C., Flachenecker, F., Harasztosi, P., Janiri, M. L., et al. (2021). The birth of new HGEs: Internationalization through new digital technologies. J. Technol. Transf. 47, 804–845. doi:10.1007/s10961-021-09861-6

Wang, F., Liu, X., Zhang, L., and Cheng, W. (2022). Does digitalization promote green technology innovation of resource-based enterprises? Stud. Sci. Sci. 40 (02), 332–344. doi:10.16192/j.cnki.1003-2053.20210824.001

Wang, H., Chen, Y., and Yang, C. (2022). Can digitalization improve the mismatch of innovation elements? based on the perspective of interregional flow of innovation elements. Shenzhen, China: Securities Market Herald, 42–51.01.

Wang, K., Sun, X., Zhang, L., and Wang, F. (2020). Does financial digitization promote the development of green finance? based on the empirical research of Chinese industrial listed companie. Collect. Essays Finance Econ. (09), 44–53. doi:10.13762/j.cnki.cjlc.2020.09.005

Wang, X., and Ning, J. (2020). Can mandatory social responsibility disclosure drive corporate green transformation? Evidence based on green patent data of listed companies in China. J. Audit Econ. 35 (04), 69–77.