94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 09 August 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.961184

This article is part of the Research TopicFinancial and Trade Globalization, Greener Technologies and Energy TransitionView all 46 articles

In order to better exploit the role of commercial insurance in preventing and mitigating household financial risks and improving social security, this paper explores the influence mechanism of household human capital, a special endowment resource that has potential influence on households’ cognitive and behavioral decisions on commercial insurance, by constructing a structural equation model based on data from the 2017 China Household Finance Survey (CHFS) and introducing its influence on households’ commercial insurance holding behavior. The results show that human capital has a significant positive effect on household commercial insurance holding behavior; financial market participation and risk preference play a part in mediating the relationship between human capital and household commercial insurance holding behavior, with financial market participation playing a greater role. According to the findings of this paper, the government and relevant institutions should increase financial literacy efforts, enhance residents’ correct understanding of commercial insurance and shape a healthy insurance market, so as to promote effective household participation in commercial insurance and the healthy development of China’s commercial insurance market.

With the rapid development of the economy, the living standard of Chinese residents is increasing and the accumulation of wealth has led to a more diversified allocation of household assets; at the same time many social issues have gradually come to the fore, such as the increasing ageing, lower birth rate and increasingly high maintenance costs, which put families at great risk of income and expenditure, and the broad coverage and low level of social insurance can no longer meet the increasing risk protection needs of families (Zhou and Xia, 2020). The China Financial Stability Report 2019 points out that household financial risk is a leading indicator of economic development and financial stability, and an important component in preventing and resolving financial risks in China. Savings have long been the main financial tool for households in China to cope with risks, but they are not sufficient to deal with all household risks, and commercial insurance gives residents more protection for their lives and property. Commercial insurance is a useful supplement to traditional social insurance, which can meet the diversified needs of different families for insurance products and improve the overall level of social protection. At the same time, as an important investment and financial management tool, commercial insurance also enriches household asset allocation, improves the financial market system and promotes stable economic development (Qin et al., 2016; Zhou and Xia, 2020). In 2020, the China Banking and Insurance Regulatory Commission proposed in its “Opinions on Promoting the Development of Commercial Insurance in Social Services” to expand the supply of commercial insurance, improve the insurance market system, establish commercial insurance as an important pillar of the social security system, and give full play to the important role of commercial insurance in protecting people’s livelihoods, which shows that the status of using commercial insurance as the third pillar of social security has been recognized at the national level. In recent years, China’s insurance industry has developed very rapidly and jumped to become the second largest insurance market in the world, but from the micro data, the level of commercial insurance holdings among Chinese households is not high, with data from the 2017 China Household Finance Survey (CHFS) showing that only 7.72% of residents nationwide have purchased commercial insurance, indicating that Chinese residents still maintain a cautious attitude towards purchasing commercial insurance (He and Li, 2009). In-depth analysis of the influencing factors of households holding commercial insurance and finding the reasons for the low participation rate in commercial insurance are of great significance in promoting the healthy development of the commercial insurance market, strengthening overall social protection and maintaining social stability.

Studies have been conducted on the factors influencing household commercial insurance holding behavior mainly in terms of demographic characteristics factors, subjective attitudes of residents, household economic status, and economic characteristics of the place of residence, but less from the perspective of human capital. Human capital is an important attribute to study the household as a micro-individual and has the unique characteristics given by the household. According to Schultz’s human capital theory (Schultz, 1961), human capital is the accumulation of people’s investment in themselves, including formal education, job training and health care, and refers to the combination of knowledge, skills, abilities, and health factors that have economic value (Yang et al., 2006), which is ultimately embodied in the person as the sum of health, knowledge and skills (Mushkin, 1962; Becker, 1994). Some scholars have found that comprehensive cognitive ability in human capital can significantly enhance household commercial insurance participation intentions and level of participation, with word ability having the greatest facilitative effect (Tz et al., 2022); financial literacy, as a form of human capital, can play a facilitating role in household commercial insurance participation decision-making behavior (Wei et al., 2019). Although existing studies confirm the association between human capital and household commercial insurance holding behavior, the specific mechanisms at play are not yet clear.

Financial market participation is also an important predictor of household commercial insurance holding behavior (Wang, 2017). Household financial market participation refers to micro financial activities in which the household is the core unit, i.e., for the holding of financial assets such as stocks, debts and insurance. Classical rational investment theory has encountered limitations in explaining household financial market participation, therefore, scholars have turned to alternative approaches to study the relationship between human capital and financial market participation (Campbell, 2006), such as the impact of investors’ IQ level and health status on market participation (Wang, 2008). Scholars have also found that households with financial assets are more likely to hold commercial insurance (Wang, 2017). Then, how human capital and financial market participation affect household commercial insurance holding behavior needs to be further clarified. Related studies have shown that different households’ risk attitudes towards commercial insurance can also have an impact on household commercial insurance holding behavior (Tian et al., 2018). The results of a study by Zhang et al. (2020) and Friedman and Savage, 1948 showed that risk averse households were more likely to purchase commercial insurance to reduce risk, but Qin et al. (2016) found a significant positive relationship between risk preferences and household commercial insurance holding behavior. Zhou and Xia (2020) point out that financial literacy can promote household business insurance holding behavior by increasing risk appetite. It can be seen that the relationship between risk preference and household commercial insurance holding behavior is still controversial, which may be related to the different research subjects and perspectives of scholars. Therefore, how risk preference affects household commercial insurance holding behavior, and what are the mechanisms of influence between human capital, risk preference and household commercial insurance holding behavior need to be further explored.

Based on the above analysis, this paper analyses the impact of household human capital on household commercial insurance holding behavior based on the 2017 China Household Finance Survey (CHFS) data from a human capital perspective, introducing financial market participation and risk preference as mediating variables to explore the mechanism of human capital’s impact on commercial insurance holding behavior. The marginal contribution of this paper is that it enriches the research exploring commercial insurance holding behavior from a micro perspective and clarifies the mechanism of human capital’s effect on commercial insurance holding behavior. The marginal contribution of this paper is to explore the proposed mechanism of the role of household human capital on commercial insurance holding behavior, to clarify the effects and paths of different household human capital on their commercial insurance holding behavior, to help gain insight into the reasons affecting the limited participation in the Chinese commercial insurance market, and to provide reference for policy formulation by relevant authorities.

Household human capital is the sum of capital embodied in the family members (Li et al., 2015). Existing studies have focused on the impact of human capital on household commercial insurance holding behavior in terms of both education level and financial literacy. Some scholars have found that the higher the level of education of residents, the easier it is for them to quickly obtain and process information about various products to participate in insurance, and thus the greater the chance of purchasing commercial insurance (Lan, 2021); the increase in financial literacy in human capital has a significant positive impact on the likelihood and level of holding commercial insurance by households (Zhou and Xia, 2020); the increase in financial literacy helps residents to understand the provisions of insurance contracts and improves households’ level of trust in commercial insurance (Wei et al., 2019), which in turn increases the likelihood of households purchasing commercial insurance and the level of holding commercial insurance (Awel and Azomahou, 2015), i.e. the higher the level of financial literacy, the greater the premium expenditure (Qin et al., 2016). Health, as an important dimension of human capital, has been relatively little studied in terms of its impact on household commercial insurance holding behavior. Existing studies have only analyzed the impact of health in terms of asset portfolio decisions, i.e., residents with better health hold fewer productive assets, more financial assets and riskier assets (Lei and Zou, 2010), Yu et al. (2021) found that commercial insurance companies tend to refuse to cover individuals in poor health, which is the main reason why residents in poor health are less likely to buy commercial insurance. However, the impact of physical health status on household commercial insurance holding behavior is not yet clear, and this paper argues that the impact of human capital on household commercial insurance holding behavior needs to be captured comprehensively. Taking the above analysis together, the following assumption is made in this paper:

H1. There is a significant positive effect of human capital, as measured by years of education, physical health status and financial literacy, on household commercial insurance holding behavior.

Household financial market participation refers to micro financial activities in which the household is the core unit, i.e., for the holding of financial assets such as stocks, debts and insurance (Hu and Zang, 2016). Scholars have studied the impact of human capital on household financial market participation from different perspectives. Empirical results from the established literature suggest that the relative paucity of financial literacy is an important constraint on households’ financial behavioral decisions (Cui et al., 2019), and that financial education can enhance households’ financial market participation by improving their financial literacy acquisition (Balloch et al., 2014), people with greater financial literacy are more likely to participate in formal financial markets (Korniotis and Kumar, 2010; Hsiao and Tsai, 2018), optimize household asset allocation (Bianchi, 2017), and make reasonable financial planning (Wu et al., 2017); Fisch and Seligman (2021) found that the relationship between financial literacy and financial market participation was U-shaped, with growth in financial literacy being associated first with decreases in participation and then with increases in participation. In terms of physical health status, when social security is inadequate, poor health of household members has a significant negative impact on households’ current and future financial asset choices (He and Wang, 2021). Households in poor health tend to hold savings assets and productive assets with higher security (Lei and Zou, 2010), and they are less likely to invest in financial assets and hold a lower proportion of them compared to households in good health (Wu et al., 2011). At the same time, education is very helpful for individuals to improve their cognitive ability and judgement, and a person’s level of education directly affects their level of analysis and mastery of information on complex and diverse financial products, and also determines their household financial market participation (Pellicer, 2005; Cui and Liu, 2021). People with high levels of education are correspondingly more likely to have access to well-paying jobs, providing a solid material basis for participation in financial markets (Lu and Yin, 2021). Based on the above analysis, this paper proposes the following research hypothesis:

H2. Human capital, as measured by years of education, physical health status and financial literacy, has a significant positive effect on household financial market participation.Commercial insurance holding decisions are part of financial asset decisions, and household financial market participation behavior determines to some extent the consumption demand for commercial insurance (Headen and Lee, 1976; Meyer and Ormiston, 1995; Drugdová, 2016). Modern commercial insurance products increasingly have the investment attributes of financial products (Wei and Yang, 2007), households holding financial assets such as stocks and funds have a higher demand for commercial insurance purchases, and households with financial assets are much more likely to hold commercial insurance than those without (Wang, 2017), household risky financial asset allocation increases the likelihood of household participation in commercial insurance through wealth and risk effects (Qiao and Zhang, 2022). Combining the above analysis, this paper proposes that:

H3. Financial market participation has a significant positive effect on household commercial insurance holding behavior.Combining Hypotheses H2, H3, this paper proposes that:

H4. Financial market participation mediates the relationship between human capital and household commercial insurance holding behavior.

Regarding the impact of human capital on residents’ attitudes towards risk, Zhang and Yin (2016) found that increasing residents’ financial literacy effectively reduces their aversion to risk and thus their rejection of financial products, meanwhile Li et al. (2020) corroborated this view, stating that there is a significant positive relationship between the level of financial literacy in human capital and residents’ confidence in participating in financial activities correlation, with the higher the level of financial literacy, the stronger their preference for risk. In terms of educational attainment, Brown and Taylor (2006) found that investors with higher education prefer risk and that investors’ risk aversion decreases with higher educational attainment (Riley and Victor, 1992); however, some scholars argue that it is an individual’s stochastic decision-making process that is correlated with educational attainment, rather than the level of risk preference, and that the two correlation is a pseudo-correlation due to individual behavioral noise (Andersson et al., 2016). This paper argues that highly educated groups are able to continuously learn new knowledge, have more open eyes and a more rational mindset, are better able to accurately identify and process complex information in the market, have a more scientific understanding of risky assets and can effectively hedge against risks, and their ability to take and control high risks is stronger. In terms of physical health status, Cho, 2016, Crainich et al. (2017) found that when investors’ health deteriorates, the gradually increasing medical burden will make investors’ risk attitudes conservative and place more importance on the safety of their investments, and households suffering from health shocks prefer to hold less risky assets (Fu et al., 2020); in other words, households in good health are less burdened with health care and other issues, invest with more focus on returns, and have a higher level of risk preferences. Taken together, this paper proposes the following hypothesis:

H5. Human capital, as measured by years of education, physical health status and financial literacy, has a significant positive effect on residents’ risk preferences.Based on modern asset portfolio theory, a rational investor’s asset portfolio is similar, consisting of a certain proportion of a market portfolio composed entirely of risky assets and a certain proportion of risk-free assets, with the higher the level of risk preference, the higher the proportion of the market portfolio held and the lower the proportion of risk-free assets held at the same time (Markowitz, 1952). Commercial insurance as a financial instrument carries a certain level of risk, and when exploring the factors influencing household commercial insurance holding behavior, many scholars also focus on the important variable of residents’ risk attitudes, but existing studies have reached different conclusions on this issue. The findings of Zhang et al. (2020) suggest that the more risk averse households are, the more likely they are to purchase commercial insurance to reduce risk; while Sun and Xiong (2019) find that households with an appetite for risk are more likely to purchase commercial insurance; the results of Hu and Zang (2016) show that when households prefer risk, they are more likely to purchase high-risk, high-yield financial assets such as stocks and reduce their allocation to commercial insurance accordingly. Combined with modern asset portfolio theory, this paper argues that commercial insurance, as a kind of insurance with both investment and protection functions and no compulsory purchase, may be more popular among risk-prefer people. Based on the above analysis, this paper proposes the following hypothesis:

H6. Risk preference has a significant positive effect on household commercial insurance holding behavior.Combining Hypotheses H5, H6, this paper proposes that:

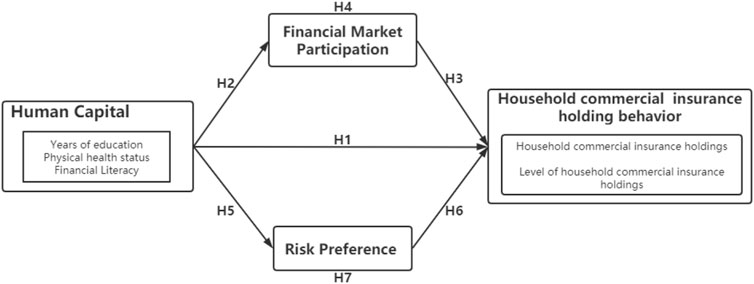

H7. Risk preference mediate the relationship between human capital and household commercial insurance holding behavior.Combining the above analysis, the mechanism of the role of human capital on household commercial insurance holding behavior constructed in this paper is shown in Figure 1.

FIGURE 1. Mechanistic model of the role of human capital on household commercial insurance holding behavior.

The data sample for this paper is drawn from the China Household Finance Survey (CHFS) Project conducted by Southwest University of Finance and Economics in 2017. The survey used a three-stage stratified sampling method, and the sample covered 29 provinces, 37,289 households and 133,183 individuals across China, covering micro household financial data on household demographic characteristics, assets and liabilities, insurance coverage, and income and expenditure. The China Household Finance Survey has a low rejection rate, and the demographic characteristics of the data are very close to those published by the National Bureau of Statistics (Gan et al., 2013), so the sample data is representative of the overall national situation. By eliminating vacant values as well as outliers, a total of 9,009 household data were selected as the sample for the empirical study in this paper. Among these 9,009 households, 75.6% of the household heads are male and 24.4% are female; the age of the household heads is mostly concentrated in the age group of 31–60 years old, accounting for 56% of the total number; and the average annual household income is RMB110,183.6.

This paper refers to Wei et al. (2019) and select two variables, commercial insurance holdings and level of commercial insurance holdings, to represent the explained variable of this paper—commercial insurance holding behavior. For the measure of commercial insurance holdings, any member of the household who is enrolled in any kind of commercial insurance takes the value of 1, while none takes the value of 0. The level of commercial insurance holdings is measured by the premium expenditure on commercial insurance, specifically the total amount of commercial insurance purchased by the household in the past year, and is logarithmically treated.

The explanatory variable in this paper is human capital, which includes three dimensions: years of education, physical health status and financial literacy. Years of education is illustrated by the average number of years of education in the household, which is transformed accordingly according to the education level in the questionnaire; physical health status is measured according to the respondents’ responses, with very good, good and average healthy taking the value of 1 and bad and very bad taking the value of 0 (Qin et al., 2016); in terms of financial literacy, this paper uses two questions in the questionnaire about interest rate calculation and inflation understanding to measure respondents’ financial literacy, following Wu et al. (2018), using the number of correct answers to the financial knowledge questions to measure their financial literacy, with values ranging from 0 to 2.

In this paper, financial market participation and risk preference are used as mediating variables respectively. Financial market participation is measured by whether residents own financial assets such as stocks, funds and debentures, with a value of 1 for holding financial assets and 0 otherwise; residents’ risk preference is measured by the answer to the question in the CHFS, “If you had a sum of money to invest, which investment item would you be most willing to choose?” The answer to this question is measured by assigning a value of 1 to the options “high-risk, high-return project” and “slightly high-risk, slightly high-return project” and 0 to the other options (Qin et al., 2016). Specific variable descriptions and descriptive statistics are shown in Table 1.

As can be seen from Table 1, only 12% of the households in the sample selected for this paper are covered by commercial insurance, and the average amount of expenditure on commercial insurance purchased by the insured households in the past year is also relatively small, indicating that the holding rate of commercial insurance among Chinese residents is low and the level of holdings is not high. The mean value of households’ financial literacy is only 0.05 and the mean value of risk preference is only 0.12, indicating that the financial literacy of Chinese residents is not satisfactory and their aversion to risk is relatively high. The average number of years of education for residents is 10.36, which is at an intermediate level, and the mean value for physical health is 0.86, indicating that residents are in good physical health.

This paper conducted a correlation analysis of the data through SPSS 26.0, as shown in Table 2. Years of education, physical health status, financial literacy and commercial insurance holdings, and level of commercial insurance holdings were significantly and positively correlated. Also, years of education, physical health status with financial market participation and risk preference were significantly positively correlated, and financial market participation and risk preference were significantly positively correlated with commercial insurance holdings and level of commercial insurance holdings. The results of the correlation analysis provided support for the subsequent data analysis.

This paper used a structural equation modeling approach to test the research hypotheses. Compared to path-by-path analysis using cascade regression, structural equation modeling allows the analysis of a pooled regression model with all latent and measured variables at once, which controls and reduces the errors caused by measured variables, avoids overestimating direct effects and underestimates the magnitude of mediating effects, and results in more accurate and unbiased estimates (Cheung and Lau, 2008). The bias-corrected bootstrap method is used to test the significance of the mediating effects, which can effectively reduce the probability of discard errors that can occur with methods such as the sobel test, and the confidence interval of the mediating effect is estimated more precisely and robustly, and thus will have higher statistical validity.

This paper builds on the mediation effect validation and estimation procedure proposed by Baron and Kenny (1986) and follows the procedural approach suggested by MacKinnon et al. (2004) and Preacher and Hayes (2008) to validate the mediating effects and assess the magnitude of the mediating effect significance. In the first step, the model of the direct effect of the explanatory and explained variables is validated and the model will show significant path coefficients supporting the direct effect; in the second step, all direct and indirect effects are added to the model at once and the significance of the path coefficients between the variables is estimated using structural equation modeling; in the third step, the significance of the mediating effect is tested using the bootstrap resampling technique by Mplus software and assess the size of their confidence intervals (Lau and Cheung, 2012; Muthe’n and Muthe’n, 2017).

In order to clarify the relationship between human capital and household commercial insurance holding behavior, this paper uses Mplus software to test the research hypotheses using structural analysis of covariance on a structural equation ensemble model. Table 3 presents the aggregate effects of each of the three dimensions of human capital on household commercial insurance holding behavior: years of education, physical health status and financial literacy all have significant positive effects on household commercial insurance holdings (β = 0.366, p < 0.001, model 1; β = 2.237, p < 0.001, model 2; β = 0.934, p < 0.05, model 3), and there were significant positive effects of years of education, physical health status and financial literacy on the level of household commercial insurance holdings (β = 0.353, p < 0.001, model 4; β = 2.051, p < 0.001, model 5; β = 1.014, p < 0.001, model 6), therefore, Hypothesis H1 was tested.

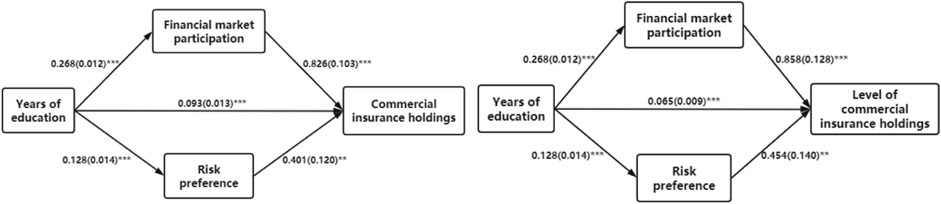

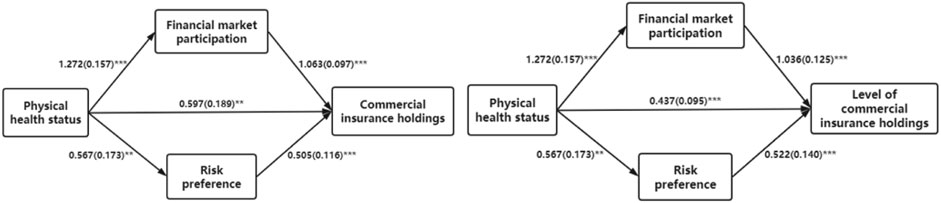

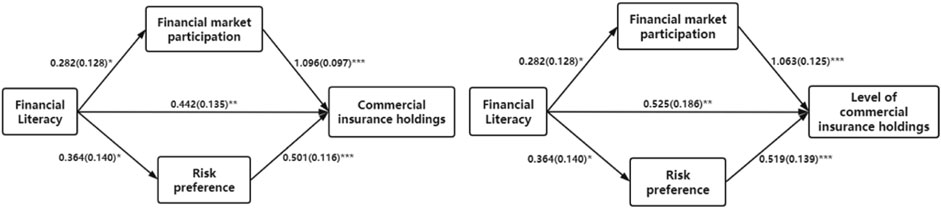

This paper introduces two mediating variables, financial market participation and risk preference, respectively. Figure 2—Figure 4 present the direct and indirect effects of human capital on household commercial insurance holding behavior, with standard errors in brackets. As can be seen from the figures, the results for each path are significant, thus Hypotheses H2, H3, H5, H6 are supported.

FIGURE 2. Results of the path analysis of years of education and household commercial insurance holding behavior.

FIGURE 3. Results of the path analysis of physical health status and household commercial insurance holding behavior.

FIGURE 4. Results of the path analysis of financial literacy and household commercial insurance holding behavior.

Next, the paper uses the procedural approach proposed by Baron and Kenny to verify the mediating role of financial market participation and risk preference: first, the explanatory variables must be significantly correlated with the explained variables; secondly, the explanatory variables must be significantly correlated with the mediating variables; thirdly, the mediating variables must be significantly correlated with the explained variables; and fourth, when the mediating variable is added, the effect of the explanatory variable on the explained variable is significantly reduced. The first three steps have been verified in the above study. In the fourth step, after the introduction of the mediating variables financial market participation and risk preference, the effect of the explanatory variables on the explained variables is significantly reduced (e.g., the effect of years of education on household commercial insurance holdings is reduced from β = 0.366, p < 0.001 to β = 0.093, p < 0.001), thus, the effect of financial market participation and risk preference on human capital play a partially mediating role in the relationship between human capital and household commercial insurance holding behavior, respectively, and Hypotheses H4, H7 are supported.

To further test the mediating role in the model, this paper uses the basic bootstrap resampling technique to test the significance of the mediating role of financial market participation and risk preferences. In this paper, 5,000 bootstrap resampling analyses were conducted on a sample of 9,009 household data and the test results obtained are shown in Table 4.

As can be seen from the 95% confidence interval column in Table 4, none of the 95% confidence intervals for the mediating effect of financial market participation contain 0, indicating that the mediating effect of financial market participation is significant. Similarly, the 95% confidence interval for the mediating effect of risk preference also does not contain 0, indicating that the mediating effect of risk preference is significant. Thus, the mediating effects of financial market participation and risk preference on the relationship between human capital and household commercial insurance holding behavior are again validated.

Also, Table 4 gives the results of comparing the two mediating effects of financial market participation and risk preference, which can be used to determine whether the two mediating effect sizes are statistically significant based on whether the indirect effect comparison results contain 0 at the 95% confidence interval. The results show that in the case of the effects of years of education and physical health status on household commercial insurance holding behavior, the indirect effect comparison results do not contain 0 at the 95% confidence interval, indicating that the mediating effect of financial market participation is significantly larger than that of risk preference, while in the effects of financial literacy on commercial insurance holding behavior, the indirect effect comparison results contain 0 at the 95% confidence interval, indicating that the two mediating effect sizes are not significantly different. Overall, human capital has an indirect effect on household commercial insurance holding behavior more through the mediating variable of financial market participation.

Based on data from the 2017 China Household Finance Survey (CHFS), this paper explores the mechanism of human capital’s influence on households’ commercial insurance holding behavior by combing existing literature to clarify the effects and paths of different households’ human capital on their commercial insurance holding behavior, and finds that:

There is a significant positive effect of human capital, as measured by years of education, physical health status and financial literacy, on household commercial insurance holding behavior, with the higher the level of human capital of a household, the more likely it is to purchase commercial insurance and spend more on commercial insurance, which is in line with the findings of scholars such as Qin et al., 2016, Zhou and Xia (2020) and Lan (2021). The level of education reflects, to a certain extent, the ability to understand and translate external information, and is more likely to make a more comprehensive understanding of commercial insurance without the interference of complex information when making asset allocations (Hou et al., 2022), and thus make more reasonable choices. Financial literacy helps to optimize the allocation of family assets and promote the increase of family wealth. Commercial insurance also has certain transaction costs, and the continuous appreciation of family assets provides a favorable support point for the purchase of commercial insurance. In contrast to Edwards’ (2008) findings that health status among household members is negatively associated with participation in insurance products, the findings of this paper suggest that good health status reduces the pressure on individuals to save and has more surplus funds to invest in higher-returning risk assets, resulting in higher rates of commercial insurance purchases. From the data sample in this paper, nearly 40% of the heads of households with commercial insurance are between 45 and 59 years old, they have certain social experience and have a stronger sense of risk protection than the younger generation; at the same time, as middle-aged people, they are burdened with the pressure of providing for their parents and children, most of their parents are very old, whose physical functions are declining, medical expenses are increasing, and basic social security can no longer meet the existing needs of the family. They need to purchase commercial medical insurance, commercial critical illness insurance and other commercial insurance to relieve the family financial pressure.

Financial market participation and risk preference mediate the relationship between human capital and household commercial insurance holding behavior, i.e., human capital positively influences household commercial insurance holding behavior through financial market participation and risk preference respectively. Specifically, higher levels of human capital in households imply a deeper understanding of financial knowledge and greater confidence in participating in financial markets when allocating household assets; at the same time, households with high levels of human capital tend to have more opportunities and resources to enrich their lives, as well as more stable social relationships and social support (Wu et al., 2022) and individuals experience greater happiness from family relationships, and this positive, happy emotional experience helps strengthen family members’ confidence in resisting risk, and their tolerance for financial risk is correspondingly higher; families with high levels of happiness are more concerned about long-term utility (Sang, 2019), and considering the risks they may take in the future, will make decisions in advance that are conducive to increasing long-term utility, and commercial insurance, which has both investment and protection functions commercial insurance is an apt choice.

By comparing the magnitude of the mediating effects of financial market participation and risk preference, it is found that human capital has more of an indirect effect on household commercial insurance holding behavior through the mediating variable of financial market participation. This may be due to the fact that financial market participation is more closely associated with households’ commercial insurance holding behavior decisions than risk preferences. The decision to hold commercial insurance is inherently part of the financial asset decision, and the purchase of commercial insurance reflects the household’s active participation in financial markets, which also determines to some extent the consumption demand for commercial insurance (Headen and Lee, 1976; Meyer and Ormiston, 1995). Households that participate in the financial market tend to have higher financial literacy and stronger investment and financial awareness than those that do not, and insurance products have the attributes of financial investment products, so households that participate in the financial market are more aware of the functions of commercial insurance and are more likely to choose the right commercial insurance for themselves.

Based on the 2017 China Household Finance Survey (CHFS) data, this paper explores the mechanism of human capital on household commercial insurance holding behavior by introducing two mediating variables, financial market participation and risk preference, from the perspective of household human capital, and constructs and empirically tests the research hypothesis model. The study finds that: firstly, among the three dimensions of human capital, there are significant direct positive effects of years of education, physical health status and financial literacy on household commercial insurance holding behavior, i.e., households with higher levels of human capital are more inclined to purchase commercial insurance and spend more on commercial insurance premiums, which is consistent with the findings of existing studies. Secondly, in addition to the direct effect, years of education, physical health status and financial literacy also have an indirect positive effect on household commercial insurance holding behavior through two mediating variables: financial market participation and risk preference, which partially mediate the relationship between human capital and household commercial insurance holding behavior respectively. Thirdly, by comparing the magnitude of the two mediating effects, it is found that years of education, physical health status and financial literacy influence household commercial insurance holding behavior more indirectly through financial market participation.

Based on the above findings, this paper puts forward the following research implications. First, increase financial knowledge popularization. Having certain financial knowledge is the basis for participating in commercial insurance. In order to improve the financial market system and promote the development of the economy, financial institutions should take the initiative to carry out free financial knowledge education, develop different programmes according to different levels of financial knowledge and different risk attitudes, and carry out different forms of educational methods to enhance the popularisation of financial knowledge and reduce information asymmetry. Secondly, to enhance residents’ correct understanding of commercial insurance and scientific approach to risk issues. The government should make use of the Internet to rally the propaganda efforts of all parties to reasonably promote commercial insurance, explain clearly to residents the use of various types of commercial insurance, the rules of use and the terms of the contract, help residents understand the essence and original intent of insurance, change their one-sided perception of insurance products, enable them to establish a correct awareness of risk prevention, and promote the healthy development of commercial insurance. Thirdly, shaping a healthy insurance market. The government should continue to improve laws, regulations and systems, regulate the signing and execution of commercial insurance contracts, and increase supervision of the insurance market; continuously improve the risk prevention and control capabilities of insurance institutions, improve the mechanism and enhance the efficiency of protecting the rights and interests of commercial insurance consumers.

The limitations of this paper are reflected in the following three aspects: first, there is a positive effect of residents’ risk preferences on household commercial insurance holding behavior, and the findings of existing studies addressing this issue are inconsistent. It may be because the impact of residents’ risk preferences varies for different types of commercial insurance, and for this reason, a more detailed analysis based on the specific type of commercial insurance is needed in the future. Secondly, there are differences in the commercial insurance holding behavior decisions of families or individuals with different family structures, income levels and occupational backgrounds, and more in-depth analysis can be conducted on these dimensions in the future. Thirdly, this paper is limited by the sample data, and the household commercial insurance holding behavior is only measured in terms of whether the household holds commercial insurance and the premium expenditure on commercial insurance, but the ratio of the premium expenditure to the household investment amount and the duration of the household holding commercial insurance are important indicators to describe the household commercial insurance holding behavior, which are to be improved in the future research.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

This paper was supported by the Beijing Union University Research Project (No. XP202009).

Comments from the editor and the referees are gratefully acknowledged.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Andersson, O., Tyran, J. R., Wengstrom, E., and Holm, H. J. (2016). Risk aversion relates to cognitive ability: Fact or fiction? J. Eur. Econ. Assoc. 14 (5), 1129–1154. doi:10.1111/jeea.12179

Awel, Y. M., and Azomahou, T. T. (2015). Risk preference or financial literacy? Behavioural experiment on index insurance demand. MERIT Working Papers 005.

Balloch, A., Nicolae, A., and Philip, D. (2014). Stock market literacy, trust, and participation. Rev. Financ. 19 (5), 1925–1963. doi:10.1093/rof/rfu040

Baron, R. M., and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personality Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Becker, G. S. (1994). Human capital: A theoretical and empirical analysis with special reference to education. Rev. Econ. 18 (1), 132. doi:10.2307/3499575

Bianchi, M. (2017). Financial literacy and portfolio dynamics. J. Finance 73 (2), 831–859. doi:10.1111/jofi.12605

Brown, S., and Taylor, K. B. (2006). Education, risk preference and wages. Sheffield: The University of Sheffield, Department of Economics. working papers 2006002. Available at: https://ideas.repec.org/p/shf/wpaper/2006002.html.

Campbell, J. Y. (2006). Household finance. J. Finance 61 (4), 1553–1604. doi:10.1111/j.1540-6261.2006.00883.x

Cheung, G. W., and Lau, R. S. (2008). Testing mediation and suppression effects of latent variables: Bootstrapping with structural equation models. Organ. Res. Methods 11 (2), 296–325. doi:10.1177/1094428107300343

Cho, I. (2016). Health and households’ portfolio choices in europe. Rev. Eur. Stud. 8 (4), 183. doi:10.5539/res.v8n4p183

Crainich, D., Eeckhoudt, L., and Courts, O. L. (2017). Health and portfolio choices: A diffidence approach. Eur. J. Operational Res. 259 (1), 273–279. doi:10.1016/j.ejor.2016.10.022

Cui, J. W., Xu, S. L., and Li, Y. F. (2019). Financial knowledge, limited attention and financial behavior. Financial Econ. Res. 34 (6), 105–119.

Cui, Y., Liu, H., Yi, J., Kang, Q., Hao, L., and Lu, J. (2021). The impact of education on household portfolio choice: Gender difference and channel analysis. Crit. Rev. Food Sci. Nutr. (4), 1–16. doi:10.1080/10408398.2021.2007045

Drugdová, B. (2016). Regarding the issue of insurance market in Slovak republic being a part of financial market. ujaf. 4 (4), 117–120. doi:10.13189/ujaf.2016.040401

Edwards, R. D. (2008). Health risk and portfolio choice. J. Bus. Econ. Statistics 26 (4), 472–485. doi:10.1198/073500107000000287

Fisch, J. E., and Seligman, J. S. (2021). Trust, financial literacy, and financial market participation. J. Pension Econ. Finance, 1–31. doi:10.1017/S1474747221000226

Friedman, M., and Savage, L. J. (1948). The utility analysis of choices involving risk. J. Political Econ. 56, 279–304. doi:10.1086/256692

Fu, X. N., Qu, S. Y., Tian, B. P., and Li, Y. P. (2020). Study on financial asset decision of Chinese elderly household based on the perspective of health shock. Front. Sci. Technol. Eng. Manag. 39 (6), 83–89. doi:10.11847/fj.39.6.83

Gan, L., Yin, Z. C., and Jia, N. (2013). Assets and residential demand of Chinese households. J. Financial Res. 394(4), 1–14.

He, W., and Wang, X. H. (2021). Research progress on household financial asset selection and influencing factors. Chin. Rev. Financial Stud. 13 (1), 95–120+124.

He, X. Q., and Li, T. (2009). Social interaction, social capital and commercial insurance purchase. J. Financial Res. 2, 116–132.

Headen, R. S., and Lee, J. F. (1976). Life insurance demand and household portfolio behavior: Authors' reply. J. Risk Insur. 43, 331. doi:10.2307/251985

Hou, Z. K., Guo, N., Li, Y., and Wang, C. L. (2022). Study on the factors influencing rural residents’ motivation to participate in commercial insurance: An empirical analysis based on data from digital economy and China family panel studies. For. Econ. 44 (2), 73–84. doi:10.13843/j.cnki.lyjj.20220402.001

Hsiao, Y. J., and Tsai, W. C. (2018). Financial literacy and participation in the derivatives markets. J. Bank. Finance 88, 15–29. doi:10.1016/j.jbankfin.2017.11.006

Hu, Z., and Zang, R. H. (2016). Risk attitudes, financial education and household financial portfolio choice. J. Bus. Econ. 298 (8), 64–76. doi:10.14134/j.cnki.cn33-1336/f.2016.08.007

Korniotis, G. M., and Kumar, A. (2010). Cognitive abilities and financial decisions. John Wiley & Sons.

Lan, S. (2021). The impact of population aging on commercial insurance purchasing behavior: Evidence from China. Acad. J. Bus. Manag. 3 (4), 55–62. doi:10.25236/AJBM.2021.030412

Lau, R. S., and Cheung, G. W. (2012). Estimating and comparing specific mediation effects in complex latent variable models. Organ. Res. Methods 15 (1), 3–16. doi:10.1177/1094428110391673

Lei, X. Y., and Zou, Y. G. (2010). On the portfolio choice of Chinese households: Health and risk preference. J. Financial Res. 355.

Li, D., Xu, J., and Fu, J. (2015). Research on sustainable livelihood capital of reservoir migrants in ethnic areas and their livelihood strategy relationship. J. China Univ. Geosciences Soc. Sci. Ed. 15 (1), 51–57. doi:10.16493/j.cnki.42-1627/c.2015.01.007

Li, J., Li, Q., and Wei, X. (2020). Financial literacy, household portfolio choice and investment return. Pacific-Basin Finance J. 62, 101370. doi:10.1016/j.pacfin.2020.101370

Lu, Y. J., and Yin, J. Y. (2021). A study on the impact of education level of the head of household on the selection of household risky financial assets. J. Nanjing Audit Univ. 18 (3), 70–80. doi:10.3969/j.issn.1672-8750.2021.03.008

MacKinnon, D. P., Lockwood, C. M., and Williams, J. (2004). Confidence limits for the indirect effect: Distribution of the product and resampling methods. Multivar. Behav. Res. 39 (1), 99–128. doi:10.1207/s15327906mbr3901_4

Meyer, J., and Ormiston, M. B. (1995). Demand for insurance in a portfolio setting. Geneva Pap. R. i-iss. p. 20 (2), 203–211. doi:10.1007/BF01258397

Mushkin, S. J. (1962). Health as an investment. J. Political Econ. 70 (5), 129–157. doi:10.1086/258730

Muthe'n, L. K., and Muthe'n, B. O. (2017). Mplus user’s guide. 8th ed. Available at: https://www.statmodel.com/download/usersguide/MplusUserGuideVer_8.pdf.

Pellicer, M. (2005). Education, financial market participation and income inequality. Florence: European University Institute, EUI PhD theses, Department of Economics -. Available at: http://hdl.handle.net/1814/5035.

Preacher, K. J., and Hayes, A. F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 40 (3), 879–891. doi:10.3758/BRM.40.3.879

Qiao, Y., and Zhang, H. (2022). Family risk financial assets allocation and commercial insurance participation: an empirical research based on data of CHFS2017. Beijing: The World of Survey and Research, 44–54. doi:10.13778/j.cnki.11-3705/c.2022.05.00505

Qin, F., Wang, W. C., and He, J. C. (2016). The effect of financial literacy on household commercial insurance participation: An empirical research based on the data of China Household Financial Survey. J. Financial Res. 58 (10), 143–158.

Riley, W. B., and Victor, C. K. (1992). Asset allocation and individual risk aversion. Financial Analysts J. 48 (6), 32–37. doi:10.2469/faj.v48.n6.32

Sang, L. (2019). Residents' happiness, subjective attitude and commercial insurance market participation: A study based on Chinese household finance survey data. Econ. Manag. 33 (2), 45–53.

Schultz, T. W. (1961). Investment in human capital. Am. Econ. Rev. 51 (1), 1–17. doi:10.2307/1818907

Sun, R. T., and Xiong, X. P. (2019). The effects of the risk attitude on the retirement plan: Evidence from rural residents in Hubei. Northwest Popul. J. 40 (4), 91–105. doi:10.15884/j.cnki.issn.1007-0672.2019.04.009

Tian, Y., Duan, X. N., and Liu, S. Y. (2018). The impact of residents' risk attitude on household commercial insurance participation behavior: An empirical analysis based on CFPS data. Finance Econ. 482 (8), 94–96. doi:10.14057/j.cnki.cn43-1156/f.2018.08.040

Tz, A., Wl, B., Kl, C., and Zl, D. (2022). Only words matter? The effects of cognitive abilities on commercial insurance participation. North Am. J. Econ. Finance 61, 101691. doi:10.1016/j.najef.2022.101691

Wang, H. Y. (2017). The status quo and factors to impact the commercial life insurance demand of Chinese household: An empirical research based on CHFS. Finance Forum 22 (3), 51–65. doi:10.16529/j.cnki.11-4613/f.2017.03.006

Wang, Y. (2008). A research on the influence of wealth effect, human capital and financial deepening on rural family portfolio: A comparative study of rural households' financial market participation. Econ. Surv. 127 (6), 127–131. doi:10.15931/j.cnki.1006-1096.2008.06.046

Wei, H. L., and Yang, X. (2007). The study on household financial assets and insurance consumption. J. Financial Res. 328 (10), 70–81.

Wei, J. L., Zheng, S. Y., and Yu, J. Y. (2019). “Family heterogeneity, internet use and commercial insurance coverage: Based on China Household Finance Survey data,” in South China finance, 51–62.9

Wu, J., Zheng, H., and Liu, R. D. (2022). Research on urban comfort experience and youth well-being: An analysis based on CGSS (2015) data. China Youth Study 315 (5), 21–28. doi:10.19633/j.cnki.11-2579/d.2022.0065

Wu, W. X., Rong, P. G., and Xu, Q. (2011). Health status and household portfolio choice. Econ. Res. J. 46 (S1), 43–54.

Wu, W. X., Wu, K., and Wang, J. (2018). Financial literacy and household debt: Empirical studies using Chinese household survey data. Econ. Res. J. 53 (1), 97–109.

Wu, Y., Yang, C., and Yin, Z. C. (2017). Financial literacy, retirement planning and household insurance decisions. Econ. Perspect. 682 (12), 86–98.

Yang, J. F., Gong, L. T., and Zhang, Q. H. (2006). Human capital formation and its effects on economic growth: An endogenous growth model including education and health inputs and its test. J. Manag. World (5), 10–18+34+171. doi:10.19744/j.cnki.11-1235/f.2006.05.002

Yu, W., Wang, Q., Guan, G., and Huang, Y. (2021). Factors affecting the purchase of commercial health insurance: Based on personal health status and the substitution effect of social insurance. Med. Political Sci. doi:10.21203/rs.3.rs-1033408/v1

Zhang, H. D., and Yin, Z. C. (2016). Financial literacy and households’ financial exclusion in China: Evidence from CHFS data. J. Financial Res. 17 (7), 80–95.

Zhang, Y. L., Feng, J., Zhao, Q. F., and Liu, J. K. (2020). Attitudes towards risk and family entrepreneurship: An empirical analysis based on China Household Finance Survey in 2011, 2013 and 2015. J. Finance Econ. 46 (3), 154–168. doi:10.16538/j.cnki.jfe.2020.03.011

Keywords: human capital, household commercial insurance holding behavior, financial market participation, risk preference, financial literacy

Citation: Xie Y, Zhang B, Yao Y, Chen X and Wang X (2022) Mechanism of human capital influence on household commercial insurance holding behavior—An empirical analysis based on China household finance survey (CHFS) data. Front. Environ. Sci. 10:961184. doi: 10.3389/fenvs.2022.961184

Received: 04 June 2022; Accepted: 12 July 2022;

Published: 09 August 2022.

Edited by:

Magdalena Radulescu, University of Pitesti, RomaniaReviewed by:

Khoa Bui Thanh, Industrial University of Ho Chi Minh City, VietnamCopyright © 2022 Xie, Zhang, Yao, Chen and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xinyu Wang, d3h5MDA2QGJ1dS5lZHUuY24=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.