- 1School of Economics, Tianjin University of Commerce, Tianjin, China

- 2Department of Environmental Physics, The University of Lahore, Lahore, Pakistan

This study investigates the dynamic impact of green energy investment and energy consumption on carbon emissions in China from 1995 to 2020. It employed the Bootstrap Autoregressive Distributed Lag method to examine the short and long-run relationship. The long-run findings indicate that green energy investment and renewable energy consumption decrease carbon emissions, whereas non-renewable energy consumption and economic growth increase carbon emissions in shorter and longer periods. The long-term reduction in carbon emissions may imply the transition toward carbon neutrality. However, the marginal contribution of renewable energy towards carbon neutrality is significantly higher than green energy investment due to investment lag effects. Moreover, the Error Correction Term (ECT) is significantly negative, authorizing the convergence towards steady-state equilibrium in case of any deviation with a 25% adjustment rate. The empirical results suggest that China should encourage green energy investment and increase the share of renewable energy sources to ensure carbon neutrality in the long run.

1 Introduction

In the modern period, achieving economic growth with environmental sustainability is the goal of both developed and developing countries. However, stimulating economic growth leads to rapid productivity of goods and services, increasing energy demand. It implies that the energy sector is considered a backbone of an economy because it links with economic prosperity. Thus, in this regard, energy is divided into two kinds, the first is non-renewable, and the second is renewable energy. Non-renewable energy sources are limited in supply, and once they are used, they cannot be replaced. They include fossil fuels such as oil, coal, and natural gas and most developing countries depend on non-renewable energy sources for their energy requirements (Hanif et al., 2019). In comparison, renewable energy is a form of energy that can be used on a recurring basis and cannot be depleted. It is also called clean energy and includes different forms such as solar, wind, hydro, tidal and geothermal. However, many past studies found that using conventional energy degrades the environment (Chunyu et al., 2021; Fatima et al., 2021). In order to achieve rapid economic growth and compete in the foreign market with more productivity and low cost, developing countries frequently use non-renewable energy sources. Thus, due to easy availability and low cost, non-renewable energy contributes to economic development, but simultaneously increasing the trend of traditional energy has become a danger to the environment. Therefore, developing countries are encouraged to use renewable energy to meet their energy requirements in various sectors of the economy.

For sustainable development, renewable energy is considered the best strategy. The importance of efficient energy has gained the focus of scholars; therefore, prevailing studies explored the influence of renewable energy consumption on the environment. However, previous research studies explored that renewable energy positively relates to carbon neutrality (Sharif et al., 2020a; Shan et al., 2021). Renewable energy is also called green energy because it reduces energy consumption through energy efficiency. Moreover, it enhances economic growth as well as environmental quality. Thus, renewable energy consumption leads the economy to low carbon emissions. In comparison, a few studies highlight that renewable energy resources have an insignificant or negative impact on mitigating environmental pollution (Apergis et al., 2010; Marques and Fuinhas, 2012) because, in the early stages of development, the limited size of the economy has not increased renewable energy. In addition, the share of renewable energy in total energy is not much increased due to a lack of investment because renewable energy is more expensive than non-renewable energy, and there is a need for investing more in the promotion of renewable energy sources. Hence, the association between these two variables is still inconclusive (Sun et al., 2022b). Recently, the policymakers and government have given their attention to green energy investment to improve the quality of the environment. Green investment is a type of investment that improves production efficiency, saves the environment from hazards, and conserves energy (Shen et al., 2021). Thus, green investment is a broader term which does not limit to renewable energy, but it also incorporates multiple techniques such as water recycling, waste processing and recycling, carbon-capture technology, electric motor cars, green buildings, and energy-saving products (Razzaq et al., 2021a; Sun et al., 2022a).

There are two strands of literature about the nexus between green investment and the environment in the current literature. One group of studies has discussed the positive contribution of green energy investment in increasing the quality of the environment (Bekun et al., 2019; Xiong and Sun, 2022). Investing in green energy increases economic growth, ensures environmental sustainability through renewable energy consumption, and further leads to green technology through research and development. Therefore, investing in green projects and providing a sustainable environment is imperative to promoting green policies. The second group of studies stated that green energy investment has a negative or no influence on the environment (Nehler and Rasmussen, 2016; Stucki, 2019). Moreover, countries are often interested in profit and energy cost-saving benefits. They do not consider the non-energy and indirect gains from green investments, such as more productivity, fewer emissions, and better product quality. As a result, the advantages of green energy investment have decreased. Hence, the findings of studies related to green energy investment and the environment are inconclusive.

Although, former empirical studies have separately explored the relationship between energy consumption, green energy investment, and carbon neutrality (Sun and Razzaq, 2022). However, there is a dearth of empirical evidence that considers all these essential factors in a multivariate framework. In addition, few prior studies related to the nexus between green energy investment and environmental damage. The prevailing studies regarding the nexus between energy consumption and carbon emissions mainly consist of panel data analysis and less attention to the time series analysis. Thus, the present research study investigates the dynamic influence of green energy investment and energy consumption on carbon neutrality in China. The reason for the selection of China is that it contributes to 30% of total carbon emissions globally, making the country the world’s largest carbon emitter because it is highly dependent on coal for energy consumption. Further, China is the fastest-growing economy with a high population, and increasing energy demand cannot satisfy from use of coal; thus, it leads to environmental degradation. China has taken essential steps in this crucial situation, including transforming non-renewable energy into renewable energy (Park et al., 2017). However, the industrial sector is the main contributor to economic growth and CO2 emissions. Thus, China made a substantial green investment in 2017 in this sector, whose share is 0.106% of total investment to increase carbon neutrality (Chen et al., 2021).

The literature, as mentioned earlier, shows that relatively little attention has been given to the dynamic role of green energy investment and energy consumption on carbon neutrality. Thus, the current study contributes to the literature. The study’s objective is to examine the short and long-run dynamic relationship between green energy investment, energy consumption, and carbon emissions in China by using the monthly data from 1995 to 2020. In addition, Bootstrap Autoregressive Distributed Lag (BARDL) modeling is applied for an empirical estimation which is superior to the conventional ARDL approach in time series analysis because it addresses the issues of low power and small size of data. Thus, the bootstrap ARDL test provides consistent and robust outcomes in estimating the short and long-run relationship. Finally, we used the stability test on the model estimations to check the reliability of the results.

The rest of the paper is organized as follows: Section 2 describes the literature review, Section 3 represents data and methodology, Section 4 shows the empirical findings and discussion, and Section 5 indicates the conclusion and policy recommendations.

2 Literature review

In this section, the literature review is divided into two dimensions. First shows the nexus between green energy investment and the environment. The second indicates the nexus between energy consumption and environmental degradation; however, this part divides energy consumption into two segments, i.e., renewable energy consumption and non-renewable energy consumption.

2.1 Green energy investment and environmental degradation

Green investment is defined as the investment that protects the environment from degradation and saves energy. However, various prior studies have examined the nexus between green technology and the environment, but the literature regarding green energy investment is not extensive. There are two schools of thought regarding the nexus between green energy investment and carbon neutrality.

One school of thought states that green energy investment substantially stimulates economic growth without damaging the environment (Sachs et al., 2019). Sachs et al. (2019) investigated the contribution of green investment and projects to achieve sustainable development goals (SDGs). Thus, green bonds, green funding, and carbon market instruments help promote sustainable growth and get SDGs. Saeed Meo and Karim (2022) examined the impact of natural resources rent, green investment, financial development, and energy use on pollution in 30 provinces of China from 1995 to 2017. The results confirmed the positive impact of green investment in reducing CO2 emissions while financial development, natural resources rent and energy consumption lead to air pollution. Lee and Min (2015) found the role of research and development (R&D) investment in green technology on environmental quality in Japan’s manufacturing firms from 2001 to 2010. The study explored the negative association between (R&D) expenditures with CO2 emissions. International Renewable Energy Agency determined the influential positive impact of green investment in controlling environmental pollution in 34 provinces of China from 2003 to 2017. Thus, green investment is essential for low carbon emissions in the environment. Wang et al. (2021) explored the link between renewable energy, green finance, and CO2 pollutants with other controlling variables in BRICS countries from 2000 to 2018. The results showed that green finance and renewable energy increase carbon neutrality while trade openness, economic growth, and foreign direct investment stimulate CO2 emissions. Therefore, green finance is the best policy for mitigating pollutant emissions in these countries.

In contrast, the other school argues that green energy investment increase carbon emissions (Nehler and Rasmussen, 2016; Stucki, 2019). Stucki (2019) explored the impact of energy investment at the firm level in Austria, Germany and Switzerland and found that if any country’s energy cost is low, corporations are unwilling to invest in green energy. They conclude that energy cost greatly impacts a firm’s decision to invest in green energy. Firms with higher energy costs invest more in green energy than firms with lower energy costs. Similarly (Nehler and Rasmussen, 2016) determined that Industrial enterprises prioritize profitability from green investments over energy cost savings and also observed that most green investment decisions do not consider advantages other than energy, such as increased productivity, reduced emissions, improved product quality, optimum material utilization, and lower repairing and cleaning costs, which, if considered, would enhance green investment. Therefore, the literature regarding green energy investment and environmental damage has mixed results.

2.2 Energy and environmental degradation

Many past studies have extensively discussed the influence of energy consumption on environmental pollution. However, literature regarding the nexus between energy usage and the environment disaggregated energy into non-renewable and renewable energy sources.

2.2.1 Non-renewable energy consumption and environment

Former studies argued that conventional energy consumption increases carbon emissions through the excessive use of fossil fuels in industrialization, urbanization, transportation, and other economic activities. Thus, a positive relationship exists between non-renewable energy consumption and environmental pollution (Khan et al., 2020; Chunyu et al., 2021). Saboori and Sulaiman (2013) empirically analyzed the influence of energy consumption on environmental pollution in Malaysia and found that high consumption of non-renewable energy sources leads to CO2 emissions. Similarly, Khan et al. (2019) explored the positive contribution of non-renewable energy consumption in deteriorating the environment in the case of Pakistan. Raza and Shah (2018) determined the effect of financial development, gross domestic product, and energy consumption on CO2 emissions in Pakistan from 1972 to 2014. The estimated results revealed that financial development, economic growth, and energy consumption significantly increase environmental degradation. Rehman and Rashid (2017) determined the role of energy usage on CO2 emissions in SAARC countries. The examined results indicated that energy consumption significantly contributes to environmental degradation. Hanif (2018) examined the positive effect of non-renewable energy consumption on CO2 emissions in 34 emerging economies from 1995 to 2015. Their findings suggest that using non-renewable energy sources mitigates the environmental pollution in these countries. Bhat (2018) found the relationship between energy consumption, economic growth, and CO2 emissions in BRICS countries from 1992 to 2016. The results revealed that traditional energy, economic growth, and population increase the environmental degradation in BRICS countries. Kim and Perron, 2009 analyzed the positive contribution of non-renewable energy towards economic development and carbon emissions in high emitting countries from 1980 to 2014. Leng Chunyu et al. (2021) examined the effect of energy consumption and financial development on CO2 emissions in European and Central Asian developing countries from 2010 to 2019. The results show that fossil fuel consumption enhances while renewable energy consumption decreases CO2 emissions. Financial development raises environmental deterioration in the short-run and reduces it in the long run in concerned countries.

2.2.2 Renewable energy consumption and environment

Renewable or efficient energy sources are alternatives to conventional energy sources that enhance the environmental quality and substantially increase economic growth through energy efficiency.

In the current literature, two strands of studies exist about the interdependence between renewable energy utilization and environmental sustainability. First-strand of studies has analyzed the positive linkage between renewable energy consumption and environmental degradation (Shan et al., 2021). Kalmaz and Kirikkaleli (2019) determined the influence of energy consumption, trade, GDP growth, and urbanization on CO2 emissions in Turkey from 1960 to 2015. The results highlight the long-run co-integration relationship among the variables, and trade, energy consumption, and economic growth increase CO2 emissions. Alharthi et al. (2021) analyzed the association between urbanization, economic growth, energy use, and CO2 emissions in the (MENA) countries from 1990 to 2015. The study found that renewable energy consumption decreases, and conventional energy usage increases CO2 emissions, respectively. Anwar et al. (2021) examined the role of clean and fossil fuel energy consumption on the CO2 emissions in ASEAN countries from 1990 to 2018. The results found the mitigating role of renewable energy sources in improving the quality of the environment in concerned countries. Sharif et al. (2020b) investigated the nexus between renewable energy consumption and environmental pollution in the top 10 carbon-emitting countries from 1990 to 2017. The findings show that renewable energy sources significantly reduce CO2 emissions in these countries, and bi-directional causality exists between these two variables.

However, the second strand of studies shows renewable energy consumption’s insignificant or inverse effect in decreasing CO2 emissions. Pata (2018) determined the relationship between clean energy usage, urbanization, financial development, and GDP on the environment in Turkey from 1974 to 2014. The estimated results show that urbanization, economic growth, and financial development raise the environmental damage while renewable energy consumption has no influential role in diminishing ecological degradation. Similarly, Apergis et al. (2010) examined the significant positive effect of renewable energy consumption on CO2 emissions in 19 developed and developing countries from 1984 to 2007. Therefore, ambiguity exists in the association between renewable energy use and pollution.

The above extensive literature review shows that many previous studies have separately examined the relationship between energy consumption and the environment, green investment, and environmental degradation. Therefore, less attention has been given to the literature about the dynamic influence of energy consumption and green energy investment on improving ecological pollution. Thus, the present study fills the literature gap by examining the dynamic effects of energy consumption and green energy investment on carbon neutrality for China in the short and long run.

3 Data and methodology

3.1 Data sources and model specification

For empirical analysis, the study utilizes China’s monthly1 data from 1995 to 2020. The data include carbon emissions (CE) measured as consumption-based carbon emissions in metric tons per capita, green energy investment (GIE) is measured in a million USD investment in green energy supply, renewable energy consumption (REC) as % of total energy consumption, non-renewable energy consumption (NREC) measured as energy % produced from fossil fuels while economic growth (GDP) is in constant. Sun et al., 2022c the data of all variables are in different units; thus, we converted them into logarithm form to receive more efficient estimates by following (Razzaq et al., 2021b). The data for carbon emissions and non-renewable energy consumption is taken from the Statistical Bulletin of China; data for green energy investment is sourced from the International Renewable Energy Agency (IRENA), while economic growth and renewable energy consumption are sourced from.

The study has adopted the empirical model of Shan et al. (2021) to examine the dynamic role of green energy investment and energy consumption on carbon emissions in China. The model specification is defined as below:

In the model equation, CE is the dependent variable, and GIE, REC, NREC, and GDP are independent variables. Moreover, coefficients are shown as from

3.2 Empirical techniques

In time series analysis, the stationary test is imperative before using the co-integration test. Thus, the current research has used both the ADF unit root and structural-based unit root tests to investigate the properties of time series data. However, past empirical studies have only applied the ADF unit root test, which is not suitable when structural breaks and their impact exist in the data. Therefore, the ZA unit root test permits the presence of structural breaks without showing the breakpoint time in time series data (Andrews and Eric, 2002).

After examining the stationary properties of the concerned variables, the study applied the bootstrap ARDL co-integration model to determine the co-integration relationship among the studied variables. The benefit of using the bootstrap ARDL method over the conventional ARDL approach is that it addresses the issues of low power and small size in the time series data. Moreover, this approach is based on a new co-integration test, thus enhancing the power of both the t-test and F-test. However, there are two conditions in the traditional ARDL test. The first condition is the significant coefficient of error correction term, and another requirement is the significant coefficients for lagged explanatory variables. In this technique, upper and lower bounds are necessary for the second condition but not required for the first condition (Pesaran et al., 2001). In addition, this method only considers those variables which are integrated with order one to examine the first condition (Goh et al., 2017). Hence, the conventional ARDL method has lacked in power and explanatory characteristics. Due to these issues, bootstrap ARDL modeling is more appropriate for time series analysis because of the inclusion of the F test on lagged coefficients of independent variables. Further, this approach incorporates the variables integrated of mixed order in the dynamic model. Therefore, the bootstrap ARDL method provides more consistent and robust results than the traditional ARDL approach (McNown et al., 2018).

Lastly, the stability test is applied in the study to examine the consistency and reliability of estimates. Generally, significant issues exist in time series data due to structural variations over time that cause inconsistent results.

4 Empirical findings and discussion

4.1 Results of unit root test

In an empirical analysis of time series data, it is essential to investigate the order of integration in the study variables. The investigation of stationary properties assists further in selecting a proper co-integration method to determine the co-integration relationship among the variables. Therefore, the study uses both ADF unit root and structural break unit root tests to analyze the stationary level of variables. The estimated results of both ADF and Zivot unit root tests are presented in Table 1. The findings of the ADF test represent that all the variables in the model are stationary at the first difference. However, the results of ADF in the presence of structural breaks may provide misleading results. This issue is resolved by the structure-based unit root test. Thus, the Zivot unit root test results also confirm that all the concerned variables are integrated at first difference with structural breaks. It means that all the variables exist in long-run co-integration.

4.2 Results of bootstrap ARDL co-integration:

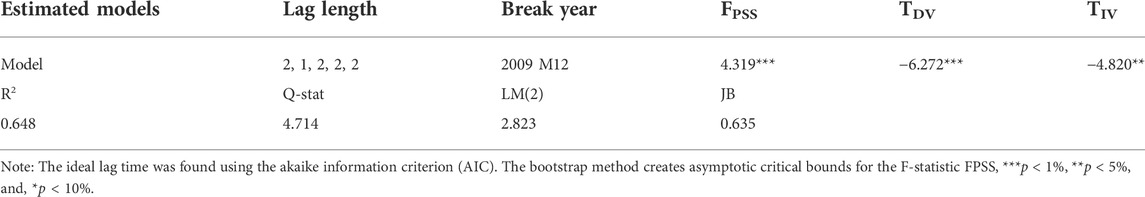

To determine the long-run co-integration between carbon emissions, green energy investment, and energy consumption, bootstrap ARDL testing is used in the study. Table 2 represents the findings of the bootstrap ARDL co-integration test. The t-test and F-test findings reject the null hypothesis of no co-integration, which means that all the variables are co-integrated in the long run. The optimal lag length selection is found using Akaike Information Criteria. Moreover, the explanatory power (R2) value is 64.8%, which confirms that all the regressor variables explain the dependent variable carbon emission. The value of JB also shows that the residuals are normally distributed in the model. In addition, there is no problem with serial correlation in the model.

4.3 Results of long run bootstrap ARDL

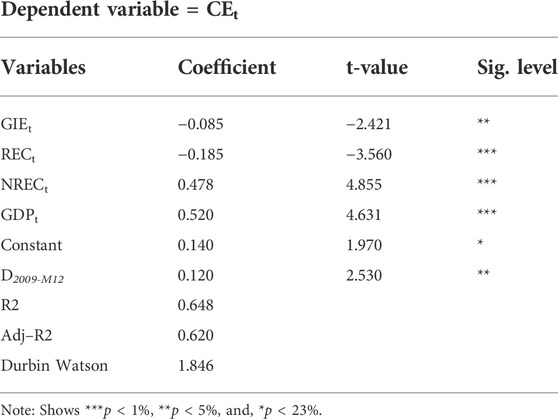

After finding the co-integration among the concerned variables, the study investigates the short and long-run results of the bootstrap ARDL approach. The long-run outcomes of the bootstrap ARDL method are presented in Table 3. In the findings, green energy investment has a significantly negative association with carbon emissions at a 5% significance level. It means that a 1% increase in green energy investment reduces carbon emissions by 8.5%. Thus, the findings are the same as the results of (Shahbaz et al., 2017) for 30 provinces of China. It means that green energy investment has played a vital role in reducing carbon emissions in China. In contrast, the findings are against Stucki (2019), who found that green energy investment increases CO2 emissions because the firms in China are incurring more energy costs in green investment; thus, they are reluctant toward green investment.

The association between renewable energy consumption and carbon emissions is significantly negative, showing that renewable energy sources are the best alternative for fulfilling energy requirements and helping to mitigate carbon emissions in China. Thus, a one percent increase in renewable energy decreases carbon emissions by 18.5%, keeping all other factors constant. The results are identical to Alharthi et al. (2021), in which clean energy usage is inversely associated with carbon emissions in MENA countries, while contrary to Pata (2018), in which renewable energy has no impact on CO2 emissions for Turkey.

In addition, the findings highlight that the coefficient of non-renewable energy consumption is 0.478, which is positive and significant. Thus, a one percent increase in non-renewable energy consumption leads to a 47.8 percent increase in carbon emissions. The estimated results indicated that China mainly uses coal as an energy source that contributes to carbon pollutants and ultimately damages the environment. These outcomes are similar to Leng Chunyu et al. (2021) for European and central Asian countries in which these countries excessively used fossil fuels for energy consumption and emitted more pollution.

Economic growth is positively related to carbon pollutants at a 1% significance level. It represents that a one percent rise in economic growth contributes to carbon emissions by 52%. Thus, the results are identical to the findings of Bhat (2018), which determined that BRICS countries polluted the environment to achieve fast economic growth. In the study, the Year 2009 has been taken as a dummy variable for empirical analysis in the bootstrap ARDL method because, after the Global Financial Crisis (2007–2008), the government of China announced a fiscal stimulus package to overcome the negative effects of Crisis. This has increased China’s economic growth enormously by 8.7% from 2009 onwards. Thus, after 2009 China is continuously on track with rapid economic growth. Therefore, the result shows that the coefficient of the dummy variable has a positive and significant influence on carbon emissions. The explanatory variable (R2) shows the model’s goodness, which shows the value of 64.8% total variation in carbon emissions. The statistic value of the Durbin Watson test shows no autocorrelation in the model.

4.4 Results of short-run bootstrap ARDL

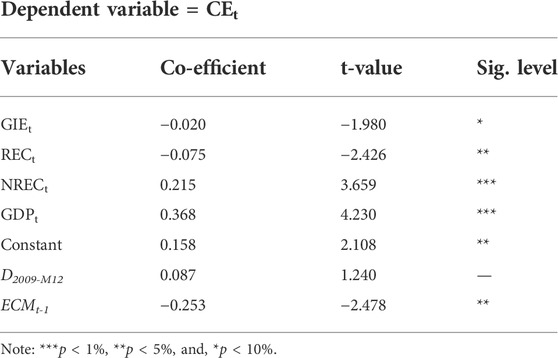

Table 4 indicates the empirical findings of bootstrap ARDL in the short run. The study explored that green energy investment and renewable energy usage are negative and significant; thus, carbon emissions decline by 2.0% and 7.5%, respectively. The findings highlight the contribution of green energy investment and renewable energy sources in decreasing pollution that deteriorates the environment in China. Thus, investing more in green energy and shifting the energy resources from non-renewable to renewable help China towards better environmental quality. The results of non-renewable energy consumption and economic growth increase carbon emissions by 21.5% and 36.8%, respectively. It implies that China’s economic growth is mainly based on its industrial and energy sectors that use fossil fuels, and as a result, carbon emission has increased. The coefficient of error correction term (ECMt-1) is 0.253, which is statistically significant and negative. It shows that a 25.3% speed of adjustment will be required for the model to achieve equilibrium in the long run.

4.5 Results of stability test

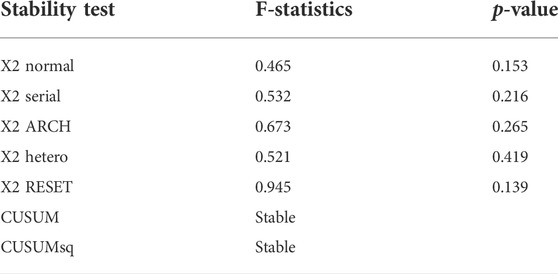

After estimating the short and long-run results of the bootstrap ARDL model, the study applied the stability test to confirm the stability of the estimates because, in time series analysis, structural variation causes instability in the data. Therefore, it is crucial to check the consistency of the estimated model by applying a stability test. The results are highlighted in Table 5, which reveals that the model has no problems with serial correction, heteroscedasticity, model specification error, and data’s non-normality. Further, CUSUM and CUSUMsq confirm the stability of the coefficients in the long run.

5 Conclusion and policy implications

China is the growing economy in the world and confronts the severe problems of environmental damage. It is imperative for China to achieve economic growth without emitting pollution. Thus, in this context, the study explores the dynamic effect of green energy investment and energy consumption on carbon emissions by applying the bootstrap ARDL approach. China’s monthly data is used from 1995 to 2020 in the study. The traditional ADF unit root test is used with a structural-based unit root test in the empirical estimations. Thus, both unit root tests confirm the stationary of variables at first difference. Then after determining the integration order of variables, the bootstrap ARDL co-integration testing is employed to check the long-run relationship among the study variables. The test findings revealed that carbon emissions, green energy investment, and energy consumption have a long-run co-integration relationship. The study then examined the long and short-run results through the bootstrap ARDL model. The long-run results of the bootstrap ARDL model represent that non-renewable energy consumption and economic growth enhance carbon emissions by 47.8% and 52%, respectively. Simultaneously, renewable energy consumption and green energy investment decline carbon emissions by 18.5% and 8.5%, respectively. The outcome of the dummy variable also positively increases carbon emissions for a longer period.

In the short run, the outcomes are similar to the long-run analysis. Thus, green energy investment and renewable energy reduce carbon emissions by 2.0% and 7.5%, respectively. At the same time, economic growth and non-renewable energy consumption positively increase carbon emissions by 36.8% and 21.5%, respectively. Therefore, the short and long-run results are the same, but the magnitude of long-run estimates is high compared to the short-run. Moreover, the error correction term is significantly negative and shows that 25.3% speed will require in the long-run equilibrium. Finally, the stability test shows that the estimated results are stable.

The outcomes of the study suggest the following recommendations:

(1) As a result of the positive contribution of green energy investment in improving environmental pollution thus, the policymakers of China should formulate restrictive green policies such as environmental taxes; this will encourage green growth and promote investment in green technology for achieving a sustainable and eco-friendly environment.

(2) The findings of renewable energy sources recommend that utilization of renewable energy minimizes air pollution levels. Policymakers should also encourage the share of renewable energy sources into total energy and increase energy innovation because clean or efficient energy consumption improves economic development and decreases carbon emissions. In addition, additional research and development funding should be allocated to renewable energy production.

(3) China is mainly based on coal for energy consumption. As a result of stronger economic growth, China’s energy requirements have increased, while the proportion of renewable energy in the energy mix has decreased. Thus, China should stimulate a reduction in the contribution of fossil fuels to total energy consumption; investments in clean energy sources are required mainly in the industrial and energy sectors.

(4) Moreover, additional energy from economic development must be converted into renewable energy sources, requiring a technical transformation that is an effective way to reduce carbon emissions in China. Developments in renewable infrastructure may be facilitated by economic advancement and income levels.

The study has a few limitations. First, it only captures China’s economy and cannot be generalized to other highly polluting economies. Future studies may explore the proposed association by comparing countries that are not included in the study, such as the United States, India, Japan, and European countries. Second, the other relevant and substantial variables, such as tourism, industrial structure, globalization, financial development, information and communication technology, and urbanization, can also be used. Similarly, the alternative proxies of disaggregated green energy investment may offer exciting results.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding authors.

Author contributions

YL: Conceptualizing, writing, drafting-original draft. HL: Data and methodology. SQ: Conceptualizing, writing, drafting-original draft. MC: Review and editing. YF: Review and editing. KR: Review and editing. YS: Review and editing.

Acknowledgments

The authors thank the financial support from the National Statistical Science Research Project (2022LY067).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1We follow Shahbaz et al. (2020) to convert the annual data into monthly data by applying a quadratic match-sum approach. The advantage of using this method is that it excludes deviations in data and resolves the problem of seasonal variation (Sharif et al., 2019).

References

Alharthi, M., Dogan, E., and Taskin, D. (2021). Analysis of CO2 emissions and energy consumption by sources in MENA countries: evidence from quantile regressions. Environ. Sci. Pollut. Res. 28 (29), 38901–38908. doi:10.1007/s11356-021-13356-0

Andrews, E. Z. D., and Eric, Z. (2002). Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J. Bus. Econ. Statistics 20 (1), 251. doi:10.2307/1391541

Anwar, A., Siddique, M., Dogan, E, and Sharif, A. (2021). The moderating role of renewable and non-renewable energy in environment-income nexus for ASEAN countries: evidence from Method of Moments Quantile Regression. Renew. Energy 164, 956–967. doi:10.1016/j.renene.2020.09.128

Apergis, N., Payne, J. E., Menyah, K., and Wolde-Rufael, Y. (2010). On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol. Econ. 69 (11), 2255–2260. doi:10.1016/j.ecolecon.2010.06.014

Bekun, F. V., Emir, F., and Sarkodie, S. A. (2019). Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci. Total Environ. 655, 759–765. doi:10.1016/j.scitotenv.2018.11.271

Bhat, J. A. (2018). Renewable and non-renewable energy consumption—Impact on economic growth and CO2 emissions in five emerging market economies. Environ. Sci. Pollut. Res. 25 (35), 35515–35530. doi:10.1007/s11356-018-3523-8

Chen, W., Chen, J., and Ma, Y. (2021). Renewable energy investment and carbon emissions under cap-and-trade mechanisms. J. Clean. Prod. 278, 123341. doi:10.1016/j.jclepro.2020.123341

Chunyu, L., Zain-ul-Abidin, S., Majeed, W., Raza, S. M. F., and Ahmad, I. (2021). The non-linear relationship between carbon dioxide emissions, financial development and energy consumption in developing European and Central Asian economies. Environ. Sci. Pollut. Res. 28 (44), 63330–63345. doi:10.1007/s11356-021-15225-2

Fatima, T., Shahzad, U., and Cui, L. (2021). Renewable and non-renewable energy consumption, trade and CO2 emissions in high emitter countries: does the income level matter? J. Environ. Plan. Manag. 64 (7), 1227–1251. doi:10.1080/09640568.2020.1816532

Goh, S. K., Yong, J. Y., Lau, C. C., and Tang, T. C. (2017). Bootstrap ARDL on energy-growth relationship for 22 OECD countries. Appl. Econ. Lett. 24 (20), 1464–1467. doi:10.1080/13504851.2017.1284980

Hanif, I., Faraz Raza, S. M., Gago-de-Santos, P., and Abbas, Q. (2019). Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: some empirical evidence. Energy 171, 493–501. doi:10.1016/j.energy.2019.01.011

Hanif, I. (2018). Impact of economic growth, non-renewable and renewable energy consumption, and urbanization on carbon emissions in Sub-Saharan Africa. Environ. Sci. Pollut. Res. 25 (15), 15057–15067. doi:10.1007/s11356-018-1753-4

Kalmaz, D. B., and Kirikkaleli, D. (2019). Modeling CO2 emissions in an emerging market: empirical finding from ARDL-based bounds and wavelet coherence approaches. Environ. Sci. Pollut. Res. 26 (5), 5210–5220. doi:10.1007/s11356-018-3920-z

Khan, M. K., Khan, M. I., and Rehan, M. (2020). The relationship between energy consumption, economic growth and carbon dioxide emissions in Pakistan. Financ. Innov. 6 (1), 1–13. doi:10.1186/s40854-019-0162-0

Khan, M. K., Teng, J. Z., and Khan, M. I. (2019). Effect of energy consumption and economic growth on carbon dioxide emissions in Pakistan with dynamic ARDL simulations approach. Environ. Sci. Pollut. Res. 26 (23), 23480–23490. doi:10.1007/s11356-019-05640-x

Kim, D., and Perron, P. (2009). Unit root tests allowing for a break in the trend function at an unknown time under both the null and alternative hypotheses. J. Econ. 148 (1), 1–13. doi:10.1016/j.jeconom.2008.08.019

Lee, K. H., and Min, B. (2015). Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 108, 534–542. doi:10.1016/j.jclepro.2015.05.114

Marques, A. C., and Fuinhas, J. A. (2012). Is renewable energy effective in promoting growth? Energy Policy 46, 434–442. doi:10.1016/j.enpol.2012.04.006

McNown, R., Sam, C. Y., and Goh, S. K. (2018). Bootstrapping the autoregressive distributed lag test for co-integration. Appl. Econ. 50 (13), 1509–1521. doi:10.1080/00036846.2017.1366643

Nehler, T., and Rasmussen, J. (2016). How do firms consider non-energy benefits? Empirical findings on energy-efficiency investments in Swedish industry. J. Clean. Prod. 113, 472–482. doi:10.1016/j.jclepro.2015.11.070

Park, C., Xing, R., Hanaoka, T., Kanamori, Y., and Masui, T. (2017). Impact of energy efficient technologies on residential CO2 emissions: a comparison of korea and China. Energy Procedia 111 (2016), 689–698. doi:10.1016/j.egypro.2017.03.231

Pata, U. K. (2018). Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J. Clean. Prod. 187, 770–779. doi:10.1016/j.jclepro.2018.03.236

Pesaran, M. H., Shin, Y., and Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. J. Appl. Econ. Chichester. Engl. 16 (3), 289–326. doi:10.1002/jae.616

Raza, S. A., and Shah, N. (2018). Impact of financial development, economic growth and energy consumption on environmental degradation: evidence from Pakistan. Munich Personal RePEc Archive 21465, 1–26. Available at: https://mpra.ub.uni-muenchen.de/87095/.

Razzaq, A., Sharif, A., Ahmad, P., and Jermsittiparsert, K. (2021a). Asymmetric role of tourism development and technology innovation on carbon dioxide emission reduction in the Chinese economy: fresh insights from QARDL approach. Sustain. Dev. 29 (1), 176–193. doi:10.1002/sd.2139

Razzaq, A., Sharif, A., Najmi, A., Tseng, M. L., and Lim, M. K. (2021b). Dynamic and causality interrelationships from municipal solid waste recycling to economic growth, carbon emissions and energy efficiency using a novel bootstrapping autoregressive distributed lag. Resour. Conservation Recycl. 166 (2020), 105372. doi:10.1016/j.resconrec.2020.105372

Rehman, M. U., and Rashid, M. (2017). Energy consumption to environmental degradation, the growth appetite in SAARC nations. Renew. Energy 111, 284–294. doi:10.1016/j.renene.2017.03.100

Saboori, B., and Sulaiman, J. (2013). Environmental degradation, economic growth and energy consumption: evidence of the environmental Kuznets curve in Malaysia. Energy Policy 60, 892–905. doi:10.1016/j.enpol.2013.05.099

Sachs, J. D., Woo, W. T., Yoshino, N., and Taghizadeh-Hesary, F. (2019). Importance of green finance for achieving sustainable development goals and energy security. Handb. Green Finance 1, 1–10. doi:10.1007/978-981-10-8710-3_13-1

Saeed Meo, M., and Karim, M. Z. A. (2022). The role of green finance in reducing CO2 emissions: an empirical analysis. Borsa Istanb. Rev. 22 (1), 169–178. doi:10.1016/j.bir.2021.03.002

Shahbaz, M., Raghutla, C., Song, M., Zameer, H., and Jiao, Z. (2020). Public-private partnerships investment in energy as new determinant of CO2 emissions: the role of technological innovations in China. Energy Econ. 86, 104664. doi:10.1016/j.eneco.2020.104664

Shahbaz, M., Shafiullah, M., Papavassiliou, V. G., and Hammoudeh, S. (2017). The CO2–growth nexus revisited: a nonparametric analysis for the G7 economies over nearly two centuries. Energy Econ. 65, 183–193. doi:10.1016/j.eneco.2017.05.007

Shan, S., Genç, S. Y., Kamran, H. W., and Dinca, G. (2021a). Role of green technology innovation and renewable energy in carbon neutrality: a sustainable investigation from Turkey. J. Environ. Manag. 294 (3), 113004. doi:10.1016/j.jenvman.2021.113004

Sharif, A., Baris-Tuzemen, O., Uzuner, G., Ozturk, I., and Sinha, A. (2020a). Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: evidence from Quantile ARDL approach. Sustain. Cities Soc. 57, 102138. doi:10.1016/j.scs.2020.102138

Sharif, A., Mishra, S., Sinha, A., Jiao, Z., Shahbaz, M., and Afshan, S. (2020b). The renewable energy consumption-environmental degradation nexus in Top-10 polluted countries: fresh insights from quantile-on-quantile regression approach. Renew. Energy 150, 670–690. doi:10.1016/j.renene.2019.12.149

Sharif, A., Raza, S. A., Ozturk, I., and Afshan, S. (2019). The dynamic relationship of renewable and non-renewable energy consumption with carbon emission: a global study with the application of heterogeneous panel estimations. Renew. Energy 133, 685–691. doi:10.1016/j.renene.2018.10.052

Shen, Y., Su, Z. W., Malik, M. Y., Umar, M., Khan, Z., and Khan, M. (2021). Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 755, 142538. doi:10.1016/j.scitotenv.2020.142538

Stucki, T. (2019). Which firms benefit from investments in green energy technologies? – the effect of energy costs. Res. Policy 48 (3), 546–555. doi:10.1016/j.respol.2018.09.010

Sun, Y., Guan, W., Razzaq, A., Shahzad, M., and An, N. (2022a). Transition towards ecological sustainability through fiscal decentralization, renewable energy and green investment in OECD countries. Renew. Energy 190, 385–395. doi:10.1016/j.renene.2022.03.099

Sun, Y., Li, Y., Wang, Y., and Bao, Q. (2022c). Financial annexation, green innovation and carbon neutrality in China. Front. Environ. Sci. 10, 831853. doi:10.3389/fenvs.2022.831853

Sun, Y., and Razzaq, A. (2022). Composite fiscal decentralisation and green innovation: imperative strategy for institutional reforms and sustainable development in OECD countries. Sustain. Dev., 1–14. doi:10.1002/sd.2292

Sun, Y., Razzaq, A., Sun, H., and Irfan, M. (2022b). The asymmetric influence of renewable energy and green innovation on carbon neutrality in China: analysis from non-linear ARDL model. Renew. Energy 193, 334–343. doi:10.1016/j.renene.2022.04.159

Wang, X., Huang, J., Xiang, Z., and Huang, J. (2021). Nexus between green finance, energy efficiency, and carbon emission: Covid-19 implications from BRICS countries. Front. Energy Res. 9 (12), 1–11. doi:10.3389/fenrg.2021.786659

Keywords: green energy investment, energy consumption, carbon emissions, carbon neutrality, China

Citation: Li Y, Li H, Chang M, Qiu S, Fan Y, Razzaq HK and Sun Y (2022) Green energy investment, renewable energy consumption, and carbon neutrality in China. Front. Environ. Sci. 10:960795. doi: 10.3389/fenvs.2022.960795

Received: 03 June 2022; Accepted: 13 July 2022;

Published: 25 August 2022.

Edited by:

Asif Razzaq, Ilma University, PakistanReviewed by:

Yu Teng, University of Portsmouth, United KingdomMuhammad Irfan, Yibin University, China

Copyright © 2022 Li, Li, Chang, Qiu, Fan, Razzaq and Sun. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ying Li, eWluZ3ppamoyMDA2QDEyNi5jb20=; Haoning Li, MTU4MjI0MzE0NjhAMTYzLmNvbQ==; Manru Chang, ODQwMzcyMjAzQHFxLmNvbQ==; Shijuan Qiu, MjcwNzM5OTYwQHFxLmNvbQ==; Yifan Fan, ZmFueWlmYW5hY0AxNjMuY29t; Hafiz Kashif Razzaq, S2FzaGlmLnJhenphcS5lZHUxQGdtYWlsLmNvbQ==; Yunpeng Sun, dGp3YWRlM0AxMjYuY29t

Ying Li

Ying Li Haoning Li

Haoning Li Manru Chang

Manru Chang Shijuan Qiu1*

Shijuan Qiu1*