- 1School of Management, China University of Mining and Technology-Beijing, Beijing, China

- 2School of Economics, Beijing Technology and Business University, Beijing, China

To confront the growing threat of climate change and achieve carbon neutrality, green governance has come under the spotlight globally. This paper investigates the effect of stock market liberalization on corporate green innovation, aiming to explore whether foreign investor engagement contributes to the green development of Chinese enterprises. Employing a staggered DID estimation, we find that firms generate a higher level of green innovation output after they experience the liberalization, and this effect is more pronounced when foreign investors become the focal firms’ top ten shareholders. Meanwhile, foreign investors who enter China’s A-share market with the implementation of this policy are value investors, indicating that stock market liberalization can help lead firms’ investment decision more future-oriented. We also find that financing constraints play a significant role in the association between stock market liberalization and corporate green innovation. The results of heterogeneity analyses show that the positive implication of liberalization on corporate green innovation is stronger for non state-owned enterprises, firms in high-tech industries and firms in less polluting industries. Our paper provides new insights into the economic effect of foreign investor engagement in emerging capital market and the factors affecting corporate green innovation in China.

1 Introduction

Technological innovation and environment protection are essential for the high-quality development of a country’s economy (Acemoglu et al., 2012; Song et al., 2018), and come to symbolize the capacity for a company’s sustainable development (Moshirian et al., 2021). From a macro level, Hsu et al. (2014) have focused on the impact of financial development and market opening on corporate innovation activities. Li et al. (2017) find that legitimacy pressure from stakeholders has an impact on corporate green technology development. Recently, an emerging body of literature emphasizes the substantial impact of stock market liberalization policy allowing foreign investors to access to domestic stock market on firm’ innovative activities (Moshirian et al., 2021; Wang, 2021; Sha et al., 2022). Since green technology progress has always been regarded as vital to a country’s economic growth and sustainable development, it is meaningful to explore whether foreign investor engagement along with the opening up of the Chinese stock market plays a crucial role in green innovation. This paper attempts to investigate the expected promoting effect of stock market liberalization on green innovative activities in the context of Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect in China (Stock Connect). Our main sample focuses on public firms from China over the period of 2011–2019. Since the natural experiment situation generated by the staggered implementation of the Stock Connect program, we use Staggered DID approach as the main identification strategy. The samples are categorized into treatment group and control group according to whether or not the firms are included in the Stock Connect program. Consistent with our expectations, the main findings show that stock market liberalization positively affects firms’ green innovation output. Specifically, after firms are subject to Stock Connect scheme, their green invention patent and utility patent count, on average, experience an increase of 17.6% and 16.6%, respectively.

To examine our expectations, we explore the possible explanations for the positive effect on firms’ green innovation in view of corporate governance and financing constraints. First, based on agent theory, foreign investors have little interest connection with the management of domestic enterprises, and they are more able to act as supervisors to restrain the management’s inefficient resource allocation (Gillan and Starks, 2003). Furthermore, investors from international markets tend to be value investors, and the possibility of arbitrage due to short-term profit expectations is much lower than that of domestic investors (Noe, 2002). Yan and Zhang (2009) find that the shareholding ratios of long-term institutional investors are positively correlated with a company’s environmental performance. In this way, the stock market connect allowing international investors to purchase local shares could generate a beneficial effect on corporate green innovation from the perspective of corporate governance.

Second, financing constraints make it more difficult for companies to obtain the funds needed for investment activities, thus inhibiting corporate green innovation output (Brown et al., 2013). Aghion et al. (2016) argue that innovation activities can easily lead to serious external financing constraints due to the uncertainty of earnings, information asymmetry in the innovation process, and high regulatory costs. According to reputation theory, when enterprises are faced with financing constraints, managers will reduce investment in innovative projects with greater uncertainty out of consideration for their personal reputation, and invest most funds for projects with better short-term benefits. Considering that the opening up of stock market facilitating overseas funds to invest in the domestic market is alleviating financing constraints (Bekaert et al., 2003; Ghosh, 2006; Gupta and Yuan, 2009), we predict the stock market liberalization can mitigate the financing constraints inherent in green innovative investments.

To examine the possible explanations for the positive effect on firms’ green innovation, we conduct the following tests. First, we have examined whether foreign investors access to the domestic A-share market after the implementation of the Stock Connect program are value investors and whether they are among the firms’ top ten shareholders. The results show that when a company has foreign investors among the top ten shareholders, its level of green innovation is significantly higher than that of other companies. Meanwhile, the consequence of the decreasing stock turnover rate after Stock Connect scheme, in line with Su and Mai (2004), indicates that foreign investors into China’s A-share market are value investors. Second, we take financing constraints as the mediating variable to examine whether financing constraints is the underlying economic channel. The results show that Stock Connect program promotes the green innovation of enterprises by alleviating financing constraints. In addition, we conduct a set of robustness tests to address the endogenous issue.

As additional analysis, we also discuss the heterogeneous effect of stock market opening up on green innovation from the perspective of the firms’ ownership, high-tech industry and main polluting industry. First, we perform group regressions through categorizing firms according to whether they are state-owned enterprises (SOEs) or not, and the empirical results suggest that stock market liberalization has a great significant impact on green innovation for non-SOEs. Second, firms’ green technology innovation may also differ due to differences in industry characteristics. We conduct an estimation by categorizing firms according to whether or not they are included in the high-tech industry. This finding indicates that stock market liberalization primarily increases the green innovation output for firms in the high-tech industry. Third, we examine the heterogeneous impact based on whether companies belong to main polluting industry. We find that the positive relation between stock market liberalization and green innovation is more notable for firms in less polluting industries.

Our paper contributes to the literature from three aspects. First, it provides important empirical evidence for the research on green innovation activities of enterprises under the background of the opening up of China’s stock market. Researchers have mainly focused on the economic consequences of stock market opening up from the following perspectives, such as increase a country’s capital allocation efficiency and productivity growth (Gupta and Yuan, 2009; Bekaert et al., 2011; Bae et al., 2012), improve corporate governance, reduce investor monitoring costs (Gillan and Starks, 2003), and promote technological innovation (Moshirian et al., 2021; Wang, 2021). Moshirian et al. (2021), focusing on public firms from 20 developed and emerging economies, have proved that the economies exhibit a higher level of innovation output after they experience stock market liberalizations. However, few empirical researches explore the microeconomic consequences of stock market liberalization in emerging markets from the perspective of corporate green innovation. By employing a natural experiment of China’s Stock Connect program, Zhang et al. (2021) demonstrate that stock market liberalization has a positive effect on the governance of Chinese firms’ non-financial behavior. In contrast to previous studies, we conduct our research from different perspectives and incorporate value investors and the shareholding ratio of foreign investors to analyze their incremental effect on enterprises who experience stock market liberalization.

Second, this article has enriched the literature on factors affecting corporate green innovation. Existing literature has studied environmental regulations (Horbach, 2008; Berrone et al., 2013; Lin et al., 2014; Wu et al., 2022), redundant resources (Horbach et al., 2012), market competition (Guo et al., 2022), stakeholder pressure and corporate internal environmental orientation (Chan, 2010; Chan et al., 2012) have a significant impact on green innovation. In recent years, there are also documents confirming that foreign investment can help improve the company’s carbon emission technology level (Perkins, 2012), and promote the company’s technology research and development (Song et al., 2015; Moshirian et al., 2021). Studies on open innovation and external support show that co-prosperity with other organizations and companies (Yang and Roh, 2019), firm’s intellectual property and government support (Roh et al., 2022a), and green marketing innovation (Roh et al., 2022b) facilitate firms’ green innovation output. Different from these studies, our paper identifies foreign investor engagement plays an important role in prompting corporate green innovation output built upon theories of information asymmetry and reputation.

Third, this article empirically verifies that foreign investors into the domestic market along with the stock market opening up are more likely to be value investors, who are more motivated to consider the enterprises’ long-term development and ultimately improve the level of green innovation output of enterprises. At the same time, this article examines the impact of foreign investors’ participation on corporate green innovation by verifying whether foreign investors are among the top ten shareholders, thus lending additional explanation for our main finding. Overall, the results suggest that foreign investor engagement contributes to the green development of Chinese enterprises.

The rest of this paper is organized as follows. Section 2 illustrates the background and hypothesis development. Section 3 describes our sample selection, variables and descriptive statistics. Section 4 presents our main empirical findings, robustness checks and additional analysis. Section 5 describes the disscussion. The conclusion, policy implications and some limitations are reported in Section 6.

2 Background and hypothesis development

2.1 Stock market liberalization in China

Lei and Lu (2017) shows that emerging economies around the world are focusing on continuing to promote the internationalization of capital markets. Chinese government has been steadily promoting the opening up of capital market in recent decades. In 2003 and 2011, China put forward the QFII (Qualified Foreign Institutional Investors) and RQFII (RMB QFII) systems. However, the QFII mechanism only permits the qualified foreign institutional investor to invest in domestic stocks within the allowable limit. The entry costs and transaction costs of QFII and RQFII are relatively high, which greatly limits foreign investment’s access to the mainland capital market. Therefore, the early QFII/RQFII system is a limited introduction of foreign capital and is a transitional institutional arrangement for opening up the capital market.

The Stock Connect trading system is a landmark event for China’s capital market opening up at this stage and of great significance in promoting the “dual circulation” of China’s capital market1. It can expand investment channels for domestic and foreign investors, and is conducive to improving foreign investor engagement in domestic capital market. On 17 November 2014 and 5 December 2016, the China Securities Regulatory Commission (CSRC) launched the Shanghai-Hong Kong Stock Connect and the Shenzhen- Hong Kong Stock Connect scheme. Under this trading mechanism, foreign investors can appoint Hong Kong brokers to apply to the Shanghai Stock Exchange (SHSE) and Shenzhen Stock Exchange (SZSE) for trading of listed stocks within the prescribed scope (that is, the target stocks included in the Shanghai Stock Connect and Shenzhen Stock Connect) through the securities trading service company established by the Hong Kong Stock Exchange2. The implementation of the Stock Connect policy breakthroughs and broadens the original QFII/RQFII system investment channels, qualifications, and investment quotas for foreign institutional investors, promotes foreign investments into domestic stock market, and to a greater extent, has realized the free flow of funds between the mainland and overseas.

2.2 Hypothesis development

The green innovation output is expected to benefit from the implementation of the Stock Connect scheme in this paper. Compared with traditional technological innovation, green technological innovation has the characteristics of large initial capital investment, long profit cycle, and difficult to predict risks, which means that green technological innovation needs to invest more capital for direction-shifting innovation (Johnstone et al., 2010; Huang et al., 2019). Hsu et al. (2014) argues that the untilization of equity is better suited for financing and stimulating innovation activities than debt in contrast to traditional investment simply using common methods. After the opening up of the stock market, a large amount of incremental funds into the domestic market will cause changes in corporate stock prices and facilitate corporate financing, thereby inducing additional investment (Henry, 2000).

Meanwhile, the serious agency problem existing in China’s state-owned enterprises makes the corporate management tend to be short-sighted, which will result in insufficient incentives for management to engage in long-term and high-risk innovative investments. The main content of stock market opening up is to relax or remove capital flow restrictions and allow overseas investors access to the domestic market for share transactions. Foreign investors can obtain the decision-making power of the invested company through stock market transactions, such as the right to appoint directors after holding a higher proportion of shares, so as to influence corporate investment decisions (Ferreira and Matos, 2008; Aggarwal et al., 2011).

In addition, foreign investors have the investment philosophy and investment experience of a developed capital market. As investors with deep professional knowledge and better information advantages, they should be able to understand the value enhancement brought about by the company’s investment in social responsibility and environmental protection (Johnson and Greening, 1999; Cox and Wicks, 2011). Therefore, we propose the core hypothesis based on the above discussion.

Hypothesis 1. Stock market liberalization exerts a positive influence on firms’ green innovation.Financing constraint is an important factor restricting enterprises to innovate. In general, enterprises’ Research and Development (R&D) activities last for a long time and the output is uncertain, therefore, sufficient and sustained capital is needed to support the whole innovation process (Hall, 2002). Internal funds alone often can not meet the R&D needs, which makes enterprises have to seek external financing. When enterprises are faced with financing difficulties, their R&D efficiency will be decreased due to the lack of sufficient funds. In order to maintain the normal operation of the enterprise and keep the stock price stable, the management will pursue short-term profits and reduce the R&D investment, which will have a negative impact on firms’ green innovation. Foreign scholars have found in the study of high-tech enterprises in the United States that financing through a developed stock market is an effective way to alleviate financial difficulties, thereby ensuring their capital investment (Carpenter and Petersen, 2002; Brown et al., 2009).The implementation of the Stock Connect program relaxes the investment restrictions between the mainland and overseas, facilitates foreign investment into the A-share market, and provides incremental capital for firms’ equity financing, thus easing their financing constraints. In addition, stock market liberalization has improved the information environment for listed corporations in the mainland (Guo et al., 2018), which will help improve market information disclosure, reduce information asymmetry, and ease enterprises’ external financing constraints. Hence, we propose the second hypothesis.

Hypothesis 2. Stock market liberalization can promote green technology innovation by alleviating corporate financing constraints.The ownership attribute of a firm usually has different effects on its R&D investment and technological innovation. There are differences in resource endowments, goals, and values between state-owned enterprises (SOEs) and private enterprises in China. SOEs are the backbone of the national economy, covering all major strategic industries and monopoly industries. Compared with SOEs, non-SOEs face fiercer market competition, leading them to be more inclined to invest in innovation for purpose of gaining competitive advantages. The innovative behaviors such as firms’ R&D activities require long-term financial support. For SOEs, their important strategic position and the connection with the government make it easy for them to obtain policy preference and financial support (Tong et al., 2014). From this, for non-SOEs, financing through the stock market is particularly important. Accordingly, the third Hypothesis is proposed.

Hypothesis 3. The positive effect of stock market liberalization on green innovation is more significant for non-SOEs.The green technology innovation of enterprises may also differ due to differences in industry characteristics. The differences in labor, capital, technology, and industrial technology development prospects of different industries will lead to differences in corporate R&D and innovation activities. The high-tech industry is a knowledge- and technology-intensive industry with rapid technological development. Only with high-quality advanced creations can enterprises win in the market competition (Zucker and Darby, 2007). Gu et al. (2018) also believe that high-tech industry is characterized by high knowledge density, high competition and high returns, which makes it necessary for enterprises in this industry to have strong technological innovation ability.In terms of corporate financing, the uncertainty of innovative activities makes high-tech companies face higher risks. Financial institutions are more cautious about loans to high-tech enterprises based on their natural prudence and the control of credit risks. Meanwhile, the risks and uncertainties of innovative tasks will cause the investment of innovative resources not to be reflected in the assets timely and accurately (Lev and Zarowin, 1999), which makes it difficult for financial institutions to obtain the relevant information, thus leading to more serious information asymmetry and higher financing constraints faced by high-tech enterprises (Hsu et al., 2014). With the implementation of the Stock Connect trading system, international investors’ access to the domestic stock market can ease the firms’ financing constraints, and further promote them to invest in green technology innovation. Thus, we propose the fourth hypothesis.

Hypothesis 4. The positive effect of stock market liberalization on green innovation is more notable for firms in high-tech industry.For companies in the polluting industry, their green innovation behaviors are more affected by environmental regulations and other national policies. Berrone et al. (2013) emphasize the role of environmental regulations on green innovation in their research, believing that firms’ green innovation activities is more like an action to respond to environmental regulations. Environmental regulations are mainly aimed at main polluting industries and try to improve or promote their relevant economic activities and pollution control behaviors. However, the regulatory pressure on the cleaning industry is relatively small, and the incentives for environmental policies to induce green technology innovation are also relatively weak. Therefore, the investment in green innovation for enterprises in cleaning industry will be more influenced by corporate strategy or organizational resources. The opening up of the stock market can effectively alleviate information asymmetry, promote the company’s rational allocation of resources, so as to invest funds in activities that can increase the value of the company. From this, we propose the green innovation activities of companies in the cleaning industry will be more affected by the opening up of the stock market.

Hypothesis 5. The positive effect of stock market liberalization on green innovation is more pronounced for firms in less polluting industries.

3 Data and methodology

3.1 Sample selection and data source

Considering that the Shanghai-Hong Kong Stock Connect program and Shenzhen-Hong Kong Stock Connect program were launched in 2014 and 2016, respectively, this paper takes annual financial data of Chinese listed firms on the Shenzhen and Shanghai Stock Exchanges from 2011 to 2019 as the sample and selects them as follows. First, we exclude the sample of listed companies in the financial industry. Second, we exclude samples of abnormal trading listed companies such as PT, ST and *ST firms. Third, we exclude the observations that withdrew from the Stock Connect program in the later period. In the end, we obtain 9,037 observations from 2,474 sample companies in 2011–2019. To minimize the effect of outliers, all continuous variables are winsorized at the 1% and 99% tails.

Green innovation, the explained variable, is sourced from Chinese Research Data Services (CNRDS) Platform, and other variables are from China Securities Market and Accounting Research (CSMAR).

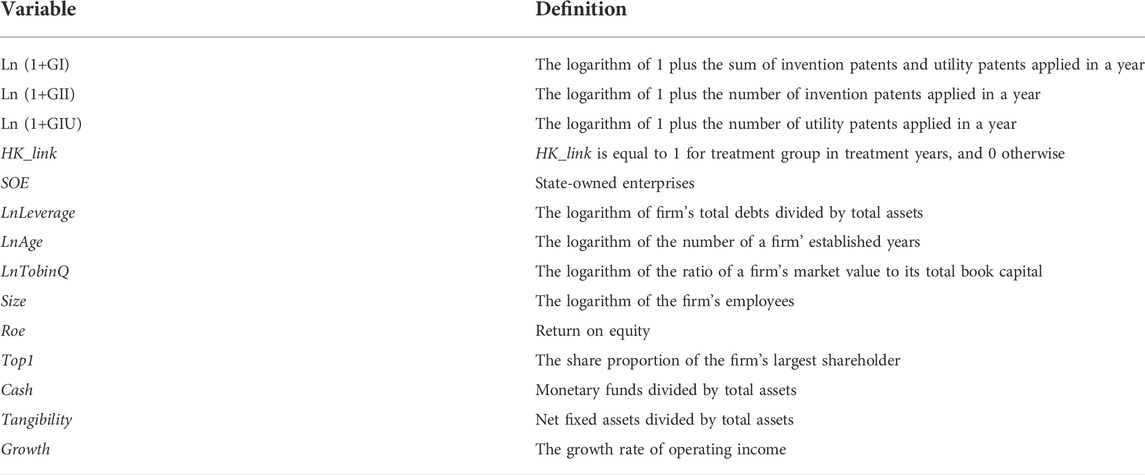

3.2 Variable definition

3.2.1 Measures of green innovation

In line with prior research (Cornaggia et al., 2013; Hsu et al., 2014), we use the number of patent applications to measure firms’ green innovation output. Meanwhile, following the existing literature distinguishing invention patents and utility patents (He and Tian, 2013; Wang, 2021), we are able to explore the effect of stock market liberalization on both the quantity and the quality of a firm’s green innovation output. In this analysis, we design three main measures for corporate green innovation. The first measure is the natural logarithm of one plus the number of green invention patents and green utility patents applied by a firm [Ln(1+GI)]. The second measure is the natural logarithm of one plus the number of green invention patents applied by a firm [Ln(1+GII)], which is defined to measure the high-quality of firm’s green innovation. The third measure is the natural logarithm of one plus the number of green utility patents applied by a firm [Ln(1+GIU)], which is defined to measure the quantity of firm’s green innovation.

3.2.2 Control variables

According to He and Tian (2013), Bu et al. (2020) and Colombo et al. (2013), this paper selects control variables as follows: corporate debt levels (LnLeverage), age (LnAge), social value creation capability (LnTobinQ), firm size (Size), return on equity (Roe), the largest shareholder’s shareholding ratio (Top1), cash-holdings (Cash), capital intensity (Tangibility) and corporate growth (Growth).

The detailed definition of the variables is shown in Table 1.

3.3 Descriptive statistics

Descriptive statistics of major variables are shown in Table 2. The maximum, minimum and standard deviation of the total amount of enterprises’ green patent applications are 5.34, 0.69, and 1.08, respectively. It shows that green innovation is unbalanced among enterprises. Similarly, the maximum, minimum and standard deviation of enterprises’ green invention patent are 4.94, 0, and 1.1, respectively. The maximum, minimum and standard deviation of enterprises’ green utility patent are 4.41, 0, and 1.04, respectively. From this, we can see that compared with utility patents, the difference between green invention patents among enterprises is more obvious. Second, the mean value of HK_link is 0.19, indicating that after the implementation of the Stock Connect policy, the number of samples within the scope of eligible shares for the Stock Connect program accounts for 19% of the total sample. Third, control variables. Except for Size, LnTobinQ, Top1 and Growth, the standard deviations of other control variables are smaller.

4 Empirical result

4.1 The effect of stock market liberalization on green innovation

Using this Stock Connect scheme as staggered plausibly exogenous shock, we take staggered DID method as the main identification approach. We first examine the general effect of stock market liberalization on firms’ green innovation output by estimating the regression model in Eq. 1:

where GreenInnovation represents the three green innovation output measures, i.e., Ln (1 + GI), Ln (1 + GII), or Ln (1 + GIU), similarly hereinafter. The subscript i represents the stock and t represents the year. HK_link is a dummy variable, equal to one if a firm’s stock has experienced stock market liberalization regardless of time, and 0 otherwise. Variable Controls includes a set of control variables, i.e., dummy variable for stated-owned enterprises (SOE), corporate leverage (LnLeverage), age (LnAge), social value creation capability (LnTobinQ), size (Size), return on equity (Roe), the share proportion of the firm’s largest shareholder (Top1), cash-holdings (Cash), capital intensity (Tangibility) and corporate growth (Growth).

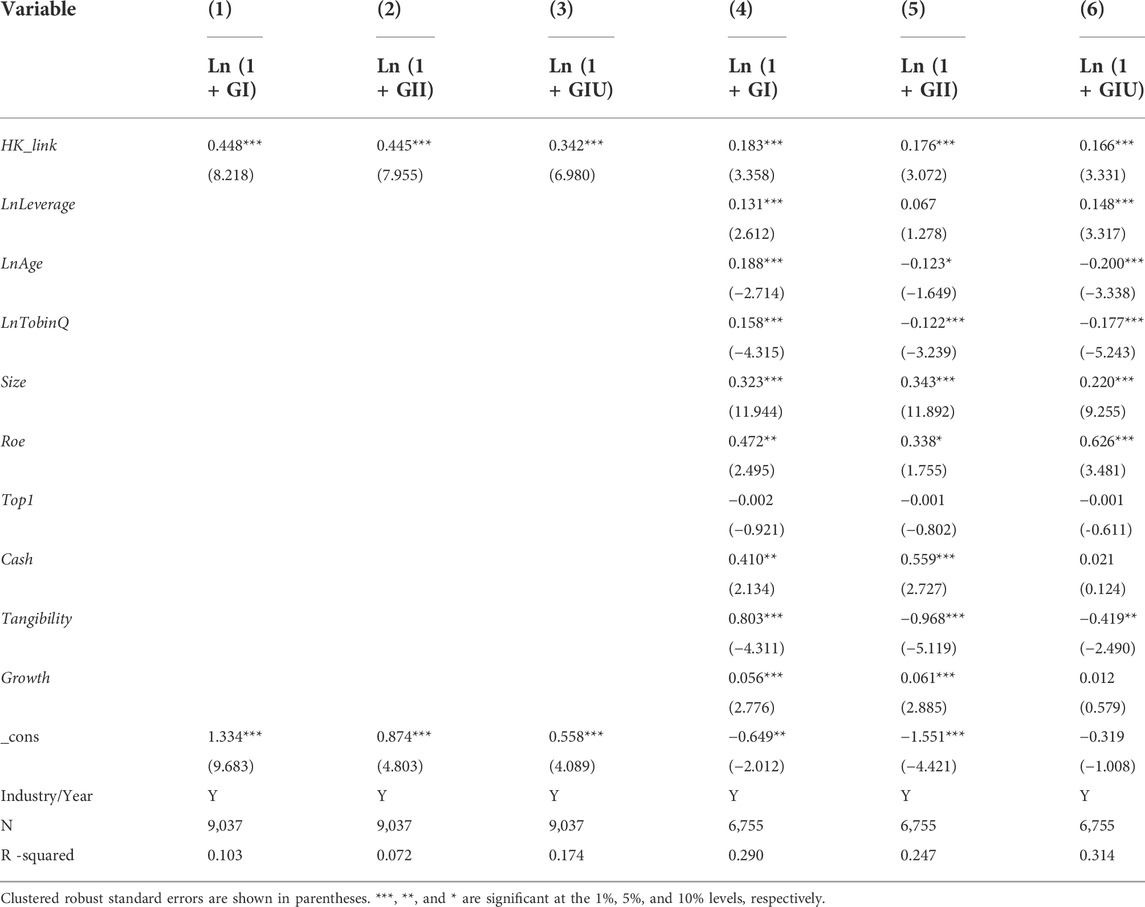

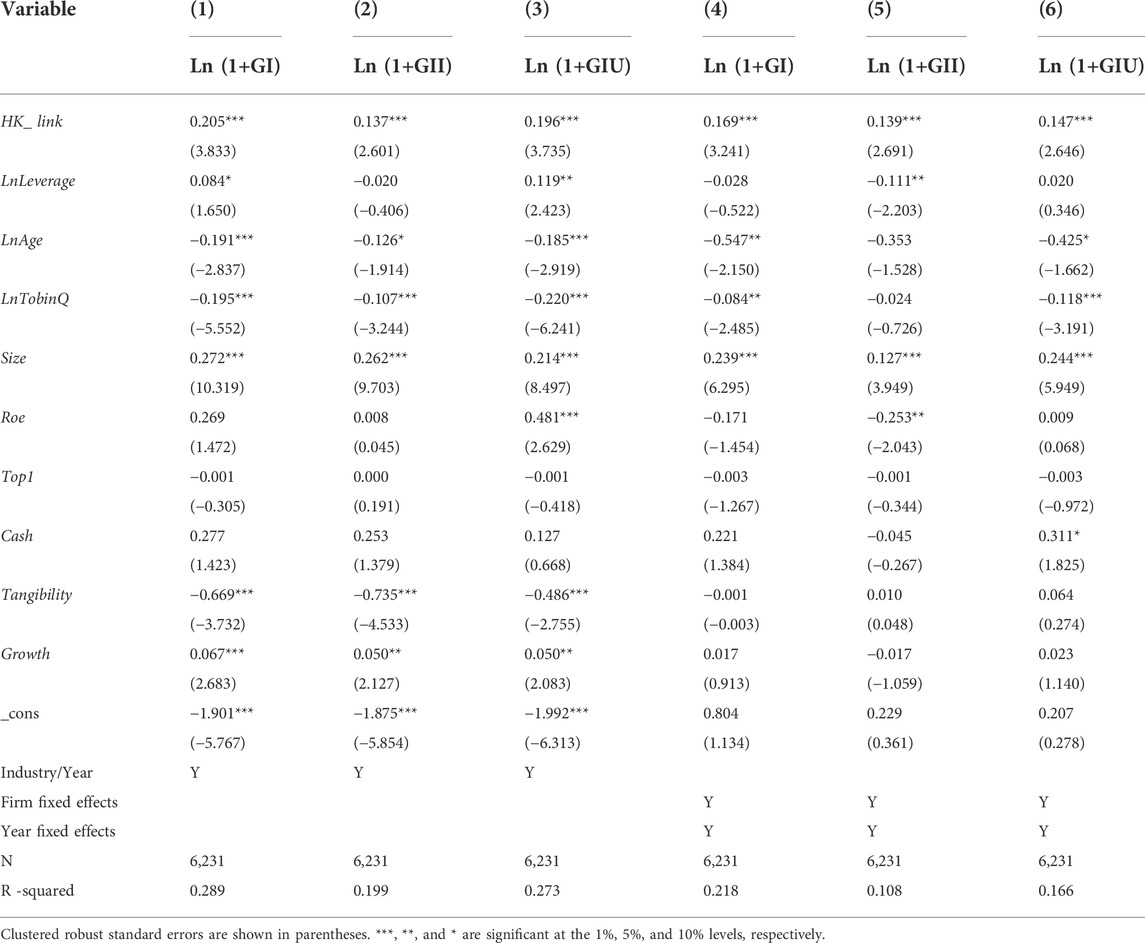

The regression results are presented in Table 3. Columns (1)–(3) are results including only HK_link dummy variables, year, and industry effects, and columns (4)–(6) are the results after incorporating other control variables that may affect green innovation. The results show that the coefficient estimates of HK_link are positive and significant at 1% in all six columns, suggesting that firms’ green innovation output increases after their stocks are within the scope of eligible shares for “Shanghai-HongKong Stock Connect” or “Shenzhen-HongKong Stock Connect,” thus lending support to Hypothesis 1. This positive effect is not only statistically significant but also economically sizable. Taking columns (4)–(6) as an example, the overall green innovation counts, invention counts and utility patent counts of firms, in general, are increased by 18.3%, 17.6%, and 16.6% respectively after they experience Stock Connect scheme, which supports H1. The baseline results suggest that stock connect schem allowing overseas investors access to the domestic crowd out firms green innovation output.

The sign and significance of the coefficients of the control variables introduced are consistent with previous research conclusions. For example, Size is positive with green innovation at the significance of 1% level, which may be due to the rich resources large-scale firms owned for their carrying out green innovation activities while small-scale enterprises have limited resources. Growth has a significant and positive effect on green innovation, which can be driven by the fact that high growth enterprises tend to think more from a long-term perspective, and their decisions are generally more forward-looking.

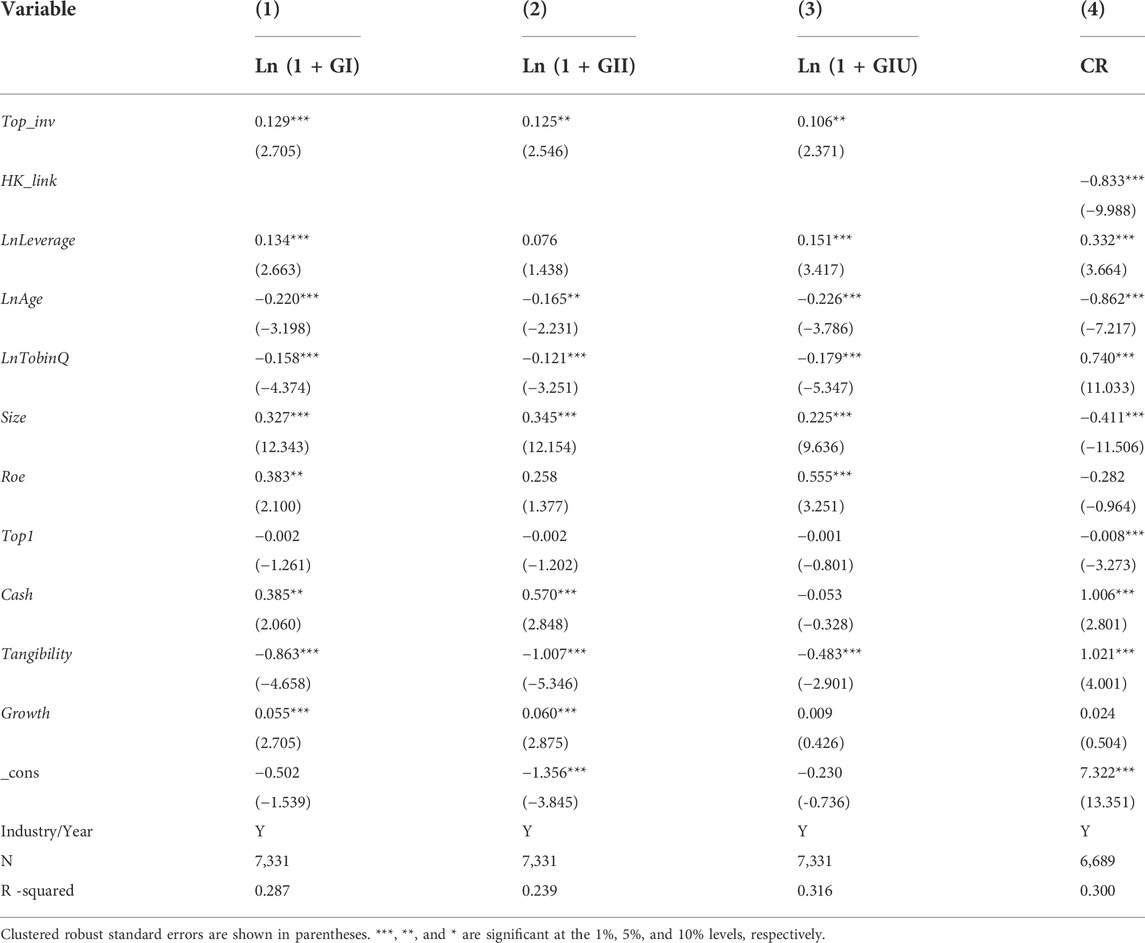

4.2 Foreign investor participation and green innovation

This paper first focuses on whether foreign investors along with the Stock Connect scheme are among the top ten shareholders of firms who experience the liberalization. The implementation of Stock Connect program has enabled foreign investors to purchase the stocks of A-share listed firms on Shanghai and Shenzhen stock markets. The more stocks held by foreign investors, the higher their participation and the greater the impact on focal firms. Therefore, referring to Lian et al. (2019), this article further examine the impact of investor participation on green innovation by including whether foreign investors become the top ten shareholders of firms.

The ownership structure of A-share firms has changed accordingly with the investment from foreign investors. When foreign investors become the top 10 shareholders, they can play a greater role and correspondingly participate more in corporate decision-making. Under the Stock Connect trading mechanism, the securities service agency for foreign investors to trade A-share stocks is “Hong Kong Central Clearing Company Limited.” When the shareholders are named “Hong Kong Central Clearing Company Limited,” they can be identified as foreign investors who enter into mainland market along with the implementation of Stock Connect policy. Accordingly, the dummy variable Top_inv is set in this paper. If “Hong Kong Central Clearing Company Limited” is among the top ten shareholders of the enterprise that year, then Top_inv = 1; otherwise, Top_inv = 0.

Columns (1)–(3) of Table 4 test the impact of whether foreign investors are among the top 10 shareholders on green innovation. The results show that the regression coefficient of Top_inv is significantly positive at the 1% level, indicating that when a company has foreign investors among the top ten shareholders, its level of green innovation is significantly higher than that of other companies without foreign investors among their top ten shareholders. It can be inferred that the deep participation of foreign investors can significantly increase the output of corporate green innovation.

This paper further examines whether foreign investors into domestic market along with the policy are value investors. After the opening of the capital market, foreign investors can choose short-term fast-forwarding and fast-out of funds and other speculative trading strategies to obtain returns, or they can choose value investment. The latter trading strategy focuses on long-term value investment, and will give more consideration to the firm’s long-term development. An important manifestation of the lack of value investors in the stock market is the high stock turnover rate (Su and Mai, 2004). Given that Stock Connect program allows foreign investors to participate in domestic equity markets, and drawn on Itzkowitz et al. (2015), this paper sets up regression model two to test whether foreign investors into domestic market due to the opening up of Stock Connect are value investors.

where CR is the stock turnover index. The regression results are reported in column (4) of Table 4, which shows that the regression coefficient of HK_link is −0.833 with a statistical significance of 1%, indicating that after the implementation of the Stock Connect program, foreign investor engagement can reduce the share turnover rate. Based on this, this paper concludes that foreign investors in the context of Stock Connect scheme are value investors in China’s A-share market, thus lending additional support to our finding that stock market liberalization significantly increases the output of corporate green innovation.

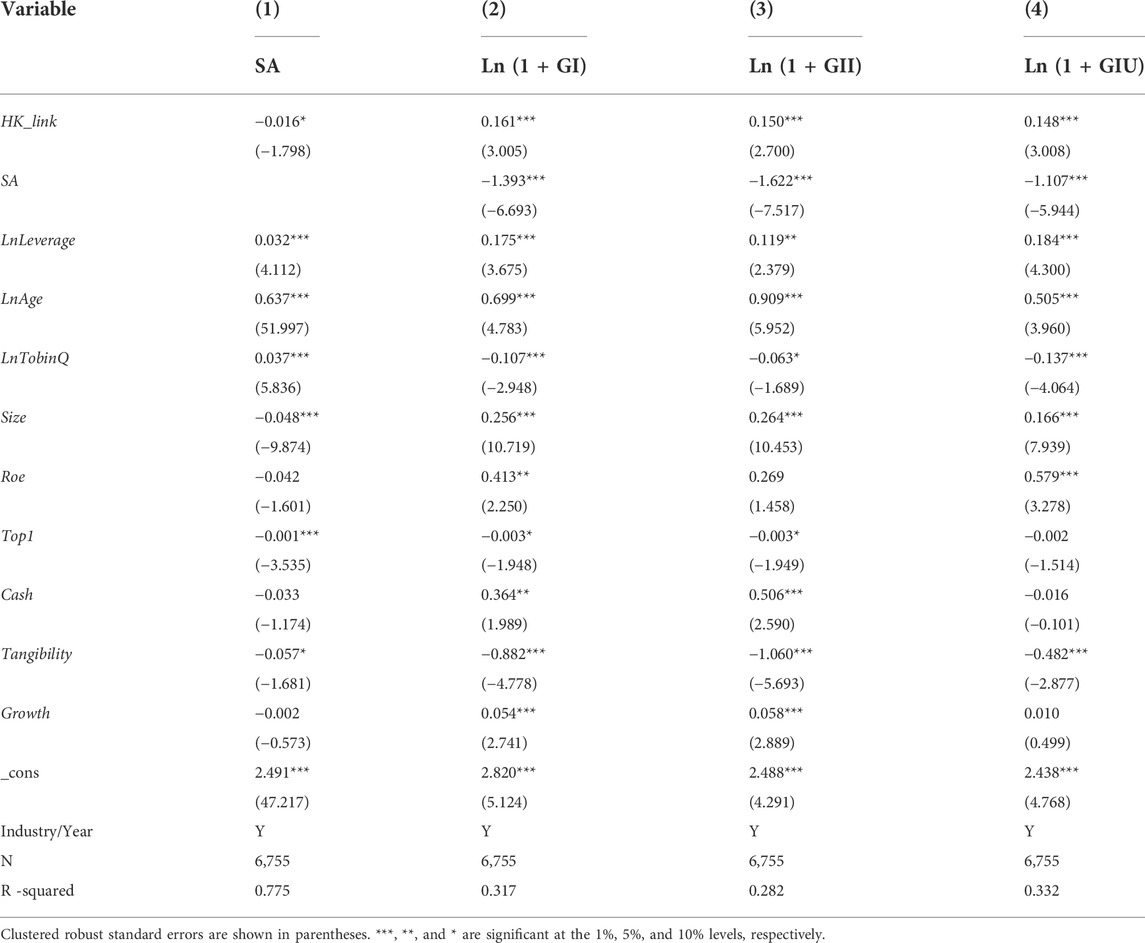

4.3 Stock market liberalization, financing constraints and green innovation

From the analysis above, we investigate whether financing constraints is the underlying economic channel through which stock market liberalization affects firms’ green innovation output. In the existing studies, KZ index and SA index are often used for constructing financing constraints. However, the calculation of KZ indicators requires the use of indicators related to financing constraints, such as cash flow, dividend payout ratio, and capital stock, which can lead to endogenous problems. In view of the fact that the scale and age of the company used in the calculation of the SA index are more exogenous, and referring to the practice of Hadlock and Pierce (2010), this paper chooses the SA index as a proxy for financing constraints3. The SA index is negative, and the greater its absolute value, the greater the financing constraints faced by the company.

Therefore, this paper takes financing constraints (SA) as the mediating variable and constructs the testing model of the mediating effect as follows:

This paper carries out the test according to the following procedures and principles. First, estimation model (2A) is to judge whether regression coefficient β1 is significant, and on this premise, we conduct subsequent mediation effect test. Second, if the regression coefficients

The test results of regression models (2B) and (2C) are presented in Table 5. The results in columns (1)–(4) show that the regression coefficient

4.4 Robustness tests

We conduct an array of robustness tests to confirm the consistency of our baseline results, including parallel trend hypothesis test, employing alternative model specifications and alternative measures for innovation.

4.4.1 Parallel trend hypothesis test

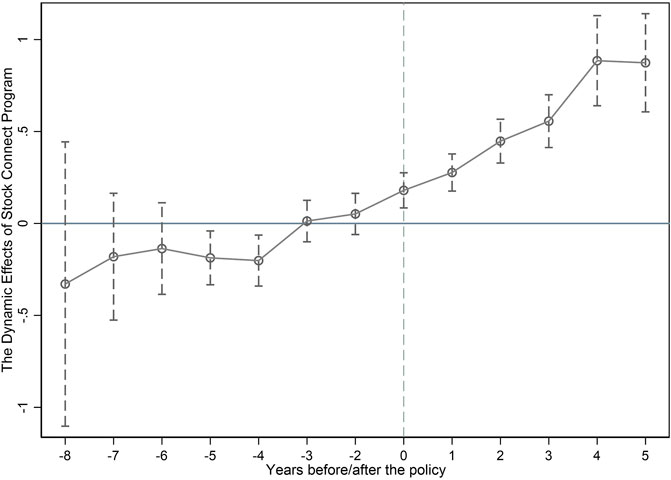

The idea of parallel trend hypothesis test for staggered DID, similar to Beck et al. (2010), is to decompose and analyze the dynamic trend of the economic effect of the policy in the annual interval through the event research method. The period before and after the policy point is equal to the current year minus the year in which the policy was implemented. Based on this, we establish the following regression model (3):

where

As shown in Figure 1, the estimated coefficients are basically negative and insignificantly different from zero for all years before the implementation of the Stock Connect program. While after the implementation of the policy, the estimated coefficients are all positive, and their significance gradually increased. This indicates that the difference in green innovation between the treatment group and the control group is not obvious before the implementation of the policy. After the implementation of the policy, the promotion effect of the Stock Connect policy on green innovation continues to increase for about 5 years after the policy time point, and then the effect levels off. The above results confirm that the staggered natural experiment in this paper satisfies the premise assumption of parallel trends.

4.4.2 Standard DID model for policy evaluation of Shanghai-HongKong Stock Connect program

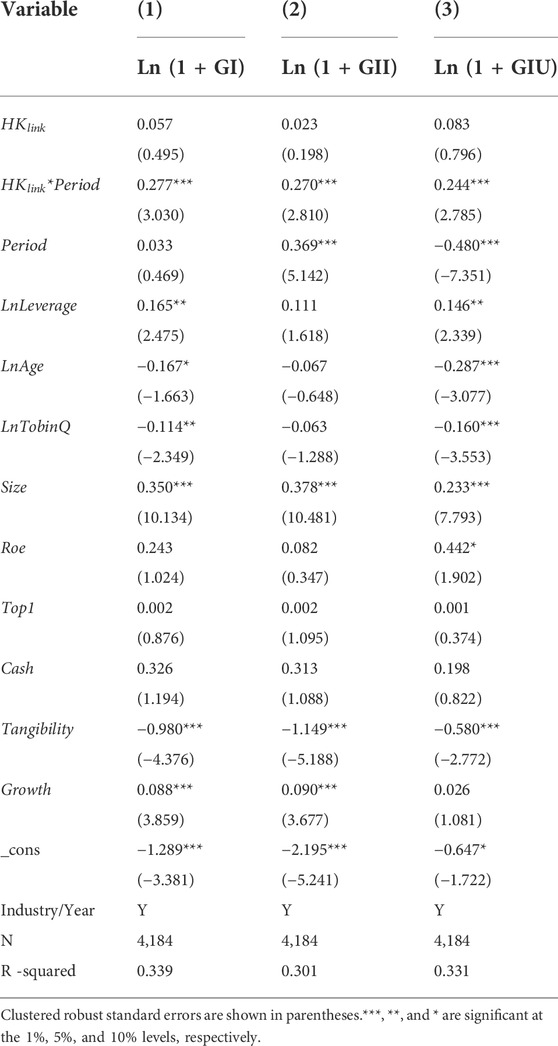

This paper uses a staggered natural experiment to test the dynamic impact of the implementation of the Stock Connect Program on green innovation. In order to further analyze the net effect of the stock market liberalization on green innovation, this paper takes the implementation of the Shanghai-Hong Kong Stock Connect program as an example, using the Standard DID model to test the changes in corporate green innovation before and after the implementation of the policy. According to the Shanghai-Hong Kong Stock Connect policy, the model is set as follows: set the samples that are included in the Shanghai-Hong Kong Stock Connect list in 2014 as the treatment group (HK_link = 1), and the samples that have not been included in the list as the control group (HK_link = 0). Set Period = 0 for the years before the implementation of Shanghai-Hong Kong Stock Connect, and Period = 1 for the years after the implementation of Shanghai-Hong Kong Stock Connect. The corresponding model 4) is as follows:

The regression results are reported in Table 6. The results in columns (1)–(3) show that the coefficients of interaction term (HK_ link * Period) are respectively 0.277, 0.270, and 0.244 with the significance level of 1%, that is, after the implementation of the Shanghai-Hong Kong Stock Connect Program in 2014, the green innovation output of enterprises included in the Shanghai-Hong Kong Stock Connect list increased significantly compared with those not included in the list. The above results further confirm our main findings.

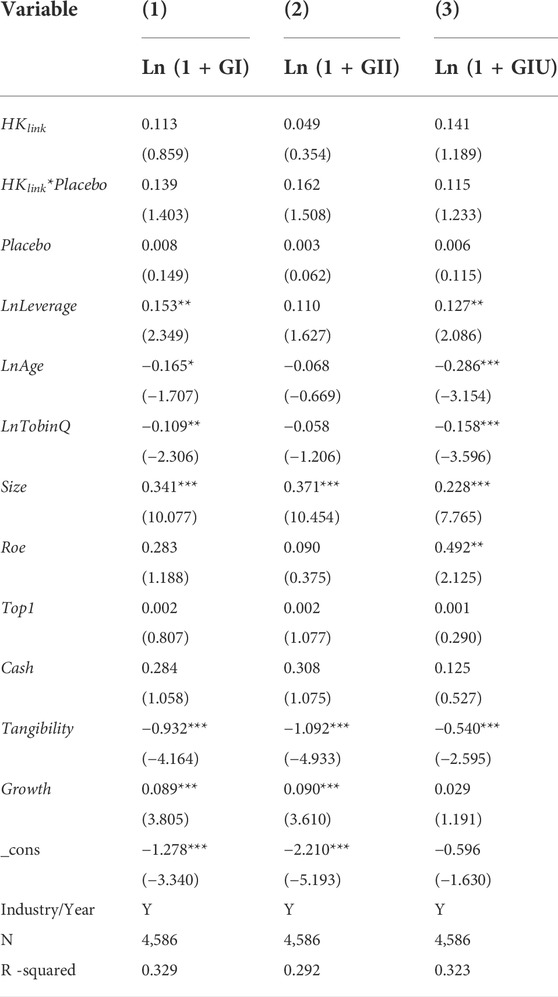

4.4.3 Robustness test: Placebo test

We use placebo test to further examine the stability of our model. Referring to Hoberg and Moon. (2017), we assumed that the policy of Shanghai-Hong Kong Stock Connect was launched in 2012, we further employ the Standard DID model to test the changes in corporate green innovation before and after 2012. The results in columns (1)–(3) of Table 7 show that the coefficients of interaction term (HK_ link * Placebo) are not significant, which support that our main findings are robust.

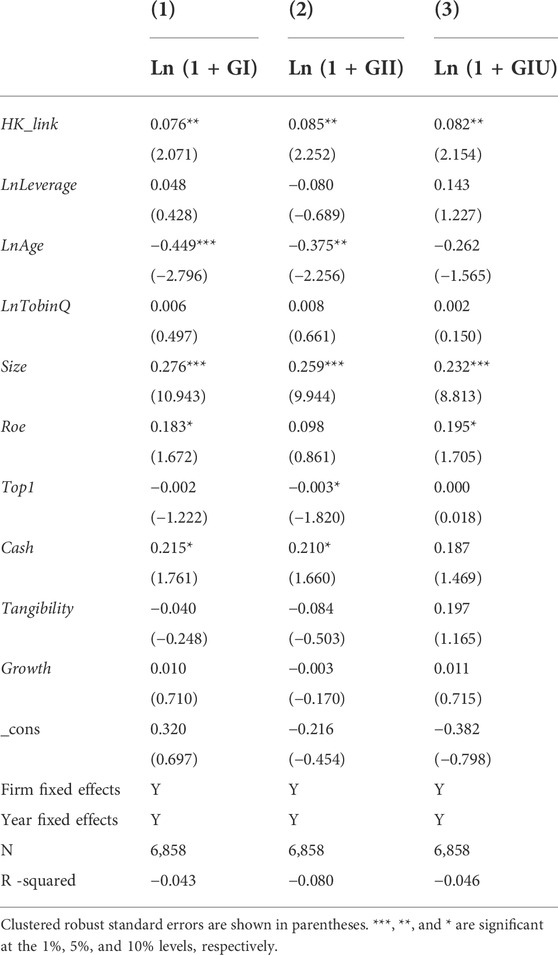

4.4.4 Robustness tests based on fixed effect model

We further control firm and year fixed effects for re-estimation. The results in columns (1)–(3) of Table 8 show that coefficients of HK_ link are respectively 0.076, 0.085, and 0.082 with the significance level of 5%, which further verify our main findings.

4.4.5 Other robustness tests: Alternative measures for green innovation

We use the number of green patents granted as alternative proxy variable for green innovation. Specifically, columns (1)–(3) of Table 9 show the results re-estimated by OLS method including control variables, the year and industry dummy variables controlled for the influence of macro policies, where the coefficients of HK_ link are respectively 0.205, 0.137, and 0.196 with the significance level of 1%. Columns (4)–(6) are the regression results after controlling for firm and year fixed effects, where the coefficients of HK_ link are respectively 0.169, 0.139, and 0.147 with the significance level of 1%. The empirical results indicate that after liberalizing the stock market, the green innovation outputs of firms included in the scope of eligible list for the Stock Connect program have increased significantly, and the positive correlations are still significant after controlling for time-invariant individual characteristics by including firm-level fixed effects and year fixed effects.

Therefore, the main finding of this paper still holds in the different specifications described above.

4.5 Additional analysis

4.5.1 The effect of heterogeneous ownership participation

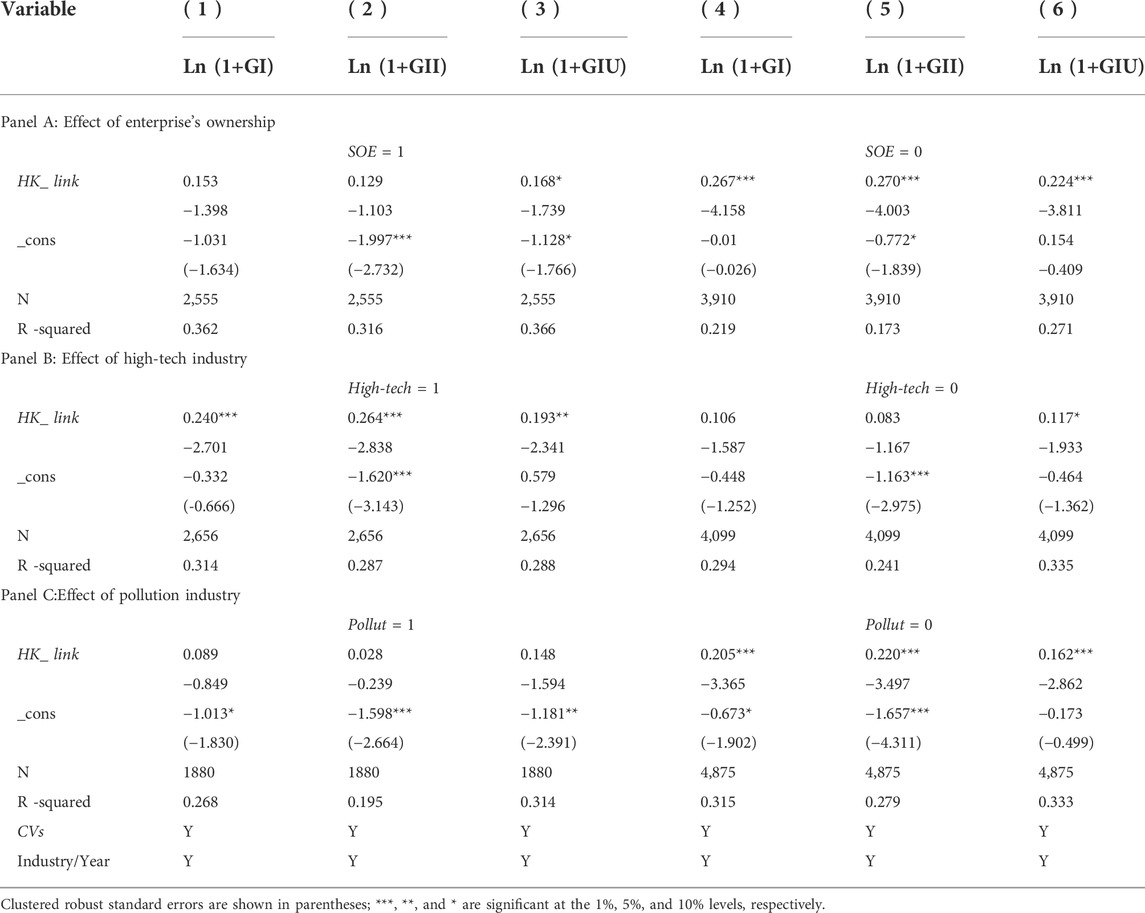

We first investigate the promoting effect of stock market opening on green innovation activities of enterprises with different ownership. SOE is set as proxy for enterprise ownership type, that is, the value of SOE is one for state-owned enterprises, and 0 otherwise. SOEs and non-SOEs are classified for group regression, and the results are shown in Panel A of Table 10. As results for SOEs shown in columns (1)–(3), the coefficient between HK_ link and Ln(1+GIU) is 0.168, significant at 10% level, but the coefficients of HK_ link are not significant with Ln(1+GI) and Ln(1+GII), indicating that stock market opening up only impacts the quantity of SOEs’ green innovation, while has no notable impact on the quality of their green innovation. For non-SOEs, the coefficient estimates of HK_ link are respectively 0.267, 0.270, and 0.224, significant at 1% level with Ln(1+GI), Ln(1+GII), and Ln(1+GIU), suggesting that stock market opening up significantly affect both the quality and quantity of non-SOEs’ green innovation output. The results support our hypothesis 3, indicating that subject to Stock Connect scheme, non-SOEs are more inclined to invest in green innovation for their long-term development.

4.5.2 The effect of the high-tech industry

Then, we conduct an estimation by categorizing firms according to whether or not they are included in the high-tech industry4. According to the specific classification standard, High-tech is set to classify firms into the high-tech subsample (High-tech = 1) and non-high-tech subsample (High-tech = 0). The corresponding results are presented in Panel B of Table 10. The results of high-tech subsample show that the correlation coefficients betweenHK_ link and GreenInnovation are respectively 0.240, 0.264, and 0.193, all 1% significantly, indicating that stock market liberalization significantly affects both the quality and quantity of green innovation for firms in the high-tech industry. For firms not in high-tech industry, the coefficient of HK _link is only significant when Ln(1+GIU) is used as the dependent variable, showing that the liberalization has no notable impact on the quality of green innovation. Hypothesis 4 is supported, which implies that international investors’ access to the domestic stock market promote firms in the high-tech industries to invest in green technology innovation.

4.5.3 The effect of the main polluting industry

We examine the heterogeneous impact of stock market opening up on green innovation by classifying companies based on whether a company belongs to main polluting industry5. Accordingly, we set Pollute equal to one for firms in the main polluting industry, and 0 otherwise. The empirical results listed in Panel C of Table 10 show that the coefficients of HK_ link are respectively 0.267, 0.270, and 0.224, all 1% significantly only for firms that do not belong to main polluting industries. The findings in this section suggest that the positive relation between stock market liberalization and green innovation is more notable for firms in less polluted industries. The results support our hypothesis 5, which implies that investments in green innovation for firms in polluting industries are more likely to be driven by environmental regulation, while Stock Connect scheme facilitating foreign investors into domestic market plays a larger incremental effect on firms’ green innovation in less polluting industries.

5 Discussion

With the advancement of economic globalization, various countries have opened up their capital markets, and an emerging body of research have been conducted on the subject of the opening policies. In line with previous research (Moshirian et al., 2021; Sha et al., 2022), we found that capital market liberalization had positive implications. Using a staggered DID estimation, the baseline results show that firms’ green innovation output increases after their stocks are within the scope of eligible shares for “Shanghai-Shenzhen-HongKong Stock Connect.” And an array of robustness tests are conducted to confirm the consistency of our baseline results, including parallel trend hypothesis test, employing alternative model specifications and alternative measures for innovation.

Additionally, we find that foreign investors along with China’s Stock Connect scheme are value investors, which help lead the focal firms’ decision more future-oriented. Meanwhile, when foreign investors become the top ten shareholders of focal firms after the implementation of stock market opening policies, they can play a greater role and correspondingly participate more in corporate decision-making, which will exert a positive effect on firms’ green innovation. The above findings are referred from the empirical results of Table 4. Based on reputation theories, managers tend to invest in projects with better short-term benefits when enterprises are confronted with financing constraints. In line with studies of Bekaert et al. (2003) and Gupta and Yuan (2009) who support that stock market opening can help alleviate financing constraints, our results in Table 5 of mechanism test show that alleviating financing constraint is a channel through which stock market liberalization promote corporate green innovation.

Furthermore, we also discuss the heterogeneous effect of stock market opening up on green innovation from the perspective of the firms’ ownership, high-tech industry and main polluting industry. The empirical results of Panel A in Table 10 show that stock market liberalization has a great significant impact on green innovation for non-SOEs, which suggest that non-SOEs are more likely to be influenced by stock market opening to invest in green innovation for their long-term development. The results of Panel B in Table 10 show that stock market liberalization primarily increases the green innovation output for firms in the high-tech industry. Lev and Zarowin (1999) supports that firm belongs to high-tech industries are confronted with more serious financing constraints out of the risks and uncertainties of their innovative tasks, so the opening up policies has a higher incremental effect for them on their innovative activities. The results of Panel C in Table 10 show that the positive relation between stock market liberalization and green innovation is more notable for firms in less polluting industries, this probably because investment in green innovation of main polluting industries are usually subject to environmental regulatory requirements, while for enterprises’ green innovative activities in less polluting industries will be more influenced by corporate strategy or organizational resources.

6 Conclusion, policy implications and limitations

6.1 Conclusion

Based on the background of China’s Stock Connect system, this article examines the impact of stock market liberalization on corporate green innovation with the empirical evidence of listed companies in China’s A-share market from 2011 to 2019. We find that the opening up of stock market alleviates financing constraints, and thus significantly promotes enterprises’ green innovation. At the same time, we verify that international investors into the China’s A-share market after the implementation of Stock Connect program are value investors, and when foreign investors are among the top ten shareholders of a firm, the firm’s green innovation will increase significantly. Apart from Hong et al. (2021), who shows that CEO narcissism positively affects corporate social (ir)responsibility based on overinvestment hypothesis, our findings demonstrating overseas value investors induced by the opening policies help the focal firms make more reasonable decisions based upon agent theory. After heterogeneity analysis on enterprise’s ownership, high-tech industry and polluting industry, we find that stock market liberalization has significantly promoted both the quality and quantity of green innovation for non-state-owned enterprises, firms in high-tech industries and firms in less polluting industries, while has no notable impact on the quality of green innovation for SOEs and firms not in high-tech industry.

6.2 Policy implications

In the context of carbon neutrality, corporate green governance is highly aware and has been considered as an important way to achieve high quality development. Stock connect policies allowing overseas invest access to domestic market has promoted China’s public firms green innovation. Based on the empirical results, we make some practical policy recommendations as follows.

First, our results show that foreign investors along with the Stock Connect scheme are value investors, which can also help lead firms focus on long-term value investment. The government should improve the infrastructure of the capital market, take advantage of the interconnectivity with overseas capital markets, and actively learn their advanced management experience and investment philosophy, and strive to narrow the gap between domestic market and foreign developed capital market.

Second, the government should continue to promote the process of opening up the capital market. Shanghai-Shenzhen-Hong Kong Stock Connect is an important innovative system for the opening up of China’s capital market, which allows overseas funds to enter the domestic market. Compared with Shanghai-Hong Kong Stock Connect, Shenzhen-Hong Kong Stock Connect has removed the total quota limit on transaction funds. The findings of this paper show that Stock Connect policy has achieved certain results, which has important implications for emerging capital markets. Therefore, the government can further continue to promote opening-up policies such as the Shanghai-London Stock Connect in a stable way, thus promoting the high-level development of domestic capital markets.

Third, the government should strengthen the optimization of the mainland stock market environment. The opening up of the capital market brings both opportunities and certain risks. The government should establish a sound information disclosure system, improve the quality of firms’ information disclosure, and alleviate the information asymmetry between investors and companies. The reduction of information asymmetry will help improve the green innovation level of enterprises and provide a favorable external environment for firms’ innovation activities.

6.3 Limitations

Some limitations imply potential directions for future research. First, this paper empirically tests the role of stock market opening up in promoting corporate green innovation, further explores the influence mechanism, and heterogeneous analysis. However, due to the limitation of the research perspective, there may be other influence mechanisms. This article will further broaden the research perspective and better identify the causal effect of the opening up of stock market on corporate green innovation. Second, heterogeneity analyses on enterprise’s ownership and high-tech industry show that the quality of corporate green innovation (invention patents) vary across enterprise’s ownership and industries, while the quantity of green innovation (utility patents) is not significantly different, which leaves us to further explore the mechanism and deep-seated reasons for this consequence in the future.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

TL: Writing the original draft, methodology, software, visualization. XL: Writing—review and editing, revising, supervision, funding acquisition. SF: Revising, proofread and editing.

Funding

This research was funded by the major project of the National Social Science Fund of China (Grant Numbers 21&ZD151).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1This manuscript has been selected to be reported in “The 3rd ISETS Energy Transition Forum: Climate Finance and Investment” on May 21, 2022.

2Political Bureau of the Communist Party of China Central Committee said China still faces uncertain situations and problems that are likely to exist in the medium and long run, and urged the country to accelerate the establishment of a “dual circulation” development pattern in which domestic economic cycle plays a leading role while international economic cycle remains its extension and supplement. https://cn.chinadaily.com.cn/a/202008/06/WS5f2b8d9da310a859d09dc5cd.html.

3According to the regulations of the Shanghai Stock Exchange and the Shenzhen Stock Exchange, the exchange regularly adjusts the constituent stocks of the SSE 180 Index and SSE 380 Index, the SZSE Index and the SZSE Small and Medium-sized Innovation Index according to the share’s market value, liquidity and other factors. Some stocks that don’t meet the stock selection requirements will be removed from the Stock Connect target list.

4SA = |-0. 737×Size+0. 043×Size^2-0. 04×Age |.

5According to the industry classification standard of National Bureau of Statistics (GB /T4754), the general equipment, special equipment, transportation equipment, electrical machinery and equipment, computer and other electronic equipment, communication equipment, instrumentation and culture, office machinery in the manufacturing industry are classified as high-tech industries.

6According to the Industry Classification Guidelines for Listed Companies revised by China Securities Regulatory Commission in 2012 and the Environmental Information Disclosure Guidelines for Listed Companies [Huan Ban Han (2010) No. 78], heavily polluting industries include coal, mining, textile, leather, paper making, petrochemical, pharmaceutical, chemical, metallurgy and thermal power.

References

Acemoglu, D., Aghion, P., Bursztyn, L., and Hemous, D. (2012). The environment and directed technical change. Am. Econ. Rev. 102 (1), 131–166. doi:10.1257/aer.102.1.131

Aggarwal, R., Erel, I., Ferreira, M., and Matos, P. (2011). Does governance travel around the world? Evidence from institutional investors. J. Financial Econ. 100 (1), 154–181. doi:10.1016/j.jfineco.2010.10.018

Aghion, P., Dechezleprêtre, A., Hemous, D., Martin, R., and Van Reenen, J. (2016). Carbon taxes, path dependency and directed technical change: Evidence from the auto industry. J. Political Econ. 124 (1), 1–51. doi:10.1086/684581

Bae, K. H., Ozoguz, A., Tan, H., and Wirjanto, T. S. (2012). Do foreigners facilitate information transmission in emerging markets? J. Financial Econ. 105 (1), 209–227. doi:10.1016/j.jfineco.2012.01.001

Beck, T., Levine, R., and Levkov, A. (2010). Big bad banks? The winners and losers from bank deregulation in the United States. J. Finance 65 (5), 1637–1667. doi:10.1111/j.1540-6261.2010.01589.x

Bekaert, G., Harvey, C. R., and Lundblad, C. (2011). Financial openness and productivity. World Dev. 39, 1–19. doi:10.1016/j.worlddev.2010.06.016

Bekaert, G., Harvey, C. R., and Lundblad, C. T. (2003). Equity market liberalization in emerging markets. J. Financ. Res. 26 (3), 275–299. doi:10.1111/1475-6803.00059

Berrone, P., Fosfuri, A., Gelabert, L., and Gomez‐Mejia, L. R. (2013). Necessity as the mother of “green” inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 34 (8), 891–909. doi:10.1002/smj.2041

Brown, J. R., Fazzari, S. M., and Petersen, B. C. (2009). Financing innovation and growth: Cash flow, external equity, and the 1990s R&D boom. J. Finance 64 (1), 151–185. doi:10.1111/j.1540-6261.2008.01431.x

Brown, J. R., Martinsson, G., and Petersen, B. C. (2013). Law, stock markets, and innovation. J. Finance 68 (4), 1517–1549. doi:10.1111/jofi.12040

Bu, M., Qiao, Z., and Liu, B. (2020). Voluntary environmental regulation and firm innovation in China. Econ. Model. 89, 10–18. doi:10.1016/j.econmod.2019.12.020

Carpenter, R. E., and Petersen, B. C. (2002). Capital market imperfections, high‐tech investment, and new equity financing. Econ. J. 112 (477), 54–72. doi:10.1111/1468-0297.00683

Chan, R. Y. K. (2010). Corporate environmentalism pursuit by foreign firms competing in China. J. World Bus. 45 (1), 80–92. doi:10.1016/j.jwb.2009.04.010

Chan, R. Y. K., He, H., Chan, H. K., and Wang, W. Y. C. (2012). Environmental orientation and corporate performance: The mediation mechanism of green supply chain management and moderating effect of competitive intensity. Ind. Mark. Manag. 41 (4), 621–630. doi:10.1016/j.indmarman.2012.04.009

Colombo, M. G., Croce, A., and Guerini, M. (2013). The effect of public subsidies on firms’ investment-cash flow sensitivity: Transient or persistent. Res. Policy 42, 1605–1623. doi:10.1016/j.respol.2013.07.003

Cornaggia, J., Mao, Y., Tian, X., and Wolfe, B. (2013). Does banking competition affect innovation? J. Financial Econ. 115 (1), 189–209. doi:10.1016/j.jfineco.2014.09.001

Cox, P., and Wicks, P. G. (2011). Institutional interest in corporate responsibility: Portfolio evidence and ethical explanation. J. Bus. Ethics 103 (1), 143–165. doi:10.1007/s10551-011-0859-0

Ferreira, M. A., and Matos, P. (2008). The colors of investors’ money: The role of institutional investors around the world. SSRN J. 88 (3), 499–533. doi:10.2139/ssrn.885777

Ghosh, S. (2006). Did financial liberalization ease financing constraints? Evidence from Indian firm-level data. Emerg. Mark. Rev. 7 (2), 176–190. doi:10.1016/j.ememar.2005.09.008

Gillan, S. L., and Starks, L. T. (2003). Corporate governance, corporate ownership, and the role of institutional investors: A global perspective. SSRN J. 13 (2), 4–22. doi:10.2139/ssrn.439500

Gu, X. M., Chen, Y. M., and Pan, S. Y. (2018). Economic policy uncertainty and innovation: An empirical analysis of China’s public companies. Econ. Res. J. 53 (02), 109–123.

Guo, Y., Fan, L., and Yuan, X. (2022). Market competition, financialization, and green innovation: Evidence from China’s manufacturing industries. Front. Environ. Sci. 185, 836019. doi:10.3389/fenvs.2022.836019

Guo, Y. S., Shen, L., and Guo, M. X. (2018). Has Shanghai-Hong Kong stock connect improved the information environment for listed companies?-- A perspective based on analyst’s attention. Secur. Mark. Rev. 10, 35–43.

Gupta, N., and Yuan, K. (2009). On the growth effect of stock market liberalizations. Rev. Financ. Stud. 22 (11), 4715–4752. doi:10.1093/rfs/hhp001

Hadlock, C. J., and Pierce, J. R. (2010). New evidence on measuring financial constraints: Moving beyond the KZ index. Rev. Financ. Stud. 23 (5), 1909–1940. doi:10.1093/rfs/hhq009

Hall, B. H. (2002). The financing of research and development. Oxf. Rev. Econ. Policy 18 (1), 35–51. doi:10.1093/oxrep/18.1.35

He, J. J., and Tian, X. (2013). The dark side of analyst coverage: The case of innovation. J. Financial Econ. 109 (3), 856–878. doi:10.1016/j.jfineco.2013.04.001

Henry, P. B. (2000). Do stock market liberalizations cause investment booms? J. Financial Econ. 58 (1-2), 301–334. doi:10.1016/S0304-405X(00)00073-8

Hoberg, G., and Moon, S. K. (2017). Offshore activities and financial vs operational hedging. SSRN J. 125, 217–244. doi:10.2139/ssrn.2456323

Hong, J. K., Lee, J. H., and Roh, T. (2021). The effects of CEO narcissism on corporate social responsibility and irresponsibility. MDE. Manage. Decis. Econ. 43, 1926–1940. doi:10.1002/mde.3500

Horbach, J. (2008). Determinants of environmental innovation: New evidence from German panel data sources. Res. Policy 37 (1), 163–173. doi:10.1016/j.respol.2007.08.006

Horbach, J., Rammer, C., and Rennings, K. (2012). Determinants of eco-innovations by type of environmental impact—the role of regulatory push/pull, technology push and market pull. Ecol. Econ. 78 (1), 112–122. doi:10.1016/j.ecolecon.2012.04.005

Hsu, P. H., Tian, X., and Xu, Y. (2014). Financial development and innovation: Cross-country evidence. SSRN J. 112 (1), 116–135. doi:10.2139/ssrn.1745682

Huang, Z., Liao, G., and Li, Z. (2019). Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Change 144, 148–156. doi:10.1016/j.techfore.2019.04.023

Itzkowitz, J., Itzkowitz, J., and Rothbort, S. (2015). ABCs of trading: Behavioral biases affect stock turnover and value. Rev. Financ. 20 (2), 663–692. doi:10.1093/rof/rfv012

Johnson, R. A., and Greening, D. W. (1999). The effects of corporate governance and institutional ownership typeson corporate social performance. Acad. Manag. J. 42 (5), 564–576. doi:10.2307/256977

Johnstone, N., Hascic, I., and Popp, D. (2010). Renewable energy policies and technological innovation: Evidence based on patent counts. Environ. Resour. Econ. (Dordr). 45 (1), 133–155. doi:10.1007/s10640-009-9309-1

Lei, Z., and Lu, H. T. (2017). Foreign portfolio investment and stock price informativeness: Evidence from the Shanghai-Hong Kong Stock Connect. Available at SSRN: http://dx.doi.org/10.2139/ssrn.2875633 (Accessed December 4, 2017)

Lev, B., and Zarowin, P. (1999). The boundaries of financial reporting and how to extend them. CFA Dig. 37 (2), 5–7. doi:10.2469/dig.v30.n3.702

Li, D., Zheng, M., Cao, C., Chen, X., Ren, S., and Huang, M. (2017). The impact of legitimacy pressure and corporate profitability on green innovation: Evidence from China top 100. J. Clean. Prod. 141 (10), 41–49. doi:10.1016/j.jclepro.2016.08.123

Lian, L. S., Zhu, S., and Chen, G. T. (2019). Capital market opening-up, non-financial information pricing and firm investment -- empirical evidence based on the shanghai-shenzhen-Hong Kong stock connect trading system. Manag. World 8, 136–154. doi:10.19744/j.cnki.11-1235/f.2019.0111

Lin, H., Zeng, S. X., Ma, H. Y., Qi, G. Y., and Tam, V. (2014). Can political capital drive corporate green innovation? Lessons from China. J. Clean. Prod. 64 (2), 63–72. doi:10.1016/j.jclepro.2013.07.046

Moshirian, F., Tian, X., Zhang, B., and Zhang, W. (2021). Stock market liberalization and innovation. J. Financial Econ. 139, 985–1014. doi:10.1016/j.jfineco.2020.08.018

Noe, T. H. (2002). Legal-System arbitrage and the theory of multinational finance. Available at SSRN: http://dx.doi.org/10.2139/ssrn.423503 (Accessed February 5, 2002)

Perkins, R., and Neumayer, E. (2012). Do recipient country characteristics affect international spillovers of Co2-efficiency via trade and foreign direct investment? Clim. Change 112 (2), 469–491. doi:10.1007/s10584-011-0204-8

Roh, T., Lee, K., and Yang, J. Y. (2022a). How do intellectual property rights and government support drive a firm's green innovation? The mediating role of open innovation. J. Clean. Prod. 2, 128422. doi:10.1016/j.jclepro.2021.128422

Roh, T., Noh, J., Oh, Y., and Park, K. S. (2022b). Structural relationships of a firm's green strategies for environmental performance: The roles of green supply chain management and green marketing innovation. J. Clean. Prod. 356, 131877. doi:10.1016/j.jclepro.2022.131877

Sha, Y., Zhang, P., Wang, Y., and Xu, Y. (2022). Capital market opening and green innovation--Evidence from Shanghai-Hong Kong stock connect and the Shenzhen-Hong Kong stock connect. Energy Econ. 111, 106048. doi:10.1016/j.eneco.2022.106048

Song, M., Chen, M., and Wang, S. (2018). Global supply chain integration, financing restrictions, and green innovation: Analysis based on 222, 773 samples. Int. J. Logist. Manag. 29 (2), 539–554. doi:10.1108/IJLM-03-2017-0072

Song, M. L., Tao, J., and Wang, S. H. (2015). FDI, technology spillovers and green innovation in China: Analysis based on data envelopment analysis. Ann. Oper. Res. 228 (1), 47–64. doi:10.1007/s10479-013-1442-0

Su, D. W., and Mai, Y. X. (2004). Liquidity and asset pricing: An empirical study of asset turnover and expected returns in China’s stock market. Econ. Res. J. 2, 95–105.

Tong, T. W., He, W., He, Z. L., and Lu, J. (2014). Patent regime shift and firm innovation: Evidence from the second amendmentto China’s patent law. Acad. Manag. Proc. 1, 14174. doi:10.5465/ambpp.2014.14174abstract

Wang, S. (2021). How does stock market liberalization influence corporate innovation? Evidence from stock connect scheme in China. Emerg. Mark. Rev. 47, 100762. doi:10.1016/j.ememar.2020.100762

Wu, G., Xu, Q., Niu, X., and Li, T. (2022). How does government policy improve green technology innovation: An empirical study in China. Front. Environ. Sci. 723 (9), 794–799. doi:10.3389/fenvs.2021.799794

Yan, X., and Zhang, Z. (2009). Institutional investors and equity returns: Are short-term institutions better in-formed? SSRN J. 22 (2), 893–924. doi:10.2139/ssrn.889708

Yang, J. Y., and Roh, T. (2019). Open for green innovation: From the perspective of green process and green consumer innovation. Sustainability 11 (12), 3234. doi:10.3390/su11123234

Zhang, Y., Zhang, J., and Cheng, Z. (2021). Stock market liberalization and corporate green innovation: Evidence from China. Int. J. Environ. Res. Public Health 18 (7), 3412. doi:10.3390/ijerph18073412

Zucker, L. G., and Darby, M. R. (2007). Star scientists, innovation and regional and national immigration. Available at SSRN: http://dx.doi.org/10.2139/ssrn.1001112 (Accessed July 20, 2007)

Keywords: foreign investor engagement, stock market liberalization, green innovation, value investors, sustainable development, dual circulation

Citation: Li T, Liu X and Fan S (2022) Foreign investor engagement: Stock market liberalization and corporate green innovation in China. Front. Environ. Sci. 10:960572. doi: 10.3389/fenvs.2022.960572

Received: 03 June 2022; Accepted: 22 August 2022;

Published: 14 September 2022.

Edited by:

Mobeen Ur Rehman, Shaheed Zulfikar Ali Bhutto Institute of Science and Technology (SZABIST), United Arab EmiratesCopyright © 2022 Li, Liu and Fan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiaoxue Liu, bGl1eHhAdGguYnRidS5lZHUuY24=

Tiantian Li

Tiantian Li Xiaoxue Liu

Xiaoxue Liu Shuangshuang Fan

Shuangshuang Fan