- Chongqing Normal University, Chongqing, China

This study explores the relationship between firms’ corporate social responsibility (CSR) and their “green” technology innovation in the context of a developing country with a high level of economic growth (China). Using data from listed companies, green patent authorization data from the State Intellectual Property Office, and social responsibility rating data from Rankin’s CSR Ratings of China from 2009 to 2017, we find that a higher CSR rating is highly positively correlated to green technology innovation as measured by number of green patents granted. Results indicated that corporate social performance plays a contributory role in green technology innovation. We also find that unabsorbed slack resources enhance the positive relationship between CSR rating and the number of green technology patents.

1 Introduction

After a long period of rapid economic growth, China now faces severe challenges in ecological environment protection. According to the Ministry of Ecology and Environment, global warming has exacerbated the warming and acidification of China’s surrounding ocean and caused ecological risks, such as sea level rise, tsunamis, and alien species invasion, that seriously threaten the safety and livelihoods of people in the China’s coastal zone2.

The question of how to achieve “green” development has become one of great concern to China in recent years, guided by the Chinese government’s new focus on innovative, coordinated, green, open, and shared development3; on the philosophy that “green mountains are gold mountains”4; and on carbon peak and neutrality targets5. Green technology innovation is seen as an important way for China to achieve its “two Carbon” goal of coordinated economic and environmental development. With the implementation of a growing number of environmental regulations and the development of low-carbon technologies, many Chinese firms have committed themselves to the production of green products both to improve their competitiveness and to reduce carbon emissions.

Research has shown that by actively considering the interests of multiple (and possibly indirect) stakeholders, such as society and the environment, and by practicing corporate social responsibility (corporate social responsibility is abbreviated as CSR), firms can not only improve their own economic performance (Flammer, 2015) but can also promote the green development of society (Boulouta and Pitelis, 2014). Therefore, society may expect firms to assume more social responsibility and to help alleviate environmental pressure through green innovation, in China in particular (Zeng et al., 2020).

Studies have shown that there is an association between CSR and corporate innovation. There is a substantial body of research on CSR and technology innovation performance, and their economic effects (Martinez-Conesa et al., 2017; Ko et al., 2020). Some authors have found that many firms are able to access new markets and in so doing introduce outside knowledge that can promote increased levels of technological innovation (Piotr and Dawid, 2010; Bocquet et al., 2013; Bocquet et al., 2017). However, there are also studies showing that the CSR increases operating costs, affecting their research and development (R&D) inputs. Thus, CSR may have a negative effect on technological innovation performance (Gallego-Álvarez et al., 2011).

Luo and Du (2015) found that by strengthening the knowledge exchange between firms and external stakeholders, involvement in social responsibility plays a role in improving the performance of firm technology innovation. Similarly, Zhou et al. (2020) argued that by improving employees’ work enthusiasm and strengthening cooperation with suppliers, CSR can increase levels of firm technology innovation. In a related paper Martinez-Conesa et al. (2017) noted that fulfilling social responsibility can enhance firms’ innovation abilities, which is an important intermediary variable by which social responsibility can improve the financial performance of firms.

Different from traditional technology innovation, green technology innovation aims to achieve coordinated economic, resource, and environmental development by using new concepts and new technologies to reduce energy consumption and environmental pollution and obtain economic benefits. Most existing research focuses on the economic benefits of technology innovation, and studies on how CSR influences green innovation are scarce by comparison. Kraus et al. (2020) pointed out that firms engaged in CSR tend to pay more attention to green development strategies and as a result enjoy higher levels of green innovation. Likewise, Chang (2015) emphasized that in firms that proactively engage in social responsibility practices, high priority is given to the cultivation of green organizational culture, and more resources tend to be allocated for green innovative activities. From the perspectives of green identity and green organizational culture, current studies tend to view green innovation as a means practice CSR, and CSR practices promote firms’ performance in green technology innovation (Kraus et al., 2020; AAchi et al., 2022).

Although existing research on CSR is abundant, there are still gaps to be explored. First, most research investigates the relationship between CSR and green technology innovation based on developed countries; only a few, studies have attended to the case of developing countries. According to Sharma (2019) developed countries have stronger environment protection consciousness and social responsibility than developing countries due to different economic development levels and cultures (Sharma, 2019). However, green technology innovation has recently become a more pressing concern in developing countries, especially for China, and the question of whether the CSR-green technology innovation relationship for North America and Western Europe also holds for developing countries deserves closer study (AAchi et al., 2022). Many developing countries are plagued by weak institutions, underdeveloped capital markets, weak contract enforcement, lack of business freedom, and weak legal systems and property rights (Ghoul et al., 2017; Ioannou and Serafeim, 2012; Lanis and Richardson, 2015).

Second, the question of what is the moderating role of firm slack resources between CSR and green technology innovation in weak institutional settings remains unanswered. Resource dependence theory posits that the survival and development of firms are restricted by resources (Hillman et al., 2009). With both social responsibility and green technology innovation, firms must integrate and reconfigure resources. Drawing upon concepts from slack theory from Singh (1986), slack resources can be classified into two types. One is unabsorbed slack resources (resources that are temporarily idle to prepare for new goals), and the other is absorbed slack resources (resources that are intentionally invested to achieve specific goals). We may therefore reasonably ask: What role do slack resources plays and what effect differences between two types of slack resources. If we ignore the regulation of firm resources (Yuan and Cao, 2022) and focus on firms’ green willingness or cultural aspects alone, we might not fully understand the relationship between the performance of CSR and green technology innovation. Furthermore, due to data availability issues, more studies have focused on the overall level of green innovation (AAchi et al., 2022) than the quantity or quality of green innovation. To fill this research gap, this study examines how CSR affects both the quantity and quality of green technology innovation and examines the moderating role of the above two types of slack resources in China specifically.

To help us with this examination, we employ green patent authorization data from the State Intellectual Property Office, social responsibility rating data from Rankin’s CSR Ratings (RKS), and the data of Chinese A-share listed companies from 2009 to 2017. We find that firms with better performance in practicing social responsibility have higher numbers of green patents authorized. Furthermore, we find that the greater a firm’s unabsorbed slack resources, the more positively CSR correlates to its green technology innovation.

The contributions of this study to the literature are twofold. First, by investigating innovation quality and the moderating effect of slack resources, this study deepens the understanding of the relationship between CSR and green technology innovation. Whereas existing studies have highlighted the role of firms’ green innovation willingness (AAchi et al., 2022) and green technology innovation as a complex intellectual activity depending on the relevant resources of firms, this study finds that unabsorbed slack resources positively moderate the relationship between CSR and green technology innovation. Second, this study provides empirical evidence from a transitional developing country that CSR does in fact have an impact on green technology innovation. There are many differences for CSR and green technology innovation (green technology innovation is abbreviated as GTI) differences between developed and developing countries. Most explorations of the relationship between CSR and green technology innovation so far has concentrated on developed economies such as the United States or those in Europe, but there is scant research on developing countries such as China. Many developing countries face more severe environmental problems than developed countries, and their firms tend to have lower awareness of CSR practices.

We also note that Kawai et al., 2018 explored the relationship between CSR and green technology innovation for China’s listed companies and the moderating effect of corporate social capital and the regulation of incentives on executives. By contrast, again, this study examines the moderating effect of firm slack resources and the quality of green technology innovation, drawing conclusions that enhance our understanding of the relationship between CSR and green technology innovation. The rest of this paper is organized as follows. Section 2 presents our theoretical analysis and research hypotheses. Section 3 describes the research design. The empirical results and analysis are presented in Section 4, and Section 5 concludes.

2 Theoretical analysis and research hypotheses

2.1 Corporate social responsibility and green technology innovation

Green technology innovation requires support from a wide range of external resources as it is a more complex intellectual activity than traditional technology innovation that necessarily involves the creation, integration, and diffusion of knowledge in different technical fields6 within an organization. It typically has the characteristics of dynamic and diverse content, a highly complex R&D process, and high levels of uncertainty (Peng et al., 2014). These features mean that green technology innovation cannot be effectively carried out by relying merely on previous technical experience or knowledge in only a single technical field (Yuan and Cao, 2022). To this end, high amounts of CSR participation can strengthen the ties between a firm and external stakeholders (Cheng et al., 2014), help a firm obtain the recognition and support of these stakeholders (Chang, 2015), and attract a wider range of resources for green technology innovation.

By forging a better relationship with external stakeholders and lowering the uncertainty of external investment, high amounts of CSR participation can help companies acquire needed external resources, including technical know-how, highly skilled workers, and outside financing. For example, firms can attract capital resources from investors and creditors (Zhang et al., 2022a; Martin and Moser, 2016); human resources in the form of excellent employees (Wiggenhorn et al., 2016); market resources, such as customers and suppliers (Flammer, 2018); public environmental and institutional resources from the government and society; and technological information from universities and research institutions. However, in the era of increasingly strong demand for environmental protection, firms with “good” CSR performance cannot afford to overlook their environmental responsibility (Meng et al., 2013) and are more likely to adopt environment-oriented innovative behaviors proactively (AAchi et al., 2022). As a result, these firms invest both internal and external resources in a complementary fashion in order to promote green technology innovation. Accordingly, we propose the following hypothesis.

H1: Good CSR performance can promote a firm’s output of green technology innovation.

2.2 The moderating role of absorbed slack and unabsorbed slack

Slack resources can be divided into absorbed slack resources (abbreviated as A-slack) and unabsorbed slack resources (abbreviated as U-slack). The unabsorbed slack resources of a firm are those resources possessed by the firm that have the potential to be developed and are able to support firm wide innovation. Firms can rapidly convert U-slack resources into those needed for all aspects of innovation activities. Absorbed slack resources, however, are difficult to reuse inside a firm once they have been put to use for specific projects.

Corporate social responsibility strategies and green technology innovation have a competitive relationship. Since both compete for firm resources, utilizing U-slack resources as either a basis for the initiation of corporate green innovation activities or as a buffer for environmental changes can positively affect corporate innovation activities. A firm can theoretically rapidly transform U-slack resources into sources for innovation activities when faced with new opportunities for market development. Although CSR is a strategic innovation rather than a technology innovation, both of these types of innovation require corporate resources.

Firms’ U-slacks resources can be readily reconfigured to new targets and thus may exert a positive moderating effect on a firm’s CSR-GTI relationship. The concept of U-slack7 resources reflects the financing and investment capacities that firms can develop and utilize in the long term (Herold et al., 2006). After integrating green technology innovation knowledge and resources, a firm needs to consume additional learning costs to identify and absorb external knowledge and resources for green technology innovation, however, and here flexible U-slack resources can provide long-term support. They can improve the efficiency and capacity for firms to manage external knowledge and resources, deliver the specific knowledge and resources needed for green technology innovation, and boost the success rate of green technology innovation as well (Lee, 2009). In contrast, A-slack representatives are difficult to repurpose. In light of this we propose the following pair of hypotheses.

H2: U-slack resources positively moderate the positive relationship of CSR performance with green technology innovation.

H3: A-slack resources have no significant positive moderating effect on the relationship between CSR performance and green technology innovation.

3 Research design

3.1 Data sources and sample selection

This study selected Chinese listed firms from the RKS index from 2009 to 2017 as a sample of relevant firms. Data on CSR ratings were collected from Rankin’s CSR Ratings (RKS), the leading independent CSR-rating entity in China (Chen and Wan, 2020). Green technology innovation data were obtained from the website of the State Intellectual Property Office through python crawling, referencing the World Intellectual Property Organization (WIPO) IPC Green Inventory to identify green patents authorized (Xing et al., 2021). Data of all moderating and control variables were collected from the WIND database provided by Shanghai Wind Information Co., Ltd., and the CSMAR database provided by Shenzhen GTA Education Tech. (Bao et al., 2017). Our final sample was obtained by excluding the following categories: 1) firms in the financial or insurance industries; 2) companies that had not released a CSR report; 3) ST (special treatment) and *ST (delisting risk warning) companies with abnormal financial data; 4) samples with key missing data, such as firm’s total number of employees. After applying these rules, we were left a total of 2,734 valid firms. Finally, we winsorized the continuous variables of firm characteristics using a 5% threshold for both tails to avoid possible estimation errors caused by outliers.

Drawing on Herold et al. (2006) and Peng et al. (2010), we measured slack resources by dividing current assets by total assets, and we classified slack resources into A-slack and U-slack. A-slack resources represent short-term solvency, (investment) financing capacity, and reflect the size of slack resources that the firm can directly utilize or transform in the short term. Higher A-slack means more “short-term idle” or “potential” resources that the firm has not fully utilized and more “short-term free” resources that can be used to support process or product innovation activities. By contrast, U-slack resources represent long-term solvency, liabilities (financing) and investment capacity of the firm, and reflect the financing and investment capacities that it can develop and utilize.

3.2 Model construction and variables

3.2.1 Model construction

We constructed the following model to test the impact of CSR on green technology innovation as well as the moderating role of firm slack resources.

where Patent represents GI or GII in different situation (variable definitions are given in Table 1); CSR denotes the CSR performance score; Control represents the control variables; Industry stands for industrial variables; Year denotes the year variable; ε is the error term for each equation (abusing notation), assumed to be distributed (i.i.d. Normal with mean 0 and variance sigma 1); A_Slack represents firm absorbed slack resources; U_Slack represents firm unabsorbed slack resources; ASla*csr is the interaction term of centralized CSR and A_Slack; and USla*csr is the interaction term of decentralized CSR and U_Slack. In the data on green patents authorized, the dependent variable consists of “merging data” that has a left-truncated distribution, referring to (Chen et al., 2017). Hence we adopt the Tobit two-stage IV method for this regression.

Research on green innovation began in the 1990s and primarily focuses on green technology innovation specifically (Qi et al., 2018). Whether a technology is “green” is determined by a general heuristic rubric that considers technologies, processes, and products that lead to reduced pollution, less raw material use, or lower energy consumption. Generally, the existing literature measures firms’ green technology innovation by questionnaire scoring or by R&D investment per unit of energy consumption, among others methods (Wang et al., 2021). However, such methods suffer from the problem of high subjectivity. To overcome this defect, we instead use the number of green patents authorized to measure firms’ performance in green technology innovation as this is a more objective measure that can be quantified and also has the benefit of a large available sample of data.

In 2010, the WIPO published the IPC Green Inventory, which classified green patents into seven categories following the United Nations Framework Convention on Climate Change: transportation, waste management, energy conservation, alternative energy production, administrative mediation or design aspects, agriculture or forestry, and nuclear power generation, and we use these categories to count firm green patents authorized each year. Whereas Chinese patent law divides patents into invention patents, utility model patents, and design patents, the IPC Green Inventory includes only invention patents and utility model patents. For this reason, the green patents authorized in this study include the total amount of green invention patents and green utility model patents. In order to take green patents’ sometimes processing times from the beginning of R&D to full patent authorization into consideration, we lag all proxy variables for green technology innovation by one period.

In the existing literature, RKS has been widely used to measure firms’ CSR performance (McGuinness et al., 2017; Wang et al., 2018), and the higher the rating score means the better the firm’s CSR performance. For mediating variables, we refer to Herold et al. (2006) and Peng et al. (2010) and measure A_Slack by dividing current assets by current liabilities and measure U_Slack by dividing owners’ equity by total liabilities. In addition, in order to avoid the multicollinearity problem caused by multiplying mediating variables and independent variables, we centralize these variables according to the suggestion of Toothaker (1994).

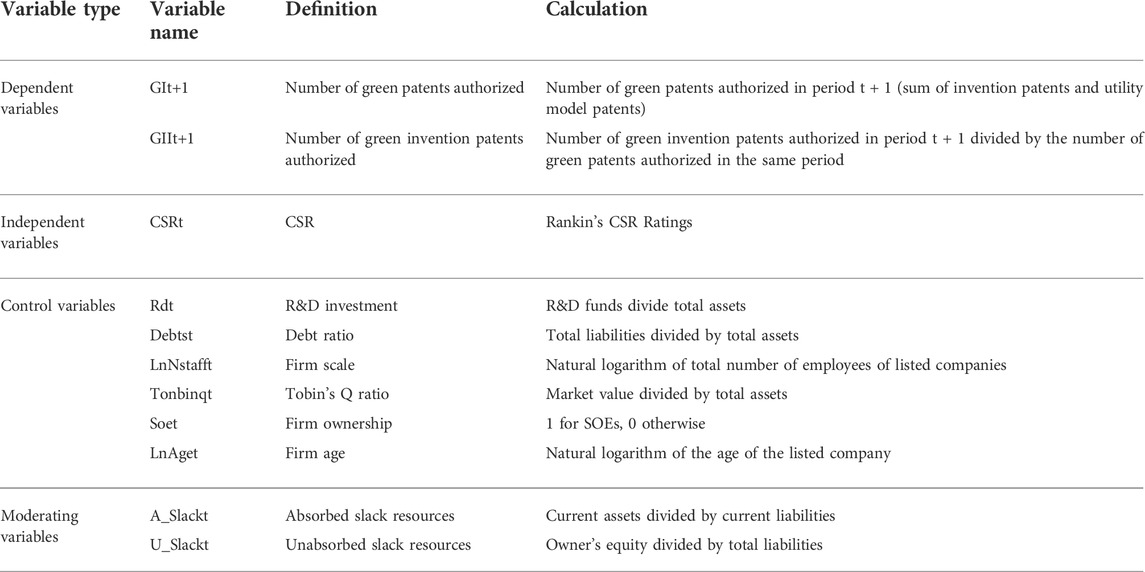

Drawing on existing studies (Qi et al., 2018), we control for several variables. Frist, R&D investment represents the importance firms attach to innovation activities (Li and Liu, 2021). Next, debt ratio (Debts) is to control for the corporate debt ratio, which is related to innovation investment. Additionally, firm scale (LnNstaff) is to control for innovation strategy differences between larger and smaller companies (Wu et al., 2018). Tobin’s Q ratio (Tonbinq) is in the regression in order to capture the investment opportunity differences across firms (Eger and Mahlich, 2014). Firm ownership (Soe) is a dummy for state-owned firms (SOE), and Firm age (LnAge) is to control for the fact that older firms may generally have more experience and problem-solving skills than younger ones (Wu and Qu, 2021). The definitions of the variables are summarized in Table 1.

3.2.2 Descriptive statistics and analysis

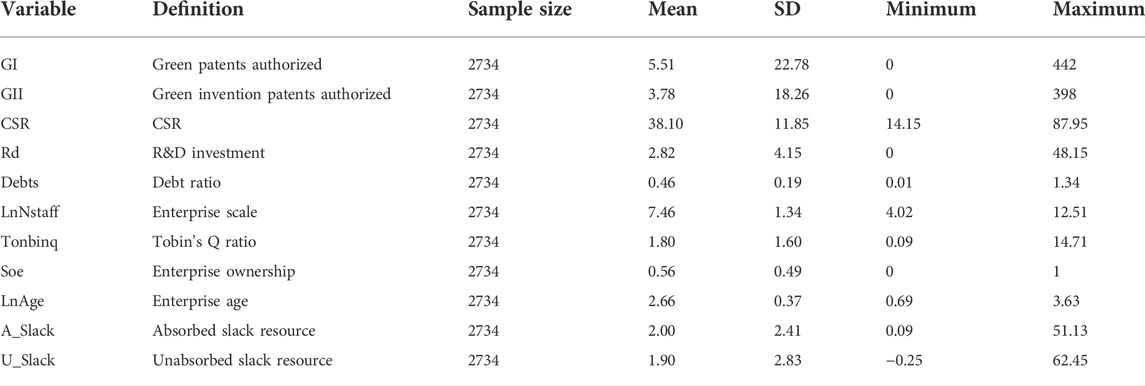

Table 2 reports the descriptive statistics each of the variables. The minimum value of green patents authorized is 0, and the maximum is 442, with a standard deviation of 22.78, indicating large variation in the number of green patents authorized among all firms. The CSR ratings have a minimum of 11.85 and a maximum of 87.95, with a standard deviation of 14.15, again pointing to a large difference in CSR performance among the firms. The average score of CSR was 38.10 points, indicating that China’s CSR is still in its infancy.

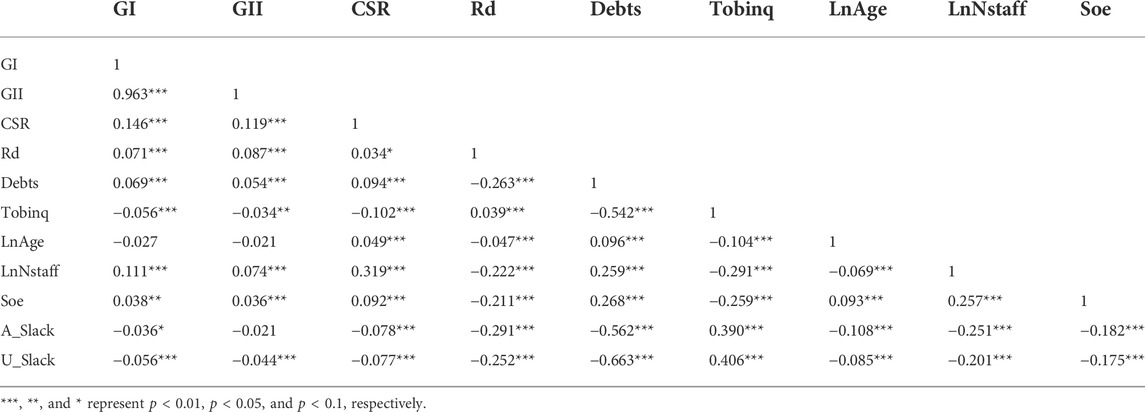

Table 3 shows the correlation coefficient matrix of the variables. The results indicate that: 1) the correlation coefficient of CSR and total green patents authorized is statistically positive at the 1% significance level, suggesting a positive correlation between CSR performance and green technological innovation; and 2) the correlation coefficients between most control variables are less than 0.5, indicating that the problem of multicollinearity is not serious in our model.

4 Empirical results and analysis

4.1 Corporate social responsibility and green technology innovation

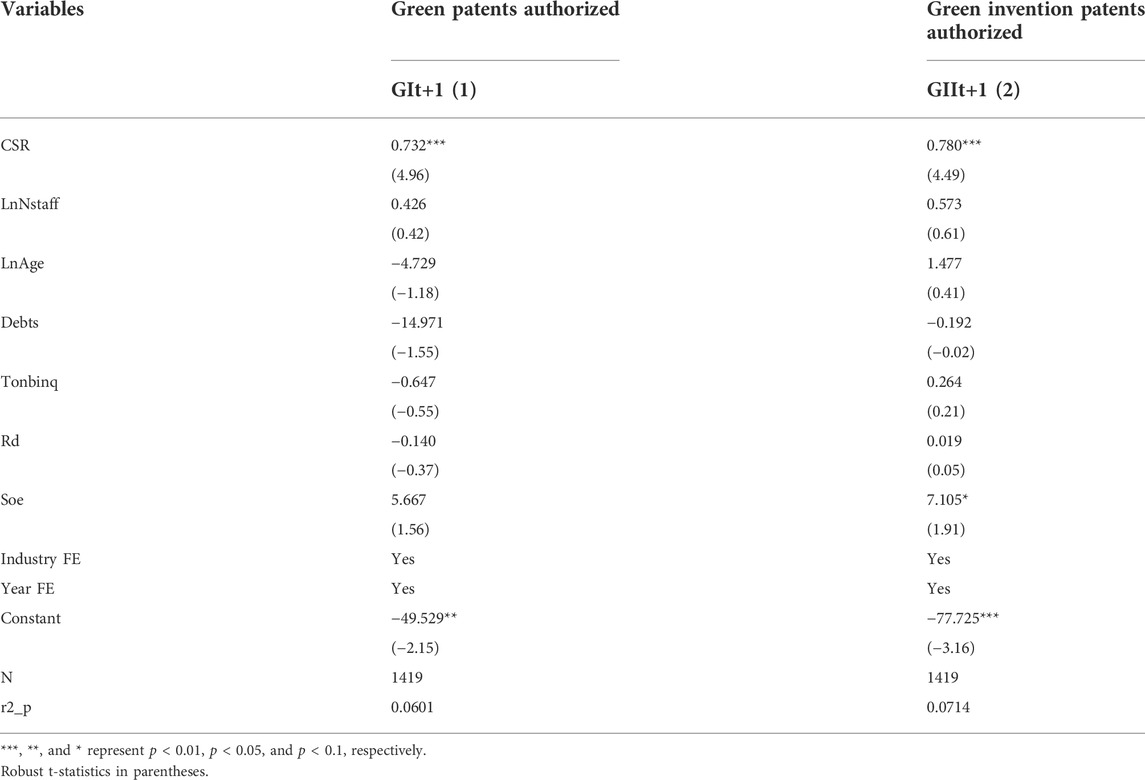

Table 4 displays the empirical results of CSR performance and green technology innovation estimations with fixed-effect panel data method. Column (1) includes the regression results of CSR performance, firm scale, firm age, debt ratio, Tobin’s Q ratio, R&D investment, firm ownership the industry effect, and the year effect. The coefficient of CSR is statistically positive (0.732***) at the 1% significance level, indicating that firms with better CSR performance had a higher number of green patents.

Among invention patents, utility model patents, and design patents, invention patents can better reflect innovation at advanced technological levels. With other conditions unchanged, the higher the number of green invention patents authorized, the greater the quantity of a firm’s green innovation. Further, we also examined the impact of CSR on the number of green invention patents authorized. Column (2) of Table 4 presents the results using green invention patents authorized as the indicator for green technology innovation, which show that the estimation coefficient on CSR is statistically significantly positive (0.780***) at the 1% significance level. This result suggests that CSR is positively related to quantitative measures of green technology innovation.

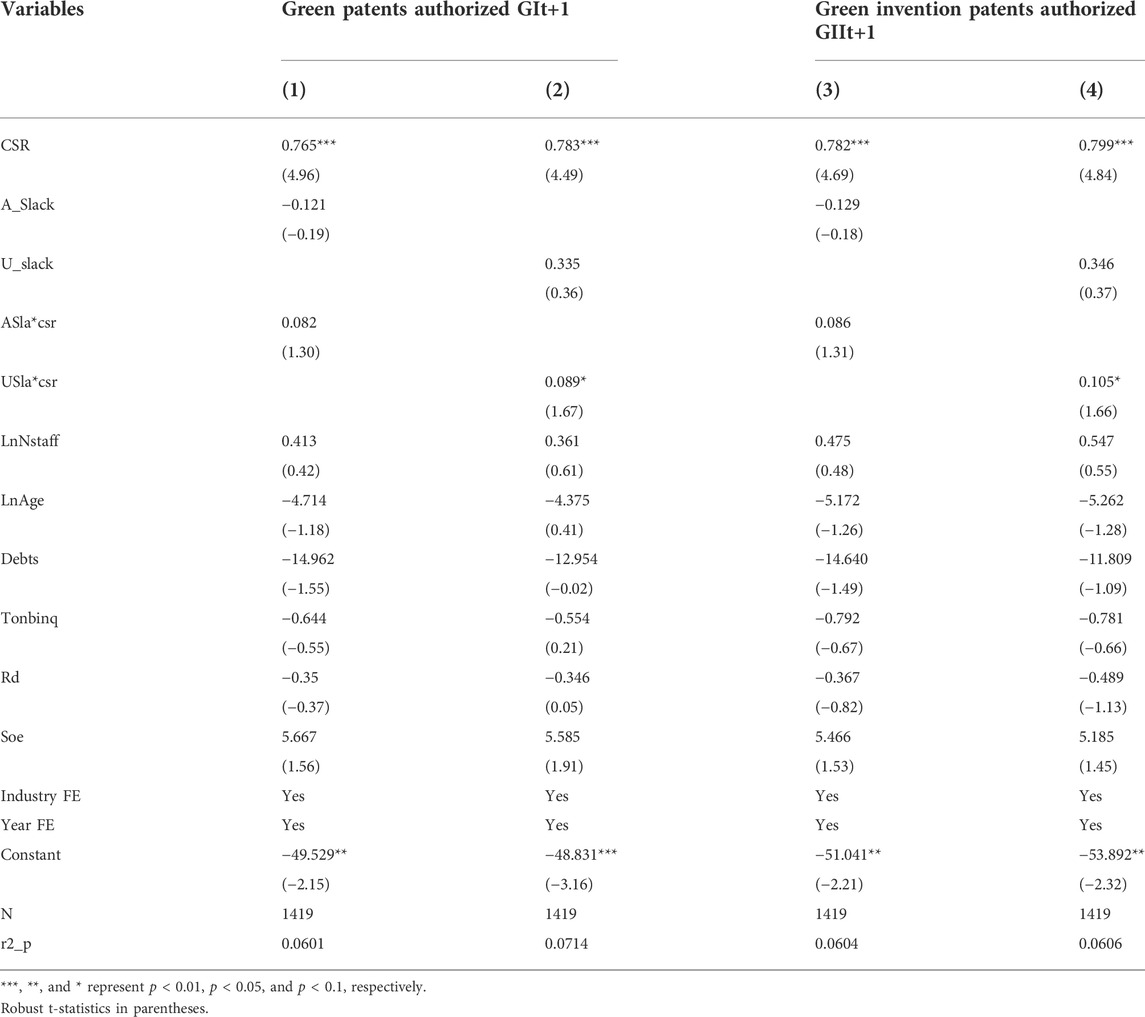

4.2 The moderating effects of both types of slack resources

In Table 5, we present the moderating effect of slack resources on the relationship between CSR performance and green technology innovation. Column (1) shows that the coefficient of the interaction term of CSR and firm A_Slack is 0.043 (statistically insignificant), so we cannot conclude that A_Slack plays a role in moderating the relationship between CSR and green technology. From a practical point of view, we may explain this by supposing that as firms pursue profit maximization in the short term, they might not consider inputting A_Slack into green innovation in their short-term decisions. Columns (2) and (4) show that the coefficient of the interaction term of CSR and U_Slack is 0.089 and 0.105 (10% significance), implying that U_Slack positively moderates the positive correlation between CSR performance and green technology innovation output.

4.3 Robustness test

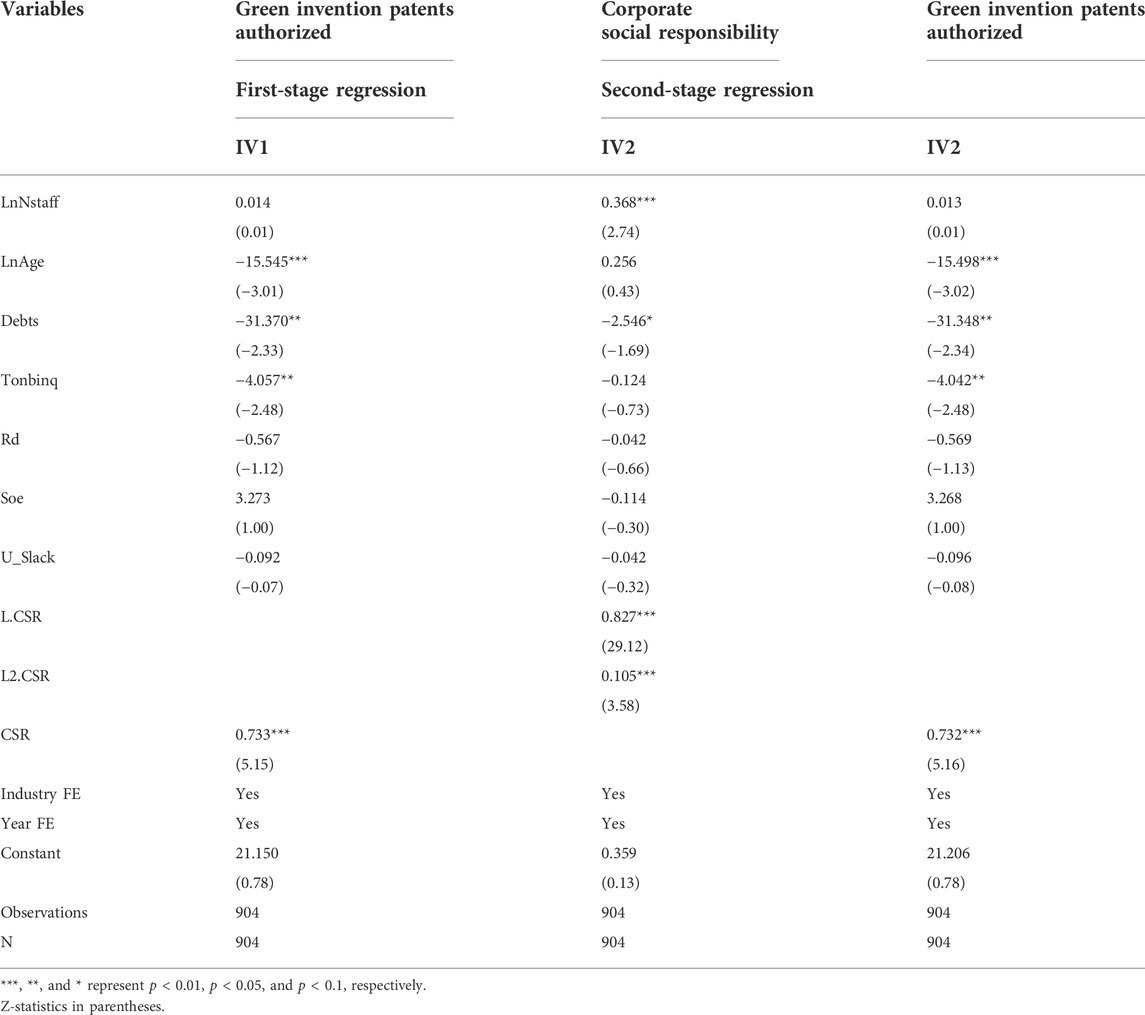

4.3.1 Two-stage Tobit IV regression

Due to the complexity of firm green technology innovation, it is difficult to encompass all influencing factors in a single model, and the omission of important variables is therefore a common source of endogeneity in related studies. Following Chen et al., 2017, we adopt a two-stage Tobit instrumental variable (IV) method to carry out regressions by adding CSR lagged by one period (L.CSR) and two periods (L2.CSR) as IVs to avoid endogeneity problems to some extent. Here, the control variables are the same as before. The first-stage results in Table 6 show that CSR’s mean values across both industries and regions are statistically positively correlated with green patents authorized (1% level). Additionally, the F-statistic of the weak instrument test is 115.50, which is far higher than 10, indicating that the IV is valid. The second-stage regression results show that after controlling for the action channel of endogenous problems that may be caused by omitted variables, the previous regression conclusions from Sections 4.1, 4.2 remain valid.

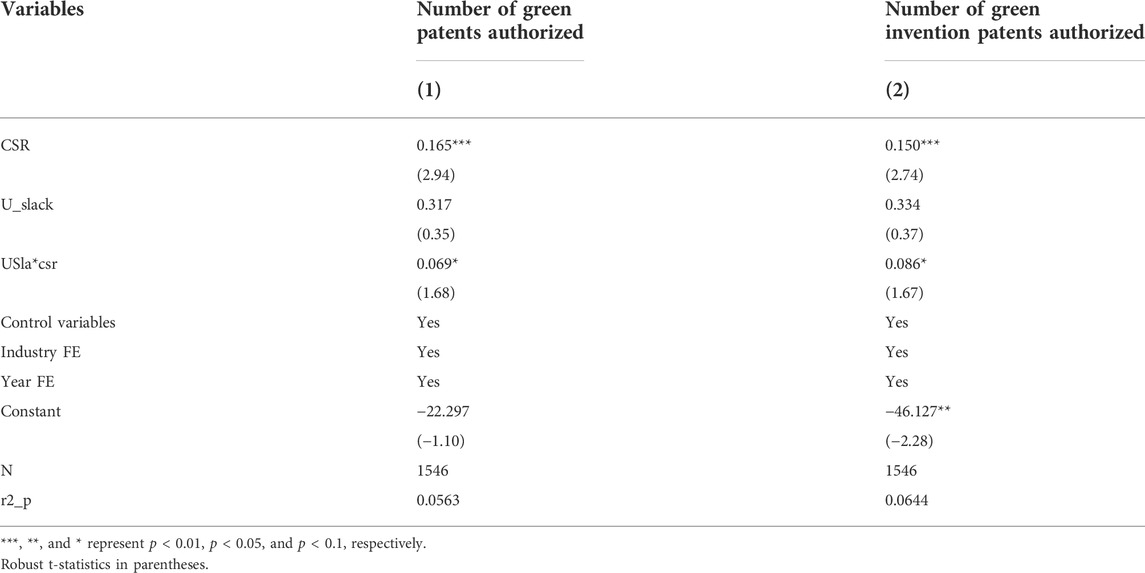

4.3.2 Changing the measurement of the independent variables

Measurement bias of the key independent variable CSR can lead to biased coefficient estimation or inconsistency in the model. For this reason, drawing on Zhang et al. (2019), we now use the CSR ratings published by hexun.com as a proxy variable of CSR and conduct our regressions again. Control variables remain unchanged, and the results are shown in Table 7. Columns (1) and (2) show that the signs and significance of the effects of CSR represented by proxy variables are consistent with the previous results, indicating the robustness of our conclusions in this respect.

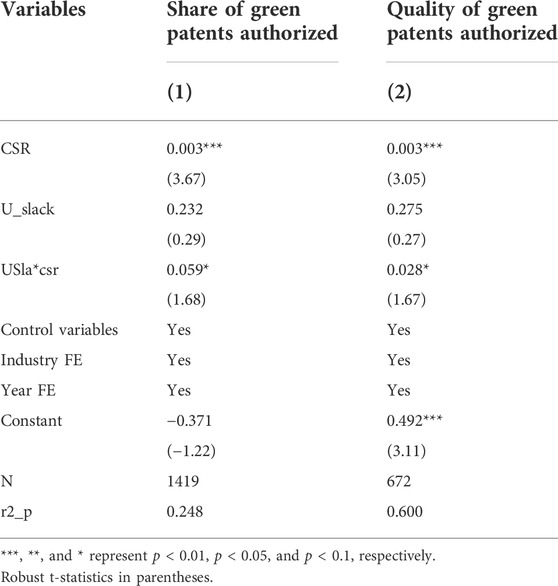

4.3.3 Changing the measurement of the dependent variables

Measurement bias of green technology innovation can lead to endogeneity problems. Based on Qi et al. (2018) and Akcigit et al. (2016), we thus carry out regressions adopting the proportion of green patents authorized and the quality of green patents authorized as the proxies of green technology innovation and use the patent knowledge width method according to the previous research of Aghion et al. (2015) and Akcigit et al. (2016). Corporate patent knowledge width refers to the level of complexity of the knowledge contained within a certain patent and reflects patent quality in terms of the complexity and extensiveness of the knowledge contained by patents. This metric is beneficial for overcoming the inadequacy of using only the quantitative dimension of patents to measure firm innovation activities. Since patents serve as important carriers of innovative knowledge oftentimes with significant economic value, the level of complexity of the knowledge contained in patents necessarily affects the quality of patents. The more complex the knowledge contained within a patent, the more difficult it is to mimic and improve on that patent. Furthermore, patents protected by the State Intellectual Property Office, get monopoly rights to their patents. This can profoundly affect corporate performance. The results of our regressions using this measure of green patent quality are presented in Columns (1) and (2) of Table 8. The signs of the coefficients are consistent with the previous results and are all statistically significant at the 1% level, indicating the robustness of the above conclusions in this respect.

4.3.4 Additionally lagged green technology innovation

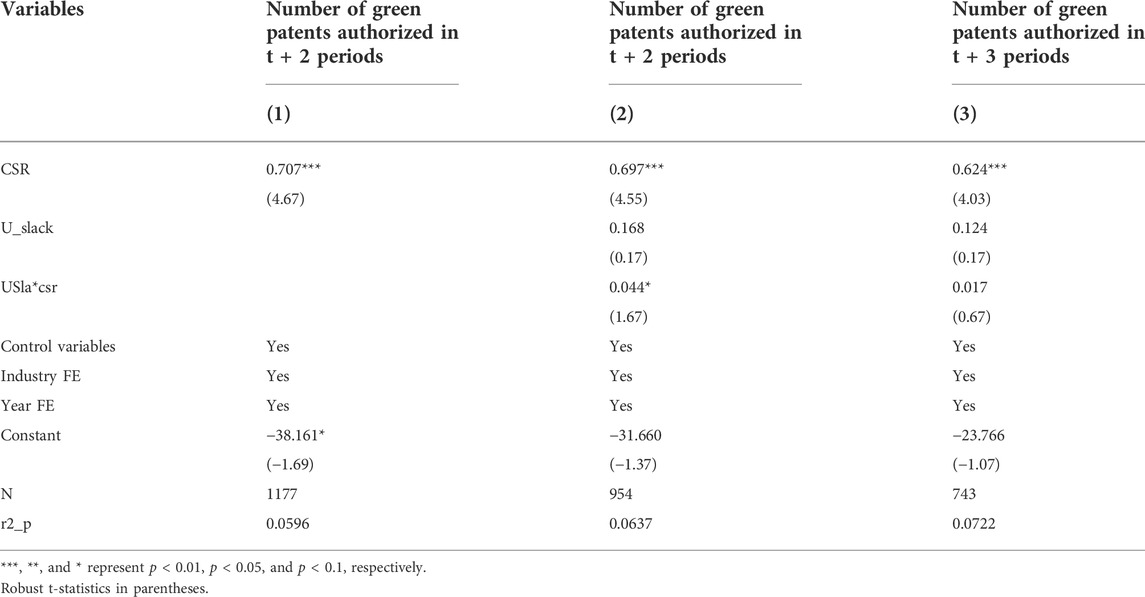

Considering the uncertainties and extended processes from R&D to patent authorization of green technology innovation in the case of China, we now lag the output of green technology innovation by t+2 and t+3 periods referring to Fang et al. (2014). The regression results are presented in Columns (1) and (3) of Table 8. Column (1) shows that the estimated coefficients of the effects of lagged green technology innovation output are statistically positive (1% level). Column (2) shows that the estimated coefficients of the moderating effect of U_Slack on lagged green technological output are statistically significant at the 10% level. Column (3) shows that the estimated coefficients of the moderating effect of U_Slack on lagged green technological output are not statistically different from 0. These results indicate that the conclusions of this study have no serious lagged correlation and that the above conclusions are robust in this respect (Table 9).

5 Conclusion

This study explored the relationship between CSR performance and firm green technology innovation with firm slack resources as mediating variables. We find that different slack resource types have different influences on the relationship between CSR performance and green technology innovation. Our regression results show that good CSR performance relates positively to green technology innovation and that firm slack resources play a partial mediating role. A larger amount of unabsorbed slack resources strengthens the positive relationship of CSR performance on green technology innovation (Aghion et al., 2005; Surroca et al., 2010; Schiederig et al., 2012; Kawai et al., 2018; Zhang et al., 2022b; Peng et al., 2014; Shen et al., 2020).

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: www.csmar.com and cpquery.cnipa.gov.cn.

Author contributions

YX completed this thesis independently.

Funding

This study received grant funding from Doctorate program of the Chongqing Federation of Social Science (Study on the impact and consequences of response mode of social responsibility performance on enterprise sustainable development resources, 2019BS068); and Science and technology research project of the Chongqing Municipal Commission of Education (Study on the mechanism and consequences of fulfilling social responsibility and improving enterprise total factor productivity, KJQN202000503). Talent Introduction Project of Chongqing Normal University (Role and path of NGO participation in corporate social responsibility construction, 19XWB016); the Fundamental Research Funds for the Central Universities (Development and Application of Urban Development and Policy Evaluation Model Based on System Dynamics, 2017CDJSK), The Fundamental Research Funds for the Central Universities (Research on the influence and economic consequences of government actions on enterprises’ non-market strategic integration decisions, 2020CDJSK01PT20).

Acknowledgments

The authors thank AiMi Academic Services (www.aimieditor.com) for the English language editing and review services.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1This study received funding from the Doctorate program of the Chongqing Federation of Social Science (study on the impact and consequences of social responsibility performance on firm sustainable development, no. 2019bs068); and the Science and Technology Research Project of the Chongqing Municipal Commission of Education (study on the mechanisms and consequences of fulfilling social responsibility and improving firm total factor productivity, no. kjqn202000503).

2Source: http://www.mee.gov.cn/ywdt/spxw/202108/t20210827_860765.shtml.

3Source: https://news.12371.cn/2015/10/29/ARTI1446118588896178.shtml.

4Source: http://cpc.people.com.cn/GB/67481/412700/.

5Source: http://www.gov.cn/xinwen/2021-04/22/content_5601515.htm.

6Examples of these technical fields include green product design, manufacturing processes, circular production, sewage treatment, and energy saving.

7U-slack resources include idle resources such as reserve funds, profit retention, and unused capacity, among others, and are flexible and easy to redeploy.

References

AAchi, A., Adeola, O., and Achi, F. C. (2022). CSR and green process innovation as antecedents of micro, small, and medium enterprise performance: Moderating role of perceived environmental volatility. J. Bus. Res. 139, 771–781. doi:10.1016/j.jbusres.2021.10.016

Aghion, P., Bloom, N., Blundell, R., Griffith, R., and Howitt, P. (2005). Competition and innovation: An inverted-U relationship. Q. J. Econ. 120 (2), 701–728. doi:10.1162/0033553053970214

Aghion, P., Akcigit, U., Bergeaud, A., Blundell, R., and Hémous, D. (2015). Innovation and top income inequality. Nber Working Papers. doi:10.2139/ssrn.2617607

Akcigit, U., Baslandze, S., and Stantcheva, S. (2016). Taxation and the international mobility of inventors? Am. Econ. Rev. 106 (10), 2930–2981. doi:10.1057/jors.1994.16

Bao, W., Yue, J., and Rao, Y. (2017). A deep learning framework for financial time series using stacked autoencoders and long-short term memory. PLoS One 12, e0180944. doi:10.1371/journal.pone.0180944

Bocquet, R., Bas, C. L., Mothe, C., and Poussing, N. (2013). Are firms with different CSR profiles equally innovative? Empirical analysis with survey data. Eur. Manag. J. 31, 642–654. doi:10.1108/SAMPJ-07-2015-0058

Bocquet, R., Le Bas, C., Mothe, C., and Poussing, N. (2017). CSR, innovation, and firm performance in sluggish growth contexts: A firm-level empirical analysis. J. Bus. Ethics 146, 241–254. doi:10.1007/s10551-015-2959-8

Boulouta, I., and Pitelis, C. N. (2014). Who needs CSR? The impact of corporate social responsibility on national competitiveness. J. Bus. Ethics 119 (3), 349–364. doi:10.1007/s10551-013-1633-2

Chang, C. (2015). Proactive and reactive corporate social responsibility: Antecedent and consequence. Manag. Decis. 53 (2), 451–468. doi:10.1108/md-02-2014-0060

Chen, X., and Wan, P. (2020). Social trust and corporate social responsibility: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 27, 485–500. doi:10.1002/csr.1814

Chen, Y., Podolski, E. J., and Veeraraghavan, M. (2017). National culture and corporate innovation. Pacific Basin Finance J. 43, 173–187. doi:10.1016/j.pacfin.2017.04.006

Cheng, B., Ioannou, I., and Serafeim, G. (2014). Corporate social responsibility and access to finance. Strateg. Manag. J. 35 (1), 1–23. doi:10.1002/smj.2131

Eger, S., and Mahlich, J. C. (2014). Pharmaceutical regulation in Europe and its impact on corporate R&D. Health Econ. Rev. 4, 23. doi:10.1186/s13561-014-0023-5

Fang, V. W., Tian, X., and Tice, S. (2014). Does stock liquidity enhance or impede firm innovation? J. Finance 69 (5), 2085–2125. doi:10.1111/jofi.12187

Flammer, C. (2015). Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach. Manag. Sci. 61 (11), 2549–2568. doi:10.1287/mnsc.2014.2038

Flammer, C. (2018). Competing for government procurement contracts: The role of corporate social responsibility. Strateg. Manag. J. 39 (5), 1299–1324. doi:10.1002/smj.2767

Gallego-Álvarez, I., Prado-Lorenzo, M. J., and García-Sánchez, I-M. (2011). Corporate social responsibility and innovation: A resource-based theory. Manag. Decis. doi:10.1108/00251741111183843

Ghoul, S. E., Guedhami, O., and Kim, Y. (2017). Country-level institutions, firm value, and the role of corporate social responsibility initiatives. J. Int. Bus. Stud. 48, 360–385. doi:10.1057/jibs.2016.4

Herold, D. M., Jayaraman, N., and Narayanaswamy, C. R. (2006). What is the relationship between organizational slack and innovation? J. Manag. Issues 18 (3), 372–392. doi:10.2307/40604546

Hillman, A. J., Withers, M. C., and Collins, B. J. (2009). Resource dependence theory: A review. J. Manag. 35 (6), 1404–1427. doi:10.1177/0149206309343469

Ioannou, I., and Serafeim, G. (2012). What drives corporate social performance? The role of nation-level institutions. J. Int. Bus. Stud. 43, 834–864. doi:10.1057/jibs.2012.26

Kawai, N., Strange, R., and Zucchella, A. (2018). Stakeholder pressures, EMS implementation, and green innovation in MNC overseas subsidiaries. Int. Bus. Rev. S0969593117307084. doi:10.1016/j.ibusrev.2018.02.004

Ko, K., Nie, J., Ran, R., and Gu, Y. (2020). Corporate social responsibility, social identity, and innovation performance in China. Pacific-Basin Finance J. 63, 101415. doi:10.1016/j.pacfin.2020.101415

Kraus, S., Rehman, S. U., and Sendra Garcia, F. J. (2020). Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technol. Forecast. Soc. Change 160, 120262. doi:10.1016/j.techfore.2020.120262

Lanis, R., and Richardson, G. (2015). Is Corporate Social Responsibility Performance Associated with Tax Avoidance? J. Bus. Ethics 127. doi:10.1007/s10551-014-2052-8

Lee, K. (2009). Why and how to adopt green management into business organizations? The case study of Korean SMEs in manufacturing industry. Manag. Decis. 47 (7), 1101–1121. doi:10.1108/00251740910978322

Li, X., and Liu, G. (2021). Can fund shareholding inhibit insufficient R&D input?--Empirical evidence from Chinese listed companies. PLoS One 16, e0248674. doi:10.1371/journal.pone.0248674

Luo, X., and Du, S. (2015). Exploring the relationship between corporate social responsibility and firm innovation. Mark. Lett. 26 (4), 703–714. doi:10.1007/s11002-014-9302-5

Martin, P. R., and Moser, D. V. (2016). Managers' green investment disclosures and investors' reaction. J. Account. Econ. 61 (1), 239–254. doi:10.1016/j.jacceco.2015.08.004

Martinez-Conesa, I., Soto-Acosta, P., and Palacios-Manzano, M. (2017). Corporate social responsibility and its effect on innovation and firm performance: An empirical research in SMEs. J. Clean. Prod. 142, 2374–2383. doi:10.1016/j.jclepro.2016.11.038

McGuinness, P. B., Vieito, J. P., and Wang, M. (2017). The role of board gender and foreign ownership in the CSR performance of Chinese listed firms. J. Corp. Finance 42, 75–99. doi:10.1016/j.jcorpfin.2016.11.001

Meng, X. H., Zeng, S. X., Tam, C. M., and Xu, X. D. (2013). Whether top executives' turnover influences environmental responsibility: From the perspective of environmental information disclosure. J. Bus. Ethics 114 (2), 341–353. doi:10.1007/s10551-012-1351-1

Peng, M. W., Li, Y., Xie, E., and Su, Z. (2010). CEO duality, organizational slack, and firm performance in China. Asia Pac. J. Manag. 27 (4), 611–624. doi:10.1007/s10490-009-9161-4

Peng, X., Yang, L., and Lilong, Z. (2014). A literature review of corporate eco-innovation: Theoretical veins, concept clarification and measurement. Acta Ecol. Sin. 34 (22), 6440–6449. doi:10.5846/stxb201302210284

Piotr, R., and Dawid, S. (2010). Exploring the relationship between CSR and innovation. Sustain. Account. Manag. Policy J. doi:10.1108/SAMPJ-07-2015-0058

Qi, S., Lin, S., and Cui, J. (2018). Can environmental rights trading market induce green innovation? -- evidence based on green patent data of listed companies in China. Econ. Res. J. 53 (12), 129–143.

Schiederig, T., Tietze, F., and Herstatt, C. (2012). Green innovation in technology and innovation management - an exploratory literature review. R&D Manage. 42 (2), 180–192. doi:10.1111/j.1467-9310.2011.00672.x

Shen, C., Li, S., Wang, X., and Liao, Z. (2020). The effect of environmental policy tools on regional green innovation: Evidence from China. J. Clean. Prod. 254, 120–122. doi:10.1016/j.jclepro.2020.120122

Sharma, E. (2019). A review of corporate social responsibility in developed and developing nations. Corp. Soc. Responsib. Environ. Manag. 26 (4), csr.1739. doi:10.1002/csr.1739

Surroca, J., Tribó, J. A., and Waddock, S. (2010). Corporate responsibility and financial performance: The role of intangible resources. Strateg. Manag. J. 31 (5), 463–490. doi:10.1002/smj.820

Toothaker, L. E. (1994). Multiple regression: Testing and interpreting interactions [J] J. Oper. Res. Soc. 45 (1), 119–120. doi:10.1057/jors.1994.16

Wang, Y., Yang, Y., Fu, C., Fan, Z., and Zhou, X. (2021). Environmental regulation, environmental responsibility, and green technology innovation: Empirical research from China. PLoS ONE 16 (9), e0257670. doi:10.1371/journal.pone.0257670

Wang, Z., Reimsbach, D., and Braam, G. (2018). Political embeddedness and the diffusion of corporate social responsibility practices in China: A trade-off between financial and csr performance? J. Clean. Prod. 198, 1185–1197. doi:10.1016/j.jclepro.2018.07.116

Wu, H., and Qu, Y. (2021). How do firms promote green innovation through international mergers and acquisitions: The moderating role of green image and green subsidy. Int. J. Environ. Res. Public Health 18, 7333. doi:10.3390/ijerph18147333

Wu, Z., Zhai, S., Hong, J., Zhang, Y., and Shi, K. (2018). Building sustainable supply chains for organizations based on qfd: A case study. Int. J. Environ. Res. Public Health 15, 2834. doi:10.3390/ijerph15122834

Wiggenhorn, J., Pissaris, S., and Gleason, K. C. (2016). Powerful CEOs and employee relations: Evidence from corporate social responsibility indicators J. Financ. Econ. 40, 85–104. doi:10.1007/s12197-014-9295-1

Xing, C., Zhang, Y., and Tripe, D. (2021). Green credit policy and corporate access to bank loans in China: The role of environmental disclosure and green innovation. Int. Rev. Financial Analysis 77, 101838. doi:10.1016/j.irfa.2021.101838

Yuan, B., and Cao, X. (2022). Do corporate social responsibility practices contribute to green innovation? The mediating role of green dynamic capability. Technol. Soc. 68. doi:10.1016/j.techsoc.2022.101868

Zeng, Y., Gulzar, M. A., Wang, Z., and Zhao, X. (2020). The effect of expected financial performance on corporate environmental responsibility disclosure: Evidence from China. Environ. Sci. Pollut. R. 1–17. doi:10.1007/s11356-020-09719-8

Zhang, F., Li, M., and Zhang, M. (2019). Chinese financial market investors attitudes toward corporate social responsibility: Evidence from mergers and acquisitions. Sustainability 11, 2615. doi:10.3390/su11092615

Zhang, N., Liang, Q., Li, H., and Wang, X. (2022a). The organizational relationship–based political connection and debt financing: Evidence from Chinese private firms. Bull. Econ. Res. 74. doi:10.1111/boer.12283

Zhang, Y., Sun, Z., and Sun, M. (2022b). Unabsorbed slack resources and enterprise innovation: The moderating effect of environmental uncertainty and managerial ability. Sustainability 14 (7), 3782. doi:10.3390/su14073782

Keywords: corporate social responsibility, green technology innovation, slack resources, moderating effect, green patent

Citation: Xie Y (2022) The relationship between firms’ corporate social performance and green technology innovation: The moderating role of slack resources1. Front. Environ. Sci. 10:949146. doi: 10.3389/fenvs.2022.949146

Received: 20 May 2022; Accepted: 05 July 2022;

Published: 22 August 2022.

Edited by:

Guangdong Wu, Chongqing University, ChinaReviewed by:

Yulong Li, Central University of Finance and Economics, ChinaYuan Chang, Central University of Finance and Economics, China

Jingli Fan, China University of Mining and Technology, Beijing, China

Copyright © 2022 Xie. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yi Xie, eGlleWkxMTE5QDE2My5jb20=

Yi Xie

Yi Xie