- 1School of Economics, Shandong University of Technology, Zibo, China

- 2School of Economics and Social Welfare, Zhejiang Shuren University, Hangzhou, China

- 3Business School, Huanggang Normal University, Huanggang, China

The impact of artificial intelligence (AI) on the economy and industry has gradually extended from the macroeconomic to the microeconomic level. Artificial intelligence technology has brought great innovation and impact to the company’s operation and management and has a strong role in promoting the level of corporate governance. Based on an in-depth analysis of the theoretical mechanism of artificial intelligence affecting corporate governance, and based on the balanced panel data of Chinese A-share listed companies from 2011 to 2020, this paper empirically analyzes the mechanism and intermediary effect of artificial intelligence affecting corporate governance. The study found that AI applications can significantly improve corporate governance levels, and a higher level of artificial intelligence application can produce a higher level of corporate governance. From the perspective of the impact path, artificial intelligence technology can significantly improve the degree of information symmetry required for corporate governance, thereby providing favorable technical conditions and decision support for improving the level of corporate governance. Artificial intelligence technology has a positive and effective impact on corporate governance through the information symmetry effect.

1 Introduction

An application of AI continues to extend to the field of enterprise management and has been widely used in all aspects of enterprise operation and management. Moreover, it has been widely used in many fields of sciences (Elahi et al., 2019b; Elahi et al., 2019c; Elahi et al., 2020; Elahi et al., 2022b). The rapid integration of artificial intelligence and enterprise management shows that artificial intelligence is not only a technical element but also a management element (Elahi et al., 2019a). The transformational impact of artificial intelligence on enterprise management has been upgraded from production and operation to higher-level corporate governance. Artificial intelligence complies with the development needs of corporate governance and has a positive impact on corporate governance. Corporate governance is at the advanced level of enterprise operation and management, at the core of enterprise management, and is the fundamental guarantee for the healthy development of an enterprise, especially for listed companies. With the application of artificial intelligence technology by enterprises, the intelligent management level of enterprises has been continuously improved, which has put forward new requirements for corporate governance, and objectively requires enterprises to enhance their governance capabilities. The core problem of corporate governance is agency cost, and the source of agency cost is information asymmetry. Traditional corporate governance is based on institutional design. For example, through the governance structure of “three meetings and one level” of Shareholders’ meetings, board of directors, board of supervisors, and managers, artificial intelligence technology can technically empower corporate governance to solve corporate governance problems. The problem of information asymmetry in the process provides a new technical path, which is of great practical value to improving the corporate governance level. Not only that, AI application makes the transparency of information required for enterprise management higher and higher, the information black box is expected to be opened, and it is more effective to improve the level of corporate governance. Therefore, understanding the adoption of technology and its application is imperative (Elahi et al., 2021a; Elahi et al., 2021b; Elahi et al., 2022a).

In recent years, scholars at home and abroad have conducted research on the impact of artificial intelligence on corporate governance. The research focuses can be summarized into four aspects: The first is the transformative impact of artificial intelligence on corporate governance. In the era of mobile internet, the deep integration of technical networks, organizational networks, and social networks not only provides new governance tools for corporate governance but also has a huge impact on traditional corporate governance models (Zhang and Chen, 2020). When corporate governance enters the era of “big data”, information self-disclosure and unofficial disclosure are strengthened, the information asymmetry in the corporate governance chain is weakened, and new governance methods begin to emerge (Li, 2014). At the same time, with the rise of the new economy represented by the internet, the utilization rate of the dual-class share system with asymmetric control rights (voting rights) and cash flow rights (residual claim rights) continues to increase in modern emerging high-tech enterprises. In the past, the research on this emerging corporate governance mechanism has mainly focused on the principal-agent problem caused by it, and there are other research gaps (Shi and Wang, 2017).

The second is the impact mechanism of artificial intelligence on corporate governance. The application of artificial intelligence in enterprise management makes the behavior of the managers tend to be “transparent”, and the “goodwill” of human nature will be more stimulated (Gao and Liu, 2018). Artificial intelligence and other technologies provide us with much useful information needed for decision making and powerful computing power, which to a certain extent solves the problem of uncertainty caused by information asymmetry and the problem of decision-making errors caused by limited human ability, the development of artificial intelligence technology has made the intellectualization of corporate governance feasible (Zhang, 2020). The “wisdom + data” decision-making model based on artificial intelligence and big data analysis can support enterprises to make more accurate management decisions (Horvitz et al., 1988). Zhao and Duan, (2020) found that the application of four artificial intelligence technologies, heuristic search, machine learning, expert system, and human-computer interaction in the field of internal governance, presents the intelligent mining of data information and knowledge, and the intelligent provision of alternative governance solutions and systems. Optimize technical logic such as specific governance behaviors (Zhao and Duan, 2020).

Third, artificial intelligence can effectively reduce information asymmetry in corporate governance. Wu (2021) believes that the “technical rational” path represented by blockchain technology can alleviate the problem of information asymmetry, create trust, improve corporate transparency, reduce agency costs, and ultimately improve corporate governance. Lou (2021) proposed that blockchain technology has the potential to comprehensively reshape corporate governance. For example, through the establishment of a decentralized organization, the problem of separation of powers can be completely solved. Enhanced transparency” and “better setting and enforcing executive compensation” to increase the “responsibility” of directors’ behavior. David Yermack (2017) proposed that blockchain represents a new application of cryptography and information technology to the age-old problem of financial records, which may drive far-reaching changes in corporate governance. Wang (2019) believed that the distributed storage and automatic execution characteristics of blockchain systems can achieve more efficient functional expansion and even replacement of major governance mechanisms such as traditional contracts and enterprise organizations.

Fourth, some scholars believe that artificial intelligence has a negative impact on corporate governance. The application of artificial intelligence in the operation and management of enterprises will lead to internal control defects and aggravate agency conflicts in the process of corporate governance (Yue Yujun and Gu et al., 2021). Artificial intelligence may lead to new problems in risk control and internal control system of enterprises, which are difficult to be effectively solved in a short period of time (Ashbaugh-Skaife et al., 2008). Doyle et al. (2007) pointed out that the application of artificial intelligence and other technologies improves the complexity of corporate governance, aggravates agency conflicts and weakens the efficiency of corporate governance. Zhao Cui and Cao Wei et al. (2020), through empirical research, believe that when the internal control mechanism of enterprises is not perfect, the corporate governance mechanism that is compatible with the business model reform brought by the application of artificial intelligence is not perfect, and artificial intelligence will have an intensified effect on the agency conflict of corporate governance.

Previous studies found that the impact of artificial intelligence on corporate governance existed, and there is an inherent connection mechanism between the two. However, the current research on the impact mechanism of artificial intelligence on corporate governance is still in the exploratory stage, few scholars have researched this aspect, the influence of artificial intelligence on corporate governance has received much academic attention, but the academic community has not formed a unified view. The current study will analyze the theoretical mechanism of artificial intelligence affecting corporate governance, and empirically test the impact mechanism of artificial intelligence on corporate governance. The marginal contribution of this paper is mainly reflected in the deepening of the research depth of the influence of AI application on corporate governance, and the expansion of the research content of the influence of AI application on the economy at the micro level. Empirical evidence on the impact mechanism of artificial intelligence on corporate governance.

2 Theoretical Analysis and Research Assumptions

The impact of artificial intelligence on enterprises has been shown from the beginning to promote enterprise technology upgrades and product iterations, but also to promote enterprise management changes. Artificial intelligence technology is one of the core development directions of the new generation of technological revolution. The application of artificial intelligence technology is an important symbol of technological innovation in enterprises, and it is also a realistic choice to maintain and improve the core competitiveness of enterprises. Although the initial motivation for enterprises to apply AI technology is not to improve the ability and level of corporate governance, it has a direct and indirect impact on corporate governance. On the one hand, considering the professionalism of artificial intelligence technology, enterprises’ application of artificial intelligence technology and continuous R&D investment objectively need to increase the degree of incentives for core technical talents to urge enterprises to include core technical personnel in the corporate governance team and participate in it. Participate in corporate governance activities, including distribution and incentive of equity, determination of salary level, the internal composition of “director, supervisor and senior management” positions, etc. On the other hand, artificial intelligence provides important technical means for enhancing the level of corporate governance, improves the internal and external environment of corporate governance, and changes the premise and assumptions of traditional corporate governance methods, Therefore, the problem that the traditional corporate governance can not eliminate or alleviate can be solved. In addition, the artificial intelligence can rely on strong learning technology, precise algorithm, neural network technology and other advanced technology, assist in the analysis of the company’s management and decision-making, greatly reduce the subjectivity of management decision and enhance the degree of rational decision-making, effective guarantee company long-term and global development of each major governance decisions more scientific and reasonable. It can be seen that the impact of artificial intelligence on corporate governance is objective and inevitable, including two aspects: active impact and passive impact. According to the above analysis, this study proposes the following research hypotheses:

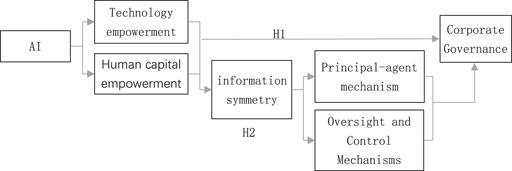

H1: AI can have an important impact on corporate governance.

Accurate and efficient information is crucial to the internal governance of enterprises, especially public offering companies, and is the basis for the orderly development of financing, investment, and operation and management of enterprises. The most important impact of artificial intelligence on corporate governance is to greatly reduce the information asymmetry that restricts the level of corporate governance. This information includes information required for corporate decision-making and execution and information required for external supervision. AI core technologies such as computer vision, robotics, biometrics, natural language processing, and machine learning can effectively change the company’s external governance environment and internal governance structure by improving the level of information symmetry. Aspects that affect corporate governance. From the perspective of the motivation to enhance information symmetry, for listed companies, the era of artificial intelligence means that listed companies have to face two “gods” (customers and investors) at the same time to obtain customers and investors in the product market and capital market. The full disclosure of business management information, including corporate governance, is more rigid, the channels for customers and investors to obtain business management information are increasingly diversified and convenient, and public opinion spreads more quickly. Therefore, listed companies can actively disclose information and the internal mechanism to guide public opinion. From the point of view of the ability to enhance information symmetry, artificial intelligence technology can open up all process links of internal production and operation of enterprises through intelligent technology, Internet technology, and digital technology, and connect relevant production and operation information of upstream and downstream enterprises in the product supply chain, and rely on artificial intelligence brain. Carry out intelligent computing, thereby significantly enhancing the ability of enterprises to obtain and process business management information, and provide strong support for timely capture of information, scientific prediction, and decision-making at the corporate governance level. All in all, both motivation and ability can fully show that the level of information symmetry has an important mediating effect in the process of AI’s impact on corporate governance. In other words, the degree of information symmetry is the mediating variable for AI to affect corporate governance. The path of influence on corporate governance can be realized through the information symmetry mechanism. Based on this, this paper proposes the following research hypotheses:

H2: The degree of information symmetry plays a mediating role in the relationship between artificial intelligence and corporate governance.

In summary, the theoretical conceptual model constructed in this paper is shown in Figure 1.

According to the impact mechanism of artificial intelligence on corporate governance, this paper proposes two research hypotheses and constructs a theoretical conceptual model with information pairing as an intermediary. The theoretical conceptual model fully reveals the mechanism by which artificial intelligence affects corporate governance. By constructing a theoretical conceptual model, this paper clarifies the causal and logical relationship between artificial intelligence and corporate governance and clarifies the chain of action between the two. In the following, we will use actual empirical data to conduct an empirical study on the theoretical conceptual model by using a linear regression model and empirically test the two research hypotheses H1 and H2.

3 Data Sources and Variable Descriptions

3.1 Sample Selection and Data Sources

This paper uses my country’s A-share listed companies from 2011 to 2020 as the research sample to establish balanced panel data, and this paper mainly uses the data provided by the CSMAR database for empirical analysis. The sample is adjusted as follows: 1) Exclude financial listed companies; 2) Exclude listed companies that delist midway; 3) Exclude ST and *ST listed companies; 4) Exclude listed companies with missing variable data and abnormal data company sample. To avoid the influence of extreme values on the research results, this paper conducts Winsorize tail processing of 1% above and below all continuous variables. After data sorting, this paper finally obtained 211 research samples.

3.2 Variable Definitions

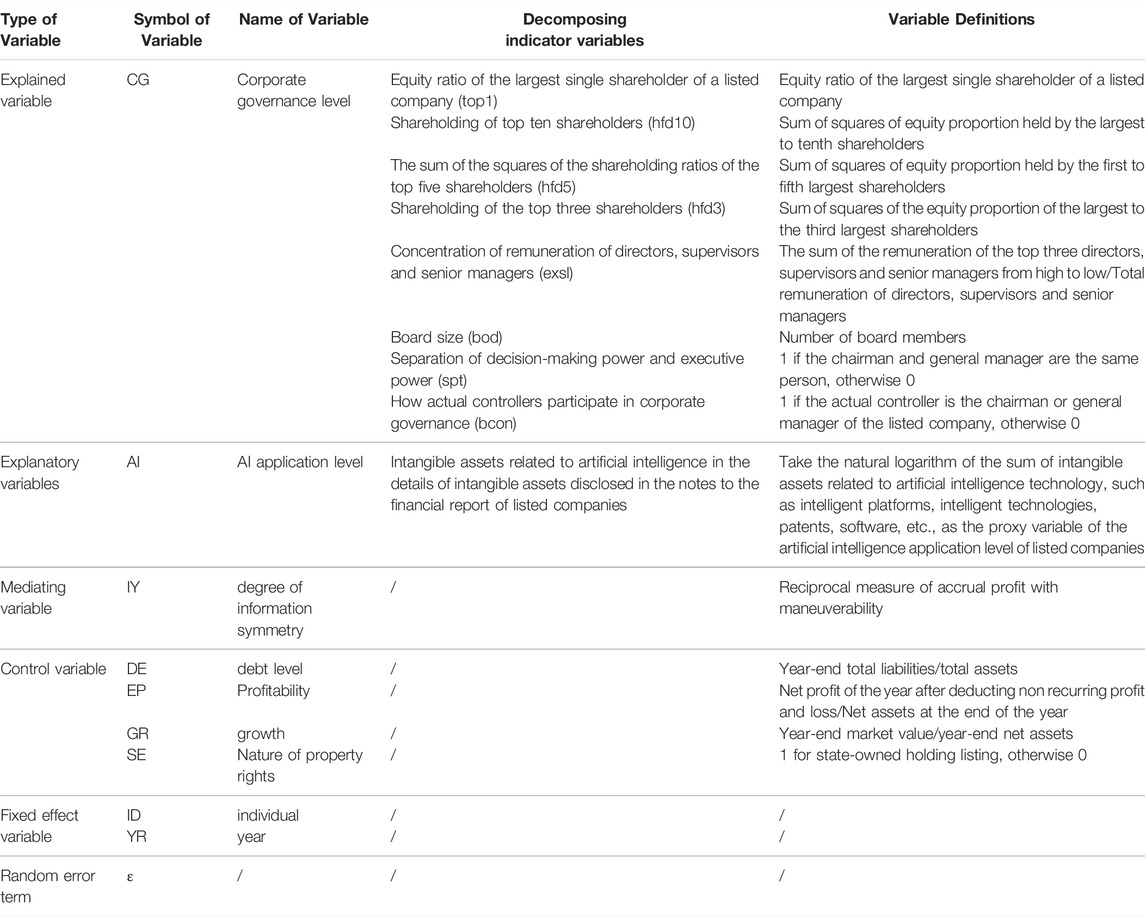

3.2.1 Explained Variable

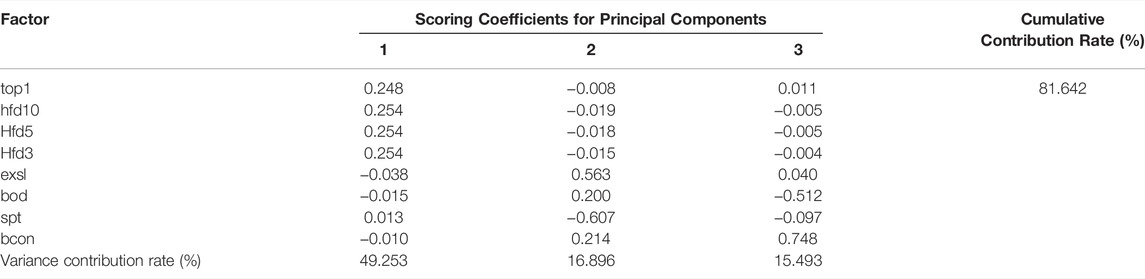

The level of corporate governance. Following Wang et al. (2019), this paper selects a set of variable indicators that reflect corporate governance level information from three aspects of listed companies’ equity structure, executive compensation, and governance institutions, including the largest shareholder’s shareholding proportion, the square sum of shareholding ratios of the top ten shareholders, the square sum of shareholding ratios of the top five shareholders, the square sum of shareholding ratios of the top three shareholders, and remuneration ratio of the total remuneration of the top three directors, supervisors and senior executives to the total remuneration of all directors, supervisors and senior executives. The size of the board of directors, whether the chairman and the general manager are held by one person, and the way the actual controller participates in corporate governance. The principal component analysis method is used to extract the corporate governance information implied by the above eight variables. To fit the comprehensive index of corporate governance level.

3.2.2 Explanatory Variable

AI application level. For the convenience of research, the natural logarithm of AI-related intangible assets in the intangible asset’s details disclosed in the notes to the financial reports of listed companies is used as a proxy variable, that is, the intangible asset details include intelligent platforms, intelligent technologies, patents, software, etc. and artificial intelligence. The natural logarithm of technology-related intangible assets reflects the AI application level of listed companies. Specifically, first extract the number of intangible assets related to artificial intelligence technology, including intelligent platforms, intelligent technologies, patents, software, and other intangible assets of listed companies. Then add up the intangible assets related to artificial intelligence technology of the same listed company in the same year. Finally, we used the natural logarithm of the intangible assets of artificial intelligence technology.

3.2.3 Mediating Variable

Degree of information symmetry. Referring to the approach of Hutton and Marcus., (2009), the reciprocal measure of accrual profit for maneuverability is used. The lower the value, the higher the degree of information symmetry.

3.2.4 Control Variable

Referring to the existing research, the debt level, profitability, growth, and property rights are selected as the control variables for artificial intelligence to affect corporate governance. The definitions of variables are given in Table 1.

3.3 Model Settings

Based on the Hausman test results, this paper selects a fixed effect model, considers individual effects and time effects, and constructs the following panel data model 1) to test the impact mechanism of artificial intelligence on corporate governance.

In panel data model (1), i represents the ith company and t represents the year,

To test the mediating effect of the degree of information symmetry in the process of AI application affecting the level of corporate governance, this paper constructs a mediation effect model for empirical analysis and uses panel data model 2) and panel data model 3) to test the research hypothesis H2 proposed in this paper, that is, the application of artificial intelligence. Whether it can affect the level of corporate governance through the information symmetry effect.

IY in the panel data model 2) and panel data model 3) is an intermediary variable, representing the degree of information symmetry, ρ represents its regression coefficient, and other variables have the same meaning as the panel data model (1).

4 Results and Discussion

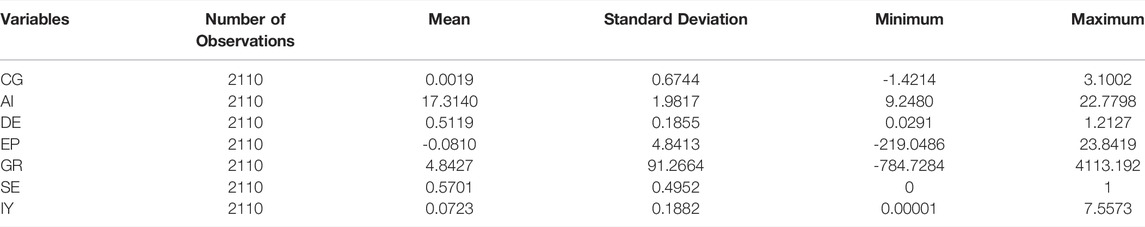

4.1 Descriptive Statistics

Table 2 shows the results of the descriptive statistics, it can be found that in addition to the relatively large dispersion of growth variables, other variable indicators such as AI application level, debt level, profitability, property rights, and information symmetry. The degree of dispersion is relatively small, the standard deviation of the variable of corporate governance level is 0.6744, the degree of dispersion is small, the average value of the variable of artificial intelligence application level is 17.3140, the minimum value is 9.2480, the maximum value is 22.7798, and the average value of the variable of information symmetry degree is 0.0723, the standard deviation is 0.1882, and the degree of dispersion is also small. At the same time, through the VIF test, the variance inflation factor of the regression model set in this paper is 1.05, which is small and far below 10, indicating that there is no serious multicollinearity among the variables of the regression model (Abbas et al., 2018; Tran et al., 2018; Zhang et al., 2022a; Zhang et al., 2022b).

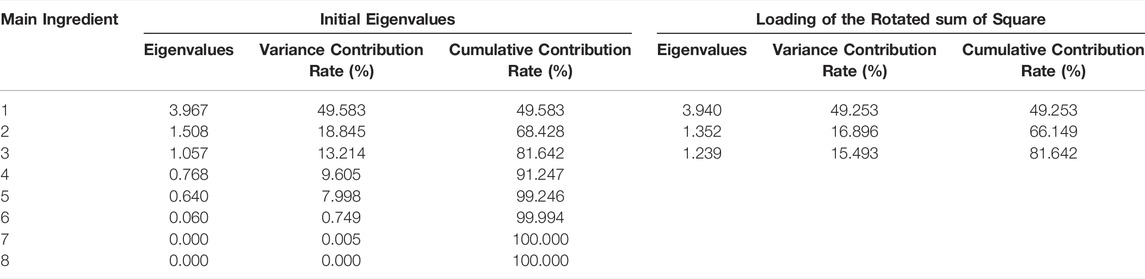

4.2 Estimation of Level of Corporate Governance

Principal component analysis has obvious advantages. It can reflect the original information and simplify the information implied by multiple evaluation indicators into several principal components, which can play a good effect of “simplifying complexity”. Therefore, this paper uses principal component analysis to measure the level of corporate governance. The principal component analysis is carried out on the aforementioned eight variable indicators that reflect the level of corporate governance. It can be seen from Table 3 that the cumulative variance contribution rate of the first three principal components reaches 81.6%, which is greater than 80%, indicating that the first three principal components can be very good. The information of the above eight indicators is expressed, and finally, three principal components are extracted. At the same time, the KMO test value is 0.755, which is greater than 0.6 and passes the test. As shown in Table 4, the level of corporate governance can be measured according to the calculated principal component score coefficient and its variance contribution rate.

4.3 Benchmark Regression

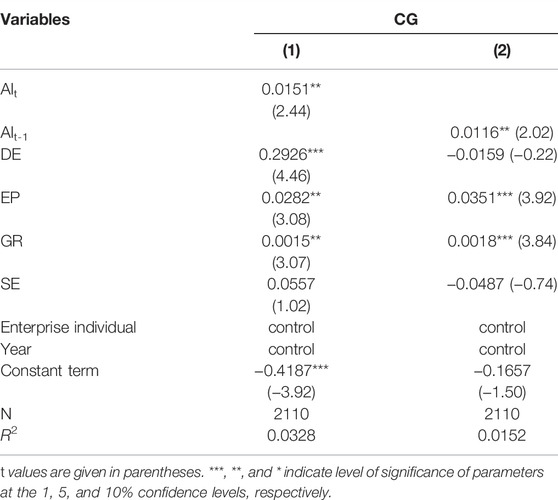

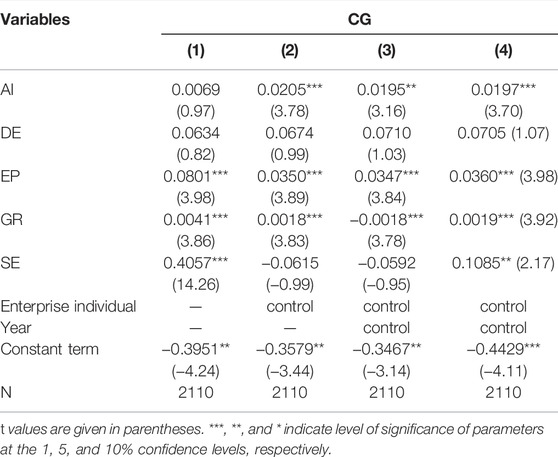

In this paper, based on the estimation of fixed effects and random effects, after the Hausman test, the p value is 0.0000, so the fixed effect model should be used, and the random effect model should be rejected, that is, there is an individual effect. Moreover, the time effect is considered in the fixed effect model for the joint significance test. Since the p value is 0.0000, it indicates that there is a time effect in the fixed effect model, and the time effect should be included in the fixed effect model. Therefore, this paper controls enterprise variables and annual time variables and uses a two-way fixed-effects model for regression analysis. To construct a reference frame and facilitate comparative analysis, a mixed analysis was also performed in this paper, and the results are shown in column 1) of Table 5. At the same time, the enterprise individual effect and the annual time effect are added to the empirical model for regression. Table 5 (column 2), reported the regression results that only consider the enterprise individual effect, and Table 5 (column 3) reported the fixed enterprise individual effect at the same time. The result of regression of effect and annual time effect is also the core regression result of this paper. To carry out the Hausman test, this paper also uses the random effect model to carry out regression estimation. Column 4 in Table 5 reported the regression results of the random effect.

TABLE 5. Regression analysis of the application of artificial intelligence and corporate governance level.

From column 3 in Table 5, it can be seen that under the control of corporate individual effect, time effect, debt level, profitability, growth, property rights and other control variables at the same time, the regression results showed that the level of artificial intelligence application and corporate governance level. The regression coefficient is 0.0195, which is significantly positive at the 5% confidence level, indicating that the application level of artificial intelligence has a positive effect on the level of corporate governance. The higher the level of artificial intelligence application, the higher the level of corporate governance. Consistent, can effectively verify the research hypothesis H1 of this paper. There is a positive and significant relationship between the debt level of listed companies and the level of corporate governance. There is a positive and significant relationship between profitability and corporate governance level at the 1% confidence level, indicating that the higher the profitability of the company, the better the financial resources to support the improvement of corporate governance and the more favorable it is to improve the level of corporate governance. Growth also has a negative relationship with corporate governance and is significant at the 1% confidence level. External investors have less involvement and control over corporate governance. The nature of property rights and the level of corporate governance are negatively significant, indicating that the governance level of state-controlled listed companies is lower than that of private listed companies. The reason is that private listed companies are more market-oriented, their equity is more diversified, and the market mechanism of corporate governance is more mature and perfect.

4.4 Robustness Check

Commonly used robustness testing methods include the instrumental variable method (Peng et al., 2020; Liu et al., 2022; Peng et al., 2022.; Zhao et al., 2022), variable lag, etc. At the same time, controlling individual effects of enterprises is also an important robustness testing method (Peng et al., 2021a; Peng et al., 2021c; Peng R. et al., 2021; Gu et al., 2021). In the above analysis process, this paper has carried out regression analysis after controlling the individual effect of enterprises. The results are shown in column 2) of Table 5. The regression coefficient of AI is still positive and significant, which is consistent with the benchmark regression results, indicating that the research hypothesis H1 still holds. Considering that few variables can be selected to replace the level of corporate governance and the level of artificial intelligence application, to further test the robustness, this paper chooses to replace the research sample data range and perform regression analysis on the variable of artificial intelligence application level with a lag of one period (Peng et al., 2021b; Wang et al., 2021; Zhao et al., 2021; Zhong et al., 2021).

4.4.1 Change in Study Sample Data Range

The panel data used in the benchmark regression in this paper is the data of listed companies from 2011 to 2020. For robustness analysis, this paper keeps the research sample unchanged and changes the time interval of the panel data to 2007–2016 to construct new panel data. Regression analysis is performed on the model 1) to test the robustness of the benchmark regression. Column 1 of Table 6 reported the results of the regression analysis using the panel data after changing the time range. From the regression results, the regression coefficient of the variable AI is 0.0151, which is significantly positive at the 5% confidence level, which is consistent with the basic regression analysis results.

4.4.2 Variable Lag

The regression results are shown in column 2 of Table 6. After replacing the current value of artificial intelligence application level with the value of one lag period, the regression coefficient of artificial intelligence application level and corporate governance level is still positive and significant at the level of 5%. Consistent with the benchmark regression results, it can also verify the research hypothesis H1 of this paper. Artificial intelligence has a significant role in promoting corporate governance, indicating the robustness of the research conclusions in this paper. It is worth noting that using the lag period value of the AI application level variable for regression can also reduce the impact of endogeneity problems on the regression results, and further improve the reliability of the regression results.

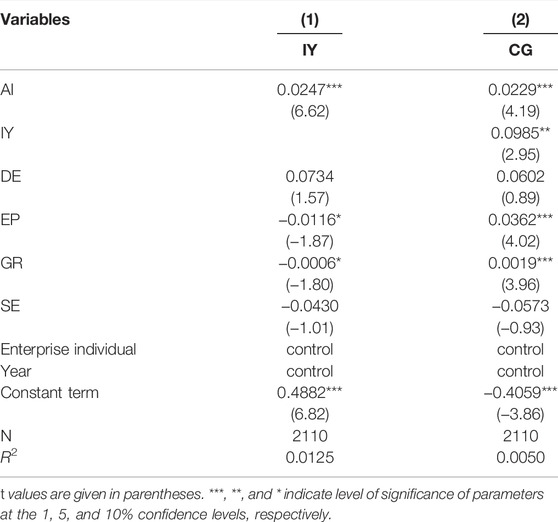

4.5 Mediating Effect Analysis

According to the above analysis, artificial intelligence applications can have an impact on corporate governance through information symmetric channels. This paper uses panel data models two and three to test. The regression results of the panel data model and three are given in columns 2 and 3 of Table 7, respectively. Column 1 reported the regression results of panel data model 2, and column 2 reported the regression results of panel data model 3. To test whether the mediating effect of artificial intelligence on corporate governance through information symmetry exists, it can be judged according to the significance and sign direction of the coefficient. Specifically, first, observe the significance and sign direction of the regression coefficient of the variable AI in panel data model 2, and the regression coefficient of the variable IY in panel data model 3, then observe whether the sign direction of the multiplication of the regression coefficients of the two is consistent with the model. The regression coefficients of the variable AI in (1) are consistent. If they are consistent, it means that there is a mediating effect.

From the regression results shown in column 1) of Table 7, it can be seen that there is a significant positive relationship between the level of artificial intelligence application and the degree of information symmetry, and column 1) showed that the coefficient of the variable AI is 0.0247, at the 1% confidence level Column 2) showed that the regression coefficient of variable IY is 0.0985, which is significantly positive at the 5% confidence level, that is, the product of the two coefficients is positive, which is in the same direction as the regression coefficient of variable AI in the panel data model (1), indicating that the mediating effect of the degree of information symmetry exists. This showed that the application level of artificial intelligence can improve the level of corporate governance through the information symmetry effect, which verifies the establishment of hypothesis H2 in this paper.

5 Conclusion and Policy Implications

The impact of artificial intelligence applications on enterprise management changes and corporate governance levels has been increased, profoundly changing the original corporate governance methods and governance levels. Through theoretical analysis and empirical research, this paper finds that the application of artificial intelligence can significantly promote the level of corporate governance, and the application of artificial intelligence can have a positive impact on the level of corporate governance through the information symmetry effect. The application of artificial intelligence can improve the level of corporate governance, and a higher level of application of artificial intelligence can produce a higher level of corporate governance. At the same time, the AI application can significantly improve the information symmetry level of corporate governance decision-making level, thereby providing a favorable foundation for improving the level of corporate governance and promoting the level of corporate governance was improved. The conclusions of this study can bring us the following main enlightenment: 1) For enterprises, the research and application of artificial intelligence technology in enterprise operation and management should be vigorously promoted, especially the application of corporate governance, and artificial intelligence should not be regarded as a technology only Instead, it should be applied from the perspective of management, and a corporate governance system focusing on information disclosure should be established through the application of artificial intelligence. 2) For policy formulation, the government should issue precise policies to encourage and support the R&D and application of artificial intelligence technologies closely related to business management, increase fiscal and taxation support, and promote the acceleration of artificial intelligence into enterprise management systems and governance systems. Integrate and penetrate, and improve the level of supervision and governance of enterprises through artificial intelligence applications. 3) For AI technology, AI has a broad space for the application and development of “management technology”, and artificial intelligence technology participates in corporate governance, which can technically empower the company’s management and corporate governance, and reduce the cost of corporate governance and decision-making. The subjective impact of AI is more objective and based on fully transparent information and facts to make analysis and decision-making. The application of artificial intelligence is beneficial to enterprises to build and enhance the “decision-making brain” function of corporate governance.

As for the path to enhance corporate governance through the application of AI technology, this paper puts forward the following suggestions:

1) Establish and improve the enterprise management information system

Fully digital economy era, the development of digital technology trends is irreversible, and artificial technology enterprises should seize the opportunity of rapid development, increase investment in R&D investment in the artificial intelligence technology, and the introduction, the positive application of advanced artificial intelligence technology, a high starting point to establish management information system, upgrade and optimization of the existing management system, grab the commanding heights. Through the application of AI technology, further through the enterprise’s internal production, management, finance, human resources, legal, procurement, sales and so on each link of the management information channel, clear the information chain, to realize the integration of enterprise internally integrated system, to provide intelligent, modern corporate governance strong basic condition. The application of AI technology is not simply to replace manual labor, it is precisely through the AI technology to solve the traditional couldn’t solve the problem of mental labor and physical labor, artificial intelligence has a large data analysis, data mining and the encryption algorithm can well guarantee the safety and efficiency of corporate governance to break through the original corporate governance bottlenecks and constraints, Highly integrated, scientific and reasonable, perceptive and predictive management information system is an important environment for successful integration and application of AI technology and corporate governance.

2) Strengthen the security and real-time disclosure of information needed for corporate governance

Security is an important basis to ensure the continuous and stable operation of AI technology in the process of corporate governance and is also a prerequisite for enterprises to fully apply AI technology in the process of corporate governance. The intelligent management information system of corporate governance can be regarded as a subsystem of enterprise management information system. Therefore, the application of AI in corporate governance depends on the safe and stable internal management system of enterprises. Corporate governance information needed for the vast majority belongs to the core of the enterprise and senior trade secrets, confidential information once leaks, will have a very adverse effect on enterprise, establish a corporate governance intelligent management system of the first level is safe, high degree of security protection directly determines the application of AI technology of company executives. AI technology itself has the function of security technology. The application of AI in corporate governance has a huge demand for security, and at the same time, AI can meet this demand. With the guarantee of security, it is necessary to enhance the real-time performance of the intelligent information system of corporate governance. Can through the enterprise internal departments and informatization office of each post personnel online routing together, to set up and improve the standardization and normalization of information transfer mode, build the whole information system authorization system, strictly implement network security isolation, establish a corporate governance information center system, strengthen the people and the information system on the synergy, Provide stereoscopic and panoramic real-time information for corporate governance.

3) Strengthen the application and construction of convenient intelligent terminal equipment and facilities

The application of artificial intelligence in corporate governance should be simultaneously constructed in software, hardware, and management concepts to cultivate and build an intelligent ecological environment of corporate governance. Corporate governance involves a large number of management personnel, which are scattered geographically and in time. For example, directors, supervisors, and senior management personnel of the company may be frequent. Independent directors of listed companies are part-time, and they usually do not work on-site in listed companies. Especially during the COVID-19 pandemic, the need for online work has been exacerbated. To shorten the decision-making level of enterprises and the distance of the intelligent information system of corporate governance, and improve the availability of intelligent information systems, enterprises not only optimize and improve the management information system should strengthen the input of intelligent equipment and facilities, including portable equipment information management, visualization, database construction, and form a complete set of network office equipment, etc. A good hardware environment can make the intelligent information system of corporate governance play a full role, transmit the information to the decision-making layer of enterprises more timely and effectively, and provide direct and indirect support for corporate governance. At the same time, to enable the decision-making layer of the enterprise to better grasp and use the intelligent information system of corporate governance, the use of intelligent information system training should also be carried out to learn and understand the functions of the intelligent information system to support corporate governance and provide the efficiency of the information system. The decision-making layer of the enterprise should quickly change the concept and thought, take the initiative to embrace artificial intelligence technology, abandon short-sighted behavior, adhere to the construction and investment of an intelligent information system of corporate governance, promote the application of artificial intelligence technology within the enterprise and even in the industrial chain, and establish the whole process of intelligent management information system.

6 Increase Policy Support for Enterprises

The government should actively encourage and guide enterprises to strengthen the independent innovation and application of AI technology in the process of corporate governance, and accelerate the transformation and utilization of AI technology in corporate governance and enterprise operation and management. There is no backward corporate governance, only backward corporate governance methods and technologies. The in-depth application of artificial intelligence technology in corporate governance needs to adhere to the dominant position of enterprises, but also can’t do without the role and policy support of the government, enterprises can be stimulated and supported to apply AI technology from the following aspects to promote the intelligence and modernization of corporate governance: First, the government should give full play to the important role of competent departments and trade associations., formulate a plan for the integration of artificial intelligence and enterprise operation and management, form “top level design”, from top to bottom push an enterprise to apply artificial intelligence technology actively in the whole process of production technology, management and management. The government should create good policy guidance and market expectations, send clear policy signals to businesses, effectively guide enterprises to apply artificial intelligence initiative and conscious behavior. Second, the government should use a combination of financial, credit, fiscal and taxation policies to support enterprises to apply the latest and cutting-edge AI technologies through randd and innovation or introduction, and accelerate the elimination and upgrading of outdated technologies. In terms of loan quota, loan interest rate and preferential tax rate, the government should provide preferential financing services and supportive policies to enterprises that actively apply AI technology to optimize and upgrade production and operation management. Third, fully tap the advantages of fiscal policy tools, give full play to the “leverage role” of finance, and strengthen financial support for AI innovation and application enterprises. The government should provide targeted financial support for AI innovation and application by means of fiscal subsidies, special debt and equity investment, and improve the incentive role of enterprises in innovation and application of AI in corporate governance.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author Contributions

XC: Data curation, Methodology, Writing — original draft. BX: Investigation. AR: Revised the article.

Funding

Shandong Province Key R&D (Soft Science) Research Project (2021RKY03057), China; Key Project of Zhejiang Province Philosophy and Social Sciences Key Research Base (20JDZD072), China; Basic Public Welfare Research Project of Zhejiang Province (LGF19G030005), China.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, A., Yang, M., Yousaf, K., Ahmad, M., Elahi, E., and Iqbal, T. (2018). Improving Energy Use Efficiency of Corn Production by Using Data Envelopment Analysis (A Non-parametric Approach). fresenius Environ. Bull. 27, 4725–4733.

Ashbaugh-Skaife, H., Collins, D. W., Kinney, W. R., and LaFond, R. (2008). The Effect of SOX Internal Control Deficiencies and Their Remediation on Accrual Quality [J]. Account. Rev. 83 (1), 217–250. doi:10.2139/ssrn.906474

Doyle, J., Ge, W. L., and McVay, S. (2007). Determinants of Weaknesses in Internal Control Over Financial Reporting [J]. J. Account. Econ. 44 (1-2), 193–223. doi:10.1016/j.jacceco.2006.10.003

Elahi, E., Zhang, L., Abid, M., Javed, M. T., and Xinru, H. (2017). Direct and Indirect Effects of Wastewater Use and Herd Environment on the Occurrence of Animal Diseases and Animal Health in Pakistan. Environ. Sci. Pollut. Res. Int. 24, 6819–6832. doi:10.1007/s11356-017-8423-9

Elahi, E., Abid, M., Zhang, H., Cui, W., and Ul Hasson, S. (2018a). Domestic Water Buffaloes: Access to Surface Water, Disease Prevalence and Associated Economic Losses. Prev. veterinary Med. 154, 102–112. doi:10.1016/j.prevetmed.2018.03.021

Elahi, E., Abid, M., Zhang, L., Ul Haq, S., and Sahito, J. G. M. (2018b). Agricultural Advisory and Financial Services; Farm Level Access, Outreach and Impact in a Mixed Cropping District of Punjab, Pakistan. Land use policy 71, 249–260. doi:10.1016/j.landusepol.2017.12.006

Elahi, E., Khalid, Z., Tauni, M. Z., Zhang, H., and Lirong, X. (2021a). Extreme Weather Events Risk to Crop-Production and the Adaptation of Innovative Management Strategies to Mitigate the Risk: A Retrospective Survey of Rural Punjab. Pakistan: Technovation, 102255.

Elahi, E., Khalid, Z., Weijun, C., and Zhang, H. (2020). The Public Policy of Agricultural Land Allotment to Agrarians and its Impact on Crop Productivity in Punjab Province of Pakistan. Land Use Policy 90, 104324. doi:10.1016/j.landusepol.2019.104324

Elahi, E., Khalid, Z., and Zhang, Z. (2022a). Understanding Farmers' Intention and Willingness to Install Renewable Energy Technology: A Solution to Reduce the Environmental Emissions of Agriculture. Appl. Energy 309, 118459. doi:10.1016/j.apenergy.2021.118459

Elahi, E., Weijun, C., Jha, S. K., and Zhang, H. (2019a). Estimation of Realistic Renewable and Non-renewable Energy Use Targets for Livestock Production Systems Utilising an Artificial Neural Network Method: A Step towards Livestock Sustainability. Energy 183, 191–204. doi:10.1016/j.energy.2019.06.084

Elahi, E., Weijun, C., Zhang, H., and Abid, M. (2019b). Use of Artificial Neural Networks to Rescue Agrochemical-Based Health Hazards: a Resource Optimisation Method for Cleaner Crop Production. J. Clean. Prod. 238, 117900. doi:10.1016/j.jclepro.2019.117900

Elahi, E., Weijun, C., Zhang, H., and Nazeer, M. (2019c). Agricultural Intensification and Damages to Human Health in Relation to Agrochemicals: Application of Artificial Intelligence. Land use policy 83, 461–474. doi:10.1016/j.landusepol.2019.02.023

Elahi, E., Zhang, H., Lirong, X., Khalid, Z., and Xu, H. (2021b). Understanding Cognitive and Socio-Psychological Factors Determining Farmers' Intentions to Use Improved Grassland: Implications of Land Use Policy for Sustainable Pasture Production. Land Use Policy 102, 105250. doi:10.1016/j.landusepol.2020.105250

Elahi, E., Zhixin, Z., Khalid, Z., and Xu, H. (2022b). Application of an Artificial Neural Network to Optimise Energy Inputs: An Energy-And Cost-Saving Strategy for Commercial Poultry Farms. Energy 244, 123169. doi:10.1016/j.energy.2022.123169

Gao, S., and Liu, J. (2018). The Impact of Artificial Intelligence on Enterprise Management Theory and its Response [J]. Sci. Res. (11).

Gu, H., Bian, F., and Elahi, E. (2021). Impact of Availability of Grandparents' Care on Birth in Working Women: An Empirical Analysis Based on Data of Chinese Dynamic Labour Force. Child. Youth Serv. Rev. 121, 105859. doi:10.1016/j.childyouth.2020.105859

Horvitz, E. J., Breese, J. S., and Henrion, M. (1988). Decision Theory in Expert Systems and Artificialintelligence[J]. Int. J. Approx. Reason. 2 (3). doi:10.1016/0888-613x(88)90120-x

Hutton, A. P., and Marcus, A. J. (2009). Tehranianh. Opaque Financial Reports, R-Square, and Crash Risk[J]. J. Financial Econ. 94 (1). doi:10.1016/j.jfineco.2008.10.003

Liu, T., Kou, F., Liu, X., and Elahi, E. (2022). Cluster Commercial Credit and Total Factor Productivity of the Manufacturing Sector. Sustainability 14, 3601. doi:10.3390/su14063601

Lou, Q. (2021). Changes and Changes of Company Law under the Background of Blockchain Technology Application [J]. Secur. Mark. Her. (9).

Peng, B., Chen, H., Elahi, E., and Wei, G. (2020). Study on the Spatial Differentiation of Environmental Governance Performance of Yangtze River Urban Agglomeration in Jiangsu Province of China. Land Use Policy 99, 105063. doi:10.1016/j.landusepol.2020.105063

Peng, B., Chen, S., Elahi, E., and Wan, A. (2021a). Can Corporate Environmental Responsibility Improve Environmental Performance? an Inter-temporal Analysis of Chinese Chemical Companies. Environ. Sci. Pollut. Res. 28 (10), 12190–12201. doi:10.1007/s11356-020-11636-9

Peng, B., Zhang, X., Elahi, E., and Wan, A. (2021b). Evolution of Spatial–Temporal Characteristics and Financial Development as an Influencing Factor of Green Ecology. Environ. Dev. Sustain. 24 (1), 789–809. doi:10.1007/s10668-021-01469-y

Peng, B., Zhao, Y., Elahi, E., and Wan, A. (2022). Does the Business Environment Improve the Competitiveness of Start‐ups? the Moderating Effect of Cross‐border Ability and the Mediating Effect of Entrepreneurship. Corp. Soc. Responsib. Environ. Manag. doi:10.1002/csr.2262

Peng, B., Zhao, Y., Elahi, E., and Wan, A. (2021c). Investment in Environmental Protection, Green Innovation, and Solid Waste Governance Capacity: Empirical Evidence Based on Panel Data from China. J. Environ. Plan. Manag., 1–24.

Peng, R., Zhao, Y., Elahi, E., and Peng, B. (2021d). Does Disaster Shocks Affect Farmers’ Willingness for Insurance? Mediating Effect of Risk Perception and Survey Data from Risk-Prone Areas in East China. Nat. Hazards 106 (3), 2883–2899. doi:10.1007/s11069-021-04569-0

Shi, X., and Wang, A. The Influence of Unique Corporate Governance Mechanism on Enterprise Innovation——Global Evidence from the Dual Shareholding System of Internet Companies [J].2017,(1).

Tran, T. K. V., Elahi, E., Zhang, L., Magsi, H., Pham, Q. T., and Hoang, T. M. (2018). Historical perspective of climate change in sustainable livelihoods of coastal areas of the Red River Delta, Nam Dinh, Vietnam. Int. J. Clim. Change Strategies Manag. 11 (5), 687–695. doi:10.1108/ijccsm-02-2018-0016

Wang, F., Cai, W., and Elahi, E. (2021). Do Green Finance and Environmental Regulation Play a Crucial Role in the Reduction of CO2 Emissions? An Empirical Analysis of 126 Chinese Cities. Sustainability 13, 13014. doi:10.3390/su132313014

Wang, Q. (2019). Analysis of the advantages and disadvantages of blockchain as a governance mechanism and legal challenges [J]. Soc. Sci. Res. (4).

Wang, S., Feng, L., and Xu, Y. (2019). State-owned equity, party organization and corporate governance from the perspective of mixed ownership reform [J]. Reform (7).

Wu, W. (2021). The integration of blockchain technology and corporate governance—value, path and legal response [J]. Secur. Mark. Her. (6).

Xu, P., and Xu, X. (2020). The logic and analysis framework of enterprise management reform in the era of artificial intelligence [J]. Manag. World (1).

Yang, Y. (2020). The impact of artificial intelligence technology on audit quality: an empirical study based on the perspective of accounting firms [J]. Technol. Econ. (5).

Zhang, J. (2020). Intelligent Management: Theoretical Innovation and Technology Development [J]. Fujian Forum Humanit. Soc. Sci. 10.

Zhang, X., and Chen, D. (2020). Enterprise business model, value co-creation and governance risk in the era of mobile Internet: A case study based on the financial fraud of Luckin Coffee [J]. Manag. World (5).

Zhang, Z., Li, Y., Elahi, E., and Wang, Y. (2022a). Comprehensive Evaluation of Agricultural Modernization Levels. Sustainability 14, 5069. doi:10.3390/su14095069

Zhang, Z., Meng, X., and Elahi, E. (2022b). Protection of Cultivated Land Resources and Grain Supply Security in Main Grain-Producing Areas of China. Sustainability 14, 2808. doi:10.3390/su14052808

Zhao, H., Zhao, X., Elahi, E., and Wang, F. (2022). Policy Evaluation of Drama-Related Intangible Cultural Heritage Tourism for Boosting Green Industry: An Empirical Analysis Based on Quasi-Natural Experiment. Sustainability 14, 5380. doi:10.3390/su14095380

Zhao, Y., Peng, B., Elahi, E., and Wan, A. (2021). Does the extended producer responsibility system promote the green technological innovation of enterprises? An empirical study based on the difference-in-differences model. J. Clean. Prod. 319, 128631. doi:10.1016/j.jclepro.2021.128631

Zhao, Z., and Duan, X. (2020). University Internal Governance from the Perspective of Artificial Intelligence: Logic, Dilemma and Path [J]. J. Southwest Univ. Natl. Humanit. Soc. Sci. Ed. (10).

Keywords: artificial intelligence, corporate governance, information symmetry, influence mechanisms, policy suggestion

Citation: Cui X, Xu B and Razzaq A (2022) Can Application of Artificial Intelligence in Enterprises Promote the Corporate Governance?. Front. Environ. Sci. 10:944467. doi: 10.3389/fenvs.2022.944467

Received: 15 May 2022; Accepted: 09 June 2022;

Published: 30 June 2022.

Edited by:

Ehsan Elahi, Shandong University of Technology, ChinaReviewed by:

Qiong Han, Yunnan Nationalities University, ChinaYing Zhou, Inner Mongolia University, China

Copyright © 2022 Cui, Xu and Razzaq. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Bo Xu, NjAxMTkwQHpqc3J1LmVkdS5jbg==

Xiuli Cui

Xiuli Cui Bo Xu2*

Bo Xu2*