- 1School of Public Administration, Fujian Normal University, Fuzhou, China

- 2School of Accounting, Fujian Jiangxia University, Fuzhou, China

Environmental taxation is a formal environmental regulation policy formed by government intervention. It is generally believed that the imposition of environmental taxation can effectively promote economic agents to reduce pollutant emissions. Thus, based on panel data from 30 provincial-level administrative regions in China, this paper examines the pollution reduction effects and regional heterogeneity of environmental taxes on three major pollutants. It is found that the current environmental taxation in China can promote the emission reduction of ammonia nitrogen, and sulfur dioxide to a certain extent, but the effect on chemical oxygen demand is not outstanding. From the results of the regional heterogeneity test, there are differences in the effect of environmental taxation on the reduction of major pollutants in each region. The current environmental tax policy has a relatively strong effect on emission reduction in the western region with little effect in the eastern and central regions. Therefore, to better utilize the policy, this paper suggests adjusting the environmental tax levy standard according to local conditions and strictly levying environmental taxes and fees on various pollutants in terms of quantity.

Introduction and Literature Review

Environmental taxation is a general term for a series of taxation system arrangements aimed at protecting the ecological environment, which has gradually developed and matured with the rising awareness of environmental protection, economic development, and the process of globalization. The imposition of environmental taxation has a dual advantage of reducing environmental pollution and promoting economic growth.

In the 1970s, some developed countries began to pay attention to environmental issues, and the “polluter pays” principle was adopted, requiring polluters to bear the cost of monitoring and regulating their emissions. In 1969, the Netherlands took the lead by imposing a tax on surface water pollution; in 1971, the U.S. Congress proposed a bill to impose a nationwide tax on sulfide emissions. In the 1990s, OECD countries introduced green tax reforms, formally imposing environmental taxes or modifying existing taxes to make them more consistent with the concept of sustainable development. Since then, an increasing number of governments have adopted the practice of environmental taxation. After nearly 40 years of implementing the emission fee system, China officially implemented the Environmental Protection Tax Law of the People’s Republic of China on 1 January 2018. China also developed an independent environmental taxation system through the “tax equalization” reform involving the conversion of the emission fee to tax, and taxing four major categories of pollutants: air, water, solid waste, and noise.

As a developing country, China is experiencing medium to high economic growth, with accelerated industrialization and urbanization, steadily rising energy demand, and escalating environmental pollution challenges. Today, China is in the early stages of implementing environmental taxation; in order to realize the double dividend of environmental taxes, it is necessary to first utilize to the related emission reduction effect and solve the main problem of serious ecological pollution at this stage.

In this study, we use panel data from 30 provincial administrative regions in China to analyze whether the environmental taxation can make the policy effect of pollution reduction. Additionally, the study also investigates whether there is regional heterogeneity in the responses of different regions to the environmental tax, in order to improve environmental taxation policy in China and green development in developing countries worldwide.

Environmental taxation originated from Pigou, who proposed the Pigouvian tax, which regulates of the behavior of economic agents by means of taxation to correct the negative externalities of environmental problem (Pigou, 1920). Specifically, environmental pollution caused by economic agents in the production process is a negative externality, and when it is not taxed, economic agents do not actively incorporate the social costs caused by environmental pollution into their production costs, leading to excessive environmental pollution emissions. By taxing environmental pollution, the administrative body internalizes this negative external effect into the production cost of the economic body, which enables it to take initiative to reduce pollution emissions in order to save costs. Therefore, in practice, can environmental taxation really reduce pollutant emissions?

Most of the existing research results acknowledge that environmental taxation improves environmental conditions, which is the primary goal of imposing environ-mental taxes (Freire-González, 2018). According to Bosquet (2000), environmental taxes are imposed to shift the tax burden away from employment, income, and investment and toward pollution, resource depletion, and waste management. Environmental taxes can have an in-fluence on environmental quality improvement by reducing both energy use and emissions. On the one hand, environmental taxation induces environmental polluters to pay for their polluting behavior so that the environment and natural resources, which have long been undervalued or even free, are not further damaged and abused; on the other hand, environmental taxation will generate a strong market price signal, forcing environmental polluters to pay for their pollution through technological innovation, seeking substitutes, improved resource utilization, reducing production, and other means to reduce resource consumption and emissions to reduce ecological damage. Aydin and Esen (2018) assessed the impact of environmental taxes on CO2 emissions in EU countries, and found that environmental taxes in the EU have a threshold effect in terms of emission reduction, and that when the tax rate exceeds the threshold, emissions can be effectively reduced. Chien et al. (2021) showed that renewable energy, innovation, and environmental taxes can reduce carbon emission levels and have a positive impact on environmental quality in developed Asian countries. Dennis et al. (2016) studied the economic impact of air pollution taxes in France and found that environmental taxes can effectively reduce pollutant emissions while also stimulating economic growth. Freire-González and Ho (2019) developed a dynamic CGE model for Spain to assess the economic and environmental impacts of a carbon tax. Their study, similarly, suggests that carbon tax policies can reduce CO2 emissions and mitigate climate risks at the lowest economic cost. Tao et al. (2021) empirically showed that eco-innovation and environmental taxes play an important role in carbon reduction in E7 countries. Environmental taxes are an important policy instrument for mitigating the negative effects of environmental externalities. Cho (2021) studied the impact of income inequality on the relationship between economic growth and environmental degradation under different levels of institutional quality among high-income countries, and found that environmental taxation is an effective tool for improving environmental quality in countries with strong institutions.

Some scholars have questioned the abatement effect of environmental taxes. Sinn (2008) proposed the famous Green Paradox, “the implementation of policy measures aimed at limiting climate change leads to the accelerated extraction of fossil energy, which in turn accelerates the accumulation of greenhouse gases in the atmosphere, resulting in environmental degradation”; it also means that “good intentions do not always cause good behavior.” Based on Mexican environmental taxation data, Blackman et al. (2010) found that government environmental regulations not only failed to push firms to develop green innovations, but actually worsened firms’ pollution behavior. Rosendahl’s study of the European Union Emissions Trading System (ETS) shows that Policy instruments to stimulate additional emission reductions within the ETS sector can reduce net emissions if they are temporary and take place early on. But they cannot reduce net emissions if they are long-term or late in the process, and may even have a significant negative impact on cumulative emissions (Rosendahl, 2019). Carrilho-Nunes and Catalão-Lopes (2022) studied the impact of environmental policies and technology transfer on greenhouse gas (GHG) emissions using environmental data from Portugal and showed that environmental policies have a negative impact on GHG emissions, while technology transfer may lead to an increase in GHG emissions. Degirmenci and Aydin (2021) studied five African countries during the period of 1994–2017 and found that the im-position of environmental taxes increased environmental degradation and unemployment in Cameroon, Ivory Coast, and Mali, among other countries.

Several scholars have studied the effect of China’s environmental tax on the re-duction of emissions. Wang et al. (2018) considered China’s Hebei Province, where an optimal combination of environmental and carbon tax was introduced. The capacity of different power generation technologies under different tax rates, as well as the carbon emission levels of atmospheric pollutants and dioxide were analyzed, and the study concluded that higher tax levels will promote the improvement of power generation technology and achieve pollution reduction. Li and Masui (2019) developed a Computable General Equilibrium (CGE) model for China’s environmental tax policy to simulate the influence of environmental taxes on emissions under various scenarios and found that environmental taxes help reduce most types of pollutants emissions. Hsu et al. (2021) used the Quantile Autoregressive Distributed Leg (QARDL) method and the Wald test, and the results confirmed that China’s carbon emission levels are significantly affected by eco-innovation, renewable energy, and environmental taxes. Zhu and Liu (2020) considered quasi-environmental resource tax data in the Yangtze River Economic Belt from 1999 to 2017 as a research sample. The impact of environmental tax on the green development of the region is analyzed in terms of tax effectiveness and timeliness. The results show that the implementation of environmental taxes has a positive role in promoting the green development of the Yangtze River Economic Belt, which is conducive to reducing regional resource consumption and pollutant emissions. Similarly, Wang and Tao (2021) also studied the Yangtze River Economic Belt in China and obtained similar results: the environmental protection tax policy can play a significant role in reducing the emission levels of two pollutants, chemical oxygen demand and sulfur dioxide.

The current academic community has conducted an in-depth analysis of the effects of environmental taxes on emission reduction. However, due to the various research samples and methods used by researchers, the conclusions drawn are diverse. Therefore, using environmental taxes as explanatory variables, this study analyzes whether China’s environmental protection tax policy reduces emissions of three major pollutants: sulfur dioxide emissions from exhaust gas, ammonia nitrogen emissions in wastewater, and chemical oxygen demand in wastewater. Furthermore, China has a vast land area, and there are large differences between provinces in terms of natural resources, economic development, and technological innovation, all of which have a great impact on pollutant emissions. The specific applicable tax amount of these taxable pollutants is determined by the provincial administrative region governments within the tax range. Therefore, we have reasons to suspect that the implementation of tax policies for environmental protection is very likely to have different emission reduction effects across various regions.

In order to test the regional heterogeneity of the emissions reduction effect of environmental taxes, this paper further divides the 30 provincial-level administrative divisions in China into three major regions: the eastern, central, and western regions; and, also analyzes the regional characteristics of the emission reduction effect of environmental taxes to provide corresponding references for administrative entities of different sizes and economic development levels.

Hypotheses

The Emission Reduction Effect of Environmental Taxation

The emissions reduction effects of environmental taxes can be found in the activities of companies, consumers, and governments. In terms of enterprises, the collection of environmental protection taxes increases the tax burden of enterprise pollution emissions, internalizes their external effects, and greatly increases production costs. In order to save costs and eliminate profit declines caused by an increase in tax burden, enterprises will improve, research, and develop innovative green technologies to enhance the efficiency of resource utilization or reduce resource consumption through green industrial innovation and reduce pollution emissions as much as possible. Businesses that have not yet been built may be regulated by environmental protection tax policies and prefer production and operation decisions that are conducive to environmental protection, thereby reducing emissions. Since the tax shifting is reflected in the price, consumers will purchase fewer high-polluting and energy-intensive products and more ecofriendly products. Concurrently, this change in consumer behavior has enhanced public environmental awareness and environmental protection across societies and has also stimulated the development of energy-efficient and environmentally conscious industries. In terms of China’s national conditions, China’s socialist market economy is led by the government. And state-owned enterprises occupy the main position. To achieve the policy objectives of the environmental protection tax, the government may increase environmental protection tax collection and investment in pollution control, thereby playing a role in reducing GHG emissions. Hence, we propose hypothesis 1:

Hypothesis 1. Environmental taxation can reduce pollutant emissions in China.

Regional Heterogeneity of Environmental Protection Taxes

The emission reduction effects produced by the same environmental tax collection standards may be different due to the different levels of economic development, marginal emission reduction costs, and environmental carrying capacity of each region. For example, by revealing the interplay between environmental taxes, energy intensity, and energy consumption in 29 OECD economies, Bashir et al. (2021) found that environ-mental taxes promote environmental awareness in OECD countries, encouraging companies to reduce GHG emissions, adopt clean production practices, and focus on energy optimization. However, for emerging economies, the implementation of environmental taxes not only hinders economic growth, but also increases the cost of commodity manufacturing. Wolde-Rufael and Mulat-Weldemeskel (2022) showed that the impact of environmental taxes and renewable energy on carbon monoxide emissions is heterogeneous, with significant negative impacts in countries with higher emissions but not in countries with lower emissions. Combined with the samples used in this study, the mainland region of China is divided into three major economic regions: the east, central, and west, based on differences in natural conditions, economic resources, economic development level, transportation conditions, and economic benefits of various regions. Judging from the degree of economic development, the eastern belt has a relatively higher level of economic benefits of production, construction, infrastructure, science and technology, operation, and management, whereas the western belt has low levels (decreasing from east to west). Natural resources such as land, mineral deposits, and hydropower are typically abundant in the western and central belts, compared with the eastern belt. The implementation of an environmental protection tax policy is very likely to have different emission reduction effects in different regions of China. Therefore, we propose hypothesis 2:

Hypothesis 2. There is regional heterogeneity in the emission reduction effects of environmental taxes.

Research Design and Methods

Method

The essence of environmental protection tax is “who pollutes, who governs,” which endogenizes negative externalities resulting from industrial pollution, thereby urging enterprises to control pollution and reduce emissions. In the context of environmental protection tax collection and management, the efficacy of pollution control and emission reduction is largely determined by the level of pollutant emissions of enterprises. Therefore, in order to test the pollution reduction effect of environmental protection taxes, this study considers the pollutant emission level of industrial enter-prises and the environmental tax as the explanatory variables; the regression analysis model is established as follows:

In the above equation,

Sample Selection and Data Acquisitions

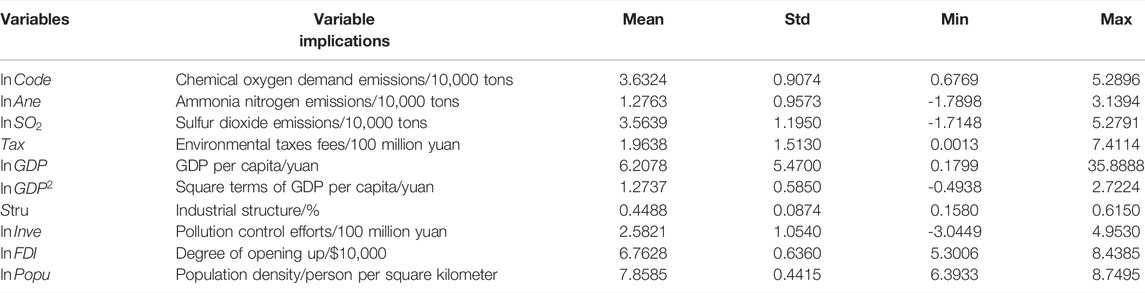

In this paper, panel data from 30 Chinese provinces, municipalities, and autonomous regions from 2006 to 2020 were used as samples, and the impact of environ-mental taxes and fees on pollutant emission levels was analyzed using individual fixed effect models. The original sample data were derived from the China Statistical Year-book, China Environmental Yearbook, and EPS data platform. The sample-related variables are defined as follows:

The Explanatory Variable

Three types of pollutant emissions, namely chemical oxygen demand

Explanatory Variables

Since 1 January 2018, China has implemented the Environmental Protection Tax Law of the People’s Republic of China, and the traditional environmental protection tax system paid in the form of sewage charges was terminated. According to the principle of tax translation of the pollutant discharge fee system to the environmental protection tax system in the Environmental Protection Tax Law, the environmental protection tax currently implemented in China has many similarities with the pollutant discharge fee. This is mainly reflected in the fact that the provisions on the objects of tax collection, the scope of collection, tax calculation method, and tax calculation standard are essentially the same. Therefore, in order to test the emission reduction effect of China’s environmental protection taxes and fees from 2006 to 2020, the environmental protection tax index data

Control Variables

Following Li (2015) and Liu (2018), the content of the control variables was set as follows:

1) The level of economic development.

Environmental economists believe that there is an environmental Kuznets curve characteristic (EKC) between economic development and environmental pollution; that is, in the early stage of economic development, pollution levels in the environment rise in tandem with local economic development; when economic development reaches a certain level, environmental pollution is gradually reduced (Beckerman, 1992; Shafik and Bandyopadhyay, 1992; Stern, 2004). Therefore, we set the economic development level as the control variable in the environmental tax emission reduction effect model and used the logarithmic representation of GDP per capita. To verify the presence of the EKC, the quadratic term of the economic development level (

2) Industrial structure (

Social production includes the primary, secondary, and tertiary major industries, and different industries use environmental resources to varying degrees of efficiency, and the quantity and density of pollutants emitted into the environment varies. Since the secondary industry produces the most pollutant emissions of the three major industries, the proportion of secondary industry output value was taken as the indicator of industrial structure.

3) Environmental pollution control efforts (

Pollution control is a key instrument for government environmental management. The larger the amount of investment in pollution control, the greater the government’s efforts to control environmental pollution, the more conducive it is to reducing pollutant emissions. Therefore, we used the pollution control investment amount index to measure the pollution control intensity of each region and take its logarithmic value.

4) Degree of opening up to the outside world (

The degree to which a region is opened up to the outside world is more reflected in the introduction of foreign investment, and most of these foreign-funded enterprises are pollution-intensive and resource-consuming that have a greater negative impact on the local environment. Therefore, many foreign investments may cause environmental pollution. In this study, we used the quantity of foreign investment to measure the level of opening up in various regions and take logarithmic values of the data.

5) Population density (

Population density is partially linked to local pollution conditions. High population density areas may be more polluted by wastewater, waste gas, solid waste, and noise pollution caused by domestic life; whereas high population density areas are usually more urbanized with relatively more efficient energy use, and people in economically developed areas have a stronger sense of environmental protection. Therefore, population density was chosen as one of the control variables, and the logarithmic value was taken for it.

Using EXCEL and Stata 14 software, this paper descriptively analyzes the collected data of the above variables, and the results are shown in Table 1.

Results and Analysis

Analysis of Regression Results of the Impact of Environmental Protection Taxes on Pollutant Emissions

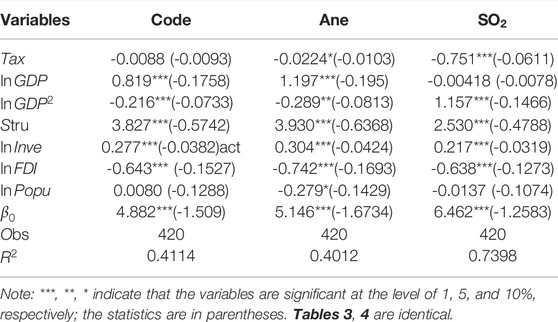

Table 2 shows the test results of the impact of environmental taxes on chemical oxygen demand, ammonia nitrogen, and sulfur dioxide emissions under full sample data conditions. The impact coefficient of environmental taxes on ammonia nitrogen and sulfur dioxide emissions was negative and significant at the statistical levels of 10 and 1%, respectively, indicating that environmental taxes and fees could help reduce emissions of ammonia nitrogen and sulfur dioxide pollutants. Moreover, the environmental tax coefficient for chemical oxygen demand emissions was negative but not statistically significant, indicating that environmental taxes have not played a role in reducing chemical oxygen demand emissions. It may be that the environmental tax collection standards for chemical oxygen demand emissions were low, and have not yet reached the emission reduction standards, and the cost of paying environmental taxes was lower than the cost of pollution control and emission reduction, therefore relevant enterprises were more willing to choose to pay for pollution.

TABLE 2. Return results of the full sample of environmental taxes and fees and three types of pollutant emissions in 30 provinces and cities in China.

In terms of the model’s control variables, although the secondary term coefficients of chemical oxygen demand and per capita GDP of ammonia nitrogen were both negative, the coefficient of sulfur dioxide was positive and statistically significant at the 1% level. The environmental Kuznets inverted-U hypothesis does not apply to all types of pollution. Combined with the regression analysis results of industrial structure and pollutant emissions, the relationship between industrial structure and the three types of pollutants is positively correlated at the significance level of 1%, indicating that the current industrial structure layout has increased the emissions of chemical oxygen demand, ammonia nitrogen and sulfur dioxide to a certain extent. The higher the share of the secondary industry, the more serious the environmental pollutant emissions, indicating that China’s current economic development level is still on the left side of the EKC to a certain extent. The positive impact of pollution control efforts on the three types of pollutants is significant at the statistical level of 1%, that is, with the increase of government pollution control efforts, the emissions of chemical oxygen demand, ammonia nitrogen and sulfur dioxide are still increasing. The possible reason was that in order to promote economic development, the government fulfilled “political achievements”, rendering investment in environmental pollution control a formality and in-efficient. The degree of opening up to the outside world is negatively correlated with the relationship between the three types of pollutants at the level of 1%, which was not in line with expectations, which may be because of the fact that a moderate amount of foreign investment can bring advanced energy-saving and emission-reduction technologies and experience to local areas, produce positive external effects, and reduce the level of pollutant emissions. Population density was not related to chemical oxygen demand and sulfur dioxide emissions but negatively affected ammonia nitrogen emission levels at the 10% level. This showed that the effect of population density on different pollution factors was different.

Heterogeneity Analysis of the Impact of Environmental Protection Taxes and Fees on Pollutant Emissions

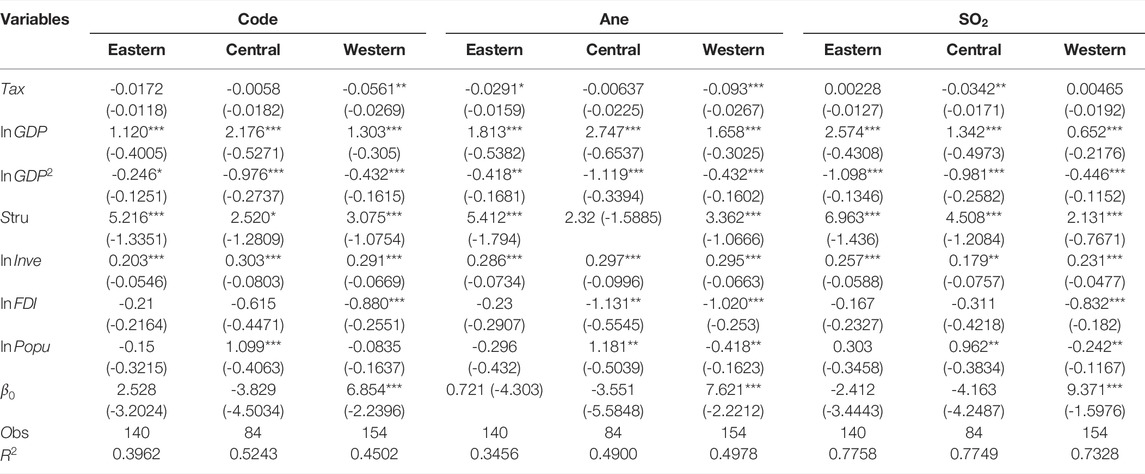

To test whether there is regional heterogeneity in the emission reduction effect of environmental taxes and fees, this study divided 30 provinces and cities in China into three regions: eastern, central, and western, and regression tests were performed on these three sub-samples; the results are shown in Table 3. Environmental taxes and fees had a significant negative effect on the ammonia nitrogen emissions in the east, the sulfur dioxide emissions in the central region, and the chemical oxygen demand and ammonia nitrogen emissions in the west; however, there was no reduction effect on the chemical oxygen demand emissions and sulfur dioxide emissions in the east, chemical oxygen demand and ammonia nitrogen emissions in the central region, and sulfur dioxide emissions in the west. It is noted that there are significant differences in the role of environmental taxes and fees in reducing pollutant emissions across these regions, and different environmental tax collection standards should be adopted in accordance to the economic development of the region. In terms of the existence of the environmental Kuznets curve, whether in the eastern, central, or western regions, the per capita quadratic term coefficient in the three types of pollutant models is negative and statistically significant at the 1% level, indicating that the traditional environmental Kuznets inverted-U hypothesis is present in socio-economic development regardless of any region. Since the level of economic development of each region is still in the left part of the environmental Kuznets curve, this implies a stage where pollutant emissions will continue to increase as the economy grows. As far as other variables are concerned, the industrial structure and the amount of investment in pollution control have played a significant role in increasing the emissions of the three types of pollutants. The negative impact of the degree of opening up to the eastern region was not significant, and population density had a significant positive impact on chemical oxygen demand, ammonia nitrogen, and sulfur dioxide emissions in the central region. The empirical results of the subregions reveal that the emission reduction effect of environmental fees on the principal pollutants varies by region, which verifies Hypothesis 2.

TABLE 3. Empirical results of environmental taxes and fees and three types of pollutant emissions in 30 prov-inces and cities in China.

Robustness Testing

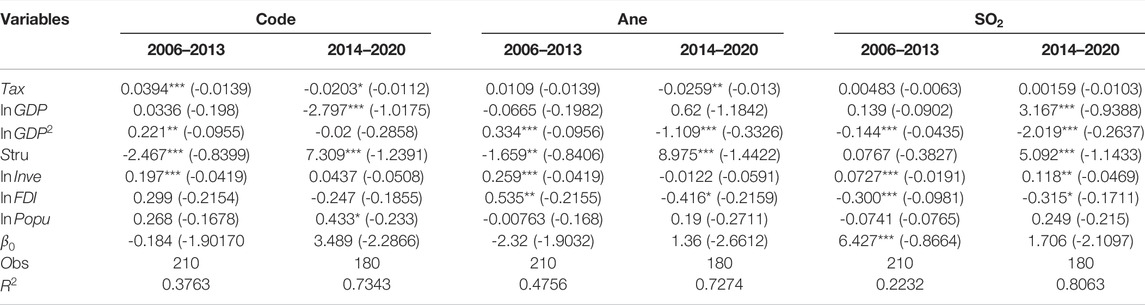

To avoid statistical errors and the contingency of selected data, and to enhance the credibility of empirical results, this paper examines whether the relationship between environmental protection taxes and pollutant emissions in 30 Chinese provinces, municipalities, and autonomous regions changes with time period. Since the National Development and Reform Commission, the Ministry of Finance, and the Ministry of Environmental Protection of China jointly issued the Notice on Adjusting the Standards for the Collection of Sewage Charges and Other Related Issues in 2014. This notice required all provinces (autonomous regions and municipalities) to adjust the sewage charges for the primary pollutants of sewage and waste gas according to real conditions and implement a differentiated sewage charging system. Provinces have adjusted the collection standards of major pollutants since 2014 in accordance with the requirements of the notice. Therefore, taking 2014 as the node, this paper divides the sample into two periods, 2006–2013 and 2014–2020, for regression testing. Test results are shown in Table 4.

TABLE 4. Results of environmental taxes and the robustness of emissions of three types of pollutants in 30 provinces and cities in China.

Table 4 shows that the impact of environmental taxes and fees on chemical oxygen demand emissions from 2006 to 2013 was positive at a statistical level of 1%; however, the impact on ammonia nitrogen and sulfur dioxide was not significant. This conclusion was unexpected, presumably because the environmental tax requirements in place during this period were too low to be applied in environmental regulation. Environ-mental taxes and fees in 2014–2018 had a significant role in reducing chemical oxygen demand and ammonia nitrogen emissions, but the impact on sulfur dioxide emissions remained insignificant. Comparing the absolute value of the regression coefficient, the value of the regression coefficient was significantly reduced, indicating that the positive effect of environmental taxes on sulfur dioxide emissions was weakening. How-ever, the effect of environmental taxes on the emission reduction of sulfur dioxide emissions during both periods was not significant. Moreover, the relationship between environmental taxes and chemical oxygen demand emissions changed from a significantly positive to a significantly negative correlation, indicating that the emission re-duction effect of environmental taxes on chemical oxygen demand was continuously enhanced. In contrast, the emission reduction effect of environmental taxes on ammonia nitrogen was significantly enhanced in the later period. The final robustness test results were not significantly different from the previous conclusions, confirming that the results of the previous model study are stable.

Conclusion

In this study, panel data from 30 Chinese provincial-level administrative regions from 2006 to 2020 were used as samples to empirically assess the emission reduction effect of environmental taxes and fees and analyze the heterogeneity characteristics of this effect. We found that:

a) In terms of the overall sample, collecting environmental taxes and fees could promote the emission reduction of ammonia nitrogen, and sulfur dioxide to a certain extent, but the effect on chemical oxygen demand was not prominent.

b) According to the results of the regional heterogeneity test, the effect of emission reduction effect of environmental taxes and fees on major pollutants in each region varies, and China’s current environmental tax policy has a relatively strong effect on emission reduction in the western region with little effect in the eastern and central regions.

c) In terms of the ECK hypothesis, both the total sample and the subsample regression results indicated the presence of a traditional environmental Kuznets inverted-U hypothesis in the process of economic development, and that China’s current economic development level is still on the left side of the environmental Kuznets curve. Therefore, the level of economic development continues to have a positive impact on pollution emissions. Furthermore, China’s current industrial structure has significantly increased chemical oxygen demand, ammonia nitrogen, and sulfur dioxide emissions, and environmental pollution control has failed to achieve the not expected pollution reduction effect.

Considering the above conclusions, we make the following suggestions to improve pollution reduction efforts:

First, environmental tax policy should be improved, the scope of environmental taxation collection expanded, and the collection standard appropriately raised. On one hand, since the current environmental tax has achieved certain emission reduction effect for certain pollutants, the scope of environmental tax should be expanded in due course. Other pollutants, such as carbon dioxide, organic matter emissions, and dust, should also be included in the scope of environmental taxation as soon as possible to achieve carbon neutrality goals. On the other hand, as previously discussed, present policies have not yet produced significant results in reducing particular pollutants; the reason might be that environmental taxation collection standards are inadequate and have not yet reached the emission reduction standards. Therefore, the collection standards should be appropriately raised and the governance of environmental protection taxes should be strengthened. The reduction of all categories of pollutant emissions must be promoted.

Second, all regions must be supervised and urged to formulate environmental protection tax policies that are in line with the actual conditions of their respective regions. The Environmental Protection Tax Law of the People’s Republic of China stipulates that “the determination and adjustment of the specific applicable tax amounts for taxable atmospheric pollutants and water pollutants shall be proposed by the people’s governments of provinces, autonomous regions, and municipalities directly under the Central Government, taking into account the environmental carrying capacity, the current situation of pollutant discharge and the requirements of economic, social, and ecological development goals in their respective regions, and within the tax range specified in the “Environmental Protection Tax Tariff Schedule” attached to this Law. In fact, at present, China’s provinces have not taken full advantage of independently formulating applicable taxes, and most of them have directly used the original sewage fee payment requirements, resulting in very different policy implementation effects across the country. We suggest that provinces should adjust collection standards according to local conditions, that is, according to the actual pollution discharge situation and economic development level in their regions; all types of pollutants must be strictly taxed on a per-unit basis to better play a policy role.

Third, the adjustment of the industrial structure should be optimized, and the structural transformation of high-polluting emission departments should be supervised. At present, the industrial structures of most Chinese provinces have entered the “three, two, one” model; however, due to the high level of pollution emissions from China’s secondary industry, it is still necessary to focus on increasing the proportion of the tertiary industry and gradually reducing the proportion of the secondary industry. In the secondary industry, as far as possible to increase the proportion of low-pollution and low-energy consumption industries, the production capacity constraints on high-pollution and high energy-consuming industries should be strengthened. The elimination mechanism of environmental protection taxes for high-pollution and high energy-consuming industries must be effectively implemented to improve production technology, accelerate transformation, and upgrade to green technologies. During this process, the government should actively cooperate to provide specific green technology innovation subsidies for enterprises, vigorously develop low-pollution and low-energy industrial technologies, and assist in realizing green production for the entire society and achieving sustainable economic development.

Fourth, the intensity of pollution control should be increased and the efficiency of governance improved. It is necessary to incorporate the pollution control level into the comprehensive evaluation system of economic and social development in various regions so that the effectiveness of pollution control investment becomes one of the important assessment indicators for local officials, while preventing local officials from being confined to the trap of “GDP growth” and introducing high-pollution and high-energy-consuming industries that can bring economic benefits. It is also necessary to strengthen the prior assessment of pollution control investment projects, formulate investment plans according to the actual situation of each province, improve the efficiency of the use of pollution control investment funds, and increase the supervision and inspection of the implementation of investment plans. The performance evaluation must be organized in a timely manner. Finally, it is necessary to strengthen environ-mental protection policies and regulations, raise the threshold of pollution emissions, improve source control, and improve the information construction of pollution emission monitoring in various regions.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author Contributions

YX: Writing–original draft, Conceptualization, Methodology. PC: Writing–original draft, Supervision, Project administration.

Funding

This work was supported by Longitudinal Research Project of Fujian Business University (Grant No. FJ 2020B114).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aydin, C., and Esen, Ö. (2018). Reducing CO2 Emissions in the EU Member States: Do Environmental Taxes Work? J. Environ. Plan. Manag. 61, 2396–2420. doi:10.1080/09640568.2017.1395731

Bashir, M. F., Ma, B., Shahbaz, M., Shahzad, U., and Vo, X. V. (2021). Unveiling the Heterogeneous Impacts of Environmental Taxes on Energy Consumption and Energy Intensity: Empirical Evidence from OECD Countries. Energy 226, 120366. doi:10.1016/j.energy.2021.120366

Beckerman, W. (1992). Economic Growth and the Environment: Whose Growth? Whose Environment? World Dev. 20, 481–496. doi:10.1016/0305-750x(92)90038-w

Blackman, A., Lahiri, B., Pizer, W., Rivera Planter, M., and Muñoz Piña, C. (2010). Voluntary Environmental Regulation in Developing Countries: Mexico's Clean Industry Program. J. Environ. Econ. Manag. 60, 182–192. doi:10.1016/j.jeem.2010.05.006

Bosquet, B. (2000). Environmental Tax Reform: Does it Work? A Survey of the Empirical Evidence. Ecol. Econ. 34, 19–32. doi:10.1016/s0921-8009(00)00173-7

Carrilho-Nunes, I., and Catalão-Lopes, M. (2022). The Effects of Environmental Policy and Technology Transfer on GHG Emissions: The Case of Portugal. Struct. Change Econ. Dyn. 61, 255–264. doi:10.1016/j.strueco.2022.03.001

Chien, F., Sadiq, M., Nawaz, M. A., Hussain, M. S., Tran, T. D., and Le Thanh, T. (2021). A Step toward Reducing Air Pollution in Top Asian Economies: The Role of Green Energy, Eco-Innovation, and Environmental Taxes. J. Environ. Manag. 297, 113420. doi:10.1016/j.jenvman.2021.113420

Cho, H. (2021). Determinants of the Downward Sloping Segment of the EKC in High-Income Countries: The Role of Income Inequality and Institutional Arrangement. Cogent Econ. Finance 9, 1954358. doi:10.1080/23322039.2021.1954358

Degirmenci, T., and Aydin, M. (2021). The Effects of Environmental Taxes on Environmental Pollution and Unemployment: A Panel Co‐Integration Analysis on the Validity of Double Dividend Hypothesis for Selected African Countries. Int. J. Finance Econ., 1–8. doi:10.1002/ijfe.2505

Dennis, M., Armitage, R. P., and James, P. (2016). Appraisal of Social-Ecological Innovation as an Adaptive Response by Stakeholders to Local Conditions: Mapping Stakeholder Involvement in Horticulture Orientated Green Space Management. Urban For. Urban Green. 18, 86–94. doi:10.1016/j.ufug.2016.05.010

Freire-González, J. (2018). Environmental Taxation and the Double Dividend Hypothesis in CGE Modelling Literature: A Critical Review. J. Policy Model. 40, 194–223. doi:10.1016/j.jpolmod.2017.11.002

Freire-González, J., and Ho, M. S. (2019). Carbon Taxes and the Double Dividend Hypothesis in a Recursive-Dynamic CGE Model for Spain. Econ. Syst. Res. 31, 267–284. doi:10.1080/09535314.2019.1568969

Hsu, C.-C., Zhang, Y., Ch, P., Aqdas, R., Chupradit, S., and Nawaz, A. (2021). A Step towards Sustainable Environment in China: The Role of Eco-Innovation Renewable Energy and Environmental Taxes. J. Environ. Manag. 299, 113609. doi:10.1016/j.jenvman.2021.113609

Li, G., and Masui, T. (2019). Assessing the Impacts of China's Environmental Tax Using a Dynamic Computable General Equilibrium Model. J. Clean. Prod. 208, 316–324. doi:10.1016/j.jclepro.2018.10.016

Li, X. H. (2015). An Empirical Study on the Pollution Disincentive Effect of Environmental Protection Tax in China. Tax. Res. 11, 94–99.

Liu, Y. (2018). Emission Reduction Effects of Environmental Tax System and its Regional Differences in China. Tax. Res. 2, 41–47.

Shafik, N., and Bandyopadhyay, S. (1992). Economic Growth and Environmental Quality: Time-Series and Cross-Country Evidence, 904. Washington, DC: World Bank Publications, 50.

Sinn, H.-W. (2008). Public Policies against Global Warming: A Supply Side Approach. Int. Tax. Public Finance 15, 360–394. doi:10.1007/s10797-008-9082-z

Stern, D. I. (2004). The Rise and Fall of the Environmental Kuznets Curve. World Dev. 32, 1419–1439. doi:10.1016/j.worlddev.2004.03.004

Tao, R., Umar, M., Naseer, A., and Razi, U. (2021). The Dynamic Effect of Eco-Innovation and Environmental Taxes on Carbon Neutrality Target in Emerging Seven (E7) Economies. J. Environ. Manag. 299, 113525. doi:10.1016/j.jenvman.2021.113525

Wang, B., Liu, L., Huang, G. H., Li, W., and Xie, Y. L. (2018). Effects of Carbon and Environmental Tax on Power Mix Planning - A Case Study of Hebei Province, China. Energy 143, 645–657. doi:10.1016/j.energy.2017.11.025

Wang, W. D., and Tao, S. Y. (2021). Research on the Regional Emission Reduction Effect of Environmental Protection Tax Based on EKC——Experimental Evidence from the Changjiang River Economic Belt. Resour. Dev. Mark. 37 (05), 545–549. doi:10.3969/j.issn.1005-8141.2021.05.006

Wolde-Rufael, Y., and Mulat-Weldemeskel, E. (2022). The Moderating Role of Environmental tax and Renewable Energy in CO2 Emissions in Latin America and Caribbean Countries: Evidence from Method of Moments Quantile Regression. Environ. Challenges 6, 100412. doi:10.1016/j.envc.2021.100412

Keywords: energy transition, environmental taxation, regional heterogeneity, emission reduction effects, policy effect

Citation: Xu Y and Chen P (2022) Energy Transition and Regional Heterogeneity of Environmental Taxation in China: From the Perspective of Emission Reduction Effects. Front. Environ. Sci. 10:944131. doi: 10.3389/fenvs.2022.944131

Received: 14 May 2022; Accepted: 27 May 2022;

Published: 14 June 2022.

Edited by:

Magdalena Radulescu, University of Pitesti, RomaniaReviewed by:

Rengui Gong, Hunan Agricultural University, ChinaBingbin Wu, Fujian Agriculture and Forestry University, China

Copyright © 2022 Xu and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Pinghua Chen, Q2hlbnhpYW9odWEwNjIzQDE2My5jb20=

Yudan Xu

Yudan Xu Pinghua Chen

Pinghua Chen