- 1Jianghai Polytechnic College, Yangzhou, China

- 2Guangling College of Yangzhou University, Yangzhou, China

- 3Finance Department, Faculty of Economics and Business Administration, Vilnius University, Vilnius, Lithuania

- 4Business School, Yangzhou University, Yangzhou, China

Low carbon investments are significant in climate change and sustainable economic growth. The research considers the impact of the COVID-19 pandemic on low carbon investments using environmental, social, and governance (ESG) factors in different regions to find the correlation between various markets and the impact of the pandemic. Our research employs the method of covariance/correlation analysis to investigate the relationship between low carbon investments in different regions. We also check the main parameters of descriptive statistics. We use the method of bivariate regression analysis to assess the impact of the COVID-19 pandemic on the performance of ESG stock indices in Emerging, European, and Global markets. The main findings reveal that the global prevalence and mortality risk of COVID-19 infection have a significant adverse effect on the performance of Emerging, European, and Global ESG stock markets. In contrast, the effect of COVID-19 cases reported deaths caused by COVID-19 infection to appear to be mixed. Our research shows that the correlation between the European ESG stock market and other ESG markets is exceptionally low or negative in the 1-year horizon. In contrast, tendencies in other markets are similar. So it means that the European ESG stock market is a good tool for diversification and risk mitigation during critical moments. Our results can be used in practice for portfolio management purposes. Institutional and other investors can use these results for low carbon portfolio management and risk mitigation.

Introduction

The COVID-19 pandemic can be named a black swan event that stifled the global economy. Unexpectedly emerged, COVID-19 resulted in complete social isolation within different countries and negatively influenced everyday life and business (resulting in employment and industry-wide shutdowns), causing many more adverse economic effects. The coronavirus pandemic and quarantine measures dramatically shocked the global economy with the deepest production slump since World War II. All scenarios of Covid’s impact, which is modeled by experts, on the economy are pessimistic. The pandemic claimed many human and economic sacrifices, in the total sense of the word: a high number of deaths lost jobs and employees, closed businesses, and collapsing economies. Macrofinancial measures designed to support a sustainable economy, applied too late or inappropriately, can increase social inequality and income imbalances. In some countries, exceptionally high public dissatisfaction is caused by the tightening of the second wave of COVID-19: There is more than just social discontent and racial unrest (Harris and Missy, 2020).

The current pandemic is a real test for the world economy and institutions of regulation of the global economy. Lots of researchers (e.g., McKibbin and Fernando, 2020; Bouey, 2020; Levine, 2020; Bakas and Triantafyllou, 2020; De Grauwe, 2020; Beck, 2020; Zandi, 2020; Abiad et al., 2020, Ramelli and Wagner, 2020; Lee, 2020) analyze and find the impact of the COVID-19 pandemic on the economy and other spheres. For example, some authors (Jordà et al., 2020) compare the COVID-19 pandemic issues with other crises. Studies that analyze the possible economic consequences of COVID-19 for world trade, economies of individual countries (Bouey, 2020), and separate sectors of the economy have appeared in a brief time (Levine, 2020).

Increased financial markets’ volatility reflected difficulties in estimating the extent of the economic damage and predicting the situation’s development, and the downturn’s consequences could be felt over many years. COVID-19 shock could be compared to the 2007–2008 Great Financial Crisis. Despite its impact caused to financial markets, no doubt being evident and significant. This recent phenomenon should be researched in more detail.

Despite high volatility in stock markets and a big economic shock due to the COVID-19 pandemic, the importance of climate change and sustainable economic growth cannot be forgotten. Climate change now is a topic that must be discussed a lot because it significantly affects people’s broad economy, community, and lives. Every day we can hear lots of announcements about natural disasters leading to losses. About half of the losses are insured. However, most of the losses are taken by others. Climate change is a significant risk that must be managed. The growing trend of catastrophic events forces us to be involved in this process and lowers the negative effect of climate change. Climate change plays a crucial role in our lives and strongly impacts economics. Climate change becomes a source of financial risk, and exposure to this type increases every day as the number of catastrophic events grows every minute. Financial institutions must take active action in risk management by adding value to the activities that lower climate risk. Central banks play an especially crucial role in the financial system; therefore, these institutions should take responsibility for climate risk mitigation. All the mentioned financial institutions.

Some authors analyze sustainability and environmental, social, and corporate governance (ESG) factors issues related with a business level and focus on the effects to company value and financial results (Egorova et al., 2022; Saygili et al., 2022; Engelhardt et al., 2021; Abdi et al., 2020; Badía et al., 2020; Bhaskaran et al., 2020; Buallay, 2020; Cordazzo et al., 2020; Drempetic et al., 2020; Garcia and Orsato, 2020; Hoang et al., 2020; Jamprasert et al., 2020; Li and Wu, 2020; Modugu, 2020; Oehmke and Opp, 2020; Oprean-Stan et al., 2020; Peng and Isa, 2020; Rajesh and Rajendran, 2020; Sabatini, 2020; Sadiq et al., 2020; Schumacher et al., 2020; Sharma et al., 2020; Sichigea et al., 2020; Tampakoudis and Anagnostopoulou, 2020; Tommaso and Thornton, 2020; Veenstra and Ellemers, 2020; Widyawati, 2020; Larcker and Watts, 2020; Mukanjari and Sterner, 2020; Palma-Ruiz et al., 2020; Pasquini, 2020), while others try to investigate the risks, benefits, and challenges related with investments in financial instruments, especially stock and bond markets (Aw et al., 2020; Amanjot, 2020; Andrew, 2020; Ardia et al., 2020; Cunha et al., 2020; Dorfleitner et al., 2020; Engle et al., 2020; Fiskerstrand et al., 2020; Garefalakis and Dimitras, 2020; Glossner et al., 2020; Gougler and Utz, 2020; Hübel and Scholz, 2020; Jens, 2020; Kaiser, 2020; Kocmanová et al., 2020; Krueger et al., 2020; Meher et al., 2020; Mercereau et al., 2020; Mercedes, 2020; Mirchandani and Rossetti, 2020; Ng and Rezaee, 2020; Rehman and Vo, 2020; Rui et al., 2020; Siri and Zhu, 2020; Vostrikova and Meshkova, 2020; Yongjun and Yupu, 2020; Zaghum et al., 2020; Ziolo et al., 2020; Khajenouri and Schmidt, 2021; Adams and Abhayawansa, 2022). Our research contributes to those scientific works related to investments, but we add more value to COVID-19 pandemic analysis and find regional stock market responses. We think that this study will help to take investment decisions having in mind regional aspects as we try to show the correlation between different markets in the COVID-19 pandemic.

Empirical studies are more focused on the country level. Studies related to China and US financial markets are oriented to investigate movements in the Shanghai Stock Exchange and New York Stock Exchange. These results make it possible to conclude the existing positive and robust relationship between fluctuations in analyzed financial markets and the number of confirmed COVID-19 cases (Sansa, 2020).

This study fills the gap in the research on the regional level. It gives a broad view of ESG investments, including Emerging Markets, Europe, and Global markets, as it is essential for institutional investors in COVID-19. Our research problem is whether low-carbon investments’ performance varies among different regions? Lately, lots of low carbon investment options have been launched, and these investments demonstrate excellent performance compared to traditional investments. Financial institutions and retail investors can use different funds to achieve their maximum goals of seeking carbon neutrality.

This research will help institutional investors such as pension funds, central banks, and other financial institutions mitigate market risk using regional factors. Institutional investors usually do not take a company-level risk and implement investment strategies using more diversified instruments. So focusing on low or negative correlation markets, institutional investors will be able to manage market risk in a sustainable and responsible stock market.

The relevance and popularity of sustainable and responsible investments get more popular every day. Everyone must add value to lower climate risk because human emissions of carbon dioxide and other greenhouse gases can be considered the key driver of climate change. Numbers show that global temperatures have risen sharply over the last few decades, and the main concern is how to solve the problem not to increase climate risk in the future. The relevance of this topic increased a lot during the pandemic period. Lots of financial institutions started to add value to climate risk management. Central banks started to work on this issue more actively, implementing socially responsible investments into their strategies. Still, at the same time, financial institutions faced significant issues in managing market risk and portfolio diversification challenges and how to implement new investments into the existing investment portfolio.

Financial institutions must take an active role in stopping climate change. Sustainable and responsible investments play a crucial role in adding value for taking efforts to decrease climate risk worldwide. Lots of financial intermediaries take part in risk management.

Different authors have analyzed if sustainable and responsible investments can generate higher profitability compared to investments not having sustainability and responsibility factors. But despite the mentioned facts, sustainable investments are getting more popular day by day. Analyzing investments, we usually have a return, which can be achieved by taking a risk position. Yue et al. (2020) found no unmistakable evidence confirming that sustainable funds can generate higher returns than traditional piers or benchmark indexes. Let’s consider participation in climate risk management and adding value to climate change. We cannot think only about profit factors and can just pay more attention to social factors. Lewis and Juravle (2010) pointed out that sustainable investments got popularity because of “the profitability of investments, company scandals, globalization, geophysical and environmental changes, changes in public opinion, political climate.” Kurtz (2020) found that “approximately 50% of assets under management (AUM) in Europe, Canada, and Australia were managed under a responsible investment policy.” The numbers increase every day. Due to reputational risk management, SRI investments attracted more attention from institutional investors. Urwin et al. (2009) pointed out that “sustainable investment can help pension funds and other financial institutions use a more effective portfolio management style.”

McKibbin and Fernando’s (2020) research is one of the earliest systematic studies of the potential economic cost of COVID-19. The authors explored scenarios of the impact of a pandemic on the macroeconomic and financial markets. They suggested that even a controlled short-term outbreak significantly impacts the global economy. The result of the COVID-19 pandemic is previously unknown intense mixed and negative shock of supply and demand, harming production. As it is argued by De Grauwe (2020), double-shocks will lead to multiple “domino effects.” Companies with high fixed costs face bankruptcy, wherefore banks lending to these companies will also experience severe problems and difficulties, which makes a banking crisis possible. Abiad et al. (2020) show the main channels of influence of COVID-19: a temporary decline in domestic consumption and investment, shrinkage of the tourism, manufacturing, and trade sectors, supply overruns, health consequences, and changed expenditures on health care.

A direct sign of the economic impact of the pandemic is a loss of trust from consumers and investors. Rational anticipation of future COVID-19 cases and the associated impact on the economy and society are among the most reasonable arguments for this rapid and sharp market decline. Ramelli and Wagner (2020), using a sector-level decomposition of stock price moves, argue that markets initially focused on the trade impact of the pandemic, also suggesting concerns about supply chains. Having analyzed the first impact of COVID-19 sentiment on the US stock market, Lee (2020) notes that the impact of COVID-19 varies depending on the industry. Mamaysky (2020) argues that the information environment played a first-order role in markets’ crisis response—the crucial influence of innumerable headlines in mass media results in adverse investors’ expectations. Considering that in February and March 2020, reliable data on the real coronavirus pandemic’s economic impact were not available, speculations “about future disastrous economic consequences and associated negative impacts on corporate profitability” (Mamaysky, 2020) significantly affected investors’ sentiment. Recent research concerns the impact of this pandemic on the global financial sector. It claims that adverse effects of tax capacity in the financial system will not occur at once. Therefore, there is time to make justified decisions (Beck, 2020; Zandi, 2020). However, side effects in the markets are sudden. As a result, it is necessary to focus on potential financial system disruptions and combine confidence in financial markets.

As this topic is among the most discussed topics nowadays, it is exciting to analyze how sustainable and responsible investments were affected by the COVID-19 pandemic. We think that all the scientists agree that the COVID-19 pandemic strongly influences the economy, but what about the stock market when we see new highs in some regions and what about sustainable and responsible investments. There are scientific works analyzing the impact of COVID-19 on the stock market in broad (e.g., Lööf et al., 2022; Lee, 2020; Albulescu, 2020a; Albulescu, 2020b; Ashraf, 2020; Al-Awadhi et al., 2020; Bloom et al., 2005; Demers et al., 2020; Ding et al., 2020; Dottling and Kim, 2020; Kapecki et al., 2020; Zhang et al., 2020, Zaremba et al., 2020; Czech et al., 2020, and Akhtaruzzaman et al., 2022), but there is a lack of scientific discussions relating to the impact on sustainable investments in the field of the stock market in different regions. Lately, we can find some more research made on ESG investments and COVID pandemic in specific countries. Jun et al. (2022) analyzed China market, and Takahashi and Yamada (2021) focused on Japanese stock market. Korean stock market using social responsible factors was analyzed by Lee et al. (2022). Pisani and Russo (2021) made a research on ESG funds having MSCI Europe index as a benchmark.

The primary purpose of this research is to find if the COVID-19 pandemic impacted sustainable and responsible investments and if there were any differences in different regions, including Emerging Markets, Europe, and Global markets.

We add value to the scientific literature by analyzing the impact of the COVID-19 pandemic impact on sustainable and responsible investments in different regions. Our results showed lots of differences between ESG investments in Emerging, European, and Global ESG stock markets during the COVID-19 pandemic and that the best choice for the highest diversification effect is the European ESG stock market.

Hence, our research expanded the list of critical literature about sustainable and responsible investments valuing the impact of the COVID-19 pandemic and considering the factor of different regions.

This article consists of three parts. Firstly, we reviewed different scientific works to find what has been done till now. Secondly, we presented methodological issues. Our methodology calculates descriptive statistics parameters, applies covariance/correlation analysis, and uses bivariate regression analysis. Finally, we discussed our results using stock market indices in different regions. Our main results show that the European ESG stock market is a good tool for diversification and risk mitigation during critical moments. Our results can be used in practice for portfolio management purposes. Institutional and other investors can use these results for SRI portfolio management and risk mitigation.

Research Framework

Main Variables and Development of Hypotheses

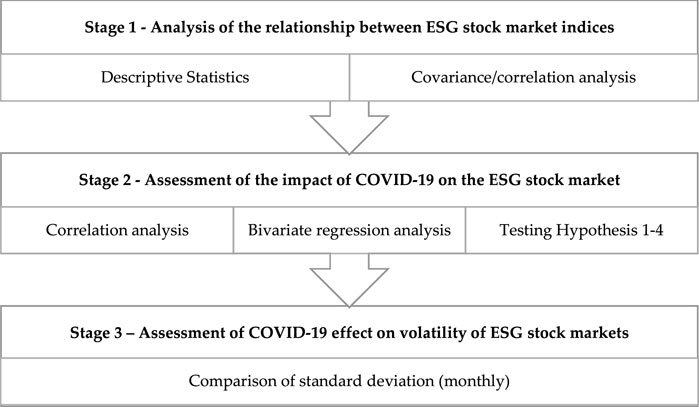

This research consists of three stages: 1) analysis of the relationship between selected ESG stock market indices, 2) analysis of the impact of COVID-19 on the ESG stock market, and 3) assessment of COVID-19 effect on the volatility of ESG stock markets, which will be discussed in detail. The research design is summarized in Figure 1.

For the empirical analysis, we used daily data of four stock market indices: S&P Emerging LargeMidCap E.S.G. Index, S&P Global 1200 ESG Index, S&P Europe 350 ESG Index, and S&P Global LargeMidCap E.S.G. Index. The choice of indices is because: 1) they are broad-based indices measuring the performance of securities from the underlying index that meet the sustainability criteria (S&P Dow Jones Indexes, 2020); 2) the choice of indices allows to analyze ESG investments in different regions, that is, Emerging, Europe, and Global markets. We used different periods to measure descriptive statistics parameters together with correlation and covariance between indices. We have chosen the other period to find the impact of COVID-19 on ESG stock market indices.

The sample covers the period from January 2020 to September 2020.

Data of stock market indices are retrieved from Reuters. In contrast, COVID-19-related data such as confirmed cases of infection, confirmed deaths, countries affected, case fatality rates, etc., are collected from World Health Organisation Coronavirus disease (COVID-19) situation reports (WHO, 2020) and the website of the European Centre for Disease Prevention and Control (ECDC, 2020).

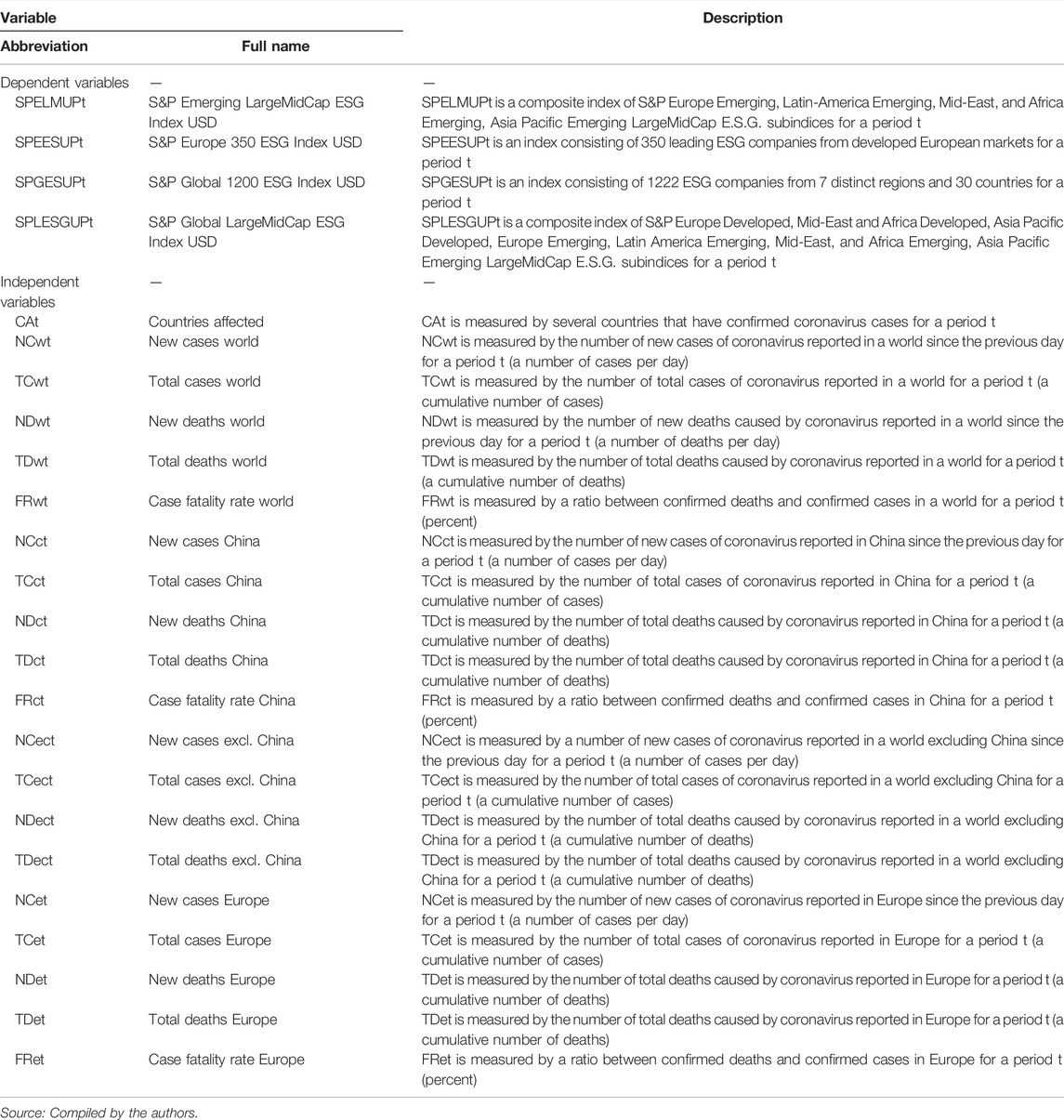

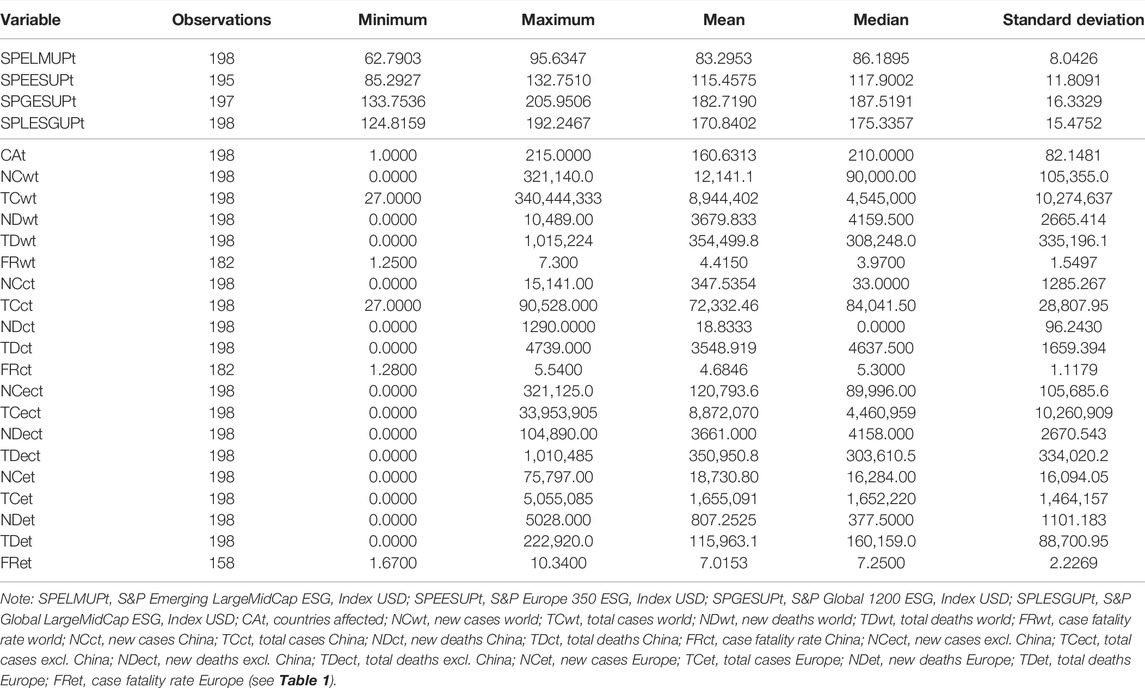

To find the impact of COVID-19 on ESG stock market indices, four dependent and twenty independent (COVID-19 related) variables are collected (Table 1), the choice of which is based on the analysis of scientific literature and criteria of data availability.

In addition, for a more detailed assessment of ESG stock markets’ reaction to the spread of COVID-19 infection, all the above variables (except the number of countries affected) are analyzed from four geographical perspectives: 1) China, 2) Europe, 3) the rest of the world excluding China, and 4) global perspective.

First, this research intends to investigate whether the geographical spread of COVID-19 infection affects ESG stock markets. As a significant number of researches showed negative (at least primary) response of the financial markets to the spread of the COVID-19 pandemic [e.g., Ashraf (2020); Al-Awadhi et al. (2020); Zhang et al. (2020); Czech et al. (2020); Albulescu (2020a); Zaremba et al. (2020) and others], our research intended to check in the direction of the reaction of ESG stock markets was the same (null and alternative hypotheses are described in Supplementary Appendix SA3). Based on the results of the literature analysis, the first hypothesis of this research is formulated as follows:

Hypothesis 1: The global prevalence of COVID-19 infection has a significant negative effect on the performance of the ESG stock market indices.

To assess the geographical spread of COVID-19 infection, some researchers (e.g., Albulescu, 2020a) use the number of countries affected by COVID-19, that is, the number of countries that have reported at least one case on a given day. Therefore, to evaluate the global prevalence of COVID-19 infection, the number of countries with confirmed infection cases (CAt) is used.

Secondly, in our research, we sought to determine whether and how the ESG stock markets are responding to the increase in the number of confirmed COVID-19 cases and deaths. Thus, the second and third hypotheses are formulated as follows:

Hypothesis 2: The number of cases of COVID-19 confirmed has a significant adverse effect on the performance of the ESG stock market indices.

Hypothesis 3: The number of deaths caused by COVID-19 reported has a significant adverse effect on the performance of the ESG stock market indices.

It is important to note that researchers select different measures to estimate the growth of COVID-19 infections and deaths. For instance, Ashraf (2020), Al-Awadhi et al. (2020), Zhang et al. (2020), and Czech et al. (2020) have used the number of total cases and total deaths, while Albulescu (2020a) and Zaremba et al. (2020) have used the measure of new cases and new deaths reported. We are given in mind that the market can react differently to the change of daily numbers and cumulative numbers; in our research, we decided to use both approaches.

Therefore, in this research, the measures of the number of new cases of COVID-19 reported per day, and the total number of COVID-19 cases confirmed in China, Europe, the rest of the world excluding China, and globally (NCct, NCet, NCect, NCwt; and TCct, TCet TCect, TCwt, respectively); and the measures of the number of new deaths caused by COVID-19 reported per day, and the total number of deaths caused by COVID-19 reported in China, Europe, the rest of the world excluding China, and globally (NDct, NDet, NDect, NDwt; and TDct, TDet TDect, TDwt, respectively) are used.

Finally, it was essential to find whether the changes in COVID-19 mortality risk affect the performance of ESG stock markets, which is why the fourth hypothesis of our research is formulated as follows:

Hypothesis 4: Mortality risk of COVID-19 infection has a significant negative effect on the performance of the ESG stock market indices.

To estimate the actual mortality rate, we need to know the number of actual (not reported) closed cases and the number of related deaths. As these estimates are unknown due to the asymptomatic manifestation of COVID-19 and many unclosed cases, we decided to analyze the current data, that is, reported cases and deaths, as suggested by researchers (Albulescu, 2020a; Ritchie and Roser, 2020). Taking this into account, to evaluate the mortality risk, the measure of COVID-19 case fatality rate is used in this research and measured as a ratio between confirmed deaths and confirmed cases in China (FRct), in Europe (FRet), and globally (FRwt).

These variables are further analyzed using the methods of descriptive statistics, correlation, and regression analysis. To support or reject research hypotheses, the method of bivariate regression analysis and the estimates of t statistics and p-values of the created models were used. For this purpose, the significance level (α) is set to 0.05 (5%).

Descriptive Statistics

In our research, we tried to find the volatility of different indices. For volatility calculation, we used standard deviation. The formula of standard deviation is shown below:

In Eq. (1)

Different scientific works confirm that fund returns, compared with the returns of other securities, do not have normal distributions. Jondeau, E. et al. stressed that “asset returns do not behave according to the bell-shaped curve, associated with the Gaussian or normal distribution.” This creates risks of “higher moments.”

Further in our research, we used skewness and kurtosis measures to find tail risk. As explained in the literature, skewness can be described as the degree of distortion from the symmetrical normal distribution, while kurtosis can be found as a tool for heavy-tailed or light-tailed distribution identification.

Skewness is defined as

Kurtosis is defined as

In Eqs (2), (3),

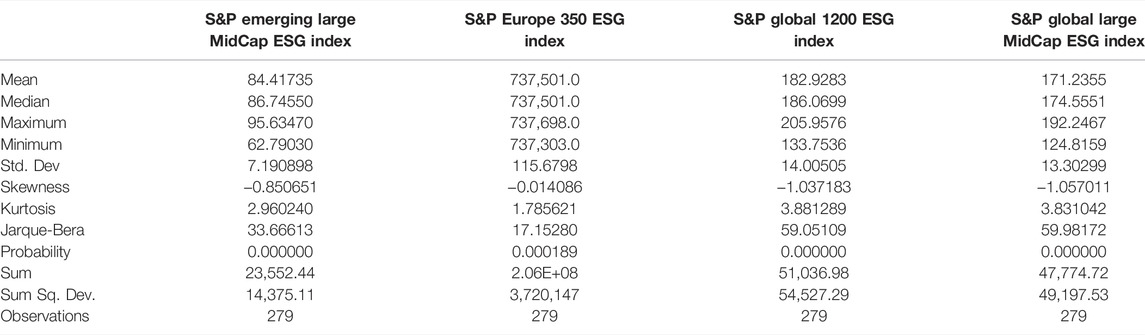

To show the main characteristics of descriptive statistics and to check data distribution, we use data from 2 September 2019, till 1 October 2020. The period was selected quite short just to look at broad tendencies as the main goal of this research was to concentrate on time related to the COVID-19 pandemic.

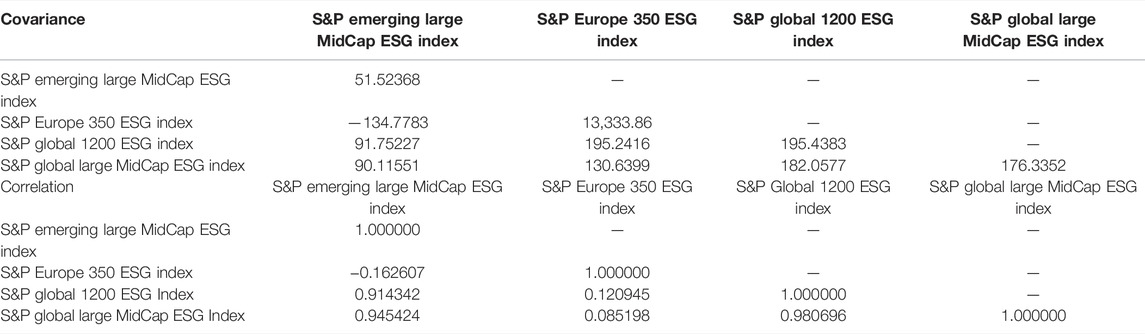

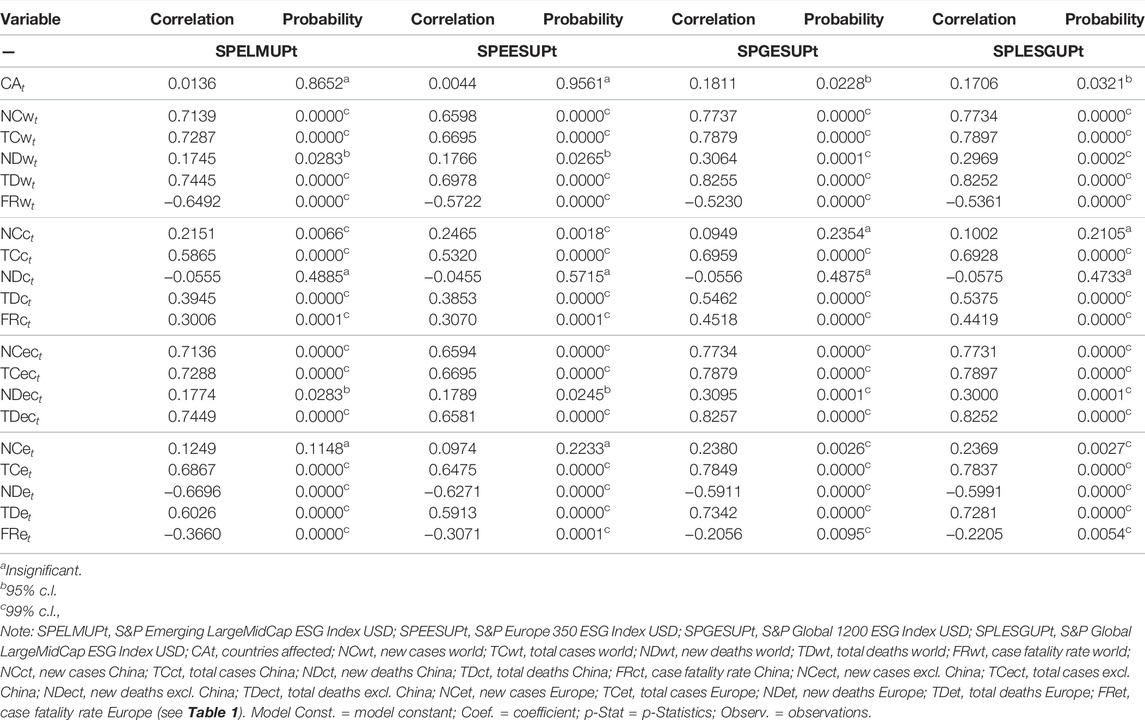

Looking at the correlation matrix (Table 3), we can see a strong positive correlation between ESG investments in Emerging markets and ESG investments in Global markets (indices: S&P Emerging LargeMidCap E.S.G. Index, S&P Global 1200 ESG Index, S&P Europe 350 ESG Index, S&P Global LargeMidCap E.S.G. Index). Nevertheless, the most interesting fact in the correlation matrix is that we have a negative correlation between the European ESG investments and Emerging markets ESG investments. Also, we would like to pay attention to the fact that the correlation between the European ESG market and Global markets is positive but exceptionally low. Therefore, we can conclude that the European ESG market might be suitable for SRI portfolio management diversification purposes.

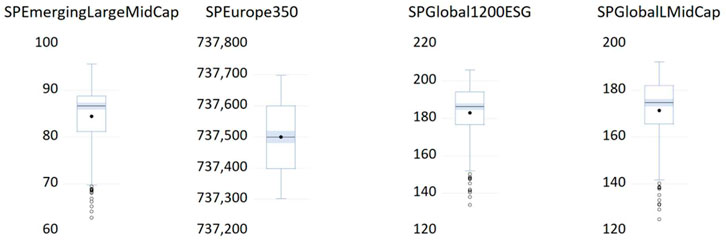

Data in Figure 2 show that the European ESG market is a bit different in the period we are analyzing as the index standing for this market does not have outliers, and we see that the median is equal to the mean of the distribution, which shows that the data have a normal distribution shape and skewness and confirm normal distribution as its level is incredibly low (see Table 2).

Regression Model Specification

The second step of analysis is to assess the impact of COVD-19 on ESG stock market indices. Firstly, correlation analysis is conducted. Secondly, bivariate linear regression models (least squares), examining the changes of dependent variables (ESG stock market indices) as the functions of each independent (COVID-19 related) variable, are constructed (Eq. (4)).

In this model, α corresponds to constant, n = 1 to 4 and corresponds to ESG market indices, k = 1 to 20 and corresponds to independent (COVID-19 related) variables (see Table 1), and ε corresponds to error. Thus, for each of the four selected ESG stock market indices, 20 bivariate linear regression models are constructed.

The descriptive statistics of dependent and independent variables are provided in Table 4. The dynamics of those variables are depicted in Supplementary Appendix SA1.

Analysis of the dynamics of COVID-19 related variables and ESG stock market indices reveals that the strongest adverse reaction of ESG stock market indices to COVID-19 is seen in March 2020–April 2020, while in the following periods investigated, such reaction is no longer clearly expressed (see Supplementary Appendix SA1). For this reason, a more detailed analysis is needed, the results of which are presented in the next section.

Results and Discussion

Correlation Between COVID-19 and the Performance of ESG Stocks

To access the effect of COVID-19 on the performance of securities meeting ESG criteria (measured by four ESG stock market indices) during the selected timeframe (01/01/2020–30/09/2020); period t = 1 … 198), at the first step, the correlation analysis of selected variables is conducted (see Table 5).

Based on the results of Table 5 (correlation coefficients and probabilities), it can be said that:

1) Only three COVID-19-related variables [number of countries affected (CAt), number of new deaths confirmed per day in China (NDct), and number of new cases confirmed per day in Europe (NCet)] are not statistically related to the performance of Emerging and European ESG stock markets (S&P Emerging LargeMidCap E.S.G. and S&P Europe 350 ESG indices) (proved to be insignificant), while even 17 variables are statistically significant (99% or 95% confidence level) related to the performance of Emerging and European ESG stock markets, 14 of them directly and only 3 (fatality rate in world (FRwt), number of new deaths confirmed per day in Europe (NDet) and fatality rate in Europe (FRet)) inversely;

2) Only two COVID-19-related variables (number of new deaths per day and total deaths in China (NDct and NCct, respectively) are not statistically related to the performance of global ESG stock markets (S&P Global 1200 ESG and S&P Global LargeMidCap E.S.G. indices), while 18 variables are statistically significant related to global indices, 15 of them directly, while only 3 (fatality rate in world (FRwt), number of new deaths confirmed per day in Europe (NDet) and fatality rate in Europe (FRet)) inversely.

As we can see, the results of correlation analysis revealed an inverse relationship between the performance of Emerging, Europe, and Global ESG stock markets and: 1) the number of deaths caused by COVID-19 infection in Europe, and 2) COVID-19 mortality risk in Europe and globally.

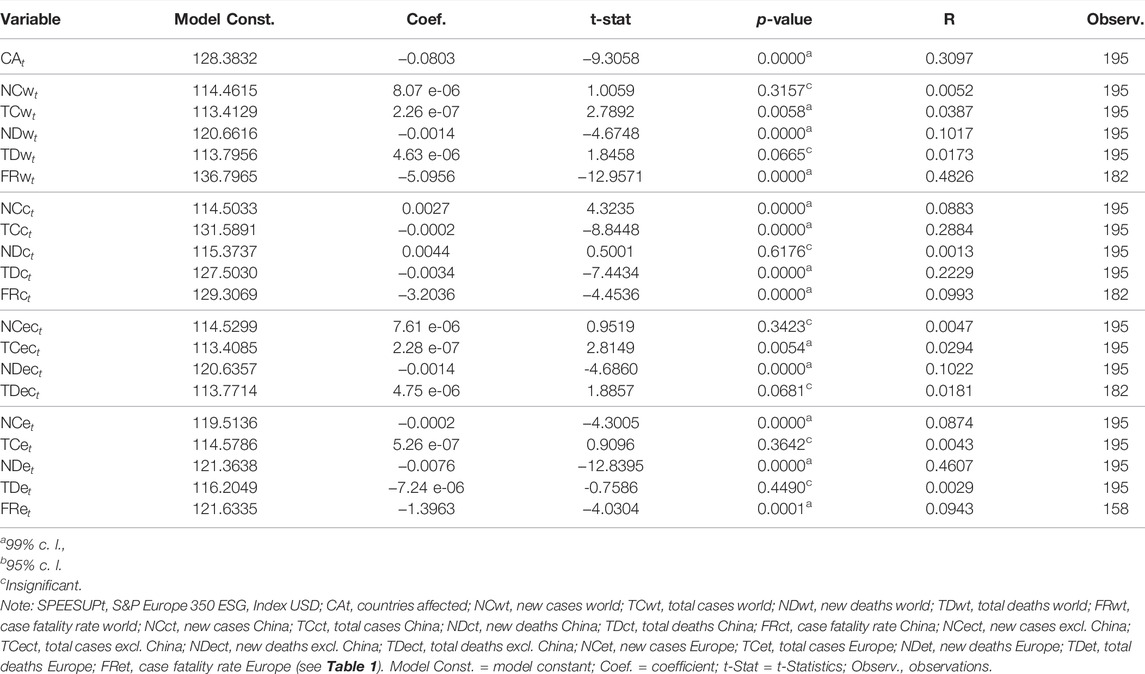

To get a clearer view of COVID-19 effect on the performance of Emerging, European, and Global ESG stock markets, the regression analysis is further performed. To assess the impact of COVID-19 on ESG stock markets, the bivariate regression models (least squares) are constructed (Tables 6, 7, 8, 9).

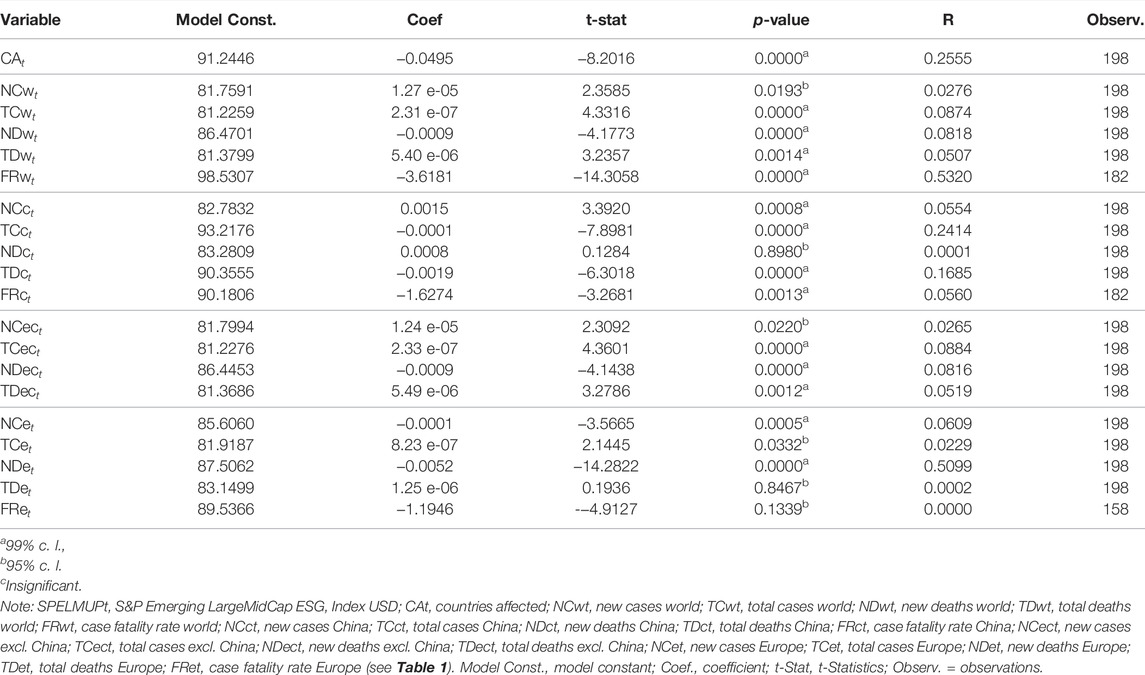

Effect of COVID-19 on the Performance of Emerging ESG Markets

The results of the assessment of COVID-19 impact on the performance of Emerging ESG markets are provided in Table 6.

Based on the results of Table 6 (t value and p statistics), it can be noticed that:

1) Three variables [number of new deaths reported per day in China (NDct), number of total deaths in Europe (TDet), and case fatality rate in Europe (FRet)] proved to have no statistically significant effect on the performance of Emerging ESG stock markets;

2) Eight variables (NCwt, TCwt, TDwt, NCct, NCect, TCec, TDect, and TCet) appear to affect the performance of the Emerging ESG stock market positively, while nine variables (CAt, NDwt, FRwt, TCct, TDct, FRct, NDect, NCet, and NDet) negatively.

3) The number of countries that reported cases of COVID-19 has s significant negative impact on the performance of emerging ESG stock markets.

4) Global and China case fatality rates had the most significant negative impact on the performance of the emerging ESG stock market.

5) The number of new deaths caused by COVID-19 appeared to have a significant negative impact on the performance of Emerging ESG stock markets in three of four geographical perspectives (Europe, rest of the world excluding China, and global).

6) An interesting result is that the market reaction to an increasing number of daily COVID-19 cases confirmed differs depending on the geographical perspective: The reaction to the increase in China, the rest of the world excluding China, and global daily cases is positive, while the reaction to increase of daily cases in Europe is significantly negative.

To conclude, it can be said that in the case of Emerging ESG stock markets, the results support Hypothesis 1 and Hypothesis 4. In contrast, in the case of the remaining hypotheses, the results are ambiguous.

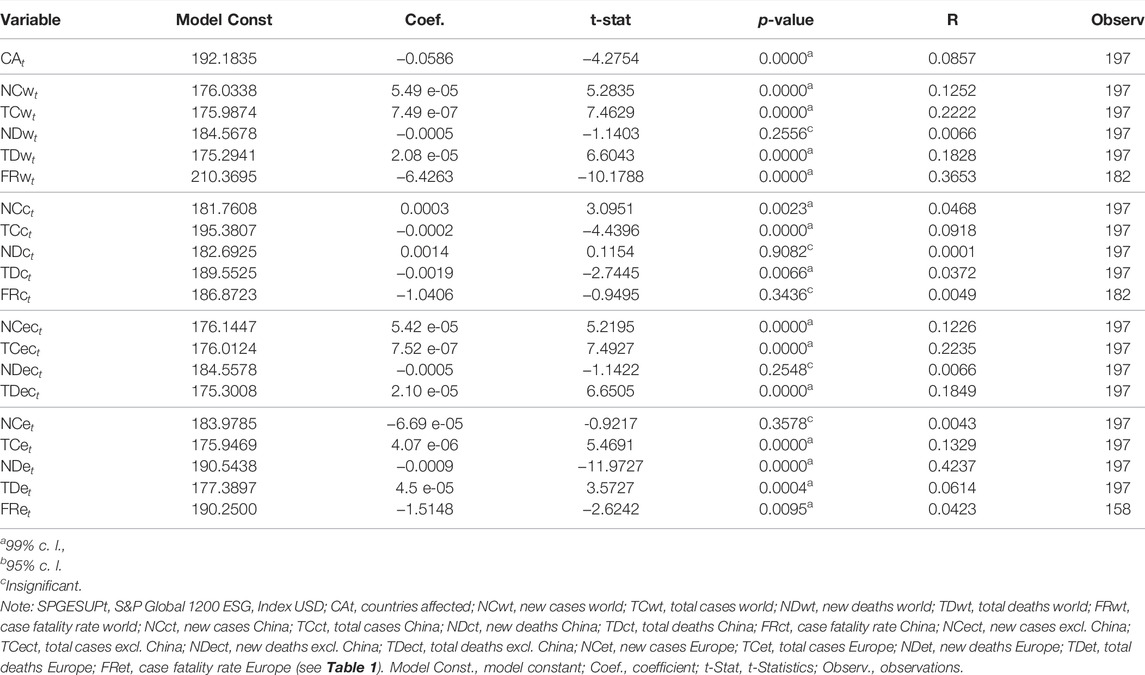

Effect of COVID-19 on the Performance of European ESG Markets

The results of the assessment of COVID-19 impact on the performance of European ESG markets are provided in Table 7.

Based on the results of Table 7 (t value and p statistics), it can be said that:

1) Seven variables (NCwt, TDwt, NDct, NCect, TDect, TCet, and TDet) proved to have no statistically significant effect on the performance of the European ESG stock market (S&P Europe 350 ESG Index).

2) 10 variables (CAt, NDwt, FRwt, TCct, TDct, FRct, NDect, NCet, NDet, and FRet) appear to affect the stock market negatively, while only 3 (TCwt, NCct, TCect) positively.

3) The number of countries that reported cases of COVID-19 has s significant negative impact on the performance of the European ESG stock markets.

4) Global case fatality rate as well as case fatality rates in Europe and China seemed to show the most significant adverse effect on the performance of the European ESG stock market.

5) The number of new deaths per day caused by COVID-19 appeared to have a significant negative impact on the performance of the European ESG stock markets in three of four geographical perspectives (Europe, rest of the world excluding China, and global), while the number of new deaths in China has no significant impact.

6) An interesting result is that the number of total deaths in China has a significant negative impact on the European market. In contrast, the number of deaths in other regions seemed to have no statistically significant impact.

To conclude, it can be said that, in the case of the European ESG stock markets, the results support Hypothesis 1, Hypothesis 3, and Hypothesis 4. In contrast, in the case of Hypothesis 2, the results are ambiguous.

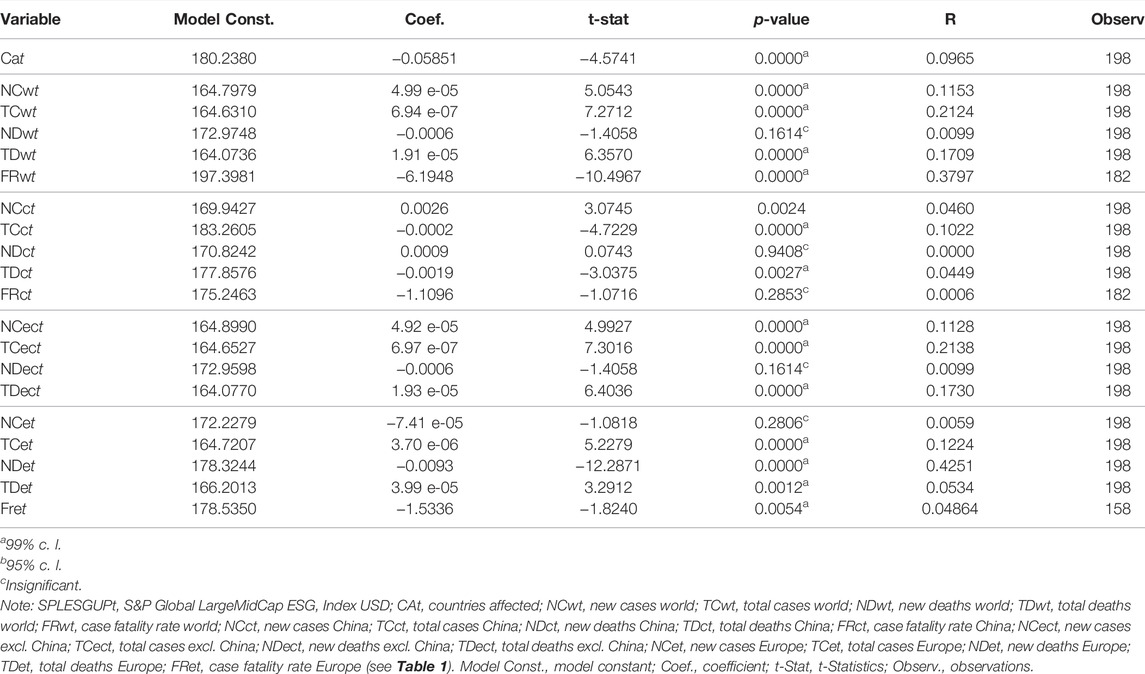

Effect of COVID-19 on the Performance of Global ESG Markets

The results of the assessment of COVID-19 impact on the performance of Global ESG markets (measured by S&P Global 1200 ESG Index and S&P Global LargeMidCap E.S.G. Index) are provided in Tables 8 and 9.

It is important to notice that: 1) the results in Table 8 and Table 9 are remarkably similar, which suggests that the impact of COVID-19 does not depend on the capitalization size and 2) the results in Tables 8 and 9 differ from the results in Tables 6 and 7, thus showing that the effect of COVID-19 on Global ESG stock markets is slightly different from that on Emerging and European ESG stock markets. The main similarities and differences are worth further discussion.

Based on the results of Tables 8 and 9 (t value and p statistics), it can be said that:

1) Five variables (number of new deaths reported per day in China, Europe, and in the rest of the world excluding China (NDwt, NDct, NDect), the number of daily new cases reported in Europe (NCet), and case fatality rate in Europe (FRet)), proved to have no statistically significant effect on the Global ESG stock market.

2) Nine variables affect the performance of the Global ESG stock market positively (NCwt, TCwt, TDwt, NCct, NCect, TCec, TDect, TCet, and TDet), while six negatively (CAt, FRwt, TCct, TDct, FRct, and NDet).

To conclude, it can be said that in the case of the Global ESG stock markets, the results support Hypothesis 1 and Hypothesis 4. In contrast, in the case of the remaining hypotheses, the results are ambiguous.

Comparison of COVID-19 Effect on Emerging, European, and Global ESG Markets

The comparison of findings allows us to say that:

1) As with Emerging and European markets, the number of countries that reported cases of COVID-19 has s significant negative impact on the performance of the Global ESG stock market.

2) As well as in the case of Emerging and European ESG stock markets, the global case fatality rate proved the most significant adverse effect.

3) It is interesting that unlike cases of Emerging and European markets, the Global ESG stock markets do not prove a significant reaction to the increase of daily COVID-19 cases in Europe, while the reaction to the increase in China, the rest of the world excluding China, and global daily cases is the same, that is, positive.

4) It is also worth mentioning that the number of new deaths per day caused by COVID-19 appeared to have a significant negative impact on the performance of the Global ESG stock markets only in one of four geographical perspectives (Europe) (in comparison with three of four perspectives in earlier cases).

5) Unlike the case of European ESG stock markets, the number of total deaths caused by COVID-19 in Europe, the rest of the world, excluding China, and globally has proven to have a significant positive impact on the performance of the Global ESG stock markets. In contrast, the reaction to increasing number of total deaths in China appeared to be negative.

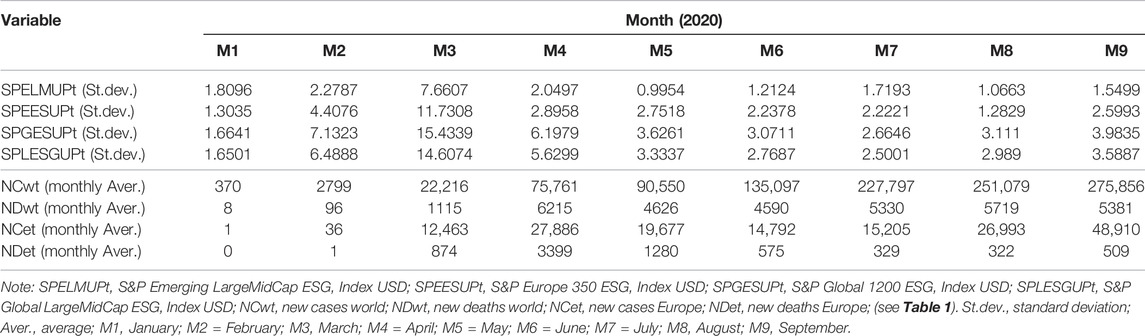

COVID-19 Effect on the Volatility of ESG Stock Markets

In addition to the results discussed, it is worth mentioning that a substantial number of authors (e.g., Albulescu, 2020b; Zaremba et. Al., 2020; Bakas and Triantafyllou, 2020; and others) expressed the impact of COVID-19 on financial volatility rather than on market returns. Therefore, to assess the short-term effect, ESG stock market volatility expressed monthly standard deviations of the values of indices are analyzed in relation to the average number of new COVID-19 cases and deaths per month (both Global and European) (Table 10).

The data in Table 10 show that the most pronounced adverse reaction (estimated by the highest volatility) of all analyzed indices was seen in March, when the number of confirmed new COVID-19 cases and deaths increased rapidly. In later periods, a decrease in volatility is seen even with the increasing incidence of COVID-19 infections.

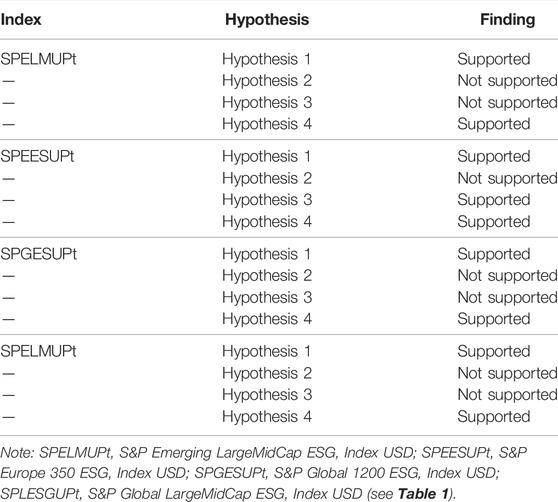

According to the summary of research results (provided in Supplementary Appendix SA2), it can be concluded that the findings of this research support the following hypotheses: H1 and H4. In contrast, hypotheses H2 and H3 cannot be supported, while the results obtained are ambiguous and require further analysis (Table 11).

This research shows that the global prevalence of COVID-19 infection, expressed as the number of countries that have confirmed COVID-19 cases, has a significant negative effect on the performance of Emerging, European, and Global ESG stock markets. This research has also revealed that the mortality risk of COVID-19 infection, measured as a case fatality rate, has a significant negative effect on ESG stock markets. The effect of COVID-19 cases reported and deaths caused by COVID-19 infection appeared to be mixed.

The results of this research also revealed that: 1) all analyzed ESG stock markets (Emerging, European, and Global) are more sensitive to the growth of COVID-19 deaths in Europe than in China; and 2) China’s COVID-19 case fatality rate has no statistically significant impact on the performance of Global ESG markets, while it negatively affects Emerging and European ESG stock markets. This suggests that markets tend to respond differently to the mortality of COVID-19 seen in different regions.

Conclusion and Future Research

Conclusion

After researching different regions and stock markets, we noticed some differences in performance and reaction to COVID 19 pandemic. The analysis of the relationship between sustainable investments in different markets revealed that ESG investments in Emerging and Global stock markets are strongly positively correlated. But the relationship between European ESG investments and Emerging markets ESG investments is inverse, so because of these results, we can say that the European ESG market can be used as a diversification measure in low carbon portfolio management.

The comparison of the regression analysis results showed specific differences between ESG investments in Emerging, European, and Global ESG stock markets. Unlike in the cases of Emerging and European ESG markets, the Global ESG stock markets do not prove a significant reaction to the increase of daily COVID-19 cases in Europe, while the reaction to the increase in China, the rest of the world, excluding China, and global daily cases is positive in all markets investigated. The other conclusions can be made that the number of new deaths per day caused by COVID-19 appeared to have a significant negative impact on the performance of the Global ESG stock markets only in one of four geographical perspectives (Europe) (in comparison with three of four perspectives in cases of Emerging and European ESG markets).

The other aspect we would like to stress from our research is that unlike in the case of the European ESG stock markets, the number of total deaths caused by COVID-19 in Europe, the rest of the world, excluding China, and globally has proven to have a significant positive impact on the performance of the Global ESG stock markets. In contrast, the reaction to the increasing number of total deaths in China appeared to be negative.

The differences in Emerging, European, and Global ESG market reactions to the COVID-19 pandemic reveal investment diversification opportunities. Private and institutional investors can achieve better portfolio market risk management results, including sustainable and responsible investments from regions with very low positive or better negative correlations. The other point that practitioners can stress is that investing in ESG investments and other values than profitability should be considered.

The summarized regression analysis results showed that an increasing number of countries that have reported COVID-19 cases have a significant adverse effect on the performance of Emerging, European, and Global ESG stock markets.

The results have also revealed that the case fatality rate of COVID-19 infection has appeared to have a significant adverse effect on ESG stock markets. In contrast, the effect of COVID-19 cases reported (new and cumulative) and deaths (new and cumulative) caused by COVID-19 infection appeared mixed.

The research also revealed that the strongest adverse reaction and volatility of ESG stock market indices to COVID-19 were seen from March 2020 to April 2020; in the later periods, such reaction is no longer dominant. Moreover, a decrease in volatility is seen even with the increasing incidence of COVID-19 infections.

Limitations and Future Research

It is particularly important to note that this research is based on limited data series. The assessment of the COVID-19 effect on ESG stock market performance (indices) using longer-term data series and assessment and comparison of the COVID-19 effect over different timeframes is a further direction for future research.

Some future research can be conducted to extend the results of our research. The longer-term data series could be used to see a more detailed picture of the analyzed issue, and the COVID-19 effect over different timeframes could be assessed and compared. It would be interesting to compare the impact of the COVID-19 pandemic on the stock market of different sectors and bond markets in future research.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, and further inquiries can be directed to the corresponding author.

Author Contributions

Conceptualization, RK, DT, GK-S, JK, and DB; methodology, DT and GS-S; software, DT and GS-S; formal analysis, DT and GS-S; investigation, DT, GS; data curation, DT, GS-S, and DB; writing-original draft preparation, DT, JK and GS-S; writing-review and editing, GS-S, DT, DB, RK, JG, GG, and XY; visualization, DT, JK, and DB; supervision, RK. All authors have read and agreed to the published version of the manuscript.

Funding

This project has received funding from the Research Council of Lithuania (LMTLT), agreement No (SCOV-20–21).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.938141/full#supplementary-material

References

Abdi, Y., Li, X., and Càmara-Turull, X. (2020). Impact of Sustainability on Firm Value and Financial Performance in the Air Transport Industry. Sustainability 12 (23), 1–23. doi:10.3390/su12239957

Abiad, A., Arao, M., Dagli, S., Ferrarini, B., Noy, I., Osewe, P., et al. (2020). The Economic Impact of the COVID-19 Outbreak on Developing Asia. Asian Dev. Bank. Briefs 128, 14. doi:10.22617/brf200096

Adams, C. A., and Abhayawansa, S. (2022). Connecting the COVID-19 Pandemic, Environmental, Social and Governance (ESG) Investing and Calls for 'harmonisation' of Sustainability Reporting. Crit. Perspect. Account. 82, 102309. doi:10.1016/J.CPA.2021.102309

Akhtaruzzaman, M., Boubaker, S., and Umar, Z. (2022). COVID-19 Media Coverage and ESG Leader Indices. Finance Res. Lett. 45, 102170. doi:10.1016/J.FRL.2021.102170

Al-Awadhi, A. M., Alsaifi, K., Al-Awadhi, A., and Alhammadi, S. (2020). Death and Contagious Infectious Diseases: Impact of the COVID-19 Virus on Stock Market Returns. J. Behav. Exp. Finance 27, 100326. doi:10.1016/j.jbef.2020.100326

Albulescu, C. (2020a). Coronavirus and Financial Volatility: 40 Days of Fasting and Fear. SSRN J. doi:10.2139/ssrn.3550630

Albulescu, C. (2020b). COVID-19 and the United States Financial Markets' Volatility. Finance Res. Lett. In press, corrected proof.

Andrew, D. (2020). An Index to Measure the Integrity of Investment Companies Investing Responsibility. Jibrm 5 (5), 36–51. doi:10.18775/jibrm.1849-8558.2015.55.3004

Ardia, D., Bluteau, K., Boudt, K., and Inghelbrecht, K. (2020). Climate Change Concerns and the Performance of Green versus Brown Stocks. Working Paper Research 395. Brussels, Belgium: National Bank of Belgium.

Ashraf, B. N. (2020). Stock Markets' Reaction to COVID-19: Cases or Fatalities? Res. Int. Bus. Finance 54, 101249. doi:10.1016/j.ribaf.2020.101249

Aw, E. N. W., LaPerla, S. J., and Sivin, G. Y. (2017). A Morality Tale of ESG: Assessing Socially Responsible Investing. J. Wealth Manag. 19, 14–23. doi:10.3905/jwm.2017.19.4.014

Badía, G., Cortez, M. C., and Ferruz, L. (2020). Socially Responsible Investing Worldwide: Do Markets Value Corporate Social Responsibility? Corp. Soc. Responsib. Environ. Manag. 27 (6), 2751–2764, November.

Bakas, D., and Triantafyllou, A. (2020). Commodity Price Volatility and the Economic Uncertainty of Pandemics. Econ. Lett. 193, 109283. doi:10.1016/j.econlet.2020.109283

Beck, T. (2020). “Finance in the Times of Coronavirus,” in Economics in the Time of COVID-19. Editors R. Baldwin, and B. Weder di Mauro (London: A VoxEU.org Book, CEPR Press), 115.

Bhaskaran, R. K., Ting, I. W. K., Sukumaran, S. K., and Sumod, S. D. (2020). Environmental, Social and Governance Initiatives and Wealth Creation for Firms: An Empirical Examination. Manage Decis. Econ. 41 (5), 710–729. doi:10.1002/mde.3131

Bloom, E. A., de Wit, V., and Carangal-San Jose, M. J. F. (2005). “Potential Economic Impact of an Avian Flu Pandemic on Asia,” in ERD. Policy Brief Series (Manila: Asian Development Bank. 14), 42.

Bouey, J. (2020). “Assessment of COVID-19's Impact on Small and Medium-Sized Enterprises,” in Implications from China (Santa Monica, California: RAND Corporation), 13.

Buallay, A. M. (2020). Sustainability Reporting and Bank's Performance: Comparison between Developed and Developing Countries. Wremsd 16 (2), 187–203. doi:10.1504/wremsd.2020.105992

Cordazzo, M., Bini, L., and Marzo, G. (2020). Does the EU Directive on Non‐financial Information Influence the Value Relevance of ESG Disclosure? Italian Evidence. Bus. Strat. Env. 29 (8), 3470–3483. doi:10.1002/bse.2589

Cunha, F. A., Oliveira, E. M., Orsato, R. J., Klotzle, M. C., Oliveira, F. L., and Caiado, R. G. (2020). Can Sustainable Investments Outperform Traditional Benchmarks? Evidence from Global Stock Markets. Bus. Strategy Environ. 29. doi:10.1002/bse.2397

Czech, K., Wielechowski, M., Kotyza, P., Benešová, I., and Laputková, A. (2020). Shaking Stability: COVID-19 Impact on the Visegrad Group Countries' Financial Markets. Sustainability 12, 6282. doi:10.3390/su12156282

De Grauwe, P. (2020). The ECB Must Finance COVID-19 Deficits. New York, NY, USA: Project Syndicate. March 18. Available at: https://www.project-syndicate.org/commentary/ecb-needs-to-embrace-covid19-monetary-financing-by-paul-degrauwe-2020-03.

Demers, E., Hendrikse, J., Joops, Ph., and Lev, B. (2020). ESG Did Not Immunize Stocks against the COVID-19 Market Crash. New York, NY, USA: NYU Stern School of Business. Available at: https://ssrn.com/abstract=3675920.

Di Tommaso, C., and Thornton, J. (2020). Do ESG Scores Effect Bank Risk Taking and Value? Evidence from European Banks. Corp. Soc. Responsib. Environ. Manag. 27 (5), 2286–2298. doi:10.1002/csr.1964

Ding, W., Levine, R., Lin, Ch., and Xie, W. (2020). Corporate Immunity to the COVID-19 Pandemic. NBER Work. Pap. 2020, 27055. Available at: https://www.nber.org/papers/w27055.

Dorfleitner, G., Kreuzer, C., and Sparrer, C. (2020). ESG Controversies and Controversial ESG: about Silent Saints and Small Sinners. J. Asset Manag. 21 (5), 393–412. doi:10.1057/s41260-020-00178-x

Dottling, R., and Kim, S. (2020). Sustainability Preferences under Stress: Evidence Form Mutual Fund Flows during COVID-19. SSRN. Available at: https://ssrn.com/abstract=3656756.

Drempetic, S., Klein, C., and Zwergel, B. (2020). The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings under Review. J. Bus. Ethics 167 (2), 333–360. doi:10.1007/s10551-019-04164-1

ECDC (European Centre for Disease Prevention and Control) (2020). COVID-19 Data. Solna, Sweden: ECDC. Available at: https://www.ecdc.europa.eu/en/covid-19/data.

Egorova, A. A., Grishunin, S. V., and Karminsky, A. M. (2022). The Impact of ESG Factors on the Performance of Information Technology Companies. Procedia Comput. Sci. 199, 339–345. doi:10.1016/J.PROCS.2022.01.041

Engelhardt, N., Ekkenga, J., and Posch, P. (2021). Esg Ratings and Stock Performance during the Covid-19 Crisis. Sustainability 13, 7133. doi:10.3390/su13137133

Engle, R. F., Giglio, S., Kelly, B., Lee, H., Stroebel, J., and Karolyi, A. (2020). Hedging Climate Change News. Rev. Financial Stud. 33 (3), 1184–1216. doi:10.1093/rfs/hhz072

Fiskerstrand, S. R., Fjeldavli, S., Leirvik, T., Antoniuk, Y., and Nenadić, O. (2020). Sustainable Investments in the Norwegian Stock Market. J. Sustain. Finance Invest. 10 (3), 294–310. doi:10.1080/20430795.2019.1677441

Garcia, A. S., and Orsato, R. J. (2020). Testing the Institutional Difference Hypothesis: A Study about Environmental, Social, Governance, and Financial Performance. Bus. Strat. Env. 29 (8), 3261–3272. doi:10.1002/bse.2570

Garefalakis, A., and Dimitras, A. (2020). Looking Back and Forging Ahead: the Weighting of ESG Factors. Ann. Operations Res. 294 (1), 151–189. doi:10.1007/s10479-020-03745-y

Glossner, S., Matos, P. P., Ramelli, S., and Wagner, A. F. (2020). Where Do Institutional Investors Seek Shelter when Disaster Strikes? Evidence from COVID-19. CEPR Discussion Papers 15070, CEPR Discussion Papers.

Gougler, A., and Utz, S. (2020). Factor Exposures and Diversification: Are Sustainably Screened Portfolios Any Different? Financ. Mark. Portf. Manag. 34 (3), 221–249. doi:10.1007/s11408-020-00354-4

Harris, S., and Missy, R. (2020). To Prepare for the Next Pandemic, the U.S. Needs to Change its National Security Priorities, Experts Say. Washington, DC, USA: The Washington Post. June 16. Available at: https://www.washingtonpost.com/national-security/toprepare-for-the-next-pandemic-the-us-needs-to-change-its-national-security-priorities-expertssay/2020/06/16/b99807c0-aa9a-11ea-9063-e69bd6520940_story.html.

Hoang, T. H. V., Przychodzen, W., Przychodzen, J., and Segbotangni, E. A. (2020). Does it Pay to Be Green? A Disaggregated Analysis of U.S. Firms with Green Patents. Bus. Strategy Environ. 29, 1331. doi:10.1002/bse.2437

Hübel, B., and Scholz, H. (2020). Integrating Sustainability Risks in Asset Management: the Role of ESG Exposures and ESG Ratings. J. Asset Manag. 21 (1), 52–69.

Jamprasert, N., Kuwalairat, P., Srivisal, N., and Sthienchoak, J. (2020). ESG and Creditworthiness: Two Contrary Evidence from Major Asian Markets. PIER Discussion Papers 129, Puey Ungphakorn Institute for Economic Research, revised Mar 2020.

Jens, H. (2020). “ESG in Private Equity and Other Alternative Asset Classes: What the Industry Has Accomplished So Far Regarding Environmental, Social and Governance Matters,” in EIKV-Schriftenreihe zum Wissens- und Wertemanagement (Luxembourg: European Institute for Knowledge & Value Management (EIKV)), Vol. 39, 39.

Jordà, O., Singh, S., and Taylor, A. (2020). Longer-run Economic Consequences of Pandemics, Unpublished Manuscript, March. Basel, Switzerland: Bank for International Settlements 2020. ISSN: 2708-0420 (online) ISBN: 978-92-9259-369-8 (online).

Jun, W., Shiyong, Z., and Yi, T. (2022). Does ESG Disclosure Help Improve Intangible Capital? Evidence from A-Share Listed Companies. Front. Environ. Sci. 10, 1–11. doi:10.3389/fenvs.2022.858548

Kaiser, L. (2020). ESG Integration: Value, Growth and Momentum. J. Asset Manag. 21 (1), 32–51. doi:10.1057/s41260-019-00148-y

Kapecki, T. (2020). Elements of Sustainable Development in the Context of the Environmental and Financial Crisis and the COVID-19 Pandemic. Sustainability 12 (15), 6188. doi:10.3390/su12156188

Khajenouri, D. C., and Schmidt, J. H. (2021). Standard or Sustainable - Which Offers Better Performance for the Passive Investor? J. Appl. Finance Bank. 11 (1), 1–4.

Kocmanová, A., Dočekalová, M. P., Meluzín, T., and Škapa, S. (2020). Sustainable Investing Model for Decision Makers (Based on Research of Manufacturing Industry in the Czech Republic). Sustainability 12 (20), 1–27.

Krueger, P., Sautner, Z., Starks, L. T., and Karolyi, A. (2020). The Importance of Climate Risks for Institutional Investors. Rev. Financial Stud. 33 (3), 1067–1111. doi:10.1093/rfs/hhz137

Kurtz, L. (2020). Three Pillars of Modern Responsible Investment. J. Investig. ESG Spec. Issue 29, 21–32. doi:10.3905/joi.2020.1.116

Larcker, D. F., and Watts, E. M. (2020). Where's the Greenium? J. Account. Econ. 69 (2), 101312. doi:10.1016/j.jacceco.2020.101312

Lee, H. S. (2020). Exploring the Initial Impact of COVID-19 Sentiment on US Stock Market Using Big Data. Sustainability 12, 6648. doi:10.3390/su12166648

Lee, S., Lee, D., Hong, C., and Park, M.-H. (2022). Performance of Socially Responsible Firms during the COVID-19 Crisis and Trading Behavior by Investor Type: Evidence from the Korean Stock Market. Finance Res. Lett. 45, 102660. doi:10.1016/J.FRL.2021.102660

Levine, D. I. (2020). Simple Steps to Reduce the Odds of a Global Catastrophe. Washington, D.C., USA: The Brookings Institution.

Lewis, A., and Juravle, C. (2010). Morals, Markets and Sustainable Investments: A Qualitative Study of 'Champions'. J. Bus. Ethics 93, 483–494. doi:10.1007/s10551-009-0235-5

Li, J., and Wu, D. (2020). Do Corporate Social Responsibility Engagements Lead to Real Environmental, Social, and Governance Impact? Manag. Sci. 66 (6), 2564–2588. doi:10.1287/mnsc.2019.3324

Lööf, H., Sahamkhadam, M., and Stephan, A. (2022). Is Corporate Social Responsibility Investing a Free Lunch? the Relationship between ESG, Tail Risk, and Upside Potential of Stocks before and during the COVID-19 Crisis. Finance Res. Lett. 46, 102499. doi:10.1016/j.frl.2021.102499

Mahn, K. D. (2016). The Impact of Sustainable Investment Strategies. J. Investig. 25, 96–102. doi:10.3905/joi.2016.25.2.096

Mamaysky, H. (2020). Financial Markets and News about the Coronavirus. Covid Econ. 38, 68–128. Available at: https://cepr.org/content/covid-economics-vetted-and-real-time-papers-0#block-block-10.

McKibbin, W., and Fernando, R. (2020). The Global Macroeconomic Impacts of Covid-19: Seven Scenarios. CAMA Working Paper, 19/2020.

Meher, B. K., Hawaldar, I. T., Mohapatra, L., Spulbar, C., and Birau, R. (2020). The Effects of Environment, Society and Governance Scores on Investment Returns and Stock Market Volatility. Int. J. Energy 10 (4), 234–239. doi:10.32479/ijeep.9311

Mercedes, A. (2020). ESG Fund Scores in UK SRI and Conventional Pension Funds: Are the ESG Concerns of the SRI Niche Affecting the Conventional Mainstream? Finance Res. Lett. 36, 101313. doi:10.1016/j.frl.2019.101313

Mercereau, B., Neveux, G., Sertã, J. P. C. C., Marechal, B., and Tonolo, G. (2020). Fighting Climate Change as a Global Equity Investor. J. Asset Manag. 21 (1), 70–83. doi:10.1057/s41260-020-00150-9

Mirchandani, N., and Rossetti, C. (2020). Using ESG to Enhance Fixed‐Income Returns: The Case of Inherent Group. J. Appl. Corp. Finance 32 (4), 117–126. doi:10.1111/jacf.12437

Modugu, K. P. (2020). Do corporate Characteristics Improve Sustainability Disclosure Evidence from the UAE. Int. J. Bus. Perform. Manag. 21 (1/2), 39–54. doi:10.1504/ijbpm.2020.106106

Mukanjari, S., and Sterner, T. (2020). Charting a "Green Path" for Recovery from COVID-19. Environ. Resour. Econ. 76 (4), 825–853. doi:10.1007/s10640-020-00479-0

Ng, A. C., and Rezaee, Z. (2020). Business Sustainability Factors and Stock Price Informativeness. J. Corp. Finance 64 (C). doi:10.1016/j.jcorpfin.2020.101688

Oehmke, M., and Opp, M. M. (2020). A Theory of Socially Responsible Investment. CEPR Discussion Papers 14351, CEPR Discussion Papers.

Oprean-Stan, C., Oncioiu, I., Iuga, I. C., and Stan, S. (2020). Impact of Sustainability Reporting and Inadequate Management of ESG Factors on Corporate Performance and Sustainable Growth. Sustainability 12 (20), 1–31. doi:10.3390/su12208536

Palma-Ruiz, J. M., Castillo-Apraiz, J., and Gómez-Martínez, R. (2020). Socially Responsible Investing as a Competitive Strategy for Trading Companies in Times of Upheaval amid COVID-19: Evidence from Spain. Int. J. Financial Stud. 8 (3), 1–13. doi:10.3390/ijfs8030041

Pasquini, C. (2020). Climate and Environmental Risk Management in Italian Banks. BANCARIA, Bancaria Ed. 3, 52–61.

Peng, L. S., and Isa, M. (2020). Environmental, Social and Governance (ESG) Practices and Performance in Shariah Firms: Agency or Stakeholder Theory? Asian Acad. Manag. J. Account. Finance 16 (1), 1–34.

Pisani, F., and Russo, G. (2021). Sustainable Finance and Covid-19: The Reaction of Esg Funds to the 2020 Crisis. Sustainability 13, 13253. doi:10.3390/su132313253

Rajesh, R., and Rajendran, C. (2020). Relating Environmental, Social, and Governance Scores and Sustainability Performances of Firms: An Empirical Analysis. Bus. Strat. Env. 29 (3), 1247–1267. doi:10.1002/bse.2429

Ramelli, S., and Wagner, S. (2020). “What the Stock Market Tells Us about the Consequences of COVID-19,” in Mitigating the COVID Economic Crisis: Act Fast and Do Whatever it Takes, a VoxEU.Org eBook. Editors R. Baldwin, and B. W. di Mauro (Washington, D.C., USA: CEPR Press). Available at: https://voxeu.org/content/mitigating-covid-economic-crisis-act-fast-and-do-whatever-it-takes.

Rehman, M. U., and Vo, X.-V. (2020). Is a Portfolio of Socially Responsible Firms Profitable for Investors? J. Sustain. Finance Invest. 10 (2), 191–212. doi:10.1080/20430795.2019.1700722

Ritchie, H., and Roser, M. (2020). What Do We Know about the Risk of Dying from COVID-19? Our World in Data. Available at: https://ourworldindata.org/covid-mortality-risk.

Rui, A., Yrjo, K., Shuai, Y., and Chendi, Z. (2020). Love in the Time of COVID-19: The Resiliency of Environmental and Social Stocks. CEPR Discussion Papers 14661, CEPR Discussion Papers.

S&P Dow Jones Indexes (2020). Index Factsheets 2020. Available at: https://www.spglobal.com/spdji/en/indices/equity/sp-500-esg-index/#overview.

Sabatini, D. (2020). Eu Sustainable Finance and New Disclosure Obligations on Esg Investments. The Impacts on Banks and Investment Firms. BANCARIA, Bancaria Ed. 1, 10–16.

Sadiq, M., Singh, J., Raza, M., and Mohamad, S. (2020). The Impact of Environmental, Social and Governance Index on Firm Value: Evidence from Malaysia. Int. J. Energy Econ. Policy 10 (5), 555–562. doi:10.32479/ijeep.10217

Sansa, N. A. (2020). The Impact of the COVID-19 on the Financial Markets: Evidence from China and USA. Available at: https://ssrn.com/abstract=3562530.

Saygili, E., Arslan, S., and Birkan, A. O. (2022). ESG Practices and Corporate Financial Performance: Evidence from Borsa Istanbul. Borsa Istanb. Rev. 22, 525–533. doi:10.1016/J.BIR.2021.07.001

Schumacher, K., Chenet, H., and Volz, U. (2020). Sustainable Finance in Japan. J. Sustain. Finance Invest. 10 (2), 213–246. doi:10.1080/20430795.2020.1735219

Sharma, P., Panday, P., and Dangwal, R. C. (2020). Determinants of Environmental, Social and Corporate Governance (ESG) Disclosure: a Study of Indian Companies. Int. J. Discl. Gov. 17 (4), 208–217. doi:10.1057/s41310-020-00085-y

Sichigea, M., Siminica, M. I., Circiumaru, D., Carstina, S., and Caraba-Meita, N. L. (2020). A Comparative Approach of the Environmental Performance between Periods with Positive and Negative Accounting Returns of EEA Companies. Sustainability 12 (18), 1–18. doi:10.3390/su12187382

Siri, M., and Zhu, S. (2020). The Integration of Sustainability in the European Framework of Investor Protection. Banca Impresa Soc. 2020 (1), 3–45.

Takahashi, H., and Yamada, K. (2021). When the Japanese Stock Market Meets COVID-19: Impact of Ownership, China and US Exposure, and ESG Channels. Int. Rev. Financial Analysis 74, 101670. doi:10.1016/J.IRFA.2021.101670

Tampakoudis, I., and Anagnostopoulou, E. (2020). The Effect of Mergers and Acquisitions on Environmental, Social and Governance Performance and Market Value: Evidence from EU Acquirers. Bus. Strat. Env. 29 (5), 1865–1875. doi:10.1002/bse.2475

Urwin, R., Worldwide, W. W., and Woods, C. (2009). Sustainable Investing Principles: Model for Institutional Investors. Oxford, UK: Oxford University Press.

Veenstra, E. M., and Ellemers, N. (2020). ESG Indicators as Organizational Performance Goals: Do Rating Agencies Encourage a Holistic Approach? Sustainability 12 (24), 1–15. doi:10.3390/su122410228

Vostrikova, E. O., and Meshkova, A. P. (2020). ESG Criteria in Investment: Foreign and Russian Experience. Finansovyj žhurnal — Financial J. 127006 (4), 117–129. doi:10.31107/2075-1990-2020-4-117-129

WHO (World Health Organization) (2020). Coronavirus Disease (COVID-19) Situation Reports, 2020/01/01-2020/10/01. Geneva, Switzerland: WHO. Available at: https://www.who.int/emergencies/diseases/novel-coronavirus-2019/situation-report.

Widyawati, L. (2020). A Systematic Literature Review of Socially Responsible Investment and Environmental Social Governance Metrics. Bus. Strategy Environ. 29 (2), 619–637. doi:10.1002/bse.2393

Yongjun, T. D., and Yupu, Z. (2020). Do shareholders Benefit from Green Bonds? J. Corp. Finance 61, 101427.

Yue, X., Han, Y., Teresiene, D., Merkyte, J., and Liu, W. (2020). Sustainable Funds' Performance Evaluation. Sustainability 12 (19), 8034. doi:10.3390/su12198034

Zaghum, U., Dimitris, K., and Sypros, P. (2020). The Static and Dynamic Connectedness of Environmental, Social, and Governance Investments: International Evidence. Econ. Model. 93, 112–124. doi:10.1016/j.econmod.2020.08.007

Zaremba, A., Kizys, R., Aharon, D. Y., and Demir, E. (2020). Infected Markets: Novel Coronavirus, Government Interventions and Stock Return Volatility Around the Globe. Finance Res. Lett. 35, 101597. doi:10.1016/j.frl.2020.101597

Zhang, D., Hu, M., and Ji, Q. (2020). Financial Markets under the Global Pandemic of COVID-19. Finance Res. Lett. 36, 101528. doi:10.1016/j.frl.2020.101528

Keywords: ESG, stock market, climate change, COVID-19, sustainable and responsible investments (SRI)

Citation: Chen J, Zhao L, Teresienė D, Keliuotytė-Staniulėnienė G, Budrienė D, Kanapickienė R, Kartasova J and Gu J (2022) Regional Response of Low Carbon Investments to the COVID-19 Pandemic: The Case of Stock Markets in Seeking Carbon Neutrality Goals. Front. Environ. Sci. 10:938141. doi: 10.3389/fenvs.2022.938141

Received: 07 May 2022; Accepted: 26 May 2022;

Published: 03 November 2022.

Edited by:

Xiao-Guang Yue, European University Cyprus, CyprusCopyright © 2022 Chen, Zhao, Teresienė, Keliuotytė-Staniulėnienė, Budrienė, Kanapickienė, Kartasova and Gu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Long Zhao, eXp6aGFvbG9uZ0AxMjYuY29t

Jiang Chen1

Jiang Chen1 Long Zhao

Long Zhao Deimantė Teresienė

Deimantė Teresienė Greta Keliuotytė-Staniulėnienė

Greta Keliuotytė-Staniulėnienė