- 1Department of Finance, School of Economics and Business Administration of Chongqing University, Chongqing, China

- 2Department of Finance, College of Finance and Economics, Chongqing, China

The problem of air pollution caused by carbon dioxide emissions has gradually attracted the international community’s attention. The study shows the effect of foreign direct investment on carbon dioxide emissions in East Asia. Based on the 2011–2020 panel data of East Asian countries, the long- and short-term impacts of trade, foreign direct investment (FDI), and economic growth on the carbon dioxide (CO2) emissions of these nations are estimated using an autoregressive distributed lag model. The results show that in the short term, an increase in per capita gross domestic product (GDP) in the current and previous periods will increase carbon dioxide emissions; an increase in FDI in the current and previous periods will increase CO2 emissions; an increase in trade openness in the current period will increase CO2 emissions. In the long term, per capita GDP, FDI, and trade openness have no significant impact on CO2 emissions. We should encourage foreign-invested enterprises to use and disseminate clean production technologies and environmentally friendly management methods and pay attention to trade structure adjustment.

1 Introduction

The era of international economic globalization spawned a series of factors influencing human beings worldwide and their surroundings. The consumption of a large amount of energy resources is needed in the rapid progress of the economy, which increases global carbon dioxide emissions. Carbon dioxide increases global temperature, and all aspects of its harm have reached an alarming level. Therefore, to reduce the global temperature rise by 1.5°C, many countries signed the Paris climate treaty in 2015. If nothing is done and the temperature rises by 2°C, the world will face the doom of destruction. The challenge of environmental pollution has also driven other international organizations to make an ongoing endeavor, such as the United Nations Framework Convention on Climate Change (UNFCCC), world Health Organization, International Energy Agency, Intergovernmental Panel on Climate Change (IPCC), United Nations Environment Programme (UNEP), World Commission on Environment and Development, etc., to reduce carbon dioxide emissions and limit the temperature rise by 1.5°C.

The problem of atmospheric environmental pollution caused by excessive carbon dioxide (CO2) emissions has attracted the global community’s attention. Environmental pollution impacts various areas such as social production and human lives; Thus, it will affect future economic development, the choices of current economic development mode, and the policy choices and distribution of economic interest patterns worldwide. The economic development of countries mostly shows evident phase characteristics. At different stages of economic development, the leading industries in the national economy vary. The production and development of the leading industries directly affect the primary energy consumption and CO2 emission level. The continuous replacement and reform of energy are an important symbol of the constant development of human society. While promoting economic growth, large volumes of CO2 emissions are produced, which pollute the natural environment and exacerbate climate change. More importantly, the current international traditional energy reserves and environmental carrying capacities are limited. Therefore, from the perspective of industrial structure evolvement, the research on foreign direct investment in East Asian countries on carbon emissions is of great significance.

Carbon emissions are mainly influenced by energy consumption, while the industrial structure under economic growth determines energy consumption. New alternative energy sources need to be developed for the sustainable and healthy development of the global economic society. These core technologies of new energy are concentrated in economically developed countries. At the same time, the period of industrialization has passed in major developed countries, and now, they are in the post-industrialized era dominated by tertiary industry. The tertiary industry has low carbon emissions. Some industries even have zero carbon emissions, which determines that the peak period has passed in the carbon emissions of developed countries. In some developed countries, per capita, carbon emissions have shown a downward trend. However, the developing countries are still in the process of industrialization, whose economic development mode is dominated by the secondary industry, an industrial model of high carbon emissions. The industrial structure determined that the developing countries have the ‘Carbon Lock-In’ limits on technology and investment. It is difficult for them to break away from the energy structure of high carbon emissions in the short run; they need more carbon emission permits in the future to meet the needs of promoting its development. However, the climatic resources have the characteristics of ‘public materials,’ the ownerless environmental capacity, and huge carbon emission reduction costs make the low carbon economy always face the fight between global public interests and state interests, and the fight between many interest groups within countries.

In the last decade, China’s average foreign direct investment (FDI) value has been USD 1,194.510 billion, USD 607.175 billion in Japan, USD 18.204 billion in South Korea, and USD 28.834 billion in Mongolia. China receives more FDI than Japan, South Korea, and Mongolia. Foreign direct investment can bring capital to a host country, advance technology and professional knowledge, and strengthen the international competition mechanism. China emits 9.827 billion tons of CO2, Japan emits 1.195 billion tons, South Korea emits 607 million tons, and Mongolia emits 18.2038 million tons. China’s CO2 emissions exceed Japan, South Korea, and Mongolia. Thus, will FDI increase CO2 emissions? This study develops a model to empirically test the effect of FDI on CO2 emissions in East Asian countries.

The rest of the paper is arranged as follows: the second part is the study background, the third part is the influence mechanism, the fourth part is the research method, the fifth part is the empirical research result, the sixth part is the discussion, some pertinence policy recommendations are put forward, the seventh part is the conclusion.

2 Study Background

Research on the relationship between FDI, energy consumption, and carbon emissions has gained value with the deepening of human industrialization. The comprehensive and systematic study of the coordination relationship between energy, environment, and economy has been important and urgent since the second-generation environmental issue in the 1980s. The academic literature on this issue has been abundant in recent years, but obtaining a clear conclusion has been difficult. There is also a lack of positive and negative evidence on the impact of FDI on China’s environment. At the theoretical level, the evidence in both aspects can be supported by two basic hypotheses: pollution halo and pollution haven. Based on a ternary research framework regarding the energy–economy–environment relationship as the object, we explore the comprehensive balance and coordination development of the FDI–energy consumption–carbon emission relationship.

he first circumstance is to analyze the relationship between FDI and carbon emissions. Hymer, the first independent researcher of FDI theory, proposed monopolistic advantage theory in his doctoral thesis in 1960. According to Hymer, the motivation for FDI was that, compared with the host nation, the investor had more favorable knowledge advantages, including production technologies, management, and organizational skills, sales skills and other intangible assets, and enterprise-scale and other monopolistic advantages, thereby obtaining more benefits from production abroad. Another reason for FDI is that strict energy environmental management and control policies are generally implemented in developed countries. Therefore, some polluting enterprises are more inclined to transfer their factories to developing countries with low environmental standards and lower production costs. Inevitably, FDI causes environmental pollution while promoting local economic development. The latter is the juvenile form of the pollution haven hypothesis. Notably, FDI in pollution-intensive industries in China is also based on this hypothesis. This hypothesis is reasonable, but it lacks strong empirical evidence. Baumol and Oates (1998) theoretically discussed the pollution haven hypothesis. They believed that if developing countries voluntarily implement lower energy and environmental standards, they would inevitably become places of concentrated pollution worldwide. Zarsky (1999), Smarzynska (2001), and Xing and Kolstad (2002) proved this hypothesis.

Based on a cointegration test, Khalil and Inam (2006) concluded the positive impact of FDI on CO2 emissions by using Pakistan’s time-series data from 1972 to 2002. Sha and Shi (2006) measured the environmental effect of FDI by using China’s panel data for the 1999–2004 period. Reportedly, FDI had a significantly negative impact on China’s ecological environment. Talukdar and Meisner (2001) examined the carbon emissions of private departments in 44 developing countries from 1987 to 1995. They found that FDI promoted CO2 emission reduction. The Organization for Economic Cooperation and Development (OECD, 1999) reported that FDI could effectively improve the environmental quality of the host nation. Green and environment-friendly technologies and effective management technologies will facilitate FDI enterprises’ compliance with the environmental standards of the host country than local enterprises (Shehzad et al., 2020; Sarfraz et al., 2019; Sarfraz et al., 2019b).

Jiang and Liu (2011) expanded the environmental Kuznets curve (EKC) and included FDI and spatial correlation. The study showed that spatial correlation significantly impacted the environmental Kuznets inverted U-shaped curve, whereas FDI had no obvious impact. Li and Lu (2010) explored the impact of international trade and other factors on the CO2 emissions of China’s industries by using the trade data of China’s 20 industries with G7 and OECD developed countries based on an environmental input-output model and net import analysis. The empirical results demonstrate that international trade can lower the total CO2 emissions and CO2 emissions per unit of the economic output of China’s industries. Based on international trade, China does not become a “pollution industry heaven” of developed countries. Liu and Yan (2011) concluded that trade opening had a negative effect on CO2 emissions based on an analysis of China’s data from 1952 to 2007. Hu et al. (2012) demonstrated the relationship between China’s trade openness and per capita CO2 emissions using a nonparametric APLM model. The empirical results show that China’s per capita CO2 emissions increase with trade openness (Shah et al., 2019; Ajaz et al., 2020). In other words, trade openness has a significant promotion effect on China’s per capita CO2 emissions. This result supported the pollution haven hypothesis, and Haug and Ucal (2019) investigated the impact of foreign trade and FDI on CO2 emissions in Turkey. Exports, imports, and FDI significantly affect per capita CO2 emissions when linear and non-linear autoregressive distributed lag (ARDL) models are used in different studies. However, FDI has no statistically significant long-term effect. In the long run, lower exports reduce per capita CO2 emissions, but higher exports are not statistically significant. Import increases have heightened per capita CO2 emissions, whereas import decreases have had no long-term effect. Nevertheless, CO2 intensity, which measures CO2 emissions per unit of energy, is unaffected by exports and imports.

Conversely, it is positively influenced by financial development and urbanization. Furthermore, they discovered that rising per capita gross domestic product (GDP) has resulted in lower CO2 emissions, at least in the last decade. Furthermore, the proportion of CO2 emissions in the total CO2 emissions has shifted. Export growth reduces CO2 emissions, whereas imports have the opposite effect. Shahbaz et al. (2019) decomposed the environmental Kuznets curve into scale, technical, and structural effects and incorporated energy consumption, trade openness, and FDI effects into the United States’ carbon emission function. The information on unknown structural damage is also introduced while studying the cointegration relationship between related variables. The empirical results show a cointegration relationship between variables in the presence of the structural mutation.

Furthermore, the scale effect increases CO2 emissions, whereas the technical effect lowers them. Energy consumption also increases carbon emissions, whereas the composition effect improves environmental quality by lowering CO2 emissions. Furthermore, free trade reduces CO2 emissions. However, increased FDI will increase carbon emissions, negatively impacting environmental quality.

Xie et al. (2019) examined the direct and spillover effects of FDI and CO2 emissions in emerging countries using a panel smooth transition regression model with non-linear and dynamic characteristics. The findings indicate that FDI can directly increase CO2 concentrations. Conversely, the economic growth spillover effect demonstrates that FDI can reduce CO2 concentrations. The impact of FDI on total CO2 emissions has shifted from positive to negative as the inflow of FDI increased, thereby confirming the pollution paradise and pollution halo hypotheses. Malik et al. (2020) used ARDL and non-linear ARDL cointegration methods and Granger causality to investigate the long- and short-term effects of per capita income, FDI, and oil price on carbon emissions in Pakistan from 1971 to 2014. Both approaches support Pakistan’s EKC hypothesis. According to the symmetrical results, both economic growth and FDI have increased carbon emissions in the long run, according to symmetrical results. Oil prices have increased emissions in the short run and decreased emissions in the long run. Mahadevan and Sun (2020) investigated the impact of FDI on China’s domestic economy and the carbon emissions associated with the Belt and Road Initiative.

The total amount of FDI flowing into the host country reduces pollution in the eastern and western regions but not in the central region. However, China’s FDI, particularly from the eastern region, has reduced pollution in the country. This fact demonstrates that China may export carbon emissions through FDI to the United Kingdom. However, the impact of Chinese FDI on BRCS pollution varies according to the country’s level of development. It has been discovered that China’s FDI does not affect the low-, middle-and high-income groups. Udemba and Yalcintas (2021) examined Algeria’s sustainable development using non-linear and long-term asymmetric cointegration data from 1970 to 2018. They discovered that economic growth had a positive impact on Algeria’s carbon emissions, fossil fuels had a negative impact on reducing Algeria’s carbon emissions, FDI had a significant impact on reducing Algeria’s carbon emissions, and natural resources had a negative impact on reducing Algeria’s carbon emissions. Liu et al. (2021) examined the long-term impact of FDI on China’s environment using the advanced panel method based on slope uniformity and the cross-section correlation test. GDP and FDI appear to positively impact carbon emissions, whereas foreign trade has an inverse relationship with carbon emissions. Qamruzzaman (2022) examined the relationship between renewable energy, FDI, and agricultural productivity using four expert groups—low-income countries, middle-low-income countries, middle-high-income countries, and a global model. Sarfraz et al. (2022) and Mohsin et al. (2022) employed the generalized method of moments, system moment method, non-linear causality test, and heterogeneous causality test to analyze the CO2 impact on the environment.

The second circumstance explores the dynamic relationship between FDI and energy consumption. Based on China’s provincial panel data from 1995 to 2008, Su and Wang (2011) established a panel vector autoregression model and an econometric panel model to conduct an empirical study on the dynamic relationship between energy consumption intensity and the FDI scale. The empirical results show that a typical inverted U-shaped relationship exists between them. In other words, energy consumption intensity first increases and then decreases with an increase in the scale of FDI. Moreover, FDI has a significantly positive impact on energy consumption intensity, maintained at approximately 4.3%. The impact of energy consumption intensity on the scale of FDI is always stable at the 5.4% level. Sun (2009) dynamically simulated the impact of FDI on two spillover channels—the technological progress efficiency and structural efficiency of China’s energy consumption—by using pulse response functions to test the causal relationship between FDI and the two channels. The results show that FDI can improve energy consumption intensity. However, the Granger causality between FDI and the structural and efficiency factors cannot be determined in the long term.

The third circumstance investigates the relationship between energy consumption and carbon emissions. Gao et al. (2011) conducted an empirical study using Henan’s carbon emission data from 1995 to 2009 and the LDM factor decomposition method based on the carbon emission model provided by the Energy Research Institute of the National Development and Reform Commission. The results show that energy efficiency is the main factor vis-à-vis curbing carbon emissions. The effect of energy structure on the change in per capita carbon emissions in Henan is not evident. An absolute reduction in CO2 emissions can be achieved when the falling rate of carbon emission intensity is greater than the GDP growth rate. Zhu et al. (2009) improved the EKC-based traditional econometric method based on Moon-Sonn, an endogenous economic growth model, and established a new model to predict carbon emission peaks. The proportion of carbon-rich (low-carbon) energy in the energy structure has gradually decreased (increased), thus lowering the rising rate of carbon emissions than energy consumption. Based on the simulation of carbon emission trends under different energy structure changes, the carbon emission peak is closely related to the energy consumption peak. The substitution of non-carbon energy and structural adjustment of fossil fuels can reduce carbon emissions and lower peak emissions.

Nevertheless, it impacts the year when the carbon emission peak occurs. Xu et al. (2006) found that the inhibition of China’s per capita carbon emissions ensues mainly from improving energy efficiency. However, adjusting the energy structure has a minimal effect. The contribution of energy structure and energy efficiency to the inhibition of carbon emissions showed an inverted U shape. Improving energy efficiency is the most effective method to reduce carbon emissions. Fan et al. (2013) decomposed the changes in carbon emissions. The result shows that per capita GDP and population have significant positive effects on carbon emission from the perspective of carbon emissions. In contrast, energy intensity has significant inhibition on carbon emissions.

The research findings on the impact of FDI on pollution levels have thus been inconclusive. The literature focuses primarily on the impact of FDI on carbon emissions in a single country, with few scholars investigating the impact of FDI on CO2 emissions in multiple nations. Consequently, the panel ARDL model is proposed to estimate the long- and short-term impact of FDI on carbon emissions in East Asian countries, and to conduct a comparative analysis of FDI, CO2 emissions, per capita GDP, trade openness, and per capita economic growth in East Asian countries. It provides a reference for East Asian countries to achieve the goals of energy conservation, e-commerce, and per capita economic growth.

3 Influence Mechanism

FDI may have three mechanisms influencing CO2 emission intensity: the pollution refuge effect, scale effect, and pollution halo. On the one hand, FDI will increase the intensity of CO2 emissions through the pollution refuge and scale effects. Inward FDI (IFDI) can accelerate regional economic growth, generate economies of scale, and increase energy consumption and CO2 emissions. Furthermore, developing countries or regions may engage in “bottom-to-bottom competition” and lower the IFDI entry threshold to attract foreign investment. This causes developed countries to transfer “high pollution, high energy consumption, and high emissions,” that is, three-high enterprises, to developing countries and regard them as “pollution shelters,” thereby increasing host countries’ CO2 emissions.

On the other hand, the foreign direct investment will produce a “pollution halo effect,” which will reduce the intensity of CO2 emissions. According to the “pollution halo hypothesis” proposed by Letchumanan and Kodama (2000), IFDI may result in a green technology spillover effect. Foreign enterprise settlements may bring advanced production technology and management modes, which will serve as models for domestic enterprises. Through imitation learning, the host country’s enterprises can fully exploit their “latecomer advantage” to catch up with the level of green technology and environmental management, optimizing the industrial structure and production process and reducing domestic CO2 emissions. When combined with the situation in East Asian countries, a large proportion of foreign investors’ investment in China is impatient, solely for the pursuit of cheap production factors, with no motivation for long-term planning and technological renewal, thereby causing significant damage to the nation’s economic ecology. Therefore, the following research hypotheses are advanced in this study:

H1: FDI has a significantly positive impact on the intensity of CO2 emissions in East Asian countries.

H2: In East Asian countries, per capita GDP significantly impacts CO2 emission intensity.

H3: Trade openness has a significantly positive impact on the intensity of CO2 emissions in East Asian countries.

4 Research Method

4.1 Theoretical Model

The long-term relationships of CO2 emissions with economic growth, FDI, and international trade are shown as follows:

where CO2 refers to CO2 emission amount per capita, PGDP refers to per capita GDP, FDI refers to per capita FDI, OPEN refers to trade openness, GDPG refers to per capita economic growth and

4.2 Empirical Study

4.2.1 Data Illustration

The panel data of East Asian countries from 2011 to 2020, obtained from the World Bank, are used in this study. Trade openness is (value of export +value of import)/PGDP.

4.2.2 Empirical Model

To estimate the long- and short-term impacts of FDI and international trade on CO2 emissions, a panel ARDL model is employed in this study. Compared to the traditional cointegration model, the ARDL model has many advantages. It can be tested and estimated regardless of the regression terms, I (0) or I (1). It is also sufficiently robust when the sample size is small, which can overcome many problems caused by nonstationary time series data. In addition, the ARDL model can be changed linearly to an error correction model integrating short- and long-term impacts and can estimate the short- and long-term relations of variables simultaneously. Based on the panel ARDL model, the explained variable y (CO2 emissions per capita) can be defined as:

where i = 1, 2, … , N represents different provinces; t = 1, 2, … , T represents different years;

The above-stated formula can be parameterized as a vector error correction model as follows:

where

5 Empirical Research Results

5.1 Descriptive Statistics

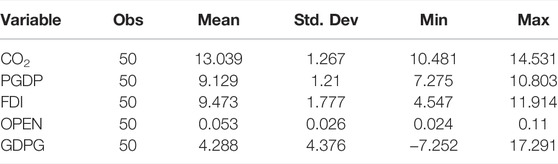

The missing values are filled in the form of exponential interpolation, and finally, 50 samples are obtained. Except for the OPEN (rate), their natural logarithms are calculated. The descriptive statistics for the relevant variables are shown in Table 1.

5.2 Hausman Test

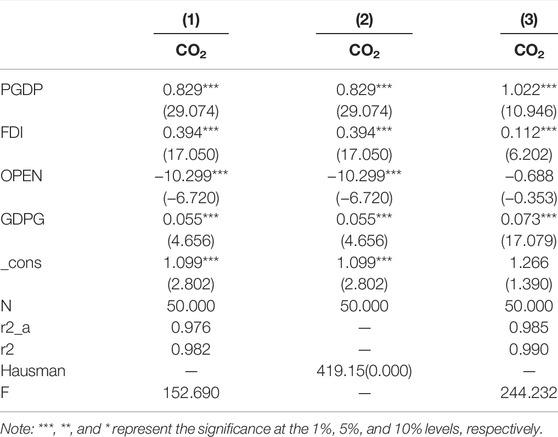

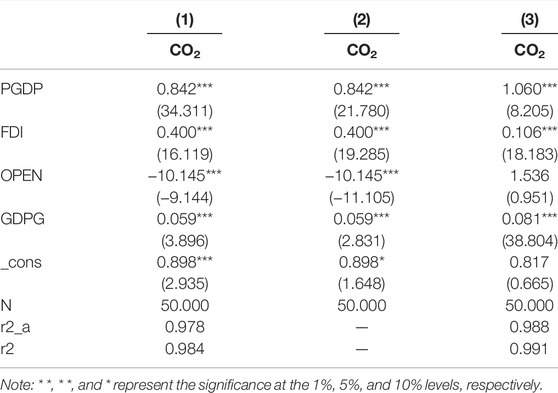

Columns 1–3 in Table 2 present the mixed regression, random effects, and fixed-effects models. The mixed regression results are consistent with the regression results of the random-effects model because the autocorrelation coefficient of the individual disturbance term is close to 0.

The mixed regression and random-effects model results show that the regression coefficient of PGDG is positive and significant at the 1% level. An increase in PGDP will drive CO2 emissions in the current period. The regression coefficient of FDI is positive and significant at the 1% level. An increase in FDI will drive CO2 emissions in the current period. The regression coefficient of OPEN is negative and significant at the 1% level. An increase in OPEN will reduce CO2 emissions in the current period. The regression coefficient of GDPG is positive and significant at the 1% level. An increase in GDPG will increase CO2 emissions in the current period.

The regression result of the mixed-effects model demonstrates that the regression coefficient of PGDG is positive and significant at the 1% level. An increase in PGDP will drive CO2 emissions in the current period. The regression coefficient of FDI is positive and significant at the 1% level. An increase in FDI will drive CO2 emissions in the current period. The regression coefficient of OPEN is negative but insignificant. An increase in OPEN has no significant impact on CO2 emissions in the current period. The regression coefficient of GDPG is positive and significant at the 1% level. An increase in GDPG will increase CO2 emissions in the current period.

To determine a more appropriate model, we conduct a Hausman test. The tested p-value is close to 0 (less than 0.05). This result indicates that the fixed effects model is more appropriate.

5.3 Panel ARDL Model

5.3.1 Stationarity Test

The p-value of each variable in the unit root test is less than 0.1, which indicates that the unit root hypothesis can be rejected at a significance level of 10%. Therefore, the data are stationary, as shown in Table 3.

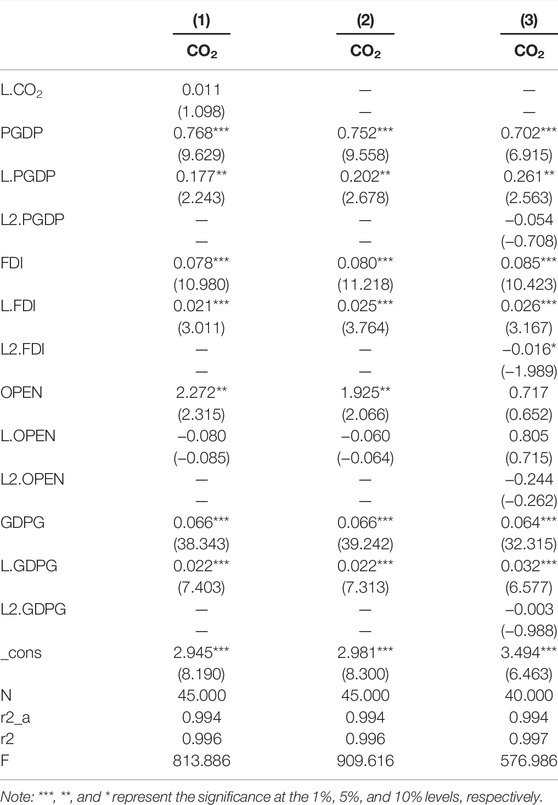

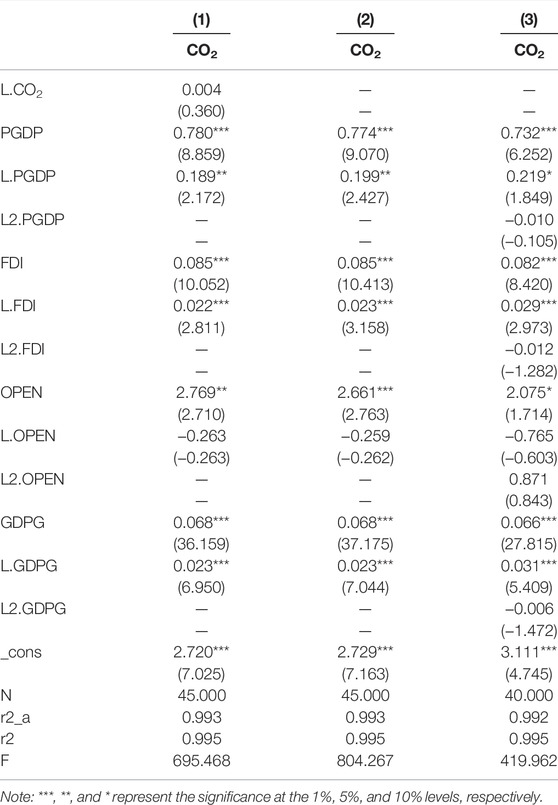

As determined above, the fixed effects model is more appropriate. Therefore, an individual fixed effect is introduced into the panel ARDL model. Table 4 presents the result of the panel ARDL model.

A panel ARDL model with fixed effects is adopted uniformly to estimate the abovementioned model. Column 1 reveals the first-order lag term with dependent variables and the first-order lag term with independent variables. Column 2 presents the first-order lag term with added independent variables, and Column 3 displays the regression results of the added first- and second-order lag terms. The lagged term of CO2 on the CO2 emissions in the current year is insignificant, whereas other variables significantly impact the CO2 emissions in the current year.

The regression coefficient of PGDP in the current period is significantly positive, thus indicating that an increase in PGDP in the current year will promote CO2 emissions. The regression coefficient of PGDP lagging one order is significantly positive, which suggests that an increase in PGDP in the last period will also increase CO2 emissions. However, the regression coefficient lagging two orders is insignificant, indicating that an increase in PGDP in the last two periods has no significant impact on CO2 emissions. In the current period, the regression coefficient of FDI is significantly positive, implying that an increase in FDI in the current year will promote CO2 emissions. The regression coefficient of FDI lagging in one order is significantly positive and indicates that increasing FDI in the last period will increase CO2 emissions.

Nonetheless, the regression coefficient lagging the two orders is insignificant, which establishes that the increase in FDI in the last two periods has no significant impact on CO2 emissions. The regression coefficient of OPEN in the current period is significantly positive, which indicates that an increase in OPEN in the current year will promote CO2 emissions. However, the regression coefficients lagging by one and two orders are insignificant, thus suggesting that an increase in OPEN in the last one to two periods has no significant impact on CO2 emissions. The regression coefficient of GDPG in the current period is significantly positive, thereby indicating that an increase in GDPG in the current year will promote CO2 emissions. The regression coefficient of GDPG lagging one order is significantly positive, implying that increasing FDI in the last period will also increase CO2 emissions. Nevertheless, the regression coefficient lagging by two orders is insignificant, thus indicating that an increase in GDPG in the last two periods has no significant impact on CO2 emissions.

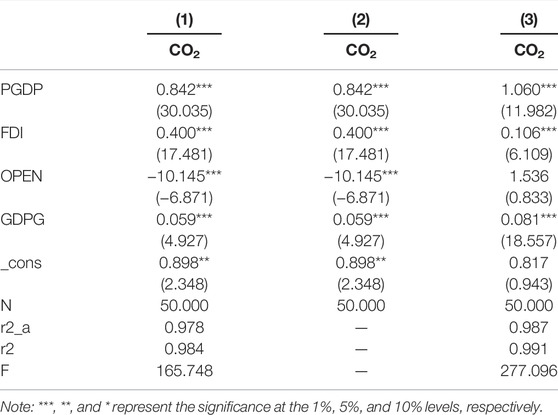

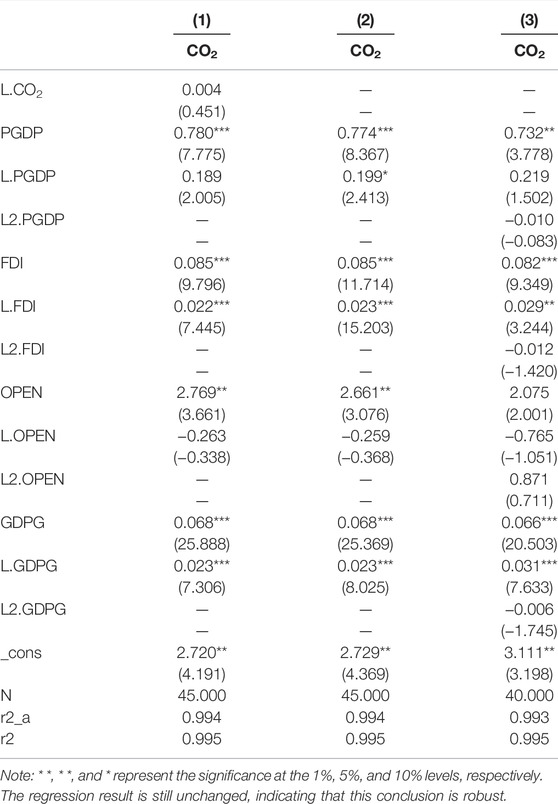

5.3.2 Robustness Test

Considering potential outliers, the abovementioned model is re-estimated after winsorization (Table 5 and Table 6).

5.3.3 Heteroscedasticity Test

This study estimates using a heteroscedasticity-robust standard error to eliminate the influence of heteroscedasticity. The results are presented in Table 7 and Table 8.

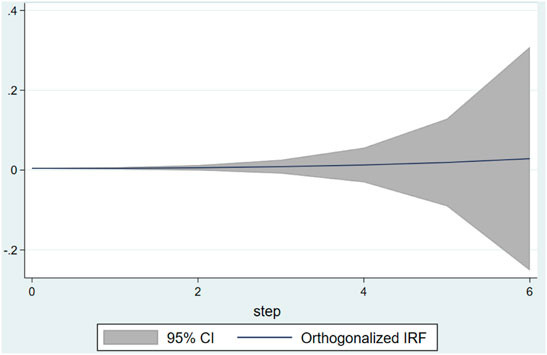

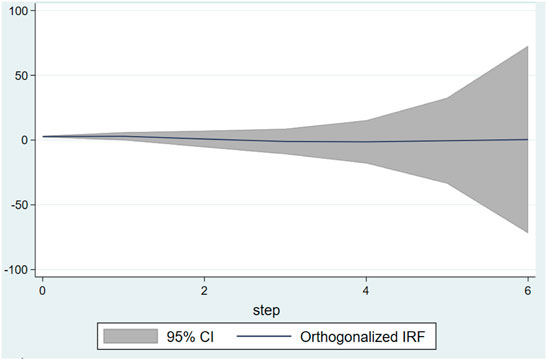

5.3.4 Panel Vector Autoregressive Model

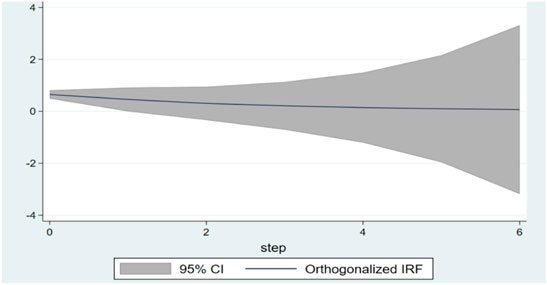

The study performs an estimation via a panel vector autoregressive model and a pulse response function to observe the long-term influence of the above variables on CO2 alone, Figure 1, Figure 2, Figure 3 and Figure 4 present the pulse responses of PGDP, FDI, OPEN, and GDPG to CO2, respectively. The ordinate in the solid line refers to the influence of a certain period on CO2, and the shaded region is the 95% confidence interval. The impact of each variable on CO2 emissions is limited to a period of 0–1. In particular, for OPEN and GDPG, the variances in their estimation coefficients will become abnormally large after four periods. Therefore, PGDP, FDI, OPEN, and GDPG have no long-term impacts on CO2.

6 Discussion

East Asian countries should encourage foreign-invested enterprises to employ and disseminate cleaner production technologies and environmentally friendly management methods, pay attention to the adjustment of trade structures, lower the share of exports of industries with high carbon emission intensity, promote the upgrade of export industries, and reduce the participation of working procedures with high pollution emission intensity. The pollution emission intensity of production is reduced by improving the technical level to offset the negative impact on the environment caused by the scale effect from both the structural and technical aspects. We further enhance the level of environmental regulation, strengthen the strictness of environmental policies, improve environmental standards, encourage enterprises to improve their technical levels, reduce environmental pollution caused by production, and minimize the impact of economic growth on environmental pollution as much as possible while developing trade and continuing to expand its opening to the outside world. The specific policy suggestions are as follows:

First, there should be a focus on guiding foreign-invested enterprises to use advanced technologies in high-energy-consuming industries by introducing foreign capital to lower the pollutant discharge of high-energy-consuming enterprises. The foreign capital in relatively clean industries should also be monitored, and the industrial layout of foreign capital should be optimized. Active play should be given to the demonstration, competition, and technology spillover effects of foreign capital, and enterprises should be helped to improve production technology and reduce carbon emissions.

Secondly, steps must be taken to reduce the share of exports of high-polluting industries and lower the share of exports of coal mining and processing, oil and natural gas mining, food, beverage and tobacco processing, papermaking and printing, petroleum processing and coking, chemical industry, nonmetallic mineral product industry, metal smelting and rolling processing industry, production and supply of electricity, steam and water, and other high-pollutant-discharge industries.

Third, the third industry should be developed, and exports from the service industry should be promoted. Compared to manufacturing and other industries, the service industry has a lower carbon emission intensity. Therefore, vigorously developing service trade is conducive to reducing pollution emission levels.

Fourth, R&D investment should be enhanced, and industrial energy consumption and pollutant discharge should be lowered. The government should encourage enterprises to research and develop, improve their independent innovation ability, and lower their energy consumption and pollutant discharge by advancing their technological level.

Fifth, the countries should enhance environmental governance and improve environmental standards. The authorities should strictly investigate and deal with various environmental violations, improve environmental standards, eliminate enterprises with backward production capacity and substandard pollution emissions, and guide businesses to increase investment in environmental governance through policy adjustments (Global Carbon Budget, 2015; Olivier et al., 2016; Global Carbon Budget, 2017; Unctad, 2017).

7 Conclusion

The long- and short-term impacts of FDI, trade openness and economic growth (per capita GDP) on the CO2 emissions of East Asian countries are examined using an ARDL model. The results show that in the short term, an increase in per capita GDP in the current and previous periods will increase CO2 emissions; an increase in FDI in the present and prior periods will increase CO2 emissions; an increase in trade openness in the current period will increase CO2 emissions. In the long term, per capita GDP, FDI, and trade openness have no significant impact on CO2 emissions.

Data Availability Statement

Publicly available datasets were analyzed in this study. This data can be found here: www.shihang.org.

Author Contributions

YW is in charge of writing the paper YH is responsible for revising the paper.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ajaz, A., Shenbei, Z., and Sarfraz, M. (2020). Delineating the Influence of Boardroom Gender Diversity on Corporate Social Responsibility, Financial Performance, and Reputation. Logforum 16 (1), 61–74. doi:10.17270/J.LOG.2019.376

Baumol, W. J., and Oates, W. E. (1998). The Theory of Environment Policy. Cambridge: Cambridge University Press

Fan, X., Ma, S. C., and Zhu, L. Z. (2013). Simulation Analysis of China’s Carbon Emission Reduction Policy—Based on China’s Energy CGE Model. Ecol. Econ. 9, 50–54.

Gao, C., Gao, G., and Tian, X. (2011). Decomposition Analysis and Reduction Approaches of Carbon Emissions for Energy Consumption in Henan Province. China Min. Mag. 20, 46–49. doi:10.3969/j.issn.1004-4051.2011.03.013

Global Carbon Budget (2015). Global Trade Information Service. Available online: https://ihsmarkit.com/products/maritime-global-trade-atlas.html accessed on May 05, 2022).

Global Carbon Budget (2017). An Annual Update of the Global Carbon Budget and Trends. Available online: http://www.globalcarbonproject.org/carbonbudget/in-dex.htm accessed on May 05, 2022).

Haug, A. A., and Ucal, M. (2019). The Role of Trade and FDI for CO2 Emissions in Turkey: Nonlinear Relationships. Energy Econ. 81, 297–307. doi:10.1016/j.eneco.2019.04.006

Hu, Z.-Y., Liu, Y.-W., and Tang, L.-W. (2012). Research on the Relationship of Energy Consumption, Carbon Emission and Economic Growth in China. J. Hunan Univ. (Nat. Sci.) 39 (7), 84–88. doi:10.3969/j.issn.1674-2974.2012.07.016

Jiang, W., and Liu, M. (2011). Foreign Direct Investment and Environmental Kuznets Curve: A Spatial Econometrical Analysis Based on Chinese Cities. Appl. Stat. Manag. 30 (4), 752–760.

Khalil, S., and Inam, Z. (2006). Is Trade Good for Environment? A Unit Root Cointegration Analysis. The Pakistan Development Review 45 (4), 1187–1196.

Letchumanan, R., and Kodama, F. (2000). Reconciling the Conflict Between the Pollution-Haven’Hypothesis and an Emerging Trajectory of International Technology Transfer. Research Policy 29 (1), 59–79.

Liu, H. J., and Yan, Q. Y. (2011). Trade Openness, FDI and China’s Carbon Dioxide Emissions. The Journal of Quantitative & Technical Economics 3, 21–35.

Liu, X., Wahab, S., Hussain, M., Sun, Y., and Kirikkaleli, D. (2021). China Carbon Neutrality Target: Revisiting FDI-Trade-Innovation Nexus with Carbon Emissions. J. Environ. Manag. 294, 113043. doi:10.1016/j.jenvman.2021.113043

Li, X., and Lu, X. (2010). International Trade, Pollution Industry Transfer and Chinese Industries’ CO2 Emissions. Economic Research Journal 1 (1), 15–26.

Mahadevan, R., and Sun, Y. (2020). Effects of Foreign Direct Investment on Carbon Emissions: Evidence from China and its Belt and Road Countries. J. Environ. Manag. 276, 111321. doi:10.1016/j.jenvman.2020.111321

Malik, M. Y., Latif, K., Khan, Z., Butt, H. D., Hussain, M., and Nadeem, M. A. (2020). Symmetric and Asymmetric Impact of Oil Price, FDI and Economic Growth on Carbon Emission in Pakistan: Evidence from ARDL and Non-linear ARDL Approach. Sci. Total Environ. 726, 138421. doi:10.1016/j.scitotenv.2020.138421

Mohsin, M., Naseem, S., Sarfraz, M., Zia-Ur-Rehman, M., and Baig, S. A. (2022). Does Energy Use and Economic Growth Allow for Environmental Sustainability? an Empirical Analysis of Pakistan. Environ. Sci. Pollut. Res. Int., 1–12. doi:10.1007/s11356-022-19600-5

OECD (1999). Environmental Labelling, Innovation and the Toolbox of Environmental Policy. Govena: OECD.

Olivier, J. G., Maenhout, G. J., and Muntean, M. (2016). Trends Inglobal CO2emissions: 2016 Report. Amsterdam: PBL Netherlands Environmental Assessment Agency.

Qamruzzaman, M. (2022). Nexus between Renewable Energy, Foreign Direct Investment, and Agro-Productivity: The Mediating Role of Carbon Emission. Renew. Energy 184, 526–540. doi:10.1016/j.renene.2021.11.092

Sarfraz, M., Qun, W., Shah, S., and Fareed, Z. (2019). Do hierarchical Jumps in CEO Succession Invigorate Innovation? Evidence from Chinese Economy. Sustainability 11, 2017. doi:10.3390/su11072017

Sarfraz, M., Naseem, S., Mohsin, M., Bhutta, M. S., and Jaffri, Z. u. A. (2022). Recent Analytical Tools to Mitigate Carbon-Based Pollution: New Insights by Using Wavelet Coherence for a Sustainable Environment. Environ. Res. 212, 113074. doi:10.1016/j.envres.2022.113074

Shah, S. G. M., Sarfraz, M., Fareed, Z., Rehman, M. A. u., Maqbool, A., and Qureshi, M. A. A. (2019). Whether CEO Succession via Hierarchical Jumps Is Detrimental or Blessing in Disguise? Evidence from Chinese Listed Firms. Zagreb Int. Rev. Econ. Bus. 22, 23–41. doi:10.2478/zireb-2019-0018

Shahbaz, M., Gozgor, G., Adom, P. K., and Hammoudeh, S. (2019). The Technical Decomposition of Carbon Emissions and the Concerns about FDI and Trade Openness Effects in the United States. Int. Econ. 159, 56–73. doi:10.1016/j.inteco.2019.05.001

Shehzad, K., Xiaoxing, L., Sarfraz, M., and Zulfiqar, M. (2020). Signifying the Imperative Nexus between Climate Change and Information and Communication Technology Development: a Case from Pakistan. Environ. Sci. Pollut. Res. 27, 30502–30517. doi:10.1007/s11356-020-09128-x

Sha, W., and Shi, T. (2006). Environment Effect of Foreign Direct Investment. World Econ. Stud. (6), 76–81. doi:10.3969/j.issn.1007-6964.2006.06.013

Smarzynska, B. K. (2001). Does Relative Location Matter for Bilateral Trade Flows? An Extension of the Gravity Model. Journal of Economic Integration 16 (3), 379–398.

Su, S., and Wang, B. (2011). The Dynamic Analysis on the Relationship between FDI and China's Provincial Energy Consumption Intensity. Technol. Econ. 30, 66–71. doi:10.3969/j.issn.1002-980X.2011.10.013

Sun, H. (2009). On the Ways of FDI's Effect on the Consumption of Energy in China. Technol. Innov. Manag. 30, 180–184. doi:10.3969/j.issn.1672-7312.2009.02.014

Talukdar, D., and Meisner, C. M. (2001). Does the Private Sector Help or Hurt the Environment? Evidence from Carbon Dioxide Pollution in Developing Countries. World Dev. 29, 827–840. doi:10.1016/S0305-750X(01)00008-0

Udemba, E. N., and Yalçıntaş, S. (2021). Interacting Force of Foreign Direct Invest (FDI), Natural Resource and Economic Growth in Determining Environmental Performance: A Nonlinear Autoregressive Distributed Lag (NARDL) Approach. Resour. Policy 73, 102168. doi:10.1016/j.resourpol.2021.102168

Xie, Q., Wang, X., and Cong, X. (2020). How Does Foreign Direct Investment Affect CO2 Emissions in Emerging countries?New Findings from a Nonlinear Panel Analysis. J. Clean. Prod. 249, 119422. doi:10.1016/j.jclepro.2019.119422

Xing, Y., and Kolstad, C. D (2002). Do Lax Environmental Regulations Attract Foreign Investment? Environmental and Resource Economics 21 (1), 1–22.

Xu, G., Liu, Z., and Jiang, Z. (2006). Decomposition Model and Empirical Study of Carbon Emissions for China, 1995-2004. China Popul. Resour. Environ. 16, 158–161. doi:10.3969/j.issn.1002-2104.2006.06.030

Zarsky, L. (1999). Havens, Halos and Spaghetti: Untangling the Evidence about Foreign Direct Investment and the Environment. Available online: https://www.eldis.org/document/A28894 accessed on May 05, 2022).

Keywords: foreign direct investment, carbon dioxide emissions, east asian countries, panel ARDL method, trade openness

Citation: Wang Y and Huang Y (2022) Impact of Foreign Direct Investment on the Carbon Dioxide Emissions of East Asian Countries Based on a Panel ARDL Method. Front. Environ. Sci. 10:937837. doi: 10.3389/fenvs.2022.937837

Received: 06 May 2022; Accepted: 30 May 2022;

Published: 13 June 2022.

Edited by:

Muddassar Sarfraz, Putra Malaysia University, MalaysiaReviewed by:

Binghui Wu, Shaanxi Normal University, ChinaMa Hongqi, China Agricultural University, China

Copyright © 2022 Wang and Huang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuan Wang, OTUxMTQ0MTA2QHFxLmNvbQ==

Yuan Wang

Yuan Wang Yingjun Huang1

Yingjun Huang1