- Hebei University of Economics and Business, Shijiazhuang, China

Innovation is the first development force; thus, it is necessary to study the factors to enhance innovation ability. What type of venture capital strategy is more conducive to promoting enterprise innovation? We use the companies listed on the Growth Enterprise Market from 2009 to 2017 as samples and employ the Poisson regression method to empirically test the impact of venture capital investment timing and rounds of venture capital on entrepreneurial innovation performance. The results indicate that 1) venture capital can significantly improve firms’ innovation performance; however, compared with the early stage investment, the late-stage investment can significantly improve the firm’s innovation performance. With the increase in investment rounds, the innovation performance of enterprises is significantly improved. 2) Investment timing has a significant negative moderating effect on the relationship between investment rounds and firm innovation, that is, late-stage investment will significantly weaken the positive impact of investment rounds on firm innovation.

Introduction

Innovation is the driving force of enterprise sustainable development. Because of its high uncertainty, spillover, and long-term characteristics, enterprise innovation needs a lot of financial support. Banks and other financial institutions have credit discrimination against start-ups, which makes venture investors an important source of capital to help enterprises develop. But venture capitalists are not “philanthropists” and tend to seek high returns rather than promote corporate innovation. However, the high return pursued by venture capital often depends on the high growth of start-ups and the professionalism of investment (Dang et al., 2014; Huang et al., 2016). In theory, professional venture capitalists can earn high returns by choosing investment strategies to promote enterprise growth. Timing and rounds are the investment strategy often adopted by venture capital. However, there are many factors affecting the return of venture capital in the capital market; it is possible for venture capital to obtain a high return without encouraging enterprise innovation. Therefore, based on the current situation of China’s market development, this article discusses whether the venture capital timing and round strategy choice will affect enterprise innovation performance1 so as to determine whether the venture capital use strategy choice affects enterprise innovation.

Scholars have long debated how the timing of venture capital investment affects the innovation performance of start-ups. Some scholars believe that early venture capital intervention can provide value-added services, reduce the degree of information asymmetry, and promote enterprise innovation. Based on market efficiency, some scholars suggest that venture capital tends to intervene in the later stage to obtain high returns more quickly and reliably. In fact, venture capital institutions have different investment objectives, risk preferences, and investment strategies; thus, the timing of entering start-up enterprises will naturally be different. Start-ups face many difficulties in the early stage, so when venture capital institutions intervene in the early stage of enterprises, they provide value-added services, such as financial support and industry experience, which is more conducive to helping enterprises improve their growth speed and lay a solid foundation for development through innovation. Due to the late start of China’s GEM market and relatively high threshold, some venture capital institutions tend to grandstand, which are more inclined to investing in the late-stage of start-up enterprises (within 3 years before IPO). Therefore, venture capital institutions invest different amounts of time and energy due to different investment timings, which results in different impacts on entrepreneurial innovation performance.

Once the venture capital invests the money, it may be “held up” by a start-up. Therefore, venture capital usually chooses the phased investment strategy to reduce the risk of being held up. At present, there are many researches regarding the phased investment strategy, but the influence on the number of investment rounds in the phased investment process is insufficient. In the GEM market, with the increase in investment rounds, venture capital has a great binding force on enterprises, which may result in two different consequences. One is to monitor the start-up enterprises to make them work harder, thus promoting innovation; the other is to hinder R&D investment due to the risk of capital shortage, thus inhibiting enterprise innovation. Furthermore, the risk of venture capital entrapment at different times is not the same. In the early stage, the information asymmetry between venture capital and entrepreneurs is high, and the risk of being caught is also high. The influence of multi-round investment may be greater than that of late-stage investment.

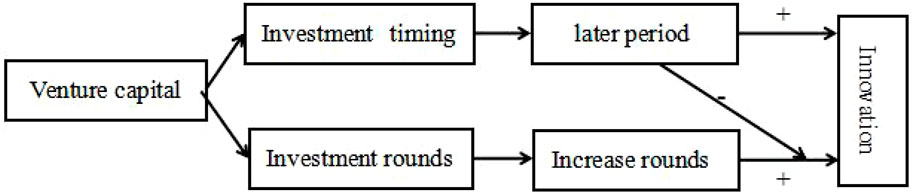

In the current GEM market, does the multi-round investment of venture capital have an impact on innovation performance? And how does the investment timing affect the relationship between multi-round investment and entrepreneurial innovation performance? Based on these problems, this article uses the enterprises listed on GEM from 2009 to 2017 as samples and combines the data collected from the Wind and CSMAR databases as well as the State Intellectual Property Office (SIPO) and prospectuses to conduct research. Using the Poisson regression and PSM methods, the research found that venture capital intervention can significantly improve enterprise innovation performance. The impact of venture capital investment timing and rounds on enterprise innovation performance is significant, which can be shown as follows: compared with early stage investment, late-stage investment can promote enterprise innovation performance more. The more investment rounds, the stronger the promotion effect on enterprise innovation activities. Further analysis revealed that investment timing has a moderating effect on the relationship between investment rounds and entrepreneurial innovation performance (see Figure 1).

The innovation of this paper mainly lies in that, based on the innovation-driven strategy and the characteristics of GEM market in China and also based on the theories of locking-up risk, monitoring cost, signal transmission, learning effect, short-term return, and convenience of long-term value acquisition, the influence of venture capital timing and multi-round selection strategy on enterprise innovation is inferred. Through the empirical test, it is proven that investment timing and cycles have a significant impact on enterprise innovation performance. By studying the common relationship between the two strategies, we found that different from early stage investment, venture capital late intervention could suppress rounds to promote enterprise innovation performance; the main reason is that the late intervention of venture capital institution and start-ups will weaken the trust relationship by increasing investment rounds. Thus, they are more willing to get what they need and seek development through successful listing.

This article can provide not only reference for in-depth research on the mechanism of venture capital influencing innovation but also guidance for the application of venture capital strategy. Furthermore, it can help relevant departments to understand the relationship between venture capital strategy and innovation performance so as to formulate more targeted incentive policies.

In addition to the introduction, this article also includes five parts: literature review, theoretical analysis and research hypothesis, research samples and variables, empirical analysis, and conclusion.

Literature Review

Timing of Venture Investment and Enterprise Innovation

At present, the positive impact of venture capital on enterprise innovation performance has been increasingly recognized, but what heterogeneity of venture capital affects innovation still needs to be studied. There are many researches on the timing of venture capital investment, which also confirms the significant effect of the investment timing strategy on enterprise performance; however, the direction of impact is different.

In the initial stage of enterprises, it is difficult for new technologies to be recognized and for external financing to be obtained. Venture capital is an important financing channel for start-ups (Huang et al., 2020). Most studies believe that the early time and large amount of venture capital intervention can enhance the ability of the invested enterprises to bear the risk of R&D failure. In addition, a longer investment period is more conducive to the value growth of enterprise innovation. For example, Gou and Dong (2013), based on the theories of “filter,” “guidance,” and “cycle,” proposed that the earlier the venture capital enters the enterprise, the more positive it is to the technological innovation of the enterprise; among them, the “cycle theory” holds that venture capital is involved in early time, and the relative investment time is long (but the paper does not discuss the holding time of venture capital). Hu (2018) demonstrated that venture capital institutions have a long expected investment period for enterprises in the early stage, pay more attention to enterprise innovation, help enterprises join technology alliances, and increase R&D investment. Cheng and Zou (2019) found that venture capital involved in the early stage of enterprise can help start-ups improve innovation performance through certification and supervision functions. Chu et al. (2021) showed that the greater the uncertainty the enterprise faces, the more the venture capital can improve the innovation level of the enterprise. On the contrary, Lin et al. (2020) pointed out that venture capital involved in the later stage of enterprise is more focused on marketing and commercial activities, as well as innovation output expansion, so it is not conducive to encouraging innovation. Cheng and Zou (2020) conducted an analysis from three aspects: the wealth effect of listing greater than the value-added effect, high agency cost, and insufficient attention to intellectual property rights in China. They found that although venture capital tends to intervene in the late-stage of enterprise, venture capital entering in the late-stage of enterprise has no value-added effect and cannot promote enterprise innovation.

Some scholars have also found that venture capital is more willing to intervene in the late-stage to support enterprise innovation. Faria and Barbosa (2014) focused on the study of whether venture capital supports innovation or venture capitalists respond to innovation performance signals of enterprises. They found that venture capitalists are more willing to support enterprise innovation after enterprises have passed the initial stage or even longer uncertain stage. From the perspective of the invested enterprises, in the later stage of development, the bargaining power of the enterprises will be improved, and they will no longer worry about financing difficulties, which will affect the best investment opportunity (Antill, 2017). Therefore, in the later stage, they are more willing to accept venture capital institutions that can help them innovate and grow.

Through the above literature review, it was found that there is no unified conclusion on which period intervention can improve the innovation performance of enterprises. Is it early intervention that makes venture capital institutions hold shares for a long time and play a large value-added and supervisory role? Or is it that in the later stage, enterprises have more choices and prefer to choose venture capital institutions that can support their innovation? To answer these questions, further research is needed.

Investment Rounds and Enterprise Innovation

Because the information asymmetry and failure risk of new enterprises are high, venture capital institutions choose to invest in stages to overcome the problem of information asymmetry (Cornelli et al., 2003); deal with market uncertainty (Panda et al., 2020); enhance the monitoring of entrepreneurs (Gompers, 1995); effectively reduce the cost of supervision (Tian, 2011; Chemmanur 2010); and better investigate, constrain, and encourage enterprises, which are conducive to venture capital to avoid the hold up hypothesis and adverse selection problem (Huang et al., 2014). Shen et al. (2014) found that by gradually integrating entrepreneurs’ human capital with physical capital, phased investment can alleviate the problem of entrepreneurs’ locking-up, play the role of supervision and guidance, and improve investment performance at the project level.

From the perspective of venture capital institutions, before investing, the internal staff of the enterprise knows more about its R&D activities. After investment, it is difficult to observe the efforts exerted by entrepreneurs on R&D activities. As one of the strongest mechanisms to overcome information asymmetry, phased investment (Sharma et al., 2016) can help venture capital institutions better understand enterprise R&D activities and establish learning hypothesis. Therefore, while providing funds for enterprises, phased investment integrates human resources with real objects, reduces the risk of brain drain, and provides guarantee for enterprises to perform innovative activities. Venture capitalists supervise the achievements of each stage of a project by stage investment and establish the monitor hypothesis. When venture capitalists find that the development prospect of a project is not optimistic, they stop injecting capital and stop losses in time, thus stimulating innovators (Pan and Sun, 2019). Staged investment can also reduce the uncertainty of technological innovation and improve the risk preference of enterprises, thus encouraging entrepreneurs to participate more in technological innovation activities (Zhang et al., 2016; Zhang et al., 2019). To obtain a higher valuation premium in the next round of financing, entrepreneurs will maintain long-term innovation activities (Chen and Luo, 2018). However, some studies have demonstrated that the staged investment strategy does not necessarily improve performance and will vary with the locking risk (Shen and Hu, 2014).

Furthermore, the stage depends on the number of rounds of influence. There is also uncertainty about how many rounds will lead to an increase in innovation. A high number of rounds of venture capital may increase the cost of negotiation and contract of venture capital institutions, which may lead to poor investment performance (Wang and Wang, 2013); enterprises with poor performance tend to be stingy in spending on innovation. Venture capital institutions invest in multiple rounds, which may also cause entrepreneurs to focus on short-term success rather than long-term value creation, a term known as Window Dressing. To ensure the next round of capital injection, entrepreneurs will not focus on innovation activities (Tian, 2011; Yung, 2018). Between rounds of investment, VCs also increase their understanding of start-ups through learning (Bergemann and Hege, 1998; Fluck 2005, Garrison, and Myers, 2007), and these are mainly based on the external hard information of the enterprise rather than the soft information (intrinsic quality) (Tian, 2011). Therefore, such learning does not allow venture capital to truly understand the innovation capability of the enterprise. However, if the supervision and agency costs of venture capital caused by multiple rounds increase to reduce investment risk and improve investment performance, then increasing investment rounds may also make entrepreneurs more focused on long-term value creation, that is, to perform innovative activities. Therefore, whether the number of rounds of phased investment stimulates innovation mainly depends on the trade-off between costs and benefits.

Through this literature review, it was found that no convincing conclusions have been drawn on whether the timing and rotation selection of venture capital investment affect enterprise innovation. In this article, two investment strategies that affect the incentive effect of venture capital on innovation, namely, timing and rounds, are put together to explore how these two strategies affect innovation. On the one hand, it intends to demonstrate how the timing and rounds of the current GEM stroke investment affect enterprise innovation; on the other hand, it aims to explore how the timing and rounds jointly affect enterprise innovation.

Theoretical Analysis and Hypothesis Development

Studies have found that venture capital in different periods has different impacts on enterprise innovation (Xu, 2015). Venture capital can provide capital for start-ups, alleviate financing constraints (Wu et al., 2012), and provide value-added services (Yin et al., 2020). By using investment experience (Chen et al., 2017), venture capital can help start-ups choose their development direction and reduce financial risks. However, China’s GEM market is still in the process of reform and development. When venture capital enters the early stage of enterprise development, investors and entrepreneurs face high technological and market uncertainties (Gou and Dong, 2013). Although venture capital firms intervene after maturity, there is a “free ride” and speculative incentive to push companies to go public (Cheng and Zou, 2020). However, from the perspective of entrepreneurial enterprises, in the later stage of development, information uncertainty is reduced and financing channels increased (Li et al., 2014). In addition, it is easier for enterprises to reach agreements with venture capital institutions that can guide their innovative growth. From the perspective of venture capital institutions, when venture capital invests in start-ups before IPO, they are more willing to promote enterprises to increase innovation investment and achievements by helping them apply for patents, so that enterprises can meet the listing conditions as soon as possible and venture capital institutions can quickly realize the goal of increasing returns from IPO withdrawal. After all, this timing strategy is easier to “achieve effect instantly” than waiting for an early stage investment. Therefore, our primary hypothesis is as follows:

Hypothesis 1: Compared with early stage investment, venture capital is more inclined to investing in late-stage to improve enterprise innovation performance.

In China’s entrepreneurial market, financing difficulties and risks are the biggest dilemmas faced by entrepreneurial enterprises when financing. Venture capital chooses the multi-round investment strategy, which is more important to reduce investment risk and failure rate. First, selecting multi-round investment strategy can solve the following problems: First, frequent interaction between venture capital and enterprises can reduce enterprise uncertainty (Dong et al., 2014). Second, multi-round investment can help enterprises solve financing problems (Hu and Zhou, 2018; Ma et al., 2018), so that enterprises have enough capital to invest in innovation. Thirdly, multi-round investment can gradually integrate the human capital of entrepreneurs with the physical capital of enterprises, alleviating the problem of entrepreneurs’ holding on to venture capitalists (Shen and Hu, 2014). Finally, multi-round investment can better play the supervision role of venture capital (Lin, 2020) and constrain entrepreneurs to focus on long-term value creation rather than “rent-seeking” activities. Venture capital can play a better supervisory role (Lin, 2020), which constrains entrepreneurs to focus on long-term value creation rather than rent-seeking activities. Second, the learning effect established through multiple rounds of investment is conducive to venture capital institutions using their professional knowledge to provide value-added services for enterprises, which is more conducive to the innovation and growth of enterprises. Third, based on the signal transfer theory, the more investment rounds, the more favorable it is for an enterprise to establish an image with innovative strength and growth potential, and the more favorable it is for the entrepreneurial enterprise to obtain more external financing (Xia and Dan, 2020), thus facilitating more capital investments in innovation. Fourth, with the increase in investment rounds, venture capital institutions will invest more, thus incurring higher cost, which encourages venture capital institutions to be patient and motivated to achieve higher long-term returns through innovation. To sum up, our second hypothesis is stated as follows:

Hypothesis 2: The more rounds of venture capital investment, the more significant the promotion effect on enterprise innovation.

There are differences in the effects of multiple rounds of investment by venture capital institutions involved at different times: When venture capital invests in start-up enterprises in the early stage, it faces a large operational uncertainty but a strong bargaining power. Due to the small scale, simple structure, and small number of employees in the early stage of start-up, the monitoring cost is relatively low, and the enterprises that pass the screening often possess strong innovation potential and growth space. For all these reasons, in the early development of the enterprise strong dependence of venture capital (Yan et al., 2018), and there is no investment in venture capital rounds greatly dilution problem, can better protect the executive decision-making (Dong and Meng, 2016); even if there is dilution, it is relatively mild and easier to reach cooperative agreements. Continuous investment is also more conducive to mitigating the risk of innovation failure caused by insufficient R&D investment. If venture capital chooses to intervene in the later stage of enterprise development, enterprise hopes to expand their scale with the help of venture capital and, at the same time, convey the signal of its good operation to the outside world. However, a single venture capital may not be able to meet the target of expanding the scale and occupying a broader market (Chen and Zhou, 2019). However, for venture capital institutions, the prospect of successful exit is clearer, and the uncertainty of innovation activities is weakened. If venture capital institutions still closely monitor enterprises, conflicts between venture capital institutions and enterprise management may occur (Liu Du et al., 2017). First, strict supervision will create an atmosphere of low tolerance for failure (Fu Leiming et al., 2013), so that managers tend to invest in projects with low risks. Second, it affects the trust of managers (Adams, 2010), which is not conducive to the information exchange between venture capital institutions and enterprises, leading to the failure of venture capital to play an effective value-added role. Therefore, the multi-round investment strategy of venture capital institutions will have a negative impact and even lead to the tendency of entrepreneurial enterprises to whitewash their performance and quickly achieve IPO. On the one hand, they expand their development space; on the other hand, they get rid of the restriction of venture capital institutions. Therefore, the multi-round investment in the later stage cannot effectively stimulate innovation. These suppositions lead to our third hypothesis as follows:

Hypothesis 3: Compared with early stage investment, the late-stage intervention strategy of venture capital will weaken the promotion effect of increasing rounds on enterprise innovation.

Samples Selection and Research Design

Sample Selection

Considering the long-term nature of innovation performance, we selected the companies listed on China’s GEM from 2009 to 2017 as the research samples. The data used in this study are divided into three parts: venture capital data, corporate innovation performance indicators, and related financial information of listed companies. First, we looked in the company’s prospectus to see if there were any venture capital institutions holding shares. This study used the studies conducted by Chen (2017) and Xu (2015) as references to determine whether an enterprise has venture capital involvement: First, we identified the names of the top ten shareholders of gem companies to determine whether they are venture capital institutions. If there are words such as “venture capital,” “science and technology investment,” and “venture capital investment” in the name of the shareholder, the shareholder is identified as a venture capital institution. Second, if there is no word of appeal in the name of the shareholder, please refer to the Directory of China Venture Capital Institutions in the appendix of the 2016 Edition of China Venture Capital Development Report compiled by the Chinese Academy of Science and Technology Development Strategy. If the name of the shareholder is included in the directory, the shareholder will be considered as a venture capital institution. Third, to ensure the comprehensiveness and accuracy of the identification of venture capital institutions, log on to the official website of the company or the Tianyan website to check the main business of the company. If its main business includes “venture capital,” it will be identified as a venture capital institution. If the shareholders are confirmed by the above methods, they are not identified as venture capital institutions, they will be classified as non-venture capital institutions. On this basis, the attribute characteristics of venture capital are divided, and the investment timing is divided according to the 3 years before listing. We call the involvement of venture capital firms in the top ten shareholders within 3 years prior to listing as late involvement (L-period), and the others are classified as early intervention. VC_rounds are defined based on the number of investment times of venture capital firms. If there are two or more venture capital institutions among the top 10 shareholders, it is a joint investment (VC_union). The holding period is defined based on whether the holding period of venture capital is longer than 3 years. Participation governance (VC_director) is defined based on whether venture capital participates in the operation and management of the invested enterprise. Second, the patent data of the listed companies were obtained from the website of the SIPO. Moreover, the financial indicators select the listed year data. To ensure the accuracy and reliability of the data, all data are selected from the CSMAR and WIND databases. Data processing involves 1) elimination of the enterprises with more missing patent data and 2) elimination of the delisted enterprises at the present stage. We ended up with 670 observations.

Define Variables

Dependent Variables

Innovation performance: Zhou et al. (2012) suggested that the number of patent applications can better reflect the innovation performance of an enterprise than the number of licenses. This study selected patent applications to measure innovation performance and used Chemmanur (2014)’s total number of patent applications from 2 years before listing to 2 years after listing as the explained variable2.

Independent Variables

1) Venture capital involvement (VC): The intervention of venture capital was measured by whether there were venture capital institutions among the top ten shareholders of enterprises listed on gem before IPO. If there are venture capital institutions among the top 10 shareholders, VC = 1; otherwise, VC = 0.

2) Venture capital intervention timing (L-period): Based on the research conducted by Cheng and Zou (2020), venture capital intervention within 3 years before listing is defined as late intervention (L-period = 1 and L-period = 0 in the early stage).

3) Venture capital rounds (VC_rounds): Referring to the study conducted by Yu et al. (2014), investment round is defined as the total number of cash investments made by venture institutions to enterprises before IPO. Each venture capital involved in different time, investment rotation superposition.

Control Variables

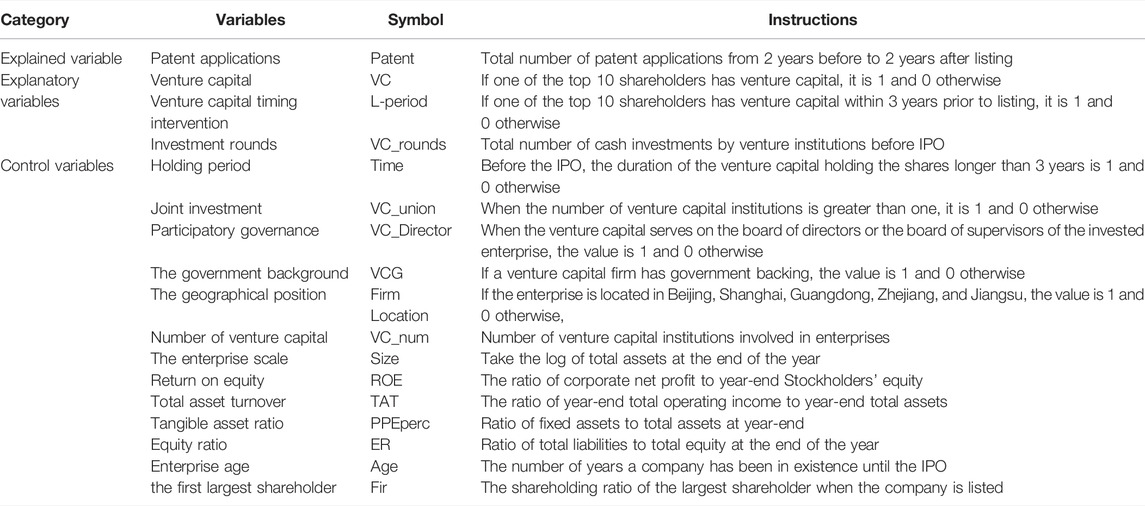

Refer to Lu and Zhang et al. (2017) to select joint investment (VC_union) and investment term (time) and to Huang et al. (2014) and Yu et al. (2014) to select firm location and government background (VCG). The larger the enterprise scale, the more funds can be used for enterprise innovation activities. The higher the return on equity, the stronger the profitability of the enterprise. The more abundant the cash flow of the enterprise, the more funds can be invested in innovation activities. The faster the asset turnover, the more funds are available and can be invested in innovation activities. The larger the ratio of fixed assets to total assets, the less funds can be used for innovation. The equity ratio is used to measure the rationality of enterprise capital structure. All these indicators affect the innovation capability of enterprises. According to Zhang et al. (2016), Zhang et al. (2020), and Zou and Cheng (2017), we selected enterprise scale (size), rate of return on equity, total asset turnover (TAT), tangible asset ratio (PPEperc), equity ratio, and the first largest shareholder (Fir). See Table 1 for specific variable definitions.

Research Design

To test the hypothesis, the number of patent applications is taken as the dependent variable, and the number of patents is a nonnegative integer, which belongs to the discrete data type. The Poisson regression model is constructed by referring to previous literatures:

First, the influence of venture capital intervention on enterprise innovation performance is tested, and model (1) is constructed:

Second, hypothesis 1 and the influence of late intervention on enterprise innovation performance are tested; then, model (2) is constructed:

Third, hypothesis 2 and the impact of investment rounds on enterprise innovation performance are tested; then, model (3) is constructed:

At last, hypothesis 3 is tested. Model 4 is used to analyze the moderating effect of investment timing on investment rounds and enterprise innovation.

X refers to all explanatory variables appearing on the right side of the equal sign, and control refers to other control variables, as defined in Table 1, which also controls the year industry fixed effect.

Empirical Results

Descriptive Statistics

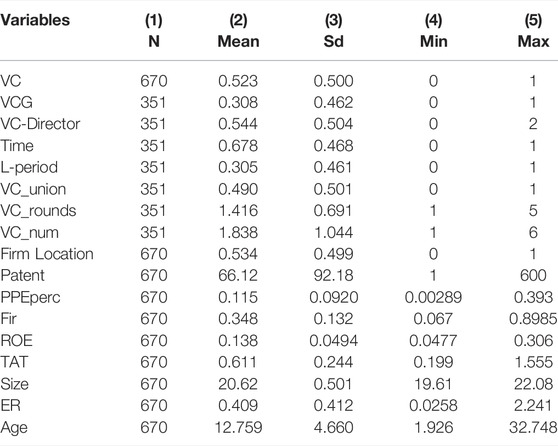

The descriptive statistical results in Table 2 indicate that the average number of patent applications of GEM listed companies is 66.12. However, the amount of patent application significantly varies among different enterprises, which may have the influence of extreme value. Therefore, to prevent extreme values from affecting the validity of the analysis results, winsorization of the variables with a maximum value of 1% was performed in this study before empirical analysis. The mean value of VC-backed companies was 0.523, indicating that the proportion of companies involved in venture capital was 52.3%. Further observation showed that 67.8% of start-ups have been held by venture capital for more than 3 years; 54.4% of venture capital institutions participate in corporate governance. The mean value of joint investment is 0.50, indicating that half of venture capital institutions choose joint investment in venture enterprises. About 30.8% of venture capitals is government-backed. The mean of the rounds of venture capital investment is 1.416, and the mean of the late-stage is 0.305, indicating that 30.5% of venture capital institutions are involved in the late-stage. As an indicator of enterprise innovation performance, the number of patent applications can only be a nonnegative integer, which is of a discrete distribution and a counting type. Referring to previous literatures (Liu et al., 2017), this sample is suitable for testing using the Poisson regression model.

Correlation Analysis

Pearson’s correlation analysis was employed to test the correlation coefficients between variables. Table 3 shows that the venture capital involved and the correlation of patent applications for 0.061, late intervention and patent applications of correlation coefficient is 0.058, all are positive correlation, consistent with expectations, which suggests that venture capital involved, and the late intervention are factors of enterprise innovation performance improvement. However, the coefficient between investment rounds and patent applications is inconsistent with what was expected; thus, it needs to be further tested. The correlation coefficients between explanatory and control variables selected in this paper are mostly lower than 0.3, indicating that the correlation between variables is low and the multicollinearity problem in the test model can be ignored.

Analysis of Regression Results

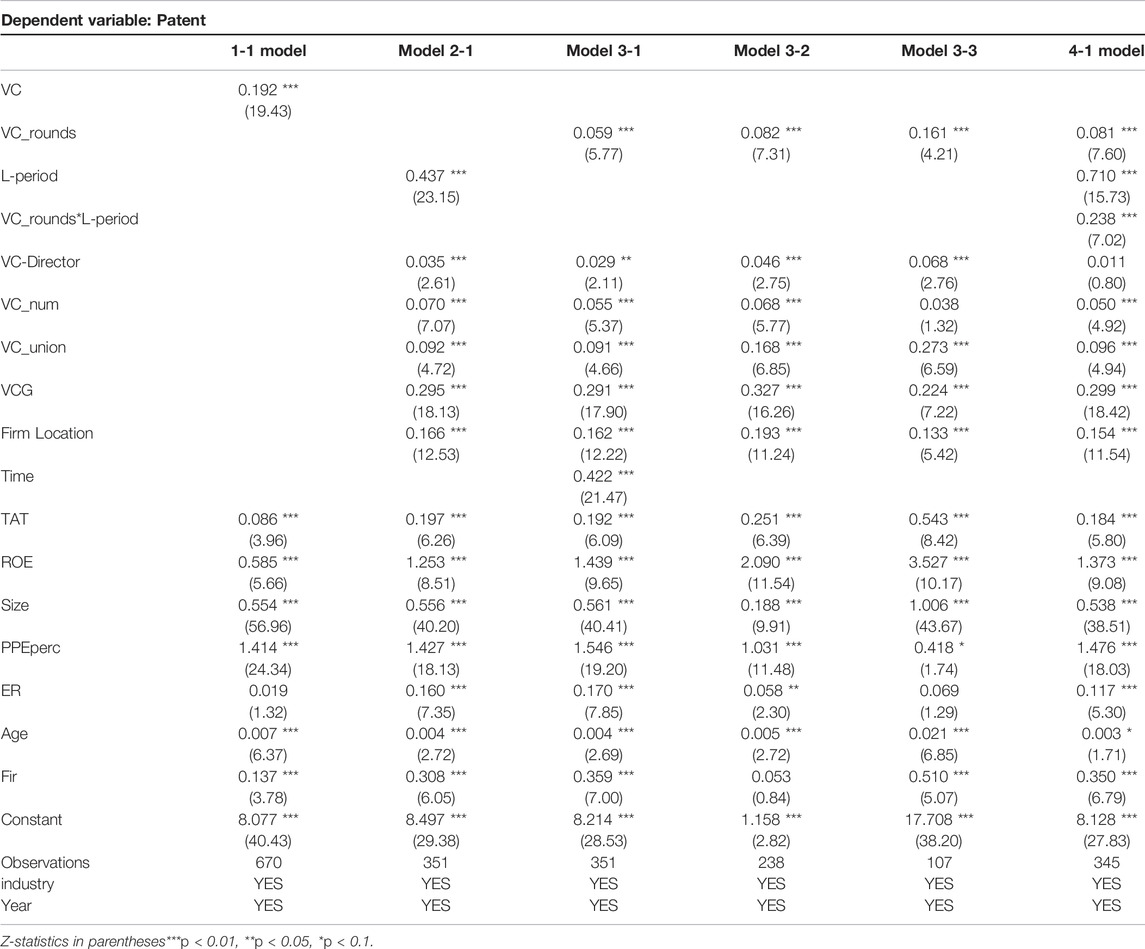

Analysis of the Impact of Venture Capital on Enterprise Innovation

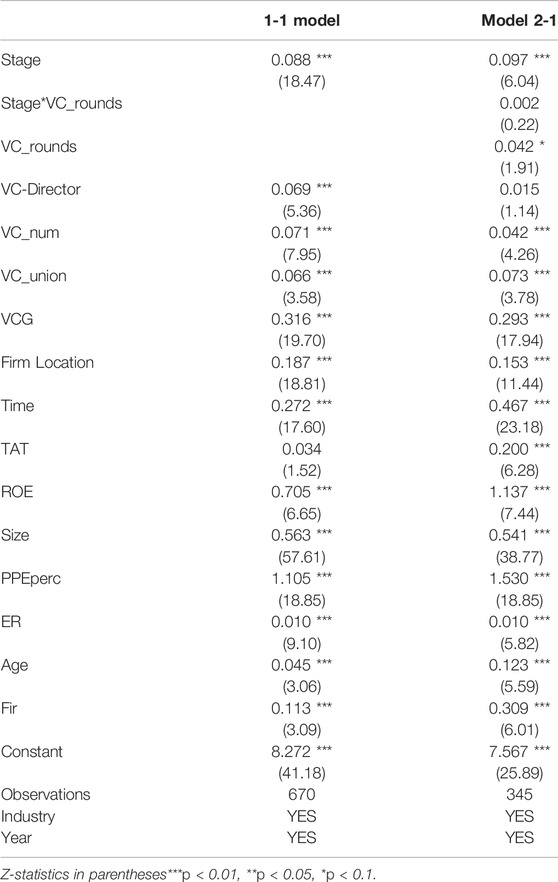

Before verifying the hypothesis in this paper, we first examine the impact of venture capital involvement on firm innovation performance. As can be seen from Model 1-1 in Table 4, the coefficient of venture capital variable is 0.192 and is significant at the 1% level, indicating that venture capital intervention can significantly improve enterprise innovation performance. At the same time, the coefficient between enterprise size and TAT is positive and significant at the 1% level, indicating that the larger the enterprise size and the faster the TAT, the more beneficial it is for enterprises to apply for patents. Consistent with most existing studies, Model 1-1 proves that venture capital intervention can improve the innovation ability of enterprises.

Empirical Analysis of the Impact of Investment Timing on Enterprise Innovation

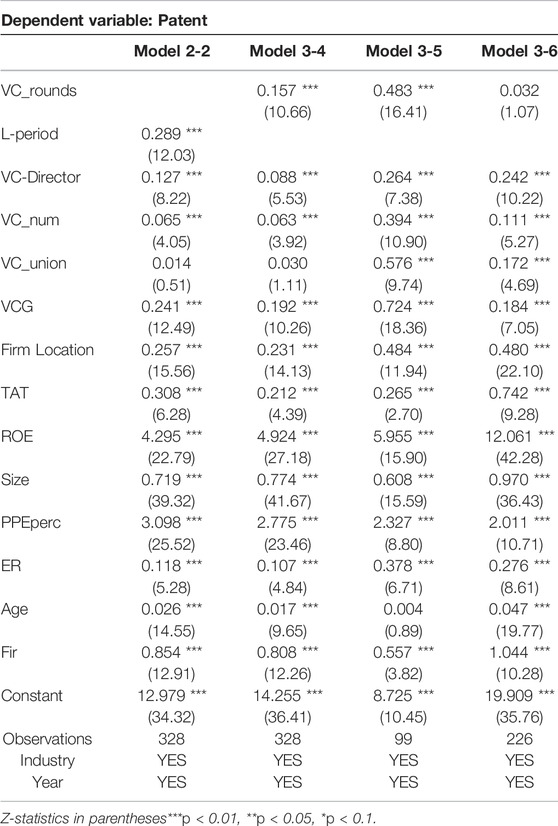

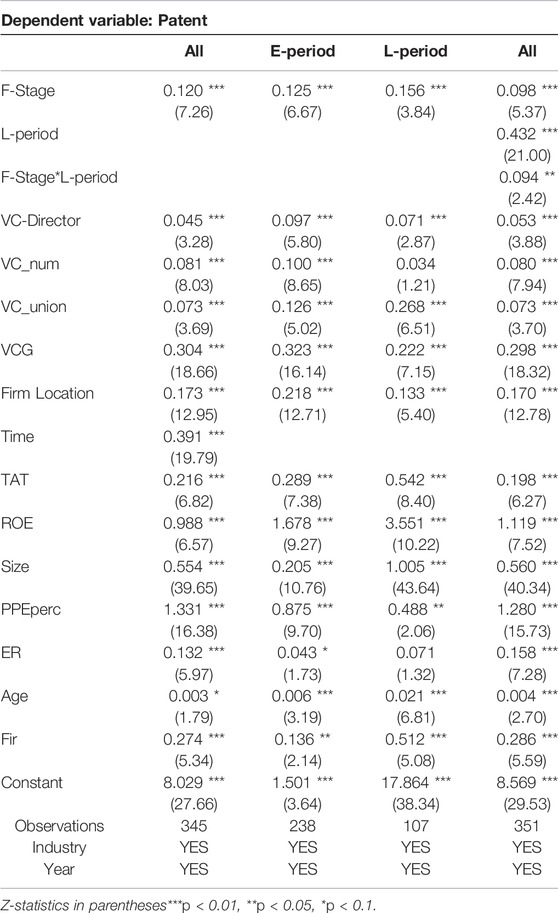

As can be seen from the results of Model 2-1 in Table 4, compared with the early intervention, the regression coefficient of venture capital investment in the late-stage to the number of enterprise patent applications is 0.437, which is significant at the 1% level, proving that the venture capital investment in the late-stage will significantly promote the improvement of enterprise innovation ability (indicated by a significant increase in the number of patent applications). Thus, hypothesis 1 is verified.

Compared with the early stage, the enterprise has tended to grow and mature and is in the IPO preparation stage. To gain more financing and growth opportunities, enterprises will pay more attention to value creation. On the one hand, they will increase investment in R&D activities; on the other hand, they will actively seek the transformation of scientific research achievements so as to pass the recognition of high-tech enterprises and obtain tax incentives. Furthermore, at the beginning of the IPO, the business enterprise financial system and accounting treatment of the specification will also more truly reflect its R&D. In the early stage of growth, the system design and accounting treatment of many start-up enterprises are not scientific and standardized, and there is a confusion between production expenditure and R&D expenditure. It is not rare that R&D expenditure is not recorded or even not recorded. In addition, the test also supports that venture capital participation management, government background and enterprise registration place can significantly affect the number of enterprise patent applications. The coefficients of participation management variables were significantly positive and significant at the 1% level. The results show that the participation of venture capital institutions in enterprise management plays a better role in supervision and has a positive impact on enterprise innovation. The coefficient of government-backed variable is significantly negative, indicating that government-backed venture capital institutions will inhibit enterprise innovation. This may be because these institutions focus more on cultivating entrepreneurial innovation capacity in the early stage due to the guidance of government departments; hence, their innovation performance in the later stage is relatively less positive. The coefficient of geographical location variable is positive and significant at the 1% level, indicating that the regional venture capital activity of enterprises has a positive effect on the improvement of innovation ability.

Regression Analysis of the Impact of Investment Rounds on Enterprise Innovation

As can be seen from Model 3-1 in Table 4, the regression coefficient of venture capital investment rounds to enterprise innovation capability is 0.059, which is significant at the 1% level, proving that the increase in venture capital investment rounds will significantly promote the improvement of enterprise innovation capability. This paper verifies the reasoning that venture capital institutions reduce uncertainty and play a supervisory role, establish learning mechanism and signal transmission effect, and tolerate waiting for long-term value creation through multiple rounds of investment.

At the same time, venture capital participation in governance, the number of venture capital institutions and the location of enterprise registration have significant impact on enterprises’ innovation ability, indicating that these variables are important factors influencing enterprises’ innovation ability, which participate in governance variable coefficient is 0.029, and a significant at 1% level, venture capital institutions involved in enterprise’s board of directors or the board of supervisors to better play to the supervisory function. The constraining behavior of start-ups is stronger; thus, it is helpful to improve the innovation performance of enterprises.

Regression Analysis of the Moderating Effect of Investment Timing on Enterprise Innovation

In this paper, by referring to the test method of the moderating effect of relevant scholars, the samples of venture capital are divided into the early and late intervention groups according to the intervention stage, and then the regression of investment rounds on the innovation capability of enterprises is conducted. As can be seen from Model 3-2, the coefficient of venture capital rounds is 0.082 at the early stage of intervention, which is significant at the 1% level, indicating that the increase in investment rounds can significantly promote the improvement of enterprise innovation ability. According to Model 3-3, the coefficient of venture capital rounds is −0.161 at the time of late intervention and is significant at the 1% level. This indicates that compared with early stage investment, venture capital chooses late intervention, and the promotion effect of multiple rounds of investment on enterprise innovation is weakened. Thus, hypothesis 3 is verified.

It can also be seen that the variable of venture capital institutions’ participation in governance in Model 3-2 is positive and significant at the 1% level, whereas in Model 3-3, it is negative and significant at the 1% level, indicating that supervision of venture capital will inhibit enterprise innovation performance in the later stage. This proves the reasoning of this paper to a certain extent: when venture capital institutions are involved in the later stage, it is not conducive to enterprise innovation that they still closely monitor enterprises. The coefficient of VC_rounds × L-period in Model 4-1 is −0.238, which is significant at the 1% level, indicating that venture capital investment in the late-stage will significantly weaken the promotion effect of investment rounds on enterprise innovation capability.

In conclusion, the investment timing of venture capital institutions has a significant moderating effect on the impact of multi-round selection on innovation. This proves that the venture capital institutions’ choice of multi-round strategy in the later stage will cause distrust of both investors and financiers, thus making the agency problem more prominent, and that it is easier to force both sides to choose the strategy of quick IPO to end cooperation and obtain what they need.

Endogeneity Problem

Instrumental Variable Method

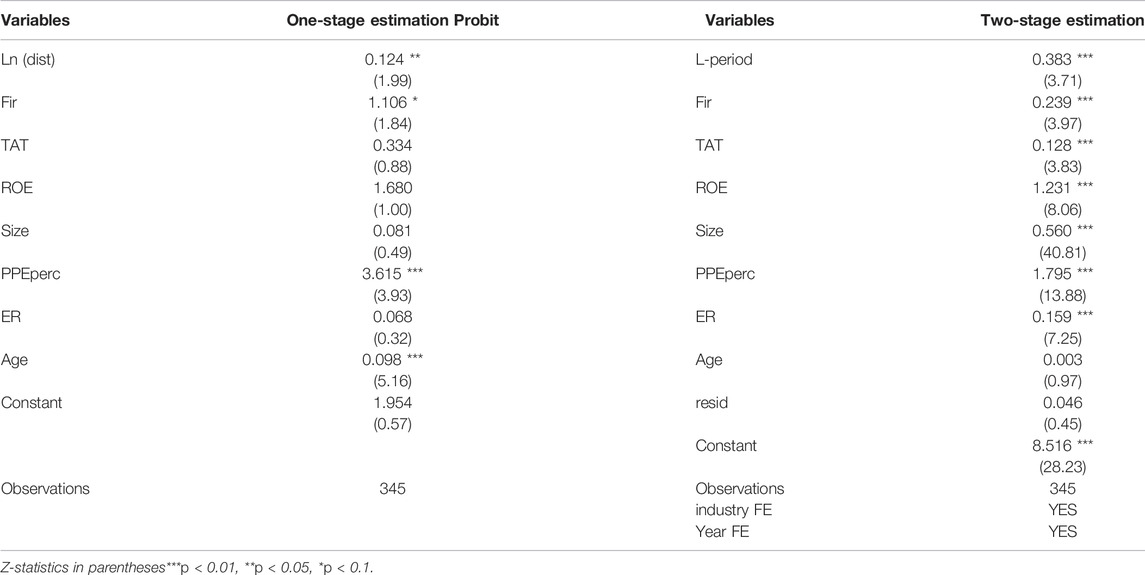

In this paper, a two-stage estimation method is adopted to alleviate possible endogeneity problems by constructing instrumental variables. In particular, the driving distance between the location of venture capital institutions and the location of enterprises (logarithmic processing) is taken as the instrumental variable of venture capital late intervention. In terms of relevance, scholars have found that venture capital institutions have “local preference” when choosing projects. Zook (2002) found that venture capital institutions tend to invest in close proximity to better supervise and assist enterprises and provide non-monetary value-added services. According to the analysis of the portfolio theory, Huang et al. (2014) suggested that in order to reduce portfolio risk and increase income, venture capital institutions are more inclined to investing most of their capital in neighboring enterprises. Dong et al. (2016) found that venture capital institutions reduce transaction and agency costs incurred by increased geographical distance through joint investment strategies. It can be observed that geographical distance affects venture capital strategy. From the perspective of externality, the distance between the location of venture capital institutions and the location of enterprises has nothing to do with the innovation performance of enterprises.

First, the probit regression results in Table 5 indicate that the driving distance between venture capital institutions and enterprises is significantly correlated with late intervention at the 5% level, thus proving the correlation. In the second-stage regression, the residual of the first stage was added as the independent variable, and the number of patent applications was taken as the dependent variable. According to the results, compared with the early stage intervention, the regression coefficient of venture capital investment in the late-stage intervention on the number of patent applications was 0.383, which was significant at the 1% level. To sum up, venture capital institutions will choose enterprises with strong innovation performance to intervene in the later stage, but the latter stage intervention can promote further improvement of enterprises’ innovation performance.

PSM Method

There are obvious endogeneity problems in the basic regression results. Whether the enterprises with strong innovation ability attract the venture capital late-stage investment or the venture capital late-stage investment intervene to promote the enterprise innovation performance is determined. To further elucidate the relationship between late-stage venture capital investment and corporate innovation ability, the nearest-neighbor matching method is adopted to match first and then regression to eliminate the endogenous problem as much as possible. After the matching, the ATT value is significant at the 10% level.

Table 6 presents the regression results after matching and only describes the regression results of the main variables (the same is true for other stability tests). As can be seen from all the regression results in Table 6, the main conclusions of this paper are still significant after the endogeneity problem is alleviated.

Robustness Test

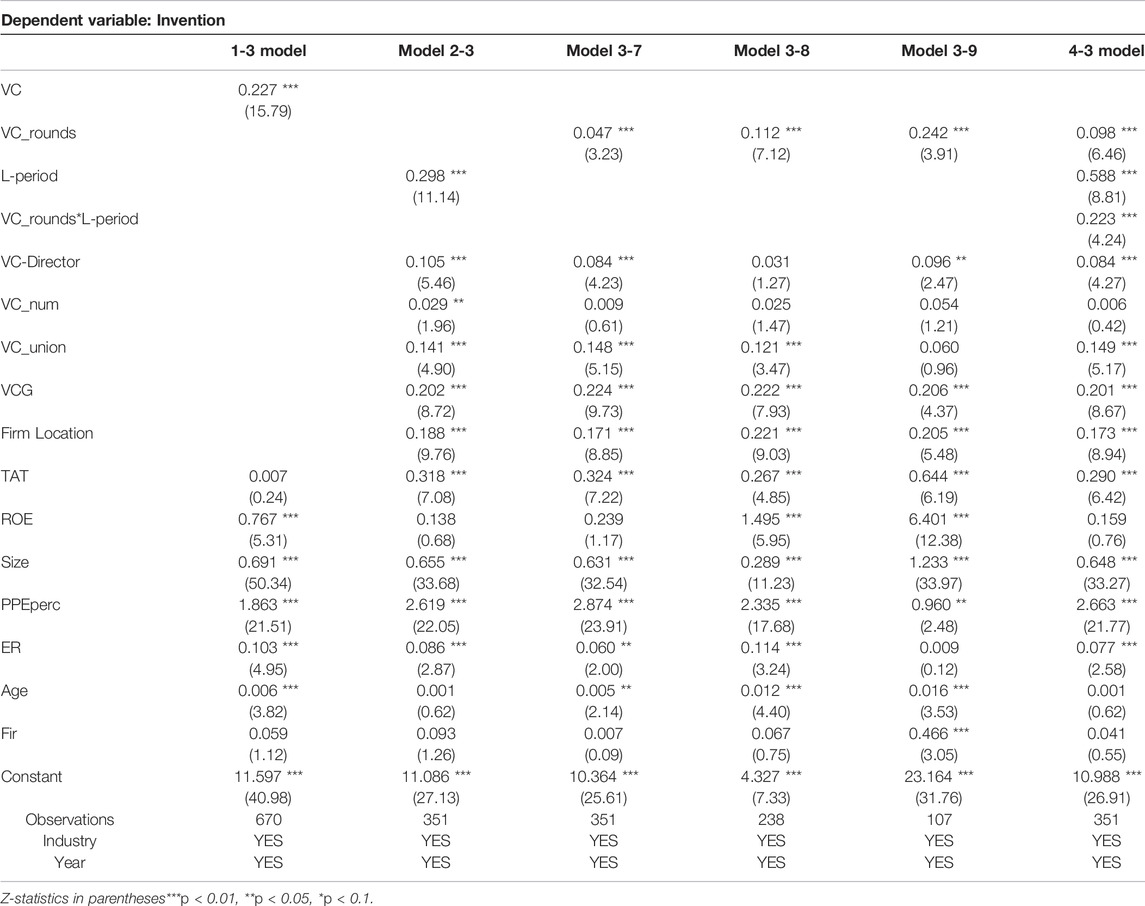

Change the Index of Innovation Capability

According to the patent law, invention patent refers to a new technical solution proposed for a product, method, or its improvement. Compared with utility models and appearance designs, invention patent has higher technical content and innovation value and can better reflect the innovation ability of an enterprise. Therefore, invention is selected as a new dependent variable for the robustness test. As shown in Table 7, using the number of invention patent applications as the dependent variable, the hypothesis proposed in this paper is tested again, and the results are consistent with those discussed above, indicating that the main conclusions of this paper are robust.

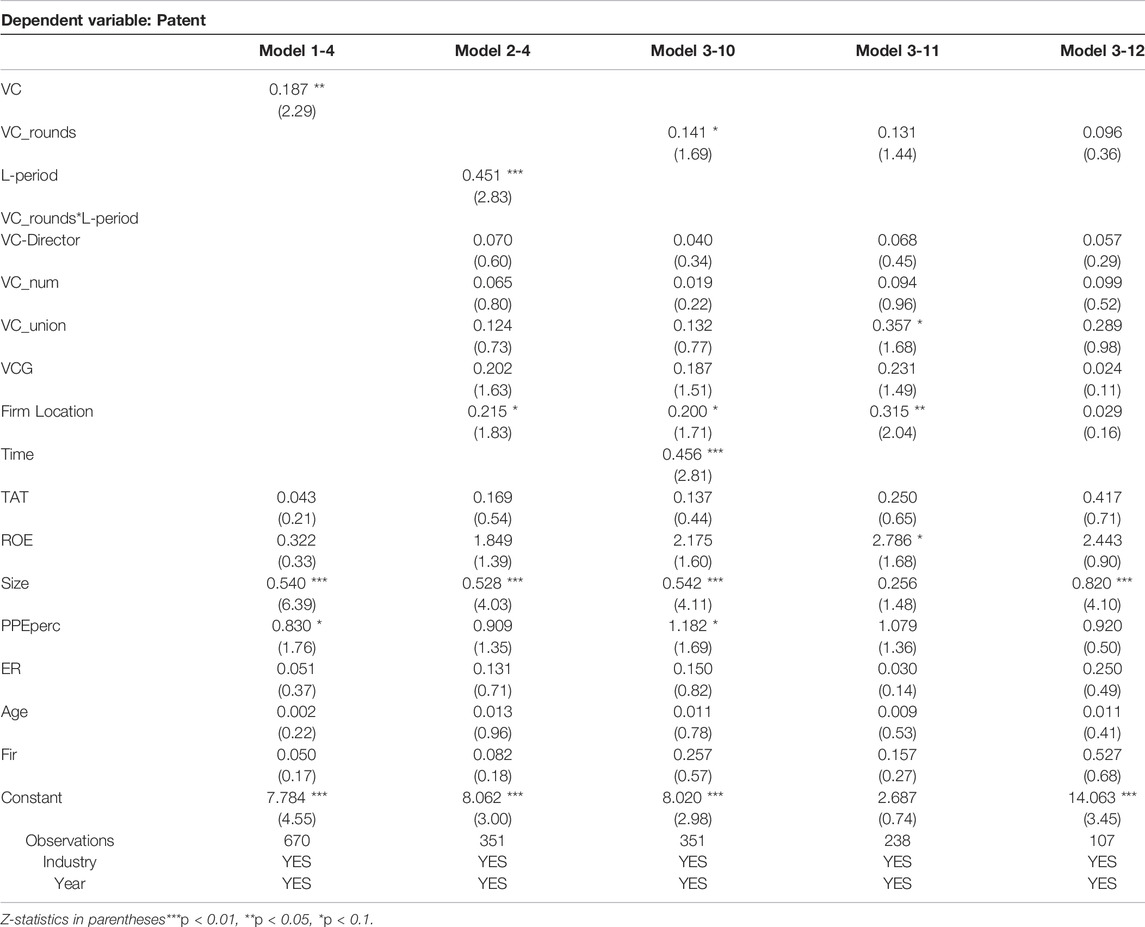

Change the Measurement Method

Since the number of patent applications is a non-negative integer, Poisson model is adopted in the analysis in this paper. However, the prerequisite for the application of Poisson model is that the mean value of dependent variable is equal to variance. Therefore, in order to avoid the regression results errors caused by the data too scattered, negative binomial regression method is used to test the influence of the risk investment strategy for the enterprise innovation ability. As shown in Table 8, all the results are consistent with those discussed above, indicating that the main conclusions of this paper are robust.

Further Study

Extended Test of the Influence of Phased Strategies

Different from previous studies, in this paper, the phased investment strategy is defined by investment rounds rather than whether it is phased or not (dummy variable). This paper argues that the impact of phased strategy on enterprise innovation capability varies with the number of investment rounds, and the intrinsic mechanism cannot be accurately explained only from the perspective of phased strategy. To further verify the speculation, Poisson regression test is conducted in Table 9 and Table 10 based on whether the phased investment strategy is adopted.

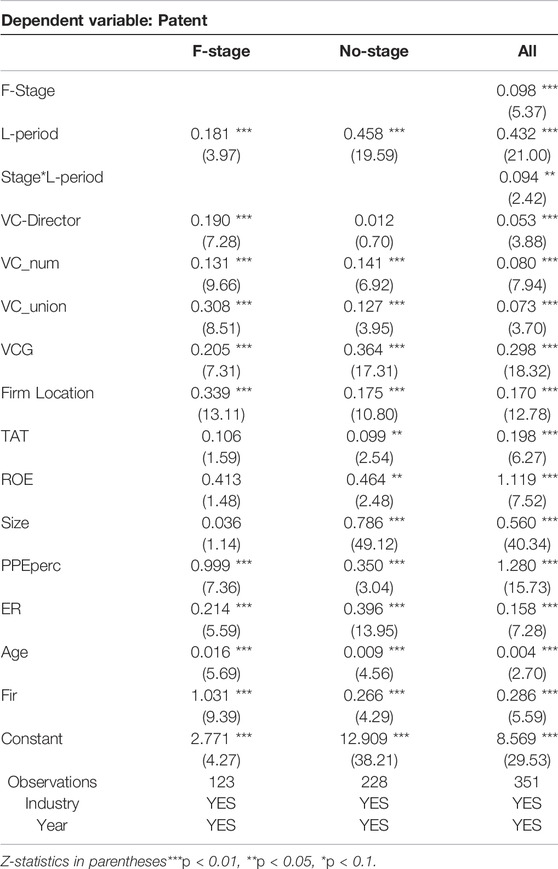

Test of the Impact of Phased Strategy on Innovation

As can be seen from the second column of Table 9, the regression coefficient of phased investment indicates that it will inhibit the innovation performance of enterprises. It can also be observed that in the early stage, the coefficient of phased investment is −0.125, which is significant. In the later stage, the coefficient of phased investment is 0.156 and is also significant. The results indicate that compared with the early stage investment, the late-stage investment strategy has a stronger inhibition effect on enterprise innovation. In the fifth column, the coefficient of Stage × L-period is −0.094, which is negative and significant, proving that the phased investment strategy with late intervention has a stronger inhibiting effect on enterprise innovation.

Test of the Moderating Effect of Phased Strategy

As can be seen from the second column of Table 10, the coefficient of late-stage intervention is 0.181, which indicates that the late-stage intervention can significantly promote the improvement of enterprises’ innovation capability. In the absence of the phased investment strategy, the coefficient of late intervention is 0.458. Late intervention has a greater effect on enterprise innovation promotion. In the fourth column, the coefficient of Stage × L-period is −0.094, which is significant, proving that when enterprises do not accept phased investment, late venture capital intervention plays a stronger role in promoting enterprise innovation.

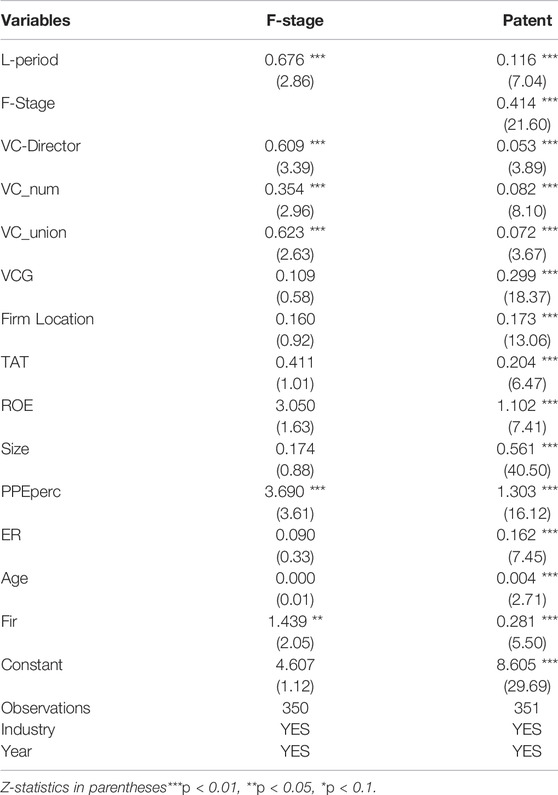

Test of the Mediating Effect of Phased Strategy

As can be seen from Table 11, according to Wen et al. (2004), we analyzed the relevant steps of the mediation effect and found that the mediation effect of phased investment is significant.

The above analysis revealed that the previous research only focuses on the phased investment strategy without considering the impact of investment rounds, which cannot truly reveal the mechanism and effect of venture capital on firms’ innovation capability. As a matter of fact, venture capital timing and rounds both affect enterprise innovation; moreover, investment timing plays a significant moderating role.

The Impact of Venture Capital Late Intervention on Innovation Performance

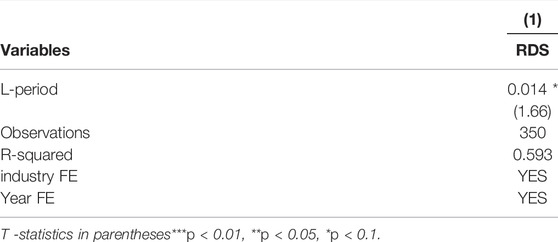

As for the impact of venture investment timing on enterprise innovation performance, most scholars believe that the earlier the investment timing, the longer the holding time. They also believe that the certification and supervision functions help start-ups improve their innovation performance. The research results of this paper indicate that venture capital investment in late-stage intervention can better promote innovation performance. To obtain patent rights, enterprises need to perform R&D activities first, and the R&D investment intensity can reflect the enterprise’s emphasis on innovation performance and investment. Innovation is one of the important means for enterprises to develop, strengthen their core competitiveness, and increase their profits. The improvement of enterprise innovation performance contributes to the increase in enterprise profitability. Therefore, from the perspective of enterprise R&D investment intensity, profit, value, and other aspects, this paper determines the reasons for the improvement of enterprise innovation performance, whether it comes from the late-stage investment strategy of venture capital or the “data” made by the enterprise for listing (to highlight the enterprise’s technology, asset strength, and development prospects, increase the number of patents in various ways).

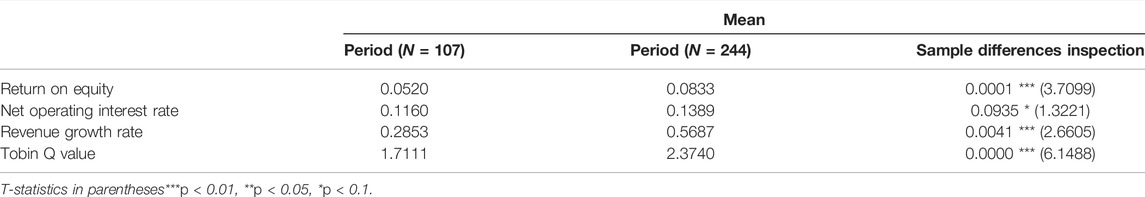

R&D investment intensity (RDS) is represented by the average of the ratio of R&D investment to sales revenue in the 3 years before listing. As can be seen from Table 12, the coefficient of R&D investment intensity in the late-stage of venture capital investment selection is 0.014, which is significant at the 10% level. The empirical results indicate that late intervention can indeed promote enterprises to increase R&D investment. In Table 13, t-test is conducted on the profitability, development capacity, and value of enterprises involved in different times 2 years after the IPO listing, and the results indicate that the profitability, development capacity, and value of enterprises involved in the early stage of venture capital are better than those involved in the late-stage of venture capital. To sum up, the possibility of “whitewashing” patents for listing cannot be ruled out, and the promotion effect of late venture capital intervention on innovation cannot be denied.

TABLE 13. Comparison of enterprise capability of venture capital institutions after the late and early intervention.

Regression Test of Investment Stage

Enterprise characteristics are important control variables for the results of this study, considering the close relationship between the investment stage and the research in this paper. We divided the timing of venture capital intervention according to the life cycle of enterprises, so we used the Zdatabase “China’s most authoritative venture capital and private equity investment database” for reference to divide the enterprise stages. When dividing the development stage of an enterprise, the establishment period is divided into the following: less than 1 year, seed stage; 1–3 years, initial stage; 3–10 years, expansion stage; and more than 10 years, mature stage. In this paper, the classification method is used for reference, and the seed, start-up, growth, and maturity stages are assigned 1–4, respectively. The higher the stage value, the closer the enterprise to the later stage when the venture capital invests. It can be seen from Table 14 that the coefficient of venture capital investment on the number of patent applications is 0.088, which is significant at the 1% level. Empirical evidence shows that the closer the venture capital investment stage to the later stage, the more it can promote enterprise innovation. It can also be seen from Table 13 that the coefficient of stage and investment rounds is 0.002 and is not significant, so it cannot explain the positive relationship between venture capital intervention in the late-stage and the inhibition of investment rounds and innovation performance. By combining the aforementioned empirical results, it was found that venture capital intervention 3 years before IPO will inhibit the promotion effect of investment rounds on enterprise innovation capability; however, when divided according to the life cycle, the timing of venture capital intervention has no inhibition effect.

Research Conclusions and Implications

Taking GEM companies listed from 2009 to 2017 as samples, the research results on the impact of venture capital timing and round selection on enterprise innovation prove that venture capital intervention significantly enhances enterprise innovation capacity. Compared with early stage venture capital, the late-stage intervention strategy significantly promotes firm innovation. The more rounds of venture capital, the more innovation can be promoted. In addition, investment timing has a negative moderating effect on the relationship between investment rounds and firm innovation, that is, the increase in investment rounds at the early stage of intervention can significantly improve firm innovation capability, whereas the increase in investment rounds at the late-stage of intervention has a significantly weakened effect on firm innovation capability. The propensity score matching (PSM) and instrumental variable method were employed to eliminate the endogeneity problem as much as possible, and the robustness tests, changing the dependent variables and measurement methods, also confirmed the above results.

The research demonstrates that in the development of GEM listed companies in China, venture capital plays a role in promoting innovation development; however, the choice of investment strategy will affect the effect. When the investment time and rounds are different, the impact of venture capital on enterprise innovation is also different. Compared with the high uncertainty of early stage investment timing, late-stage venture capital is more willing to help enterprises apply for patents and promote the transformation of research results to achieve a quick decision; thus, the effect of promoting innovation is more obvious. Overall, with the increase of investment rounds, the degree of information asymmetry between venture capital institutions and enterprises gradually decreases, and the risk of holding up is effectively alleviated. The monitoring cost of venture capital institutions also decreases with the increase of investment rounds. Learning effect and signal transmission make venture capital institutions more willing to encourage enterprises to achieve long-term value improvement through innovation. And as the size of their investments and ownership increases, venture capital firms become more patient to achieve high long-term returns. Therefore, the increase in investment cycles significantly improves the innovation performance of start-ups.

Considering that investment timing and rotation selection are usually combined strategies of venture capital, the relationship between the two strategies is further investigated. The results indicate that investment timing has a negative moderating effect on the relationship between investment rounds and entrepreneurial innovation performance. Venture capital institutions involved in the early stage of enterprise development choose multiple rounds of investment, which can not only solve the problem of excessive dilution of equity of venture enterprises but also alleviate the problem of insufficient R&D investment hindering innovation. Late start-ups have clear plans and choose a mature development strategy. This type of multi-round monitoring easily leads to the loss of trust foundation and the increase in agency contradictions; hence, both sides are willing to achieve the IPO goal as soon as possible. Venture enterprises can quickly get rid of the involvement of venture capital, and venture capital institutions can quickly get returns and exit. The result of the game between start-ups and venture capital institutions in the later stage is not to promote business innovation, but to spread good news outwards, a phenomenon known as the Windows Dressing. Therefore, compared with the late-stage investment strategy, the increase in venture capital rounds is more likely to promote the innovation and development of enterprises when the investment timing is early.

Current research focuses more on the impact of investment timing and phased investment on entrepreneurial performance. This paper extends phased investment to investment rounds to study the impact of investment rounds on enterprise innovation capability. In addition, this paper explores how investment timing affects the relationship between investment rounds and firm innovation impact, which is more helpful to reveal the mechanism of venture capital’s impact on firm innovation. Based on the characteristics of GEM in China, we analyzed the motivation, purpose, and characteristics of innovation of venture capital institutions and entrepreneurial enterprises and provided a reasonable explanation from the theoretical perspectives of locking-up risk, monitoring cost, signal transmission, and convenience of short-term return and long-term value acquisition.

Based on China’s innovation-driven strategy and GEM market, this paper investigates the impact of venture capital timing and round selection on entrepreneurial innovation. On the one hand, it provides reference for in-depth research on the mechanism of venture capital influencing innovation; on the other hand, it provides guidance for the application of venture capital strategy. Furthermore, it helps relevant departments understand the relationship between venture capital strategy and innovation performance, so as to improve the effect of policy incentives more pertinently. The drawback of this paper is that due to the time requirement of data collection and analysis, this paper is limited to the data of GEM and fails to include the data of SCIENCE and Technology Innovation Board and NEEQ in the research.

Data Availability Statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/supplementary material.

Author Contributions

XL: put forward thesis ideas, guided empirical analysis and thesis writing, and revised the thesis. YZ: collected data, made empirical analysis, and completed the first draft.

Funding

National Social Science Foundation of China general Project “Research on the Impact of Venture capital heterogeneity on enterprise innovation and sustainable development mechanism” (17BGL072).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1In this paper, innovation capability and innovation performance represent the same meaning.

21. The number of granted patents has the problem of cancellation without timely payment of annual fees, which is difficult to disclose in time, whereas the number of patent applications is relatively stable. 2. The patented technology is likely to have an impact on business performance during the application process, with publicly disclosed patent application data more timely than patent grant data.

References

Adams, R. B. (2010) Asking Directors about Their Dual Roles[C].Finance and Corporate Governance Conference. doi:10.2139/ssrn.1362339

Antill, S. (2017). Investment Timing with Costly Search for Financing[J]. Social Science Electronic Publishing. doi:10.2139/ssrn.3000080

Bergemann, D., and Ulrich, H. (1998). Venture Capital Financing, Moral Hazard. J. Bank. Finance 22 (6). doi:10.1016/s0378-4266(98)00017-x

Chemmanur, T. J., and Loutskina, E., Xuan Tian and Elena Loutskina. Corporate Venture Capital, Value Creation, and Innovation [J], Tian, X. Rev. Financ. Stud., 2014, ,27(8) : 2434 ∼ 2473.doi:10.1093/rfs/hhu033

Chemmanur, T. J., Hull, T., and Krishnan, K. (2010). Do Local and International Venture Capitalists Play Well Together? International Venture Capital Investments and the Development of Venture Capital Markets[J]. Soc. Sci. Electron. Publ. 31 (5), 573–594. doi:10.1016/j.jbusvent.2016.07.002

Chen, Y., and Luo, Z. (2018). The Impact of Investment Strategies on Technological Innovation Outcomes: A Case Study Based on DID Model [J]. J. Soochow Univ. (Philosophy Soc. Sci. 39 (01), 107–114. doi:10.19563/j.cnki.sdzs.2018.01.013

Chen, M., and Zhou, B. (2019). An Empirical Study on the Influence of Entrepreneur's Political Affiliation on Entrepreneurial Firm Performance [J]. J. Xi 'an Shiyou Univ. Soc. Sci. Ed. 28 (01), 37–44. doi:10.3969/j.issn.1008-5645.2019.01.006

Chen, Si., He, W., and Zhang, R. (2017). Venture Capital and Firm Innovation: Impact and Potential Mechanism [J]. Management World 01, 158–169. doi:10.19744/j.cnki.11-1235/f.2017.01.014

Cheng, L., and Zou, S. (2019). The Impact of Venture Capital Entry Time and Technology Preference on Innovation Performance: A PSM Test Based on the Growth Enterprise Market [J]. Sci. Res. Manag. 40 (07), 215–223. doi:10.19571/j.cnki.1000-2995.2019.07.021

Cheng, L., and Zou, S. (2020). The Impact of Venture Capital Late Entry on Firm Innovation Performance: Selection Effect or Value-Added Effect? [J]Manag. Rev. 32 (01), 80–90. doi:10.14120/j.cnki.cn11-5057/f.2020.01.011

Chu, C. C., Li, Y. L., Li, S. J., and Ji, Y. (2021). Uncertainty, Venture Capital and Entrepreneurial Enterprise Innovation—Evidence from Companies Listed on China's GEM [J]. Pacific-Basin Finance J. (11), 101576. doi:10.1016/j.pacfin.2021.101576

Cornelli, F., and Yosha, O. (2003). Stage Financing and the Role of Convertible Securities. Rev. Econ. Stud. 70, 1–32. doi:10.1111/1467-937x.00235

Dang, X., Zhang, C., and Wang, Y. (2014). Venture Capital Firms' Specialization and Investment Performance: Empirical Evidence from China's Venture Capital Industry [J]. Sci. Technol. Prog. Countermeas. 31 (12), 7–11. doi:10.6049/kjjbydc.20131000279

Dong, J., and Meng, D. (2016). The Influence of Human Capital Characteristics of Senior Management Team on Venture Capital Introduction Strategy [J]. Res. Manag. 37 (11), 89–97. (in Chinese). doi:10.19571/j.cnki.1000-2995.2016.11.011

Dong, J., Zhai, H., and Wang, J. (2014). Venture Capital Firms' Management Model: The Perspective of Industry Expertise and Uncertainty [J]. Foreign Econ. Manag. 36 (09), 3–11. doi:10.16538/j.cnki.fem.2014.09.003

Faria, A. P., and Barbosa, N. (2014). Does Venture Capital Really Foster Innovation? Econ. Lett. 122 (2), 129–131. doi:10.1016/j.econlet.2013.11.014

Fluck, Z., Garrison, K., and Myers, S. C. (2005). Venture Capital Contracting and Syndication: An Experiment in Computational Corporate Finance [J]. NBER Working Papers. doi:10.3386/w11624

Fu, L., Wan, D., and Zhang, Y. (2013). Science of Management in Science and Technology, 34 (1), 172–180. CNKI:SUN:KXXG.0.2013-01-020

Gompers, P. A. (1995). Optimal Investment, Monitoring, and the Staging of Venture Capital. J. Finance 50 (5), 1461–1489. doi:10.1111/j.1540-6261.1995.tb05185.x

Gou, Y., and Dong, J. (2013). Research on the Impact of Venture Capital Entry Timing on Enterprise Technological Innovation [J]. China Soft Sci. (03), 132–140. doi:10.3969/j.issn.1002-9753.2013.03.013

Hu, L., and Zhou, Z. (2018). Can the Shareholding of Venture Capital Institutions Ease the Constraints of Subsequent Financing? Empirical Evidence from Chinese Listed Companies [J]. Econ. Manag. 40 (07), 91–109. doi:10.19616/j.cnki.bmj.2018.07.006

Huang, F., Peng, T., and Yan, S. H. A. O. (2014). How Geographical Distance Influences Venture Capital's Investment in New Enterprises [J]. Nankai Manag. Rev. 17 (06), 83–95. doi:10.3969/j.issn.1008-3448.2014.06.010

Huang, F., Wang, J., and Zhu, G. (2016). The Influence of Venture Capital Specialization on Technological Innovation of Invested Enterprises [J]. Res. Sci. Sci. 34 (12), 1875–1885. doi:10.16192/j.cnki.1003-2053.2016.12.013

Huang, X., Huang, C., and Su, J. (2020). Quantitative Research on the Development Policy Text of Science and Technology Finance in China Based on Policy Tools [J]. J. Inf. Technol. 39 (01), 130–137. doi:10.3969/j.Issn.1002-1965.2020.01.018

Li, L., Yan, B., and Chunxia, G. U. (2014). Intellectual Property Rights Protection, Information Asymmetry and Capital Structure of High-Tech Enterprises [J]. Manag. World (11), 1–9. doi:10.19744/j.cnki.11-1235/f.2014.11.002

Lin, J. (2020). Analysis on the Mechanism and Adjusting Factors of Venture Capital's Effect on Enterprise Value-Added [J]. J. Shanghai Univ. Int. Bus. Econ. 27 (03), 25–37. doi:10.16060/j.cnki.issn2095-8072.2020.03.003

Liu, D., Wan, D., and Wu, Z. (2017). Research on the Influence of Venture Capital Stage Investment on Enterprise R&D Investment [J]. Res. Sci. Sci. 35 (03), 396–406. doi:10.16192/j.cnki.1003-2053.2017.03.011

Ma, Y., Cai, J., and Wang, M. (2018). The Impact of Venture Capital and Equity Ownership on Technological Innovation Output of Start-Ups: The Mediating Effect of R&D Investment [J]. Sci. Technol. Prog. Countermeas. 35 (15), 1–8. doi:10.6049/kjjbydc.2017090370

Pan, L., and Sun, L. (2019). The Impact of Venture Capital on Regional Technological Innovation: An Empirical Analysis Based on the Data of China in the Past 20 Years [J]. Sci. Technol. Manag. Res. 39 (14), 203–209. doi:10.3969/j.issn.1000-7695.2019.14.026

Panda, S. N., and Gopalaswamy, A. K. (2020). An Analysis of Timing Decision in Venture Capital Staged Financing: Evidence from India[J]. Management Research Review. ahead-of-print(ahead-of-print). doi:10.1108/MRR-09-2019-0424

Sharma, J. K., and Tripathi, S. (2016). Staged Financing as a Means to Alleviate Risk in VC/PE Financing[J]. J. Private Equity. doi:10.1016/jpe.2016.2016.1.051

Shen, W., and Hu, L. (2014). Research on the Impact and Mechanism of Staged Investment Strategy on Venture Capital Performance [J]. Contemp. Econ. Sci. 36 (03), 64–74+126. doi:10.3969/j.issn.1002-2848.2014.03.008

Tian, X. (2011). The Causes and Consequences of Venture Capital Stage Financing. J. Financial Econ. 101 (1), 132–159. doi:10.1016/j.jfineco.2011.02.011

Wang, Y., and Wang, X. (2013). Research on the Investment Strategy and Performance of Venture Capital Institutions by Stages [J]. Sci. Technol. Manag. Res. 33 (19), 201–204+220. doi:10.3969/j.issn.1000-7695.2013.19.046

Wu, C., Wu, S., and Cheng, J. (2012). An Empirical Study on the Impact of Venture Capital on the Investment and Financing Behavior of Listed Companies [J]. Econ. Res. J. (1), 105–119. doi:10.3969/j.issn.1001-828X.2017.34.043

Xia, Q., and Dan, H. E. (2020). Do Government R&D Subsidies Promote Enterprise Innovation: An Explanation from the Perspective of Signal Theory [J]. Sci. Technol. Prog. Countermeas. 37 (01), 92–101. doi:10.6049/kjjbydc.2019020409

Xu, H., Wan, D., and Jin, X (2015). Venture Capital Background, Shareholding Ratio and START-UP R&D Investment [J]. Res. Sci. Sci. 33 (10), 1547–1554. doi:10.16192/j.cnki.1003-2053.2015.10.014

Yan, Z., Liu, G., and Han, L. (2018). Research on the Impact of Social Network Centrality of Venture Capital Investors on Innovation Performance of NeeQ Firms [J]. Chin. J. Manag. 15 (04), 523–529. doi:10.3969/j.issn.1672-884x.2018.04.006

Yin, M., Sun, Y., and Fei, Y. (2020). The Impact of Private Venture Capital on the Entrepreneurial Capability of New Firms [J]. Chin. J. Manag. 17 (04), 544–550. doi:10.3969/j.issn.1672-884x.2020.04.008

Yu, Y., Luo, W., Li, Y., and Qi, Z. (2014). Investment Behavior and Investment Effect of State-Owned Venture Capital [J]. Econ. Res. J. 49 (02), 32–46. (in Chinese). CNKI:SUN:JJYJ.0.2014-02-003

Yung, C. (2018). Entrepreneurial Manipulation with Staged Financing[J]. J. Bank. Finance, 100. doi:10.1016/j.jbankfin.2018.06.016

Zhang, X., and Zhang, Y. (2016). Venture Capital, Innovation and IPO Performance [J]. Econ. Res. J. 51 (10), 112–125.

Zhang, L., Zhang, S., and Tao, N. (2016). Financial System Risk Tolerance Capacity and Economic Growth: Evidence from a Cross-Country Analysis. Glob. Econ. Rev. 45 (2), 97–115. doi:10.1080/1226508x.2015.1124343

Zhang, Y., Zhang, Y., and Li, J. (2017). Syndicated" Venture Capital and Enterprise Innovation [J]. Financial Res. 06, 159–175. CNKI:SUN:JRYJ.0.2017-06-012

Zhang, L., Guo, Y., Zhang, S., and Pan, Y. (2019). Research on the Innovation Support Path of Venture Capital to S&T Enterprises from the Perspective of RiskTolerance [J]. Sci. Manag. Res. 37 (01), 86–89. doi:10.19445/j.cnki.15-1103/g3.2019.01.023

Zhang, W. (2020). Venture Capital Involvement and Firm Innovation: Empirical Evidence Based on PSM Model [J]. Sci. Technol. Prog. Countermeas. 37 (02), 10–18. doi:10.6049/kjjbydc.Q201908773

Zhou, X., Cheng, L., and Wang, H. (2012). Is the Higher the Level of Technological Innovation, the Better the Financial Performance of Enterprises [J]. Financial Res. (08), 166–179. CNKI:SUN:JRYJ.0.2012-08-016

Zook, M. A. (2002). Grounded Capital: Venture Financing and the Geography of the Internet Industry, 1994-2000. J. Econ. Geogr. 2 (2), 151–177. doi:10.1093/jeg/2.2.151

Keywords: venture capital, investment timing, investment rounds, innovation performance, venture capital strategy

Citation: Li X and Zhao Y (2022) Research on the Impact of Venture Capital Strategy on Enterprise Innovation Performance: Based on Evidence of Investment Timing and Rounds. Front. Environ. Sci. 10:935441. doi: 10.3389/fenvs.2022.935441

Received: 04 May 2022; Accepted: 01 June 2022;

Published: 13 July 2022.

Edited by:

Umer Shahzad, Anhui University of Finance and Economics, ChinaReviewed by:

Khoa Bui Thanh, Industrial University of Ho Chi Minh City, VietnamMincong Tang, Beijing Jiaotong University, China

Yawei Qi, Jiangxi University of Finance and Economics, China

Copyright © 2022 Li and Zhao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yunjia Zhao, ODYzMTY4MDc2QHFxLmNvbQ==

Xiwen Li

Xiwen Li Yunjia Zhao

Yunjia Zhao