- 1School of Economics and Management, Huazhong Agricultural University, Wuhan, China

- 2Department of Management Engineering and Equipment Economics, Naval University of Engineering, Wuhan, China

ESG investment strategy has attracted increasing attention from the financial market, and the inconsistency of enterprise ESG rating results of different rating agencies has gradually become the focus of attention of regulators and investors. In this article, the listed companies with ESG ratings in Shanghai and Shenzhen A-shares from 2016 to 2020 were selected as the research samples. Combined with difference-in-differences model and ordinary least squares methods, the rationality of these ESG ratings was evaluated by examining the difference in the impact of three international ESG rating agencies, such as Bloomberg, and three Chinese ESG rating agencies, such as Sino-securities, on the stock price crash risk. The research findings are as follows: First, after incorporating the ESG ratings of FTSE Russell, MSCI, and China Alliance of Social Value Investment, the stock price crash risk of enterprises is significantly reduced. Second, the company's share price crash risk will be lower when the ESG evaluation results of Bloomberg or MSCI is better. Third, compared with social indicators, investors pay more attention to the environmental performance of enterprises in decision making. Enterprises with high environmental scores have lower stock price crash risk. The findings of this article play an enlightening role for China to improve its ESG system, construct an ESG disclosure policy, and improve the market role of ESG rating.

1 Introduction

Since the financial initiative of the United Nations Environment Programme first put forward the concept of ESG (Environmental, Social, and Governance), ESG has gradually become an important indicator to measure the sustainable development capability and social responsibility of enterprises internationally. Many global investment agencies regard the ESG performance of enterprises as an important indicator of investment decision making, and many of them have carried out ESG rating analyses of enterprises, such as Morgan Stanley, China Alliance of Social Value Investment, Bloomberg, FTSE Russell, and Shanghai Sino-securities. However, rating agencies at home and abroad have their own unique considerations and handling habits in scoring methods, evaluation indicators, and coverage, which make the current ESG rating results of Chinese enterprises obtained by different rating agencies quite different. For example, Zijin Mining (stock code: 601899) has poor evaluation in the ESG rating of MSCI(Morgan Stanley Capital International) and Sustainalyticsl (CCC/56.01), medium evaluation in SynTao Green Finance and FTSE Russell (B+/2.4), and good evaluation in Sino-securities, Social Value Investment Alliance and Wonder (AA/A+/8.36). Different ESG ratings of the same company not only make ESG information disclosure contents of different listed companies vary widely but also interfere with investors’ investment decisions, which is not conducive to the stability of the financial market. Reasonable evaluation of ESG ratings by different agencies and improvement of the ESG rating system will not only help to standardize ESG information disclosure standards and improve ESG data quality, but also effectively alleviate the information asymmetry between investors and enterprises, help investors accurately identify potential ESG values and risks, and reduce investment decision-making costs. It has important practical significance for the healthy development of financial markets.

So, how to reasonably evaluate ESG ratings by different agencies? In fact, for investors, an ESG rating is a reference index of value investment beyond short-term financial indicators. Using ESG rating can better tap sustainable companies. Therefore, the ESG evaluation of an enterprise is highly correlated with its stock price. SynTao Green Finance (2020) divided the Shanghai and Shenzhen 300 constituent stocks into high and low groups according to their ESG ratings. It was found that the combined stock price with high ESG would be higher, and was is a significant positive correlation between ESG performance and stock price. The performance of enterprises in the stock market has been widely concerned by enterprise managers, investors, and government departments, and the stock price crash risk has attracted more attention from stakeholders. The sudden plunge in a company’s stock price will make the wealth of shareholders shrink rapidly, disturb the trading order of the capital market, affect the efficiency of resource allocation, and even lead to serious social and economic turmoil (Chen et al., 2001). For example, the global financial turmoil caused by the subprime mortgage crisis in 2008 and the stock market crash in China in 2015 all damaged investors’ confidence and caused financial market turmoil, and at the same time had a huge impact on the social economy. In 2010, BP’s Deepwater Horizon drilling rig exploded in the United States, which caused a large amount of oil leakage and was difficult to deal with. The explosion has caused an environmental tragedy. At the same time, the company’s share return rate dropped sharply, and its market value shrank by tens of billions of dollars in a short time, which even caused people to reflect on the oil industry. Generally, existing research believes that information asymmetry is the direct cause of the stock price crash risk. When negative corporate news accumulates for a long time and suddenly breaks out, it will cause negative reactions from investors, leading to the company’s stock price turmoil (Kim and Zhang, 2016; Wei and Zeng, 2018; Wu et al., 2019). Therefore, it is important to improve the information environment for stabilizing the financial market (Han et al., 2019; Bao et al., 2020). The more transparent the information disclosed by the company, the lower the stock price crash risk (Hutton et al., 2009). ESG is the off-balance sheet information that investors focus on. ESG evaluation can show investors the performance of enterprises in the environment, society, and management, and alleviate the problem of information asymmetry, thus affecting the stock price crash risk. In addition, from the perspective of investor confidence, Kim et al. (2014) found that the disclosure of corporate social responsibility can increase public confidence, thus reducing the stock price crash risk. Based on this, this article evaluated the rationality of ESG ratings by examining the differences in the impact of ESG ratings of different rating agencies on the stock price crash risk and revealed the characteristics of ESG ratings with higher rating effects.

The possible contributions of this article are as follows: 1) At present, there are many studies on the impact of ESG on enterprises. Some scholars have discussed the relationship between ESG rating and capital market performance (Eccles et al., 2014; Lins et al., 2017; Bae et al., 2021; Gu et al., 2022), enterprise value (Sassen et al., 2016; Aboud and Diab, 2018; Atan et al., 2018), investment and financing (Dhaliwal et al., 2011; Goss and Roberts, 2011; Cheng et al., 2014; Dimson et al., 2015; Qiu and Ying, 2019), institutional investors’ shareholding preference (Zhou et al., 2020), and agency structure (Cucari et al., 2018; Manita et al., 2018; Liu et al., 2022). However, few scholars have examined the economic consequences of ESG rating from the perspective of risk. This study supplements the existing research. 2) There are many ESG rating agencies, showing a state of a hundred schools of thought contending, but the rating quality is also varied. By studying the relationship between ESG ratings of different agencies and the stock price crash risk, this study discussed the impact of different ESG ratings on the financial market performance of enterprises, providing a reference for managers, investors, and scholars engaged in related research when choosing ESG rating agencies. 3) Some scholars have explored the relationship between enterprises’ information transparency (Jin and Myers, 2006; Hutton et al., 2009), social responsibility (Huang and Li, 2020; Tu et al., 2020; Huang et al., 2022), governance (Kim et al., 2011a; Quan et al., 2016; Bhargava et al., 2017; Xia and Jia, 2019), diversified operation (Shao et al., 2020) and enterprise risk. However, no scholar has yet examined the impact of an enterprise’s sustainable development capability on the stock price crash risk. This study explored the influencing factors of the stock price crash risk from the angles of environment, society, and governance, enriching the research in related fields.

The rest of this article is as follows: the second part compares and analyzes ESG ratings of different agencies; the third part is the research design of this article, namely, data source and model design; the fourth part is empirical analysis, which studies the relationship between ESG ratings of different agencies and the stock price crash risk; the fifth part is the result discussion and conclusion. By discussing the results of empirical analysis, the conclusion of this article is drawn; and the sixth part is the conclusion and suggestions, summarizing the main conclusions of this article and putting forward corresponding suggestions.

2 Comparative Analysis of ESG Ratings

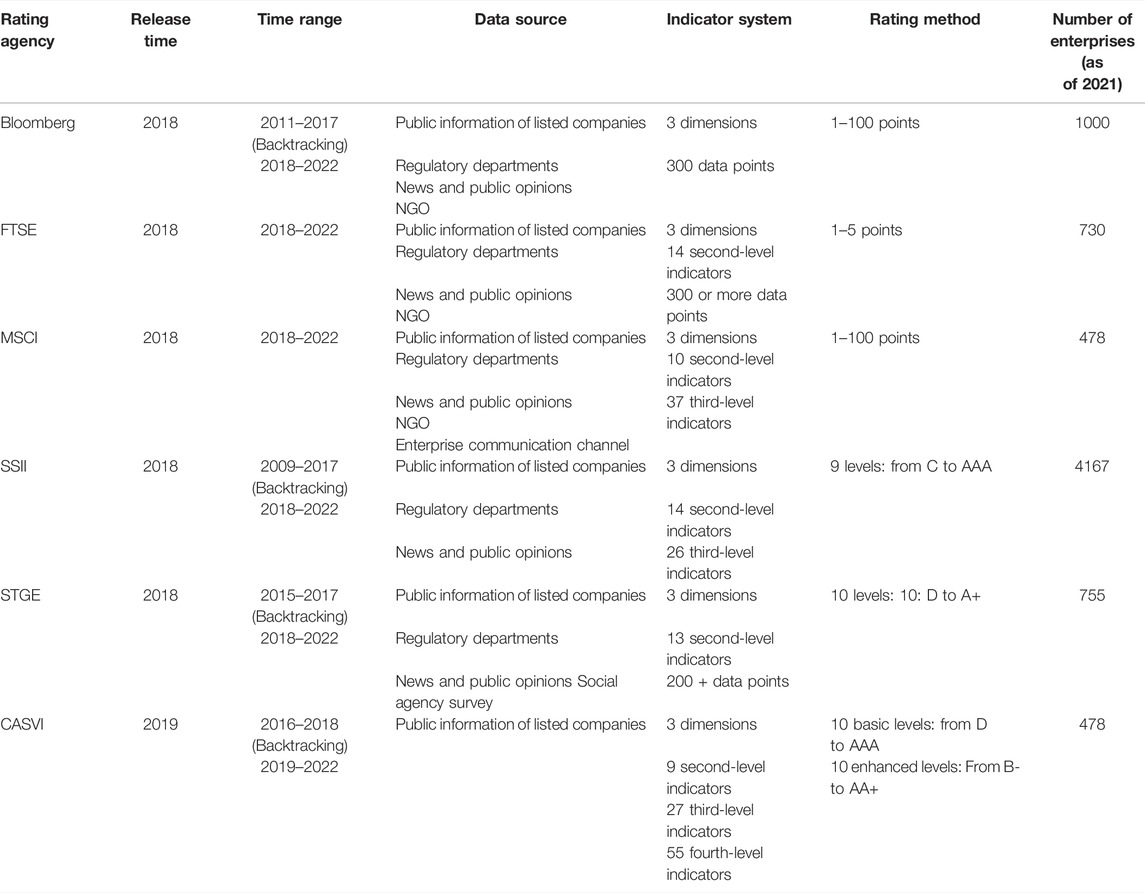

With increasing attention paid to ESG by enterprises, investors, and governments, more and more agencies have promulgated their own ESG evaluation systems. Currently, there are over 600 ESG rating agencies worldwide. Among them, the evaluation scope of Bloomberg, Morgan Stanley (hereinafter referred to as MSCI), and FTSE Russell (hereinafter referred to as FTSE) include Chinese listed companies, and their evaluation has a certain authority. Although China’s ESG evaluation system was built later, it is also developing rapidly with the implementation of the concept of green development and sustainable development in domestic enterprises. At present, there are about 20 ESG rating agencies in China, among which Sino-Securities Index Information (hereinafter referred to as SSII), SynTao Green Finance (hereinafter referred to as STGF), and China Alliance of Social Value Investment (hereinafter referred to as CASVI) are the representatives. ESG ratings of different agencies have certain differences in coverage, rating method, and indicator, which also affect the choice of investors and enterprises. Table 1 shows the comparison of ESG rating systems of different agencies.

(1) From the perspective of the company coverage, the ESG rating of SSII has the widest coverage, with 4,167 companies, basically, namely, all A-share listed companies. Other rating agencies in China cover 300–800 companies, and most of them are based on CSI 300 or CSI 800 constituent stock. Most of the reference data of international rating agencies cover the whole world, among which Bloomberg’s ESG rating covers the largest number of Chinese companies, with 1,000 listed companies. The ESG systems of FTSE and MSCI cover less than 800 Chinese enterprises, respectively.

(2) In terms of the release date, STGF, together with Caixin Media and BusinessBigData, released the LANDSEA·China ESG Prosperity Index to describe the national macro-ESG development. Then, in June 2018, STGF announced the release of China’s first A-share listed company ESG database and evaluation system. Other local Chinese agencies, such as SSII and CASVI, also started to release ESG ratings in 2018 and 2019, respectively. ESG indicators of international agencies were built earlier, but they included Chinese listed companies in 2018 and later. In terms of the time range, FTSE and MSCI include the data released from 2018 to the latest 2022. The data of STGF and CASVI can date back to 2015 and 2016, respectively. The ESG ratings of SSII and Bloomberg cover a wider time range, dating back to 2009 and 2010, respectively.

(3) From the data analysis, the data of ESG rating agencies mainly come from the official website and announcements of listed companies as well as from regulatory authorities, news, and public opinions. In addition, the data source of MSCI and FTSE includes data from NGOs and industry associations, and the data source of MSCI also includes corporate communication channels. STGF has the channels of a social agency investigation. On the analysis method, SSII adopts a web crawler and semantic analysis naming combined with entity recognition when processing data; CASVI has built a “social value evaluation model of listed companies” which consists of two parts: “screening submodel” and “scoring submodel.”

(4) From the perspective of rating indicators, the ESG evaluation system generally includes three levels of indicators. The first-level indicators include three dimensions, namely, environment, society, and corporate governance. The second-level indicators are the subdivision issues under the above three dimensions. The third-level indicators are the specific indicators and data points under key issues. In terms of the first-level indicators, all agencies include three dimensions, namely, environment, society, and governance. On this basis, CASVI has added the indicator of economic benefits and conducted ESG evaluation on enterprises from the perspective of objectives, methods, and benefits. This is also the difference between the evaluation model of CASVI and those of other agencies. For first-level indicators related to environment and society, the choices of different agencies are mostly similar. However, in terms of corporate governance indicators, SSII only chose two aspects, management structure and shareholders’ equity, without including salary management and information disclosure indicators that most agencies and investors are concerned about. STGF and MSCI pay extra attention to anti-corruption indicators. On the whole, different countries have different concerns about economic activities at different times, and the ESG evaluation system should also observe the customs of the place and keep pace with the times. For example, the ESG evaluation indicator system of SSII incorporates more indicators that are in line with the current development stage of China, such as the punishment of CSRC and targeted poverty alleviation.

(5) Judging from the evaluation methods, ESG evaluation methods of different agencies can basically be divided into two categories: “rating” and “scoring”. FTSE, MSCI, and Bloomberg choose “scoring” ESG; SSII, STGF, and CASVI choose “rating” ESG. In the “scoring” evaluation, FTSE sets scores to 0–5, while MSCI and Bloomberg set scores to 0–100. In the “rating” evaluation, agencies usually divide enterprises into 7–10 grades, while CASVI has set up 10 enhanced grades from B- to AA+ in addition to the 10 basic grades from D to AAA to slightly adjust the enterprise scores.

(6) Judging from the rating results, the specific ESG rating system of each agency is different, and their rating results for the company are also different. Some scholars used 500 companies listed in the United States from 2010 to 2017 as samples and found that the average correlation among six rating agencies, such as MSCI is 0.45. Among them, the average correlation of corporate governance was the lowest, while the average correlation of environment was the highest (Gibson Brandon et al., 2021). Some scholars have also studied the correlation between ESG ratings of China’s STGF and SSII, and found that the correlation coefficient between them is about 0.17 (Shen et al., 2022). Berg et al. (2019) studied five ESG rating agencies, such as MSCI, and found that the differences among ESG ratings of different agencies mainly come from the differences in scope, measurement, and weight, and the overall differences are mainly caused by measurement differences.

To sum up, ESG’s scoring method includes quantitative and qualitative elements, namely, different weighting factors of each industry, and subjective judgments of enterprises and relevant indicators according to the information disclosed by enterprises and other public information scores aggregated to form an overall score. However, the evaluation methods of ESG rating agencies are not consistent, and different information service providers use different indicators, methods, and basic data, and different subcategories and different numbers, weights, and scopes of indicators. Especially, there are obvious differences between overseas agencies’ ESG evaluation of Chinese enterprises and that of domestic agencies, which is mainly reflected in the evaluation indicators and the important weight distribution of indicators. However, the definition and statement of ESG-related indicators by Chinese rating agencies are not uniform. This reduces the comparability among evaluation systems and affects the consistency of ESG evaluation.

3 Research Design

3.1 Sample Selection and Data Sources

In this study, listed companies with ESG ratings in Shanghai and Shenzhen A-shares are selected as research samples. Since almost all the rating agencies to be evaluated in this study began to publish their ESG ratings of Chinese listed companies in 2018, to investigate the changes in stock price crash risk before and after different ESG agencies published their ratings, this study selected 2 years before and after ESG publishing as the research interval. That is, the sample period is from 2016 to 2020. ESG rating data of enterprises come from the WIND database and Bloomberg etc., and financial accounting data of enterprises come from the CSMAR database. Referring to the practices of existing related literatures, we screened the initial samples as follows to avoid the influence of abnormal samples: 1) the samples of financial enterprises are excluded because the financial statement structure and business model of the financial industry are quite different from those of general non-financial enterprises; 2) the samples of ST and *ST companies are eliminated because companies with troubled operations are more likely to have the stock price crash risk; and 3) company samples with missing data are eliminated. In addition, all continuous variables are winsorized at 1 and 99 percentiles to reduce the influence of outliers.

3.2 Definition and Measurement of Variables

3.2.1 Explained Variables

As for the measurement method of stock price crash risk, this article used the methods of Chen et al. (2001), Kim et al. (2011b), and Xu et al. (2012) for reference to calculate the stock price crash risk of each enterprise. First of all, the following regression was made to the weekly returns of stocks:

In model (1), rj,t is the weekly return rate of the jth stock in the tth period considering the reinvestment of cash dividend; rm, t is the weekly return rate of the market weighted by the circulating market value in the tth period; ri,t is the weekly return rate of the industry calculated by weighting the circulating market value of industry i; εj,t represents the part of the weekly stock return rate of the jth company, that is, not explained by the weekly market return rate and the weekly industry return rate. If εj,t is negative and the value is smaller, then the degree to which the weekly stock price crash risk of the jth company deviates negatively from the weekly stock return rate of the market and industry is greater, which means that the stock price crash risk of the company is greater. To make εj, t with highly deviated distribution present normal distribution, the logarithm of εj, t was converted to obtain the firm-specific weekly returns Wj,t,t of each firm.

Based on model (2), this study constructed the stock price crash variable: negative coefficient of skewness, NCSKEW.

In model (3), n is the number of trading weeks of j stock in a year. The larger the value of NCSKEW, the more serious the skewness coefficient, and the greater the stock price crash risk of the company.

3.2.2 Explanatory Variables

Firstly, this study constructed a dummy variable (ESG): whether the enterprise is included in the ESG rating. The value takes one in the year when the enterprise was included in the ESG rating and in the following years, otherwise, it takes 0. Although the year in the ESG databases of agencies, such as SSII and Bloomberg, can be traced back to around 2010, all companies’ ESG values were 0 for years before 2018 because the database was launched in that year. According to the specific ESG evaluation results (ESGL), the ESG evaluation results of different agencies can basically be divided into “rating” and “scoring”. For “scoring” ESG, FTSE, MSCI, and Bloomberg select the original score to represent ESGL; for “rating” ESG, SSII, STGF, and CASVI assign values from one and from low to high and use the values to represent ESG evaluation results. It should be noted that CASVI sets ten enhanced grades from B- to AA+ in addition to the ten basic grades from D to AAA. For the enhanced grades, they are concrete to the last two decimal places. For example, B+, BB- and BB are assigned values of 5.33, 5.67, and 6 respectively.

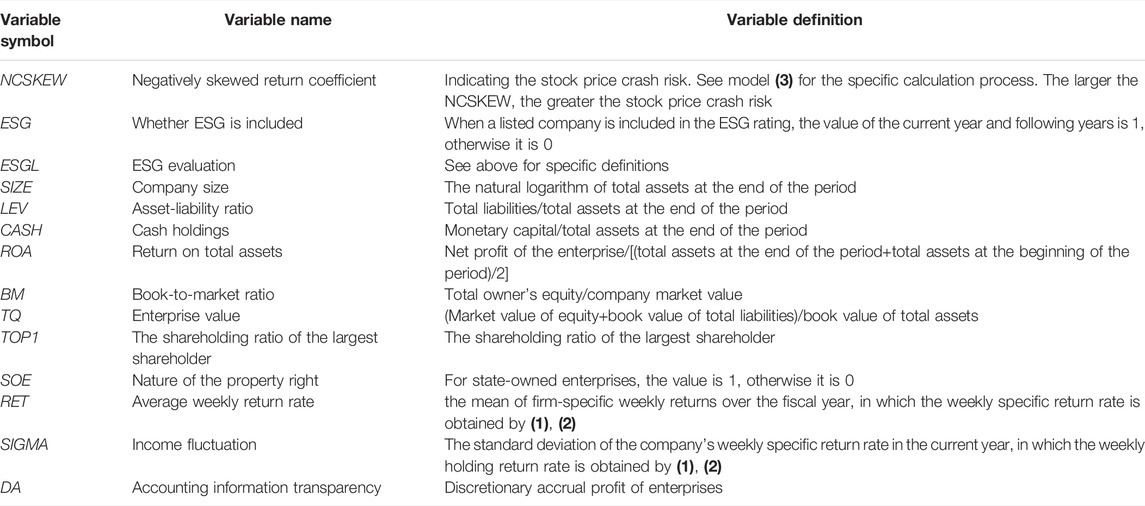

3.2.3 Other Control Variables

With reference to the related literature on the stock price crash risk, this study controlled the company SIZE (SIZE), asset-liability ratio (LEV), CASH holding level (CASH), return on total assets (ROA), book-to-market ratio (BM), Tobin Q value (TQ), the largest shareholder’s shareholding ratio (TOP1), property right nature (SOE), the mean of firm-specific weekly returns over the fiscal year (RET), the standard deviation of the mean of firm-specific weekly returns over the fiscal year (SIGMA), accounting information transparency (DA). In addition, this study also introduced dummy variables of year and industry to control the related influences. Specific definitions and measurements of variables are shown in Table 2.

3.3 Model Setting

Firstly, to explore the impact of incorporating the ESG rating system on the risk of stock price crash risk, this article constructs a model (4). Because other information such as the current ESG performance of the enterprise will be fed back to the investors in the capital market, which will affect the risk of the stock price crash in the next period of the enterprise, this study dealt with the explanatory variables and all control variables in a lag period and controlled the fixed effects at time and company level. In terms of the time range, the model includes the year when the ESG evaluation system was launched, 2 years before and after, and the period from 2016 to 2020. CASVI launched the rating system in 2019, so the range of data selection of this agency is 2017–2020.

Model (4) mainly focuses on the coefficient β1 of ESG. When the coefficient β1 is significantly negative below the level of 10%, it indicates that the stock price crash risk is significantly reduced after the listed company is included in the ESG rating. This suggests that the information asymmetry between enterprises and investors can be significantly alleviated after the ESG rating of this agency is released, which then alleviates the stock price crash risk. In addition, the coefficient β1 of ESG ratings issued by different agencies can be compared at the same time. The larger the ESG rating coefficient β1 of a rating agency, the more effective of ESG rating is in alleviating information asymmetry.

To study the relationship between ESG evaluation results and stock price crash risk, this article set up a model (5). This model controls not only variables but also time and industry.

Model (5) mainly focuses on the coefficient γ1 of ESGL. If the coefficient γ1 of ESGL should be significantly negative below the level of 10%, it means that the higher the ESG evaluation result of a listed company, the lower the stock price crash risk of the company. This suggests that the agency’s ESG rating can be an effective decision-making basis for investors, helping investors accurately identify potential ESG values and risks. In addition, the ESGL coefficient γ1 of different agencies can be compared at the same time. The larger ESGL the coefficient γ1 of a rating agency, the higher the investment reference value of the ESG rating.

4 Empirical Analysis

4.1 Descriptive Statistics

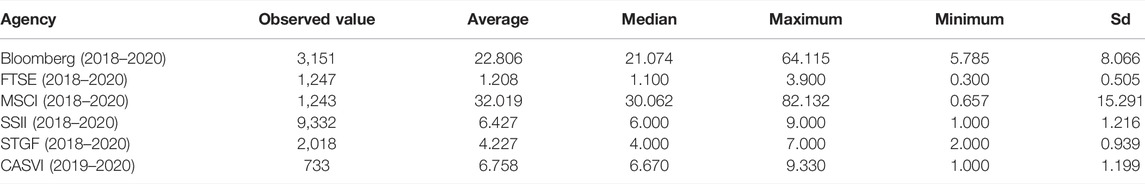

Descriptive statistical results of ESG rating are shown in Table 3. From the results of descriptive statistics, it can be seen that the ESG rating of SSII contains the largest number of Chinese listed companies, and its sample size is also the largest. CASVI has the smallest sample size because of its late launch. The average ESG rating of each agency is slightly larger than its median, and the ESG rating results tend to be slight to the right. In addition, among the ratings of all agencies, MSCI has the largest standard deviation of 15.291, and FTSE has the smallest standard deviation of 0.505.

4.2 Correlation Analysis

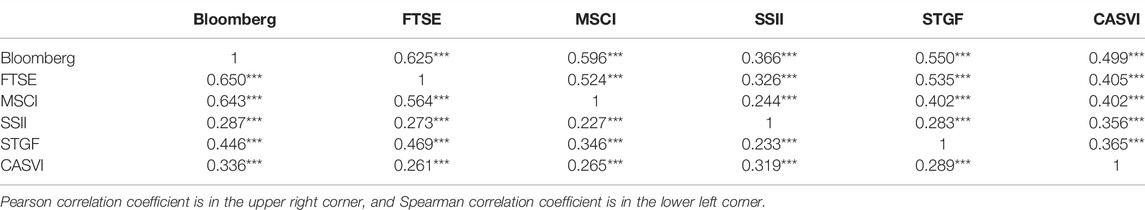

Table 4 shows the correlation coefficients between ESG evaluations of agencies. It can be seen that ESG ratings of all agencies are significantly positively correlated, but the correlation coefficients are all below 0.7. It is worth noting that the correlation coefficients of international agencies Bloomberg, FTSE, and MSCI are all above 0.5, while the correlation coefficients of ESG ratings of domestic rating agencies are all less than 0.4. This reflects that there are more similarities in the rating methods among international agencies, and their evaluation systems are more consistent. On the contrary, China’s ESG rating started late, lacking the support of relevant policies and systems, and lacking financial market supervision. The evaluation systems adopted by different agencies in China may be quite different, resulting in low correlation coefficients.

4.3 Analysis of Results

4.3.1 Impact of Inclusion in ESG Rating on the Stock Price Crash Risk

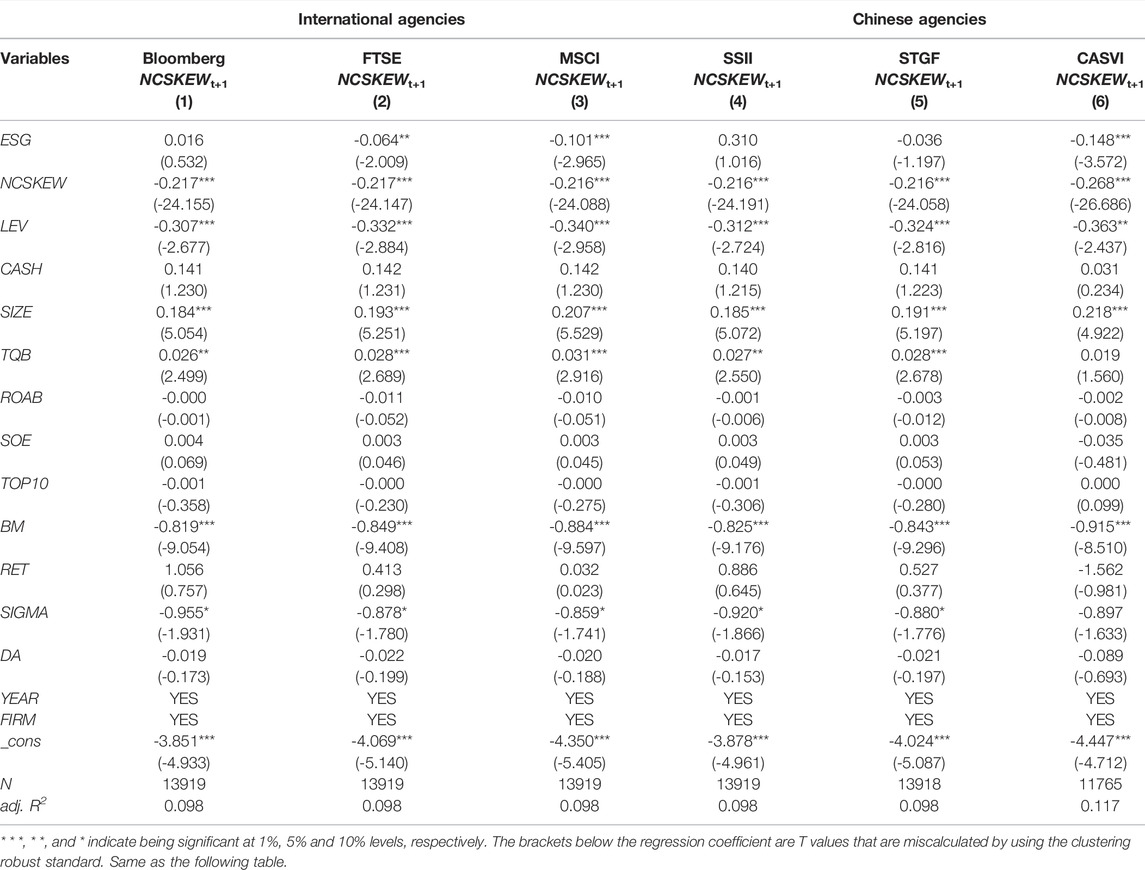

The impact of inclusion in ESG rating on the stock price crash risk of Chinese listed companies is shown in Table 5. In column (2) and column (3) of Table 5, the influence coefficients of ESG ratings of FTSE and MSCI on the stock price crash risk are −0.064 (p value < 0.05) and −0.101 (p value < 0.01), respectively. This indicates that compared with Chinese enterprises that are not included in the ESG ratings of FTSE and MSCI, the stock price crash risk of Chinese enterprises that are included in the ESG ratings of FTSE and MSCI is lower. According to column (1) in Table 5, the influence coefficient of ESG rating on the stock price crash risk is 0.016 (p value > 0.1). This shows that the inclusion in Bloomberg’s ESG rating will not significantly affect the stock price crash risk of Chinese companies. The impact of inclusion in the Chinese ESG rating on the stock price crash risk is shown in Table 5 (4)–(6). The regression results show that the stock price crash risk has not changed significantly when enterprises are included in the ESG evaluation systems of SSII and STGF, but it has dropped significantly when enterprises are included in the ESG evaluation system of CASVI.

4.3.2 Impact of ESG Rating Results on the Stock Price Crash Risk of Enterprises

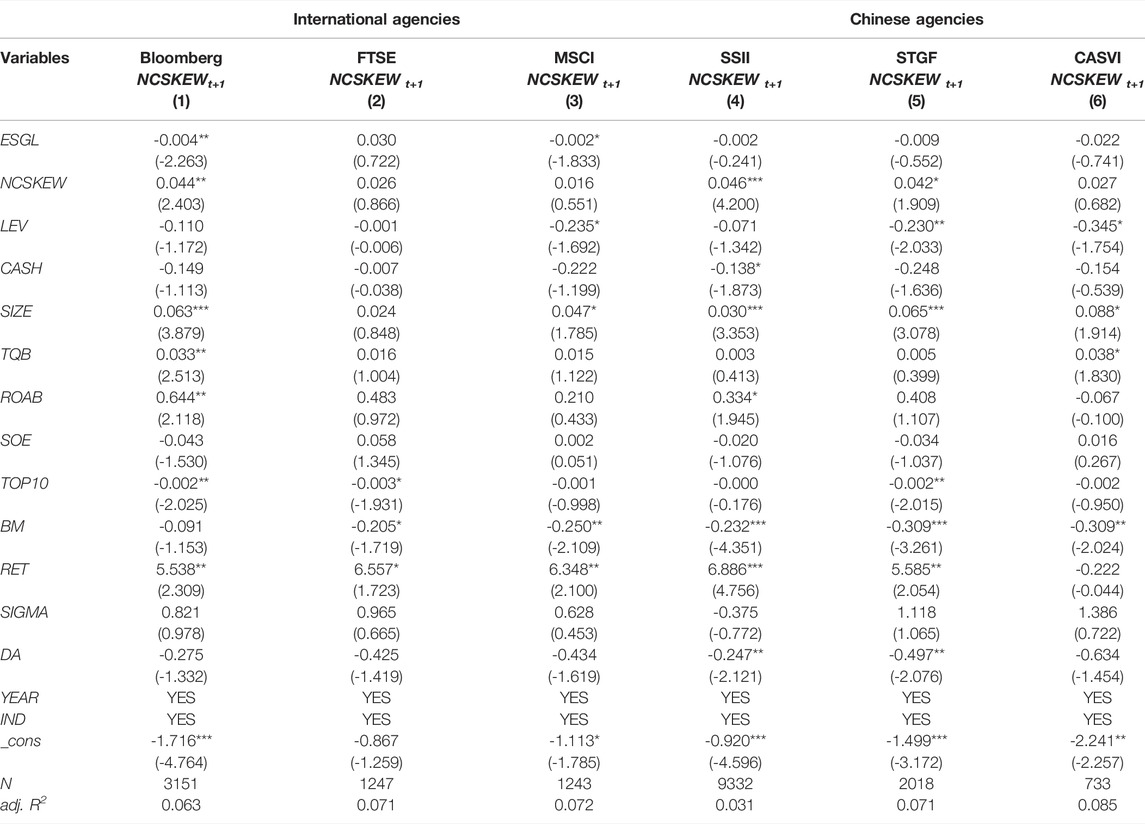

The regression results of international agencies’ ESG evaluation on the stock price crash risk are shown in Table 6 (1)–(3). It can be seen that when the ESG data of Bloomberg and MSCI are used, the regression coefficients of ESG rating on the stock price crash risk are −0.004 (p value < 0.05) and −0.002 (p value < 0.1), respectively. This indicates that the higher the ESG evaluations of Bloomberg and MSCI on Chinese listed companies, the lower the stock price crash risk of these listed companies. When using the ESG data of FTSE, the coefficient of ESG is not significant, indicating that the ESG rating results of FTSE will not significantly affect the stock price crash risk of Chinese listed companies. The regression coefficients of ESG ratings of domestic agencies on the stock price crash risk of enterprises are shown in Table 6 (4)–(6). The regression coefficients of the ESG rating of domestic agencies on the stock price crash risk of listed companies are all not significant, which is also in sharp contrast with international agencies. This shows that the local ESG ratings in China will not significantly affect the stock price crash risk of listed companies.

4.3.3 Impact of Different Indicators on the Stock Price Crash Risk of Enterprises

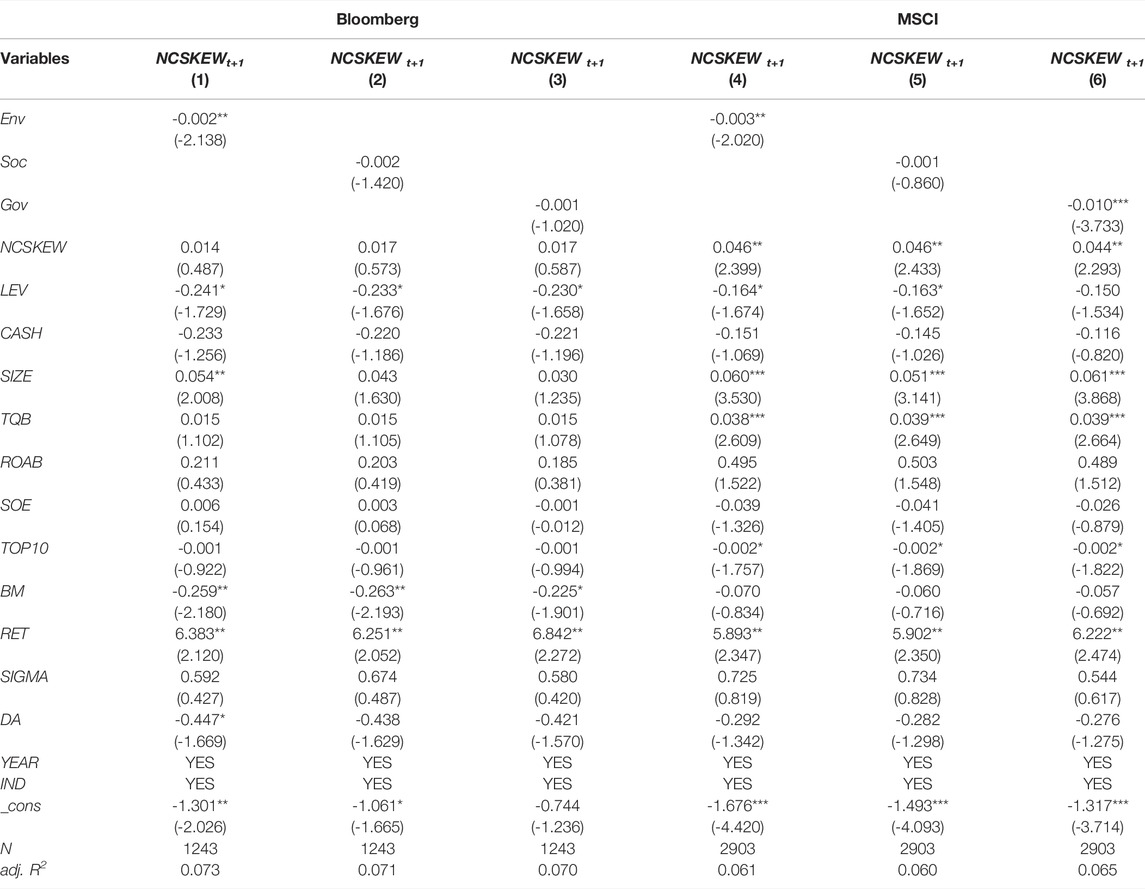

Bloomberg and MSCI publish not only ESG comprehensive rating results, but also specific ratings in three dimensions, namely, environment (E), society (S), and governance (G), to the international community. Columns (1) and (3) of Table 6 show that the comprehensive ESG rating results of Chinese enterprises by Bloomberg and MSCI significantly alleviate the stock price crash risk of these enterprises. Do these specific rating results have the same impact on the stock price crash risk? To further study the impact of environment, society, and governance on the performance of enterprises in the capital market, this article explored the relationship between E, S, and G and the stock price crash risk of listed companies based on the rating data of Bloomberg and MSCI from 2018 to 2020. The regression results are shown in Table 7. It can be seen that in Bloomberg’s data, the regression coefficient corresponding to E indicators of the enterprise is −0.002(p value < 0.05), while the coefficients corresponding to the S and G indicators are not significant; in MSCI data, the corresponding influence coefficients of enterprises E and G are −0.003 (p value < 0.05) and −0.01 (p value < 0.01) respectively. This indicates that the better the company’s performance in terms of E indicators disclosed by Bloomberg and E and G indicators disclosed by MSCI, the lower the stock price crash risk.

5 Discussion

(1) After being included in the ESG evaluation system, the stock price crash risk of enterprises will be affected, but the market reaction to ESG rating varies from agency to agency. After being included in the ESG ratings of MSCI, FTSE, and CASVI, the stock price crash risk of listed companies is significantly reduced. However, the inclusion in the ESG ratings of Bloomberg, SSII and STGF will not significantly affect the stock price crash risk. Kim et al. (2014) and Ye et al. (2015) believe that the higher the information transparency of enterprises, the lower the stock price crash risk. After an enterprise is included in the ESG rating, its ESG performance is disclosed to the market, and its information transparency is also improved, thus reducing the stock price crash risk. According to the test results, it can be found that compared with other rating agencies, ESG ratings of MSCI, FTSE, and CASVI have played a better role in information transmission. The possible reason is that although only a small number of Chinese listed companies are covered in FTSE, MSCI, and ESG evaluation systems, they generally have high social attention. When these listed companies that are widely concerned among investors are included in the ESG rating, they can better alleviate information asymmetry and improve information transparency, thus alleviating the stock price crash risk.

(2) The higher the ESG rating, the lower the stock price crash risk. The influence coefficients of ESG ratings of different agencies on the stock price crash risk are mostly negative. The influence coefficients of ESG ratings of Bloomberg and MSCI on the stock price crash risk are significantly negative at significance levels of 5% and 10%. This shows that the higher the ESG rating of an enterprise, the more confidence investors have in it, and the lower the stock price crash risk of the enterprise. As the information disclosure of enterprises’ environment and society will affect investors’ decisions (Aerts et al., 2008), when the disclosure quality is high, it will also increase investors’ confidence, thus suppressing the stock price crash risk of enterprises (Kim et al., 2014). However, the ESG ratings of FTSE and local agencies in China cannot significantly affect the stock price crash risk of listed companies. Compared with other rating agencies, the ESG rating results of Bloomberg and MSCI are more trusted by investors. With the improvement of the ESG rating of enterprises by these two agencies, investors have more confidence in enterprises. Bloomberg and MSCI were established in 1981 and 1935, respectively, while FTSE and other four agencies were established after the 21st century. The results show that investors may trust the ESG ratings of senior agencies more. At the same time, Bloomberg and MSCI have accumulated more users during their years of operation, thus attracting more investors’ attention to the market. Of course, this result cannot rule out that the ESG ratings of Bloomberg and MSCI may be more reasonable.

(3) The higher the rating time coverage, the greater or more significant the impact of ESG evaluation on the stock price crash risk. According to the theory of limited attention, investors’ time and energy are limited, and it is difficult for them to obtain and understand all the information in the market. Therefore, investors will choose more attractive information to analyze and judge, and apply the judgment results to the stock market, thus causing the change in the company’s stock price. Rating agencies with a wide range of time make it easier for investors to obtain the historical ESG data of enterprises and make a comprehensive evaluation of the long-term performance of enterprises. Bloomberg’s ESG rating covers more than 1,000 A-share companies in China, and the coverage time can be traced back to 2011. Its time coverage is significantly higher than that of other international ESG agencies. Thus, its ESG rating is more comparable. Investors will also pay more attention to the data disclosed by this agency when examining the ESG performances of different companies.

(6) In terms of specific indicators, investors pay more attention to the environment (E) performance of enterprises. With the proposal of China’s “carbon peaking and carbon neutrality” goals, more and more investors pay attention to the environmental governance ability of enterprises, especially in China. Therefore, whether the ESG rating of Bloomberg or that of MSCI, the environment (E) performance of enterprises significantly affects their stock price crash risk.

6 Conclusion

This article has evaluated three international ESG ratings, such as Bloomberg, and three Chinese ESG ratings, such as SSII, by empirically testing the impact of ESG ratings on the stock price crash risk. The findings are as follows: First, seen from the results before and after being included in the ESG rating, the ESG rating systems of FTSE, MSCI, and CASVI can play a better role in information transmission. After being included in the ratings of these three agencies, the stock price crash risk of enterprises is significantly reduced. Secondly, seen from the ESG rating results, the better the ESG evaluation results of listed companies by Bloomberg and MSCI, the lower the stock price crash risk. The ESG evaluation results of these agencies are more trusted by investors, and their high ESG rating results can effectively enhance investors’ confidence in enterprises and reduce the stock price crash risk. Third, compared with social indicators, investors pay more attention to the environmental performance of enterprises. Enterprises with high environment scores have lower stock price crash risk.

The findings of this article have the following enlightenment for China to improve its ESG system, formulate ESG disclosure policies, and improve the market function of ESG rating:

(1) Promoting the standardization of the ESG evaluation system and building a resilient evaluation system. At present, agencies at all levels have their own unique choices when choosing specific indicators and data points of ESG evaluation, and the calculation methods and weights of specific indicators are also different, thus affecting the consistency of indicators and methods of different agencies. A standardized ESG evaluation system can ensure that different agencies have a unified general direction in data judgment, reduce unfavorable subjective judgments, improve the toughness of ESG indicators, and enhance investors’ confidence in the data of the agencies.

(2) Improving the ESG information disclosure system and building a disclosure mechanism suitable for local situations. At present, the ESG data of each agency mainly comes from publicly available information, such as corporate annual reports and social responsibility reports, and it is difficult to fully and truly understand the ESG situation of enterprises. At the government level, China has issued the policy documents related to ESG disclosure, such as the Guide to Social Responsibility and the Governance Guidelines for Listed Companies. On this basis, China should continue to improve ESG disclosure policies and promote the improvement of enterprise information disclosure quality in light of the actual situation of investment and market in China.

(3) China’s rating agencies should strengthen publicity to increase investors’ attention. It is found that the ESG ratings issued by the late-established agencies have not received enough attention from investors, and their results have no significant relationship with the stock price crash risk. Therefore, China’s rating agencies should strengthen the publicity of their ESG rating results and increase the exposure of their own ESG rating, thus improving the usability of their ESG rating results in the financial market.

(4) Communication among rating agencies should be strengthened. Rating indicators and methods should be optimized, and the ESG evaluation model should be improved. It is found that the ESG ratings of senior agencies are easier to gain the trust of investors, and their results are significantly related to the stock price crash risk. By learning from the rating experience of other rating agencies, introducing new important indicators to replace the backward ones, and adjusting the rating methods, it is beneficial to further improve the ESG evaluation system, strengthen the standardization of ESG rating, increase the recognition of investors, and then, improve the usability of ESG rating results in the financial market.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author Contributions

SiL and ShL led the conceptual design of the manuscript, SiL and PY wrote the initial drafts, SiL advised the formal analysis, and all authors reviewed the manuscript and provided comments and feedback.

Funding

This work was supported by the following fund projects: the National Social Science Fund Youth Project (No. 18CGL011) and General project of philosophy and social science research of the Ministry of Education (No. 18JHQ083).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aboud, A., and Diab, A. (2018). The Impact of Social, Environmental and Corporate Governance Disclosures on Firm Value. Jaee 8 (4), 442–458. doi:10.1108/JAEE-08-2017-0079

Aerts, W., Cormier, D., and Magnan, M. (2008). Corporate Environmental Disclosure, Financial Markets and the Media: An International Perspective. Ecol. Econ. 64 (3), 643–659. doi:10.1016/j.ecolecon.2007.04.012

Atan, R., Alam, M. M., Said, J., and Zamri, M. (2018). The Impacts of Environmental, Social, and Governance Factors on Firm Performance. Meq 29 (2), 182–194. doi:10.1108/MEQ-03-2017-0033

Bae, K.-H., El Ghoul, S., Gong, Z., and Guedhami, O. (2021). Does CSR Matter in Times of Crisis? Evidence from the COVID-19 Pandemic. J. Corp. Finance 67, 101876. doi:10.1016/j.jcorpfin.2020.101876

Bao, X., Luo, Q., Li, S., Crabbe, M. J. C., and Yue, X. (2020). Corporate Social Responsibility and Maturity Mismatch of Investment and Financing: Evidence from Polluting and Non-polluting Companies. Sustainability 12 (12), 4972. doi:10.3390/su12124972

Berg, F., Kölbel, J., and Rigobon, R. (2019). Aggregate Confusion: The Divergence of ESG Ratings. Forthcoming Rev. Finance. doi:10.2139/ssrn.3438533

Bhargava, R., Faircloth, S., and Zeng, H. (2017). Takeover Protection and Stock Price Crash Risk: Evidence from State Antitakeover Laws. J. Bus. Res. 70, 177–184. doi:10.1016/j.jbusres.2016.08.021

Chen, J., Hong, H., and Stein, J. C. (2001). Forecasting Crashes: Trading Volume, Past Returns, and Conditional Skewness in Stock Prices. J. Financial Econ. 61 (3), 345–381. doi:10.1016/S0304-405X(01)00066-6

Cheng, B., Ioannou, I., and Serafeim, G. (2014). Corporate Social Responsibility and Access to Finance. Strat. Mgmt. J. 35 (1), 1–23. doi:10.1002/smj.2131

Cucari, N., Esposito De Falco, S., and Orlando, B. (2018). Diversity of Board of Directors and Environmental Social Governance: Evidence from Italian Listed Companies. Corp. Soc. Responsib. Environ. Mgmt. 25 (3), 250–266. doi:10.1002/csr.1452

Dhaliwal, D. S., Li, O. Z., Tsang, A., and Yang, Y. G. (2011). Voluntary Nonfinancial Disclosure and the Cost of Equity Capital: The Initiation of Corporate Social Responsibility Reporting. Acc. Rev. 86 (1), 59–100. doi:10.2308/accr.00000005

Dimson, E., Karakaş, O., and Li, X. (2015). Active Ownership. Rev. Financ. Stud. 28 (12), 3225–3268. doi:10.1093/rfs/hhv044

Eccles, R. G., Ioannou, I., and Serafeim, G. (2014). The Impact of Corporate Sustainability on Organizational Processes and Performance. Manag. Sci. 60 (11), 2835–2857. doi:10.1287/mnsc.2014.1984

Gibson Brandon, R., Krueger, P., and Schmidt, P. S. (2021). ESG Rating Disagreement and Stock Returns. Financial Analysts J. 77 (4), 104–127. doi:10.1080/0015198X.2021.1963186

Goss, A., and Roberts, G. S. (2011). The Impact of Corporate Social Responsibility on the Cost of Bank Loans. J. Bank. Finance 35 (7), 1794–1810. doi:10.1016/j.jbankfin.2010.12.002

Gu, J., Yue, X.-G., Nosheen, S., Naveed-ul-Haq, L., and Shi, L. (2022). Does More Stringencies in Government Policies during Pandemic Impact Stock Returns? Fresh Evidence from GREF Countries, a New Emerging Green Bloc. Resour. Policy 76, 102582. doi:10.1016/j.resourpol.2022.102582

Han, Y., Shao, X.-F., Cui, X., Yue, X.-G., Bwalya, K. J., and Manta, O. (2019). Assessing Investor Belief: An Analysis of Trading for Sustainable Growth of Stock Markets. Sustainability 11 (20), 5600. doi:10.3390/su11205600

Huang, J. B., Chen, L. Q., and Ding, J. (2022). Corporate Social Responsibility, Mediacoverage and Stock Price Crash Risk. Chin. J. Manage. Sci. 30 (3), 1–12. doi:10.16381/j.cnki.issn1003-207x.2020.2183

Huang, P. P., and Li, S. H. (2020). CSR Report Tone and Stock Price Crash Risk. J. Audit. Econ. 35 (01), 69–78. doi:10.3390/su11205600

Hutton, A. P., Marcus, A. J., and Tehranian, H. (2009). Opaque Financial Reports, R2, and Crash Risk☆. J. Financial Econ. 94 (1), 67–86. doi:10.1016/j.jfineco.2008.10.003

Jin, L., and Myers, S. (2006). R2 Around the World: New Theory and New Tests. J. Financial Econ. 79 (2), 257–292. doi:10.1016/j.jfineco.2004.11.003

Kim, J.-B., Li, Y., and Zhang, L. (2011a). CFOs versus CEOs: Equity Incentives and Crashes. J. Financial Econ. 101 (3), 713–730. doi:10.1016/j.jfineco.2011.03.013

Kim, J.-B., Li, Y., and Zhang, L. (2011b). Corporate Tax Avoidance and Stock Price Crash Risk: Firm-Level Analysis. J. Financial Econ. 100 (3), 639–662. doi:10.1016/j.jfineco.2010.07.007

Kim, J.-B., and Zhang, L. (2016). Accounting Conservatism and Stock Price Crash Risk: Firm-Level Evidence. Contemp. Acc. Res. 33 (1), 412–441. doi:10.1111/1911-3846.12112

Kim, Y., Li, H., and Li, S. (2014). Corporate Social Responsibility and Stock Price Crash Risk. J. Bank. Finance 43, 1–13. doi:10.1016/j.jbankfin.2014.02.013

Lins, K. V., Servaes, H., and Tamayo, A. (2017). Social Capital, Trust, and Firm Performance: The Value of Corporate Social Responsibility during the Financial Crisis. J. Finance 72 (4), 1785–1824. doi:10.1111/jofi.12505

Liu, X. X., Li, H. Y., and Kong, X. X. (2022). Research on the Influence of Party Organization Governance on Enterprise ESG Performance. Collect. Essays Financ. Econo. 281 (1), 100–112. doi:10.13762/j.cnki.cjlc.2022.01.008

Manita, R., Bruna, M. G., Dang, R., and Houanti, L. H. (2018). Board Gender Diversity and ESG Disclosure: Evidence from the USA. Jaar 19 (2), 206–224. doi:10.1108/JAAR-01-2017-0024

Qiu, M. Y., and Ying, H. (2019). An Analysis of Enterprise' Financial Cost with ESG Performance under the Background of Ecological Civilization Construction. J. Quant. Tech. Econ. 36 (3), 108–123. doi:10.13653/j.cnki.jqte.2019.03.007

Quan, X. F., Xiao, B. Q., and Wu, S. N. (2016). Can Investor Relations Management Stabilize the Stock Market? Manag. World 1, 139–152+188. doi:10.19744/j.cnki.11-1235/f.2016.01.014

Sassen, R., Hinze, A.-K., and Hardeck, I. (2016). Impact of ESG Factors on Firm Risk in Europe. J. Bus. Econ. 86 (8), 867–904. doi:10.1007/s11573-016-0819-3

Shao, X.-F., Gouliamos, K., Luo, B. N.-F., Hamori, S., Satchell, S., Yue, X.-G., et al. (2020). Diversification and Desynchronicity: An Organizational Portfolio Perspective on Corporate Risk Reduction. Risks 8 (2), 51. doi:10.3390/risks8020051

Shen, H. T., Li, S. Y., Lin, H. H., and W, X. (2022). Rethinking the Relevance of ESG Rating Value from the Perspective of Risk. Finance Acc. Mon. 5, 11–19. doi:10.19641/j.cnki.42-1290/f.2022.05.002

SynTao Green Finance (2020). An Evolving Process: Analysis of China A-Share ESG Ratings. AvaliableAt: https://en.syntaogf.com.cn/products/asesg2020 (Accessed November 30, 2021).

Tu, W.-J., Yue, X.-G., Liu, W., and Crabbe, M. J. C. (2020). Valuation Impacts of Environmental Protection Taxes and Regulatory Costs in Heavy-Polluting Industries. Ijerph 17 (6), 2070. doi:10.3390/ijerph17062070

Wei, P., and Zeng, G. F. (2018). Environmental Information Disclosure, Analyst Attentionand Stock Price Synchronicity: Evidence from Strong Environmental Sensitive Industries. J. Shanghai Univ. Finance Econ. 20 (2), 39–58. doi:10.16538/j.cnki.jsufe.2018.02.003

Wu, X. H., Guo, X. D., and Qiao, Z. (2019). Institutional Investor Clique and Stock Price Crash Risk. China Ind. Econ. 2, 117–135. doi:10.19581/j.cnki.ciejournal.20190131.007

Xia, C. Y., and Jia, F. S. (2019). Share Pledge of Controlling Shareholders and Stock Price Crash: "actual Injury" or "emotional Catharsis. Nankai Bus. Rev. 5, 165–177. Available at: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=LKGP201905015andDbName=CJFQ2019

Xu, N. X., Jiang, X. H., Yi, Z. H., and Xu, X. Z. (2012). Analysts' Conflict of Interest, Optimistic Deviation and Stock Price Crash Risk. Econ. Res. J. 7, 127–140. Available at: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=JJYJ201207011andDbName=CJFQ2012

Ye, K. T., Cao, F., and Wang, H. C. (2015). Can Internal Control Information Disclosure Reduce the Stock Price Crash Risk? J. Financ. Res. 2, 192–206.

Keywords: ESG rating, stock price crash risk, information asymmetry, investors’ attention, investors’ trust, ESG investment

Citation: Li S, Yin P and Liu S (2022) Evaluation of ESG Ratings for Chinese Listed Companies From the Perspective of Stock Price Crash Risk. Front. Environ. Sci. 10:933639. doi: 10.3389/fenvs.2022.933639

Received: 01 May 2022; Accepted: 16 May 2022;

Published: 24 June 2022.

Edited by:

Xiao-Guang Yue, European University Cyprus, CyprusCopyright © 2022 Li, Yin and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shuai Liu, bnVlbXNlQDE2My5jb20=

Sicheng Li

Sicheng Li Pengfei Yin

Pengfei Yin Shuai Liu2*

Shuai Liu2*