- 1Academy of China Council for the Promotion of International Trade, Beijing, China

- 2School of Business and Economics, United International University, Dhaka, Bangladesh

Energy–growth nexus has gained immense interest among researchers, policymakers, and academicians, and with conclusive evidence, it is revealed that sustainable economic growth significantly relies on energy availability and security. Another line of studies postulated that excessive fossil fuel application had created adversity for environmental degradation and ecological imbalance. However, the energy demand from renewable and non-renewable has intensified with the act of several macro-fundaments, and countries have been investing efforts to figure them out in energy policy formulation; thus, BRI (please see Appendix A) are not out of the trend. The motivation of the study was to explore the role of urbanization, remittances, and globalization in energy consumption in BRI nations for the period 2004–2020. A panel of 59 (fifty-nine) BRI nations has been considered a sample countries’ assessment and their selection purely depended on the data availability. Several panel data estimation techniques have been applied, including CIPS and CADF, for panel unit root test, cointegration test with error correction, dynamic seemingly unrelated regression, and Dumitrescu–Hurlin panel heterogeneous causality test. The coefficient of globalization has exposed negative (positive) and statistically significant ties with non-renewable (renewable) energy consumption, whereas remittances and urbanization revealed positive and significant associations with both renewable and non-renewable energy consumption. The directional causality test documented bidirectional causality between globalization and renewable energy consumption and urbanization, globalization, and remittances to non-renewable energy consumption.

1 Introduction

Nations with limited energy sources halted the economic progress, and excessive application of conventional energy resulted in degradation of environmental quality and ecological imbalance. In the contest to ensure sustainable economic growth and environmental protection, existing literature has extensively focused on the energy transition from fossil fuel to clean energy, that is, renewable energy integration in economic activities (Yang et al., 2020). Practitioners and academics alike see the present debate over energy policy and regulation as a key subject of study in the age of globalization. Development in economics, society, and the environment depends on energy use (Kahouli, 2017). Energy insecurity has grown since the global economy has expanded rapidly in recent years, altering global energy consumption levels due to the widening disparity between supply and demand for energy. As a result, the world’s economies have difficulty maintaining an adequate energy supply. For example, the global economy has increased 22.9 times between 1971 and 2019, whereas overall energy consumption levels climbed roughly 2.2 times to their 1971 level. By taking into account the energy availability, literature has produced a plethora of evidence focusing on the energy–growth nexus (Suri and Chapman, 1998; Belloumi, 2009; Belke et al., 2011; Arouri et al., 2012; Tang and Tan, 2014; Zaman and Moemen, 2017; Salahuddin et al., 2018; Raza et al., 2020; Appiah-Otoo, 2021; Meo et al., 2021; Nair et al., 2021; Sharma et al., 2021; Zhuo and Qamruzzaman, 2021). The study of Magazzino et al. (2021), for example, investigated the effects of energy consumption on the economic growth of the Brazilian economy with the application of machine learning. The study documented that renewable energy incorporation in industrial development ensures higher productivity with economic sustainability. Furthermore, another line of studies is available in the literature focusing on determining the determent of energy consumption in the economy (Rabab Mudakkar et al., 2013; Azam et al., 2016; Sineviciene et al., 2017; Fuerst et al., 2020).

Over the last decades, the selection of energy sources has been significantly guided by the adversity in environmental protection and ecological imbalance, implying that sustainable economic development with controlled environmental degradation has been placed on apex concern, especially in the developing nations (Jahanger et al., 2022a). Existing literature has postulated that developing nations have shown concern for environmental damage restoration with an appropriate selection of energy sources (Baloch et al., 2019; Abdo et al., 2022). As a discussion, the present study has considered remittances, urbanization, and globalization on energy consumption in BRI countries. Existing literature postulated that ensuring overall and equitable economic growth demands energy availability at a reasonable price. The energy consumption trend and expectations are influenced by money flow in the economy, suggesting that the capital adequacy or households’ excess purchasing power crates development forces in the economy, that is, additional consumption results in increasing aggregated production level; eventually, the impact of energy demand has accelerated. In their study, Rahman et al. (2021) revealed the potential role of remittances in augmenting energy consumption in South Asian countries. The study postulated that remittances act as a stimulating factor in clean energy integration through industrial development. Remittances, either directly or indirectly, have the potential to increase energy consumption per capita. Directly, remittances enhance the quality of life for recipient families by increasing their discretionary income; consequently, they will need to use more energy. There are three different manifestations of indirect effect. Remittances may have a multiplier effect on an economy by increasing demand across various industries, including construction, retail commerce, financial mediation, insurance, real estate, and transportation (Akçay and Demirtaş, 2015). On the other side, remittances have the potential to enhance economic production through improving education and health, which in turn boosts human capital.

The motivation of the study was to explore the role of urbanization, remittances, and globalization in energy consumption in BRI (please see Appendix‐A) for the period 2004–2020. The present study has considered renewable and non-renewable energy consumption for empirical assessment. The intention to include both energy sources in the empirical assessment is to explore the fresh insight into a comparable impact from GLO, UR, and remittance on energy demand in BRI nations. Finally, the article puts forward policy suggestions for energy development in the light of environmental protection.

The Belt and Road Initiative (BRI) countries have been selected as a case study. State-to-state cooperation and strategic alliances between countries are becoming more common. As a part of China’s “going global strategy,” the Belt and Road Initiative (BRI) was announced by the Chinese government in 2013 (Chen, 2016). The Belt and Road Initiative (BRI) has spawned a slew of debates, particularly over energy consumption, foreign direct investment, and financial development (Rauf et al., 2018). The Silk Road Economic Belt and the Maritime Silk Road of the Twenty-First Century are covered under the B&R program. This effort aims to connect infrastructure networks and enhance trade between Asia, Europe, and Africa using the historic Silk Road pathways. Consequently, the activities of the B&R initiative are centered on developing energy cooperation along the B&R corridors. While there are some beneficial aspects to the B&R energy sector plan, such as greater financial aid and infrastructure development, it is not without flaws. China’s production, energy supply, and energy efficiency are predicted to increase due to the B&R plan. On the other hand, international groups expect that China’s outmoded industries will be moved to other parts of the globe, reducing pollution and energy consumption (Jelinek, 2017). This adversarial mentality will exclude or block the participation of many economies in this project. Consequently, these nations will be unable to carry out technical development, funding, or expertise-related operations on their territory (Han et al., 2018; Li et al., 2022). BRI initiatives in clustered countries will have a multiplier effect on human effort, whether officially or informally. Indeed, every coin has two sides: on the one hand, bilateral cooperation and globalization will benefit restricted economies. On the other hand, it may have shocking consequences, such as environmental degradation due to massive energy consumption for power generation, industrial development, mass communication, transportation, and urbanization, as well as the clearing of woodlands to make way for road and rail network lines (Hussain J. et al., 2020).

The contribution of the study to the existing literature is as follows: first, according to the existing literature, many researchers have investigated energy nexus focusing on BRI countries. However, little empirical assessment is implemented to assess the role of urbanization, globalization, and remittances in energy demand from non-renewable and renewable energy sources. This study has offered a comparative assessment by explaining the elasticities of GLO, UR, and REM. Second, the competitive assessment output will support formulating the energy policies dealing with the clean energy integration and reducing reliance on fissile fuel.

The study has employed panel data estimation techniques, including CIPS and CADF, for panel unit root test, cointegration test with error correction, dynamic seemingly unrelated regression, and Dumitrescu–Hurlin panel heterogeneous causality test. The coefficient of globalization has exposed negative (positive) and statistically significant ties with non-renewable (renewable) energy consumption, whereas remittances and urbanization revealed positive and significant associations with both renewable and non-renewable energy consumption. The directional causality test documented bidirectional causality between globalization and renewable energy consumption and urbanization, globalization, and remittances to non-renewable energy consumption. The rest of the article is organized as follows: Section 2 explains the literature review. Section 3 discusses the data and methodology. Section 4 provides the estimated results along with its discussion. The final section concludes the article.

2 Literature Review

There is no question that China’s projected Belt and Road Initiative (BRI) would substantially influence the international economy in many aspects, including financial, environmental, economic, energy, educational, and political (Godement and Kratz, 2015; Pant, 2017). As with other important economic variables, the development of financial markets can positively stimulate and bring about a number of changes within an economy, such as facilitating the easy availability of financial capital, stimulating global investments, and making energy-efficient appliances more widely available. It can also help minimize financial risks, reduce borrowing costs, and improve transparency in economic transactions between borrowers and lending institutions. With fixed investment, these economic stimuli may impact energy use in various countries (Saud et al., 2018). Financing for energy-efficient projects comes from the financial industry, but energy is also essential to the financial sector’s proper operation. The financial sector’s development can increase liquidation for investment activities and industrial growth, support new infrastructure, and considerably influence energy usage (Islam et al., 2013). Since the empirical literature is divided into two distinct sections, this research categorizes it into two sections: time-series and panel-country data sections.

2.1 Globalization and Energy Consumption

Human civilizations have long been subjected to the fast growth of the contemporary world economy, an economy that has existed since at least the mid-1400s, overcoming crisis-after-crisis in the process of accumulation. Rapid technological advancement has been an integral component of this development, which has consolidated the global division of labor and increased the significance of distant events for all humanity. This division of labor enables further growth of rationalized production. It extends worldwide to expand markets and supply cheap labor and material resources to enhance surplus value (Foster, 1999 and 2002; Harvey, 1999). Structural globalization is a widening and deepening network of interconnected networks, particularly in politics, economic, and cultural globalization. Globalization rapidly opens economies via trade and foreign direct investment (FDI), impacting energy usage. Technology transfers via globalization, for example, may not be energy-efficient, resulting in increased energy usage. Energy consumption rises when economic activities expand due to globalization (Danish and Ulucak, 2021; Jahanger et al., 2021), but the consequent transfer of new technology and knowledge might lower consumption and demand (Qamruzzaman and Jianguo, 2020). Globalization accelerates economic expansion in developed and emerging countries, resulting in increased energy consumption and GHG emissions (Qamruzzaman et al., 2021). As an augmenting factor for energy consumption, existing literature has produced evidence of the positive and statistically significant link between globalization and energy consumption, see, for instance, Marques et al. (2017) and Saud et al. (2018). Empirical results show that globalization increases energy usage. Globalization is widely acknowledged to boost fossil fuels’ economic activity and energy consumption. Because of Pakistan’s exposure to the rest of the world’s rigorous trade and investment rules, the country consumes much energy.

Given the importance of energy conservation as a primary goal of environmental sustainability, governments worldwide are looking for key variables that contribute to increased energy use. Countries increasingly rely on natural resources to achieve greater degrees of globalization (Jahanger et al., 2022b). In their study, Hussain H. I. et al. (2020) examined how natural resource returns and globalization affect energy consumption in major Asian nations. A unique nonparametric technique of causation in quantile was used to find quantile-based causal connections between natural resources and globalization on the returns and volatility of energy use in selected Asian nations. The Brock–Dechert–Scheinkman test (BDS test) verified that all variables were nonlinear. Quantile cointegration also indicated a nonlinear long-run link between natural resources and energy usage. It was shown that natural resource returns, and globalization had a strong causal effect on energy consumption returns in all nations. In contrast, there was no causal relationship between energy use and natural resource returns or globalization in any investigated Asian nation. The results help policymakers create programs that minimize energy use.

Shahbaz et al. (2018) used the nonlinear autoregressive-distributed lag (NARDL) technique to investigate the asymmetric influence of economic expansion and globalization on energy consumption. The study documented that a positive economic shock boosts energy consumption, whereas a negative shock stifles it in the BRICS nations. Energy consumption is positively affected by a positive shock in globalization, whereas energy consumption is adversely affected by a negative shock in globalization. Furthermore, Marques et al. (2017) established the increased energy–growth nexus with globalization using data from 1971 to 2013 in 43 nations. The results of the directional causality test detected feedback linkage between energy–growth nexus; however, the effects of globalization, that is, political, economic, and social globalization, had exposed heterogeneous to energy consumption.

Acheampong et al. (2021) examined the nexus between globalization, economic growth and energy consumption in a panel of 23 countries for the period 1970–2016. The study employed generalized the method of the moment with an instrumental value approach and documented a negative and statistically significant association between globalization and energy consumption. In particular, economic, political, and social globalization deters conventional energy conventions. In the study by Shahbaz et al. (2016), it is apparent that the energy demand in India has been negatively induced by economic globalization and overall globalization. A study suggests that fossil fuels, especially in the long run, have decreased with economic internationalization.

2.2 Remittances and Energy Consumption

Remittances can raise per capita energy consumption in developing nations directly and indirectly. Migrant remittances directly influence receivers’ lives by increasing their discretionary income, enabling them to enhance their community’s quality of life. As a result, their energy usage will rise. Bayangos (2012) investigated the link between remittances and real disposable personal income and the relationship between remittances and real personal consumption expenditures in the Philippines. According to the study, remittances increase personal income and consumer expenditure. However, indirect effects might appear in one of three ways. To begin with, recipient families’ spending can have a multiplier impact on the economy: remittances enhance demand in various sectors, including construction, retail commerce, financial mediation, insurance, real estate, and transportation. Second, remittances may help create human capital, boosting economic production by increasing education and health outcomes. The third advantage of remittances is that they may increase the amount of money available for productive investments since they are an external financial resource. Productive investments provide future family income from sources other than remittances. Senbeta (2013) revealed that migrant remittances have a favorable effect on physical capital development and investment in a study using panel data from 50 developing nations.

In recent literature, remittances have been acknowledged with great concern. When one group of researchers documented positive roles in the economy, such as human capital development, financial intermediation and development (Muneeb et al., 2021), industrial output, household consumption, and poverty reduction (Miao and Qamruzzaman, 2021), whereas has another line of evidence been produced in the literature with a negative note precisely documenting environmental degradation (Ahmad et al., 2021), an increase of inequality, and import reliance among others. Furthermore, remittances benefit the recipient economy by augmenting poor people’s income (Majeed, 2016), functioning as a critical source of funding for household savings and investment, and stimulating economic growth. On the other side, remittances have a negative effect on an economy by raising the real exchange rate, lowering labor market participation, and fueling inflation (Narayan et al., 2011). Increased remittances resulted in a significant increase in family income and, as a consequence, poverty alleviation. Remittances allow households to purchase luxury items such as vehicles and other forms of mobility, hence increasing their consumption and other commodity expenditures. They were, however, unable to acquire these things due to a shortage of money.

Furthermore, increased demand for long-lasting items drives up demand for energy and fuel. Consequently, remittances may, on the one hand, help alleviate poverty in Pakistan. Simultaneously, a rise in remittances may be connected with a decline in environmental quality. Furthermore, long-lasting things significantly increase carbon emissions into the environment. Many earlier studies in the present literature suggest that increased remittances greatly improved the deposit ratio by fostering a stronger financial system (Mugableh, 2015). Furthermore, remittances establish new and existing enterprises, which contribute directly or indirectly to global carbon emissions. We can reliably assume that remittance impacts an economy’s consumption pattern; therefore, we can expect remittance to increase energy consumption via greater investment, which leads to increasing industrialization. Energy consumption in an economy includes both renewable and non-renewable forms of energy (electricity, coal, gas, solar energy, and so on) to which people have access.

A study conducted by Rahman and Amin (2018) focused on the nexus between remittances and energy consumption in Bangladesh from 1980–2015. The vector error correction and Granger causality test have been implemented in exploring the intensity of remittances in augmenting energy consumption. The study documented the long-run association between remittances inflows and energy consumption in the long and short-run; moreover, the causality test confirmed the unidirectional causal effects of emittances on energy consumption. Akçay and Demirtaş, (2015) examined the nexus between remittances and energy consumption in the context of Morocco from the period 1975–2010. Using the Granger causality test, the study exposed that remittance directly influences energy consumption in the short and long run. Variance decomposition and impulse response tests have shown that the change can influence future changes in energy consumption in international remittances. It is also observed that remittances indirectly influence energy consumption through economic growth and industrialization of Morocco.

2.3 Urbanization and Energy Consumption

Particularly, in emerging nations, urbanization has become a major source of economic development. In terms of greater access to education and the job market, fewer transportation expenses, and superior living conditions, moving from rural to urban residence makes economic sense. According to conventional wisdom, urbanization may raise energy consumption by moving output to a more energy-intensive end, increasing traffic flow, and stimulating infrastructure demand (Bai and Imura, 2000). However, urbanization may have a negative impact on energy owing to economies of scale in mass manufacturing, a decrease in personal transportation, and the adoption of green construction standards (Poumanyvong and Kaneko, 2010). As a result, the impact of urbanization on energy use is unclear. The theoretical and empirical literature has thoroughly studied the link between urbanization and energy use. The link between urbanization and energy intensity, according to Poumanyvong and Kaneko (2010) and Shahbaz et al. (2016), is dependent on several factors, including income level, industrialization and development phase, and population density in urban areas, which is also related to the type of energy pattern (non-renewable or renewable energies). By controlling for a country’s industrial development and technical progress, Liu and Xie (2013) discovered that the impacts of urbanization and industrialization on energy consumption varied between geographical locations. Human activities have become more important in environmental deterioration. Urbanization-related energy consumption is a hot topic in the study. However, the impact of urbanization on energy efficiency is debated because the existing literature has shown that urbanization increases energy use for moving economic activities and industrialization. The study by Liu (2009) has shown that urbanization increases energy consumption in the short and long term. Similarly, Madlener and Sunak (2011) find that urbanization increases energy consumption by expanding infrastructure. Al-mulali et al. (2012) have investigated the long-term influence of urbanization on energy consumption and established urbanization and energy use go in hand. Moreover, Al-mulali et al. (2013) continue to study the long-term relationship between urbanization and energy use in MENA nations. The study has documented that only high-income nations have a favorable long-term association. Similarly, Poumanyvong and Kaneko (2010) and Li and Lin (2015) show that urbanization has a favorable influence on energy usage in high-income nations but a negative effect in middle-income countries.

Sheng et al. (2017) investigated the effect of urbanization on energy consumption and efficiency by taking a panel of 78 nations for the period 1995–2012. The empirical output with system-GMM has documented that the urbanization process leads to increased energy consumption and degrades energy efficiency prospects. It suggests that energy inefficiency is the consequence of the process of urbanization. Urbanization is often considered to be the most important driver of economic development. The relationship between a nation’s level of urbanization and its energy consumption, which is dependent on the amount of economic activity in that country, has long been recognized (Yang et al., 2016). In a study, Nathaniel et al. (2019) investigated the association between ecological footprint, urbanization, and energy consumption in South Africa from 1965–2014. Bayer–Hanck cointegration test established a long-run association among variables; furthermore, the results of ARDL output revealed that excessive energy consumption and urbanization have a detrimental effect on environmental degradation. In a study, Liu (2009) examined the empirical effects by implementing the equation with the function of energy consumption, urbanization, financial development, and economic growth for the period 1978–2008. ARDL-bound testing confirms the long-run cointegration in terms of urbanization impact on energy consumption; the study documented that urbanization leads to a higher level of energy consumption.

Salim and Shafiei (2014) examined the influence of urbanization on the use of non-renewable and renewable energy in OECD nations. They discovered that although urbanization has a beneficial impact on non-renewable energy consumption, it has a statistically negligible effect on renewable energy consumption. Furthermore, they argue that the Granger causality test demonstrates no causal relationship between non-renewable energy usage and urbanization. In a study, Liu (2009) documented urbanization’s effects on China’s energy consumption as a decreasing trend, implying that energy-efficient technology integration in industrialization relies on energy consumption. Holtedahl and Joutz (2004) advocated that there are two plausible explanations for why urbanization will increase energy use. First, urbanization improves energy availability by allowing residences to be more easily linked to the grid. Second, families who previously lacked access to electricity in rural regions are likely to increase their dependency on it in urban areas due to greater current equipment usage and the acquisition of new ones.

2.4 Limitations in the Existing Literature

(1) According to the existing literature, a growing number of studies have been investigating the impact of globalization, urbanization, and remittances on energy consumption with time services and panel data in the different equations, meaning that target variables were present in a scattered manner, not in an equation. The present study has extended the existing literature by dragging the fresh insights into the empirical nexus between target variables and energy consumption in a single assessment.

(2) The existing literature revealed a one-directional assessment of energy consumption nexus with other macro-fundaments, indicating energy consumption measured by either renewable energy consumption or non-renewable energy consumption. The impact of target variables that are urbanization, globalization, and remittances on renewable and non-renewable energy in BRI nations with a commutative assessment is missing in the empirical studies. The present study has derived to mitigate the existing gap with fresh evidence.

3 Materials and Methods

3.1 Model Specification

The energy nexus has been extensively investigated in the empirical literature by taking two likes of direction: determents of energy computation and the effects of energy consumption on aggregate economic units’ performance. Following the empirical studies such as Mrabet et al. (2019); Qamruzzaman (2021); Shahbaz et al. (2018); Zhuo and Qamruzzaman (2021), and Kumar et al. (2016), the study developed the following generalized empirical mode of execution:

where REC denotes renewable energy consumption, NREC denotes non-renewable energy consumption, GLO denotes globalization, UR stands for urbanization, and REM represents remittances inflows; following the existing literature, see, for instance, the study added two additional variables in the empire equation; those are financial development (FD) and foreign direct investment (FDI). Eq. 1 can be reproduced by the inclusion of new variables as follows:

Before estimation, all the variables were transformed into a natural logarithm. Finally, Eq. 2 can be reproduced in the following manner:

where REC denotes renewable energy consumption, NREC denotes non-renewable energy consumption; GLO explains globalization; UR stands for urbanization, REM stands for remittances, FDI denotes foreign direct investment, and FD stands for financial development. The coefficient of

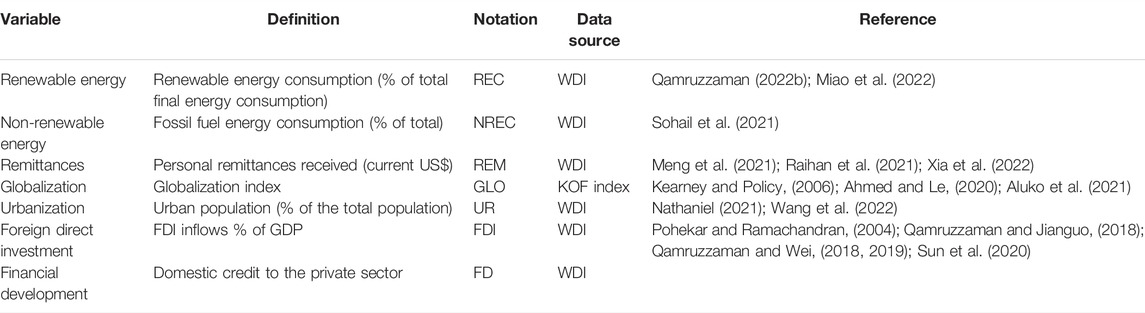

3.2 Variables Definition and Sources

The present study intends to assess the effects of remittances inflows, urbanization, globalization, foreign direct investment, and financial development on energy consumption measured by renewable and non-renewable energy sources in BRI countries. A panel of 59 (fifty-nine) countries has been considered for empirical assessment.

Energy consumption: As dependent variables, the study has considered renewable and non-renewable energy sources for empirical assessment. According to the existing literature, two lines of evidence have been found regarding the proxies of energy consumption; a group of researchers focuses on conventional energy consumption (Hussain et al., 2022), and another group concentrates on renewable energy sources (Dong and Pan, 2020; Wang et al., 2021). Furthermore, another line of studies in recent times has deployed for both renewable and non-renewable energy consumption in assessing energy nexus (Abbas et al., 2020; Khan et al., 2021). To gain an in-depth understanding and explore a fresh insight, the present study has considered renewable and non-renewable energy consumption as a proxy for energy consumption.

Remittances: Remittance inflows in the economy have produced two effects: the second, excess purchasing power by the households induces additional consumption in the economy and boosts. The economic impact of remittances also can be observed in energy demand (Akçay and Demirtaş, 2015). The study of Adams and Cuecuecha (2013) documented the remittance’s role in economic growth and poverty reduction in the economy; moreover, energy consumption augmentation was documented in Ghana. International remittances are widely acknowledged as a substantial source of income for families left behind in their home countries, especially in developing nations. For most recipient households, remittance seems to be their primary source of income. As a consequence, it is anticipated that remittances would improve recipient families’ living standards and alleviate budget constraints, allowing for a beneficial change in domestic spending patterns.

Urbanization: Urbanization is a significant aspect of economic growth, including structural changes that impact energy usage (Jones, 1989). Urbanization concentrates people and businesses. It entails shifting labor from agriculture to industry and services, and within the industry, from low-energy primary product processing to high-energy metals and chemicals. Urbanization is responsible for changes in energy usage due to new manufacturing activities and the decline of existing ones. However, modernizing industrial technology introduces additional changes that impact energy efficiency. High-density cities consume less fuel than low-density cities because travel distances are shorter, and residents are more inclined to utilize public transportation. Another argument is that street lighting requires little power regardless of city density; therefore, bigger cities use less per capita (Larivière and Lafrance, 1999). As a result, there is significant bidirectional causality between urbanization and energy usage. Thus, the issue of urbanization and energy use should be tighter and more focused.

Globalization: As the world’s economies combine into a single market, “globalization” describes this trend. Nations’ globalizing efforts have been linked to liberalization policies, notably in the international industry. Energy market expansion, a need for global economic growth, has also been associated with globalization. Furthermore, national economy global integration prompts trade liberalization, foreign capital flows, knowledge sharing, and spillover effects (Chen and Chen, 2011). Resources like gas, oil, and coal have helped connect the globe in recent years. As a result, countries may have a tight relationship via energy exchange. This shows that globalization may be a significant factor in energy use (Qamruzzaman, 2014; Adebayo and Kirikkaleli, 2021). The impact of globalization on economic performance can be discovered in a three-dimensional way; first, economic globalization is explained by the augmentation of trade and investment between the host economy and others. Economic globalization opens markets for settling the unsettled demand with the assistance of others’ knowledge and technical know-how. These events eventually create additional energy demand. Second, Social globalization refers to population empowerment with advanced technical knowledge and expertise from other nations (Zhuo and Qamruzzaman, 2022). Advanced technological integration in the economy increases energy efficiency and forces the energy transition to clean energy instead of fossil fuel. Third, political globalization stands for international alliance and agreement with a common interest, such as environmental protection has a position at the apex. Political globalization promotes energy transition on the ground of environmental protection and ecological balance; moreover, energy efficiency can be ensured with green technological adaptation with common consensus (Godil et al., 2021).

Foreign direct investment: Domestic capital adequacy through foreign investment has played a critical role in ensuring sustainable economic growth. Furthermore, the impact of FDI has also been investigated in terms of energy demand in the economy (Amri, 2016; Salim et al., 2017; Bu et al., 2019). The FDI–energy nexus has revealed two lines of directional association; first, a group of researchers has documented that energy availably encourages foreign investors to channel their capital in the form of investment (Kok and Acikgoz Ersoy, 2009; Ranjan and Agrawal, 2011), and the second line of studies has established inflows of FDI in the economy that create additional demand for industrialization and economic progress (Leitão, 2015; Doytch and Narayan, 2016; Li et al., 2019).

3.3 Estimation Strategy

3.3.1 Cross-Sectional Dependency Test and Test of Heterogeneity

Globalization established interconnection worldwide; therefore, every economy is prone to react due to economic shocks in other economies (Jia et al., 2021; Qamruzzaman, 2022a; Zhuo and Qamruzzaman, 2022). As a result, empirical research employing panel data will almost certainly be necessary to ascertain the existence of cross-sectional dependence. Literature has suggested several ways to detect the possible presence of cross-sectional dependency by employing the CDlm test proposed by Breusch and Pagan (1980), the CDlm test with scaled version following Pesaran (2004), the CD test following Pesaran (2006), and the bais-adjusted LM test proposed by Pesaran et al. (2008).

The LM test statistics can be computed with the following equation:

where

The scaled version of the Lagrange multiplier (CDlm) can be implemented in the following manner:

The proposed cross-sectional test established by Pesaran (2006), commonly known as the CD test, can be executed with the following equation:

Finally, the CD test following Pesaran et al. (2008), known as the bias-adjusted LM statistics, can be computed with the following equation:

3.4 Panel Unit Root Test

The discovery of the properties of variables in empirical estimation has been considered a critical step, especially in panel data assessment. For detecting variable stationarity properties, the study applied three first-generation unit root tests such as Levin, Lin and Chu test (Levin et al. (2002), Im, Pesaran, and Shin W-stat (Im et al., 2003), and ADF–Fisher–Chi-square test (Maddala and Wu 1999). However, due to the issue of cross-sectional dependency (CSD), the study utilized second-generation unit root tests, namely, cross-sectional augmented Dickey–Fuller (CADF) and cross-sectional augmented Im, Pesaran, and Shin (CIPS) familiarized by Pesaran (2007).

The framework for the unit root test with CADF following Pesaran (2007) is as follows:

Substituting long-term in Eq. 7 results in the subsequent Eq. 8:

where

where the parameter

3.5 Westerlund Cointegration Test

The next step in panel data analysis is to determine the series’ long-run cointegration after establishing the stationarity of the study variables. Given CSD and heterogeneity concerns, we need second-generation panel cointegration tests that provide exact and trustworthy information on the long-run cointegration relationship between variables across various circumstances. The research used the error correction-based cointegration given by Westerlund (2007) to address the aforementioned problem. The cointegration test with error correction produces two sets of results: two group test statistics (Gt & Ga) and two-panel test statistics (Pt & Pa). The null hypothesis of Westerlund cointegration is that there is no long-run relationship between UR, GLO, REM, and EC (REC &NRC) in BRI nations.

The error correction techniques for long-run cointegration assessment are as follows:

The results of group test statistics can be derived with Eqs 12 and 13:

The test statistics for panel cointegration can be extracted by implementing the following Eqs 14 and 15:

3.6 Dynamic Seemingly Unrelated Regression

Using Mark et al. (2005)’s dynamic unrelated regression (DSUR) model, the influence of remittances, urbanization, and globalization on energy consumption in BRI countries was explored. The DSUR approach is practical for panels with N-cointegrating regression equations much less than T time-series data. Furthermore, when heterogeneous sets of regressors are utilized in regressions and equilibrium errors are related through cointegration regressions, the DSUR outperforms non-system alternatives such as dynamic ordinary least squares (DOLS) and provides efficiency advantage methods. Furthermore, as previously stated, the DSUR may be used on heterogeneous or homogeneous panels (Hongxing et al., 2021; Andriamahery and Qamruzzaman, 2022).

The following DSUR equation is to be executed in detecting the variables’ elasticity of energy consumption:

Dumitrescu and Hurlin’s (2012) Panel Causality Test

The present study has considered the modified non-Granger causality test offered by Dumitrescu and Hurlin (2012), which is capable of addressing the non-dynamic properties among the research units over the conventional Granger causality test. The following empirical estimation is to be implemented to document the directional association:

The test forms the average statistic linked with the homogeneous null non-causality (HNC) hypothesis as follows:

The harmonized z-test statistic can be derived by using the following equation:

4 Results and Discussions

4.1 The Slope of Homogeneity and Cross-Sectional Dependency Test

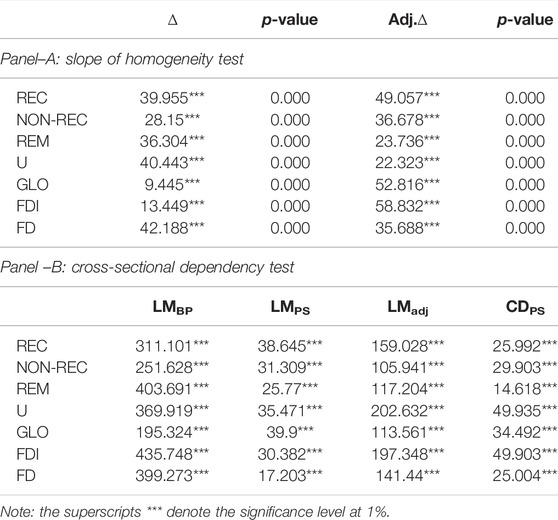

In panel data estimation, it is imperative to investigate the slope of homogeneity and cross-sectional dependency for selecting the appropriate panel data estimation techniques (Miao and Qamruzzaman, 2021; Qamruzzaman et al., 2021; Yang et al., 2021; Andriamahery and Qamruzzaman, 2022). For assessing the homogeneity test, the study employed the proposed techniques by Pesaran and Yamagata (2008) with the null hypothesis of “the slope of homogeneity” against the alternative hypothesis of “the slope of heterogeneity.” The homogeneity test results and cross-sectional dependency test are displayed in Error! Reference source not found. The test statistics and associated p-value of test statistics displayed in Panel–A of Table 2 confirm the rejection of the null hypothesis that the slope of the coefficients is heterogeneous. The study has implemented several cross-sectional dependency tests following Breusch and Pagan (1980), Pesaran (2004), Pesaran (2006), and Pesaran et al. (2008). The test statistics and associated p-value in panel–B of Table 2 suggest the null hypothesis’s rejection, alternatively confirming the sharing of certain common dynamics among the research units.

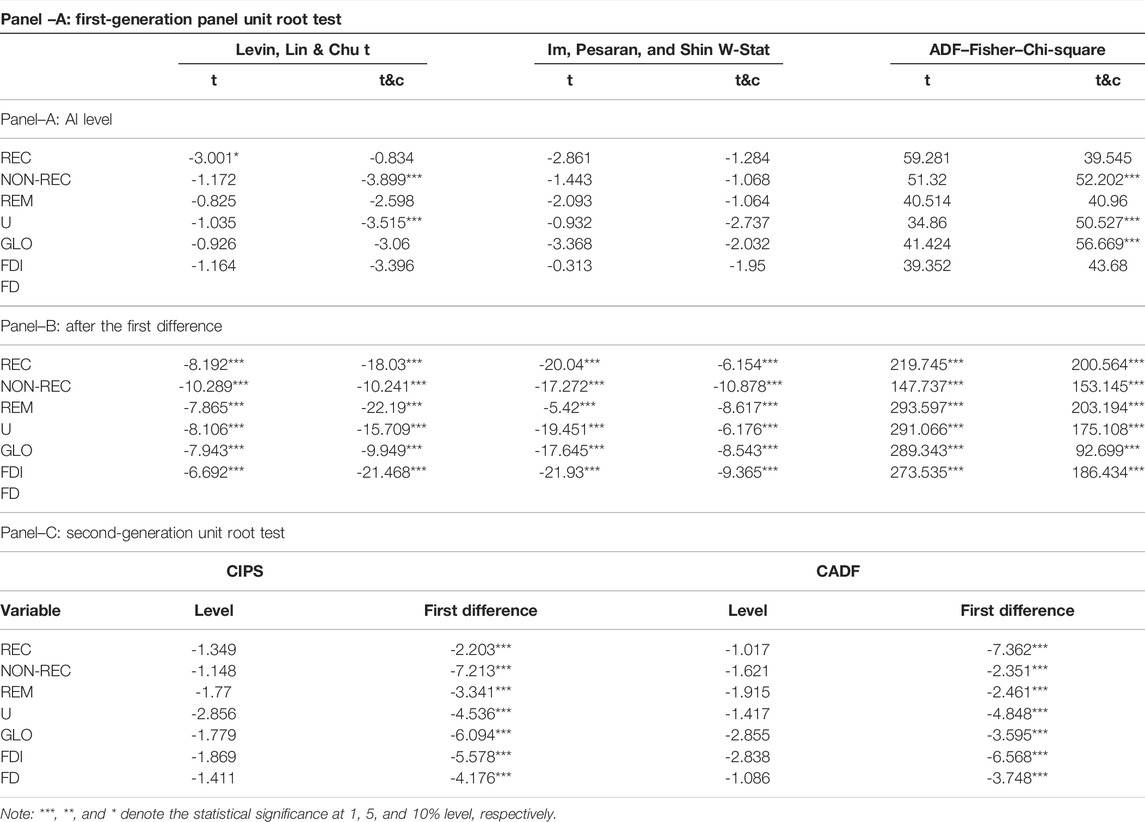

Identification of the variable’s order of integration in empirical estimation positively guided selecting appropriate econometrical techniques to document the variable’s elasticity. The present study has implemented both first-generation panel unit root tests following Levin–Lin–Chu (LLC) familiarized by Levin et al. (2002), Hadri (2000), and Breitung (2001) and the second-generation panel unit root tests commonly known as CIPS and CADF initiated by Pesaran (2007), which are capable of handling the cross-sectional dependency among research units. The results of the first-generation unit root tests are displayed in panel-A of Table 3. According to test statistics and associated p-value (see panel-A of Table 3), it is manifested that all the variables are stationary after the first difference. However, the first-generation estimator may not be the appropriate reliable results due to the test’s low power (O'Connell, 1998). Next, the study implemented a unit root test with cross-sectional dependency, and their results are displayed in panel–B of Table 3. The study documented the rejection of the null hypothesis since the p-values of all the test statistics are statistically significant at 1%.

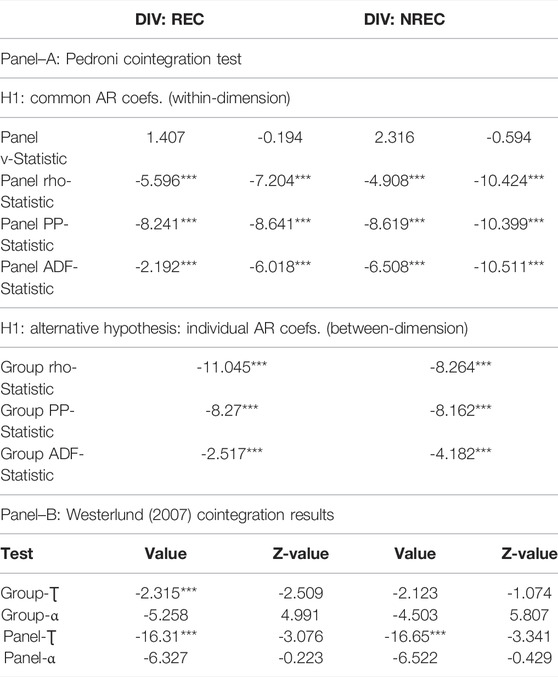

4.2 Panel Cointegration test

Next, the study has implemented a panel cointegration test to establish the long-run cointegration between urbanization, remittances, globalization, and energy consumption in BRI nations. To do so, the study has executed the cointegration test following Pedroni (1999; 2004)and Westerlund panel cointegration test proposed by Westerlund (2007). The results of the panel cointegration test are displayed in Table 4. Referring to the test statistics and associated p-value of the Pedroni cointegration test (see panel–A of Table 4), it is obvious that the majorities are statistically significant out of 11 test statistics at a 1% significance level. This suggests the availability of long-run association in the empirical equation. Furthermore, in the cointegration test with the error correction term (see panel–B of Table 4), it is apparent that both group and probability statistics are significant at a 1% significance level. The finding suggests that the null hypothesis of no cointegration is rejected. Thus, cointegration exists among the analyzed variables, namely, EC, UR, REM, and GLO.

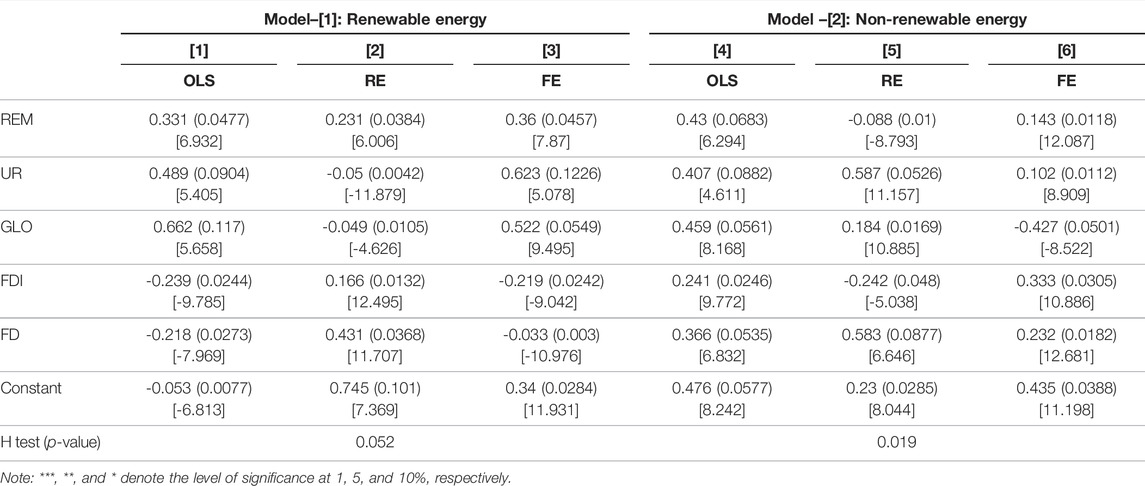

4.3 Baseline Estimation With OLS, Fixed Effect, and Random Effect Models

To get a preliminary understanding of the possible association between remittances, urbanization, and globalization with energy consumption, the study has implemented the baseline assessment through ordinary OLS, random effects (RE), and fixed effects (FE). According to the test statistics from the Hausman test, the fixed effect model has revealed efficient estimation in this regard.

Referring to empirical output displayed in col [3] of Table 5, the study findings suggest the positive and statistically significant elasticity to renewable energy consumption from remittance inflows in the economy (a coefficient of 0.361), urbanization (a coefficient of 0.623), and globalization (a coefficient of 0.522). It advocates that clean energy integration in the aggregate economic activities and environmental protection can be accelerated through efficient channelizing of migrant remittances, planned urban development, and global integration, while foreign direct investment (a coefficient of -0.219) and financial development (a coefficient of -0.033) revealed a negative association with renewable energy consumption in BRI nations.

Furthermore, baseline model estimation with non-renewable energy consumption as a dependent variable (see, col [6] of Table 5) was carried out. The coefficients of remittances (a coefficient of 0.143) and urbanization (a coefficient of 0.102) have exposed a positive tie to an increase in non-renewable energy demand in the economy, whereas globalization has been detected as negative and statistically significant. The financial development (a coefficient of 0.232) and foreign direct investment (a coefficient of 0.435) have found the augmenting factors for non-renewable energy demand in BRI nations.

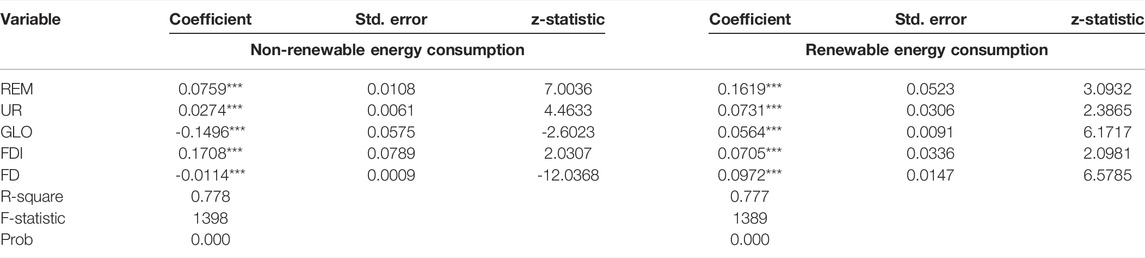

4.4 DSUR Long-Run Estimation Results

The study documents the variable magnitudes on energy consumption in BRI nations. The target model assessment with DSUR output is displayed in Table 6.

Referring to the nexus between remittances and renewable (non-renewable) energy consumption, the study has documented a positive and statistically significant connection with a coefficient of 0.1619 (0.0759). In particular, a 10% growth in remittance inflows in the economy will increase energy demand acceleration by 1.619% int. Our study findings are supported by the existing literature, such as Das et al. (2021) for Bangladesh, Qin and Ozturk, (2021) for China, and Rahman et al. (2021) for the South Asian economy. Remittances’ impact on energy consumption in BRI nations is obvious because of excess money flows in the economy, that is, remittance receipts and households have increased their present consumption, and capital accumulation has been accelerated. Capital adequacy and excess demand in the economy inject forces into aggregated output promotion, and therefore the demand for energy consumption has increased. Remittances contribute to both domestic consumption and foreign reserves at the macro-level, help in the growth of the financial sector, assure capital market development, and boost a country’s balance of payment position. Remittances may play an essential role in sponsoring social initiatives on a large scale (Akçay and Demirtaş, 2015). Finally, micro-remittances may play an important role in self-insurance and income assistance inside the recipient country.

The impact of urbanization on renewable (non-renewable) energy consumption has revealed a positive association, indicating that the energy demand has augmented in BRI nations regardless of the sources. More precisely, a 10% growth in urbanization in BRI nations will increase the energy demand by 0.274% for non-renewable energy consumption and 0.734% for renewable energy consumption. Our findings are in line with the existing literature, see, for instance, Salim and Shafiei, (2014) for OECD, Yang et al. (2016) for China, and Yu et al. (2020) for BRI nations. Mrabet et al. (2019) revealed that developing nations intensify their non-renewable energy demand due to urban development compared to emerging nations. The use of non-renewable and renewable energy in OECD nations is affected by urbanization, according to Salim and Shafiei, (2014). Furthermore, the study advocated that although urbanization decreases non-renewable energy usage, it has a statistically minor impact on renewable energy use.

The magnitudes of globalization on renewable energy consumption (non-renewable energy consumption) has revealed positive (negative) and statistically significant association. Study findings advocate that global economic integration encourages and increases the clean energy demand in the economy, whereas the excessive dependency on non-renewable energy sources has declined. In particular, a 10% further globalization integration of the economy can positively grow green energy production by augmenting the renewable energy demand by 0.564%. The energy demand for conventional sources has decreased by 1.496%. Globalization has a long-term positive (detrimental) impact on energy use, which is similar to the findings by Qamruzzaman and Jianguo, (2020) for India and Saud et al. (2018) for China but not by Dogan and Deger, (2016) for Brazil or Shahbaz and Lean, (2012) for Singapore. Globalization is a long-term process that helps the B&R project reduce its energy use. The negative association might be due to the adoption of advanced energy-efficient technologies into industrial processes, or it could be due to a lack of improvement in the total production factor and economic growth. Rapid economic growth leads to a large energy demand for goods and services if modern or energy-efficient technologies are not used in the production process (Solarin et al., 2013). Furthermore, globalization assists the transfer of innovative technologies from cross-border, that is, from developed countries to developing countries. It brings an innovative production method rather than the traditional production methods and increases the comparative advantages among different nations. It boosts trade and economic activities, thus boosting financial markets and bringing innovation and fresh knowledge to the regions.

The study found that FDI promotes energy consumption in B&R initiative countries, that is, the coefficient of FDI has exposed positive and statistically significant to renewable (a coefficient of 0.0705) and non-renewable (a coefficient of 0.1708). In particular, a 10% growth in foreign direct investment will increase energy consumption by 0.705% in renewable energy and 1.708% in non-renewable energy sources. FDI inflows, as we discovered, are a crucial driver of the high energy consumption in the initiative zones, and this conclusion has been verified by studies undertaken for the G20, Malaysia, and the SAARC region, including Lee Shujah ur et al. (2019) and Ozturk and Acaravci, (2013). However, in terms of the United States, our findings differ from Farhani and Solarin, (2017). Foreign direct investment (FDI) in the region and the establishment and growth of new and existing enterprises by foreign investors increase the region’s need for energy. Foreign direct investment may raise per capita energy consumption by bringing inefficient energy consumption technologies, a lack of knowledge, and high population movement. In the B&R initiative nations, FDI inflows positively impact energy usage.

The study documented that financial development deters (promotes) non-renewable energy (non-renewable energy) in BRI countries, implying that financial development in the economy reduces the non-renewable energy demand and assists in establishing the environmental sustainability of the inclusion of inclusion green energy. More specifically, a 10% growth in financial development will reduce non-renewable energy consumption by 0.114% and accelerate renewable energy consumption by 0.972% in BRI nations. On a more general level, this confirmation is consistent with studies by Alam et al. (2015) and Shoaib et al. (2017) for South Asian Association for Regional Cooperation (SAARC) member nations.

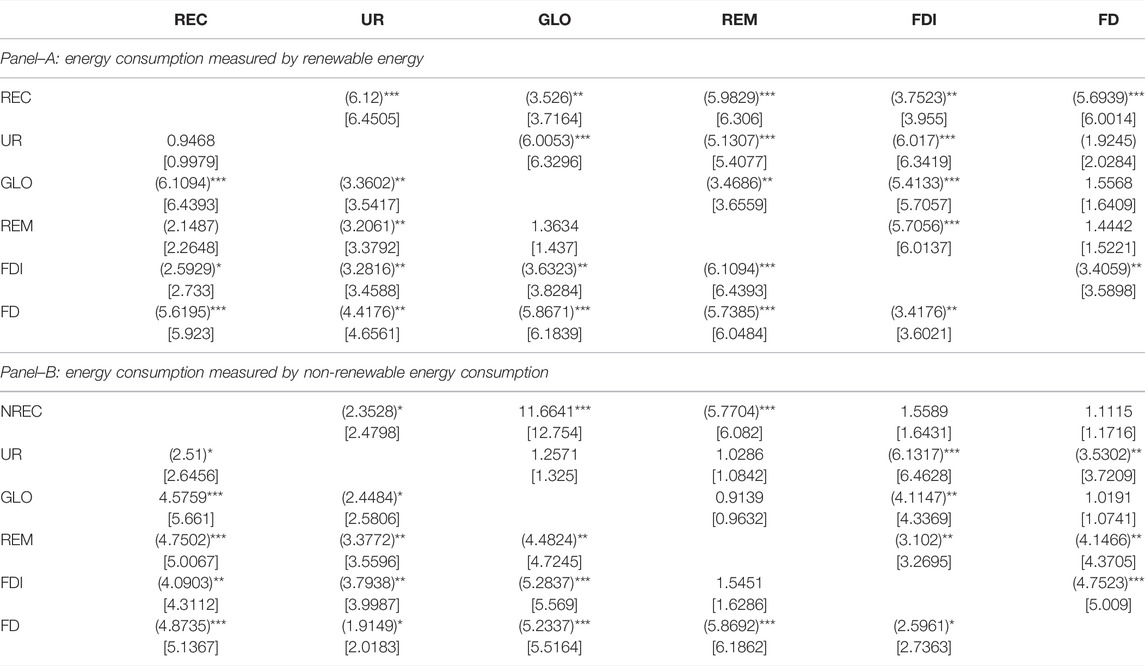

4.5 Dumitrescu–Hurlin Panel Causality

The panel grange causality test results are displayed in Table 7, including panel–A for REC and panel–B for NON-REC. Referring to causality test output where energy consumption is measured by renewable energy consumption, displayed in panel–A, the study documented bidirectional causality running between globalization and renewable energy consumption [REC←→GLO]; foreign direct investment and renewable energy consumption [FDI←→REC]; and financial development and renewable energy consumption [FD←→REC]. Moreover, the unidirectional causality revealed between urbanization to renewable energy consumption [UR→REC], which is supported by the existing literature such as Halicioglu (2007) for Turkey and Zhang and Lin, (2012) for China and remittances to renewable energy consumption [REM→REC]. Referring to causality results displayed in panel–B with non-renewable energy sources to measure energy consumption in the equation, the study divulged bidirectional causality running between urbanization, globalization, and remittances to non-renewable energy consumption [NREC←→REM], [NREC←→UR], which is supported by Shahbaz and Lean, (2012) for Tunisia, [NREC←→GLO], and furthermore, unidirectional causality available between non-renewable energy to foreign direct investment and financial development [NREC→FDI; NREC→FD].

4.6 Discussion of the Findings.

Inflows of remittances in BRI countries revealed positive and statistically significant energy consumption, but in terms of elasticity, remittances augmented clean energy integration more prominently than non-renewable sources. Our study findings are supported by the existing literature works, such as Das et al. (2021) for Bangladesh, Qin and Ozturk, (2021) for China, Rahman et al. (2021) for the South Asian economy, Akçay and Demirtaş, (2015) for Morocco, and Ari (2022) for MENA economics. Study findings suggest that a household’s capacity to expense with migrant remittances boosts purchasing power and simultaneously injects capital-intensive forces with additional energy demand for economic progress. Remittance inflows intensify the energy consumption in the economy positively in two distinct manners that are direct and indirect energy consumption. Remittance inflows immediately enhance recipient families’ disposable income and fueling demand for durable and luxury items such as refrigerators and vehicles that need energy to operate (Deng et al., 2022). Indirectly, increasing economic activity due to remittance inflows may increase energy use. The multiplier effect and the beneficial spillover effect can boost energy consumption because recipient families create demand for products and services such as retail trade, real estate development, and transportation when they spend their remittances (Brown et al., 2020).The study by Sahoo and Sethi, (2020) revealed that remittance inflows in India accelerate energy consumption through industrial development channels. Remittances inflow in the economy augmented the present level of energy consumption through two distinct models. First, remittance-led energy consumption can be observed with a direct impact, indicating the increase in the standard of living of the population due to additional purchasing power and positive change in the present level of consumption. Furthermore, remittance inflows ensure foreign reserves adequacy and stability in international payment, which eventually confirms exchange rate stability and boosts economic activities with excess energy demand (Ratha and Mohapatra, 2007). Second, remittance-led financial development explained that domestic savings have increased with the increase of migrant remittances, eventually boosting capital formation and investment. Rahman et al. (2021) documented that remittances increase energy consumption more in the long run than in the short run.

The coefficient of urbanization has established positive and statistically significant association with energy consumption in BRI nations. Study findings suggest that overall economic development through industrialization and infrastructural development will increase the energy demand. Our findings are in line with existing literature, see, for instance, Salim and Shafiei, (2014) for OECD, Yang et al. (2016) for China, Yu et al. (2020) for BRI nations, and Belloumi and Alshehry, (2016) for Saudi Arabia. Energy consumption acceleration with urbanization can be experienced in diversified channels. First and foremost, increased energy consumption by urban infrastructure is required to support increased economic activity in metropolitan regions. As a consequence of urbanization, production is migrating away from agriculture, which consumes less energy, and toward industrial sectors, which use more energy (Jones, 1991; Sadorsky, 2013; Usman et al., 2022b). Second, contemporary structures have more energy-consuming equipment than older buildings (refrigerators and air conditioning) (Usman et al., 2022a). Finally, as cities grow more urbanized, motorized traffic and congestion rise, resulting in higher energy use (Ferdaous and Qamruzzaman, 2014; Wang, 2014; Jianguo and WEI, 2016; Jianguo and Qamruzzaman, 2017). Urbanization, populations, and economic activity are increasingly concentrated in cities; due to rural-to-urban migration, agricultural industries in rural regions are losing personnel to the city’s industrial and service sectors, respectively (Zheng and Walsh, 2019). As a result of this economic structural transformation, we now utilize natural resources and energy differently. Agricultural production has shifted from low-energy to high-energy demanding forms of production, although new technology and industrialization have impacted the sector (Nathaniel et al., 2019). As a result of urbanization, the amount of production and the market’s breadth has increased dramatically in recent decades. Furthermore, the construction, operation, and maintenance of urban infrastructure and services, such as housing, water supply, roads, and bridges, are expected to use more energy than their rural counterparts (Madlener and Sunak, 2011). It appears that non-renewable fossil fuels will continue to be the primary source of energy for humans even though electricity generation from renewable energy sources (hydropower, biomass, biofuels, wind, and geothermal and solar power) has increased significantly in developed countries in recent years. Renewable energy sources are also constrained since they are not always readily accessible. Poumanyvong and Kaneko, (2010) discovered that urbanization has a considerable influence on transportation and road energy consumption in high-income countries, which may explain an increase in non-renewable energy consumption (higher than the low- and middle-income groups). People in industrialized nations still widely rely on personal vehicles for their daily errands. Motorized passenger traffic uses up to ten times as much energy as a well-organized and demand-oriented public transit system (Weiler, 2006). In contrast, the transportation sector is strongly reliant on fossil fuels (97 percent of transportation energy is derived from oil).

The impact of globalization has been documented with positive (and negative) on renewable (non-renewable) energy consumption in BRI nations. Our findings are supported by the existing literature, for instance, by Qamruzzaman and Jianguo (2020) for India and Saud et al. (2018) for China, but not by Dogan and Deger, (2016) for Brazil, Shahbaz and Lean, (2012) for Singapore, and Liu (2022) for China. National economy global integration prompts trade liberalization, foreign capital flows, knowledge sharing, and spillover effects (Chen and Chen, 2011). Resources such as gas, oil, and coal have helped connect the globe in recent years. As a result, countries may have a tight relationship via energy exchange. This shows that globalization may be a significant factor in energy use (Adebayo and Kirikkaleli, 2021). The impact of globalization on economic performance can be discovered in three dimensions; first, economic globalization is explained by the augmentation of trade and investment between the host economy and others. Economic globalization opens markets for settling the unsettled demand with the assistance of others’ knowledge and technical know-how. These events eventually create additional energy demand. Second, social globalization refers to population empowerment with advanced technical knowledge and expertise from other nations (Zhuo and Qamruzzaman, 2022). Advanced technological integration in the economy increases energy efficiency and forces the energy transition, including clean energy instead of fossil fuel. Third, political globalization stands for international alliance and agreement with a common interest, such as environmental protection has a position at the apex. Political globalization promotes energy transition on the ground of environmental protection and ecological balance; moreover, energy efficiency can be ensured with green technological adaptation with common consensus (Godil et al., 2021).

5 Conclusion and Policy Recommendations

The motivation of the study was to explore the role of urbanization, remittances, and globalization on energy consumption in BRI nations for the period 2004–2020. A panel of 59 (fifty-nine) BRI nations has been considered for the assessment, and the selection of sample countries purely depended on data availability. Several panel data estimation techniques have been applied, including CIPS and CADF for panel unit root test, cointegration test with error correction, dynamic seemingly unrelated regression, and Dumitrescu–Hurlin panel heterogeneous causality test. The coefficient of globalization has exposed negative (positive) and statistically significant ties with non-renewable (renewable) energy consumption, whereas remittances and urbanization revealed positive and significant associations with both renewable and non-renewable energy consumption. The directional causality test documented bidirectional causality between globalization and renewable energy consumption and urbanization, globalization, and remittances to non-renewable energy consumption.

On a policy note, the study has come up with the following suggestions for future development with the best possible effects of remittances, globalization, and urbanization on energy development in BRI countries:

(1) Remittance leads to economic growth worldwide through poverty reduction, domestic market expansion, and equitable development, which is critical for achieving sustainable development goals (SDG). Furthermore, efficient channelizing remittance in society increases the aggregated output with the micro- and macro-level contribution at the cost of excess energy demand and environmental adversity. Remittance leads to energy consumption in the economy, according to the existing literature, while remittance recipient households can use some of their additional income to meet increased energy demand. It is important for the government to distribute energy at a subsidized rate for low-income households. Finally, some energy sources are the major producers of greenhouse gases. Therefore, to reduce the potential negative impact on the environment, the government of BRI nations should use alternative sources of energy, such as nuclear power plants. Therefore, it is advocated that the government in respective economies must be very cautious in remittance inflow reallocation for capital allocation and investment with the appropriate consensus of clean energy integration.

(2) Globalization offers international integration in terms of economic and financial development. Advanced knowledge sharing, technological advancement, energy efficiency, and optimization of natural resources are the ultimate benefits of global integration. A new approach to energy usage must be devised to achieve the necessary economic growth and environmental quality via globalization. This procedure must be more eco-friendly. Energy efficiency, reduced energy consumption, fuel switching, and technological advancements are examples of non-destructive economic growth strategies that do not damage the environmental quality or upset ecological equilibrium. Thus, it is suggested to keep an eye on global development in every aspect, and the government has to act accordingly; otherwise, the ultimate opportunity from globalization is energy efficiency, security, and diversification that can be missed out and leads to ecological imbalance. Hence, from a policy perspective, we suggest that policymakers in these economies should not underestimate the significant role of globalization in energy demand function while formulating and implementing environmental policies.

(3) Economic growth stimulated through urbanization should not be the cost of environmental degradation. The clean energy integration in urban development has to be insured by offering structured environmental policies and expectations. Evidence implies that urbanization has a considerable inverted U-shaped impact on energy intensity, as empirical evidence shows. This suggests that, although nations must use a large amount of energy during the first stages of urbanization, urbanization stops increasing the intensity of energy consumption beyond a certain point. When taken to this level, improving energy efficiency in diverse nations would spur urbanization, and as a result, it is appropriate to base energy consumption on the amount of urbanization in a given region.

The present study is not out of certain limitations. First, we investigated the role of remittances, urbanization, and globalization in energy consumption in BRI nations, and future studies can be initiated with the inclusion of domestic capital adequacy and the green environment concept. Second, future studies can be implemented with the nonlinearity framework for addressing the impact of urbanization, remittances, and globalization on energy demand in BRI nations.

Data Availability Statement

Publicly available datasets were analyzed in this study. These data can be found at: World Development Indicators published by the World Bank.

Author Contributions

MQ: introduction, methodology, and empirical model estimation; LZ: data accumulation, literature survey, first draft preparation, and final preparation.

Funding

This study received financial support from the Institute for Advanced Research (IAR), United International University, under Publication Grant: IAR/2022/Pub/020.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Appendix A: List of BRI countries

References

Abbas, Q., Nurunnabi, M., Alfakhri, Y., Khan, W., Hussain, A., and Iqbal, W. (2020). The Role of Fixed Capital Formation, Renewable and Non-renewable Energy in Economic Growth and Carbon Emission: a Case Study of Belt and Road Initiative Project. Environ. Sci. Pollut. Res. 27 (36), 45476–45486. doi:10.1007/s11356-020-10413-y

Abdo, A.-B., Li, B., Qahtan, A. S. A., Abdulsalam, A., Aloqab, A., and Obadi, W. (2022). The Influence of FDI on GHG Emissions in BRI Countries Using Spatial Econometric Analysis Strategy: the Significance of Biomass Energy Consumption. Environ. Sci. Pollut. Res. doi:10.1007/s11356-022-19384-8

Acheampong, A. O., Boateng, E., Amponsah, M., and Dzator, J. (2021). Revisiting the Economic Growth-Energy Consumption Nexus: Does Globalization Matter? Energy Econ. 102, 105472. doi:10.1016/j.eneco.2021.105472

Adams, R. H., and Cuecuecha, A. (2013). The Impact of Remittances on Investment and Poverty in Ghana. World Dev. 50, 24–40. doi:10.1016/j.worlddev.2013.04.009

Adebayo, T. S., and Kirikkaleli, D. (2021). Impact of Renewable Energy Consumption, Globalization, and Technological Innovation on Environmental Degradation in Japan: Application of Wavelet Tools. Environ. Dev. Sustain 23, 16057–16082. doi:10.1007/s10668-021-01322-2

Ahmad, W., Ozturk, I., and Majeed, M. T. (2022). How Do Remittances Affect Environmental Sustainability in Pakistan? Evidence from NARDL Approach. Energy 243, 122726. doi:10.1016/j.energy.2021.122726

Ahmed, Z., and Le, H. P. (2020). Linking Information Communication Technology, Trade Globalization Index, and CO2 Emissions: Evidence from Advanced Panel Techniques. Environ. Sci. Pollut. Res. Int. 28, 8770–8781. doi:10.1007/s11356-020-11205-0

Akçay, S., and Demirtaş, G. (2015). Remittances and Energy Consumption: Evidence from Morocco. Int. Migr. 53 (6), 125–144. doi:10.1111/imig.12202

Al-mulali, U., Binti Che Sab, C. N., and Fereidouni, H. G. (2012). Exploring the Bi-directional Long Run Relationship between Urbanization, Energy Consumption, and Carbon Dioxide Emission. Energy 46 (1), 156–167. doi:10.1016/j.energy.2012.08.043

Al-mulali, U., Fereidouni, H. G., Lee, J. Y. M., and Sab, C. N. B. C. (2013). Exploring the Relationship between Urbanization, Energy Consumption, and CO2 Emission in MENA Countries. Renew. Sustain. Energy Rev. 23, 107–112. doi:10.1016/j.rser.2013.02.041

Alam, A., Malik, I. A., Abdullah, A. B., Hassan, A., Faridullah, U., Awan, U., et al. (2015). Does Financial Development Contribute to SAARC׳S Energy Demand? from Energy Crisis to Energy Reforms. Renew. Sustain. Energy Rev. 41, 818–829. doi:10.1016/j.rser.2014.08.071

Aluko, O. A., Osei Opoku, E. E., and Ibrahim, M. (2021). Investigating the Environmental Effect of Globalization: Insights from Selected Industrialized Countries. J. Environ. Manag. 281, 111892. doi:10.1016/j.jenvman.2020.111892

Amri, F. (2016). The Relationship Amongst Energy Consumption, Foreign Direct Investment and Output in Developed and Developing Countries. Renew. Sustain. Energy Rev. 64, 694–702. doi:10.1016/j.rser.2016.06.065

Andriamahery, A., and Qamruzzaman, M. (2022). A Symmetry and Asymmetry Investigation of the Nexus between Environmental Sustainability, Renewable Energy, Energy Innovation, and Trade: Evidence from Environmental Kuznets Curve Hypothesis in Selected MENA Countries. Front. Energy Res. 9 (873). doi:10.3389/fenrg.2021.778202

Appiah-Otoo, I. (2021). Impact of Economic Policy Uncertainty on Renewable Energy Growth. Energy Res. Lett. 2 (1), 19444. doi:10.46557/001c.19444

Ari, A. (2022). Remittances and Energy Consumption: A Panel Data Analysis for MENA Countries. Ijeep 12 (1), 120–125. doi:10.32479/ijeep.11878

Arouri, M. E. H., Ben Youssef, A., M'Henni, H., and Rault, C. (2012). Energy Consumption, Economic Growth and CO2 Emissions in Middle East and North African Countries. Energy Policy 45, 342–349. doi:10.1016/j.enpol.2012.02.042

Azam, M., Khan, A. Q., Zafeiriou, E., and Arabatzis, G. (2016). Socio-economic Determinants of Energy Consumption: An Empirical Survey for Greece. Renew. Sustain. Energy Rev. 57, 1556–1567. doi:10.1016/j.rser.2015.12.082

Bai, X., and Imura, H. (2000). A Comparative Study of Urban Environment in East Asia: Stage Model of Urban Environmental Evolution. Int. Rev. Environ. Strategies 1 (1), 135–158.

Baloch, M. A., Zhang, J., Iqbal, K., and Iqbal, Z. (2019). The Effect of Financial Development on Ecological Footprint in BRI Countries: Evidence from Panel Data Estimation. Environ. Sci. Pollut. Res. 26 (6), 6199–6208. doi:10.1007/s11356-018-3992-9

Belke, A., Dobnik, F., and Dreger, C. (2011). Energy Consumption and Economic Growth: New Insights into the Cointegration Relationship. Energy Econ. 33 (5), 782–789. doi:10.1016/j.eneco.2011.02.005

Belloumi, M., and Alshehry, A. (2016). The Impact of Urbanization on Energy Intensity in Saudi Arabia. Sustainability 8 (4), 375. doi:10.3390/su8040375

Belloumi, M. (2009). Energy Consumption and GDP in Tunisia: Cointegration and Causality Analysis. Energy Policy 37 (7), 2745–2753. doi:10.1016/j.enpol.2009.03.027

Breitung, J. (2001). “The Local Power of Some Unit Root Tests for Panel Data,” in Nonstationary Panels, Panel Cointegration, and Dynamic Panels (Emerald Group Publishing Limited), 161–177.

Breusch, T. S., and Pagan, A. R. (1980). The Lagrange Multiplier Test and its Applications to Model Specification in Econometrics. Rev. Econ. Stud. 47 (1), 239–253. doi:10.2307/2297111

Brown, L., McFarlane, A., Campbell, K., and Das, A. (2020). Remittances and CO2 Emissions in Jamaica: An Asymmetric Modified Environmental Kuznets Curve. J. Econ. Asymmetries 22, e00166. doi:10.1016/j.jeca.2020.e00166

Bu, M., Li, S., and Jiang, L. (2019). Foreign Direct Investment and Energy Intensity in China: Firm-Level Evidence. Energy Econ. 80, 366–376. doi:10.1016/j.eneco.2019.01.003

Chen, H. (2016). China's 'One Belt, One Road' Initiative and its Implications for Sino-African Investment Relations. Transnatl. Corp. Rev. 8 (3), 178–182. doi:10.1080/19186444.2016.1233722

Chen, Z. M., and Chen, G. Q. (2011). An Overview of Energy Consumption of the Globalized World Economy. Energy Policy 39 (10), 5920–5928. doi:10.1016/j.enpol.2011.06.046

Danish, S., Saud, S., Baloch, M. A., and Lodhi, R. N. (2018). The Nexus between Energy Consumption and Financial Development: Estimating the Role of Globalization in Next-11 Countries. Environ. Sci. Pollut. Res. Int. 25 (19), 18651–18661. doi:10.1007/s11356-018-2069-0

Danish, , and Ulucak, R. (2021). A Revisit to the Relationship between Financial Development and Energy Consumption: Is Globalization Paramount? Energy 227, 120337. doi:10.1016/j.energy.2021.120337

Das, A., McFarlane, A., and Carels, L. (2021). Empirical Exploration of Remittances and Renewable Energy Consumption in Bangladesh. Asia-Pac J. Reg. Sci. 5 (1), 65–89. doi:10.1007/s41685-020-00180-6

Deng, Z., Liu, J., and Sohail, S. (2022). Green Economy Design in BRICS: Dynamic Relationship between Financial Inflow, Renewable Energy Consumption, and Environmental Quality. Environ. Sci. Pollut. Res. 29 (15), 22505–22514. doi:10.1007/s11356-021-17376-8

Dogan, B., and Deger, O. (2016). How Globalization and Economic Growth Affect Energy Consumption: Panel Data Analysis in the Sample of BRIC Countries. Int. J. Energy Econ. Policy 6 (4).

Dong, F., and Pan, Y. (2020). Evolution of Renewable Energy in BRI Countries: A Combined Econometric and Decomposition Approach. Ijerph 17 (22), 8668. doi:10.3390/ijerph17228668

Doytch, N., and Narayan, S. (2016). Does FDI Influence Renewable Energy Consumption? an Analysis of Sectoral FDI Impact on Renewable and Non-renewable Industrial Energy Consumption. Energy Econ. 54, 291–301. doi:10.1016/j.eneco.2015.12.010

Dumitrescu, E.-I., and Hurlin, C. (2012). Testing for Granger Non-causality in Heterogeneous Panels. Econ. Model. 29 (4), 1450–1460. doi:10.1016/j.econmod.2012.02.014

Farhani, S., and Solarin, S. A. (2017). Financial Development and Energy Demand in the United States: New Evidence from Combined Cointegration and Asymmetric Causality Tests. Energy 134, 1029–1037. doi:10.1016/j.energy.2017.06.121

Ferdaous, J., and Qamruzzaman, A. (2014). Impact of International Trade, Remittances and Industrialization on the Economic Growth of Bangladesh. Editor. Board Members 13 (8), 485–495.

Fuerst, F., Kavarnou, D., Singh, R., and Adan, H. (2020). Determinants of Energy Consumption and Exposure to Energy Price Risk: a UK Study. Z Immob. 6 (1), 65–80. doi:10.1365/s41056-019-00027-y

Godement, F., and Kratz, A. (2015). One Belt, One Road’: China’s Great Leap Outward. Beijing: European Council on Foreign Relations.

Godil, D. I., Sharif, A., Ali, M. I., Ozturk, I., and Usman, R. (2021). The Role of Financial Development, R&D Expenditure, Globalization and Institutional Quality in Energy Consumption in India: New Evidence from the QARDL Approach. J. Environ. Manag. 285, 112208. doi:10.1016/j.jenvman.2021.112208

Hadri, K. (2000). Testing for Stationarity in Heterogeneous Panel Data. Econ. J. 3 (2), 148–161. doi:10.1111/1368-423x.00043

Halicioglu, F. (2007). Residential Electricity Demand Dynamics in Turkey. Energy Econ. 29 (2), 199–210. doi:10.1016/j.eneco.2006.11.007

Han, L., Han, B., Shi, X., Su, B., Lv, X., and Lei, X. (2018). Energy Efficiency Convergence across Countries in the Context of China's Belt and Road Initiative. Appl. Energy 213, 112–122. doi:10.1016/j.apenergy.2018.01.030

Hashem Pesaran, M., and Yamagata, T. (2008). Testing Slope Homogeneity in Large Panels. J. Econ. 142 (1), 50–93. doi:10.1016/j.jeconom.2007.05.010

Holtedahl, P., and Joutz, F. L. (2004). Residential Electricity Demand in Taiwan. Energy Econ. 26 (2), 201–224. doi:10.1016/j.eneco.2003.11.001

Hongxing, Y., Abban, O. J., and Dankyi Boadi, A. (2021). Foreign Aid and Economic Growth: Do Energy Consumption, Trade Openness and CO2 Emissions Matter? A DSUR Heterogeneous Evidence from Africa's Trading Blocs. PLOS ONE 16 (6), e0253457. doi:10.1371/journal.pone.0253457

Hussain, H. I., Haseeb, M., Tvaronavičienė, M., Mihardjo, L. W. W., and Jermsittiparsert, K. (2020a). The Causal Connection of Natural Resources and Globalization with Energy Consumption in Top Asian Countries: Evidence from a Nonparametric Causality-In-Quantile Approach. Energies 13 (9), 2273. doi:10.3390/en13092273

Hussain, J., Khan, A., and Zhou, K. (2020b). The Impact of Natural Resource Depletion on Energy Use and CO2 Emission in Belt & Road Initiative Countries: A Cross-Country Analysis. Energy 199, 117409. doi:10.1016/j.energy.2020.117409

Hussain, M. N., Li, Z., Sattar, A., and Ilyas, M. (2022). Evaluating the Impact of Energy and Environment on Economic Growth in BRI Countries. Energy & Environ. 0 (0), 0958305X2110738. doi:10.1177/0958305x211073805

Im, K. S., Pesaran, M. H., and Shin, Y. (2003). Testing for Unit Roots in Heterogeneous Panels. J. Econ. 115 (1), 53–74. doi:10.1016/s0304-4076(03)00092-7

Jahanger, A., Usman, M., and Ahmad, P. (2022a). A Step towards Sustainable Path: The Effect of Globalization on China's Carbon Productivity from Panel Threshold Approach. Environ. Sci. Pollut. Res. 29 (6), 8353–8368. doi:10.1007/s11356-021-16317-9

Jahanger, A., Usman, M., and Balsalobre‐Lorente, D. (2021). Autocracy, Democracy, Globalization, and Environmental Pollution in Developing World: Fresh Evidence from STIRPAT Model. J. Public Aff. n/a (n/a), e2753. doi:10.1002/pa.2753

Jahanger, A., Usman, M., Murshed, M., Mahmood, H., and Balsalobre-Lorente, D. (2022b). The Linkages between Natural Resources, Human Capital, Globalization, Economic Growth, Financial Development, and Ecological Footprint: The Moderating Role of Technological Innovations. Resour. Policy 76, 102569. doi:10.1016/j.resourpol.2022.102569

Jelinek, J. A. (2017). Shifting Relations in South-East Asia: The Changing Philippine-Sino-American Foreign Relations in the Early Era of the Duterte Administration. Central European University.