- 1Business School, Guilin University of Electronic Technology, Guilin, China

- 2School of Economics and Management, Wuhan University, Wuhan, China

China’s extensive growth since reforming and opening its economy has led to increased pollution, and under the United Nations Framework Convention on Climate Change, Chinese companies must initiate green innovation to meet the world trend and enhance their international competitiveness. In addition, with institutional and cultural differences, policy drive is a key focus of China’s development. Therefore, China’s Energy Saving and Emission Reduction policy has its own necessity and characteristics as a mechanism for green innovation in enterprises. This study examines the impact of the 13th Five-Year Plan on green innovation from the perspective of the Energy Saving and Emission Reduction policy. First, the data of 100 listed enterprises in two control zones (TCZ) and non-two-control zones (non-TCZ) from 2014 to 2019 were selected to identify whether the implementation of the policy has an impact on the innovation of heavily polluting enterprises using the double-difference method (DID). The study found that the 13th Five-Year Plan for Energy Saving and Emission Reduction had a negative impact on the innovation of heavily polluting enterprises. Further, the study found that the policy had a negative impact on enterprises’ innovation through the transmission channel of increasing the environmental cost of enterprises, thus reducing investment in research and development (R&D). It is suggested that the state should start with the policy itself, identify its precise target, and formulate flexible environmental regulation policies.

1 Introduction

China’s GDP has grown rapidly because of reform and opening-up measures, and according to economic data released by the National Bureau of Statistics, China has overtaken Japan to become the world’s second-largest economy. Although China has been at the center of industrialization in recent years, the secondary sector in China accounted for 37.8% of the GDP in 2020, which is still higher than that of Germany, a manufacturing powerhouse, and the world average. The advent of the information age has led to a flourishing economy (Işık, 2013), an increase in government investment to boost GDP per capital, and a growing problem of pollutant emissions (Işık et al., 2022) with environmental issues coming to the fore. According to a report published by the Ministry of Ecology and Environmental Protection, China’s carbon emissions will reach 13.9 billion tons in 2020, accounting for 30% of the world’s emissions. In the context of economic growth, which is obtained by energy consumption and polluting the environment, and in the context of China’s special socialist system, the formulation and successful implementation of effective policies can help the government to establish a good image, and the people will be more obedient to their guidance (Ahmad et al., 2021). Thus, the government’s macro-control measures to regulate population activities can effectively relieve environmental pressure to a certain extent, accelerate the transformation of economic growth mode from extensive to intensive, and realize the upgrading of industrial structure. The policies of the Five-Year Plan for Energy Saving and Emission Reduction are aimed at reducing the number of people living in the country. Moreover, it targets heavily polluting enterprises and provides for a reduction in the total emissions of major pollutants by approximately 40% by 2020. In the 13th Five-Year Plan issued by the State Council in 2017, it is stipulated that the value of energy consumption in 2020 will be reduced by 15% compared to the national energy consumption of 10,000-yuan GDP in 2015. Another key indicator is the reduction in total emissions of volatile organic compounds (VOC) by more than 10% in 2020 compared to 2015 (Yan et al., 2020). Environmental regulation is an important means and tool to motivate enterprises to act on protecting the environment (Rugman and Verbeke, 1998), including administrative command-based environmental regulation and market-based environmental regulation. Command-and-control environmental regulation manages subjects through local standards, regulations, and other means (Fan and sun, 2020), to achieve environmental control and promote the development of green technological innovation in enterprises. Energy conservation and emission reduction policies, as command and control environmental regulatory instruments, have been implemented in a macro-context, where the consequences of man-made destruction of the earth’s natural environment and global warming have become evident in recent years. Therefore, measures to mitigate environmental degradation are urgently needed. At the micro-level, China’s environmental regulatory policy has long been dominated by command-and-control environmental administrative instruments (Tao et al., 2021). In addition, China is in the midst of industrialization, which allows for economic transformation, so it is possible to combine this with command-based environmental regulation to adjust the status quo to an extensive economic growth mode. Unlike other environmental regulations, the Energy Conservation and Emission Reduction policy is a product of Five-Year Plans, each of which specifies a different emission reduction target and is progressive in its efforts, with a certain degree of tolerance in terms of corporate innovation; thus, differing from the impact of other environmental regulation policies on corporate innovation. The Energy Saving and Emission Reduction policy is a nationwide environmental governance strategy with a wider scope than other environmental regulations, so studying these policies can provide a more comprehensive response to the effects of environmental regulations adopted by the government. The 13th Five-Year Plan for Energy Saving and Emission Reduction considers the current environmental situation and development trends. It clearly stipulates optimizing the industrial and energy structure, strengthening energy conservation in key areas, enhancing the reduction of major pollutants, vigorously developing the recycling economy, mobilizing the whole society to participate in energy conservation and emission reduction, etc., which is systematically and comprehensively targeted in terms of program provisions. It is in line with China’s socialist national conditions by clearly defining emission reduction targets, while promoting the achievement of policy objectives through social monitoring.

As the economy grows and environmental issues become more prominent, the positive impacts of renewable energy—despite being widely accepted and used in recent years—on CO2 emissions in some regions are less than the negative impacts of fossil energy (Işık et al., 2019). With the trend of globalization, the development of international trade and the booming tourism industry have had a negative impact on the environment (Isik et al., 2017). Therefore, in the context of economic development and globalization, unilateral reliance on sustainable energy sources is not effective in alleviating environmental pressures, and companies should innovate their production methods. For example, the optimal contract theory suggests that executive incentives can achieve synergy of interests between shareholders and management, reduce agency costs, and thus promote the efficiency of corporate innovation (Grossman and Hart, 1983); while the higher echelon theory suggests that managerial experience, values, and personal traits influence corporate innovation (Hambrick and Mason, 1984). Corporate green innovation also depends on external environmental regulation, and when firms face elevated levels of environmental regulation, clean technology firms with external investment are more likely to avoid environmental regulation by purchasing production equipment and off-the-shelf technology (Emilio and Kensuke, 2018). Yan et al. (2020) found that government-led funds can promote firm innovation in conjunction with private venture capital. In the context of China’s special socialist system, environmental policies implemented by a country inevitably have an impact on some enterprises. Innovation is an important form of resource reallocation within enterprises (Bernard et al., 2010) and has an enormous impact on the output (Yi et al., 2017) and product quality (Feng, 2020). Therefore, under the pressure of policies, heavy polluters or enterprises with excessive emissions must make changes, and enterprise innovation is a better choice; however, a better choice is not necessarily a suitable choice. First, a fixed production process was established in enterprises with heavy pollution after long-term inheritance. Therefore, the cost of the production process and the investment in industrial upgrading is tremendous, which compels these enterprises to abandon innovation. Second, the early neoclassical economic theory argues that environmental regulatory policies could constrain firms’ productive activities, leading to endogenous costs (Walter and Ugelow, 1979; Feiock and Rowland, 1990; Copeland and Taylor, 1997), crowding out productive investment (Haveman and Christainsem G B, 1981) and reducing corporate research and development (R&D). The implementation of the mandatory collection of pollution charges required by the policy of Energy Saving and Emission Reduction decreases enterprises’ R&D investment and may lead to a decline in their transformation, thus exerting negative effects on their green innovation. Finally, a certain period is needed for green patents to be developed and authorized, so it is not guaranteed that the implementation of energy-saving and emission-reduction policies will have a positive effect, instead of a negative effect on the green innovation of enterprises in recent years. The 13th Five-Year Plan for Energy Saving and Emission Reduction influences enterprises’ green innovation through certain mechanisms. The policy focuses on optimizing the energy structure of industries and strengthening the emission reduction of major pollutants. This leads to a curtailment in the investment capital of heavy polluters in terms of innovation. Therefore, this study examines the impact of the 13th Five-Year Plan for Energy Saving and Emission Reduction policy on the green innovation of heavily polluting enterprises, and analyzes whether the plan has an impact on green innovation through the channel of influencing enterprises’ emission fees. This study uses the DID model to manually collect the number of green patents to examine the impact of the Energy Saving and Emission Reduction policy on green innovation of heavily polluting enterprises and to examine whether this policy can force those enterprises to transform. The innovations of this study are as follows: 1) This study combines macro- and micro-enterprise data to study the mechanism of environmental cost in enterprise innovation, exploring its independent and convergent characteristics. The conclusions reached are more reliable and scientific, providing a perspective on the restrictive factors that the state should consider in the process of achieving the purpose of environmental regulation implementation. 2) Owing to its institutional characteristics, China’s Energy Conservation and Emission Reduction policy is an important national environmental regulatory policy, and it is crucial to study its implementation effect. This study treats energy conservation and emission reduction policy as an exogenous shock and a quasi-natural experiment, combining DID model to analyze the impact of the policy on green innovation of heavily polluting enterprises and mitigate the interference of endogenous problems, which not only provides empirical evidence to reveal the effect of energy conservation and emission reduction in China but also enriches the influence factors and channels of green innovation of heavily polluting enterprises. 3) The literature study on environmental regulation consisted of a wide industry sample, and the research results and the real situation of migration were ignored due to the diverse nature of the industries. This study focused on the heavily polluting enterprises, accurately identified environmental regulation policy implementation effect, explored property heterogeneity and industry, and revealed energy conservation and emissions reduction policy in diverse properties rights and different influences under industry.

2 Literature Review

The impact of environmental regulation policies, primarily the Energy Saving and Emission Reduction policy, on business innovation can be grouped into two categories. One of them is inhibition; China is currently undergoing industrialization and the long-standing pattern of relying on industry to generate economic growth is unlikely to change in the future. Moreover, clean technology enterprises are relatively weak in automation and have poor pollution control capabilities; environmental regulatory policies, mainly the Energy Saving and Emission Reduction policy, increase the unit emission and operating costs of polluting firms (Langpap and Shimshack, 2010), divert technological innovation inputs to environmental management projects (Kemp and Pontoglio, 2011), divert financial resources from firms, and extract funds for technological innovation activities, thus reducing productivity (Gray, 1987) and profitability (Palmer et al., 1995; Greenstone, 2002). China entered the industrial era 40 years ago, and some enterprises have developed a very mature production system and are more resistant to the transition, preferring to pay sewage charges to meet the needs of the policy. This increases the production costs of enterprises and reduces their profit margins, reducing their incentive to innovate green technology (Dean and Brown, 1995). Therefore, environmental regulations have a crowding-out effect on firms’ R&D investments through the rising cost of environmental management, which is detrimental to their technological innovation (Kneller and Manderson, 2012). China is the largest unitary state in the world, and environmental regulation policies are in the form of “Central treat, local pay.” In the weak incentive–weak constraint institutional environment, although local governments actively participate to obtain resource elements and other preferential policies from the central government, many of their efforts are tentative and not implemented with positive attitudes and actions (Liu et al., 2019), which causes the deviation of environmental regulations from the expected results; and thus, the inability to effectively play the role of the government in pushing back the green technological innovation of enterprises. High polluting firms will be more significantly affected because of the simultaneous cost pressure effect, process innovation incentive effect, and market-oriented incentive effect of environmental regulation (Liu and fan, 2019), but if the policy simply emphasizes emission reduction targets and fails to implement flexible environmental regulation policies, coupled with the shrinkage of overall economic activity due to COVID-19 and national economic policy uncertainty, innovation incentives for heavily polluting firms will struggle (Işık et al., 2020; Leeuwen and Mohnen, 2017). The second is “facilitative.” A series of energy conservation and emission reduction policies implemented in China since the reform and opening-up of the country have effectively contributed to the continuous improvement of industrial green productivity and have initially demonstrated the effectiveness of the green revolution in environmental policies (Chen, 2010). Porter’s hypothesis is quite representative and suggests that reasonable environmental regulations can promote the technological progress of enterprises, produce innovation compensation and first-mover advantage (Porter and Linde, 1991), and are beneficial for improving the competitiveness of enterprises (Liu and Zhou, 2018). Other scholars later supported this view (Berman and Bui, 2001), complementing the Porter hypothesis. Pearce (1991) argues that a carbon tax can be used to reduce the level of tax distortion and improve the quality of the environment (the first dividend) while simultaneously promoting job or investment growth (the second dividend). Meanwhile, the market-based policy of Energy Saving and Emission Reduction focusing on carbon emission trading can provide incentives for enterprises and assist them in improving a high-quality production level (Hu and tang, 2020). Other arguments suggest a “U-shaped” relationship between environmental regulation and green technological innovation (Liu et al., 2017; Meng and Yu, 2022). The relationship between environmental regulation and firm innovation is not measurable (Chan et al., 2016).

Many factors influence corporate green innovation. From an intra-firm perspective, based on principal–agent theory, firm owners cede the right to manage the firm; the dual personalities of narcissism and humility of managers are conducive to the establishment of a corporate innovation culture and promote corporate innovation performance (Zhang et al., 2017), and managerial experience is positively related to innovation investment (Yang et al., 2022); corporate capital structure also affects corporate innovation to a certain extent (Zhang and Xu, 2022); and from a financial perspective, environmental management accounting activities can help firms engage in green innovation. In terms of the external environment, flexible and differentiated environmental regulation policies can directly provide goals, directions, and opportunities for clean technological innovation (Joern et al., 2013), so environmental regulation has a positive effect on promoting green technology innovation (Wang et al., 2020). However, the Porter hypothesis clearly states that some strict environmental regulations are conducive to firms’ innovation and those regulations increase the pressure on companies to reduce pollution and emissions, leading to higher production costs and thus a “crowding-out effect” on firms’ innovation resources (Petroni et al., 2019). He et al. (2019) found that green credit significantly promotes a delay in technological innovation. Additionally, Cao et al. (2021) adopted DID to evaluate the impact of the implementation of Green Credit Guidelines on the green innovation activities of enterprises.

A review of the existing literature reveals a wealth of research on corporate innovation, which provides a solid theoretical foundation for this study. However, there are some limitations in the existing literature. First, given the quality and availability of micro-enterprise data and macro-policy data, few existing studies on corporate green innovation have examined in depth the mechanisms through which the Energy Saving and Emission Reduction policy affects corporate green innovation from a macro–micro perspective, and even fewer have examined the channels through which these mechanisms work. Second, in previous studies, most research on environmental regulation has focused on all industries, ignoring the bias between the findings and the reality due to the diversity of industries. The Energy Saving and Emission Reduction policy has focused on polluting industries; therefore, this study uses heavily polluting enterprises as research subjects, which can help accurately identify the effectiveness of the policies. Third, the Energy Saving and Emission Reduction policy explored in this study as a product of the Five-Year Plan and an important environmental regulation tool has a positive starting point. However, the findings of this study differ from those of previous studies, and there may be a lack of targeting in policy formulation, leading to an unexpected contradictory outcome. The findings of this study can help the country to enhance flexibility in policy formulation and provide input for subsequent policy formulation and implementation.

3 Theoretical Analysis and Hypothesis

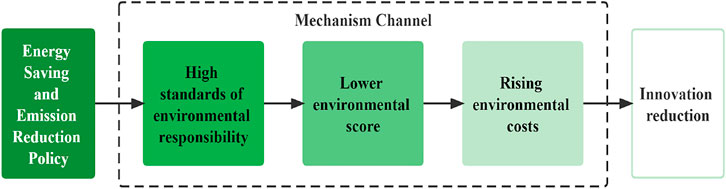

The Energy Saving and Emission Reduction policy influences the number of green patents held by companies through the increased cost of pollution control. The detailed analysis is as follows.

First, the increase in pollution abatement costs caused by the policy of Energy Saving and Emission Reduction will exert negative effects on the green innovation of enterprises. When the government implements a policy, it places explicit restrictions on the total amount of pollutants discharged by firms. Therefore, when local governments at all levels respond to national policies, they inevitably put pressure on companies. However, unlike the situation under command control regulation, enterprises with high energy consumption can continue to produce until the marginal emission cost is equal to the price of emission rights, and they will not pay a fine higher than the marginal emission cost or be forced to stop production. Considering the demand for innovation of production methods and extremely high costs of raw material, the emission cost paid is lower than the R&D expenditure; some established companies with heavy pollution after a long period of inheritance (such as steel, coal, paper, and other industries) are likely to choose to pay pollution charges to continue production. When the operating cost of enterprises increases, it will have a crowding-out effect on innovation and investment. Therefore, additional environmental costs reduce enterprises’ investment and harm their innovation in other aspects (Tu et al., 2019). In this case, the number of green patents decreases accordingly. Moreover, the effect of the policy is influenced by region, industry, and participants. If they are not fully considered in the initial stages, they may be negatively affected. Moreover, firms will hesitate to comply with related regulations, and their enthusiasm for green innovation will be impaired (Anouliès, 2017). Eventually, enterprises’ green innovation will also be affected. Therefore, the policy of Energy Saving and Emission Reduction increases the cost to companies, weakens their profitability, and reduces their innovation investment by internalizing the negative effects of environmental pollution in the external world. In particular, when the marginal profit of green patents is less than their marginal cost, it is more difficult for enterprises to improve their enthusiasm for participating in the R&D of green patents. Therefore, in the face of the policy of Energy Saving and Emission Reduction, if the environmental cost is less than the R&D cost of green patents, firms will choose to pay the former, which will reduce their investment in R&D and be unconducive to their innovation, resulting in a reduction in the green innovation of enterprises. Figure 1 illustrates the mechanism channel of the impact of Energy Saving and Emission Reduction policy on corporate green innovation. Second, if the revenue from the sale of emission rights is greater than the cost of developing green patents or if the cost of purchasing emission rights is greater than the cost of developing green patents, then the profit maximization drive will lead to green innovation. In addition, at the beginning of the government’s environmental regulation policy, the role of “compliance cost” is higher than the role of “innovation compensation,” which is not conducive to green technology innovation. As policies become more formalized and rationalized, the “compliance cost” is lower than the “innovation compensation,” and firms are pressured to choose green technology innovation as a production method. Therefore, this study proposes the null hypothesis H0: The 13th Five-Year Plan for Energy Saving and Emission Reduction will not have a negative impact on the green innovation of heavily polluting enterprises. Alternative hypothesis H1: The 13th Five-Year Plan for Energy Saving and Emission Reduction will have a negative impact on the green innovation of heavily polluting enterprises by increasing the cost of pollution control.

4 Model Specification and Data Description

4.1 Data Sources

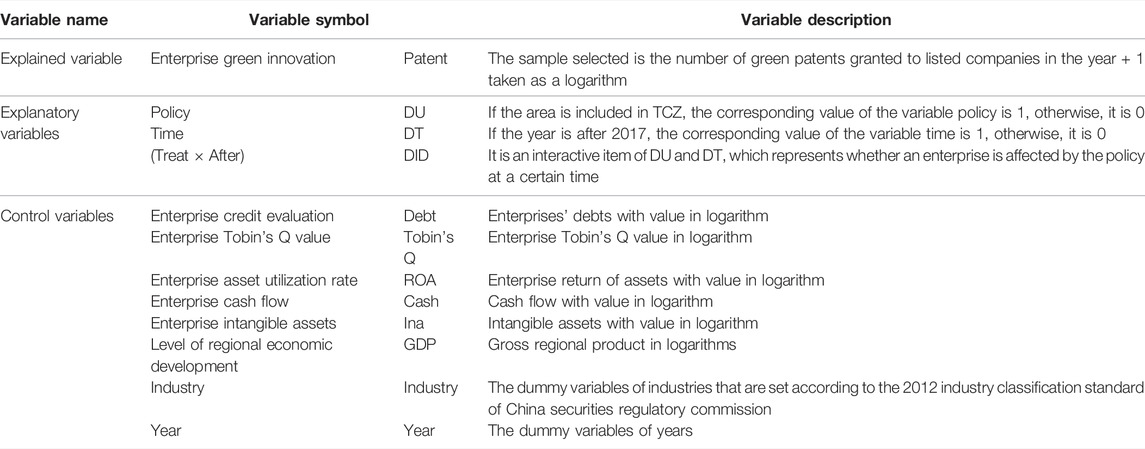

This study uses patent data and the corresponding economic data of listed companies in China. The data on patents of listed companies were obtained from the People’s Republic of China State Intellectual Property Office (SIPO. https://www.cnipa.gov.cn). The data on their economic characteristics were obtained from the China Stock Market & Accounting Research Database (CSMAR. https://www.gtarsc.com) and the National Bureau of statistics of the People’s Republic of China (NBSPRC. https://www.stats.gov.cn). The data on regional characteristics were obtained from the Ministry of Ecology and Environment of the People’s Republic of China (MEE. https://www.mee.gov.cn). Table 1 presents the variables.

4.2 Data Description

4.2.1 Explained Variable

In this study, the number of green patents granted to listed companies in the sample in the current year is selected to measure corporate green innovation and is denoted by patent. Data from SIPO and CSMAR.

4.2.2 Explanatory Variables

In this study, the 13th Five-Year Plan for Energy Saving and Emission Reduction issued by the State Council in 2016 is used as the explanatory variable if the sample year is after 2016 post = 1, and vice versa post = 0. Ten cities in the TCZ in the east and west and 10 cities in the non-TCZ with heavy pollution-listed enterprises were studied as the analysis objects, with the TCZ (19.01%) as the experimental group and the non-TCZ (13.7%) as the control group. (TCZ or two-control zone refers to the control zone for acid rain or sulfur dioxide emissions set by the National Environment Bureau, while the non-two-control zone refers to the zone that does not have any control set for the area.) If the enterprises belong to the TCZ, policy = 1 and vice versa = 0. Data for the TCZ were collected manually and obtained from the MEE.

4.2.3 Control Variables

Firm-level and regional economic characteristics were selected as control variables for the model in this study.

Enterprise credit evaluation. Scholars have shown that bank loans reflect market investors’ evaluations of corporate credit (Colombo and Groce, 2013). Simultaneously, moderate debt management can compensate for insufficient funds for business operations and long-term development, and enterprises can use more funds to improve technical equipment, reform processes, and conduct innovation activities. Therefore, the corporate debts of listed companies in the sample are introduced as the control variable to evaluate the credit of enterprises, which is represented by the variable “Debts” with value in logarithm.

Tobin’s Q value. Tobin’s Q value is used to study whether the value of an enterprise’s assets in the market is overestimated or underestimated, and a high Tobin’s Q value indicates a high rate of return on industrial investment. Therefore, introducing Tobin’s Q value of enterprises as the control variable can measure the intensity of enterprises’ investment in industry, which is represented by the variable “Tobin’s Q” with value in logarithm.

Enterprise asset utilization rate. Introducing the utilization rate of enterprises’ assets as a control variable can assist us in recognizing the degree of utilization of enterprises’ assets. Therefore, the return of assets of heavily polluting listed companies in the sample is introduced into the model as a control variable, which is represented by the variable “ROA” with value in logarithm.

Enterprise cash flow. It is believed that the larger the cash flow of enterprises, the faster the funds may flow for enterprise innovation. Therefore, enterprise cash holdings are introduced into the model as a control variable to measure its cash flow, which is represented by the variable “Cash” with value in logarithm.

Enterprise intangible assets. It is represented by variable “Ina” with a logarithmic value.

4.3 Debts, Tobin’s Q, ROA, Cash, and Ina Data Are From CSMAR

Regarding the level of regional economic development, relative to cities with a lower level of economic development, cities with a higher level are likely to provide greater support for enterprise innovation. The gross regional product of the city where the company is located is chosen as a control variable to measure the level of regional economic development and is expressed in logarithms as GDP. GDP data are from NBSPRC.

4.4 Model Specification

In the 1980s, a special method for evaluating the effects of policies, the difference-in-differences method (DID), was developed in foreign economics, drawing on experimental tests of effectiveness in the natural sciences (Ashenfelter, 1978, Ashenfelter and Card, 1985), and has since been widely cited. In an earlier study, for example, Card and Krueger (1994) used the DID method to calculate the effect of a minimum wage increase in New Jersey. Later, this method was widely used in policy research; for example, Oster-Aaland (2007) used the DID model to test whether the tailgating policy could make a difference in students’ alcohol consumption, and Liu et al. (2022) used the DID model to test whether the Leading Officials’ Accountability Audit of Natural Resources policy could significantly promote green innovation. Social science research is virtually impossible to conduct as a controlled experiment and can only be completed as a natural (or quasi-natural) experiment. Under natural experiments, DID method is used to obtain statistically significant unbiased estimates of policy effects by selecting a pre-experimental sample (“experimental group” or “treatment group”), and a post-experimental sample (“experimental group” or “treatment group”) differences (Shi and chu, 2017). From an econometric point of view, the double-difference method is a comparative static method of regression using individual data, which avoids the endogeneity problems associated with the traditional method of treating policy as an “independent variable.” This study adopts the double-difference method (DID) to identify the impact of the Energy Saving and Emission Reduction policy on corporate green innovation based on the following considerations: 1) To a greater extent, DID avoids the problem of endogeneity, as policies are made by the state and are exogenous to micro-economic agents, and thus do not suffer from reverse causality. 2) The traditional approach to policy evaluation is mainly through a dummy variable for the occurrence of a policy, but DID approach combines the occurrence of a policy with the point of occurrence, which is more rigorous, scientific, and more effective in assessing the effect of a policy. The model was constructed as follows:

where DU is a grouping dummy variable; if individual i is affected by policy implementation, then individual i belongs to the treatment group and the corresponding DU takes the value of 1. If individual i is not affected by policy implementation, then individual i belongs to the control group and the corresponding DU takes the value of 0. DT is a policy implementation dummy variable that takes the value of 0 before policy implementation and the value of 1 after policy implementation. DU*DT is a grouping dummy variable; The interaction term with the policy implementation dummy variable, whose coefficient picture then reflects the net effect of policy implementation. Controlit is the control variable,

5 Empirical Analysis

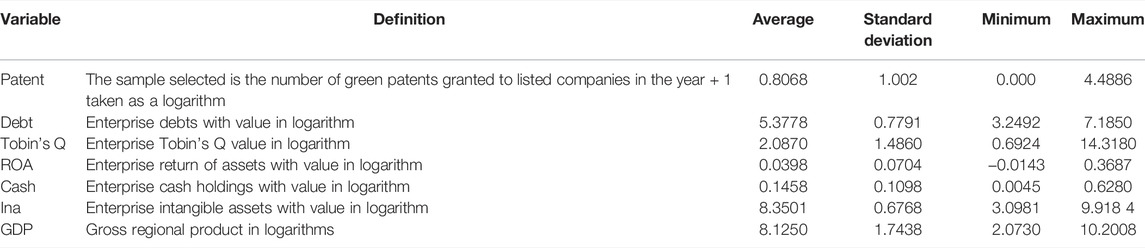

5.1 Descriptive Analysis

The descriptive statistics of the variables selected in this study are shown in Table 2. From 2014 to 2019, the maximum value of the number of green patents granted to enterprises was 4.4886, and the minimum value was 0, indicating that there was a major difference in the number of green patents between enterprises.

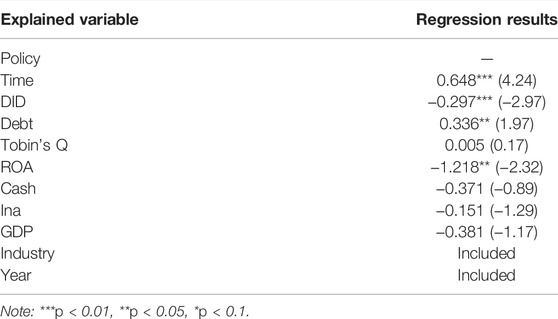

5.2 Regression Analysis

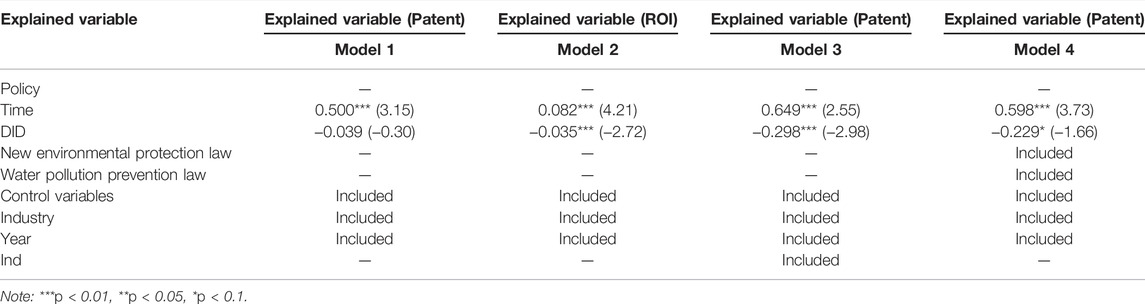

Table 3 shows the regression results of the effect of the Energy Saving and Emission Reduction policy on enterprises’ green innovation. According to the results, the policy is negatively associated with green innovation in heavily polluting firms at the 1% level, which is less than the conventional 5% significant value, thus rejecting the null hypothesis and also verifying the existence of the alternative hypothesis H1 that the Energy Saving and Emission Reduction policy has a negative effect on green innovation by companies. The theoretical reason for this is that China entered the industrialization era earlier. Therefore, heavy polluting industrial enterprises have developed to date and have formed a certain pattern in terms of production systems, and when the state implements environmental regulation policies, it restricts the emission behavior of enterprises through compulsory means. This invariably increases the environmental costs of firms, especially the heavy polluting enterprises which have developed over a long period; facing long-term and unpredictable innovation results, they choose a more secure production model in the face of high environmental costs, and then, unlike before the implementation of the policy, the increase in costs leads to pressure on innovation investment and a reduction in innovation capacity. This research differs from previous studies in that: 1) due to the Chinese institutional context and the authority of the Porter hypothesis, previous studies have demonstrated the positive impact of environmental regulation policies on firms. For example, Theyel (2000), based on data from a survey of US chemical companies, found that the adoption of environmental management practices integrated with production processes had a positive impact on corporate green technology innovation. He and Shen (2019), based on data on Chinese listed companies, found that environmental management systems promote green technological innovation in firms through the mediating effects of their internal resource management practices (i.e., utilization, accumulation, and allocation of resources). Chen et al. (2022) argue that environmental regulation has a long-term positive effect on green technological progress and green economic development but rarely considers the consequences of policy implementation in terms of the adverse effects of the policy. The scientific and comprehensive empirical analysis in this study draws conclusions that differ from those of the previous studies and exposes the limitations of national policy implementation. 2) Previous studies have been more monotonous in describing the direct impact of policies on enterprises; however, this study takes heavily polluting enterprises as the research sample, considers the channels affecting green innovation of these companies, proves the impact of channels of policies through mechanism tests, clarifies the channels of policies affecting innovation, and offers test results that are more scientific and reliable. 3) Since earlier findings were based on industry-wide samples, as Energy Saving and Emission Reduction policy is highly targeted, it is difficult to prove the real consequences of the implementation of the policies from the conclusions drawn from previous studies; the findings of this study are based on a sample of heavily polluting enterprises and can accurately capture the effects of policy implementation.

5.3 Robustness Test

5.3.1 Parallel Trend Test

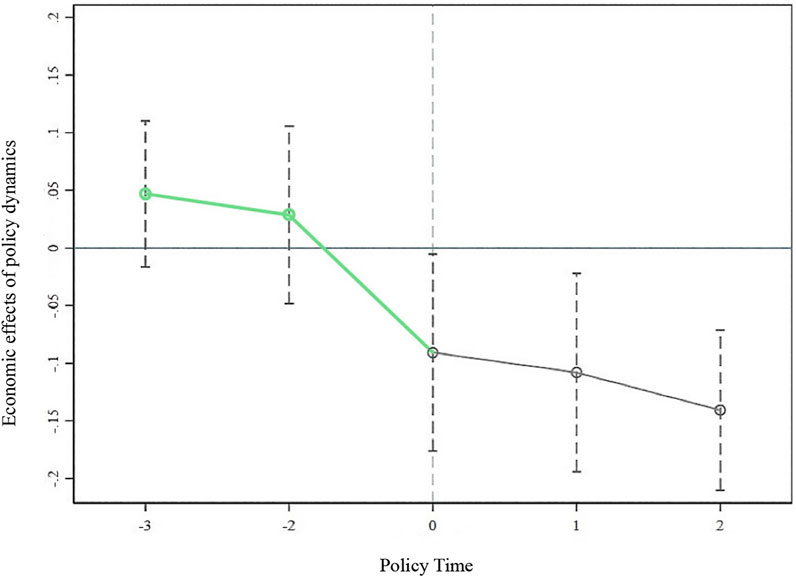

This investigation used an event study approach to assess the parallel trend hypothesis and dynamic effects. Figure 2 shows the results of the parallel trend hypothesis test, where the horizontal axis is from 2 years before to 2 years after policy implementation. The estimated coefficient of DID before policy implementation is not significant, and the estimated coefficient of DID after policy implementation is significant; that is, the parallel trend hypothesis is satisfied.

5.3.2 Placebo Test

Similar to other studies on policy consequences, owing to the complexity of the real economy and society, micro-firm behavior may be influenced by many other unobservable macro-factors in addition to the policy effects covered by the study itself. Thus, even if the parallel trend condition is satisfied between the experimental and control groups, there is uncertainty whether the empirical results obtained are necessarily caused by the implementation of the 13th Five-Year Plan for Energy Saving and Emission Reduction. To further enhance the credibility of the main test, a placebo test was designed for this study. The general idea is to select a year in which the policy did not occur as the hypothetical policy implementation year and then conduct the same test as the main test. If the test result is significant and consistent with the result of the main test, it indicates that the result obtained from the main test exists in the absence of policy implementation and fails the placebo test; and if the test result is not significant, it indicates that the result obtained from the main test that exists in the absence of policy implementation was not present in the absence of the policy and passed the placebo test. In this study, the policy was set to 2015 to examine whether the effect of the 13th Five-Year Plan for Energy Saving and Emission Reduction on green innovation exists. The results are presented in Table 4 (Model 1) and the results show that the DID coefficient is not significant and, therefore, passes the placebo test.

5.3.3 Substitution Variable Test

To further prove the hypothesis, a robustness test was conducted using the replacement variable method, replacing the original variable with the ratio of the number of green patents granted to the current year’s R&D expenditure investment, expressed as the ROI. According to the regression results, the Energy Saving and Emission Reduction policy was significantly negatively correlated with ROI at the 1% level, further validating hypothesis 1, as shown in Table 4 (Model 2).

5.3.4 High-Order Clustering Robustness Standard Error Test

As the random perturbation terms for the same individual and region are correlated across years, using higher-order clustering robust standard errors better captures the characteristics of within-group correlations, resulting in consistent estimates of the true standard errors. The test results are shown in Table 4 (Model 3) and remain significant, indicating that they pass the higher-order clustering robust standard error test.

5.3.5 Exclusion of Other Policies’ Interference

In the process of implementing the 13th Five-Year Plan for Energy Saving and Emission Reduction, the State introduced the Water Pollution Prevention Law and the New Environmental Protection Law of the People’s Republic of China, which may have an impact on the estimation results of this study. To exclude the impact of these policies to identify the “net effect” of the policy, this study introduces the grouping variable POLICY in the base regression model with each policy. Model 4 reveals that the results still hold after controlling for other policies that may affect the green innovation of firms, indicating that the base regression results are robust.

5.4 Heterogeneity Analysis

5.4.1 Shareholding Heterogeneity

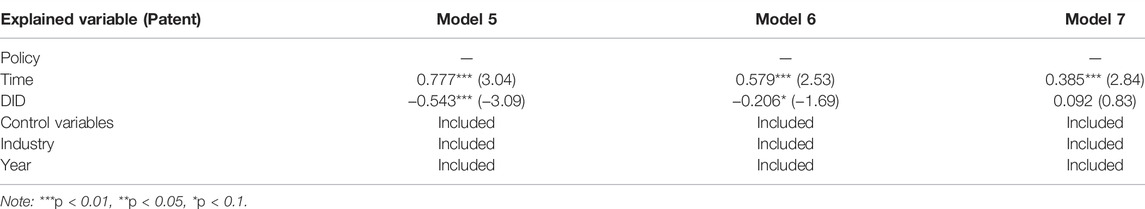

The difference in the nature of shareholding implies a different company positioning. State-owned enterprises (SOE), because of their special property rights and their production and operation in response to the state’s call, are required by state guidelines to be more cautious and stricter; in terms of policy implementation, public officials in SOEs are the most direct targets of accountability if the expected outcomes of the policy are not achieved (Liu and Xiong, 2022). In addition, the higher the administrative rank of the public officials of SOEs, the greater the responsibility for environmental protection and the stronger the supervision. Therefore, when the state issues environmental policies, SOEs take certain environmental management measures to meet the environmental standards set by the state; while non-state-owned enterprises are relatively less motivated in terms of state environmental constraints, as their business goal is to maximize their own interests, so they invest less in environmental costs. Another view is that the attributes of SOEs also make it easier for them to access external funding channels through banks and other financial institutions, mitigating the crowding-out effect of environmental regulations on internal financing and lowering environmental costs. Therefore, they are not conducive to the long-term reversal of corporate innovation (Lou and Ran, 2016). Thus, based on the nature of equity, the sample data were divided into state-owned and non-state-owned enterprises. Table 5 shows that the 13th Five-Year Plan for Energy Saving and Emission Reduction has a significant negative correlation with green innovation for SOEs, with a correlation coefficient of −0.543 (Model 5), and a significant negative correlation with non-SOEs, with a correlation coefficient of −0.206 (Model 6). This is because SOEs have strong political relevance and are more regulated by local governments, which will exert pressure on SOEs’ environmental management and are more active in fulfilling their social responsibility. When SOEs’ environmental performance is not up to standard, they tend to pay more environmental costs and R&D investment is further reduced; and non-SOEs, influenced by profit-seeking goals, find it difficult to actively invest significant resources to cooperate with the government’s environmental governance efforts regardless of the cost (Zhang et al., 2019). Consequently, SOEs’ output in R&D will become less, with the implementation of the policy, in relation to non-SOEs.

5.4.2 Industry Heterogeneity

In terms of innovation drivers, the role of environmental regulation policies is clear industry heterogeneous, with excessively polluting and high-emission industries being more affected by environmental policies (Antonioli et al., 2013; Kang et al., 2020). The 13th Five-Year Plan for Energy Saving and Emission Reduction focuses on strengthening energy conservation in key areas and enhancing the reduction of major pollutants, which is more targeted at heavily polluting companies. The policy concentrates on directly strengthening the performance assessment mechanism for environmental management within enterprises, compulsorily institutionalizing pollution control guidelines, highlighting the government’s intention to restrict the production and operation of heavily polluting firms and expand their investment and construction behavior, and addressing the problem of heavy environmental pollution at the source (Xu, 2022). As non-heavy polluters are less damaging in terms of emissions and, therefore, have lower costs to invest in environmental management, the avenue for extracting R&D and innovation investment through emissions charges may not exist. The regression results proved that the impact of the 13th Five-Year Plan for Energy Saving and Emission Reduction on non-heavily polluting enterprises was not significant (Model 7), indicating that the policy was focused on the impact on heavily polluting enterprises.

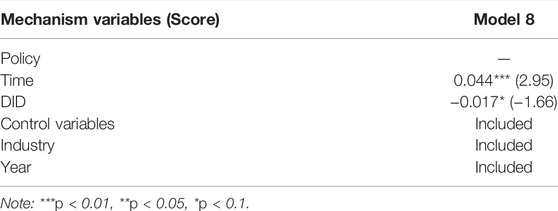

5.5 Mechanism Test

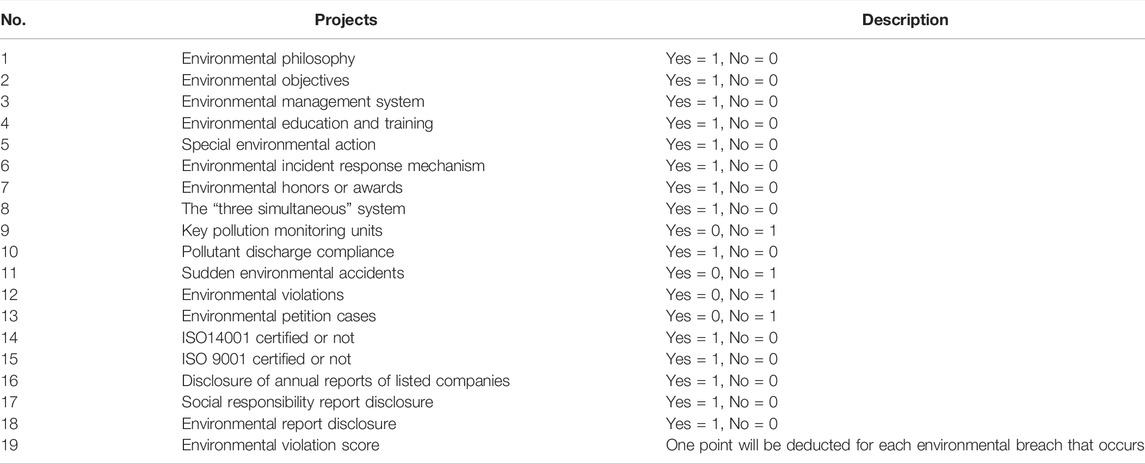

The Energy Saving and Emission Reduction policy had a negative impact on green innovation through the rise in environmental costs, thus causing a constriction in R&D costs for heavy polluters. This study draws on Dai et al. (2021). According to signaling theory, if an enterprise increases its own environmental investment, as a profit-maximizing whole, it will certainly announce this information to its stakeholders and the public, and thus be able to show that it has assumed its responsibility for environmental management. Therefore, the measure of environmental costs for heavily polluting enterprises—the higher the score, the better the environmental responsibility of the enterprise. Nineteen subdivisional indicators were selected to measure the enterprise’s environmental score; for each environmental responsibility fulfilled by an enterprise, 1 point was awarded, and for each environmental violation, 1 point was subtracted. According to Table 6 (Model 8), the regression results indicate that the 13th Five-Year Plan for Energy Saving and Emission Reduction has a negative impact on the scores of heavily polluting enterprises, which may be due to the fact that since the implementation of the policy, the government has strengthened its environmental supervision efforts so that environmental violations have become standardized and environmental scores have become lower in enterprises. When a firm’s environmental score becomes low, as environmental penalties have a special deterrent effect on the environmental governance of the target firm (Chen et al., 2021), they will bring market risk to the company and raise its debt financing cost (Xu and Qi, 2020), so the firm will choose to invest more money in environmental governance to improve its environmental score, while R&D investment will be restricted and negatively affect innovation. This explains how the 13th Five-Year Plan for Energy Saving and Emission Reduction leads to a decrease in innovation capacity through an increase in environmental costs for ecofriendly firms. The breakdown of the environmental scores is shown in Table 7.

6 Conclusion

6.1 Conclusions and Recommendations

As a national policy to cope with rapid economic growth and damage to resources and the environment, the 13th Five-Year Plan aims to alleviate the contradiction between economic development and environmental issues, achieve ecologically sustainable development, and focus on the balance between social and environmental benefits. With rapid economic development, pollutant emissions in China have become increasingly prominent. The 13th Five-Year Plan, a comprehensive work program for energy conservation and emission reduction introduced in 2017, sets comprehensive emission reduction targets: it stipulates that by 2020, the national energy consumption of 10,000 yuan of GDP will drop by 15% compared to 2015, with policy emphasis on optimizing industrial and energy structures, strengthening energy conservation in key areas, optimizing the industrial and energy structure, and reinforcing the reduction of major pollutants, as well as a series of mandatory emission reduction programs. Therefore, in response to the call for sustainable development, this study explores the impact of the 13th Five-Year Plan for Energy Saving and Emission Reduction on the green innovation of heavily polluting enterprises and explores the impact mechanisms involved. The research found that the policy had a negative impact on green innovation in heavily polluting enterprises through the effect of increased environmental costs because, after the implementation of the command-based emission reduction policy, companies were under pressure to pay extra costs for environmental protection. The increase in environmental costs had a crowding-out effect on R&D investment, and firms increased their operating costs and reduced the effectiveness of innovation significantly. Further research found that the negative impact of the Energy Saving and Emission Reduction policy on innovation was more pronounced among state-owned enterprises and heavily polluting enterprises, which could reasonably be explained by the fact that the implementation of national policies is more stringent on SOEs; subsequently, they may need to invest more in environmental management than non-state-owned enterprises in order to achieve the expected results of the policies, and innovation will be significantly reduced. The effect of national policies is clearly industry heterogeneous; the more polluting the industry, the more environmental costs it must invest in meeting policy needs than low polluters. Therefore, heavily polluting firms are squeezed more severely in terms of R&D investment than non-heavy polluters.

Based on these findings, the following policy insights emerge from this study: First, the state should consider the heterogeneity of industry and property rights before formulating and implementing policies. For example, command-based environmental regulation policies are more stringent for heavily polluting industries and state-owned enterprises, and policy pressures cause results that are contrary to the intended goals; therefore, the government should be flexible in formulating and improving environmental policies. Policy implementation needs to focus on the impact channels of innovation for sustainable development. This study concludes that policy implementation has a negative impact on a firm’s innovation by raising environmental costs, and that the adverse effects of policy can be mitigated by addressing the channels, such as moderate emissions levies and reasonable R&D subsidies, to promote green innovation. For pollution-intensive industries, which are mainly resource consuming and labor intensive, the government can help alleviate the pressure of environmental costs brought about by the policy by moderately reducing the levy of sewage charges, further increasing the intensity of subsidies, lowering the threshold of green credit financing for enterprises, or implementing preferential tax policies. This would raise the awareness of green independent research and development, and better promote environmental costs. Second, the implementation of environmental regulation policies requires the integration of the advantages of various types of ecofriendly rules to form a strong and effective “combination blow” and to promote the coordination of different environmental guidelines. On the contrary, it is necessary to combine policy with the market economy, divide regions with different policy-carrying capacities according to the market economy, coordinate regional division of labor and cooperation, promote the adjustment of industrial structure in each region based on development advantages; and concurrently improve the regional environmental regulation and trading mechanism, build a price system that reflects market supply and demand, the degree of scarce resources and the cost of resources and environment, and optimize regional environmental allocation by market means. Third, it is a long-term process of obtaining positive feedback on the implementation of environmental regulations. In this process, the government can strengthen the propaganda of innovation, continuously guide enterprises to form a green development model, encourage them to innovate in environmental protection, stimulate their endogenous motivation to protect the environment, increase their motivation to increase environmental cost investment, and achieve a positive cycle, so that economic development and environmental protection can work together. Enterprises should also have a certain sense of innovation, and in the face of a green economy, it is important to know that green innovation is the goal of long-term development, and that they need to uphold the concept of innovation and actively implement industrial transformation.

6.2 Limitations and Future Research Directions

This study had certain limitations. First, the year of policy implementation is 2017, and owing to the problem of data disclosure, the experimental group had a short research year, which made it difficult to prove the long-term effect of policy implementation. Second, the incomplete disclosure of green patent information of some non-heavily polluting enterprises caused the absence of part of the sample and reduced the sample size. Third, the environmental cost data of different enterprises involved distinct detailed accounts, and some companies did not disclose specific items, which was not conducive to data statistics.

Environmental problems brought about by economic development have always existed, and the reliance on environmental regulation to alleviate environmental pressures is in line with China’s socialist national conditions. Based on the research ideas in this study, the following directions can be improved. First, the channels through which policy affects green innovation should be integrated and categorized. There are many different channels through which policy can influence green innovation in enterprises, and a single analysis of one or several channels cannot determine the channels through which policy has an impact on green innovation. Therefore, in future research, the channels of influence can be integrated and classified, with each category including systematic and complete secondary indicators, which can improve the accuracy of the channels through which policy influences innovation. Second, the green innovation framework should be unified. Green innovation is a broad concept, including technical innovations such as products, technologies, and processes, and non-technical innovations such as management and services; and from the perspective of the supply chain, green innovation also includes the construction of green supply chain networks. The diversity of content leaves green innovation without a clear definition and relies solely on indicators to measure it. Future research can clarify the concept of green innovation and establish a unified framework for integrating the hierarchy of innovation processes, which can significantly reduce the degree of bias in research related to green innovation. Third, it is important to distinguish the differences in the Energy Saving and Emission Reduction policy. Based on China’s current political system and ecological context, the government has continued to introduce environmental regulations to reduce emissions and alleviate environmental pressures, but the various content of environmental policies contradicts each other, and the boundaries are blurred. The next Five-Year Plan will also introduce energy conservation and emission reduction policies. Therefore, when studying the effects of these policies, it is important to clarify their specific content and to distinguish between energy conservation and emission reduction policies and other environmental regulations so as to avoid inaccurate findings due to the influence of the latter.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material; further inquiries can be directed to the corresponding author.

Author Contributions

K-CC was responsible for the outline layout of the article, JZ was responsible for the writing of the article, and H-RL, CJ, and YL were responsible for the data and literature collection of the article, Correspondence author K-CC responsible for the revision of the paper, reply to the comments of reviewers.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ahmad, M., Akhtar, N., Jabeen, G., Irfan, M., Khalid Anser, M., Wu, H., et al. (2021). Intention-Based Critical Factors Affecting Willingness to Adopt Novel Coronavirus Prevention in Pakistan: Implications for Future Pandemics. Ijerph 18 (11), 6167. doi:10.3390/ijerph18116167

Anouliès, L. (2017). Heterogeneous Firms and the Environment: A Cap-And-Trade Program[J]. J. Environ. Econ. Manag. 84, 84–101. doi:10.1016/J.JEEM.2017.02.004

Antonioli, D., Mancinelli, S., and Mazzanti, M. (2013). Is Environmental Innovation Embedded within High-Performance Organisational Changes? the Role of Human Resource Management and Complementarity in Green Business Strategies. Res. Policy 42 (4), 975–988. doi:10.1016/j.respol.2012.12.005

Ashenfelter, O. C., and Card, D. (1985). Using the Longitudinal Structure of Earnings to Estimate the Effect of Training Programs[J]. Rev. Econ. Statistics 67 (4). doi:10.2307/1924810

Ashenfelter, O. C. (1978). Estimating the Effect of Training Programs on Earnings[J]. Rev. Econ. Statistics 60 (1). doi:10.2307/1924332

Berman, E., and Bui, L. T. M. (2001). Environmental Regulation and Productivity: Evidence from Oil Refineries[J]. Rev. Econ. Statistic 83 (3), 498–510. doi:10.1162/00346530152480144

Bernard, A. B., Redding, S. J., and Schott, P. K. (2010). Multiple-Product Firms and Product Switching. Am. Econ. Rev. 100 (1), 70–97. doi:10.1257/aer.100.1.70

Cao, Q. T., Zhang, X. Y., and Yang, X. (2021). Green Effect and Influence Mechanism of Green Credit Policy-Based on the Evidences of Green Patent Data of Chinese Listed Companies[J]. Finance Forum. doi:10.16529/j.cnki.11-4613/f.2021.05.003

Card, D., and Krueger, A. B. (1994). Minimum Wages and Employment: a Case Study of the Fast-Food Industry in New Jersey and Pennsylvania[J]. Am. Econ. Rev. 84 (4), 772–793. doi:10.3386/w4509

Chan, H. K., Yee, R. W. Y., Dai, J., and Lim, M. K. (2016). The Moderating Effect of Environmental Dynamism on Green Product Innovation and Performance. Int. J. Prod. Econ. 181, 384–391. doi:10.1016/j.ijpe.2015.12.006

Chen, S. H., Lei, L., and Zhou, Z. L. (2022). Environmental Regulation, Green Technological Progress and Green Economy Development: Empirical Research of PVAR Model Based on the Panel Data of Eleven Provinces and Cities in the Yangtze River Economic Belt[J/OL]. Sci. Technol. Prog. Policy, 1–9. doi:10.6049/kjjbydc.C202106043

Chen, S. Y. (2010). Energy-Save and Emission-Abate Activity with its Impact O on Industrial Win-Win Development in China:2009-2049[J]. Econ. Res. J. (3), 129–143.

Chen, X. Y., Xiao, H., and Zhang, G. Q. (2021). Do Environmental Punishments Promote Corporate Environmental Governance? an Analysis Based on the Process and Outcome Dual Dimensions[J]. Bus. Manag. J. 43 (06), 136–155. doi:10.19616/j.cnki.bmj.2021.06.009

Colombo, M. C., and Groce, M. Guerini. (2013). The Effect of Public Subsidies on Firms' Investment-Cash Flow Sensitivity: Transient or Persistent. [J]Research Policy 42, 1605. doi:10.2139/ssrn.1596073

Copeland, B. R., and Taylor, M. S. (1997). The Trade-Induced Degradation Hypothesis. Resour. Energy Econ. 19 (4), 321–344. doi:10.1016/s0928-7655(97)00015-8

Dai, P. Y., Yang, S. G., and Yuan, L. (2021). Capital Market Opening up and Corporate Total Factor Productivity[J]. J. World Econ. 44 (08), 154–178.

Dean, T. J., and Brown, R. L. (1995). Pollution Regulation as a Barrier to New Firm Entry: Initial Evidence and Implications for Future Research. Amj 38 (1), 288–303. doi:10.5465/256737

Emilio, G., and Kensuke, T. (2018). Abatement Expenditures, Technology Choice and Environmental Performance: Evidence from Firm Responses to Import Competition in Mexico[J]. J. Dev. Econ. 133, 264–274. doi:10.1016/J.JDEVECO.2017.11.004

Fan, D., and Sun, X. T. (2020). Environmental Regulation, Green Technological Innovation and Green Economic Growth[J]. China Popul. Resour. Environ., 30(6): 105–115. doi:10.12062/cpre.20200123

Feiock, R., and Rowland, C. K. (1990). Environmental Regulation and Economic Development: the Movement of Chemical Production Among States. West. Polit. Q. 43 (3), 561–576. doi:10.1177/106591299004300308

Feng, M. (2020). Multi-product Export Firms, Product Switching and Learning by Exporting[J]. J. Int. Trade (9), 50–64. doi:10.13510/j.cnki.jit.2020.09.004

Greenstone, M. (2002). The Impacts of Environmental Regulations on Industrial Activity: Evidence from the 1970 and 1977 Clean Air Act Amendments and the Census of Manufactures. J. Political Econ. 110 (6), 1175–1219. doi:10.1086/342808

Grossman, S., and Hart, O. (1983). An Analysis of the Principal-Agent Problem[J]. Econometrical 51 (01), 7–45. doi:10.2307/1912246

Hambrick, D. C., and Mason, P. A. (1984). Upper Echelons: The Organization as a Reflection of its Top Managers. Acad. Manag. Rev. 9 (2), 193–206. doi:10.2307/258434

Haveman, R., and Christainsen G B, H. (1981). Environmental Regulations and Productivity Growth[J]. Nat. Resour. J. 21 (3), 489–509. doi:10.1016/0308-597X(81)90168-8

He, L. Y., Liang, X., and Yang, X. L. (2019). Can Green Credit Promote the Technological Innovation of Environmental Protection Enterprises? [J]. Financial Econ. Res. 34 (5), 109–121.

He, W. L., and Shen, R. (2019). ISO 14001 Certification and Corporate Technological Innovation: Evidence from Chinese Firms. J. Bus. Ethics 158 (1), 97–117. doi:10.1007/s10551-017-3712-2

Hu, H., and Tang, E. (2020). The Impact of Environmental Equity Trading on Corporate Quality Production - Empirical Evidence Based on Carbon Trading[J]. J. MACRO - Qual. Res.. doi:10.13948/j.cnki.hgzlyj.2020.05.004

Işık, C., Kasımati, E., and Ongan, C. (2017). Analyzing the Causalities between Economic Growth, Financial Development, International Trade, Tourism Expenditure And/on the CO2 Emissions in Greece[J]. Energy sources., 665–673. doi:10.1080/15567249.2016.1263251

Işık, C., Ongan, S., Bulut, U., Karakaya, S., Irfan, M., Alvarado, R., et al. (2022). Reinvestigating the Environmental Kuznets Curve (EKC) Hypothesis by a Composite Model Constructed on the Armey Curve Hypothesis with Government Spending for the US States. Environ. Sci. Pollut. Res. 29, 16472–16483. doi:10.1007/s11356-021-16720-2

Işık, C., Ongan, S., and Özdemir, D. (2019). Testing the EKC Hypothesis for Ten US States: an Application of Heterogeneous Panel Estimation Method. Environ. Sci. Pollut. Res. 26 (11), 10846–10853. Epub 2019 Feb 18. PMID: 30778930. doi:10.1007/s11356-019-04514-6

Işık, C., Sirakaya-Turk, E., and Ongan, S. (2020). Testing the Efficacy of the Economic Policy Uncertainty Index on Tourism Demand in USMCA: Theory and Evidence. Tour. Econ. 26 (8), 1344–1357. doi:10.1177/1354816619888346

Işık, C. (2013). The Importance of Creating a Competitive Advantage and Investing in Information Technology for Modern Economies: an ARDL Test Approach from Turkey. J. Knowl. Econ. 4, 387–405. doi:10.1007/s13132-011-0075-2

Joern, H., Michael, P., Malte, S., and Volker, H. (2013). The Two Faces of Market Support-How Deployment Policies Affect Technological Exploration and Exploitation in the Solar Photovoltaic Industry[J]. Res. Policy 42 (4), 989–1003. doi:10.1016/j.respol.2013.01.002

Kang, Z. Y., Tang, X. L., and Liu, X. (2020). Environmental Regulation, Enterprise Innovation and Export of Chinese Enterprises-Retest Based on Porter Hypothesis[J]. J. Int. Trade (2), 125–141. doi:10.13510/j.cnki.jit.2020.02.009

Kemp, R., and Pontoglio, S. (2011). The Innovation Effects of Environmental Policy Instruments - A Typical Case of the Blind Men and the Elephant? Ecol. Econ. 72, 28–36. doi:10.1016/j.ecolecon.2011.09.014

Kneller, R., and Manderson, E. (2012). Environmental Regulations and Innovation Activity in UK Manufacturing Industries. Resour. Energy Econ. 34 (2), 211–235. doi:10.1016/j.reseneeco.2011.12.001

Langpap, C., and Shimshack, J. P. (2010). Private Citizen Suits and Public Enforcement: Substitutes or Complements? J. Environ. Econ. Manag. 59 (3), 235–249. doi:10.1016/j.jeem.2010.01.001

Leeuwen, G., and Mohnen, P. (2017). Revisiting the Porter Hypothesis: An Empirical Analysis Ot Green Innovation for the Netherlands[J]. Econ. Innovation New Technol. 26 (1/2), 63–77. doi:10.1080/10438599.2016.1202521

Liu, C. M., Sun, Z., and Zhang, J. (2019). Research on the Effect of Carbon Emission Reduction Policy in China’s Carbon Emissions Trading Pilot[J]. China Popul. Resour. Environ., 29(11):49–58.

Liu, H., and Fan, B. (2019). Analysis of the Generation Mechanism and Deviation Effect of Policy Pilots - the Example of Centrally Initiated Policy Pilots[J]. Leadersh. Sci. (04), 60–64. doi:10.19572/j.cnki.ldkx.2019.04.015

Liu, J. J., and Xiong, Z. Q. (2022). The Impact of Environmental Regulation on the Transformation and Upgrading of State-Owned Enterprises: New Evidence from Environmental Accountability[J]. Theory Pract. Finance Econ. 43 (02), 114–122. doi:10.16339/j.cnki.hdxbcjb.2022.02.015

Liu, W., Tong, J., and Xue, J. (2017). Industry Heterogeneity, Environmental Regulation and Industrial Technology Innovation[J]. Sci. Res. Manag. 38 (5), 1–11. doi:10.19571/j.cnki.1000-2995.2017.05.001

Liu, Y. Q., She, Y. A., Liu, S., and Tang, H. (2022). Can the Leading Officials' Accountability Audit of Natural Resources Policy Stimulate Chinese Heavy-Polluting Enterprises' Green Behavior? [J]. Environ. Sci. Pollut. Res.. doi:10.1007/s11356-022-18527-1

Liu, Y., and Zhou, M. (2018). Does Environmental Regulation Hinder Firm Competitiveness: A Theoretical Analysis Based on Heterogeneous Firms[J]. J. World Econ. (4), 150–167.

Lou, C. L., and Ran, M. S. (2016). The Influence of Environmental Regulation on Enterprise Technology Lnnovation under Financing Constraints[J]. Syst. Eng. (12), 66–73.

Meng, D., and Yu, Y. (2022). Dual Environmental Regulation, Innovation Ecology and Green Technology Innovation - A Re-examination of the Porter Hypothesis[J/OL]. Soft Sci., 1–12.

Oster-Aaland, L. K., Neighbors, C., and Neighbors, Clayton. (2007). The Impact of a Tailgating Policy on Students' Drinking Behavior and Perceptions. J. Am. Coll. Health 56 (3), 281–284. doi:10.3200/JACH.56.3.281-284

Palmer, K., Oates, W. E., and Portney, P. R. (1995). Tightening Environmental Standards: The Benefit-Cost or the No-Cost Paradigm? J. Econ. Perspect. 9 (4), 119–132. doi:10.1257/jep.9.4.119

Pearce, D. (1991). The Role of Carbon Taxes in Adjusting to Global Warming. Econ. J. 101 (407), 938–948. doi:10.2307/2233865

Petroni, G., Bigliardi, B., and Galati, F. (2019). Rethinking the Porter Hypothesis the Underappeciated Importance of Value Appropriation and Pollution Intensity[J]. Rev. policy Res. 36 (1), 121–140. doi:10.1111/ropr.12317

Porter, M. C., and Linde, V. (1991). TO Warda New Conception of the Environment - Competitiveness Relationship[J]. J. Econ. Perspective 9, 97. doi:10.1257/jep.9.4.97

Rugman, A. M., and Verbeke, A. (1998). Corporate Strategies and Environmental Regulations: an Organizing Framework. Strat. Mgmt. J. 19 (4), 363–375. doi:10.1002/(sici)1097-0266(199804)19:4<363::aid-smj974>3.0.co;2-h

Shi, H. J., and Chu, E. M. (2017). DID Model of Policy Effect Evaluation[J]. Statistics Decis. (17), 80–83. doi:10.13546/j.cnki.tjyjc.2017.17.018

Tao, F., Zhao, J. Y., and Zhou, H. (2021). Does Environmental Regulation Improve the Quantity an D Quality of Green Innovation-Evidence from the Target Responsibility System of Environmental Protection[J]. China Ind. Econ. (02), 136–154. doi:10.19581/j.cnki.ciejournal.2021.02.016

Theyel, G. (2000). Management Practices for Environmental Innovation and Performance. Int. J. Operations Prod. Manag. 20 (2), 249–266. doi:10.1108/01443570010304288

Tu, Z., Zhou, T., Ren, J., and Gan, T. (2019). Environmental Regulation Reform and High Quality Economic Development: Evidence Based on the Adjustment of Industrial Pollution Charge Standard [J]. Econ. Manag. Res.. doi:10.13502/j.cnki.issn1000-7636.2019.12.007

Walter, I., and Ugelow, J. L. (1979). Environmental Policies in Developing Countries. J. 8 (2/3), 102–109.

Wang, Z. Y., Cao, Y., and Lin, S. L. (2020). The Characteristics and Heterogeneity of Environmental Regulation's Impact on Enterprises? Green Technology Innovation-Based on Green Patent Data of Listed Firms in China [J]. Stud. Sci. Sci.. doi:10.16192/j.cnki.1003-2053.20200916.001

Gray, W. B. (1987). The Cost of Regulation: OSHA,EPA and the Productivity Slowdown[J]. Am. Econ. Rev. 77 (5), 998–1006.

Xu, G. (2022). Impact and Consequences of the New Environmental Protect Law Implementation on the Financing of Heavily Polluting Enterprises[J]. Modern Finance and Economics. J. Tianjin Univ. Finance Econ. 42 (02), 96–113. doi:10.19559/j.cnki.12-1387.2022.02.007

Xu, Y. K., Qi, Y., and Song, P. F. (2020). Environmental Punishment, Corporate Performance and B Mission Reduction Incentive-Empirical Evidence from China’s Industrial Listed Companies[J]. J. China Univ. Geosciences Soc. Sci. Ed. 20 (04), 72–89.

Yan, A., Groh, A. P., and Quas, A. (2020). Bridging the Equity Gap for Young Innovative Companies: The Design of Effective Government Venture Capital Fund Programs[J]. Res. Policy 49 (10), 2–18. doi:10.1016/j.respol.2020.104051

Yang, Z., Chen, J., and Ling, H. C. (2022). Does More Experience Lead to Innovation? - Diversity of Professional Experience, Policy Perceptions and Firm Innovation Among Private entrepreneurs[J/OL]. J. Industrial Eng. Eng. Manag., 1–16. doi:10.13587/j.cnki.jieem.2022.06.003

Yi, J. T., J S, Fu., and Meng, S. (2017). Multiproduct Exporters, Product Switching, and Resource Allocations[J]. Finance Trade Econ. 38 (10), 131–145.

Ying, R. Y., Tian, C. C., and Zhang, B. B. (2020). ECER Project, Export Product Scope Adjustment and Firm’s Markups[J]. J. Southeast Univ. (Philosophy Soc. Sci. 22 (04), 47–59+156157. doi:10.13916/j.cnki.issn1671-511x.2020.04.006

Zhang, C., and Xu, C. (2022). Nature of Shareholding, Capital Structure and Corporate Innovation[J]. Econ. Theory Bus. Manag. 42 (03), 38–53.

Zhang, H., Ou, A. Y., Tsui, A. S., and Wang, H. (2017). CEO Humility, Narcissism and Firm Innovation: A Paradox Perspective on CEO Traits. Leadersh. Q. 28 (5), 585–604. doi:10.1016/j.leaqua.2017.01.003

Keywords: energy saving and emission reduction, green patents, heavy pollution, DID, innovation

Citation: Chai K-C, Zhu J, Lan H-R, Jin C, Lu Y and Chang K-C (2022) Research on the Mechanism of China’s Energy Saving and Emission Reduction Policy on Green Innovation in Enterprises. Front. Environ. Sci. 10:930534. doi: 10.3389/fenvs.2022.930534

Received: 28 April 2022; Accepted: 25 May 2022;

Published: 07 July 2022.

Edited by:

Cem Işık, Anadolu University, TurkeyReviewed by:

Wenjian He, Nanjing University of Information Science and Technology, ChinaAbdul Rehman, Henan Agricultural University, China

Copyright © 2022 Chai, Zhu, Lan, Jin, Lu and Chang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ke-Chiun Chang, a2VjaGl1bkBnbWFpbC5jb20=

Kuang-Cheng Chai

Kuang-Cheng Chai Jiawei Zhu

Jiawei Zhu Hao-Ran Lan

Hao-Ran Lan Chengsheng Jin

Chengsheng Jin Yujiao Lu

Yujiao Lu Ke-Chiun Chang

Ke-Chiun Chang