- 1School of Accountancy, Shandong University of Finance and Economics, Jinan, China

- 2School of Economics and Management, Tongji University, Shanghai, China

- 3Laval University, Quebec, QC, Canada

“Porter Hypothesis” believes that environmental protection regulations contribute to cleaner production and green technology innovation which benefit to enhance manufacturing firm performance . We take China’s new “Environmental Protection Regulations (2015), as a quasi-natural experiment, using A-share listed companies in Shenzhen and Shanghai in 2012–2017 as a research sample. Using the propensity score matching and double difference (PSM-DID) method, we empirically test the impact of environmental regulations on the financial performance of these companies. The results show that the new Environmental Protection Law has significantly improved corporate profits of large enterprises large firms. Different from the innovation mechanism emphasized in the literature based on the Porter hypothesis, we find that “Compliance cost heterogeneity” caused by the scale difference of firms better explains the impact of environmental regulations on the profit margin of listed manufacturing firms. Overall, this study contributes novel insights about the economic consequences of environmental regulation and establishes an initial foundation for investigating environmental regulation from the perspective of compliance cost heterogeneity.

1 Introduction

The rapid growth of China’s economy over the last four decades has also created serious environmental problems. According to the Environmental performance index (EPI) (2022), China ranked 94th among 133 countries in 2006 and 120th among 180 countries in 2018, indicating that China’s environmental quality is still at the lower end of the world ranking. Serious environmental problems prevalent in China have promoted awareness of environmental consequences and people’s demand for a cleaner production environment has become more and more intense (Hoque et al., 2018; Meng et al., 2022). The previous economic growth model has been replaced by environment friendly sustainable economic growth. Against this background, it seems logical for the government to strengthen environmental regulations, as reflected in the new Environmental Protection Law officially implemented on 1 January 2015.

It should be pointed out that the United Nations Sustainable Development Goals (SDGS) in 2015 are 17 global development goals formulated by the United Nations. The SDGs aim to solve the three dimensions of society, economy and environment in an integrated manner from 2015 to 2030. development issues and turn to the path of sustainable development. Many of these goals align with our research goals, particularly those on clean energy, climate, and ecology. The objectives of China’s new “Environmental Protection Regulations” are inherently consistent with the above objectives.

The new environmental protection in China are generally referred to by the media as the most stringent environmental protection law in China, and its rigor is manifested in the following ways: First, a system of daily capped fines for companies that violate the law and regulations has been established, and the deterrent effect of the new Environmental Protection Law has been improved. Second, the most severe means of administrative punishment will be used for those who violate the law. Firms that discharge heavy pollution can be sealed, seized, or ordered to close. Third, there are clear stipulation of the environmental protection responsibilities of local governments, which have been specifically targeted for the implementation of environmental protection laws and related environmental policies. Moreover, the higher emphasize on the role of local governments’ responsibilities will change the notion that local governments only pay attention to GDP growth and ignore environmental conditions. Overall, the new Environmental Protection Law has made significant changes from the past in terms of governance concepts, legal systems, inspection and supervision, and administrative law enforcement. Nguyen et al. (2021) found that firms’ governance structure also contributes to environmental performance. However, in the face of such rigorous law enforcement, different or even questioning voices have begun to appear. Some people are worried about strict enforcement of environmental protection laws leading to a decline in firms’ profitability, as raw material prices have risen and some firms have suffered from shortages of enough works for their workers. As a major policy change towards cleaner production that requires rigorous investigations on the effectiveness of the new environmental protection on the firm performance (Shao et al., 2020).

The implementation of the new environmental protection law has significantly improved China’s environmental governance level1, and the emission of waste gas and wastewater has decreased significantly. However, it has also increased the pollution discharge costs and operating costs of enterprises, affecting the profits of enterprises, especially those in heavy pollution industries. If an enterprise fails to make continuous profits in the market, it may lead to the breakage of the capital chain or insolvency, and face the risk of bankruptcy (Albrizio et al., 2017; Guo et al., 2018; Blackman, 2021). Especially under the background of innovation driven era, enterprises’ improvement of core technology level and reduction of operation cost and pollution discharge cost are conducive to the sustainable development of enterprises (Rassier and Earnhart, 2010; Greenstone et al., 2012). Therefore, no matter what policy background and market environment, improving the innovation ability and operating efficiency of enterprises is the driving force for the long-term prosperity and sustainable development of enterprises (Xie et al., 2017; Fan et al., 2019). So, what is the relationship between environmental regulation and enterprise efficiency? Has the implementation of the new environmental protection law affected the profit margin of enterprises?

The relationship between environmental regulation and corporate productivity has always been a keen issue in academia that has resulted in diametrically opposing views. The “compliance cost” viewpoint holds that environmental regulation destroys the best choices established by enterprises according to their technology, resources, market demand, etc., which will inevitably lead to a sharp increase in the short-term cost of enterprises, resulting in a decrease in profit margins, as proved by the empirical results of many scholars (Jaffe et al., 1995; Rassier and Earnhart, 2010; Greenstone et al., 2012; Li and Ramanathan, 2018; Zhong et al., 2021). In contrast, the “Porter hypothesis” states that appropriate environmental regulations promote enterprise innovation, and innovation offsets can even exceed the cost of regulation compliance to improve the profitability of companies (Porter and Linde, 1995). Some empirical results support the Porter hypothesis and believe that environmental regulation can achieve a “win-win” relationship between environmental improvement and enterprise development (Berman and Bui, 2001; Lanoie et al., 2011; Jefferson et al., 2013; Peng et al., 2018; Mohiuddin et al., 2022).

Research has not reached a consistent conclusion on the impact of environmental regulation on corporate performance. The reason that these conclusions are inconsistent may be that in the real market environment, the relationship between environmental regulation and corporate financial performance is not a single “stimulus-response” relationship. To have an effect, environmental regulation must be in a market environment composed of various complex economic factors, some of which will affect the efficiency of policies and regulations (such as information asymmetry). Some others will help enterprises obtain excess profits (such as technological breakthroughs) and form a substitution effect on government environmental regulation. Thus, the net effect of environmental regulations is difficult to observe. In addition, it is difficult for researchers to find a near-perfect natural experiment to ensure that there are “common trends” in various factors that affect the financial performance of enterprises, and it is impossible to accurately define which policies belong to strict and flexible environmental regulations. Therefore, previous studies on the correlation between the two may present completely opposite results due to missing variables and different choices of natural experiments, confusing the relationship between environmental regulation and financial performance.

Our research focuses on the impact of the implementation of the new Environmental Protection Law on the financial performance of large companies in heavily polluting industries. A correct understanding and investigation of this issue will help to enhance the consciousness of firms to assume environmental responsibilities, enable them to form a benign interactive relationship between environmental protection and performance, and build a green development model of sustainability. Therefore, based on the quasi-natural experiment of the new Environmental Protection Law, we used A-share listed companies in Shenzhen and Shanghai from 2012 to 2017 as samples and used the propensity score matching and double difference (PSM-DID) method to test the impact of environmental regulations on corporate financial performance. This study provides the comprehensive evaluation of the policy effectiveness brought by the new Environmental Protection Law. Our study differs from previous studies as we address firms from polluted manufacturing industries while taking into consideration of the size of the firms and refuting long-held assumptions developed by the Porter hypothesis on the relationship between environmental regulations and innovation for firm performance.

Our contribution to the environmental protection literature is confirm that the implementation of cleaner production standards has a positive impact on the profit margin of manufacturing enterprises, and further reveals the impact path of compliance cost heterogeneity. Most scholars focus on the “Porter Hypothesis” to investigate whether environmental regulation coordinates environmental protection and economic development through technological innovation. Although Shao et al. (2020) and Fan et al. (2019) both pointed out that environmental regulation has more ways to affect the profit margin of enterprises, they did not further analyze and verify whether environmental regulation can coordinate environmental protection and economic development through other methods. Different from the technological innovation mechanism emphasized in the “Porter Hypothesis”, we believe that due to economies of scale in equipment, resource utilization and management that meet the requirements of stricter environmental regulations, the implementation of cleaner production standards leads to a small increase in the average cost, which called compliance cost, of large-scale enterprises. Therefore, environmental regulation improves the profit margin of large-scale enterprises with low compliance costs, and reduces the profit margin of small-scale enterprises with high compliance costs. Overall, we finds that the “compliance cost heterogeneity” caused by enterprise scale differences rather than the “Porter Hypothesis” better explains the impact of cleaner production standards on the profitability of Chinese manufacturing enterprises. This discovery expands the existing literature’s understanding of the mechanism of environmental regulation affecting the profitability of enterprises and is a supplement to the “Porter Hypothesis".

The paper is organized as follows: Section 2 is literature review, which summarizes and outlines relevant studies on the relationship between environmental regulation and corporate performance; Section 3 is the research methodology, which describes the data sources, variable selection, and model setting used in this study; Section 4 is the analysis of the empirical results; Section 5 presents the discussion; and Section 6 is the conclusion.

2 Literature Review

At present, it is difficult to reach an agreement on the relationship between environmental regulation and corporate performance. Two different views exist in parallel. In the traditional view, environmental regulations impose various restrictions on companies’ existing pollutant discharge behaviors, which inevitably lead to increased costs for companies, thereby reducing corporate profits and performance (Rassier and Earnhart, 2010; Greenstone et al., 2012; Dai et al., 2021). Some studies have supported this view (Yu et al., 2021). Jorgenson and Wilcoxen (1990) compared the impact of environmental regulation on the growth of the U.S. economy and found that environmental regulation led to a decline in the performance of heavily polluting companies in the U.S. Conrad and Wastl (1995) found that the cost of pollution control led to a decline in Total Factor Productivity (TFP) in some polluting industries in Germany. Gray and Shadbegian (2003) studied the production of the paper, petroleum, and steel industries and found that the productivity of companies with higher environmental costs was significantly lower than that of companies with lower environmental costs. Gollop and Roberts (1983), Jorgenson and Wilcoxen (1990), Barbera and McConnell (1990), and Javeed et al. (2020) studied the impact of environmental regulation on corporate performance from the perspective of productivity and reached the same conclusion. This view is the compliance cost hypothesis, which holds that strict environmental regulations force firms to change their existing economic behavior and use more capital for pollution control or the introduction of environmental protection equipment. The crowding-out effect leads to a decrease in capital used for production and operations, a reduction in firm productivity, and a decline in firm performance. Meanwhile, environmental regulations stimulate enterprises to engage in rent-seeking behavior. The rise of enterprise costs and expenses will crowd out the original production funds, resulting in a slowdown in the growth of enterprise productivity in the short term (Blackman, 2021). Some resources are also limited in use or additional environmental fees for them are charged, which makes the original free environmental resources of firms become costly economic resources (Albrizio et al., 2017; Guo et al., 2018). Enterprises also need to pay pollution discharge fees and fines. Such economic costs increase the production costs of firms along with the cost of production factors. When the company’s technical level and customer consumption demand remain constant, the internalization of the company’s external environmental costs leads to an increase in product sales costs, which reduces the company’s profit margin (Christainsen and Haveman, 1981).

Another view holds that environmental regulations have a positive effect of the Porter hypothesis on industrial performance. Porter asserts that there is a real possibility of achieving a “win-win” pattern between environmental regulation and enterprise productivity2. The research of “Porter Hypothesis” focuses on the verification of its three subdivision hypotheses. A weak version of the Porter hypothesis emphasizes that environmental regulation can improve the innovation ability of enterprises. Many companies in heavily polluting industries realize that they must take a series of methods to improve their production processes and eliminate backward production capacity when facing environmental regulation policies (Berman and Bui, 2001; Lanoie et al., 2011; Peng et al., 2018). Therefore, the company actively carries out innovation activities to improve its innovation level and reduce energy consumption and pollution emissions to avoid being punished for violations (Li and Wu, 2016; Yuan and Xiang, 2018). Hojnik and Ruzzier (2016) found that, compared with other factors, the implementation of mandatory regulations and policies by the government is the main driving force of enterprise innovation. Calel and Dechezlepretre (2016) found that under the EU emissions trading system, companies have carried out low-carbon innovation, which has increased the number of low-carbon patent applications in Europe by nearly 1%. A strong version of the Porter hypothesis believes that strict and appropriate environmental regulations may stimulate regulated companies to optimize resource allocation efficiency and improve technological levels under changing constraints (Porter, 1991; Porter and Linde, 1995). environmental regulation improves the innovation level of enterprises, and produces the “innovation compensation” effect, which will offset the compliance costs arising from compliance with environmental regulations and increase the productivity of the enterprise (Hu et al., 2017; Yuan et al., 2017). Some scholars’ empirical results support the positive impact of environmental regulation on corporate performance. Berman and Bui (2001) studied air quality and environmental regulations, and found that the overall factor productivity of regional enterprises with greater environmental regulation intensity has increased significantly. Lanoie et al. (2011) proposed that environmental access regulation is not only conducive to environmental technological innovation but also to innovation, which reduces costs. Yang and Yao (2012) showed that Chinese enterprises that have passed the ISO14000 environmental management system certification have better economic performance. In addition, a narrow version of the Porter hypothesis believes that compared with strict environmental regulation policies such as command and control, flexible environmental regulation policies are more conducive to enterprises to improve their innovation level (Jefferson et al., 2013; Mohiuddin et al., 2022). Flexible environmental regulations allow enterprises to have a buffer period to adjust in the face of policy shocks, so as to select the most appropriate technical solutions (Xie et al., 2017; Fan et al., 2019). Rubashkina et al. (2015) found that carefully formulated and strictly enforced environmental regulations will benefit both the environment and firms, based on data from manufacturing companies in 17 European countries. Ren et al. (2022) government environmental protection have obvious promoting effects on green product innovation, green process innovation, and end management innovation.

Some studies have found that environmental regulations have no significant effect on business performance. Alpay et al. (2002) found that environmental regulation had a negative impact on the productivity of the U.S. food processing industry from 1971 to 1994 but had a positive impact on the productivity of the Mexican food processing industry during the same period. Coria and Jaraite (2015) found that CO2 emission policies had no significant impact on the production behavior and economic benefits of Swedish enterprises.

Many studies have examined the relationship between environmental regulation and enterprise productivity, industrial performance, and technological innovation (Wang and Shen, 2016; Mohiuddin et al., 2019; Hsu et al., 2021). However, most of the literature supporting the view that environmental regulation can improve the profitability of firms is based on the Porter hypothesis perspective, namely, that environmental regulation promotes innovation to improve the profitability of firms and follows a simple dichotomy at the level of research methods (Lanoie et al., 2011; Rubashkina et al., 2015; Ren et al., 2022). If this study finds that environmental regulation can improve the firm profit rate, the Porter hypothesis is considered tenable; otherwise, it is not tenable. This research method does not provide an in-depth analysis of other mechanisms by which environmental regulation affects corporate performance and ignores the path by which environmental regulation improves corporate profitability without affecting corporate innovation (Ren et al., 2022). Therefore, this study examines the impact of the Environmental Protection Law on corporate performance and examines whether the Porter hypothesis is tenable in the case of environmental regulation in regards to Chinese listed manufacturing firms.

3 Research Methodology

3.1 Sample Selection and Data Collection

We selected the 2012–2017 A-share listed companies in China and Shanghai as the initial sample, and excluded the following: 1) companies with PT and Special Treatment (ST) status; 2) financial and insurance companies; and 3) companies with severely missing required data. In order to avoid the influence of extreme values, this study implemented winsorized treatment on all continuous variables at the level of 1%. As a result, 9,361 company-year sample data were obtained. The data in this study were derived from the CSMAR and WIND databases.

To explore the specific impact of the new Environmental Protection Law on enterprise performance, the sample enterprises were divided into two groups: the experimental group, which was affected by the policy, and the control group, which was almost unaffected by the policy. The relevant definitions of the “Guidelines for Environmental Information Disclosure of Listed Companies” have been published by the Ministry of Environmental Protection. The heavily polluting industries include 16 types of industries: thermal power, steel, cement, electrolytic aluminum, coal, metallurgy, chemical, petrochemicals, building materials, paper, brewing, pharmaceutical, fermentation, textile, leather, and mining industries. We selected sample companies in the above industries as the experimental group and the remaining companies that were less affected by environmental protection laws as the control group. As a result, we obtained 726 sample companies from among the heavily polluting industries.

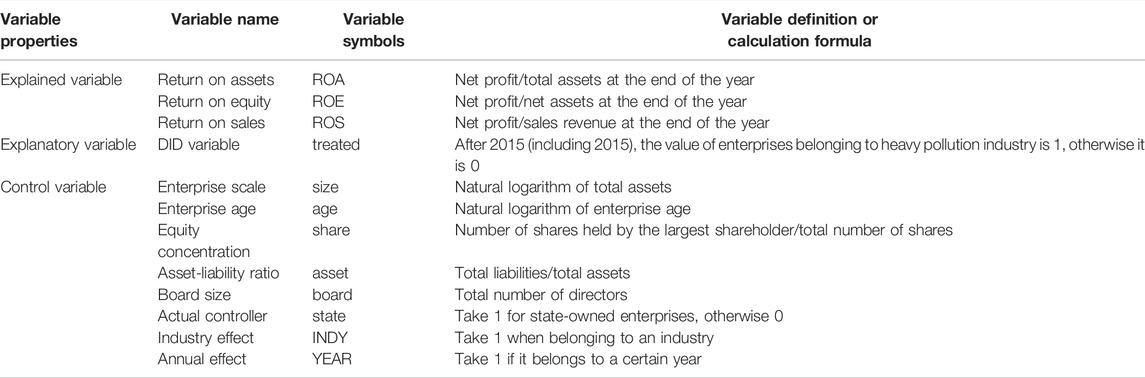

3.2 Model Setting and Variable Definition

We judged the specific impact of the new Environmental Protection Law by comparing whether there were significant differences in performance between enterprises affected and almost unaffected by the new Environmental Protection Law. However, we could not simultaneously observe the two states of the same enterprise affected by the new Environmental Protection Law and unaffected by the new Environmental Protection Law; and the influence of other potential factors on enterprise performance could not be excluded. Therefore, the two methods of PSM and DID were used to solve the problem of data loss caused by “counterfacts,” and to eliminate possible missing variables, so that the effects of the new Environmental Protection Law could be obtained. The net effect on corporate performance is as follows:

In the above model, the subscript i represents the enterprise, and t represents the year.

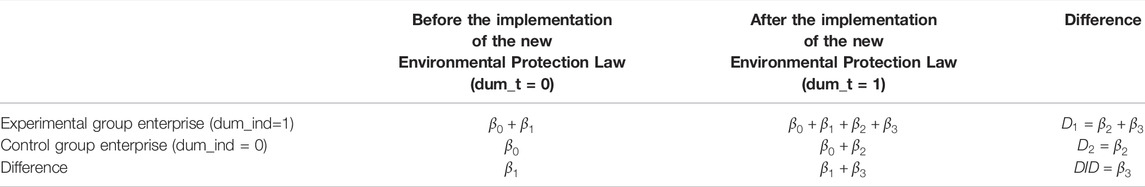

The net effect logic of the new Environmental Protection Law using the DID method is as follows. The dummy variable dum_ind indicates whether enterprise i belongs to a heavily polluting industry, and the dummy variable dum_t indicates whether the year in which enterprise i is located is after 2015. The two dummy variables are multiplied to obtain the key explanatory variable

To specifically analyze the impact mechanism of the implementation of the new Environmental Protection Law on corporate performance, the following regression analysis was performed. First, we examined whether the implementation of the new Environmental Protection Law promotes enterprise innovation from the perspective of innovation input and output. The regression model is shown in Eq. 2.

In the above formula,

In the above formula,

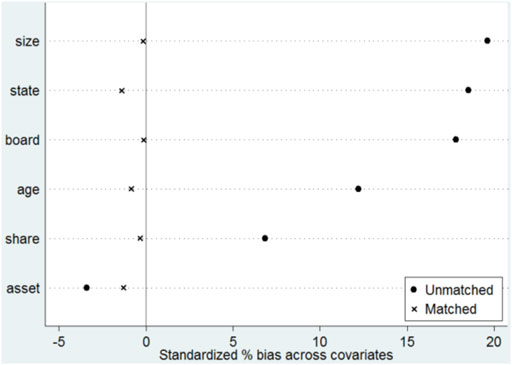

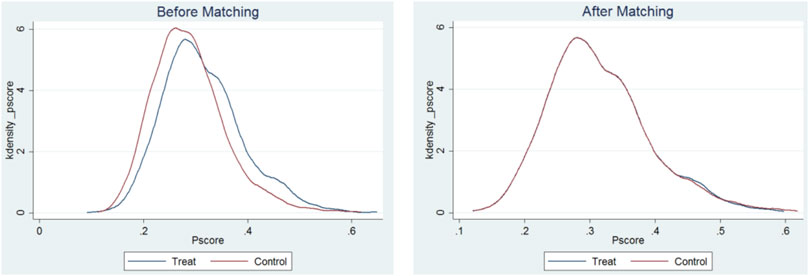

The double differential model (DID) requires the experimental and control groups to have a “common trend” before the policy is implemented, and the performance difference between the processing and experimental groups to not change significantly over time. Therefore, the propensity score matching method was used to eliminate the interference of factors that do not change with time or cannot be observed in the model, and the net effect of the new Environmental Protection Law on the explained variables was obtained as much as possible. Specifically, we took the sample enterprises of the heavy pollution industry as the treatment group and other sample enterprises as the control group and used a logit model to calculate the tendency score of each enterprise. The selected characteristic variables include enterprise scale, age, equity concentration, asset-liability ratio, number of directors, and actual controllers and adopt time and industry fixed effects. Subsequently, the 1:1 nearest-neighbor and no-replacement principles were used for matching, and a 0.25-fold standard deviation of the propensity score was used to set a caliper to find matching samples for companies affected by the new Environmental Protection Law. Figure 1 shows the results of the parallel hypothesis test. Experience shows that the standard deviation between the characteristic variables after matching is less than 10%, and the matching results of this tendency value test show that the standard deviation of most variables is greatly reduced after matching and the standard deviation of each variable is less than 10%. These parameters indicate no significant difference in the sample mean between the treatment and control groups. Finally, we obtained 5,520 matched samples. Figure 2 presents a graph of the density function of the sample companies’ propensity scores before and after matching. After matching, the probability densities of the propensity scores of the experimental and control groups were very close and the matching effect improved.

4 Analysis of Empirical Results

4.1 Descriptive Statistics

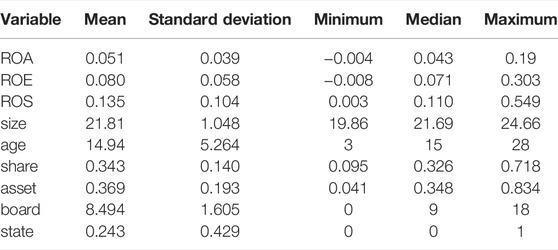

Table 3 lists the descriptive statistics of the main variables. We found that the mean of the explained variable ROA was 0.051, and its median was 0.043. The mean ROE was 0.080 and the median ROE was 0.071. The mean ROS was 0.135 and the median ROS was 0.110. The median and average of the three are relatively close and follow a normal distribution. Correlation statistical analysis showed that each control variable was significantly related to the explained variable, among which the size of the enterprise, age, asset-liability ratio, board size, and actual controller were significantly negatively correlated with ROA, and equity concentration was significantly positively correlated with ROA. In addition, the maximum correlation coefficient between each variable was 0.548, and the variance inflation factor value of each variable did not exceed 10; therefore, no serious concerns regarding multicollinearity were indicated.

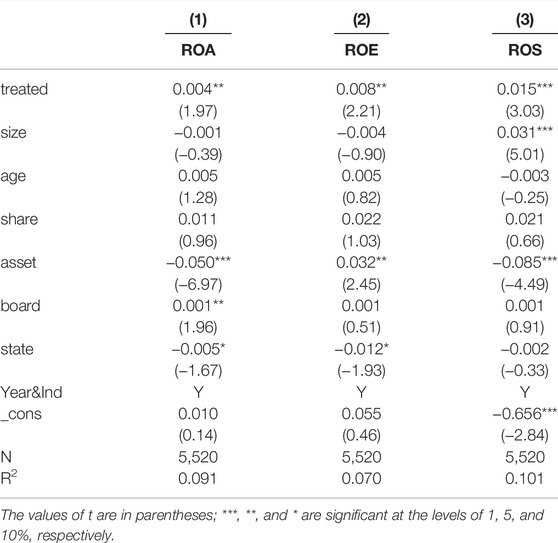

4.2 The Influence of the New Environmental Protection Law on Enterprise Performance

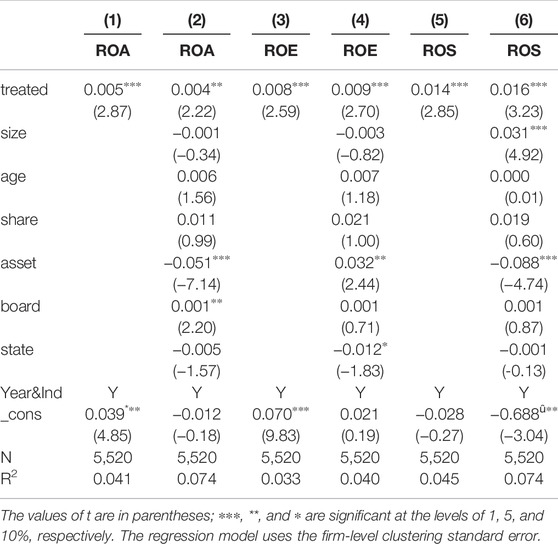

We used a fixed-effects regression model and model 1) to analyze the average treatment effect of the new Environmental Protection Law on performance. The regression results are presented in Table 4. Column 1) lists the net effect of the new Environmental Protection Law on performance without control variables. The coefficient of the key explanatory variable treated is significantly positive at 1% (0.005, t = 2.87). The control variable is added in column 2), and the coefficient of the multiplication term is still significantly positive (0.004, t = 2.22), indicating that after the implementation of the new Environmental Protection Law, the ROA of enterprises affected by the policy increased significantly. The inspection of ROE and ROS in columns (3–6) also reached a consistent conclusion, which shows that the new Environmental Protection Law had an impact on corporate performance. The regression results also show that the new Environmental Protection Law had an impact on the performance of enterprises. After the implementation of the new Environmental Protection Law, the performance of enterprises in heavily polluting industries significantly improved, which supports the research hypothesis of this study.

4.3 Robustness Test

4.3.1 Balance Test

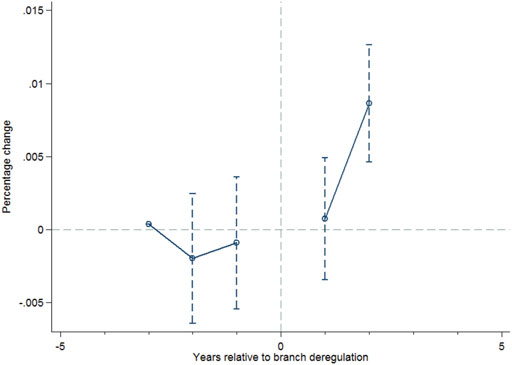

An important prerequisite for obtaining unbiased estimates using the DID method is that the common trend assumption is established, which means that in the absence of the implementation of the new Environmental Protection Law, the difference between the profit margins of the processing group and the control group should not significantly change over time. If factors before the implementation of the new Environmental Protection Law leads to significant changes in profit margin differences between different industries, then the common trend assumption may not hold and the regression results will be biased. A common method for testing the common trend hypothesis is to consider the following regression equation.

In the above model,

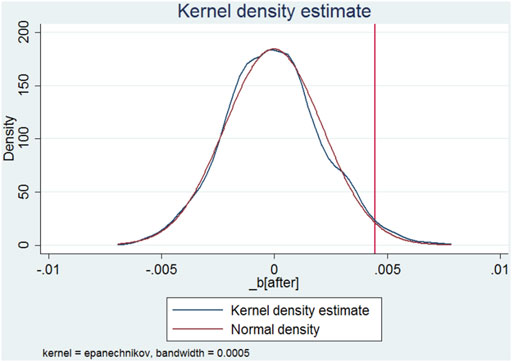

To further verify whether the DID results in this study were caused by unobservable factors, a placebo test was conducted by randomly assigning the treatment effect of the new Environmental Protection Law to the full sample companies. Specifically, some enterprises were randomly selected as the new treatment group (the number of samples in the new treatment group was the same as that of the original treatment group), and it was assumed that these companies are affected by the new Environmental Protection Law, while the other companies are almost unaffected by this law. If random sampling yields significant results, it may indicate interference from other factors. We conducted 1,000 random samplings and performed regression according to Model 1). Figure 4 shows the distribution of the regression coefficients of the key explanatory variables treated using random sampling. The distribution is concentrated around the value of 0, and the coefficient of 0.004 [from column 2) of Table 4] treated in the previous regression is obviously an abnormal value in the placebo test; which is significantly different from the distribution area of the concentrated distribution of the regression coefficients. Therefore, the placebo test results indicated that the regression results in this study were unlikely to be driven by potential factors.

4.3.2 High-Dimensional Fixed Effect

In this study, high-dimensional fixed effects were used for testing, and the regression results are shown in Table 5. For different performance indicators, the coefficients of the key explanatory variables treated were significantly positive, which is consistent with the previous regression.

TABLE 5. High-dimensional fixed effect of the new Environmental Protection Law and enterprise performance.

5 Discussion

The above analysis shows that the implementation of the new Environmental Protection Law has significantly improved the level of enterprise performance. One of the possible reasons is that the implementation of the new Environmental Protection Law can be conducive to innovation of firms. In that case, the strong Porter hypothesis led to the improvement of financial performance of heavily polluting enterprises can be justified. However, there is another possible reason for the heterogeneity in the compliance costs of firms of different sizes: large firms vs. SMEs and their respective performances.

Due to the economies of scale in production equipment and resource management needed to meet stricter environmental regulations, the average cost of large-scale enterprises increased less when the new Environmental Protection Law was implemented, meaning that the compliance costs of large-scale enterprises were lower. Small and mid-size enterprises (SMEs) must incur higher costs to meet the production standards stipulated by the new Environmental Protection Law (Matylaityte and Gocke, 2015; Xiaoning and Wei, 2017). The Chinese listed companies examined in this study belong to a group of large companies in the stock market and their compliance costs are lower than those of SMEs. Compared to SMEs, they have an incumbent advantage, which led to the implementation of the new Environmental Protection Law and promotes the performance of listed companies. Meanwhile, the implementation of the new Environmental Protection Law may also have led to the withdrawal of some SMEs from the market, which helped to increase the market share of large enterprises and improve their profit margins.

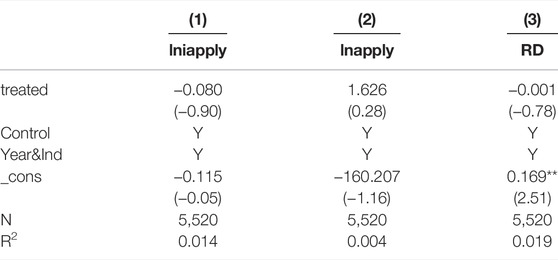

5.1 Impact of the Implementation of the New Environmental Protection Law on Firm Innovation

We analyzed the impact of the new Environmental Protection Law on corporate innovation from two perspectives: innovation input and innovation output. In the regression results shown in Table 6, columns 1) and 2) examine the impact of the implementation of the new Environmental Protection Law on the number of invention patent applications and the total number of patent applications, respectively, and column 3) examines the impact of the implementation of the new Environmental Protection Law on R&D investment. The regression results show that the implementation of the new Environmental Protection Law had no significant impact on enterprise innovation input and innovation output; therefore, the improvement of enterprise performance in the previous regression was unlikely to be achieved through the mechanism of promoting enterprise innovation.

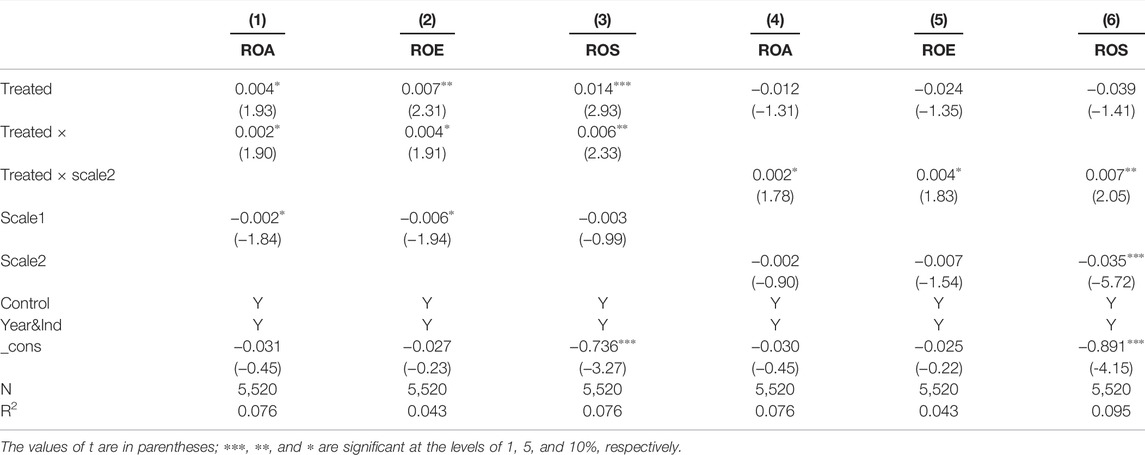

5.2 Impact of the Implementation of the New Environmental Protection Law on Firms of Different Sizes

We examined the impact of the interaction between the implementation of the new Environmental Protection Law and firm size on firm performance. The regression results are presented in Table 7. Firm size is measured by the logarithm of total assets and the total number of employees. Columns (1–3) use the logarithm of total assets and columns (4–6) use the total number of employees. According to the regression results, the interaction between the implementation of the new Environmental Protection Law and the size of the enterprise has a significant positive impact on ROA, ROE, and ROS, which shows that the implementation of the new Environmental Protection Law was more beneficial to larger firms. Therefore, compliance cost heterogeneity is more likely to explain the improvement in corporate performance under the new Environmental Protection Law.

TABLE 7. Impact of the new Environmental Protection Law on the performance of enterprises of different scales.

In summary, we did not find evidence that the new Environmental Protection Law promotes firm innovation, but did find that large firms can rely on lower compliance costs to obtain more benefits from it. Therefore, we believe that the heterogeneity in compliance costs caused by differences in enterprise size rather than the Porter hypothesis can better explain the impact of the new Environmental Protection Law on the performance of heavily polluting manufacturing firms. Based on China’s specific management situation, we discuss why the new Environmental Protection Law has promoted the performance of listed companies.

First, the environmental protection legislation and enforcement depends on local context and the environmental protection standards should also match with the local context. The implementation of environmental protection laws will have the greatest impact on firms that have the worst compliance under previous regime. It is difficult to say that China’s listed companies must do well in environmental protection compliance, but in a relative sense, listed firms should do well in environmental protection compliance comparing to non-listed firms. According to Liang and Langbein (2021), large firms have achieved better emission compliance rates, and state-owned enterprises have led the way in emission reduction. Environmental protection law enforcement is mainly aimed at companies with the worst compliance. If companies perform well in terms of compliance, environmental protection laws will not have a significant impact.

Second, listed firms face deterrents from capital markets in terms of environmental compliance. If a listed company encounters a major environmental accident or a major environmental pollution incident and encounters law enforcement by the government and media reports to the public, it may have a significant impact on the company’s performance in the capital market. Therefore, compared to SMEs, listed companies must be more concerned about environmental impacts. To the best of our knowledge, there have been no serious environmental violations in terms of compliance. According to the “Summary of 2015 Online List of Pollution Source Monitoring Risks of Listed Companies,” 73.2% of the state-controlled firms have implemented self-monitoring, and 90% of the listed firms have disclosed monitoring data. This indicates that the information disclosure level of listed firms is still relatively high and we can infer that there is a comparative advantage in the overall environmental compliance of listed firms in China.

Finally, the environmental compliance of many SMEs in China is much lower than that set by international norms. The environmental protection costs for some SMEs are basically equal to zero. The SME production process involves issues such as illegal production, excessive emissions, absence of pollution control facilities, and improper functioning of pollution control facilities. Government authorities have repeatedly emphasized governance issues against such companies, and the government has strict enforcement policies. Relevant regulations require these enterprises to stop, govern, and resolve their relocation and resurgence. Therefore, strict law enforcement has caused some SMEs to withdraw from the market, while listed companies that are less affected by the new environmental protection laws have the opportunity to expand their market share and improve corporate performance. The discussion above shows that the new Environmental Protection Law has had a positive effect on corporate performance.

6 Conclusion

Based on the quasi-natural experiment of the new Environmental Protection Law in 2015, using data from A-share listed companies in China from 2012 to 2017, this study empirically tested the impact of the implementation of the new Environmental Protection Law on corporate performance using the PSM-DID method. The results show that the implementation of the new Environmental Protection Law has significantly improved the performance of enterprises.

In further analysis, the Porter hypothesis of environmental regulation was tested, but there was no evidence that the implementation of the new Environmental Protection Law promoted enterprise innovation. Therefore, it is concluded that the Porter hypothesis may not explain the impact of the implementation of the new Environmental Protection Law on the performance of Chinese enterprises. In the process of testing another possible mechanism, we found that the implementation of the new Environmental Protection Law plays a stronger role in promoting the performance of large-scale enterprises. Therefore, it can better explain the impact of the implementation of the new Environmental Protection Law on the performance of large enterprises by inferring the “compliance cost heterogeneity” caused by differences in the size of enterprises.

Data Availability Statement

The data analyzed in this study is subject to the following licenses/restrictions: Dataset is available on request for research purpose. Requests to access these datasets should be directed to c2hhb2hvbmdNdUAxNjMuY29t.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

The research project is supported by the Natural Science Foundation of Shandong Province, China (ZR2019MG040), and the Ministry of education of Humanities and Social Science project, China (19YJAZH063).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Taking 2015-2017 as an example, China’s total SO2 emissions decreased from 18.591 million tons to 8.7539 million tons, a decrease of 52.9%; The total discharge of wastewater in China decreased from 73.532 billion tons to 69.97 billion tons, a decrease of 4.8%.

2Jaffe and Palmer (1997) divided the Porter hypothesis into three versions: a narrow version of the Porter hypothesis that flexible environmental regulation promote enterprise innovation; a weak version of the Porter hypothesis that environmental regulation only helps enterprise environmental innovation; and a strong version of the Porter hypothesis that asserts that environmental regulation can not only promote enterprise innovation, but also make innovation compensation exceed the compliance cost of enterprise, so as to improve the profit margin of enterprise. We mainly test the strong version of the Porter hypothesis.

References

Albrizio, S., Kozluk, T., and Zipperer, V. (2017). Environmental Policies and Productivity Growth: Evidence across Industries and Firms. J. Environ. Econ. Manag. 81 (1), 209–226. doi:10.1016/j.jeem.2016.06.002

Alpay, E., Kerkvliet, J., and Buccola, S. (2002). Productivity Growth and Environmental Regulation in Mexican and U.S. Food Manufacturing. Am. J. Agric. Econ. 84 (4), 887–901. doi:10.1111/1467-8276.00041

Barbera, A. J., and McConnell, V. D. (1990). The Impact of Environmental Regulations on Industry Productivity: Direct and Indirect Effects. J. Environ. Econ. Manag. 18 (1), 50–65. doi:10.1016/0095-0696(90)90051-y

Berman, E., and Bui, L. T. M. (2001). Environmental Regulation and Productivity: Evidence from Oil Refineries. Rev. Econ. Statistics 83 (3), 498–510. doi:10.1162/00346530152480144

Blackman, A. (2021). Alternative Pollution Control Policies in Developing Countries. Rev. Environ. Econ. Policy 4 (2), 234–253. doi:10.1093/reep/req005

Calel, R., and Dechezleprêtre, A. (2016). Environmental Policy and Directed Technological Change: Evidence from the European Carbon Market. Rev. Econ. Statistics 98 (1), 173–191. doi:10.1162/rest_a_00470

Christainsen, G. B., and Haveman, R. H. (1981). The Contribution of Environmental Regulations to the Slowdown in Productivity Growth. J. Environ. Econ. Manag. 8 (4), 381–390. doi:10.1016/0095-0696(81)90048-6

Conrad, K., and Wastl, D. (1995). The Impact of Environmental Regulation on Productivity in German Industries. Empir. Econ. 20 (4), 615–633. doi:10.1007/bf01206060

Coria, J., and Jaraite, J. (2015). Carbon Pricing: Transaction Costs of Emissions Trading vs. Carbon Taxes. Work. Pap. Econ. 39 (5), 512–514. doi:10.2139/ssrn.2573689

Dai, Z., Zhang, Y., and Zhang, R. (2021). The Impact of Environmental Regulations on Trade Flows: A Focus on Environmental Goods Listed in APEC and OECD. Front. Psychol. 12, 773749. doi:10.3389/fpsyg.2021.773749

Environmental performance index (EPI) (2022). Environmental Performance Index. Yale Center for Environmental Law & Policy. Available at: https://epi.yale.edu (Accessed January 28, 2022).

Fan, H., Zivin, J. S. G., Kou, Z., Liu, X., and Wang, H. (2019). Going Green in China: Firms’ Responses to Stricter Environmental Regulations. NBER Working Paper.

Gollop, F. M., and Roberts, M. J. (1983). Environmental Regulations and Productivity Growth: The Case of Fossil-fueled Electric Power Generation. J. Political Econ. 91 (4), 654–674. doi:10.1086/261170

Gray, W. B., and Shadbegian, R. J. (2003). Plant Vintage, Technology, and Environmental Regulation. J. Environ. Econ. Manag. 46 (3), 384–402. doi:10.1016/s0095-0696(03)00031-7

Greenstone, M., List, J. A., and Syverson, C. (2012). The Effect of Environmental Regulation on the Competitiveness of U.S. Manufacturing. National Bureau of Economic Research, Working Paper, NO.18392, 1–52.

Guo, Y., Xia, X. N., Zhang, S., and Zhang, D. (2018). Environmental Regulation, Government R&D Funding and Green Technology Innovation: Evidence from China Provincial Data. Sustainability 10, 940. doi:10.3390/su10040940

Hojnik, J., and Ruzzier, M. (2016). What Drives Eco-Innovation? A Review of an Emerging Literature. Environ. Innovation Soc. Transitions 19, 31–41. doi:10.1016/j.eist.2015.09.006

Hoque, A., Mohiuddin, M., and Su, Z. (2018). Effects of Industrial Operations on Socio-Environmental and Public Health Degradation: Evidence from a Least Developing Country (LDC). Sustainability 10 (11), 3948. doi:10.3390/su10113948

Hsu, C.-C., Quang-Thanh, N., Chien, F., Li, L., and Mohsin, M. (2021). Evaluating Green Innovation and Performance of Financial Development: Mediating Concerns of Environmental Regulation. Environ. Sci. Pollut. Res. 28 (40), 57386–57397. doi:10.1007/s11356-021-14499-w

Hu, D., Wang, Y., Huang, J., and Huang, H. (2017). How Do Different Innovation Forms Mediate the Relationship between Environmental Regulation and Performance? J. Clean. Prod. 161, 466–476. doi:10.1016/j.jclepro.2017.05.152

Jaffe, A. B., and Palmer, K. (1997). Environmental Regulation and Innovation: A Panel Data Study. Rev. Econ. Statistics 79 (4), 610–619. doi:10.1162/003465397557196

Jaffe, A., Peterson, S. R., and Portney, P. R. (1995). Environmental Regulation and the Competitiveness of U.S. Manufacturing: What Does the Evidence Tell Us. J. Econ. Literature 33 (1), 132–163.

Javeed, S. A., Latief, R., and Lefen, L. (2020). An Analysis of Relationship between Environmental Regulations and Firm Performance with Moderating Effects of Product Market Competition: Empirical Evidence from Pakistan. J. Clean. Prod. 254, 120197. doi:10.1016/j.jclepro.2020.120197

Jefferson, G., Tanaka, H. S., and Yin, W. (2013). Environmental Regulation and Industrial Performance: Evidence from Unexpected Externalities in China. SSRN Working Paper.

Jorgenson, D. W., and Wilcoxen, P. J. (1990). Environmental Regulation and U.S. Economic Growth. RAND J. Econ. 21 (2), 314–340. doi:10.2307/2555426

Lanoie, P., Laurent-Lucchetti, J., Johnstone, N., and Ambec, S. (2011). Environmental Policy, Innovation and Performance: New Insights on the Porter Hypothesis. J. Econ. Manag. Strategy 20 (3), 803–842. doi:10.1111/j.1530-9134.2011.00301.x

Li, B., and Wu, S. (2016). Effects of Local and Civil Environmental Regulation on Green Total Factor Productivity in China: A Spatial Durbin Econometric Analysis. J. Clean. Prod. 153 (1), 342–353. doi:10.1016/j.jclepro.2016.10.042

Li, R., and Ramanathan, R. (2018). Exploring the Relationships between Different Types of Environmental Regulations and Environmental Performance: Evidence from China. J. Clean. Prod. 196, 1329–1340. doi:10.1016/j.jclepro.2018.06.132

Liang, J., and Langbein, L. (2021). Are State-Owned Enterprises Good Citizens in Environmental Governance? Evidence from the Control of Air Pollution in China. Adm. Soc. 53 (8), 1263–1292. doi:10.1177/00953997211005833

Matylaityte, J., and Gocke, M. (2015). Modelling Economic Hysteresis Losses Caused by Sunk Adjustment Costs. Magks Pap. Econ. 8 (5), 43–58. doi:10.13140/RG.2.1.1867.8809

Meng, Q., Mohiuddin, M., and Cao, Y. (2022). Sustainable Production Clauses and Positioning in the Global Value Chain: An Analysis of International Investment Agreements (IIA) of the ICT Industry in Developing and Developed Markets. Sustainability 14 (4), 2396. doi:10.3390/su14042396

Mohiuddin, M., Hosseini, E., Faradonbeh, S. B., and Sabokro, M. (2022). Achieving Human Resource Management Sustainability in Universities. Int. J. Environ. Res. Public Health 19 (2), 928. doi:10.3390/ijerph19020928

Mohiuddin, M., Rashid, M. M., Al Azad, M. S., and Su, Z. (2019). Back-Shoring or Re-Shoring: Determinants of Manufacturing Offshoring from Emerging to Least Developing Countries (LDCs). Int. J. Logist. Res. Appl. 22 (1), 78–97. doi:10.1080/13675567.2018.1475554

Nguyen, T. H. H., Elmagrhi, M. H., Ntim, C. G., and Wu, Y. (2021). Environmental Performance, Sustainability, Governance and Financial Performance: Evidence from Heavily Polluting Industries in China. Bus. Strat. Env. 30, 2313–2331. doi:10.1002/bse.2748

Peng, B., Tu, Y., Elahi, E., and Wei, G. (2018). Extended Producer Responsibility and Corporate Performance: Effects of Environmental Regulation and Environmental Strategy. J. Environ. Manag. 218, 181–189. doi:10.1016/j.jenvman.2018.04.068

Porter, M. E. (1991). America’s Green Strategy. Sci. Amercian 264 (4), 193–246. doi:10.1038/scientificamerican0491-168

Porter, M. E., and Linde, C. V. D. (1995). Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Rassier, D. G., and Earnhart, D. (2010). The Effect of Clean Water Regulation on Profitability: Testing the Porter Hypothesis. Land Econ. 86 (2), 329–344. doi:10.3368/le.86.2.329

Ren, K., Kong, Y.-S., Imran, M., and Bangash, A. K. (2022). The Impact of the Voluntary Environmental Agreements on Green Technology Innovation: Evidence from the Prefectural-Level Data in China. Front. Environ. Sci. 10, 833724. doi:10.3389/fenvs.2022.833724

Rubashkina, Y., Galeotti, M., and Verdolini, E. (2015). Environmental Regulation and Competitiveness: Empirical Evidence on the Porter Hypothesis from European Manufacturing Sectors. Energy Policy 83 (35), 288–300. doi:10.1016/j.enpol.2015.02.014

Shao, S., Hu, Z., Cao, J., Yang, L., and Guan, D. (2020). Environmental Regulation and Enterprise Innovation: A Review. Bus. Strategy Environ. 29 (7), 1465–1478. doi:10.1002/bse.2446

Wang, Y., and Shen, N. (2016). Environmental Regulation and Environmental Productivity: The Case of China. Renew. Sustain. Energy Rev. 62, 758–766. doi:10.1016/j.rser.2016.05.048

Xiaoning, L., and Wei, W. (2017). Environmental Regulation, Corporate Profit Margins and Compliance Cost Heterogeneity of Different Scale Enterprises. Chin. Ind. Econ 6., 155–174. doi:10.19581/j.cnki.ciejournal.2017.06.023

Xie, R.-H., Yuan, Y.-J., and Huang, J.-J. (2017). Different Types of Environmental Regulations and Heterogeneous Influence on “Green” Productivity: Evidence from China. Ecol. Econ. 132, 104–112. doi:10.1016/j.ecolecon.2016.10.019

Yang, X., and Yao, Y. (2012). Environmental Compliance and Firm Performance: Evidence from China. Oxf. Bull. Econ. Statistics 74 (3), 397–424. doi:10.1111/j.1468-0084.2011.00649.x

Yu, H., Liao, L., Qu, S., Fang, D., Luo, L., and Xiong, G. (2021). Environmental Regulation and Corporate Tax Avoidance: A Quasi-Natural Experiments Study Based on China's New Environmental Protection Law. J. Environ. Manag. 296, 113160. doi:10.1016/j.jenvman.2021.113160

Yuan, B., Ren, S., and Chen, X. (2017). Can Environmental Regulation Promote the Coordinated Development of Economy and Environment in China's Manufacturing Industry?-A Panel Data Analysis of 28 Sub-sectors. J. Clean. Prod. 149 (15), 11–24. doi:10.1016/j.jclepro.2017.02.065

Yuan, B., and Xiang, Q. (2018). Environmental Regulation, Industrial Innovation and Green Development of Chinese Manufacturing: Based on an Extended CDM Model. J. Clean. Prod. 176, 895–908. doi:10.1016/j.jclepro.2017.12.034

Keywords: new environmental protection law, manufacturing firms, firm performance, propensity score matching, difference-in-differences model

Citation: Mu S, Wang X and Mohiuddin M (2022) Impact of Environmental Protection Regulations on Corporate Performance From Porter Hypothesis Perspective: A Study Based on Publicly Listed Manufacturing Firms Data. Front. Environ. Sci. 10:928697. doi: 10.3389/fenvs.2022.928697

Received: 12 May 2022; Accepted: 13 June 2022;

Published: 08 July 2022.

Edited by:

Usama Awan, Lappeenranta University of Technology, FinlandReviewed by:

Gulnaz Muneer, Bahauddin Zakariya University, PakistanJoanna Rosak-Szyrocka, Częstochowa University of Technology, Poland

Mohammad Delwar Hussain, Green University of Bangladesh, Bangladesh

Copyright © 2022 Mu, Wang and Mohiuddin. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Muhammad Mohiuddin, bXVoYW1tYWQubW9oaXVkZGluQGZzYS51bGF2YWwuY2E=

Shaohong Mu1

Shaohong Mu1 Muhammad Mohiuddin

Muhammad Mohiuddin