- 1School of Economics and Management, Beijing University of Technology, Beijing, China

- 2School of Economics and Management, Taiyuan University of Technology, Taiyuan, China

Over time environmental degradation has become a severe concern globally, especially in China. Therefore, to solve this serious issue, environmental economists have tried their best to explain the crux of environmental degradation. Besides such efforts, they have not reached a single opinion. Nowadays, economic progress has been considered a primary target to compete with other nations at any cost of environmental degradation. But, there may be some alternative solutions to reduce such costs, and the existing literature has not considered such core indicators. Thus, the present study assesses the eco-friendly variables for a sustainable environment in which green finance, green energy, and research and development expenditures. Moreover, this study also focuses on socio-economic factors like economic growth, urbanization, and openness. Time series estimators such as fully modified ordinary least square and Markov switching regression model are employed to investigate selected variables’ long-run impact on carbon emissions. The estimated outcomes show the significant contribution of green finance, green energy, openness, and R&D expenditures to environmental quality. Likewise, China’s urbanization and economic progress are harmful to environmental quality. Moreover, this study investigates the causal association between the selected variables and shows the two-way causal association between openness and emissions, RE and openness, and green finance and R&D expenditures. The results of the uni-directional association are also interesting. The current study develops some interesting policy implications for a sustainable environment on behalf of empirical outcomes.

1 Introduction

It is possible that reaching carbon neutrality, a state in which the amount of carbon dioxide released into the atmosphere is equal to the amount removed. It will emerge as the most important global environmental objective of the 21st century. Many nations have publicly stated their intention to achieve carbon neutrality in response to growing concerns regarding the impact that rising atmospheric concentrations of carbon dioxide (CO2) and other greenhouse gases will have on the world’s climate (see here for more information). The United Kingdom made a commitment in 2019 to reach this objective, which is also referred to as having net-zero carbon emissions by the year 2050. It was then followed in 2020 by Japan and in 2060 by China, whose target year is 2060 (Gang Cheng et al., 2021). In the latter half of the year 2020, the Secretary-General of the United Nations issued a call to action to all of the world’s governments, urging them to declare a Climate Emergency in their countries until carbon neutrality is reached (S. A. R. Khan et al., 2021c; Shan et al., 2021).

On 12 December 2015, a landmark UN climate agreement was signed in Paris by all countries in response to the ever-increasing global greenhouse effect in order to combat climate change. This agreement was to take effect immediately (Tao et al., 2021). As part of the Paris agreement of 2015, all nations committed to limiting warming to less than 2.0°C and making efforts to bring it down to less than 1.5°C through the accomplishment of carbon reduction around the year 2050. (Ma et al., 2022). The pre-industrial temperature was 1.2°C lower than the global average temperature in 2020, and the effects of this warming can be felt worldwide (Ji et al., 2021a). According to the most recent climate data, there is an immediate need to step up our efforts to cut down on the amount of greenhouse gases in the atmosphere in order to stop the progression of global warming (S. A. R. Khan et al., 2021d).

It is of the utmost importance to reduce carbon emissions from fossil fuels and food while simultaneously encouraging carbon sequestration in terrestrial and marine ecosystems if we are going to achieve carbon neutrality and support human activities in a sustainable manner (Safi et al., 2021) (Latif et al., 2021). Reducing carbon emissions to net-zero is difficult to achieve because of the magnitude of the fluxes involved, even though various countries have devised various strategic routes to achieve carbon neutrality (Dong et al., 2022) (Huang et al., 2022; Iqbal et al., 2019b, 2019a). According to the International Energy Agency, the world will not be able to reach its goal of becoming carbon neutral by 2050 unless new crude oil, natural gas, and Coal are not extracted or developed after 2021 (Qiang Ma et al., 2021). In this regard, research into and adoption of renewable energy from carbon-free sources (wind, tide, sunlight and so on) and biomass is the key to bridging the gap between the rhetoric and the reality of net-zero CO2 emissions (S. A. R. Khan et al., 2021a).

Every nation on Earth has a responsibility to act consistently with its endowment of energy resources and the employment of technologies that promote social equity while having a minimal negative impact on nature (Chien et al., 2021) (Hou et al., 2019; Yumei et al., 2021; Yaming Zhang et al., 2022). However, the intolerable degradation of the natural environment caused by fossil fuels can only be mitigated by decoupling the demand for energy from the economy’s growth and by decreasing the use of fossil fuels (Yu and Zhang, 2022). Emerging economies face a number of challenges as a result of their growing financial and economic requirements. This is because an increase in economic activity simultaneously increases the energy demand, primarily from conventional sources such as gas, coal, oil, and so on (Dong et al., 2022). A strategic commodity to achieve sustainable development is renewable energy (RE) (Guo et al., 2022). It is assumed that various renewable energy sources, such as solar, wind, waste, and biomass, are cost-effective and environmentally friendly because they reduce pollution, offer better security to the energy, lessen the harmful effects of climate change, and finally provide low-cost electricity to remote areas (Ma et al., 2022). However, most of the research (Huang et al., 2021) on renewable energy’s impact on the environment has come to optimistic conclusions (S. A. R. Khan et al., 2021d).

According to the endogenous growth theory, technological advancements that come about as a result of investments in research and development (R&D) can result in increased production efficiency and efficiency in the use of natural resources and energy. Because they can better afford investments in research and development (Hou et al., 2019; Mohsin et al., 2021; Rao et al., 2022; Yumei et al., 2021; Yaming Zhang et al., 2022, Yaming Zhang et al., 2021), countries are better able to adopt efficient technologies as their incomes grow. More efficient technologies lead to a cleaner environment because they reduce the load placed on natural resources and cut down on the amount of emissions and waste produced as byproducts (Ya Cheng et al., 2021; Shao et al., 2021). For example, increasing investments in research and development can improve environmental quality under conditions in which effective environmental management systems are in place to ensure appropriate waste management (Huang et al., 2021).

The impact that advances in technology will have on carbon emissions, on the other hand, is a priori a matter of conjecture. Research and development may have a negative impact on environmental quality through the scale effects of a larger production, which are associated with higher growth and trade openness even though R&D has positive effects on economic growth and trade (see this link for more information). Even though advancements in technology may make it possible to increase productivity, doing so may still require the application of a greater quantity of natural resources, which may increase CO2 emissions (Khan et al., 2022a). This possibility is strengthened by the fact that the returns on investment in R&D tend to decrease over time. Because it gets harder to make discoveries as the amount of previously accumulated knowledge grows, the amount of induced research and development gradually decreases over time (S. A. R. Khan et al., 2021e; Mehmood, 2021). Despite this, there is an ongoing requirement for additional inputs of natural resources to support the economy’s expansion.

To promote social development, finance is an important factor in coordinating and allocating resources in various fields (Akadiri et al., 2021). Still, it is also a major driver of the increase in carbon emissions, which limits regional green development to a certain extent. There is a large funding gap for local green development because green projects generally have strong positive externalities that benefit the economy and society. Still, the financial industry’s profits do not increase because of these positive externalities. Environmentally friendly projects benefit both the economy and society because capital is profit-seeking. As a result, new financial instruments and policies are required to boost investment, improve financing’s environmental benefits, and achieve sustainable development objectives. Green Finance refers to a wide range of policies and new financial instruments, including green funds, green bonds, green banks, fiscal policies, carbon trading markets, and fin-tech. As a distinct form of finance, green finance aims to transfer environmental risks and improve environmental quality. In addition to environmental and sustainable finance, the term green finance is used. Significant progress has been made in the financial sector, which is critical to ensuring that growth in the economy does not adversely affect the natural environment (S. A. R. Khan et al., 2021b).

The following are some of how this paper adds to the body of previously published research: (1) It is assumed that this will be a pioneering effort to analyze the relationship between carbon dioxide emissions and renewable energy, green finance, and research and development expenditures (R&D) to mitigate global warming using the annual data from the Chinese economy. This will consider the significant role economic progress, openness, and urbanization play in the equation. (2) The FMOLS and MS-Regression models are used in this study to validate long-run association aimed variables to analyze the impact of RE on the mitigation of global warming. The carbon neutrality goal aims to achieve a level of net-zero co2 emission by the mid-21st century. It has been suggested by over 130 governments and regions. This target has been referred to as the net-zero carbon emissions target. It is a well-known fact that lowering emissions of greenhouse gases is essential to the sustainable growth of the world. It is also the case that governments are obligated to continuously foster economic expansion and work toward raising the general level of people’s living standards. Renewable energy is widely available and has a tremendous growth potential; as a result, it protects against disruptions in the energy supply and helps alleviate energy shortages. However, one must also keep in mind that the role of RE in environmental sustainability varies from study to study, which is something that must not be forgotten. As a result, the majority of the research done in this day and age has concentrated on the pattern of utilization of renewable energy. In a similar vein, China has made significant progress in developing green energy and has attempted to increase the use of renewable energy. In order to realize the goal of a carbon-free economy or carbon neutrality, it is essential to cultivate the right mentality of enhancing economic activities while simultaneously working toward the creation of a clean environment. According to Qin, (2021), a greater use of non-renewable energy sources in economic activities, such as Coal, crude oil, and natural gas, rather than renewable energy may result in environmental degradation by increasing carbon emissions. This could have a negative impact on the quality of the environment. In addition, Chishti and Sinha, (2022) argued that using renewable resources is beneficial to the environment because it lowers levels of carbon dioxide emission. In contrast, fossil fuels and non-renewable resources have negative effects on the environment. Although our paper is part of a large body of research done in the past to explain the connection between renewable energy consumption, our primary focus is on renewable energy consumption, as this topic has received insufficient attention in previous research. We use the recently developed methodologies to conduct a more precise analysis of the correlation between the consumption of renewable energy sources. The current study demonstrates the importance of environmental quality when it has serious consequences for human beings. This is demonstrated by the presence of an energy-environment model in the study. As a result, policymakers are concentrating their efforts on implementing policies that will improve the quality of the environment by reducing emissions (Habiba and Xinbang, 2022; Yu et al., 2022). It is common knowledge that carbon emissions contribute to climate change; consequently, higher authorities are making some efforts to transition the world toward one powered by renewable energy.

Similarly, the remaining aspects of the research are separated into the following sections: a review of the existing literature (Section 2), followed by data and methodology, results and discussion, and finally, a conclusion and some suggestions for future research (Section 4). (Section 5). (The Fifth Section).

2 Literature Review

2.1 Renewable Energy and Carbon Emissions

It is now common knowledge that if the rate of global warming is not slowed down by implementing effective countermeasures, the entire world will unescapably be forced to deal with ferocious and environmental catastrophes. According to Feng et al. (2022), the reduction of 25% of world GDP due to uncontrolled greenhouse gas emissions is likely, while limiting emissions will only cost about 1% of GDP. In addition to endangering people’s ability to feed themselves and their families, the continued increase in CO2 emissions, the primary cause of climate change, will cause temperatures to soar even higher. It is important to remember that the world’s energy landscape is dynamic and ever-changing, and this poses a serious problem for countries that rely on imported energy. The global energy landscape is constantly changing and adapting to new developments. This situation has existed in its current form for a considerable period of time (Shahbaz et al., 2013; Khan et al., 2022b). It is important to note that the areas of conflict in the Middle East contain a disproportionately high concentration of the world’s energy sources. For this reason, in this context, t According to the United States, an economic policy has been developed to promote energy efficiency and lessen America’s heavy reliance on foreign oil. It is possible to attest that RE is an essential component in which investments are being made to guarantee both energy independence and energy security.

On the other hand, the consumption of fossil fuels continues to play an outsized role in the majority of countries’ current economic activities (i.e., Coal, oil, natural gas). However, in recent years, many nations have shifted their focus away from fossil fuels and toward alternative forms of energy generation. This is because When fossil fuels are burned, they greatly contribute to global warming, climate change, acid rain, and other environmental issues. Renewable energy sources, such as hydropower, biomass, wind, Sun, and geothermal energy, would be used in this scenario, have slowly emerged as the pack leader in the global energy advertise. This scenario is based on a scenario in which renewable energy sources have gradually emerged as the leader of the pack. In addition to satisfying the demand for an endless supply of energy, they can also meet t A range of renewable energy sources, especially those that don’t generate greenhouse gases, are needed (Bhuiyan et al., 2018; Mngumi et al., 2022).

The most significant contributors to atmospheric carbon dioxide levels are primarily population expansion, industrialization, and Coal and the usage of fossil energy. As a result, there is widespread agreement that renewable energy (RE) must continue its rapid expansion to combat the worrisome rise in average global temperature observed over the past several years. The International Energy Agency suggests using nuclear power, renewable energy, and improvements in energy efficiency as the means via which global temperatures can be reduced to within 2°C of what they were before industrialization. In a study that followed the same pattern as the previous one, Mahalik et al. (2017) conducted research using data acquired from a panel of 17 nations that are members of the Group for Economic Co-operation and Development (OECD) (Al-Mulali et al., 2015). They discovered that the use of RE has, in point of fact, a negative effect on the emergence of CO2 emissions.

Furthermore, (Handayani and Surachman, 2017), researched CO2 emissions have a long-term and short-term impact. According to the results of their study, renewable energy can be regarded as an important factor in reducing carbon dioxide produced during the process of power generation. This was the conclusion of their investigation into the long-term and short-term causality of the CO2 emissions. According to research carried out by Sharma et al. (2021), renewable energy can serve as a viable replacement for conventional forms of energy derived from fossil fuels and cut down on CO2 emissions significantly. In addition, According to, there appears to be a significant negative impact on CO2 emissions from increased consumption of RE and other forest plantations over a long period of time (Irfan et al., 2022; Wen et al., 2022; Xiang et al., 2022). A reduction in carbon dioxide emissions will follow after an increase in the proportion of renewable energy in the energy consumption function, which will cause the intensity of renewable energy to rise. It was also believed by (Li et al., 2021) that advancements in technology and a reduction in costs are variables that have made the promotion of RE economically feasible and can enhance carbon reduction. Government therefore can contribute to enhance environmental quality by encouraging the use of RE and by substituting traditional energy sources.

According to a number of other studies, Renewable Energy (RE) does not prevent pollution effectively. While China’s policy to promote renewable energy development has been widely publicized, (Koengkan et al., 2019), it was believed that the decline in co2 emission would be extremely minimal. This is due to China’s focus on renewable energy development. In a survey of 19 countries, (Irfan Khan et al., 2021), found that nuclear energy consumption significantly negatively impacts carbon dioxide emissions. On the other hand, renewable energy consumption has a positive impact. Due to the low share of RE, which has not yet reached a sufficient level to begin reducing CO2 emissions, this situation may have an explanation. There are several ways to look at this situation, including Fossil fuels still make up the majority of the world’s largest and most important industries’ final energy consumption, with Coal accounting for the most. Fossil fuel combustion produces the majority of greenhouse gas emissions, which are then converted into useful forms of energy. Consequently, energy substitution was not achieved despite the limited supply of renewable energy sources. As a result, (Probst et al., 2021), made the point that the sustainability of RE varies greatly across different parts of the world (Zeng et al., 2017). said to be minimal, as well, the negative impact of RE on CO2 emissions Due to rising economic expansion and non-renewable energy usage, the slowing impact may be obscured. Renewable energy (RE) does not significantly negatively impact CO2 emissions. Energy extraction from precious metal deposits, which are necessary for RE development, is also a significant drain on energy resources in its opposite direction. As well as polluting the environment (soil, water, and food), heavy metals like lead and Mercury pose a health risk to humans. The mining sector has also boosted its extraction of precious minerals as a result of the increasing expansion in consumption for RE. Due to the rising importance of Renewable Energy (RE). As a result, mining has wreaked havoc on ecosystems that are otherwise rich in biodiversity.

With the release of carbon neutralisation objectives in a number of nations, many activities have been developed to be extremely efficient with their use and green low-carbon development. This was done in order to ensure that there is the progress made in both areas. As the three countries that produce the most carbon dioxide emissions in the world, India, China, and ISA have all begun competing in a green energy race in an effort to find practical answers to the issue of global warming. In each of these three nations, energy is not only the most significant contributor to overall carbon emissions but also an essential component in laying the groundwork for continued economic and social advancement (Ye et al., 2022). The transformation of energy to green and low in carbon In the wake of this, the two nations are striving to alter the energy policy trend by focusing more on renewable energy (RE). However, because of the expense of decarbonization, it is unclear whether or not RE can serve as a useful tool in pursuing the organization’s objective of reaching carbon neutrality. As a result, we have decided to investigate the possible cause-and-effect relationship between RE and CO2.

2.2 R&D Expenditures and Environmental Degradation

A growing body of economic research emphasizes technological innovation to combat climate change and promote long-term well-being, particularly in the energy sector. In a few of the contributions, the evolution of technological processes was examined. Others look into the most efficient ways to meet the electricity demand, taking into account both financial and environmental considerations, to find the most cost-effective solutions. For Charfeddine and Kahia, (2019), natural gas is a more important part of Greece’s energy mix and how Community Support Framework Program II has altered energy consumption and CO2 emissions in the country.

The factors that determine innovation and the obstacles to its spread have received a lot of attention. The discussion is centred on two distinct approaches: the first is economical, and the second is technological. Among other examples, imperfect knowledge, R&D spillover effects, and agent-principal problems are all examples of market failures that need to be addressed by government action. According to the methodology, public policy should solve all difficulties, despite of whether market failings are to blame. These challenges include, among others, bounded rationality and uncertainty. The most recent research emphasizes the importance of developing and enacting policies to lower and do away with various kinds of market failures and obstacles. As a result, many scholarly works have been devoted to investigating the myriad of factors that contribute to the failure of numerous industries to innovate.

Several empirical studies have demonstrated the significance of companies establishing environmental goals, as these goals have a direct and indirect impact on the innovation process. This has brought to light the importance of the matter. In this vein, Costa (Rufei Ma et al., 2021) analyzed as part of their innovation initiatives, firms seek to increase energy efficiency. The findings that they obtained for Spanish manufacturing companies highlight the significance of the size of an enterprise concerning innovation in energy efficiency. In addition, they discovered that businesses whose innovations are geared toward lessening their impact on the environment are more likely to innovate in ways that lead to greater energy efficiency.

There are other studies that look at how energy intensity changes across countries or regions and examine if it converges with time. According to these studies, energy efficiency improvements have been blamed for the reduction in energy intensity between countries and regions. (Meijer et al., 2019) say that changes in the overall energy intensity of the economy and changes in the energy intensity of specific economic sectors are the two most important factors that determine the progression of energy intensity. (Mehmood, 2021; Zafar et al., 2021) argue that innovative effort is critical to reducing energy intensity in the business context. In general, Porter and Van der Linde had already considered this possibility. There is a connection between the amount of money spent by the government and the structure of energy consumption that is discussed in (Samour et al., 2022). Efforts to empirically link greenhouse gas emissions with economic agents’ innovative efforts, measured by R&D, have recently taken a special interest in the topic. Consequently (Rauf et al., 2018), investigated the link between the amount of public funding allocated to energy research and the energy intensity levels recorded in the EU-15 countries between 1974 and 2007. He performed a Granger causality analysis, in which he specified an error correction for the model in order to accomplish this. According to these findings, energy consumption and government-funded research and development are linked in the long term, and public funding for energy research is linked to reduced consumption in the short term.

Qaiser (2022) examined the relationship between public energy R&D and CO2 emissions per unit of GDP and its two components: energy intensity and carbonization factor, using panel data for 13 developed economies from 1980 to 2004. From 1980 to 2004, researchers worked on this project. The findings show that increasing public investment in R&D is not enough to boost the innovation process on its own. Government funding for energy-related research has successfully increased energy efficiency, but it has had no impact on the carbonization factor or emission intensity (Martí-Ballester, 2021) used the Environmental Kuznets Curve model to show that public spending on policies for R&D and I energy has an inverse relationship with greenhouse gas emissions in Spain. In their research, they presented this evidence.

Oil and gas had a positive income elasticity, while Coal’s demand was negatively elastic. According to this, cleaner energy will be encouraged if economic growth is maintained. Researchers have discovered that the advancements in fossil fuel R&D are driven by the consumption of fossil fuels, which in turn drives consumption of fossil fuels through the dynamic links between energy use and energy R&D. Global greenhouse gas emissions (GHG) emissions have been rising since 1992, according to (Jingjing Chen et al., 2021). The latter studied 24 OECD countries from 1992 to 2010. They show that reducing greenhouse gas emissions can be linked to government efforts in innovation and energy substitution. An integrated assessment model with multiple externalities and an endogenous representation of energy-related technological advancements were used by (Tao Zhang et al., 2022) in their study. A variety of innovation policies were examined, both on their own and in conjunction with various other mitigation policies. According to the findings, innovation policies alone will not be enough to stabilize global emissions. Combining climate and innovation policies yields gains of 10% for a strict climate policy and 30% for a more moderate one. Climate and innovation policies can have a positive impact if they are combined. However, these gains are diminished when more plausible global innovation policy arrangements are considered. According to a study by (Xiong et al., 2020) using a sample of Japanese manufacturing companies between 2001 and 2010, green research and development positively correlated with a financial performance at the firm level. The researchers discovered a link between green R&D and increased carbon emissions.

2.3 Financial Sector and Carbon Emissions

Numerous studies have focused their attention on determining whether or not there is a correlation between economic growth and CO2 emissions. Empirical analyses of data from Pakistan (Kuwait, and Malaysia, lower-middle-income countries, upper-middle-income countries, and high-income countries, South Asian economies (On the other hand, some case studies have found the complete opposite to be true. For instance (Xiong et al., 2020), looked at 46 countries in sub-Saharan Africa between 2000 and 2015 and discovered that financial development tended to increase CO2 emissions. The research conducted by Acheampong utilized the system-generalized method of moments approach, which can perform a more accurate correlation analysis by addressing the endogeneity problem. In the same vein, a case study carried out in Turkey revealed that financial development had a significant impact on CO2 emissions. This impact was ranked second only to economic growth and urbanization in terms of its importance. A very similar situation to this one was discovered to exist in 24 of the countries that make up the Middle East and North Africa (MENA) region. In these countries, it was discovered that financial indicators (the proportion of domestic credit extended to the private sector as a % age of real GDP) did not have any connection to reducing carbon emissions.

In addition, some prerequisites need to be met before there can be a significant connection made between economic growth and CO2 emissions. As per capita income and other output indicators have a greater impact on carbon mitigation, policies are urgently needed to strengthen financial development in these economies. Financial variables enter into the equation for reducing emissions only when the financial sector is well-developed and liberalized. Medium-sized economies like Pakistan face this challenge. In periods of liberalization, financial variables play a role in emission mitigation. Because there are many ways to define financial development, different financial indicators each have their unique impact on the amount of carbon dioxide released into the atmosphere. Financial development and the market value of listed companies are important factors in reducing CO2 emissions. At the same time, the efficiency and volume of stock trading are important factors that prevent carbon mitigation in China’s provinces, according to a panel data analysis. Similar findings were found in another study investigating the effect that financial development has on the CO2 emissions embedded in trade. This study found that increasing financial scale leads to an increase in emissions, whereas increasing financial efficiency and financialization leads to a decrease in the emissions embedded in traded goods and services (Quan et al., 2021).

The financial sector’s variables have been linked to the CO2 emissions determinants. Financial development has a negligible impact on CO2 emissions when compared to the use of renewable energy sources. For example, according to (Wu et al., 2022), renewable energy can effectively reduce CO2 emissions in the MENA region, whereas the development of financial markets had no significant effect on emissions reduction. The researchers also discovered a link between renewable energy use and financial factors (Xu et al., 2021). Using less renewable energy as a result of financial development in MENA countries may lead to a decline in environmental quality. This suggests that the Middle East and North Africa (MENA) region needs to better allocate resources to promote positive financial outcomes.

Further evidence has been uncovered that financial development is critical in reducing carbon emissions and energy consumption to a more manageable level. Climate change can be traced back to both of these factors. When it comes to carbon emissions, for example, research has shown that economic development can increase carbon intensity in certain Chinese provinces while at the same time significantly lowering carbon intensity in neighbouring provinces. The net result is lower carbon dioxide emissions (CO2) per unit of GDP. An opposing view was put forth by (Ji et al., 2020), who asserted that the financial scale in China is positively associated with carbon intensity and thus promotes increased carbon emissions. The authors concluded that the country’s efforts to reduce carbon emissions should be bolstered in this area. This favourable result was found to be false in the short term. However, in the long run, it was found to be correct. Existing research has used various financial variable definitions and data structures and methods that differ. This may be one of the reasons for the disparity in the findings of the various studies. However, the ratio of bank deposits to GDP used by (Ji et al., 2021b) and (Babu et al., 2020) to measure financial development differed. The following table includes these two ratios. The Autoregressive Distributed Lag Approach–Error Correction Model (ARDL–ECM) was used with time-series data by (Xi Chen et al., 2021), while (Muhammad et al., 2017) built a panel dataset with spatial econometrics methodology and used ARDL–ECM. This article cites both sets of researchers.

3 Data and Methods

3.1 Model Construction

It is necessary to conduct a quantitative analysis of the impact that green finance has in order to systematically investigate the impact that green finance has on CO2 emissions in China. Investments made by the private and public sectors in projects aimed at reducing energy consumption and protecting the environment are known as green investments. The public sector is the primary focus of this article; therefore, the definition of green investment will be based on the proportion of China’s total fiscal expenditure allocated to programmes that encourage energy efficiency and environmental stewardship. This index was chosen for use for a couple of different reasons. As a starting point, there is a lack of reliable data on the private sector’s capital equity investment in energy conservation and environmental preservation. It should be noted that the data presented here is not complete (Lv et al., 2021). A second thing to keep in mind when looking at green securities and green credit financing is that they mostly apply to the private sector and thus show how private sector investment affects green finance. As a result, it is thought that excluding private sector equity investments from the green investment index will better represent the impact of government spending on the index.

Clean energy sources (such as solar and wind power) and natural gas infrastructure construction have benefited from China’s rapid economic growth. An infrastructure for natural gas can now be built. Higher incomes can also help increase the availability of affordable clean energy and promote modernization and carbon reduction in household energy consumption (reference here). China’s west-east transmission projects for both electric power and gas have contributed significantly to the rational allocation of resources and optimization of the country’s energy structure (Raberto et al., 2019). In addition, policies that reduce emissions (such as Coal to electricity and Coal to gas) cannot be ignored because of their positive effects. Coal to electricity and Coal to gas are two examples of these policies.

3.2 Econometric Model

Following the investigation conducted in Section 3, this study conducts additional research into China’s Green finance’s effect on CO2 emissions. Based on this, CO2 emissions are the dependent variable, and green finance, along with renewable energy, economic growth, openness, R&D expenditures, and urbanization, is the core independent variable. This study uses time-series data for empirical analysis, and it takes into consideration the possibility of a lag effect caused by CO2 emissions (Jingxiao Zhang et al., 2021). The econometric model is constructed as follows:

By taking natural log on both sides,

In contrast, the variables LC, LGF, LRE, LG, LOP, LRD, and LUR in Eq. 2 represent the natural log of carbon emissions, green finance, renewable energy consumption, economic growth, output, and research and development expenditures, and urbanization, respectively. Similarly, t represents the time period between the years 1998 and 2018. This study uses balanced time series data for the empirical analysis to investigate the impact of green finance on CO2 emissions in China in a quantitative manner. In addition, the sample data for the variables in this study are processed using the logarithmic method in order to eliminate the possibility of heteroscedasticity and prevent data fluctuations. The data of China’s CO2 emissions (abbreviated as C) serve as the primary dependent variable in this study. These data were obtained from the World Bank.

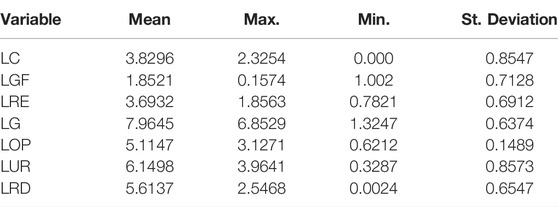

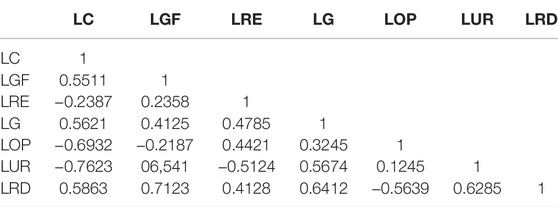

In addition (Zaman et al., 2016), the level of economic growth (denoted as G) is measured by gross domestic product (GDP) in US current dollars, renewable energy consumption (denoted as RE) is measured by the % age of total energy consumption, openness (denoted as OP) is measured by the ratio of exports plus imports to GDP in US current dollars, and the urbanization (denoted as UR) is measured by the proportion of the total population, green finance (denoted with GF), and research and development (RD). The World Development Indicator is the source of information used to determine the levels of GDP, RE, OP, R&D, and UR. Table 1 contains the definitions of the variables mentioned above and their descriptive statistics, which include observations, standard deviation, mean value, minimum value and maximum value.

3.3 Estimation Procedure

3.3.1 Unit Root Tests

The ADF test developed by (Shan et al., 2021) and the Zivot–Andrews test with a single structural break is utilized in this study. In order to determine the extent of the datasets’ integration, the ADF test is carried out. One of the most significant flaws of this method is the possibility of misinterpreting potential violations of procedure within a collection of facts that did not originate in a fixed location. Alternately, if the analyzed sequence contains a structural split, it can’t support the null hypothesis of unit origin. This problem is dealt with by employing the Zivot–Andrews root test, which involves making one structural break.

3.3.2 Bayer and Hanck Cointegration Test

A variety of cointegration methods have been documented in econometric literature to determine whether the variables are co-integrated. Researchers such as (Wu et al., 2021) have found that if there is some kind of linear stationary arrangement between several series, the long-term association between the series is more likely to hold (2006). Co-integration and non-cointegration null hypotheses differed less when results from each of the tests were taken into account. In a similar vein, it is possible to get more accurate results by calculating the statistical significance of each test (M. S. Mubarik M. S. et al., 2021). As previously mentioned, this investigation used the Bayer and Hanck cointegration method (Eqs 3, 4).

Likewise, Prob. EG, Prob.JOH, Prob. BO, and Prob.BDM is denoted with individual probabilities of each test.

3.3.3 FMOLS

Cointegration regression estimates can be produced using this unique quantification method (Du et al., 2019). Without compromising the robustness of the variables, the method addresses the problem of endogeneity and autocorrelation. In addition to this, it makes the existence of the endogeneity problem and serial correlation possible (Eq. 5).

In addition, it makes it possible to co-integrate Yi and Xi with the slope of i where i may or may not be homogenous across i. Because of this, the equation can be written as Eq. 6, which is its shorthand form.

Similarly, t = 1, 2, ….., T and i = 1, … …., N. The simultaneous covariance is showed as Ω01, while the weighted sum of auto-covariance is Γi. Thus, FMOLS equation can be written as Eq. 7,

3.3.4 MS-ECM Approach

EKC’s hypothesis was tested using the MS-ECM and FMOLS techniques, respectively. Cointegration estimation can benefit greatly from this methodology. This model’s universal form can be written as (Eq. 7).

Where,

The rate of adjustment to long-term equilibrium is measured by β; independent variables Xt and the explained variable Yt are included in the equations. And the first difference operator is Δ. Comparing the MS-ECM to other error correction models, there are numerous advantages. Without prior knowledge of the number of regimes, the number of breaks, and the date of breaks, this methodology does not provide any preliminary information on these variables.

3.4 Error Correction Based Granger Causality Analysis

Given that the two econometric methods used in this study, namely FMOLS and MS-ECM, cannot trace the causality association among the variables, we move on to the Granger causality model. In the event that there is no evidence presented for the cointegration of the variables, the Granger causality test will be defined using the vector autoregression test in the first differences (Luo et al., 2019). If we find evidence of cointegration, however, we will have to include a one-period lag error correction term in the Granger causal test mode (ECT-1). Suppose the findings show a long-term connection between the indicators of environmental quality that were specified. In that case, the next step is to quantify the vector error correction model (VECM), which is given in the Eqs 10–15 that are presented in the following paragraph by succeeding Engle and Granger (1987).

When a system is subjected to a shock (S), ECT-1 is used to correct long-term Granger causality errors in order to restore equilibrium.

4 Results and Discussion

The findings of the correlation matrix are detailed in Table 2. At the 1% significance level, there is a positive association between green finance and carbon emission. At a significance level of 1%, this table also reveals that the LRE has a negative association with CO2 levels, while economic growth and the LRE have a positive association with emission levels. At the same time, openness and urbanization have a negative relationship with CO2 emissions, which is significant at the 1% level.

The results of the Bayer-Hanck test of cointegration, a combined cointegration test, are shown in Table 3 below. These results validate the presence of a cointegration association among the variables that were chosen.

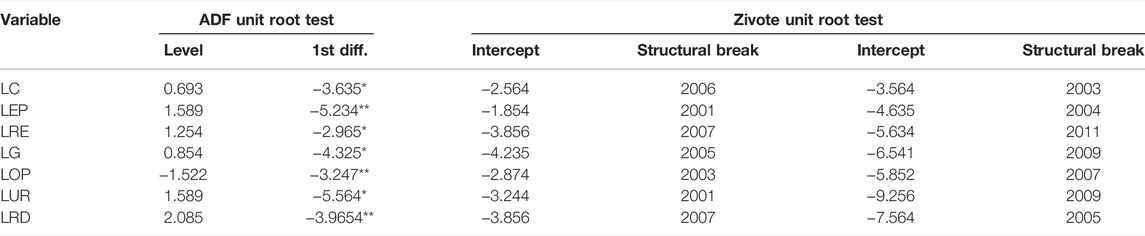

At the 5% level of significance, the critical values are significant. The results of three different unit root tests are displayed in Table 4. These tests include ADF and ZA. According to the findings, not one of the variables is significantly stationary, but all of these variables reach a point where they are significantly stationary after the first difference. On the other hand, the ZA test takes into account structural breaks while conducting unit root analysis. ADF does not take this into account. Selected macroeconomic and environmental variables are non-stationary when they are level, but they become stationary when the first difference is between them. This harmony between the results of these three tests is confirmed because the variables become stationary when there is the first difference (Yan et al., 2020). The trace and maximum Eigenvalue tests are the most likely approach to run the cointegration test because there is no mixed stationarity of level and first difference, and the sample size is quite large. For example, the assumption that there are no mixed stationarities of level and first difference is based on these tests.

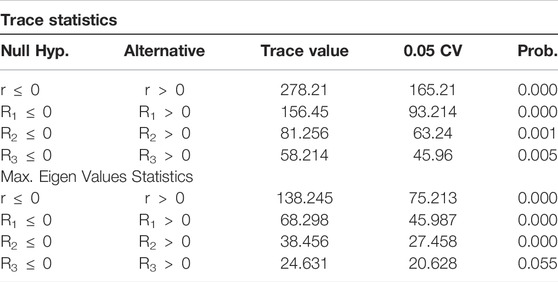

The results presented in Table 5 above indicate that there are LR relations between energy intensity, carbon emission, and the exogenous variables that pertain to it. All of the given H0 further elaborate that there is no cointegration. This equation can be rejected if the trace and maximum Eigenvalues are higher than the critical value with a significance level of 5%. (Hardin-Ramanan et al., 2018). The model in question contains a total of four cointegration equations.

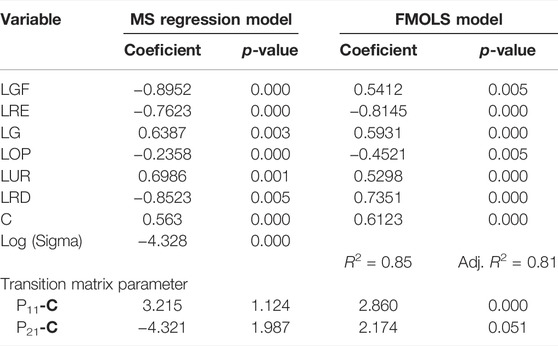

4.1 Long-Run Outcomes of FMOLS and MSR Estimators

This study uses the Fully Modified Ordinary Least Square (FMOLS) and Markov Switching Regressions (MS) model for reliable outcomes concerning environmental quality. FMOLS and MS are both models for Markov switching regressions. The primary objective of this research is to calculate the zero carbon in the China economy. As a result, the current study emphasises green finance, green energy, and R&D expenditures as the primary factors that can influence the level of emissions. On the other hand, economic growth, openness, and urbanization will serve as control variables. According to the co-efficient that has been provided for green finance, it has been shown to have a negative association with carbon emissions. According to the specifications of the FMOLS and MS models, this implies that a one % increase in this factor would result in a decrease in carbon emissions of 0.895% and 0.541%, respectively. Increasing the amount of green finance leads to better financial efficiency and more innovative green financial products and services, forming a positive feedback loop with the environment and promoting society’s green development. This is why green projects and green technology are beneficial to the growth of green finance. This turn helps to foster a society that is more environmentally conscious. However, the impact of green finance on reducing carbon emissions is somewhat impressive; however, the marginal effect tends to decrease as the economic level improves. In the context of the industrial structure transformation, the pattern of change is becoming more complicated, and the rate of emission reduction is accelerating. This suggests that green finance has a more pronounced impact on reducing carbon emissions at this stage of economic development. The high growth potential of intangible assets and environmentally friendly businesses can be achieved not only by the high value of the product or technology but also by the results of market transformation, resulting in green technology innovation with increased carbon reduction and a stronger financial system in terms of greenness, prosperity, and development. The key to receiving financial support is a large number of green projects and green technology. On the other hand, as the economy continues to advance, new factors that influence the reduction of carbon emissions are beginning to emerge, or some previously unconsidered factors are gradually becoming relevant. Therefore, in situations where there is a low proportion of the secondary industry, green finance has a greater impact on reducing carbon emissions.

In a similar vein, using renewable energy sources has a negative impact on the amount of carbon dioxide released into the atmosphere. This explains why a 1% significant increase in renewable energy consumption would cause a decline in emissions levels by 0.762% under one specification and 0.814% under the other specification. Renewable energy use has been shown to contribute to economic growth while reducing environmental damage in 85 developed and developing economies studied between 1991 and 2012 by (Ali Shah et al., 2021). However, findings from (d’Amore-Domenech et al., 2020) in 19 developed and developing economies show the opposite, showing that renewable energy use does not contribute to economic growth and reduces environmental damage. The results for the selected country are consistent with the findings of Bhattacharya. Therefore, it is possible to say that switching from the use of energy sources that do not regenerate to the consumption of energy sources that do regenerate (which is synonymous with a decline in the level of dependency on fossil fuels) contributes to an improvement in the quality of the environment (Xie et al., 2019). In addition, the elasticity estimates highlight that the CO2 emission figures of the selected economy are relatively inelastic to positive shocks to the consumption levels of renewable energy.

In a similar vein, economic growth also performs admirably to improve the general standard of an economy, but it has a detrimental impact on the level of emissions. Therefore, the estimated results demonstrate a positive relationship between economic growth and carbon emissions. They imply that an increase in this factor by 1% would cause an increase in carbon emissions of 0.638% and 0.593%, respectively. The estimated results show that economic growth is positively correlated with carbon emissions. As a result, the damage done to the environment gets worse as countries’ economic growth tends to increase. This relationship is only observed when no technologies exist to improve energy efficiency, energy savings, and renewable energy, all of which are inaccessible to the economy in question due to the high cost of these technologies. Because a higher level of economic growth involves a wider range of economic activities, a higher level of energy consumption goes hand in hand with that level of growth (Fujii and Managi, 2019). As a direct result of this, the byproducts of energy consumption emit pollution into the atmosphere, which lowers the quality of the environment.

Trade openness is one factor that is considered a determinant of carbon emissions, and it is known to have a detrimental effect on carbon emissions. According to the estimated coefficient, a one % increase in this factor would decrease carbon emissions by 0.235% and 0.452%, respectively. In the long run, increased commercial openness is associated with increased CO2 emissions. As a result, the propensity for increased trade openness to lower emissions is likely to materialize more in the economy that has been specified. Furthermore (Luo et al., 2019), discovered that reducing carbon dioxide emissions in the United States is only achieved in the long run when trade openness is increased. In the long run, increased trade openness has been shown to have a negative impact on carbon dioxide emissions in the United States. This was confirmed by (Gao et al., 2021). There is a correlation between increased trade openness and lower emissions, and this correlation can be explained. Countries initially exposed to greater trade openness might not have the technological capacity to compete favourably on the international market. As a result, there is a good chance that the product will generate a lot of pollution. On the other hand, throughout a longer period of time, the technical capacity of the economy may grow as a result of opportunities presented by the influx of foreign capital, local investments in technology, and exposure to improved international management practices. Consequently, over time, there will likely be a reduction in the amount of pollution caused by the production.

In the final section, urbanization is also considered a factor in environmental pollution. According to FMOLS and MS regression parameters, an increase of this factor by one % would lead to an increase in the overall level of pollution in the environment of 0.698% and 0.829%, respectively. The migration of people from rural areas to newly emerging cities is one of the earliest signs of urbanization. This migration is responsible for the concentration of manufacturing activities and the development of the industry. To begin with, the labour force working in agricultural fields has been decreasing due to urbanization, which has led to the expansion of the two-sector economy. In this stage of industrial development, a significant amount of fossil fuels, such as coal and gasoline, are utilized for production activities due to the prevalence of primary technologies. Compared to agricultural production with low energy intensity, a significant amount of carbon dioxide is released into the atmosphere. Second, the requirements and patterns of behaviour of private households change as a result of urbanization. Families in urban areas are more likely to rely on goods and services provided by businesses (M. Mubarik et al., 2021a). The ongoing expansion of energy consumption, such as heating installations and electric appliances, is a significant contributor to the production of greenhouse gases (GHG). Third, urbanization drives up the demand for transportation on both the intercity and intracity levels of the city (Dongyang Zhang et al., 2021). The growth of both private and public transportation will inevitably degrade the quality of the environment. One more thing to consider is the increased need for urban infrastructure brought on by increased industrialization and urbanization in the cities. The building of public infrastructure, including highways, bridges, sewage systems, and other similar projects, requires significant energy and results in increased carbon emissions. In addition, as urbanization continues, there is a steady decline in the amount of land that is readily available. It is more common to construct multi-story buildings, which are more expensive and consume more power. On the other hand, the limits of cities will become increasingly expansive. There is a risk that agricultural land and natural areas will be extensively appropriated. All of these mechanisms work together to drive up carbon emissions.

In a similar vein, the results of research and development expenditures have been in line with what was anticipated initially. Because of this, it has a bad reputation in relation to carbon emissions. According to the information provided by this association, a one % increase in this factor would result in a decrease in carbon emissions in china of 0.852% and 0.735%, respectively. It is possible to explain it using appropriate logic and appropriate prior studies. The findings regarding the effect of the money spent on research and development are more encouraging as they indicate a negative impact on emissions. The evidence currently available, such as the studies conducted by (Dong et al., 2022) on BRIC countries, is consistent with the finding that R&D has a negative impact on emissions. On the other hand, (Gouda et al., 2021), found that the level of R&D activity has an uncertain impact on the amount of carbon emissions produced. To achieve the goal of having net zero emissions by the year 2050, however, economies will need to increase their level of investment in low-carbon innovations, as recommended by the Committee on Climate Change (CCC). The findings of our empirical research lend credence to this proposition. The adverse effects of the financial crisis on carbon emissions are prima facie evidence of the changes in the quantity of aggregate demand and its composition that have occurred as a direct result of the financial crisis.

4.2 Model Stability Tests

This study performs the SERIAL, ARCH, WHITE and RAMSAY tests to check out the model stability. According to the given p-values, there is no serial correlation in the selected model.

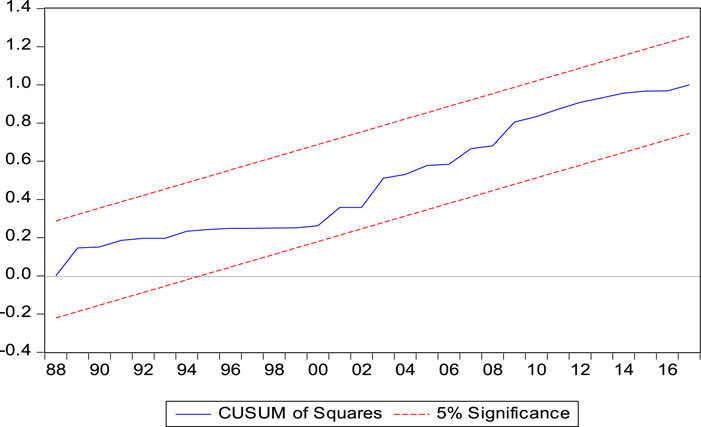

4.3 CUSUM and RS-CUSUM Tests

After determining the requirements for the definition of each contingent’s residual stability, CUSUM and RS-CUSUM are subjected to testing. Figure 1 number provides definitions of the results for mean stability and variance (CUSUM and RS-CUSUM).

4.4 Granger Causality Test

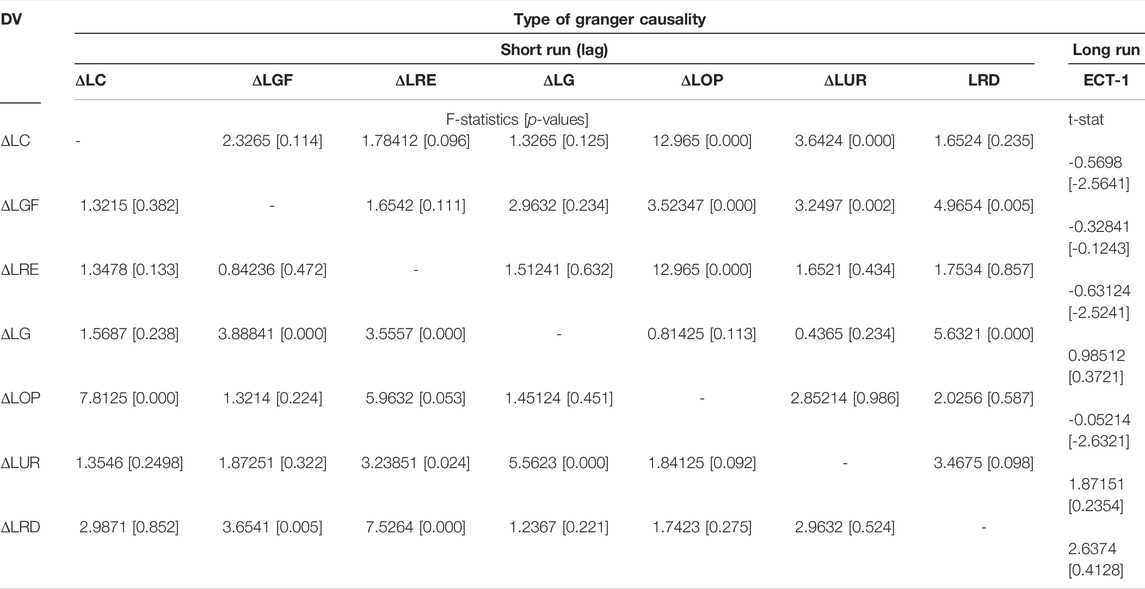

The results of the Granger causality test are displayed in the given Table 8, which can be found here. It emphasizes the uni-directional and the bi-directional causality associations that exist among the variables. For example, because researchers discovered a bi-directional causality association between openness and carbon emissions, any change in openness would lead to an increase in carbon emissions and vice versa. In addition to this, it was discovered that there is a two-way causal association between the consumption of renewable energy and the openness and green finance to R&D expenditures under the chosen model (Ganda, 2019). On the other hand, there was a one-way association between energy poverty and openness and urbanization. In a similar vein, emissions contribute to urbanization, and economic growth is a contributor to both energy poverty and the consumption of renewable energy sources. During the most recent cycle, the green finance granger causes R&D expenditures, while the urbanization granger causes renewable energy consumption and overall economic growth (Tables 6, 7, 8).

5 Conclusion and Policy Recommendations

The topic of major concern for people worldwide right now is the pollution of the natural environment. Consequently, the countries of the world are working hard to develop and put into effect credible policies that will assist in achieving economic growth without negatively impacting the environment. Emerging economies, in particular, are expected to make significant contributions to global output and, as a result, are also likely to account for a significant portion of the global greenhouse gas emissions. For this reason, it is of the utmost importance that environmental pollution is brought under control. In China, conduct a comprehensive investigation into the dynamic linkages between green finance and CO2 emissions. In addition, the consumption of renewable energy, expenditures on research and development, economic progress, openness, and urbanization are taken into consideration as the variables that explain carbon emissions in this study (Xie et al., 2018). The primary findings are that green finance in China has shown a significant downward trend in carbon emissions in China. To put it another way, an increase in the quantity and quality of the environment would result from a significant improvement in green finance. However, there is a negative relationship between the expenditures on renewable energy, openness, and R&D, as well as the emissions of carbon dioxide. Urbanization and economic growth have been shown to have a positive relationship with carbon emissions, as was discovered last. In addition, the Granger causality test is carried out in this investigation so that an estimate of the causal association between variables can be obtained.

This study suggests some policy changes that could be made in order to achieve zero carbon emissions. Based on our findings, we have concluded a significant connection between economic growth and environmental degradation. When applied to a policy context, this means that in situations where the financial sector is important for the real economy, it also has crucial implications for the stability of the environment. As a result (Wang et al., 2019), economic development and financial activities ought to be centred on enhancing the quality of the environment. The promotion of forms of financialization that are more environmentally friendly ought to be a priority. Public and macroeconomic policy development should centre on environmentally friendly and sustainable forms of finance. It should be discouraged to allocate financial resources to industries that have a lower environmental impact efficiency. At the same time, resources should be allocated to industries that positively impact the environment. Based on our empirical research findings on R&D expenditures, we have concluded that R&D expenditures are good for the natural environment. Because the statistics demonstrated very strong and empirically robust results, we have strong confidence in our ability to infer that research and development are essential to addressing environmental challenges. Because of this, it is necessary to direct both public policy and the distribution of resources toward research and development when formulating policies and, in particular, when attempting to reduce carbon emissions. This will make it easier for us to accomplish our goal of reducing carbon emissions to a net-zero.

The development of the economy, the development of the environment (Wang et al., 2021), and the use of energy sources within the country should all be considered when formulating energy policy from the perspective of policymaking. In addition, the encouragement of the use of renewable sources of energy carries with it benefits not only for the state of the environment but also for the nation’s economy. Therefore, economic growth is necessary if sufficient resources are to be generated for the research and development of technologies based on renewable energy sources and the infrastructure associated with these technologies. In a similar vein, policymakers need to put in place appropriate incentive mechanisms in order to foster the growth of renewable energy sources and increase their availability to markets. The formation of partnerships between the public and private sectors makes it easier to transfer technology to bring renewable energy projects to market. Our research lends credence to the concept that renewable sources of energy have a wide range of positive effects, including the reduction of carbon emissions, improvement of air quality, and acceleration of economic expansion.

As a result, China ought to thoughtfully consider appropriate trade policies and the utilization of renewable energy, alternative energy, and nuclear energy to minimize the adverse effects on the environment. In addition, it would appear that liberalizing trade would be beneficial to the environment for the economy in question. As a result of this, the promotion of environmentally friendly and efficient products in their use of energy is encouraged in these countries. Second, even though it has been determined that globalization does not contribute to environmental prosperity in India, it is of the utmost importance to make certain that the use of renewable energy resources meets the increase in energy demand that is a direct result of globalization. In this regard, a particular economy may consider trading renewable energy with the countries that are immediately adjacent to it. As a result (Xia et al., 2019), the environmental outcomes associated with the globalization of trade may be improved further.

Policymakers in China should prioritize accelerating the process of sustainable urbanization and improving public infrastructure to encourage the rapid development of urban cities and take advantage of the benefits of agglomeration effects and economies of scale. This will have a positive impact on India’s economy, which will have a positive impact on urbanization. Typically, this stage is accompanied by the development of the industry and structural shifts in both the economy and society. In addition, governments should develop a guide to sustainable lifestyles, including topics such as environmentally friendly travel and the utilization of renewable energy sources. Countries that have experienced rapid urbanization should prioritize efficient and well-organized urban expansion to reduce the likelihood of both traffic congestion and overcrowding. This study could be expanded in the future by looking at policy thresholds and critical mass levels at which renewable energy could boost economic growth without negatively impacting environmental quality.

Data Availability Statement

Publicly available datasets were analyzed in this study. This data can be found here: FDI.

Author Contributions

According to the energy-environment model, there is a link between RE and CO2 that may be seen empirically. It has been shown that emissions of carbon dioxide have a detrimental effect on RE. This demonstrates how the tough environment is giving more importance to pollution levels as it becomes more difficult. Policymakers are encouraged to implement policies that encourage a low-carbon economy as a result of the rise in carbon dioxide emissions. RE has also been shown to be heavily influenced by state-by-state policy differences in the USA. CO2 emissions contribute to global warming, and the government should do something to make it easier for people to move to a renewable energy (RE)-based world.

Funding

Supported by the Philosophy and Social Sciences Foundation of Ministry of Education of China (Grant No. 13JHQ052), the Excellent Postgraduate Courses Fundation of Beijing University of Technology (Grant No. CR20201720).

Conflict of Interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Akadiri, S. S., Adebayo, T. S., and Adebayo, S. (2021). Asymmetric Nexus Among Financial Globalization, Non-renewable Energy, Renewable Energy Use, Economic Growth, and Carbon Emissions: Impact on Environmental Sustainability Targets in India. Environ. Sci. Pollut. Res. 29, 16311–16323. doi:10.1007/s11356-021-16849-0

Al-Mulali, U., Ozturk, I., and Lean, H. H. (2015). The Influence of Economic Growth, Urbanization, Trade Openness, Financial Development, and Renewable Energy on Pollution in Europe. Nat. Hazards 79, 621–644. doi:10.1007/s11069-015-1865-9

Ali Shah, S. A., Longsheng, C., Solangi, Y. A., Ahmad, M., and Ali, S. (2021). Energy Trilemma Based Prioritization of Waste-To-Energy Technologies: Implications for Post-COVID-19 Green Economic Recovery in Pakistan. J. Clean. Prod. 284, 124729. doi:10.1016/J.JCLEPRO.2020.124729

Babu, L., Mohan, S. V., Mohan, M., and Pradeepkumar, A. P. (2020). Highly Mature Sediments in the Tropical Monsoonal Environment of Southwestern India: an Appraisal Based on Weathering Indices. Ecofeminism Clim. Change 2, 69–82. doi:10.1108/EFCC-05-2020-0017

Bhuiyan, M. A., Zaman, K., Shoukry, A. M., Gani, S., Sharkawy, M. A., Sasmoko, A. K., et al. (2018). Energy, Tourism, Finance, and Resource Depletion: Panel Data Analysis. Energy Sources, Part B Econ. Plan. Policy 13 (11-12), 463–474. doi:10.1080/15567249.2019.1572837

Charfeddine, L., and Kahia, M. (2019). Impact of Renewable Energy Consumption and Financial Development on CO2 Emissions and Economic Growth in the MENA Region: A Panel Vector Autoregressive (PVAR) Analysis. Renew. Energy 139, 198–213. doi:10.1016/j.renene.2019.01.010

Chien, F., Ananzeh, M., Mirza, F., Bakar, A., Vu, H. M., and Ngo, T. Q. (2021). The Effects of Green Growth, Environmental-Related Tax, and Eco-Innovation towards Carbon Neutrality Target in the US Economy. J. Environ. Manag. 299, 113633. doi:10.1016/j.jenvman.2021.113633

Chishti, M. Z., and Sinha, A. (2022). Do the Shocks in Technological and Financial Innovation Influence the Environmental Quality? Evidence from BRICS Economies. Technol. Soc. 68, 101828. doi:10.1016/j.techsoc.2021.101828

d’Amore-Domenech, R., Santiago, Ó., and Leo, T. J. (2020). Multicriteria Analysis of Seawater Electrolysis Technologies for Green Hydrogen Production at Sea. Renew. Sustain. Energy Rev. 133, 110166. doi:10.1016/j.rser.2020.110166

Dong, F., Zhu, J., Li, Y., Chen, Y., Gao, Y., Hu, M., et al. (2022). How Green Technology Innovation Affects Carbon Emission Efficiency: Evidence from Developed Countries Proposing Carbon Neutrality Targets. Environ. Sci. Pollut. Res., 1–20. doi:10.1007/S11356-022-18581-9/TABLES/13

Dongyang Zhang, D., Mohsin, M., Rasheed, A. K., Chang, Y., and Taghizadeh-Hesary, F. (2021). Public Spending and Green Economic Growth in BRI Region: Mediating Role of Green Finance. Energy Policy 153, 112256. doi:10.1016/J.ENPOL.2021.112256

Du, K., Li, P., and Yan, Z. (2019). Do green Technology Innovations Contribute to Carbon Dioxide Emission Reduction? Empirical Evidence from Patent Data. Technol. Forecast. Soc. Change 146, 297–303. doi:10.1016/j.techfore.2019.06.010

Engle, R. F., and Granger, C. W. J (1987). Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica: Journal of the Econometric Society, 251–276.

Feng, S., Zhang, R., and Li, G. (2022). Environmental Decentralization, Digital Finance and Green Technology Innovation. Struct. Change Econ. Dyn. 61, 70–83. doi:10.1016/j.strueco.2022.02.008

Fujii, H., and Managi, S. (2019). Decomposition Analysis of Sustainable Green Technology Inventions in China. Technol. Forecast. Soc. Change 139, 10–16. doi:10.1016/j.techfore.2018.11.013

Ganda, F. (2019). The Impact of Innovation and Technology Investments on Carbon Emissions in Selected Organisation for Economic Co-operation and Development Countries. J. Clean. Prod. 217, 469–483. doi:10.1016/j.jclepro.2019.01.235

Gang Cheng, G., Zhao, C., Iqbal, N., Gülmez, Ö., Işik, H., and Kirikkaleli, D. (2021). Does Energy Productivity and Public-Private Investment in Energy Achieve Carbon Neutrality Target of China? J. Environ. Manag. 298, 113464. doi:10.1016/j.jenvman.2021.113464

Gao, X., Wang, S., Ahmad, F., Chandio, A. A., Ahmad, M., and Xue, D. (2021). The Nexus between Misallocation of Land Resources and Green Technological Innovation: a Novel Investigation of Chinese Cities. Clean. Techn Environ. Policy 23, 2101–2115. doi:10.1007/s10098-021-02107-x

Gouda, M., El-Din Bekhit, A., Tang, Y., Huang, Y., Huang, L., He, Y., et al. (2021). Recent Innovations of Ultrasound Green Technology in Herbal Phytochemistry: A Review. Ultrason. Sonochemistry 73, 105538. doi:10.1016/j.ultsonch.2021.105538

Guo, L., Zhao, S., Song, Y., Tang, M., and Li, H. (2022). Green Finance, Chemical Fertilizer Use and Carbon Emissions from Agricultural Production. Agriculture 12, 313. doi:10.3390/AGRICULTURE12030313

Habiba, U., and Xinbang, C. (2022). The Impact of Financial Development on CO2 Emissions: New Evidence from Developed and Emerging Countries. Environ. Sci. Pollut. Res. 29, 31453–31466. doi:10.1007/s11356-022-18533-3

Handayani, D., and Surachman, E. N. (2017). Sukuk Negara as Financing Strategy for Renewable Energy Infrastructure: Case Study of Muara Laboh Geothermal Power Project. Int. J. Energy Econ. Policy 7, 115–125.

Hardin-Ramanan, S., Chang, V., and Issa, T. (2018). A Green Information Technology Governance Model for Large Mauritian Companies. J. Clean. Prod. 198, 488–497. doi:10.1016/j.jclepro.2018.07.047

Hou, Y., Iqbal, W., Muhammad Shaikh, G., Iqbal, N., Ahmad Solangi, Y., and Fatima, A. (2019). Measuring Energy Efficiency and Environmental Performance: A Case of South Asia. Processes 7, 325. doi:10.3390/pr7060325

Huang, S.-Z., Chien, F., and Sadiq, M. (2021). A Gateway towards a Sustainable Environment in Emerging Countries: the Nexus between Green Energy and Human Capital. Econ. Research-Ekonomska Istraživanja, 1–18. doi:10.1080/1331677x.2021.2012218

Huang, W., Saydaliev, H. B., Iqbal, W., and Irfan, M. (2022). MEASURING THE IMPACT OF ECONOMIC POLICIES ON CO2 EMISSIONS: WAYS TO ACHIEVE GREEN ECONOMIC RECOVERY IN THE POST-COVID-19 ERA. Clim. Change Econ., 1–29. doi:10.1142/S2010007822400103

Iqbal, W., Altalbe, A., Fatima, A., Ali, A., and Hou, Y. (2019a). A DEA Approach for Assessing the Energy, Environmental and Economic Performance of Top 20 Industrial Countries. Processes 7, 902. doi:10.3390/PR7120902

Iqbal, W., Yumei, H., Abbas, Q., Hafeez, M., Mohsin, M., Fatima, A., et al. (2019b). Assessment of Wind Energy Potential for the Production of Renewable Hydrogen in Sindh Province of Pakistan. Processes 7, 196. doi:10.3390/pr7040196

Irfan, M., Shahid, A. L., Ahmad, M., Iqbal, W., Elavarasan, R. M., Ren, S., et al. (2022). Assessment of Public Intention to Get Vaccination against COVID ‐19: Evidence from a Developing Country. Eval. Clin. Pract. 28, 63–73. doi:10.1111/jep.13611

Ji, X., Hou, C., Shi, M., Yan, Y., and Liu, Y. (2020). An Insight into the Research Concerning Panax Ginseng C. A. Meyer Polysaccharides: A Review. Food Rev. Int., 1–17. doi:10.1080/87559129.2020.1771363

Ji, X., Cheng, Y., Tian, J., Zhang, S., Jing, Y., and Shi, M. (2021a). Structural Characterization of Polysaccharide from Jujube (Ziziphus Jujuba Mill.) Fruit. Chem. Biol. Technol. Agric. 8, 1–7. doi:10.1186/S40538-021-00255-2/TABLES/2

Ji, X., Zhang, Y., Mirza, N., Umar, M., and Rizvi, S. K. A. (2021b). The Impact of Carbon Neutrality on the Investment Performance: Evidence from the Equity Mutual Funds in BRICS. J. Environ. Manag. 297, 113228. doi:10.1016/j.jenvman.2021.113228

Jingjing Chen, J., Wang, Q., and Huang, J. (2021). Motorcycle Ban and Traffic Safety: Evidence from a Quasi-Experiment at Zhejiang, China. J. Adv. Transp. 2021, 1–13. doi:10.1155/2021/7552180

Jingxiao Zhang, J., Ouyang, Y., Ballesteros-Pérez, P., Li, H., Philbin, S. P., Li, Z., et al. (2021). Understanding the Impact of Environmental Regulations on Green Technology Innovation Efficiency in the Construction Industry. Sustain. Cities Soc. 65, 102647. doi:10.1016/j.scs.2020.102647

Irfan Khan, I., Hou, F., Irfan, M., Zakari, A., and Le, H. P. (2021). Does Energy Trilemma a Driver of Economic Growth? the Roles of Energy Use, Population Growth, and Financial Development. Renew. Sustain. Energy Rev. 146, 111157. doi:10.1016/j.rser.2021.111157

Khan, S. A. R., Godil, D. I., Jabbour, C. J. C., Shujaat, S., Razzaq, A., and Yu, Z. (2021a). Green Data Analytics, Blockchain Technology for Sustainable Development, and Sustainable Supply Chain Practices: Evidence from Small and Medium Enterprises. Ann. Oper. Res., 1–25. doi:10.1007/s10479-021-04275-x

Khan, S. A. R., Godil, D. I., Quddoos, M. U., Yu, Z., Akhtar, M. H., and Liang, Z. (2021b). Investigating the Nexus between Energy, Economic Growth, and Environmental Quality: A Road Map for the Sustainable Development. Sustain. Dev. 29, 835–846. doi:10.1002/SD.2178

Khan, S. A. R., Ponce, P., Thomas, G., Yu, Z., Al-Ahmadi, M. S., and Tanveer, M. (2021c). Digital Technologies, Circular Economy Practices and Environmental Policies in the Era of Covid-19. Sustainability 13, 12790. doi:10.3390/su132212790

Khan, S. A. R., Ponce, P., and Yu, Z. (2021d). Technological Innovation and Environmental Taxes toward a Carbon-free Economy: An Empirical Study in the Context of COP-21. J. Environ. Manag. 298, 113418. doi:10.1016/j.jenvman.2021.113418

Khan, S. A. R., Yu, Z., and Sharif, A. (2021e). No Silver Bullet for De-carbonization: Preparing for Tomorrow, Today. Resour. Policy 71, 101942. doi:10.1016/j.resourpol.2020.101942

Khan, S. A. R., Godil, D. I., Yu, Z., Abbas, F., Shamim, M. A., et al. (2022a). Adoption of Renewable Energy Sources, Low-Carbon Initiatives, and Advanced Logistical Infrastructure—An Step toward Integrated Global Progress. Sustain. Dev. 30 (1), 275–288. doi:10.1002/SD.2243

Khan, S. A. R., Ponce, P., Yu, Z., and Ponce, K. (2022b). Investigating Economic Growth and Natural Resource Dependence: An Asymmetric Approach in Developed and Developing Economies. Resour. Policy 77, 102672. doi:10.1016/J.RESOURPOL.2022.102672

Koengkan, M., Fuinhas, J. A., and Marques, A. C. (2019). “The Relationship between Financial Openness, Renewable and Nonrenewable Energy Consumption, CO2 Emissions, and Economic Growth in the Latin American Countries: An Approach with a Panel Vector Auto Regression Model,” in The Extended Energy-Growth Nexus: Theory and Empirical Applications. Editors J. A. Fuinhas, and A. C. Marques (Academic Press), 199–229. doi:10.1016/B978-0-12-815719-0.00007-3

Latif, Y., Shunqi, G., Bashir, S., Iqbal, W., Ali, S., and Ramzan, M. (2021). COVID-19 and Stock Exchange Return Variation: Empirical Evidences from Econometric Estimation. Environ. Sci. Pollut. Res. 28, 60019–60031. doi:10.1007/s11356-021-14792-8

Li, N., Pei, X., Huang, Y., Qiao, J., Zhang, Y., and Jamali, R. H. (2021). Impact of Financial Inclusion and Green Bond Financing for Renewable Energy Mix: Implications for Financial Development in OECD Economies. Environ. Sci. Pollut. Res. 29, 25544–25555. doi:10.1007/s11356-021-17561-9

Luo, Q., Miao, C., Sun, L., Meng, X., and Duan, M. (2019). Efficiency Evaluation of Green Technology Innovation of China's Strategic Emerging Industries: An Empirical Analysis Based on Malmquist-Data Envelopment Analysis Index. J. Clean. Prod. 238, 117782. doi:10.1016/j.jclepro.2019.117782

Lv, C., Shao, C., and Lee, C.-C. (2021). Green Technology Innovation and Financial Development: Do Environmental Regulation and Innovation Output Matter? Energy Econ. 98, 105237. doi:10.1016/j.eneco.2021.105237

Ma, Q., Tariq, M., Mahmood, H., and Khan, Z. (2022). The Nexus between Digital Economy and Carbon Dioxide Emissions in China: The Moderating Role of Investments in Research and Development. Technol. Soc. 68, 101910. doi:10.1016/J.TECHSOC.2022.101910

Mahalik, M. K., Babu, M. S., Loganathan, N., and Shahbaz, M. (2017). Does Financial Development Intensify Energy Consumption in Saudi Arabia? Renew. Sustain. Energy Rev. 75, 1022–1034. doi:10.1016/J.RSER.2016.11.081

Martí-Ballester, C.-P. (2021). Analysing the Financial Performance of Sustainable Development Goals-Themed Mutual Funds in China. Sustain. Prod. Consum. 27, 858–872. doi:10.1016/j.spc.2021.02.011

Mehmood, U. (2021). Examining the Role of Financial Inclusion towards CO2 Emissions: Presenting the Role of Renewable Energy and Globalization in the Context of EKC. Environ. Sci. Pollut. Res. 29, 15946–15954. doi:10.1007/s11356-021-16898-5

Meijer, L. L. J., Huijben, J. C. C. M., van Boxstael, A., and Romme, A. G. L. (2019). Barriers and Drivers for Technology Commercialization by SMEs in the Dutch Sustainable Energy Sector. Renew. Sustain. Energy Rev. 112, 114–126. doi:10.1016/j.rser.2019.05.050

Mngumi, F., Shaorong, S., Shair, F., and Waqas, M. (2022). Does Green Finance Mitigate the Effects of Climate Variability: Role of Renewable Energy Investment and Infrastructure. Environ. Sci. Pollut. Res. 1, 1–13. doi:10.1007/s11356-022-19839-y

Mohsin, M., Hanif, I., Taghizadeh-Hesary, F., Abbas, Q., and Iqbal, W. (2021). Nexus between Energy Efficiency and Electricity Reforms: A DEA-Based Way Forward for Clean Power Development. Energy Policy 149, 112052. doi:10.1016/j.enpol.2020.112052

Mubarik, M., Raja Mohd Rasi, R. Z., Mubarak, M. F., and Ashraf, R. (2021a). Impact of Blockchain Technology on Green Supply Chain Practices: Evidence from Emerging Economy. Manag. Environ. Qual. 32, 1023–1039. doi:10.1108/MEQ-11-2020-0277

Mubarik, M. S., Kazmi, S. H. A., and Zaman, S. I. (2021b). Application of Gray DEMATEL-ANP in Green-Strategic Sourcing. Technol. Soc. 64, 101524. doi:10.1016/j.techsoc.2020.101524