- School of Finance, Shandong University of Finance and Economics, Jinan, China

Market-oriented environmental policy has made an indelible contribution to promoting sustainable development in China. We consider the introduction of the Sulfur dioxide Emissions Trading Pilot Scheme (SETPS) as a quasi-natural experiment and adopt PSM-DID method to study the reduction effect of SETPS on corporate carbon emissions. We find that SETPS can effectively promote the carbon emission reduction of enterprises, which highlights the dual significance of market-based environmental regulation policies in the field of pollution reduction and carbon emission reduction. Considering the heterogeneity of enterprises, SETPS imposes a more significant effect on carbon emission reduction of enterprises with high energy consumption and high pollution. The mediation effect analysis indicates that the indirect reduction effects of SETPS on the carbon emission through the marketization process and the development of non-state-owned economy. In addition, results from the test of moderation effect suggest that both financing constraint and ownership are the moderation factors for SETPS to affect enterprise carbon emission reduction. The empirical results suggest that there exists such a green bonus: reduction effect of introducing the SETPS on firm level carbon emission and other pollutant discharges. It should be paid more attention by the authorities.

Introduction

Global warming poses a serious threat to global sustainability. Excessive carbon emissions are the main cause of climate change (Lin et al., 2018; Xiang et al., 2021; Yang et al., 2022). Since China’s reform and opening up, the Chinese government has accelerated the pace of industrialization and development at the expense of the environment (Zhang et al., 2021). China’s energy consumption structure is dominated by traditional fossil fuels (Schreifels et al., 2012; Umar et al., 2021; Xiao et al., 2022). It is an important source of environmental pollution. Since 2006, China has been the world’s number one emitter of carbon dioxide (Guan et al., 2021). In 2021, China’s carbon dioxide emissions accounted for 30.7% of the world’s total carbon dioxide emissions, and its share of pollution continues to grow. Achieving sustainable environmental development is a very important issue, especially for developing countries (Nawaz et al., 2021). In September 2020, Chinese President Xi Jinping announced that China would strive to achieve its carbon peak by 2030 and be carbon neutral by 2060. To sum up, China has been suffering from the greenhouse effect for a long time and has an urgent need to reduce carbon emissions. Therefore, it is necessary to measure the policy effects of environmental regulation policies.

The Chinese government has adopted two kinds of environmental regulation policies. One is command-and-control policies, such as environmental emission standards and non-tradable emission permits. The other is market-oriented policies, such as environmental taxes and emission trading schemes. In terms of environmental governance, traditional command-and-control environmental regulation policies may appear as “government failure.” The single traditional command-and-control environmental regulation policy has been unable to achieve the ideal emission reduction effect, and the traditional environmental regulation policy may to some extent damage the economic benefits of enterprises (Gray et al., 1993).

Compared with traditional command-and-control environmental regulation policies, emissions trading schemes are regarded as effective policies to address global climate change (Coase, 1960; Jog & Kosmopoulou, 2014; Xiao et al., 2022). These schemes can control the cost of emission reduction (Montgomery, 1972; Tietenberg, 1985), technological incentives, and the advantages of political acceptability (Anke et al., 2020). The system entrusts enterprises with the right to discharge pollutants within the limits set by the government. And then economic entities can sell excess emission rights in the emission trading market, or buy additional emission rights from other enterprises. The scheme’s ultimate purpose is to introduce a forced mechanism for enterprises through market means. It aims to maximize profits while achieving the best pollution control effect.

Our study aims to investigate the effect of sulfur dioxide emission trading pilot scheme (SETPS) on firm carbon emissions, that is, whether the introduction of SETPS will cause the enterprise to reduce carbon emissions. In 2007, Chinese government approved 11 pilot provinces1 for emission right trading. In order to avoid the intervention of endogenous problems and other policies, we chose the propensity score matching difference-in-differences (PSM-DID) method to conduct quasi-natural experiments. Moreover, we also used the Annual Environmental Survey of Polluting Firms (AESPF) and the Annual Survey of Industrial Firms (ASIF) to collect pollution panel data from Chinese industrial enterprises span from 1998 to 2013. The results indicated that introduction of SETPS imposes a significant reduction effect on corporate carbon emission. This means that an SETPS not only can achieve pollution reduction, but can also achieve an additional carbon reduction effect.

The contribution of this paper can be summarized in the following three aspects. First, we enrich the literature on the effect and evaluation of market-oriented environmental regulation policies. Contrary to traditional environmental regulation policies, an SETPS is a market-oriented policy. Not only does it achieve an SO2 emission reduction (Chang & Wang, 2010; Cheng et al., 2016; Wu et al., 2019; Chen et al., 2022), but it also achieves an additional carbon emission reduction effect. This highlights the importance of market-oriented policies in pollution reduction and carbon abatement.

Second, we further tested the moderation effect. The results demonstrated that both financial constraints and ownership are moderation factors of SETPS, affecting enterprise carbon emission reduction; the moderation effect of financial constraints is slightly greater than that of the ownership.

Third, we tested the influence mechanism of an SETPS on enterprise carbon emission reduction through a mediation effect analysis. The results indicated that SETPS can influence carbon emissions by promoting the marketization process and the development of the non-state-owned economy. The mediation effect of the marketization process is more significant.

Finally, we also conducted a variety of robustness tests, such as a placebo test, and all the results indicated robustness. Considering the heterogeneity of enterprises, an SETPS has a more significant effect on the carbon emission reduction of enterprises with high energy consumption and high pollution levels.

The remainder of the thesis is arranged as follows. Chapter 2 introduces the institutional background and describes the literature review. Chapter 3 discusses our model design and data sources. Chapter 4 reports the empirical results and tests. Finally, Chapter 5 summarizes the paper and provides policy implications.

Literature Review

China’s emission trading system has progressed through the initial, exploratory, and deepening stages. In the 1960s, Coase (1960) proposed the important role of property rights theory in public management, laying the foundation for the theoretical development of emission rights trading (Dales, 1968). It has been demonstrated that by incorporating the concept of property rights into pollution control. The emission trading system can reduce emissions through the commercialization of emission rights in a perfect competition market. With the gradual improvement of the domestic market economy, the decisive role of the market mechanism in the allocation of environmental factors has become an important idea to explore a new path for environmental governance.

In 2002, the former State Environmental Protection Administration initiated a pilot scheme of sulfur dioxide emission trading in seven provinces and cities. It passed a resolution to conduct pilot emission trading in 7 provinces and cities. In 2007, the Ministry of Finance, the Ministry of Environmental Protection, and the National Development and Reform Commission approved 11 provinces for pilot projects for trading of pollution discharge rights. The emission trading policy was officially launched, and now 28 provinces and cities in China have conducted pilot schemes in emission trading. The pilot schemes use SO2 as the main component, and further include nitrogen oxides, chemical oxygen demand, and ammonia nitrogen.

Existing research on the policy effects of SETPS focus primarily on the schemes’ effects on emission reduction, economic growth (Ramanathan et al., 2017), enterprise innovation, and total factor productivity (Ren et al., 2020; Tang et al., 2020; Peng et al., 2021). More researchers have focused on SO2 about the emission reduction effect of SETPS. Many studies have concluded that an SETPS has a positive emission reduction effect on SO2 (Loschel et al., 2019; Zhu et al., 2019; Wu et al., 2020; Zhang et al., 2020). Regardless of whether the research uses panel data of pilot provinces in China (Wu et al., 2019) or focuses on a specific province (Cheng et al., 2016), the SETPS has been demonstrated to achieve good emission reduction effects. At the same time, the policy effects of an SETPS have regional heterogeneity, that is, the results are different in different regions (Chen, 2022), and the results may be related to other conventional policies (Chang & Wang, 2010).

However, some studies have come to quite different conclusions, suggesting that China’s emissions trading policies have not been effective in reducing sulfur dioxide emissions (Greenstone, 2004; Wang et al., 2004; Gerking & Hamilton, 2008). The reasons for the failure to implement China’s emission trading system are that the pilot areas have not really institutionalized sulfur dioxide emission trading. Lacking domestic institutional innovation, it is difficult to adapt the scheme to China’s national conditions (Shin, 2013). Furthermore, China has not formed a perfect emission trading market (Wang et al., 2004).

Sulfur dioxide and carbon dioxide are highly homologous. Their emissions are correlated (Agee et al., 2014). Therefore, it is feasible and necessary to consider the coordinated treatment of atmospheric pollutants and greenhouse gases (Labriet et al., 2009; Zhang & Wang, 2011). In fact, an introduction of SETPS may be able to promote the emission reduction of carbon at the same time as the emission reduction of SO2. However, to date, in the process of studying the policy effect of SETPS, few studies have focused on the schemes’ effect on carbon emission reduction.

To fill this gap, the PSM-DID model is adopted to estimate the effect of implementing the SETPS. Potential endogeneity problems are avoided and the results are more robust. Second, to better estimate the policy effects of an SETPS, we constructed an enterprise pollution dataset that included 13,314 observations span from 1998 to 2013.Third, historical research studies lack robustness tests and heterogeneity analyses. Various robustness tests, moderation effect tests, and heterogeneity analyses were conducted. Finally, few historical documents have analyzed the influence mechanism of the SETPS policy effect, whereas we tested the mediation effect.

Methodology and Data

Model Specification

Propensity Score Matching

On the basis of considering the effects of market-oriented environmental regulation policies, we selected fuel consumption, gross industrial production value, effluent charges, exhaust gas treatment capacity, firm exports, and enterprise growth as the characteristic variables to match the treatment group with the control group. The model is represented by the following equation:

In Eq. 1,

Difference-In-Differences Estimation

To measure the impact of China’s emissions permit system on carbon emissions, it was necessary to exclude the effect of other policies on carbon emissions. Therefore, we adopted the PSM-DID method to solve the endogeneity problem. Based on Beck et al. (2010), the model can be represented as follows:

In Eq. 2,

Variable Definition

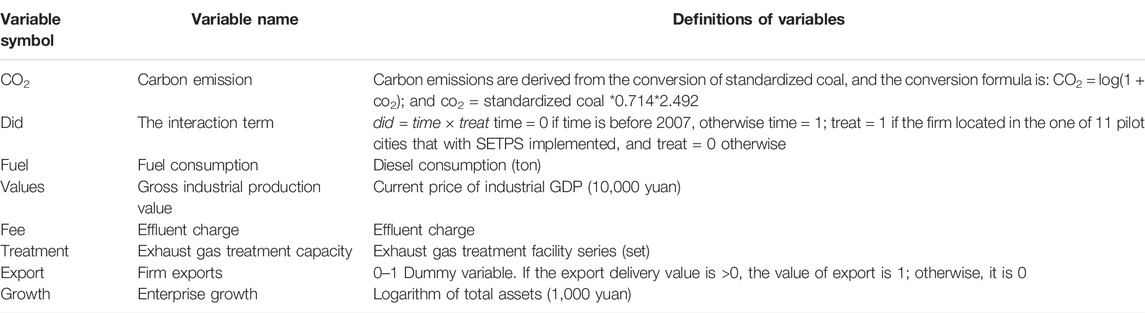

The definitions of variables used in the empirical analysis are listed in Table 1.

Dependent Variable

The dependent variable is carbon dioxide emissions, which are calculated using the carbon emission coefficient method. The conversion formula is: CO2 = log(1 + co2), and co2 = standardized coal *0.714*2.492. China’s energy consumption structure is dominated by traditional fossil fuels (Huang et al., 2011; Schreifels et al., 2012; Umar et al., 2021), which are an important source of environmental pollution. We therefore chose carbon dioxide emissions as the dependent variable.

Independent Variable

The independent variable is an SETPS. This means that by giving enterprises the right to discharge pollutants within the limits set by the government, they can sell excess emission rights in the emission trading market or buy additional emission rights from other enterprises. Marketization gives enterprises a forced mechanism to achieve the best pollution control effect. An SETPS is represented by the interaction term

Control Variable

We selected enterprise-level control variables based on the existing literature in the field of environmental regulation (Hu et al., 2020; Du & Li, 2020; Bertarelli & lodi, 2019; Ouyang et al., 2020), that is, factors such as fuel consumption, gross industrial product, effluent charge, exhaust gas treatment capacity, firm exports, and enterprise growth. In the current international division of labor, China is still mainly at the lower end of the value chain. Enterprises can obtain advanced technology and management experience through exports and improve production efficiency (Clerides et al., 1998; Yang et al., 2017), thus influencing the energy conservation and emission reduction activities of the industry. In addition, the capital flow of enterprises restricts the updating of products or technologies (Yin et al., 2022). Companies with higher profitability tend to invest more in the introduction of environmental protection facilities and technologies, thus affecting the pollution emission intensity of these enterprises.

Data Sources

Firm Pollution Data

Corporate carbon emission data are issued by the Annual Environmental Survey of Polluting Firms (AESPF) of China. Established in the 1980s by China’s Ministry of Ecology and Environment, the AESPF records data on industrial emissions and how effectively companies are reducing emissions. The database mainly includes enterprise pollutant emissions (such as SO2, nitrogen oxide, industrial waste water, industrial waste gas, smoke, and solid waste), the application of cleaning facilities and energy consumption (including fresh water, circulating water, coal, fuel, clean gas, etc.), and other indicators. Pollution data in the database are highly representative, with industrial enterprises included in the dataset accounting for approximately 85% of the total pollution. Sample enterprises need to report a large amount of environment-related information to environmental authorities every year. After verification, these data are compiled into standardized reports and then included in the database.

Other Firm-Level Data

Other firm-level data are issued by the Annual Survey of Industrial Firms (ASIF). The ASIF, compiled by the National Bureau of Statistics, is a micro enterprise data set widely used by scholars, both in China and internationally, and has strong representativeness with regard to studying enterprise issues. Its sample ASIF range includes all state-owned and non-state-owned industrial enterprises with sales of more than ¥5,000,000. The database includes two types of information regarding enterprises: One is basic information on the enterprise (including the legal person code, enterprise name, legal representative, and other indicators), and the other is financial data on the enterprise (current assets, accounts receivable, long-term investment, fixed assets, and other indicators). We matched the AESPF with ASIF based on the company names and then the corporate codes. After excluding outliers and eliminating records which violate the accounting standards, we obtained 13,314 observations between 1998 and 2013.

Descriptive Statistics

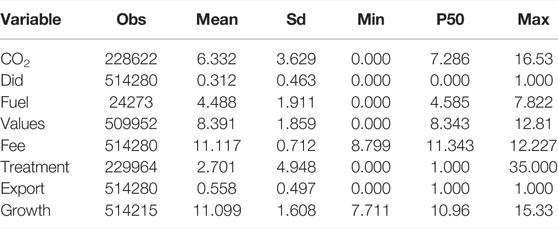

The descriptive statistics of variables is shown in Table 2 including the number of observed values, the mean, the standard deviation, and the maximum and minimum values. The mean value of carbon emissions is 6.332, and the standard deviation is 3.629, indicating that there are huge differences among firms.

Empirical Results and Discussion

Benchmark Regression

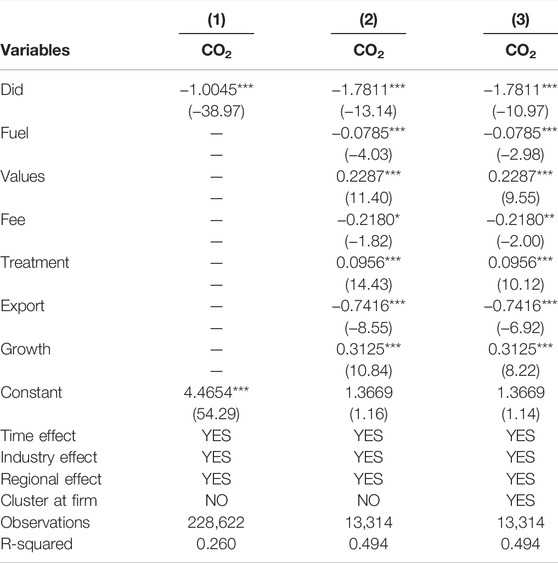

Of our central interest is to examine the carbon emission effect of SETPS on enterprises. With the choice of fixed effects that are used to absorb confounding unobservable at time, region or industry level, the regression results as presented in Column 1) of Table 3. Consistent with the conclusion of Wang et al. (2019) and Yu et al. (2022), there is a negative and statistically significant coefficient about

Test for Assumption of Parallel Trend

The key prerequisite for the DID model to effectively identify causality is the establishment of the common trend hypothesis. Before the implementation of an SETPS, the difference in carbon emissions between enterprises in the treatment group and the control group will not change systematically over time. Based on Beck et al. (2010), the dynamic model to test the common trend as follows:

In Eq. 3,

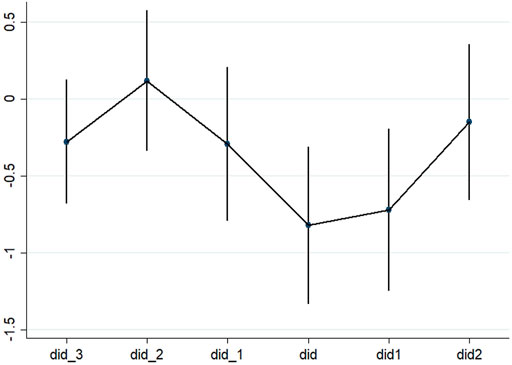

The results are presented in Figure 1. The figure illustrates that the parameters

Robustness Checks

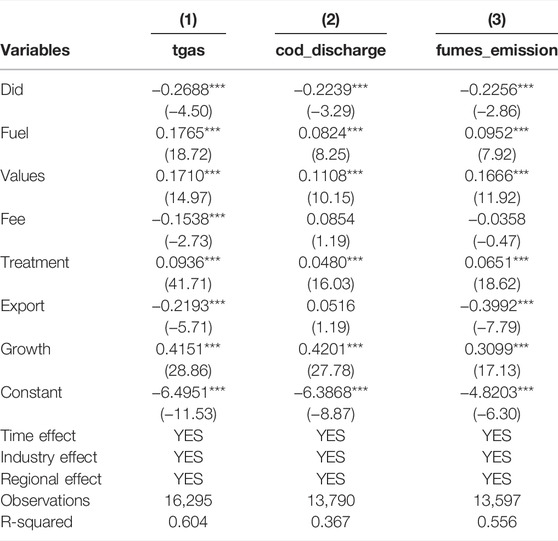

Replacing Dependent Variables

Considering the diversity of enterprise emissions, this study replaced the dependent variable carbon with total industrial gas emissions (tgas), chemical oxygen demand (cod_discharge) and industrial fumes emissions (fumes_emission), respectively. It examined whether an SETPS also imposes reduction effect on these emissions. As shown in Table 4, the results indicate that an SETPS has a strong inhibitory effect on the discharge of these pollutants and statistically significant at the 1% level. This indicates that SETPS achieved the dual significance of promoting carbon emission reduction and pollution emission reduction. The reason may be that SETPS significantly promotes enterprises adopting green innovation (Ren et al., 2020; Tang et al., 2020; Peng et al., 2021), forcing enterprises to transform and upgrade to clean enterprises, thereby reducing the overall level of enterprise pollution rather than specific emissions. In addition, it can be seen from the regression results that the emission reduction effect for other pollutants is better than that for carbon emission reduction. The reason may be that the main purpose of SETPS is to achieve SO2 emission abatement by trading SO2 emission permits. Although carbon emission discharged by enterprises together with pollutants in industrial production, an SETPS does not reduce carbon emissions as much as pollutants.

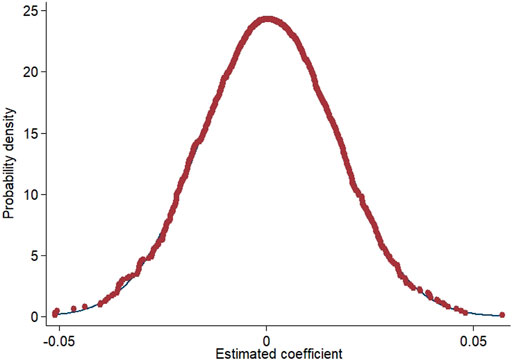

Placebo Test

Furthermore, we used a placebo test to solve the estimation error caused by missing variables. We randomly chose enterprises that implemented SETPS every year and repeated the regression to Eq. 2 1,000 times. As shown in Figure 2, the coefficients obtained based on the random sample estimation are all distributed near 0, which indicates that the influence of the SETPS on the carbon emissions of an enterprise is not affected by the missing variables.

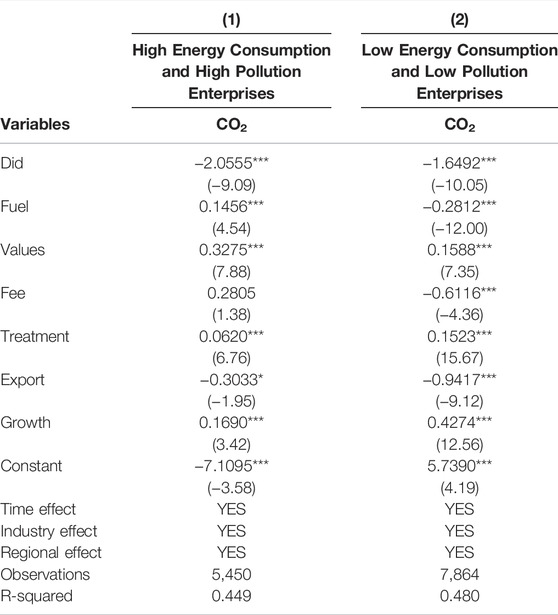

Heterogeneity

The industry where an enterprise is located has a significant influence on its pollution emission levels. Industries with high energy consumption and high pollution levels will inevitably produce more carbon emissions, so it is necessary to further understand the impact of industry heterogeneity on the emission reduction effect. This study divided enterprises into high energy consumption and high pollution enterprises on the one hand, and low energy consumption and low pollution enterprises on the other hand. As shown in Table 5 we report the results for enterprise carbon emission measured by pollution degree. In both columns, the estimated coefficients for

Further Discussion

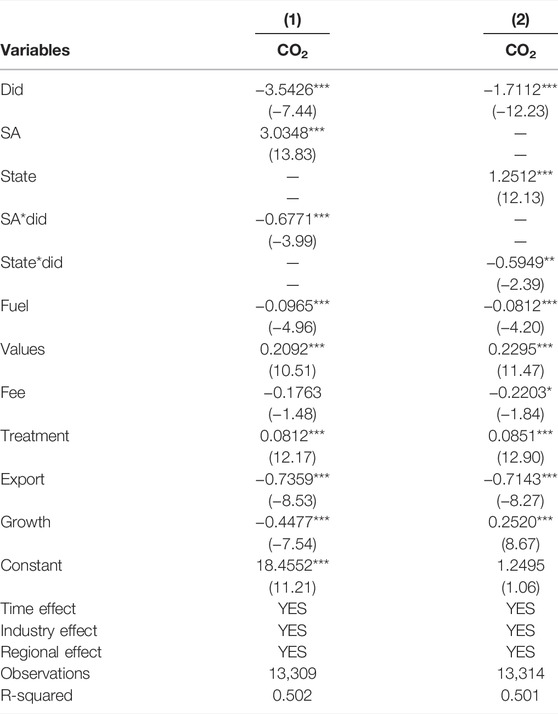

This study investigates whether financial constraints and ownership are moderation factors for SETPS to affect enterprise carbon emissions. The moderation effect has been tested according the following models:

(1) Moderation effect Model 1—Financial constraints (SA):

(2) Moderation effect Model 2—Ownership (state):

In terms of financial constraints (SA), this study divided enterprises into two categories according to whether they have financial constraints. With regard to the nature of the enterprises (state), this study classified enterprises according to their actual controllers. If the actual controllers are central or state organs, they were classified as state-owned enterprises, and the rest were classified as non-state-owned enterprises. When an enterprise is state-owned, state = 1; otherwise, state = 0.

As shown in Table 6, when it comes to the interaction term between

Mechanism Analysis

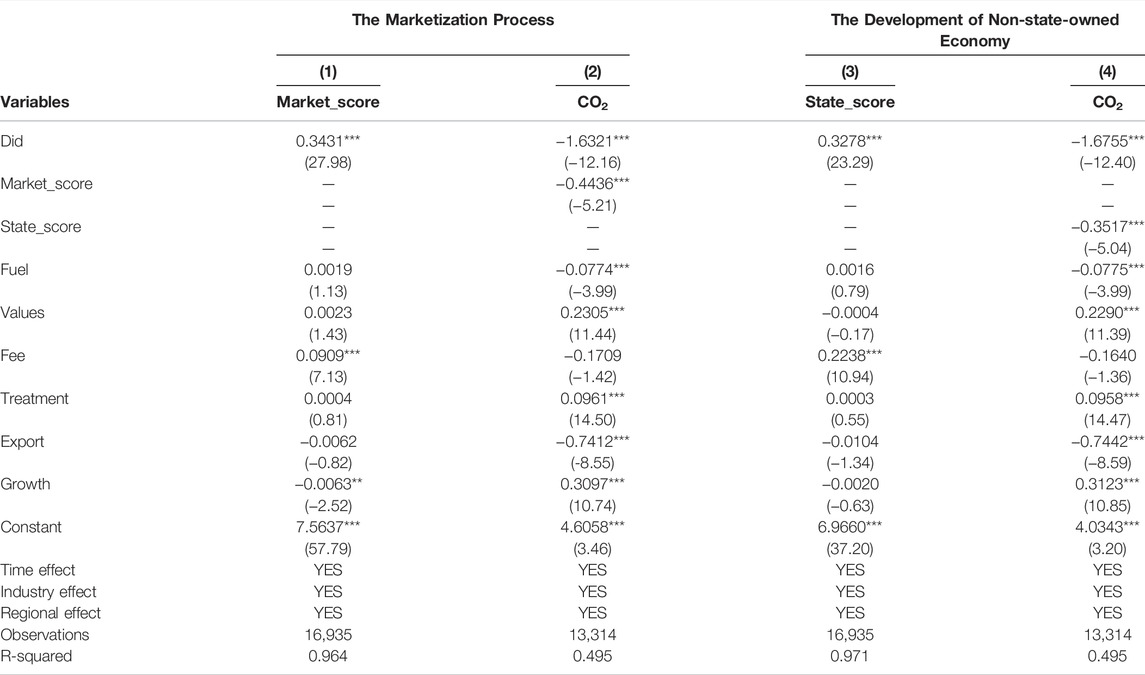

Next, we analyzed the mechanism of SETPS’s influence on carbon emissions using the mediation effect test. With the wide application of market-based environmental regulation policies, the marketization process is accelerated, and the trading market of emission rights becomes more mature. In addition, state-owned enterprises have problems with regard to principal-agent relationship (Zhang, 1997) and the policy burden (Lin et al., 1998), due to their nature. These problems can be solved by introducing non-state-owned capital into state-owned enterprises governance (Kornai et al., 2003). Therefore, we speculate that SETPS can influence carbon emissions by promoting the marketization process and the development of the non-state-owned economy. When testing, we controlled for time effect, industry effect, and region effect in all regressions. The estimated results are presented in Table 7.

The Marketization Process

It can be clearly seen from column 2) of Table 7 that the marketization process is inversely related to the proportion of carbon emissions. The coefficient of market_score is −0.4436 and is statistically significant at 1% level, which demonstrates that SETPS can indeed reduce the enterprise carbon emissions by speeding up the process of marketization. Specifically, the effect of SETPS on enterprise carbon emission reduction by affecting the marketization process is 0.3431*(−0.4436) = −0.1522. In addition, according to the above basic regression results, the total effect of SETPS on enterprise carbon emission reduction is −1.78. This accounts for approximately 8.6% of the total effect, indicating that the mediation effect of the marketization process is relatively significant.

The Development of the Non-state-owned Economy

Based on column (4) of Table 7, we document that the coefficient of state_score is −0.3517 and is statistically significant at 1% level. This demonstrates that SETPS can reduce carbon emissions by promoting the development of the non-state economy. Specifically, SETPS has an effect of 0.3278*(−0.3517) = −0.1153 on the carbon emission reduction of enterprises by affecting the development of the non-state-owned economy. Its mediation effect is slightly smaller than that of the marketization process.

Conclusion and Policy Implication

This paper examines whether sulfur dioxide emission trading pilot scheme (SETPS) can help reduce the carbon emissions of enterprises. We hypothesize that the implementation of SETPS can negatively affect carbon emissions. Based on the pollution data of Chinese industrial enterprises from 1998 to 2013, we adopted the propensity score matching-difference in differences (PSM-DID) method to evaluate the impact of SETPS on enterprise carbon dioxide emissions in these pilot areas. The results demonstrate that the introduction of SETPS has a positive effect on the carbon emission reduction of enterprises, while the pollution emission differences in different industries lead to the heterogeneity of emission reduction effect. Specifically, SETPS achieves better emission reduction effect for enterprises in high pollution industries. We also find that SETPS reduces carbon emissions by promoting the marketization process and the development of the non-state-owned economy. In addition, both financial constraints and enterprise nature can regulate the impact of SETPS on carbon emissions.

Our research provides certain policy implications. First, faced with the “carbon neutrality” target, the command-and-control environmental regulation policy has been unable to achieve the desired emission reduction goal. the Chinese government should vigorously promote market-oriented environmental regulation policies such as SETPS. The emission rights could be distributed reasonably according to enterprise needs through market means. Implementation of SETPS can not only promote SO2 emission abatement, but also impose a reduction effect on carbon emission and other pollutant discharges, which constitutes a green bonus for the policy.

Second, Industrial differences should be taken into account when controlling carbon emissions in China. Authority should, based on industrial particularity, introduce more targeted policies and supporting mechanisms to reduce carbon emissions. Enterprises from high-polluting industries should be allocated relatively more emission rights. This will assist in increasing the incentive for companies to reduce emissions.

Then, A perfect emission trading market need to be constructed, allowing market to display the decisive role in allocating resources. The government should continue to consistently deepen market-oriented reform and promote the development of the non-state-owned economy. Speeding the marketization process support the full operation of SETPS and improve the efficiency of emission rights allocation.

Eventually, Government should pay more attention to the moderation effect of financing constraints on enterprise emission reduction, to ensure that enterprises have sufficient funds for environmental protection. One effective measure is to reduce the financing constraints of enterprises, thus increasing the working capital of enterprises and giving enterprises more incentive to use capital for green innovation to improve air quality.

In addition, the article also has some limitations inevitably. This paper only analyzes the effectiveness of market policy on enterprise carbon emission. However, the marketization policy and the traditional environmental regulation policy complement each other, and the coordination of various policies will achieve better emission reduction effect. If data are available, future research can focus on exploring policy effects under the framework of constructing multiple policy combinations.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding authors.

Author Contributions

YZ: methodology, writing—review and editing, supervision, and resources. SS: methodology, software, and visualization. YX: formal analysis, data curation, and investigation. LY: writing—review and editing, supervision, and project administration. SC: data curation, formal analysis and software. DJ: resources, software, and visualization. ZX: conceptualization, validation, resources, data curation, funding acquisition and writing original draft. All authors: contributed to the article and approved the submitted version.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

We acknowledge the financial support from Shandong Province Key Research Project of Financial Application (2019-JRZZ-15), Taishan Scholars Program of Shandong Province, China (Grant Numbers: ts201712059 and tsqn201909135) and Youth Innovative Talent Technology Program of Shandong Province, China (Grant Number: 2019RWE004). All errors remain our own.

Footnotes

111 pilot provinces are: Tianjin, Hebei, Shanxi, Inner Mongolia, Jiangsu, Zhejiang, Henan, Hubei, Hunan, Chongqing, Shaanxi.

References

Agee, M. D., Atkinson, S. E., Crocker, T. D., and Williams, J. W. (2014). Non-separable Pollution Control: Implications for a CO2 Emissions Cap and Trade System. Resour. Energy Econ. 36 (1), 64–82. doi:10.2139/ssrn.220165210.1016/j.reseneeco.2013.11.002

Anke, C.-P., Hobbie, H., Schreiber, S., and Möst, D. (2020). Coal Phase-Outs and Carbon Prices: Interactions between EU Emission Trading and National Carbon Mitigation Policies. Energy Policy 144, 111647. doi:10.1016/j.enpol.2020.111647

Beck, T., Levine, R., and Levkov, A. (2010). Big Bad Banks? the Winners and Losers from Bank Deregulation in the United States. J. Finance 65 (5), 1637–1667. doi:10.1111/j.1540-6261.2010.01589.x

Bertarelli, S., and Lodi, C. (2019). Heterogeneous Firms, Exports and Pigouvian Pollution Tax: Does the Abatement Technology Matter? J. Clean. Prod. 228, 1099–1110. doi:10.1016/j.jclepro.2019.04.340

Chang, Y.-C., and Wang, N. (2010). Environmental Regulations and Emissions Trading in China. Energy Policy 38 (7), 3356–3364. doi:10.1016/j.enpol.2010.02.006

Chen, J., Huang, S., Shen, Z., Song, M., and Zhu, Z. (2022). Impact of Sulfur Dioxide Emissions Trading Pilot Scheme on Pollution Emissions Intensity: A Study Based on the Synthetic Control Method. Energy Policy 161, 112730. doi:10.1016/j.enpol.2021.112730

Cheng, B., Dai, H., Wang, P., Xie, Y., Chen, L., Zhao, D., et al. (2016). Impacts of Low-Carbon Power Policy on Carbon Mitigation in Guangdong Province, China. Energy Policy 88, 515–527. doi:10.1016/j.enpol.2015.11.006

Clerides, S. K., Lach, S., and Tybout, J. R. (1998). Is Learning by Exporting Important? Micro-dynamic Evidence from Colombia, Mexico, and Morocco. Q. J. Econ. 113 (3), 903–947. doi:10.1162/003355398555784

Coase, R. H. (1960). The Problem of Social Cost. J. Law Econ. 3, 1–44. doi:10.1002/9780470752135.ch110.1086/466560

Du, W., and Li, M. (2020). Assessing the Impact of Environmental Regulation on Pollution Abatement and Collaborative Emissions Reduction: Micro-evidence from Chinese Industrial Enterprises. Environ. Impact Assess. Rev. 82, 106382. doi:10.1016/j.eiar.2020.106382

Gerking, S., and Hamilton, S. F. (2008). What Explains the Increased Utilization of Powder River Basin Coal in Electric Power Generation? Am. J. Agric. Econ. 90 (4), 933–950. doi:10.1111/j.1467-8276.2008.01147.x

Gray, W., and Shadbegian, R., 1993. Environmental Regulation and Manufacturing Productivity at the Plant Level. doi:10.3386/w4321

Greenstone, M. (2004). Did the Clean Air Act Cause the Remarkable Decline in Sulfur Dioxide Concentrations? J. Environ. Econ. Manag. 47, 585–611. doi:10.1016/j.jeem.2003.12.001

Guan, Y., Shan, Y., Huang, Q., Chen, H., Wang, D., and Hubacek, K. (2021). Assessment to China's Recent Emission Pattern Shifts. Earth's Future 9 (11), e2021EF002241. doi:10.1029/2021ef002241

Hu, Y., Ren, S., Wang, Y., and Chen, X. (2020). Can Carbon Emission Trading Scheme Achieve Energy Conservation and Emission Reduction? Evidence from the Industrial Sector in China. Energy Econ. 85, 104590. doi:10.1016/j.eneco.2019.104590

Liangxiong, H., Li, Z., and Yuan, S. (2011). Pollution Spillover in Developed Regions in China-Based on the Analysis of the Industrial SO2 Emission. Energy Procedia 5 (C), 1008–1013. doi:10.1016/j.egypro.2011.03.178

Jog, C., and Kosmopoulou, G. (2014). Experimental Evidence on the Performance of Emission Trading Schemes in the Presence of an Active Secondary Market. Appl. Econ. 46, 527–538. doi:10.1080/00036846.2013.857128

Kornai, J., Maskin, E., and Roland, G. (2003). Understanding the Soft Budget Constraint. J. Econ. literature 41 (4), 1095–1136. doi:10.1257/jel.41.4.1095

Labriet, M., Caldes, N., and Izquierdo, L. (2009). A Review on Urban Air Quality, Global Climate Change and CDM Issues in the Transportation Sector. Ijgw 1 (1-3), 144–159. doi:10.1504/ijgw.2009.027086

Lin, B., and Jia, Z. (2018). Impact of Quota Decline Scheme of Emission Trading in China: A Dynamic Recursive CGE Model. Energy 149, 190–203. doi:10.1016/j.energy.2018.02.039

Lin, J. Y., Cai, F., and Li, Z. (1998). Competition, Policy Burdens, and State-Owned Enterprise Reform. Am. Econ. Rev. 88 (2), 422–427.

Löschel, A., Lutz, B. J., and Managi, S. (2019). The Impacts of the EU ETS on Efficiency and Economic Performance - an Empirical Analyses for German Manufacturing Firms. Resour. Energy Econ. 56, 71–95. doi:10.1016/j.reseneeco.2018.03.001

Montgomery, W. D. (1972). Markets in Licenses and Efficient Pollution Control Programs. J. Econ. Theory 5, 395–418. doi:10.1016/0022-0531(72)90049-x

Nawaz, M. A., Seshadri, U., Kumar, P., Aqdas, R., Patwary, A. K., and Riaz, M. (2021). Nexus between Green Finance and Climate Change Mitigation in N-11 and BRICS Countries: Empirical Estimation through Difference in Differences (DID) Approach. Environ. Sci. Pollut. Res. 28 (6), 6504–6519. doi:10.1007/s11356-020-10920-y

Ouyang, X., Li, Q., and Du, K. (2020). How Does Environmental Regulation Promote Technological Innovations in the Industrial Sector? Evidence from Chinese Provincial Panel Data. Energy Policy 139, 111310. doi:10.1016/j.enpol.2020.111310

Peng, J., Xie, R., Ma, C., and Fu, Y. (2021). Market-based Environmental Regulation and Total Factor Productivity: Evidence from Chinese Enterprises. Econ. Model. 95, 394–407. doi:10.1016/j.econmod.2020.03.006

Ramanathan, R., He, Q., Black, A., Ghobadian, A., and Gallear, D. (2017). Environmental Regulations, Innovation and Firm Performance: A Revisit of the Porter Hypothesis. J. Clean. Prod. 155, 79–92. doi:10.1016/j.jclepro.2016.08.116

Ren, S., Hu, Y., Zheng, J., and Wang, Y. (2020). Emissions Trading and Firm Innovation: Evidence from a Natural Experiment in China. Technol. Forecast. Soc. Change 155, 119989. doi:10.2139/ssrn.311792910.1016/j.techfore.2020.119989

Sewell, W. R. D. (1969). J. H. Dales, Pollution, Property & Prices: An Essay in Policy-Making and Economics. Toronto: University of Toronto Press, 1968, Pp. Vii, 111. Can. J. Pol. Sci. 2. 386–387. doi:10.1017/s0008423900025282

Schreifels, J. J., Fu, Y., and Wilson, E. J. (2012). Sulfur Dioxide Control in China: Policy Evolution during the 10th and 11th Five-Year Plans and Lessons for the Future. Energy Policy 48, 779–789. doi:10.1016/j.enpol.2012.06.015

Shin, S. (2013). China's Failure of Policy Innovation: the Case of Sulphur Dioxide Emission Trading. Environ. Polit. 22 (6), 918–934. doi:10.1080/09644016.2012.712792

Tang, H.-l., Liu, J.-m., Mao, J., and Wu, J.-g. (2020). The Effects of Emission Trading System on Corporate Innovation and Productivity-Empirical Evidence from China's SO2 Emission Trading System. Environ. Sci. Pollut. Res. 27 (17), 21604–21620. doi:10.1007/s11356-020-08566-x

Segerson, K., and Tietenberg, T. (1986). Emissions Trading: An Exercise in Reforming Pollution Policy. Land Econ. 62, 214. doi:10.2307/3146340

Umar, M., Ji, X., Kirikkaleli, D., and Alola, A. A. (2021). The Imperativeness of Environmental Quality in the United States Transportation Sector amidst Biomass-Fossil Energy Consumption and Growth. J. Clean. Prod. 285, 124863. doi:10.1016/j.jclepro.2020.124863

Wang, J., Yang, J., Ge, C., Cao, D., and Schreifels, J. (2004). Controlling Sulfurdioxide in China: Will Emission Trading Work? Environ. Sci. Policy Sustain. Dev. 46 (5), 28–39. doi:10.1080/00139150409604389

Wu, X., Gao, M., Guo, S., and Maqbool, R. (2019). Environmental and Economic Effects of Sulfur Dioxide Emissions Trading Pilot Scheme in China: A Quasi-Experiment. Energy & Environ. 30 (7), 1255–1274. doi:10.1177/0958305x19843104

Wu, Y., Wang, P., Liu, X., Chen, J., and Song, M. (2020). Analysis of Regional Carbon Allocation and Carbon Trading Based on Net Primary Productivity in China. China Econ. Rev. 60, 101401. doi:10.1016/j.chieco.2019.101401

Xiang, L., Chen, X., Su, S., and Yin, Z. (2021). Time-varying Impact of Economic Growth on Carbon Emission in BRICS Countries: New Evidence from Wavelet Analysis. Front. Environ. Sci. 9. 1. doi:10.3389/fenvs.2021.715149

Xiao, Z., Ma, S., Sun, H., Ren, J., Feng, C., and Cui, S. (2022). Time-varying Spillovers Among Pilot Carbon Emission Trading Markets in China. Environ. Sci. Pollut. Res. 1. 1–16. doi:10.1007/s11356-022-19914-4

Xiao, Z., Yu, L., Liu, Y., Bu, X., and Yin, Z. (2022). Does Green Credit Policy Move the Industrial Firms toward a Greener Future? Evidence from a Quasi-Natural Experiment in China. Front. Environ. Sci. 9. 1. doi:10.3389/fenvs.2021.810305

Yang, Z., Fan, M., Shao, S., and Yang, L. (2017). Does Carbon Intensity Constraint Policy Improve Industrial Green Production Performance in China? A Quasi-DID Analysis. Energy Econ. 68, 271–282. doi:10.1016/j.eneco.2017.10.009

Yang, Z., Ren, J., Ma, S., Chen, X., Cui, S., and Xiang, L. (2022). The Emission-Inequality Nexus: Empirical Evidence from a Wavelet-Based Quantile-On-Quantile Regression Approach. Front. Environ. Sci. 10. 1. doi:10.3389/fenvs.2022.871846

Yin, Z., Peng, H., Xiao, Z., Fang, F., and Wang, W. (2022). The Carbon Reduction Channel through Which Financing Methods Affect Total Factor Productivity: Mediating Effect Tests from 23 Major Carbon-Emitting Countries. Environ. Sci. Pollut. Res. 1. 1–13. doi:10.1007/s11356-022-19945-x

Yu, P., Hao, R., Cai, Z., Sun, Y., and Zhang, X. (2022). Does Emission Trading System Achieve the Win-Win of Carbon Emission Reduction and Financial Performance Improvement? -Evidence from Chinese A-Share Listed Firms in Industrial Sector. J. Clean. Prod. 333, 130121. doi:10.1016/j.jclepro.2021.130121

Zhang, J., and Wang, C. (2011). Co-benefits and Additionality of the Clean Development Mechanism: An Empirical Analysis. J. Environ. Econ. Manag. 62 (2), 140–154. doi:10.1016/j.jeem.2011.03.003

Zhang, Y., Li, S., Luo, T., and Gao, J. (2020). The Effect of Emission Trading Policy on Carbon Emission Reduction: Evidence from an Integrated Study of Pilot Regions in China. J. Clean. Prod. 265, 121843. doi:10.1016/j.jclepro.2020.121843

Zhang, S., Wu, Z., Wang, Y., and Hao, Y. (2021). Fostering Green Development with Green Finance: An Empirical Study on the Environmental Effect of Green Credit Policy in China. J. Environ. Manage 296, 113159. doi:10.1016/j.jenvman.2021.113159

Zhang, W. (1997). Decision Rights, Residual Claim and Performance: a Theory of How the Chinese State Enterprise Reform Works. China Econ. Rev. 8 (1), 67–82. doi:10.1016/s1043-951x(97)90013-4

Keywords: sulfur dioxide emission trading pilot scheme, carbon emissions, PSM-DID, mediation effect, moderation effect

Citation: Zhao Y, Su S, Xing Y, Yu L, Cui S, Jiang D and Xiao Z (2022) The Green Bonus: Carbon Reduction Effect of Sulfur Dioxide Emissions Trading Pilot Scheme. Front. Environ. Sci. 10:917887. doi: 10.3389/fenvs.2022.917887

Received: 11 April 2022; Accepted: 09 May 2022;

Published: 26 May 2022.

Edited by:

Mihaela Onofrei, Alexandru Ioan Cuza University, RomaniaReviewed by:

Elchin Suleymanov, Baku Enginering University, AzerbaijanLuigi Aldieri, University of Salerno, Italy

Copyright © 2022 Zhao, Su, Xing, Yu, Cui, Jiang and Xiao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lu Yu, eXVsdTE5OTYwNUAxNjMuY29t; Zumian Xiao, eGlhb3p1bWlhbkBzZHVmZS5lZHUuY24=

Yang Zhao

Yang Zhao Zumian Xiao

Zumian Xiao