- 1School of International Economics and Trade, University of International Business and Economics, Beijing, China

- 2School of Applied Economics, Renmin University of China, Beijing, China

Firms are critical stakeholders to achieve sustainable development. Thus, corporate environmental performance is a subject of broad concern. In an era of globalization, the relationship between trade and environment is hotly debated. One of the central questions is—will imported intermediates contribute to pollution abatement? Using Chinese firm-level data from 2000 to 2013, the article measures the technology spillover of imported intermediates and empirically tests the inhibitory effect and influence mechanism on pollution intensity with a fixed effects model and an instrumental variable approach. We find that: 1) the technology spillover directly increases innovation and indirectly affects innovation by importing diversity. Imported intermediates empower firms with insufficient innovation to control pollution. However, the incentive effect declines when innovation gradually improves. 2) The technology spillover diffuses along the industrial chain. Downstream firms benefit from the diffusion and thus have lower pollution intensity than upstream firms. 3) The technology spillover contributes to the end-of-pipe emission reduction. Also, it improves energy efficiency and promotes source governance. Furthermore, the environmental benefits of imported intermediates differ along a number of dimensions including sourcing countries, firm ownership, and location. Thus, we pinpoint a new channel concerning trade-induced technique effect. Meanwhile, our results confirm the rationale of liberalization and facilitation policies for imported intermediates, that is, trade policies have the potential to better contribute to sustainable development goals.

1 Introduction

In recent decades, both academia and policymakers have focused on investigating the drivers of environmental deterioration. The combustion of fossil energy sources is primarily responsible for the explosion of emissions and consequent climate change. Voluminous research studies have unfolded several key determinants including financial development, innovation, globalization, and trade openness (Ahmad et al., 2020; Can et al., 2021; Ahmad et al., 2022). One of the main conclusions drawn from these results is that firms are in the center of the stage. Also, along with the deepening of globalization, a lot of attention has been paid to the environmental effect of trade. Given the positive impact from trade-induced technique effect, bilateral trade liberalization would not necessarily harm the environment of developing countries. Here, the technique effect is proxied by the emission intensity. International trade affects the emission intensity by altering the technologies used by firms, yet the extent of trade’s contribution is inconclusive (Cherniwchan and Taylor, 2022).

Clearly, innovation and technological progress are among the two fundamental driving forces in alleviating the environmental pressure in response to the imperative fight against pollution. Green technology can be derived not only from indigenous research and development but also from the introduction and integration of foreign advanced clean technologies. In the era of global value chain and widespread production networks, developed countries often locate certain parts of the production chain as well as lead international technological innovation. On the one hand, for firms in developed economies, offshoring is cost-effective via taking the advantage of low cost in developing economies. On the other hand, for firms in developing countries, trade in intermediate goods serves as one means of global technology transfer and diffusion. The positive side of such exchange of materials among firms can be summarized as follows: the knowledge spillover from high-tech imported intermediate products may bring benefits for firms that are not yet at the production technology frontier. Enterprises can rapidly improve their own technical level and production efficiency by learning from trade. At the same time, diversified intermediate products that are mutually complementary with domestic products can be conducive to the optimal allocation of resources and promote the improvement of productivity. In this aspect, importing intermediate inputs might be beneficial for environmental protection. In He and Huang, (2022), they have illustrated that importing intermediates can effectively reduce pollution intensity. However, more empirical evidence should be provided to test this statement, given that the evidence from developing countries is still scant.

As one of the largest developing countries, China has made remarkable achievements in industrialization at the expense of serious pollution problems since the reforms and opening-up. During the 13th Five-Year Plan period, Chinese governments at all levels have taken actions to encourage technological transformation and upgrading in the industries. In particular, firms are encouraged to strengthen international communication and cooperation in green technology on many occasions. Furthermore, since the 1990s, China has been committed to reducing tariffs and non-tariff trade barriers and actively promoting trade in imports, especially since China accessed the WTO in 2001, the scale of Chinese intermediate input imports has continued to expand. Precisely, the volume reached 1.61 trillion US dollars in 2018, which is over nine-fold rise since 2000. Will the technology spillover from imported intermediates become an effective channel to assuage the environmental pressure of Chinese manufacturing enterprises? If so, what is the potential mechanism?

To formally tackle these issues, we begin with an estimation on the magnitude of technology spillover of imported intermediates, employing a unique Chinese manufacturing firms’ dataset from 2000 to 2013. Next, we focus on the impact and pathways of technology spillover on pollution intensity at the firm level. By doing so, this study advances current research in three aspects detailed in the following paragraphs.

First, our study contributes to the long-lasting debates concerning trade and environment, especially at the micro-level. Our unique dataset, containing rich information on firms’ importing and pollution emissions, allows us to open the “black box” of an import bundle to analyze the effect of imported intermediate inputs on firm’s pollution control and thus also green development. Previous studies usually employ indirect indicators to explore the environmental effects of importing at a macro-level due to data constraints. For example, Gutiérrez and Teshima, (2018) used regional air pollution concentration to investigate the Mexican firms’ environmental performance. Clearly, regional pollution, stemmed from various pollutants and their interactions, may not be a good proxy to reflect the emission of each firm. In this sense, our unique firm-level dataset provides arguably more comprehensive and accurate information about the emission of different pollutants. Therefore, it serves as a good data foundation for further identification of causal effects between importing and pollution.

Second, the empirical results hardly support the so-called pollution haven hypothesis. Using the micro-data of a developing country, we find that knowledge spillover plays an important role in enhancing the environmental performance. The effect diverges after differentiating the development degree of import sources. Although the relationship between import sources, firm’s characteristics, and resulting increased productivity or innovation has been extensively discussed, import sources and their connection with firm’s environmental performance have not been thoroughly investigated. Hence, by separating import sources into developing and developed countries, we delineate that importing from the developed sources tends to have a larger marginal effect on the reduction of pollution intensity. Moreover, compared with non-heavily polluting firms, we find that these heavily polluting firms engaging in the transaction of imported intermediate products can reduce their pollution intensity on account of the positive impact of the embedded technology. The two facts imply that firms in developing countries can benefit from the international trade in intermediate goods. The technology spillover from developed countries may contribute to alleviate the environmental pressure of pollution-choked firms.

Third, we also attempt to single out the role of the industrial chain. Shapiro (2020) stated that upstream industries rely more on dirty inputs like energy, while downstream industries spend more on relatively clean factor inputs like labor and intermediate inputs. At the firm level, we confirm Shapiro’s findings, especially we find that downstream firms use more intermediate inputs and have lower pollution intensity. Meanwhile, relative to upstream firms, technology spillover from imported intermediate inputs in downstream firms exhibits a stronger impact on pollution intensity.

The rest of this study is structured as follows: we review related literatures and expound our contributions in section 2. In section 3, we describe our estimation strategy and data. Section 4 introduces the empirical analysis and discusses the findings with the underlying mechanism represented in Section 5. Concluding remarks are provided in Section 6.

2 Literature review

Recent literature has documented the critical role of trade in the firm’s environmental performance, although the mechanism varies from scale effect, structural reform, technological progress due to learning effects, and arising competition in the domestic market (Cherniwchan, 2017; LaPlue, 2019). However, existing theories on firm’s participation in international trade and pollution behavior mostly emphasize on exporting rather than importing (Batrakova and Davies, 2012; Kreickemeier and Richter, 2014; Forslid et al., 2018; Li et al., 2020; Pei et al., 2021). Relatedly, there is a growing literature exploring the relationship between importing behavior (Sun et al., 2018), input tariff reduction (Cui et al., 2020), and pollution. These articles usually take WTO accession or reduction of trade barriers as external shocks to importing. Clearly, such shocks tend to cause larger scales and more variety of imports, followed by fiercer competition and more technology diffusion. However, the environmental effects of such types of shocks are quite complicated and ambiguous at best. Few studies directly tackle the problem of firms’ import behavior of intermediate inputs based on their pollution emission intensity. In a closely related work, He and Huang, (2022) found that importing intermediate goods will lead to an increase in firms’ production scale, thereby increasing their total emission. Meanwhile, the importing behavior also increases abatement investment to reduce the emission intensity. Yet, their work does not mention the possible technological effects.

To advance this line of research, this study looks directly at the effect of imported intermediates on pollution using firm-level data. However, some researchers concentrating on the possibility that the intermediate imports can stimulate productivity and innovative activities provide indirect evidence to speculate the relation between intermediate imports and environment, as the enhancement of productivity and innovation are beneficial for alleviating the environmental pressure (Bloom et al., 2010; Shapiro and Walker, 2018).

Several studies find that imports of intermediate products or decline in input tariffs are conducive to productivity gains. Productivity can increase through three channels via imported intermediate inputs: learning, improved input quality, and increase in input variety. Amiti and Konings, (2007) found that a 10 percent fall in input tariffs in Indonesia leads to a 12 percent gain in the productivity of importing firms, much higher than the productivity gain from reducing output tariffs. Kasahara and Rodrigue, (2008) used plant-level Chilean manufacturing data to confirm the conclusion that imported intermediate goods can improve productivity. Topalova and Khandelwal, (2011) found a qualitatively similar conclusion based on Indian data. Bas and Strauss-Kahn, (2015) stated that using more varieties of imported input results in higher TFP and export scope. Halpern et al. (2015) constructed a model of importers in Hungarian and found that importing from all varieties would increase a firm’s productivity by 22 percent due to imperfect substitution between foreign and domestic inputs. Elliott et al. (2016) found that importers importing high skill- and technology-intensive products and more varieties of inputs display stronger learning effects.

In terms of innovation, Bøler et al. (2015) showed that firms tend to increase imports with less expensive R&D. The action contributes to reducing production costs and ultimately boosting innovation. Liu and Qiu, (2016) investigated the effects of intermediate input tariff reduction on innovation of Chinese firms and also testified two opposite impacts. In particular, intermediate input tariff reduction can promote innovation by reducing innovation costs and restrain innovative activities due to the cheaper foreign technologies. Using a dataset of Chinese manufacturing firms, Chen et al. (2017) concentrated on the mechanism by which importing stimulated innovative activities and testified the effect of knowledge spillovers on R&D cost reduction.

The aforementioned studies suggest that a plausible channel through which imported intermediates affect firm performance is the technology spillover. Hence, measuring the technology content embodied in intermediate imports is of significance. To do so, several empirical research studies pioneered by Grossman and Helpman, (1991) and followed by Coe et al. (1997), Lichtenberg and Pottelsberghe de la Potterie, (1998), and Coe et al. (2009) measure the knowledge diffusion by R&D stocks and document the extent to which domestic and foreign knowledge affects productivity at the aggregate level. A common feature of these studies is that they construct measures of foreign R&D by using shares of total bilateral imports on GDP as weights for the foreign R&D stocks from source countries. In contrast, Madsen (2007) used patent counts to evaluate the knowledge content. Meanwhile, different from these previous studies, there are studies focusing on the industry level rather than aggregate data. The idea that intermediate inputs embody R&D knowledge and that their use is correlated with higher productivity at the industry level was examined by Scherer (1982), Griliches and Lichtenberg, (1984), Goto and Suzuki, (1989), and Keller (2004). Nishioka and Ripoll, (2012) proposed the concept of R&D content of intermediate input to represent the R&D stock embodied in intermediate goods used in production and used international input–output tables to capture transaction information of intermediate inputs at the industry level.

Building on the aforementioned studies, our article advances discussions concerning the environmental welfare of trade liberalization from the perspective of importing. In particular, we explicitly address how the technology spillover from imported intermediates contributes to pollution control. Moreover, we offer micro-evidence from a large developing country.

3 Empirical strategy and data

3.1 Estimation specification

To analyze panel data, a fixed effects model is a useful technique. This method can remove the effect of those omitted time-invariant factors that may bias the estimated results. Thus, we can assess the net effect of the predictors on the outcome variable. In this article, we used a fixed effects model to estimate the effects of technology spillover of intermediate input imports on the pollution intensity of Chinese manufacturing firms. Our baseline estimating equation is:

where i is index firms and t is years. The variable lnSO2it denotes the emission intensity of SO2 of a specific firm. lnspilloverit is the technology spillover of imported intermediate inputs.

3.2 Key variables

Our key independent variable is the technology spillover of intermediate input imports. According to the LP model constructed by Lichtenberg and Pottelsberghe de la Potterie, (1998), the specific process is as follows: foreign R&D capital stock

In formula 2,

In formula 3,

Our dependent variable is the emission intensity of SO2 by a firm in a given year. As encountering various observations of zero emission, we use the following transformed measure as our dependent variable

Following common practice and previous literatures, several financial indicators are included as control variables since they may affect the environmental performance. We control for the firm age as new firms tend to adjust with the latest pollution abatement technology better than the older ones (Cui et al., 2020). After subtracting from the open year from the current year, adding one and taking the logarithm, we can obtain the variable lnage. Then, we control the variable size, measured by the logarithm of total assets, to mitigate the potential scale effects on pollution. Moreover, a high level of enterprise debt can lead to stricter cost management and restrict the environmental expenditures (Xiao and Wang, 2020). Similarly, the firm’s financing constraint can eventually impose pressure on environmental management (Zhang et al., 2019). Therefore, we add the two factors into our model to control for their potential influences.

Next, we divide total liability by total assets to obtain the variable levity and use the logarithm of interest expenditures to evaluate the financing ability finance. Many studies underpin that exporters have better environmental performance than non-exporters (Batrakova and Davies, 2012; Richter and Schiersch, 2017; and Pei et al., 2021). Thus, we add the firm exporting status export into the model specification. In terms of the external competition faced by each firm, we calculate the Herfindahl–Hirschman Index (HHI) based on the firm’s main business income to evaluate the market competition. Generally, the smaller the value of HHI, the fiercer the competition. In order to alleviate the impact of extreme values on the efficiency and accuracy of the estimation result, we winsorize all the continuous variables at the level of 1 and 99%. Table 1 presents the summary statistics of the main variables used in this article.

3.3 Data

Our unique dataset is formed by manually combining firm-level operating data on Chinese manufacturing firms with firm-level customs data on trade transactions and pollution emission for the years 2000–2013. We introduce each dataset in order. Our first data source is the annual survey of manufacturing enterprises from China’s National Bureau of Statistics. The database provides rich information on Chinese firms, containing official name, industry, location, ownership, employment, age, and financial performances such as assets, liability, output, and intermediate inputs. Our second data source is the Chinese green development database from China’s National Bureau of Statistics. It collects information on production, emissions of various pollutants, and energy consumption of heavily polluting firms that account for over 85 percent of total emission of major pollutants in China. It is currently regarded as one of the most comprehensive and reliable micro-enterprise environmental data in China.

Our third data source, the disaggregated product-level trade transaction data and China’s customs trade database are obtained from China’s General Administration of Customs. It records a variety of information for each trading firm’s product list, including identifiers, trading price, transaction quantities, the relevant customs regime (ordinary trade, processing trade, and other forms of trade), eight-digit HS product code, import sources, and export destinations. Since the tax code of the customs data is HS eight-digit, we need to transfer into HS six-digit. In order to identify the information of intermediate products imported by enterprises, we uniformly convert the tax codes contained in the database into BEC classification codes defined by the United Nations. When the BEC codes are 111, 121, 21, 22, 31, 322, 42, and 53, these eight categories of products are defined as intermediate products. Referring to the method of Brandt et al. (2017), we merge the three datasets using the firm code and official name of each firm and then double-check the matched outcomes using location information. Our analysis is based on this unique dataset, an unbalanced panel of 25,702 import enterprises and a total of 83,865 observations, with detailed information on firm characteristics, pollution emission, and international trade transaction during the period of 2000–2013.

To conduct mechanism analysis, this article utilizes the Chinese Patent Application Database to acquire the proxy variable of innovation at the enterprise level. R&D expenditure can reflect innovation input, but R&D of each firm is available only for the years 2001–2003 and 2005–2007. Moreover, due to the various subsidy schemes in China, the distortion of R&D data is much severer than patent data (Liu and Qiu, 2016). Thus, we do not employ R&D intensity to evaluate indigenous innovation. Rather, the patent database contains over 20 million patent data accepted and published by China’s State Intellectual Property Office (SIPO) between 1985 and 2015, including relevant indicators such as the applicant’s name, patent types, number of patents, and application time. This article merges the aforementioned databases by the firm name and company address year by year, consolidates different patent information of the same company, and finally obtains the detailed data of invention patents and other different patent types at the firm level from 2000 to 2013.

4 Empirical analysis and findings

4.1 Main results

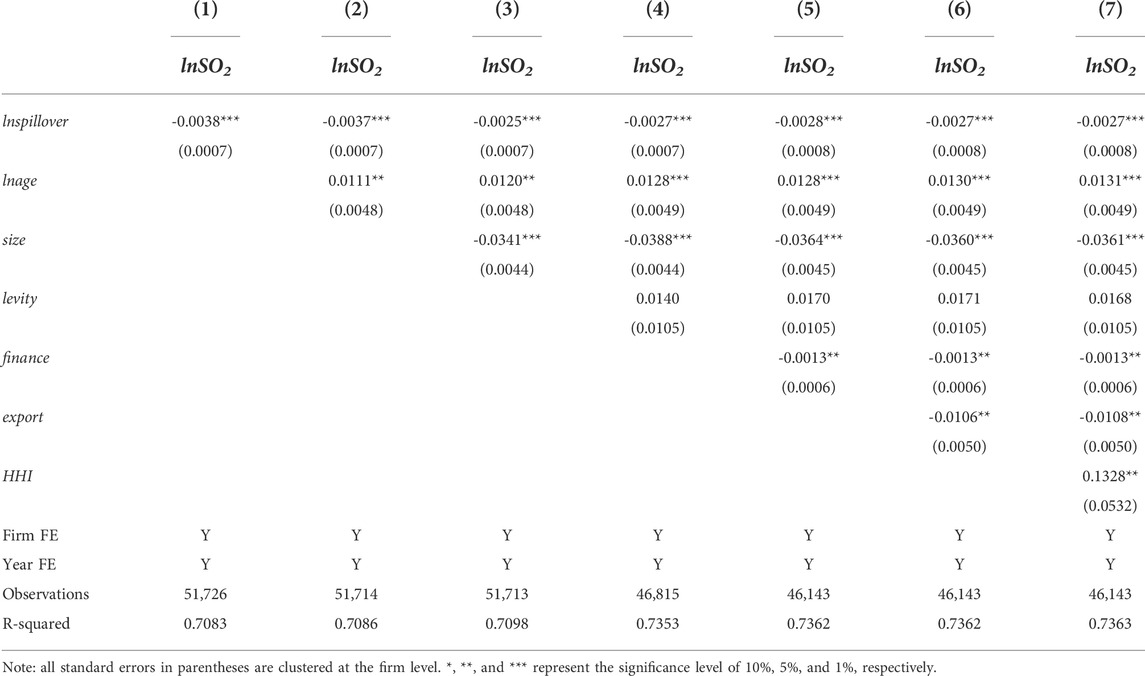

Table 2 presents the regression results based on formula 1, with the control variables introduced step by step. The central estimation outcomes reveal that the technology spillover of intermediate input imports can dramatically reduce the firm’s SO2 emission intensity. In column 1, with only firm fixed effect and year fixed effect being controlled for, we find a statistically significant and negative estimate for lnspillover. The negative sign indicates that firms importing intermediate inputs can acquire benefits of pollution reduction as the existing technology spillover. In columns 2–7, we include several time-varying control variables that may influence the environmental performance, such as age, firm size, financial ability, export status, and competition pressure. Apparently, the negative effect of technology spillover from imported intermediate inputs on pollution is robust to these additional controls. As for the effects of the control variables, we find that a firm with a shorter history, a larger size, and much stronger financial ability has a better performance in curbing the emission. Exporters also performed better than non-exporters, which is consistent with the previous findings. The positive coefficient between HHI and lnS O 2 indicates that market competition can force firms paying more attention to pollution control. However, the effect of firm’s levity is not statistically significant.

4.2 Endogeneity checks

If firms from cleaner sectors import more intermediate products, we have to disentangle the actual reason of the less pollution being more importing or cleaner sectors. Therefore, we conducted a two-sample t-test between clean sectors and heavily polluting sectors. It is found that the mean of lnspillover is significantly smaller than that of heavily polluting sectors.1 Evidently, clean sectors do not seem to import more intermediate and have larger spillovers than heavily polluting sectors.

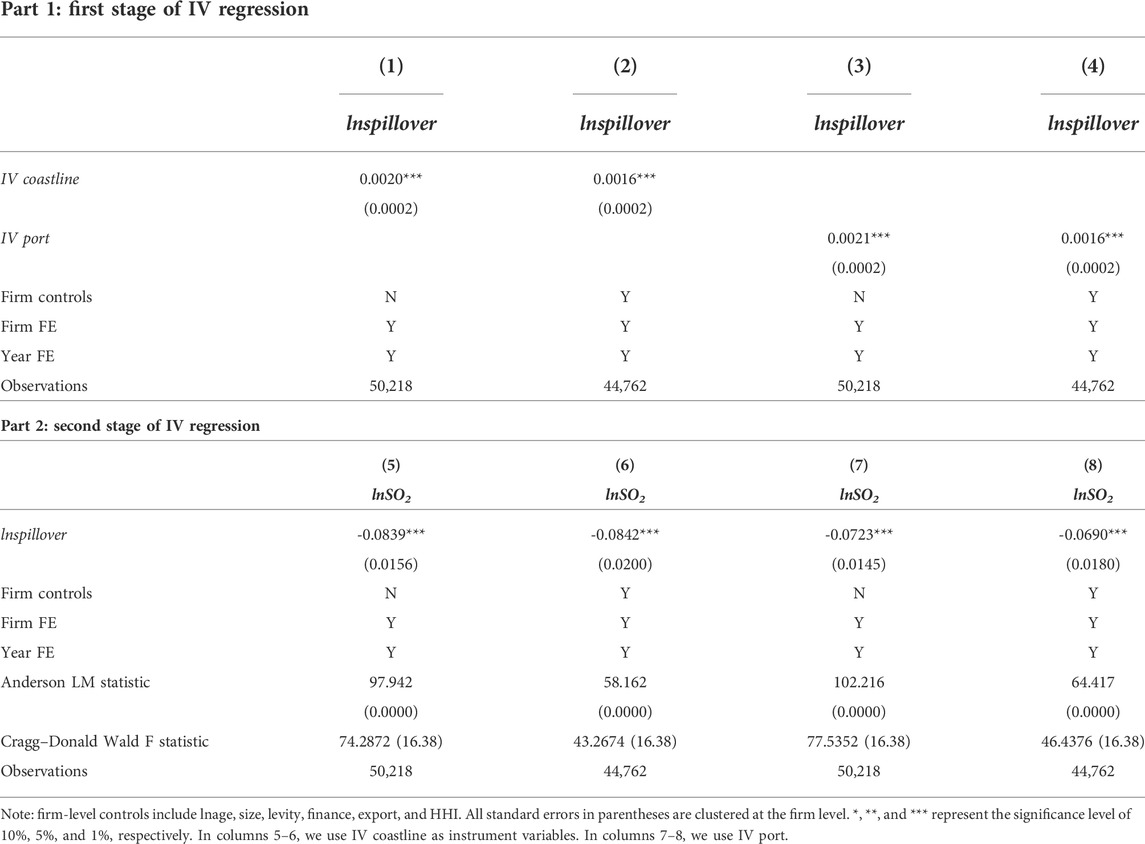

Then, to address the potential endogeneity issue arising from omitted variable concern, our strategy is the instrumental variable approach. This requires an instrument that is correlated with importing intermediates but uncorrelated with any characteristics of firms that may affect their environmental performance. We adopt the distance from the located city of each firm to the coastline (Nunn and Wantchekon, 2011) and the distance to the nearest port (Wang and Chanda, 2018; Souza-Rodrigues, 2019). The distances capture a firm’s exposure to the external demand for imported intermediates, since maritime is the main transport mode of global trade covering over 90% of traded goods. Also, the transportation costs are contingent on the distances. Enterprises should pursue higher value under the limit of transportation costs. It is more beneficial for those remote enterprises to import high-tech intermediate products. Otherwise, they can obtain the low-tech and locally available intermediates nearby. Hence, the distances are positively correlated with the technology spillover of imported intermediates. Additionally, the distances hinge on the firms’ location. They do not directly correlate with the pollution intensity.

Since geographic conditions cannot materially change during the sampling period, we multiply them with the annual average price of Brent crude oil in USD and the annual RMB/USD exchange rate to construct time-varying instrumental variables. Specifically, we extract the coastline from the administrative map of China and calculate the distance from the located city of each firm to the coastline. The data of ports are from China’s Ministry of Transport. The data of annual exchange rates are from China’s National Bureau of Statistics. The Brent crude oil price is from the website of Intercontinental Exchange (ICE).

To guarantee the robustness of estimation, we run the first-stage regressions both with and without control variables. The results of the first-stage regression are reported in columns 1–4 of Table 3. The first-stage F-value exceeding 10 suggests no concerns about weak instrumental variables. In the second stage, we use the predicted technology spillover as independent variables and relate them to the SO2 emission intensity. The results are reported in columns 5–8 of Table 3. We find that the exogenous increase in technology spillover from imported intermediate inputs has an inhibitory effect on the firm’s pollution intensity. When we use the distance from each firm to the coastline and the distance closest to the port to construct the instrument variables, the coefficient of predicted technology spillover is significant at the 1% significance level whether we control for additional variables or not.

4.3 Robustness checks

In this subsection, we further check the robustness of our results to address other related concerns. Most of the results are presented in Table 4.

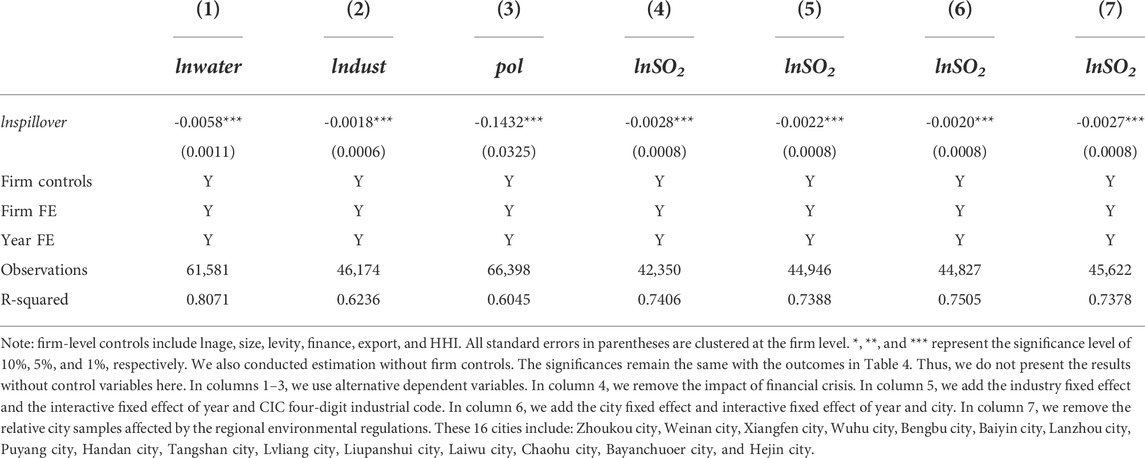

4.3.1 Alternative dependent variables

In the article, we adopt the logarithm of SO2 emission intensity as the dependent variable in the baseline regression. However, firms emit various types of pollutants indicating that SO2 may not be inclusive to reflect the overall environmental performance. In this regard, this article uses two alternative strategies to examine the outcome variables: 1) use of other main pollutants to reevaluate the firm pollution. Specifically, we mainly consider the discharge intensity of industrial sewage and dust as alternatives. 2) Constructing a comprehensive pollution index. After normalization, we assign the equal weights to five gaseous pollutants and three water pollutants and summarize to obtain the composite index

4.3.2 Addressing the impact of global financial crisis

The financial crisis in 2008 had imposed the far-reaching impact on the global economic trends and the ways how firms engage in international trade. The contraction of external demand brought about by the financial crisis affects the scale and composition of intermediate goods imported by enterprises. Therefore, the financial crisis may contaminate the specification and the estimation results. To address such concern, this article removes the samples of the financial crisis and conducts the regression again. The regression results are shown in column 4 of Table 4. The estimated coefficient remains significantly negative at the 1% level, proving yet another robustness (i.e., excluding the impact of the financial crisis).

4.3.3 Addressing the impact of related environmental policies

In response to heavy corporate pollution, the Chinese government has launched a wide range of administrative and market-regulated environmental policies. The environmental regulation policies during the sampling period are usually implemented across specific industries and regions. For instance, Cleaner Production Industry Standards and Disposal of Outdated Production Capacity are carried on several specific industries. To address these issues, we add the fixed effect of the four-digit CIC industrial code and the interaction term of four-digit industry code and year to control for the potential policy shock in related industries. The regression results shown in column 5 of Table 4 indicate that the technology spillover from the import of intermediate goods still has a significant mitigating effect on environmental pollution, after excluding the external shock of industrial environmental policies.

Moreover, in order to factor out the impact of the city-level restrictive environmental policies, this article controls the city fixed effect and the city-time interactive fixed effect. Since the regional environmental regulatory policies, such as Permission Restriction on Regions and River Basins, are applied in certain specific cities, this article reviews the baseline regression after excluding the relevant city samples. The corresponding results reported in columns 6–7 of Table 4, compared with the baseline estimation, have no significant changes. After excluding the impact of associated regional environmental regulatory policies over the same period, the technology spillover from importing intermediate inputs remains a stable effect on the suppression of corporate pollution.

4.4 Heterogenous effects

We explore the possible heterogeneous effects of technology spillover on pollution as firms performed differently in many dimensions. Results are reported in Table 5.

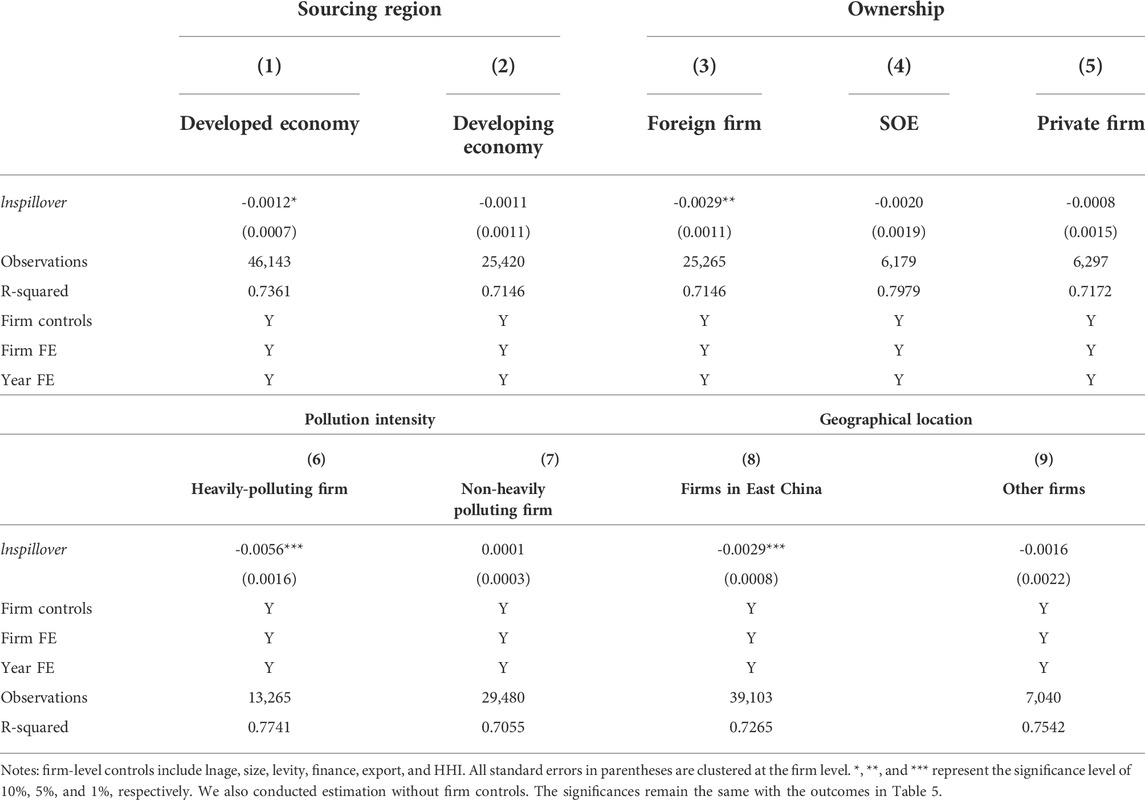

4.4.1 Import sources

Since imported inputs may differ in terms of their embodied technology level, inputs with a higher tech content will provide a greater contribution to productivity and thus may contribute more to pollution control. Due to the considerable technological gap between developing and developed countries, the sources of intermediate input imports may have a different impact on pollution. Thus, we test whether inputs imported from developed countries are particularly helpful in improving firm environmental performance by introducing separate import measures in our baseline specification, which enables us to observe the differential benefits of inputs sourced from developed countries compared with the intermediate inputs importing from developing counterparts. As a result, in columns 1–2 of Table 5, we indicate that the technology spillover from the developed countries can drastically reduce pollution at the firm level, whereas this is not evident in developing countries.

4.4.2 Firm ownership

In terms of ownership structure, we can divide them into three main types: state-owned enterprises (SOEs), foreign enterprises, and private enterprises. This article examines the effect of technological spillover on environmental pollution from intermediate input imports from firms with different characteristics. The results of columns 3–5 in Table 5 specify that the technology spillover of imported intermediates can promote pollution control of foreign enterprises, whereas this is not obvious for state-owned enterprises and private enterprises. Foreign enterprises can often obtain advanced technical guidance, management experience, and knowhow and tacit information from the parent company, acquiring more technology spillover of imported intermediate inputs. However, in terms of technology absorption and innovation, and research and development, the private enterprises are difficult to compare with the foreign companies. State-owned enterprises are less responsive to the environmental regulations and subsequent cost fluctuations. Compared with the foreign firms, they rely less on imported intermediate inputs to boost innovation and technology improvement. Therefore, the effect on SOEs is not evident.

4.4.3 Pollution intensity

The pollution haven hypothesis speculates that developing countries often become pollution havens for developed countries to transfer local pollution due to the weaker environmental regulations. We divided the sample into heavily polluting (pollution intensity larger than the average in the same four-digit CIC industry) and non-heavily polluting firms and conducted grouped regression. Columns 6–7 in Table 5 states that the heavily polluting firms can restrain emissions by the technology spillover of imported intermediate products, while those non-heavily polluting firms cannot gain the same benefit. The outcomes are at best inconsistent with the conclusion of the pollution haven hypothesis (PHH). China has not become a “dust bin” to accommodate pollution exported from developed countries. In the previous discussion, we have verified that technology spillover from developed countries dominates the reduction of Chinese firms’ pollution intensity. Then, we find that the technology spillover from imported intermediate inputs is conducive to alleviate the environmental burden of pollution-choked firms. Such evidence implies that trade in intermediate goods may not be considered a means to transfer pollution for developed countries. Rather, the embedded R&D content brings environmental benefits to enterprises in developing countries.

4.4.4 Geographical location

The different levels of economic development and environmental regulation in different regions of China lead to diverged environmental performance of companies as they have a specific geographical location. In general, compared with other regions in China, the eastern region has more advanced awareness of green development concept and better experience in green governance. Columns 8–9 in Table 5 present the existing differences in technology spillover from importing intermediate inputs if we consider the geographical location of firms. It appears that only enterprises located in eastern areas can benefit from the intermediate input imports.

5 Mechanism

Why does technology spillover from intermediate input imports can reduce the firm-level pollution emissions? To understand the empirical results, we conducted further analysis to examine several possible channels including innovation, import variety, and industrial spillover. Moreover, we explore that whether firms’ behavior of pollution control can be affected by the intermediate input imports.

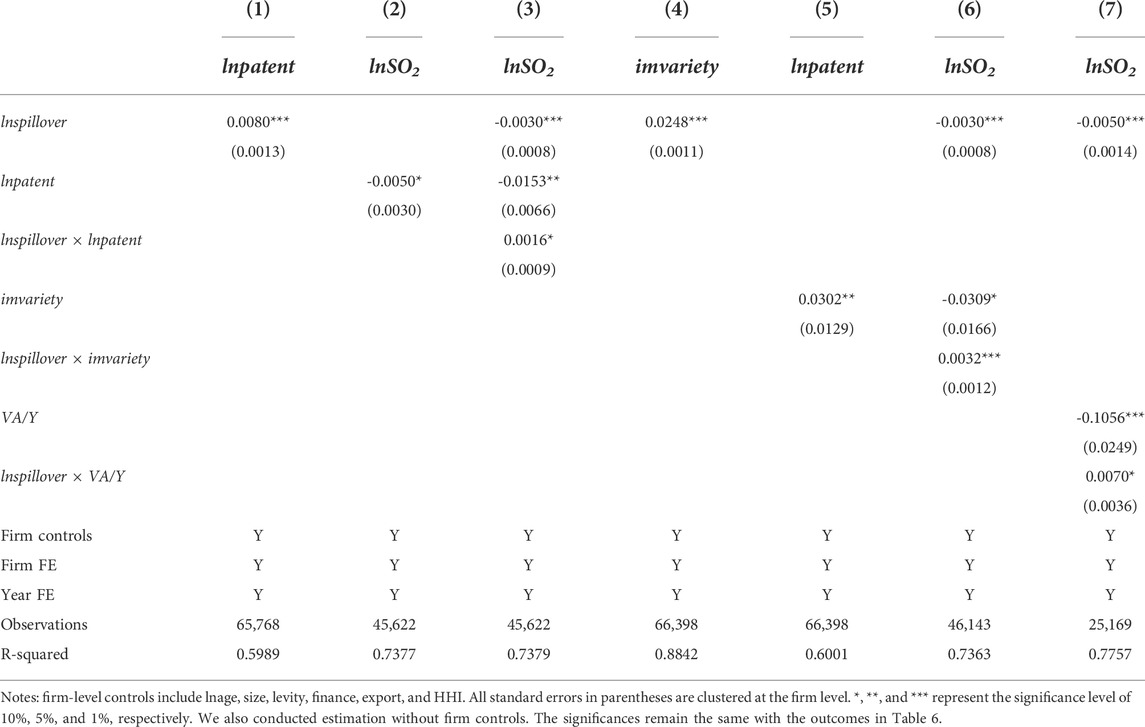

5.1 Innovation

In this article , we use the logarithm of the number of annual patents of each firm as the proxy variable to measure the innovation performance of the firm. There are different types of patents in the database, such as invention, utility model, and design. We here use the approved invention patents. To examine whether technology spillover from intermediate input imports can influence pollution by the way of innovation, we add the interaction term of innovations lnpatent and technology spillover lnspillover in the baseline regression model. Column 1 in Table 6 states that technology spillover can strengthen the firm’s innovation. Column 2 in Table 6 indicates that innovation is also beneficial to the pollution control. The positive coefficient of interaction term in column 3 of Table 6 shows that the increasing innovation will weaken the environmental effect of technology spillover from the intermediate input imports. When the capability of independent innovation is insufficient, the cost-reducing importing technology can play a complementary role. When the innovation increases, the marginal environmental effect of the relative economic importing strategy will decrease. The corporate innovation becomes more effective in substituting imported intermediate inputs, namely, firms with a higher level of innovation depend less on the technology spillover to restrain individual pollution.

5.2 Import diversity

Column 4 in Table 6 shows that importing intermediate products can increase the import variety, which can encourage innovation as shown in column 5 of Table 6. The positive interaction term of import variety and technology spillover in column 6 of Table 6 clarifies that the increasing variety will curb the impact on pollution imposed by technology spillover from intermediate imports. The more the varieties of imported intermediate products, the more the technologies available for enterprises to choose. The sufficient substitution between imports relatively decreases acquisition cost and positively pulls up firms’ innovation. The technological spillover of imported intermediate products indirectly affects the innovation of enterprises through a variety of intermediate products to ultimately reduce the pollution intensity of enterprises, namely, the diversity of intermediate products is also an important channel for embedded technology to affect the environmental pollution.

5.3 Industrial chains’ spillover

In general, the firm embedded in the relatively downstream in the value chain can acquire more technology spillover as more intermediate inputs can be utilized. Following Antràs and Chor, (2018), we apply the value-added rate2 VA/Y, i.e., the value added divided by the principal business income, to measure the downstream degree by the distance from the primary factor input. The smaller the value of VA/Y, the more intermediate inputs relative to the use of primary factor input and the more downstream (i.e., closer to final users) the firm is embedded in the industrial chain. Then, we introduce the interaction term of downstream degree and technology spillover in the benchmark regression and observe the coefficient sign to examine whether technology spillover from imported intermediate input can affect corporate pollution by the diffusion of industrial chain.

In column 6 of Table 6, the positive coefficient indicates that downstream firms have lower pollution intensity, echoing the findings in Shapiro (2020). In column 7 of Table 6, the significantly positive coefficient of the interaction term means that technology spillover of imported intermediate inputs for downstream firms can impose a stronger inhibitory effect on pollution intensity. Downstream firms are possible to acquire more knowledge, information, and advanced technology embodied in the intermediate inputs. The spillover encourages domestic enterprises to improve production efficiency and innovative capabilities, thereby promoting pollution control and reducing the firm’s emission.

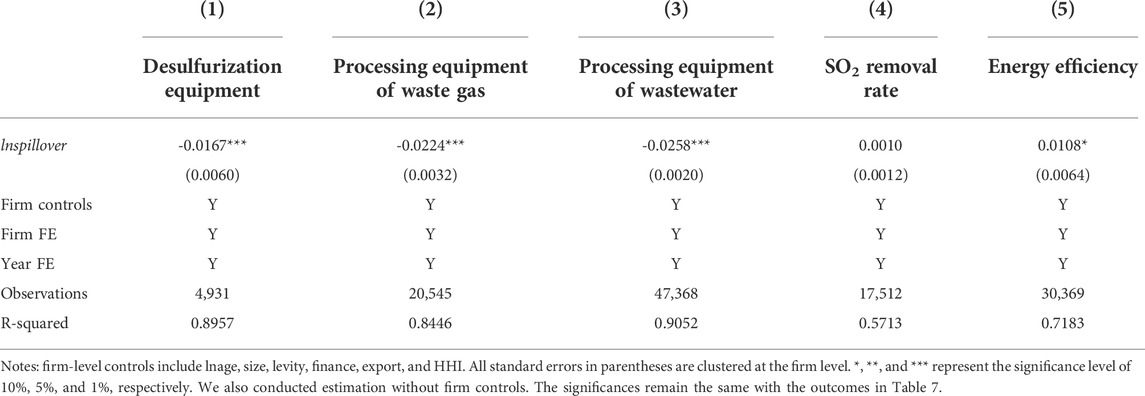

5.4 Pollution prevention and treatment

This article first examines whether the technology spillover of imported intermediate products cuts back on the emission reduction expenditure of enterprises. Due to the lacking of pollutant discharge fees from specific enterprises in consecutive years, this article quantifies the in-kind abatement investment. Since the purchase of emission reduction equipment is a sort of direct and effective method of end-of-pipe processing, we use the logarithm of the following three indicators: the ratio of the amount of desulfurization equipment to the actual total output, the ratio of the quantity of waste gaseous treatment equipment to the actual total output, and the ratio between the number of wastewater treatment equipment and the actual total output. The results in columns 1–3 of Table 7 confirm that the technology spillover of imported intermediate products can save costs of end-of-pipe treatment at the firm level. This article uses the sulfur dioxide removal rate as an indicator to measure the regulatory intensity of environmental policies for enterprises. The results in column 4 of Table 7 imply that the technology spillover from imported intermediate products do not result in a relaxation of environmental regulations. In other words, the government does not intend to eliminate environmental control to reduce the firm’s external costs to stabilize the domestic production affected by the competition from imported intermediate inputs.

The utilization of efficient and relatively clean energy can directly reduce sulfur dioxide emissions from fossil fuels and impose an immediate impact on pollution at the source. The efficiency of energy utilization can reflect the technical level of pollution control, energy conservation, and corporate emission reduction. Therefore, this article examines whether the technological spillover of imported intermediate products can finally enhance governance, promote technology upgrades, and reduce pollution at the point of origin. Energy efficiency can be expressed by dividing the total value of a firm’s industrial production by energy consumption, that is, the value of industrial production per unit of energy consumption. Due to the lack of complete data on the energy consumption structure of enterprises in China’s green development database, this article instead selects the consumption of crude coal and fuel oil, which generate more sulfur dioxide during combustion than clean energy, converts them into standard coal, and summarizes to represent the corporate energy consumption. The results in column 5 of Table 7 suggest that the technology spillover of imported intermediate products can improve the corporate energy efficiency by source monitoring and technology upgrades to curb the expansion of pollutant emission.

6 Concluding remarks

There is substantial empirical evidence on the impact of imported intermediate inputs on firm’s productivity and innovations. We know less about the relationship between the technology spillover from the intermediate imports and pollution emission at the firm level. This article is among the first attempts to fill in the gap. Based on the merged panel data of multiple micro-enterprise datasets, we aim to examine the impact of imported intermediate inputs on the environmental performance of enterprises through technological spillover effects and interpret the mechanism behind the impact. Employing a unique combined rich dataset of Chinese manufacturing firms and using geographical conditions, exchange rate, and global oil price to construct instruments for potential endogenous variables, we document a negative causal relationship between technology spillover of intermediate input imports and firms’ pollution intensities. The estimation results remain hold after a battery of robustness checks. The estimation results are consistent with many studies on the environmental effects of imports. Indubitably, import-induced technique effect suppresses pollution emissions. The special contribution of this article is to explain how the technology spillover of imports plays a role.

Our analysis of the underlying mechanism finds that: 1) in terms of lower pollution, firms with less innovation depend more on the technology spillover and benefit more from importing intermediate inputs. 2) As more foreign high-tech intermediate inputs in the domestic market, the increasing imports diversity in the domestic market can promote innovation, thereby indirectly affecting pollution reduction. 3) Technology spillover can continuously transmit along the industrial chain, so that downstream firms benefit more from the complex and diversified intermediate inputs to improve their environmental performance. Moreover, in terms of firms’ pollution prevention and treatment, the technology spillover of imported intermediate inputs can save expenditures in end-of-pipe processing. Alternatively, it encourages firms to adopt source governance to control pollutant generation by improving energy efficiency and promoting energy transition and technological upgrading.

Our study emphasizes the importing side for green development. Empirical findings show that the expansion of imported intermediate goods can bring various benefits, at least for the firm-level innovation and pollution reduction. In this aspect, those policies promoting trade openness can encourage imported technology and thus reduce environmental burden. Nonetheless, the government has to strike for a balance between trade gains and sustainable development. Indeed, many countries tend to impose lower tariffs on relatively dirty industries than clean industries. Imposing high tariffs on downstream goods rather than upstream goods forces consumers to demand more relatively dirty factors and leads to more pollution (Shapiro, 2020). Moreover, boosting imports can lead to an explosion of output and thus also emissions. For example, regional trade agreements, following WTO rules, are committed to employing zero or close to zero tariffs among members. Tian et al. (2022) showed that complete tariff elimination among the Regional Comprehensive Economic Partnership (RCEP) members would increase the yearly global CO2 emissions from fuel combustion by about 3.1 percent, doubling the annual average growth rate of global CO2 emissions in the last decade. In this sense, inclusive policies such as expanding green product lists and promoting trade facilitation are urgently needed for balancing trade gains and environmental protection.

Furthermore, the scope of our article is limited to manufacturing firms. Wang and Lu, (2020) argued that servicification is positively correlated with innovation, and the effect differs in different economies with distinct characteristics such as income and structural transition phases. An in-depth study on the role of servicification can be conducted. Additionally, the environmental impact on importing is manifold. We only focus on the technology spillover. The competition effect on firms’ environmental performance deserves a more detailed explanation. Wu et al. (2022) examined the impact of import competition on the pollution intensity of heterogeneous manufacturing enterprises. We leave these interesting topics for future research.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

YH and JP designed the study, conducted the analysis, and wrote the manuscript.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The review editor BS declared a past co-authorship with the author JP.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1The mean of lnspillover of cleaner sectors is 5.4797, and the mean of lnspillover of heavily polluting sectors is 5.6275 (t = -6.2371, P(T < t) = 0.0000).

2Following Antràs et al. (2017), a simple measure to capture such GVC positioning is the ratios VA/Y, with large values of this measure being associated with higher upstreamness (i.e., further away from final users) or lower downstreamness (i.e., closer to primary inputs).

References

Ahmad, M., Ahmed, Z., Bai, Y., Qiao, G., Popp, J., Oláh, J., et al. (2022). Financial inclusion, technological innovations, and environmental quality: analyzing the role of green openness. Front. Environ. Sci. 10, 851263. doi:10.3389/fenvs.2022.851263

Ahmad, M., Jiang, P., Majeed, A., Umar, M., Khan, Z., Muhammad, S., et al. (2020). The dynamic impact of natural resources, technological innovations and economic growth on ecological footprint: an advanced panel data estimation. Resour. Policy 69, 101817. doi:10.1016/j.resourpol.2020.101817

Amiti, M., and Konings, J. (2007). Trade liberalization, intermediate inputs, and productivity: evidence from Indonesia. Am. Econ. Rev. 97 (5), 1611–1638. doi:10.1257/aer.97.5.1611

Antràs, P., Fort, T. C., and Tintelnot, F. (2017). The margins of global sourcing: Theory and evidence from US firms. Am. Econ. Rev. 107 (9), 2514–2564. doi:10.1257/aer.20141685

Antràs, P., and Chor, D. (2018). On the measurement of upstreamness and downstreamness in global value chains. NBER. National Bureau of Economic Research Working Paper Series No. 24185. doi:10.3386/w24185

Bas, M., and Strauss-Kahn, V. (2015). Input-trade liberalization, export prices and quality upgrading. J. Int. Econ. 95 (2), 250–262. doi:10.1016/j.jinteco.2014.12.005

Batrakova, S., and Davies, R. B. (2012). Is there an environmental benefit to being an exporter? Evidence from firm-level data. Rev. World Econ. 148 (3), 449–474. doi:10.1007/s10290-012-0125-2

Berlemann, M., and Wesselhöft, J.-E. (2014). Estimating aggregate capital stocks using the perpetual inventory method: a survey of previous implementations and new empirical evidence for 103 countries. Rev. Econ. Statistics 65 (1), 1–34. doi:10.1515/roe-2014-0102

Bloom, N., Genakos, C., Martin, R., and Sadun, R. (2010). Modern management: good for the environment or just hot air? Econ. J. 120 (544), 551–572. doi:10.1111/j.1468-0297.2010.02351.x

Bøler, E. A., Moxnes, A., and Ulltveit-Moe, K. H. (2015). R&D, international sourcing, and the joint impact on firm performance. Am. Econ. Rev. 105 (12), 3704–3739. doi:10.1257/aer.20121530

Brandt, L., Van Biesebroeck, J., Wang, L., and Zhang, Y. (2017). WTO accession and performance of Chinese manufacturing firms. Am. Econ. Rev. 107 (9), 2784–2820. doi:10.1257/aer.20121266

Can, M., Ahmed, Z., Mercan, M., and Kalugina, O. A. (2021). The role of trading environment-friendly goods in environmental sustainability: does green openness matter for OECD countries? J. Environ. Manag. 295, 113038. doi:10.1016/j.jenvman.2021.113038

Chen, Z., Zhang, J., and Zheng, W. (2017). Import and innovation: evidence from Chinese firms. Eur. Econ. Rev. 94, 205–220. doi:10.1016/j.euroecorev.2017.02.008

Cherniwchan, J. (2017). Trade liberalization and the environment: evidence from NAFTA and U.S. manufacturing. J. Int. Econ. 105, 130–149. doi:10.1016/j.jinteco.2017.01.005

Cherniwchan, J. M., and Taylor, M. S. (2022). International trade and the environment: Three remaining empirical challenges. National Bureau of Economic Research Working Paper Series No. 30020. doi:10.3386/w30020

Coe, D. T., Helpman, E., and Hoffmaister, A. W. (2009). International R&D spillovers and institutions. Eur. Econ. Rev. 53 (7), 723–741. doi:10.1016/j.euroecorev.2009.02.005

Coe, D. T., Helpman, E., and Hoffmaister, A. W. (1997). North-south R & D spillovers. Econ. J. 107 (440), 134–149. doi:10.1111/1468-0297.00146

Cui, J., Tam, O. K., Wang, B., and Zhang, Y. (2020). The environmental effect of trade liberalization: evidence from China's manufacturing firms. World Econ. 43 (12), 3357–3383. doi:10.1111/twec.13005

Elliott, R. J. R., Jabbour, L., and Zhang, L. (2016). Firm productivity and importing: evidence from Chinese manufacturing firms. Can. J. Economics/Revue Can. d'economique. 49 (3), 1086–1124. doi:10.1111/caje.12226

Forslid, R., Okubo, T., and Ulltveit-Moe, K. H. (2018). Why are firms that export cleaner? International trade, abatement and environmental emissions. J. Environ. Econ. Manag. 91, 166–183. doi:10.1016/j.jeem.2018.07.006

Goto, A., and Suzuki, K. (1989). R & D capital, rate of return on R & D investment and spillover of R & D in Japanese manufacturing industries. Rev. Econ. Statistics 71 (4), 555. doi:10.2307/1928096

Griliches, Z., and Lichtenberg, F. (1984). Interindustry technology flows and productivity growth: a reexamination. Rev. Econ. Statistics 66 (2), 324. doi:10.2307/1925836

Grossman, G. M., and Helpman, E. (1991). Trade, knowledge spillovers, and growth. Eur. Econ. Rev. 35 (2), 517–526. doi:10.1016/0014-2921(91)90153-A

Gutiérrez, E., and Teshima, K. (2018). Abatement expenditures, technology choice, and environmental performance: Evidence from firm responses to import competition in Mexico. J. Develop. Econ. 133, 264–264. doi:10.1016/j.jdeveco.2017.11.004

Halpern, L., Koren, M., and Szeidl, A. (2015). Imported inputs and productivity. Am. Econ. Rev. 105 (12), 3660–3703. doi:10.1257/aer.20150443

He, L.-Y., and Huang, G. (2022). Are China's trade interests overestimated? Evidence from firms’ importing behavior and pollution emissions. China Econ. Rev. 71, 101738. doi:10.1016/j.chieco.2021.101738

Kasahara, H., and Rodrigue, J. (2008). Does the use of imported intermediates increase productivity? Plant-level evidence. J. Dev. Econ. 87 (1), 106–118. doi:10.1016/j.jdeveco.2007.12.008

Keller, W. (2004). International technology diffusion. J. Econ. Literature 42 (3), 752–782. doi:10.1257/0022051042177685

Kreickemeier, U., and Richter, P. M. (2014). Trade and the environment: the role of firm heterogeneity. Rev. Int. Econ. 22 (2), 209–225. doi:10.1111/roie.12092

LaPlue, L. D. (2019). The environmental effects of trade within and across sectors. J. Environ. Econ. Manag. 94, 118–139. doi:10.1016/j.jeem.2019.01.007

Li, L., Löschel, A., Pei, J., Sturm, B., and Yu, A. (2020). Trade liberalization and SO2 emissions: firm-level evidence from China's WTO entry. Westfälische Wilhelms-Universität Münster, Centrum für Angewandte Wirtschaftsforschung (CAWM), Münster. Tech. rep., CAWM Discussion Paper, submitted for publication.

Lichtenberg, F. R., and Pottelsberghe de la Potterie, B. v. (1998). International R&D spillovers: a comment. Eur. Econ. Rev. 42 (8), 1483–1491. doi:10.1016/S0014-2921(97)00089-5

Liu, Q., and Qiu, L. D. (2016). Intermediate input imports and innovations: evidence from Chinese firms' patent filings. J. Int. Econ. 103, 166–183. doi:10.1016/j.jinteco.2016.09.009

Madsen, J. B. (2007). Technology spillover through trade and TFP convergence: 135 years of evidence for the OECD countries. J. Int. Econ. 72 (2), 464–480. doi:10.1016/j.jinteco.2006.12.001

Nishioka, S., and Ripoll, M. (2012). Productivity, trade and the R&D content of intermediate inputs. Eur. Econ. Rev. 56 (8), 1573–1592. doi:10.1016/j.euroecorev.2012.08.004

Nunn, N., and Wantchekon, L. (2011). The slave trade and the origins of mistrust in africa. Am. Econ. Rev. 101 (7), 3221–3252. doi:10.1257/aer.101.7.3221

Pei, J., Sturm, B., and Yu, A. (2021). Are exporters more environmentally friendly? A re-appraisal that uses China’s micro-data. World Econ. 44 (5), 1402–1427. doi:10.1111/twec.13024

Richter, P. M., and Schiersch, A. (2017). CO2 emission intensity and exporting: evidence from firm-level data. Eur. Econ. Rev. 98, 373–391. doi:10.1016/j.euroecorev.2017.07.011

Scherer, F. M. (1982). Inter-industry technology flows and productivity growth. Rev. Econ. Statistics 64 (4), 627. doi:10.2307/1923947

Shapiro, J. S. (2020). The environmental bias of trade policy. Q. J. Econ. 136 (2), 831–886. doi:10.1093/qje/qjaa042

Shapiro, J. S., and Walker, R. (2018). Why is pollution from US manufacturing declining? The roles of environmental regulation, productivity, and trade. Am. Econ. Rev. 108 (12), 3814–3854. doi:10.1257/aer.20151272

Souza-Rodrigues, E. (2019). Deforestation in the amazon: a unified framework for estimation and policy analysis. Rev. Econ. Stud. 86 (6), 2713–2744. doi:10.1093/restud/rdy070

Sun, J., Mooney, H., Wu, W., Tang, H., Tong, Y., Xu, Z., et al. (2018). Importing food damages domestic environment: evidence from global soybean trade. Proc. Natl. Acad. Sci. U. S. A. 115 (21), 5415–5419. doi:10.1073/pnas.1718153115

Tian, K., Zhang, Y., Li, Y., Ming, X., Jiang, S., Duan, H., et al. (2022). Regional trade agreement burdens global carbon emissions mitigation. Nat. Commun. 13 (1), 408. doi:10.1038/s41467-022-28004-5

Topalova, P., and Khandelwal, A. (2011). Trade liberalization and firm productivity: the case of India. Rev. Econ. Stat. 93 (3), 995–1009. doi:10.1162/REST_a_00095

Wang, C., and Lu, Y. (2020). Can economic structural change and transition explain cross-country differences in innovative activity? Technol. Forecast. Soc. Change 159, 120194. doi:10.1016/j.techfore.2020.120194

Wang, T., and Chanda, A. (2018). Manufacturing growth and local employment multipliers in China. J. Comp. Econ. 46 (2), 515–543. doi:10.1016/j.jce.2017.10.002

Wu, C., Su, N., Guo, W., and Wei, W. (2022). Import competition and the improvement in pollutant discharge from heterogeneous enterprises: evidence from China. J. Environ. Manag. 310, 114809. doi:10.1016/j.jenvman.2022.114809

Xiao, H., and Wang, K. (2020). Does environmental labeling exacerbate heavily polluting firms’ financial constraints? Evidence from China. China J. Account. Res. 13 (2), 147–174. doi:10.1016/j.cjar.2020.05.001

Keywords: imported intermediates, technology spillover, R&D, pollution of enterprises, green development

Citation: Huang Y and Pei J (2022) Imported intermediates, technology spillover, and green development: Evidence from Chinese firms. Front. Environ. Sci. 10:909055. doi: 10.3389/fenvs.2022.909055

Received: 31 March 2022; Accepted: 14 July 2022;

Published: 10 August 2022.

Edited by:

Muhlis Can, BETA Akademi-SSR Lab, TurkeyReviewed by:

Youxing Huang, Ocean University of China, ChinaZahoor Ahmed, Cyprus International University, Cyprus

Copyright © 2022 Huang and Pei. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jiansuo Pei, anNwZWlAcnVjLmVkdS5jbg==

Yingfei Huang

Yingfei Huang Jiansuo Pei

Jiansuo Pei