- 1School of Public Administration and Policy, Renmin University of China, Beijing, China

- 2Faculty of Economics and Management, East China Normal University, Shanghai, China

- 3School of Environmental Science and Engineering, Shanghai Jiao Tong University, Shanghai, China

- 4School of International and Public Affairs, Shanghai Jiao Tong University, Shanghai, China

- 5School of Management, Nanjing University of Posts and Telecommunications, Nanjing, China

Under the dual pressure of central environmental performance appraisal and fiscal pressure, local Chinese governments, especially those in resource-dependent cities, struggle with reprioritizing environmental protection over economic growth while staying under budget. However, the empirical impact of such endeavors on pollution control remains underexplored. Based on 2003–2018 panel data on resource-dependent cities in China, this paper adopts a dynamic panel model to explore the effect of local government fiscal pressure on air pollution. The results show that (1) due to the effect of path dependency on existing economic development patterns, resource-dependent cities suffer from a vicious circle where fiscal pressure aggravates air pollution emissions. (2) As shown by the heterogeneity test, air pollution emissions increase significantly as financial pressure becomes severe; the situation also worsens in mature-type resource-dependent cities. (3) The increase in the number of years in the office of top local government leaders exacerbates the negative effect of fiscal pressure on air pollution; in contrast, the increase in age of these officials mitigates the negative effect. (4) The results of the mechanism test show that financial pressure mainly aggravates environmental degradation by hindering industrial structure upgrading and inhibiting urban green innovation.

1 Introduction

Since the reform and opening up, an extensive growth model has driven the rapid development of China’s economy at the expense of environmental quality (Wei et al., 2021a; Wei et al., 2021b; Shen et al., 2021). In recent years, improvements have been made under a series of environmental regulations. According to the 2020 National Overview of Ecological and Environmental Quality, 202 out of 337 cities at or above the prefectural level met the national standards for air quality. The rest of these cities still need to make improvements.

Resource-dependent cities are those with resource exploitation and processing as the leading industry. As suppliers of energy and essential raw materials, these cities contribute to China’s long-term economic growth, but the industrial structure based on energy consumption significantly impacts environmental pollution. In China, resource-based cities account for 43% of the total number of cities. As one of the major national strategies for energy development, the transformation of resource-dependent cities is highly related to the country’s ability to acquire and utilize natural resources and has an important impact on the sustainable development of the national economy. Cities with poor ambient air quality are mainly resource-dependent cities. In these cities, the distortion of energy consumption and factor endowment structure has led to a low comprehensive utilization rate of resources, high energy consumption and pollutant emissions, and dependence on resource-based industries that cause severe environmental pollution (Li et al., 2015; Ma et al., 2018; Marais et al., 2018). The country’s 14th Five-Year Plan prioritizes the transformation of resource-dependent cities to mitigate the problem. The plan attaches great importance to the imbalance and incongruity between economic development and ecological protection in resource-dependent cities.

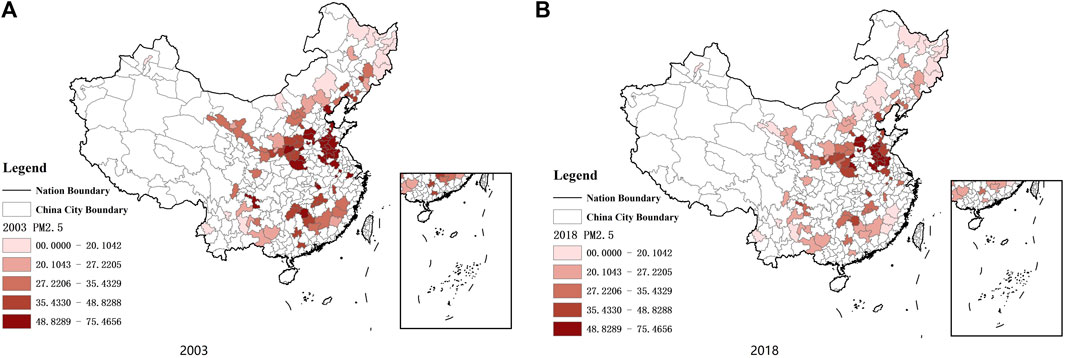

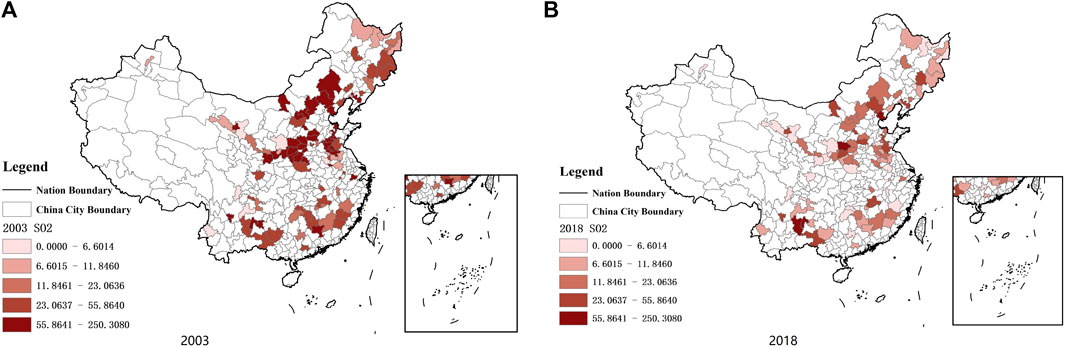

Economic growth has reached a plateau in recent years, and fiscal pressure has increased in parallel with stagnation. At the same time, accelerating ecological improvement and maintaining high-quality development has become the national strategy, as stated in a report of the 19th Communist Party of China (CPC) National Congress. Therefore, it is essential to understand how local governments should coordinate and balance economic growth and environmental protection, especially in resource-dependent cities where trade-offs are difficult to make. Figures 1, 2 show the PM2.5 and industrial SO2 emission concentrations of resource-dependent cities in 2003 and 2018. Over time, air pollution emissions have decreased, but the overall concentration level remains high.

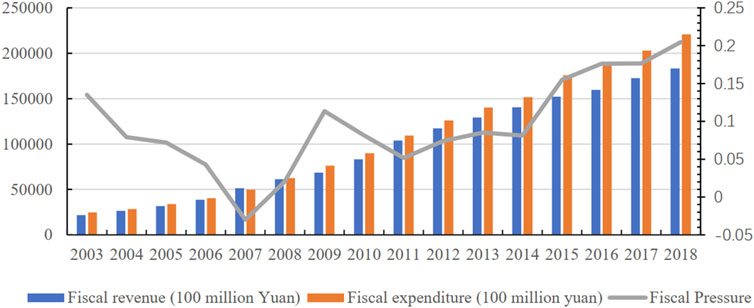

An increase in financial pressure weakens the government’s ability to coordinate economic regulation and the public service supply, which is not conducive to the high-quality development of the national economy (Xu et al., 2020). One of the ways that the central government incentivizes local governments and officials is through performance evaluations. Since the tax distribution reform in 1994, the central government has been in charge of distributing fiscal revenue, while local governments control economic development and fiscal expenditure. As a result, local governments rely heavily on transfer payments from the central government, and the vertical imbalance of the fiscal system intensifies local financial pressure. The situation worsened after major fiscal and tax system reforms, such as the agricultural tax reform and value-added tax reform (Xu et al., 2020). Figure 3 shows China’s fiscal revenue and expenditure. The gap between fiscal revenue and expenditure increases year by year, and fiscal pressure increases year by year. In recent years, since China’s implementation of the large-scale “tax and fee reduction” policy, together with the impact of COVID-19, the government’s fiscal revenue has decreased while expenditure has increased. As a result, fiscal pressure on governments has significantly increased.

In the transitional stage of economic development, the sources of financial pressure on local governments are even more multifaceted. On the one hand, they face top-down political performance evaluation pressure from the central government; on the other hand, pressure also comes from the bottom-up demand for public infrastructure, environmental health, and peer pressure from other local governments. In other words, the natural endowment fund gap caused by the reform of the financial system and the competitive fund gap caused by the promotion tournament have led to the severe financial pressure faced by local governments.

Resource-dependent cities contribute to China’s industrialization by providing sufficient resources for the country’s economic growth, but the unsustainable exploitation of resources causes severe ecological and environmental problems. Therefore, the transformation and upgrading of resource-dependent cities are the keys to achieving high-quality development. Under tremendous fiscal pressure, it is essential to understand whether resource-dependent cities can reverse the traditional mentality of development first, save the environment later, and transform the development mode. This paper focuses on the impact of fiscal pressure on air quality and the mechanism of this impact in resource-dependent cities. A total of 114 resource-dependent cities in China were selected to test the environmental effects of fiscal pressure and the mechanism from 2003 to 2018 based on a dynamic panel model. Specifically, the system generalized method of moments (SYS-GMM) and difference generalized method of moments (DIFF-GMM) methods are adopted. The paper has sought to provide an alternative explanation for the dual dilemma of economic growth and environmental protection in resource-based cities and identifies the role of fiscal pressure in the transformation and upgrading of resource-based cities.

2 Theoretical Foundation and Hypotheses

The principal-agent theory is the basis of fiscal decentralization theory. The information asymmetry between the central and local governments is likely to cause a moral hazard in the performance of local government functions. Under vertical fiscal imbalance, local governments face the dilemma of alleviating financial pressure while achieving high-quality development. Kou and Han (2021) explored the relationship between local fiscal pressure and local environmental regulatory behavior based on 2003–2017 Chinese provincial panel data. Their study found that fiscal pressure weakens local environmental regulation. Bai et al. (2018) took tax competition as a strategy for coping with fiscal pressure to explore the environmental effects induced by corporate income tax competition and the value-added tax in 30 provinces in China. Their study found that interregional tax competition not only reduces local environmental quality but also produces spillover effects and worsens the environment of neighboring regions. In contrast, other studies have shown that fiscal decentralization positively impacts environmental quality (Wen and Lee, 2020; Su et al., 2021).

Economic development is highly reliant on resource-dependent industries in resource-dependent areas, and financial pressure may aggravate the imbalance of the industrial structure, forming a resource curse and accelerating pollution emissions. On the one hand, resource-dependent cities have been adopting a high energy consumption and high emission production mode for a long time, and the regional industrial development mode has become path-dependent, posing a great threat to ecology and the environment (Karlsson, 2012; Takatsuka et al., 2015; Jiao et al., 2020). On the other hand, based on officials’ promotion incentive theory, financial pressure will force local governments to choose the development mode of emphasizing development and ignoring environmental protection. This incentivization mechanism will relax environmental regulation, accelerate resource industry development, and aggravate environmental pollution. Denise et al. (2017) showed that local governments produce a race-to-the-bottom effect and aggravate environmental degradation under fiscal pressure. Lin and Zhou (2021) studied the environmental performance of fiscal decentralization from the perspective of vertical fiscal imbalance based on 2000–2017 Chinese provincial panel data. The study showed that vertical fiscal imbalance could weaken environmental performance and cause more severe environmental deterioration in eastern China. Local governments tend to support high-tax industries to relieve financial pressure and increase budgetary revenue. Although such industries can relieve financial pressure, local governments in regions with greater financial pressure will relax environmental regulation more and attract large taxpayers by lowering the threshold of environmental protection, causing a substantial negative impact on environmental quality (Cole and Fredriksson, 2009; Dean et al., 2009; Han and Kung, 2015). Therefore, this paper proposes the following hypothesis:

H1: In resource-dependent cities, a high resource endowment leads to serious environmental problems in the region, and financial pressure accelerates air pollution emissions and further aggravates environmental deterioration, leading to the “Matthew effect”.

Furthermore, as the government is the leading actor in regional environmental governance, the decision-making behavior of local governments has an essential impact on regional environmental governance. The individual characteristics of officials, such as their age, term of office, and other individual factors, affect their governing philosophy and decision-making behavior (Mccabe et al., 2008). On the one hand, the increasing age of local officials is conducive to improving environmental quality. Based on 2002–2014 panel data on Chinese cities, Yu et al. (2019b) explored the environmental effects of the individual characteristics of government officials. They found that older officials attach more importance to environmental issues. In contrast, young local officials have a strong desire for promotion and ample promotion space. Therefore, they will sacrifice environmental quality to promote economic growth in the short term and introduce high-pollution and high-tax enterprises to drive economic growth.

As officials get senior in age, the probability of promotion decreases. They become more rational in industrial planning and transformation for sustainable urban development and have relatively strong motivation to improve basic public services, such as regional environmental quality (Li and Zhou, 2005). Admittedly, while promotion incentives become relatively low for older officials, the potential cost of the punishment increases due to increased environmental accountability posed by the central government. Hence, the officials are more motivated to implement environmental measures and improve environmental quality to avoid the risk of punishment (Bai and Kung, 2014). In addition, older local officials may have more experience in politics and better coordinate the relationship between regional economic growth and environmental protection.

On the other hand, the longer the tenure of local officials is, the worse the environmental effects of fiscal pressure. Fan and Tian (2013) found that with an increase in the term of office of local officials, the probability that they will be “captured” by current enterprises gradually increases; additionally, the government-enterprise collusion network surrounding officials solidifies gradually. The longer the term of local officials is, the greater the likelihood that government-enterprise collusion will occur. Enterprises rely on the government to provide policy guidance and financial support for their production and operation. In turn, the government relies on the enterprises in its jurisdiction to guarantee employment and economic growth. Therefore, under government-enterprise collusion, local officials with longer terms of office have the incentive to lower regional environmental regulatory standards, thus acquiescing to local enterprises to maintain an extensive development mode and reducing the production costs of enterprises (Wu et al., 2014; Jia, 2017). Such practice leads to an increase in environmental pollution and a decrease in the environmental quality of the jurisdiction. Maintaining an appropriate level of turnover of officials can restrain government-enterprise collusion to a certain extent, which is conducive to environmental governance. Therefore, the following hypothesis is proposed:

H2: In resource-dependent cities, with the increase in the tenure of officials, the air pollution effect of financial pressure intensifies. As local officials become senior in age, the environmental effects of fiscal pressure can be ameliorated.

If financial pressure in resource-dependent cities aggravates regional air pollution, this phenomenon naturally raises the next question. What are the mechanisms of the impact of financial pressure on air quality deterioration? Previous studies show that technological progress, especially green technology innovation, is an important means of achieving green development (Aghion et al., 2016; Acemoglu et al., 2012; Calel and Dechezlepretre, 2016). The choice of technology is not only coupled with the thought, perception, knowledge, and skills of the technology creator but is also subject to the factor endowment characteristics of the technology origin (Basu and Weil, 1998; Antonelli, 2016; Dong and Wang, 2021). For example, if regional capital and skills are relatively abundant and the market size is relatively large, regional technological progress will be characterized by a capital or skill bias (Acemoglu, 2002; Jerzmanowski and Tamura, 2019; Chen, 2020). Therefore, the energy endowment characteristics of resource-dependent cities are likely to lead to a nonclean bias in regional technological progress, further hindering the development of regional low-carbon environmental technologies and forming a pollution “lockin effect” (Balsalobre-Lorente et al., 2018; Unruh, 2002; Unruh and Hermosilla, 2006). According to resource curse theory, the economic development of such regions does not benefit from large-scale resource development and crowds out other types of production activities, forming a resource advantage trap (Gylfason, 2001; Sachs and Warner, 2001; Papyrakis and Gerlagh, 2007), and inhibits green technology innovation (Li and Xu, 2018). In addition, resource-dependent cities in China suffer from other problems, such as unreasonable resource development and lagging industrial structure adjustment (Sun and Ding, 2005; Li and Dewan, 2017; Li et al., 2021), which worsen the situation.

Regarding the industrial structure, resource-dependent cities are dominated by the secondary industry, and resource-dependent industries with higher pollution emissions have lower resource exploitation and utilization costs. Regional industrial development is gradually prone to path dependency, aggravating regional environmental deterioration (Romanelli and Khessina, 2005). The transformation and upgrading of the economic development mode of resource-dependent cities are imminent (Emrah and Cali, 2018). Therefore, the following hypothesis is proposed:

H3: In resource-dependent cities, financial pressure intensifies environmental degradation mainly by crowding out green technology innovation and hindering the upgrading of industrial structures.

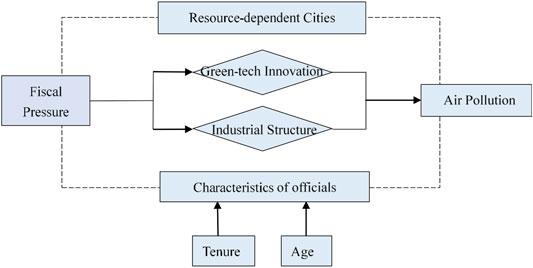

In summary, the mechanism of the impact of financial pressure on air pollution in resource-dependent cities is shown in Figure 4. The rest of this paper is structured as follows. Section 3 describes the econometric models and data sources, Section 4 shows the empirical results, and Section 5 includes the conclusion and policy implications.

3 Econometric Models and Data Sources

The potential path-dependent characteristic of pollution emissions is taken into account to test the environmental effects of fiscal pressure. This characteristic refers to the situation that the environmental situation in the previous year may have an impact on the environmental situation in the next year (Shao et al., 2011). The omission of dynamic characteristics may lead to model bias (Wooldridge, 2001). Therefore, this paper examines the effect of fiscal pressure on pollution emissions in resource-dependent cities through a dynamic panel model, which can reflect the path-dependent characteristic of pollution emissions.

where

Dependent variables:

Key independent variable: Fiscal stress is caused by fiscal deficits resulting from persistent imbalances between fiscal revenues and fiscal expenditures. Specifically, under the fiscal decentralization system, the persistent imbalance between local government revenues and expenditures or the fiscal gap induced by the imbalance between fiscal revenues and expenditures results in a consolidated fiscal balance (Cai et al., 2022). In this paper, we refer to Bai et al. (2018) and use the gap between fiscal expenditure and fiscal revenue as a proportion of fiscal revenue to characterize fiscal pressure, with large values characterizing high fiscal pressure.

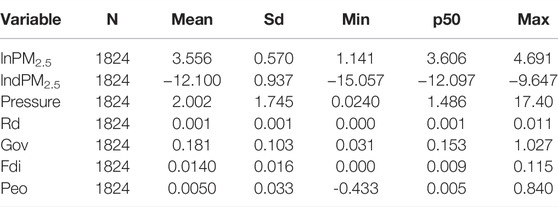

Control variables: Research and development (R&D) investment (Rd): Technological progress is an important factor that affects environmental conditions and depends on regional R&D investment. Thus, this paper uses the share of science expenditure in GDP to characterize R&D investment (Dong and Wang, 2021). Foreign direct investment (Fdi): The impact of foreign direct investment on the environment may lead to the pollution haven effect or the pollution halo effect. This paper uses the product of the actual use of foreign investment and the annual average exchange rate as a proportion of GDP for characterization (Zhang and Zhou, 2016). Governance (Gov): The government is the dominant force in environmental governance. We use the share of government fiscal expenditure in GDP to characterize government dominance (Li and Xu, 2018). The population growth rate (Peo): According to the impact–population–affluence–technology (IPAT) model, population growth is an important factor that affects environmental conditions, for which it is necessary to control the population growth rate (Zhou and Liu, 2016). Based on the segmentation of resource-dependent cities in the Sustainable Development Planning of National Resource-dependent Cities (2003–2020), the study collated data on 114 prefecture-level resource-dependent cities. Data were collected from the Statistical Yearbook of Chinese Urban Cities and Statistical Yearbook of China’s Regional Economy. The descriptive statistics of the variables are presented in Table 1.

4 Results

4.1 Baseline Model

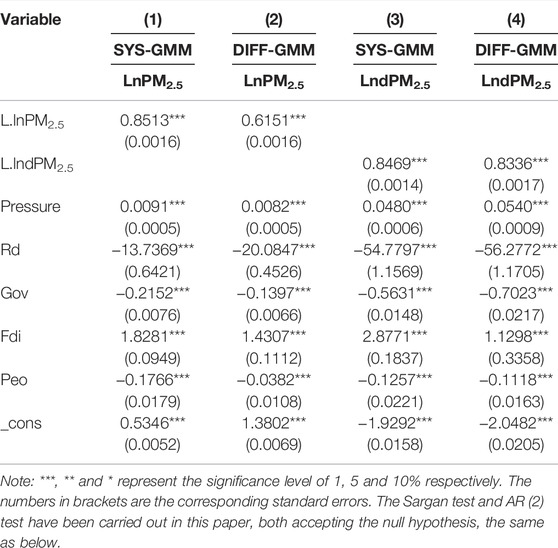

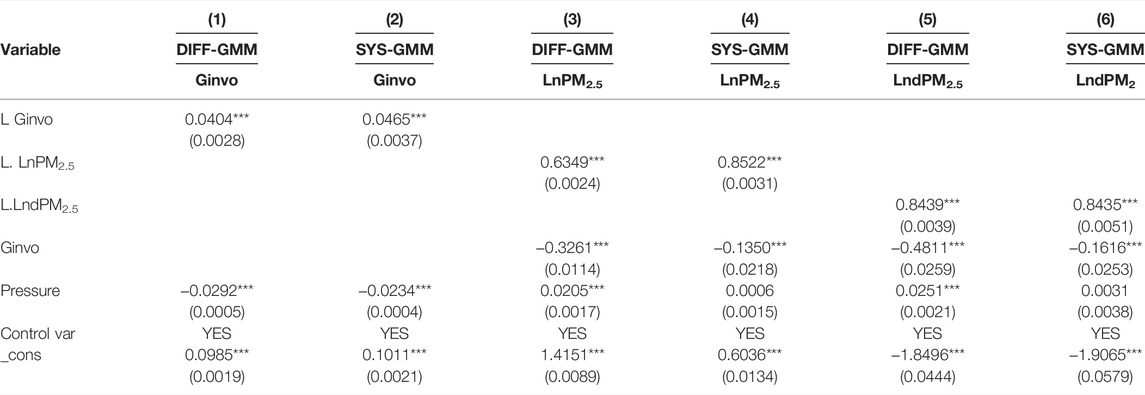

Table 2 shows the regression results of the impact of financial pressure on pollution emissions in resource-dependent cities. Model (1) and model (2) take the PM2.5 concentration as the regression result of the explained variable, and model (3) and model (4) take the PM2.5 concentration per unit of output as the regression result of the explained variable. In addition, the SYS-GMM and DIFF-GMM regression methods are used to estimate the dynamic panel model, which can effectively alleviate problems of endogeneity and reduce bias in the empirical results.

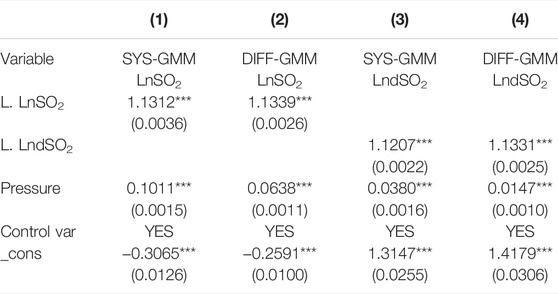

TABLE 2. Baseline test of the impact of financial pressure on pollution emission of resource-dependent cities.

The results show that regardless of whether the PM2.5 concentration or the PM2.5 concentration per unit of output is the explained variable, the coefficient of financial pressure on resource-dependent cities remains positive and significant at the 1% level under different regression models. This indicates that financial pressure on resource-dependent cities will accelerate pollution emissions and lead to environmental deterioration. The result shows that governments will take extensive measures to stimulate production at the cost of sacrificing the environment when dealing with fiscal pressure in resource-dependent cities. H1 is proven to be valid. Regarding the control variables, the coefficient of the first-order lag term of pollution emissions remains positive and significant at the 1% level, indicating that pollution emissions have strong path-dependent characteristics. The impact of R&D investment (Rd) on pollution emissions remains negative and significant at the 1% level, indicating that increasing R&D investment can restrain pollution emissions and improve environmental quality by promoting technological progress. The influence of government leadership (Gov) on pollution emissions is negative and significant at the 1% level, indicating that the government, as the main body of environmental governance, plays a vital role in improving environmental quality. The influence of foreign direct investment (Fdi) on pollution emissions is positive and significant at the 1% level, indicating that foreign direct investment aggravates environmental pollution and that the pollution haven effect is established in China’s resource-dependent cities. The impact of population growth (Peo) on pollution emissions is significantly negative, indicating that the current slowdown in population growth in China is conducive to reducing pollution emissions and improving environmental quality to a certain extent.

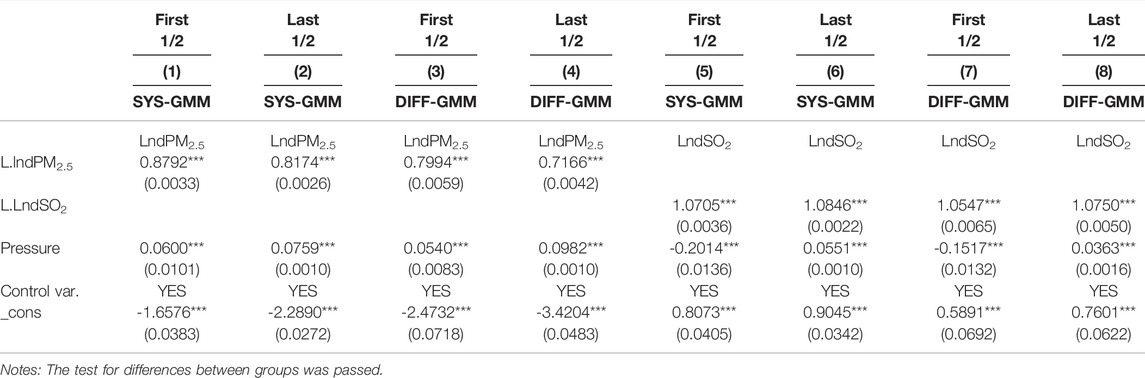

Robustness tests are conducted by replacing the explanatory variables; that is, PM2.5 emissions are replaced by SO2 emissions. The regression results are shown in Table 3. In models (1) and (2), the regression results are based on using the SO2 concentration as the explanatory variable, while in models (3) and (4), the SO2 concentration per unit of output is used. The dynamic panel models are estimated using the SYS-GMM and DIFF-GMM regression methods. The results show that regardless of whether the explanatory variable is the SO2 concentration or the SO2 concentration per unit of output and regardless of the regression method that is used, the regression coefficient of fiscal pressure (Pressure) remains positive and significant at the 1% level, which further confirms that fiscal pressure has a positive effect on air pollution emissions and induces pollution effects that are detrimental to environmental quality improvement.

TABLE 3. Robustness test of the impact of financial pressure on pollution emission of resource-dependent cities.

4.2 Heterogeneity Analysis

The entire sample is divided into two parts for grouped regressions: cities with financial pressure at the first 50% median and those with financial pressure at the last 50% median. The regression results are presented in Table 4. In models (1)–(4), the regression results are based on using the PM2.5 concentration per unit of output as the explanatory variable, and in models (5)–(8), the regression results are based on using the SO2 concentration per unit of output for the robustness test. Models (1), (3), (5), and (7) show the regression results for cities with fiscal pressure in the first 50% median; models (2), (4), (6), and (8) show the regression results for cities with fiscal pressure in the last 50% median. Models (1), (2), (5), and (6) are regressed using the SYS-GMM method; models (3), (4), (7), and (8) are regressed using the DIFF-GMM method. The empirical results show that the regression coefficients of fiscal pressure in the high median group are larger than those in the low median group regardless of whether the PM2.5 concentration per unit of output or the SO2 concentration per unit of output is chosen as the explanatory variable. The results indicate that environmental pollution is more severe in resource-based cities with higher fiscal pressure. In such cities, the government actively develops the advantages of resource industries. It accelerates the development of resource industries to relieve fiscal pressure, squeezing out environmental protection expenditures and relaxing environmental controls. This means that in resource-based cities with higher fiscal pressure, local government behavior may be distorted, and some behaviors incentivize production through various sacrifices to the environment.

TABLE 4. Influence of different financial pressure intensities on air pollution emissions in resource-dependent cities.

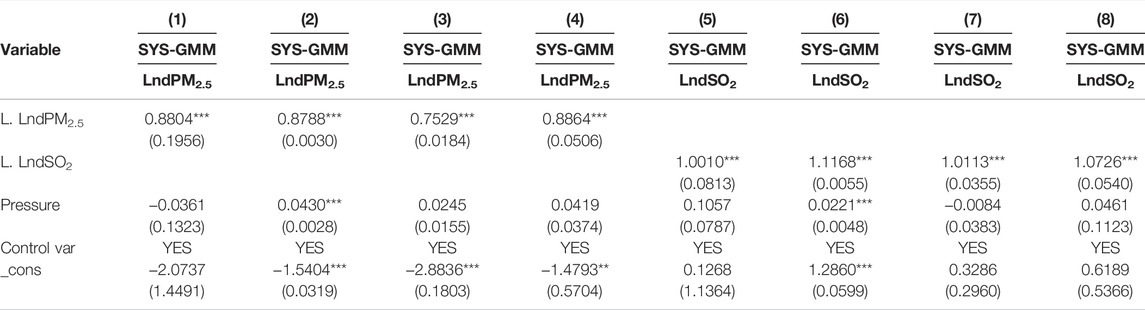

Additionally, based on the classification method for resource-based cities in the Sustainable Development Planning of National Resource-based Cities (2003–2020), we divide these cities into four categories: the growth type, mature type, decline type, and regenerative type. Based on this division, the impact of fiscal pressure on pollution emissions in different types of resource-based cities is further examined in a disaggregated manner. The regression results are presented in Table 5. Models (1)–(4) show the regression results when the PM2.5 concentration per unit of output is the explanatory variable; models (5)–(8) show the regression results when the SO2 concentration per unit of output is the explanatory variable. Models (1) and (5) show the regression results for growth-type resource-based cities; models (2) and (6) show the regression results for mature-type cities; models (3) and (7) show the regression results for decline-type resource-based cities; and models (4) and (8) show the regression results for regenerative-type resource-based cities. The results show that the coefficient of fiscal pressure remains positive and significant at the 1% level only for mature-type resource-based cities regardless of whether the PM2.5 concentration per unit of output or the SO2 concentration per unit of output is the explanatory variable. The results suggest that fiscal pressure is more likely to induce environmental degradation in mature-type resource-based cities than in other types of resource-based cities.

TABLE 5. Impact of financial pressure on air pollution emissions in different resource-dependent cities.

The possible reason for this result is that there are differences in the government’s development patterns and development priorities for the four types of resource-based cities. Growing cities mainly promote their regulated and orderly development, raise the access threshold for resource development, and reasonably determine the development intensity. Mature cities should promote their leapfrog development, lengthen the industrial chain, and cultivate resource deep-processing enterprises. Declining cities vigorously develop the succession of alternative industries and solve the most prominent historical legacy problems to accelerate their transformation and development. Regenerative cities guide their innovative development, improve the quality and efficiency of development, and establish a long-term mechanism for sustainable development.

For this reason, the fiscal pressure of mature resource cities is more likely to induce environmental degradation than that of other types of resource-based cities. Mature resource cities have a large scale of resource industries, and resource development has reached a stable stage. However, the government’s leapfrog development model for mature cities and higher dependence on resource industries make the regional development more likely to expose disadvantages such as a single resource industry structure as financial pressure increases. The high resource endowment leads to the environmental pollution “lockin” effect, and the environmental deterioration becomes evident.

4.3 Individual Characteristics of Officials

To verify H2 and test the influence of the age and tenure of officials on the environmental effect of fiscal pressure, this paper constructs an interaction term between fiscal pressure and the individual characteristics of officials to explore their effect on the environmental effect of fiscal pressure. With reference to the method of Yu et al. (2019a), the following model is proposed:

Equation 2 tests the moderating effect of officials’ age on fiscal pressure, while Eq. 3 tests the moderating effect of officials’ tenure on fiscal pressure. We expect the result that β_1 < 0, β_2 > 0. Regarding the method used by Yao and Zhang (2013), the age of an official is measured by subtracting the birth year of the official from the age of the official during his or her term of office, while the term of an official is represented by the time from when the official takes office to when he or she leaves office. In this paper, officials are local party secretaries and mayors, and the data come from the official websites of governments at all levels (Yu et al., 2019b).

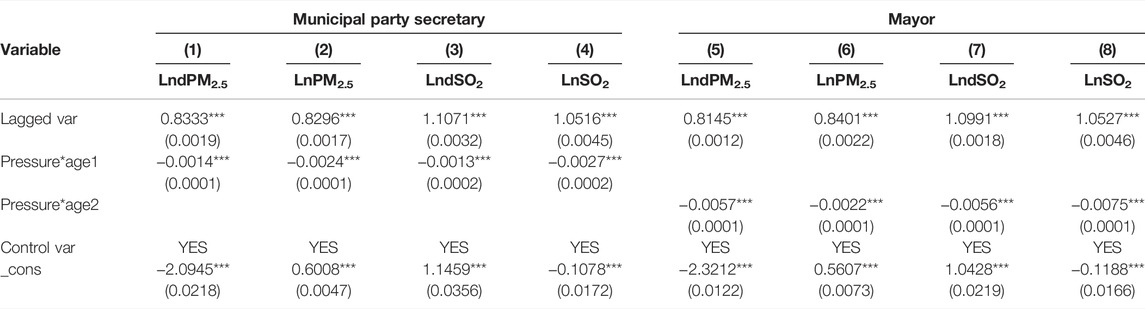

Table 6 shows the regression results of the effect of officials’ age on the environmental effect of financial pressure. Models (1)–(4) show the regression results of the interaction term between the age of municipal party secretaries and financial pressure; models (5)–(8) show the regression results of the interaction term between mayors’ age and financial pressure. Models (1) and (5) show the regression results when the PM2.5 concentration per unit of output is the explained variable; models (3) and (7) show the regression results when the SO2 concentration per unit of output is the explained variable; models (2) and (6) show the regression results when the PM2.5 concentration is the explained variable; and models (4) and (8) show the regression results when the SO2 concentration is the explained variable. The regression results show that the coefficient of the interaction term between the age of either party secretaries or mayors and financial pressure is negative and significant at the 1% level. The results show that the increase in the age of local officials is conducive to weakening the positive impact of financial pressure on pollution emissions and promoting an improvement in regional environmental quality.

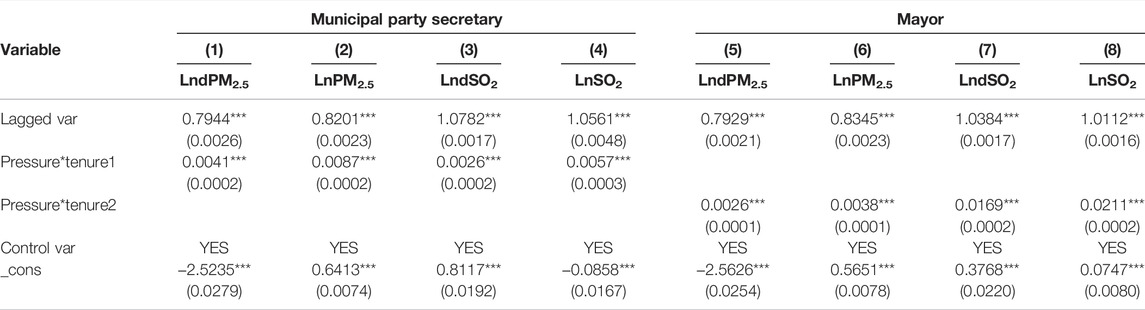

Table 7 shows the regression results of the impact of officials’ tenure on the environmental effect under fiscal pressure. Models (1)–(4) show the regression results of the interaction term between municipal secretaries’ tenure and fiscal pressure; models (5)–(8) show the regression results of the interaction term between mayors’ tenure and fiscal pressure. Models (1) and (5) show the regression results when the PM2.5 concentration per unit of output is the explanatory variable. In contrast, models (3) and (7) show the regression results when the SO2 concentration per unit of output is the explanatory variable. Models (2) and (6) show the regression results when the PM2.5 concentration is the explanatory variable, and models (4) and (8) show the regression results when the SO2 concentration is the explanatory variable. The regression results show that the coefficients of the interaction term between the tenure of either municipal party secretaries or mayors and fiscal pressure remain positive and significant at the 1% level. The results indicate that as local officials’ tenure in office increases, it exacerbates the positive effect of fiscal pressure on pollution emissions, which is not conducive to improving environmental quality. Therefore, H2 is valid.

4.4 Test of the Transmission Mechanism

The results above show that fiscal pressure in resource-based cities exacerbates pollution emissions and is not conducive to improving environmental quality. The question naturally arises regarding the mechanism through which fiscal pressure in resource-based cities affects pollution emissions. Empirical studies show that the regional industrial structure is an important factor that affects regional environmental conditions. If the dominant industry in a region is environmentally friendly, then the environmental conditions are good; otherwise, they deteriorate. As regional fiscal pressure increases, local governments tend to loosen environmental controls in exchange for economic growth. They also accelerate the development of pillar industries, which in resource-based cities are often not environmentally friendly, hindering industrial structure optimization and accelerating environmental pollution (Ebenstein, 2012). In addition, green technology innovation has become an important tool for improving environmental quality, and the academic community has reached a consensus on this point (Acemoglu et al., 2012; Shen et al., 2021). Therefore, an increase in government fiscal pressure may have a crowding-out effect on green technology innovation. Therefore, to test H3, this paper employs the method used by Gelbach (2016) to test the transmission role of the industrial structure and green technology innovation in the pollution effect of fiscal pressure. The following regression equation is established:

where

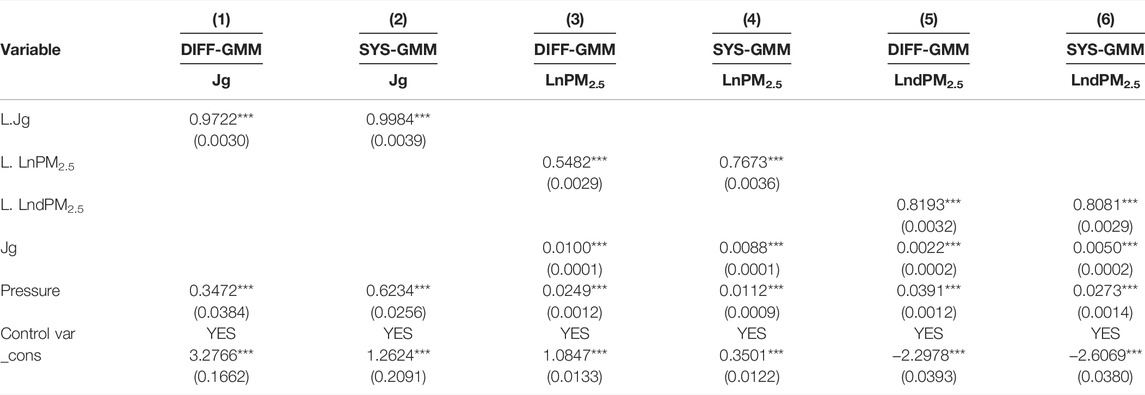

Table 8 shows the regression results of the industrial structure transmission mechanism of the impact of financial pressure on pollution emissions. DIFF-GMM regression is used for models (1), (3), and (5), and SYS-GMM regression is used for models (2), (4), and (6). Models (1) and (2) show the regression results of the mediation model, and models (3)–(6) show the regression results of the comprehensive model. Models (3)–(4) show the regression results when the PM2.5 concentration is the explained variable, and models (5)–(6) show the regression results when the PM2.5 concentration per unit of output is the explained variable. The results of models (1) and (2) show that financial pressure has a positive effect on upgrading an industrial structure dominated by the secondary industry; that is, financial pressure will hinder industrial structure upgrading. The results of models (3)–(6) show that regardless of whether the PM2.5 concentration or the PM2.5 concentration per unit of output is the explained variable, an industrial structure dominated by the secondary industry aggravates environmental pollution, indicating that the financial pressure of resource-dependent cities will hinder industrial structure upgrading. A high degree of dependence on resource endowment leads to a lack of freedom in economic development. Therefore, rapid economic development can be achieved by accelerating the development of the secondary industry, forming a “resource gospel” for economic growth, and helping to relieve financial pressure to a certain extent. However, accelerating secondary industry development can also aggravate environmental pollution.

TABLE 8. Transmission mechanism of financial pressure pollution effect in resource-dependent cities -industrial structure effect.

Table 9 shows the regression results of the green technology innovation transmission mechanism of the effect of fiscal pressure on pollution emissions. Models (1), (3), and (5) are regressed through the DIFF-GMM method, and models (2), (4), and (6) are regressed through the SYS-GMM method. Models (1) and (2) show the regression results of the mediated model. Models (3)–(6) show the regression results of the integrated model, where models (3)–(4) show the regression results when the PM2.5 concentration is the explanatory variable, and models (5)–(6) show the regression results when the PM2.5 concentration per unit of output is the explanatory variable. The results of models (1) and (2) show that fiscal pressure has a negative effect on green technology innovation, meaning that fiscal pressure crowds out green technology innovation in the region. Furthermore, the results of models (3)–(6) show that the effect of green technology innovation on pollution emissions is negative regardless of whether the PM2.5 concentration or PM2.5 concentration per unit of output is the explanatory variable. These results indicate that fiscal pressure in resource-based cities will force local governments to squeeze out investment in green technology innovation, weaken the green technology innovation capacity of the region, enhance economic development at the expense of the environment, and gain an economic growth advantage. For this reason, H3 is proven to be valid.

TABLE 9. Transmission mechanism of fiscal pressure pollution effect in resource-dependent cities - green technology innovation effect.

5 Conclusions and Policy Implications

This paper explores the environmental effects of governmental fiscal pressure and use a dynamic panel model based on 2003-2018 panel data on resource-based cities in China. The findings show that (1) fiscal pressure has a significant air pollution effect in resource-based cities, and environmental deterioration becomes more pronounced as the intensity of fiscal pressure increases. Comparing different types of resource-based cities, we find that the air pollution effect of fiscal pressure is most significant in mature-type resource-based cities. (2) As the tenure of officials increases, the air pollution effect of fiscal pressure intensifies; in contrast, as the age of local officials increases, it facilitates an improvement in the air pollution effect of fiscal pressure. (3) Fiscal pressure exacerbates environmental degradation mainly by impeding industrial structure upgrading and crowding out urban green innovation. Based on the conclusions above, we propose the following suggestions for the economic transformation and upgrading of resource-based cities. Following suggestions for the economic transformation and upgrading of resource-based cities are proposed.

First, multichannel transfer payment mechanisms should be established to improve the efficiency of local government fiscal expenditures and to relieve fiscal pressure in resource-based regions. Finances are a key factor in the government’s environmental governance, and fiscal pressure aggravates environmental pollution. Thus, fiscal pressure can be eased by accelerating the optimization and transformation of the fiscal expenditure structure and establishing horizontal transfer payments between regions. Additionally, by improving the fiscal expenditure evaluation system, we can achieve the goals of economical, efficient, and effective fiscal expenditure, coordinating the development of regions, and promoting the construction of ecological civilization to realize the high-quality development of resource-based regions.

Second, green development should be incorporated into the promotion assessment mechanism for government officials, and the role of the individual characteristics of officials in the environmental governance of resource-based regions should be fully considered. For example, the empirical results show that older local officials have a catalytic effect on improving regional environmental quality. For this reason, the appointment of local officials should not blindly emphasize youthfulness; instead, officials should be scientifically judged based on their contribution to high-quality urban development. Additionally, longer tenures of officials do not effectively improve regional environmental quality. Therefore, a reasonable assessment and tenure system should be established to promote environmental quality improvement through appropriate changes in officials while ensuring policy stability and the continuity of officials’ appointments.

Third, it is essential to stimulate regional green technology innovation through policies to ensure that we can give full play to the leading role of green technology innovation in the transformation and upgrading of resource-based cities. The transformation and upgrading of resource-based cities is a gradual process. Full consideration can be given to promoting the derivation, extension, and replacement of the industrial chain of resource-based cities through green technology innovation to realize the green development of the industrial chain. The government should also actively promote the transformation of resource industries. We can optimize the industrial structure and crack the pollution lockin effect formed by dependence on resource industries through technological progress, promoting the leapfrog development of mature-type resource-based cities. Improving the diversified industrial system and comprehensively promoting the transformation and upgrading of resource-based cities are also necessary.

This paper focuses on the macro-level analysis of the cities. However, with the development of more energy-intensive, high-emission industries and the disclosure of more corporate environmental information, future research will be able to look into micro-level enterprise data. This will help to identify the impact of financial pressure on pollution with new evidence of the environmental effects of large-scale firms. In addition, with the advent of a new round of the scientific and technological revolution, follow-up research will further focus on the crucial role of artificial intelligence and big data technology in the transformation of resource-dependent cities.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author, ZJ, upon reasonable request.

Author Contributions

CH: software, methodology, writing original draft, and project. BL: software, methodology, investigation, writing original draft. LT: Investigation, visualization. JZ: conceptualization, writing- review and editing, funding acquisition, supervision. FS: data curation, methodology, formal analysis, writing original draft.

Funding

This research is funded by the Shanghai Philosophy and Social Sciences Program (Project No: 2020EGL012) and Shanghai Pujiang Talent Program (Project No: 2020PJC073).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acemoglu, D., Aghion, P., Bursztyn, L., and Hemous, D. (2012). The Environment and Directed Technical Change. Am. Econ. Rev. 102 (1), 131–166. doi:10.1257/aer.102.1.131

Acemoglu, D. (2002). Directed Technical Change. Rev. Econ. Stud. 69, 781–809. doi:10.1111/1467-937x.00226

Aghion, P., Dechezleprêtre, A., Hémous, D., Martin, R., and Van Reenen, J. (2016). Carbon Taxes, Path Dependency, and Directed Technical Change: Evidence from the Auto Industry. J. Political Econ. 124 (1), 1–51. doi:10.1086/684581

Antonelli, C. (2016). Technological Congruence and the Economic Complexity of Technological Change. Struct. Change Econ. Dyn. 38, 15–24. doi:10.1016/j.strueco.2015.11.008

Bai, J., Lu, J., and Li, S. (2018). Fiscal Pressure, Tax Competition and Environmental Pollution. Environ. Resour. Econ. 73 (1), 1–17. doi:10.1007/s10640-018-0269-1

Bai, Y., and Kung, J. K.-s. (2014). The Shaping of an Institutional Choice: Weather Shocks, the Great Leap Famine, and Agricultural Decollectivization in China. Explor. Econ. Hist. 54 (10), 1–26. doi:10.1016/j.eeh.2014.06.001

Basu, S., and Weil, D. N. (1998). Appropriate Technology and Growth. Q. J. Econ. 113 (4), 1025–1054. doi:10.1162/003355398555829

Balsalobre-Lorente, D., Shahbaz, M., Roubaud, D., and Farhani, S. (2018). How Economic Growth, Renewable Electricity and Natural Resources Contribute to CO2 Emissions? Energy Policy 113, 356–367. doi:10.1016/j.enpol.2017.10.050

Cai, G., Zhang, X., and Yang, H. (2022). Fiscal Stress and the Formation of Zombie Firms: Evidence from China. China Econ. Rev. 71, 101720. doi:10.1016/j.chieco.2021.101720

Calel, R., and Dechezleprêtre, A. (2016). Environmental Policy and Directed Technological Change: Evidence from the European Carbon Market. Rev. Econ. Statistics 98 (1), 173–191. doi:10.1162/rest_a_00470

Chen, C. (2020). Technology Adoption, Capital Deepening, and International Productivity Differences. J. Dev. Econ. 143, 102388. doi:10.1016/j.jdeveco.2019.102388

Cole, M. A., and Fredriksson, P. G. (2009). Institutionalized Pollution Havens. Ecol. Econ. 68 (4), 1239–1256. doi:10.1016/j.ecolecon.2008.08.011

Dean, J. M., Lovely, M. E., and Wang, H. (2009). Are Foreign Investors Attracted to Weak Environmental Regulations? Evaluating the Evidence from China. J. Dev. Econ. 90 (1), 1–13. doi:10.1016/j.jdeveco.2008.11.007

Denise, V., Lorentzen, P., and Mattingly, D. (2017). Racing to the Bottom or to the Top? Decentralization, Revenue Pressures, and Governance Reform in China. World Dev. 95, 164–176. doi:10.1016/j.worlddev.2017.02.021

Dong, Z., and Wang, H. (2021). Urban Wealth and Green Technology Choice. Econ. Res. J. 56 (04), 143–159.

Ebenstein, A. (2012). The Consequences of Industrialization: Evidence from Water Pollution and Digestive Cancers in China. Rev. Econ. Statistics 94 (1), 186–201. doi:10.1162/rest_a_00150

Emrah, K., and Cali, N. (2018). Social Sciences and the Mining Sector: Some Insights into Recent Research Trends. Resour. Policy 58, 257–267.doi:10.1016/j.resourpol.2018.05.014

Fan, Z., and Tian, B. (2013). Tax Competition, Tax Enforcement and Tax Avoidance. Econ. Res. J. 48 (01), 137–150.

Gelbach, J. B. (2016). When Do Covariates Matter? and Which Ones, and How Much? J. Labor Econ. 34, 509–543. doi:10.1086/683668

Gylfason, T. (2001). Natural Resources, Education, and Economic Development. Eur. Econ. Rev. 45, 847–859. doi:10.1016/s0014-2921(01)00127-1

Han, L., and Kung, J. K.-S. (2015). Fiscal Incentives and Policy Choices of Local Governments: Evidence from China. J. Dev. Econ. 116, 89–104. doi:10.1016/j.jdeveco.2015.04.003

Jerzmanowski, M., and Tamura, R. (2019). Directed Technological Change & Cross-Country Income Differences: A Quantitative Analysis. J. Dev. Econ. 141, 102372. doi:10.1016/j.jdeveco.2019.102372

Jia, R. (2017). Pollution for Promotion. 21st Century China Center Research Paper No. 2017-05. Available at SSRN: https://ssrn.com/abstract=3029046.

Jiao, W., Zhang, X., Li, C., and Guo, J. (2020). Sustainable Transition of Mining Cities in China: Literature Review and Policy Analysis. Resour. Policy (29), 101867. doi:10.1016/j.resourpol.2020.101867

Karlsson, R. (2012). Carbon Lock-In, Rebound Effects and China at the Limits of Statism. Energy Policy 51, 939–945. doi:10.1016/j.enpol.2012.09.058

Kou, P., and Han, Y. (2021). Vertical Environmental Protection Pressure, Fiscal Pressure, and Local Environmental Regulations: Evidence from China's Industrial Sulfur Dioxide Treatment. Environ. Sci. Pollut. Res., 1–16. doi:10.1007/s11356-021-14947-7

Li, B., and Dewan, H. (2017). Efficiency Differences Among China's Resource-Based Cities and Their Determinants. Resour. Policy 51, 31–38. doi:10.1016/j.resourpol.2016.11.003

Li, H., Lo, K., and Wang, M. (2015). Economic Transformation of Mining Cities in Transition Economies: Lessons from Daqing, Northeast China. Int. Dev. Plan. Rev. 37 (3), 311–328. doi:10.3828/idpr.2015.19

Li, H., and Zhou, L. A. (2005). Political Turnover and Economic Performance: the Incentive Role of Personnel Control in China. J. Public Econ. 89 (9), 1743–1762. doi:10.1016/j.jpubeco.2004.06.009

Li, J., and Xu, B. (2018). Curse or Blessing: How Does Resource Abundance Affect China's Green Economic Growth?. Econ. Res. J. 53 (09), 151–167.

Li, S., Zhao, Y., Xiao, W., Yue, W., and Wu, T. (2021). Optimizing Ecological Security Pattern in the Coal Resource-Based City: A Case Study in Shuozhou City, China. Ecol. Indic. 130, 108026. doi:10.1016/j.ecolind.2021.108026

Lin, B., and Zhou, Y. (2021). Does Fiscal Decentralization Improve Energy and Environmental Performance? New Perspective on Vertical Fiscal Imbalance. Appl. Energy 302, 117495. doi:10.1016/j.apenergy.2021.117495

Li, J., and Xu, B. (2018). Curse or Blessing: How Does Natural Resource Abundance Affect Green Economic Growth in China? Econ. Res. J. 53 (9), 151–161.

Ma, D., Fei, R., and Yu, Y. (2018). How Government Regulation Impacts on Energy and CO2 Emissions Performance in China's Mining Industry. Resour. Policy 62, 651–663. doi:10.1016/j.resourpol.2018.11.013

Marais, L., Mckenzie, F. H., Deacon, L., Nel, E., Rooyen, D. v., and Cloete, J. (2018). The Changing Nature of Mining Towns: Reflections from Australia, Canada and south Africa. Land Use Policy 76, 779–788. doi:10.1016/j.landusepol.2018.03.006

Mccabe, B. C., Feiock, R. C., Clingermayer, J. C., and Stream, C. (2008). Turnover Among City Managers: the Role of Political and Economic Change. Public Adm. Rev. 68 (2), 380–386. doi:10.1111/j.1540-6210.2007.00869.x

Papyrakis, E., and Gerlagh, R. (2007). Resource Abundance and Economic Growth in the United States. Eur. Econ. Rev. 51 (4), 1011–1039. doi:10.1016/j.euroecorev.2006.04.001

Romanelli, E., and Khessina, O. M. (2005). Regional Industrial Identity: Cluster Configurations and Economic Development. Organ. Sci. 16 (4), 344–358. doi:10.1287/orsc.1050.0131

Sachs, J., and Warner, A. (2001). The Curse of Natural Resources. Eur. Econ. Rev. 45 (4), 827–838. doi:10.1016/s0014-2921(01)00125-8

Shao, S., Yang, L., Yu, M., and Yu, M. (2011). Estimation, Characteristics, and Determinants of Energy-Related Industrial CO2 Emissions in Shanghai (China), 1994-2009. Energy Policy 39, 6476–6494. doi:10.1016/j.enpol.2011.07.049

Shen, F., Liu, B., Luo, F., Wu, C., Chen, H., and Wei, W. (2021). The Effect of Economic Growth Target Constraints on Green Technology Innovation. J. Environ. Manag. 292, 112765. doi:10.1016/j.jenvman.2021.112765

Su, C.-W., Umar, M., and Khan, Z. (2021). Does Fiscal Decentralization and Eco-Innovation Promote Renewable Energy Consumption? Analyzing the Role of Political Risk. Sci. Total Environ. 751, 142220. doi:10.1016/j.scitotenv.2020.142220

Sun, M., and Ding, S. (2005). The Analysis on the Reasons of Institution System in Chinese Resource-Typed Cities' Recession. Econ. Geogr. 25 (2), 273–276.

Takatsuka, H., Zeng, D.-Z., and Zhao, L. (2015). Resource-based Cities and the Dutch Disease. Resour. Energy Econ. 40, 57–84. doi:10.1016/j.reseneeco.2015.01.003

Unruh, G. C., and Carrillo-Hermosilla, J. (2006). Globalizing Carbon Lock-In. Energy Policy 34 (10), 1185–1197. doi:10.1016/j.enpol.2004.10.013

Unruh, G. C. (2002). Escaping Carbon Lock-In. Energy Policy 30 (4), 317–325. doi:10.1016/s0301-4215(01)00098-2

Wooldridge, J.M. (2001). Econometric Analysis of Cross Section and Panel Data. Cambridge, MA: The MIT Press.

Wang, F., He, J., and Niu, Y. (2022). Role of Foreign Direct Investment and Fiscal Decentralization on Urban Haze Pollution in China. J. Environ. Manag. 305, 114287. doi:10.1016/j.jenvman.2021.114287

Wei, W., Li, J., Chen, B., Wang, M., Zhang, P., Guan, D., et al. (2021b). Embodied Greenhouse Gas Emissions from Building China's Large-Scale Power Transmission Infrastructure. Nat. Sustain., 1–9. doi:10.1038/s41893-021-00704-8

Wei, W., Xin, Z., Geng, Y., Li, J., Yao, M., Guo, Y., et al. (2021a). The Reallocation Effect of China's Provincial Power Transmission and Trade on Regional Heavy Metal Emissions. iScience 24, 102529. doi:10.1016/j.isci.2021.102529

Wen, H., and Lee, C.-C. (2020). Impact of Fiscal Decentralization on Firm Environmental Performance: Evidence from A County-Level Fiscal Reform in China. Environ. Sci. Pollut. Res. 27, 36147–36159. doi:10.1007/s11356-020-09663-7

Wu, J., Deng, Y., Huang, J., Morck, R., and Yeung, B. (2014). Incentives and Outcomes: China's Environmental Policy. Capitalism Soc. 9 (1), 1–41. doi:10.2139/ssrn.2206043

Xu, C., Pang, Y., and Liu, D. (2020). Local Fiscal Pressure and Government Expenditure Efficiency: The Reform of Income Tax Sharing as A Quasi-Natural Experiment. Econ. Res. J. 55 (06), 138–154.

Yu, Y., Liu, D., and Gong, Y. (2019a). Target of Local Economic Growth and Total Factor Productivity. Manag. World 35 (07), 26–42. doi:10.19744/j.cnki.11-1235/f.2019.0090

Yu, Y., Yang, X., and Li, K. (2019b). Effects of the Terms and Characteristics of Cadres on Environmental Pollution: Evidence from 230 Cities in China. J. Environ. Manag. 232, 179–187. doi:10.1016/j.jenvman.2018.11.002

Yao, Y., and Zhang, M. (2013). Official Performance and Promotion Tournament: Evidence from Urban Data. Econ. Res. J. 48(01), 137–150.

Zhang, C., and Zhou, X. (2016). Does Foreign Direct Investment Lead to Lower CO 2 Emissions? Evidence from a Regional Analysis in China. Renew. Sustain. Energy Rev. 58, 943–951. doi:10.1016/j.rser.2015.12.226

Keywords: resource-dependent cities, fiscal pressure, air pollution, industrial upgrading, urban green innovation, China

Citation: Hui C, Shen F, Tong L, Zhang J and Liu B (2022) Fiscal Pressure and Air Pollution in Resource-Dependent Cities: Evidence From China. Front. Environ. Sci. 10:908490. doi: 10.3389/fenvs.2022.908490

Received: 30 March 2022; Accepted: 02 May 2022;

Published: 31 May 2022.

Edited by:

Jiashuo Li, Shandong University, ChinaReviewed by:

Kangyin Dong, University of International Business and Economics, ChinaYang Zhou, Fudan University Shanghai, China

Chen Feng, Shanghai University of Finance and Economics, China

Copyright © 2022 Hui, Shen, Tong, Zhang and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jingru Zhang, emhhbmdqaW5ncnVAc2p0dS5lZHUuY24=; Bei Liu, ZW5lcmd5YmVpQG5qdXB0LmVkdS5jbg==

Changhong Hui1

Changhong Hui1 Jingru Zhang

Jingru Zhang