- 1Hangzhou Dianzi University Information Engineering School, Hangzhou, China

- 2School of Business and Economics, United International University, Dhaka, Bangladesh

- 3Department of Accounting, College of Business Administration, Prince Sattam Bin Abdulaziz University, Al-Kharj, Saudi Arabia

The aim of this study is to gauge the impact of global economic policy uncertainty and natural resource prices, that is, oil prices and gold prices, on Bitcoin returns by using monthly data spanning from May 2013 to December 2021. The study applies ARDL and nonlinear ARDL for evaluating the symmetric and asymmetric effects of Global Economic Uncertainty (GU), oil price (O), and natural gas price on Bitcoin volatility investigated by using the ARCH-GARCH-ERAGCH and non-granger causality test. ARDL model estimation establishes a long-run cointegration between GU, O, G, and Bitcoin. Moreover, GU and oil price exhibits a negative association with Bitcoin and positive influences running from gold price shock to Bitcoin in the long run. NARDL results ascertain the long-run asymmetric relations between GU, oil price, gold price (G), and Bitcoin return. Furthermore, GU’s asymmetric effect and positive shock in gold price negatively linked to Bitcoin return in the long run, whereas asymmetric shock in oil price and negative shocks in gold price established a positive linkage with Bitcoin. The results of ARCH effects disclose the volatility persistence in the variables. The causality test reveals that the feedback hypothesis explains the causal effects between GU and Bitcoin and unidirectional causality running from Bitcoin to gold price and oil price to Bitcoin.

1 Introduction

The globe has seen remarkable breakthroughs in cryptography and processing power over the last two decades, resulting in the emergence of a new sort of currency, cryptocurrencies. Bitcoin, founded in 2009, has established itself as the forerunner of cryptocurrencies, being the most practical and widely adopted one to date. The technology is disseminated via a network of wallets and nodes, enabling faster, more affordable, borderless transactions, and complete anonymity if desired. Bitcoin’s early adopters were primarily libertarians hostile to any government and those selling illegal items. Satoshi Nakamoto invented Bitcoin in 2008 and made it available to the public on January 8 2009. The founders of Bitcoin sought to establish a cash-like payment system that allowed online transactions and kept many of the benefits of physical cash (Berentsen and Schär, 2018).

In recent years, digital currencies have gained much interest, invading the intellectual, financial, and public policy sectors. The problem arises from a theoretical standpoint because digital currencies have contested characteristics that cast doubts on the traditional notion of money. The word “digital money” is vague because of a technical definition; it might refer to a protocol, platform, currency, or payment system (Dutta and Bouri, 2022) (Athey et al., 2016). Bitcoin (BTC) has got practically all of the attention among digital currencies; it was created in 2009 and functions as a peer-to-peer kind of electronic cash, allowing online transactions without using the banking system (Nakamoto, 2008). Digital money is commonly referred to as cryptocurrency since it uses encryption to govern the manufacturing of coins and transactions. Bitcoin is a potential alternative currency to traditional currencies (such as the US dollar, Euro, and Japanese yen) that offers several advantages, including low or no transaction fees, a regulated and well-known algorithm for creating new currencies, and complete transparency in all transactions. The success of Bitcoin has spawned a swarm of other cryptocurrencies termed “Altcoins,” but none have been able to threaten Bitcoin’s market dominance.

Of all the virtual currencies presently in use, Bitcoin has the largest market cap and number of transactions. The Bitcoin market friction is neither influenced by financial market fundamentals nor key macro fundamentals in the economy. Market fluctuations happen because of market behavior, that is, supply–demand interactions and major market behaviors, such as the foreign exchange market, global economic phenomenon, and business prospects. Therefore, Bitcoin’s price may theoretically be isolated from the economic and market cycles arising from monetary policy and central bank money supply management. In a study, Karame et al. (2015) established that Bitcoin’s price is determined based on the tread volume and the supply of currency. The same line of thought is available in the studies by Li and Wang (2017) and Athey et al. (2016). The performance of Bitcoin increases with other investment goals in conjunction (Wu et al., 2014) and offers diversity advantages (Briere et al., 2015). Moreover, in a portfolio with other commodities, Bitcoin is considered an effective partnership with gold and global inflation obligations because a small supply presents a straightforward precaution against inflation (Harper, 2013).

The price of financial assets is influenced by intrinsic value, investors’ expectations, the price of natural resources, and global phenomena. Over the past decades, with the advancement of behavioral finance, a growing number of researchers have evaluated the impacts of both commodity and human behavior on financial asset price fluctuations (Coulton et al., 2016; Liu et al., 2017; Dutta et al., 2020; Su and Li, 2020). Since its inception, the class of financial assets, Bitcoin, has been placed in an important position in financial literacy and understanding the inherent dynamism. Many researchers have invested time and effort to explore the key determinants. In the literature, finance scholars expose several determents that play a critical role in Bitcoin market performance, such as gold price (Kang et al., 2019), investors’ sentiment (Entrop et al., 2020; Su and Li, 2020), oil price (Okorie and Lin, 2020), the exchange rate (Chu et al., 2015; Hencic and Gouriéroux, 2015), global economic policy uncertainty (Fang et al., 2019; Wang et al., 2019; Lin, 2020), Twitter sentiment (Kaminski, 2014), online communities’ reaction (Kim et al., 2016), and inflation (Malik, 2020).

The aim of this study is to expose the impacts of global economic policy uncertainty (GU), oil price (O), and gold price (G) on Bitcoin return (BR). The study applies the test of cointegration to detect possible long-run association and symmetric and asymmetric effects of EU, G, and O on BR, investigated by performing ARDL-bound testing introduced by Pesaran and Shin (1998), Pesaran et al. (2001a), and the nonlinear framework familiarized by Shin et al. (2014). Furthermore, volatility transmission and linkage are assessed by implementing ARCH and GARCH effects (Bollerslev, 1986). Furthermore, the empirical models’ directional effects investigate the non-granger causality test familiarized by Toda and Yamamoto (1995).

This article’s remaining structure is as follows: Section 2 represents a relevant literature survey. Variable definition and methodology of the study are available in Section 3. Empirical model estimations and their interpretation are explained in Section 4. Study findings and conclusion are explained in Section 5.

2 Literature Review: Bitcoin Coin Determents

In recent years, digital currencies have grown in attention, inevitably approaching the environment of academia, economics, and public policies. This value emerges from a scholarly perspective because it has characteristics that create many political and financial tensions. Bitcoin has been catching almost all of its reflection in digital currency. This virtual currency was developed in 2009 and served as a peer-to-peer version of electronic cash that purchases the internet without intermediating the financial system (Nakamoto, 2008). The price driver of Bitcoin can be grouped into internal and external factors. Internal factors refer to the interaction between supply–demand variables directly pertinent to Bitcoin markets. External factors include country specifics and global phenomena (Kaminski, 2014).

2.1 Global Economic Policy Uncertainty and Bitcoin

The stable economic policy helps shape economic prospects and guides sustainable thriving, whereas economic uncertainty slows development. Under global uncertainty, researchers, including Baur (2013) and Wu et al. (2019), gauge the behavioral aspects of financial assets for hedging in uncertainty and risk mitigation. Financial assets, such as gold and Bitcoin, can act as a safe haven during a financial crisis with unique attributes. It has also been suggested that Bitcoin has been introduced to counter skepticism and insecurity in the present financial system; if any investors lose interest in conventional currencies or the economy, they might resort to Bitcoin. In a study, Fang et al. (2019) gauge the influences of global economic policy uncertainty on the volatility of Bitcoin, gold quantities, and bonds. Findings established that global economic policy uncertainty critically influences the volatility of Bitcoin commodities and gold quantities, but insignificant magnitudes appear for the bond. A similar vein of conclusion is demonstrated in the study of Bouri et al. (2017a), Demir et al. (2018), and Guesmi et al. (2019).

In the literature, the price of financial assistance and commodities immensely relies on the state of economic uncertainty, implying that a higher level of economic uncertainty can cause market movement in a positive direction (Demir et al., 2018). In the literature, economic uncurtaining and Bitcoin nexus explain that the positive association can serve as a safe-haven strategy, but a negative correlation implies a low level of economic uncertainty. When the EPU level is high, and the Bitcoin-gold correlation is negative, Bitcoin is seen as a hazard. However, Bitcoin may not serve as a haven when EPU levels are low.

Furthermore, Wu et al. (2019) evaluate the “safe-haven” properties of Bitcoin and gold for global economic policy uncertainty by applying the GARCH model and quantile regression. The study reveals that Bitcoin is more responsive to EPU shock, whereas gold exhibits stability by showing a marginal hedge and safe-haven coefficient. They also explain that under bullish and bearish market conditions, both gold and Bitcoin perform hedging properties with insignificant impact. Further evidence is available in the study by Wang et al. (2020). They reveal that Bitcoin return reaches the peak during economic uncertainty and the returns gradually decrease as uncurtaining diminishes stability. In another study, Wang et al. (2019) assess risk spillover effects arising from EPU on the Bitcoin performance by applying a multivariate quantile regression and causality tests. Studies establishing the negligible effects of EPU on Bitcoin in all quantile and Granger causality reveal no causal effects running from EPU on Bitcoin. Thus, they advocate that Bitcoin can be a haven for investors, especially during economic volatility.

2.2 Oil Price and Bitcoin

The role of oil price in predicting Bitcoin price and return volatility is also investigated in the literature (Ciaian et al., 2016). In a study, Palombizio and Morris (2012) postulate that oil price shocks indicate inflation by raising the general price level, resulting in the appreciation and depreciation of Bitcoin prices in the market. An increase in the economy’s price level results in shrinking economic progress and capital availability, thus adversely enticing Bitcoin markets (Bouoiyour et al., 2014). A growing number of researchers, including Van Wijk (2013), Guizani and Nafti (2019), and Bouri et al. (2017b), expose a negative association between oil market shocks and Bitcoin return. Wang et al. (2016) evaluated the impact of oil price on the daily volume trade and Bitcoin prices by applying VECM. The cointegration test results establish a long-run association among the variables. Moreover, considering the oil price elasticity on Bitcoin, the study discloses an insignificant effect in the short-run but statistically significant negative influences detected in the long-run. However, no association between the gold price and Bitcoin is also available in the empirical literature Briere et al. (2015), Das and Kannadhasan (2018). The empirical literature suggests that the co-movement of oil price and Bitcoin may not be true in all senses.

2.3 Gold Price and Bitcoin

The position of gold as a surrogate currency, inflation buffer, safe-haven asset, and its usage to achieve greater risk diversification in investor portfolios has received increased attention in the financial literature from policymakers, portfolio owners, and risk managers. After the abandonment of gold convertibility, this is especially the case. Gold’s function as a substitute currency represents its historical role as a store of wealth and trading media, being a valuable resource and widely regarded among diverse cultures. The substitute currency role of gold is often related to its more recent dollar hedge function. Its price volatility is closely linked to money rather than other macroeconomic and financial variables.

A growing number of researchers in the empirical literature evaluate the strategy of a safe haven through investigating the nexus between gold and Bitcoin, but conclusive evidence is yet to be disclosed. In a study, Bouoiyour and Selmi (2015) postulate that for commodity prices, especially silver and gold, Bitcoin can act as a haven; however, this benefit only prevails in the short run, and the effects gradually diminish as time progress. Hence, in the long run, the hedging capacity of Bitcoin is reduced. Dwyer (2015) observes in his findings that Bitcoin returns are more volatile than gold returns, and a similar line of conclusion is available in the study of Dyhrberg (2016).

Bouri et al. (2018) evaluate the effects of commodity prices on Bitcoin by using the daily data from July 17 2010 to February 2 2017, using the quantile nonlinear framework. Studies reveal that future Bitcoin price movements can be forecast by following aggregated commodity prices, especially gold. In contrast, Klein et al. (2018) establish that the gold and Bitcoin markets behave the opposite, and their connection to equity markets is fundamentally different because of distinct prosperities and possessions. They also advocate that only the asymmetric variance of gold markets is observed in Bitcoin return expectations. Thus, the “haven” tag for Bitcoin is not prominently established. In a study, Malik (2020) gauges the impact of gold price money supply on Bitcoin price in India for a period of 156 weeks spanning from 2017–2019 by using VECM. The study reveals that gold money supply and Bitcoin traded volume significantly influence prices. However, neutral effects between shocks in the gold market and Bitcoin performance are also established in the literature by Dyhrberg (2016), Erdas and Caglar (2018), and Das et al. (2020).

2.4 Limitations of the Existing Literature

Because of macro fundamentals, the Bitcoin price movement is apparent from the existing literature. Several studies have investigated the Bitcoin price movement with natural resource prices and economic policy uncertainties by using conventional economical tools. Asymmetrical effects of natural resource prices and uncertainties on Bitcoin performance have yet to be extensively investigated. The aim of the study is to establish a bridge by exploring fresh insight into explaining the asymmetric effects of natural resource prices and uncertainties on Bitcoin behavior both in the long run and short run.

3 Data and Methodology of the Study

3.1 Data and Variable Definition

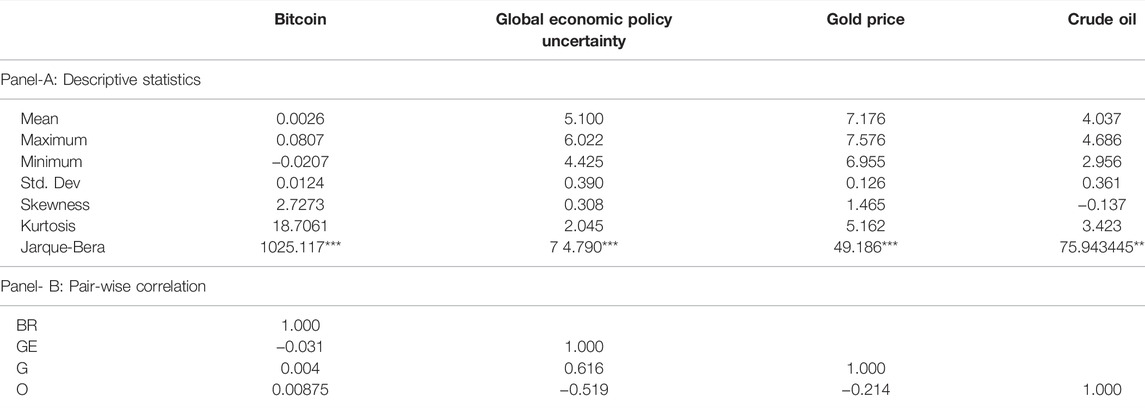

This study considers four variables for the empirical model: Bitcoin return, gold price, crude oiling price, and the global economic policy uncertainty index. The study uses monthly time series data from May 2013 to December 2021. The return of Bitcoin derives from the natural logarithmic of the price difference, bt = 100*log(Pt/Pt-1). The Bitcoin price information is extracted from coindesk (2021);1. Pertinent information on gold price is exported from the World Gold Council (2021);2 and information on crude oil price from DailyFX (2021);3. The linkage between Bitcoin return and the oil price movement and Bitcoin return and gold price has been investigated under the assumption of a safe haven or diversifier (Gkillas et al., 2020). Significant research on the function of cryptocurrencies as a haven amid global financial crises has been carried out. Selmi et al. (2018) investigated the ability of cryptocurrencies to operate as hedges, safe havens, or diversifiers under market stress. The usefulness of Bitcoin in hedging against excessive oil price volatility is compared to that of gold in their research. They use a quantile technique to find possible divergences under a range of market scenarios and conclude that both assets might function as safe havens during times of economic instability. Furthermore, Guesmi et al. (2019) demonstrated that integrating Bitcoin in portfolios and investment methods that include oil, gold, and equities reduces risks by using a multivariate GARCH specification. For the proxy of global economic policy uncertainty (GU), studies by Lin (2020), Fang et al. (2019), and Wang et al. (2019) consider the GEPU index4, which is based on a study by Baker et al. (2016). Fang et al. (2019) emphasize the relevance of global economic or financial volatility when analyzing Bitcoin and other assets. As previously said, the ability of cryptocurrencies to function as a haven in a global financial catastrophe is important. Bouri et al. (2017b)and Bouri et al. (2017a) assess Bitcoin-based hedging options against global uncertainty using a quantile approach, with the American stock market’s volatility index acting as the first crucial component (VIX). They believe that Bitcoin may help investors with shorter investment horizons and reduce risks during instances of high market volatility. Both Demir et al. (2018) and Aalborg et al. (2019) come to the same conclusion: Bitcoin may be used to mitigate risk. The descriptive statistics and unconditional correlation are shown in Table 1.

3.2 The Methodology of the Study

Nowadays, Autoregressive Distributed Lagged (ARDL) has been applied extensively, for instance, by Qamruzzaman and Karim (2020). ARDL offers unique benefits over the existing conventional test of cointegration. According to Ghatak and Ju, (2001), ARDL has a more adaptive capacity for establishing relationships between variables, that is, regardless of sample size, it can be either small or finite, consisting of 30–80 observations. Second, the issue pertinent to a mixed order of integration is fully accommodated in ARDL. Third, Pesaran et al. (2001a) advocated that serial correlation and indignity can be resolved by selecting appropriate lags. Finally, empirical model estimation with ARDL can simultaneously produce long-run and short-run coefficients (Pesaran et al., 2001a). A basic ARDL model for these variables X, Y, and Z can be expressed as follows:

where

In recent times, the nonlinearity assessment in the empirical literature has become one of the main areas using either form of data (Xu et al., 2021; Zhuo and Qamruzzaman, 2021; Andriamahery and Qamruzzaman, 2022; Karim et al., 2022; Qamruzzaman, 2022; Xia et al., 2022; Zhuo and Qamruzzaman, 2022), that is, time series and panel data, especially after the inception of the nonlinear framework by Shin et al. (2014). Under the nonlinear framework, it is possible to detect the positive and negative shocks in the explanatory variable of the dependent variables both in the short run and long run (Ali et al., 2018; Qamruzzaman and Jianguo, 2018a; Qamruzzaman and Jianguo, 2018b; Qamruzzaman and Jianguo, 2018c).

The asymmetric long-run equation of Bitcoin return is

where bt is the return of Bitcoin in the period t,

The decomposition of EU, G, and O estimates applies the following equations:

In the long and short run, asymmetry is investigated in the following ways.

First, the empirical model is to be estimated by applying OLS.

Second, three cointegration tests are to be performed for long-run asymmetry, that is, the F-test of Pesaran et al. (2001b), which involves the testing of the hypothesis “no cointegration” [

In the third step, the presence of long-run and short-run asymmetries is investigated. The long-run symmetry is evaluated by the null hypothesis of “long-run symmetry” (

To assess the directional causality between Bitcoin return (bt), gold price (G), oil price (O), and global economic policy uncertainty (GU), we follow the framework proposed by Toda and Yamamoto (1995), widely known as the non-causality test. The assumption of exiting the Granger causality test, that is, some jointly zero parameters, is not valid with integrated variables. Therefore, to overcome the existing limitations in the traditional causality test, Toda and Yamamoto (1995) proposed a causality test using the modified WALD test with restrictions on a VAR parameter (k). The Toda and Yamamoto (1995) causality test is based on the idea of vector autoregressive at the level (P=K + Dmax) with a correct VAR order K and d as an extra lag, where d represents the maximum order of integration of the time series. We summarized the empirical model of the VAR system in the following equations, where each variable is treated as a dependent variable in the respective equations.

To detect the volatility in the system study, we introduce the following mean equation for GARH effect estimation.

The second model is the exponential GARCH effect.

4 Model Estimation and Interpretation

4.1 Unit Root Test

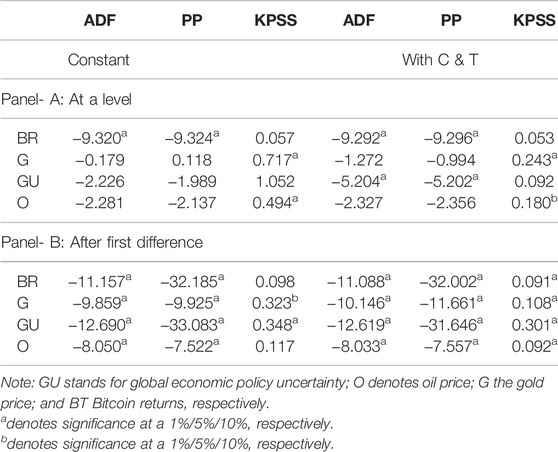

Studies have performed tests of stationary following the ADF test (Dickey and Fuller, 1979), P-P test (Phillips and Perron, 1988), and KPSS test (Kwiatkowski et al., 1992) for detecting the variables’ integration order. The result of unit root tests is shown in Table 2. The study reveals that variables are of mixed order integration, that is, few variables are stationary at the level I (0), and few become the first difference I (1).

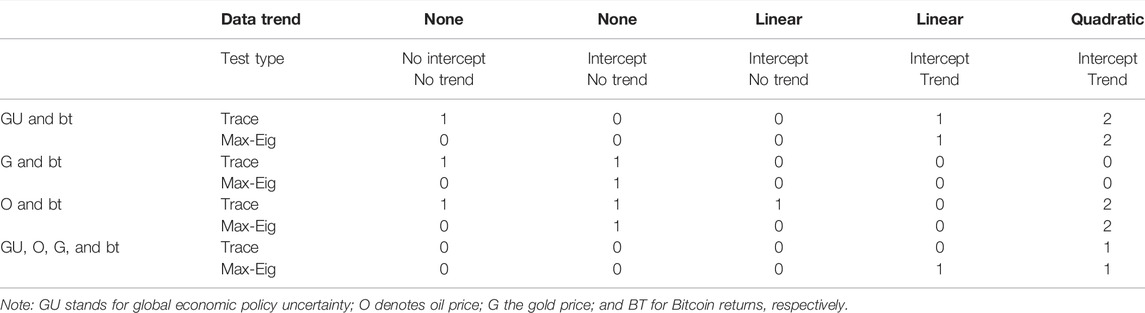

Next, the long-run cointegration among Bitcoin returns, goal prices, oil prices, and global economic policy uncertainty is investigated by the following the framework proposed by Johansen and Juselius (1990) and Johansen (1991). Table 3 shows the results of the cointegration test. The rejection of the null hypothesis, that is, “on cointegration,” confirms the presence of a long-run association in the equation.

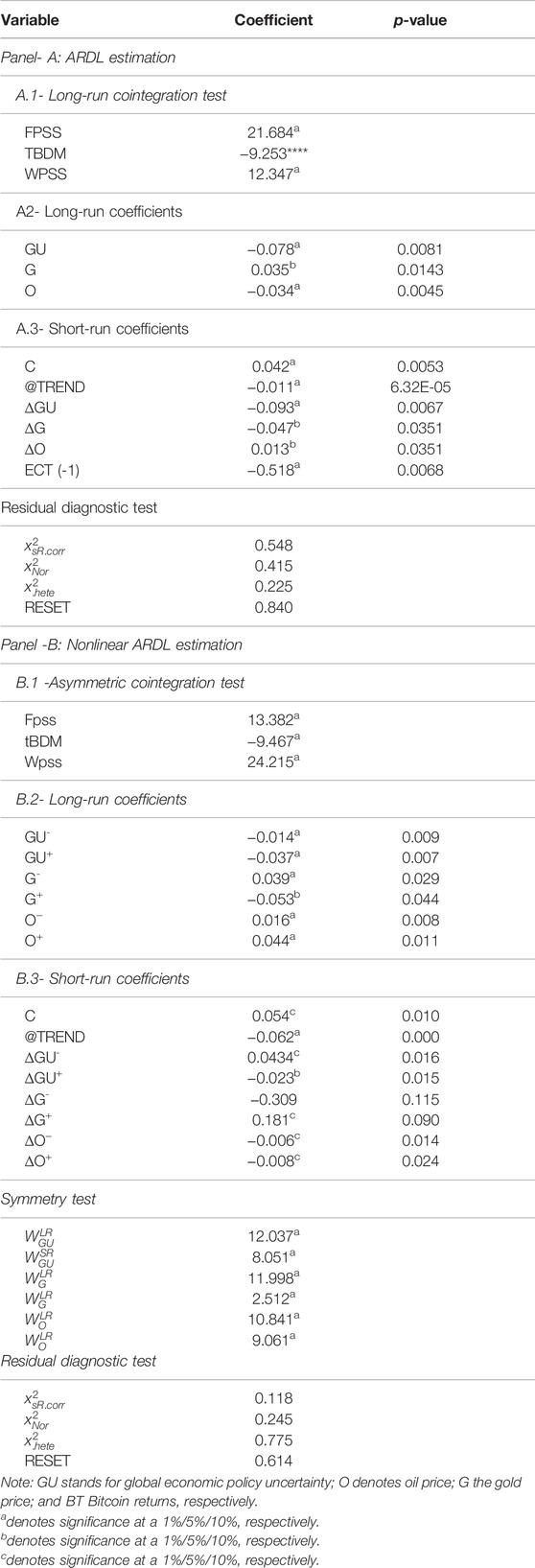

Next, the study assesses the long-run and short-run effects of EU, gold, and oil on Bitcoin returns by performing ARDL under the assumption of symmetry and asymmetry. Model estimation results, shown in Table 4 consist of panel-A for liner ARDL model outcomes and panel- B for nonlinear ARDL effects.

Results of the long-run cointegration under ARDL (see panel A.1) confirm a long-run association in the empirical equation by rejecting the null hypothesis of “no cointegration,” a 1% level of significance. This finding suggests the existence of movements in the long run. Next, the long-run magnitudes of GU, oil, and gold on Bitcoin (see panel A.2) are evaluated. The study establishes adverse effects from shocks in GU (coefficient of −0078) and oil price (a coefficient of −0.034) toward Bitcoin returns. In contrast, the gold price (a coefficient of 0.035) is positively linked to Bitcoin returns. These findings suggest that Bitcoin performance’s stability immensely relies on the strength of the global economy and oil prices. Additionally, in the short run, adverse effects were established from GU (coefficient of −0.0693) and gold price (a coefficient of −0.047) to Bitcoin and a positive association between the oil price (a coefficient of 0.013) and Bitcoin. The error correction coefficient confirms the disequilibrium in the short-run rectification and reaches a long-run equilibrium at a speed of 51.2%.

Panel-B in Table 4 shows nonlinear ARDL estimation. The test statistics of Fpss, tBDM, and Wpss are statistically significant at a 1% level of significance, indicating the presence of asymmetric relations between GU, gold, oil, and Bitcoin. In the long run, studies reveal a negative linkage between GU’s asymmetry and the positive shock in gold with Bitcoin. Studies postulate that innovation causes GU in either direction, the responsiveness of Bitcoin is imperative, but positive shocks are more significant than adverse shocks. Furthermore, an upraising in the gold market can cause instability in the Bitcoin market because of investors’ perceptions and expectations about gold and Bitcoin in terms of hedging strategy. On the other hand, a positive link was established between the asymmetry of oil and adverse shocks in gold and Bitcoin, and the findings suggest that shocks in oil price can cause in Bitcoin either way. Moreover, positive shocks in oil are more prominent than negative shocks on Bitcoin, whereas adverse gold shocks can boost Bitcoin performance.

In the short-run, positive shocks in GE (coefficient of −0.023), adverse shocks in the gold price (a coefficient of −0.309), and positive and negative shocks in the oil price (coefficients of −0.008 and −0.006) established a negative link with Bitcoin return. Conversely, adverse shocks in GE (a coefficient of 0.0434) and positive innovation in gold price (a coefficient of 0.181) are positively linked with Bitcoin returns. Understanding short-run asymmetric effects, it is apparent that Bitcoin’s stable performance significantly relies on reducing the uncertainty concerning the global economic situation and the thriving of the gold market. Furthermore, the symmetry test results confirm the presence of asymmetry in both the long run and short run by rejecting the null hypothesis of symmetry at a 1% level of significance.

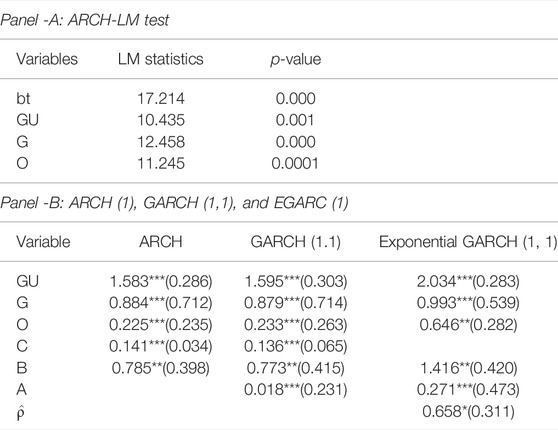

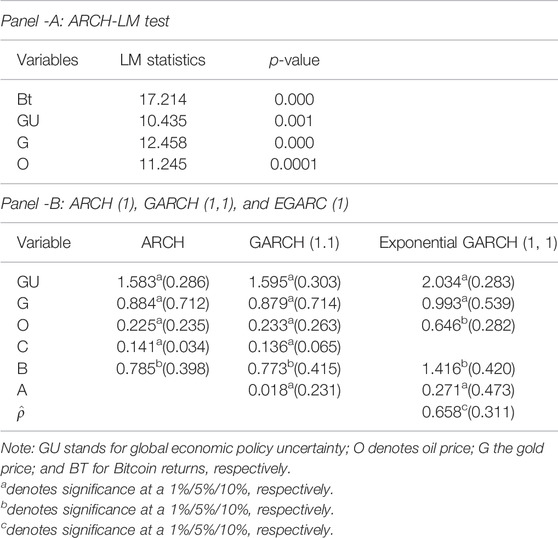

Next, the study applies the ARCH-LM test to evaluate the series’ volatility, and the results are shown in Table 5 andTable 6, The ARCH-LM test rejects the null hypothesis, indicating that the associate’s p-value of each test is statistically significant. These findings suggest that ARCH effects exist in the series. The coefficients of ARCH (column -1), GARCH (column -2), and EGARCH (column -3) are statistically significant at a 1% level of significance, indicating that the persistence of volatility prevails in all variables. The coefficient of α and β exposes a difference from the zero level that implies its capacity to predict future volatility with the lagged value of conditional variance and lagged residuals. Moreover, with the asymmetric effects in EGARCH, it is apparent that positive shocks in the market entice conditional volatility by 1.658, whereas negative shocks can cause a volatility by 0.342. Findings suggest that positive variation is more powerful than a negative impulse in the market.

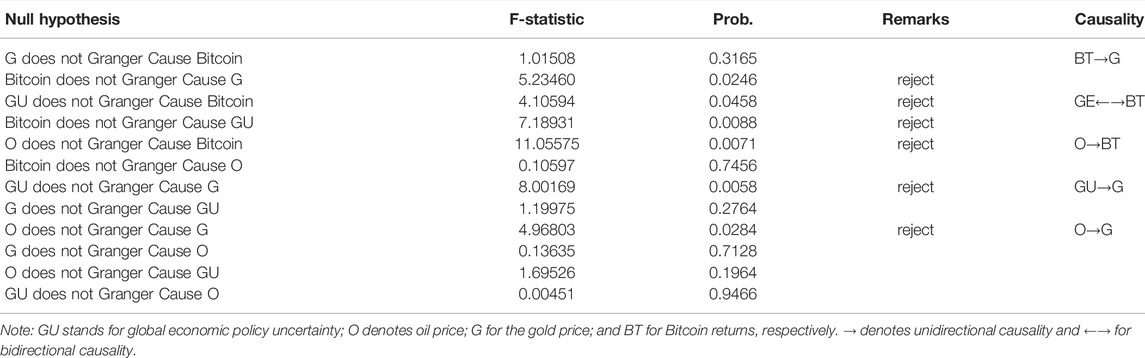

The following study performed a Granger causality test for detecting the directional association between natural resource prices, uncertainties, and Bitcoin performance. The study has implemented a pair-wise Granger causality test and non-Granger casualty test following Toda-Yamamoto (1995). The results of the pair-wise causality test are shown in Table 7. Referring to test statistics, the study documented unidirectional causality between Bitcoin and gold price [BT→G]; oil price and Bitcoin performance [O→BT]; and global uncertainty and gold price. Furthermore, the feedback hypothesis explains the causality between global uncertainty and Bitcoin performance [BT←→GU]. Considering the pair-wise causality test results, it is obvious that oil price and global economic uncertainty play a critical role in Bitcoin behavior.

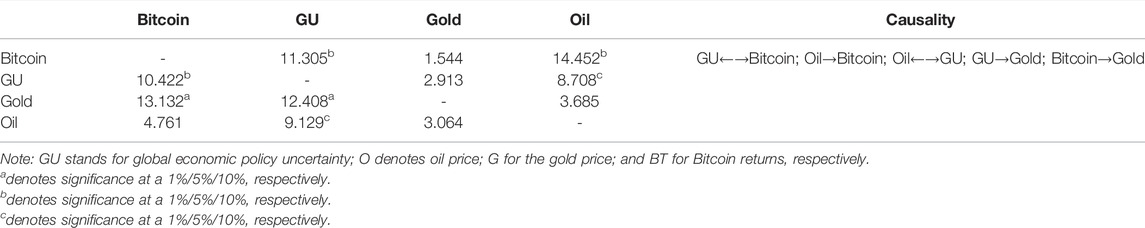

The results of directional causality following Toda and Yamamoto (1995) are shown in Table 8. Studies have established several causal relationships in the model estimation. However, the feedback hypothesis explains the directional causality between global economic policy uncertainty and Bitcoin return [GU←→Bitcoin] and oil price and global economic policy uncertainty [O←→GU]. These findings suggest that global economic stability is critical for both the Bitcoin and oil markets and vice versa. Thus, it is imperative to have a continuous closer look at the oil markets’ movement because instability in global economic progress can cause virtual currency markets. Furthermore, the study also divulges unidirectional causality running from oil market price to Bitcoin [O→bt] and global economic policy uncertainty to the gold market [GU→G].

4.2 Robustness Test

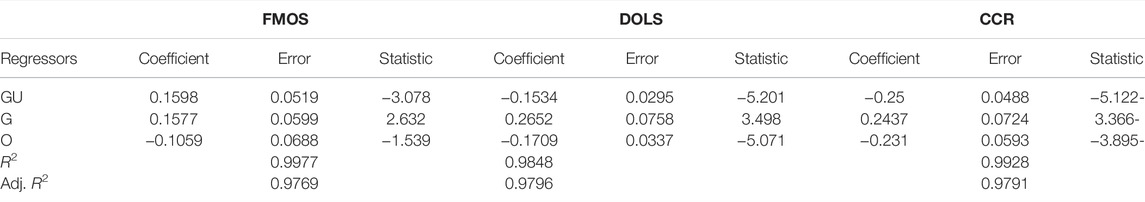

The following section further investigates estimation accuracy with the daily basis data by using dynamic OLS, fully-modified OLS, and canonical cointegrating regression (CCR). The robustness test results, especially for the long-run, are shown in Table 9. The coefficients sign confirms the accuracy of the long-run coefficient derived from autoregressive distributed lagged (ARDL).

5 Findings and Conclusion

Bitcoin emerged as a focal point in the financial investment goal with Fintech’s growth. Digital currency progress gives investors greater ways to diversify their investments. Several national governments have presently approved Bitcoin as a currency, and recent research supports Bitcoin’s currency function, which can also be used for investing and hedging. The study’s aim is to gauge the impact of GU, gold, and oil on Bitcoin returns from April 2013 to December 2021. The study applies linear and nonlinear ARDL to evaluate symmetric and asymmetric effects on Bitcoin returns in the long and short run. The ARCH-GARCH model was used to capture the presence of volatility and directional causality defects following the non-Granger causality test of Toda and Yamamoto (1995).

Results of unit root tests confirm that variables are integrated in a mixed order, indicating that the null hypothesis of the unit root rejected either at a level I (0) or after the first difference I (1). However, neither variable exposes stationary after the second difference. The availability of long-run cointegration assets by performing a cointegration test following Johansen (1991) and results reveal at least one cointegration equation with either Max Eigen or Trace Statistics.

The results of Fpass, Wpass, and tBDM reject the null hypothesis of no cointegration because all test statistics are statistically significant at a 1% level of significance. In the long run, the coefficients of GE expose adverse effects running toward Bitcoin performance, which is in line with the studies performed by Bouri et al. (2017a), Demir et al. (2018), and Guesmi et al. (2019). In a study, Wang et al. (2020) advocate that economic policy uncertainty causes volatility in Bitcoin’s trade volume, provided that a higher Bitcoin return exposes economic uncertainty. It suggests that the investor’s perception of Bitcoin is a “haven” for investment.

The asymmetric effects of global economic policy uncertainty, gold price, and oil price on Bitcoin: Fpss, Wpss, and tBDM ascertain the long-run asymmetry association in the equation. Furthermore, in the long-run asymmetry, the shock of GU and positive shocks in gold price are negatively linked to Bitcoin return. In contrast, asymmetry shock in oil price and negative shocks in gold price expose the positive linkage to Bitcoin return. These findings suggest that predicting the Bitcoin market performance under the asymmetry shock can play a decisive role; thus, complete consideration is obligatory for policy formulation.

The results of the causality tests following Toda and Yamamoto (1995) reveal bidirectional causality running between global economic policy uncertainty and Bitcoin return [GU←→ Bitcoin]. This finding suggests that the feedback hypothesis explains the causality between GU and Bitcoin. Furthermore, unidirectional causality runs from oil to Bitcoin [O→ Bitcoin] and Bitcoin to gold price [ Bitcoin →G]. The findings are in line with the findings by Atik et al. (2015). However, the finding establishes a contradictory position against the finding revealed by Kang et al. (2019).

Data Availability Statement

Publicly available datasets were analyzed in this study. These data can be found at: 47. coindesk. Bitcoin. 2021; available at https://www.coindesk.com/. 48. World Gold Council. Gold Price 2021; available at: https://www.gold.org/. 49. DailyFX. Crude oil. 2021; available at: https://www.dailyfx.com/crude-oil.

Author Contributions

MD: conceptualization, data curation, and first draft. MQ: literature survey, estimation, discussion, and final preparation. AH: methodology, estimation, and first draft preparation.

Funding

This study received financial support from the Institute for Advanced Research (IAR), United International University, Research Grant: IAR/2022/Pub/014.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

The authors want to express their heartfelt gratitude and sincere thanks to the Editor-in-Chief for kind consideration in their world-renowned reputed journal. Furthermore, they also express gratitude to the esteemed reviewer for their time and effort in reviewing their submission and valuable suggestions.

Footnotes

3https://www.dailyfx.com/crude-oil.

4http://www.policyuncertainty.com/global_monthly.html.

References

Aalborg, H. A., Molnár, P., and de Vries, J. E. (2019). What Can Explain the Price, Volatility and Trading Volume of Bitcoin? Finance Res. Lett. 29, 255–265. doi:10.1016/j.frl.2018.08.010

Ali, U., Shan, W., Wang, J.-J., and Amin, A. (2018). Outward Foreign Direct Investment and Economic Growth in China: Evidence from Asymmetric ARDL Approach. J. Bus. Econ. Manag. 19, 706–721. doi:10.3846/jbem.2018.6263

Andriamahery, A., and Qamruzzaman, M. (2022). A Symmetry and Asymmetry Investigation of the Nexus between Environmental Sustainability, Renewable Energy, Energy Innovation, and Trade: Evidence from Environmental Kuznets Curve Hypothesis in Selected MENA Countries. Front. Energy Res. 9. doi:10.3389/fenrg.2021.778202

Athey, S., Parashkevov, I., Sarukkai, V., and Xia, J., (2016) Bitcoin Pricing, Adoption, and Usage: Theory and Evidence. Stanford University Graduate School of Business, 16–42.

Atik, M., Kose, Y., Yılmaz, B., and Saglam, F. (2015). Crypto Currency: Bitcoin and Effects on Exchange Rates. J. Fac. Econ. Adm. Sci. 6 (11), 247–261.

Baker, S. R., Bloom, N., and Davis, S. J. (2016). Measuring Economic Policy Uncertainty*. Q. J. Econ. 131, 1593–1636. doi:10.1093/qje/qjw024

Banerjee, A., Dolado, J., and Mestre, R. (1998). Error-correction Mechanism Tests for Cointegration in a Single-Equation Framework. J. time Ser. analysis 19, 267–283. doi:10.1111/1467-9892.00091

Baur, D. G. (2013). The Autumn Effect of Gold. Res. Int. Bus. Finance 27, 1–11. doi:10.1016/j.ribaf.2012.05.001

Berentsen, A., and Schär, F. (2018). A Short Introduction to the World of Cryptocurrencies. Review 100 (1), 1–19. doi:10.20955/r.2018.1-16

Bollerslev, T. (1986). Generalized Autoregressive Conditional Heteroskedasticity. J. Econ. 31, 307–327. doi:10.1016/0304-4076(86)90063-1

Bouoiyour, J., Selmi, R., and Tiwari, A. (2014). Is Bitcoin Business Income or Speculative Bubble? Unconditional vs. Conditional Frequency Domain Analysis. Ann. Financial Econ. 10 (01), 1550002. doi:10.1142/s2010495215500025

Bouri, E., Gupta, R., Lahiani, A., and Shahbaz, M. (2018). Testing for Asymmetric Nonlinear Short- and Long-Run Relationships between Bitcoin, Aggregate Commodity and Gold Prices. Resour. Policy 57, 224–235. doi:10.1016/j.resourpol.2018.03.008

Bouri, E., Gupta, R., Tiwari, A. K., and Roubaud, D. (2017a). Does Bitcoin Hedge Global Uncertainty? Evidence from Wavelet-Based Quantile-In-Quantile Regressions. Finance Res. Lett. 23, 87–95. doi:10.1016/j.frl.2017.02.009

Bouri, E., Molnár, P., Azzi, G., Roubaud, D., and Hagfors, L. I. (2017b). On the Hedge and Safe Haven Properties of Bitcoin: Is it Really More Than a Diversifier? Finance Res. Lett. 20, 192–198. doi:10.1016/j.frl.2016.09.025

Brière, M., Oosterlinck, K., and Szafarz, A. (2015). Virtual Currency, Tangible Return: Portfolio Diversification with Bitcoin. J. Asset Manag. 16, 365–373. doi:10.1057/jam.2015.5

Chu, J., Nadarajah, S., and Chan, S. (2015). Statistical Analysis of the Exchange Rate of Bitcoin. Plos one 10, e0133678. doi:10.1371/journal.pone.0133678

Ciaian, P., Rajcaniova, M., and Kancs, d. A. (2016). The Economics of BitCoin Price Formation. Appl. Econ. 48, 1799–1815. doi:10.1080/00036846.2015.1109038

coindesk (2021). Bitcoin. Available at: https://www.coindesk.com/price/ Bitcoin.

Coulton, J. J., Dinh, T., and Jackson, A. B. (2016). The Impact of Sentiment on Price Discovery. Acc. Finance 56, 669–694. doi:10.1111/acfi.12128

DailyFX (2021). Crude Oil. Available at: https://www.dailyfx.com/crude-oil.

Das, D., and Kannadhasan, M. (2018). Do global Factors Impact Bitcoin Prices? Evidence from Wavelet Approach. J. Econ. Res. 23, 227–264.

Das, D., Le Roux, C. L., Jana, R. K., and Dutta, A. (2020). Does Bitcoin Hedge Crude Oil Implied Volatility and Structural Shocks? A Comparison with Gold, Commodity and the US Dollar. Finance Res. Lett. 36, 101335. doi:10.1016/j.frl.2019.101335

Demir, E., Gozgor, G., Lau, C. K. M., and Vigne, S. A. (2018). Does Economic Policy Uncertainty Predict the Bitcoin Returns? an Empirical Investigation. Finance Res. Lett. 26, 145–149. doi:10.1016/j.frl.2018.01.005

Dickey, D. A., and Fuller, W. A. (1979). Distribution of the Estimators for Autoregressive Time Series with a Unit Root. J. Am. Stat. Assoc. 74, 427–431. doi:10.1080/01621459.1979.10482531

Dutta, A., and Bouri, E. (2022). Outliers and Time-Varying Jumps in the Cryptocurrency Markets. Jrfm 15, 128. doi:10.3390/jrfm15030128

Dutta, A., Das, D., Jana, R. K., and Vo, X. V. (2020). COVID-19 and Oil Market Crash: Revisiting the Safe Haven Property of Gold and Bitcoin. Resour. Policy 69, 101816. doi:10.1016/j.resourpol.2020.101816

Dwyer, G. P. (2015). The Economics of Bitcoin and Similar Private Digital Currencies. J. Financial Stab. 17, 81–91. doi:10.1016/j.jfs.2014.11.006

Dyhrberg, A. H. (2016). Bitcoin, Gold and the Dollar - A GARCH Volatility Analysis. Finance Res. Lett. 16, 85–92. doi:10.1016/j.frl.2015.10.008

Entrop, O., Frijns, B., and Seruset, M. (2020). The Determinants of Price Discovery on Bitcoin Markets. J. Futur. Mark. 40, 816–837. doi:10.1002/fut.22101

Erdas, M. L., and Caglar, A. E. (2018). Analysis of the Relationships between Bitcoin and Exchange Rate, Commodities and Global Indexes by Asymmetric Causality Test. East. J. Eur. Stud. 9, 27.

Fang, L., Bouri, E., Gupta, R., and Roubaud, D. (2019). Does Global Economic Uncertainty Matter for the Volatility and Hedging Effectiveness of Bitcoin? Int. Rev. Financial Analysis 61, 29–36. doi:10.1016/j.irfa.2018.12.010

Ghatak, S., and Ju, Siddiki. (2001). The Use of the ARDL Approach in Estimating Virtual Exchange Rates in India. J. Appl. Statistics 28, 573–583. doi:10.1080/02664760120047906

Gkillas, K., Bouri, E., Gupta, R., and Roubaud, D. (2020). Spillovers in Higher-Order Moments of Crude Oil, Gold, and Bitcoin. Q. Rev. Econ. Finance. doi:10.1016/j.qref.2020.08.004

Guesmi, K., Saadi, S., Abid, I., and Ftiti, Z. (2019). Portfolio Diversification with Virtual Currency: Evidence from Bitcoin. Int. Rev. Financial Analysis 63, 431–437. doi:10.1016/j.irfa.2018.03.004

Guizani, S., and Nafti, I. K. (2019). The Determinants of Bitcoin Price Volatility: An Investigation with ARDL Model. Procedia Comput. Sci. 164, 233–238. doi:10.1016/j.procs.2019.12.177

Harper, J. (2013). What Is the Value of Bitcoin? Cato Institute. Available at http://www.cato.org/blog/what-value-bitcoin (Accessed July 26, 2020).

Hencic, A., and Gouriéroux, C. (2015). Noncausal Autoregressive Model in Application to Bitcoin/USD Exchange Rates. Econ. risk, 17–40. Springer. doi:10.1007/978-3-319-13449-9_2

Johansen, S. (1991). Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models. Econometrica 59, 1551–1580. doi:10.2307/2938278

Johansen, S, and Juselius, K (1990). Maximum Likelihood Estimation and Inference on Cointegration – with Applications to the Demand for Money. Oxf. Bull. Econ. Statistics 51, 169–210. doi:10.1111/j.1468-0084.1990.mp52002003.x

Kaminski, J. (2014) Nowcasting the Bitcoin Market with Twitter Signals. arXiv preprint arXiv:1406.7577.

Kang, S. H., McIver, R. P., and Hernandez, J. A. (2019). Co-movements between Bitcoin and Gold: A Wavelet Coherence Analysis. Phys. A Stat. Mech. its Appl. 536, 120888. doi:10.1016/j.physa.2019.04.124

Karame, G. O., Androulaki, E., Roeschlin, M., Gervais, A., and Čapkun, S. (2015). Misbehavior in Bitcoin. ACM Trans. Inf. Syst. Secur. 18, 1–32. doi:10.1145/2732196

Karim, S., Qamruzzaman, M., and Jahan, I. (2022). Nexus between Information Technology, Voluntary Disclosure, and Sustainable Performance: What Is the Role of Open Innovation? J. Bus. Res. 145, 1–15.

Kim, Y. B., Kim, J. G., Kim, W., Im, J. H., Kim, T. H., Kang, S. J., et al. (2016). Predicting Fluctuations in Cryptocurrency Transactions Based on User Comments and Replies. Plos one 11, e0161197. doi:10.1371/journal.pone.0161197

Klein, T., Pham Thu, H., and Walther, T. (2018). Bitcoin Is Not the New Gold - A Comparison of Volatility, Correlation, and Portfolio Performance. Int. Rev. Financial Analysis 59, 105–116. doi:10.1016/j.irfa.2018.07.010

Kwiatkowski, D., Phillips, P. C. B., Schmidt, P., and Shin, Y. (1992). Testing the Null Hypothesis of Stationarity against the Alternative of a Unit Root. J. Econ. 54, 159–178. doi:10.1016/0304-4076(92)90104-y

Li, X., and Wang, C. A. (2017). The Technology and Economic Determinants of Cryptocurrency Exchange Rates: The Case of Bitcoin. Decis. Support Syst. 95, 49–60. doi:10.1016/j.dss.2016.12.001

Lin, Z-Y. (2020). Investor Attention and Cryptocurrency Performance. Finance Res. Lett. 40:101702. doi:10.1016/j.frl.2020.101702

Liu, B.-Y., Ji, Q., and Fan, Y. (2017). Dynamic Return-Volatility Dependence and Risk Measure of CoVaR in the Oil Market: A Time-Varying Mixed Copula Model. Energy Econ. 68, 53–65. doi:10.1016/j.eneco.2017.09.011

Malik, S. (2020). Drivers of Bitcoin Prices: An Empirical Analysis oF India. J. Crit. Rev. 7, 1252–1258.

Okorie, D. I., and Lin, B. (2020). Crude Oil Price and Cryptocurrencies: Evidence of Volatility Connectedness and Hedging Strategy. Energy Econ. 87, 104703. doi:10.1016/j.eneco.2020.104703

Palombizio, E., and Morris, I. (2012). Forecasting Exchange Rates Using Leading Economic Indicators. Open Access Sci. Rep. 1, 1–6. doi:10.4172/scientificreports.402

Pesaran, M. H., and Shin, Y. (1998). An Autoregressive Distributed-Lag Modelling Approach to Cointegration Analysis. Econ. Soc. Monogr. 31, 371–413. doi:10.1017/ccol521633230.011

Pesaran, M. H., Shin, Y., and Smith, R. J. (2001a). Bounds Testing Approaches to the Analysis of Level Relationships. J. Appl. Econ. 16, 289–326. doi:10.1002/jae.616

Pesaran, M. H., Shin, Y., and Smith, R. J. (2001b). Bounds Testing Approaches to the Analysis of Level Relationships. J. Appl. Econ. 16, 289–326. doi:10.1002/jae.616

Phillips, P. C. B., and Perron, P. (1988). Testing for a Unit Root in Time Series Regression. Biometrika 75, 335–346. doi:10.1093/biomet/75.2.335

Qamruzzaman, M., and Jianguo, W. (2018a). Does Foreign Direct Investment, Financial Innovation, and Trade Openness Coexist in the Development Process: Evidence from Selected Asian and African Countries? Br. J. Econ. Finance Manag. Sci. 16, 73–94.

Qamruzzaman, M. (2022). An Asymmetric Investigation of the Nexus between Economic Policy Uncertainty, Knowledge Spillover, Climate Change and Green Economy: Evidence from BRIC Nations. Front. Environ. Sci. 682. doi:10.3389/fenvs.2021.807424

Qamruzzaman, M., Jianguo, W., and Jianguo, W. (2018b). Investigation of the Asymmetric Relationship between Financial Innovation, Banking Sector Development, and Economic Growth. Quantitative Finance Econ. 2, 952–980. doi:10.3934/qfe.2018.4.952

Qamruzzaman, M., and Jianguo, W. (2018c). Nexus between Financial Innovation and Economic Growth in South Asia: Evidence from ARDL and Nonlinear ARDL Approaches. Financ. Innov. 4, 20. doi:10.1186/s40854-018-0103-3

Qamruzzaman, M., and Karim, S. (2020). Nexus between Economic Volatility, Trade Openness and FDI: An Application of ARDL, NARDL and Asymmetric Causality. Asian Econ. Financial Rev. 10, 790–807. doi:10.18488/journal.aefr.2020.107.790.807

Selmi, R., Mensi, W., Hammoudeh, S., and Bouoiyour, J. (2018). Is Bitcoin a Hedge, a Safe Haven or a Diversifier for Oil Price Movements? A Comparison with Gold. Energy Econ. 74, 787–801. doi:10.1016/j.eneco.2018.07.007

Shin, Y., Yu, B., and Greenwood-Nimmo, M. (2014). Festschrift in Honor of Peter Schmidt. Springer, 281–314. doi:10.1007/978-1-4899-8008-3_9Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework

Su, X., and Li, Y. (2020). Dynamic Sentiment Spillovers Among Crude Oil, Gold, and Bitcoin Markets: Evidence from Time and Frequency Domain Analyses. Plos one 15, e0242515. doi:10.1371/journal.pone.0242515

Toda, H. Y., and Yamamoto, T. (1995). Statistical Inference in Vector Autoregressions with Possibly Integrated Processes. J. Econ. 66, 225–250. doi:10.1016/0304-4076(94)01616-8

Wang, G-J., Xie, C., Wen, D., and Zhao, L. (2019). When Bitcoin Meets Economic Policy Uncertainty (EPU): Measuring Risk Spillover Effect from EPU to Bitcoin. Finance Res. Lett. 31. doi:10.1016/j.frl.2018.12.028

Wang, J., Xue, Y., and Liu, M. (2016). “An Analysis of Bitcoin Price Based on VEC Model,” in 2016 International Conference on Economics and Management Innovations (Zhengzhou, China: Atlantis Press).

Wang, P., Li, X., Shen, D., and Zhang, W. (2020). How Does Economic Policy Uncertainty Affect the Bitcoin Market? Res. Int. Bus. Finance 53, 101234. doi:10.1016/j.ribaf.2020.101234

World Gold Council (2021). Gold Price Available at: https://www.gold.org/.

Wu, C. Y., Pandey, V. K., and Dba, C. (2014). The Value of Bitcoin in Enhancing the Efficiency of an Investor’s Portfolio. J. financial Plan. 27, 44–52.

Wu, S., Tong, M., Yang, Z., and Derbali, A. (2019). Does Gold or Bitcoin Hedge Economic Policy Uncertainty? Finance Res. Lett. 31, 171–178. doi:10.1016/j.frl.2019.04.001

Xia, C., Qamruzzaman, M., and Adow, A. H. (2022). An Asymmetric Nexus: Remittance-Led Human Capital Development in the Top 10 Remittance-Receiving Countries: Are FDI and Gross Capital Formation Critical for a Road to Sustainability? Sustainability 14, 3703. doi:10.3390/su14063703

Xu, S., Qamruzzaman, M., and Adow, A. H. (2021). Is Financial Innovation Bestowed or a Curse for Economic Sustainably: the Mediating Role of Economic Policy Uncertainty. Sustainability 13, 2391. doi:10.3390/su13042391

Zhuo, J., and Qamruzzaman, M. (2021). Do financial Development, FDI, and Globalization Intensify Environmental Degradation through the Channel of Energy Consumption: Evidence from Belt and Road Countries. Environ. Sci. Pollut. Res., 1–20. doi:10.1007/s11356-021-15796-0

Keywords: global economic uncertainty, Bitcoin, oil price, gold price, ARDL, NARDL, EGARCH, causality

Citation: Dai M, Qamruzzaman M and Hamadelneel Adow A (2022) An Assessment of the Impact of Natural Resource Price and Global Economic Policy Uncertainty on Financial Asset Performance: Evidence From Bitcoin. Front. Environ. Sci. 10:897496. doi: 10.3389/fenvs.2022.897496

Received: 17 March 2022; Accepted: 13 April 2022;

Published: 27 May 2022.

Edited by:

Elie Bouri, Lebanese American University, LebanonCopyright © 2022 Dai, Qamruzzaman and Hamadelneel Adow. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Md. Qamruzzaman, emFtYW5fd3V0MTZAeWFob28uY29t

†ORCID: Md. Qamruzzaman, orcid.org/0000-0002-0854-2600; Anass Hamadelneel Adow, orcid.org/0000-0002-0280-3726

Maoyu Dai1

Maoyu Dai1 Md. Qamruzzaman

Md. Qamruzzaman