94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 23 June 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.896036

This article is part of the Research TopicGreen Innovation and Industrial Ecosystem Reconstruction in Achieving Environmental SustainabilityView all 34 articles

The development of the regional economy is of major concern against the backdrop of the “new normal.” As a problem that has persisted in China for decades, zombie firms have a negative impact on regional and industrial sustainable development. This study first presents a novel method for identifying zombie firms and then analyzes the characteristics of zombie firms in the Yangtze River Delta Urban Agglomerations during a specified period. A fixed-effect model is used to examine the impact of firm zombification on normal enterprise investment. Despite the low level of zombification of industrial enterprises in the Yangtze River Delta Urban Agglomeration, the results of the study indicate that it has a considerable negative influence on enterprise investment. After applying multiple methods for robustness testing and constructing instrumental variables to solve the endogeneity problem, our results have remained stable. The carbon intensity effect and the competitive weakening effect are also examined as two impact mechanisms. Our findings have significant theoretical and practical ramifications: 1) It introduces a novel concept for defining zombie firms, which will aid in the improvement of the technique of identifying zombie firms based on the Chinese Industrial Enterprise Database; 2) It proposes a novel approach to zombie firm research, and it is critical to better understand the harmful effects of zombie firms on industrial sustainable development and to make specific efforts to address them; 3) It makes recommendations to the government on how to establish industrial policy. The policy tilt towards state-owned enterprises should be adjusted, while regional economic characteristics should be fully considered to ensure the sustainable development of the industry and the region.

In the context of the “new normal,” in which the economic structure is gradually optimized, the economic growth rate is gradually slowed, and the economic drive is fully transformed, the transformation and development of China’s regional economy is a prerequisite for constructing a moderately prosperous society and achieving socialist modernization in its entirety. As one of the most important economic regions in China, the Yangtze River Delta Urban Agglomerations is an economic zone composed of 26 cities with the best urbanization foundation, the fastest economic development, and the strongest competitive power in the eastern coastal region. According to public data, the Yangtze River Delta Urban Agglomerations account for only 2.3 percent of the total area of China, yet contribute about a quarter of China’s GDP. As a result, the economic and industrial sustainable development of the Yangtze River Delta Urban Agglomerations has been widely concerned. The status quo and impact of zombie firms in the Yangtze River Delta Urban Agglomerations are of considerable theoretical and practical importance in promoting the transformation of government functions, economic sustainable development, and industrial policy adjustment in the region.

In recent years, experts and policymakers have paid increased attention to zombie firms, which are mature enterprises that are heavily indebted, chronically unprofitable, and have no way of repaying their loans over a long period. Zombie firms control a substantial quantity of land, capital, energy, labor, and other essential resources, but they are unable to provide comparable economic benefits, which is the “pain point” of economic progress and industrial sustainable development in modern society. The existence of zombie firms not only has extremely negative consequences for investors and creditors but also increases macroeconomic operational risks, preventing resources from flowing to higher-returning enterprises, obstructing economic transformation and upgrading, as well as effective industrial structure adjustment. Zombie firms may also cause substantial debt defaults, rendering a large number of maturing debts unpayable, wreaking havoc on the market and financial ecosphere, and posing a major concealed threat to economic development and social stability. In late years, the Chinese government has begun to place a high priority on the issue of zombie firms.

There has been a growth in research on zombie firms since the groundbreaking research of Caballero, Hoshi and Kashyap (Caballero et al., 2008). However, it is predominantly concerned with market congestion and aggregate growth difficulties (Caballero et al., 2008; Adalet McGowan et al., 2018; Andrews and Petroulakis, 2019). With the exception of the research by Goto and Wilbur (2019) and Carreira et al. (2021), most of the existing research is based on the samples of large listed companies, and the zombie firm problem of other enterprises has not been explained in detail. In addition, the majority of extant research only focuses on the state of zombie firms at the national level, rather than taking China’s special economic zones into account. For all we know, our work is the first to reveal the influence of zombie firms in the context of a region where small and medium-sized enterprises gather (Yangtze River Delta Urban Agglomerations). It has the advantage of presenting evidence for the entire industry and region. The research also makes a methodological addition to the identification of zombie firms, which is a distinct feature too. The typical NH-CHK approach cannot be utilized to identify zombie firms due to the features of the Chinese Industrial Enterprise Database. Through the ongoing infusion of bank loans, zombie businesses can typically greatly extend their survival time in the market (Okamura, 2011). In this context, “profitability” and “debt ratio” are more suitable for identifying zombie firms in the Chinese Industrial Enterprise Database than the “subsidized” interest rate criterion after eliminating normal enterprises with poor initial operating conditions. At the same time, we consider the healthy enterprises that may be erroneously identified as zombie firms at the beginning of their establishment and make the identification procedure easier.

We address, in particular, the following issues: What is the status of zombie firms in the Yangtze River Delta Urban Agglomerations over a long period? What position do SMEs occupy in the zombie firms of the Yangtze River Delta Urban Agglomerations? What impact does the existence of zombie firms have on private investment in healthy firms in this area? What are the mechanisms that affect the impact of zombie firms on enterprise investment?

The study is based on the Chinese Industrial Enterprises Database, the China City Statistical Yearbook, and the China Statistical Yearbook on Environment for the period 2003–2013. During this interval, due to the influence of the Financial Crisis and the four-trillion economic stimulus plan, the time variation trend of the proportion of zombie firms can be accurately observed. A fixed-effect model is used to investigate whether the investment of other normal firms is crowded out by zombie firms. The empirical findings demonstrate that, while the share of zombie firms in the Yangtze River Delta Urban Agglomerations is low, they have driven out non-zombie firms’ investment significantly. Specifically, a 0.229 percentage point reduction in non-zombie investment is connected with a rise of 1 percentage point in the ratio of zombie firms (debt-weighted). We verify the robustness of our empirical results by changing the calculation method of enterprise investment, unifying the statistical caliber of the sample, replacing the calculation method of zombie enterprise ratio, and replacing the proportion of zombie firms with different weighting methods. Our regression results remain significant after employing the instrumental variables method to address the endogeneity problem. In addition, the results of the mechanism analysis demonstrate that zombie firms influence the regular investment of enterprises through the carbon intensity effect and the competitive weakening effect.

The remaining sections of our paper are arranged as follows. Section 2 is a review of previous research on zombie firms, while Section 3 describes the data processing and the identification methods of zombie firms. Section 4 empirically analyzes the influence of zombie firms on enterprise investment. The results of robustness checks are also reported in this section. Section 5 is the conclusion of this paper, including relevant policy recommendations and directions for further research.

Zombie firms have been a concern over the last 2 decades. The two countries most concerned by relevant research are Japan and China. The problem of zombie firms has also received a lot of attention in the United Kingdom, the United States, Canada, Portugal, and other European countries. It has been shown that, depending on the definition of zombie firms, the share of zombie firms in advanced economies might range from 6 to 12 percent (Banerjee and Hofmann, 2018). The problem is far more common than previously imagined, affecting almost all economic communities. Since the “Plaza Accord,” the existence of zombie firms has been considered to be the cause of the “lost decade” (Fukao and Ug Kwon, 2006). The stagnation of the Japanese economy caused by zombie firms has also had a lasting and far-reaching impact on global economic development, especially in the wake of the economic crisis. Countries affected include, but are not limited to, France, Italy, China, and South Korea (Hoshi and Kashyap, 2015). The term “zombie firm” was first proposed as a professional economic term by Edward Kane (Kane, 1987). At present, the academics agree on the definition of zombie firms, which are defined as “enterprises in commercial difficulties and lack of self-sufficiency that are protected from bankruptcy and liquidation by creditors or government support” (Katz, 2003; Hoshi and Kim, 2012). In other words, zombie firms refer to a category of enterprises that are deeply in debt and lack profitability, and cannot repay their debts over an extended period, yet fail to exit the market for a variety of reasons.

The research on the stagnation in Japan in the late 20th century by Peek and Rosengren (2005) and Caballero et al. (2008) has been regarded as the beginning of related research on zombie firms. Both studies emphasized that the existence of zombie firms is actually the reason for the misallocation of resources during this period, which resulted in a delay in the withdrawal of inefficient enterprises. Existing research has shown that the incentives for the emergence of zombie firms are often multifaceted. From the perspective of external incentives, the improper allocation of credit resources and government intervention is related to the establishment and sustainable survival of zombie firms. Banks often tend to provide zombie credit to enterprises in order to cover up poor debts, which is one of the chief causes of the emergence of zombie firms (Fukuda et al., 2006; Hoshi, 2006). The long-term relationship between a bank and a borrower may lead to private contracts, and the bank may continue to lend to the borrower as a result, despite the fact that this is unethical (Nishimura and Kawamoto, 2003; Beck et al., 2018). Regulatory forbearance may also give opportunities to weak banks, which in turn may lead to the emergence of zombie firms (Okamura, 2011). That is to say, under-capitalized banks do not have to worry too much about being penalized by the authorities for the bad loans, thus they prefer to roll over loans to inefficient firms (Storz et al., 2017; Schivardi et al., 2022). Subsidization programs enacted by the government may also serve as a breeding ground for zombie firms. To maintain stability, the government routinely provides financial and other resources to enterprises facing bankruptcy through various subsidy programs, thereby assisting these enterprises in surviving in the market (Jaskowski, 2015). In general, accommodating policies boost the confidence of banks in the resurrection of zombie firms and thus influence the proper utilization of bank loans (White, 2012). Meanwhile, such policies reduce the difficulty and cost of enterprise financing, further guaranteeing the survival of unproductive firms (Borio and Hofmann, 2017). The internal causes of firms’ “zombification” are their lack of comparative advantages and low operating efficiency. Shen and Chen (2017) found through the study of energy mining and manufacturing enterprises that low operating efficiency is the main reason for enterprises to become zombies. They also proposed that factor endowment advantage and technological comparative advantage can explain the appearance of zombie firms; that is, enterprises that do not conform to the comparative advantage have a greater chance of becoming zombie firms.

The prevalence of zombie firms has been proved to have a multifaceted impact on the macro-economy. In recent years, there has been an upsurge in studies assessing the impact of zombie firms, with the research viewpoint mostly focusing on market congestion and aggregate growth challenges. According to the study by Caballero et al. (2008), zombie firms that are unable to exit from the market smoothly may be the primary cause of market congestion and the loss in aggregate productivity in Japan. According to some research findings, the higher the ratio of zombie firms, the lower the efficiency of capital redistribution (Tan et al., 2016; Adalet McGowan et al., 2018; Gouveia and Osterhold, 2018; Andrews and Petroulakis, 2019). Zombie congestion is becoming a common obstacle for young firms to enter the market. This is because the existence of zombie enterprises causes market congestion, distorts the normal competition mechanism, and increases the likelihood that normal enterprises will encounter resource constraints (San-Jose et al., 2022). In addition, the presence of zombie congestion may also have a hindering effect on the progress and upgrading of efficient enterprises in the market (Adalet McGowan et al., 2018). Job losses and lower profitability may also be caused by zombies. The studies of Arrowsmith et al. (2013) and Adalet McGowan et al. (2018) show that zombie congestion increases the resource limitations encountered by healthy firms, diminishes the efficiency of resource reallocation, and consequently reduces the overall productivity of society. Evidence from China also supports this point. Huang et al. (2021) confirmed that the prevalence of zombie firms squeezed the marginal return of factors and increased the marginal cost of input factors of normal firms, thereby significantly reducing the TFP level at the industry level. Li et al. (2021) analyzed the impact of zombie enterprises on the four sources of total TFP growth and verified that zombie enterprises can adversely affect TFP growth by hindering technological progress and deteriorating resource allocation. Furthermore, as a very inefficient category of enterprises, zombie firms are not only unproductive, but also have a certain degree of contagiousness (Ahearne and Shinada, 2005; Hoshi, 2006). Namely, the existence of zombie firms may result in the transition of healthy companies with which they collaborate into zombie enterprises as well.

As a result, a decrease in the number of zombies is predicted to result in significant economic benefits. The focus of the discussion on zombie firm disposal strategy is mostly on three aspects: enterprise revival, government policy, and firm exit. Downsizing has been proved to be an effective way to revive zombie firms (Fukuda and Nakamura, 2011). However, the implementation of scaling down (or restructuring) necessitates two important prerequisites: improved bank supervision and the perfection of the bankruptcy restructuring system (Nakamura, 2017; Andrews and Petroulakis, 2019). Effective restructuring policy, like debt restructuring, and reduction of corporate restructuring barriers will also help zombie firms back to good financial health and promote their recovery (Adalet McGowan et al., 2018; Carreira et al., 2021). For developing countries, governments should utilize the appropriate “helping hands” to assist healthy enterprises with the potential to develop further based on market-oriented principles, so as to gradually dispose of the problems of zombie firms. Government intervention, such as financial support for zombie firms and preferential industrial policies in the name of boosting the economy, must be reduced (Han et al., 2019; Geng et al., 2021). In conclusion, an efficient zombie firm screening mechanism, a bankruptcy procedure that promotes redistribution, and the appropriate government intervention mechanism will aid in the alleviation of the zombie firm problems.

To summarize, zombie firms as an important issue in the sustainable development of industry have aroused widespread concern. The research results of Caballero, Hoshi, and Kashyap were seminal, laying the groundwork for the research related to zombie firms (Caballero et al., 2008). Academics have conducted talks in many directions on this premise. However, as Imai pointed out, the majority of these studies have been conducted based on the data of stock exchange-listed companies, implying that they exclusively focus on zombie problems among large enterprises (Imai, 2016). The fact is that small and medium-sized enterprises (SMEs) account for a sizable portion of the Yangtze River Delta Urban Agglomerations and even in all other economies (Wang and Wu, 2011; Luo et al., 2018). Furthermore, practically all existing research on Chinese zombie firms is based on provincial-level data, and no relevant study on zombie firms exists in China’s special economic regions. Given this, these two major deficiencies will be remedied by our research.

The data used in this paper are all from the China City Statistical Yearbook, the China Statistical Yearbook on Environment, and the Chinese Industrial Enterprise Database over the period 2003–2013. The reliability of the data in 2010 is poor due to the excessive number of missing values in the Chinese Industrial Enterprise Database. To ensure that our findings and conclusions are based on normal data, we exclude the data of 2010 and treat the remaining years as consecutive years. The Chinese Industrial Enterprises Database includes all manufacturing enterprises (above scale)1 in mainland China with different types of ownership. This database contains the basic information, financial data, and production and sales of almost all enterprises in China’s manufacturing industry, and is one of the most commonly used databases in China. Since the national economic industry classification standards in China have changed, we unified the four-digit industry classification of the national economy according to the relevant standards in the process of data processing2. Although the Chinese Industrial Enterprises Database is one of the most commonly used databases in China, its initial data has the characteristics of chaotic matching, missing indexes, and abnormal indexes. Therefore, this paper refers to a set of more rigorous processing methods provided by Brandt et al. (2012) for the Chinese Industrial Enterprises Database and processes the data from the Chinese Industrial Enterprises Database from 2003 to 2013. Based on running Brandt code, the manual method is used again to cross-match the enterprise code, enterprise name, legal person name, and enterprise address. The missing and wrong samples, such as the start year and the number of employees, are all corrected. Considering the problems of misstatement and understatement of data, this paper refers to the current accounting standards to eliminate data that is abnormal and do not meet the accounting standards. 1) Lack of important financial indicators (e.g., total assets, total liabilities, total fixed assets, total profits, capital received, number of employees, etc.). 2) Do not comply with current Generally Accepted Accounting Principle (GAAP), such as total current assets are greater than total assets, total fixed assets are greater than total assets, profit margin of total assets are greater than 1, paid-in capital is less than or equal to 03, etc., 3) Eliminate enterprises with less than 20 employees (small and micro enterprises4 with too few employees often have imperfect accounting systems and their data quality is difficult to control). 4) Repetitive year matching with the enterprise code. In light of this, city-level control variables are matched to the Chinese Industrial Enterprises Database, utilizing the city’s four-digit codes and years as matching tools. As a result, a total of 763,152 unbalanced panel data sets were obtained.

There are various ways to identify zombie enterprises. For example, Mohrman and Stuerke regard negative equity companies as the most extreme type of zombie firms (Mohrman and Stuerke, 2014). The most commonly used measurement methods of zombie firms are the CHK method and the NH-CHK approaches. Caballero et al. (2008) introduced the classic CHK standard in 2008, which detects zombie firms based on their interest expenses. Specifically, firms with actual net interest expenses of less than the minimum required net interest expenses are defined as zombie firms. To remedy the defects of the CHK method by using the preferential loan as the only condition, Fukuda and Nakamura (2011) established FN-CHK standards by adding profitability and evergreen loan indicators. Although the CHK method and FN-CHK method are commonly used to identify zombie firms in the world, these two methods do not apply to the Chinese Industrial Enterprise Database. That is because indicators required by these two standards such as long-term loans, short-term loans, corporate bonds and loan interest rates are not disclosed in the Chinese Industrial Enterprise Database. According to the identities of the Chinese Industrial Enterprise Database, several methods of zombie enterprise identification, such as the official standard, the actual profit method, and the over-borrowing method, are proposed. The official standard is formulated by the State Council of China. The enterprises that do not have competitiveness and profitability, occupy resources inefficiently, do not meet the relevant national standards, and have continuously lost for more than 3 years are identified as zombie enterprises (i.e., continuous loss method). Although the continuous loss method is simple and clear, it does not take into account the situation that enterprises cannot make ends meet in the initial stage of establishment, and it is easy to mistakenly identify the enterprises in the initial stage as zombie enterprises. Therefore, we propose the identification method of this paper based on the excessive lending method and the actual profit method. In order to easily and accurately identify zombie enterprises, we identify industrial enterprises that meet the following conditions as zombie firms: 1) Asset-liability ratio greater than 50%. The asset-liability ratio represents the ability of a company to carry out commercial activities with the cash or other assets granted by creditors and is also an essential indicator reflecting the degree of loan security provided by creditors. In accounting practice, a high asset-liability ratio is usually regarded as a signal of danger in enterprise operations. At the same time, the high asset-liability ratio is also in line with the characteristics of the “high debt” of zombie firms. 2) Actual profit less than 0. In this paper, the actual profit is defined as the total profit minus the income tax payable, so as to eliminate the influence of taxes and fees paid in advance on the actual profit and to reflect the operating status and solvency of the enterprise. Lack of profitability is an important criterion. The actual profit is less than 0, which means that the enterprise is suffering a loss, which is in line with the characteristics of zombie firms mentioned above. 3) Age of enterprise is 8 years or above. It is necessary to separate early-established enterprises in zombie enterprise identification to reduce the false identification rate. China’s manufacturing businesses have an average lifespan of 8 years. Therefore, we set the criteria for the enterprise older than 8 years, that is, focusing on the enterprises that have outlived regional average age (and left the growth period), to avoid misidentifying the enterprises at the initial stage of establishment, with high debt ratio or poor operating income as zombie firms, and avoiding data loss caused by factors such as enterprise merger and split. 4) Current year liabilities increased compared to the previous year. Increasing liabilities indicates a growth in loans taken by enterprises, which is consistent with the characteristics of zombie firms receiving a bank-provided blood transfusion. In summary, this paper identifies the industrial enterprises with high asset-liability ratios, weak solvency, increasing liabilities, and separated from the founding period in the Yangtze River Delta Urban Agglomerations as zombie firms.

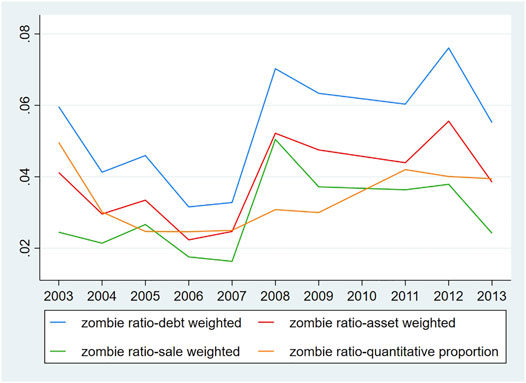

In this section, we investigate the features of zombie firms in the Yangtze River Delta Urban Agglomerations from five aspects. First, we report the time-varying trend of the ratio of zombie firms in this region from 2003 to 2013. Figure 1 shows the results of the proportion of zombie firms under different weighting methods. The blue line indicates the proportion of zombie firms weighted by debt, the green line indicates the proportion of zombie firms weighted by sales, the red line indicates the proportion of zombie firms weighted by assets, and the orange line indicates the proportion of zombie firms in the total number of industrial enterprises. From a general perspective, the average share of zombie firms (quantitative proportion) is 3.36% during the sample period (2003–2013). From the perspective of the time dimension, the share of zombie firms in the Yangtze River Delta Urban Agglomerations decreased gradually before 2008 and rose significantly in 2008, which may be caused by the Financial Crisis in 2008. With the introduction of the four-trillion economic stimulus plan, the share of zombie firms fell to a low level by 2011. However, with the reduction in policy efforts and the slowdown in economic growth, the proportion of zombie enterprises rose again after 2011, with the debt-weighted, asset-weighted, and quantitative ratios being higher than pre-crisis levels, while the sales-weighted ratio was slightly lower than pre-crisis levels. On the whole, the quantitative proportion of zombie firms is much smaller than its debt-weighted share, asset-weighted share, and overall larger than its sales-weighted share, which indicates that the zombie firms in the Yangtze River Delta Urban Agglomerations in this period occupy a large number of resources, builds up debts but fails to generate corresponding income. That is to say, the operating conditions of zombie firms have deteriorated, and the elimination of zombie firms is a matter of concern.

FIGURE 1. Proportion of zombie firms in the Yangtze River Delta Urban Agglomerations from 2003 to 2013.

Second, we show the regional characteristics of zombie firms from 2003–2013. Figure 2 shows the proportion of zombie enterprises in different regions away from the regional economic center (Shanghai). We selected Shanghai as the economic center of the Yangtze River Delta Urban Agglomerations and divided the 26 cities into five groups according to an interval of 100 km. Among them, 0–100 km includes Shanghai, Suzhou, Nantong, and Jiaxing; 100–200 km including Wuxi, Changzhou, Hangzhou, Ningbo, Shaoxing, Huzhou, Zhoushan; 200–300 km includes Nanjing, Zhenjiang, Yancheng, Yangzhou, Taizhou (3212), Jinhua, Taizhou (33105), Wuhu, Ma ‘anshan, Xuancheng; 300–400 km including Tongling, Chuzhou, Chizhou; 400–500 km includes Hefei and Anqing. The blue line indicates 0–100 km, the red line indicates 100–200 km, the green line indicates 200–300 km, the orange line indicates 300–400 km, and the yellow line indicates 400–500 km. Overall, the ratio of zombie firms in different distances decreased gradually before 2008, which is consistent with the trend reported in Figure 1. After 2008, however, the proportion of zombie firms in each group exhibited divergent trajectories. Specifically, the proportion of zombie firms in cities within 200 km increased and subsequently decreased after 2008, corresponding with the trend depicted in Figure 1, but the proportion of zombie firms in cities beyond 200 km decreased. In addition, before 2008, the proportion of zombie firms in cities more than 300 km was significantly greater than in cities less than 300 km. After 2008, the proportion of zombie firms in cities within 200 km was significantly greater than that in the other three groups of cities. This may be due to the fact that, as a result of the Financial Crisis, less developed cities located far from the economic center are unable to continue providing financial support for zombie firms, causing some zombie firms to withdraw from the market and thereby reducing the proportion of local zombie firms.

Third, the cross-industry features of zombie firms in this region are examined. Industries in the Yangtze River Delta Urban Agglomerations are divided according to the two-digit codes of the manufacturing industry. Based on the two-digit industry code, Table 1 presents the results of the three industries with the highest and lowest proportion of zombie firms. On the whole, the proportion of zombie firms in the Yangtze River Delta Urban Agglomerations from 2003 to 2013 was the highest in beverage manufacturing, production and supply of gas, and production and supply of water, which were all above 5.14%. In the production and supply of water industries, the proportion of zombie firms even approached 10%. This might be attributable to regional demand factors and employee protection legislation. The industries with the lowest proportion of zombie firms are tobacco processing, oil, and gas extraction, timber processing, and wood, bamboo, cane, palm, fiber, and straw product manufacturing, which are all below 3.1%. The tobacco processing industry has the lowest proportion of zombie firms among all these industries. This characteristic is also congruent with the real situation, since tobacco products, which are very in-demand and addictive, have a reasonably steady demand throughout the Yangtze River Delta and the entire nation. Therefore, it is difficult for tobacco-related businesses to go insolvent and lose productive vitality. In terms of industry dimension, zombie firms have obvious industry characteristics, which are consistent with the industrial characteristics of the Yangtze River Delta region, proving that disposing of zombie firms is an important measure to solve the problem of overcapacity.

Fourth, we analyze the ownership characteristics of zombie firms in the region from 2003–2013. Enterprises in the Yangtze River Delta Urban Agglomerations are divided into SOEs and non-SOEs according to their types of ownership. The proportion of zombie firms is calculated, respectively and the results are shown in Figure 3. From the proportion of the two types of enterprises in the total number of enterprises in the region, the share of state-owned zombie firms is much lower than that of non-state-owned zombie firms. Among them, the average proportion of state-owned zombie firms is only 0.17%, while the average proportion of non-state-owned zombie firms is 3.19%. From the perspective of time trend, similar to the trend depicted in Figure 1, the share of non-state-owned zombie firms had a fall followed by an increase. On the other hand, there is a progressive drop in the share of state-owned zombie firms, which may be tied to China’s state-owned enterprise reform.

Finally, we analyze the scale characteristic of zombie firms in the Yangtze River Delta Urban Agglomerations. According to the Notice on Printing and Issuing Standards for Small and Medium-sized Enterprises6, all enterprises are divided into two groups based on the number of employees: SMEs and non-SMEs. Our data shows that the number of SMEs accounts for 97.3% of the total number of industrial enterprises in the Yangtze River Delta Urban Agglomerations. We also show the proportions of the two scales of zombie firms in Figure 4. As can be seen from the figure, the proportion of small and medium-sized zombie firms is significantly higher than that of non-small and medium-sized zombie firms. Specifically, small and medium-sized zombie firms accounted for 3.26% of all industrial enterprises on average, while non-small and medium-sized zombie firms accounted for only 0.1% of all industrial enterprises on average. From the perspective of time trend, the proportion of small and medium-sized zombie firms shows a fall followed by an increase, which is consistent with the trend reported in Figure 1. Although it can be seen from the figure that the proportion of non-small and medium-sized zombie enterprises is relatively stable, the specific data shows that its changing trend is consistent with the trend in Figure 1.

The biggest feature of zombie firms is that they absorb a large amount of capital investment but cannot convert it into profits and output. The crowding of resources by inefficient enterprises means that other normal enterprises can get few resources. That is, the production activities of normal enterprises will be restricted, and investment expansion will be inhibited. Therefore, in the benchmark regression, we hope to verify whether the presence of zombie firms in the economically active Yangtze River Delta urban Agglomerations has squeezed out the investment of non-zombie firms. The specific measurement model settings are as follows:

Where c is the city, i is the industry, f is the enterprise, and t is the year. The explained variable (i.e., the dependent variable of this paper)

In order to minimize the bias of empirical results, this paper selected multiple variables as control variables. The control variable

Where,

2) Population density (PD), measured by logarithmic form, represents the scale of the consumer market. 3) The proportion of the non-agricultural population (Urbanization), representing the degree of urbanization. 4) The GDP share of the tertiary industries (Structure), representing the industrial structure of each city. Adjustment and optimization of industrial structures may assist in industrial sustainable development. 5) Total credit/GDP (Credit). The credit scale represents the intensity of financial macro-control. 6) Local budget expenditure/GDP (Expenditure), representing the basic financial expenditure of the local government. 7) Total export-import volume/GDP (Trade), representing the trade openness of the city. 8) Foreign direct investment/GDP (FDI), representing the utilization of foreign capital. The descriptive statistical results of the main variables are shown in Table 2. Each variable has passed the test for multicollinearity. The results are shown in Table 3 below.

In order to avoid endogenous problems as far as possible, we add a variety of control variables to the benchmark regression and use non-zombie firm samples for regression to reduce the impact of missing variables or reverse causal problems. The benchmark regression results are shown in Table 4. Columns (1) and (2) show the regression results of incorporating enterprise-level control variables and city-level control variables, respectively. The city fixed effect, industry fixed effect and year fixed effect are all controlled. Column (3) shows the results after adding all control variables and controlling only year fixed effect. Column (4) shows the results after adding all control variables and controlling city fixed effect, industry fixed effect, and year fixed effect. It can be seen from Table 4 that the proportion of urban zombie firms (weighted by debts) shows a significantly negative impact on the investment of local non-zombie enterprises in all regressions. That is, the greater the proportion of urban zombie firms, the less investment local non-zombie enterprises get. Column (4) of regression results shows that when the year, industry, city fixed effect, and other factors are controlled constant, the proportion of urban zombie firms increases by one percentage point, and the investment of non-zombie firms decreases by 22.9%. At the same time, the coefficient symbol before the variable representing the pollution emission density is the same as the coefficient symbol of the proportion of zombie firms (weighted by debts). Zombie firms tend to be concentrated in highly polluting industries, so the higher the pollution density, the more significant the extrusion effect of zombie firms on the investment of normal firms, which is in line with our expectations. The coefficient of foreign direct investment is significant and positive. To achieve its goal of stimulating the local economy, the government is likely to bring in large amounts of foreign investment. As a result, the injection of foreign capital can provide necessary funds for enterprises, thus promoting the development of enterprises.

This section tests the robustness of our results 1) by employing another alternative definition of enterprise investment; 2) by unifying the statistical caliber of the sample 3) by calculating the proportion of zombie firms under a different identification strategy; 4) by replacing the proportion of zombie firms with different weighting methods. Regarding the first test, an index is used to replace the original dependent variable. According to current accounting standards, the ratio of fixed assets to total assets can be regarded as a substitute variable for enterprise investment. Column (1) of Table 5 shows the regression results. Second, the statistical caliber of the samples was unified. As the statistical caliber of the Chinese Industrial Enterprises Database changed from main business revenue of over RMB five million to over RMB 20 million in 2011, we conducted robustness tests on a sample of all data with main business revenue of over RMB 20 million from 2003 to 2013. Column (2) of Table 5 shows the results after unifying the statistical caliber. Third, to identify zombie firms, another strategy is employed. According to the Theory of Corporate Lifecycles, the creation and expansion of an enterprise usually take place in a long-range cycle of 12 years. To this end, the identification strategy of zombie firms is changed. We use debt ratios higher than 70% and the age of enterprises greater than 12 to replace the original identification conditions, and recalculate the proportion of zombie firms (debt-weighted) to conduct robustness checks. The results are shown in Column (3) of Table 5. Fourth, the proportion of zombie firms weighed by assets is used to replace the debt-weighted ratio. The results are shown in Column (4) of Table 5. The coefficient symbols before the key variables representing the proportion of zombie enterprises and other control variables are completely consistent with the benchmark regression, which proves that our research results are held.

To avoid the endogeneity problems caused by omitted variables, we incorporated as many control variables as possible into the benchmark regression. However, reverse-causality problems may also result in endogenous bias. Using instrumental variables in regression is a typical method for addressing omitted variables and reverse-causality problems. To satisfy the correlation and exogeneity requirements of the instrumental variables, this paper refers to Nunn and Qian, constructs the instrumental variable as the proportion of SOEs in the current year multiplied by the national SOEs’ asset-liability ratio in the previous year, and employs the GMM method to address the endogeneity issue (Nunn and Qian, 2014). In particular, the asset-liability ratios of SOEs nationwide are from the Finance Yearbook of China. Table 6 displays the regression results for the instrumental variable method. The coefficient before the proportion of zombie firms is significantly negative. Meanwhile, the value of the Cragg-Donald Wald F Statistic is greater than the stock-Yogo weak ID test critical values at the 10% level, which proves that there is no weak instrumental variable problem. In other words, the benchmark regression result of this paper is still consistent after considering the endogeneity problem.

At the pillar of the national economy, state-owned enterprises shoulder the important tasks of economic development and maintaining social fairness and stability, and they are always criticized for their privileges on bank loans, investment and financing, government subsidies, and so on (Dai et al., 2019). In other words, state-owned enterprises usually have a greater advantage in accessing resources than non-state-owned enterprises. Therefore, the proportion of state-owned enterprises weighted by total assets is used to represent the share of the urban state-owned economy and is categorized according to its mean value. Column (1) and Column (2) of Table 7 show the ownership structure differences of the benchmark regression. The results show that zombie firms have a significantly negative impact on enterprise investment in areas with a high proportion of state-owned economies, while zombie firms have no significant impact on enterprise investment in areas with a low proportion of state-owned economies, which is consistent with our prediction.

To further demonstrate the locational differences in the impact of zombie firms on enterprise investment, we divided the 26 cities into a near-central group and a far-central group with a boundary of 300 km according to the distance grouping in Section 3.3. Column (3) and Column (4) of Table 7 show the regression results of locational differences. The effect of zombie firms on enterprise investment is significantly negative in cities close to the economic center, while it is not significant in cities far from the economic center. This may be due to the fact that Shanghai, as an economically developed first-tier city, has a certain radiation effect on neighboring cities. Therefore, the investment behavior of enterprises in cities closer to Shanghai will be more sensitive to the presence of zombie firms.

As a developing country, China’s existing energy mix is highly dependent on fossil energy sources such as coal due to its limited level of economic development and therefore inevitably has high carbon emissions. At present, few studies have combined carbon emissions with the problem of zombie enterprises, but zombie firms are clearly related to carbon emissions. Therefore, this paper innovatively analyzes carbon emission intensity as one of the mechanisms by which zombie firms affect enterprise investment. This study first calculates the carbon dioxide emissions of each city by referring to the 2006 IPCC Guidelines for National Greenhouse Gas Inventories and then uses the logarithm of carbon emissions of prefecture-level cities to represent the carbon emission intensity. The regression results of the mediation effect model show that the coefficients before carbon emission and investment are all significant, which proves that there is a partial mediation effect of carbon emission. In Column (3) of Table 8, the opposite signs of the coefficients before zombie firms and carbon emission indicate a suppressing effect of carbon emission. This may be due to the fact that zombie firms are usually concentrated in highly polluting manufacturing industries, and their presence exacerbates carbon emission intensity. Enterprises are increasing their investment in energy conservation and emission reduction to meet national policies, which in turn hinders normal investment behavior.

Zombie firms absorb large amounts of resources but fail to generate corresponding economic benefits, so their existence disrupts normal market competition. This paper takes the Herfindahl Index as the degree of competition in the market, based on the sales of double-digit industries. The regression results in Table 9 show that the competitive weakening effect is one of the mechanisms that leads to a disincentive effect of zombie firms on business investment. Zombie firms, as low-efficiency enterprises that should have withdrawn from the market but survive for various reasons, weaken the normal market competition and make high-quality enterprises unable to occupy the market, thus affecting the investment behavior of enterprises.

This study reveals that even in the economically developed region such as the Yangtze River Delta Urban Agglomerations, zombie firms still exist. In this region, the share of small and medium-sized zombie firms is much higher than that of non-small and medium-sized zombie firms. From 2003 to 2013, although zombie firms accounted for a relatively low proportion in the region, the negative impact on normal enterprises was very obvious, which significantly squeezed out the investment of non-zombie enterprises. Even after considering multiple control variables, robustness checks, and endogeneity problems, the results are still hold. In addition, our study considers, for the first time, the association of zombie firms with the green economy. Not only do we build pollution emission intensity indicators as control variables using the entropy method in the benchmark regression, but we also include carbon emission indicators in the mechanism analysis, innovatively viewing zombie firms as a link between the economy and the environment. Therefore, accurately identifying zombie firms and properly dealing with zombie firms can help improve the investment level of enterprises, optimize the efficiency of resource allocation, and promote the sustainable development of regional economy. Accordingly, the government and academia should start working on several aspects at the same time to promote the solution for zombie firms.

At present, there is still no accurate identification method for zombie firms, so it is still a problem worthy of continuous attention. It is not appropriate to use the “government hand” to define the standard in actual zombie firm treatment measures, forcing enterprises to withdraw from the market. We need to combine the actual situation in China and the data characteristics of the database to explore a more practical and accurate identification method based on the existing identification methods of zombie firms. Accurate identification of zombie firms is not only helpful to the accuracy of theoretical research results but also helps with the implementation of relevant government policies. The research of this paper has also made a new attempt on the identification method of zombie firms, but obviously, this identification method also has some shortcomings, so a more stable identification method is also one of the future research directions of this paper.

The government also needs to consider two aspects when formulating relevant policies. On the one hand, existing studies have pointed out that banks are unwilling to generate bad debts under certain regulatory standards, which may be one of the causes of zombie firms, but the core issue may be that the government has too strong intervention ability in resource allocation. Under the special political system of China, government policy favoring state-owned enterprises has always existed in the past. Therefore, the market-oriented reform of state-owned enterprises and financial system should be promoted at the national level, and the policy direction should be adjusted to block the formation of zombie firms. On the other hand, zombie firms cannot be disposed quickly and smoothly, which may have become an important factor affecting the conversion of old and new kinetic energy in China. The enterprises that have lost their competitiveness cannot be withdrawn, and new enterprises are difficult to form and develop. Even in economically developed areas like the Yangtze River Delta Urban Agglomerations, cities far from the economic center are often places with excess capacity and concentration of zombie enterprises. The extrusion effect of zombie firms on private investment of normal enterprises found in this paper provides empirical evidence for this observation. Therefore, while implementing the policy of “market mechanism plays a decisive role in resource allocation,” existing zombie firms must be disposed of by classification. The government can start from two directions: enterprise-scale and enterprise condition. First of all, it is necessary to distinguish scale and adopt different disposal methods according to the characteristics of zombie firms with different scales. In addition, a distinction should be made between enterprises that have the potential to “revive” and those that must exit the market. Some zombie firms are only temporarily suffering from operational difficulties, and market-oriented acquisition and merger, debt-equity swaps, and other means can be adopted to help them out of short-term difficulties. For those zombie firms that continue to suffer losses and do not conform to the direction of industrial restructuring, liquidation and bankruptcy should be carried out as soon as possible.

Our recommendations for future research can be divided into several directions. First, the pollution emission density and carbon emission intensity indices involved in this paper show that the existence of zombie firms not only has a direct impact on the economy but is also closely related to environmental issues, which in turn affect the sustainable development of the region. However, there are few studies that specifically consider this topic. Therefore, the zombie firm problem can be linked with the green economy problem in future studies, and its findings will aid in promoting the growth of an environmentally friendly economy. Second, a more accurate zombie firm identification method suitable for the Chinese Industrial Enterprises Database is also a research direction worthy of further discussion. The influence of cyclical factors and enterprises’ factors should be further distinguished. Due to the influence of industrial policies and economic cycles, enterprises with the leading profitability in the industry may also receive credit subsidies or suffer from operational problems. When the economic cycle turns better, these enterprises can get out of their difficulties by themselves and therefore should not be considered as zombie firms. It is also suggested that further investigations should eliminate the enterprises in the top 5% or top 10% of ROA in each industry according to the industry classification standards of the CSRC to verify whether zombie firms still have a significant negative impact on non-zombie enterprises in the Yangtze River Delta after eliminating the impact of cyclical factors. Third, the Guangdong-Hong Kong-Macao Greater Bay Area, Beijing-Tianjin-Hebei Region, Chengdu-Chongqing Economic Circle, and the three provinces of the northeast are all important economic regions in China. Consequently, in a future study, it will be necessary to evaluate the distribution characteristics of zombie firms in regions with various economic characteristics and discuss their impact on local non-zombie firms.

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

HW is the main author of this paper and responsible for the full text. YK is responsible for directing the writing of this paper and adjusting the research ideas. JS is mainly responsible for the empirical regression of this paper.

This work is supported by the National Social Science Fund of China (No. 20BGL099) and the Humanities and Social Sciences Project of Ministry of Education (No. 21YJC630112).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

We also thanks for the support from Team Building Project of Philosophy and Social Science of Jiangsu Province. We are grateful to referees for their constructive comments and suggestions. We are responsible for any remaining errors.

1The standard of above scale has changed. Specifically, the standard before 2011 was more than five million yuan of main business income, and after 2011 changed to more than 20 million yuan of main business income

2The national economic industry classification was revised in 2002 and 2011. Combined with GB/T 4754–1994 national economic industry and code and GB/T4754-2002 national economic industry and code, this paper unified the four-digit industry classification of national economy

3China began to implement the subscription system of registered capital in 2014, allowing registered capital to be gradually in place in several years. The paid-in capital system before 2014 requires the registered capital to be in place once in the current period. This paper selects the data from 2003–2013, so the paid-in capital shall not be less than or equal to 0

4China defines industrial enterprises with fewer than 20 employees as small and micro enterprises

5Two different cities with the same pronunciation, distinguished by a four-digit city code

6The standard was issued in 2011 to replace Measures on the Classification of Large, Small and Medium-sized Enterprises in Statistics (Interim) issued by the National Bureau of Statistics in 2003

Adalet McGowan, M., Andrews, D., and Millot, V. (2018). The Walking Dead? Zombie Firms and Productivity Performance in OECD Countries. Econ. Policy 33, 685–736. doi:10.1093/epolic/eiy012

Ahearne, A. G., and Shinada, N. (2005). Zombie Firms and Economic Stagnation in Japan. Int. Econ. Econ. Policy 2, 363–381. doi:10.1007/s10368-005-0041-1

Andrews, D., and Petroulakis, F. (2019). Breaking the Shackles: Zombie Firms, Weak Banks and Depressed Restructuring in Europe (OECD Economics Department Working Papers No. 1433), OECD Economics Department Working Papers. doi:10.1787/0815ce0c-en

Arrowsmith, M., Griffiths, M., Franklin, J., Wohlmann, E., Young, G., and Gregory, D. (2013). SME Forbearance and its Implications for Monetary and Financial Stability. Bank Engl. Q. Bull. 53, 296–303.

Banerjee, R., and Hofmann, B. (2018). The Rise of Zombie Firms:causes and Consequences. BIS Q. Rev, 67–77.

Beck, T., Degryse, H., De Haas, R., and van Horen, N. (2018). When Arm’s Length Is Too Far: Relationship Banking over the Credit Cycle. J. Financial Econ. 127, 174–196. doi:10.1016/j.jfineco.2017.11.007

Borio, C., and Hofmann, B. (2017). Is Monetary Policy Less Effective when Interest Rates Are Persistently Low?. BIS Working Paper.

Brandt, L., Van Biesebroeck, J., and Zhang, Y. (2012). Creative Accounting or Creative Destruction? Firm-Level Productivity Growth in Chinese Manufacturing. J. Dev. Econ. 97, 339–351. doi:10.1016/j.jdeveco.2011.02.002

Caballero, R. J., Hoshi, T., and Kashyap, A. K. (2008). Zombie Lending and Depressed Restructuring in Japan. Am. Econ. Rev. 98, 1943–1977. doi:10.1257/aer.98.5.1943

Carreira, C., Teixeira, P., and Nieto-Carrillo, E. (2021). Recovery and Exit of Zombie Firms in Portugal. Small Bus. Econ. doi:10.1007/s11187-021-00483-8

Dai, X., Qiao, X., and Song, L. (2019). Zombie Firms in China’s Coal Mining Sector: Identification, Transition Determinants and Policy Implications. Resour. Policy. 62, 664–673. doi:10.1016/j.resourpol.2018.11.016

Fukao, K., and Ug Kwon, H. (2006). Why Did Japan's TFP Growth Slow Down in the Lost Decade? an Empirical Analysis Based on Firm-Level Data of Mmnufacruring Firms. Jpn. Econ. Rev. 57, 195–228. doi:10.1111/j.1468-5876.2006.00359.x

Fukuda, S.-i., and Nakamura, J.-i. (2011). Why Did ‘Zombie’ Firms Recover in Japan?. World Econ. 34, 1124–1137. doi:10.1111/j.1467-9701.2011.01368.x

Fukuda, S., Kasuya, M., and Akashi, K. (2006). The Role of Trade Credit for Small Firms:An Implication from Japan’s Banking Crisis. Bank of Japan Working Paper Series.

Geng, Y., Liu, W., and Wu, Y. (2021). How Do Zombie Firms Affect China’s Industrial Upgrading? Econ. Model. 97, 79–94. doi:10.1016/j.econmod.2021.01.010

Goto, Y., and Wilbur, S. (2019). Unfinished Business: Zombie Firms Among SME in Japan’s Lost Decades. Jpn. World Econ. 49, 105–112. doi:10.1016/j.japwor.2018.09.007

Gouveia, A. F., and Osterhold, C. (2018). Fear the Walking Dead: Zombie Firms, Spillovers and Exit Barriers (OECD Productivity Working Papers No. 13), OECD Productivity Working Papers. doi:10.1787/e6c6e51d-en

Han, S., You, W., and Nan, S. (2019). Zombie Firms, External Support and Corporate Environmental Responsibility: Evidence from China. J. Clean. Prod. 212, 1499–1517. doi:10.1016/j.jclepro.2018.12.136

Hoshi, T., and Kashyap, A. K. (2015). Will the U.S. And Europe Avoid a Lost Decade? Lessons from Japanʼs Postcrisis Experience. IMF Econ. Rev. 63, 110–163. doi:10.1057/imfer.2014.22

Hoshi, T., and Kim, Y. (2012). Macroprudential Policy and Zombie Lending in Korea. ABFER Annual Confer.

Hoshi, T. (2006). Economisc of the Living Dead. Jpn. Econ. Rev. 57, 30–49. doi:10.1111/j.1468-5876.2006.00354.x

Huang, S., Xie, W., and Xu, X. (2021). Industrial Policy, Productivity and Zombie Firms. SSRN J. 1–61. doi:10.2139/ssrn.3820751

Imai, K. (2016). A Panel Study of Zombie SMEs in Japan: Identification, Borrowing and Investment Behavior. J. Jpn. Int. Econ. 39, 91–107. doi:10.1016/j.jjie.2015.12.001

Jaskowski, M. (2015). Should Zombie Lending Always Be Prevented? Int. Rev. Econ. Finance 40, 191–203. doi:10.1016/j.iref.2015.02.023

Kane, E. J. (1987). Dangers of Capital Forbearance: The Case of the FSLIC and 'Zombie' S&Ls. Contemp. Econ. Policy 5, 77–83. doi:10.1111/j.1465-7287.1987.tb00247.x

Li, X., Shen, G., and Jin, X. (2021). Impact of Zombie Firms on China’s Aggregate TFP Dynamics. Econ. Sci. 01, 44–56. doi:10.12088/PKU.jjkx.2021.01.04

Luo, Y., Jie, X., Li, X., and Yao, L. (2018). Ranking Chinese SMEs Green Manufacturing Drivers Using a Novel Hybrid Multi-Criterion Decision-Making Model. Sustainability 10, 2661. doi:10.3390/su10082661

Mohrman, M. B., and Stuerke, P. S. (2014). Shareowners’ Equity at Campbell Soup: How Can Equity Be Negative? Account. Educ. 23, 386–405. doi:10.1080/09639284.2014.910814

Nakamura, J.-i. (2017). “Evolution and Recovery of Zombie Firms: Japan’s Experience,” in Japanese Firms during the Lost Two Decades. SpringerBriefs in Economics (Tokyo: Springer Japan), 7–36. doi:10.1007/978-4-431-55918-4_2

Nishimura, K. G., and Kawamoto, Y. (2003). Why Does the Problem Persist? ‘Rational Rigidity’ and the Plight of Japanese Banks. World Econ. 26, 301–324. doi:10.1111/1467-9701.00524

Nunn, N., and Qian, N. (2014). US Food Aid and Civil Conflict. Am. Econ. Rev. 104, 1630–1666. doi:10.1257/aer.104.6.1630

Peek, J., and Rosengren, E. S. (2005). Unnatural Selection: Perverse Incentives and the Misallocation of Credit in Japan. Am. Econ. Rev. 95, 1144–1166. doi:10.1257/0002828054825691

San-Jose, L., Urionabarrenetxea, S., and García-Merino, J.-D. (2022). Zombie Firms and Corporate Governance: What Room for Maneuver Do Companies Have to Avoid Becoming Zombies? Rev. Manag. Sci. 16, 835–862. doi:10.1007/s11846-021-00462-z

Schivardi, F., Sette, E., and Tabellini, G. (2022). Credit Misallocation during the European Financial Crisis. Econ. J. 132, 391–423. doi:10.1093/ej/ueab039

Shen, G., and Chen, B. (2017). Zombie Firms and Over-capacity in Chinese Manufacturing. China Econ. Rev. 44, 327–342. doi:10.1016/j.chieco.2017.05.008

Storz, M., Koetter, M., Setzer, R., and Westphal, A. (2017). Do We Want These Two to Tango? on Zombie Firms and Stressed Banks in Europe. ECB Working Paper Series.

Sun, H., Kporsu, A. K., Taghizadeh-Hesary, F., and Edziah, B. K. (2020). Estimating Environmental Efficiency and Convergence: 1980 to 2016. Energy 208, 118224. doi:10.1016/j.energy.2020.118224

Sun, H., Edziah, B. K., Sun, C., and Kporsu, A. K. (2021). Institutional Quality and its Spatial Spillover Effects on Energy Efficiency. Socio-Econ. Plan. Sci. 101023, 101023. doi:10.1016/j.seps.2021.101023

Tan, Y., Huang, Y., and Woo, W. T. (2016). Zombie Firms and the Crowding-Out of Private Investment in China. Asian Econ. Pap. 15, 32–55. doi:10.1162/ASEP_a_00474

Wang, H., and Wu, C. (2011). Green Growth as the Best Choice for Chinese Small and Medium Enterprises in Sustainable Development. Asian Soc. Sci. 7, p81. doi:10.5539/ass.v7n5p81

Keywords: zombie firms, extrusion effect, Yangtze River Delta Urban Agglomerations (YRDUA), SMEs—small and medium sized enterprises, industrial sustainable development

Citation: Wang H, Kong Y and Shi J (2022) The Role of Zombie Firms in Industrial Sustainable Development: Evidence From Yangtze River Delta Urban Agglomerations. Front. Environ. Sci. 10:896036. doi: 10.3389/fenvs.2022.896036

Received: 14 March 2022; Accepted: 27 May 2022;

Published: 23 June 2022.

Edited by:

Kai Fang, Zhejiang University, ChinaReviewed by:

Xiuyan Liu, Southeast University, ChinaCopyright © 2022 Wang, Kong and Shi. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Haijing Wang, d2FuZ2hqMTI3QDE2My5jb20=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.