- School of Economics and Finance, Huaqiao University, Quanzhou, China

In the carbon neutrality strategy, facilitating the green innovation of enterprises and promoting industrial upgradation have become a key issue. We explore the relationship between the financial ecological environment, financing constraints, and green innovation of manufacturing enterprises based on endogenous growth and stakeholder theories. Manufacturing companies listed on Shanghai Stock Exchange and Shenzhen Stock Exchange during 2010–2020 are taken as samples. With the help of principal component analysis, a comprehensive index of the annual financial ecological environment is constructed. The SA index is employed to measure the financing constraints of firms, and the number of granted green patents is used to measure the green innovation of manufacturing enterprises. We conclude that the green innovation of manufacturing enterprises will relax their financing constraints. The financial ecological environment positively moderates the relationship between green innovation and corporate financing constraints. An excellent financial ecological environment enhances the mitigation effect of green innovation of manufacturing enterprises on their financing constraints. Policy implications are given according to the conclusion.

1 Introduction

Since the government proposed “promoting green, circular, and low-carbon development” and “create a beautiful China” in 2017, China’s ecological civilization construction has become an important strategic goal. The close combination of technological innovation, the key driving force of economic growth, green development, and the active implementation of green innovation (GI), can help China break the trade-off between economic growth and environmental protection (Li and Xiao, 2020). The manufacturing industry is the mainstay industry of China’s economy. On the one hand, it is an essential vehicle for creating social and economic wealth. On the other hand, it consumes natural resources. Therefore, the manufacturing industry is the key to coordinating economic development and environmental protection. Consequently, promoting GI in manufacturing enterprises has become a high-profile issue.

Currently, China’s economy is transforming the development mode, improving the industrial structure, and switching the driving force of growth. GI carried out by enterprises is vital to China’s high-quality economic development. However, GI may encounter more serious financing constraints than normal innovation as GI is at more expense with higher risk and greater uncertainty and dual externalities of the economy and environment. The manufacturing industry is the pillar of China’s real economy, and green upgradation is essential to sustainable development. In 2021, the value added of the manufacturing industry accounted for 27.4% of China’s GDP. Chinese manufacturing enterprises face trade barriers, such as green, carbon tariffs, and technology barriers, in the international market. However, they suffer severe overcapacity caused by upgrading domestic consumption. Therefore, they must follow the Chinese government’s policy of supply-side structural reform, implement a GI development strategy, improve the product supply structure, and transform and upgrade. It is of great practical significance to investigate the relationship between financing constraints and the GI of manufacturing enterprises in China. The financial ecological environment is an essential factor affecting the financing constraints of the enterprises. An excellent financial ecological environment can change the resource allocation, channel funds to enter green and low-carbon industries, alleviate the financing constraints of enterprises, and help the GI.

The important factors influencing the GI of firms have been studied in multiple dimensions, providing a solid theoretical basis for the GI-transforming and -upgrading firms. But the literature pays little attention to the impact of GI on financing constraints. Consequently, the listed companies in the manufacturing industry in the Chinese stock market are taken as a sample. The principal component analysis method is used to build a comprehensive index to measure the annual financial ecological environment to describe the internal and external economic factors of manufacturing firms, with the number of granted green patents as the proxy for GI. The SA index is employed to measure the financing constraints of the firms. The relationship between GI and financing constraints of the manufacturing enterprises and the moderating effect of the financial ecological environment are further analyzed.

The rest of the article is organized as follows. Section 2 provides a literature review and puts forward the research hypotheses. Section 3 introduces the research design, and Section 4 presents the empirical analysis. Section 5 provides the conclusion and policy implications.

2 Literature Review and Research Hypotheses

This study is mainly related to three topics: financial ecological environment, the relationship between GI and financing constraints, and the relationship between financial ecological environment, GI, and financing constraints. The literature review and corresponding hypotheses are as follows.

2.1 Financial Ecological Environment

The effective operation and development of financial organizations are inseparable from the macro-factor of the financial ecological environment. Bai (2001) defined the financial ecological environment as the development, utilization, and efficiency of financial resources and declared that the sustainable development of finance must be based on the sustainability of the financial ecological environment. Based on the concept of ecosystem, coined by the British ecologist Tansley (1935), Zhou (2004) proposed the concept of a financial ecological environment and applied it to China’s financial system. The financial ecological environment refers to some primary conditions of financial operation, including the legal and institutional environment, the market order, and the modern corporate system. Xu (2005) elucidated that financial ecology is the generalization of ecology in finance, using the ecological methods to study the financial system. The financial ecological environment can be divided into hard and soft environments. The soft environment depends on the hard environment, and the core of the hard environment is the legal regime. Lin (2005) used the system theory approach to analyze the relationship between subsystems in the financial ecosystem. Han and Lei (2008) studied the relationship between the changes in China’s financial ecological environment and the development of financial agents. Improving the financial ecological environment can significantly promote the development of financial agents. Wan and Rao (2008) analyzed the excessive bank borrowing of listed firms from the perspective of financial ecology. They found that excessive bank borrowing is due to internal factors and external financial ecological environments. He (2011) compared the common financial ecological environment assessment methods, such as normal standardization, expert method, standard deviation weighting, factor analysis, analytic hierarchy process, and fuzzy comprehensive evaluation. Deng and Chen (2014) constructed the evaluation indicator system of the regional financial ecology for China. Wang and Feng (2015) assessed the financial ecological environment in various regions of China from the four dimensions, government governance, economic foundation, financial development, and institutional and cultural construction. Zhou and Xiu (2017) examined the impact of the financial ecological environment and debt governance on the capacity utilization of listed companies in manufacturing industries in China. Grafe and Mieg (2019) combined financial ecology, as an analytical tool, with infrastructure, as a perspective and set up a conceptual model in the context of the U.K. Municipal Bonds Agency to understand the impacts of financialization on cities. It concludes by outlining some of the spatial effects of the UK’s changing financial ecology of urban infrastructure. Zhong et al. (2020) explored the poverty alleviation effect of the regional financial ecological environment in the case of Yunnan, China. Sun et al. (2021) put together five groups or subgroups to evaluate the quality of institutions, consistent with the excellent degree of the financial ecological environment. These groups are government size, the legal system with property rights, sound money, freedom to trade internationally, and credit, labor, and business regulations. The spatial spillover effects of institutional quality on energy efficiency, an important aspect of GI, are studied. Li and Chen (2021) built a dynamic model of the financial ecosystem based on the three dimensions of financial ecosystem: actors, environment, and regulation and conducted early warning research.

2.2 Green Innovation and Financing Constraints

Green innovation is also known as eco-innovation, environmental innovation, or sustainable innovation. GI has three aspects: green products, green processes, and green management innovations (Huang et al., 2015). Fussler and James (1996) proposed the initial concept of eco-innovation and defined it as evolving new processes and products that offer business and customer value by reducing environmental hazards. Rennings (2000) introduced the term eco-innovation and described it as developing new ideas, products, services, processes, and management systems. Subsequently, the concept of GI keeps developing and extending. Schiederig et al. (2012) argued that GI is sustainable innovation and is often associated with the concepts of externality, sustainable development, and environmental problems. Driessen et al. (2013) advocated that GI has the characteristics of externality, reducing environmental pressure, and having ecological benefits. Ghisetti and Rennings, 2014 adopted the definition that environmental innovation is the production, assimilation, or exploitation of a product; production process; service; or management or business methods novel to the firm or organization. This reduces environmental risk, pollution, and other negative impacts of resource use throughout its life cycle (including energy use) compared to relevant alternatives. Wu (2019) asserted that GI combines “green” from the perspective of social responsibility and “innovation” from the perspective of economic development. It can solve environmental problems and improve competitiveness by reducing production costs and differentiating management.

Fazzari et al.’s (1988) research is a classic study on corporate financing constraints. There are two approaches to measuring the financing constraints of firms, cash flow sensitivity, and financing constraint index. Fazzari et al. (1988) claimed that enterprises are accompanied by high cash flow sensitivity of investment when facing severe financing constraints. However, Almeida et al. (2004) implied that companies with financing constraints save or hold most of their cash flow when better investment opportunities are expected. Commonly used financing constraint indexes include the KW index (Kaplan and Luigi, 1997), WW index (Whited and Wu 2006), and SA index (Hadlock and Pierce 2010). As the first two indexes involve many endogenous variables and have obvious defects, Hadlock and Pierce (2010) divided the enterprise financing constraints into five levels. They then introduced two exogenous variables, firm size, and age, to construct the SA index. Therefore, the SA index involves fewer endogenous variables and is more robust, accurate, and easy to calculate.

The study of financing constraints from financial development has drawn more attention. For example, Love (2003) showed that firms usually experience tighter financing constraints in countries where finance is less developed. Likewise, Khurana et al. (2006) found that the financial markets in less developed economies force enterprises to obtain funds from internal financing to avoid the high cost of external funding.

Most existing studies on the relationship between GI and financing constraints mainly investigate the impact of financing constraints on GI. For instance, Aghion et al. (2009) showed that GI activities, such as green inventions and patents, are more likely to be replaced by other investment activities when firms are subjected to financing constraints. In addition, Ye (2021) analyzed the impact of financing constraints on GI and the moderating effect of government subsidies on this impact. However, there is little literature on the impact of GI on financing constraints. Therefore, this study examines the relationship between GI and financing constraints of the manufacturing enterprises from the perspective of the impact of GI on financing constraints.

The endogenous growth theory advocates that technological innovation is the key to ensuring sustainable economic growth, and for the manufacturing enterprises, GI is an important source of sustainable development. Therefore, GI will inevitably be encouraged by government subsidies. However, it will also be favored by investors, helping broaden the financing channels of the enterprises. Moreover, China’s financial system is bank-centered, and bank lending covers most corporate external funding. Therefore, the strategies of sustainable development and environmental protection formulated by enterprises have increasingly become the banks’ focus, and the GI of enterprises will also be supported by the banks’ green loans. Hence, the first hypothesis is as follows.

H1: Green innovation helps relax the financing constraints of the manufacturing firms.

2.3 Financial Ecological Environment, Green Innovation, and Financing Constraints

The stakeholder theory claims that firms may benefit from GI. Through GI, firms will likely get a better social reputation, more significant market share, favorable consumer feedback, and government policy support. Many studies have discussed the economic consequences of GI in the literature. The studies of the financial implications of GI involve three issues. First is the impact of GI on environmental performance. For example, Küçükoğlu and Pınar (2015) stated that GI activities have a significant effect on a company’s environmental performance and competitive advantage. Qi et al. (2018) highlighted that GI is the key to achieving enterprise competitiveness and environmental protection, and the enterprises undertaking GI get government support. Second is the impact of GI on economic performance. Jiang et al. (2018) indicated that green entrepreneurial orientation positively influences environmental and financial performances. Similarly, Tang et al. (2018) found that green process innovation and product innovation can significantly and positively affect enterprise financial performance. Third is the impact of GI on employment and society. For example, Kunapatarawong et al. (2016) argued that companies that engage in GI have a relatively large number of employments. This phenomenon is more significant in companies that voluntarily carry out GI. In addition, Fang and Na (2020) found that GI helps enterprises establish a good social image of the fulfilling social responsibilities.

Thus, there is almost no literature on the moderating effect of the financial ecological environment on the relationship between GI and financing constraints of the manufacturing firms. GI of firms is conducive to environmental protection and sustainable development. Furthermore, an excellent financial ecological environment will strengthen the mitigation effect of GI on firms’ financing constraints. However, the contradiction between the huge investment in innovation activities and the uncertainty of output exerts tight external financing constraints on firms. External fund providers cannot fully grasp the real information of the internal R&D activities, resulting in information asymmetry between internal managers and external fund providers. In an excellent financial ecological environment, financial intermediaries can obtain relevant internal information through specific channels and transmit the GI information of manufacturing enterprises to the financial market. This alleviates the problem of information asymmetry and helps enterprises obtain external funding. Therefore, for manufacturing enterprises, a good financial ecological environment enhances GI and weakens the degree of financing constraints. Then, the second hypothesis is proposed as follows.

H2: For manufacturing enterprises, the financial ecological environment positively moderates the relationship between GI and financing constraints. A good financial ecological environment enhances the mitigation effect of GI on the financing constraints of manufacturing enterprises.

3 Research Design

3.1 Sample and Data

Manufacturing enterprises listed on Shanghai Stock Exchange and Shenzhen Stock Exchange are selected as samples. The sample period is 2010–2020. The selection follows two principles. First, companies with missing data are eliminated to ensure data reliability. Second, companies with ST, *ST, and PT are deleted. The number of listed companies in the manufacturing industry is 1045. All the continuous variable data are processed with winsorization at 1% and 99% quantiles to avoid the influence of outliers. Panel data regression models are adopted in this study.

3.2 Variables

3.2.1 Financial Ecological Environment

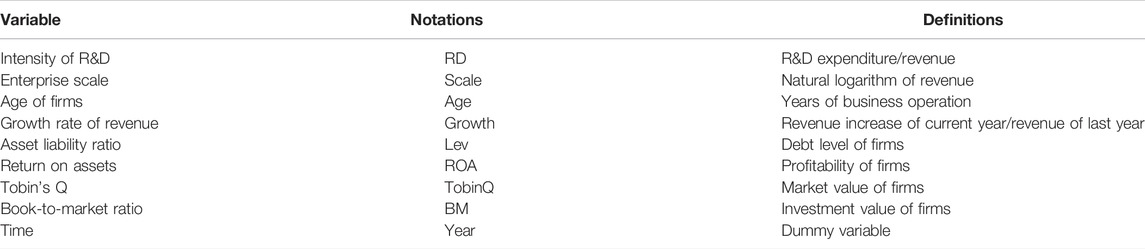

Following Hao et al. (2020), we used the principal component analysis to extract features of the indicators about firms or provinces where firms are located and constructed the financial ecological environment index denoted by FE. Table 1 shows the indicators.

3.2.2 Green Innovation

Liu and Wang (2021) claimed that patents show the quality of innovation. Similarly, green patents reveal the quality of GI. Therefore, we use the number of granted green patents to measure the GI of enterprises. Specifically, the number of GIs and utility models held by listed companies in the manufacturing industry is used as the number of green patents to measure GI.

3.2.3 Financing Constraints

We use the SA index (Hadlock and Pierce 2010) to measure the financing constraints of firms, denoted by FC. The greater the SA index, the tighter the firm’s financing constraints. In addition, the WW index (Whited and Wu 2006) is used to conduct a robustness check. The calculation for financing constraints is as follows:

where size is the natural logarithm of a firm’s total assets and Age is the age of a firm. FC is the dependent variable in the regression models.

3.2.4 Control Variables

In addition, other factors, such as the control variables, might affect the dependent variable. The definitions and notations of the control variables are listed in Table 2.

3.3 Models

To test H1, we build a panel data regression model M1 with year fixed effect.

where

To test H2, we build a panel data regression model M2 with year fixed effect.

where

4 Empirical Analysis

We employ the panel data of 1,045 listed companies in China’s manufacturing industry for 2010–2020 in the regression analyses of M1 and M2. Furthermore, when studying the moderating effect of the financial ecological environment, we decentralize the GI and financial ecological environment before multiplying the GI and FE to alleviate the possible multicollinearity of the model due to the continuity of the data.

4.1 Descriptive Statistics

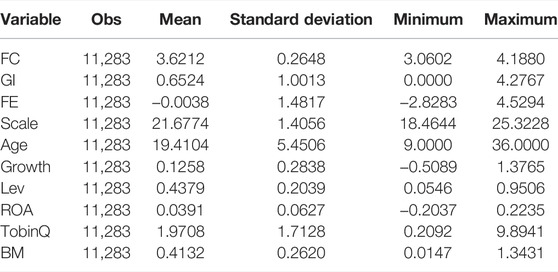

Table 3 shows the descriptive statistics after winsorization. Table 3 indicates that the maximum GI is 4.2767, the minimum GI is 0, the average GI is 0.6524, and the standard deviation of GI is 1.0013. This means that the number of granted green patents owned by the manufacturing companies listed in China’s stock market varies greatly. Therefore, the maximum financial ecological environment index FE is 4.5294, the minimum FE is -2.8283, the mean of FE is -0.0038, and the standard deviation of FE is 1.4817. Furthermore, this implies that the financial ecological environment for the various listed companies in the manufacturing industry is diversified.

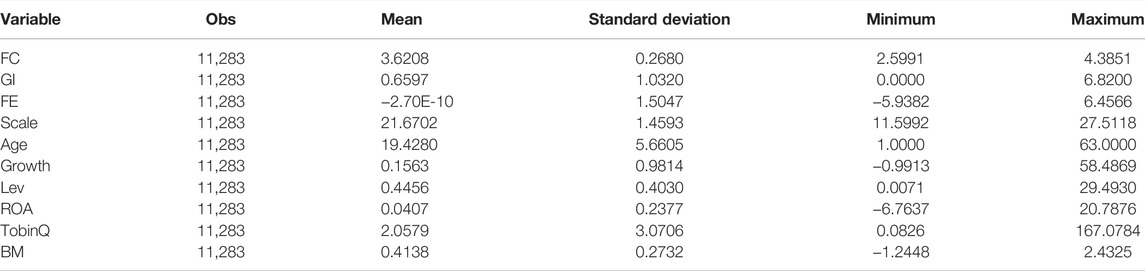

We compare the descriptive statistics of the variables before winsorization in Table 4 and those after winsorization in Table 3 to highlight the justification for the data processing by winsorization. Tables 3, 4 show that the number of observations is the same after the data were winsorized at the 1% and 99% quantiles. Still, the minima and maxima have changed, and the influence of the outliers has been eliminated to a certain extent.

4.2 Correlation Analysis

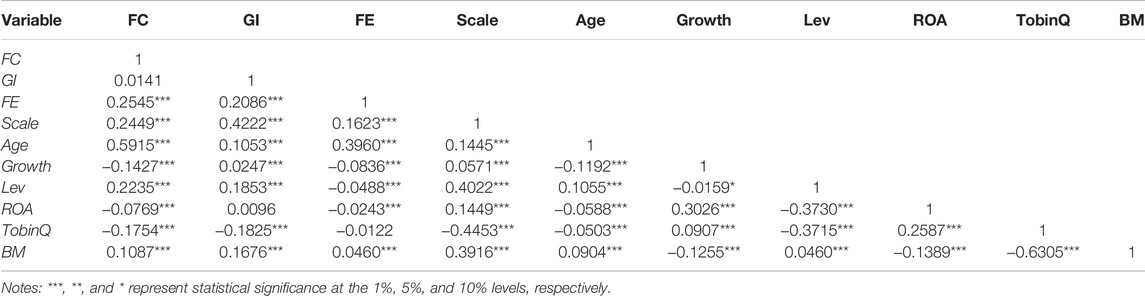

Table 5 presents the Pearson correlation coefficients of the variables. Table 5 shows that the explained variable (FC) is correlated with all the control variables, indicating that the choice of control variables is plausible. Furthermore, as the correlation coefficients of all the variables are all less than 0.8, severe multicollinearity in our regression analyses does not exist.

4.3 Regression Analysis

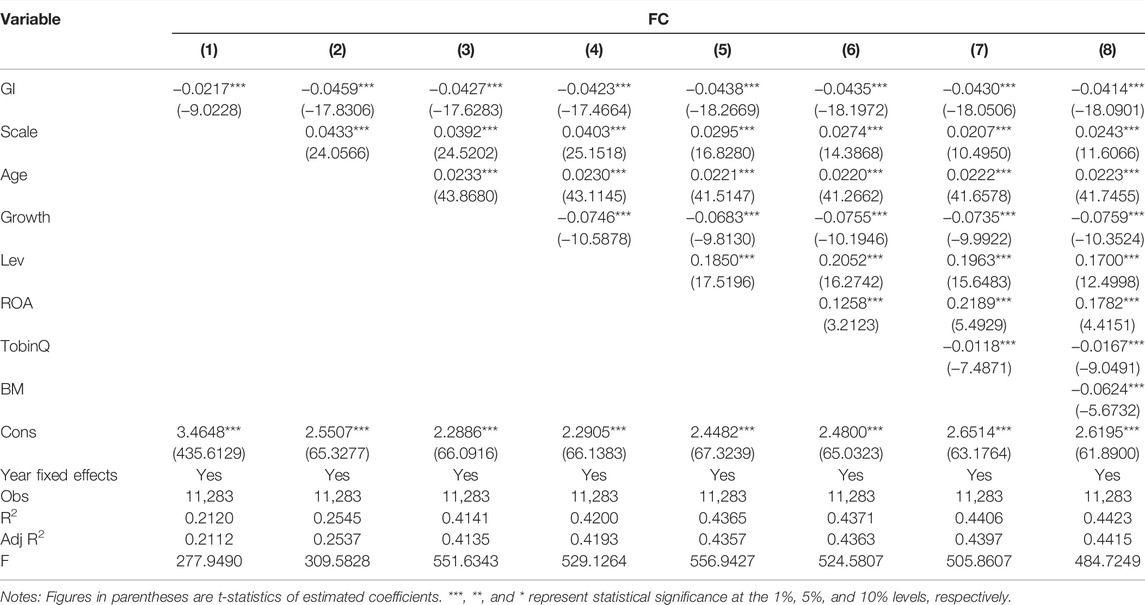

The stepwise regression analysis method is used in our models. Model M1 is used to analyze the relationship between GI and financing constraints of manufacturing enterprises and test H1. Table 6 shows the regression results.

Column (8) of Table 6 shows that the regression coefficient of green innovation (GI) is −0.0414, and it is significantly negative at the 1% level. So, we can infer that GI negatively impacts the financing constraints of the firms. Therefore, H1 is verified, and GI helps relax the financing constraints of the manufacturing enterprises. In addition, the coefficients of all the control variables are significant. The coefficients of Scale, Age, Lev, and ROA are positive, and the coefficients of Growth, TobinQ, and BM are negative.

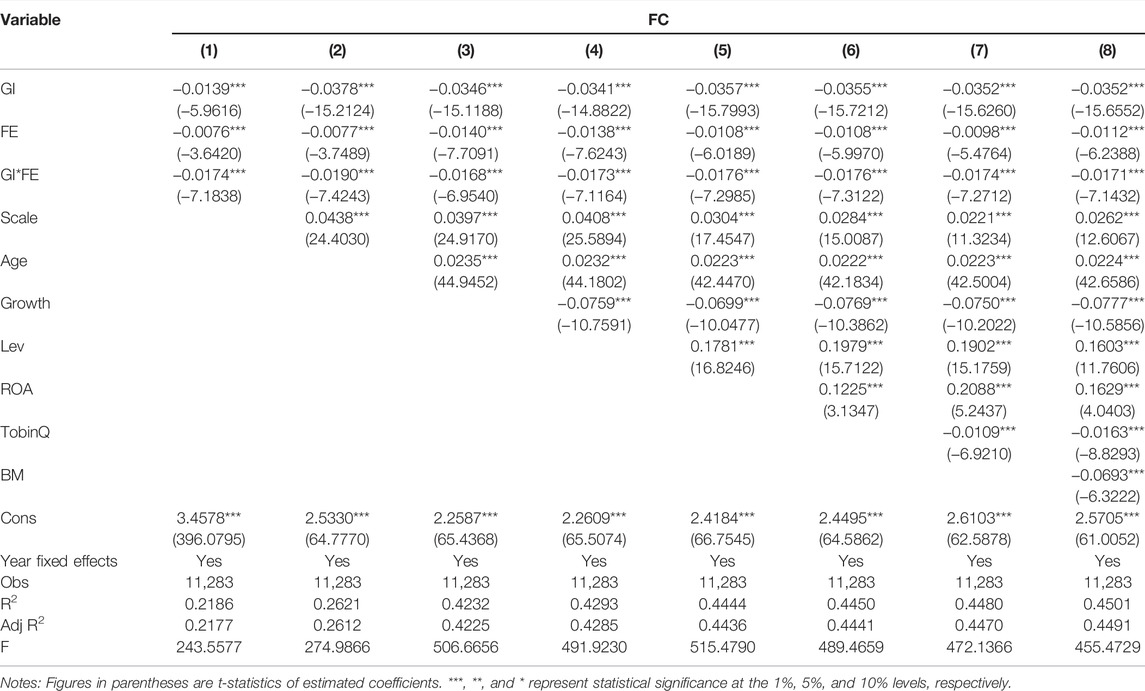

Table 7 shows the regression results of model M2. Column (8) of Table 7 shows that green innovation (GI) is negatively correlated with the financing constraint FC, and the coefficient of GI is significant at the level of 1%. Hence, hypothesis H1 is verified again.

We calculate the internal and external financial ecological environment indicators through principal component analysis, construct the comprehensive index of the annual financial ecological environment (FE), and introduce the product term GI*FE into model M2. This is to test the moderating effect of the financial ecological environment on the relationship between GI and financing constraints. We can understand the role of the product term GI*FE in the model from two perspectives. From a statistical standpoint, the influence of the independent variable GI on the dependent variable FC will be moderated by another variable, FE, that is, FE will affect the strength of the correlation between GI and FC. While from the perspective of economic implications, the financial ecological environment affects the intensity of the influence of GI on the financing constraints.

Column (8) of Table 7 also shows that the coefficient of GI*FE is negative at the 1% significance level. Therefore, the financial ecological environment positively moderates the relationship between green innovation, GI, and financing constraints, FC, of the manufacturing enterprises. Consequently, a good financial ecological environment enhances the mitigation effect of GI on financing constraints of the manufacturing enterprises, that is, hypothesis H2 is verified.

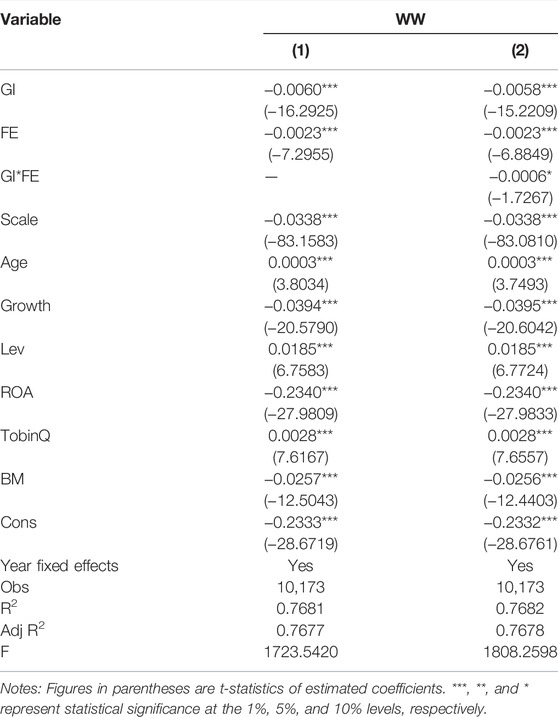

4.4 Robustness Check

We substitute the WW index for the SA index as the proxy variable for financing constraints in models M1 and M2 to check the robustness. The calculation formula of the WW index (Whited and Wu 2006) is as follows:

where CF is the ratio of a firm’s cash flow to its total assets, DIV is a dummy variable whose value is 1 when the firm pays dividends, TL is the ratio of its total long-term liabilities to its total assets, size is the natural logarithm of its total assets, ISG is the sales growth rate of the industry that the firm is in, and SG is the sales growth rate of the firm.

Table 8 shows the regression results. We find that the explanatory (green innovation GI) and moderating variables (financial ecological environment FE) have a significant impact on the explained variable (financing constraint FC), and the magnitude and the direction of impact are, by and large, consistent with the original models, M1 and M2. Therefore, it is demonstrated that the selection of variables is reasonable, and the regression results of the models are robust and reliable.

5 Conclusion and Policy Implications

We investigate the relationship between the financial ecological environment, GI, and financing constraints of manufacturing enterprises based on endogenous growth and stakeholder theories. Manufacturing companies listed on Shanghai and Shenzhen stock exchanges are taken as samples. A comprehensive index of the annual financial ecological environment is constructed with principal component analysis to explain the financial condition of the economy. The number of granted green patents is used to measure the GI of the manufacturing enterprises. The conclusion is as follows.

Green innovation eases the financing constraints of the manufacturing companies. The greater the number of GIs, the more funding the manufacturing enterprises received from the government, investors, and financial institutions. Thus, the manufacturing enterprises have broadened the financing channels through GI and reduced the degree of corporate financing constraints.

The financial ecological environment positively moderates the relationship between GI and the financing constraints of the manufacturing enterprises. A good financial ecological environment enhances the mitigation effect of GI on financing constraints.

In light of the conclusion, policy implications for promoting GI are provided to the manufacturing firms, financial institutions, and governments.

Manufacturing enterprises must increase their investment in GI to grow continuously and steadily in the fierce market competition. Furthermore, GI is an important method for enterprises to fulfill social responsibility and has become a significant determinant of acquiring funding. Mainly, GI can effectively ease the financing constraints of manufacturing enterprises. Moreover, GI needs technology and talents. Therefore, enterprises should increase the recruitment of high-level skills and strengthen technical exchanges and cooperation with universities and research institutions.

Financial institutions should promote green finance, play the role of information media, and help relieve firms’ GI financing pressure. Financial institutions efficiently transmit the GI of manufacturing enterprises to the financial market through business linkages. This signals good development to alleviate the problem of information asymmetry and increase the availability of external financing. Additionally, financial institutions should assist companies and the market in improving the pricing mechanism of green products, green processes, and technologies to better serve the green development of enterprises.

The government must improve the financial ecological environment and adopt subsidies, tax incentives, and policy support to foster GI in manufacturing enterprises. With rewards and punishment arrangements by the government, the market mechanism can fully play to guide the GI and reduce environmental pollution. In addition, talents and technology are the keys to the success of GI. Therefore, the government should introduce human resource policies to attract senior talents, build a high-quality financial ecological environment, and help enterprises engage in GI.

The capital market should offer various green financing models. Issuance of green financial bonds by financial institutions should be encouraged to effectively help reduce the financing cost of GI projects. Furthermore, the China Securities Regulatory Commission and other financial regulatory authorities should render policy support for effective supervision over the issuance of green bonds by nonfinancial companies. They should help financial institutions carry out green financial innovation and provide more financing channels for green upgradation.

There are some limitations to this study. First, the sample in this study is the listed manufacturing companies in the Chinese stock market, not including the non-listed manufacturing enterprises. Second, enterprise heterogeneity is not considered in the empirical analyses, affecting the relationship between the financial ecological environment, GI, and financing constraints. Finally, the green finance policy helps alleviate the financing constraints and promotes GI in enterprises. Therefore, GI and financing constraints will become a hot issue to be studied in the future.

Data Availability Statement

The data analyzed in this study is subject to the following licenses/restrictions: The datasets analyzed for this study can be obtained from the Wind Economic Database, CSMAR Database, and China Statistical Yearbook. They are available from the authors on request. Requests to access these datasets should be directed to YW, anJfd2FuZ3lhanVuQDE2My5jb20=.

Author Contributions

LZ: supervision, conceptualization, methodology, funding acquisition, conceptualization, writing—original draft, and writing—reviewing and editing. YW: methodology, data curation, and writing—reviewing and editing.

Funding

This work was financially supported by the National Social Science Fund of China (20BJL015).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

The authors would like to thank the editorial board and anonymous referee for giving several constructive suggestions.

References

Aghion, P., Veugelers, R., and Serre, C. (2009). “Cold Start for the Green Innovation Machine,” in Bruegel Policy Contributions 2009/12 (Brussels: Bruegel).

Almeida, H., Campello, M., and Weisbach, M. S. (2004). The Cash Flow Sensitivity of Cash. J. Financ. 59, 1777–1804. doi:10.1111/j.1540-6261.2004.00679.x

Bai, Q. (2001). An Introduction to Financial Sustainable Development. Beijing: China Financial Publishing House.

Deng, Q., and Chen, R. (2014). A Research of Constructing Regional Financial Ecological Main Bodies’ Indicator System and Competitiveness Evaluation. Int. Bus. Manage. 8, 20–25. doi:10.3968/j.ibm.1923842820130801.1035

Driessen, P. H., Hillebrand, B., Kok, R. A. W., and Verhallen, T. M. M. (2013). Green New Product Development: The Pivotal Role of Product Greenness. IEEE Trans. Eng. Manage. 60, 315–326. doi:10.1109/TEM.2013.2246792

Fang, X., and Na, J. (2020). Stock Market Reaction to Green Innovation: Evidence from GEM Firms. Econ. Res. J. 55, 106–123.

Fazzari, S. M., Hubbard, R. G., Petersen, B. C., Blinder, A. S., and Poterba, J. M. (1988). Financing Constraints and Corporate Investment. Brookings Pap. Econ. Activity 1988, 141–195. doi:10.2307/2534426

Fussler, C., and James, P. (1996). Driving Eco-Innovation: A Breakthrough Discipline for Innovation and Sustainability. London: Pitman Publishing.

Ghisetti, C., and Rennings, K. (2014). Environmental Innovations and Profitability: How Does it Pay to Be Green? an Empirical Analysis on the German Innovation Survey. J. Clean. Prod. 75, 106–117. doi:10.1016/j.jclepro.2014.03.097

Grafe, F.-J., and Mieg, H. A. (2019). Connecting Financialization and Urbanization: The Changing Financial Ecology of Urban Infrastructure in the UK. Reg. Stud. Reg. Sci. 6, 496–511. doi:10.1080/21681376.2019.1668291

Hadlock, C. J., and Pierce, J. R. (2010). New Evidence on Measuring Financial Constraints: Moving beyond the KZ Index. Rev. Financ. Stud. 23, 1909–1940. doi:10.1093/rfs/hhq009

Han, T., and Lei, Y. (2008). Financial Ecological Environment Change and Financial Development. J. World Econ. 3, 71–79. doi:10.3969/j.issn.1002-9621.2008.03.008

Hao, Y., Ye, B., Gao, M., Wang, Z., Chen, W., Xiao, Z., et al. (2020). How Does Ecology of Finance Affect Financial Constraints? Empirical Evidence from Chinese Listed Energy- and Pollution-Intensive Companies. J. Clean. Prod. 246, 119061. doi:10.1016/j.jclepro.2019.119061

He, C. (2011). A Comparative Study of Regional Financial Ecological Evaluation Methods. Financ. Theor. Pract. 378, 81–85.

Huang, X., Hu, Z., Fu, C., and Yu, D. (2015). Influence Mechanism of green Innovation Strategy on Enterprise Performance: Intermediary Effect Based on green Dynamic Capability. Sci. Technol. Prog. Pol. 32, 104–109. doi:10.6049/kjjbydc.2015030337

Jiang, W., Chai, H., Shao, J., and Feng, T. (2018). Green Entrepreneurial Orientation for Enhancing Firm Performance: A Dynamic Capability Perspective. J. Clean. Prod. 198, 1311–1323. doi:10.1016/j.jclepro.2018.07.104

Kaplan, S. N., and Zingales, L. (1997). Do Investment-Cash Flow Sensitivities Provide Useful Measures of Financing Constraints? Q. J. Econ. 112, 169–215. doi:10.1162/003355397555163

Khurana, I. K., Martin, X., and Pereira, R. (2006). Financial Development and the Cash Flow Sensitivity of Cash. J. Financ. Quant. Anal. 41, 787–808. doi:10.1017/S0022109000002647

Kunapatarawong, R., and Martinez-Ros, E. (2016). Towards Green Growth: How Does Green Innovation Affect Employment? Res. Pol. 45, 1218–1232. doi:10.1016/j.respol.2016.03.013

Küçükoğlu, M. T., and Pınar, R. İ. (2015). Positive Influences of Green Innovation on Company Performance. Proced. - Soc. Behav. Sci. 195, 1232–1237. doi:10.1016/j.sbspro.2015.06.261

Li, Q., and Xiao, Z. (2020). Heterogeneous Environmental Regulation Tools and Green Innovation Incentives: Evidence from Green Patents of Listed Companies. Econ. Res. J. 55, 192–208.

Li, Y., and Chen, W. (2021). Systematic Dynamics of Regional Financial Ecosystems Stability: The Example of Hebei Province. J. Syst. Sci. 3, 125–130.

Lin, Y. (2005). Financial Ecological Construction: An Analysis Based on System Theory. J. Financ. Res. 8, 44–52.

Liu, B., and Wang, X. (2021). The Risk Compensation Effect of Enterprise Green Innovation on Stock Returns. Bus. Manage. J. 43, 136–157. doi:10.19616/j.cnki.bmj.2021.07.009

Love, I. (2003). Financial Development and Financing Constraints: International Evidence from the Structural Investment Model. Rev. Financ. Stud. 16, 765–791. doi:10.1093/rfs/hhg013

Qi, S., Lin, S., and Cui, J. (2018). Do Environmental Rights Trading Schemes Induce Green Innovation? Evidence from Listed Firms in China. Econ. Res. J. 53, 129–143.

Rennings, K. (2000). Redefining Innovation - Eco-Innovation Research and the Contribution from Ecological Economics. Ecol. Econ. 32, 319–332. doi:10.1016/s0921-8009(99)00112-3

Schiederig, T., Tietze, F., and Herstatt, C. (2012). Green Innovation in Technology and Innovation Management - an Exploratory Literature Review. R&D Manage 42, 180–192. doi:10.1111/j.1467-9310.2011.00672.x

Sun, H., Edziah, B. K., Sun, C., and Kporsu, A. K. (2021). Institutional Quality and its Spatial Spillover Effects on Energy Efficiency. Socio-Economic Plann. Sci., 101023. doi:10.1016/j.seps.2021.101023

Tang, M., Walsh, G., Lerner, D., Fitza, M. A., and Li, Q. (2018). Green Innovation, Managerial Concern and Firm Performance: An Empirical Study. Bus. Strat. Env. 27, 39–51. doi:10.1002/bse.1981

Tansley, A. G. (1935). The Use and Abuse of Vegetational Concepts and Terms. Ecology 16, 284–307. doi:10.2307/1930070

Wan, L., and Rao, J. (2008). Study on Excessive Bank Borrowing of Listed Firms from the Perspective of Financial Ecology. J. Mod. Account. Audit. 4, 32–39.

Wang, G., and Feng, G. (2015). Evaluation of Financial Ecological Environment in China (2013-2014). Beijing: China Financial Publishing House.

Whited, T. M., and Wu, G. (2006). Financial Constraints Risk. Rev. Financ. Stud. 19, 531–559. doi:10.1093/rfs/hhj012

Ye, C. (2021). Financing Constraints, Government Subsidies and Enterprise Green Innovation. Stat. Decis. 37, 184–188. doi:10.13546/j.cnki.tjyjc.2021.21.038

Zhong, W., Zhong, C., and Zheng, M. (2020). Research on Poverty Reduction Effect and Path of Regional Financial Ecological Environment. Stat. Decis. 36, 138–141. doi:10.13546/j.cnki.tjyjc.2020.09.029

Zhou, X. (2004). Refine Legeal System and Improve Financial Ecology. Beijing: Financial News. (December 7th).

Keywords: manufacturing enterprises, financial ecological environment, financing constraints, green innovation, endogenous growth theory, stakeholder theory

Citation: Zhao L and Wang Y (2022) Financial Ecological Environment, Financing Constraints, and Green Innovation of Manufacturing Enterprises: Empirical Evidence From China. Front. Environ. Sci. 10:891830. doi: 10.3389/fenvs.2022.891830

Received: 08 March 2022; Accepted: 06 April 2022;

Published: 16 May 2022.

Edited by:

Huaping Sun, Jiangsu University, ChinaReviewed by:

Dexiang Mei, Chongqing Technology and Business University, ChinaTingqiang Chen, Nanjing Tech University, China

Copyright © 2022 Zhao and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Linhai Zhao, bG9uZ21lbjE2OEAxMjYuY29t

Linhai Zhao

Linhai Zhao Yajun Wang

Yajun Wang