94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 15 June 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.890096

This article is part of the Research Topic ESG Investment and Its Societal Impacts View all 28 articles

This study aims to examine the effects of Corporate Social Responsibility (CSR) and green finance dimensions on the environmental performance of banking institutions in a developing economy like Bangladesh. In order to identify the relationship between the study variables, primary data were collected from 388 employees of Private Commercial Banks (PCBs) in Bangladesh using a non-probabilistic convenience sampling method and analyzed using the Structural Equation Modeling (SEM) approach. The results suggested that CSR practices have a positive influence on the environmental performance. Furthermore, the results indicated that the social, economic and environmental aspects of green financing significantly influence the environmental performance of banking institutions. Overall, the paper concludes that CSR practices and financing of various eco-friendly projects play a crucial role in improving the environmental performance of organizations and ultimately promote a sustainable development in the country. Finally, the study’s findings can help managers of banking institutions in emerging economies like Bangladesh strengthen internal resources such as CSR activities and green finance to improve environmental performance. Therefore, the major policy implications are further discussed.

Recently, most countries, especially the emerging ones, have prioritized economic advancement over environmental growth. As a result, they are facing several environmental issues, such as climate change, biodiversity loss, environmental degradation, soil erosion, air pollution, deforestation, land loss, etc. (Zheng et al., 2021a). Bangladesh is considered to be one of the next emerging countries in the world (Nawaz et al., 2020), with huge investment, growth and economic potential to become a market leader in the 21st century (Akter et al., 2018; Zheng et al., 2021a). However, like most developing nations, Bangladesh is also grappling with the problem of climate change and its associated environmental implications (Zheng et al., 2021a). To alleviate these threats and promote a sustainable development, they have developed several initiatives, including the adoption of green financing (Hossain, 2019; Zheng et al., 2021a). In this regard, banking institutions play a critical role by supporting socially responsible initiatives and financing a variety of eco-friendly projects, such as clean energy, alternative energy, energy efficiency, renewable energy, green industry development and waste management, among others (Akter et al., 2018; Zhixia et al., 2018), all of which greatly contribute to an organization’s sustainability performance (Teixeira and Canciglieri Junior, 2019) and the country’s sustainable economic development (Zheng et al., 2021a). Green finance (GF) is a growing concept (Liu et al., 2020) and can be defined as a new monetary tool that integrates economic benefits with environmental preservation (Wang and Zhi, 2016). Corporate social responsibility (CSR), on the other hand, is seen as another activity that assists organizations in improving their business for long-term sustainability (Kolk, 2016). Any organization’s environmental performance can be measured by a number of metrics including low environmental emissions, pollution control, waste reduction and recycling (Lober, 1996). As a result, CSR and GF can be viewed as important approaches to increasing an organization’s environmental sustainability (Kala et al., 2020; Suganthi, 2020).

For several decades, scholars have used CSR to assess an organization’s performance (Ali et al., 2020; Kraus et al., 2020). However, there has been little emphasis dedicated to investigating green finance dimensions and CSR practices in the sphere of environmental performance. Moreover, a few studies have found that green finance significantly improves the environmental performance (Chen et al., 2022; X. Zhang et al., 2022), sustainability performance (Indriastuti and Chariri, 2021; G. Zheng et al., 2021a), and financial performance (Indriastuti and Chariri, 2021). Despite this, Wang et al. (2022) recently investigated the effect of green financing dimensions in accomplishing, excelling, and improving CSR in the banking sector. The study discovered that green finance and its corresponding dimensions (social, economic, and environmental) play a role in increasing the various facets of CSR such as employees, consumers, communities, legal and ethical issues, and stakeholders. Furthermore, literature has confirmed that CSR practices significantly improves organizational performance (Abbas, 2020; Famiyeh, 2017; Galant and Cadez, 2017; Javed et al., 2020; Laskar, 2018; Rı’os-Manrquez et al., 2021; Saeidi et al., 2021; Ying et al., 2021; G. Zhou et al., 2021), environmental performance (Ghisetti and Rennings, 2014; Bamgbade et al., 2018; Kraus et al., 2020; Suganthi, 2020; Ajibike et al., 2021; Sinha et al., 2021), and sustainability performance (Abbas et al., 2019; Ajibike et al., 2021; Indriastuti and Chariri, 2021; Pham et al., 2021; Sadiq et al., 2021). Despite the fact that numerous studies have evaluated a company’s environmental and financial performance through CSR, academics continue to focus on this link due to inconclusive findings (Kraus et al., 2020). Besides, a couple of studies have been conducted to measure the impact of green banking practices on banks’ environmental performance in Sri Lanka (Shaumya and Arulrajah, 2017), India (Kala et al., 2020), Nepal (Risal and Joshi, 2018) and Pakistan (Rehman et al., 2021). In the context of Bangladesh, a few studies have attempted to explore GF and sustainability performance of financial institution (G. Zheng et al., 2021a), as well as CSR and corporate performance (Alamgir and Uddin, 2017). However, the effect of CSR and GF dimensions (social, economic, and environmental) on the environmental performance of banking institutions remain largely unexplored. In addition, there exist limited studies in the direction of CSR, GF and environmental performance based on the primary data. To the best of the author’s knowledge, no research has been conducted on the influence of CSR and GF dimensions on bank environmental performance.

In filling the aforementioned research gap, this study aims to answer the following two research questions: Do CSR practices have a positive influence on the environmental performance of PCBs in Bangladesh? Do GF dimensions such as social, economic and environmental have a positive effect on the environmental performance of PCBs in Bangladesh? In this study, we build on CSR and GF concepts to better understand how banks engage in green financing and social responsibility to improve their overall organizational sustainability. To construct our argument, we deploy the legitimacy theory to understand how corporations might legitimize their social responsibility actions (Suchman, 1995), and extend the concept of GF (Dörry and Schulz, 2018) to improve organizational sustainability performance. Furthermore, this is an empirical study based on survey data collected from the banking industry of an emerging economy such as Bangladesh. In order to examine the relationship between the study variables such as CSR practices, green finance dimensions (social, economic, and environmental), and environmental performance, the study used a structured questionnaire to collect the primary data from 388 bankers of private commercial banks (PCBs) using a non-probabilistic convenience sampling method. Subsequently, the structural equation modeling (SEM) approach was employed to analyze the obtained primary data. Empirical findings indicate that CSR practices have a positive influence on the environmental performance of banking institutions. In addition, the results show that the social, economic, and environmental aspects of green financing have a significant influence on environmental performance.

Moreover, in light of the existing literature on CSR, GF and environmental performance in the context of banking institutions in emerging economies, the empirical findings of the study offer a number of theoretical and practical contributions. First, this study is one of the first to empirically examine the positive association between the various components of GF (social, economic, and environmental) on the environmental performance of banking institutions in Bangladesh, which was overlooked by previous studies (Chen et al., 2022; X. Zhang et al., 2022; G. Zheng et al., 2021a). Second, the significant positive link between CSR and environmental performance in the context of banking sector represents a novel contribution to the existing literature on CSR and organizational sustainability. As a result, the study’s empirical findings are consistent with the concepts of GF and legitimacy theory, which illustrate that GF and CSR practices improve firms’ environmental performance by highlighting the need of societal consent in attaining long-term sustainable growth (Indriastuti and Chariri, 2021). Finally, the empirical findings can help managers of banking institutions in emerging economies like Bangladesh strengthen internal resources such as CSR activities and green finance to improve environmental performance.

The reminder of the paper is organized as follows: Section 2 presents related literature and relevant hypotheses. Section 3 advances the research methodology, followed by the results and discussions in Section 4. Section 5 provides study conclusion and directions for future research.

According to the legitimacy theory, societal consent is crucial to the promotion of an organization’s environmental sustainability. Besides, legitimacy theory asserts that firms actively seek and maintain legitimacy by integrating corporate ideals, policies, and strategies with community values (Dowling and Pfeffer, 1975). As a result, organizations must choose activities that are appropriate and consistent with social perspectives, beliefs, and norms. Furthermore, green finance can be viewed as a company’s strategy to gain and maintain legitimacy (Chariri, Anis et al., 2018) because it helps businesses to control the environmental implications of their operations by minimizing energy use and decreasing carbon emissions and other adverse consequences (Minatti Ferreira et al., 2014; Chen et al., 2022). According to the legitimacy theory, the substance and extent of CSR activities are determined by the link between societal expectations (e.g., in the form of prevailing social ideologies), managers’ attitudes toward what they believe to be legitimate societal expectations, and company behavior (Gray et al., 1988). As a result, in accordance with the legitimacy idea, businesses should use green finance, social, and environmental initiatives to gain, maintain, or restore their legitimacy. Therefore, the current study developed a comprehensive research model based on the notion of legitimacy theory to evaluate the relationship between GF dimensions, CSR activities, and EP in the setting of banking institutions in an emerging country like Bangladesh.

The concept of CSR have a long and complicated history (Saeidi et al., 2021). However, it rose to prominence in the 20th century, particularly the early 1950s and has attracted the attention of academics and businesses in recent years (Carrington et al., 2019). The theories, concepts and ideas of CSR are frequently regarded as a western phenomenon due to the region’s solid organizational frameworks as well as efficient and fair legislation (Ansong, 2017). Despite the popularity of CSR concept in the academia and businesses, it lacks a clear and unified definition (Bussmann et al., 2021). The absence of diverse theoretical limits and conceptualization has led to the proliferation of CSR definitions. However, the unified CSR standard definitions advocate that companies must design their strategies in accordance with the society’s ethical expectations (Vuković et al., 2020). According to Carroll (1979), CSR is defined as a firm’s social responsibility, which includes society’s regulatory, economic, moral and discretionary demands of enterprises at any particular time. Furthermore, CSR is defined as a firm’s sense of responsibility to the society and community (both ecological and social) in which it exists (Kaschny and Nolden, 2018). CSR refers to strategies that organizations or firms use to conduct business in a way that is ethical, socially responsible, and developmentally useful to the community (Mocan et al., 2015). Reducing carbon footprints, volunteering, and investing in environmentally conscious business are among the most important CSR activities undertaken by banking institutions (Mocan et al., 2015). Therefore, CSR initiatives can be understood as initiatives that organizations undertake for the benefit of society and the environment in order to achieve overall organizational performance and sustainability.

Since its inception, GF has acquired a substantial traction in the economic conversation among international organizations and state governments (D. Zhang et al., 2019). GF has also gained popularity among academics, scholars, researchers and practitioners (D. Zhang, 2018; G. W. Zheng et al., 2021a), and it now represents a new financial model that stresses green investment to safeguard the environment while also promoting economic success (Wang et al., 2019). GF is seen as a vital component of sustainable banking, with a significant influence on the expansion of a balanced economy and markets in general (Akter et al., 2018; Hoque et al., 2019; G. W. Zheng et al., 2021a). GF is a holistic approach that combines numerous initiatives to enhance the monetary system’s economic, social and environmental performance, as measured by Environmental, Social and Governance (ESG) criteria, i.e., factors that are critical components of long-term economic growth and finance (G. Zheng et al., 2021a). The main operations of GF include green bonds, microfinance, sustainable funds, impact investments, active ownership, credits for environmental sustainability and enhancement of entire financial systems. As defined by the EU high-level expert group on sustainable finance, GF is a financial system that addresses challenges such as environmental sustainability, sustainable housing, pension, infrastructural facilities, technological advancement, reducing carbon emissions, as well as other long-term academic and societal issues (G. Zheng et al., 2021a).

Furthermore, several previous studies have described GF as the development of economic, social and environmental implications of financial services (X. Zhou et al., 2020), with a broad influence on the expansion of a sustainable economy and company (Akter et al., 2018). The term “GF” refers to a set of three dimensions known as the “Triple Bottom Line,” which includes social, economic, and environmental aspects (Malsha et al., 2020; G. W. Zheng et al., 2021a). Most research, in particular, identify GF parameters in a unique way. Only a few studies, however, have looked at the connections between the social, economic and environmental components of GF in the banking industry (Akter et al., 2018; Raihan, 2019; G. W. Zheng et al., 2021a). Recently, Zheng et al. (2021a) investigated the development of GF in the Bangladeshi banking sector, particularly in PCBs, and found that the level of consciousness, perceptions and comprehension of the important dimensions of GF and green financing among PCBs bankers was adequate for the successful implementation of GF in Bangladesh to facilitate the country’s long-term eco-development. The study also highlighted renewable energy, energy efficiency, alternative energy, waste management, green sector growth, and so on as key sources of green financing by banking institutions.

Environmental performance is an element of environmental sustainability efficiency that relates to the company’s natural environment activities and goods (Klassen and Whybark, 1999), and can be best assessed via the effective use of the material, as stated by Tung et al. (2014). Furthermore, the emission intensity was applied to estimate the environmental performance of the firm (Qi et al., 2014), and the study stated that the firm’s environmental impact can be calculated using different index, ranking or environmental score. Also, the environmental performance of the firm determines the priorities of sustainability that set the strategic goals in order to meet the objectives of stakeholders, investors, staff, consumers, distributors, and local authorities and also fulfill the regulatory and legal requirements of organizations (Shaumya and Arulrajah, 2017; Akter et al., 2018; Risal and Joshi, 2018). While environmental performance is not the same as organizational protection of the environment, constructive and consistent effort to achieve such well-defined goals of conserving natural resources and business productivity is something far wider (Shaumya and Arulrajah, 2017). Hence, the banking sector is considered one of the key stakeholders in the idea of GF, which has a direct and indirect detrimental effect on environmental performance (Rehman et al., 2021). As a result, the environmental performance of banking institutions can be measured by the activities and strategies that assist organizations in reducing paper usage and energy consumption, improving banks’ compliance with environmental standards, lowering carbon emissions, and providing staff with environmental protection and energy savings training (X. Zhang et al., 2022).

While several scholars have studied the association between CSR and financial and non-financial performance, only a few have explored the relationship between CSR and environmental performance in the context of developing countries (Suganthi, 2020). More recently, the relationship between CSR and environmental performance for long-term business success was investigated by Suganthi, (2020). The study discovered that CSR initiatives significantly improve an organization’s environmental performance, demonstrating that CSR initiatives enable a business look inwards and drives employees to adopt solid and liquid waste reduction. Organizations that invest in CSR projects are more likely to achieve cost savings, enhanced quality, adaptability, better delivery, as well as overall long-term sustainability (Famiyeh, 2017). Furthermore, Sidhoum and Serra (2017) investigated the relationship between CSR and many aspects of performance across United States electric utilities, including the environment, social, economic and governance. The study discovered that economic and environmental performance as well as economic and social performance are strongly linked. It also stated that environmentally friendly technology will promote financial health and aid in the development of a better environmental system, resulting in improved economic outcomes as well as sustainability. Furthermore, CSR perception has a substantial effect on environmental performance (Channa et al., 2021). Despite this, CSR had no significant impact on environmental performance (Kraus et al., 2020). Environmental performance can be enhanced through management commitment to CSR; they can reduce contamination and materials waste during the production process, resulting in recyclable products (Rivera et al., 2017). In this study, CSR initiatives can be defined as initiatives that “organizations undertake for the benefit of society and the environment in order to achieve overall organizational performance, including the environmental performance. Hence, the following hypothesis has been formulated:

Hypothesis 1 (H1): CSR activities positively influence the banks’ environmental performance.

The economic element of GF is recognized as the most powerful factor driving sustainable funding in banking industries, thus contributing to organizational sustainability (Zheng et al., 2021a). Banks, like other corporate sectors such as energy, manufacturing or chemical industry, cannot ignore ecological problems and must accept environmental responsibility to meet economic goals, enhance their reputation and operate more efficiently (Gallego-Álvarez and Pucheta-Martínez, 2020). Environmental measures pursued by financial institutions are a source of competitive advantage (Carnevale and Mazzuca, 2014). Kala et al. (2020) identified the various green initiatives adopted by the banking institutions to improve their environmental performance. Recently, the research has demonstrated that the economic aspects of GF boost the sustainability performance of banking institutions significantly (Zheng et al., 2021a). This implies that the economic aspect of GF plays an important role in improving the bank’s environmental performance because it addresses issues that lead to sustainable economic growth, competitive advantage and the acquisition of financial implications of climate change from the government. Based on the above reasoning, the following hypothesis has been formulated.

Hypothesis 2 (H2): The economic aspect of GF positively influences the banks’ environmental performance.

The pursuit of environmental benefits as a result of social responsibility is the most important motivation for banking financial institutions to generate green credit and for businesses to perform eco-innovation (Wu et al., 2021). Banking organizations are primarily involved in money and credit transactions, which have no direct impact on the environment (Jaeggi et al., 2018). Green bond issuance lowers financing costs of companies and increases their resource efficiency, thus allowing them to better serve the society and fulfill their social responsibilities (X. Zhou and Cui, 2019). Zheng et al. (2021a) researched the factors impacting the sustainability performance of financial institutions in Bangladesh and discovered that the social element of GF had a favorable impact on sustainability performance. Furthermore, the literature indicates that banking institutions’ financing of various eco-friendly initiatives may contribute to societal benefits such as engaging the local community in development programs, offering staff benefits, and improving brand awareness (Raihan, 2019; Zheng et al., 2021a). As a result, it can be concluded that the social side of GF plays an important role in enhancing banks’ environmental performance through sponsorship of eco-friendly projects. Thus, the following research hypothesis is advanced.

Hypothesis 3 (H3): The social aspect of GF positively influences the banks’ environmental performance.

GF encompasses a wide range of financial instruments and policies targeted at reducing carbon emissions, including carbon market instruments, green banks, green bonds and community-based green funds (Ilma, 2020). It also includes financing investment in various socially responsible initiatives that deliver environmental advantages in the larger framework of sustainable development, such as air, water and soil pollution reduction (Guild, 2020). GF is an investment that is meant to have a positive impact on the environment (Koirala, 2019). On the other hand, sustainable finance is a broader concept that encompasses all three aspects of sustainable development including environmental, social and economic (Mehralian et al., 2016). According to a study by Zheng et al. (2021a), the environmental element of GF has a direct impact on the sustainability performance of financial institutions. According to the study of Raihan, (2019) and Zheng et al. (2021a), GF provides a variety of environmental benefits, including reduced energy usage and carbon emissions from banking activities, hence boosting overall organizational environmental sustainability. In this study, we therefore argue that the environmental element of GF is essential in improving the environmental performance of banking institutions due to its direct link with organizational sustainability. Thus, the following research hypothesis is postulated:

Hypothesis 4 (H4): The environmental aspect of GF positively influences the banks’ environmental performance.

The hypothesized conceptual framework of the study is shown in Figure 1. The conceptual research model was designed based on the theoretical foundation and review of the recent literature on CSR activities, different aspects of GF (social, economic and environmental), as well as the environmental performance of organizations.

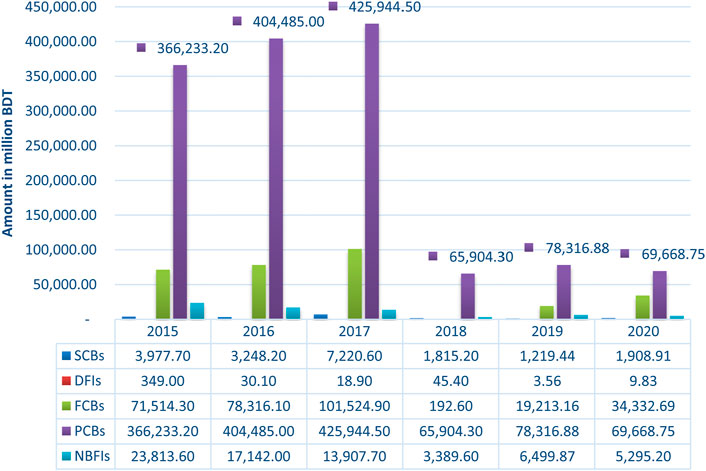

This paper aims to examine the effects of CSR activities and various dimensions of GF namely social, economic and environmental on the environmental performance of banking institutions in Bangladesh. As illustrated in Figure 2, PCBs were specifically chosen for this study due to their major contribution to direct GF in Bangladesh (Hossain, 2019). Due to the unknown features of the population for this study, a non-probability convenience sampling method was employed to obtain a sample from the required population. The primary data was acquired using a structured questionnaire approach from 388 commercial bank staffs, including managers, assistant managers, officers, senior officers, and junior officers. A total of 467 questionnaires were distributed, out of which 79 were excluded due to incomplete responses. The final sample size is 388, indicating an effective rate of 83.08%, which exceeds the response rate of 25–30% suggested by Murphy (2003). The data was collected during the period between February and March 2019 from the sample banks located in Dhaka, Bangladesh. Of the respondents, 75.3% were male, while 24.7% were female. In terms of age, around 65% of the respondents are in age range 26–35, while only 6.3% are above 55. In addition, 48.5% had masters’ degree; 27.6%, undergraduate degree; and 15.2%, higher secondary certificate.

FIGURE 2. Green financing by banks and non-banks financial institutions in Bangladesh during the period 2015–2020.

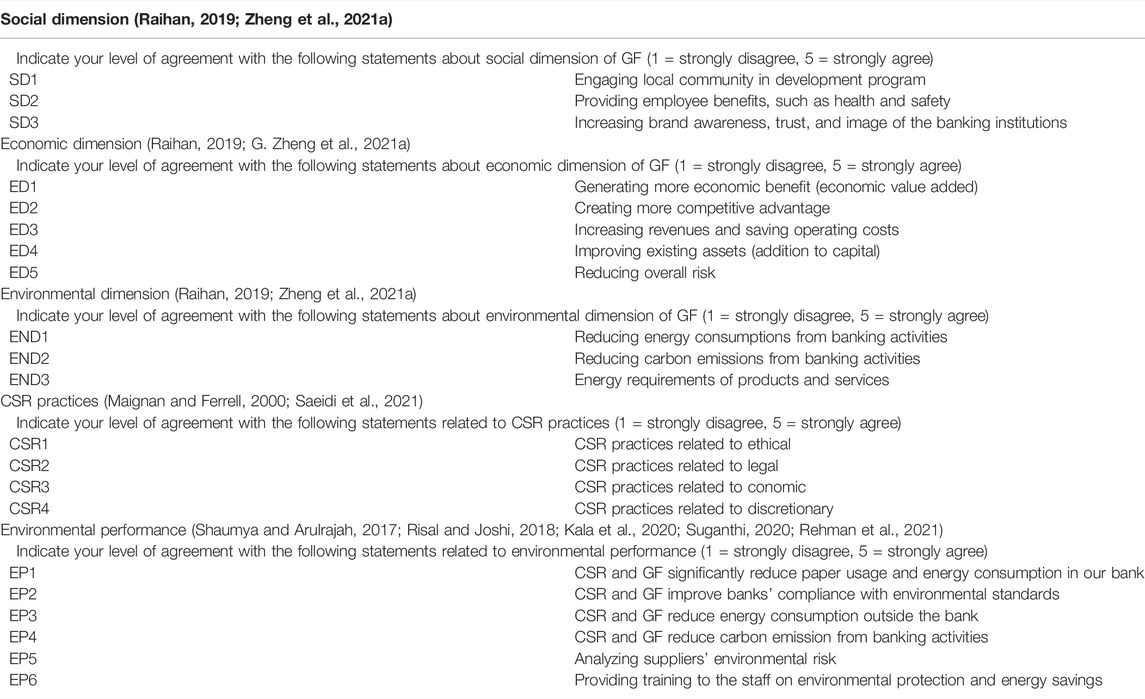

A structured questionnaire was used to collect the primary data. Table 1 shows the variables that were adapted from previous studies and included 21 items to measure GF dimensions (social, economic, and Environmental), CSR practices, and environmental performance. The questionnaire items represent the constructs of CSR, environmental performance and the various dimensions of GF, namely social, economic and environmental. The social (three items), economic (five items) and environmental (three items) dimensions of GF were adapted from the previous studies (Raihan, 2019; Zheng et al., 2021a; Zheng et al., 2021b). The five items used to measure CSR were adapted from earlier studies of Maignan and Ferrell (2000) and Saeidi et al. (2021), while environmental performance scale was measured with the six items culled from previous works (Shaumya and Arulrajah, 2017; Risal and Joshi, 2018; Kala et al., 2020; Suganthi, 2020; Rehman et al., 2021). Except for demographic questions, all questionnaire items were graded on a 5-point Likert scale, with 1 indicating “strongly disagree” and 5, “strongly agree.” Respondents were asked demographic questions such as their gender, age and level of education.

TABLE 1. Items of the questionnaire to measure GF dimensions, CSR practices, and Envrionmental Performance.

The study used Confirmatory Factor Analysis (CFA) and the Structural Equation Model (SEM) to analyze the acquired primary data. Nunnally and Bernstein (1994) argued that the validity of the scale is critical for the instrument used in diverse cultures. Hence, the CFA model was used to validate the research instrument, and also evaluate the model’s reliability, convergent and discriminant validity, and overall fit based on previous studies (Fornell and Larcker, 1981; Bentler, 1992; Hu and Bentler, 1999). Finally, SEM was employed to test the proposed hypotheses.

Table 2 shows the descriptive statistics and correlation analysis of study variables. The mean value indicates that social, economic and environmental dimension of GF are the most important determinants of environmental performance. The skewness and kurtosis values were both less than the cut-off values, ±3 and ±10, respectively, as indicated by Kline (2011). The correlation analysis revealed a weak connection between the research variables, demonstrating the absence of multicollinearity problem.

In agreement with Gerbing and Anderson (1988), the outcomes of CFA, standardized coefficients and various model fit indices were used to assess the measurement model of the study. Furthermore, the Cronbach’s Alpha (CA) and Composite Reliability (CR) values were employed to determine the reliability and validity of the research data. As highlighted in Table 1, the CA values for all the variables ranged from 0.711 to 0.837, which is satisfactory and exceed the standard value of 0.70 (Nunnally and Bernstein, 1994). Similarly, in Table 3, the CR values ranged from 0.753 to 0.833, which is higher than the minimal cut-off value of 0.7 (Fornell and Larcker, 1981). Based on the findings of CA and CR, the validity of the constructs and internal consistency of the measuring items are appropriate and acceptable. Table 3 provides the standard estimates of factor loadings that were used to determine the proposed model’s convergent validity. In the CFA analysis, the standard factor loadings (see Table 3) varied between 0.631 and 0.826, which is greater than the 0.5 cut-off value provided by Hair et al. (2010). On the other hand, the AVE values (see Table 4) ranged between 0.431 and 0.558, which is greater than the recommended limit of 0.50 (Fornell and Larcker, 1981). Accordingly, the convergent validity of measurements is deemed adequate and satisfactory.

Furthermore, the constructs’ discriminant validity was estimated using the Fornell–Larcker criteria and the Heterotrait–Monotraits ratio (HTMT). To determine the discriminant validity, the square root of a construct’s AVE value must be greater than its highest correlation with any other construct in the model (Fornell and Larcker, 1981). Table 4 shows that the AVE for each factor surpasses the squared inter-factor correlation. As a result, discriminant validity was observed in all constructs. For robustness, this study also measured the HTMT value due to its supremacy over Fornell-Larcker in various situations (Henseler et al., 2015), and recorded a value lower than 0.90 (see, appendix Appendix Table A1), implying the absence of a discriminant validity problem (Henseler et al., 2015). Therefore, the results indicate a high level of discriminant validity between the factors employed in the model. Also, the result in Table 4 indicated that the Variance Inflation Factor (VIF) varied between 1.194 and 1.454, which satisfy the standard value of one to five (Zuur et al., 2010). This shows that multicollinearity was not a barrier to proceeding to the next analysis. The VIF is a useful approach for determining whether or not independent variables exhibit multicollinearity, as suggested by Kleinbaum et al. (1988). Moreover, Appendix Table A2 (see, appendix) shows the results of the measurement model and reveals the model fit indices as being within the acceptable limits (Hu and Bentler, 1999). The measurement model fit statistics are p-value = 0.000; Chi-square/df = 1.933; RMR = 0.030; GFI = 0.939; AGFI = 0.915; CFI = 0.957; IFI = 0.958; TLI = 0.946; RMSEA = 0.051. Therefore, the overall model fit is adequate and satisfactory. The outputs of the CFA measurement model with standardized estimates, as can be shown in Figure 3.

Figure 4 demonstrates the structural model of the study, which shows the impacts of the relationship between the latent variables and the constructs. It can be concluded that the CSR and three dimensions of GF (social, economic and environmental) have a positive effect on banks’ environmental performance. Further, the model fit indices were also used to identify the structural model suitability. Appendix Table A2 (see, appendix) shows that the findings of the structural model fit indices were within the acceptable standards limit (Hu and Bentler, 1999). The structural model fit statistics are p-value = 0.000; Chi-square/df = 1.923; RMR = 0.029; GFI = 0.940; AGFI = 0.920; CFI = 0.961; IFI = 0.960; TLI = 0.952; RMSEA = 0.049. Therefore, the overall structural model can be considered acceptable and satisfactory.

Table 5 shows the outcomes of the research hypotheses. The results revealed that CSR has a positive impact on banks’ environmental performance; therefore, H1 is supported. Table 5 indicates that H2 is also supported, indicating that the economic aspect of GF has a positive and significant impact on environmental performance. Furthermore, the results showed that social aspect of GF has a significant positive relationship with the environmental and therefore supports H3. In addition, the results revealed a significant positive association between the environmental aspect of GF and EP, thus corroborating H4. Hence, it can be concluded that CSR activates, and GF dimensions play a critical role in enhancing overall environmental performance of banking institutions in Bangladesh, thereby aiding the country’s sustainable economic development.

The link between CSR and firm performance including cost, market, environmental, and sustainability has been thoroughly researched all around the world. However, the evidence of relationship is still inconclusive (Bahta et al., 2021), which could be due to the neglect of the social, economic and environmental elements of GF. The relationship between CSR and environmental performance can be better understood when examined from the standpoint of green financing. As a result, the current study used SEM to examine the relationship between CSR activities, GF dimensions and bank environmental performance in Bangladesh. The findings of this study demonstrated a significant link between CSR and bank environmental performance, implying that the evolution of socially responsible acts improves environmental performance while also providing several business benefits. In other words, participation in CSR activities such as ethical, legal, economic and discretionary can help banks enhance their internal and external environmental performance, and hence their overall sustainability. In comparison to earlier research, our findings support the notion that CSR policies have a favorable impact on the environmental performance of banking institutions in developing countries like Bangladesh. This empirical investigation is corroborated by past studies (Sidhoum and Serra, 2017; Bamgbade et al., 2018; Suganthi, 2020; Ahmad et al., 2021), which discovered a strong link between CSR policies and environmental performance in large manufacturing companies. Besides that, the empirical finding is consistent with the legitimacy theory, which explains the engagement of banking institutions in spending and implementing CSR initiatives, as social pressure and regulatory standards have required businesses to engage in CSR practices in order to promote social acceptance and environmental sustainability (Suttipun et al., 2021). Hence, the findings of this study contribute to past research on CSR and environmental performance, and strengthen the evidence that CSR has an impact on banking organizations’ environmental performance.

Furthermore, the empirical results indicated that the three dimensions of GF namely social, economic and environmental performance have a substantial influence on the environmental performance of banking institutions in Bangladesh. This suggests that the participation of banking institutions in green financing is related to better environmental performance. Research has also established a definite relationship between various dimensions of GF (social, economic and environmental) and sustainability performance in financial institutions. The present study is the first to investigate these relationships in the Bangladeshi banking sector; in particular, endorsement of this findings has not been reported in the related GF and environmental performance literature. However, Zheng et al. (2021a) conducted a very similar study and discovered that the social, economic and environmental aspects of GF have a substantial influence on the sustainability performance of financial institutions in Bangladesh. Less obvious supports can also be found in the studies of Raihan (2019) and Zheng et al. (2021a). The findings corroborate with the legitimacy theory (Dowling and Pfeffer, 1975), which states that firms actively seek and maintain legitimacy by aligning their principles, policies, and strategies with community values. As a result, green finance can be viewed as a strategy for an organization to achieve and maintain legitimacy (Chariri, Anis et al., 2018). Hence, it can be concluded that GF and its dimensions play a critical role in enhancing overall environmental performance of banking institutions in Bangladesh, thereby aiding the country’s achievement of SDGs.

In light of the existing literature on CSR, GF and environmental performance in the context of financial institutions in emerging economies, the empirical findings of the study offer a number of theoretical implications. First, this study is one of the first to empirically examine the effect of various components of GF (social, economic and environmental) on the environmental performance of banking institutions in Bangladesh. Furthermore, the model developed in this study could be applied to new scenarios or to developing countries in general. Researchers can continue to expand and replicate this research in the future, as the measurement scales have been validated using AMOS statistical analysis techniques, such as structural equation modeling. Second, the significant positive link between CSR and environmental performance in the context of banking sector represents a novel contribution to the existing literature on CSR and organizational sustainability. As a result, the study’s empirical findings are consistent with the concepts of green finance and legitimacy theory, which illustrate that green finance and CSR practices improve firms’ environmental performance by highlighting the need of societal consent in attaining long-term sustainable growth (Indriastuti and Chariri, 2021). The study provides several avenues for future research to identify how banking organizations might improve their overall sustainability performance while implementing environmental policies, such as pollution reduction and control.

Furthermore, the study’s empirical findings suggest a variety of practical implications for scholars, academic researchers, banking institutions, managers, governments and legislators concerned with promoting environmental sustainability for financial institutions, primarily through the financing of various ecofriendly projects and socially responsible programs. The findings showed that Bangladeshi banks’ CSR activities play a significant role in the implementation of environmentally sustainable projects. Therefore, the study outcomes direct top managers in the industry and legislators to spend more on social responsibility, improve their managerial attitudes towards the natural environment and set up the right kinds of sustainability cultures in their banks. For example, Bangladesh Bank (BB), the country’s central bank, and the government could encourage environmental sustainability and ultimately promote the country’s long-term development by reimbursing or rewarding financial institutions that carefully follow socially responsible practices and strategies. This should be a straightforward itinerary for industry managers to follow, which can also help them improve their environmental performance. Furthermore, the study also found that the three dimensions of GF positively influence the environmental performance of banking institutions. Therefore, we conclude that financing of various environmentally friendly projects such as renewable energy, green industry development, alternative energy, waste management and so on could improve banking institutions’ internal and external environmental performance, thus aiding the achievement of the country’s SDGs. The findings advise the financial institutions to incorporate GF into their regular financing procedures to improve their environmental performance. In this context, the BB should assess and advise financial institutions on how to enhance their environmental performance, as well as promote green financing as a tool for the country’s long-term economic development.

A significant limitation of this study is its use of data from Bangladesh only, and hence, the generalizability of the findings is limited to the Bangladeshi banking system. Future research should validate the hypothesis using data from the financial sectors of other emerging nations as well. Furthermore, additional research can evaluate the impact of other dimensions such as green banking activities including employee, daily-operation, policy and customer-related practices on environmental performance via the mediating effect of green financing. Another disadvantage of this study is that the CSR initiatives, GF and environmental performance were evaluated from the viewpoint of internal stakeholders. Hence, future research based on external stakeholders such as consumers and suppliers may be conducted to examine the influence of CSR programs and green financing on the overall performance of banking institutions in other emerging nations.

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

This research was funded by the Key Research Institute of Philosophy and Social Sci-ence of the Education Department of Shaanxi Provincial Government Grant Number is 18JZ010 and APC was funded by the same grant.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The researchers would like to express their gratitude to the re-viewers for their efforts to improve the quality of this paper.

Abbas, J., Mahmood, S., Ali, H., Raza, M. A., Ali, G., Aman, J., et al. (2019). The Effects of Corporate Social Responsibility Practices and Environmental Factors through a Moderating Role of Social Media Marketing on Sustainable Performance of Firms' Operating in Multan, Pakistan. Sustainability 11, 3434. doi:10.3390/su11123434

Abbas, J. (2020). Impact of Total Quality Management on Corporate Green Performance through the Mediating Role of Corporate Social Responsibility. J. Clean. Prod. 242, 118458. doi:10.1016/j.jclepro.2019.118458

Ahmad, N., Ullah, Z., Arshad, M. Z., Kamran, H. w., Scholz, M., and Han, H. (2021). Relationship between Corporate Social Responsibility at the Micro-level and Environmental Performance: The Mediating Role of Employee Pro-environmental Behavior and the Moderating Role of Gender. Sustain. Prod. Consum. 27, 1138–1148. doi:10.1016/j.spc.2021.02.034

Ajibike, W. A., Adeleke, A. Q., Mohamad, F., Bamgbade, J. A., and Moshood, T. D. (2021). The Impacts of Social Responsibility on the Environmental Sustainability Performance of the Malaysian Construction Industry. Int. J. Constr. Manag. 0 (0), 1–10. doi:10.1080/15623599.2021.1929797

Akter, N., Siddik, A. B., and Mondal, M. S. Al. (2018). Sustainability Reporting on Green Financing : A Study of Listed Private Sustainability Reporting on Green Financing : A Study of Listed Private Commercial Banks in Bangladesh. J. Bus. Technol. (Dhaka) XII (July), 14–27.

Alamgir, M., and Uddin, M. N. (2017). The Mediating Role of Corporate Image on the Relationship between Corporate Social Responsibility and Firm Performance: An Empirical Study. Int. J. Bus. Dev. Stud. 9 (1), 91–111.

Ali, H. Y., Danish, R. Q., and Asrar‐ul‐Haq, M. (2020). How Corporate Social Responsibility Boosts Firm Financial Performance: The Mediating Role of Corporate Image and Customer Satisfaction. Corp. Soc. Resp. Env. Ma 27 (1), 166–177. doi:10.1002/csr.1781

Ansong, A. (2017). Corporate Social Responsibility and Firm Performance of Ghanaian SMEs: The Role of Stakeholder Engagement. Cogent Bus. Manag. 4 (1), 1333704. doi:10.1080/23311975.2017.1333704

Bahta, D., Yun, J., Islam, M. R., and Bikanyi, K. J. (2021). How Does CSR Enhance the Financial Performance of SMEs? the Mediating Role of Firm Reputation. Econ. Research-Ekonomska Istraživanja 34 (1), 1428–1451. doi:10.1080/1331677X.2020.1828130

Bamgbade, J. A., Kamaruddeen, A. M., Nawi, M. N. M., Adeleke, A. Q., Salimon, M. G., and Ajibike, W. A. (2019). Analysis of Some Factors Driving Ecological Sustainability in Construction Firms. J. Clean. Prod. 208, 1537–1545. doi:10.1016/j.jclepro.2018.10.229

Bentler, P. M. (1992). On the Fit of Models to Covariances and Methodology to the Bulletin. Psychol. Bull. 112 (3), 400–404. doi:10.1037/0033-2909.112.3.400

Bussmann, K.-D., Oelrich, S., Schroth, A., and Selzer, N. (2021). “Corporate Social Responsibility,” in The Impact of Corporate Culture and CMS: A Cross-Cultural Analysis on Internal and External Preventive Effects on Corruption (Springer International Publishing), 99–112. doi:10.1007/978-3-030-72151-0_6

Carnevale, C., and Mazzuca, M. (2014). Sustainability Reporting and Varieties of Capitalism. Sust. Dev. 22 (6), 361–376. doi:10.1002/sd.1554

Carrington, M., Zwick, D., and Neville, B. (2019). Activism and Abdication on the inside: The Effect of Everyday Practice on Corporate Responsibility. J. Bus. Ethics 160 (4), 973–999. doi:10.1007/s10551-018-3814-5

Carroll, A. B. (1979). A Three-Dimensional Conceptual Model of Corporate Performance. Acad. Manage. Rev. 4 (4), 497–505. doi:10.5465/amr.1979.4498296

Channa, N. A., Hussain, T., Casali, G. L., Dakhan, S. A., and Aisha, R. (2021). Promoting Environmental Performance through Corporate Social Responsibility in Controversial Industry Sectors. Environ. Sci. Pollut. Res. 28 (18), 23273–23286. doi:10.1007/s11356-020-12326-2

Chariri, A., Bukit, G. R. S. B., Eklesia, O. B., Christi, B. U., and Tarigan, D. M. (2018). Does Green Investment Increase Financial Performance? Empirical Evidence from Indonesian Companies. E3S Web Conf. 31, 09001. doi:10.1051/e3sconf/20183109001

Chen, J., Siddik, A. B., Zheng, G.-W., Masukujjaman, M., and Bekhzod, S. (2022). The Effect of Green Banking Practices on Banks’ Environmental Performance and Green Financing: An Empirical Study. Energies 15 (4), 1292. doi:10.3390/en15041292

Dörry, S., and Schulz, C. (2018). Green Financing, Interrupted. Potential Directions for Sustainable Finance in Luxembourg. Local Environ. 23 (7), 717–733. doi:10.1080/13549839.2018.1428792

Dowling, J., and Pfeffer, J. (1975). Organizational Legitimacy: Social Values and Organizational Behavior. Pac. Sociol. Rev. 18 (1), 122–136. doi:10.2307/1388226

Famiyeh, S. (2017). Corporate Social Responsibility and Firm's Performance: Empirical Evidence. Srj 13 (2), 390–406. doi:10.1108/SRJ-04-2016-0049

Fornell, C., and Larcker, D. F. (1981). Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 18 (1), 39. doi:10.2307/3151312

Galant, A., and Cadez, S. (2017). Corporate Social Responsibility and Financial Performance Relationship: a Review of Measurement Approaches. Econ. Research-Ekonomska Istraživanja 30 (1), 676–693. doi:10.1080/1331677X.2017.1313122

Gallego‐Álvarez, I., and Pucheta‐Martínez, M. C. (2020). Environmental Strategy in the Global Banking Industry within the Varieties of Capitalism Approach: The Moderating Role of Gender Diversity and Board Members with Specific Skills. Bus. Strat. Env. 29 (2), 347–360. doi:10.1002/bse.2368

Gerbing, D. W., and Anderson, J. C. (1988). An Updated Paradigm for Scale Development Incorporating Unidimensionality and its Assessment. J. Mark. Res. 25 (2), 186–192. doi:10.1080/13549839.2018.1428792

Ghisetti, C., and Rennings, K. (2014). Environmental Innovations and Profitability: How Does it Pay to Be Green? an Empirical Analysis on the German Innovation Survey. J. Clean. Prod. 75, 106–117. doi:10.1016/j.jclepro.2014.03.097

Gray, R., Owen, D., and Maunders, K. (1988). Corporate Social Reporting: Emerging Trends in Accountability and the Social Contract. Account. Auditing \& Account. J. 1 (1), 6–20. doi:10.1108/eum0000000004617

Guild, J. (2020). The Political and Institutional Constraints on Green Finance in Indonesia. J. Sustain. Finance Invest. 10 (2), 157–170. doi:10.1080/20430795.2019.1706312

Hair, J. F., Black, W. C., Babin, B. J., and Anderson, R. E. (2010). Multivariate Data Analysis. Fourth Edn. Prentice Hall.

Henseler, J., Ringle, C. M., and Sarstedt, M. (2015). A New Criterion for Assessing Discriminant Validity in Variance-Based Structural Equation Modeling. J. Acad. Mark. Sci. 43, 115–135. doi:10.1007/s11747-014-0403-8

Hoque, N., Mowla, M. M., Uddin, M. S., Mamun, A., and Uddin, M. R. (2019). Green Banking Practices in Bangladesh: A Critical Investigation. Ijef 11 (3), 58. doi:10.5539/ijef.v11n3p58

Hossain, M. (2019). “Green Finance in Bangladesh,” in Handbook of Green Finance (Sustainable Development), 1–26. doi:10.1007/978-981-10-8710-3_2-1

Hu, L. T., and Bentler, P. M. (1999). Cutoff Criteria for Fit Indexes in Covariance Structure Analysis: Conventional Criteria versus New Alternatives. Struct. Equ. Model. A Multidiscip. J. 6, 1–55. doi:10.1080/10705519909540118

Ilma, M. A. (2020). Sustainable Finance: Customer Loyalty or Green Environment? Int. J. Contemp. Acc. 2 (2), 155–172. doi:10.25105/ijca.v2i2.8316

Indriastuti, M., and Chariri, A. (2021). The Role of Green Investment and Corporate Social Responsibility Investment on Sustainable Performance. Cogent Bus. Manag. 8 (1), 120. doi:10.1080/23311975.2021.1960120

Jaeggi, O., Webber Ziero, G., Tobin-de la Puente, J., and Kölbel, J. F. (2018). “Understanding Sustainable Finance,” in Positive Impact Investing: A Sustainable Bridge between Strategy, Innovation, Change and Learning. Editor K. Wendt (Springer International Publishing), 39–63. doi:10.1007/978-3-319-10118-7_3

Javed, M., Rashid, M. A., Hussain, G., and Ali, H. Y. (2020). The Effects of Corporate Social Responsibility on Corporate Reputation and Firm Financial Performance: Moderating Role of Responsible Leadership. Corp. Soc. Responsib. Env. 27 (3), 1395–1409. doi:10.1002/csr.1892

Kala, K. N., Vidyakala, K., and S, J. (2020). A Study on the Impact of Green Banking Practices on Bank ’ S Environmental Performance with Special Reference to Coimbatore City. Afr. J. Bus. Econ. Res. 15 (3), 1–6. doi:10.31920/1750-4562/2020/09/20n3a21

Kaschny, M., and Nolden, M. (2018). Innovation and Transformation: Basics, Implementation and Optimization. Cham: Springer. doi:10.1007/978-3-319-78524-0Innovation and Transformation

Klassen, R. D., and Whybark, D. C. (1999). The Impact of Environmental Technologies on Manufacturing Performance. Amj 42 (6), 599–615. doi:10.5465/256982

Kleinbaum, D. G., Kupper, L. L., and Muller, K. E. (1988). Applied Regression Analysis and Other Multivariable Methods. Belmont, CA: Duxbury Press.

Kline, R. (2011). “Convergence of Structural Equation Modeling and Multilevel Modeling,” in The SAGE Handbook of Innovation in Social Research Methods. SAGE Publications Ltd., 562–589. doi:10.4135/9781446268261

Koirala, S. (2019). “SMEs: Key Drivers of Green and Inclusive Growth,” in OECD Green Growth Papers, No. 2019/03 (Paris: OECD Publishing). doi:10.1787/8a51fc0c-en

Kolk, A. (2016). The Social Responsibility of International Business: From Ethics and the Environment to CSR and Sustainable Development. J. World Bus. 51 (1), 23–34. doi:10.1016/j.jwb.2015.08.010

Kraus, S., Rehman, S. U., and García, F. J. S. (2020). Corporate Social Responsibility and Environmental Performance: The Mediating Role of Environmental Strategy and Green Innovation. Technol. Forecast. Soc. Change 160, 120262. doi:10.1016/j.techfore.2020.120262

Laskar, N. (2018). Impact of Corporate Sustainability Reporting on Firm Performance: an Empirical Examination in Asia. Jabs 12 (4), 571–593. doi:10.1108/JABS-11-2016-0157

Liu, N., Liu, C., Xia, Y., Ren, Y., and Liang, J. (2020). Examining the Coordination between Green Finance and Green Economy Aiming for Sustainable Development: A Case Study of China. Sustainability 12 (9), 3717. doi:10.3390/su12093717

Lober, D. J. (1996). Evaluating the Environmental Performance of Corporations. J. Manag. Issues 8, 184.

Maignan, I., and Ferrell, O. C. (2000). Measuring Corporate Citizenship in Two Countries: The Case of the United States and France. J. Bus. Ethics 23 (3), 283–297. doi:10.1023/A:1006262325211

Malsha, K. P. P. H. G. N., Arulrajah, A. A., and Senthilnathan, S. (2020). Mediating Role of Employee Green Behaviour towards Sustainability Performance of Banks. Jgr 9 (2), 92–102. doi:10.22495/jgrv9i2art7

Mehralian, G., Nazari, J. A., Zarei, L., and Rasekh, H. R. (2016). The Effects of Corporate Social Responsibility on Organizational Performance in the Iranian Pharmaceutical Industry: The Mediating Role of TQM. J. Clean. Prod. 135, 689–698. doi:10.1016/j.jclepro.2016.06.116

Minatti Ferreira, D. D., Borba, J. A., Rover, S., and Dal-Ri Murcia, F. (2014). Explaining Environmental Investments: A Study of Brazilian Companies. Environ. Qual. Manag. 23 (4), 71–86. doi:10.1002/tqem.21374

Mocan, M., Rus, S., Draghici, A., Ivascu, L., and Turi, A. (2015). Impact of Corporate Social Responsibility Practices on the Banking Industry in Romania. Procedia Econ. Finance 23, 712–716. doi:10.1016/s2212-5671(15)00473-6

Murphy, S. A. (2003). Optimal Dynamic Treatment Regimes. J. R. Stat. Soc. Series B Stat. Methodol. 65 (2), 331–335. doi:10.1111/1467-9868.00389

Nawaz, M. A., Seshadri, U., Kumar, P., Aqdas, R., Patwary, A. K., and Riaz, M. (2020). Nexus between Green Finance and Climate Change Mitigation in N-11 and BRICS Countries: Empirical Estimation through Difference in Differences (DID) Approach. Environ. Sci. Pollut. Res. 28, 6504–6519. doi:10.1007/s11356-020-10920-y

Pham, D. C., Do, T. N. A., Doan, T. N., Nguyen, T. X. H., Pham, T. K. Y., Kim, T., et al. (2021). The Impact of Sustainability Practices on Financial Performance: Empirical Evidence from Sweden. Cogent Bus. Manag. 8 (1), 26. doi:10.1080/23311975.2021.1912526

Qi, G. Y., Zeng, S. X., Shi, J. J., Meng, X. H., Lin, H., and Yang, Q. X. (2014). Revisiting the Relationship between Environmental and Financial Performance in Chinese Industry. J. Environ. Manag. 145, 349–356. doi:10.1016/j.jenvman.2014.07.010

Raihan, M. Z. (2019). Sutainable Finance for Growth and Development of Banking Industry in Bangladesh: An Equity Perspective. MIST J. Sci. Technol. 7 (1), 41–51.

Rehman, A., Ullah, I., Afridi, F.-e. -A., Ullah, Z., Zeeshan, M., Hussain, A., et al. (2021). Adoption of Green Banking Practices and Environmental Performance in Pakistan: a Demonstration of Structural Equation Modelling. Environ. Dev. Sustain 23, 13200–13220. doi:10.1007/s10668-020-01206-x

Ríos-Manríquez, M., Ferrer-Ríos, M. G., and Sánchez-Fernández, M. D. (2021). Structural Model of Corporate Social Responsibility. An Empirical Study on Mexican SMEs. PLOS ONE 16 (2), e0246384–22. doi:10.1371/journal.pone.0246384

Risal, N., and Joshi, S. K. (2018). Measuring Green Banking Practices on Bank's Environmental Performance: Empirical Evidence from Kathmandu Valley. J. Bus. Soc. Sci. 1 (1), 44–56. doi:10.3126/jbss.v1i1.22827

Rivera, J. M., Muñoz, M. J., and Moneva, J. M. (2017). Revisiting the Relationship between Corporate Stakeholder Commitment and Social and Financial Performance. Sust. Dev. 25 (6), 482–494. doi:10.1002/sd.1664

Sadiq, M., Nonthapot, S., Mohamad, S., Chee Keong, O., Ehsanullah, S., and Iqbal, N. (2021). Does Green Finance Matter for Sustainable Entrepreneurship and Environmental Corporate Social Responsibility during COVID-19? Cfri 12, 317–333. doi:10.1108/CFRI-02-2021-0038

Saeidi, P., Robles, L. A. A., Saeidi, S. P., Zamora, M. I. V., Isabel, M., and Zamora, V. (2021). How Does Organizational Leadership Contribute to the Firm Performance through Social Responsibility Strategies? Heliyon 7 (July), e07672. doi:10.1016/j.heliyon.2021.e07672

Shaumya, S., and Arulrajah, A. (2017). The Impact of Green Banking Practices on Bank's Environmental Performance: Evidence from Sri Lanka. Jfbm 5 (01), 77–90. doi:10.15640/jfbm.v5n1a7

Sidhoum, A., and Serra, T. (2017). Corporate Social Responsibility and Dimensions of Performance: An Application to U.S. Electric Utilities. Util. Policy 48, 1–11. doi:10.1016/j.jup.2017.06.011

Sinha, A., Mishra, S., Sharif, A., and Yarovaya, L. (2021). Does Green Financing Help to Improve Environmental & Social Responsibility? Designing SDG Framework through Advanced Quantile Modelling. J. Environ. Manag. 292 (April), 112751. doi:10.1016/j.jenvman.2021.112751

Suchman, M. C. (1995). Managing Legitimacy: Strategic and Institutional Approaches. Acad. Manage. Rev. 20 (3), 571–610. doi:10.2307/258788

Suganthi, L. (2020). Investigating the Relationship between Corporate Social Responsibility and Market , Cost and Environmental Performance for Sustainable Business. South Afr. J. Bus. Manag. 51 (1), 1–13. doi:10.4102/sajbm.v51i1.1630

Suttipun, M., Lakkanawanit, P., Swatdikun, T., and Dungtripop, W. (2021). The Impact of Corporate Social Responsibility on the Financial Performance of Listed Companies in Thailand. Sustainability 13 (16), 8920. doi:10.3390/su13168920

Teixeira, G. F. G., and Canciglieri Junior, O. (2019). How to Make Strategic Planning for Corporate Sustainability? J. Clean. Prod. 230, 1421–1431. doi:10.1016/j.jclepro.2019.05.063

Tung, A., Baird, K., and Schoch, H. (2014). The Relationship between Organisational Factors and the Effectiveness of Environmental Management. J. Environ. Manag. 144, 186–196. doi:10.1016/j.jenvman.2014.05.025

Vuković, A., Miletić, L., Čurčić, R., and Ničić, M. (2020). Consumers' Perception of CSR Motives in a Post‐socialist Society: The Case of Serbia. Bus. Ethics A Eur. Rev. 29 (3), 528–543. doi:10.1111/beer.12271

Wang, K., Tsai, S.-B., Du, X., and Bi, D. (2019). Internet Finance, Green Finance, and Sustainability. Sustainability 11 (14), 3856. doi:10.3390/su11143856

Wang, Y., and Zhi, Q. (2016). The Role of Green Finance in Environmental Protection: Two Aspects of Market Mechanism and Policies. Energy Procedia 104, 311–316. doi:10.1016/j.egypro.2016.12.053

Wang, L., Wang, Y., Sun, Y., Han, K., and Chen, Y. (2022). Financial Inclusion and Green Economic Efficiency: Evidence From China. J. Environ. Plan. Manag. 65 (2), 240–271. doi:10.1080/09640568.2021.1881459

Wu, S., Wu, L., and Zhao, X. (2021). Can the Reform of Green Credit Policy Promote Enterprise Eco-Innovation? A Theoretical Analysis. J. Industrial Manag. Optim. 18 (2), 1453–1485. doi:10.3934/jimo.2021028

Ying, M., Tikuye, G. A., and Shan, H. (2021). Impacts of Firm Performance on Corporate Social Responsibility Practices : The Mediation Role of Corporate Governance in Ethiopia Corporate Business. Sustain. Switz. 13 (17), 13. doi:10.3390/su13179717

Zhang, D. (2018). Energy Finance: Background, Concept, and Recent Developments. Emerg. Mark. Finance Trade 54 (8), 1687–1692. doi:10.1080/1540496X.2018.1466524

Zhang, D., Zhang, Z., and Managi, S. (2019). A Bibliometric Analysis on Green Finance: Current Status, Development, and Future Directions. Finance Res. Lett. 29 (February), 425–430. doi:10.1016/j.frl.2019.02.003

Zhang, X., Wang, Z., Zhong, X., Yang, S., and Siddik, A. B. (2022). Do Green Banking Activities Improve the Banks’ Environmental Performance? the Mediating Effect of Green Financing. Sustainability 14 (2), 989. doi:10.3390/su14020989

Zheng, G.-W., Siddik, A. B., Masukujjaman, M., Fatema, N., and Alam, S. S. (2021b). Green Finance Development in Bangladesh: The Role of Private Commercial Banks (PCBs). Sustainability 13 (2), 795–817. doi:10.3390/su13020795

Zheng, G.-W., Siddik, A. B., Masukujjaman, M., and Fatema, N. (2021a). Factors Affecting the Sustainability Performance of Financial Institutions in Bangladesh: The Role of Green Finance. Sustainability 13 (18), 10165. doi:10.3390/su131810165

Zhixia, C., Hossen, M. M., Muzafary, S. S., and Begum, M. (2018). Green Banking for Environmental Sustainability-Present Status and Future Agenda: Experience from Bangladesh. Asian Econ. Financial Rev. 8 (5), 571–585. doi:10.18488/journal.aefr.2018.85.571.585

Zhou, G., Sun, Y., Luo, S., and Liao, J. (2021). Corporate Social Responsibility and Bank Financial Performance in China: The Moderating Role of Green Credit. Energy Econ. 97, 105190. doi:10.1016/j.eneco.2021.105190

Zhou, X., and Cui, Y. (2019). Green Bonds, Corporate Performance, and Corporate Social Responsibility. Sustainability 11 (23), 6881. doi:10.3390/su11236881

Zhou, X., Tang, X., and Zhang, R. (2020). Impact of Green Finance on Economic Development and Environmental Quality: a Study Based on Provincial Panel Data from China. Environ. Sci. Pollut. Res. 27 (16), 19915–19932. doi:10.1007/s11356-020-08383-2

Keywords: CSR, green finance, environmental perfomance, banks, SEM, Bangladesh

Citation: Guang-Wen Z and Siddik AB (2022) Do Corporate Social Responsibility Practices and Green Finance Dimensions Determine Environmental Performance? An Empirical Study on Bangladeshi Banking Institutions. Front. Environ. Sci. 10:890096. doi: 10.3389/fenvs.2022.890096

Received: 05 March 2022; Accepted: 26 May 2022;

Published: 15 June 2022.

Edited by:

Lu Yang, Shenzhen University, ChinaReviewed by:

Tachia Chin, Zhejiang University of Technology, ChinaCopyright © 2022 Guang-Wen and Siddik. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Abu Bakkar Siddik, bHMxOTAzMDlAc3VzdC5lZHUuY24=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.