- 1School of Economics, Yunnan University, Kunming, China

- 2School of Economics and Management, Northeast Agricultural University, Harbin, China

- 3School of Management and Economics, Beijing Institute of Technology, Beijing, China

- 4Center for Energy and Environmental Policy Research, Beijing Institute of Technology, Beijing, China

- 5Faculty of Management Science, Department of Business Administration, ILMA University, Karachi, Pakistan

- 6School of Economics and Management, University of Chinese Academy of Sciences, Beijing, China

- 7School of Business and Economics, University Putra Malaysia, Selangor, Malaysia

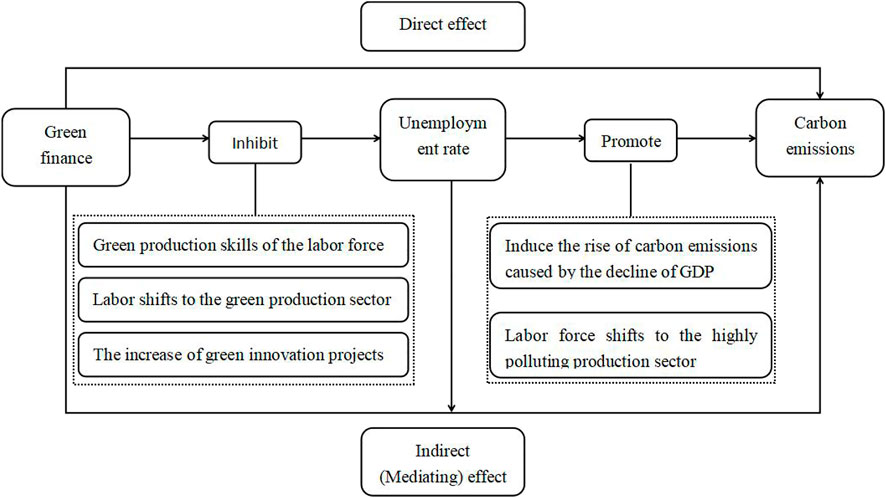

China’s economy has developed rapidly since the reform and opening up, but under the long-term traditional extensive development model, energy consumption is excessive and carbon emissions rank first in the world. Therefore, how to reduce carbon emissions is a current hot issue in China. Although many scholars have found that green finance is the basic driving force to promote carbon emission reduction, its role path is diverse, and it still needs to be explored in width and depth. Especially in the green transformation stage of the economy, the potential unemployment risk is also a matter of concern. This study selects 30 provincial panel data from the Chinese mainland for the 2004–2019 years to investigate the impact of green finance on carbon emissions from the perspective of unemployment using ordinary least square (OLS), generalized method of moments (GMM), and mediating effect models. In addition, in order to avoid the bias of regression results caused by the cross-section dependence of the data, the feasible generalized least squares (FGLS) and the panel-corrected standard errors (PCSE) models are used for the robust test after correction. The findings show that 1) green finance has a significant inhibitory impact on carbon emissions; 2) green finance has significantly reduced the unemployment rate; 3) carbon emissions increase significantly with increasing the unemployment rate; and 4) there is regional heterogeneity in the effect of green finance on carbon emissions in eastern, central, and western China. Green finance in the eastern and central regions significantly inhibits carbon emissions, especially in the central region, while insignificantly in the western region. 5) According to the OLS and mediating effect regression results, economic growth and environmental regulation play a significant positive role in promoting carbon emissions. This study has theoretical reference significance for accelerating the realization of the dual carbon goal and alleviating phased unemployment.

1 Introduction

From the international context, in recent years, global attention to climate change has continued to increase (Anser et al., 2020a; Alharthi et al., 2021; Hua et al., 2022). To reduce global greenhouse gas emissions, countries around the world have carried out a series of measures to deal with climate change (Yang et al., 2021a; Balsalobre-Lorente et al., 2022; Usman et al., 2022). Through unremitting endeavors lately, China has largely accomplished the Millennium Development Goals and became the world’s second-biggest economy and the top exporter (Zhao et al., 2020; Irfan et al., 2021a; Koondhar et al., 2021; Zhao et al., 2021). To better cope with climate deterioration and assume the responsibility of great powers, the Chinese government affirms at the 70th United Nations General Assembly and Climate Summit to improve the 2015 Paris Agreement’s carbon reduction goals (Abbasi et al., 2022). Specifically, gross carbon emissions will peak in 2030 and achieve carbon neutrality in 2060 (Wu et al., 2020; Ren et al., 2021; Shen et al., 2022). While China affirms that carbon emissions will peak by 2030 is not surprising, the commitment to carbon neutrality is unexpected (Iqbal et al., 2021; Wen et al., 2022). Since China has far less time to achieve carbon neutrality and peak carbon emissions than developed countries, its economy, and energy mix need to adjust to low-carbon and decarbonization depth with unprecedented intensity (Al et al., 2019; Iqbal et al., 2019a; Khan et al., 2021; Rauf et al., 2021), thus facilitating an orderly peaking of carbon emissions across regions, sectors, and industries (Wu H. et al., 2019; Hao et al., 2020). Also, the achievement of carbon neutralization and peak carbon emission goals require a large amount of investment (Tang et al., 2022; Xiang et al., 2022). It is urgent to accelerate the construction of green finance and the national carbon emission trading market, guide the rational allocation of resources, leverage resources to lean toward green and low-carbon projects, and promote green and low-carbon development (Razzaq et al., 2021a; Qiu et al., 2021).

From the domestic environment, green finance is a wide conception (Ahmad et al., 2021; Ali et al., 2021). According to the definition in the Guidance on Building a Green Financial System issued by the Chinese government in 2016, green finance refers to economic activities that support environmental improvement, climate change, and the economical and efficient use of resources, that is, financial services providers for project investment and financing, project operation and risk management in the fields of environmental protection, energy conservation, clean energy, green transportation (Irfan and Ahmad, 2021), and green buildings (Jiang et al., 2020). Green finance not only involves investment and financing support services for various types of green projects such as clean energy and green materials, but also refers to financial services such as green credit, green bonds, green industry investment, green development funds, green insurance, and other financial services that support the transformation of the economy to green development (Taghizadeh-Hesary and Yoshino, 2019; Sun, 2021; Meo and Abd, 2022). As an emerging financial model, green finance provides powerful financial tools to support carbon emission reduction with the continuous enrichment and improvement of its product connotation and business types (Taghizadeh-Hesary and Yoshino, 2019; Hafner et al., 2020; Razzaq et al., 2020). Green finance is not only significant support for green enterprises through providing funds but can also significantly improve energy efficiency and ultimately achieve the vision of “carbon neutralization and peak carbon emissions” (Hou et al., 2019; Iqbal et al., 2019b; Shen et al., 2021). According to relevant calculations, China needs a huge amount of green financial investment of more than 100 billion yuan to achieve the goal of “carbon neutrality and peak carbon emissions”. In addition to government funds, most of them need to be market-oriented to guide and encourage social capital through financial system investment and financing (Hao et al., 2021; Razzaq et al., 2021b; Ren et al., 2022b).

Green finance, with green credit, green securities, green assets, and green protection as the principle apparatuses, has grown quickly (Chandio et al., 2021; Tanveer et al., 2021; Fang et al., 2022). The “green capital” has extended its help for green ventures and sped up the green change of energy structure and modern construction (Irfan et al., 2021b). In this process, green finance indirectly affects carbon emissions by affecting the unemployment rate. With the green transformation of China’s economy, some traditional polluting industries are bound to face structural upgrading (Zhu et al., 2014; Ren et al., 2022c). However, in the process of transformation from an extensive industry to a high-tech industry, a large number of low-level labor force members, including those in such enterprises, face the risk of unemployment (Sima et al., 2020). In addition, the traditional polluting enterprises are affected by the crowding-out effect in the development process of green finance, and their financing environment is squeezed, which may increase the unemployment rate due to the shortage of funds (Razzaq et al., 2021a; Ren et al., 2022a; Shi et al., 2022). However, green finance can further influence the allocation of resources and urge enterprises to invest more funds to cultivate green, scientific, and technological talents, to reduce the unemployment rate. In addition, green finance will inevitably drive the flow of talents under the influence of the financial spillover effect, to transport the labor force eliminated by traditional polluting enterprises to the green production sector (Dao et al., 2011; Hao et al., 2021). It is also worth noting that green finance would promote the increase of green entrepreneurship projects and create more jobs (Silajdžić et al., 2015). Therefore, in the green transformation stage of the economy, green finance contributes to reducing the unemployment rate and improving the employment rate. Meanwhile, the reduction of the unemployment rate is of great significance to carbon emission reduction (Islam et al., 2021). As mentioned above, green finance provides financial support for the improvement of labor quality in the process of green transformation of traditional polluting enterprises through resource allocation, thus influencing the unemployment rate (Zhou et al., 2022). In addition, green finance also provides material conditions for the market labor force to flow from polluting enterprises to green production departments. This transfer of the labor force not only reduces the unemployment rate but also promotes the upgrading of industrial structures and green economic transformation, thus influencing carbon emissions (Wang and Li, 2021). Therefore, the decline in the unemployment rate is closely related to the increase in green talent and carbon emissions. However, few scholars currently conduct empirical research on the above issues. So what are the specific impacts of green finance and the unemployment rate on carbon emissions? This study has theoretical and practical significance and puts green finance, unemployment rate, and carbon emissions into a unified research framework for empirical research for the first time, which enriches the current basic research theory of carbon emissions. In addition, this study provides a new research path for carbon emission reduction and speeds up the realization of the dual carbon goal.

The contributions of this study are as follows: Firstly, it investigates the dynamic effect of green finance on carbon emissions, which enriches the existing literature for China to accelerate the realization of the double carbon goal and serves as some reference for developing economies similar to China to achieve their carbon reduction goals. Secondly, compared with previous scholars who studied the impact of green finance on carbon emissions from the perspective of industrial structure and technological innovation, this study examines the impact of green finance on carbon emissions by taking the unemployment rate as a mediating variable, complementing the existing research on green finance and carbon emissions. Finally, this study also conducts a regional heterogeneity in the effects of green finance and unemployment on carbon emissions, which formulate relevant policies depending on local differences in each area.

The structure of this study is organized as follows: Section 2 reviews the literature and research hypothesis; Section 3 gives the methodology and data; Section 4 proceeds with results analysis; and Section 5 summarizes the entire text and made important recommendations.

2 Literature review and research hypothesis

2.1 Green finance and carbon emissions

Financial development is an important indicator affecting carbon emissions (Shahbaz et al., 2013; Acheampong et al., 2020; Shahbaz et al., 2020). Some scholars have found that financial development could promote carbon emissions (Zhang et al., 2020). From the perspectives of the stock market, energy consumption, economic growth, and political system, these scholars use time series, spatial measurement, and other methods to prove that financial development can promote carbon emissions (Iqbal et al., 2020). Zhang et al. (2011) observe that monetary advancement was not just the primary justification for the increment in carbon emissions, yet in addition, different monetary improvement markers diversely affect carbon emissions. Among them, the effect of the financial mediating scale on carbon emissions is more noteworthy than other financial advancement pointers, for example, financial mediating effectiveness, securities exchange scale, and productivity. Adams and Klobodu (2018) added political elements to the investigation and discovered that financial improvement was the key component prompting the expansion of carbon emissions. Shen et al. (2020) support that a created financial system can diminish data deviation and make it more straightforward for organizations to fund. This will help enterprises expand production scale and lead to an increase in carbon emissions. Chen and Zhang (2014) find that the improvement of financial scale and efficiency would significantly improve the level of carbon emissions by using the spatial econometric model. Boutabba (2014) utilizes the time-series information from 1971 to 2008 to concentrate on the connection between carbon emissions, financial development, exchange receptiveness, and energy utilization. It is observed that finance improvement emphatically affected per capita carbon emissions.

However, different researchers argue that green finance has a conspicuous inhibitory impact on carbon emissions. Researchers who support this hypothesis have demonstrated that green finance has a huge inhibitory impact on carbon emissions through spatial panel models. Liu et al. (2015) find that the green credit policy will significantly reduce the production emissions of energy-intensive industries in the short and medium-term through the transmission path of green credit. He (2019) constructed a VAR model by estimating four components: green credit, green conservation, green protection, and green entrepreneurship, and observed that the development of green finance would radically reduce the level of national CO2 emissions and promote sustainable economic development. Shao and Fang (2021) built an exhaustive record of green finance development through the entropy weight technique, and at this point not considered single factors, for example, green credit, protections, and venture, alone to make the general development of green finance more intuitive. Based on this, the following hypothesis is proposed in this study.

Hypothesis 1. Green finance has a significant inhibitory effect on carbon emissions.

2.2 Green finance and unemployment rate

In the green transformation stage of China’s economy, green finance is closely related to employment. Finance could not only support the labor–capital investment of enterprises and reduce the risk of unemployment but also promote labor market liquidity through the spillover effect. Since the unemployment rate is an indicator to measure the employment situation of a country, to more intuitively clarify the relationship between green finance and the unemployment rate. Ndubuaku et al. (2021) utilize the ARDL model and annualized time-series information from 1999 to 2019 to research the effect of financial development on the employment rate in Nigeria. The result shows that financial development altogether affects the employment rate. Alkhateeb et al. (2017) used the ARDL cointegration method to investigate the relationship between finance and employment in Saudi Arabia from 1980 to 2015. They found that financial development could assume an important part in economic development and occupation creation. Yang et al. (2015) revealed that the expansion of financial development scale restrained the employment of the primary and secondary industries, however, advanced the employment of the tertiary business and the improvement of financial productivity assumes a positive part in advancing the employment of the tertiary business. Besides, as macro-economic policies such as green finance are limited to green and low-carbon industries, China will create a large number of jobs in the future and promote the transformation of employment into technology-biased and environment-friendly jobs. At the same time, green finance provides financial support for the improvement of labor quality to adapt to the green economy model, which reduces the cost of the unemployment rate and other costs in the process of economic green transformation, and promotes the decline of the unemployment rate (Sun, 2021). In addition, the resource allocation function and spillover effect of green finance will optimize the distribution structure of the labor force in the market, promote the transfer of more labor force from the polluting production sector to the cleaner production sector, reduce the risk of some labor force, and thus hinder the rise of the unemployment rate. Lee (2020) believed that green finance could alleviate employment pressure and provide the impetus for economic development. Khobai et al. (2020) revealed that clean energy investment has improved the employment level in the long term, and has little impact on employment in the short term. He (2017) agreed that clean energy has increased the national employment and the employment of the clean energy industry, but it has a negative impact on the employment of the traditional energy industry. Therefore, the development of green and clean energy played a strong role in promoting green employment, while reducing carbon emissions. Based on this, the following hypothesis is proposed in this study.

Hypothesis 2. Green finance has a significant inhibitory effect on the unemployment rate.

2.3 Unemployment rate and carbon emissions

In the green transformation stage of the economy, it is inevitably accompanied by the transformation from high energy-consuming industries to green and clean energy industries, and from traditional industries to green and low-carbon industries (Steward, 2012). In this process, the labor force will also undergo structural transfer between industries and industries; that is, the labor force will transfer from traditional industry, high energy, and high consumption industries to green and low-carbon industries. Green finance squeezes financial resources from the polluting production sector to the green production sector, while the labor force will also flow accompanied by financial resources (Wang, 2020). This kind of labor mobility can reduce the impact of economic transformation on the unemployment rate, to reduce it. In addition, green finance also promotes the green transformation of the labor force, cultivates more green talents, and alleviates the impact of economic green reform on employment stability. Meanwhile, a large number of green start-ups have sprouted with the support of green finance, and then more social unemployed people are absorbed by green environmental protection production enterprises, thus improving the reemployment rate of social unemployed people (Henzelmann et al., 2011). Therefore, in the context of “carbon neutralization and peak carbon emissions” goals, part of the reasons for the decline of the unemployment rate have to be attributed to the improvement of green production skills of the labor force, the structural transfer of labor force, and the increase of green innovation projects, which are closely related to carbon emissions. George et al. (2012) pointed out that large-scale development of electricity has a positive effect on reducing unemployment in Nigeria. Bulavskkaya and Reynès (2018) found that the clean energy industry has created thousands of jobs in the Netherlands and effectively promoted economic growth. Mu et al. (2018) confirmed that the improvement of clean energy has positively affected China’s business level, especially the scale expansion of wind energy and solar energy industry, which can create employment. To sum up, it can be concluded that green talent training, industrial structure upgrading, and green innovation projects are conducive to improving production efficiency and energy efficiency, to reduce carbon emissions (Cheng et al., 2021).

Conversely, the rising unemployment rate may contribute to rising carbon emissions. Some scholars have conducted extensive research on the relationship between the unemployment rate and economic development, among which the most famous is the alternative relationship between the unemployment rate and GDP proposed by American economist Okun (1962). Besides, by studying a large number of developed and developing economies, Ball (2019) concluded that the coefficient of developing economies is on average lower than that of developed economies, and the effectiveness of Okun Law is different in different economies. Benos and Stavrakoudis (2020) concluded that the dependence between GDP and unemployment by using copula function analysis is only strong in the United States and France. That is, if the unemployment rate becomes higher, the economic level will decline. These research documents show that rising unemployment will lead to a decline in the level of the economy. Other scholars have found that the decline in the economic level will lead to an increase in carbon emissions. According to Wang et al. (2022c), when the level of GDP per capita is within a certain range, if the economic level decreases, to develop the economy rapidly, the government will take measures to stimulate the development of some high energy-consuming industries, so carbon emissions will rise. In addition, there are many reasons for the rise in unemployment. On the one hand, there is insufficient motivation for capital to stimulate employment and insufficient new jobs. On the other hand, the employment skills of the unemployed are not high. Under the background of carbon neutralization and peak carbon emission goals, some employees with low skill levels eliminated by the polluting production sector in the market in the process of transformation and upgrading cannot improve their skills and comprehensive quality in a short time, so the unemployment rate rises. On this basis, such displaced unemployed people are likely to enter the production sector with higher pollution levels under the condition of a lack of training capital, thus increasing the increase of total carbon emissions (Aceleanu et al., 2015).

Although the green finance development level has ranked first in the world, it is still being promoted in the form of the pilot in China, which still cannot meet the market demand. Therefore, the support of green finance to stabilize employment in green transformation is still insufficient, which makes the mobility of market labor in different sectors low and industrial structure upgrading less efficient, thus delaying the green transformation of the economy and detrimental to carbon emission reduction. It is also worth noting that most of the environmental protection, low-carbon, and green production departments in the market are science and technology-based, small and medium-sized enterprises, which have the characteristics of high investment, high risk, and long cycle (Machiba, 2011). Therefore, enterprises usually cannot fully absorb the unemployed, but control the development scale and reduce the employed due to capital constraints. In the short term, such unemployed people are likely to be squeezed out of highly polluting production sectors, which is not conducive to the improvement of industrial structure and energy structure, and finally stimulate the increase of carbon emissions (Zhou et al., 2013). Based on this, the following hypothesis is proposed in this study.

Hypothesis 3. The rise of the unemployment rate promotes carbon emissions.Based on the above research, this study summarizes the following research gaps: firstly, the current literature pays more attention to the research on financial development and carbon emissions, while the research on green finance and carbon emissions stays at the theoretical level. Secondly, although some scholars study the relationship between green finance and carbon emissions, few scholars take the unemployment rate as a mediating variable to expand their research. Finally, the research on the regional heterogeneity of green finance on carbon emissions needs to be supplemented to promote the coordinated development of China’s carbon emissions.

3 Methodology

3.1 Model establishment

3.1.1 OLS panel regression model construction

Under the premise that other variables are controlled for their effects on carbon emissions, following the study findings and empirical norms of Bai et al. (2022), this study examines the effects of green finance on carbon emissions. The model is set up in the following form:

where

3.1.2 Generalized method of moments

However, OLS is a static regression model and does not consider endogeneity among variables. To further explore the dynamic relationship between carbon emissions and green finance, this study lags carbon emissions by one period and applies a dynamic panel regression model. The specific model is as follows:

Among them,

3.1.3 Construction of mediating effect model

In addition, to verify the mediating effect of employment in green finance and carbon emission, this study sets the following model:

In Eqs 4 and 5,

3.2 Variables description

3.2.1 Explained variable

The explained variable is expressed by carbon emission (

In Eq. 6,

3.2.2 Core explanatory variable

Concerning Yin et al. (2021), this study constructs green finance (

3.2.3 Control variable

1) Economic growth

2) Economic openness

3) Environmental regulation

4) Financial development level

3.2.4 Mediating variable

In this study, the mediating variable is measured by the unemployment rate

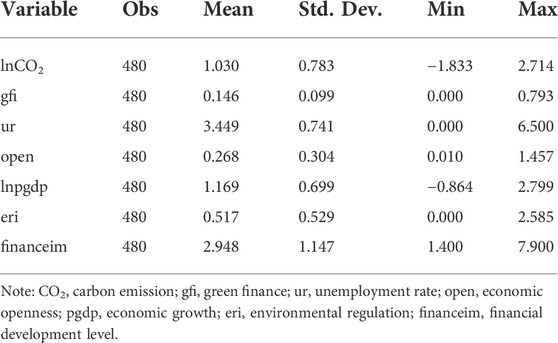

3.3 Descriptive statistics

This study selects 30 provincial panel data of the Chinese mainland from 2004 to 2019 as the research objects. The original data come from the China Statistical Yearbook, China Financial Yearbook, China Environmental Statistical Yearbook, China Industrial Statistics Yearbook, China Insurance Yearbook, China Environmental Statistics Yearbook, the Statistical Yearbook of each province, and Wind database. Descriptive statistics are shown in Table 1.

4 Results and discussion

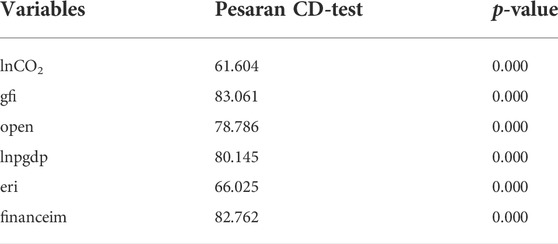

4.1 Discussion on cross-sectional dependence and slope heterogeneity tests

As marketization continues to increase as well as economic interactions among various areas intensify in frequency, correlations among areas are increasingly significant. Consequently, inconsistency and bias in the estimates arising from the cross-sectional dependence formed by the various areas may occur when examining some economic stories by using the panel data of the composition of the above-mentioned area as methodologically (e.g., Baltagi, 2008; Pesaran, 2015b) and empirically shown (e.g., Baltagi, 2008; Hasanov et al., 2016; Hasanov et al., 2021; Hasanov and Mikayilov, 2021; Liddle and Hasanov, 2022). Referring to Pesaran (2015a) and Hasanov and Mikayilov (2021), the Pesaran test with weak exogenous cross-sectional dependence is examined for the study sample in this study. The test results are shown in Table 2.

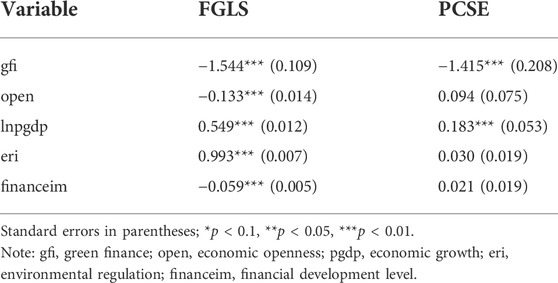

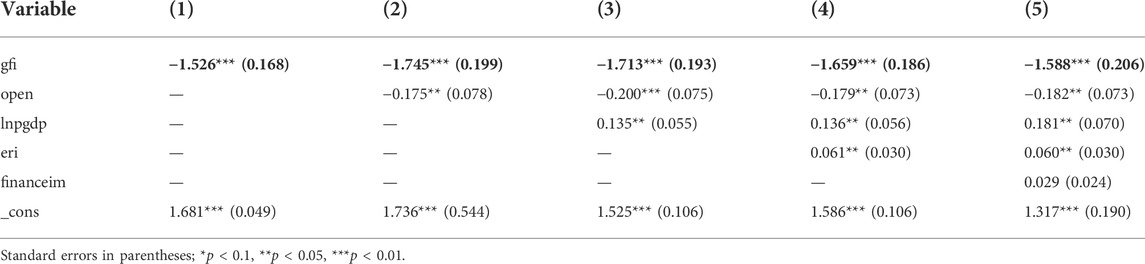

However, the FGLS estimation method is able to correct for the heteroscedasticity, cross-sectional correlation, and sequence-correlation problems due to the cross-section data, improving the consistency, and effectiveness of the panel regression. Therefore, this study uses the feasible generalized least squares (FGLS) to substitute the residual vectors of each individual cross-section into the covariance matrix of cross-section heteroscedasticity and uses GLS to obtain the parameter estimates. It is worth noting that when the number of times T in the panel data model is less than the section number N, the standard deviation of the FGLS estimation parameters cannot fully reflect the variation, so the panel-corrected standard errors (PCSE) should be considered to deal with the complex panel error structure. The PCSE method substitutes the residual term into the diagonal matrix by retaining the OLS estimation parameters and correcting its standard deviation, which is an alternative to FGLS and enables a more accurate regression estimation of the panel data. Therefore, to solve the complex panel error structure, the FGLS and PCSE estimates were used to correct the model. Test results are presented in Table 3. The results show that the FGLS and PCSE estimates are essentially the same and are generally consistent with the benchmark regression results, so the benchmark regression results in this study are robust.

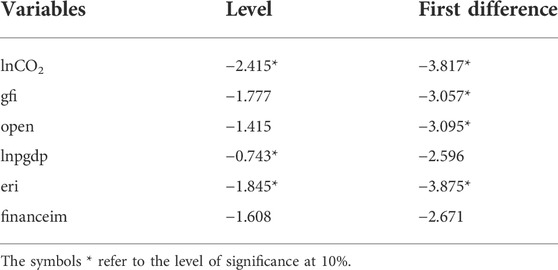

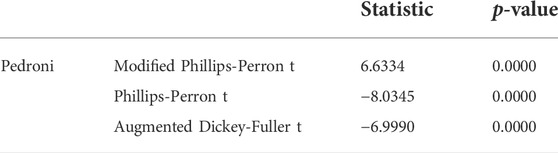

4.2 Discussion on panel unit root test and cointegration test results

The variables used in the analysis are often drifting and hence their mean, variance, and covariance change over time (e.g., see Pesaran, 2015b). Therefore, in order to maintain the validity of the econometric test and estimation results the panel data should be subjected to a unit root test to check whether they have stationarity (Baltagi, 2008; Pesaran, 2015b). Following Meo et al. (2020), and Hasanov et al. (2021), the cross-section dependence unit root test proposed by Pesaran (2007), is employed in this study to verify whether there is a unit root for the dataset (see Table 4). Pesaran (2007) suggests that most of the variables are stationary and most of them become stationary after the first difference. After finding the order of integration in the panel, this study also attempts to investigate whether there is a cointegration relationship between the variables (see Tables 5 and 6). Table 5 that Pedroni test is rejected at the 1% level, so there is a cointegration among them, which also implies that the benchmark regression model can be used for the estimation. Besides, Table 6 demonstrates that a null hypothesis of no cointegration cannot be rejected for the results of the Westlund (2007) test that Gt, Pt, and Pa variables are cointegrated, while the remaining one cannot reject the null hypothesis of no cointegration. As Hasanov et al. (2021), the Westlund (2007) test causes under-rejection in small samples.

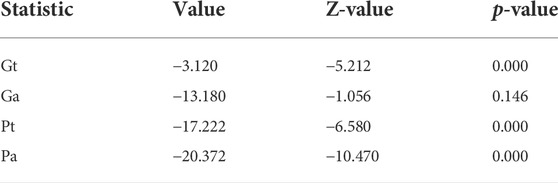

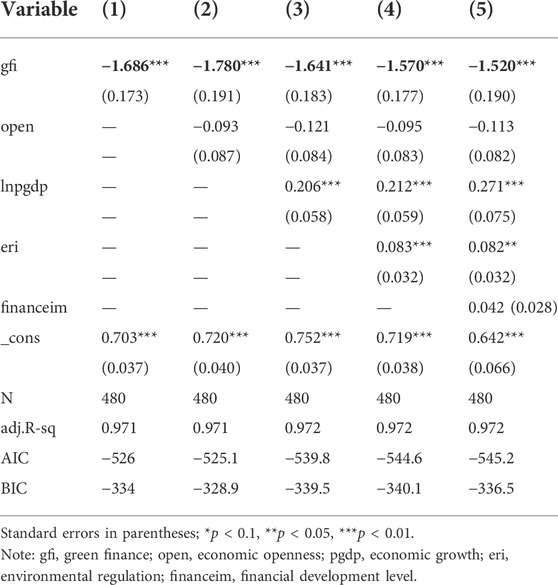

4.3 Discussion on OLS panel regression result

To add to the robustness of the regression result, this study utilizes the stepwise regression method of progressively expanding the control factors, and increasing the robustness and validity of the results. The time and individual effects were fixed to reduce the impact on estimated results (see Table 7). Table 7 reveals that the coefficients of the core explanatory variable

4.4 Discussion on panel regression model result

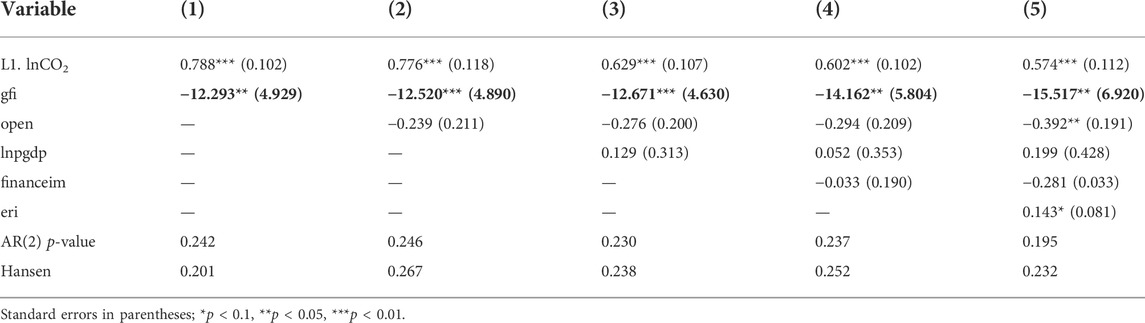

To further verify the dynamic relationship between green finance and carbon emissions, this study introduces the GMM model to alleviate the endogenous problem. Some necessary tests should be required before using the GMM model (see Table 8). Table 8 reports that according to the p-value of AR(2), there is no second-order autocorrelation in the random disturbance term. Hansen test results show that there is no over-identification problem of instrumental variables, indicating that the estimation results are effective. The lagged period of the explained variable is significantly positive at the 1% level, implying that carbon emissions in the earlier period will have a positive impact on carbon emissions in the later period. Besides, the core explanatory variable

4.5 Discussion on robustness test result

To additionally demonstrate the robustness of the above results, a two-stage least squares test (2SLS) is conducted, and the outcomes are displayed in Table 9. It can be seen that in the process of stepwise 2SLS regression, the contribution of green finance to carbon emissions is significantly negative at the level of 1%. The significance and indication of the core explanatory variable have not changed except for the little difference in the regression coefficient. The openness, per capita GDP, financial development, and environmental regulation are significant at the level of 10%, which is consistent with the results of OLS panel regression and dynamic panel GMM regression. The results of stepwise OLS panel regression, GMM dynamic panel regression, and 2SLS robust regression show that the results of empirical regression are reliable and have good stability. Therefore, the research results of this study are robust.

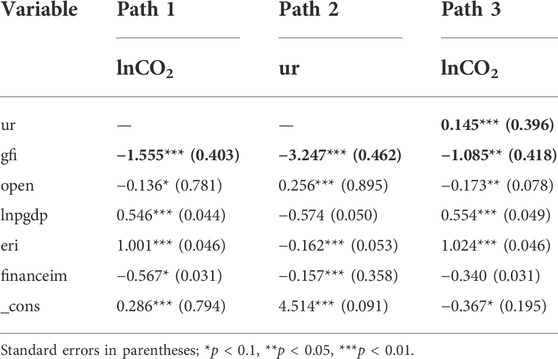

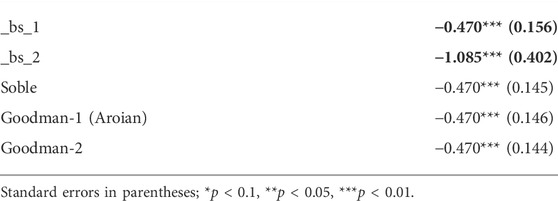

4.6 Discussion on mediating effect regression result

According to the mediating effect of the unemployment rate on the impact of green finance on carbon emissions, the next test is carried out according to the mediating effect test process. As shown in Table 7, in the bootstrap test, the direct effect and mediating effect are significantly negative at the level of 1%, that is, the direct effect and indirect effect of green finance on carbon emissions are negative, while the Sobel test is significantly negative at the level of 1%, which proves the stability of the mediating effect.

As shown in Table 10, the impact of green finance on carbon emissions in path 1 is significantly negative at the level of 1%, that is, it has a significant inhibitory effect. The indirect regression results of path 2 show that the impact of green finance on the unemployment rate is significantly negative at the level of 1%, therefore, Hypothesis 2 is verified. It can be seen from path 3 that the unemployment rate and carbon emissions show a significant positive effect at the level of 1%, that is, the increase in the unemployment rate will increase carbon emissions. Therefore, Hypothesis 3 is verified. Therefore, combining the results in Tables 10 and 11, it is clear that green finance can significantly reduce carbon emissions by diminishing the unemployment rate. One potential explanation is that, ceteris paribus, the financing constraints induced by green finance will raise firms’ production costs, thereby reducing their production size and the number of employees they can absorb. However, Porter’s hypothesis confirms that in this case, the polluting firm may have a comparative advantage due to the impact on competitors in terms of production process transformation and products. Moreover, the green financial tools currently adopted by China do not directly constrain total carbon emissions, but rather attempt to reduce them by financing adjustments and technological advances. Therefore, if the “use of new technologies” is implicit in this process, then the carbon abatement technology itself generates job creation and thus reduces unemployment. For instance, green finance stimulates the R&D and application of emission reduction technologies, which require additional labor input in the process and thus create some employment opportunities. Also, these abatement technologies may convert by-products (e.g., residues) generated in the production process into commodities, thereby increasing corporate profits and corresponding employment opportunities. This not only further reduces unemployment but also curbs carbon emissions.

In addition, it can be seen from Tables 5 and 6 that a open has a significant inhibitory effect on carbon emissions, but it has a significant promoting effect on

4.7 Discussion on regional heterogeneity result

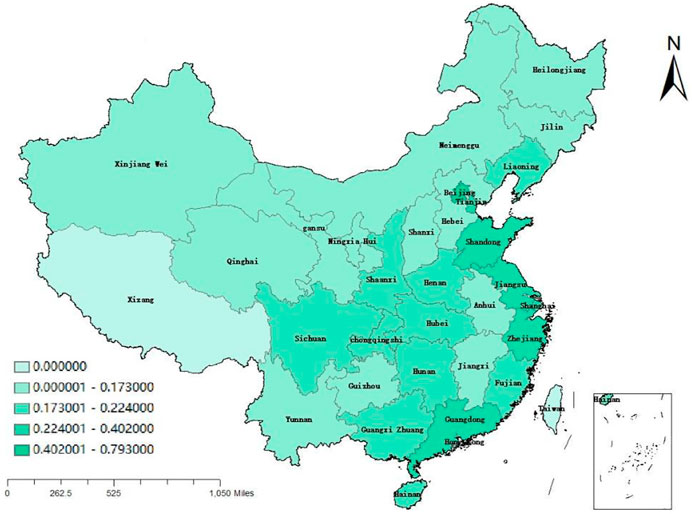

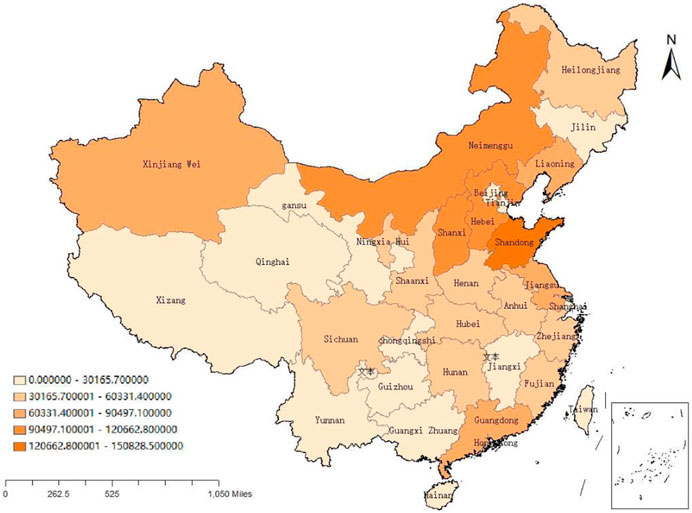

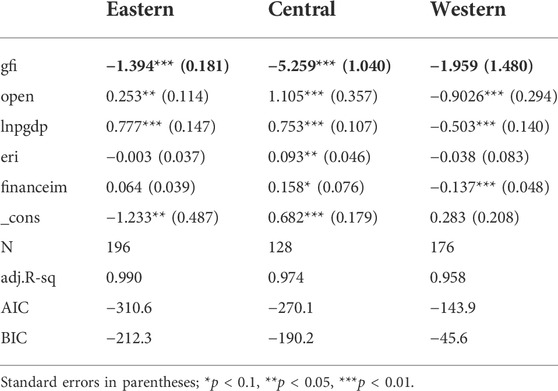

There may also be significant regional heterogeneity in the impact of green finance on carbon emissions in different regions due to their different natural endowments, economic levels, industrial structures, and policy preferences (Islam et al., 2022; Yang et al., 2022). This study divides China’s 30 provinces (cities) into three parts according to the level of economic development: eastern, central, and western (Yang et al., 2021c). The eastern region includes Beijing, Tianjin, Shandong Province, Hebei, Jiangsu, Shanghai, Zhejiang, Fujian, Guangdong, and Hainan; The central region includes Shanxi, Inner Mongolia, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, Hunan, and Guangxi; the western region includes Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang. As shown in Figure 2, there are extraordinary contrasts in the development level of green finance in the eastern, central, and western, and the essential development status shows a pattern of slow decrease to the inland. The development of green finance in the eastern coastal regions is relatively high. The development of the central region is relatively deficient except Hubei Province, Henan Province, and Hunan Province, and the development of green finance in the western region is relatively deficient except Sichuan Province and Chongqing. However, there are differences in carbon emissions. According to Figure 3, carbon emissions are relatively high in the central region, especially Shanxi Province and Inner Mongolia in the central region, Hebei Province, and Shandong Province in the eastern region, and moderate in some eastern coastal provinces and developed regions such as Beijing, Shanghai, Zhejiang Province, and Fujian Province.

On this basis, this study uses the OLS model to analyze the regional heterogeneity of the impact of green finance on carbon emissions in eastern, central, and western regions. Table 12 shows that green finance has a significant inhibitory effect on carbon emissions in the eastern and central regions at the level of 1% but insignificant in the western region. One potential reason is that the eastern region mainly gathers political, economic, and cultural centers, and the economic level is relatively developed (Yan et al., 2021). Therefore, the development of green finance can be better supported in the eastern region. However, the local industrial structure is biased toward the tertiary industry, with the majority of high-tech industries, a high level of technological innovation, high energy efficiency, and low carbon emissions compared with the central region (Baloch et al., 2020). Therefore, the inhibitory effect of green finance on carbon dioxide emission is less than that of the central region. Besides, the central region has a relatively dense population, high pressure of employment competition, and many high energy-consuming industries, such as coal, steel, and other industries. Therefore, green finance has a greater impact on the industries in the central region to promote the green transformation and upgrading of industries. With the support of green financial development, the employment pressure can also be better alleviated, to reduce the unemployment rate in the central region, and further curb carbon emissions. Therefore, it has a stronger effect on restraining carbon emissions. Finally, the development level of green finance in the western region is relatively low, coupled with its vast territory and sparse population, the energy demand is relatively low compared with the eastern and middle regions, and the ecological environment is high. Therefore, the inhibitory effect of green finance on carbon emissions is insignificant.

5 Conclusions and policy recommendations

Using the panel data of 30 provincial administrative regions in China from 2004 to 2019, this study investigates the impact of green finance on carbon emissions based on an unemployment rate perspective. This study takes the unemployment rate as the mediating variable to study the impact of green finance on carbon emissions for the first time, which enriches the current research path and theoretical basis and provides more empirical reference evidence for realizing the dual carbon goal. The statistical results found that green finance has a significant inhibitory impact on carbon emissions. Green finance has significantly reduced the unemployment rate. The unemployment rate has a significant positive effect on carbon emissions. Green finance can reduce carbon emissions by diminishing the unemployment rate. There is regional heterogeneity in the effect of green finance on carbon emissions in eastern, middle, and western China. Specifically, green finance in the eastern and central regions significantly inhibits carbon emissions, while in the western region not significantly. In response to the above findings, the study draws corresponding strategic recommendations.

First, speeding up the improvement of the green finance standard framework and motivation and limitation instrument. Policymakers should continue to establish a more effective green financial incentive system, and guide financial resources to green and low-carbon projects. Besides, policymakers should accelerate research on the establishment of emission reduction support tools and encourage the financial sector to increase support for green and low-carbon projects with significant emission reductions. Through innovation sharing, policymakers can actively cultivate green finance, speed up the reform of energy-intensive industries, and achieve carbon emission reduction.

Second, policymakers should utilize the green finance funding leverage and channeling effect to drive the rapid development of low-carbon, zero-carbon, and carbon-negative industries to develop a scale effect to expand employment. Furthermore, policymakers should play the substitution effect of green finance to accelerate the migration of workers from coal, steel, oil, and other industries to low-carbon industries to optimize the labor market and thus achieve stable employment rates. Finally, policymakers shall employ green finance to increase wages and subsidies for those employed in low-carbon industries, thereby promoting employment for the purpose of indirectly reducing carbon emissions.

Third, policymakers should find out the development process of green finance according to local conditions, formulate green financial development plans accurately according to the actual situation of each region and the attributes of industrial construction, and implement financial and industrial policies following local conditions. Economically developed areas should make use of their developed financial level to vigorously develop green finance and infiltrate into areas, where the green financial level is underdeveloped to achieve the role of a bellwether. While implementing green finance, the central and western regions should optimize the existing green finance development policies by drawing on the advanced experience of the eastern regions, thereby maximizing carbon emission reduction.

However, this study still has some limitations. Firstly, it is only based on China’s inter-provincial panel data, and other countries may have the same problems, so future research can be expanded to international research samples. Secondly, it lacks case analysis. Future research can further support the research conclusion of this study by investigating the pilot efficiency of green finance policy. Finally, the impact of green finance on carbon emissions may have a nonlinear relationship, so future scholars can deepen this research by adding threshold variables.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding authors.

Author contributions

YC: Conceptualization, Project administration, Formal analysis, Writing—review and editing, Data curation, Writing—original draft. GW: Software, Visualization, Conceptualization, Methodology. MI: Writing—original draft, Writing—review, and editing, Formal analysis, Validation. DW: Writing—review and editing, Validation. JC: Writing—review and editing, Writing—original draft, Conceptualization, Methodology, Funding acquisition, Supervision.

Funding

This work was supported in part by the Ministry of Science and Technology of China under Grant 2020AAA0108400, in part by the National Natural Science Foundation of China under Grant 71825007, and in part by the Strategic Priority Research Program of CAS under Grant XDA2302020.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbasi, K. R., Shahbaz, M., Zhang, J., Irfan, M., and Alvarado, R. (2022). Analyze the environmental sustainability factors of China: The role of fossil fuel energy and renewable energy. Renew. Energy 187, 390–402. doi:10.1016/j.renene.2022.01.066

Aceleanu, M., Serban, A., and Burghelea, C. (2015). "Greening" the youth employment-A chance for sustainable development. Sustainability 7 (3), 2623–2643. doi:10.3390/su7032623

Acheampong, A. O., Amponsah, M., and Boateng, E. (2020). Does financial development mitigate carbon emissions? Evidence from heterogeneous financial economies. Energy Econ. 88. doi:10.1016/j.eneco.2020.104768

Adams, S., and Klobodu, E. K. M. (2018). Financial development and environmental degradation: Does political regime matter? J. Clean. Prod. 197 (PT1), 1472–1479. doi:10.1016/j.jclepro.2018.06.252

Ahmad, B., Da, L., Asif, M. H., Irfan, M., Ali, S., and Akbar, M. I. U. D. (2021). Understanding the antecedents and consequences of service-sales ambidexterity: A motivation-opportunity-ability (MOA) framework. Sustainability 13 (17), 9675. doi:10.3390/su13179675

Alharthi, M., Dogan, E., and Taskin, D. (2021). Analysis of CO2 emissions and energy consumption by sources in MENA countries: Evidence from quantile regressions. Environ. Sci. Pollut. Res., 1–8. doi:10.1007/s11356-021-13356-0

Ali, S., Yan, Q., Sajjad Hussain, M., Irfan, M., Ahmad, M., Razzaq, A., et al. (2021). Evaluating green technology strategies for the sustainable development of solar power projects: Evidence from Pakistan. Sustainability 13 (23), 12997. doi:10.3390/su132312997

Alkhateeb, T., Mahmood, H., Sultan, Z. A., and Ahmad., N. (2017). Financial market development and employment nexus in Saudi Arabia. MPRA Pap.

Anser, M. K., Alharthi, M., Aziz, B., and Wasim, S. (2020b). Impact of urbanization, economic growth, and population size on residential carbon emissions in the SAARC countries. Clean. Techn Environ. Policy 22 (4), 923–936. doi:10.1007/s10098-020-01833-y

Anser, M. K., Hanif, I., Alharthi, M., and Chaudhry, I. S. (2020a). Impact of fossil fuels, renewable energy consumption and industrial growth on carbon emissions in Latin American and Caribbean economies. Atmosfera 33 (3), 201–213. doi:10.20937/atm.52732

Asbahi, A. A. M. H. A., Gang, F. Z., Iqbal, W., Abass, Q., Mohsin, M., and Iram, R. (2019). Novel approach of principal component analysis method to assess the national energy performance via Energy Trilemma Index. Energy Rep. 5, 704–713. doi:10.1016/j.egyr.2019.06.009

Bai, J., Chen, Z., Yan, X., and Zhang, Y. (2022). Research on the impact of green finance on carbon emissions: Evidence from China. Econ. Research-Ekonomska Istraživanja 2022, 1–20. doi:10.1080/1331677x.2022.2054455

Ball, L., Furceri, D., Leigh, D., and Loungani, P. (2019). Does one law fit all?Okun’s law in advanced and developing economies. Open Econ. (in press).

Baloch, Z. A., Tan, Q., Iqbal, N., Mohsin, M., Abbas, Q., Iqbal, W., et al. (2020). Trilemma assessment of energy intensity, efficiency, and environmental index: Evidence from BRICS countries. Environ. Sci. Pollut. Res. 27 (27), 34337–34347. doi:10.1007/s11356-020-09578-3

Balsalobre-Lorente, D., Ibáñez-Luzón, L., Usman, M., and Shahbaz, M. (2022). The environmental Kuznets curve, based on the economic complexity, and the pollution haven hypothesis in PIIGS countries. Renew. Energy 185, 1441–1455. doi:10.1016/j.renene.2021.10.059

Benos, N., and Stavrakoudis, A. (2020). Okun's law: Copula-based evidence from G7 countries. Q. Rev. Econ. Finance. doi:10.1016/j.qref.2020.10.004

Boutabba, M. A. (2014). The impact of financial development, income, energy and trade on carbon emissions: Evidence from the indian economy. Econ. Model. 40 (jun), 33–41. doi:10.1016/j.econmod.2014.03.005

Bulavskaya, T., and Reynés., F. (2018). Job creation and economic impact of renewable energy in Netherlands. Renew. Energy 119, 528. doi:10.1016/j.renene.2017.09.039

Cao, J., Law, S. H., Samad, A. R. B. A., Mohamad, W. N. B. W., Wang, J., and Yang, X. (2021). Impact of financial development and technological innovation on the volatility of green growth-evidence from China. Environ. Sci. Pollut. Res. 28 (35), 48053–48069. doi:10.1007/s11356-021-13828-3

Chandio, A. A., Jiang, Y., Akram, W., Adeel, S., Irfan, M., and Jan, I. (2021). Addressing the effect of climate change in the framework of financial and technological development on cereal production in Pakistan. J. Clean. Prod. 288, 125637. doi:10.1016/j.jclepro.2020.125637

Chen, B., and Zhang, L. (2014). The impact of financial development to carbon emissions from the perspective of dynamic spatial. Soft Sci. 28 (7), 5.

Chen, X. (2020). Financial structure, technological innovation and carbon emissions:with additional studies on the development of green financial system. Soc. Sci. Guangdong 4, 10.

Chen, Y., and Lee, C.-C. (2020). Does technological innovation reduce co2 emissions?cross-country evidence. J. Clean. Prod. 263 (2), 121550. doi:10.1016/j.jclepro.2020.121550

Cheng, C., Ren, X., Dong, K., Dong, X., and Wang, Z. (2021). How does technological innovation mitigate CO2 emissions in OECD countries? Heterogeneous analysis using panel quantile regression. J. Environ. Manag. 280, 111818. doi:10.1016/j.jenvman.2020.111818

Dao, V., Langella, I., and Carbo, J. (2011). From green to sustainability: Information Technology and an integrated sustainability framework. J. Strategic Inf. Syst. 20 (1), 63–79. doi:10.1016/j.jsis.2011.01.002

Fang, Z., Razzaq, A., Mohsin, M., and Irfan, M. (2022). Spatial spillovers and threshold effects of internet development and entrepreneurship on green innovation efficiency in China. Technol. Soc. 68, 101844. doi:10.1016/j.techsoc.2021.101844

Hafner, S., Jones, A., Anger-Kraavi, A., and Pohl, J. (2020). Closing the green finance gap - a systems perspective. Environ. Innovation Soc. Transitions 34, 26–60. doi:10.1016/j.eist.2019.11.007

Hao, Y., Ba, N., Ren, S., and Wu, H. (2021). How does international technology spillover affect China's carbon emissions? A new perspective through intellectual property protection. Sustain. Prod. Consum. 25, 577–590. doi:10.1016/j.spc.2020.12.008

Hao, Y., Gai, Z., and Wu, H. (2020). How do resource misallocation and government corruption affect green total factor energy efficiency? Evidence from China. Energy Policy 143, 111562. doi:10.1016/j.enpol.2020.111562

Hasanov, F. J., Bulut, C., and Suleymanov, E. (2016). Do population age groups matter in the energy use of the oil-exporting countries? Econ. Model. 54, 82–99. doi:10.1016/j.econmod.2015.12.018

Hasanov, F. J., Khan, Z., Hussain, M., and Tufail, M. (2021). Theoretical framework for the carbon emissions effects of technological progress and renewable energy consumption. Sustain. Dev. 29 (5), 810–822. doi:10.1002/sd.2175

Hasanov, F. J., and Mikayilov, J. I. (2021). The impact of total factor productivity on energy consumption: Theoretical framework and empirical validation. Energy Strategy Rev. 38, 100777. doi:10.1016/j.esr.2021.100777

He, L., Wu, M., and Fang, Y. (2017). Study on the impact of total and structure of renewable energy investment on carbon emission. J. China Univ. Geosciences Soc. Sci. 01, 76–88. doi:10.16493/j.cnki.42-1627/c.2017.93.009

He, W., Chen, H., and Wang, Z. (2019). An empirical study on the dynamic relationship between green financial development and carbon emissions——testing based on VAR model. J. Guizhou Normal Univ. Soc. Sci. 1, 10.

Henzelmann, T., and Hoff, P. (2011). “Green finance and the new green gold,” in Green growth, green profit (London: Palgrave Macmillan), 209–222. doi:10.1057/9780230303874_17

Hou, Y., Iqbal, W., Muhammad Shaikh, G., Iqbal, N., Ahmad Solangi, Y., and Fatima, A. (2019). Measuring energy efficiency and environmental performance: A case of south asia. Processes 7 (6), 325. doi:10.3390/pr7060325

Hua, F., Alharthi, M., Yin, W., Saeed, M., Ahmed, I., and Ali, S. A. (2022). Carbon emissions and socioeconomic drivers of climate change: Empirical evidence from the logarithmic mean divisia index (LMDI) base model for China. Sustainability 14 (2), 2214. doi:10.3390/su14042214

Iqbal, W., Altalbe, A., Fatima, A., Ali, A., and Hou, Y. (2019b). A DEA approach for assessing the energy, environmental and economic performance of top 20 industrial countries. Processes 7 (12), 902. doi:10.3390/pr7120902

Iqbal, W., Fatima, A., Yumei, H., Abbas, Q., and Iram, R. (2020). Oil supply risk and affecting parameters associated with oil supplementation and disruption. J. Clean. Prod. 255, 120187. doi:10.1016/j.jclepro.2020.120187

Iqbal, W., Tang, Y. M., Chau, K. Y., Irfan, M., and Mohsin, M. (2021). Nexus between air pollution and NCOV-2019 in China: Application of negative binomial regression analysis. Process Saf. Environ. Prot. 150, 557–565. doi:10.1016/j.psep.2021.04.039

Iqbal, W., Yumei, H., Abbas, Q., Hafeez, M., Mohsin, M., Fatima, A., et al. (2019a). Assessment of wind energy potential for the production of renewable hydrogen in Sindh Province of Pakistan. Processes 7, 196. doi:10.3390/pr7040196

Irfan, M., and Ahmad, M. (2021). Relating consumers' information and willingness to buy electric vehicles: Does personality matter? Transp. Res. Part D Transp. Environ. 100, 103049. doi:10.1016/j.trd.2021.103049

Irfan, M., Elavarasan, R. M., Ahmad, M., Mohsin, M., Dagar, V., and Hao, Y. (2022). Prioritizing and overcoming biomass energy barriers: Application of AHP and G-TOPSIS approaches. Technol. Forecast. Soc. Change 177, 121524. doi:10.1016/j.techfore.2022.121524

Irfan, M., Elavarasan, R. M., Hao, Y., Feng, M., and Sailan, D. (2021a). An assessment of consumers' willingness to utilize solar energy in China: End-users' perspective. J. Clean. Prod. 292, 126008. doi:10.1016/j.jclepro.2021.126008

Irfan, M., Hao, Y., Ikram, M., Wu, H., Akram, R., and Rauf, A. (2021b). Assessment of the public acceptance and utilization of renewable energy in Pakistan. Sustain. Prod. Consum. 27, 312–324. doi:10.1016/j.spc.2020.10.031

Islam, M. M., Alharthi, M., and Murad, M. W. (2021). The effects of carbon emissions, rainfall, temperature, inflation, population, and unemployment on economic growth in Saudi Arabia: An ARDL investigation. Plos one 16 (4), e024874310. doi:10.1371/journal.pone.0248743

Islam, M. M., Irfan, M., Shahbaz, M., and Vo, X. V. (2022). Renewable and non-renewable energy consumption in Bangladesh: The relative influencing profiles of economic factors, urbanization, physical infrastructure and institutional quality. Renew. Energy 184, 1130–1149. doi:10.1016/j.renene.2021.12.020

Jahanger, A., Usman, M., Murshed, M., Mahmood, H., and Balsalobre-Lorente, D. (2022). The linkages between natural resources, human capital, globalization, economic growth, financial development, and ecological footprint: The moderating role of technological innovations. Resour. Policy 76, 102569. doi:10.1016/j.resourpol.2022.102569

Jiang, H., Wang, W., Wang, L., and Wu, J. (2020). The effects of the carbon emission reduction of China’s green finance—an analysis based on green credit and green venture investment. Financ. Forum 25, 39–48+80.

Jiang, T., Yu, Y., Jahanger, A., and Balsalobre-Lorente, D. (2022). Structural emissions reduction of China's power and heating industry under the goal of" double carbon": A perspective from input-output analysis. Sustain. Prod. Consum. doi:10.1016/j.spc.2022.03.003

Khan, I., Hou, F., Irfan, M., Zakari, A., and Le, H. P. (2021). Does energy trilemma a driver of economic growth? The roles of energy use, population growth, and financial development. Renew. Sustain. Energy Rev. 146, 111157. doi:10.1016/j.rser.2021.111157

Khobai, H., Kolisi, N., Moyo, C., Anyikwa, I., and Dingela, S. (2020). Renewable energy consumption and unemployment in South Africa. Int. J. Energy Econ. Policy 10 (2), 170–178. doi:10.32479/ijeep.6374

Koondhar, M. A., Tan, Z., Alam, G. M., Khan, Z. A., Wang, L., and Kong, R. (2021). Bioenergy consumption, carbon emissions, and agricultural bioeconomic growth: A systematic approach to carbon neutrality in China. J. Environ. Manag. 296, 113242. doi:10.1016/j.jenvman.2021.113242

Lee, J. W. (2020). Green finance and sustainable development goals: The case of China. Jafeb 7 (7), 577–586. doi:10.13106/jafeb.2020.vol7.no7.577

Li, R., Wang, X., and Wang, Q. (2022). Does renewable energy reduce ecological footprint at the expense of economic growth? An empirical analysis of 120 countries. J. Clean. Prod., 131207.

Liddle, B., and Hasanov, F. (2022). Industry electricity price and output elasticities for high-income and middle-income countries. Empir. Econ. 62 (3), 1293–1319. doi:10.1007/s00181-021-02053-z

Liu, J., Yan, X., Lin, S., Wu, J., and Fan, Y. (2015). The Short,Medium and long term effects of green credit policy in China based on a financial CGE model. Chin. J. Manag. Sci. 23 (004), 46–52.

Machiba, T. (2011). “Eco-innovation for enabling resource efficiency and green growth: Development of an analytical framework and preliminary analysis of industry and policy practices,” in International economics of resource efficiency (Berlin: Physica-Verlag HD), 371–394. doi:10.1007/978-3-7908-2601-2_19

Meo, M. S., Sabir, S. A., Arain, H., and Nazar, R. (2020). Water resources and tourism development in south asia: An application of dynamic common correlated effect (DCCE) model. Environ. Sci. Pollut. Res. 27 (16), 19678–19687. doi:10.1007/s11356-020-08361-8

Mu, Y., Cai, W., Evans, S., Wang, C., and Roland-Holst, D. (2018). Employment impacts of renewable energy policies in China: A decomposition analysis based on a cge modeling framework. Appl. Energy 210, 256–267. doi:10.1016/j.apenergy.2017.10.086

Ndubuaku, V., Inim, V., Samuel, U. E., Rosemary, I. H., and Prince, A. I. (2021). Financial development on employment rate in Nigeria. Rwe 12 (1), 267. doi:10.5430/rwe.v12n1p267

Okun, A. (1962). “Potential GNP: Its measurement and significance,” in Proceedings of the business and economics statistics section.

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econ. 22 (2), 265–312. doi:10.1002/jae.951

Pesaran, M. H. (2015a). Testing weak cross-sectional dependence in large panels. Econ. Rev. 34 (6-10), 1089–1117. doi:10.1080/07474938.2014.956623

Pesaran, M. H. (2015b). Time series and panel data econometrics. Oxford, UK: Oxford University Press.

Qiu, W., Zhang, J., Wu, H., Irfan, M., and Ahmad, M. (2021). The role of innovation investment and institutional quality on green total factor productivity: Evidence from 46 countries along the “Belt and Road”. Environ. Sci. Pollut. Res. 2021, 1–15.

Rauf, A., Ozturk, I., Ahmad, F., Shehzad, K., Chandiao, A. A., Irfan, M., et al. (2021). Do tourism development, energy consumption and transportation demolish sustainable environments? Evidence from Chinese provinces. Sustainability 13 (22), 12361. doi:10.3390/su132212361

Razzaq, A., Ajaz, T., Li, J. C., Irfan, M., and Suksatan, W. (2021a). Investigating the asymmetric linkages between infrastructure development, green innovation, and consumption-based material footprint: Novel empirical estimations from highly resource-consuming economies. Resour. Policy 74, 102302. doi:10.1016/j.resourpol.2021.102302

Razzaq, A., Sharif, A., Aziz, N., Irfan, M., and Jermsittiparsert, K. (2020). Asymmetric link between environmental pollution and COVID-19 in the top ten affected states of us: A novel estimations from quantile-on-quantile approach. Environ. Res. 191, 110189. doi:10.1016/j.envres.2020.110189

Razzaq, A., Wang, Y., Chupradit, S., Suksatan, W., and Shahzad, F. (2021b). Asymmetric inter-linkages between green technology innovation and consumption-based carbon emissions in BRICS countries using quantile-on-quantile framework. Technol. Soc. 66, 101656. doi:10.1016/j.techsoc.2021.101656

Ren, S., Hao, Y., and Wu, H. (2022c). Digitalization and environment governance: Does internet development reduce environmental pollution? J. Environ. Plan. Manag., 1–30. doi:10.1080/09640568.2022.2033959

Ren, S., Hao, Y., and Wu, H. (2021). Government corruption, market segmentation and renewable energy technology innovation: Evidence from China. J. Environ. Manag. 300, 113686. doi:10.1016/j.jenvman.2021.113686

Ren, S., Hao, Y., and Wu, H. (2022a). How does green investment affect environmental pollution? Evidence from China. Environ. Resour. Econ. 81 (1), 25–51. doi:10.1007/s10640-021-00615-4

Ren, S., Hao, Y., and Wu, H. (2022b). The role of outward foreign direct investment (OFDI) on green total factor energy efficiency: Does institutional quality matters? Evidence from China. Resour. Policy 76, 102587. doi:10.1016/j.resourpol.2022.102587

Saeed Meo, M., and Karim, M. Z. A. (2022). The role of green finance in reducing CO2 emissions: An empirical analysis. Borsa Istanb. Rev. 22 (1), 169–178. doi:10.1016/j.bir.2021.03.002

Shahbaz, M., Kumar Tiwari, A., and Nasir, M. (2013). The effects of financial development, economic growth, coal consumption and trade openness on co2 emissions in South Africa. Energy Policy 61 (oct), 1452–1459. doi:10.1016/j.enpol.2013.07.006

Shahbaz, M., Nasir, M. A., Hille, E., and Mahalik, M. K. (2020). UK's net-zero carbon emissions target: Investigating the potential role of economic growth, financial development, and R&D expenditures based on historical data (1870-2017). Technol. Forecast. Soc. Change 161, 120255. doi:10.1016/j.techfore.2020.120255

Shao, X., and Fang, T. (2021). Analysis on the coupling effect between regional green finance and industrial structure——based on new institutional economics. J. Industrial Technol. Econ. 40 (1), 8.

Shen, Y., Su, Z. W., Malik, M. Y., Umar, M., Khan, Z., and Khan, M. (2020). Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 755 (Pt 2), 142538. doi:10.1016/j.scitotenv.2020.142538

Shen, Y., Su, Z.-W., Malik, M. Y., Umar, M., Khan, Z., and Khan, M. (2021). Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 755, 142538. doi:10.1016/j.scitotenv.2020.142538

Shen, Z., Wu, H., Bai, K., and Hao, Y. (2022). Integrating economic, environmental and societal performance within the productivity measurement. Technol. Forecast. Soc. Change 176, 121463. doi:10.1016/j.techfore.2021.121463

Shi, R., Irfan, M., Liu, G., Yang, X., and Su, X. (2022). Analysis of the impact of livestock structure on carbon emissions of animal husbandry: A sustainable way to improving public health and green environment. Front. Public Health 145.

Silajdžić, I., Kurtagić, S. M., and Vučijak, B. (2015). Green entrepreneurship in transition economies: A case study of Bosnia and Herzegovina. J. Clean. Prod. 88, 376–384.

Sima, V., Gheorghe, I. G., Subić, J., and Nancu, D. (2020). Influences of the industry 4.0 revolution on the human capital development and consumer behavior: A systematic review. Sustainability 12 (10), 4035. doi:10.3390/su12104035

Steward, F. (2012). Transformative innovation policy to meet the challenge of climate change: Sociotechnical networks aligned with consumption and end-use as new transition arenas for a low-carbon society or green economy. Technol. Analysis Strategic Manag. 24 (4), 331–343. doi:10.1080/09537325.2012.663959

Sun, C. (2021). The correlation between green finance and carbon emissions based on improved neural network. Neural Comput. Appl. 2021, 1–15. doi:10.1007/s00521-021-06514-5

Taghizadeh-Hesary, F., and Yoshino, N. (2019). The way to induce private participation in green finance and investment. Finance Res. Lett. 31, 98–103. doi:10.1016/j.frl.2019.04.016

Tang, C., Irfan, M., Razzaq, A., and Dagar, V. (2022). Natural resources and financial development: Role of business regulations in testing the resource-curse hypothesis in ASEAN countries. Resour. Policy 76, 102612. doi:10.1016/j.resourpol.2022.102612

Tanveer, A., Zeng, S., Irfan, M., and Peng, R. (2021). Do perceived risk, perception of self-efficacy, and openness to technology matter for solar PV adoption? An application of the extended theory of planned behavior. Energies 14 (16), 5008. doi:10.3390/en14165008

Usman, M., and Balsalobre-Lorente, D. (2022). Environmental concern in the era of industrialization: Can financial development, renewable energy and natural resources alleviate some load? Energy Policy 162, 112780. doi:10.1016/j.enpol.2022.112780

Wang, J., Wang, W., Ran, Q., Irfan, M., Ren, S., Yang, X., et al. (2022). Analysis of the mechanism of the impact of internet development on green economic growth: Evidence from 269 prefecture cities in China. Environ. Sci. Pollut. Res. 29 (7), 9990–10004. doi:10.1007/s11356-021-16381-1

Wang, Q., Dong, Z., Li, R., and Wang, L. (2022a). Renewable energy and economic growth: New insight from country risks. Energy 238, 122018. doi:10.1016/j.energy.2021.122018

Wang, Q., and Li, L. (2021). The effects of population aging, life expectancy, unemployment rate, population density, per capita GDP, urbanization on per capita carbon emissions. Sustain. Prod. Consum. 28, 760–774. doi:10.1016/j.spc.2021.06.029

Wang, Q., Wang, L., and Li, R. (2022c). Renewable energy and economic growth revisited: The dual roles of resource dependence and anticorruption regulation. J. Clean. Prod. 337, 130514. doi:10.1016/j.jclepro.2022.130514

Wang, Q., Wang, X., and Li, R. (2022b). “Does urbanization redefine the environmental Kuznets curve,” in An empirical analysis of, 134.

Wang, X. (2020). Research on the impact mechanism of green finance on the green innovation performance of China's manufacturing industry. Manag. Decis. Econ.

Wen, C., Akram, R., Irfan, M., Iqbal, W., Dagar, V., Acevedo-Duqued, Á., et al. (2022). The asymmetric nexus between air pollution and COVID-19: Evidence from a non-linear panel autoregressive distributed lag model. Environ. Res. 209, 112848. doi:10.1016/j.envres.2022.112848

Wu, H., Hao, Y., and Weng, J.-H. (2019). How does energy consumption affect China's urbanization? New evidence from dynamic threshold panel models. Energy policy 127, 24–38. doi:10.1016/j.enpol.2018.11.057

Wu, H., Xu, L., Ren, S., Hao, Y., and Yan, G. (2020). How do energy consumption and environmental regulation affect carbon emissions in China? New evidence from a dynamic threshold panel model. Resour. Policy 67, 101678. doi:10.1016/j.resourpol.2020.101678

Xiang, H., Chau, K. Y., Iqbal, W., Irfan, M., and Dagar, V. (2022). Determinants of social commerce usage and online impulse purchase: Implications for business and digital revolution. Front. Psychol. 13, 837042. doi:10.3389/fpsyg.2022.837042

Xiong, Q., and Sun, D. (2022). Influence analysis of green finance development impact on carbon emissions: An exploratory study based on fsQCA. Environ. Sci. Pollut. Res. 2022, 1–12. doi:10.1007/s11356-021-18351-z

Yan, J., Zhao, J., Yang, X., Su, X., Wang, H., Ran, Q., et al. (2021). Does low-carbon city pilot policy alleviate urban haze pollution? Empirical evidence from a quasi-natural experiment in China. Int. J. Environ. Res. Public Health 18 (21), 11287. doi:10.3390/ijerph182111287

Yang, Kaijun, Pan, Juan & Wang, Shu. (2015). Financial development, technological progress and intra-regional employment structure change-an empirical study based on provincial panel data in the eastern region of China. Econ. (1), 19–24. doi:10.15931/j.cnki.1006-1096.2015.01.004

Yang, X., Su, X., Ran, Q., Ren, S., Chen, B., Wang, W., et al. (2021a). Assessing the impact of energy internet and energy misallocation on carbon emissions: New insights from China. Environ. Sci. Pollut. Res. 2021, 1–25. doi:10.1007/s11356-021-17217-8

Yang, X., Wang, J., Cao, J., Ren, S., Ran, Q., and Wu, H. (2021b). The spatial spillover effect of urban sprawl and fiscal decentralization on air pollution: Evidence from 269 cities in China. Empir. Econ. 2021, 1–29. doi:10.1007/s00181-021-02151-y

Yang, X., Wang, W., Su, X., Ren, S., Ran, Q., Wang, J., et al. (2022). Analysis of the influence of land finance on haze pollution: An empirical study based on 269 prefecture‐level cities in China. Growth Change 2022, 1–34. doi:10.1111/grow.12638

Yang, X., Wang, W., Wu, H., Wang, J., Ran, Q., and Ren, S. (2021c). The impact of the new energy demonstration city policy on the green total factor productivity of resource-based cities: Empirical evidence from a quasi-natural experiment in China. J. Environ. Plan. Manag. 2021, 1–34. doi:10.1080/09640568.2021.1988529

Yang, Z., Abbas, Q., Hanif, I., Alharthi, M., Taghizadeh-Hesary, F., Aziz, B., et al. (2021). Short- and long-run influence of energy utilization and economic growth on carbon discharge in emerging SREB economies. Renew. Energy 165 (1), 43–51. doi:10.1016/j.renene.2020.10.141

Yin, Z., Sun, X., and Xing, M. (2021). Research on the impact of green finance development on green total factor productivity. Statistics Decis. 3, 6.

Zhang, Y.-J. (2011). The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 39 (4), 2197–2203. doi:10.1016/j.enpol.2011.02.026

Zhang, Z., Li, Z., and Li, X. (2020). Impact of financial development and urbanization on per capita energy consumption and carbon emissions. Statistics Decis. 8, 5.

Zhao, X., Peng, B., Elahi, E., Zheng, C., and Wan, A. (2020). Optimization of Chinese coal-fired power plants for cleaner production using Bayesian network. J. Clean. Prod. 273, 122837. doi:10.1016/j.jclepro.2020.122837

Zhao, Y., Peng, B., Elahi, E., and Wan, A. (2021). Does the extended producer responsibility system promote the green technological innovation of enterprises? An empirical study based on the difference-in-differences model. J. Clean. Prod. 319, 128631. doi:10.1016/j.jclepro.2021.128631

Zhou, G., Zhu, J., and Luo, S. (2022). The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecol. Econ. 193, 107308. doi:10.1016/j.ecolecon.2021.107308

Zhou, X., Zhang, J., and Li, J. (2013). Industrial structural transformation and carbon dioxide emissions in China. Energy policy 57, 43–51. doi:10.1016/j.enpol.2012.07.017

Keywords: mediating effect, regional heterogeneity, peak carbon emissions, green finance, the unemployment rate

Citation: Cui Y, Wang G, Irfan M, Wu D and Cao J (2022) The effect of green finance and unemployment rate on carbon emissions in china. Front. Environ. Sci. 10:887341. doi: 10.3389/fenvs.2022.887341

Received: 01 March 2022; Accepted: 27 June 2022;

Published: 22 July 2022.

Edited by:

Fakhri J. Hasanov, King Abdullah Petroleum Studies and Research Center (KAPSARC), Saudi ArabiaReviewed by:

Daniel Balsalobre-Lorente, University of Castilla-La Mancha, SpainWasim Iqbal, Shenzhen University, China

Qiang Wang, China University of Petroleum, Beijing, China

Majed Alharthi, King Abdulaziz University, Saudi Arabia

Copyright © 2022 Cui, Wang, Irfan, Wu and Cao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Gangyi Wang, YXdneUBjYXUuZWR1LmNu; Muhammad Irfan, aXJmYW5zYWhhckBiaXQuZWR1LmNu; Desheng Wu, ZHd1QHVjYXMuYWMuY24=; Jianhong Cao, eGlhdGlhbmRlZ3VvZ3VvQGdtYWlsLmNvbQ==

Yiniu Cui

Yiniu Cui Gangyi Wang2*

Gangyi Wang2* Muhammad Irfan

Muhammad Irfan Jianhong Cao

Jianhong Cao