- 1School of Foreign Studies, Lingnan Normal University, Zhanjiang, China

- 2Vilnius University, Faculty of Economics and Business Administration, Finance Department, Vilnius, Lithuania

- 3Business School, University of Technology Sydney, Sydney, NSW, Australia

The COVID-19 pandemic is a real shock to society and business and financial markets. The government bond market is an essential part of financial markets, especially in difficult times, because it is a source of government funding. The majority of existing ESG studies report positive impacts on corporate financial performance regarding environmental, social, and governance. Thus, understanding governments’ financial practices and their relevant ESG implications is insufficient. This research aims to value the impact of the COVID-19 pandemic on different government bond curve sectors. We try to identify the reactions to the COVID-19 pandemic in the government bond market and analyze separate tenors of government bond yields in different regions. We have chosen Germany and the United States government bond yields of 10, 5, and 3 years tenor for the analysis. As independent variables, we have chosen daily cases of COVID-19 and daily deaths from COVID-19 at the country and global levels. We used daily data from 02 January 2020–19 March 2021, and divided this period into three stages depending on the COVID-19 pandemic data. We employed the methods of correlation-regression analysis (ordinary least squares and least squares with breakpoints) and VAR-based impulse response functions to evaluate the effect of the COVID-19 pandemic on government bond yields both in the long and short run. Our analysis revealed the impact of the spread of the COVID-19 pandemic on government bond yields differs depending on the country and the assessment period. The short-term responses vary in direction, strength, and duration; the long-term response of Germany’s yields appeared to be more negative (indicating the decrease of the yields), while the response of the United States yields appeared to be more positive (i.e., increase of yields).

1 Introduction

The COVID-19 pandemic strongly impacted the outlook of global economic activity, financial market, society’s sentiments, and consumer and business confidence indicators (Teresiene et al., 2021a). The COVID-19 pandemic is different from other financial and economic crises (Yue et al., 2020a, Yue et al., 2020b, Yue et al., 2021). This time, it substantially affected almost all sectors, and the biggest reason for such consequences was a lockdown in all countries. But the lockdown was the only way to protect society and the economy from much more significant adverse effects. The government bond market is substantial in dire and difficult times because it is the primary source of government funding, and yield volatility is related to the debt costs. The role of the government in critical moments is essential. The support is needed not only for society but for business as well. Government bonds are the main part of pension funds and central banks’ investment portfolios, directly connecting with the benefits to society and the economy.

The International Monetary Fund (IMF) noted in its World Economic Outlook 2021 that “the ravage of the new COVID-19 pandemic has made the prospects for the global economic recovery extraordinarily uncertain.” The COVID pandemic affected the economy in all countries. Different authors focus on separate issues related to the pandemic environment (Edrus et al. (2022).

In parallel with the COVID 19 pandemic, Environmental, Social, and Governance (ESG) is a newly emerging investment for extensive companies to create economic value and balance financial earnings and environmental, social sustainable development (Abhayawansa and Tyagi, 2021). Since the concept of ESG was formally proposed by the United Nations in 2004, more and more investors have paid attention to ESG and gradually integrated it into the business practice of corporate social responsibility (Eccles and Viviers, 2011). The emergence of ESG connects corporate social responsibility with global sustainable development issues and reveals the need for upgrading and business transformation of responsible investment in the new era (Leins, 2020). ESG aims to meet the needs of the present without jeopardizing future generations and human capital (Kotsantonis and Serafeim, 2020). ESG is perceived as an emerging investment strategy with a clear, logical chain - corporate ESG performs well, demonstrating corporate capabilities in environmental protection, social responsibility, governance model, and risk control, thus achieving win-win economic, social, and ecological benefits (Chen andYang, 2020, Orazbayеv et al., 2019).

Economic activities are increasingly affecting the environment comprehensively. Companies and their relevant investors shoulder the responsibility to lead a sustainable agenda for their economic activities (Christensen et al., 2022). Based on ESG evaluation and rating information, investors observe the ESG performance of enterprises and evaluate their contribution to enterprises (investment objects) in promoting sustainable economic development and fulfilling social responsibility (Avetisyan and Hockerts, 2017; Amel-Zadeh and Serafeim, 2018; Xiong et al., 2020). ESG contributes to creating long-term value and continuously sustainable development and boosts the confidence of society, investors, and customers (Suttipun, 2021).

In the era of financial turbulence and economic uncertainty of COVID19, however, there are challenges for both companies’ strategic decisions to maintain economic returns and ESG performance. Existing research focuses on the company’s ESG performance (Halbritter and Dorfleitner, 2015; Hill, 2020), ESG data (Kotsantonis and Serafeim, 2019), and disclosure (Lokuwaduge and Heenetigala, 2017), reporting the positive ESG influences on corporate financial performance. Nevertheless, most research overlooked ESG from the perspective of governments. First, the company’s capability to do ESG relies on its financial sourcing from bank loans and the regional government fiscal measures. ESG is pertinent to the effect on the cost of debt financing (Raimo et al., 2021). Second, Although the green bond market has grown quickly in recent years, it is still a niche market that is priced differently from conventional bonds (Hachenberg and Schiereck, 2018). Within this study, we focus on the perspective of government bonds in the context of COVID 19 financial turbulences to inform ESG implications. Therefore, this research aims to value the impact of the COVID-19 pandemic on different government bond curve sectors in different regions. We choose the government bond as our research object. The reasons are the circulating connections among companies, banks, and government banks. Banks hold an average of 9% government bonds assets on regular times (Gennaioli et al., 2018), especially when banks make fewer loans and operate in less financially developed countries. By comparison, banks with the average exposure to government bonds exhibit a lower growth rate of loans than banks without bonds during default years. This research is significant and adds value to the finance literature analyzing government bond yield dynamics in critical moments and stressful scenarios. Governments need to reconsider the maturity of new debt in critical moments. It is also significant for portfolio managers and pertinent changes in fund management and accountability relative to ESG issues (Holland, 2011), especially institutional ones, to manage huge government bond portfolios for pension schemes or income generation for the government budget.

This article sheds light on bond yield volatility during critical moments using the case of the COVID- 19 pandemics. We create value to the literature by analyzing different regions and government bond sectors according to their maturity. We have covered three different markets as most authors focused on one market. We had an aim to compare the impact of the pandemic in separate regions.

This paper consists of different sections. In Section 2, we present a literature review where we analyze different views about the impact of the COVID-19 pandemic on financial markets. We point out that we add value to literature analysis by comparing different regions and different maturities of government bonds. The latter focus is essential for practitioners in portfolio management and diversification decisions. In Section 3 we describe the methodology and finally present our results. For methodological issues, we analyzed the research of Golmankhane et al. (2021) and Rashid et al. (2021), which gave us valuable insights. To value the impact of the COVID-19 pandemic, we have chosen two government bond markets: Germany and the United States. We used three different maturities for the analysis–10 years, 5 years, and 3 years - as we wanted to compare the pandemic’s effect on long and mid-term government bond markets. Our results first present the main tendencies of government bond yields from the pandemic’s start. After that, by dividing the period into three stages, we tried to value the impact of the COVID-19 pandemic in different periods. The dependent variables selected for the research are 10 years German government bond yield; 5 years German government bond yield; 3 years German government bond yield; 10 years United States government bond yield; 5 years United States government bond yield; 3 years United States government bond yield.

2 Literature Review

The government bond market is essential for every country and economy related to public finance and the governments’ ability to attract funds using financial markets. Since the COVID-19 pandemic spread widely and affected all over the World, the financial markets also demonstrated a substantial response. Financial markets first reacted to the news about the pandemic and started the process of “flight to quality.” Loayza and Michael Pennings (2020), in their research, pointed out that in the periods of “flight to quality”—when investors are choosing safe assets for their portfolios emerging, and developing countries face difficulties to finance budget deficits because of higher debt costs. Only international financial markets can help in such moments, and emerging countries have to use opportunities to attract funds using Eurobonds or international bonds. A similar situation we had during the financial crisis in the 2008–2009 period. Acharya et al. (2016) investigated the European sovereign debt crisis and the role of central banks. They pointed out that it was hazardous for commercial banks because they increased their risk by including risky domestic debt in investment portfolios, especially in peripheral countries. The central bank’s impact on sovereign bond yields during a recession period was analyzed by Altavilla et al. (2019), but these authors also analyzed other financial markets.

Different authors analyzed the government bond market, trying to identify the impact of monetary or fiscal policy decisions during the COVID-19 pandemic period (Beirne et al., 2020; Beirne et al., 2020; Bordo and Duca, 2020; Central Bank of Malaysia, 2020; Kothari, 2020; Macchiarelli, 2020; Zaghini, 2020; Elfayoumi and Hengge, 2021; Fendel et al., 2021; Fratto et al., 2021; Rebucci et al., 2021). Other authors focused more on the COVID-19 pandemic risks and paid more attention to sovereign credit default spreads and credit risk (Cevik and Ozturkkal, 2020; Nelufule, 2020; Novick et al., 2020; OECD, 2020; PwC, 2020). While some of them even tried to identify the opposite impact of low bond yields on various business sectors during the pandemic period (EIOPA 2020).

Some authors focused more on the United States Treasuries, pointing to stress and illiquidity issues using treasury inconvenience yields during the pandemic (He et al., 2020), while others analyzed corporate or municipal bond markets COVID-19 pandemic effects (Lonski 2020). Beirne et al. (2020) tried to value the impact of fiscal stimulus and quantitative easing of central banks and analyzed global financial markets in different countries, identifying the COVID-19 pandemic effect. Still, those authors focused more on capital flows and revealed that emerging markets had experienced a more substantial impact of COVID-19 on the bond market than developed economies. We add value to this type of research by analyzing different regions and different tenors of government bonds.

But the most common way of analyzing the government market was the 10 year government bond tenor sector. Our article adds value to the literature and practical investment decisions framework because we analyze the government bond market, consider different government bonds’ maturities, and use that approach for other regions. Our results, in some cases, support Sène et al. (2021) findings that confirmed cases of COVID-19 pandemic lead to increased yields because additional information calmed investor concerns about future trends in economics. The latter research focused on the Eurobond market and revealed that announcements from international organizations: International Monetary Fund, the World Bank, and other official institutions calmed down the markets. It means that the negative effect of the COVID-19 pandemic was not so significant because of the support from official organizations.

Orazio and Maximilian (2020) researched the COVID-19 pandemic effect on long-term E.U. bond yields. Finlay et al. (2020) investigated the Australian government fixed income market in the pandemic period. The authors’ most significant attention was paid to the bond market’s functioning and the central bank’s role. Central banks all over the World helped to reduce high volatility in financial markets. Investors focus on central banks’ future steps and easing monetary policy as a tool and support for economic growth.

The effect of the COVID-19 pandemic on financial markets was analyzed by Zhang et al. (2020), who found a substantial increase in global market price volatility. The authors focused more on stock market volatility and pointed out that monetary and fiscal policy responses can encourage further uncertainties in the global financial markets. Hu et al. (2021) analyzed stock market using the sample of film and drama sector. Chen et al. (2021) analyzed whether investor sentiment has a higher possibility of predicting energy assets volatility than VIX and other uncertainty indices. Hao et al. (2021) focused on the combined effect of foreign direct investment spillovers and remittances inflow on the real effective exchange rate. Teresiene et al. (2021b) and Pan and Yue (2021) analyzed the impact of the COVID-19 pandemic on economic and economic sentiment indicators, which influence financial markets.

Sovereign debt issues attract the attention of different scientists, especially in critical moments of the economic cycle. Ferreira (2018) wrote about the Greek debt crisis and discussed the issues related to public debt. The author made an investigation covering fifteen different European countries and applied a time-varying analysis of the Hurst exponent. The results of the following research showed that there was a long-range memory in sovereign bonds. The Hurst exponent method was also applied by Carbone et al. (2004), but this research focused on the German market’s high-frequency data. Bariviera et al. (2012) also analyzed the European bond market using the Hurst exponent, focusing on the corporate and sovereign bonds market’s informational efficiency. The main findings showed that financial crises had different impacts on corporate and sovereign bonds’ informational efficiency. An interesting fact was that the financial crisis affected the informational efficiency of the corporate bond market.

Zunino et al. (2012) analyzed the efficiency of sovereign bond markets using bond indices from developed and emerging countries. The authors used a sophisticated statistical tool–the complexity –entropy causality plane, which helped rank separate bond markets and distinguished different market dynamics. The authors revealed a correlation between permutation entropy, economic development, and financial market size in the latter study.

Sanchez and Wilkinson (2020) analyzed the effect of the COVID-19 pandemic on the municipal bond market and found that the pandemic affected the United States municipal bond market from different sides as the Federal Reserve changed the direction of the yields. Firstly, the investors tried to refuse the exposure in such positions because of possible credit risk increases. Still, lately, when the Federal Reserve decided to take municipal bonds for collateral purposes for particular loans, the situation had changed, and the yields decreased. So we see that the direct effect of the COVID-19 pandemic can be changed and managed by the financial system players. Wei et al. (2020) revealed that the Federal Reserve emergency lending facilities’ impact on municipal bonds and state government bonds was significant. The authors stressed the importance of liquidity backstops.

3 Methodology

For the assessment of the impact of the spread of the COVID-19 pandemic on the government bond market, we selected the yields of two countries–Germany and the United States government bonds. The yields of three different maturities–10 years, 5 years, and 3 years, were analyzed to compare the pandemic’s effect on long and mid-term government bond markets. The main reason for our choice to analyze German yields is related to practical issues. In practice, portfolio managers consider the German yield curve a benchmark for Europe. The United States bond yield curve is a benchmark for the American continent. The chosen maturities are the most popular points on the curve considering asset management issues. For future research, it would be interesting to add 2 year duration bonds as well.

From the analysis of scientific literature, it can be noticed that different authors (for example, Acharya and Sascha 2020; Verma et al., 2021; Albulescu 2021; and others) use the regression approach to evaluate the impact of the COVID-19 pandemic on financial markets. Different authors used similar variables to identify the impact of the COVID-19 pandemic on government bond yields. Klose (2020) analyzed 10 years bond yields as a dependent variable and chose COVID-cases, change of COVID-cases, and statistics of COVID-cases-World and its changes as well as independent variables.

The analysis of scientific literature (for example, Xu 2021; Milani 2020; Beirne et al., 2020; Ahundjanov et al., 2020; Fabiani et al., 2020; Thakur 2020; Brueckner and Vespignani 2020; Mzoughi et al., 2020 and others) also revealed that to determine the reaction of economics and financial markets to the spread of COVID-19 pandemic, impulse response functions are widely used. For example, Mzoughi et al. (2020) have used the VAR model-based impulse response functions to assess the effect of COVID-19 on the oil process, CO2 emissions, and stock markets and revealed the positive but short-lived response of equity market volatility to the COVID-19 pandemic. Brueckner and Vespignani (2020) have also used VAR-based impulse response functions and identified a significant positive effect of COVID-19 infections on the performance of the Australian stock market. Xu (2021) employed structural GARCH-in-Mean VAR-based impulse response functions and revealed a small magnitude negative impact of COVID-19 cases growth on the stock markets.

Our research consists of the following stages, which are discussed briefly.

At first, in Stage 1, the trends of the government bond yields are analyzed, and the relationship between the yields of different countries’ government bond yields is being estimated using the method of correlation analysis (Pearson correlation coefficient) (Section 4.1). Afterward, in Stage 2, the impact of the spread of the COVID-19 pandemic on the yields of Germany and the United States government bonds is being assessed. Stage 2 itself consists of 2 steps:

Firstly, taking into account the wide application of the regression approach in similar research, we use the correlation-regression analysis to assess the effect of the COVID-19 pandemic on government bond yields (Section 4.2). To determine the potential linear association between selected government bond yields and COVID-19 related variables, the Pearson correlation coefficient is being calculated. To evaluate the impact of the spread of the COVID-19 pandemic on selected countries’ government bond yields, simple linear or bivariate regression models are constructed for each pair of dependent (yield) and independent (COVID-19 related) variables. And finally, the statistical characteristics (t-value, p-statistics, R squared) of these models are being assessed. It is essential to mention that the impact is assessed in a longer and a shorter run: the pandemic’s longer-term effect on government bond yields is set by analyzing the period from 02 January 2020–19 March 2021 (whole period investigated); before constructing regression models, the stability of the data of the whole period was also estimated using Breakpoint Unit Root test. The data were also analyzed for structural breaks using minimized Dickey-Fuller t-statistics and CUSUM of Squares test. For variables with structural breaks, linear regression was conducted using least squares with breakpoints (BREAKLS).

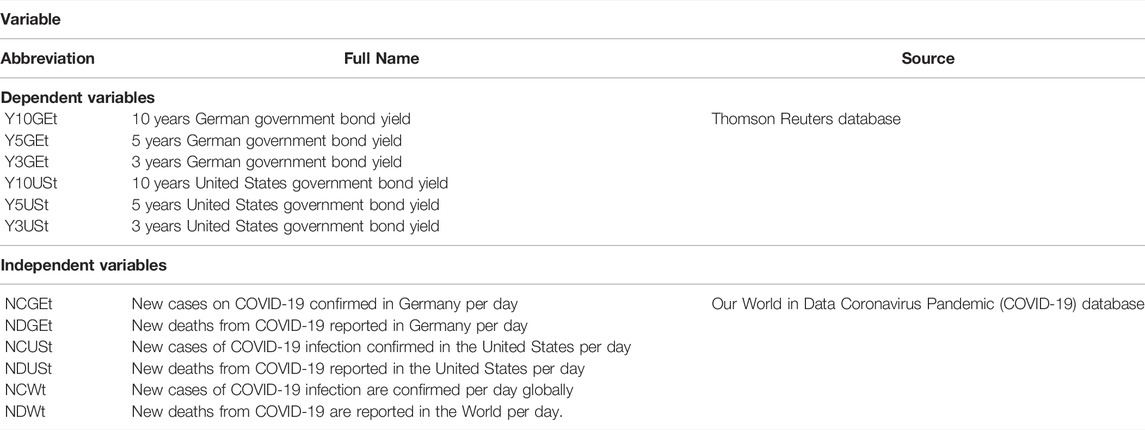

For the shorter-term pandemic effect, the historical period is divided into three phases; the selection of these phases is based on the dynamics of the COVID-19 related variables (see Figure 1): 1) Phase I covers data from 02 January 2020–30 April 2020; 2) Phase II covers data from 01 May 2020–30 September 2020–; and 3) Phase III covers data from 01 October-2020–19 March 2022. Phases I and III reflect the first and the second wave of the COVID-19 pandemic, while Phase II reflects a relatively quiet period with a lower growth rate of infection cases.

FIGURE 1. Dynamics of COVID-19 related variables (2020/01/02–2021/03/19). Note: M1 = January; M2 = February; M3 = March; M4 = April; M5 = May; M6 = June; M7 = July; M8 = August; M9 = September; M10 = October; M11 = November; M12 =December; for variable abbreviations see Table 1.

Secondly, we use the impulse response functions to determine the response of government bond yields to the shock of the COVID-19 pandemic (Section 4.3). The impulse response functions are constructed based on two-variable vector autoregression (VAR) models for each pair of dependent (yield) and independent (COVID-19 related) variables:

At first, the unit root test is conducted: we use the Augmented Dickey-Fuller (ADF) test to check the stationarity of variables–the results (see Table 1) shows that all research variables are stationary. Thus, it is meaningful to construct VAR models. Secondly, we use Akaike information criteria to determine the most suitable lag selection (the lags suggested by this criterion are indicated in Supplementary Figures S4–S9). Finally, the impulse response functions (as well as accumulated impulse response functions) are constructed, and results are interpreted.

It is important to notice that in our research, we do not construct multiple regression models due to the multicollinearity of regressors. Thus, given the results of literature analysis and data availability, we select six dependent variables; and based on previous studies (for example, Klose 2020; Albulescu 2021; Ashraf, 2020; Brueckner and Vespignani 2020; and others). We select six independent COVID-19 related variables (see Table 1). We chose COVID-cases and COVID-deaths variables to assess whether the bond markets reach differently to the growth of COVID-19 cases and deaths caused by COVID-19 infection, and we choose country-level and global-level variables to assess whether the reaction to the spread of the COVID-19 in the country and to the global spread of COVID-19 is different.

Descriptive statistics of selected independent (COVID-19 related) and dependent (yield) variables are provided in Supplementary Appendix Table SA.

We use the daily data for our research (Figure 1),, and the period from 2020–01-02 to 2021–03-19 is analyzed (only the trading days are analyzed; thus, the research sample consists of 302 observations). The selected government bond yields data is retrieved from the Thompson Reuters database. In contrast, the data on daily COVID-19 cases and deaths from COVID-19 is collected from the Our World in Data Coronavirus Pandemic (COVID-19) database. For data analysis, Eviews 11 software package is used.

4 Results and Discussion

In this section, the dynamics of the government bond yields in Germany and the United States are analyzed, and the impact of the spread of the COVID-19 pandemic on Germany and United States government bond yields of different maturities is estimated.

4.1 Analysis of the Trends of Government Bond Yields

The COVID-19 pandemic had a strong shock on financial markets. The demand for safe assets increased, and yields started decreasing. Later, investors understood that there was significant support from governments, central banks, and international organizations. Because of the latter, investors started to take more risk and began investing in riskier assets supporting their market value growth. We could see significant inflows of funds in the equity market. Ten-year yield growth was supported by inflation expectations in all regions, especially the United States

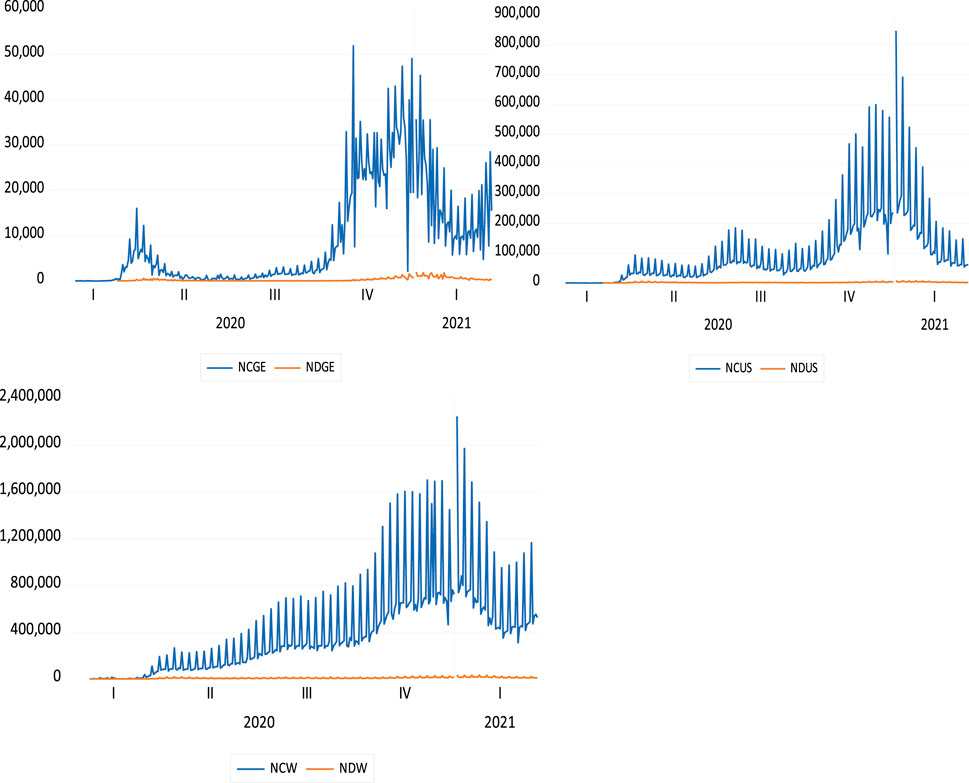

The dynamics of Germany and the United States government bond yields at different maturities are provided in Figure 2.

FIGURE 2. Dynamics of Germany (A) and United States (B) government bond yields at different maturities (2020/02/01–2021/19/03).Note: M1 = January; M2 = February; M3 = March; M4 = April; M5 = May; M6 = June; M7 = July; M8 = August; M9 = September; M10 = October; M11 = November; M12 =December; for variable abbreviations see Table 1.

As shown in Figure 2, during the primary outbreak of the COVID-19 (first quarter of 2020), the yields of selected countries’ government bonds decreased sharply as investors started to search for safe assets in the face of rapidly increased uncertainty in the markets. In the cases of all countries analyzed, a market adjustment is observed in later periods when the demand for riskier assets increases as a result of reduced uncertainty.

Moreover, the correlation analysis of the yields of different maturities in selected countries revealed that (see Supplementary Appendix Table SB) the yields of German government bonds of different maturities are directly correlated with the yields of United Stated government bonds (statistically significant positive correlation in the cases of 3, 5, and 10 years maturities).

Further, it is essential to analyze how the spread of the COVID-19 pandemic is related to the recent changes in government bond yields.

4.2 Assessment of the Spread of the COVID-19 Pandemic on the Government Bond Yields

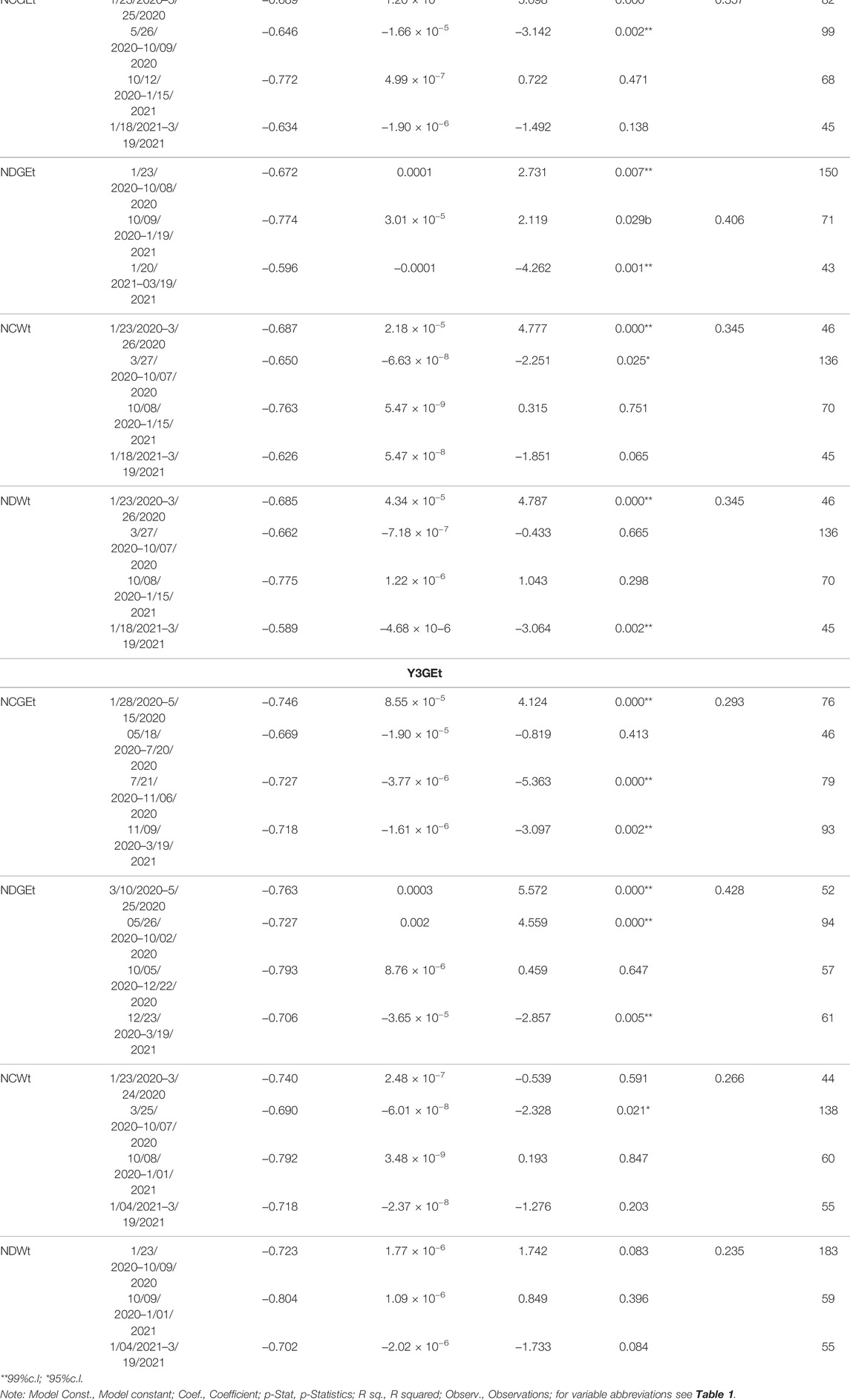

At first, the impact is estimated using the long period’s data (2020/1/02 to 2021/03/19). The research results are provided in Supplementary Appendix Table SC and Tables 2–3.

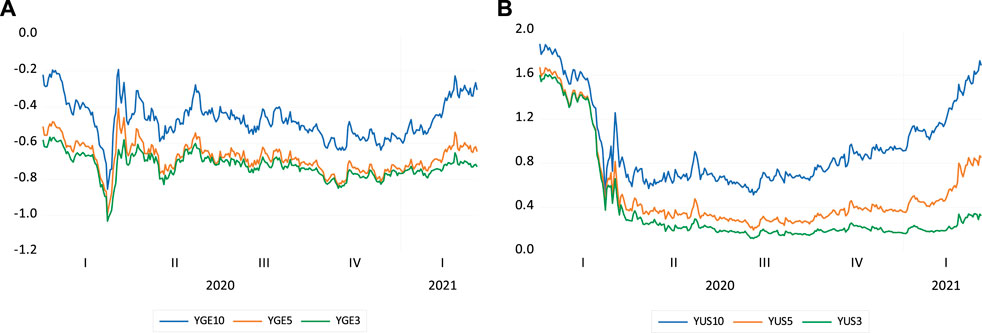

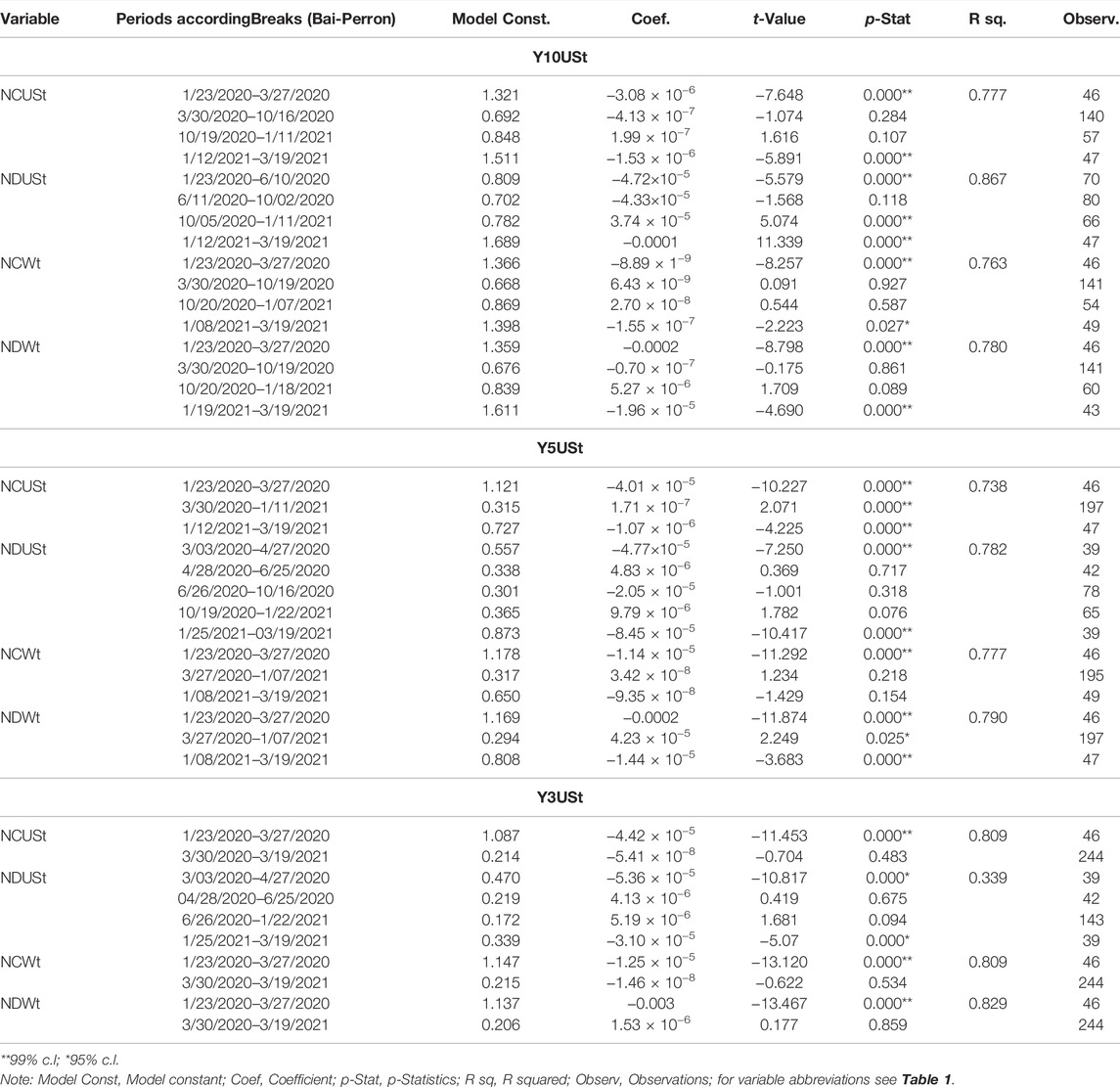

TABLE 2. Linear regression (Least Squares with Breakpoints) models for COVID-19 effect on Germany government bond yields.

TABLE 3. Linear regression (Least Squares with Breakpoints) models for COVID-19 impact on the United States government bond yields.

The results of correlation analysis (Supplementary Appendix Table SC) show that:

1) in most cases, the yields of different maturities of German government bonds are inversely related to COVID-19 variables both in Germany and globally (statistically significant negative correlation is observed);

2) a more reverse situation is observed in the case of U.S. government bonds, where the yields of shorter-term (3 and 5 years) bonds are directly related to COVID-19 variables both in the U.S. and globally, while the yields of longer-term (10 years) bonds are inversely related to COVID-19 variables.

Further, the regression analysis is conducted to get a clearer view of the impact of the spread of the COVID-19 pandemic on the government bond yields. The Breakpoint Unit Root test (Supplementary Appendix Table SD) showed that 11 variables are stationary, and 1 of the variables are stationary at the first difference; thus, they can be used for further analysis. On the other hand, minimized Dickey-Fuller t-statistics and CUSUM of Squares test (Supplementary Appendix Figures SE–F) indicated the existence of structural breaks in selected variables. Taking this into account, linear regression models using least squares with breakpoints (BREAKLS) instead of ordinary least squares were conducted. The results are provided in Tables 2–3. The results allow discussion of the similarities and differences of government bond market reactions to COVID-19 in different countries.

The linear regression models for the COVID-19 effect on Germany government bond debt yields are provided in Table 2.

Based on the results of Table 2 (t-values, p-statistics, and R-squared, it can be stated that:

1) in the case of Germany, the yields of 3, 5, and 10 years government bonds were positively affected by the spread of the COVID-19 pandemic in the country during the first wave of the pandemic (the statistically significant positive impact has been identified), i.e., the yields have initially increased in the face of the COVID-19 pandemic; the yields of 5 years bonds were influenced by both country and global level pandemic situation, while the yields of 10 and 3 years bonds positively reacted only to the country-level situation;

2) it is also worth mentioning that during the last 2 months of investigated period, the reaction of 10 years Germany’s government bond yields to the global-level COVID-19 situation was negative;

3) the results appeared to be mixed during the recovery period and at the beginning of the second wave of the COVID-19 pandemic.

These results show that even though the primary reaction to the COVID-19 pandemic was related to the increase of bond yields, in the later stages of the COVID-19 pandemic, the yields of different maturities of Germany’s government bonds decreased, showing the importance of the Germany government bonds as the benchmark, low-risk assets in the periods of financial markets distress.

The linear regression models for the COVID-19 effect on United States government bond debt yields are provided in Table 3.

Based on the results of Table 3 (t-values, p-statistics, and R-squared, it can be stated that:

1) contrary to the previously analyzed case of Germany, in the United States, the statistically significant negative impact of COVID-19 variables on the yields of the United States government bonds (of different maturities) was established; the effect is observed both in the country and global level;

2) the negative impact is also observed during the last months of investigated period (which partially coincides with the second wave of the COVID-19 pandemic), while the response to the changes in the pandemic situation during the so-called quiet period appeared to be mixed.

To sum up, the long and mid-term yields of the United States government bonds have decreased in the face of the COVID-19 pandemic. The main reason for such tendencies could be the pandemic risks that are not concentrated over a long period.

Summarizing the regression analysis results, it can be stated that initially, the yields of German government bonds were positively affected by the global COVID-19 situation, i.e., the spread of the COVID-19 pandemic has caused the increase in Germany’s yields. At the same time, the subsequent negative effect can also be observed. Contrary, the yields of the United States government bonds were initially affected inversely, i.e., decreased in the face of the COVID-19 pandemic and reacted to both country-level and global situations.

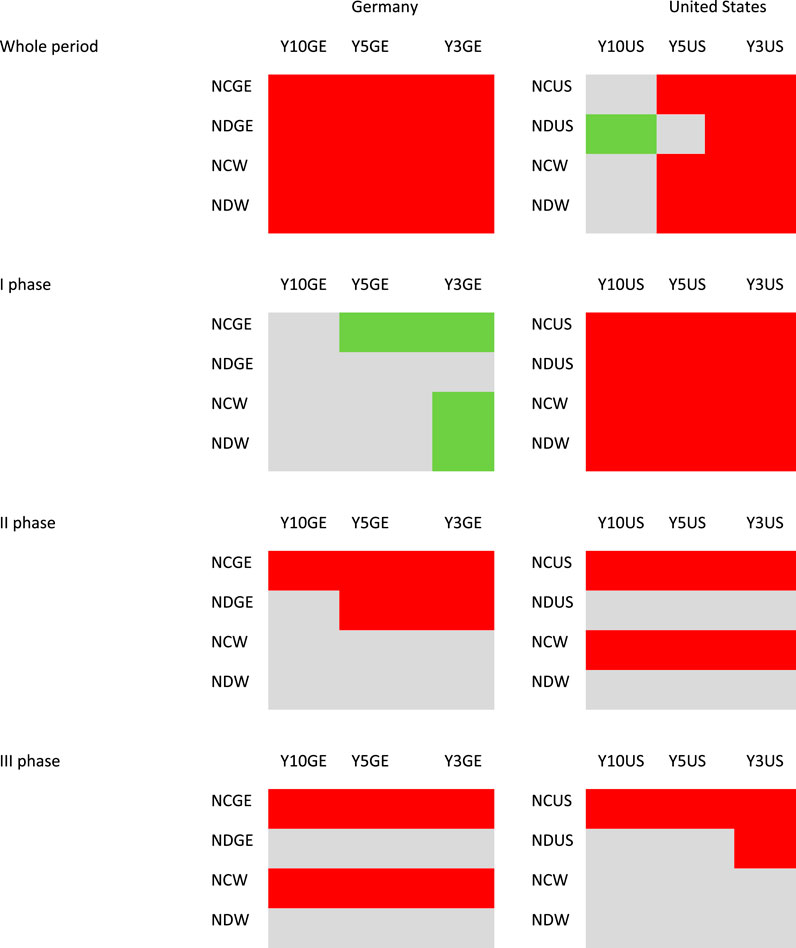

Secondly, the impact of the spread of the COVID-19 pandemic on government bond yields is assessed from a short-term perspective (regression models for different phases). The results of the assessment are provided in Figure 3 (Panels c–h) (summarized results) and Supplementary Appendix Tables SG–SJ (detailed results).

FIGURE 3. Summary of the results of the COVID-19 pandemic impact on selected countries’ government bond yields of different maturities in different periods.Note: Whole period = 2020/1/02-2021/03/19; I Phase = 2020/1/02-2020/04/30; II Phase = 2020/05/01-2020/09/30; III Phase = 2020/10/1-2021/03/19; for variable abbreviations see Table 1.

The assessment results of the spread of COVID-19 impact on bond yields in the short term (in separate phases) show significant differences between countries and between periods (phases). These differences are related to the effect’s significance and direction and are worth further discussion.

Assessing the impact of the spread of the COVID-19 pandemic on government bond yields during Phase I (the first wave of a pandemic) (Figure 3, Panels c–d), it can be observed that:

1) in the case of Germany, the impact during the first wave is also significantly different: the 10 years yields remained unaffected while the five and 3 years yields were affected directly, i.e., increased; the 3 years yields reacted to both country-level and global COVID-19 situation;

2) however, such significant differences are not observed in the United States’ case–the effect seemed to be inverse, i.e., the yields (of all maturities) decreased.

Assessing the impact of the spread of the COVID-19 pandemic on government bond yields during Phase II (relatively “calm” period) (Figure 3, Panels e–f), it can be observed that:

1) generally, the direction of the COVID-19 impact has also changed in comparison with Phase I in Germany, causing the yields of bonds (all maturities) to decrease; conversely to the results of the whole period and Phase 1, the reaction to global level COVID-19 situation is not observed in Phase II;

2) In the United States case, the effect is similar to the effect observed during Phase I and the whole period, except for the fact that the market reacted only to the deaths variable (both at the country and global level).

Assessing the impact of the spread of the COVID-19 pandemic on government bond yields during Phase III (the second wave of a pandemic) (Figure 3, Panels g–h), it can be observed that:

1) the results demonstrate a negative effect on selected countries’ government bond yields (all maturities), i.e., the spread of the COVID-19 pandemic caused the yields to decrease in Phase III;

2) in Germany, markets react to both country-level and global situations, while in the United States, the reaction only to country-level daily cases is observed.

It is worth mentioning that the models showing this impact have higher R’s than models showing the impact of country-lever COVID-19 situation, i.e., are of higher explanatory power

4.3 Evaluation of the Response of Government Bond Yields to the Shock of the COVID-19 Pandemic

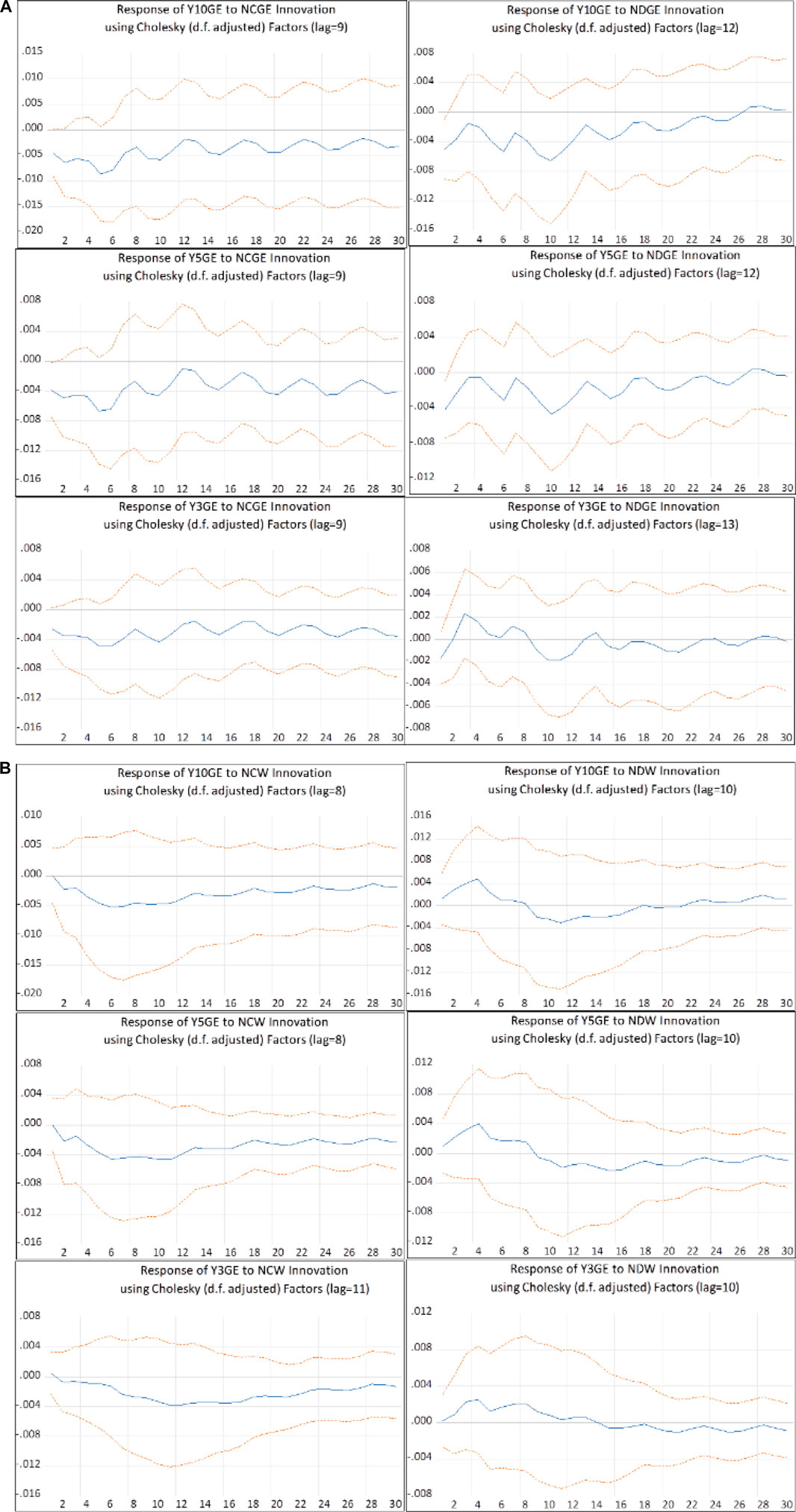

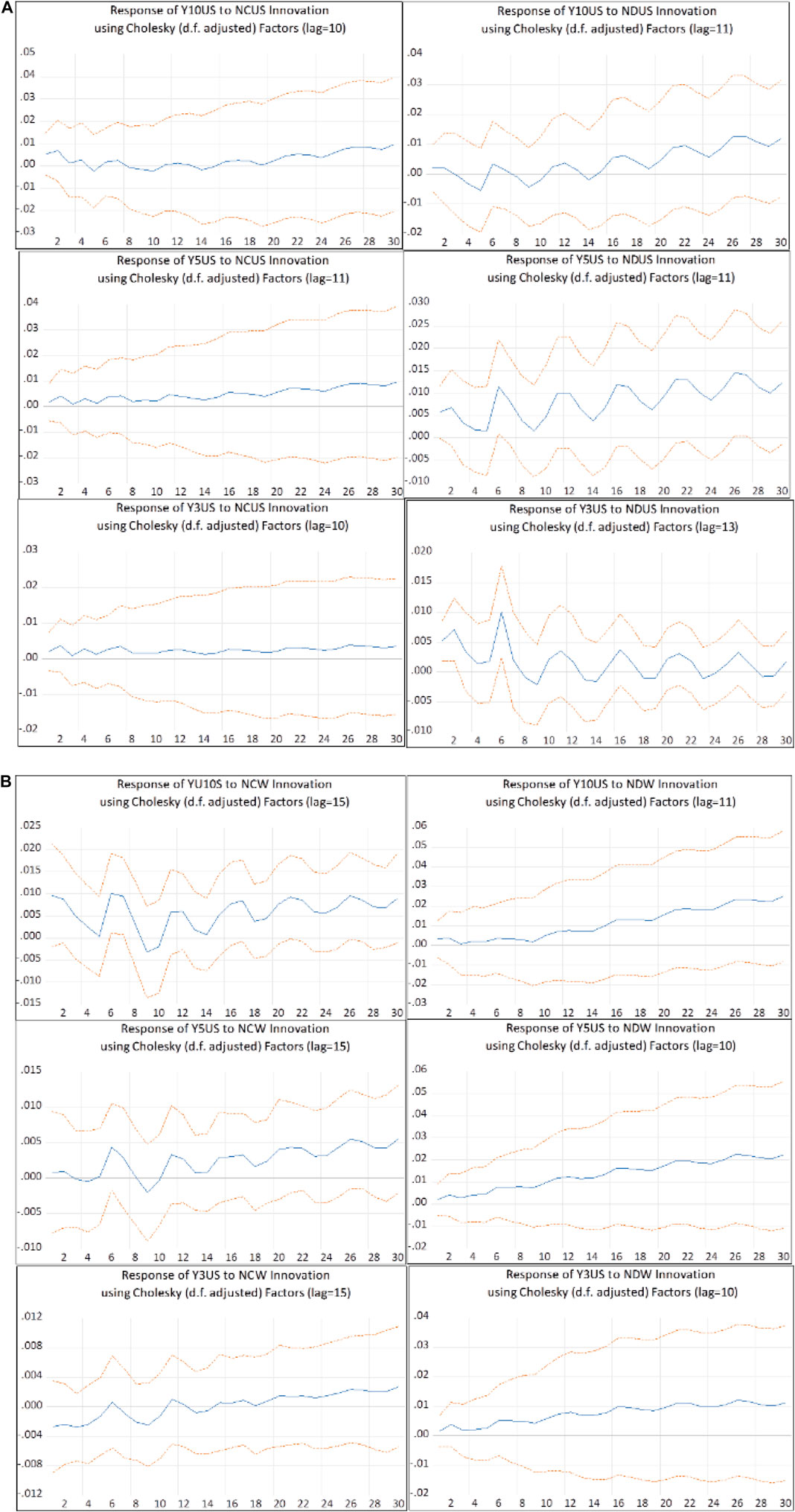

Finally, to better assess the primary response of the yields of selected countries government bonds (the direction, strength, and duration of this response), using the baseline models of VAR with one dependent and one independent variable, the impulse response functions (Figures 4, 5, Supplementary Appendix Figures SK–SL) are constructed, and the results are discussed.

FIGURE 4. Response of German government bond yields to the spread of the COVID-19 pandemic in the country and global level. Note: The effect of the country-level COVID-19 situation can be seen in (A), while the effect of the global level situation is shown in (B).

FIGURE 5. Response of the United States government bond yields to the spread of the COVID-19 pandemic in the country and global level. Note: The effect of the country-level COVID-19 situation can be seen in (A), while the effect of the global level situation is shown in (B).

Figure 4 shows the dynamic effects of COVID-19 daily new cases and deaths on the yields of German government bonds. The effect of the country-level COVID-19 situation can be seen in Panel a, while the effect of the global level situation is shown in Panel b.

In the case of Germany, the analysis of the impulse response functions shown in Figure 4 and Supplementary Appendix Figure SK reveals:

1) the negative response of yields (different maturities) to the increase of daily cases reported in Germany (Panel a): the response of yields (different maturities) reaches its peak at day six and does not exceed 0.01%; accumulated long-term response of yields (different maturities) (see Supplementary Appendix Figure SK) is also negative;

2) the negative response of longer-term (5 and 10 years) yields and initial positive response of shorter-term (3 years) yields to the growth of deaths caused by COVID-19 in the country (the response of 3 years turn to positive at day nine and remains volatile) (Panel a); however, after the initial negative response, the accumulated long-term response (see Supplementary Appendix Figure SK) to new deaths in the country becomes positive;

3) the initial negative response of the yields (of all maturities) to the global increase of COVID-19 cases (Panel b): the response of 3, 5, and 10 years yields reaches its peak at days 6, 6, and 11, respectively and approaches to zero in 30 days, and long-term yield appeared to demonstrate the strongest negative response; after an initial negative response, the long-term accumulated response appeared to be negative for long-term and around zero for shorter-term bonds (see Supplementary Appendix Figure SK);

4) the initial positive response of yields (different maturities) to the increase of deaths from COVID-19 reported globally: the response of 3, 5, and 10 years yields reaches its peak at day 4, and turn to negative at day 8, 9, and 13, respectively; the accumulated long term response is positive in case of 10 years-yield and slightly negative in case of 3 and 5 years yield (see Supplementary Appendix Figure SK).

Figure 5 shows the dynamic effects of COVID-19 daily new cases and deaths on the United States government bonds’ yields. The effect of the country-level COVID-19 situation can be seen in Panel a, while the effect of the global level situation is shown in Panel b.

In the case of the United States, the analysis of the impulse response functions shown in Figure 5 and Supplementary Appendix Figure SL indicates:

1) the slightly positive response of shorter-term (3 and 5 years) yields and the volatile response of long-term (10 years) yield to the increase of daily new cases of COVID-19 at a country-level (Panel a); accumulated long-term response is positive;

2) the positive but volatile response of yields (all maturities) to the increase of daily deaths caused by COVID-19 at the country level; the accumulated long term response is also positive;

3) the initial positive response of longer-term yields (5 and 10 years) and negative response of shorter-term yield (3 years) to the global increase of daily cases of COVID-19: the response of 3 years yield turn to positive at day 15; accumulated long-term response appeared to be around zero;

4) the initial positive response of yields (different maturities) to the global increase of daily deaths from COVID-19: accumulated long-term response is also positive for all maturities.

As we can see from the results of impulse response function analysis, although the short-term initial responses vary in direction, strength, and duration, the long term response of German government bond yields appeared to be of a more negative nature (indicating the decrease of the yields), while the long term response of the United States government bonds appeared to be more positive (i.e., an increase of yields). The long-term response is related to the countries’ inflation level expectations, which have strong connections with local monetary and fiscal policy issues.

In summarizing, it can be stated that the impact of the spread of the COVID-19 pandemic on Germany and United States government bond yields differs depending on the country and the assessment period.

5 Conclusion

The COVID-19 pandemic has caused economic pressure. The COVID-19 pandemic substantially impacted the financial markets, including the Government bond market. The fiscal and monetary policy influenced the direct effect because governments and central banks made substantial efforts to lower the pandemic shock’s negative impact. More government departments and social organizations will use ESG information to make decisions and investments. Indeed, our research findings regarding the government bond market during the COVID-19 pandemic inform corporate decision-making. Countries’ carbon neutrality and zero emissions targets have boosted the ESG demand and the need to raise funds via government bonds. Moreover, governments have increased their ESG attention. A green government-bond index could contribute to attracting foreign investment.

Our research showed different tendencies of government bond yields in two regions: the United States, and Germany (as a proxy for the euro area); as a result, the impact of the spread of the COVID-19 pandemic government bond yields seemed to be different depending on the country and the assessment period. We have chosen separate periods to value the actual effects and shocks of pandemic levels and waves, which helped us identify some tendencies.

Firstly, the results revealed different effects of the COVID-19 pandemic depending on the period investigated. In the first months of the pandemic, the yields of German government bonds demonstrated a positive reaction (increase). In contrast, the yields of the United States government bonds demonstrated a negative reaction (decrease) to the spread of the COVID-19 pandemic. The response both to the country-level and the global situation was identified.

The first wave in Germany was quite interesting as we noticed that long-term yields were not affected while the 3-year tenor sector increased. Long-term yields are usually impacted by inflation expectations which could lower the effect. Germany is like a benchmark yield curve for the euro area and the minor risky asset in this region. We think that 3 year maturity is not among those popular ones, so for this reason, it was affected contrarily. The most liquid and most minor risky assets are up to 2 years maturity. The COVID-19 pandemic situation during the first wave was not so bad in the United States compared with other regions. Because of that and, of course, of the currency issues, government bonds were very attractive for local investors and foreign investors. So, due to high demand, the yields decreased in all maturity buckets.

The results are, to some extent, different for the second phase: Germany and the United States bonds demonstrated a decrease in yield, we did not notice any differences compared to the United States’s first stage. Tendencies of the second wave of the COVID-19 pandemic were very different in separate regions. In the United States case, effects in Germany and the United States were influenced strongly by other factors such as central bank interventions and substantial political risk volatility.

The analysis of impulse response functions revealed that yield response differs depending on the maturity of the bonds. The markets also respond differently to a country-level and global pandemic situation. Although the short-term initial yield responses vary in direction, strength, and duration, it could be stated that the long-term response of German government bond yields appeared to be of a more negative nature, while the reaction of the United States government bonds was more positive.

Summarizing our research results, we would like to stress that in stressful situations, for a short period, yields of government securities usually decrease because investors need safe assets, but later, other factors begin to influence stronger, and the negative effect of any crisis or pandemic decreases. As such, our empirical findings based on contexts Germany and the United States had practical implications to strengthen business investors’ capability to cope with fear of failure at stressful situations of turbulent global financial markets (Dong, 2022).

Practitioners in asset management could use our research findings in the risk management and investment management area. For example, portfolio managers in commercial banks, investment companies, or central banking should pay attention to regional and term structure issues, risk management decisions, and diversification. In addition, the results of stressful situations suggest that financial players should pay significant attention to the investment horizon by investing in short-term debt securities.

The limitations of this research are that we focus only on specific markets and specific tenors of government bonds. The other limitation is that the COVID-19 pandemic environment must be valued if the research is repeated in the future. For further research, we would like to recommend analyzing different maturities of government bonds and focusing on only green and sustainable bonds. Also, it would be interesting to add more countries to the analysis and compare the government bond sector with the corporate bond sector in environmental investments.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author Contributions

Conceptualization, YZ, RK, DT, GK-S, AK; methodology, DT, GK-S; software, DT GK-S; formal analysis, DT, GK-S; investigation, DT, GK-S; data curation, DT, G.K-S; writing-original draft preparation, AK, DT, GK-S RD and YZ; writing-review and editing, DT, GK-S, YZ, RK, RD, and KP visualization, DT, AK, GK-S; supervision, RK All authors have read and agreed to the published version of the manuscript.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or any claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.881260/full#supplementary-material

References

Abhayawansa, S., and Tyagi, S. (2021). Sustainable Investing: the Black Box of Environmental, Social, and Governance (ESG) Ratings. Jwm 24 (1), 49–54. doi:10.3905/jwm.2021.1.130

Acharya, V., Pierret, D., and Sascha, S. (2016). “Lender of Last Resort Versus Buyer of Last Resort,” in ZEW’Centre for European Economic Research. Discussion Paper. Zürich, Switzerland: The Swiss Finance Institute. Avaliable at: http://www.ssrn.com/abstract=2762265.

Acharya, V. V., and Steffen, S. (2020). “The Risk of Being a Fallen Angel and the Corporate Dash for Cash in the Midst of COVID,” in Review of Corporate Finance Studies 9 (3), 430–471. Accessed July 1, 2021.

Ahundjanov, B. B., Akhundjanov, S. B., and Okhunjanov, B. B. (2020). Information Search and Financial Markets under COVID-19. Entropy (Basel) 22 (7), 1–18. doi:10.3390/e22070791

Albulescu, C. T. (2021). COVID-19 and the United States Financial Markets' Volatility. Finance Res. Lett. 38 (July 2020), 101699. doi:10.1016/j.frl.2020.101699

Altavilla, C., Brugnolini, L., Gürkaynak, R. S., Motto, R., and Ragusa, G. (2019). Measuring Euro Area Monetary Policy. J. Monetary Econ. 108, 162–179. doi:10.1016/j.jmoneco.2019.08.016

Amel-Zadeh, A., and Serafeim, G. (2018). Why and How Investors Use ESG Information: Evidence from a Global Survey. Financial Analysts J. 74 (3), 87–103. doi:10.2469/faj.v74.n3.2

Ashraf, B. N. (2020). Stock Markets' Reaction to COVID-19: Cases or Fatalities? Res. Int. Bus. Finance 54, 101249. doi:10.1016/j.ribaf.2020.101249

Avetisyan, E., and Hockerts, K. (2017). The Consolidation of the ESG Rating Industry as an Enactment of Institutional Retrogression. Bus. Strat. Env. 26 (3), 316–330. doi:10.1002/bse.1919

Bariviera, A. F., Guercio, M. B., and Martinez, L. B. (2012). A Comparative Analysis of the Informational Efficiency of the Fixed Income Market in Seven European Countries. Econ. Lett. 116 (3), 426–428. doi:10.1016/j.econlet.2012.04.047

Beirne, J., Renzhi, N., Sugandi, E., and Ulrich, V. (2020). SSRN Electronic Journal Financial Market and Capital Flow Dynamics during the COVID-19 Pandemic. Tokyo, Japan: Asian Development Bank Institute.

Bordo, M. D., and Duca, J. V. (2020). How New Fed Corporate Bond Programs Dampened the Financial Accelerator in the Covid-19 Recession 54. Cambridge, MA: Hoover Institution.

Brueckner, M., and Vespignani, J. (2020). Covid-19 Infections and the Performance of the Stock Market: An Empirical Analysis for Australia. SSRN Electron. J. 40, 173–193. doi:10.1111/1759-3441.12318

Carbone, A., Castelli, G., and Stanley, H. E. (2004). Time-Dependent Hurst Exponent in Financial Time Series. Phys. A Stat. Mech. its Appl. 344, 267–271. doi:10.1016/j.physa.2004.06.130

Central Bank of Malaysia (2020). Coping with COVID-19 : Risk Developments in the First Half of 2020. Kuala Lumpur, Malaysia: Central Bank of Malaysia, 22–27.

Cevik, S., and Ozturkkal, B. (2020). Contagion of Fear: Is the Impact of COVID-19 on Sovereign Risk Really Indiscriminate? IMF Working Paper 263. Washington, DC: IMF.

Chen, H.-Y., and Yang, S. S. (2020). Do investors Exaggerate Corporate ESG Information? Evidence of the ESG Momentum Effect in the Taiwanese Market. Pacific-Basin Finance J. 63, 101407. doi:10.1016/j.pacfin.2020.101407

Chen, Z., Liang, C., and Umar, M. (2021). Is Investor Sentiment Stronger Than VIX and Uncertainty Indices in Predicting Energy Volatility? Resour. Policy 74, 8. doi:10.1016/j.resourpol.2021.102391

Christensen, D. M., Serafeim, G., and Sikochi, A. (2022). Why Is Corporate Virtue in the Eye of the Beholder? the Case of ESG Ratings. Account. Rev. 97 (1), 147–175. doi:10.2308/tar-2019-0506

Dong, R. K. (2022). Emotion and International Business: Theorising Fear of Failure in the Internationalisation. Front. Psychol. 13, 850816. doi:10.3389/fpsyg.2022.850816

Eccles, N. S., and Viviers, S. (2011). The Origins and Meanings of Names Describing Investment Practices that Integrate a Consideration of ESG Issues in the Academic Literature. J. Bus. Ethics 104 (3), 389–402. doi:10.1007/s10551-011-0917-7

Edrus, R. A., Siri, Z., Haron, M. A., Safari, M., and Kaabar, M. K. A. (2022). Econometric Analysis of Macroeconomic to Age-specific Mortality Rate in Malaysia: Evidence from Panel Data. Hindawi. J. Math. 2022, 13. doi:10.1155/2022/8268177

EIOPA (2020). Impact of Ultra Low Yields on the Insuracne Sector, Including First Effects of COVID-19 Crisis. Frankfurt am Main, Germany: European Insurance and Occupational Pensions Authority.

Elfayoumi, K., and Hengge, M. (2021). Capital Markets, COVID-19 and Policy Measures. Washington, DC: IMF.

Fabiani, A., Heineken, J., and Falasconi, L. (2020). Monetary Policy and Corporate Debt Maturity. Social Science Research Network, Elsevier: Rochester, NY.

Fendel, R., Neugebauer, F., and Zimmermann, L. (2021). Reactions of Euro Area Government Yields to Covid-19 Related Policy Measure Announcements by the European Commission and the European Central Bank. Finance Res. Lett. 42 (December), 101917. doi:10.1016/j.frl.2020.101917

Ferreira, P. (2018). Efficiency or Speculation? A Time-Varying Analysis of European Sovereign Debt. Phys. A Stat. Mech. its Appl. 490, 1295–1308. doi:10.1016/j.physa.2017.08.137

Finlay, R., Seibold, C., and Xiang, M. (2020). Government Bond Market Functioning and COVID-19. Sydney, NSW: Reserve Bank of Australia, 11–20.

Fratto, C., Vannier, B. H., Mircheva, B., and De Padua, D. (2021). Unconventional Monetary Policies in Emerging Markets and Frontier Countries. Washington, DC: IMF.

Gennaioli, N., Martin, A., and Rossi, S. (2018). Banks, Government Bonds, and Default: What Do the Data Say? J. Monetary Econ. 98, 98–113. doi:10.1016/j.jmoneco.2018.04.011

Golmankhane, A. K., Ali, K. K., Yilmazer, R., and Kaabar, M. K. A. (2021). Economic Models Involving Time Fractal. J. Math. Model. Finance (JMMF) 1 (1), 159–178. doi:10.22054/jmmf.2021.57757.1024

Hachenberg, B., and Schiereck, D. (2018). Are Green Bonds Priced Differently from Conventional Bonds? J. Asset Manag. 19 (6), 371–383. doi:10.1057/s41260-018-0088-5

Halbritter, G., and Dorfleitner, G. (2015). The Wages of Social Responsibility - where Are They? A Critical Review of ESG Investing. Rev. Financial Econ. 26, 25–35. doi:10.1016/j.rfe.2015.03.004

Hao, L., Ahmad, S., Chang, H. L., and Umar, M. (2021). Knowledge Spill-Over and Institutional Quality Role in Controlling Dutch Disease: a Case of BRICS Countries. Resour. Policy 72, 8. doi:10.1016/j.resourpol.2021.102114

He, Z., Nagel, S., and Song, Z. (2020). Treasury Inconvenience Yields during the Covid-19 Crisis. SSRN Electron. J. 143, 57–79. doi:10.3386/w27416

Hill, J. (2020). Environmental, Social, and Governance (ESG) Investing: A Balanced Analysis of the Theory and Practice of a Sustainable Portfolio. New York, NY: Academic Press.

Holland, J. (2011). A Conceptual Framework for Changes in Fund Management and Accountability Relative to ESG Issues. J. Sustain. Finance Invest. 1 (2), 159–177. doi:10.1080/20430795.2011.582328

Hu, J., Yue, X.-G., Teresiene, D., and Ullah, I. (2021). How COVID19 Pandemic Affect Film and Drama Industry in China: an Evidence of Nonlinear Empirical Analysis. Econ. Research-Ekonomska Istraživanja 1, 19. doi:10.1080/1331677X.2021.1937262

Klose, J. (2020). COVID-19 and Financial Markets : A Panel Analysis for European Countries Joint Discussion Paper Series in Economics by the Universities of Aachen ∙ Gießen ∙ Göttingen No . 25-2020 Jens Klose and Peter Tillmann COVID-19 and Financial Markets : A Panel Anal. Aachen, Germany: Universities of Aachen.

Kothari, S. P. (2020). Division of Economic and Risk Analysis. Washington, DC: U.S. Securities and Exchange Commission.

Kotsantonis, S., and Serafeim, G. (2019). Four Things No One Will Tell You about ESG Data. J. Appl. Corp. Finance 31 (2), 50–58. doi:10.1111/jacf.12346

Kotsantonis, S., and Serafeim, G. (2020). Human Capital and the Future of Work: Implications for Investors and ESG Integration. J. Financial Transformation 51, 115–130.

Leins, S. (2020). 'Responsible Investment': ESG and the Post-crisis Ethical Order. Econ. Soc. 49 (1), 71–91. doi:10.1080/03085147.2020.1702414

Loayza, N., and Michael Pennings, S. (2020). Macroeconomic Policy in the Time of COVID-19 : A Primer for Developing Countries. Washington, DC: World Bank.

Lokuwaduge, C. S. D. S., and Heenetigala, K. (2017). Integrating Environmental, Social and Governance (ESG) Disclosure for a Sustainable Development: An Australian Study. Bus. Strat. Env. 26 (4), 438–450. doi:10.1002/bse.1927

Lonski, J. (2020). Resurgent COVID-19 Threatens Corporate Credit ’ S Resurgent COVID-19 Threatens Corporate Credit ’ S Improved Trend.” Moody’s Analytics. Atlanta, GA: Moody’s Analytics, 23.

Macchiarelli, C. (2020). Government Bond Term Premia during the Pandemic. Natl. Inst. Econ. Rev. 254, 2–4.

Milani, F. (2020). COVID-19 Outbreak, Social Response, and Early Economic Effects: A Global VAR Analysis of Cross-Country Interdependencies. New York, NY: Cold Spring Harbor Laboratory.

Mzoughi, H., Urom, C., Salah Uddin, G., and Khaled, G. (2020). The Effects of COVID-19 Pandemic on Oil Prices, CO2 Emissions and the Stock Market: Evidence from a VAR Model. SSRN Electron. J. doi:10.2139/ssrn.3587906

Nelufule, A. (2020). IMPACT OF COVID-19 AND SOVEREIGN DOWNGRADE ON SA GOVERNMENT DEBT. Pretoria, Republic of South Africa: National Treasury.

Novick, B., Basses, S., Riaz, K., Oare, D., Brindley, S., Takasaki, M., et al. (2020). Lessons from COVID-19 : US BBB Bonds and Fallen Angels. New York, NY: BlackRock, Inc.

OECD (2020). Global Financial Markets Policy Responses to COVID-19. Paris, France: The Organisation for Economic Co-operation and Development. AvaliableAt: https://www.oecd.org/coronavirus/policy-responses/global-financial-markets-policy-responses-to-covid-19-2d98c7e0/ (Accessed July 17, 2021).

Orazbayеv, B., Santeyeva, S., Zhumadillayeva, A., Dyussekeyev, K., Agarwal, R. K., Yue, X.-G., et al. (2019). Sustainable Waste Management Drilling Process in Fuzzy Environment. Sustainability 11 (24), 6995. doi:10.3390/su11246995

Orazio, D., and Maximilian, W. (2020). Www.Econstor.Eu. Working paper. Kiel, Germany: Leibniz Information Centre for Economics.

Pan, K., and Yue, X.-G. (2021). Multidimensional Effect of Covid-19 on the Economy: Evidence from Survey Data. Econ. Research-Ekonomska Istraživanja 1, 28. doi:10.1080/1331677X.2021.1903333

PwC (2020). Financial Market Impacts of COVID-19. London, United Kingdom: PricewaterhouseCoopers. AvaliableAt: https://www.pwc.co.za/en/assets/pdf/financial-market-impacts-of-covid-19.pdf (Accessed July 23, 2020).

Raimo, N., Caragnano, A., Zito, M., Vitolla, F., and Mariani, M. (2021). Extending the Benefits of ESG Disclosure: The Effect on the Cost of Debt Financing. Corp. Soc. Responsib. Environ. Manag. 28 (4), 1412–1421. doi:10.1002/csr.2134

Rashid, S., Sultana, S., Ashraf, R., and Kaabar, K. A. M. (2021). On Comparative Analysis for the Black-Scholes Model in the Generalized Fractional Derivatives Sense via Jafari Transform. Hindawi. J. Funct. spaces 2021, 22. doi:10.1155/2021/7767848

Rebucci, A., Hartley, J. S., and Jimenez, D. (2021). An Event Study of COVID-19 Central Bank Quantitative Easing in Advanced and Emerging Economies. NBER Work. Pap. Ser. 107, 1689–1699. doi:10.3386/w27339

Sène, B., Mbengue, M. L., and Allaya, M. M. (2021). Overshooting of Sovereign Emerging Eurobond Yields in the Context of COVID-19. Financ. Res. Lett. 38 (September), 101746. doi:10.1016/j.frl.2020.101746

Suttipun, M. (2021). The Influence of Board Composition on Environmental, Social and Governance (ESG) Disclosure of Thai Listed Companies. Int. J. Discl. Gov. 18 (4), 391–402. doi:10.1057/s41310-021-00120-6

Teresiene, D., Keliuotytė-Staniulėnienė, G., and Kanapickienė, R. (2021b). Sustainable Economic Growth Support through Credit Transmission Channel and Financial Stability: In the Context of the COVID-19 Pandemic. Sustainability 13, 2692. doi:10.3390/su13052692

Teresiene, D., Keliuotyte-Staniuleniene, G., Liao, Y., Kanapickiene, R., Pu, R., Hu, S., et al. (2021a). The Impact of the COVID-19 Pandemic on Consumer and Business Confidence Indicators. Jrfm 14, 159. doi:10.3390/jrfm14040159

Thakur, S. (2020). Effect of Covid 19 on Capital Market with Reference to S&P 500. Ijar 8 (6), 1180–1188. doi:10.21474/ijar01/11203

Verma, P., Dumka, A., Bhardwaj, A., Ashok, A., Kestwal, M. C., and Kumar, P. (2021). A Statistical Analysis of Impact of COVID19 on the Global Economy and Stock Index Returns. Sn Comput. Sci. 2 (1), 1–13. doi:10.1007/s42979-020-00410-w

Wei, Bin., Vivian, Z. Y., and Yue, V. Z. (2020). The Federal Reserve’s Liquidity Backstops to the Municipal Bond Market during the COVID-19 Pandemic. Atlanta, GA: Federal Reserve Bank of Atlanta, Policy Hub (05).

Xiong, W., Han, Y., Crabbe, M. J. C., and Yue, X.-G. (2020). Fiscal Expenditures on Science and Technology and Environmental Pollution: Evidence from China. Ijerph 17 (23), 8761–8822. doi:10.3390/ijerph17238761

Xu, L. (2021). Stock Return and the COVID-19 Pandemic: Evidence from Canada and the US. Finance Res. Lett. 38 (July 2020), 101872. doi:10.1016/j.frl.2020.101872

Yue, X.-G., Han, Y., Teresiene, D., Merkyte, J., and Liu, W. (2020a). Sustainable Funds’ Performance Evaluation. Sustainability 12, 8034. doi:10.3390/su12198034

Yue, X.-G., Liao, Y., Zheng, S., Shao, X., and Gao, J. (2021). The Role of Green Innovation and Tourism towards Carbon Neutrality in Thailand: Evidence from Bootstrap ADRL Approach. J. Environ. Manag. 292, 112778. doi:10.1016/j.jenvman.2021.112778

Yue, X.-G., Shao, X.-F., Li, R. Y. M., Crabbe, M. J. C., Mi, L., Hu, S., et al. (2020b). Risk Prediction and Assessment: Duration, Infections, and Death Toll of the COVID-19 and its Impact on China's Economy. Jrfm 13 (4), 66. doi:10.3390/jrfm13040066

Zaghini, A. (2020). Covid Economics: Vetted and Real-Time Papers: Bond Markets. AvaliableAt: https://portal.cepr.org/call-papers (Accessed August 1, 2020).

Zhang, D., Hu, M., and Ji, Q. (2020). Financial Markets under the Global Pandemic of COVID-19. Finance Res. Lett. 36, 101528. doi:10.1016/j.frl.2020.101528

Keywords: COVID-19 pandemic, bond market, government bond yields, impulse response function (IRF), ESG (environment, social, governance)

Citation: Zhou Y, Teresienė D, Keliuotytė-Staniulėnienė G, Kanapickiene R, Dong RK and Kaab Omeir A (2022) The Impact of COVID-19 Pandemic on Government Bond Yields. Front. Environ. Sci. 10:881260. doi: 10.3389/fenvs.2022.881260

Received: 22 February 2022; Accepted: 17 May 2022;

Published: 17 June 2022.

Edited by:

Shigeyuki Hamori, Kobe University, JapanReviewed by:

Mohammed K. A. Kaabar, University of Malaya, MalaysiaMuhammad Umar, Qingdao University, China

Copyright © 2022 Zhou, Teresienė, Keliuotytė-Staniulėnienė, Kanapickiene, Dong and Kaab Omeir. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Deimantė Teresienė, ZGVpbWFudGUudGVyZXNpZW5lQGV2YWYudnUubHQ=

Yang Zhou1

Yang Zhou1 Deimantė Teresienė

Deimantė Teresienė Greta Keliuotytė-Staniulėnienė

Greta Keliuotytė-Staniulėnienė Rebecca Kechen Dong

Rebecca Kechen Dong Ahmad Kaab Omeir

Ahmad Kaab Omeir