- 1School of Economics and Statistics, Guangzhou University, Guangzhou, China

- 2Department of Banking and Finance, Eastern Mediterranean University, Famagusta, Turkey

- 3Department of Busxiness Administration, Institute of Southern Punjab, Multan, Pakistan

This study examines the short run, long run, and causal relationships among financial liberalization, healthcare expenditures, and defense expenditures on sustainable development in Pakistan covering the period from 1971 to 2017. The paper also explored the asymmetric relationships among the target variables. To explore these relationships, ARDL and NARDL Models are utilized. Additionally, advanced econometric techniques such as Maki cointegration and quasi-GLS unit root are used to take multiple structural breaks into account. Maki cointegration results show a stable long run relationship between the underlying variables. The findings of ARDL suggest a positive effect of financial liberalization and health expenditures while the negative effect of military expenditures on sustainable development. NARDL estimates suggest strong asymmetry as sustainability responds to positive (negative) shocks in militarization, health expenditures, and financial liberalization differently. The Toda-Yamamoto causality test shows that any policy to target health expenditures and financial liberalization significantly alters sustainable development and vice versa. For robustness checks, FMOLS and alternative proxy of sustainable development are used. The key findings posited the need to shift military expenditures to health expenditures and financial markets to achieve sustainable development goals in Pakistan.

1 Introduction

The drastic inferences of climate change to the ecosystems and human lives have remained an alarming situation for the ecologists, policymakers, and general public. The Earth’s surface is producing rampant atmospheric heat which is substantially contributed by Nitrous Oxide, Fluorinated gases, Methane, Carbon dioxide (CO2), and other greenhouse gases (Singh et al., 2020). The rapid escalation in economic activities, energy demand, population, and other human activities are responsible for environmental degradation around the globe (Jahanger et al., 2021). The industrial boom in various countries largely compromised environmental quality leading to health problems, natural resource depletion, and land erosion. If sustainable development initiatives are not considered seriously, humanity will face a dark and dangerous future (Ulucak et al., 2019). Since maintaining and preserving sustainable performance is the foremost concern of the world (Pervaiz et al., 2021), current empirical studies are thriving to identify certain factors that reduce environmental issues without compromising economic growth (Doğan et al., 2020; Doğan et al., 2021; Koseoglu et al., 2022; Xia et al., 2022).

According to Global Climate Risk Index, Pakistan is the fifth-most vulnerable country to climate change (Eckstein et al., 2019). Over the last decade, Pakistan has faced 152 extreme weather events and lost around 10,000 lives with an economic loss worth USD 3.8 billion due to environmental disasters (Ahmed T. et al., 2020; Ullah et al., 2021). Researchers have identified several determinants of pollutant emissions in Pakistan, including energy consumption, financial development, globalization, foreign direct investment (FDI), urbanization, industrial growth, and international tourism (Ali et al., 2019; Khan et al., 2019; Godil et al., 2020; Munir and Ameer, 2020; Ali et al., 2021).

In the last few years, significant debate among economists and environmentalists has emerged against defense expenditures. Countries spending a substantial amount of their national income on military defense are facing economic deterioration, income inequality, and environmental degradation (Alptekin and Levine, 2012; Raza et al., 2017; Ahmed Z. et al., 2020). Testing nuclear weapons, maintaining heavy machinery and active armed operations intensify militarization leading to an increase in fuel consumption and thermal radiation (Solarin et al., 2018; Qayyum et al., 2021) Thus, militarization is one of the most ecologically destructive human activities and a serious threat to national sustainability (Gokmenoglu et al., 2021).

Since their independence from British Rule, India and Pakistan have been arch-enemies. To date, both neighboring countries have violated several ceasefire agreements, been involved in numerous border skirmishes, and four full-fledged armed conflicts (Amir-ud-Din et al., 2020). Their continuous arms race has compelled Pakistan to spend a substantial portion of its gross domestic product (GDP) on defense which could have been utilized on economic, social, and environmental development (Jalil et al., 2016; Hussain, 2019; Raju and Ahmed, 2019). Certain efforts are made by previous studies to empirically link militarization with economic growth (Alptekin and Levine, 2012; Karadam et al., 2017; Saba and Ngepah, 2019), environmental degradation (Ahmed S. et al., 2020; Gokmenoglu et al., 2021), industrialization (Saba and Ngepah, 2020) and some social development indicators (Doğan et al., 2018; Biswas et al., 2019; Coutts et al., 2019). Nonetheless, there is a dearth of empirical literature on the relationship between military expenditures and sustainable performance, especially in the context of Pakistan.

On the other hand, a liberalized financial sector is crucial for the economic development of Pakistan (Adeel-Farooq et al., 2017; Naveed and Mahmood, 2019). In the early 1990s, Pakistan recognized the importance of an efficient financial mechanism and introduced diverse financial reforms under structural adjustment programs (SAP) to mitigate the distortion in the financial markets (Ashraf et al., 2022). Excessive control over interest and exchange rates may restrict savings, discourage investments, increase the margin of financial intermediation, increase financial markets segmentation, and retard the efficient allocation of resources which eventually lead to financial instability (Bumann et al., 2013; Akinsola and Odhiambo, 2017). Financial liberalization reduces informational asymmetries and enhances FDI cash flows leading to accelerated economic development (Tamazian et al., 2009; Kim et al., 2010). Besides the increase in economic activities by the liberalized financial system, it has an inevitable effect on the environment. Although there are studies on the relationship between financial development and environmental quality (Jalil and Feridun, 2011; Shah et al., 2019; Zakaria and Bibi, 2019), the link between financial liberalization1 and the environment is underexplored (Hua and Boateng, 2015). Accordingly, we attempt to fill the gap in the literature by investigating the impact of financial liberalization on the sustainable performance of a country.

Climate change and severe levels of greenhouse gas (GHG) emissions are a serious threat to public health. Accordingly, prior studies reveal that environmental degradation mainly due to GHG emissions increases healthcare expenditures (Alimi et al., 2020; Anwar et al., 2021). Most of the studies have focused on the cause-effect from CO2 emissions to health expenditures, recent evidence has also revealed that health expenditures play a vital role in economic development and restricting environmental degradation (Chaabouni and Zghidi, 2016; Wang et al., 2019). The developing countries are facing a dual-sword challenging situation where they are dealing with both economic and environmental concerns. Unfortunately, these economies are not allocating an adequate level of budget for the healthcare expenditures compared to the GHGs they are emitting (Usman et al., 2019). The situation of the healthcare system is not satisfactory in Pakistan. Both adult and infant mortality rates in Pakistan are very high as compared to other developing countries with similar economic growth patterns (Saleem et al., 2021). Even amid the health crisis, Pakistan allocate more budget to military expenditures compared to health expenditures (Siddiqa, 2020). Thus, it is important to investigate if the health spending of Pakistan is linked to its sustainable growth. Since an increase in healthcare services alleviates poverty, boosts productivity and GDP (Rahman et al., 2018; Raghupathi and Raghupathi, 2020), we believe that healthcare expenditures improve the sustainable performance of an economy.

Along with symmetric effects, researchers have also evaluated the asymmetric effect of financial liberalization, health expenditures, and militarization on economic growth and environmental degradation (Chen et al., 2020; Ullah et al., 2020; Ullah et al., 2021; Zeeshan et al., 2021). Positive and negative shocks in the target variables may respond differently to sustainable development. Thus, this study provides insight into postulation whether there is a positive-positive, negative-negative, or linear relationship between health expenditures, financial liberalization, militarization, and sustainable development. Assuming linearity among underlying variables may produce biased policy implications.

The main objective of the study is to assess the symmetric and asymmetric effect of military expenditures, financial liberalization, and health expenditures on sustainable development in both the short and long run. This study is the first attempt to investigate the underlying relationship, especially in the context of Pakistan, as most of the previous studies have analyzed these variables with individual dimensions of sustainable development, i.e., economic growth (Bumann et al., 2013; Chaabouni et al., 2016; Adeel-Farooq et al., 2017; Ahmed S. et al., 2020), social indicators (Töngür and Elveren, 2017; Biswas et al., 2019; Coutts et al., 2019; Owumi and Eboh, 2021), and environmental quality (Jalil and Feridun, 2011; Wang et al., 2019; Gokmenoglu et al., 2021).

Second, along with extensively used techniques such as autoregressive distributed lag (ARDL) bound test (Pesaran et al., 2001) for cointegration, Augmented Dickey-Fuller (Dickey and Fuller, 1979), and Phillips Perron (Phillips and Perron, 1988) for unit root testing, we have applied advanced econometric techniques including quasi-generalized least squares (quasi-GLS) (Carrion-i-Silvestre et al., 2009), and Maki (2012) cointegration to account for possible structural breaks. Third, the short run and long run symmetric and asymmetric effects are evaluated using ARDL and NARDL. The NARDL approach produces valid estimates compared to Markov-Switching and smooth transition ECM, especially for a small sample size (Chen et al., 2020; Ullah et al., 2020). For robustness checks, the fully modified ordinary least squares (FMOLS) (Phillips and Hansen, 1990) is utilized. Lastly, Toda and Yamamoto’s (1995) causality test is utilized for the causal relationship between the target variables which accounts for the structural breaks in the series.

The remainder of this paper is structured as follows. Section 2 offers a detailed review of the prior relevant literature. Section 3 explains the data and methodology. A detailed description of econometric techniques is provided in Section 4. Empirical results are reported in Section 5 and discussion in Section 6. Lastly, Section 7 concludes the study with policy implications.

2 Literature Review

In the wake of biodiversity degradation, air pollution, illiteracy, gender inequalities, health risks, and poverty, United Nations (UN) is thriving to establish global strategies to achieve sustainable development (Griggs et al., 2013). Sustainable development is defined as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs” (Brundtland, 1987). It identifies the need for environmentally sound and inclusive growth to mitigate poverty and develop shared fortune for the global population. The three important components of sustainable development include social inclusion, environmental stewardship, and social inclusion (Muralikrishna and Manickam, 2017).

Despite the attention drawn by policymakers, there is a dearth of literature on the determinants of sustainable development. Koirala and Pradhan (2020) studied the determinants of sustainable development in 12 Asian countries over the period 1990–2014 using fixed- and random-effect estimators. The authors revealed that national resource rent and inflation rate are negatively associated with sustainable development while there is a positive effect of per capita income and financial development. Similarly, Kaimuri and Kosimbei (2017) found a negative effect of energy efficiency, unemployment, and household consumption per capita but the insignificant effect of trade, real GDP, and resource productivity on sustainable development in Kenya. Hess (2010) established a positive association of financial development, the share of natural resources in exports, working-age population, and human development with sustainable development in developing countries. Based on the data of 72 developing and 40 developed countries, Güney (2019) asserted a positive effect of renewable energy consumption on sustainable development.

We further extend the sustainable development literature by investigating the role of financial liberalization, defense expenditures, and health expenditures. Although the empirical evidence on the relationship between these three variables and sustainable development is not established, their causal, short run, and long run relationships are analyzed with economic, social, and environmental indicators. For instance, Adeel-Farooq et al. (2017) analyzed the effect of financial liberalization on economic growth in Pakistan over the period 1985–2014. The authors found that financial liberalization has a positive impact on Pakistan’s economic growth only in the long run. Similar results were asserted by Naveed and Mahmood (2019) in the long run but a negative effect in the short run using multivariate cointegration technique and error-correction mechanism. While considering the non-linear relationship between financial liberalization and economic crisis in 28 transition economies, Hartwell (2017) argued that financial openness increases the probability of a crisis until the economy reaches a higher level of liberalization. Similarly, Chen et al. (2020) found the asymmetric effect of financial development (principally constitutes financial liberalization) on economic growth in Kenya using NARDL.

Although a wide range of studies investigates the impact of financial liberalization on economic growth, its relation with social and environmental indicators is underexplored. Kim et al. (2021) examined the effect of financial liberalization on income inequality in both developing and developed countries from the year 1989–2011. The authors revealed that financial openness alleviates poverty and income inequality, especially in the presence of weak democratic structures. Hua and Boateng (2015) investigated the long run association between financial openness and CO2 emissions across 167 countries over the period 1970–2007. Especially in the Northern economies, the authors found a negative effect of financial liberalization on CO2 emissions. Boufateh and Saadaoui (2020) considered 22 African economies to assess the asymmetric financial development shocks on CO2 emissions using the non-linear panel ARDL-PMG Model. The authors asserted that positive financial development shocks help African economies to curb air pollution. Nonetheless, there are few studies related to asymmetric effects of financial development and no previous study, to the best of our knowledge, explored the effect of financial liberalization on sustainable development.

The trade-off between military spending and socio-economic indicators such as education, health, income inequality explains the reason for studying militarization (Coutts et al., 2019; Biscione and Caruso, 2021; Vallejo-Rosero et al., 2021). This gun-vs-butter tradeoff is also relevant for sustainable development. The evidence in previous literature is quite mixed related to the role of military expenditures. Using a balanced panel of 35 African countries over the period 1990–2015, Saba and Ngepah (2019) suggest a feedback causality between defense expenditures and industrialization. On the other hand, based on the Wavelet approach, Khalid and Habimana (2021) purported that military expenditures do not promote economic growth in the long run in Turkey. Similar results were asserted by Ahmed S. et al. (2020) in the context of Myanmar. Tao et al. (2020) also found the crowding-out effect of militarization on sustainable economic growth in Romania. There is also a strand of literature that revealed between military expenditures and economic growth in middle eastern countries and Turkey (Karadam et al., 2017), in South Africa (Phiri, 2019), in Pakistan and India (Ullah et al., 2021), and in top defense expenders (Hatemi-J et al., 2018).

Studies also hold militarization accountable for uneven income distribution and compromising the quality of the natural environment. Some theoretical evidence in this regard can be derived from the “treadmill of destruction” theory and the “guns vs. butter” Model. Grounded on the “treadmill of destruction” theory, Clark et al. (2010) argued that militarization is positively associated with energy consumption and exacerbates ecological degradation irrespective of whether the military is involved in conflicts or not. Similarly, studies support the “guns vs. butter” Model that military expenditures crowd out social welfare resulting in socio-environmental issues. For instance, in the long run, Raza et al. (2017) found a positive impact of military expenditures on income inequality in Pakistan. Doğan et al. (2018) also examined the effect of military expenditures on income inequality in North American countries. The authors revealed an inverted U-shaped relationship between military expenditures and income inequality. Gokmenoglu et al. (2021) investigated that military expenditures impede air quality and alleviate environmental degradation in Turkey based on FMOLS and Todo-Yamamoto causality test.

Similarly, Ahmed et al. (2020c) also analyzed the effect of military spending on environmental degradation and economic growth in Pakistan using cointegration and bootstrap causality. Their findings suggest that military spending is negatively associated with economic growth while positively related to ecological footprints. Biswas et al. (2019) employed panel data of 76 countries from 2000 to 2014 and argued that defense expenditures make no contribution to human development and only marginally contribute to GDP. In both the short run and long run, Ullah et al. (2021) found an asymmetric relationship between military expenditures and CO2 emissions using NARDL. In light of the aforementioned evidence, it can be postulated that positive (negative) shocks in military expenditures impede (improve) sustainable development in Pakistan.

Our third target variable is healthcare expenditures. Since there is inconclusive evidence related to the role of healthcare spending for economic, social, and environmental sustainability, two distinct hypotheses exist. The first hypothesis argues that health is a basic necessity due to which government intervention in the healthcare sector is essential. However, the second hypothesis considers healthcare as a luxury good that should be left to market forces. Accordingly, previous studies found both unidirectional and bidirectional causality between health expenditures and economic growth (Chaabouni and Abednnadher, 2014; Chaabouni and Zghidi, 2016). Wang et al. (2019) examined the short run and long run relationships between healthcare expenditures, CO2 emissions, and economic growth using autoregressive distributed lag (ARDL) in Pakistan and found significant estimates. The authors also reveal bidirectional Granger causality between the underlying variables. Although the nexus between health expenditures and sustainable development is underexplored, Khan S. A. R. et al. (2020) investigated that a higher level of healthcare expenditures undermine economic growth in the presence of low labor productivity and poor environmental performance in Southeast Asian countries.

Pervaiz et al. (2021) also investigated the long run relationship between health expenditures and CO2 emissions using FMOLS and DOLS techniques in BRICS countries. The authors argued that air pollution negatively affects human health leading to an upsurge in health expenditures. Using ARDL techniques, similar relationships are found by researchers in MENA (Yazdi and Khanalizadeh, 2017) and ASEAN (Haseeb et al., 2019). However, Moosa and Pham (2019) argued that the association between environmental degradation and health expenditures varies across countries based on their per capita income. Although the antecedents of health expenditures are empirically examined in the previous studies, there is a dearth of literature related to the impact of health expenditures on sustainable development. Additionally, few studies explored the asymmetric links among healthcare expenditures, economic growth, and environmental degradation (Khan A. et al., 2020; Fan et al., 2021; Mujtaba and Ashfaq, 2021). Adequate government funding in healthcare systems may help countries to achieve SDGs by training the health workforce and enhancing health literacy (Liaropoulos and Goranitis, 2015; Chotchoungchatchai et al., 2020). Thus, we posited that positive (negative) shocks in healthcare expenditures improve (curb) sustainable development.

3 Data and Methodology

The underlying variables of the study include financial liberalization, military expenditures, health expenditures, and sustainable development. The current study uses the data for Pakistan over the period from 1971 to 2017. In order to monitor and assess sustainable development, a wide range of indices reflecting economic, social, and environmental dimensions are developed (Bilbao-Ubillos, 2013; Estoque and Murayama, 2014; Strezov et al., 2017; Hickel, 2020). Nonetheless, a consensus is not yet developed on a single index acceptable among political and scientific communities. It is believed that there is a dearth of the clear route through which sustainable development can be achieved (Wilson et al., 2007; Nourry, 2008). After a thorough analysis of various sustainable development indices, Nourry (2008) argued that no indicator can give a comprehensive insight into sustainability.

Based on the fundamental dimensions of sustainable development, we have assessed the economic aspect with GDP, the social aspect with life expectancy (Bilas et al., 2014), and the environmental aspect with ecological footprints (Moffatt, 2000; Siche et al., 2008). The index is developed using principal component analysis (PCA) to address the multicollinearity issue. Without losing the original information, PCA diminishes a large sum of correlated values into smaller uncorrelated values called components by incorporating their variances (Jolliffe, 1986). Nonetheless, for robustness checks, we have used an additional proxy, i.e., adjusted net saving (ANS). Previous studies have employed this measurement to assess sustainable development or green growth (Hess, 2010; Koirala and Pradhan, 2020; Ahmed et al., 2021). Adjusted net saving can be measured using following formula:

where GNS is gross national saving, DPC is depreciation of produced capital, CEE is current (non-fixed capital) expenditure on education, RDN is rent from the depletion of natural capital, damages from CO2 emissions, and GNI is gross national income.

Previous literature has developed the de jure and de facto measures of financial liberalization. For developing countries, studies find de factor measures more appropriate (Yao et al., 2018). For the de facto measure, a composite index based on Broad Money to GDP, domestic credit to the private sector (as a percentage of GDP), gross domestic savings to GDP, and FDI inflows. The data of all variables including military expenditures are retrieved from the World Development Indicators (WDI, 2017) except health expenditures and ecological footprints. The data of health expenditure is collected from the Pakistan Bureau of statistics while ecological footprints from Global Footprints Network (2019).

The following Model (Eq. 2) is developed to investigate the effect of military expenditures, health expenditures, and financial liberalization on sustainable development:

where SD, sustainable development; FL, financial liberalization; HE, health expenditures; ME, military expenditures, and µt = error term.

Additionally, our study aims to examine the asymmetries between our target variables. By employing the non-linear ARDL Model by Shin et al. (2014), we investigate whether positive (negative) shocks in militarization, healthcare expenditures, and financial liberalization affect sustainable development in the short and long run. Following previously used empirical approaches the non-linear Model is developed below:

where β+ and β- are the asymmetric parameters and

4 Econometric Techniques

Our preliminary analysis includes the testing of the unit root. Initially, Augmented Dickey and Fuller (1979) and Phillips and Perron (1988) tests are analyzed to ensure the stationarity of series at the order I (0) or I (1). However, the stationarity of underlying variables is also assessed using Carrion-i-Silvestre et al. (2009) unit root test. The conventional unit root tests (i.e., ADF or PP) do not take structural breaks into account which lose the power and size of the test, leading to spurious empirical results (Hecq and Urbain, 1993). Carrion-i-Silvestre et al. (2009) unit root test allows up to five structural breaks in both slope and level. The algorithm of Bai and Perron (2003) is utilized by Carrion-i-Silvestre et al. (2009) to estimate structural breaks. Additionally, it incorporated the quasi-GLS detrending technique of Elliott et al. (1992) that allows asymptotic power functions.

In order to identify long run parameters or equilibrium between our underlying variables, Gregory and Hansen (1996) and Hatemi-j (2008) developed cointegration tests with structural breaks but the test of Maki (2012) performed better to deal with unknown multiple structural breaks. Likewise Carrion-i-Silvestre et al. (2009), Maki (2012) cointegration also provides up to five structural breaks stemming from the data. We utilized the regime shift approach that allows for structural breaks in levels and regressors. A wide range of studies has used this approach in economic and finance literature (Doğan, 2018; Rafindadi and Usman, 2019). Thus, we believe that Maki’s (2012) approach efficiently tests the cointegration relationship between sustainable development and its determinants. Four Models are developed by Maki (2012) to perform the test, i.e., Model 0 includes a break in intercept and no trend, Model 1 is related to a break in intercept, coefficients, and no trend, Model 2 includes a break in intercept, coefficients, and with a trend, last Model 3) includes break in intercept, coefficient, and trend. These Models can be expressed as:

where Dt, is the dummy variable, Dt = 1 if t > Tbi, and 0 if otherwise. Tbi represents the break years in the series. µt,1, µt,2, µt,3, µt,4 are the error terms for Eqs 4–7, which are identically and independently distributed with zero means. The null hypothesis states no cointegration among underlying variables.

Since the study is also interested in short-run effects along with long run effects using ARDL, the bounding testing approach consistent with previous studies is applied (Chen et al., 2020; Ullah et al., 2020; Baloch et al., 2021). Subject to the identification of valid lag order, the ARDL approach is able to mitigate serial correlation, omitted variables, and endogeneity bias (Pesaran et al., 2001). The short-run and long run coefficients are estimated after ensuring the cointegration. To use the bound testing approach, Eq. 2 is rewritten as an ARDL version of the Vector Error Correction Model (VECM):

where Δ is the difference operator, β0 is the drift component, εt is the estimated error term, β1, β2, and β3 are the short-run coefficients while γ1, γ2, and γ3 denote long-run parameters. θECTt-1 is the error correction term that signifies the long-run convergence and speed of adjustment to the equilibrium. The null hypothesis for Eq. 8 tests the presence of no cointegration (i.e., H0 = γ1 = γ2 = γ3 = 0) whereas the alternative hypothesis specific the presence of cointegration (i.e., H1: γ1 ≠ γ2 ≠ γ3 ≠ 0) among the underlying variables. The Wald F-statistics value is estimated with the concerned critical values following previous studies (Pesaran et al., 2001; Nkoro and Uko, 2016). The F-statistic value less than the lower bound critical value shows no cointegration while F-statistics above the upper bound critical value indicates the presence of cointegration. The F-statistic value between lower and upper bound critical values indicates that the test results are inconclusive. For the lag selection criterion, the Akaike information criterion (AIC) is selected based on previous studies (Chen et al., 2020; Baloch et al., 2021).

After ensuring the validity of the Models using diagnostic tests, we transformed Eq. 2 into ARDL (p, q) with the long run regression Model to derive a NARDL Model as shown below:

where λ denotes the autoregressive parameters,

where

Both long run and short run asymmetric effects are incorporated into ECM non-linear equations. Over the short-run, null hypothesis of symmetric adjustment can be tested using Wald test as: π+ = π− for all j = 1,2,3, … ,q-1, and for long run as: θ+ = θ−. The decomposition of financial liberalization, health expenditures, and militarization in its negative and positive partial sums may provide complex interdependencies to evaluate non-linear cointegration. The NARDL Model of Shin et al. (2014) has the ability to efficiently disentangle the interactions between financial liberalization, health expenditures, militarization, and sustainable development by incorporating the asymmetric response of underlying variables toward sustainable development over time. To test the null hypothesis of ρ = 0 against the alternative hypothesis of ρ < 0 for detecting cointegration, the FPSS statistic of Pesaran et al. (2001) and tBDM of Banerjee et al. (1998). The cointegration can be detected when the value (FPSS) is above the upper bound. On the other hand, the test will be inconclusive if the value is between upper and lower bound.

After ensuring the long run relationship among variables, the long run coefficients are further estimated using the fully modified ordinary least squares (FMOLS) method developed by Phillips and Hansen (1990) and dynamic OLS (Stock and Watson, 1993) for robustness checks. This technique has the advantage over others in dealing with serial correlation issues, endogeneity, and sample bias (Narayan and Narayan, 2005). Following FMOLS Model is estimated for the long run relationships:

where Xt is an I (1) variable and Yt is a (k × 1) vector of I (1) regressors.

Lastly, the possible causal relationships among the variables are investigated using Toda and Yamamoto (1995). It is a modified version of the Granger causality and produces consistent and robust causality Wald test statistic even when the order of integration in a time-series is I (0), I, (1), or a mix of these orders. Basically, it is constructed on the vector regressive (VAR) structure (k + dmax) where dmax is the optimum order of integration, and k is the optimum order in the VAR system. Eqs 13–16 are specified to study the causal relationships using Toda and Yamamoto (1995):

5 Empirical Results

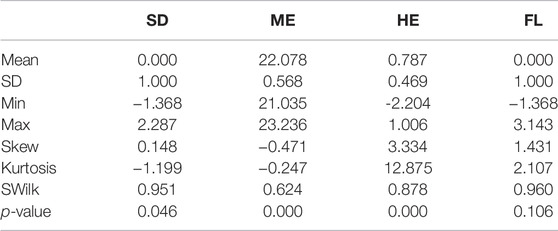

The descriptive statistics of the variables are given in Table 1. The mean values, standard deviation, minimum, maximum, skewness, kurtosis, and Shapiro-Wilk statistics are given in the Table. Since our number of observations is less than 50, the Shapiro-Wilk test is more appropriate for testing normality (Mishra et al., 2019). Additionally, the study proceeds with the deterministic properties of these parameters.

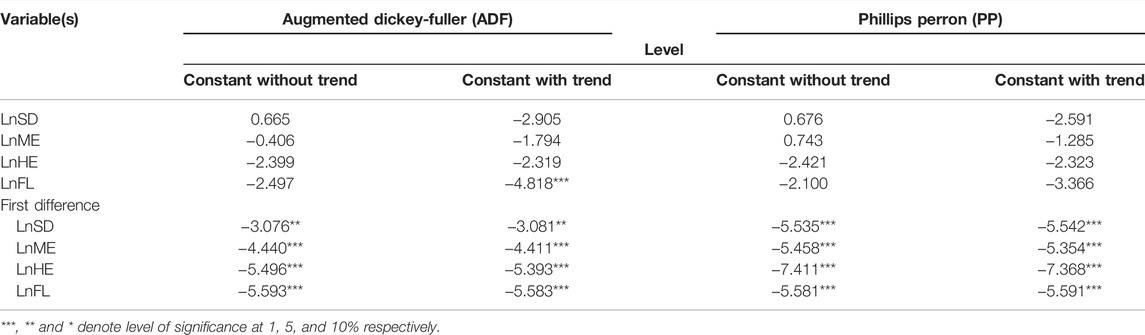

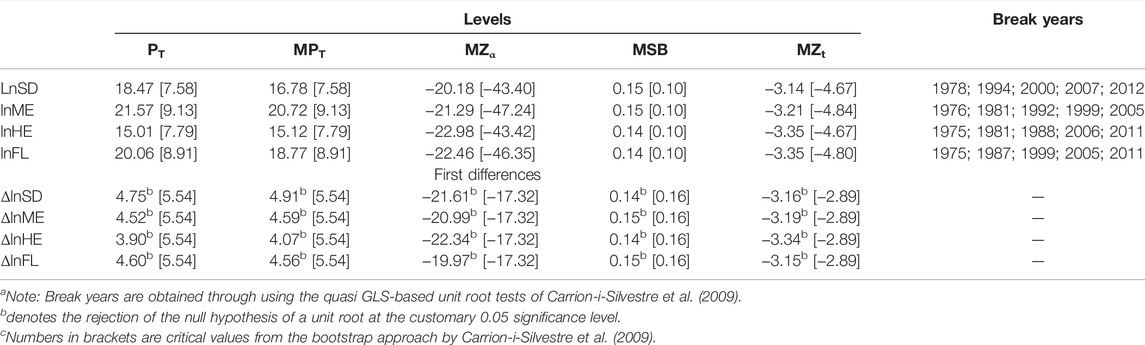

Initially, ADF and PP unit root tests are applied to ensure if the series is stationary at level or first difference. The findings reported in Table 2 show that all variables are stationary either at I (0) or I (1). None of the variable series is integrated at the order I (2). In addition to PP and ADF tests, the Carrion-i-Silvestre et al. (2009) unit root test is adopted to investigate the integration orders of the variables under the existence of multiple structural breaks. Table 3 represents the results of the Carrion-i-Silvestre et al. (2009) unit root test. According to unit root test results, the null hypothesis of there is a unit root under multiple structural breaks in the series can be rejected when we take the first differences of the variables. All variables in Eq. 1 are stationary at their first differences under multiple structural breaks meaning that all variables are integrated of order one, I (1).

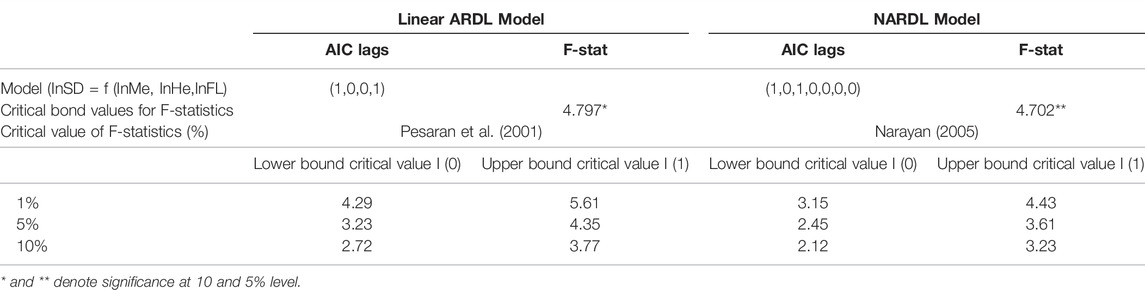

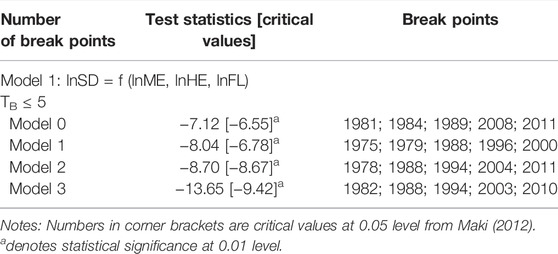

The existence of the long run equilibrium relationship among variables under multiple structural breaks is investigated by Maki’s (2012) cointegration test and ARDL bound testing test. Table 4 shows bound testing cointegration F-statistics values for both ARDL and NARDL. To avoid the classical assumptions’ violation, different tests are utilized to selected optimum lags. Starting from high lag order, lags are decided based on AIC. The F-test values denote the existence of long run cointegration among underlying variables. The critical values developed by Pesaran et al. (2001) and Narayan (2005) are utilized to compare the F-statistics. Since both F-test values are above upper bound critical values (5% for all Models), the null hypothesis of no cointegration can be rejected. Accordingly, we suggest a long run relationship among sustainable development, health expenditures, military expenditures, and financial liberalization. The ECTt-1 further confirms the existence of the long run relationships (see Table 6). Besides bound testing, the results of Maki (2012) cointegration test are reported in Table 5. The test also indicates that there is a long run equilibrium relationship among target variables in Pakistan when structural breaks are taken into consideration in all Models of Maki (2012). Our findings suggest that financial liberalization, health, and military expenditures are long run determinants of sustainable development for the case of Pakistan over the period 1971–2017.

TABLE 5. Maki (2012) Cointegration test under multiple structural breaks.

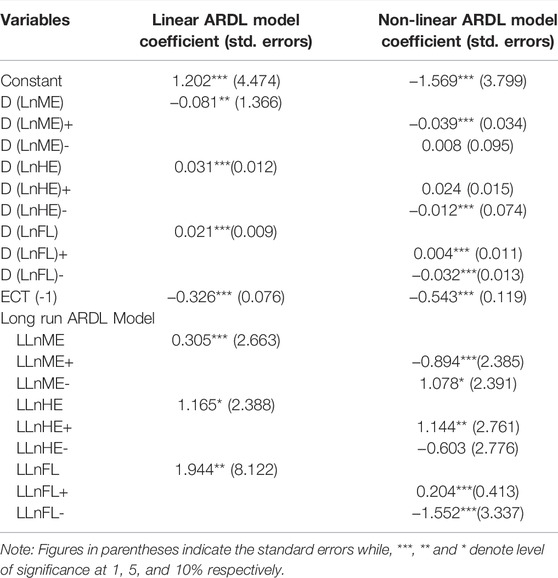

After the confirmation of cointegration among variables, the ARDL and NARDL Models are utilized for the estimation of short run and long run coefficients (see Table 6). The results of linear estimations confirm the negative effect of militarization on sustainable development in both the short and long run. This evidence suggests the “tread of destruction” and the crowding-out effect of militarization in Pakistan consistent with previous studies (Ahmed Z. et al., 2020; Gokmenoglu et al., 2021; Ullah et al., 2021). Our findings also suggest no significant effect of health expenditures in the short run but a positive effect on sustainable development in the long run. Although the effect of health expenditures is not observed on sustainable development in previous studies, our study postulated that an increase in health expenditures can help Pakistan to achieve its SDGs goals (Liaropoulos and Goranitis, 2015; Chotchoungchatchai et al., 2020).

The linear ARDL estimates also show a significant and positive effect of financial liberalization on sustainable development in both the short and long run. It is purported that financial liberalization does not hamper environmental quality (Hua and Boateng, 2015) and is a good mechanism for sustainable economic growth. Finally, the ECM coefficient value is significant and negative (−0.326), suggesting that a deviation from the long run equilibrium level of sustainable development in 1 year is corrected by 33% in the subsequent year. Some interesting insights are provided by non-linear ARDL estimations.

The findings show that positive shocks in military expenditures impede sustainability in the short-run and the effect gets stronger in the long run as the coefficient value increase from −0.04 to −0.89. Nonetheless, the negative shock in militarization improves sustainable development in the long run only. Results are consistent with the prior literature that there is an asymmetric effect of militarization on economic or environmental factors (Hatemi-J et al., 2018; Amir-ud-Din et al., 2020; Ullah et al., 2021). In the context of health expenditures, the evidence strongly suggests the non-linear relationship between health expenditures and sustainable development. The effect and negative in short-run only when negative shocks in health expenditures occur. On the other hand, the positive effect on sustainability can be observed in the long run only when there are positive shocks in health expenditures. In tandem with the postulations of Fan et al. (2018), we suggest more budget allocation to the healthcare sector to promote sustainable economic department and reduction of militarization’s crowding effect. Finally, the results of NARDL show that positive (negative) shocks in financial liberalization improve (impede) sustainable development in both the short and long run. However, the effect is stronger in the long run.

5.1 Robustness Checks

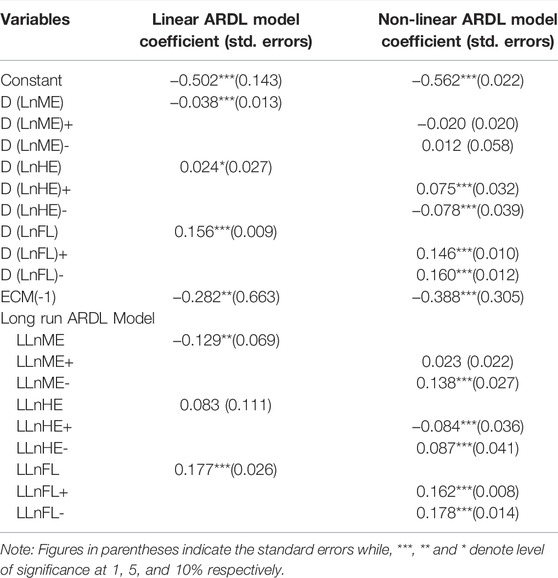

For robustness checks, we have utilized adjusted net saving (ANS) as an alternative proxy of sustainable development. However, the results largely remain the same except for militarization (see Table 7). Using ANS as a proxy, we find no significant effect of positive (negative) shocks of militarization in the short run. Additionally, in the long run, negative shocks in military expenditures improve green growth but positive shocks play no role in influencing sustainability. Despite the little variation, the findings suggest asymmetry among the underlying variables.

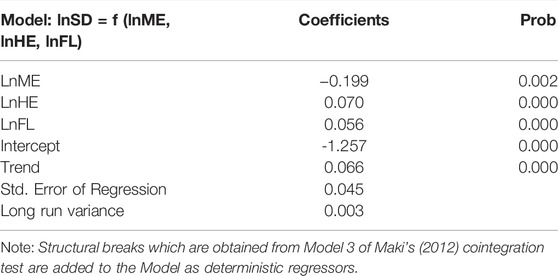

The long run coefficients of the variables are also estimated by the FMOLS approach (see Table 8). Our findings suggest that health expenditure and financial liberalization have significant and positive impacts on sustainable development in long run for the case of Pakistan. When health expenditure and financial liberalization increase by 1%, the sustainable development of Pakistan increases by 0.070 and 0.056% in long run, respectively. Our findings also reveal that military expenditure has a significant and negative impact on sustainable development in the long run. If military expenditure increases by 1%, sustainable development decreases by 0.199% for in Pakistan. Estimated long run coefficients suggest that health expenditure and financial liberalization contribute to the sustainable development of Pakistan while military expenditure impedes sustainability.

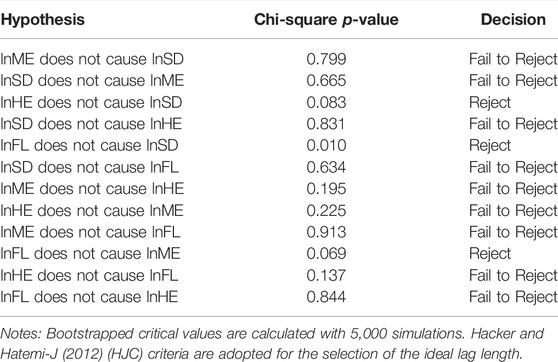

The causal relationships among variables are investigated by Toda and Yamamoto’s (1995) causality test. Table 9 represents the results of the Toda and Yamamoto (1995) causality test. Causality results suggest that unidirectional relationships are running from health expenditure and financial liberalization to sustainable development. When there is a change in health expenditure and financial liberalization, there is a change in the sustainable development of Pakistan. Moreover, we can conclude that sustainable development in Pakistan is health expenditure and financial liberalization driven. There is also a unidirectional causality running from financial liberalization to military expenditure meaning that changes in financial liberalization cause changes in military expenditure of Pakistan.

TABLE 9. Toda and Yamamoto (1995) Causality test results.

6 Discussion

The findings of our study are in accordance with the theoretical propositions. Although it is the first attempt to empirically test the military expenditures with sustainable development, the detrimental effects of militarization are consistent with the results of Gokmenoglu et al. (2021) and Ahmed Z. et al. (2020). In tandem with the “treadmill of destruction” theory, we argue that military mobility, training, weapon testing, and other activities increase the energy demands, pushing regimes to fulfill these demands through GHG emitting resources (Clark et al., 2010). Therefore, imprudent spending on military activities is against the UN’s 2030 agenda for sustainable development. Countries need to rethink their opportunity cost and size of defense spending that could instead be used to directly stimulate green growth (Tian et al., 2020).

Especially in the context of Pakistan, the government is allocating more budget to militarization leaving less financial resources for other productive sectors. For instance, the defense spending of Pakistan was around 3.60% of GDP (in the year 2016) which is greater than the military expenditures of some stable economies such as India (2.5%), China (1.92%), and the United States (3.2%). Our results can also be supported by the postulation of Korkmaz (2015) that a high level of militarization crowd out investment in health, infrastructure, and human capital which impede economic development. On the other hand, our results suggest increasing healthcare expenditures for the long-term sustainability of Pakistan.

Unfortunately, the Pakistani government is ambiguously allocating resources. Even during the peak of the COVID-19 pandemic, the government of Pakistan allocated more budget to defense (USD 7.85 billion) and a very repressive level of budget for the healthcare sector (USD 151 million) for the financial year 2020–2021 (Siddiqa, 2020). Our results are not consistent with Pervaiz et al. (2021) who found a negative effect of health expenditures on air quality. Especially for Pakistan, we are strongly in favor of increasing healthcare expenditures to spur sustainable development. Currently, the “out-of-pocket” healthcare expenditures are very high, elevating the vulnerability of poor households to health shocks. In order to achieve green growth by 2030, Pakistan needs to shift its military expenditures to health expenditures (Brollo and Hanedar, 2021).

In accordance with health expenditures, our findings also support financial liberalization as a strong mechanism to improve sustainable growth. To some extent, our findings can be supported by the results of Adeel-Farooq et al. (2017) and Hua and Boateng (2015) that economic growth coupled with environmental quality can be spurred by financial liberalization. More financial openness in a country like Pakistan can act as a strategic tool to achieve sustainability as powers can be swung to financial markets from military and bureaucracy, fetching energy-efficient eco-friendly technologies to the country. Some support can also be derived from ecological modernization theory (York and Rosa, 2003) that economic growth of a developing country can be stimulated by increasing healthcare expenditures and financial liberalization without ruining the environmental quality.

7 Conclusion and Policy Implications

The effect of financial liberalization, health expenditures, and military expenditures on sustainable development remained underexplored in previous studies. In an attempt to fill the theoretical and econometric gap, our study estimates short run and long run relationships among these variables using ARDL and NARDL approaches. Additionally, Maki cointegration under multiple structural breaks. Our results from Maki cointegration reveal the stable long run relationship between financial liberalization, health expenditures, military expenditures, and sustainable development. The findings of ARDL and NARDL assert the positive effect of financial liberalization and health expenditures while the negative effect of military expenditures on sustainable development in Pakistan. Additionally, NARDL suggests strong asymmetry among target variables. Based on the causality test, it can be also be purported that any policy to target health expenditures and financial liberalization will significantly affect the sustainable performance of Pakistan.

Grounded on the study’s findings, certain policy implications can be retrieved. Pakistan should not ignore the pollution-promoting facet of militarization and switch its defense expenditures to health and production-driven sectors. Owing to the internal conflicts and political instability in Pakistan, combat expenditures can be retained. However, it is high time to reduce non-combat expenditures to avoid macroeconomic, health, and environmental shocks. Additionally, investment in healthcare is an indirect investment in productive human capital which is one of the main drivers of sustainable development. Since our findings suggest that healthcare is a basic necessity and not a mere luxury for the sustainability of Pakistan, encouraging public-private partnerships will explore new avenues of investment in the healthcare sector. Lastly, more financial openness will help the economy to grow along with the reduction of environmental sustainability. Although the financial markets of South Asia are more liberalized after the post-reform period, military involvement in political affairs has hampered the democratic quality in Pakistan. Unless the detrimental effect of militarization is not scaled down, Pakistan will remain on the verge of an environmental catastrophe.

The study has certain limitations. First, it explores the underlying relationship in the context of Pakistan only. Second, the time span is limited to the year 2017. Some devastating events such as the coronavirus pandemic and the Russia-Ukraine war substantially changed the economic and political dynamics of the countries. These events are major structural breaks and may significantly change our estimated results. Third, only three variables are considered to investigate their effect on sustainable development. There is a fundamental role of green technology, clean energy, and eco-innovation to achieve carbon neutrality targets which should be incorporated in future frameworks.

Data Availability Statement

The data for this study was extracted from secondary sources which are publicly available. However, the data can be provided on demand.

Author Contributions

All authors equally contributed to conception and design, acquisition of data, analysis and interpretation of data. They also drafted the article for important intellectual content. All authors approved final version to be published and agreement to be accountable for all aspects of the work in ensuring that questions related to the accuracy or integrity of any part of the work are appropriately investigated and resolved.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Despite common practice to treat financial liberalization and financial development analogous, the concepts are not identical. Financial development represents improvement and progress of the financial structure while financial liberalization denotes dismantling of barriers in the access and provision of financial services.

References

Adeel-Farooq, R. M., Bakar, N. A. A., and Raji, J. O. (2017). Trade Openness, Financial Liberalization and Economic Growth: The Case of Pakistan and India. South Asian J. Business Stud. 6, 229. doi:10.1108/SAJBS-06-2016-0054

Ahmed, F., Kousar, S., Pervaiz, A., and Shabbir, A. (2022). Do institutional Quality and Financial Development Affect Sustainable Economic Growth? Evidence from South Asian Countries. Borsa Istanbul Rev. 22, 189–196. doi:10.1016/j.bir.2021.03.005

Ahmed, S., Alam, K., Rashid, A., and Gow, J. (2020a). Militarisation, Energy Consumption, CO2 Emissions and Economic Growth in Myanmar. Defence Peace Econ. 31 (6), 615–641. doi:10.1080/10242694.2018.1560566

Ahmed, T., Zounemat-Kermani, M., and Scholz, M. (2020b). Climate Change, Water Quality and Water-Related Challenges: a Review with Focus on Pakistan. Int. J. Environ. Res. Public Health 17 (22), 8518. doi:10.3390/ijerph17228518

Ahmed, Z., Zafar, M. W., and Mansoor, S. (2020c). Analyzing the Linkage between Military Spending, Economic Growth, and Ecological Footprint in Pakistan: Evidence from Cointegration and Bootstrap Causality. Environ. Sci. Pollut. Res. 27 (33), 41551–41567. doi:10.1007/s11356-020-10076-9

Akinsola, F. A., and Odhiambo, N. M. (2017). The Impact of Financial Liberalization on Economic Growth in Sub-saharan Africa. Cogent Econ. Finance 5 (1), 1338851. doi:10.1080/23322039.2017.1338851

Ali, M. U., Gong, Z., Ali, M. U., Wu, X., and Yao, C. (2021). Fossil Energy Consumption, Economic Development, Inward FDI Impact on CO 2 Emissions in Pakistan: Testing EKC Hypothesis through ARDL Model. Int. J. Fin Econ. 26 (3), 3210–3221. doi:10.1002/ijfe.1958

Ali, R., Bakhsh, K., and Yasin, M. A. (2019). Impact of Urbanization on CO2 Emissions in Emerging Economy: Evidence from Pakistan. Sustain. Cities Soc. 48, 101553. doi:10.1016/j.scs.2019.101553

Alimi, O. Y., Ajide, K. B., and Isola, W. A. (2020). Environmental Quality and Health Expenditure in ECOWAS. Environ. Dev. Sustain. 22 (6), 5105–5127. doi:10.1007/s10668-019-00416-2

Alptekin, A., and Levine, P. (2012). Military Expenditure and Economic Growth: A Meta-Analysis. Eur. J. Polit. Economy 28 (4), 636–650. doi:10.1016/j.ejpoleco.2012.07.002

Amir-ud-Din, R., Waqi Sajjad, F., and Aziz, S. (2020). Revisiting Arms Race between India and Pakistan: a Case of Asymmetric Causal Relationship of Military Expenditures. Defence Peace Econ. 31 (6), 721–741. doi:10.1080/10242694.2019.1624334

Anwar, M. A., Madni, G. R., and Yasin, I. (2021). Environmental Quality, Forestation, and Health Expenditure: a Cross-Country Evidence. Environ. Dev. Sustain. 23, 16454–16480. doi:10.1007/s10668-021-01364-6

Ashraf, S., Tariq, M. I., and Zhuang, P. (2022). Empirical Analysis of Agricultural Trade Liberalization and Economic Growth in Pakistan ARDL Approach. J. Intell. Fuzzy Syst. Pre-pres, 1–5. doi:10.3233/jifs-219311

Bai, J., and Perron, P. (2003). Computation and Analysis of Multiple Structural Change Models. J. Appl. Econ. 18 (1), 1–22. doi:10.1002/jae.659

Baloch, A., Shah, S. Z., Habibullah, M. S., and Rasheed, B. (2021). Towards Connecting Carbon Emissions with Asymmetric Changes in Economic Growth: Evidence from Linear and Nonlinear ARDL Approaches. Environ. Sci. Pollut. Res. 28 (12), 15320–15338. doi:10.1007/s11356-020-11672-5

Banerjee, A., Dolado, J., and Mestre, R. (1998). Error-correction Mechanism Tests for Cointegration in a Single-Equation Framework. J. time Ser. Anal. 19 (3), 267–283. doi:10.1111/1467-9892.00091

Bilas, V., Franc, S., and Bosnjak, M. (2014). Determinant Factors of Life Expectancy at Birth in the European Union Countries. Coll. Antropol 38 (1), 1–9.

Bilbao‐Ubillos, J. (2013). The Limits of Human Development Index: The Complementary Role of Economic and Social Cohesion, Development Strategies and Sustainability. Sustain. Develop. 21 (6), 400–412.

Biscione, A., and Caruso, R. (2021). Military Expenditures and Income Inequality Evidence from a Panel of Transition Countries (1990-2015). Defence Peace Econ. 32 (1), 46–67. doi:10.1080/10242694.2019.1661218

Biswas, R. K., Kabir, E., and Rafi, R. B. R. (2019). Investment in Research and Development Compared to Military Expenditure: Is Research Worthwhile? Defence Peace Econ. 30 (7), 846–857. doi:10.1080/10242694.2018.1477235

Boufateh, T., and Saadaoui, Z. (2020). Do Asymmetric Financial Development Shocks Matter for CO2 Emissions in Africa? A Nonlinear Panel ARDL-PMG Approach. Environ. Model. Assess. 25 (6), 809–830. doi:10.1007/s10666-020-09722-w

Brollo, F., and Hanedar, E. (2021). Pakistan: Spending Needs for Reaching Sustainable Development Goals (SDGs). IMF Working Pap. 2021 (108).

Brundtland, G. H. (1987). Our Common Future-Call for Action. Envir. Conserv. 14 (4), 291–294. doi:10.1017/s0376892900016805

Bumann, S., Hermes, N., and Lensink, R. (2013). Financial Liberalization and Economic Growth: A Meta-Analysis. J. Int. Money Finance 33, 255–281. doi:10.1016/j.jimonfin.2012.11.013

Carrion-i-Silvestre, J. L., Kim, D., and Perron, P. (2009). GLS-based Unit Root Tests with Multiple Structural Breaks under Both the Null and the Alternative Hypotheses. Econom. Theor. 25 (6), 1754–1792. doi:10.1017/s0266466609990326

Chaabouni, S., and Abednnadher, C. (2014). The Determinants of Health Expenditures in Tunisia. Int. J. Inf. Syst. Serv. Sector (Ijisss) 6 (4), 60–72. doi:10.4018/ijisss.2014100104

Chaabouni, S., Zghidi, N., and Ben Mbarek, M. (2016). On the Causal Dynamics between CO 2 Emissions, Health Expenditures and Economic Growth. Sustain. Cities Soc. 22, 184–191. doi:10.1016/j.scs.2016.02.001

Chaabouni, S., Zghidi, N., and Ben Mbarek, M. (2016). On the Causal Dynamics between CO 2 Emissions, Health Expenditures and Economic Growth. Sustain. cities Soc. 22, 184–191. doi:10.1016/j.scs.2016.02.001

Chen, H., Hongo, D. O., Ssali, M. W., Nyaranga, M. S., and Nderitu, C. W. (2020). The Asymmetric Influence of Financial Development on Economic Growth in Kenya: Evidence from NARDL. SAGE Open 10 (1), 2158244019894071. doi:10.1177/2158244019894071

Chotchoungchatchai, S., Marshall, A. I., Witthayapipopsakul, W., Panichkriangkrai, W., Patcharanarumol, W., and Tangcharoensathien, V. (2020). Primary Health Care and Sustainable Development Goals. Bull. World Health Organ. 98 (11), 792–800. doi:10.2471/blt.19.245613

Clark, B., Jorgenson, A. K., and Kentor, J. (2010). Militarization and Energy Consumption. Int. J. Sociol. 40 (2), 23–43. doi:10.2753/ijs0020-7659400202

Coutts, A., Daoud, A., Fakih, A., Marrouch, W., and Reinsberg, B. (2019). Guns and Butter? Military Expenditure and Health Spending on the Eve of the Arab Spring. Defence Peace Econ. 30 (2), 227–237. doi:10.1080/10242694.2018.1497372

Dickey, D. A., and Fuller, W. A. (1979). Distribution of the Estimators for Autoregressive Time Series with a Unit Root. J. Am. Stat. Assoc. 74 (366a), 427–431. doi:10.1080/01621459.1979.10482531

Doğan, B., Balsalobre-Lorente, D., and Nasir, M. A. (2020). European Commitment to COP21 and the Role of Energy Consumption, FDI, Trade and Economic Complexity in Sustaining Economic Growth. J. Environ. Manage. 273, 111146. doi:10.1016/j.jenvman.2020.111146

Doğan, B., Can, M., and Değer, O. (2018). “Military Expenditures and Income Inequality: Empirical Evidence from North American Countries,” in Handbook of Research on Military Expenditure on Economic and Political Resources (Pennsylvania, USA: IGI Global), 192–210.

Doğan, B., Driha, O. M., Balsalobre Lorente, D., and Shahzad, U. (2021). The Mitigating Effects of Economic Complexity and Renewable Energy on Carbon Emissions in Developed Countries. Sustain. Develop. 29 (1), 1–12.

Doğan, B. (2018). The Financial Kuznets Curve: a Case Study of Argentina. Empirical Econ. Lett. 17 (4), 527–536.

Eckstein, D., Künzel, V., Schäfer, L., and Winges, M. (2019). Global Climate Risk index 2020. Bonn: Germanwatch.

Elliott, G., Rothenberg, T. J., and Stock, J. H. (1992). Efficient Tests for an Autoregressive Unit Root. Econometrica 64, 813–836. doi:10.3386/t0130

Estoque, R. C., and Murayama, Y. (2014). Social-ecological Status index: A Preliminary Study of its Structural Composition and Application. Ecol. Indicators 43, 183–194. doi:10.1016/j.ecolind.2014.02.031

Fan, H., Liu, W., and Coyte, P. C. (2018). Do Military Expenditures Crowd-Out Health Expenditures? Evidence from Around the World, 2000-2013. Defence Peace Econ. 29 (7), 766–779. doi:10.1080/10242694.2017.1303303

Fan, Y., Ullah, I., Rehman, A., Hussain, A., and Zeeshan, M. (2021). Does Tourism Increase CO2 Emissions and Health Spending in Mexico? New Evidence from Nonlinear ARDL Approach. Int. J. Health Plann. Manage. 37, 242. doi:10.1002/hpm.3322

Godil, D. I., Sharif, A., Agha, H., and Jermsittiparsert, K. (2020). The Dynamic Nonlinear Influence of ICT, Financial Development, and Institutional Quality on CO2 Emission in Pakistan: New Insights from QARDL Approach. Environ. Sci. Pollut. Res. 27 (19), 24190–24200. doi:10.1007/s11356-020-08619-1

Gokmenoglu, K. K., Taspinar, N., and Rahman, M. M. (2021). Military Expenditure, Financial Development and Environmental Degradation in Turkey: A Comparison of CO 2 Emissions and Ecological Footprint. Int. J. Fin Econ. 26 (1), 986–997. doi:10.1002/ijfe.1831

Gregory, A. W., and Hansen, B. E. (1996). Residual-based Tests for Cointegration in Models with Regime Shifts. J. Econom. 70 (1), 99–126. doi:10.1016/0304-4076(69)41685-7

Griggs, D., Stafford-Smith, M., Gaffney, O., Rockström, J., Öhman, M. C., Shyamsundar, P., et al. (2013). Sustainable Development Goals for People and Planet. Nature 495 (7441), 305–307. doi:10.1038/495305a

Güney, T. (2019). Renewable Energy, Non-renewable Energy and Sustainable Development. Int. J. Sustain. Develop. World Ecol. 26 (5), 389–397.

Hacker, S., and Hatemi, -J. A. (2012). A Bootstrap Test for Causality With Endogenous Lag Length Choice: Theory and Application in Finance. J. Econ. Stud. 39 (2), 144–160. doi:10.1108/01443581211222635

Hartwell, C. A. (2017). If You’re Going through Hell, Keep Going: Nonlinear Effects of Financial Liberalization in Transition Economies. Emerging Markets Finance and Trade 53 (2), 250–275.

Haseeb, M., Kot, S., Hussain, H. I., and Jermsittiparsert, K. (2019). Impact of Economic Growth, Environmental Pollution, and Energy Consumption on Health Expenditure and R&D Expenditure of ASEAN Countries. Energies 12 (19), 3598. doi:10.3390/en12193598

Hatemi-J, A., Chang, T., Chen, W.-Y., Lin, F.-L., and Gupta, R. (2018). Asymmetric Causality between Military Expenditures and Economic Growth in Top Six Defense Spenders. Qual. Quant 52 (3), 1193–1207. doi:10.1007/s11135-017-0512-9

Hatemi-j, A. (2008). Tests for Cointegration with Two Unknown Regime Shifts with an Application to Financial Market Integration. Empir Econ. 35 (3), 497–505. doi:10.1007/s00181-007-0175-9

Hecq, A., and Urbain, J.-P. (1993). Misspecification Tests, Unit Roots and Level Shifts. Econ. Lett. 43 (2), 129–135. doi:10.1016/0165-1765(93)90025-8

Hess, P. (2010). Determinants of the Adjusted Net Saving Rate in Developing Economies. Int. Rev. Appl. Econ. 24 (5), 591–608. doi:10.1080/02692170903426070

Hickel, J. (2020). The Sustainable Development index: Measuring the Ecological Efficiency of Human Development in the Anthropocene. Ecol. Econ. 167, 106331. doi:10.1016/j.ecolecon.2019.05.011

Hua, X., and Boateng, A. (2015). “Trade Openness, Financial Liberalization, Economic Growth, and Environment Effects in the North-South: New Static and Dynamic Panel Data Evidence,” in Beyond the UN Global Compact: Institutions and Regulations (Bingley, UK: Emerald Group Publishing Limited), 253–289. doi:10.1108/s2051-503020150000017020

Hussain, E. (2019). India-Pakistan Relations: Challenges and Opportunities. J. Asian Security Int. Aff. 6 (1), 82–95. doi:10.1177/2347797018823964

Jahanger, A., Usman, M., and Ahmad, P. (2021). A Step towards Sustainable Path: the Effect of Globalization on China’s Carbon Productivity from Panel Threshold Approach. Environ. Sci. Pollut. Res. 2021, 1–16.

Jalil, A., and Feridun, M. (2011). The Impact of Growth, Energy and Financial Development on the Environment in China: a Cointegration Analysis. Energ. Econ. 33 (2), 284–291. doi:10.1016/j.eneco.2010.10.003

Jalil, A., Nadeem Abbasi, H. K., and Bibi, N. (2016). Military Expenditures and Economic Growth: Allowing Structural Breaks in Time Series Analysis in the Case of India and Pakistan. Qual. Quant 50 (4), 1487–1505. doi:10.1007/s11135-015-0217-x

Jolliffe, I. T. (1986). “Principal Components in Regression Analysis,” in Principal Component Analysis (Berlin, Germany: Springer), 129–155. doi:10.1007/978-1-4757-1904-8_8

Kaimuri, B., and Kosimbei, G. (2017). Determinants of Sustainable Development in Kenya. J. Econ. Sustain. Dev. 8 (24), 17–36.

Khalid, U., and Habimana, O. (2021). Military Spending and Economic Growth in Turkey: A Wavelet Approach. Defence Peace Econ. 32 (3), 362–376. doi:10.1080/10242694.2019.1664865

Khan, A., Hussain, J., Bano, S., and Chenggang, Y. (2020a). The Repercussions of Foreign Direct Investment, Renewable Energy and Health Expenditure on Environmental Decay? an Econometric Analysis of B&RI Countries. J. Environ. Plann. Manage. 63 (11), 1965–1986. doi:10.1080/09640568.2019.1692796

Khan, M. K., Teng, J.-Z., Khan, M. I., and Khan, M. O. (2019). Impact of Globalization, Economic Factors and Energy Consumption on CO2 Emissions in Pakistan. Sci. total Environ. 688, 424–436. doi:10.1016/j.scitotenv.2019.06.065

Khan, S. A. R., Zhang, Y., Kumar, A., Zavadskas, E., and Streimikiene, D. (2020b). Measuring the Impact of Renewable Energy, Public Health Expenditure, Logistics, and Environmental Performance on Sustainable Economic Growth. Sustain. Dev. 28 (4), 833–843. doi:10.1002/sd.2034

Khoshnevis Yazdi, S., and Khanalizadeh, B. (2017). Air Pollution, Economic Growth and Health Care Expenditure. Econ. Research-Ekonomska Istraživanja 30 (1), 1181–1190. doi:10.1080/1331677x.2017.1314823

Kim, D.-H., Hsieh, J., and Lin, S.-C. (2021). Financial Liberalization, Political Institutions, and Income Inequality. Empir Econ. 60 (3), 1245–1281. doi:10.1007/s00181-019-01808-z

Kim, D.-H., Lin, S.-C., and Suen, Y.-B. (2010). Are Financial Development and Trade Openness Complements or Substitutes? South. Econ. J. 76 (3), 827–845. doi:10.4284/sej.2010.76.3.827

Koirala, B. S., and Pradhan, G. (2020). Determinants of Sustainable Development: Evidence from 12 Asian Countries. Sustain. Develop. 28 (1), 39–45. doi:10.1002/sd.1963

Korkmaz, S. (2015). The Effect of Military Spending on Economic Growth and Unemployment in Mediterranean Countries. Int. J. Econ. Financial Issues 5 (1), 273–280.

Koseoglu, A., Yucel, A. G., and Ulucak, R. (2022). Green Innovation and Ecological Footprint Relationship for a Sustainable Development: Evidence from Top 20 green Innovator Countries. Sustain. Develop. doi:10.1002/sd.2294

Liaropoulos, L., and Goranitis, I. (2015). Health Care Financing and the Sustainability of Health Systems. Int. J. Equity Health 14 (1), 80–84. doi:10.1186/s12939-015-0208-5

Maki, D. (2012). Tests for Cointegration Allowing for an Unknown Number of Breaks. Econ. Model. 29 (5), 2011–2015. doi:10.1016/j.econmod.2012.04.022

Mishra, P., Pandey, C. M., Singh, U., Gupta, A., Sahu, C., and Keshri, A. (2019). Descriptive Statistics and Normality Tests for Statistical Data. Ann. Card. Anaesth. 22 (1), 67–72. doi:10.4103/aca.ACA_157_18

Moosa, N., and Pham, H. N. A. (2019). The Effect of Environmental Degradation on the Financing of Healthcare. Emerging Markets Finance and Trade 55 (2), 237–250. doi:10.1080/1540496x.2018.1439375

Mujtaba, G., and Ashfaq, S. (2021). The Impact of Environment Degrading Factors and Remittances on Health Expenditure: an Asymmetric ARDL and Dynamic Simulated ARDL Approach. Environ. Sci. Pollut. Res. 2021, 1–17. doi:10.1007/s11356-021-16113-5

Munir, K., and Ameer, A. (2020). Nonlinear Effect of FDI, Economic Growth, and Industrialization on Environmental Quality: Evidence from Pakistan. Manage. Environ. Qual. Int. J. doi:10.1108/MEQ-10-2018-0186

Muralikrishna, I. V., and Manickam, V. (2017). in Introduction. Environmental Management (Amsterdam, Netherlands: Elsevier), 1–4. doi:10.1016/b978-0-12-811989-1.00001-4

Narayan, P. K., and Narayan, S. (2005). Estimating Income and price Elasticities of Imports for Fiji in a Cointegration Framework. Econ. Model. 22 (3), 423–438. doi:10.1016/j.econmod.2004.06.004

Narayan, P. K. (2005). The Saving and Investment Nexus for China: Evidence from Cointegration Tests. Appl. Econ. 37 (17), 1979–1990. doi:10.1080/00036840500278103

Naveed, S., and Mahmood, Z. (2019). Impact of Domestic Financial Liberalization on Economic Growth in Pakistan. J. Econ. Pol. Reform 22 (1), 16–34. doi:10.1080/17487870.2017.1305901

Nkoro, E., and Uko, A. K. (2016). Autoregressive Distributed Lag (ARDL) Cointegration Technique: Application and Interpretation. J. Stat. Econometric Methods 5 (4), 63–91.

Nourry, M. (2008). Measuring Sustainable Development: Some Empirical Evidence for France from Eight Alternative Indicators. Ecol. Econ. 67 (3), 441–456. doi:10.1016/j.ecolecon.2007.12.019

Owumi, B. E., and Eboh, A. (2021). An Assessment of the Contribution of Healthcare Expenditure to Life Expectancy at Birth in Nigeria. J. Public Health (Berl.). doi:10.1007/s10389-021-01546-6

Pervaiz, R., Faisal, F., Rahman, S. U., Chander, R., and Ali, A. (2021). Do health Expenditure and Human Development index Matter in the Carbon Emission Function for Ensuring Sustainable Development? Evidence from the Heterogeneous Panel. Air Qual. Atmosphere Health 2021, 1–12.

Pesaran, M. H., Shin, Y., and Smith, R. J. (2001). Bounds Testing Approaches to the Analysis of Level Relationships. J. Appl. Econ. 16 (3), 289–326. doi:10.1002/jae.616

Phillips, P. C. B., and Hansen, B. E. (1990). Statistical Inference in Instrumental Variables Regression with I(1) Processes. Rev. Econ. Stud. 57 (1), 99–125. doi:10.2307/2297545

Phillips, P. C. B., and Perron, P. (1988). Testing for a Unit Root in Time Series Regression. Biometrika 75 (2), 335–346. doi:10.1093/biomet/75.2.335

Phiri, A. (2019). Does Military Spending Nonlinearly Affect Economic Growth in South Africa? Defence Peace Econ. 30 (4), 474–487. doi:10.1080/10242694.2017.1361272

Qayyum, U., Anjum, S., and Samina Sabir, S. (2021). Armed Conflict, Militarization and Ecological Footprint: Empirical Evidence from South Asia. J. Clean. Prod. 281, 125299. doi:10.1016/j.jclepro.2020.125299

Rafindadi, A. A., and Usman, O. (2019). Globalization, Energy Use, and Environmental Degradation in South Africa: Startling Empirical Evidence from the Maki-Cointegration Test. J. Environ. Manag. 244, 265–275. doi:10.1016/j.jenvman.2019.05.048

Raghupathi, V., and Raghupathi, W. (2020). Healthcare Expenditure and Economic Performance: Insights from the United States Data. Front. Public Health 8, 156. doi:10.3389/fpubh.2020.00156

Rahman, M. M., Khanam, R., and Rahman, M. (2018). Health Care Expenditure and Health Outcome Nexus: New Evidence from the SAARC-ASEAN Region. Glob. Health 14 (1), 113–211. doi:10.1186/s12992-018-0430-1

Raju, M. H., and Ahmed, Z. (2019). Effect of Military Expenditure on Economic Growth: Evidences from India Pakistan and China Using Cointegration and Causality Analysis. Asian J. German Eur. Stud. 4 (1), 1–8. doi:10.1186/s40856-019-0040-6

Raza, S. A., Shahbaz, M., and Paramati, S. R. (2017). Dynamics of Military Expenditure and Income Inequality in Pakistan. Soc. Indic Res. 131 (3), 1035–1055. doi:10.1007/s11205-016-1284-7

Saba, C. S., and Ngepah, N. (2020). Empirical Analysis of Military Expenditure and Industrialisation Nexus: A Regional Approach for Africa. Int. Econ. J. 34 (1), 58–84. doi:10.1080/10168737.2019.1641541

Saba, C. S., and Ngepah, N. (2019). Military Expenditure and Economic Growth: Evidence from a Heterogeneous Panel of African Countries. Econ. Research-Ekonomska Istraživanja 32 (1), 3586–3606. doi:10.1080/1331677x.2019.1674179

Saleem, A., Cheema, A. R., Rahman, A., Ali, Z., and Parkash, R. (2021). Do health Infrastructure and Services, Aging, and Environmental Quality Influence Public Health Expenditures? Empirical Evidence from Pakistan. Soc. Work Public Health 36 (6), 688–706. doi:10.1080/19371918.2021.1920540

Shah, W. U. H., Yasmeen, R., and Padda, I. U. H. (2019). An Analysis between Financial Development, Institutions, and the Environment: a Global View. Environ. Sci. Pollut. Res. 26 (21), 21437–21449. doi:10.1007/s11356-019-05450-1

Shin, Y., Yu, B., and Greenwood-Nimmo, M. (2014). “Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework,” in Festschrift in Honor of Peter Schmidt (Berlin, Germany: Springer), 281–314. doi:10.1007/978-1-4899-8008-3_9

Siche, J. R., Agostinho, F., Ortega, E., and Romeiro, A. (2008). Sustainability of Nations by Indices: Comparative Study between Environmental Sustainability index, Ecological Footprint and the Emergy Performance Indices. Ecol. Econ. 66 (4), 628–637. doi:10.1016/j.ecolecon.2007.10.023

Siddiqa, A. (2020). Why Is Pakistan Spending So Much Money on Defence amid COVID-19? [Online]. Doha, Qatar: Al Jazeera. Available at: https://www.aljazeera.com/opinions/2020/7/1/why-is-pakistan-spending-so-much-money-on-defence-amid-covid-19 (Accessed 10 15, 2021).

Singh, N., Singh, S., and Mall, R. K. (2020). “Urban Ecology and Human Health: Implications of Urban Heat Island, Air Pollution and Climate Change Nexus,” in Urban Ecology (Amsterdam, Netherlands: Elsevier), 317–334. doi:10.1016/b978-0-12-820730-7.00017-3

Solarin, S. A., Al-Mulali, U., and Ozturk, I. (2018). Determinants of Pollution and the Role of the Military Sector: Evidence from a Maximum Likelihood Approach with Two Structural Breaks in the USA. Environ. Sci. Pollut. Res. 25 (31), 30949–30961. doi:10.1007/s11356-018-3060-5

Stock, J. H., and Watson, M. W. (1993). A Simple Estimator of Cointegrating Vectors in Higher Order Integrated Systems. Econometrica 61, 783–820. doi:10.2307/2951763

Strezov, V., Evans, A., and Evans, T. J. (2017). Assessment of the Economic, Social and Environmental Dimensions of the Indicators for Sustainable Development. Sust. Dev. 25 (3), 242–253. doi:10.1002/sd.1649

Tamazian, A., Chousa, J. P., and Vadlamannati, K. C. (2009). Does Higher Economic and Financial Development lead to Environmental Degradation: Evidence from BRIC Countries. Energy policy 37 (1), 246–253. doi:10.1016/j.enpol.2008.08.025

Tao, R., Glonț, O. R., Li, Z.-Z., Lobonț, O. R., and Guzun, A. A. (2020). New Evidence for Romania Regarding Dynamic Causality between Military Expenditure and Sustainable Economic Growth. Sustainability 12 (12), 5053. doi:10.3390/su12125053

Tian, N., da Silva, D. L., and Kuimova, A. (2020). “Military Spending and the Achievement of the 2030 Agenda for Sustainable Development,” in United Nations Office of Disarmament Affairs (UNODA) Occasional Papers, Ed. U. Nations., 21–37. doi:10.18356/bda22fe8-en

Toda, H. Y., and Yamamoto, T. (1995). Statistical Inference in Vector Autoregressions with Possibly Integrated Processes. J. Econom. 66 (1-2), 225–250. doi:10.1016/0304-4076(94)01616-8

Töngür, Ü., and Elveren, A. Y. (2017). The Nexus of Economic Growth, Military Expenditures, and Income Inequality. Qual. Quantity 51 (4), 1821–1842.

Ullah, A., Zhao, X., Kamal, M. A., and Zheng, J. (2020). Modeling the Relationship between Military Spending and Stock Market Development (A) Symmetrically in China: An Empirical Analysis via the NARDL Approach. Physica A: Stat. Mech. its Appl. 554, 124106. doi:10.1016/j.physa.2019.124106

Ullah, S., Andlib, Z., Majeed, M. T., Sohail, S., and Chishti, M. Z. (2021). Asymmetric Effects of Militarization on Economic Growth and Environmental Degradation: Fresh Evidence from Pakistan and India. Environ. Sci. Pollut. Res. 28 (8), 9484–9497. doi:10.1007/s11356-020-11142-y

Ulucak, R., Yücel, A. G., and Koçak, E. (2019). “The Process of Sustainability,” in Environmental Kuznets Curve (EKC) (Amsterdam, Netherlands: Elsevier), 37–53. doi:10.1016/b978-0-12-816797-7.00005-9

Usman, M., Ma, Z., Wasif Zafar, M., Haseeb, A., and Ashraf, R. U. (2019). Are Air Pollution, Economic and Non-economic Factors Associated with Per Capita Health Expenditures? Evidence from Emerging Economies. Int. J. Environ. Res. Public Health 16 (11), 1967. doi:10.3390/ijerph16111967

Vallejo-Rosero, P., García-Centeno, M. C., Delgado-Antequera, L., Fosado, O., and Caballero, R. (2021). A Multiobjective Model for Analysis of the Relationships between Military Expenditures, Security, and Human Development in NATO Countries. Mathematics 9 (1), 23.

Wang, Z., Asghar, M. M., Zaidi, S. A. H., and Wang, B. (2019). Dynamic Linkages Among CO2 Emissions, Health Expenditures, and Economic Growth: Empirical Evidence from Pakistan. Environ. Sci. Pollut. Res. 26 (15), 15285–15299. doi:10.1007/s11356-019-04876-x

Wilson, J., Tyedmers, P., and Pelot, R. (2007). Contrasting and Comparing Sustainable Development Indicator Metrics. Ecol. indicators 7 (2), 299–314. doi:10.1016/j.ecolind.2006.02.009

Xia, W., Apergis, N., Bashir, M. F., Ghosh, S., Doğan, B., and Shahzad, U. (2022). Investigating the Role of Globalization, and Energy Consumption for Environmental Externalities: Empirical Evidence from Developed and Developing Economies. Renew. Energ. 183, 219–228. doi:10.1016/j.renene.2021.10.084

Yao, S., He, H., Chen, S., and Ou, J. (2018). Financial Liberalization and Cross-Border Market Integration: Evidence from China's Stock Market. Int. Rev. Econ. Finance 58, 220–245. doi:10.1016/j.iref.2018.03.023

Yolcu Karadam, D., Yildirim, J., and Öcal, N. (2017). Military Expenditure and Economic Growth in Middle Eastern Countries and Turkey: a Non-linear Panel Data Approach. Defence Peace Econ. 28 (6), 719–730. doi:10.1080/10242694.2016.1195573

York, R., and Rosa, E. A. (2003). Key Challenges to Ecological Modernization Theory. Organ. Environ. 16 (3), 273–288. doi:10.1177/1086026603256299

Zakaria, M., and Bibi, S. (2019). Financial Development and Environment in South Asia: the Role of Institutional Quality. Environ. Sci. Pollut. Res. 26 (8), 7926–7937. doi:10.1007/s11356-019-04284-1

Keywords: sustainable develoment, healthcare expenditure, militarization, NARDL, Maki cointegration

Citation: Meiling L, Taspinar N, Yahya F, Hussain M and Waqas M (2022) The Symmetric and Asymmetric Effect of Defense Expenditures, Financial Liberalization, Health Expenditures on Sustainable Development. Front. Environ. Sci. 10:877285. doi: 10.3389/fenvs.2022.877285

Received: 16 February 2022; Accepted: 06 April 2022;

Published: 16 May 2022.

Edited by:

Diogo Ferraz, Universidade Federal de Ouro Preto, BrazilReviewed by:

Buhari Doğan, Süleyman Demirel University, TurkeyAli Gokhan Yucel, Erciyes University, Turkey

Copyright © 2022 Meiling, Taspinar, Yahya, Hussain and Waqas. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Farzan Yahya, ZmFyemFuLnlhaHlhQHlhaG9vLmNvbQ==

Li Meiling1

Li Meiling1 Farzan Yahya

Farzan Yahya