94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 11 March 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.864335

This article is part of the Research TopicGreen Innovation and Industrial Ecosystem Reconstruction in Achieving Environmental SustainabilityView all 34 articles

Dongyang Shen1

Dongyang Shen1 Wenjian He1,2*

Wenjian He1,2*By optimizing enterprises’ capital structure, the deleveraging policy has a close relationship with green innovation. Taking the Opinions on Actively and Steadily Reducing Enterprise Leverage issued by the State Council of China in 2016 as an exogenous shock and utilizing the panel date of listed manufacturing enterprises in China from 2010 to 2019, this paper constructs a DID model and conducts a series of robustness tests, which quantitatively confirm that the deleveraging policy can play a positive role in improving enterprise green innovation. Furthermore, heterogeneity analysis reveals that the deleveraging policy can promote the application of green invention patents to a greater extent and has a greater effect on green innovation in state-owned enterprises, large-scale enterprises, technology-intensive enterprises, and enterprises in financially developed regions. Ultimately, the mechanism test confirms that the deleveraging policy provides long-term funds for enterprise green innovation by promoting enterprise equity financing. And with the strengthening of shareholders’ supervision and management, it also effectively ensures the stable development of green innovation.

Since the reform and opening up, China’s economy has grown rapidly. However, the extensive economic development pattern has accelerated the energy consumption and increased pollution emissions, which restricted the sustainable development of economy and ecology (Wu et al., 2020a; Zhao et al., 2020). Therefore, it has become a hot topic to coordinate economic development and environmental protection. Existing studies show that green innovation can reduce enterprise pollution emission in productive activities and obtain economic benefits, which is an important way to break the dilemma of limited resources and polluted environment (Jens, 2008; Amore and Bennedsen, 2015; Song and Yu, 2017). In 2015, the State Council of China issued the Made in China 2025 document, which listed green development as one of the basic strategies to enhance comprehensive national strength, and required manufacturing enterprises to build an efficient, clean, low-carbon, and circular green manufacturing system as soon as possible.

In fact, due to the high risk and uncertainty characteristics, green innovation often requires long-term and stable funds (Horbach et al., 2012; Huang and Li, 2015). Thus, enterprise financing ability is one of the key factors to ensure the stable capital investment of green innovation (Xiang et al., 2021). Based on the pecking order theory, when internal financing cannot completely meet enterprises’ demand for funds, debt financing becomes the suboptimal choice of enterprises because it enables enterprises to allocate large capital flow with less cash (Bartoloni, 2013). However, to cope with the high leverage since the publication of Four Trillion Plan policy in 2008, the State Council of China issued the Opinions on Actively and Steadily Reducing Enterprise Leverage (OASREL) in 2016. The OASREL not only requires enterprises to accelerate the liquidation of debt arrears and reduce the scale of loans but also encourages enterprises to develop equity financing. Intuitively, the implementation of deleveraging policy will reduce enterprises’ debt funds and green innovation investment, which seems to have an adverse influence on enterprise green innovation.

Nevertheless, different from general innovation, green innovation has higher risk and uncertainty, which makes it difficult for enterprises to obtain economic benefits in the short term (Xiang et al., 2021). Moreover, the intangible assets of knowledge capital produced by green innovation are also incapable to be utilized as collateral (Lindman and Sderholm, 2015). Therefore, creditors who pursue stable interest income are more sensitive to green innovation, which reduces the willingness of creditors on green innovation (Brown et al., 2012; Hsu et al., 2014). That is, debt financing is probably not the main source of funds for green innovation, and the reduction of enterprise debt funds caused by deleveraging policy may not do substantial harm to green innovation. Moreover, the deleveraging policy promotes enterprise equity financing, whose investors generally pay more attention to long-term benefits of enterprises (Chen et al., 2014). Under the background of rising demand for green development, green innovation can reduce production costs of enterprise, expand competitiveness, and increase profitability by giving green attributes to enterprise products (Amore and Bennedsen, 2015). Hence, equity investors will have stronger preferences for enterprise green innovation (Brown et al., 2012; Brown et al., 2013; Brown et al., 2017; Yang et al., 2020), and the deleveraging policy will play a positive role in promoting enterprise green innovation.

In summary, the implementation of deleveraging policy could change the capital structure of enterprises and have a close relationship with enterprise green innovation. It is of great value to concentrate on the internal mechanism of the impact of deleveraging policy on enterprise green innovation. However, existing literature studies mainly focus on the macroeconomic effects of leverage ratio. Specifically, based on the financial deepening theory, some scholars confirm that the increase of leverage ratio is helpful to economic growth (Levine et al., 2000; Beck and Levine, 2004; Levine, 2005). Nevertheless, based on the debt-deflation theory, more researchers find that deleveraging reduces asset price, which increases credit constraints and improves financial volatility by using a fixed-effect model and generalized method of moments (Schularick and Taylor, 2012; Buttiglione et al., 2014). Furthermore, some scholars incorporate these two theories into the same analytical framework. They confirm that increasing the leverage ratio can play a pulling role in economic growth in the early stage of development and have a negative impact on economic growth in the long run. In other words, the effect of deleveraging on economic growth shows an inverted U-shape (Reinhart and Rogoff, 2010; Cecchetti and Kharroubi, 2012).

In addition, from the micro perspective, some literature studies mostly discuss the impact of debt structure on enterprise innovation, and no consistent conclusion has been reached. To be specific, the increasing debt financing is conducive to transmitting positive signals and further alleviating financing constraints of enterprise, playing a positive role in enterprise innovation (Laeven and Valencia, 2012; Bartoloni, 2013). However, other scholars found that increasing debt financing brings high financial risks to enterprises, which inhibits enterprise innovation activities (Müeller and Zimmermann, 2009). Besides, some scholars also put forward that debt financing does not make a significant difference to enterprise innovation, and what actually works is the enterprise equity financing (Brown et al., 2012; Brown et al., 2013; Brown et al., 2017).

The existing literature studies mostly concentrate on the impact of leverage ratio on macroeconomic growth and the influence of debt structure on micro enterprise innovation. However, few studies pay attention to the particularity of green innovation and the impact of capital structure changes on enterprise green innovation from the perspective of deleveraging policy. Simultaneously, the fixed-effect model and generalized method of moments in existing studies cannot effectively handle endogenous problems. Thus, our paper theoretically analyzes the impact of deleveraging policy on enterprise green innovation from the perspective of capital structure. On this basis, we take the implementation of the OASREL in 2016 as the exogenous shock and construct a DID model to quantitatively confirm that the deleveraging policy significantly improves enterprise green innovation. The result passes a series of robustness tests and remains valid. Further heterogeneity analysis indicates that the deleveraging policy can promote the application of green invention patents to a greater extent, and its facilitation effect on enterprise green innovation is more significant in state-owned enterprises, large-scale enterprises, technology-intensive enterprises, and enterprises in financially developed regions. Ultimately, the mechanism test proves that the deleveraging policy can not only ease enterprise financing constraints to provide sufficient funds for enterprise green innovation but also strengthen the supervision of major shareholders to ensure the stable development of enterprise green innovation.

The main contributions of this paper are as follows. Firstly, this paper broadens the relevant research on the influencing factors of green innovation from the perspective of micro enterprise capital structure. Existing studies mainly focus on the impact of debt structure on enterprise innovation but barely explore the effect of capital structure on enterprise green innovation in view of deleveraging policy (Bartoloni, 2013; Brown et al., 2017). On the one hand, existing studies cannot capture the possible systemic impact of capital structure after the implementation of deleveraging policy. On the other hand, they also failed to reveal the uniqueness of green innovation. That is, green innovation is generally in the dilemma of financing constraints owing to its higher risk and uncertainty, and its double externality of knowledge spillovers and environmental protection further reduces the possibility of enterprise green innovation (Sun et al., 2021; Xiang et al., 2021). Based on the characteristic of green innovation, our paper identifies the preference differences between creditors and equity investors. Then, we prove that the deleveraging policy can reduce enterprise debt and promote equity financing, so as to meet the fund needs of green innovation and improve enterprise green innovation.

Secondly, this paper also enriches the research on the economic effect of deleveraging policy. Existing literature studies mostly concentrate on the effects of deleveraging on macroeconomic (Schularick and Taylor, 2012) and micro enterprise innovation (Brown et al., 2012; Bartoloni, 2013), while few studies discuss its impact on enterprise green innovation. This paper puts forward the hypothesis that the deleveraging policy can optimize the enterprise capital structure and promote enterprise green innovation through theoretical mechanism analysis. By quantitative research, this paper affirms the positive impact of deleveraging policy on promoting enterprise green innovation, which verifies the rationality of deleveraging policy from the perspective of sustainable development.

The remainder of this paper is organized as follows. Section 2 presents the institutional background and puts forward the research hypothesis. Section 3 describes the model setting and description of data. Sections 4 and Sections 4 and 5 report the empirical and mechanism test results, respectively, followed by conclusion and policy enlightenments in Section 6.

To alleviate the impact of the economic crisis in 2008, China introduced the Four Trillion Plan policy to stimulate economic development. As a result, the average leverage ratio of enterprise sector grows rapidly, and the debt burden of enterprises is more serious. With the potential risks, deleveraging has become a necessary measure to prevent the economic risks in China. Based on this, in October 2015, the Fifth Plenary Session of the 18th Communist Party of China (CPC) Central Committee clearly put forward the requirement of reducing the leverage ratio. At the end of 2015, the Central Economic Work Conference took deleveraging as one of the core tasks of the supply side structural reform to optimize the enterprise debt structure, which required enterprises to gradually reduce the leverage ratio to a reasonable level and promote steady economic growth. Although the deleveraging requirement was first proposed in 2015, but in fact, the deleveraging requirement in 2015 just put forward the guiding suggestions and did not list enterprises as the object of policy implementation, it only created a universal institution environment. Based on this, the State Council of China issued the Opinions on Actively and Steadily Reducing Enterprise Leverage in October 2016, which not only defined enterprises as the mainstay to achieve the goal of deleveraging but also standardized the ways of enterprise deleveraging, thus having a strong restrictive effect on enterprise behavior.

The OASREL pointed out that, for zombie enterprises that lose development prospects, they should conduct bankruptcy liquidation and pay off their debts. And for general enterprises, the OASREL required them to actively and steadily reduce their leverage ratio, which accelerated enterprises’ liquidation of fund arrears. In addition, the OASREL also encouraged enterprises in temporary arrears to use means like bank credit to carry out debt integration and optimization. At the same time, the OASREL clearly proposed enterprises to actively develop equity financing by pushing forward private equity, strengthening trading market infrastructure, and so on. Among those measures, market-oriented bank debt to equity swap is the important way that can not only reduce enterprise debt and leverage but also achieve the purpose of adjusting enterprise capital structure, thus enhancing enterprise capital strength. In addition, the OASREL requests government to strengthen supervision and standardize enterprise behavior of deleveraging by constructing joint punishment mechanisms, which effectively ensures the implementation of deleveraging policy.

In conclusion, the implementation of the OASREL defines the way of deleveraging, standardizes the specific measures of enterprise deleveraging, and further implements the goal of deleveraging. According to the Choice database (http://choice.eastmoney.com/), the leverage ratio of Chinese listed enterprises in 2014 and 2015 was 43.97 and 42.24%, respectively, and decreased to 40.70 and 40.15% in 2016 and 2017. The above data show an obvious effect of the deleveraging policy, providing a realistic basis for our study.

Based on the high risk and long return cycle of enterprise green innovation, creditors who obtain stable interest income have higher risk aversion to borrowing enterprises that conduct green innovation. On the contrary, equity investors pursue long-term income, and thus, they show stronger investment preference (Hsu et al., 2014; Brown et al., 2017). Therefore, though the OASREL forces the reduction of debt funds, it may not do substantial damage to enterprise green innovation. Moreover, encouraging equity financing in the context of green development will further stimulate equity investors’ investment preference for green innovation, so as to provide long-term funds for green innovation (Hoskisson et al., 2002). In the meantime, the OASREL also strengthens the ability of major shareholders to supervise and manage enterprises, which could restrict the opportunistic behavior of managers and then ensure the stable development of green innovation. Based on this, our paper attempts to reveal the mechanism between the deleveraging policy and enterprise green innovation from the perspective of enterprise financing and internal supervision.

Compared with general innovation, green innovation usually has greater risks and a longer payback period, leading to higher adjustment cost (Hall, 2002; Malen and Marcus, 2019). In addition, enterprises generally have multi-dimensional targets such as the maximization of enterprise value and environmental and social benefits; thus, green innovation with greater uncertainty often requires more investment (Wang and Chu, 2019). From the perspective of debt financing, the uniqueness of green innovation often makes it difficult for enterprises to achieve economic benefits in the short term (Xiang et al., 2021), which may hardly meet the pursuit of creditors for a stable interest income. Moreover, creditors need to bear the risk that the loan cannot be repaid due to the failure of green innovation. Thus, creditors are less willing to lend funds to enterprises that carry out green innovation activities (Brown et al., 2012; Hsu et al., 2014; Chen et al., 2014). Xiang et al. (2021) utilized the Poisson model and proved that debt financing had no significant effect on enterprise green innovation. That is, the reduction of enterprise debt caused by the deleveraging policy will not exert a substantial influence on green innovation. More importantly, excessive debt will increase the interest burden of enterprises, and the reduction of enterprise debt scale can lessen the interest expenditure, thus decreasing financial risk and bankruptcy possibility of enterprises (Qi et al., 2018). Meanwhile, the reduction of cash flow also restrains the over investment behavior of enterprises, which enables them to invest in activities that can expand competitive advantages and further push forward with enterprise green innovation (Cai and Zhang, 2011).

In contrast to the creditors, equity investors mainly concentrate on the long-term operating performance of enterprises; thus, the continuous investment and high return characteristics of green innovation are consistent with equity investors’ goal of pursuing long-term benefits (Hsu et al., 2014). Under the background of actively encouraging green development, enterprise green innovation can not only obtain government subsidies (Montmartin and Herrera, 2015) but also reduce energy losses and environmental externalities in production activities, thus effectively allocating enterprise resources and reducing enterprise costs. Meanwhile, by transforming to resource-saving enterprises, enterprises can establish a good external image and win public praise, further expanding their competitive advantage to earn excess profits through giving their products’ green attributes (Li et al., 2019). Consequently, the deleveraging policy will promote the preference of equity investors for green innovation, ensuring the requirement of enterprise green innovation for long-term funds. Besides, equity financing does not need to repay the interest; thus, enterprises generally face relatively low financial pressure, which can effectively ensure the continuity of green innovation activities (Xiang et al., 2021).

In conclusion, owing to the different preferences for green innovation between creditors and equity investors, the deleveraging policy’s reducing enterprise debt funds will not inhibit green innovation. Simultaneously, by promoting enterprise equity financing, the deleveraging policy offers a steady source of funds for green innovation, which has a stimulative impact on enterprise green innovation.

Based on this, this paper puts forward hypothesis 1:

H1: Ceteris paribus, the deleveraging policy can provide long-term and stable funds for enterprise by facilitating equity financing, so as to improve enterprise green innovation.

According to the debt control hypothesis, debt financing can not only provide funds for enterprises but also supervise and restrict the enterprise behaviors, which is regarded as an enterprise governance strategy (Qin and Gao, 2020). Then, the agency cost between managers and shareholders decreases, which further promotes the efficiency of enterprise organizational (Xiao, 2006; Morellec et al., 2012). When enterprises increase the debt financing, creditors tend to add restrictive regulations on debt contracts to avoid risks that the funds lent to the enterprise cannot be repaid. The restrictions inhibit managers’ opportunistic behavior of using free cash flow to pursue personal profits and reduce managers’ immoral behavior of occupying shareholders’ rights and benefits, partly alleviating the interest conflict between shareholders and managers (Armstrong et al., 2010). Thus, the deleveraging policy’s forcing enterprises to reduce their debt scale can reduce the original creditors’ influence on supervising enterprise business decisions and further increase agency cost problems. Moreover, increasing inefficient investment will restrict enterprises’ long-term activities.

Nevertheless, the deleveraging policy strengthens the ability of major shareholders to supervise and manage enterprises by promoting equity financing, which can partly make up for the negative impact of weakening the supervision of creditors. From the perspective of enterprise equity, the deleveraging policy emphasizes the importance of market-oriented debt to equity swap. Since debt to equity swap could change the enterprise’s ownership structure and even dilute the equity to a certain extent, enterprises will choose private placement to reduce their leverage ratio. As a non-public refinancing method with low issuance threshold, private placement mainly distributes to major shareholders, which concentrates the enterprise equity to a large extent (Henrik and Mattias, 2005). Furthermore, through strengthening equity concentration, the deleveraging policy reduces the supervision cost of major shareholders and strengthens their supervision impact on enterprise operation and management activities. Then, the over-investment behavior of managers can be inhibited, further promoting the development of enterprises’ long-term activities.

It is noteworthy that some scholars pointed out that the increase of investors caused by private placement would influence the decision made by major shareholders (Qin and Gao, 2020). In fact, shareholders who purchase new shares issued by private placement generally have hitchhiking psychology; thus, they have little motivation to participate in enterprise decision-making. Therefore, even if the number of new investors rises, it may not affect the result of major shareholders to supervise and manage enterprise decision-making. Furthermore, shareholders who pay more attention to the long-term performances of enterprise will continue to promote enterprise green innovation with their stronger green innovation preference under the background of green development.

In conclusion, although the deleveraging policy weakens the impact of creditors’ supervision, it actually makes up for this negative influence by strengthening equity concentration. The improving ability of major shareholders to supervise and manage enterprises effectively ensures the stable development of green innovation.

Based on this, our paper puts forward hypothesis 2:

H2: Ceteris paribus, the deleveraging policy could improve enterprise green innovation by strengthening the supervision and management of major shareholders.

In order to estimate the impact of deleveraging policy on enterprise green innovation more accurately and alleviate the bias of variable selection, our paper takes the implementation of the OASREL as a quasi-natural experiment and constructs a DID model. Although the deleveraging policy is implemented uniformly at the national level and there is no clear control group, its impact will actually have divergence due to the different leverage ratio of enterprise before policy’s implementation. In other words, the enterprises with a higher leverage ratio are affected greatly by the deleveraging policy. Based on this, referring to existing research practices, our paper adds the interaction term

where

So far, existing scholars have had a heated discussion on the definition of green innovation, and finally, their conclusions tend to be consistent. Referring to existing studies, our paper defines the green innovation as the new technologies or processes that are helpful to reduce pollution and save resources (Chen et al., 2006). Then, according to the existing literature studies, it takes a long time from a patent application to a granted patent, and the number of granted green patents that some scholars use to measure enterprise green innovation cannot reflect enterprises’ current creativity (Amore and Bennedsen, 2016; Deng et al., 2021; Xia et al., 2021; Wu et al., 2022). Thus, our paper utilizes the number of green patent applications to measure enterprises’ green innovation ability (Zhang et al., 2020; Shao et al., 2020). Meanwhile, referring to Zhang et al. (2020), we choose to take the natural logarithm of the green patent application numbers plus one as the dependent variable, thus making the data distribution more consistent with normal distribution (Zhou et al., 2021). In addition, we divide the number of green patent applications into green invention patents and green utility models in heterogeneity analysis to further explore the possible impact of deleveraging on different structures of green innovation.

In order to alleviate the endogenous problem caused by missing variables, combining with the existing literature studies and relevant studies, our paper comprehensively considers the influencing factors at the enterprise level and then selects the following variables as the control variables. First, the natural logarithm of total assets (

Apart from these factors at the enterprise level, regional economic development, environmental regulation intensity, and industrial structure will also affect deleveraging policy and enterprise green innovation. Therefore, our paper chooses per capita GDP (

In China, manufacturing industry is the mainstay of the national economy, and its pollution emission accounts for about 70% of the total industrial sector, which generates more pollution and faces greater environmental pressure. In addition, manufacturing enterprises are the main part of green patent applications, which is more suitable to our study. Therefore, we select Chinese manufacturing enterprises listed on Shanghai and Shenzhen Stock Exchanges from 2010 to 2019 as the research objects.

Our green patent dataset of listed manufacturing enterprises is collected from the State Intellectual Property Office (SIPO). In order to identify every green patent, we refer to the International Green Patent Classification List (IGPCL) given by the World Intellectual Property Organization (WIPO) in 2010 and divide the green patents into the following seven types: alternative energy production, transportation, energy conservation, waste management, agriculture and forestry, management regulation design, and nuclear power. If the IPC of a patent belongs to the above IGPCL, it is classified as a green patent. Then, we obtain other main enterprise-level data from the China Stock Market & Accounting Research Database. The province-level data are collected from the EPS global statistical platform and the China Statistical Yearbook.

After obtaining the original data, we processed the data through the following steps. First, we match the enterprise-level data with province-level data based on the province where the enterprise is located. Second, we exclude enterprises that have much missing data. Third, considering that ST and *ST refers to the special listed enterprises that have, respectively, suffered losses for two and three consecutive years, we also excluded them to avoid financial abnormality. Finally, we also winsorize all of our continuous variables at the 1 and 99% levels to reduce the influence of extreme data. After all these processes, we obtain an effective sample size of 12,713 observations.

The main variables used in this paper and their descriptive statistics are shown in Table 1, which describes basic characteristics at enterprise and province levels, including the mean values, standard deviation, and t-value between the control group and the treatment group. As is displayed in columns 1 and 3 of Table 1, the average green patent applications of treatment group are 0.6504, which is higher than that of the control group (0.3793). It indicates that, before the implementation of the deleveraging policy, the green innovation in Chinese manufacturing enterprises has divergence between enterprises with a higher or lower leverage ratio. Furthermore, column 5 of Table 1 shows that, apart from differences in green innovation, the control variables we select have significant differences between the treatment group and the control group. All of those baseline characteristics are included in the next empirical model, so as to make sure that our treatment group and control group can have the same trend before the implementation of the deleveraging policy.

Before the baseline regression, our paper conducts the correlation test to avoid potential multicollinearity problem between variables that we select, and the results are shown in Table 2. As is displayed, the correlation coefficients are all less than 0.5 apart from the correlation coefficient between Mkt and Pgdp (0.724). Then, we calculate the VIF values of variables. The values of Mkt and Pgdp are 4.11 and 2.9, respectively, which are both less than 10; thus, the multicollinearity problem between variables is not serious. Next, by observing the correlation coefficient between

Based on model (1), our paper examines the effect of the deleveraging policy on enterprise green innovation. The regression results are shown in Table 3. By observing column 1 of Table 3, the interaction term

The premise of applying the DID model is to meet the parallel trend assumption, i.e., the change trend of green innovation of high-leverage enterprises should be consistent with that of low-leverage enterprises before the implementation of the OASREL. Based on this, we use the event study method to test the parallel trend assumption (Li et al., 2017), which can not only test the parallel trend before the impact of the OASREL but also observe the dynamic effect of deleveraging policy on enterprise green innovation. The estimation model is specified as follows:

where the interaction term

The estimation result of the parallel trend test is displayed in Figure 1, in which 2015 (the year before the implementation of the deleveraging policy) is set as the reference year. It can be seen that the impact of interaction term

In order to examine whether there are other unobservable factors that may influence the effect of deleveraging policy on enterprise innovation, our paper constructs a series of counterfactuals to test the robustness of our baseline regression results with a placebo test. Our paper randomly assigns the treatment group and the control group by bootstrap and repeats the regression 500 times according to model (1). If enterprise green innovation is also improved, it indicates that there may exist other unobservable systematic factors resulting in the promotion of green innovation, instead of being influenced by the deleveraging policy. As shown in Figure 2, the t-value of the deleveraging policy’s coefficient on enterprise green innovation presents an approximately normal distribution, which is mostly around 0 and rarely around ± 3 and ± 4. It indicates that the proportion of positive or negative regression coefficients is small, proving that there is no fictitious treatment effect. Therefore, it can be inferred that the improved enterprise green innovation is due to the impact of deleveraging policy rather than other unobservable variables.

In order to test and verify the robustness of our baseline regression result, our paper carries out a series of robustness tests as follows.

In our baseline regression, we only consider the current-period effect of the deleveraging policy. In order to further test and verify the robustness of our results, we, respectively, introduce the first-order lagged term and the second-order lagged term of the number of green patent applications into our model and conduct regression again, and the results are shown in columns 1-2 of Table 4. It can be seen that the interaction terms still have positive impacts on the number of green innovation patent applications of enterprises at the 1% level, and its regression coefficient is 0.1672 and 0.1533, respectively, which is consistent with the baseline regression results. Thus, the lagging green patent does not affect the above baseline regression results.

Enterprise leverage is a continuous variable, whose result could be influenced by self-defined grouping. Therefore, we replace the dummy variable of enterprise leverage with a continuous variable and then construct a DID model to regress again. Specifically, the whole sample is automatically divided into the treatment group that has a higher leverage ratio and the control group that has a lower leverage ratio. The results are shown in columns 3-4 of Table 4. It can be seen that the interaction term

Although the number of green patent applications considers the time from a patent application to the patent acquisition (Shao et al., 2020), it is difficult for green patent applications to reflect the quality of green innovation. Therefore, according to Qi et al. (2018), the number of granted green patents can reflect the quality of enterprise green innovation to a certain extent. In order to test the robustness of our baseline regression result, we, respectively, utilize the first lagged term and second lagged term of granted green patent to measure enterprise green innovation and then carry out regression again. The regression results are shown in columns 1-2 of Table 5. It can be found that the coefficients of interaction terms are still positive and significant at the 1% level, whose results are consistent with the baseline regression.

The baseline regression in our paper adopts clustering robust standard error at the enterprise level, but the high-order clustering robust standard error can reduce the deviation of statistical inference, which has a direct impact on the significance of sample regression results. Hence, referring to Han et al. (2020), we choose to use clustering robust standard error at the industry level to verify the robustness of our regression conclusion, and the result is shown in column 3 of Table 5. It can be seen that the coefficient of the interaction term

Considering that the patent type, property right nature, industry characteristics, enterprise scale, and financial marketization degree will differentiate the impact of deleveraging policy on enterprise green innovation, our paper further carries out grouping regression to reveal the heterogeneous effect of deleveraging policy on enterprise green innovation.

Different from ordinary patents that have three types, green patents are divided into two categories: green invention patents and green utility models. Between them, the technological content of invention patents is higher than that of green utility models. Therefore, green invention patents often attract more investors that are sensitive to green innovation. At the same time, invention patents play a greater role in promoting financial performances and market competitiveness of enterprises, which can better meet the needs of shareholders for the economic benefits of green innovation. Therefore, our paper conjectures that, between the two types of green patents, the deleveraging policy will contribute to promoting the number of green invention patent applications more obviously.

Based on the above analysis, we divide the total number of green patent applications into green invention patent applications and green utility model applications. The results are shown in columns 1-2 of Table 6. It can be seen that the deleveraging policy has a positive impact on the number of green invention patent applications and green utility model applications at the 5% level and the 1% level, respectively. Notice that the coefficient of the total number of green invention patent applications is 0.1762, which is higher than that of the total number of utility model patent applications (0.1538). The results prove that the deleveraging policy has a more promotion effect on green invention patents, which is in line with our prediction.

According to Schumpeter hypothesis, large-scale enterprises have more advantages in obtaining economic resources like investment support than small- and medium-sized enterprises, so as to perform better in innovation activities (Schum peter, 1942). Specifically, large-scale enterprises have both sufficient funds and diversified financing channels for green innovation. In comparison with small-scale enterprises, large-scale enterprises are less dependent on debt financing and have a better internal regulatory structure. Thus, the implementation of deleveraging policy is more conducive to equity financing of large-scale enterprises, having a greater effect on easing enterprises’ financing constraints and strengthening their internal supervision. Moreover, large-scale enterprises can attract more innovative talents and have stronger ability to bear and resist risks, which make large-scale enterprises generally more popular with investors. Therefore, our paper infers that, after the implementation of the deleveraging policy, the positive impact on green innovation may have a greater influential effect on large-scale enterprises.

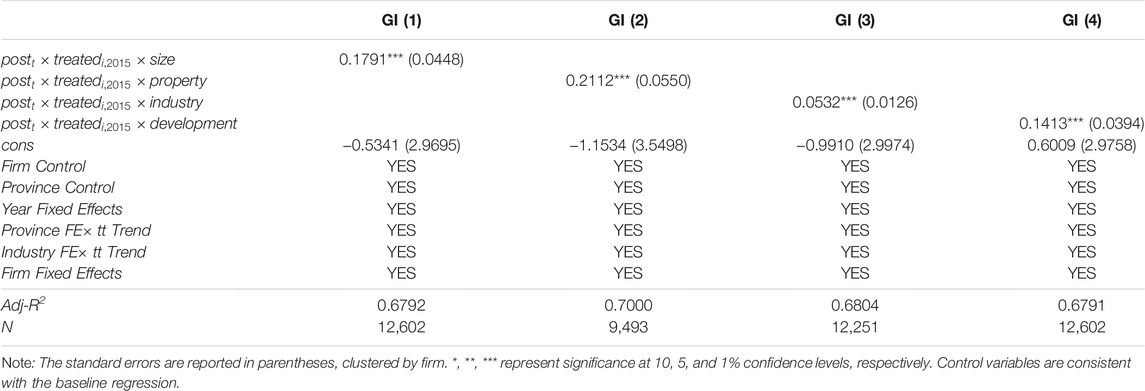

To verify the above conjecture, our paper constructs an interaction item of

TABLE 7. Heterogeneity analysis: enterprise size, property right, industry characteristics, and financial development.

In view of enterprise property rights, in China, state-owned enterprise is the mainstay of economic development, which makes it easier for enterprise to establish political connections with the government, which provides them potential guarantee (Tong et al., 2014). Generally, financial institutions dominant by banks prefer to lend to state-owned enterprises owing to their close relationship with the government. The relatively low financing constraints of state-owned enterprises effectively ensure the demand of stable investment for green innovation. Moreover, compared with non-state-owned enterprises, state-owned enterprises pay more attention to environmental and social benefits so that they have higher enthusiasm for environmental activities like green innovation. In addition, the government has listed state-owned enterprises as the key objects of deleveraging and even incorporated deleveraging into their performance appraisal. Hence, we speculate that the impact of deleveraging policy on green innovation has a stronger positive role in state-owned enterprises.

Based on the above analysis, we construct interaction term variables of

Taking the industry characteristics into account, the manufacturing industry is widely classified, and the investment and R&D capacity of manufacturing industries for green innovation also differentiate. Among those manufacturing industries, technology-intensive enterprises belong to the high-tech industrial sector. With a large proportion of knowledge and technology, technology-intensive enterprises mainly rely on advanced technology for production activities. Moreover, accompanied by the rapid renewal of products, technology-intensive enterprises need to constantly develop new products to adapt to the fierce competitive environment. Therefore, compared with other types of enterprises, technology-intensive enterprises have a greater preference for green innovation activities. Moreover, technology-intensive enterprises have the advantages of technology and talents, lower cost, and higher success rate. Thus, our paper speculates that, after the implementation of the deleveraging policy, the promotion of enterprise green innovation has a more obvious impact on technology-intensive enterprises.

To confirm the above inference, we construct an interaction term variable of

Taking financial development into consideration, compared with underdeveloped regions, the financial systems in financially developed regions are generally more advanced, which provides much wider financial channels and options for enterprises (Muganyi et al., 2022). Meanwhile, financial institutions like banks usually have a stronger regulatory capacity, which effectively improves the efficiency of enterprise resource allocation and further promotes the conduct of productive activities. In addition, the asymmetric information problems in financially developed regions are relatively less serious, effectively reducing enterprise financing costs and easing their financing constraints. Hence, we expect that, after the implementation of the deleveraging policy, enterprises in regions with more developed financial markets can make full use of the advantages of developed financial market and continuously provide sufficient funds for enterprise green innovation. The effect of the deleveraging policy in promoting enterprise green innovation is much greater.

Following the above analysis, our paper constructs an interaction term of

Apart from the direct effect of the deleveraging policy on enterprise green innovation, our previous theoretical analysis indicates that, on the one hand, the deleveraging policy can reduce enterprise debts and increase equity financing, so as to ease financing constraints and provide stable funds for enterprise green innovation. On the other hand, the deleveraging policy could also strengthen the supervision and management of major shareholders on enterprise operation and further inhibit managers’ opportunistic behavior, promoting the steady development of green innovation activities. On this basis, our paper carries out the following tests to examine whether hypothesis 1 and hypothesis 2 in our paper are true or not.

Our paper first tests whether the deleveraging policy can improve enterprise green innovation by promoting equity financing and further easing enterprise financing constraints. Referring to the present research (Zhou et al., 2020), we select the change rate of owner’s equity

Based on model (1), model (3) adds the interaction term

The result is shown in column 1 of Table 8. It can be seen that

To examine if the deleveraging policy can promote enterprise green innovation by strengthening internal supervision, our paper uses the shareholding ratio of the top five shareholders (

Based on model (1), model (4) adds the interaction term

It is worth noting that excessive equity concentration of shareholders may lead to single investment of enterprises and avoidance of high-risk activities (Chen et al., 2014). Controlling shareholders will tend to extract private benefits and pursue personal and political agendas, which cannot create economic benefits to enterprises (Chen et al., 2011). Thus, we also use the proportion of the largest shareholder (

Taking the Opinions on Actively and Steadily Reducing Enterprise Leverage issued by the State Council of China in 2016 as the natural exogenous shock, our paper constructs a DID model to investigate the impact of deleveraging policy on enterprise green innovation by using the panel data of listed manufacturing companies from 2010 to 2019. We find that, after the implementation of the OASREL, the deleveraging policy has steadily improved enterprise green innovation, which has passed a series of robustness tests. Furthermore, the results of heterogeneity analysis indicate that the deleveraging policy can promote the applications of green invention patent to a greater extent and has a greater effect on green innovation in state-owned enterprises, large-scale enterprises, technology-intensive enterprises, and enterprises in financially developed regions. Finally, the mechanism test proves that the deleveraging policy can not only ease enterprise financing constraints to provide sufficient funds for enterprise green innovation but also strengthen the supervision of major shareholders to ensure the stable development of enterprise green innovation.

Based on the above conclusions, our paper draws the following enlightenments. Firstly, as an important means to prevent economic risks of enterprises, the deleveraging policy improves enterprise green innovation by forcing enterprises to optimize their capital structure, which verifies the rationality of existing deleveraging policy from the perspective of sustainable development. Secondly, the deleveraging policy improves enterprise innovation by promoting equity financing. Thus, the government should lower the threshold for enterprise equity financing and continuously support enterprise to develop equity financing through various means like debt to equity swap and private placement. Finally, according to the results of heterogeneity analysis, as green innovation has high risk and needs sufficient funds, the government is supposed to reduce excessive intervention in resource allocation and improve the fairness of competitive environment to alleviate enterprises’ dilemma of resource acquisition. In addition, enterprises should focus on their knowledge accumulation and technology development to promote their competitiveness.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

DS curated the data and performed the methodology. WH conceptualized the research idea and was responsible for project supervision and funding acquisition. DS and WH were involved in formal analysis, wrote the original draft, and reviewed and edited the paper.

This work was supported by the National Natural Science Foundation of China (Grant No. 72003079), the Humanities and Social Sciences Research of the Ministry of Education of China (Grant No. 18YJC790041), and the Natural Science Foundation of Jiangsu Province (Grant No. BK20190775).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The authors sincerely thank the editor and reviewers for valuable comments and suggestions.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.864335/full#supplementary-material

Amore, M. D., and Bennedsen, M. (2015). Corporate Governance and green Innovation. J. Environ. Econ. Manag. 75, 54–72. doi:10.1016/j.jeem.2015.11.003

Amore, M. D., and Bennedsen, M. (2016). Corporate Governance and green Innovation. J. Environ. Econ. Manag. 75 (C), 54–72. doi:10.1016/j.jeem.2015.11.003

Armstrong, C. S., Guay, W. R., and Weber, J. P. (2010). The Role of Information and Financial Reporting in Corporate Governance and Contracting. J. Account. Econ., Vol 50, Issues 2–3, Pages 179–234. doi:10.1016/j.jacceco.2010.10.001

Bartoloni, E. (2013). Capital Structure and Innovation: Causality and Determinants. Empirica 40, 111–151. doi:10.1007/s10663-011-9179-y

Beck, T., and Levine, R. (2004). Stock Markets, Banks and Growth: Panel Evidence. J. Bank. Financ. 28, 423–442. doi:10.1016/S0378-4266(02)00408-9

Bertrand, M., and Mullainathan, S. (1999). Is There Discretion in Wage Setting? A Test Using Takeover Legislation. RAND J. Econ. 30 (3), 535–554. doi:10.2307/2556062

Brown, J. R., Martinsson, G., and Petersen, B. C. (2013). Law, Stock Markets, and Innovation. J. Finance 68, 1512–1529. doi:10.1111/jofi.12040

Brown, J. R., Martinsson, G., and Petersen, B. C. (2012). Do financing Constraints Matter for R&D? Eur. Econ. Rev. 56 (8), 1512–1529. doi:10.1016/j.euroecorev.2012.07.007

Brown, J. R., Martinsson, G., and Petersen, B. C. (2017). Stock Markets, Credit Markets, and Technology-Led Growth. J. Financial Intermediation 32, 45–59. doi:10.1016/j.jfi.2016.07.002

Brusoni, S., and Prencipe, A. (2013). The Organization of Innovation in Ecosystems: Problem Framing, Problem Solving, and Patterns of Coupling. Adv. Strateg. Manag. 30 (1), 167–194. doi:10.1108/S0742-3322(2013)0000030009

Cai, J., and Zhang, Z. (2011) Leverage Change, Debt Overhang, and Stock Prices. Journal of Corporate Finance, Vol 17, Issue 3, Pages 391–402. doi:10.1016/j.jcorpfin.2010.12.003

Cecchetti, S., and Kharroubi, E. (2012) Reassessing the Impact of Finance on Growth. BIS Working Papers,

Chen, V. Z., Li, J., and Shapiro, D. M. (2011). Are OECD-Prescribed "good Corporate Governance Practices" Really Good in an Emerging Economy? Asia Pac. J. Manag. 28 (1), 115–138. doi:10.1007/s10490-010-9206-8

Chen, V. Z., Li, J., Shapiro, D. M., and Zhang, X. (2014). Ownership Structure and Innovation: An Emerging Market Perspective. Asia Pac. J. Manag. 31 (1), 1–24. doi:10.1007/s10490-013-9357-5

Chen, Y.-S., Lai, S.-B., and Wen, C.-T. (2006). The Influence of green Innovation Performance on Corporate Advantage in Taiwan. J. Bus. Ethics 67, 331–339. doi:10.1007/s10551-006-

Czarnitzki, D., and Hottenrott, H. (2011). R&D Investment and Financing Constraints of Small and Medium-Sized Firms. Small Bus Econ. 36, 65–83. doi:10.1007/s11187-009-9189-3

Deng, Y. L., You, D. M., and Wang, J. J. (2021). Research on the Nonlinear Mechanism Underlying the Effect of Tax Competition on green Technology Innovation - an Analysis Based on the Dynamic Spatial Durbin Model and the Threshold Panel Model. Resour. Pol. Vol. 76.102545. doi:10.1016/j.resourpol.2021.102545

Eleonora Bartoloni (2013). Capital Structure and Innovation: Causality and Determinants. Empirica Vol 40 (Issue 1), 111–151. doi:10.1007/s10663-011-9179-y

Hall, B. H. (2002). The Financing of Research and Development. Oxford Rev. Econ. Pol. 18 (1), 35–51. doi:10.1093/oxrep/18.1.35

Han, C., Chen, Z., and Wang, Z. (2020). Study on the Mechanism of Firm’s Pollution Reduction under the Constraints of Energy-Saving Target. China Ind. Econ. 10, 43–61. Chinese. doi:10.19581/j.cnki.ciejournal

Henrik, C., and Mattias, N. (2005). The Choice between Rights Offerings and Private Equity Placements. J. Financial Econ. Vol 78 (Issue 2), 375–407. November 2005. doi:10.1016/j.jfineco.2004.12.002

Horbach, J., Rammer, C., and Rennings, K. (2012). Determinants of Eco-Innovations by Type of Environmental Impact - the Role of Regulatory Push/pull, Technology Push and Market Pull. Ecol. Econ. 78, 112–122. doi:10.1016/j.ecolecon.2012.04.005

Hoskisson, R. E., Hitt, M. A., Johnson, R. A., and Grossman, W. (2002). Conflicting Voices: The Effects of Institutional Ownership Heterogeneity and Internal Governance on Corporate Innovation Strategies. Acad. Manage. J. 45 (4), 697–716. doi:10.5465/3069305

Hsu, P.-H., Tian, X., and Xu, Y. (2014). Financial Development and Innovation: Cross-Country Evidence. J. Financial Econ. 112 (1), 116–135. doi:10.1016/j.jfineco.2013.12.002

Huang, J. W., and Li, Y. H. (2015). Green Innovation and Performance: The View of Organizational Capability and Social Reciprocity. Journal of Business Ethics, 145(2)309–324. doi:10.1007/s10551-015-2903-y

Jens, H. (2008). Determinants of Environmental Innovation—New Evidence from German Panel Data Sources. Res. Pol. 37 (1), 163–173. doi:10.1016/j.respol.2007.08.006

Laeven, L., and Valencia, F. (2012). The Use of Blanket Guarantees in Banking Crises. J. Int. Money Finance 31 (Issue 5), 1220–1248. doi:10.1016/j.jimonfin.2012.01.014

Levine, R. (2005) Finance and Growth: Theory and Evidence. Handbook of Economic Growth. Edition 1, Volume 1, Chapter 12, Pages 865–934

Levine, R., Loayza, N., and Beck, T. (2000). Financial Intermediation and Growth: Causality and Causes. J. Monetary Econ. 46, 31–77. doi:10.1016/S0304-3932(00)00017-9

Li, D., Zheng, M., Cao, C., Chen, X., Ren, S., and Huang, M. (2017). The Impact of Legitimacy Pressure and Corporate Profitability on green Innovation: Evidence from China Top 100. J. Clean. Prod. 141, 41–49. doi:10.1016/j.jclepro.2016.08.123

Li, G., Wang, X., Su, S., and Su, Y. (2019). How green Technological Innovation Ability Influences enterprise Competitiveness. Tech. Soc. 59, 101136. doi:10.1016/j.techsoc.2019.04.012

Lindman, S., and Sderholm, P. (2015). Wind Energy and green Economy in Europe: Measuring Policy-Induced Innovation Using Patent Data. Appl. Energ. 179, 1351–1359. doi:10.1016/j.apenergy.2015.10.128

Liu, X. P., and Zhang, X. L. (2021). Industrial Agglomeration, Technological Innovation and Carbon Productivity: Evidence from China. Res. Cons Rec. Vol. 166.105330. doi:10.1016/j.resconrec.2020.105330

Malen, J., and Marcus, A. A. (2019). Environmental Externalities and Weak Appropriability: Influences on Firm Pollution Reduction Technology Development. Business Soc. 58, 1599–1633. doi:10.1177/0007650317701679

Montmartin, B., and Herrera, M. (2015). Internal and External Effects of R&D Subsidies and Fiscal Incentives: Empirical Evidence Using Spatial Dynamic Panel Models. Res. Pol. 44, 1065–1079. doi:10.1016/j.respol.2014.11.013

Morellec, E., Nikolov, B., and Schürhoff, N. (2012) Orporate Governance and Capital Structure Dynamics. J. Finance 67(3) : 803–848. doi:10.1111/j.1540-6261.2012.01735.x

Muganyi, T., Yan, L., Yin, Y., Sun, H. P., Sun, H., Gong, X., et al. (2022). Fintech, Regtech, and Financial Development: Evidence from China. Financ. Innov. 8, 29. doi:10.1186/s40854-021-00313-6

Müller, Elisabeth., and Zimmermann, Volker. (2009). The Importance of Equity Finance for R&D Activity. Small Business Economics Volume 33,. Issue 3, 2009303–2009318. doi:10.1007/s11187-008-9098-x

Qi, H. D., Liu, H., and Zhu, W. (2018) Research on Deleveraging Performance of Over-indebted Enterprises. Accounting Research, (12),3–11.

Qin, H. L., and Gao, Y. W. (2020) Would the Deleveraging Policy Affect the Confidence of Investors? Economic Review (01) (In Chinese) doi:10.19361/j.er.2020.01.02

Reinhart, C. M., and Rogoff, K. S. (2010). Growth in a Time of Debt. Am. Econ. Rev. 100 (2), 573–578. doi:10.1257/aer.100.2.573

Schularick, M., and Taylor, A. M. (2012). Credit Booms Gone Bust:Monetary Policy,Leverage Cycles,and Financial Crises. American Econ. Rev. 102 (2), 18701029–20081061. doi:10.1257/aer.102.2.1029

Shao, S., Hu, Z., Cao, J., Yang, L., and Guan, D. (2020). Environmental Regulation and Enterprise Innovation: A Review. Bus Strat Env 29, 1465–1478. doi:10.1002/bse.2446

Song, W., and Yu, H. (2017). Green Innovation Strategy and green Innovation: The Roles of green Creativity and green Organizational Identity. Corp. Soc. Responsib. Environ. Mgmt. 25 (2), 135–150. doi:10.1002/csr.1445

Sun, H., Edziah, B. K., Kporsu, A. K., Sarkodie, S. A., and Taghizadeh-Hesary, F. (2021). Energy Efficiency: the Role of Technological Innovation and Knowledge Spillover. Technol. Forecast. Soc. Change, 120659. doi:10.1016/j.techfore.2021.120659

Tong, T. W., He, W., He, Z.-L., and Lu, J. (2014). Patent Regime Shift and Firm Innovation: Evidence from the Second Amendment to China's Patent Law. Amproc 2014, 14174. doi:10.5465/ambpp.2014.14174abstract

Wang, Q., Qu, J., Wang, B., Wang, P., and Yang, T. (2019). Green Technology Innovation Development in China in 1990-2015. Sci. Total Environ. 696, 134008. doi:10.1016/j.scitotenv.2019.134008

Wang, X., and Chu, X. (2019). A Study of green Technology Innovation and Financing Contracts Arrangement in Manufacturing Industry. Stud. Sci. Sci. 37 (02), 351–361. In Chinese. doi:10.16192/j.cnki.1003-2053.2019.02.021

Wu, H., Xu, L., Ren, S., Hao, Y., and Yan, G. (2020a). How Do Energy Consumption and Environmental Regulation Affect Carbon Emissions in China? New Evidence from a Dynamic Threshold Panel Model. Resour. Pol. 67, 101678. doi:10.1016/j.resourpol.2020.101678

Wu, W., Liang, Z., and Zhang, Q. (2020b). Effects of Corporate Environmental Responsibility Strength and Concern on Innovation Performance: The Moderating Role of Firm Visibility. Corp Soc. Responsibility Env 27 (3), 1487–1497. doi:10.1002/csr.1902

Wu, J., Xia, Q., and Li, Z. Y. (2022). Green Innovation and Enterprise Green Total Factor Productivity at a Micro Level: A Perspective of Technical Distance. J. Clean. Prod. 344, 131070. doi:10.1016/j.jclepro.2022.131070

Xia, L., Gao, S., Wei, J. C., and Ding, Q. Y. (2021). Government Subsidy and Corporate green Innovation - Does Board Governance Play a Role? Energy Policy Vol 161, 112720. doi:10.1016/j.enpol.2021.112720

Xiang, X. J., Liu, C., and Yang, M. (2021). Who Is Financing Corporate green Innovation? Int. Rev. Econ. Finance Vol 78, 321–337. doi:10.1016/j.iref.2021.12.011

Xiao, Z. P. (2006). A Test of the Free Cash Folw and Debt Control Hypothesis—Empirical Evidence from Audit Fees of Chinese Listed Companies. Business Manag. J. 06, 10.19616/j.cnki.bmj.2006.06.006.

Yang, B., Chou, H.-I., and Zhao, J. (2020). Innovation or Dividend Payout: Evidence from China. Int. Rev. Econ. Finance 68, 180–203. doi:10.1016/j.iref.2020.03.008

Zhang, Y. M., Li, X. L., and Xing, C. (2020). How Does China's green Credit Policy Affect the green Innovation of High Polluting Enterprises? the Perspective of Radical and Incremental Innovations. J. Clean. Prod. Vol 336, 130387. doi:10.1016/j.jclepro.2022.130387

Zhao, J., Jiang, Q., Dong, X., and Dong, K. (2020). Would Environmental Regulation Improve the Greenhouse Gas Benefits of Natural Gas Use? A Chinese Case Study. Energy Economy 87, 104712. doi:10.1016/j.eneco.2020.104712

Zhou, M. L., Chen, F. L., and Chen, Z. F. (2021). Can CEO Education Promote Environmental Innovation: Evidence from Chinese Enterprises. J. Clean. Prod. Vol. 297.126725. doi:10.1016/j.jclepro.2021.126725

Keywords: deleveraging policy, green innovation, difference-in-differences model, mechanism analysis, heterogeneity

Citation: Shen D and He W (2022) Research on the Impact of Deleveraging Policy on Enterprise Green Innovation: An Empirical Study in China. Front. Environ. Sci. 10:864335. doi: 10.3389/fenvs.2022.864335

Received: 28 January 2022; Accepted: 15 February 2022;

Published: 11 March 2022.

Edited by:

Huaping Sun, Jiangsu University, ChinaReviewed by:

Zhengjie Chen, Nanjing University, ChinaCopyright © 2022 Shen and He. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wenjian He, aGV3ZW5qaWFuQDEyNi5jb20=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.