94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 13 May 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.860942

This article is part of the Research Topic Wind and Solar Energy Sources: Policy, Economics, and Impacts on Environmental Quality View all 8 articles

This paper aims to examine the asymmetric impact of oil price shocks on environmental degradation for a panel of six Gulf Cooperation Council (GCC) countries from 1996 to 2016. We use the dynamic seemingly unrelated regressions (DSUR) approach that considers cross-sectional dependency to reveal the interrelations between oil price shocks and carbon dioxide (CO2) emissions. The finding shows that the positive shocks of oil prices have a statistically significant negative effect on CO2 emissions, while negative shocks of oil prices did not affect CO2 emissions. More specifically, the positive oil price shocks have negatively influenced the CO2 emissions in Oman, Bahrain, Saudi Arabia, Qatar, and United Emirates Arab. In turn, the most negative effect is found in Qatar and Saudi Arabia. Meanwhile, the negative shocks of oil prices have statistically significant effects on the CO2 emission of Oman and Saudi Arabia. While for other countries, it does not have a significant impact. Also, the results support an environmental Kuznets curve in Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates; in contrast, the hypothesis was rejected in Bahrain and Oman. This study could help policymakers adopt renewable energy policies and use energy-saving technologies to sustain economic development and improve environmental quality.

Environmental degradation is well-known as a result of the dynamic interaction between social, institutional, technological, and economic, especially fluctuations in energy prices (Al-Mulali et al., 2016; Munir et al., 2019; Li et al., 2020; Malik et al., 2020). Environmental degradation is a worldwide issue in which carbon dioxide (CO2) emissions are a significant cause of global temperature increase (Usman et al., 2020; Anser et al., 2021). CO2 has been used consistently as an indication of environmental degradation, with implications for air pollution, global warming and is responsible for climate change (Abokyi et al., 2019; Bayoumi and Fernandez, 2019; Charfeddine and Kahia, 2019; Ehigiamusoe and Lean, 2019; Ehigiamusoe et al., 2020; Usman et al., 2020). CO2 is produced by burning solid fossil fuel waste, tree and wood products, and chemical reactions (Waqih et al., 2019). It is one of the most significant greenhouse gases that accounts for about 80% of global greenhouse gas emissions in the world (Li et al., 2020). This rise in CO2 levels has resulted in environmental degradation such as erratic precipitation, depletion of the ozone layer, and biodiversity loss (Agbanike et al., 2019; Ahmed et al., 2020; Ali et al., 2020; Ari and Sentürk, 2020). As a result, CO2 emissions have been included in this study as an indicator of the environmental degradation that may result from oil price shocks, especially in the Gulf Cooperation Council (GCC), which depends heavily on non-renewable sources such as oil (Haque, 2020).

Oil prices are viewed as a major contributor to increased economic growth and energy consumption at the expense of environmental quality in the literature (Agbanike et al., 2019; Murshed and Tanha, 2019; Ullah et al., 2020). Because of the challenges of environmental quality and climate change, oil price shocks continue to be a major source of concern for policymakers (Ullah et al., 2020). CO2 emissions (He and Richard, 2010; Hammoudeh et al., 2014), air pollution (Chen and Lin, 2015), environmental degradation (Saboori et al., 2016), promoting energy substitution (Ullah et al., 2020), and energy consumption are all likely to be affected by oil price shocks in the positive and negative parts (Agbanike et al., 2019).

Numerous studies concentrate on the relationship between oil price and macroeconomic indicators (Hammoudeh et al., 2014; Tan et al., 2014; Apergis and Payne, 2015; Hammoudeh et al., 2015). Oil price fluctuates from time to time, and sometimes this fluctuation comes with shocks. Oil price shocks are formally defined as a change in oil price relative to the price of oil that consumers and companies have expected. In other words, it unexpected component of the oil price (Kilian and Stock, 2015). Oil price shocks are the most effective tool for managing resource allocation, investment and risk management, reducing the use of fossil fuels, energy conservation, and CO2 emissions (Lean et al., 2015; Dong et al., 2017; Ullah et al., 2020).

Furthermore, positive and negative oil price shocks are likely to raise or decrease CO2 emissions (Hammoudeh et al., 2014; Chai et al., 2016; Shahbaz et al., 2017; Malik et al., 2020). Higher oil prices, for example, could lower CO2 emissions, according to the research (He and Richard, 2010; Zaghdoudi, 2017). Low oil prices may have resulted in greater usage of fossil fuels, which has exacerbated their negative effects on the environment by increasing CO2 emissions. (Wang and Li, 2016; Maji et al., 2017; Agbanike et al., 2019). Detrimental oil price shocks, according to Ullah et al. (2020), may have a negative impact on economic growth and maintain dirty environments in carbon emitters. Oil price shocks, in other words, may have asymmetric effects on CO2 emissions (Constantinos et al., 2019; Apergis and Gangopadhyay, 2020; Ullah et al., 2020). Oil price shocks are an important variable because changes in energy costs can have a significant impact on pollution and CO2 emissions (Al-Mulali et al., 2016; Ullah et al., 2020). As a result, while making environmental decisions to achieve sustainable development, a policy framework is essential. Understanding how oil price shocks affect CO2 emissions in the GCC is critical for long-term economic development (GCC).

The relationship between oil price shocks and CO2 emission has grabbed much attention from policymakers and researchers, where the focus is to reduce CO2 emissions without affecting economic growth. Also, the intention to move towards the positive and negative shocks of oil prices has become imperative for environmental quality. Meanwhile, governments, market participants, and policymakers pay close attention to how oil price shocks affect the environment by raising CO2 emissions (Murshed and Tanha, 2019; Ullah et al., 2020). On the other hand, to minimize the impact of positive and negative oil price shocks on environmental pollution or CO2 emissions (Apergis, and Gangopadhyay, 2020), the use of clean and renewable energy sources has been urged (Wang et al., 2019). As a result, looking at the links between oil prices and environmental deterioration (for example, CO2 emissions) can reveal significant behavioral biases in energy policy-making. Therefore, the symmetric effects of oil price shocks on CO2 emissions must be re-examined.

Oil prices can drop dramatically in a matter of days, causing damage to any production or financing plans that rely on oil earnings in countries that rely on oil revenues. As a result, economic activities and growth may be affected. According to the Environmental Kuznets Curve (EKC) theory, economic expansion has a significant impact on pollution levels (Kuznets, 1955). As a result, the two most essential engines of economic activity are the price of oil and pricing margins. Oil waste, on the other hand, is a consequence of consumption and is an important pollutant in the environment. As a result, understanding how oil price shocks influence the environment is critical.

Policymakers and scholars have focused their attention on the relationship between oil price shocks and carbon emissions, intending to reduce CO2 without affecting economic growth (Maji et al., 2017; Agbanike et al., 2019; Ullah et al., 2020). Oil price shocks and their impact on CO2 emissions are a fascinating topic that needs to be investigated, particularly in light of the two extreme situations seen in the last decade, namely the peak in oil prices in 2008 and the ongoing drop in crude oil prices since 2014. (Constantinos et al., 2019). This study focuses on GCC-6 countries of Oman, Kuwait, Bahrain, UAE, Bahrain, Saudi Arabia, and Qatar as it is at the forefront of this problem. GCC-6 countries account for approximately 30% of the total crude oil reserves of the world (Haque, 2020) but provide about 33% of global primary energy consumption (IEA 2019). This implies that changes in oil prices will have significant effects on the environment.

For example, the Kingdom of Saudi Arabia is the ninth-largest CO2 emitter in the Arab Gulf region, with 601,046 tonnes produced annually at a rate of 5.2 per cent (World Bank, 2016). Kuwait has some of the highest CO2 emissions in the world (International Energy Agency, 2005), with CO2 emissions per capita reaching 23.91 metric tonnes in 2018. (World Data Atlas, 2018). With CO2 emissions of 218, 788, 684 tonnes in 2015 and an annual change of +4.43 per cent, the UAE ranks among the world’s greatest per capita emissions from fossil fuel burning (Global Benchmarks, 2016). Such variations in CO2 emissions are one of the most difficult dangers to the environment in the GCC region, which is causing environmental damage. Therefore, we consider these countries as an appropriate sample based on their significant share of CO2 emissions.

Oil-exporting countries, such as the GCC, rely largely on revenue from oil exports. As a result, the low price of oil has an impact on many elements of life in these countries, particularly economic activities and investment plans. Given oil price fluctuations have an impact on output, it is logical to expect them to have an impact on real GDP (Bergmann, 2019; Naseer et al., 2016). Venezuela is an outstanding example of the significance of negative oil price shocks to countries that rely on oil exports as their principal source of revenue over the previous 5 years. Oil price shocks also have an impact on environmental pollution, as oil production and consumption activities are among the most significant polluters in the environment (Bruvoll and Medin, 2003). Furthermore, it is widely acknowledged that rising oil costs may compel countries to lower their energy consumption (Al-Mulali et al., 2016; Agbanike et al., 2019; Haque, 2020). As a result of the rise in energy prices, less energy will be consumed, resulting in lower CO2 emissions (Al-Mulali et al., 2016; Li et al., 2020; Malik et al., 2020).

In the context of GCC-6 countries, this study poses the following research questions based on the previous discussion: Is it true that the EKC hypothesis holds in GCC? Is there a link between oil price shocks and environmental degradation? Do negative and positive oil price shocks affect CO2 emissions? Aside from the theoretical foundation for the EKC, the hypothesis intuitively assumes a direct and explicit relationship between production and CO2 emission. Apart from a few recent attempts, Boufateh (2019), noticed the absence of the oil price element as a common feature of all publications on the EKC theory. The author suggested that adding more variables to the EKC hypothesis should be justified in such a way that the new variables reflect shock transmission pathways from production to CO2 emissions, or at the very least proxies which are designed to take the place of these variables to guarantee that there is no endogeneity issue.

As a result, the aim is to test the EKC hypothesis and to study the implications of asymmetric oil price shocks on the verification of this hypothesis and on per capita CO2 emission in the GCC. To begin, we used oil prices shocks (both negative and positive) to examine their impact on GCC carbon emissions, which is a novel contribution. However, the literature on the oil price shocks (both positive and negative shocks) and CO2 emissions in GCC is limited. Within the existing GCC literature, support for the EKC hypothesis is still disputed in the case of Pakistan (Al-Mulali et al., 2016; Haque, 2020). Second, we have extended earlier research such as Al-Mulali and Ozturk (2016) and Haque (2020) by excluding energy consumption from our model to avoid biassing our findings, resulting in a more definitive EKC hypothesis and negative and positive oil price shocks as determinants of CO2 emission in GCC.

Thirdly, this study selects 6 GCC countries, based on data availability, to investigate a gap in the empirical literature about the influence of oil price shocks (both positive and negative shocks) on CO2 emissions in the GCC region using data from 1996 to 2016. Lastly, we have used a dynamic seemingly unrelated regression (DSUR) technique which assumes the long-term cross-sectional dependency (Pesaran, 2007) across the sample countries to examine the relationship between the variable of the study to assess how positive and negative price shocks impact CO2 emission in the case of GCC. Shortly, this model has the advantage of being able to the knowledge of researchers’ and academicians’ expertise eager to employ panel data analysis and to overcome the contemporaneous correlation in the data. Also, we have been argued that linear ARDL and DOLS estimates methodology to explore the symmetric long-run relationship between the oil price shocks on CO2 emissions.

Our empirical results confirm positive shocks of oil prices have a statistically significant negative effect on CO2 emissions. Furthermore, they also confirm the presence of the EKC hypothesis in the selected GCC countries. Therefore, the findings of this study will make it possible for policymakers to better assimilate the predictive power of oil prices shocks (both negative and positive) price on CO2 emissions in GCC. As a result, the GCC countries will be able to devise strategies to mitigate the effects of rising and falling oil prices on CO2 emissions. The association between price shocks and CO2 emissions will be used by governments to develop a risk management approach for dealing with energy price volatility. It would also make it easier to develop environmental policies and programs that address oil price volatility and a greater emphasis on clean economic growth, which might be more effective for environmental sustainability, government budget protection, and achieving stability. It would also help politicians establish suitable energy price policies and pay close attention to its leveraging effects, which would help GCC countries decrease environmental challenges and promote energy conservation in the long term.

The remainder section of this paper is structured as follows. Section 2 introduces the literature review of the research. Section 3 provides an overview of the GCC countries’ economies. Section 4 explains the data sources and methodology; Section 5 presents the results, Section 6 displays a discussion, and Section 7 gives the conclusion and policy implications.

A vast literature examines the effects of oil price shocks on different environmental degradation variables for oil-exporting and importing countries. For example, Cashin et al. (2014) argued that oil price shocks, directly and indirectly, affect the environment and ecology of oil-exporting and importing countries. The direct impact is a change in oil production and consumption, and the indirect effect is the shift of shocks through international trade. Wang and Li (2016) found that an increase (decrease) in oil prices reduces (increases) carbon intensity. Using the panel cointegration methodology (panel FMOLS and DOLS), Zaghdoudi (2017) discovered that oil prices have a statistically significant effect on CO2 emission in the OECD countries. Constantinos et al. (2019) examined the relationship between crude oil prices and the volume of carbon emissions. The findings revealed that a rise or decrease in crude oil prices causes an asymmetric decline. This result is only applicable in the long term, as inelastic demand for crude oil may not translate to a reduction in carbon emissions in the short term.

In the short run, asymmetric effects are confirmed, running only from carbon emissions to crude oil prices. Boufateh (2019) realized that oil price shocks affect CO2 emissions differently in China and the United States by applying the nonlinear ARDL approach. The results showed that positive and negative changes in crude oil prices have an impact on CO2 emissions. Li et al. (2020) uncovered symmetric impacts of energy prices on CO2 emissions in China. After controlling for other economic and energy market parameters as well as regional correlations of these variables, the results demonstrate that energy pricing has a considerable negative impact on China’s CO2 emissions. Likewise, the influence of low and high oil prices on CO2 emissions in China was studied by Bilgili et al. (2020). This study confirmed previous findings that oil prices have a negative impact on CO2 emissions from 1960 to 2014. Ullah et al. (2020) found that the positive and negative changes in oil prices affect carbon emissions differently in the top ten carbon emitters countries in the short and long run. In a recent study, Umar et al. (2020) revealed that a 1% increase in energy price leads to a 0.02% decrease in carbon emission in 13 African nations.

Some studies examine the effects of oil price shocks on CO2 emissions in oil-exporting countries. For example, He and Richard (2010) retrieved that oil prices have negative effects on CO2 emissions in Canada. Payne (2012) indicated a significant long-term negative impact of oil prices on carbon dioxide emissions in the United States. Hammoudeh et al. (2014) found that positive oil price shocks have a negative impact on CO2 emissions. Saboori et al. (2016) found evidence of the favorable effects of high oil prices on the environment in the context of OPEC countries. To put it another way, an increase in oil prices in exporting countries will drive their citizens to seek higher environmental quality. Maji et al. (2017) noticed that lower oil prices can increase carbon emissions and reduce environmental quality in Malaysia. Nwani (2017) showed that higher crude oil prices create economic conditions that generate more energy consumption and CO2 emissions in Ecuador. Agbanike et al. (2019) discovered that rising crude oil prices increase energy consumption, government consumption expenditure, and energy consumption all result in CO2 emissions, which have a detrimental impact on economic growth in Venezuela’s oil-rich economy.

As for oil-importing countries, some studies examine the effects of oil price shocks on CO2 emissions in oil-importing countries. Balaguer and Cantavella (2015) found that oil prices have negative effects on CO2 emissions in Spain. Using the ARDL model, Abumunshar et al. (2020) investigated the causal relationship between oil price and Turkey’s carbon emissions. The ARDL long-run coefficients revealed that oil prices had a long-term negative impact on CO2 emissions in Turkey. In addition, the findings show that nonrenewable energy, such as oil, natural gas, and coal, increased CO2 emissions. Jiao et al. (2021), reveal higher oil prices and income inequality helped reduce carbon emissions in India using the NARDL technique in the long run from 1980 to 2018. Among the other important determinants of CO2 emissions, Murshed (2020) discovered that higher crude oil prices reduce CO2 emissions. A rise in the real price of crude oil reduces 0.16–0.44%, on average, ceteris paribus. This could be attributed to higher oil costs lowering demand and the usage of crude oil, resulting in lower CO2 emissions across selected South Asian economies: Bangladesh, Pakistan, India, Nepal, Sri Lanka, and the Maldives. Similarly, Murshed (2021) discovered that while liquefied petroleum gas (LPG) is a fossil fuel, it is a cleaner fuel than typically consumed fossil fuels like crude oil and coal, which helps to cut CO2 emissions in South Asian countries. Apergis and Gangopadhyay (2020) attained that long-term relationships between pollution, energy use, and oil prices have been characterized by nonlinear and asymmetric linkages to indicate hidden co-complementarity. Malik et al. (2020) observed that an oil price increase will increase CO2 emissions in the short run while reducing emissions in the long run in Pakistan. Li et al. (2020) found symmetric impacts of energy prices on CO2 emissions in China.

Contrary to the expectations, some empirical studies showed that an enhancement (decline) in oil price has a positive (negative) impact on CO2 emissions. Mensah et al. (2019) analyzed the effect of fossil fuel energy use, economic growth, and CO2 emissions. They found the unidirectional causality from oil price to CO2 emissions. Chaudhry et al. (2020) located that a decrease in oil price significantly affects environmental degradation in Pakistan. Lin and Jia (2019) obtained that higher energy price leads to a higher reduction of CO2 emissions. Zhang et al. (2019) demonstrated that energy price contributes to a decrease in CO2 emissions in China. Wang et al. (2019) revealed that removing oil price distortion will reduce CO2 emissions of China’s transport sector by 599 million tons in the studying period. Gbatu et al. (2019) investigated the short-and-long-run associations between CO2 emissions and Liberia’s key macroeconomic variables. According to ARDL and DOLS estimates, the results show a significant positive impact of oil price on CO2 emissions in the long run. Mahmood et al. (2020) indicated a positive asymmetric impact of oil income share on CO2 emissions in Saudi Arabia.

In terms of the GCC countries, most studies focus on examining the relationship between oil prices and the real GDP and energy consumption (see, for example, Nusair, 2016; Nasir et al., 2019; Haque, 2020). Only a few studies examine the relationship between oil price shocks and CO2 emissions in the GCC countries or are limited to individual country studies. For example, Alshehry and Belloumi (2015) explored oil prices on GDP growth and CO2 for Saudi Arabia. They find out that an upward trend in oil prices increases oil usage and deteriorates the environment by emitting more carbon emissions. However, focusing on single countries did not consider the shocks in oil prices (positive and negative). The results of this study are expected to encourage further studies on the potential relationship between oil price shocks and CO2 emissions in all GCC countries.

In the recent research, Haque (2020) examined the nexus among changes in GDP per capita, crude oil price shocks, carbon emissions, trade, and population in GCC countries from 1985–to 2014. The author found that oil price shocks negatively affect energy consumption, while the higher the energy consumption would increase CO2 emissions. Mohammed et al. (2022) argued that oil is a major source of income and exports in the GCC countries, but it is pollution-oriented and accelerates CO2 emissions in production and consumption activities. Aljadani et al. (2021) discovered that whereas oil price strengthens the link between economic growth and environmental quality at the level, quadratic, and cubic levels, oil rent weakens it. Furthermore, in the context of a COVID-19 outbreak, the long-term incidences of positive shocks to oil prices are not similar to the negative shock to CO2 emissions, implying the existence of asymmetric consequences on CO2 emissions in long-term forms. According to this study, an oil price shock could be beneficial to the Saudi economy’s macroeconomic guidance in 2019–2020. Therefore, a study on the relationship between oil price shocks and CO2 emissions lacks in GCC from the reviewed literature. This study will contribute to the existing literature in this area by studying the impact of oil price shocks and CO2 emissions.

The GCC countries rely on economic and financial sources of income. This is because the oil sector accounts for a substantial portion of the government revenues in the GCC economy, and an increase in the oil sector has both direct and indirect effects on pollution emissions. The oil industry exports a lot of pollution as a direct result of its operations. The oil sector helps the economy of the GCC members flourish through exerting indirect influence. As a result of the booming oil sector, GCC governments can spend more on their economies, increasing pollution emissions as a result of the expansionary fiscal policy (Mahmood et al., 2022).

The oil production in these countries is highly interrelated to economic activity, fiscal revenue, export earnings, and foreign exchange (The Economic Outlook and Policy Challenges in the GCC Countries 2017). Hydrocarbon and governmental activities heavily funded by oil revenues account for the majority of total GDP in most GCC countries, which are the oil-exporting countries and rentier state countries. Furthermore, non-governmental sectors (non-oil sectors) often depend on oil. The primary sources of manufacturing value-added in GCC oil exporters include refinery, chemical, and other mining/extractive industries. Most of these activities derive from the oil industry. Concerning the fiscal revenue in the GCC, oil is the primary source of government revenue in most GCC countries. In 2014, the share of oil revenue in total revenue ranged from 24 per cent in Bahrein to 90 per cent in Kuwait, with 77 per cent as the average.

Similarly, regarding exports in all GCC except the UAE, oil is the main export product because it accounts for above 80 per cent of total exports in half of GCC, and above 60 per cent in all of them except the UAE (IMF annual report, 2016). Apart from economic issues in the GCC countries, environmental problems appear to be one of the urgent issues in GCC. Based on the Environmental Performance Index (EPI) index, all six countries occupy the centre. This situation became worse with significant revenues from the high oil price in the last 10 years after toppling Saddam Hussein’s regime in Iraq.

According to the Annual meeting of Arab ministries of finance held in April 2016, the report explains the relationship between oil price and economic growth. It also describes the six countries as countries that heavily depend on oil prices. In these countries, fiscal revenue, economic activity, export earnings, and foreign exchange rely on oil production.

In 2010, while crude oil’s share of the world’s fossil fuel consumption was 38%, the share of coal was 35%, and the share of natural gas was 27% of the total fossil fuel consumption. Thus, crude oil is the most significant demanded fossil fuel globally, and its fluctuations and determinant factors are among the most encouraging topics for energy researchers and economists. One important question arrive here: Do the oil price shocks impact environmental degradation in the short or long term in GCC countries? In addition, if the impact is exciting, is it asymmetric or symmetric or linear or nonlinear, what is its effect on the quality of the environment in the GCC.

To investigate the effect of oil price shocks on environmental degradation, we specify the following empirical model (Abumunshar et al. (2020); Husaini et al., 2021):

where CO2 is CO2 emissions of country i in year t, GDPP and

According to EKC, we expect

To investigate the nonlinear effects of oil price shocks, we follow Shin et al. (2014), Badeeb and Lean (2018), Badeeb et al. (2021) and Husaini and Lean (2021) to decompose the oil price to positive

Two variables

We compile the dependent and explanatory variables dataset for the six GCC countries, i.e., Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates, over 1996 to 2016. We collect the annual data on CO2 emissions (metric tons per capita), and energy consumption per capita (million Btu per Person) from World Development Indicators (2020). We get the data of real GDP per capita from Pen World Table (PWT) version 9.1 and West Texas Intermediate (WTI) (US $ per bb) from the United States Energy Information Administration.

In Figure 1, we display the bilateral relationship between explanatory variables and CO2 emission, all of which are in logs form. In panel A, we present the bilateral relationship between real GDP per capita and CO2 emission per capita and show the estimated line in red colour. The estimated line is

In panels B and C, we present the bilateral relationship between CO2 emission and energy use and CO2 emission and oil prices. We can see that increasing energy use and oil prices will increase the CO2 emission in the GCC countries. In panels D and E, the bilateral relations between CO2 emission and positive components of oil prices and negative components are presented. Thus, there is a positive link between CO2 emission and positive shocks in oil prices and a negative linkage between CO2 emission and negative shocks in oil prices.

We present the descriptive statistics in Table 1. The results of the Jarque-Bera test indicate all variables except positive components of oil prices are distributed non-normally at the 5% significant level. In panel B, we present the bilateral correlation matrix. There is a positive linkage between CO2 emission and all explanatory variables except negative shocks in oil prices. Except for the coefficient of

We apply the second generation of panel data estimators to estimate the regression models 1) and (4). Hence, we follow a four-step estimation strategy. In the first step, we test the null hypothesis of cross-sectional dependence. In the second step, the stochastic properties of variables are tested using the second generation of the panel unit root test, namely Pesaran (2007) panel unit root test. In the third step, existing long-run relationships between variables in Eqs 1, 4 are tested using Westerlund (2007) panel cointegration test, which allows for cross-sectional dependence. Finally, in step four, the long-run relationship among variables in the Eqs 1, 4 are estimated using two first-generation panel data estimators, namely FMOLS and DOLS and the second-panel data dynamic SUR estimator.

Four tests were examined to determine the dependency of cross-sectional panel data variables. These include Breusch and Pagan (1980)’s LM test, Baltagi et al. (2012)’s bias-corrected scaled LM test (BC-LM test), Pesaran (2004)’s scaled LM test (S-LM test), and Pesaran (2004)’s CD test (CD test) as following:

where N, T, and

We apply the Pesaran (2007)’s cross-sectional augmented Dickey-Fuller (CADF) unit root test to examine the stochastic properties of variables in Eqs 1, 4. Suppose the results of unit root tests indicate that all variables are integrated of order 1 (i.e., I(1)). In that case, the long-run relationship among variables should be tested using second generation of panel co-integration tests. In this paper, we test the null hypothesis of no cointegration using the second generation of the tests, namely Westerlund (2007)’s panel co-integration test which is robust to cross-sectional dependence.

Westerlund (2007) developed the following error correction model to test the null hypothesis of no cointegration:

where y and x are dependent and explanatory variables, respectively.

By rejecting the null hypothesis of no cointegration, the long-run relationship among variables in Eqs 1, 4 is estimated by second-generation estimators of panel data, which can control for cross-sectional dependence. In this paper, we estimate the long-run relationship between CO2 emission and explanatory variables in Eqs 1, 4 using DSUR estimator, which was developed by Mark et al. (2005) by taking into account the cross-sectional dependence.

Consider a two-variable regression model with

where y and x are dependent and explanatory variables, h is a number of lag(s) and lead(s) of dependent and explanatory variables. The lag(s) and lead(s) terms are included in the system regression models to control the endogeneity error terms. Mark et al. (2005) developed a two-step procedure to estimate the system Eq. 10. In the first step, the

In Table 2, we offer the test statistics of the Breusch and Pagan (1980)’s LM test, Baltagi et al. (2012)’s bias-corrected scaled LM test (BC-LM test), Pesaran (2004)’s scaled LM test (S-LM test), and Pesaran (2004)’s CD test (CD test). As seen, the test statistics indicate the null hypothesis of no cross-sectional dependence is rejected at a 1% significant level except CD tests for

Pesaran (2007)’s CADF panel unit root test is applied to test the null hypothesis of an existing unit root in the data generating process of the variables. In contrast, three variables

The results of the CADF unit root test indicate three variables

The results of the univariate ADF unit root test in panel B indicate that all three variables oilP, oilP_pos, and oilP_neg are I(1) according to both models with only intercept and intercept and linear trend. With a little condescension, we conclude that all panel data variables and time series variables in the study are I(1). Thus, in the next step, we test the existing long-run relationship between variables in Eqs 1, 4 using Westerlund (2007)’ panel cointegration test.

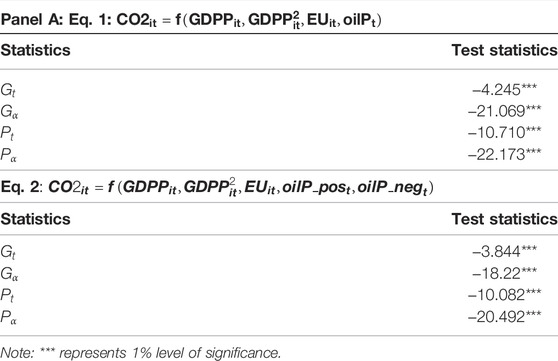

The results of the null hypothesis test for the lack of cointegration between the variables in Eqs 1, 4 using the Westerlund (2007) co-integration panel test in panels A and B are presented in Table 4 respectively. We offer the test statistics and related robust p-values, which are computed using bootstrapping process, for all four test statistics, including

TABLE 4. The results of Westerlund (2007) panel cointegration test.

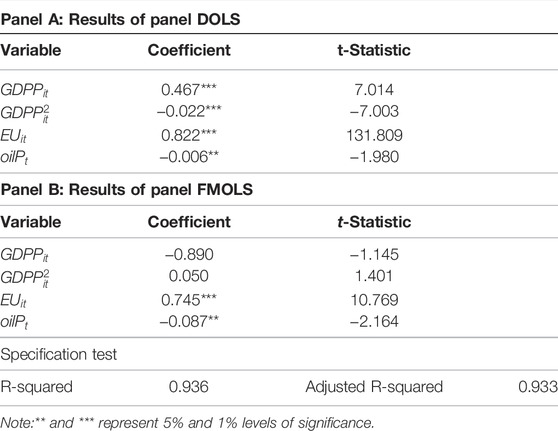

We present the estimation results of Eq. 1 by panel DOLS and FMOLS in panels A and B of Table 5, respectively. The results of the panel DOLS estimator indicate 1) oil price has a statistically significant negative effect (at 5%) on CO2 emission in the GCC countries. A 10 per cent increase in the oil price will decrease CO2 emissions by about 0.06%. 2) The coefficients of

TABLE 5. Estimation results of Eq. 1 by panel DOLS and panel FMOLS.

The results of the panel FMOLS estimator indicate 1) oil price has a statistically significant negative effect (at 5%) on CO2 emission in the GCC countries. A 10 per cent increase in the oil price will decrease CO2 emission by about 0.87% (greater than estimated by the panel DOLS estimator). 2) The coefficients of

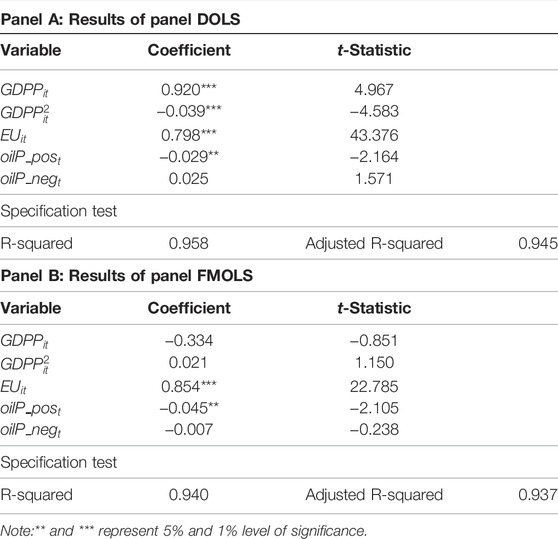

We present Eq. 4 estimation results by panel DOLS and panel FMOLS in panels A and B in Table 6. The estimated coefficient of positive oil price component by panel DOLS and panel FMOLS is negative, statistically significant at 5%. The results indicate that positive shocks to oil prices will decrease the CO2 emission in the GCC countries. In contrast, the estimated coefficient of the negative oil price component by panel DOLS and FMOLS estimators is statistically insignificant. Thus, only positive shocks to oil prices have a statistically significant effect on CO2 emission and help reduce air pollution. In contrast, negative shocks have neutral effects on CO2 emission.

TABLE 6. Estimation results of Eq. 1 by panel DOLS and panel FMOLS.

One of the main shortcomings of panel DOLS and panel FMOLS estimators is that they cannot overcome the problem related to cross-section dependence. Hence in the final step, we re-estimate the Eqs 1, 4 using panel DSUR. The results are prepared in Table 7.

We present the estimation results of Eqs 1, 4 by panel DSUR estimator in panels A and B, respectively. Panel A1 reports the panel DSUR estimator and panel A2 reports a single country DSUR estimator of Eq. 1. The results of the panel DSUR estimator indicate 1) oil price has a statistically significant negative effect (at 1%) on CO2 emission in the GCC countries. Its coefficient equals −0.104 (greater than panel DOLS and FMOLS) and indicates a 10 per cent increase in the oil price will decrease CO2 emission by about 1.04%. 2) The coefficients of

The results of a single DSUR estimator for each country indicate 1) except Kuwait. For other GCC countries, the oil prices negatively affect the CO2 emission, and the most negative effect is related to Saudi Arabia (equals -0.481). For Kuwait, the null hypothesis of the neutral effect of oil price on CO2 emission is not rejected at conventional cut-off points. 2) The sign and statistically significance of

The estimation results of Eq. 4 by panel DSUR estimator in panel B1 indicate 1) positive shocks of oil price have a statistically significant negative effect (at 1%) on CO2 emission in the GCC countries. Ten points of positive shock of oil prices will decrease CO2 emission by about 1.98%. In contrast, the negative shocks of oil prices do not have statistically significant effects on CO2 emission. The results are in line with our previous results using panel FMOLS and panel DOLS estimators. 2) The sign and statistical significance of other explanatory variables are the same as our results for Eq. 1.

The results of a single DSUR estimator for each country indicate 1) except Kuwait. For other GCC countries, the positive shocks to oil prices have a statistically significant negative effect on the CO2 emission and the most negative effect on Qatar and Saudi Arabia. The negative shocks of oil prices have statistically significant effects on the CO2 emission of Oman and Saudi Arabia. 2) The sign and statistically significant of

For robustness checking, Brent crude oil price substitutes the WTI oil price in our estimations. We encounter that the results are consistent and robust with the main findings.

The primary goal of this study is to see how positive and negative oil price shocks affect environmental degradation. The findings suggest that the GCC countries under investigation are cross-sectionally dependent. According to long-run DSUR estimates, positive oil price shocks have a statistically significant negative influence on CO2 emissions. Our findings are in line with the previous work of Malik et al. (2020) for Pakistan, Shahbaz et al. (2017) for Australia, Umar et al. (2020) for African countries, Ullah et al. (2020) for the top ten carbon emitters, and Abumunshar et al. (2020) for Turkey. This result is in line with Bilgili et al. (2020) for United States and China, which also found that the increase in oil prices in the US is a negative effect on CO2 emissions. These findings support the findings of Haque (2020), who discovered that an increase in oil prices reduced energy consumption by 0.22 per cent while higher energy consumption increases CO2 emissions in the GCC. This result is also consistent with Malik et al. (2020), who found that in the long-run relationship between oil price and carbon emission, an increase in the oil price (positive shock in the partial sum of oil price) reduces carbon emission while a decrease in the oil price (negative shocks in the partial sum of oil price) increases carbon emission.

Oil price shocks, on the other hand, have had a negative impact on CO2 emissions in Oman, Bahrain, Saudi Arabia, Qatar, and the United Arab Emirates. Qatar has the largest detrimental impact, followed by Saudi Arabia. Oil price negative shocks have statistically significant effects on CO2 emissions in Oman and Saudi Arabia, but not in other nations. These findings confirm the work of Aljadani et al. (2021), who find that there is a long-term negative and significant association between oil rent (OILRENT) and CO2 emissions, and a rise of 1% in oil rent (OILRENT) will result in a 0.25 per cent reduction in environmental deterioration in Saudi Arabia. The outcome of this study is similar to (Wang and Li, 2016; Maji et al., 2017; Agbanike et al., 2019; Constantinos et al., 2019), which supports the significant negative impact of oil price on CO2 emissions. To be more precise, the energy prices exert a negative effect on CO2 emissions in line with some previous empirical literature (Li et al., 2020). The results are in line with results using panel FMOLS and panel DOLS estimators showing that oil price has a significant negative effect on CO2 emissions.

In the meanwhile, the EKC theory is not rejected in Kuwait, Oman, Qatar, Saudi Arabia, or the UAE; nevertheless, it is rejected in Bahrain and Oman. This means that an increase in oil prices will decrease the carbon emissions in the selected countries. However, this research found that both positive and negative oil price shocks have little effect on pollution. The Fully Modified OLS was used to achieve this outcome. The DSUR approach was also used to elucidate the influence of oil price shocks and other explanatory variables on CO2 emissions in GCC nations for the robustness assessment. The results of the long-run estimation show that positive oil price shocks have a negative but insignificant effect on pollution. This conclusion is consistent with Chang et al. (2009) and Sadorsky’s reasoning (2009a and 2009b). They found that the impact of oil prices on environmental deterioration is inversely proportional to the country’s economic development rate. They also pointed out that nations with greater economic growth transition to clean energy sources (renewable energy) faster than countries with lower economic growth to reduce pollution caused by oil price shocks.

The effect of negative oil price shocks on CO2 emissions in GCC nations, on the other hand, demonstrates that negative oil price shocks have statistically significant effects on CO2 emissions. This means that a decline in oil prices has a greater impact on pollution than an increase in oil prices. This is in line with Marques and Fuinhas’s (2011) findings, who argued that prices of fossil-based fuels are not significant tools for mitigating carbon emissions. Similar findings reported by Sun et al. (2019) reveal that energy price does not matter in predicting changes in CO2 emission in China. They suggested that oil prices are not suitable tools to encourage the consumption of renewable energy sources.

The short-run results of the current analysis revealed that both positive and negative oil price shocks have no statistically significant influence on pollution. In other words, the effect of total energy consumption is statistically significant and positive in all of the estimated models. This is consistent with prior research that found that energy usage has a favourable impact on carbon emissions in GCC countries (Salahuddin and Gow, 2014; Salahuddin et al., 2015; Al-mulali and Che Sab, 2018; Al-Saidi and Elagib, 2018).

Moreover, the statistically significant positive and negative coefficients of GDP and square of GDP, respectively, support the EKC hypothesis in the selected GCC countries. This finding is in line with the result of several studies such as Hamdi and Sbia (2013) for the panel of GCC; Jaunky (2011) for Bahrain, Oman, and UAE; Arouri et al. (2012) for Egypt, Lebanon, Bahrain, Saudi Arabia, and Oman; and Ozcan (2013) for UAE, Egypt, and Lebanon.

The GCC countries have observed the benefits of renewables as a cost-effective and reliable power source. This may be attributed to initiatives and favourable policies adopted by these countries and programs towards developing renewable energy sources in these countries. All GCC countries have also targeted that 10% of the power production come from renewable energy sources by 2020 and are rapidly moving towards realizing this target.

The key to renewable energy development in the GCC region is solar power, as it is the single most abundant renewable energy source available. The region’s topography gives it immense solar energy potential throughout the year. It benefits the space to develop large solar power plants—almost 85–90% of the money spent on renewable energy. For example, Saudi Arabia has announced plans to invest more than $ 100 billion to generate 41 gigawatts of electricity using solar power. Dubai has also unveiled plans to invest about $ 4 billion to generate 1 gigawatt of electricity using solar energy. The six Gulf countries have begun construction of solar power plants with investments of over $ 155 billion to create more than 84 gigawatts of power and are scheduled to be completed by 2017, Other examples of these policies include renewable energy initiatives, such as Saudi Arabia’s six greenfield economic cities (combined with efforts to elevate cities like Mecca to Smart City status). Lusail’s Smart and Sustainable City, Pearl-Qatar Island, and Energy City Qatar are three projects in Qatar. Two projects in the United Arab Emirates (Masdar City in Abu Dhabi and Smart City Dubai).

Oil price shocks have become a major decisive factor in environmental degradation, thus calling policymakers and researchers to investigate its causes. In this study, we explored the short- and long-run effects of oil price shocks on the CO2 emissions for a panel of six GCC countries from 1996 to 2016. Although various studies have been conducted on this topic for countries in Western Europe, America, Asia, and Africa, the studies that have been undertaken on the GCC countries are very limited. Therefore, the present study’s findings can positively impact both the literature and future decisions of policymakers.

The long-run interactions between oil price shocks and CO2 emissions were investigated using the DSUR technique in our study. In the long run, the estimates revealed no significant relationship between negative oil price shocks and CO2 emissions. Nonetheless, a strong negative relationship was discovered between positive oil price shocks and CO2 emissions. Also, a single DSUR estimate shows that positive oil price shocks have had a negative impact on CO2 emissions in Oman, Bahrain, Saudi Arabia, Qatar, and the United Arab Emirates. At the same time, the findings revealed that Qatar had the largest detrimental impact, followed by Saudi Arabia.

Meanwhile, the negative shocks of oil prices have statistically significant effects on the CO2 emission of Oman and Saudi Arabia, and for other countries, it does not have a significant effect. Moreover, the results also support the existence of the EKC in Kuwait, Oman, Qatar, Saudi Arabia, and the UAE. In contrast, the hypothesis is rejected in Bahrain and Oman.

Positive oil price shocks have no significant effect on CO2 emissions, but negative shocks have a considerable impact on CO2 emissions in the GCC countries. This is understandable, given that the UAE liberalized energy pricing following the negative impact of oil prices in 2014, resulting in lower domestic consumption. Saudi Arabia and Kuwait, which have been reclaimed, have also increased domestic energy prices by roughly 50%, but they still retain support. Overall, such a reduction, combined with the start-up of solar power plants via the big projects outlined above, reduces dependency on fossil fuels for energy generation. However, there is a positive effect of economic growth on the CO2, on the level of the economic situation of the country, where the countries have positive GDP effect with CO2, but Oman and Bahrain have less economic growth compared with other four countries like Kuwait, Qatar, KSA, and UAE. These countries are on top of the largest energy reserve in the world—also, a significant positive effect between energy consumption and CO2 in GCC countries.

The data presented here concerning causal relationships between oil price shocks and CO2 emissions has policy implications for GCC countries. According to the findings, GCC governments may prioritize clean and green economic growth by maintaining oil prices as low as feasible, which would be more effective in terms of environmental sustainability. The environmental degradation problem in these countries cannot be solved systematically and solely by economic growth. The efforts should focus on non-oil sectors, focusing more on diversifying its energy mix, with a higher percentage of renewable (clean) energy production, adopting new policies regarding the development of efficient projects, and employing green finance tools to achieve sustainable economic growth. Economic policy which is supposed to be followed by GCC governments implies investment in renewable energy and smart energy, rather than fossil fuel energy to achieve their sustainable development goals and shed light on urgent global issues. These economies could invest primarily in low-carbon renewable energy resources and aim to outperform key acts where the green economy looks to be a top government goal. To achieve long-term economic development goals, policymakers must concentrate on new energy sources. To attain a digital economy, GCC countries must modify their economic growth patterns and promote economic diversification activities, as well as improve the efficiency of the energy sector. The government and policymakers should push for a more thorough reform of oil price shocks, paying special attention to the indirect risk of price shocks and their leveraging consequences. Furthermore, changes in oil prices and CO3 emissions result in GCC nations needing authorities and policymakers to approach diesel and gasoline policies independently.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

AE: Conceptualization, Methodology, Data Curation, Formal analysis, Writing-Original draft HHL: Supervision, Conceptualization, Methodology, Writing-Reviewing and Editing, Resources UA-M: Validation, Writing-Reviewing and Editing.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abokyi, E., Appiah-Konadu, P., Abokyi, F., and Oteng-Abayie, E. F. (2019). Industrial Growth and Emissions of CO2 in Ghana: The Role of Financial Development and Fossil Fuel Consumption. Energy Rep. 5, 1339–1353. doi:10.1016/j.egyr.2019.09.002

Abumunshar, M., Aga, M., and Samour, A. (2020). Oil Price, Energy Consumption, and CO2 Emissions in Turkey. New Evidence from a Bootstrap ARDL Test. Energies 13, 5588. doi:10.3390/en13215588

Agbanike, T. F., Nwani, C., Uwazie, U. I., Anochiwa, L. I., Onoja, T. G. C., and Ogbonnaya, I. O. (2019). Oil Price, Energy Consumption and Carbon Dioxide (CO 2) Emissions: Insight into Sustainability Challenges in Venezuela. Lat. Am. Econ. Rev. 28 (1), 1–26. doi:10.1186/s40503-019-0070-8

Ahmed, S., Ahmed, K., and Ismail, M. (2020). Predictive Analysis of CO2 Emissions and the Role of Environmental Technology, Energy Use and Economic Output: Evidence from Emerging Economies. Air Qual. Atmos. Health 13. doi:10.1007/s11869-020-00855-1

Al-Mulali, U., and Che Sab, C. N. B. (2018). Electricity Consumption, CO2 Emission, and Economic Growth in the Middle East. Energy Sources, Part B Econ. Plan. Policy 13 (5), 257–263. doi:10.1080/15567249.2012.658958

Al-Mulali, U., and Ozturk, I. (2016). The Investigation of Environmental Kuznets Curve Hypothesis in the Advanced Economies: the Role of Energy Prices. Renew. Sustain. Energy Rev. 54, 1622–1631. doi:10.1016/j.rser.2015.10.131

Al-Saidi, M., and Elagib, N. A. (2018). Ecological Modernization and Responses for a Low-Carbon Future in the Gulf Cooperation Council Countries. Wiley Interdiscip. Rev. Clim. Change 9 (4), e528.

Ali, S., Ejaz, S., Anjum, M. A., Nawaz, A., and Ahmad, S. (2020). “Impact of Climate Change on Postharvest Physiology of Edible Plant Products,” in Plant Ecophysiology and Adaptation under Climate Change: Mechanisms and Perspectives I (Singapore: Springer), 87–115. doi:10.1007/978-981-15-2156-0_4

Aljadani, A., Toumi, H., Toumi, S., Hsini, M., and Jallali, B. (2021). Investigation of the N-Shaped Environmental Kuznets Curve for COVID-19 Mitigation in the KSA. Environ. Sci. Pollut. Res. 28, 29681–29700. doi:10.1007/s11356-021-12713-3

Alshehry, A. S., and Belloumi, M. (2015). Energy Consumption, Carbon Dioxide Emissions and Economic Growth: The Case of Saudi Arabia. Renew. Sustain. Energy Rev. 41, 237–247. doi:10.1016/j.rser.2014.08.004

Anser, M. K., Syed, Q. R., Lean, H. H., Alola, A. A., and Ahmad, M. (2021). Do Economic Policy Uncertainty and Geopolitical Risk Lead to Environmental Degradation? Evidence from Emerging Economies. Sustainability 13 (11), 5866. doi:10.3390/su13115866

Apergis, N., and Gangopadhyay, P. (2020). The Asymmetric Relationships between Pollution, Energy Use and Oil Prices in Vietnam: Some Behavioural Implications for Energy Policy-Making. Energy Policy 140, 111,430–111,442. doi:10.1016/j.enpol.2020.111430

Apergis, N., and Payne, J. E. (2015). Renewable Energy, Output, Carbon Dioxide Emissions, and Oil Prices: Evidence from South America. Energy Sources, Part B Econ. Plan. Policy 10 (3), 281–287. doi:10.1080/15567249.2013.853713

Ari, I., and Şentürk, H. (2020). The Relationship between GDP and Methane Emissions from Solid Waste: A Panel Data Analysis for the G7. Sustain. Prod. Consum. 23, 282–290. doi:10.1016/j.spc.2020.06.004

Arouri, M. E. H., Ben Youssef, A., M'Henni, H., and Rault, C. (2012). Energy Consumption, Economic Growth and CO2 Emissions in Middle East and North African Countries. Energy Policy 45, 342–349. doi:10.1016/j.enpol.2012.02.042

Badeeb, R. A., and Lean, H. H. (2018). Asymmetric impact of oil price on Islamic sectoral stocks. Energy Economics, 71, 128–139. doi:10.1016/j.resourpol.2021.102326

Badeeb, R. A., Szulczyk, K. R., and Lean, H. H. (2021). Asymmetries in the Effect of Oil Rent Shocks on Economic Growth: A Sectoral Analysis from the Perspective of the Oil Curse. Resour. Policy 74, 102326. doi:10.1016/j.resourpol.2021.102326

Balaguer, J., and Cantavella, M. (2015). Estimating the Environmental Kuznets Curve for Spain by Considering Fuel Oil Prices. Ecol. Indic. 60, 853–859.

Baltagi, B. H., Feng, Q., and Kao, C. (2012). A Lagrange Multiplier Test for Cross-Sectional Dependence in a Fixed Effects Panel Data Model. J. Econ. 170 (1), 164–177. doi:10.1016/j.jeconom.2012.04.004

Bayomi, N., and E. Fernandez, J. (2019). Towards Sustainable Energy Trends in the Middle East: A Study of Four Major Emitters. Energies 12 (9), 1615. doi:10.3390/en12091615

Bilgili, F., Mugaloglu, E., and Koçak, E. (2020). “The Impact of Oil Prices on CO2 Emissions in China: a Wavelet Coherence Approach,” in Econometrics of Green Energy Handbook, 31–57. doi:10.1007/978-3-030-46847-7_2

Boufateh, T. (2019). The Environmental Kuznets Curve by Considering Asymmetric Oil Price Shocks: Evidence from the Top Two. Environ. Sci. Pollut. Res. 26 (1), 706–720. doi:10.1007/s11356-018-3641-3

Breusch, T. S., and Pagan, A. R. (1980). The Lagrange Multiplier Test and its Applications to Model Specification in Econometrics. Rev. Econ. Stud. 47, 239–253. doi:10.2307/2297111

Bergmann, P. (2019). Oil Price Shocks and GDP Growth: Do Energy Shares Amplify Causal Effects? Energy Econ. 80, 1010–1040.

Bruvoll, A., and Medin, H. (2003). Factors behind the Environmental Kuznets Curve. A Decomposition of the Changes in Air Pollution. Environ. Resour. Econ. 24 (1), 27–48. doi:10.1023/a:1022881928158

Cashin, P., Mohaddes, K., and Raissi, M. (2014). The Differential Effects of Oil Demand and Supply Shocks on the Global Economy. Energy Econ. 44, 113–134. doi:10.1016/j.eneco.2014.03.014

Chai, J., Zhou, Y., Liang, T., Xing, L., and Lai, K. (2016). Impact of International Oil Price on Energy Conservation and Emission Reduction in China. Sustainability 8 (6), 508. doi:10.3390/su8060508

Chang, T.-H., Huang, C.-M., and Lee, M.-C. (2009). Threshold Effect of the Economic Growth Rate on the Renewable Energy Development from a Change in Energy Price: Evidence from OECD Countries. Energy Policy 37, 5796–5802. doi:10.1016/j.enpol.2009.08.049

Charfeddine, L., and Kahia, M. (2019). Impact of Renewable Energy Consumption and Financial Development on CO2 Emissions and Economic Growth in the MENA Region: A Panel Vector Autoregressive (PVAR) Analysis. Renew. Energy 139, 199–213. doi:10.1016/j.renene.2019.01.010

Chaudhry, I. S., Azali, M., Faheem, M., and Ali, S. (2020). Asymmetric Dynamics of Oil Price and Environmental Degradation: Evidence from Pakistan. Reads 6 (1), 1–12. doi:10.47067/reads.v6i1.179

Chen, L. J., and Lin, Y. L. (2015). Does Air Pollution Respond to Petroleum Price. Int. J. Appl. Econ 12, 104–125.

Constantinos, K., Eleni, Z., Nikolaos, S., and Bantis, D. (2019). Greenhouse Gas Emissions-Crude Oil Prices: an Empirical Investigation in a Nonlinear Framework. Environ. Dev. Sustain 21 (6), 2835–2856. doi:10.1007/s10668-018-0163-6

Dong, K., Sun, R., Hochman, G., Zeng, X., Li, H., and Jiang, H. (2017). Impact of Natural Gas Consumption on CO2 Emissions: Panel Data Evidence from China's Provinces. J. Clean. Prod. 162, 400–410. doi:10.1016/j.jclepro.2017.06.100

Ehigiamusoe, K. U., and Lean, H. H. (2019). Effects of Energy Consumption, Economic Growth, and Financial Development on Carbon Emissions: Evidence from Heterogeneous Income Groups. Environ. Sci. Pollut. Res. 26 (22), 22611–22624. doi:10.1007/s11356-019-05309-5

Ehigiamusoe, K. U., Lean, H. H., and Smyth, R. (2020). The Moderating Role of Energy Consumption in the Carbon Emissions-Income Nexus in Middle-Income Countries. Appl. Energy 261, 114215. doi:10.1016/j.apenergy.2019.114215

Fernández-Vázquez, J.-S., and Sancho-Rodríguez, Á. (2020). Critical Discourse Analysis of Climate Change in IBEX 35 Companies. Technol. Forecast. Soc. Change 157, 120063. doi:10.1016/j.techfore.2020.120063

Gbatu, A. P., Wang, Z., Junior, P. K. W., and Sesay, V. A. (2019). How Do Energy Consumption, Output, Energy Price, and Population Growth Correlate with CO2 Emissions in Liberia. Ijgenvi 18, 209–235. doi:10.1504/ijgenvi.2019.102776

Gulf Cooperation Council (2017). The Economic Outlook and Policy Challenges in the GCC Countries. Available at: https://www.imf.org/en/Publications/Policy-Papers/Issues/2017/12/14/pp121417gcc-economic-outlook-and-policy-challenges.

Hamdi, H., and Sbia, R. (2013). Dynamic Relationships between Oil Revenues, Government Spending and Economic Growth in an Oil-dependent Economy. Econ. Model. 35, 118–125. doi:10.1016/j.econmod.2013.06.043

Hammoudeh, S., Mensi, W., Reboredo, J. C., and Nguyen, D. K. (2014). Dynamic Dependence of the Global Islamic Equity Index with Global Conventional Equity Market Indices and Risk Factors. Pacific-Basin Finance J. 30, 189–206. doi:10.1016/j.pacfin.2014.10.001

Hammoudeh, S., Nguyen, D. K., and Sousa, R. M. (2015). US Monetary Policy and Sectoral Commodity Prices. J. Int. Money Finance 57, 61–85. doi:10.1016/j.jimonfin.2015.06.003

Haque, M. I. (2020). Negating the Role of Institutions in the Long Run Growth of an Oil Producing Country. Ijeep 10 (5), 503–509. doi:10.32479/ijeep.9870

He, J., and Richard, P. (2010). Environmental Kuznets Curve for CO2 in Canada. Ecol. Econ. 69 (5), 1083–1093. doi:10.1016/j.ecolecon.2009.11.030

Husaini, D. H., Lean, H. H., and Ab. Rahim, R. (2021). The Relationship between Energy Subsidies, Oil Prices, and CO2 Emissions in Selected Asian Countries: a Panel Threshold Analysis. Australas. J. Environ. Manag. 28 (4), 1–16. doi:10.1080/14486563.2021.1961620

IEA (2019). World Energy Outlook. Paris: IEA. Available at: https://wwwieaorg/reports/world-energy-outlook-2019.

International Energy Agency (IEA) (2005). Middle East and North Africa Insights. Paris, France: IEA.

International Monetary Fund (IMF) (2016). Annual Meeting of Arab Ministers of Finance: A Economic Diversification in Oil-Exporting Arab Countries. Prepared by Staff of the International Monetary Fund. Available at: https://www.imf.org/external/np/pp/eng/2016/042916.pdf.

Jaunky, V. C. (2011). The CO 2 Emissions-Income Nexus: Evidence from Rich Countries. Energy Policy 39, 1228–1240. doi:10.1016/j.enpol.2010.11.050

Jiao, Z., Sharma, R., Kautish, P., and Hussain, H. (2021). Unveiling the Asymmetric Impact of Exports, Oil Prices, Technological Innovations, and Income Inequality on Carbon Emissions in India. Resour. Policy 74. doi:10.1016/j.resourpol.2021.102408

Kilian, L., and Stock, J. H. (2015). Anticipation, Tax Avoidance, and the Price Elasticity of Gasoline Demand John Coglianese Lucas W. Davis. Ann Arbor 1001, 48109.

Lean, H. H., McAleer, M., and Wong, W.-K. (2015). Preferences of Risk-Averse and Risk-Seeking Investors for Oil Spot and Futures before, during and after the Global Financial Crisis. Int. Rev. Econ. Finance 40, 204–216. doi:10.1016/j.iref.2015.02.019

Li, K., Fang, L., and He, L. (2020). The Impact of Energy Price on CO2 Emissions in China: a Spatial Econometric Analysis. Sci. Total Environ. 706, 135942. doi:10.1016/j.scitotenv.2019.135942

Lin, B., and Jia, Z. (2019). Impacts of Carbon Price Level in Carbon Emission Trading Market. Appl. Energy 239, 157–170. doi:10.1016/j.apenergy.2019.01.194

Mahmood, H., Adow, A. H., Abbas, M., Iqbal, A., Murshed, M., and Furqan, M. (2022). The Fiscal and Monetary Policies and Environment in GCC Countries: Analysis of Territory and Consumption-Based CO2 Emissions. Sustainability 14 (3), 1225. doi:10.3390/su14031225

Mahmood, H., Alkhateeb, T. T. Y., and Furqan, M. (2020). Oil Sector and CO2 Emissions in Saudi Arabia: Asymmetry Analysis. Palgrave Commun. 6, 88. doi:10.1057/s41599-020-0470-z

Maji, I. K., Habibullah, M. S., Saari, M. Y., and Abdul-Rahim, A. S. (2017). The Nexus between Energy Price Changes and Environmental Quality in Malaysia. Energy Sources, Part B Econ. Plan. Policy 12 (10), 903–909. doi:10.1080/15567249.2017.1323052

Malik, M. Y., Latif, K., Khan, Z., Butt, H. D., Hussain, M., and Nadeem, M. A. (2020). Symmetric and Asymmetric Impact of Oil Price, FDI and Economic Growth on Carbon Emission in Pakistan: Evidence from ARDL and Non-linear ARDL Approach. Sci. Total Environ. 726, 138421. doi:10.1016/j.scitotenv.2020.138421

Mark, N. C., OgakiSul, M. D., and Sul, D. (2005). Dynamic Seemingly Unrelated Cointegrating Regressions. Rev. Econ. Stud. 72, 797–820. doi:10.1111/j.1467-937x.2005.00352.x

Marques, A. C., and Fuinhas, J. A. (2011). Drivers Promoting Renewable Energy: A Dynamic Panel Approach. Renew. Sustain. Energy Rev. 15 (3), 1601–1608. doi:10.1016/j.rser.2010.11.048

Mensah, I. A., Sun, M., Gao, C., Omari-Sasu, A. Y., Zhu, D., Ampimah, B. C., et al. (2019). Analysis on the Nexus of Economic Growth, Fossil Fuel Energy Consumption, CO2 Emissions and Oil Price in Africa Based on a PMG Panel ARDL Approach. J. Clean. Prod. 228, 161–174. doi:10.1016/j.jclepro.2019.04.281

Munir, Q., Lean, H. H., and Smyth, R. (2019). CO2 Emissions, Energy Consumption and Economic Growth in the ASEAN-5 Countries: A Cross-Sectional Dependence Approach. Energy Econ. 2019, 104571.

Murshed, M. (2020). An Empirical Analysis of the Non-linear Impacts of ICT-Trade Openness on Renewable Energy Transition, Energy Efficiency, Clean Cooking Fuel Access and Environmental Sustainability in South Asia. Environ. Sci. Pollut. Res. doi:10.1007/s11356-020-09497-3

Murshed, M. (2021). LPG Consumption and Environmental Kuznets Curve Hypothesis in South Asia: a Time-Series ARDL Analysis with Multiple Structural Breaks. Environ. Sci. Pollut. Res. 28, 8337–8372. doi:10.1007/s11356-020-10701-7

Murshed, M., and Tanha, M. (2019). Oil Price Shocks and Renewable Energy Transition: Empirical Evidence from Net Oil-Importing South Asian Economies. Energy Ecol. Environ., 183–203.

Nasir, M. A., Al-Emadi, A. A., Shahbaz, M., and Hammoudeh, S. (2019). Importance of Oil Shocks and the GCC Macroeconomy: A Structural VAR Analysis. Resour. Policy 61, 166–179. doi:10.1016/j.resourpol.2019.01.019

Nasser, A. M., Hasim, H. M., and Al-Busaidi, K. (2016). Modeling the Impact of the Oil Sector on the Economy of Sultanate of Oman. Int. J. Energy Econ. Policy 6 (1), 120–127.

Nusair, S. A. (2016). The Effects of Oil Price Shocks on the Economies of the Gulf Co-operation Council Countries: Nonlinear Analysis. Energy Policy 91, 256–267. doi:10.1016/j.enpol.2016.01.013

Nwani, C. (2017). Causal Relationship between Crude Oil Price, Energy Consumption and Carbon Dioxide (CO2) Emissions in Ecuador. OPEC Energy Rev. 41 (3), 201–225. doi:10.1111/opec.12102

Payne, J. E. (2012). The Causal Dynamics between US Renewable Energy Consumption, Output, Emissions, and Oil Prices. Energy Sources, Part B Econ. Plan. Policy 7 (4), 323–330. doi:10.1080/15567249.2011.595248

Pesaran, M. H. (2007). A Simple Panel Unit Root Test in the Presence of Cross-Section Dependence. J. Appl. Econ. 22 (2), 265–312. doi:10.1002/jae.951

Pesaran, M. H. (2004). “General Diagnostic Tests for Cross Section Dependence in Panels,” in University of Cambridge, Working Paper, CWPE 0435 (Cambridge, UK: Institute for the Study of Labor).

Saboori, B., Al-mulali, U., Bin Baba, M., and Mohammed, A. H. (2016). Oil-induced Environmental Kuznets Curve in Organization of Petroleum Exporting Countries (OPEC). Int. J. Green Energy 13 (4), 408–416. doi:10.1080/15435075.2014.961468

Sadorsky, P. (2009b). Renewable Energy Consumption and Income in Emerging Economies. Energy Policy 37 (10), 4021–4028. doi:10.1016/j.enpol.2009.05.003

Sadorsky, P. (2009a). Renewable Energy Consumption, CO2 Emissions and Oil Prices in the G7 Countries. Energy Econ. 31 (3), 456–462. doi:10.1016/j.eneco.2008.12.010

Salahuddin, M., and Gow, J. (2014). Economic Growth, Energy Consumption and CO2 Emissions in Gulf Cooperation Council Countries. Energy 73, 44–58. doi:10.1016/j.energy.2014.05.054

Salahuddin, M., Gow, J., and Ozturk, I. (2015). Is the Long-Run Relationship between Economic Growth, Electricity Consumption, Carbon Dioxide Emissions and Financial Development in Gulf Cooperation Council Countries Robust? Renew. Sustain. Energy Rev. 51, 317–326. doi:10.1016/j.rser.2015.06.005

Shahbaz, M., Bhattacharya, M., and Ahmed, K. (2017). CO2emissions in Australia: Economic and Non-economic Drivers in the Long-Run. Appl. Econ. 49 (13), 1273–1286. doi:10.1080/00036846.2016.1217306

Shin, Y., Yu, B., and Greenwood-Nimmo, M. (2014). Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in honor of Peter Schmidt, 281–314. New York: Springer

Sun, C., Ding, D., Fang, X., Zhang, H., and Li, J. (2019). How Do Fossil Energy Prices Affect the Stock Prices of New Energy Companies? Evidence from Divisia Energy Price Index in China's Market. Energy 169, 637–645. doi:10.1016/j.energy.2018.12.032

Tan, F., Lean, H. H., and Khan, H. (2014). Growth and Environmental Quality in Singapore: Is There Any Trade-Off? Ecol. Indic. 47, 149–155. doi:10.1016/j.ecolind.2014.04.035

Ullah, S., Chishti, M. Z., and Majeed, M. T. (2020). The Asymmetric Effects of Oil Price Changes on Environmental Pollution: Evidence from the Top Ten Carbon Emitters. Environ. Sci. Pollut. Res. 27, 29623–29635. doi:10.1007/s11356-020-09264-4

Umar, B., Alam, M. M., and Al-Amin, A. Q. (2020). Exploring the Contribution of Energy Price to Carbon Emissions in African Countries. Environ. Sci. Pollut. Res. Int. 28 (63). doi:10.1007/s11356-020-10641-2

Union of Concerned Scientists (2018). Each Country's Share of CO2 Emissions. Available at: https://www.ucsusa.org/resources/each-countrys-share-co2-emissions.

Usman, M., Hayat, N., and Bhutta, M. M. A. (2020). SI Engine Fueled with Gasoline, CNG and CNG-HHO Blend: Comparative Evaluation of Performance, Emission and Lubrication Oil Deterioration. J. Therm. Sci., 1–13. doi:10.1007/s11630-020-1268-4

Wang, Q., and Li, R. (2016). Impact of Cheaper Oil on Economic System and Climate Change: A SWOT Analysis. Renew. Sustain. Energy Rev. 54, 925–931. doi:10.1016/j.rser.2015.10.087

Wang, X., Bai, M., and Xie, C. (2019). Investigating CO2 Mitigation Potentials and the Impact of Oil Price Distortion in China's Transport Sector. Energy Policy 130, 320–327. doi:10.1016/j.enpol.2019.04.003

Waqih, M. A. U., Bhutto, N. A., Ghumro, N. H., Kumar, S., and Salam, M. A. (2019). Rising Environmental Degradation and Impact of Foreign Direct Investment: an Empirical Evidence from SAARC Region. J. Environ. Manag. 243, 472–480. doi:10.1016/j.jenvman.2019.05.001

Westerlund, J. (2007). Panel Cointegration Tests of the Fisher Hypothesis. J. Appl. Econ. Forthcom. 23 (2), 193–233.

World Bank (2018). CO2 Emissions (Metric Tons Per Capita) - Kuwait. Available at: https://data.worldbank.org/indicator/EN.ATM.CO2E.PC?locations=KW.

World Bank (2016). World Bank Annual Report. Available at: http://worldbank.org/annualreport.

Worldometers (2016). Worldometers. Available at: https://www.worldometers.info/co2-emissions/united-arab-emirates-co2-emissions/.

Zaghdoudi, T. (2017). Internet Usage, Renewable Energy, Electricity Consumption and Economic Growth: Evidence from Developed Countries. Econ. Bull. Access Econ. 37 (3), 1612–1619.

Keywords: cross-sectional dependence, GCC countries, positive and negative oil price shocks, CO2 emission, environmental kuznets curve

Citation: Ebaid A, Lean HH and Al-Mulali U (2022) Do Oil Price Shocks Matter for Environmental Degradation? Evidence of the Environmental Kuznets Curve in GCC Countries. Front. Environ. Sci. 10:860942. doi: 10.3389/fenvs.2022.860942

Received: 24 January 2022; Accepted: 14 April 2022;

Published: 13 May 2022.

Edited by:

Gagan Deep Sharma, Guru Gobind Singh Indraprastha University, IndiaReviewed by:

Muntasir Murshed, North South University, BangladeshCopyright © 2022 Ebaid, Lean and Al-Mulali. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hooi Hooi Lean, bGVhcm5teUBnbWFpbC5jb20=, aG9vaWxlYW5AdXNtLm15

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.