95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 10 May 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.858548

This article is part of the Research Topic ESG Investment and Its Societal Impacts View all 28 articles

With the disclosure of ESG, the investment related to ESG disclosure has increased, and the trend of changes in intangible capital has shown an “inverted S-shaped” curve. The research shows that, in the initial stage of investment in ESG construction, new ESG investments increase intangible capital. With the increase in ESG investment and the advancement of time, the positive effect of the increase in ESG scores on intangible capital begins to appear and gradually offsets the cost of ESG investment. However, when the ESG score of a company is raised to a certain level, the marginal effect of continuing to increase ESG investment will reduce the increase in intangible capital.

Climate change has become a real and urgent crisis facing mankind, and a serious and long-term challenge. To address global climate change, the United Nations calls on countries to take practical action to reduce carbon emissions and to achieve harmony between humans and nature. Balancing the environment and economic development to achieve a harmonious coexistence between humans and nature, the issue of environmental sustainability has become one of the top priorities of current concerns. The Party Central Committee attaches great importance to the sustainable development of the environment and economy, and green and low-carbon strategies are gradually emerging. The 18th Party Central Committee, with Comrade Xi Jinping at the core, has put forward the climate action goals of “ecological civilization construction” and “carbon neutral, carbon peak”. According to the “Carbon Summit Action Plan by 2030” issued by the State Council in 2021, during the period of the “14th Five-Year Plan”, a green and low-carbon approach has become the way to promote high-quality development and ecological civilization construction. The United Nations continues to promote the ESG (environmental, social, governance) regulation as the main body for carbon reduction. Since ESG first appeared in the UN’s Who Cares Wins report in 2004 and the United Nations Global Compact (UNGC) and the United Nations Environment Programme Sustainable Finance Initiative (UNEPFI) jointly released the Principles for Responsible Investment (PRI) in 2006, ESG regulation and disclosure policies worldwide have been gradually improved. For example, the European Union has a centralized department for the development of ESG regulatory policy, and has established a complete “regulation–guidance–training–disclosure” system for the regulation of ESG disclosure and mandatory legislation on information disclosure. In the US, the disclosure of ESG information is guided by the market; for example, a large number of passive ESG fund products are issued by mutual fund companies, which broaden the financial financing channels of listed companies with high ESG performance and motivate listed companies to disclose ESG voluntarily. In Japan, pension fund investment is used as a capital guide to invest in listed companies with high ESG performance and motivate listed companies to actively disclose their ESG information.

In order to implement the goals of the Paris Agreement, the Chinese government has proposed the goal and initiatives of “carbon neutrality and carbon peaking” in 2020. As a public enterprise, listed companies should play the role of capital market and be the main force to achieve carbon neutrality and the carbon peak strategy. In order to urge Chinese listed companies to improve the quality of information disclosure, the relevant Chinese authorities started to improve the relevant system as early as 2016. In 2016, the People’s Bank and seven other ministries and commissions issued the Guidance on Building a Green Financial System, proposing to establish and improve the mandatory environmental information disclosure system for listed companies. In the same year, the CSRC revised the provisions on the content and format of annual and semi-annual reports in The Guidelines on the Content and Format of Information Disclosure by Companies Issuing Public Securities. Companies and their subsidiaries that are key emission units announced by the environmental protection authorities should disclose relevant environmental information. In December 2017, the CSRC promulgated The Guidelines on the Content and Format of Information Disclosure by Companies Issuing Public Securities No. 2: Content and Format of Annual Reports (Revised 2017), which stipulates that if the content of environmental information is disclosed in the form of interim reports during the reporting period, the subsequent progress or changes shall be explained. Companies other than key emission units may disclose their environmental information with reference to the above requirements, and if not, the reasons shall be fully explained. Companies are encouraged to voluntarily disclose relevant information that is conducive to protecting ecology, preventing pollution and fulfilling environmental responsibilities. In September 2018, the SEC issued the revised Code of Governance for Listed Companies, which states that “listed companies should pay attention to the welfare of the communities in which they are located, environmental protection, public welfare and other issues while maintaining the company’s sustainable development and maximizing shareholders’ interests, and attach importance to the company’s social responsibility.” Under the urging of relevant authorities, the amount of voluntary ESG information disclosures by listed companies has increased significantly. According to data from the Shanghai Stock Exchange, of the 1,420 listed companies that released their annual reports in 2017, 855 made disclosures of environmental information, an increase of 235% from the previous year. Among them, 386 companies were key emission units and 439 were voluntary disclosures. In addition, 666 listed companies disclosed environmental information in their semi-annual reports in 2018, up 40% from the previous year, according to Shenzhen Stock Exchange data. A total of 215 companies voluntarily disclosed more environmental information, including the establishment and implementation of the environmental responsibility system, the amount of environmental investment, the acquisition of environmental management system certification and the development of cleaner production audits. More than 1,500 listed companies disclosed environmental information in their semi-annual reports in 2021, making it the year in which listed companies disclosed the most ESG-related information. While listed companies are disclosing ESG-related information, Chinese public funds are launching ESG products on an increasingly large scale. According to the data of the China Responsible Investment Annual Report 2020, the scale of China’s pan-ESG public securities funds per month was 120.972 billion yuan in 2020, and the number of pan-ESG indices released reached 52, including 15 in the ESG preferred category, 6 in the corporate governance preferred category, 2 in the starting low-carbon preferred category, and 27 in the energy-saving and environmental protection industry category.

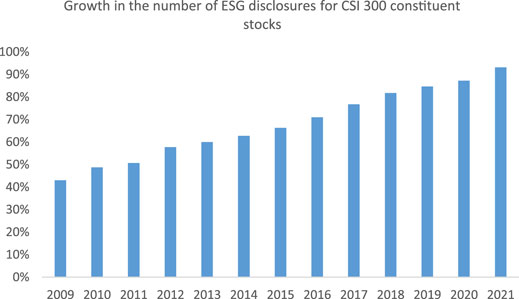

The voluntary disclosure of ESG by listed companies has increased significantly, as shown in Figure 1. As shown in Figure 1, the number of ESG information disclosures of CSI 300 constituents, for example, increased by 43% in 2009 and reached 81.8% in 2018. In the process of the voluntary disclosure of ESG information, how do listed companies implement the content of ESG information? Does investing working capital in ESG-related disclosures lead to corporate operating performance, and what is the mechanism by which ESG information disclosure is causing changes in intangible capital ? The traditional view is that managers have a special responsibility to maximize shareholder value under the constraints of relevant laws and regulations, whereas some argue that management has a more important responsibility not only to shareholders but also to a wider range of stakeholders. When management is biased toward social responsibility, it invests more in ESG disclosure and reports implementing higher cost socially responsible investments, which can increase intangible capital even if financial incentives exist. Firms perform better financially when management’s preference for CSR investments is higher than when managers have a strong preference for wealth (Martin, 2021). It has also been shown that there is a non-negative relationship between ESG disclosure and corporate financial performance (Li et al., 2017; Wang and Sarkis, 2017; Kuo et al., 2021), and it will cause changes in intangible capital.

FIGURE 1. Growth in the number of ESG disclosures for CSI 300 constituent stocks. Source: Shang Dao Rong Green, Wind Information.

Overall, existing studies have not analyzed the impact of ESG disclosure on the intangible capital of firms in terms of changes in ESG scores due to ESG disclosure by micro firms. The possible marginal contributions of this study include: first, introducing the square of log ESG scores, exploring the dynamic process of the changes in voluntary ESG disclosure on intangible capital, and revealing the “inverted U” type relationship between ESG disclosure and intangible capital; second, exploring the impact of the change in ESG score on intangible capital from the perspective of micro-corporate ESG change, and further elucidating the impact of ESG disclosure on intangible capital. Finally, the impact of ESG disclosure on intangible capital is discussed from the perspective of developing countries, which enriches the relevant research results at the level of ESG disclosure. Generally, there is a transition period after listed companies receive regulatory requirements, but the process of ESG information disclosure by Chinese companies shows that listed companies are responsive to disclosure (as seen in Figure 1), reflecting their sense of social responsibility as public companies.

Intangible capital is usually defined as the intangible resources that enter the production process (Yang and Shi, 2018), mainly including software, intellectual property, brand and innovative business process (Crouzet and Eberly, 2018), and is highly correlated with tangible capital (McGrattan Ellen and Prescott, 2014), is one of the important driving forces of enterprise business activities. In the early stage of enterprise digital transformation, except for equipment related to digital equipment, enterprises need to invest intangible resources such as human resources, technical know-how, information network and enterprise culture in business process transformation, management and operation training, software maintenance and other fields.

In the context of advocating for the green economy, sustainable investment is increasingly becoming one of the important issues of concern for all aspects of society. In response to the carbon neutrality and carbon peaking strategies advocated by the government, listed companies are increasingly focusing on disclosing information about ESG, and investors are increasingly concerned about corporate ESG disclosure (Khan et al., 2016). ESG disclosure is valuable to shareholders and can have an impact on corporate value, but ESG can amplify the true value of overvalued companies and reduce the true value of undervalued firms (Bofinger et al., 2022). What is the contribution of voluntary ESG disclosure for listed companies to the listed companies themselves? To this end, studies have been conducted on the relationship between ESG disclosure and corporate financial performance, but the findings are mixed. A total of 90% of the studies suggest that there is a non-negative relationship between ESG disclosure and corporate financial performance, such as Wang and Sarkis (2017) and Li et al. (2017). The main studies can be divided into two types. The “social impact hypothesis” believes that the better a company fulfills its social responsibility, the better its financial performance will be. Its logic has two points: 1) improving social influence and attracting more customers through corporate social responsibility initiatives can build a positive, upbeat social image, and increase intangible capital, which in turn can widely attract potential customers and expand the market share. 2) Improving employees’ sense of belonging and identity can enhance productivity. By attaching importance to the working environment of employees and establishing a comprehensive talent training mechanism, companies can bring a sense of belonging to their employees and promote their initiative, thus improving the overall productivity of the company. Therefore, ESG investment can lead to higher financial performance through the above two social impact mechanisms. The optimal social responsibility hypothesis proposes that the relationship between CSR and corporate financial performance is not a simple linear relationship, but rather a relationship similar to an inverted U-shape; if a company invests too much in ESG, it will correspondingly reduce its financial profit (Bowman and Haire, 1975), but can increase intangible capital. Based on this, hypothesis 1:

Hypothesis 1: ESG information disclosure promotes the increase of intangible capital.

In terms of the drivers of the impact of intangible capital at ESG disclosure sites, there are studies to enhance ESG performance by decomposing corporate value into profitability and the cost of equity capital (Zhang et al., 2021), and by increasing Tobin’s Q (Wong et al., 2021), improving corporate cash flow (Gregory, 2021) and reducing the cost of debt (Eliwa et al., 2021) to enhance intangible capital. Furthermore, Kuo et al. (2021) tracking study of ESG performance indicators and the short-term financial performance of 30 airlines worldwide showed that in the initial stage of ESG implementation, airlines’ return on assets tended to decrease; in the long-term implementation process, ESG implementation helped airlines’ return on assets increase.

It has also been shown that ESG disclosure shows a weak correlation with intangible capital (Friede et al., 2015). In non-linear models, ESG disclosure has a U-shaped relationship with financial performance, whereas in linear models, ESG disclosure has no linear relationship with financial performance (Nollet et al., 2016). For emerging market countries, ESG disclosure is not related to firm profitability (Garcia et al., 2017).

Although studies on ESG information disclosure and corporate value have reached different conclusions, under the carbon neutral and carbon peak strategy, the voluntary disclosure of ESG information by listed companies helps to achieve communication with suppliers and consumers and realize the improvement of intangible capital. ESG information disclosure and improvement of intangible capitalis a nonlinear relationship. The early stage of ESG information disclosure leads to a significant increase in costs and a decline in corporate business performance; when ESG inputs reach a certain level, ESG information disclosure will promote the improvement of intangible capital.

Intangible capital, such as software and information system, is becoming more and more important to corporate profitability, and the expansibility of intangible capital makes it easier for enterprises to obtain competitive advantages (Autor et al., 2020; Akcigit and Ates, 2021). The influence of intangible capital on enterprise performance can be summarized from two aspects. On the one hand, enterprise productivity can be improved by improving industry concentration and market power (Crouzet Nicolas Eberly, 2019; Crouzet Nicolas Eberly, 2019); On the other hand, enterprises adopt more intangible capital and scale-biased technology brought about by the progress of information technology to form the “superstar” effect (Autor et al., 2020) and achieve stable profit growth. Intangible capital not only has an impact on business performance, but also affects the quality of macro-economy. Intangible capital is an important source of productivity and economic growth (Yang and Shi, 2018). Crouzet and Eberly (2021) research shows that intangible capital affects the accuracy of TOTAL factor productivity in The United States, especially when the mismeasurement of intangible capital and the increase of the addition rate will lead to one-third to two-thirds of the downward deviation of total factor productivity growth in the United States.

Studies have shown that there is a certain promoting relationship between firm performance and intangible capital. Based on this, hypothesis 2 are proposed:

Hypothesis 2: ESG disclosure and intangible capital have an inverted U shape.Since the mandatory disclosure of ESG information by listed companies started in 2017, some companies may fail to comprehend the role of ESG in the early stage of ESG disclosure, resulting in ESG scores that may not reflect the true value of the company. However, ESG disclosure enables communication with investors, and it plays a key moderating role, which mitigates the negative impact of disadvantaged firms and weakens the positive impact of advantaged firms (Fatemi et al., 2018). There are significant changes in corporate ESG ratings as firms continue to increase their investment in ESG. Changes in ESG rating affect stock price performance. Shanaev and Ghimire (2021) investigate the impact of changes in 748 ESG ratings on the stock returns of U.S. companies from 2016 to 2021 by using a calendar time portfolio approach. Their study then showed that ESG rating upgrades result in a 0.5% increase in monthly returns, whereas ESG rating downgrades are detrimental to stock performance. Of course, ESG disclosure helps to mitigate uncertainty (Gregory, 2022), and the voluntariness of firms to increase ESG disclosure to mitigate uncertainty increases. Because enterprise performance and intangible capital have promotion relationship, hypothesis 3 is proposed:Hypothesis:3: Changes in ESG scores affect intangible capital.

1) Model

To measure the relationship between ESG disclosure and intangible capital, the following model is introduced:

esgit in Equation 1 denotes the logarithm of the ESG score of company i in period t, represents the result of ESG “output”. lnint_capit denotes the logarithm of intangible capital i in period t. Xit denotes the set of control variables, mainly the log of the net cash flow at the end of the period (lncash), the log of net profit that is attributable to the parent company of company (lnprofit), the log of the assets and liabilities (lndebt), the log of capital expenditure (lncapital), the log of the return on net assets (lnroe), the log of R&D spending (lnxrd), the log of the top ten shareholders’ shareholding ratio (lnshare_holder). To further characterize the relationship between ESG disclosure and the intangible capital of listed companies, this study controls for time and firm fixed effects.

Intangible capital has been considered to be particularly elusive, and its depreciation rate is unknown, so it is difficult to adopt the methods traditionally used to evaluate the capital stock (Tambe et al., 2020). How to measure intangible capital is one of the core issues concerned by academia. Throughout the existing studies, the main methods for measuring intangible capital are as follows: Enterprises’ intellectual capital and organizational capital (Peters & Taylor, 2017), Tobin Q (Brynjolfsson et al., 2021), IT investment measurement (Tambe et al., 2020), input-output measurement (McGrattan Ellen and Prescott, 2014). Intangible capital input mainly includes intellectual capital and organizational capital (Eisfeldt and Papanikolaou, 2014; Peters and Taylor, 2017), intellectual capital is measured by R&D input expenditure, and the sum of selling, General, and Administrative (SG&A) expenditure and intellectual capital and organizational capital are counted as intangible capital by perpetual inventory method. The intangible capital accounting method in this study is based on Peters and Taylor (2017).

2) Description of data and key indicators

ESG disclosure data for A-shares started in 2017, and the data collection period for the equity study is from 2017 to 2020 for non-ST stocks in A-shares. ESG indicators refer to CSR scores, and this study mainly uses A-share Wind scoring criteria and FTSE Russell scoring criteria.

The main variables involved in this study are shown in Table 1. As shown in Table 1, the mean value of the ESG score of the listed companies is 6.29, and the minimum and maximum values are 2.15 and 9.68, respectively, indicating that under the policy initiative, listed companies all start to disclose the relevant ESG indicators, but the funds invested in the governance of ESG by different companies show large differences, which can be seen mainly from the ESG score. The differences in the capital invested in ESG governance can be seen from the relevant financial indicators, such as the fact that the mean value of the logarithm of the cash flow of the listed companies is 1.59, and the minimum and maximum values are −4.61 and 9.79, respectively, indicating that there is significant heterogeneity in the cash flow of the listed companies. This leads to significant differences in the effect of enterprises in ESG governance due to financial constraints.

The sample size of FTS Russell ESG scores data is less, only about 1,400. Although there are fewer observations of FTSE Russell ESG scores, it also shows heterogeneity in ESG scores across companies.

1) Basic regression results

The results of the benchmark regressions of this study are presented in Table 2. Column (1) of Table 2 indicates that ESG disclosure helps to increase intangible capital, as shown by the significantly positive coefficient of lnesg. However, the improvement of intangible capital by ESG disclosure is not instantaneous, and the growth rate of the listed companies’ intangible capital slows down as companies increase their investment in the ESG field. This shows that the coefficient of (lnesg)2 is significantly negative, indicating that the investment in the ESG field and the intangible capital of the listed companies show a typical “inverted U” trend. After further controlling for financing constraints (sa), the results in column (2) of Table 2 remain robust, and the conclusion that ESG disclosure helps improve intangible capital still holds. To test the robustness of this result, the ESG disclosure data is replaced with the business reputation indicator, and the results are presented in column 3) of Table 2. The results in column (3) of Table 2 remain robust. The above findings suggest that ESG disclosure helps to improve intangible capital, but the investment in the area of ESG shows a non-linear relationship with the intangible capital of the listed companies.

The main reasons for the non-linear relationship between the ESG information disclosure of listed companies and intangible capital are as follows: firstly, ESG information disclosure requires relevant information in the fields of environment, social responsibility and governance, etc. According to the framework of the Securities and Futures Commission on ESG disclosure, listed companies collate and collect relevant information or data in the fields of environment, social responsibility and governance, and then they need to increase certain equipment and labor in the first phase. This will undoubtedly cause an increase in the short-term costs of enterprises, which will lead to increase in their short-term intangible capital level. Secondly, ESG disclosure helps to improve performance. When a company takes the initiative to undertake social responsibility, it can announce to the public that it has established a positive image, which in turn attracts potential customers, improves the market share and increases net profit, it can also increase intangible capital. Finally, ESG disclosure helps retain talents. By attaching importance to the working environment of employees and establishing a comprehensive talent training mechanism, companies bring a sense of belonging and humanistic care to their employees, promoting their initiative and, thus, improving the overall productivity of the company, which in turn improves intangible capital.

However, with the increase of ESG investment, the improvement effect of ESG score on intangible capital weakens. When the ESG score of an enterprise is raised to a certain extent, the enterprise has established a good image among the public, and it may be “uneconomical” to maintain a better image through ESG investment.

2) Robustness tests

As we all know, in accounting indicators, some indicators are directly related to each other. In order to overcome the endogeneity problem caused by the connection between indicators, we need to use other tools to test. In this paper, the improvement of ESG score of explanatory variables may be related to R&D investment, net profit, asset-liability ratio and other indicators.

Due to the possible endogeneity problem in OLS regression, GMM, 2SLS and partial sample deletion methods are introduced to test the robustness of the benchmark regression results, which are shown in Table 3. Column (1) of Table 3 uses the GMM method, and its findings are consistent with column (2) of Table 2, i.e., ESG disclosure helps increase intangible capital, as shown by the significantly positive coefficient of lnesg. However, the improvement of ESG disclosure on intangible capital is not instantaneous, and the growth rate of the listed companies’ intangible capital slows down as the companies’ investment in the ESG field increases, which shows that the coefficient of (lnesg)2 is significantly negative. This indicates that the investment in the ESG field and the intangible capital of listed companies show a typical “inverted U” type trend. Column (2) of Table 3 adopts the 2SLS method, and its results are consistent with column (1) of Table 3. Since some public enterprises are relatively more active after the Chinese government authorities advocated ESG information disclosure, and public enterprises in China are mainly state-owned enterprises, the data sample of state-owned enterprises is retained on the basis of column (2) of Table 2, and its regression results are consistent with column (2) of Table 2. The above result shows that the disclosure of ESG information by public companies helps intangible capital, but the positive relationship between ESG disclosure and intangible capital is not linear; ESG disclosure increases inputs and decreases cash flow, leading to a decrease in operating performance. However, as ESG information disclosure reaches a certain level, the average ESG inputs begin to decline, and intangible capital appears to improve. Similarly, the accuracy of the benchmark regression results was verified again by different methods.

3) Further Discussion

According to the Wind ESG indicator system, it involves 3 major dimensions, 27 topics and more than 300 indicators. For example, in the environmental indicators, indicators such as waste water, waste gas, and green buildings are covered, so that enterprises need to increase investment in environmental governance in order to reduce the “three wastes”. Among the social indicators, it mainly involves indicators such as R&D and innovation, occupational health and safety production, product quality, employment, etc. These indicators involve maintaining customer relationships, and it is necessary to increase R&D investment to improve product quality. Governance indicators include auditing, ESG governance, equity and shareholders, corruption and other indicators. Improving governance also requires investment.

Based on the analysis of the above three dimensional indicators, in order to obtain a higher ESG score, it is necessary to continuously increase investment. Therefore, changes in ESG scores can reflect changes in a company’s social, environmental, and governance investments.

The above findings explain the relationship between ESG disclosure and the intangible capital of listed companies, but the interaction between changes in ESG scores due to ESG inputs and intangible capital has not been addressed. How does ESG disclosure reflect ESG inputs? The existing data cannot portray the ESG input of listed companies at all. In order to further portray the relationship between the ESG inputs of listed companies and intangible capital, another indicator needs to be found. This study uses the change in ESG score (esg_diff) to portray the impact of corporate ESG input. The reasons for choosing the change in ESG score to reflect the change in ESG input are as follows: firstly, a third-party evaluation organization by investigating the EGS score of listed companies is relatively objective. Secondly, since the change in ESG score itself can reflect the indicator of corporate ESG improvement or lack thereof, when the ESG score improves, it is reasonable to believe that the ESG input of listed companies increases, and when the ESG score decreases, then the listed companies’ ESG input has not been increased.

Table 4 shows the relationship between changes in the ESG scores of listed companies and intangible capital. Column (1) of Table 4 considers the influence of DYNAMIC changes of ESG on intangible capital of listed companies, and the results show that change in ESG score helps to increase intangible capital, as shown by the significantly positive coefficient of lnesg_diff. However, the improvement of intangible capital by change in ESG score is not instantaneous, and the growth rate of the listed companies’ intangible capital slows down as companies increase their investment in the ESG field. This shows that the coefficient of (lnesg_diff)2 is significantly negative, indicating that the investment in the ESG field and the intangible capital of the listed companies show a typical “inverted U” trend.

Column (2) of Table 4 introduces the lagged period variable (l_profit) of net profit attributable to the parent company of listed companies, and the results show that the increase in ESG input will reduce the current net profit of enterprises, but will have a boosting effect on the net profit of the latter period, which shows that the coefficient of lnprofit is significantly negative, whereas l_profit (lagged period net profit) is significantly positive.

Column (3) of Table 4 introduces the two-period lagged variable (l2_profit) of net profit attributable to the parent company of the listed companies, and its results show that the increase in ESG input will reduce the current net profit of enterprises, but have a boosting effect on the net profit of the latter two periods, which shows that the coefficient of lnprofit is significantly negative, whereas l2_profit (two-period lagged net profit) is significantly positive, and the two-period lagged net profit significance level and coefficient are greater than that of the lagged one period. This indicates that the current net profit decreases little with the increase in ESG investment, but has an increasing marginal impact on the future net profit.

Column (4) of Table 4 introduces the lagged three period variable (l3_profit) of net profit attributable to the parent company of the listed companies. The results show that the increase in ESG investment will reduce the net profit of enterprises in the current period, but will have a boosting effect on the net profit in the next three periods, as shown by the significantly negative coefficient of lnprofit and the significantly positive coefficient of l3_profit (lagged three period net profit). The results indicate that the increase in ESG investment will reduce the net profit of the company in the current period, but will have a significant contribution to the net profit in the next three periods.

The relationship between changes in ESG scores and intangible capital verifies that the changes in ESG disclosure on intangible capital are not linear as traditionally believed, but rather show a non-linear relationship. The reasons for the non-linear relationship between the change in ESG disclosure and intangible capital are as follows: first, the increase in ESG investment in the short term and increase intangible capital, but in the future years, the increase in ESG investment and intangible capital increase will present “uneconomic” conditions. Secondly, the marginal improvement in future performance is better than the decline in short-term business performance, indicating that the future benefits that the companies can obtain can compensate for the short-term decline in performance, which is one of the motivations for companies to be willing to actively disclose ESG information.

4) Heterogeneity Analysis

The data description in Table 1 already shows that heterogeneity characteristics exist among different listed companies. Moreover, the heterogeneity is evident in different types of companies. In order to study the relationship between ESG and intangible capital, this study examines the heterogeneity from the business level and the region where the companies are located, and the results are shown in Table 5.

Columns (1) to (4) of Table 5 show the geographic regions in which the companies are located, which can generally be divided into four regions, namely, East, Central, West and Northeast. For listed companies in the East, Central and West, the results in column (1), (2) and (3) of Table 5 show that the ESG disclosure of the listed companies promotes intangible capital, and with the increase in ESG disclosure investment, ESG disclosure and intangible capital show an “inverted U” shape, which shows that the coefficient of lnesg is significantly positive, whereas the coefficient of (lnesg)2 is significantly negative. For listed companies in Northeastern regions, the results in columns (4) of Table 5 indicate that ESG information disclosure by listed companies does not contribute to the improvement of intangible capital, and there is no “inverted U” type relationship between ESG information disclosure and intangible capital. The reasons for the above differences may be as follows: firstly, for the East, Central and West, the listed companies are located in a region with better economic vitality, the communication between enterprises and investors is more adequate, and the listed companies are more willing to disclose information. Secondly, for the regions with relatively weak economic vitality, the exposure of the listed companies may not be too high, and they also face certain financial constraints. Thirdly, the transformation and upgrading of the old industrial base in northeast China is slow.

Columns (5) and (6) of Table 5 measure the impact of ESG disclosure on intangible capital in terms of good and bad corporate performance. The classification of good and bad corporate performance is based on the mean value of the logarithm of the return on net assets of the listed companies, and those greater than the mean value are included in the group of good performance, whereas those less than the mean value are included in the group of poor performance. Column (5) of the table shows that the ESG disclosure of the listed companies promotes the improvement of intangible capital, and the ESG disclosure and intangible capital show an “inverted U” type relationship. Column (6) of the table shows that the ESG disclosure of the listed companies with poor intangible capital does not promote the increase in current net profit, but there is also an “inverted U” type relationship between ESG disclosure and intangible capital. The possible reasons for this situation for the poor performers are as follows: first, they face financial constraints to increase ESG investment in the short term and may not have the funds or may not invest in ESG disclosure at the expense of current operating cash flow, which may affect their business performance. Second, in terms of improving the public image of the company, it is less likely that the company’s management will improve its public image from ESG investment because the poor performance of the company already has a negative impact on the public.

To further portray the heterogeneity of different firms, an indicator reflecting firms’ revenue per capita is introduced, and the mean value of the logarithm of revenue per capita is used as the benchmark; firms with a logarithm of revenue per capita greater than this mean value are included in the group with high revenue per capita, and vice versa in the group with low revenue per capita. Columns (7) and (8) of Table 5 analyze the results of the impact of ESG disclosure on intangible capital in terms of revenue per capita. Column (7) shows the group with high revenue per capita, ESG disclosure promotes the improvement of intangible capital, and ESG disclosure has an inverted U-shaped relationship with intangible capital. Column (8) shows the group with low revenue per capita, and for this group, ESG disclosure does not promote an increase in current net profit, but there is also an “inverted U” relationship between ESG disclosure and intangible capital. The possible reasons for this situation for the group with low revenue per capita are as follows: first, for listed companies with low revenue per capita, their own operating performance may be less than satisfactory, and the management faces a difficult choice between ESG investment and maintaining the existing operation due to the financial constraints on corporate ESG investment. Secondly, for listed companies with low revenue per capita, ESG investment can hardly improve revenue per capita in the short term, resulting in the weak willingness to participate in corporate ESG investment.

The above heterogeneity analysis shows that ESG information disclosure and intangible capital present large differences across companies. For developing regions in the Central and Western, listed companies are significantly more willing to disclose ESG than those in the East regions; for listed companies with good performance, listed companies are also significantly more willing to disclose ESG information. For listed companies with good revenue per capita, listed companies are significantly more willing to disclose ESG information than those with poor revenue per capita.

The report of the 19th Party Congress pointed out that China’s economy has shifted from the stage of high-speed growth to the stage of high-quality development. Social responsibility and corporate green innovation both contribute to China’s high-quality development, but it is difficult to balance social and economic benefits at the same time, and it is a question of whether both can bring economic benefits to the enterprises themselves while bringing social benefits. In response to global climate change, China has made a solemn commitment to the world to achieve carbon neutrality and carbon peaking, and in order to achieve this goal, the relevant Chinese authorities have formulated relevant policies and measures to promote enterprises to steadily promote carbon reduction plans. Listed companies are the public enterprises in China’s manufacturing industry, and their voluntary ESG disclosure has become a key concern for social monitoring. Under pressure from various aspects, by 2017, more and more companies have voluntarily disclosed ESG by listed companies, and the quality of ESG disclosure has become better and better, which is shown by the slow process of improvement in companies’ ESG scores.

Is there a relationship between ESG score improvement and intangible capital? To unravel this mystery, this study introduces the square of intangible capital and explores the dynamic process of the change in voluntary ESG disclosure on intangible capital, showing that ESG disclosure significantly contributes to the performance of listed companies, but ESG disclosure and intangible capital show an “inverted U” shape. The relationship between ESG disclosure and intangible capital is further analyzed by using ESG score change (esg_diff) to characterize the impact of corporate ESG input. The study shows that the increase in ESG input reduces the current net profit of the company, but significantly contributes to the net profit of the next period, the next two periods and the next three periods.

However, there is significant heterogeneity in the effect of ESG disclosure on intangible capital. The heterogeneity of ESG disclosure in east, central, west and northeast regions shows that ESG disclosure promotes intangible capital only in the eastern region and has an “inverted U” shape, whereas there is no such relationship in the other regions. In terms of good or bad intangible capital, ESG disclosure promotes intangible capital in the group with good performance, and ESG disclosure has an “inverted U” relationship with intangible capital, whereas there is no significant relationship between ESG disclosure and intangible capital in the group with poor performance. From the perspective of revenue per capita, ESG disclosure promotes intangible capital in the group with high revenue per capita, and ESG disclosure has an “inverted U” relationship with intangible capital, although there is no significant relationship between ESG disclosure and intangible capital in the group with high revenue per capita. However, there is an “inverted U” relationship between ESG disclosure and intangible capital in the group with low revenue per capita.

The above study shows that the ESG information disclosure of listed companies has shown a large differentiation, and this differentiation is likely to further expand. Some listed companies that have completed the first phase of climate target commitment through product transformation and business transformation have gradually started to pursue more stringent and comprehensive environmental and climate targets in order to further reduce the indirect impact of their products and business on the climate. A common goal is the “carbon footprint neutrality” goal, which calculates the total carbon emissions generated during the production process, from raw material processing to final product production, and helps upstream producers use alternative raw materials and renewable energy to build a carbon footprint for each link of the entire industry chain as part of the “carbon neutral” development goal. In order to balance the ESG disclosure of listed companies and help relatively backward enterprises enhance and improve ESG information disclosure, the following levels of improvement are needed, and the following policy insights are derived:

First, improve ESG disclosure scoring standards to achieve comparability among indicators. Compared with foreign countries, domestic ESG-related research is still in the initial stage. Not only are there relatively few studies dedicated to the evaluation of ESG indicators for listed companies, and the definition and connotation of ESG have not yet reached a consensus, but there are also limitations in the research on the individual evaluation of listed companies’ fulfillment of social responsibility and green development by relevant rating research institutions. Moreover, ESG research institutions have formed their own schools of thought, lacking absolutely convincing index systems and evaluation methods, and some studies only publish the evaluation results without disclosing the evaluation indexes and evaluation methods, and the evaluation itself lacks transparency.

As shown in Table 1, as corporate heterogeneity leads to large differences in ESG information disclosure input by listed companies, whether it is the Wind ESG score or FTSE Russell’s ESG score, these two indicators only have total scores without further differentiating each score item of E, S and G. The comparability of ESG scores among different industries needs to be further improved.

Second, tax incentives are given in the field of ESG information input to prompt enterprises to establish and improve detailed indicator systems. For ESG rating agencies, the database of ESG ratings of domestic listed companies is weak, and the data source of ESG-related indicators is a difficult problem. The main data sources of existing research include the public disclosure of listed companies’ financial reports and social responsibility reports as well as data from media, data provided by third-party organizations, questionnaires, data information obtained from field research, etc. Therefore, there exists the phenomenon that some evaluation institutions backwardly deduce the evaluation system based on experience and internal data, which lacks certain scientificity and operability.

Listed companies need to disclose ESG information, and the ESG implementation of all aspects of governance requires investment from all aspects of ESG one by one, such as the purchase of environmental protection equipment, etc., all of which reduce corporate operating cash and is an extremely difficult choice for companies with poor operating performance. In order to help company improve ESG information disclosure, the government can consider giving companies certain tax incentives in the area of ESG investment to increase their motivation.

Third, form a socialized guidance enterprise ESG disclosure mechanism. Drawing on the experience of the United States and Japan in socially guiding enterprises to voluntarily disclose ESG information. Policy makers should formulate relevant policies which can promote public funds and pension funds to establish ESG fund products. The ESG fund products can expand financial financing channels for listed companies.

Fourth, for the listed companies in Northeastern regions, the relevant departments appropriately give policy inclination to listed enterprises in these regions to help them quickly establish and improve ESG information disclosure to increase their enthusiasm toward disclosing ESG information.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

WJ is responsible for article writing and model building, ZS for building research ideas and models, TY for literature translation.

Guangxi science and technology base and talent special project: research on incentive mechanism of user information sharing in live e-commerce - based on social capital perspective (No., 2020AC19034). 2021 Guangxi 14th Five-Year Education Science Planning Key Special Project: Research on the influence of learning communities on users’ online learning behavior in the information technology environment (No., 2021A033). 2021 Guangxi 14th Five-Year Education Science Planning Key Special Project: Research on the influence of short video sharing on Chinese cultural identity of international students in China - taking Jitterbug as an example (No., 2021ZJY1607). 2022 Guangxi Degree and Postgraduate Education Reform Project: Research on Cultivating Innovation and Practical Ability of Postgraduates in Local Universities in Guangxi. (No., JGY2022122). Guangxi undergraduate teaching reform project in 2022: research on the construction of marketing professional course Civics under online and offline mixed teaching mode. (No., 2022JGB185 ). Teaching reform project of Guilin University of Electronic Science and Technology: research on the construction of Civic Government of the course of Brand Management. (No., JGB202114). Doctoral research initiation project of Guilin University of Electronic Science and Technology: “Research on the incentive mechanism of knowledge sharing in online medical communities” (No., US20001Y). Guangxi Zhuang Autonomous Region College Students Entrepreneurship Training Project (Anxingbao - Dao Traffic Safety Warning APP).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Akcigit, U., and Ates, S. T. (2021). Ten Facts on Declining Business Dynamism and Lessons from Endogenous Growth Theory. Am. Econ. J. Macroecon. 13, 257–298. doi:10.1257/mac.20180449

Autor, D., Dorn, D., Katz, L. F., Patterson, C., and Van Reenen, J. (2020). The Fall of the Labor Share and the Rise of Superstar Firms*. Q. J. Econ. 135, 645–709. doi:10.1093/qje/qjaa004

Avramov, D., Cheng, S., Lioui, A., and Tarelli, A. (2021). Sustainable Investing with ESG Rating Uncertainty. J. Financial Econ. doi:10.1016/j.jfineco.2021.09.009

Bofinger, Y., Heyden, K. J., and Rock, B. (2022). Corporate Social Responsibility and Market Efficiency: Evidence from ESG and Misvaluation Measures. J. Bank. Finance 134, 106322. doi:10.1016/j.jbankfin.2021.106322

Bowman, E. H., and Haire, M. (1975). A Strategic Posture toward Corporate Social Responsibility. Calif. Manag. Rev. 18 (2), 49–58. doi:10.2307/41164638

Brynjolfsson, E., Rock, D., and Syverson, C. (2021). The Productivity J-Curve: How Intangibles Complement General Purpose Technologies. Am. Econ. J. Macroecon. 13, 333–372. doi:10.1257/mac.20180386

Chappell, N., and Jaffe, A. (2018). Intangible Investment and Firm Performance. Rev. Ind. Organ 52, 509–559. doi:10.1007/s11151-018-9629-9

Christensen, D. M., Serafeim, G., and Sikochi, A. (2021). Why Is Corporate Virtue in the Eye of the Beholder? the Case of ESG Ratings. Account. Rev. 97 (1), 147–175. doi:10.2308/tar-2019-0506

Crouzet, N., and Eberly, J. (2018). Intangibles, Investment, and Efficiency. AEA Pap. Proc. 108, 426–431. doi:10.1257/pandp.20181007

Crouzet Nicolas Eberly, J. C. (2019). Understanding Weak Capital Investment: The Role of Market Concentration and Intangibles. NBER Working Paper 25869. New York, NY: National Bureau of Economic Research. doi:10.3386/w25869

DasGupta, R. (2021). Financial Performance Shortfall, ESG Controversies, and ESG Performance: Evidence from Firms Around the World. Finance Res. Lett. 46, 102487. doi:10.1016/j.frl.2021.102487

Eisfeldt, A. L., and Papanikolaou, D. (2014). The Value and Ownership of Intangible Capital. Am. Econ. Rev. 104 (5), 189–194. doi:10.1257/aer.104.5.189

Eliwa, Y., Abound, A., and Saleh, A. (2021). ESG Practices and the Cost of Debt: Evidence from EU Countries. Crit. Perspect. Account. 79, 102097. doi:10.1016/j.cpa.2019.102097

Fatemi, A., Glaum, M., and Kaiser, S. (2018). ESG Performance and Firm Value: The Moderating Role of Disclosure. Glob. Finance J. 38, 45–64. doi:10.1016/j.gfj.2017.03.001

Friede, G., Busch, T., and Bassen, A. (2015). ESG and Financial Performance: Aggregated Evidence from More Than 2000 Empirical Studies. J. Sustain. Finance Invest. 5, 210–233. doi:10.1080/20430795.2015.1118917

Garcia, A. S., Mendes-Da-Silva, W., and Orsato, R. J. (2017). Sensitive Industries Produce Better ESG Performance: Evidence from Emerging Markets. J. Clean. Prod. 150, 135–147. doi:10.1016/j.jclepro.2017.02.180

Gregory, E. D., Schneck, W. C., and Frankforter, E. L. (2021). swSim: Solid Wave Simulation. SoftwareX 14, 100698. doi:10.1016/j.softx.2021.100698

Gregory, R. P. (2022). ESG Scores and the Response of the S&P 1500 to Monetary and Fiscal Policy during the Covid-19 Pandemic. Int. Rev. Econ. Finance 78, 446–456. doi:10.1016/j.iref.2021.12.013

Khan, M., Serafeim, G., and Yoon, A. (2016). Corporate Sustainability: First Evidence on Materiality. Account. Rev. 91 (1), 1697–1724. doi:10.2308/accr-51383

Kuo, T.-C., Chen, H.-M., and Meng, H.-M. (2021). Do corporate Social Responsibility Practices Improve Financial Performance? A Case Study of Airline Companies. J. Clean. Prod. 310, 127380. doi:10.1016/j.jclepro.2021.127380

Li, X., Xu, F., and Jing, K. (2022). Robust Enhanced Indexation with ESG: An Empirical Study in the Chinese Stock Market. Econ. Model. 107, 105711. doi:10.1016/j.econmod.2021.105711

Li, Y., Gong, M., Zhang, X. Y., and Koh, L. (2017). The Impact of Environmental, Social, and Governance Disclosure on Firms Value: the Role of CEO Power. Br. Account. Rev. 50, 60–75. doi:10.1016/j.bar.2017.09.007

Martin, P. R. (2021). Corporate Social Responsibility and Capital Budgeting. Account. Organ. Soc. 92 (2), 101236. doi:10.1016/j.aos.2021.101236

McGrattan, E. R., and Prescott, E. C. (2014). A Reassessment of Real Business Cycle Theory. Am. Econ. Rev. 104, 177–182. doi:10.1257/aer.104.5.177

Nollet, J., Filis, G., and Mitrokostas, E. (2016). Corporate Social Responsibility and Financial Performance: a Non-linear and Disaggregated Approach. Econ. Model. 52, 400–407. doi:10.1016/j.econmod.2015.09.019

Peters, R. H., and Taylor, L. A. (2017). Intangible Capital and the Investment-Q Relation. J. Financial Econ. 123, 251–272. doi:10.1016/j.jfineco.2016.03.011

Schiederig, T., Tietze, F., and Herstatt, C. (2012). Green Innovation in Technology and Innovation Management - an Exploratory Literature Review. R&D Manage 42 (2), 180–192. doi:10.1111/j.1467-9310.2011.00672.x

Shanaev, S., and Ghimire, B. (2021). When ESG Meets AAA: The Effect of ESG Rating Changes on Stock Returns. Finance Res. Lett., 102302

Tambe, P., Hitt, L. M., Rock, D., and Brynjolfsson, E. (2020). Digital Capital and Superstar Firms. NBER Working Paper. New York, NY: National Bureau of Economic Research. doi:10.3386/w28285

Wang, Z., and Sarkis, J. (2017). Corporate Social Responsibility Governance, Outcomes, and Financial Performance. J. Clean. Prod. 162, 1607–1616. doi:10.1016/j.jclepro.2017.06.142

Wong, W. C., Batten, J. A., Ahmad, A. H., Mohamed-Arshad, S. B., Nordin, S., and Adzis, A. A. (2021). Does ESG Certification Add Firm Value? Finance Res. Lett. 39, 101593. doi:10.1016/j.frl.2020.101593

Yang, S., and Shi, X. (2018). Intangible Capital and Sectoral Energy Intensity: Evidence from 40 Economies between 1995 and 2007. Energy Policy 122, 118–128. doi:10.1016/j.enpol.2018.07.027

Keywords: ESG, business performance, corporate profits, net profit, marginal effect

Citation: Jun W, Shiyong Z and Yi T (2022) Does ESG Disclosure Help Improve Intangible Capital? Evidence From A-Share Listed Companies. Front. Environ. Sci. 10:858548. doi: 10.3389/fenvs.2022.858548

Received: 20 January 2022; Accepted: 26 April 2022;

Published: 10 May 2022.

Edited by:

James Crabbe, Oxford University, United KingdomReviewed by:

Muhammad Mohsin, Jiangsu University, ChinaCopyright © 2022 Jun, Shiyong and Yi. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zheng Shiyong, c2hpeW9uZ3poZW5nMTIzQHdodS5lZHUuY24=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.