- School of Economics, Huazhong University of Science and Technology, Wuhan, China

We take the “Environmental Information Disclosure Measures (Trial)” implemented in China as a quasi-natural experiment and use the difference-in-difference (DID) method to identify the impact of environmental information disclosure (EID) on local exports. Additionally, we further investigate the impact of fiscal decentralization on local governments’ performance of this centrally mandated environmental information disclosure policy. Our results suggest that EID significantly hinders local exports, and such an inhibition effect exhibits obvious regional and stringency heterogeneity. Furthermore, the degree of fiscal decentralization is positively related to the enthusiasm of local governments in implementing the EID policy, thus strengthening EID’s inhibitory impact on local exports. As for the mechanisms behind, we verify that EID activates the “cost effect” and increases the cost of local pollution control. However, it cannot stimulate local innovation at the same time, and the “innovation effect” does not work, which ultimately results in a decrease in local exports; for cities with a high degree of fiscal decentralization, local governments tend to actively implement the centrally-mandated environmental protection policy by increasing investments in environmental pollution control and stimulating the innovation vitality of local enterprises. But the benefits from the innovation improvement cannot fully offset the negative impact of the increase in environmental costs in the short term, and local exports are further reduced.

Introduction

Since its accession to the World Trade Organization in 2001, China began to participate in the global industrial division, ultimately resulting in the worsening of environmental pollution problems. During this process, a large number of labor-intensive and resource-intensive industries have been transferred from developed countries to China, which on the one hand promotes the development of China’s industrialization process, but on the other hand, enhances the extensive economic growth mode of “high pollution, high emissions, and high energy consumption,” causing extremely serious environmental pollution problems and making China become one of the most polluted countries in the world (Huang, 2017). In order to control the worsening environmental pollution, the Chinese government has made strenuous efforts to regulate environmental pollution and has taken various measures to ensure that the whole economy grows with less environmental damage. The government’s environmental regulation has developed from the initial stage (command-and-control type) to the promotion and application stage (market-based type), and now to the innovation stage (information disclosure type) (Fang et al., 2019). Studies have shown that environmental information disclosure policies in China can promote water pollution management (Pan and Fan, 2020), improve the accuracy of air-quality reports (Feng et al., 2021), and upgrade the overall environmental quality of the pilot cities (Feng and He, 2020). While its significant environmental effects have been recognized, environmental information disclosure’s economic effects are also worth investigating.

In the process of China’s rapid economic development, exports, as one of the engines to promote economic growth, play an extremely important role. The good performance of Chinese exports is, however, largely attributed to the low domestic environmental costs. With the continuous improvement of environmental governance and the introduction of advanced environmental regulation approaches, such as environmental information disclosure, the environmental cost advantage that Chinese exporting firms once had is gradually disappearing. How will it affect Chinese exports? At the same time, under the fiscal decentralization system in China, local governors, who are the policy implementers and local agents being assessed by the central government on local economic performance, may react differently when they enjoy different fiscal autonomy. Will local governments firmly implement the EID policy to curb local environmental pollution, thereby presenting the characteristic of “racing to the top”? Or will they selectively implement the EID policy and even intend to sacrifice the environment to achieve better economic performance, showing the characteristic of “racing to the bottom”? Answering these questions is beneficial to finding the balance of economic development and environmental protection and is of great practical significance.

This paper mainly relates to two strands of literature. The first strand of literature is about the economic effects of EID policy. Some scholars study the impact of the EID policy on Chinese listed firms’ economic performance. Yang et al. (2020) show that EID policy has a significant impact on the listed firms’ value. Wang et al. (2020) report that EID policy is positively related to the investment efficiency of Chinese A-listed companies. Shi et al. (2019) claim that EID policy hinders the inflow of FDI but it also promotes the exit of polluting firms and increases the entry of clean firms, ultimately optimizing the FDI structure in China. Lu and Li (2020) find that EID policy exerts a significant impact on the enterprises’ location choices, especially for clean enterprises. Later, some scholars turn to studying China’s export performance. Up to now, there exist only two studies that focus on the impact of EID on exports. Fang et al. (2019) suggest that EID policy reduces the export scale of Chinese exporting firms and the inhibitory effect is significant in firms that are non-state-owned, large, or low-productivity. Lu et al. (2020) show that EID can promote a firm’s decision-making for export and that the relationship between EID and export scale is nonlinear, which depends on the type of EID.

The second strand of literature is about local governments’ performance towards centrally mandated environmental regulation policies under the background of China’s fiscal decentralization system. When faced with environmental protection and regulations, local governments used to behave in two totally distinct ways. One way is to selectively implement the environmental protection policies and present the characteristic of “racing to the bottom”. Jin and Shen (2018) claim that under the dual systems of fiscal decentralization and performance appraisal, local governments’ competitive behaviors for local economic growth may lead to their selective implementation of environmental policies. To be specific, in order to obtain more resources for local development and gain prominent achievement and a better reputation, local governments may adopt the strategy of “racing to the bottom” to selectively implement the centrally mandated environmental regulation policies and even lower the environmental standards to create sufficient incentives to attract flowing resources, highlighting the profit-making characteristics of the local governments (Zhou, 2004, 207; Zhu et al., 2011; Zhang, 2016). The other way is to earnestly implement the environmental protection policies and even promote their environmental standards. For cities in the transition period, local governments may adopt the attitude of “racing to the top” to execute environmental regulations and try to create a better living and production environment for the inflow of high-quality talents and investments in favor of local development (Konisky, 2007; Zhang and Zhu, 2010).

Despite the abovementioned progress, there still exist some shortcomings in the relevant fields. For instance, literature that studies EID’s impact on exports is still quite rare, leaving a large research gap to fill in. At the same time, very little is done on the relationship between fiscal decentralization and local governments’ actions on EID policy. Few scholars consider the economic impacts of environmental regulation policies, especially EID policies, from the perspective of fiscal decentralization. Last but not the least, environmental regulation has been mainly measured by indicators such as pollutant discharges and pollution abatement investments in the existing literature (Lei et al., 2017; Liu et al., 2018; Zhou et al., 2019), which may cause potential endogeneity problems and consequently bias estimation results.

To overcome the abovementioned shortcomings, we take the “Environmental Information Disclosure Measures (Trial)” (EID policy for short) implemented since 2008 as a quasi-natural experiment and use the DID method to estimate the impact of the EID policy on local exports with the panel data of 284 cities in China. We also consider the impact of fiscal decentralization and further investigate the performance of the local governments with different fiscal powers when implementing the centrally mandated EID policy. Apart from that, we shed light on the underlying mechanisms of how EID policy exerts an effect on local exports and analyze how fiscal decentralization affects the local governors’ implementation of EID policy. We also do a series of robustness checks to confirm the reliability of our results.

Our results show that EID significantly inhibits local exports, and this inhibition effect presents significant regional and stringency heterogeneity. Additionally, we find a positive relationship between the degree of fiscal decentralization and the inhibitory effect of EID on local exports, which means that in cities with a higher degree of fiscal autonomy, local governors have a stronger motivation to comply with the centrally-mandated EID policy and chase for the “green achievements”. The mechanism behind it is that EID policy significantly increases local pollution abatement costs but hinders innovation activities, thus leading to a decrease in local exports. Local governments with higher fiscal power are more likely to increase investments in pollution control and encourage local innovation activities. However, the benefits from the innovation improvement cannot fully offset the negative impact of the increase in environmental costs in the short term, and local exports are further reduced.

The original contributions of our study to the existing literature are as follows. Firstly, we enrich the existing literature on the policy effects of Chinese environmental information disclosure, which deserves more attention and concerns. We also investigate how local governors behave when faced with a centrally-mandated policy from the perspective of fiscal decentralization, filling the large research gap. Furthermore, we are the first to further uncover the mechanisms of how EID policy affects local exports and how local governors react to the environmental policy, which enables us to put forward targeted policy recommendations. Secondly, we take the EID policy as a quasi-natural experiment and use the DID method to identify the casual effect of the EID policy on local exports, largely avoiding the potential endogeneity problems caused by the irrationality from the measurement of environmental regulation and systematic measurement errors from data collection.

The remainder of this paper is organized as follows. In Policy Background and Research Hypotheses, we introduce the policy background and propose our hypotheses. In Model Specification and Data Sources, we describe the model specifications and data sources. In Empirical Results and Analysis we report the empirical results, including results of baseline regression, robustness checks, heterogeneity tests, and mechanism tests. In Conclusion and Policy Implications, we conclude and provide policy recommendations.

Policy Background and Research Hypotheses

Policy Background

Facing the worsening environmental pollution since China’s accession to the World Trade Organization in 2001, the Chinese government has been earnestly exploring solutions to seek a balance between economic growth and environmental protection. Since 2003, the Chinese government has issued a series of environmental laws and regulations to guide and manage the enforcement of the disclosure of environmental information. The “Cleaner Production Promotion Law” issued in 2003 and the “Interim Measures on Clean Production Checks” issued in 2004 set mandatory information disclosure obligations for key enterprises listed due to their heavy pollution caused by production. To further encourage public supervision and publication in environmental protection, the General Office of the State Council launched the “Decision on implementing the scientific development concept and strengthening environmental protection” in 2005. This “Decision” explicitly requires enterprises to disclose environmental information, and advises local governments to improve the efficiency of social supervision and enhance the management of environmental violations. On February 8, 2007, the State Environmental Protection Administration (SEPA) (now the Ministry of Ecology and Environment) issued the “Environmental Information Disclosure Measures (Trial)”, which came into effect with the “Government Information Disclosure Bill” issued by the General Office of the State Council on May 1, 2008. Both of them provided local governments and local enterprises with detailed and specific guidance for disclosure the of environmental information.

To systematically evaluate local governments’ performance of EID policy, the Institute of Public and Environmental Affairs (IPE) and the US Natural Resources Defense Council (NRDC) jointly developed the “Pollution Information Transparency Index” (PITI index) according to the requirements of the Trial. Precisely, they first chose1131 cities in China as pilot cities and then evaluated their yearly performance of the EID policy since 2008. Then each city is given a PITI score, which is mainly based on the following eight aspects: the daily over-standard of pollution sources; information on violations of regulations; centralized remediation information of pollution sources; clean production audit information; overall evaluation information of corporate environmental behaviors; complaints processing results of public environmental issues or corporate pollution environment; the environmental protection acceptance results of the construction project; the relevant information on the sewage charges; and the disclosure of the application. (Fang et al., 2019).

Therefore, only the information disclosure performance of 113 cities is assessed yearly and supervised by the public. The remaining cities may disclose local environmental information as their counterparts do, but they are less regulated and their performance receives less attention from the citizens and organizations as well. Thus, we regard the 113 pilot cities as the treatment group since the local governors have a stronger desire to disclose local environmental information and they are more regulated (by the “Measures” and also the public) in a sense. And those cities without PITI are regarded as control groups since they are not effectively regulated. The discrepancy between these groups provides us with a good chance to conduct a DID method to identify the effect of EID on local exports and further investigate the effect of fiscal decentralization.

Research Hypotheses

EID and Local Exports

As a strict environmental regulation, the EID policy brings new constraints to local governments and export firms. For local governments, they have to invest more in the purchase of large-scale pollution treatment equipment and the construction of better pollution-control facilities. Local governments also need to change their internal personnel and regular work arrangements, setting proper inspection frequency and intensity to ensure the disclosure quality of local firms. All the above-mentioned adjustments generate extra administrative costs. For local firms, when faced with the EID policy, they have to make a series of internal adjustments in terms of production procedures and energy consumption, which ultimately increase firms’ marginal costs. Those rising adjustment costs essentially represent the increase in compliance costs (Clarkson et al., 2015). At the same time, in order to respond to policy requirements and comply with public supervision, firms must take specific measures, such as monitoring the emission process, collecting and providing environmental data, and even obtaining environmental certification labels (Ren et al., 2019). It means that firms also have to adjust their internal management and business strategies apart from rearrangements in the production sector, thereby increasing the operating costs and reducing their economic performance (Liu and Zhang, 2017). Therefore, the additional costs brought by EID policy make it unconducive for local exports to expand (Hering and Poncet, 2014; Shi and Xu, 2018; Gao et al., 2019).

Although environmental regulation brings extra environmental costs, which is unfavorable for firms’ economic performance, it may also force firms to improve production technology, stimulate independent innovation, explore cleaner production procedures, and thus strengthen product competitiveness (Porter and Van der Linde 1995). According to the Porter Hypothesis, proper implementation of environmental regulations helps to improve firms’ economic performance. Song et al. (2019) also show that the government’s environmental supervision exerts a positive impact on firms’ technological innovation and that firms will carry out green technology innovation in order to achieve the required emission reduction goal (Chen et al., 2019). With the enhancement of the public’s environmental awareness, consumers would prefer to choose green products. The innovation improvements mentioned above would help offset the adverse effect of the increasing environmental costs and are conducive to the expansion of local exports. Therefore, we propose:

Hypothesis 1: EID will affect local exports positively if innovation effects dominate cost effects, and negatively if cost effects dominate innovation effects.

Fiscal Decentralization and Centrally-Mandated EID Policy

Due to the multi-level environmental governance system in China, the state council plays the roles of target setting and final performance assessing, while local governors are entitled the administrative power on local firms (Zhang and Xie, 2020). Under this background, local governors play a dual role. On the one hand, they are the major implementers of EID policies and the direct supervisors of local firms; on the other hand, they are competitors who are highly motivated to achieve better economic performance in their jurisdiction for personal promotions in the future (Li and Zhou, 2004; Zhou, 2007). As fiscal decentralization reflects devolution of the authority by the central government to lower-level governments on financial expenditure, revenue, and other relative affairs, the degree of fiscal decentralization could be recognized as the degree of fiscal autonomy and further be regarded as a kind of political resource which is conductive for local governors to achieve their political ambition. Consequently, higher degree of fiscal decentralization enjoyed by the governor of a city means greater financial autonomy of this city, so the local governor’s motivation to create “green achievements” should be significantly stronger than that to get more economic benefits. Implementing the centrally mandated EID policy and promoting environmental performance will be the better choice for local governors to obtain a good reputation and get further promotion, showing the characteristic of “racing to the top”. For governors in cities with a lower degree of fiscal decentralization, achieving better economic performance and obtaining adequate fiscal funds for local development would be their priority. Therefore, they may selectively implement the EID policy, which may benefit local polluting firms with lower production costs and ultimately promote the local economy. At the same time, these governors could earn “grey profits” from their collusion with the polluting firms, thus weakening the export effect of EID policy. Based on the abovementioned rationale, we propose:

Hypothesis 2: The degree of fiscal decentralization is positively related to the governments’ performance of centrally mandated EID policy. A higher degree of fiscal decentralization results in a stronger impact of EID on local exports.

Model Specification and Data Sources

Model Specification

We consider the export gravity model the basic model. Since the traditional gravity model is generally applicable for bilateral trade, we extend the application of the gravity model to an extreme case: China is on one side of bilateral trade, and the rest of the world is on the other side. For the extension of the trade gravity model, scholars mainly modify the original model by introducing new explanatory variables, which could be divided into two categories: one covers the endogenous variables that affect the trade volume, such as population, per capita GDP, and so on; the other covers virtual variables such as preferential trade agreements and integration organizations. In this way, we further incorporate new variables, which are closely related to our research goal, and get an extended gravity model.

In this paper, we use the difference-in-difference (DID) method to estimate the effects of the EID policy on local exports. Specifically, DID is a quasi-experimental design that uses the longitudinal data from treatment and control groups to obtain an appropriate counterfactual to estimate a causal effect. DID is typically used to estimate the effect of a specific policy shock or a kind of treatment (such as an enactment of a policy, a newly issued law, or medical projects) by comparing the changes in outcomes over time between a group that is enrolled in a program or affected by a policy shock (the treated group) and a group that is not (the control group). In this way, the common setting of the DID method is to add the interaction term of the policy dummy variable (which differentiates the affected group from the others) and the policy time dummy (which identifies the time before and after the policy shock). The coefficient of the interaction term indicates the net effect of the policy shock. Based on the extended gravity model using the DID method, our model is specified as follows:

where

Considering that fiscal decentralization may also affect the performance of local governments, we further use the triple interaction terms to investigate the implementation of EID by local governments with different degrees of fiscal decentralization. Our model is specified as follows:

In Eq. 2, the coefficient

Variable Selection

Dependent variable: real export value at city level (Export). We take the real export value of each city as the dependent variable to study the impact of EID on the export volume of each city. In addition, in order to ensure the robustness of baseline results, we also use real export per capita (Excap) as an alternative dependent variable to carry out the regression.

Independent variable: the EID policy shock. As instructed by the DID method, we create the interaction term between the policy dummy variable and the year dummy variable (

Control variables: following the practice of Sheng and Wang (2012), Hering and Poncet (2014), Xue and Su (2014), and Gu et al. (2016), we also select a series of city-level control variables to control the potential impact of other factors at the city level. Since the exports of a city are affected by the city’s economic development level, population, industrial structure, infrastructure construction, tax preference, financial development level, and environmental pollution, we select the GDP growth rate, population density, proportion of total industrial output value in GDP, total passenger transport volume, proportion of value added tax receivable in GDP in this year, and industrial wastewater discharge as control variables.

Data Source

In this paper, we use balanced panel data for 284 cities in China from 2004 to 2013. Our time span is limited to 2004–2013, mainly based on the following considerations: firstly, the EID policy starts in 2008, which is within this time interval. Secondly, when we use the DID method to identify the causal effect of EID on local exports, an important premise is to ensure that there should be no systematic impact of other shocks on the treatment group and the control group after the EID policy shock appears, so the selected time span should not be too long (Chen, 2020). After 2013, EID in China officially enters a new stage, with significant changes in evaluation indicators and evaluation subjects. Besides, a series of other environmental policies, such as the “Central Environmental Protection Inspection” plan and the new “Environmental Protection Law”, have been launched since 2013. Local exports in years after 2013 are obviously affected by multiple environmental policies and cannot reflect the net effect of the EID policy anymore, thus we limit the research interval to 2013. In addition, since China joined the WTO in 2001, the level of trade liberalization has improved rapidly. Along with the continual decline in trade tariffs and the reduction in non-tariff barriers, China’s exports increased dramatically. Therefore, we started the research period in 2004 to minimize the lag effect of trade liberalization. Finally, it is also a common practice in the existing literature to choose this time span (Fang et al., 2019; Shi et al., 2019).

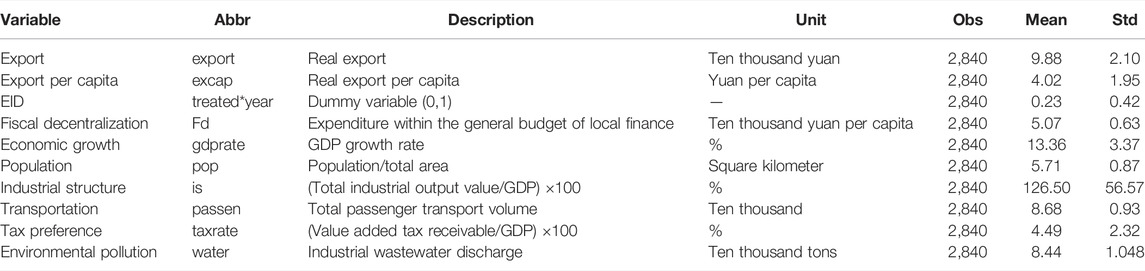

All the original data at city level in this paper are obtained from China City Statistical Yearbook and China Regional Economic Yearbook in 2004–2013. All nominal variables are adjusted to real value based on the price in 1980, and a natural logarithm is taken to eliminate the heteroscedasticity problem. The data ratios used in this paper are all calculated and sorted by the authors. A statistical description of all the variables is shown in Table 1:

Empirical Results and Analysis

Baseline Result

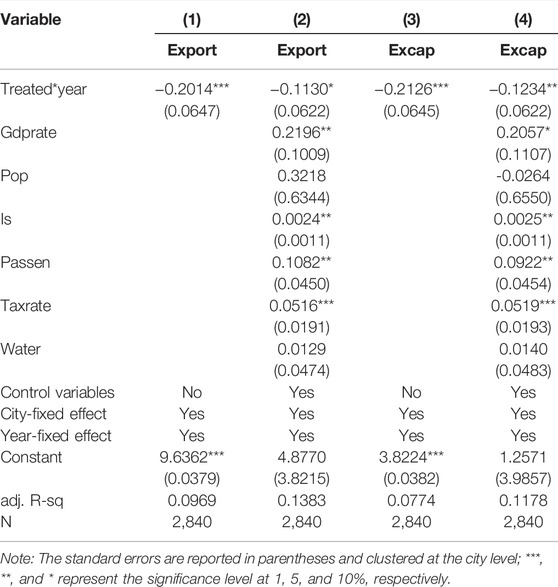

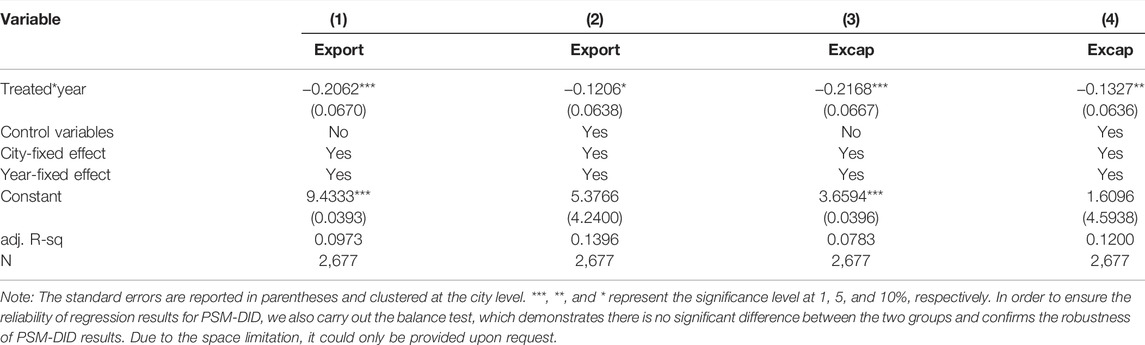

In order to investigate the impact of EID on local exports, we ran the baseline regression based on Eq. 1 with the DID method, and the results are presented in Table 2. It can be seen from columns (1) and (2) that the coefficients of treated * year are significantly negative, indicating that EID significantly inhibits local exports, and this result still holds after including control variables. If other conditions remain unchanged, the EID policy reduces the local exports of the treatment group by generally 20.14–11.30% compared with the control group. From columns (3) and (4), we can see that when the dependent variable changes to the real export per capita, the results are still consistent with the previous one, that is, the EID still shows a restraining effect on the real export per capita. The coefficients of other control variables show that GDP growth rate, industrial development, transportation development, and tax preference will significantly promote local exports. Population density and environmental pollution also exhibit a positive but not significant effect on local exports.

After we find the inhibitory effect EID has on local exports, we turn to investigating how fiscal decentralization affects the implementation of EID by local governments. We estimate Equation 2 and the results are presented in Table 3. As shown in the results of columns (1) and (2), the coefficients of treated * year * are significantly negative, indicating that a higher degree of fiscal decentralization witnesses a stronger inhibitory effect of EID on exports. These results suggest that local governors in cities with a higher degree of fiscal autonomy are more likely to obey the requirements of EID policy and try to promote local economic growth with better environmental conditions, chasing the “green achievements”. It highlights their characteristic of “racing to the top”. Apart from that, we also use income indicators to measure the fiscal decentralization degree of each city. Specifically, we calculate the income within the general budget of local finance per capita for each city, and the regression results are listed in columns (3) and (4). It can be seen that when the fiscal decentralization degree is calculated by the “income indicator”, the coefficients of treated * year * fr are still significantly negative, which means the positive relationship between fiscal decentralization and EID’s inhibitory impact on local exports is not due to the measurement of fiscal decentralization.

Robustness Checks

Parallel Trend and Dynamic Effect

In order to ensure the validity of the DID method used to measure the impact of EID on exports, we first test the parallel trend hypothesis to prove the exclusion of the expected effect. Specifically, we set the year 2008 as the base year, then the year before 2008 is prefixed with pre, and the year after 2008 is prefixed with post, that is to say, 2007 is represented by pre_1 and 2009 is post_1, and so on. We run regression for the Eq. 3 and dynamic effects for export and excap are shown in Figures 1A,B

No matter what form the dependent variable takes, the coefficients of interaction terms for the policy dummy variable and the year dummy variable before the year 2008 are close to zero and are not significant. In the years after 2008, however, the coefficients of the interaction term were significantly negative. Thus, we can conclude that no systematic difference exists in the pre-intervention between the treatment group and the control group and further prove the validity of the DID approach we use in the model.

FIGURE 1. Parallel trend test (A): Parallel trend test for export (B): Parallel trend test for export per capita.

PSM-DID Estimation

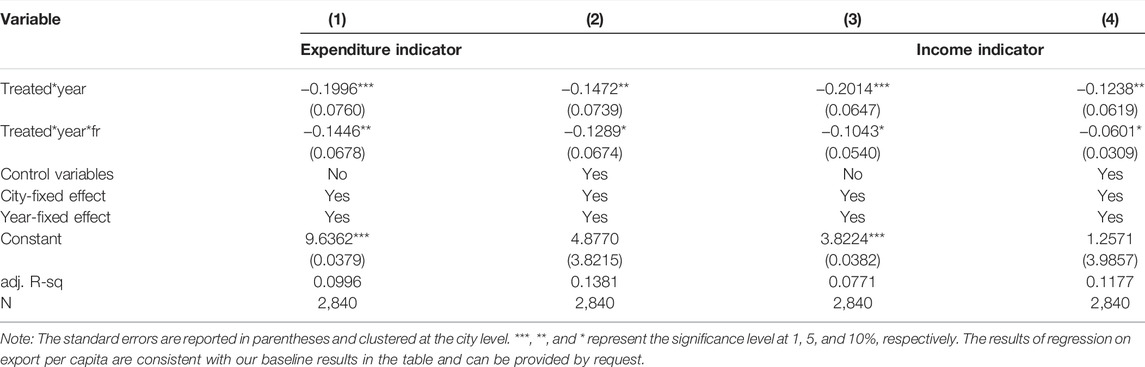

In order to eliminate the potential problem caused by the large difference between the treatment group and the control group, we further used the propensity score matching method (PSM) to match the treatment group with the control group. We use the logit model to estimate the propensity scores and then carry out the DID estimation for the matching cities. According to the results in columns (1)–(2) of Table 4, after matching the observations, EID still shows a significant inhibition effect on local exports.

Placebo Tests

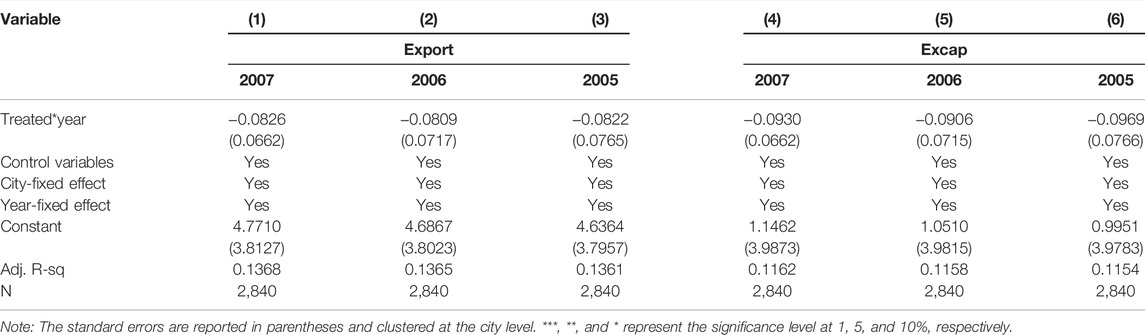

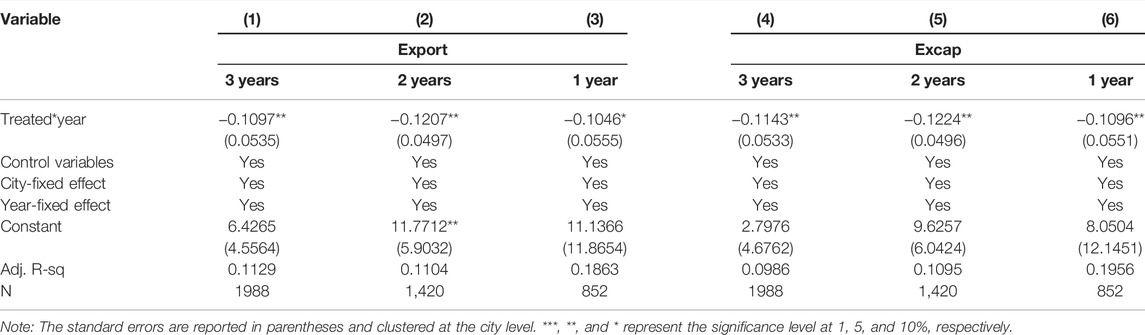

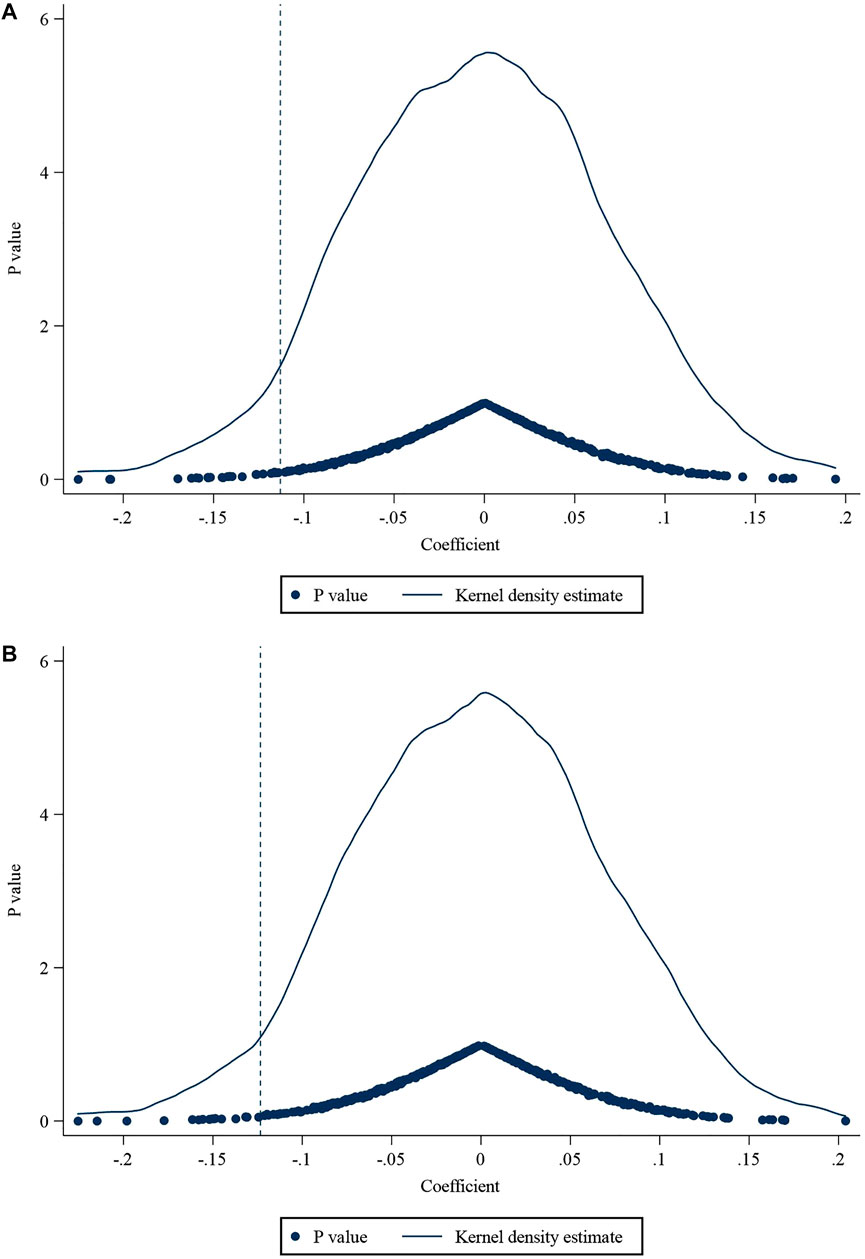

Furthermore, we use a set of placebo tests to confirm the robustness of our baseline results. Our placebo tests are conducted in three ways. Firstly, we randomly select policy times and set them 1 year, 2 years, and 3 years before the real policy time, respectively. We define these false year dummies as

Since the new settings mentioned above are far from reality, we expect that the coefficients estimated from the three placebo tests should not be significant, otherwise it indicates that our original model setting is inappropriate and our baseline results are fairly unconvincing. The regression results of the first two settings are presented in Tables 5, 6. It is clear the coefficients of the double interaction terms are not significant, confirming the robustness of the baseline results. And from Figures 2A,B it can be seen that the distribution of coefficients of the double interaction term is concentrated around zero, again verifying the reliability of our baseline result.

FIGURE 2. Placebo Tests (A): Random selections for EID cities (export) (B): Random selections for EID cities (export per capita).

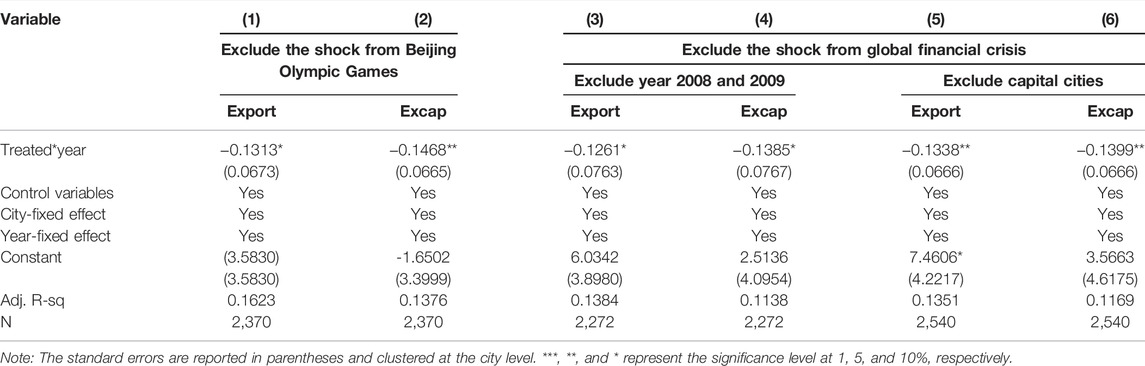

Excluding Other Shocks

In order to exclude the possible impact of other policy shocks, we take into account two prominent events that happened in 2008, which may bias our estimation. Firstly, we consider the effort the Chinese government made in 2008 to reduce air pollution in Beijing for the 2008 Beijing Olympic Games. According to He et al. (2016), Beijing is not the only city that has been required to constrain its air pollution, but its neighboring provinces, such as Hebei, Tianjin, Shanxi, Neimenggu, and Liaoning, were also affected at the same time. Thus, in a similar way to Shi and Xu (2018), we exclude Beijing and other cities in the neighboring provinces mentioned to avoid the potential impact of this event for a robustness test, and the regression results are shown in columns (1)–(2) in Table 7. The second shock we take into consideration is the global financial crisis, which broke out in the United States in 2007 and then rapidly spread to the rest of the world in 2008. To reduce the possibility that it may bias our estimation, we try to drop observations in years 2008 and 2009 to directly reduce its impact. And at the same time, we also try to exclude the municipalities and capital cities of all the provinces, which are generally the biggest victims and are affected more than other cities by the global shocks. The estimation results are shown in columns (3)–(6) in Table 7.

According to the estimations in column (1)–(2), after we exclude 47 cities which may be subject to additional environmental regulation in the sample cities, the coefficients of double interaction term that we concern about are still significantly negative. And estimations from Columns (3)–(6) show that after dropping observations that may be affected by the global economic crisis, the coefficients the Treated*year remain significantly negative. The inhibitory effect of EID on local exports still exists even after we exclude the potential impact from other shocks. All these tests confirm the reliability of our baseline results.

Heterogeneity Tests

Regional Heterogeneity Test

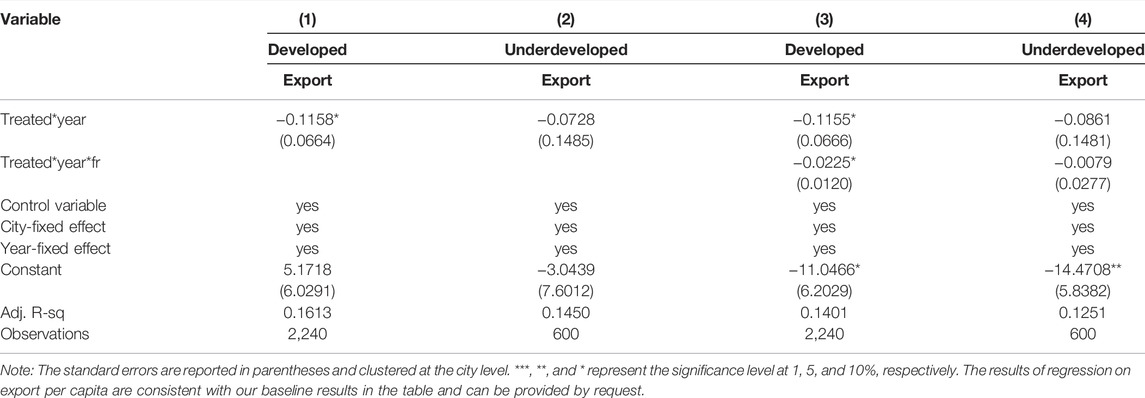

Due to the uneven economic development among different regions in China, we divide the 284 cities into eastern, central, and western regions according to their geographical locations. Considering that cities belonging to eastern and central regions are more developed than western cities, we regard cities in eastern and central regions as the economically developed group, and the western cities are taken as the economically undeveloped group. Then we investigate the impact of EID on local exports in economically developed and undeveloped groups, respectively. The results are presented in Table 8.

From columns (1)–(2) of Table 8, it can be seen that EID significantly suppresses the growth of local exports in the cities of developed groups, while in the cities of undeveloped groups, the inhibitory effect exists but not significantly. In the same way, we also investigate whether there are regional differences in the impact of local fiscal decentralization on the implementation of EID by local governments. It can be seen from columns (3)–(4) that among the cities implementing EID, the degree of fiscal decentralization still shows a significant positive relationship with the implementation of EID by local governments, especially in cities located in eastern and central regions. In these cities, local governments with a high degree of fiscal decentralization show strong motivation for environmental governance, thus strengthening the export inhibition effect of EID and highlighting the characteristic of “racing to the top.” However, this effect is not significant in the western city samples.

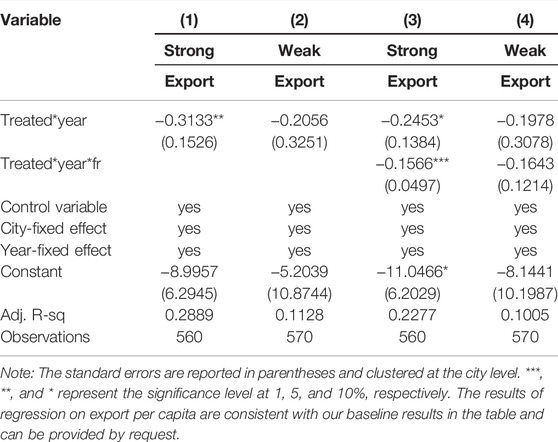

Stringency Heterogeneity Test

As the score of PITI can be deemed as environmental regulation stringency (Shi et al., 2019), we further divide the 113 cities that implemented EID into strong environmental regulation groups and weak environmental regulation groups according to their scores of PITI in 2008, and carry out DID regression to explore the effects of EID on exports under different environmental regulation stringency. It can be seen from columns (1)–(2) in Table 9 that for the cities with high scores, EID still significantly inhibited local exports, and the results remain unchanged after including control variables. For the cities with low scores of EID, however, the restraining effect of EID on local exports still exists but is not significant. Then, we investigate again the impact of the degree of decentralization of local finance on the implementation of EID by local governments. From columns (3)–(4), the coefficients of triple interaction terms including local fiscal decentralization are still significantly negative in the cities with high scores of PITI but not significantly negative in the cities with low scores of PITI, which indicates that the positive relationship between the degree of fiscal decentralization and the implementation of EID by local governments is more prominent in the cities with high scores of PITI. Thus, for the cities with stronger environmental regulation, a higher degree of fiscal decentralization causes a stronger motivation to implement EID by local governments, exhibiting the characteristic of “racing to the top.”

Mechanism Analyses

In the previous subsections, we find that EID significantly hinders local export expansion and that fiscal decentralization strengthens the negative effect of EID on local exports. In order to investigate how EID reduces local exports and why fiscal decentralization is positively related to the EID’s inhibitory effect on local exports, we further analyze the potential mechanisms, namely the innovation effect and cost effect mentioned in section 2, and see how they work.

We use the innovation index and yearly investment in industrial pollution control of each city (Cui et al., 2019) as the intermediate outcome variables to see how EID influences these two mechanisms, respectively. The data for the innovation index of Chinese cities is obtained from the “FIND Report on City and Industrial Innovation in China (2017)”2 and the data of yearly investment in industrial pollution control is from the China City Statistical Yearbook 2013. Since our observations are Chinese cities, the data of innovation index and pollution control investments are also at the city level, and we believe the innovation and pollution cost of a city are positively correlated with firms’ performance in that city, whose exports constitute the aggregate export volume of the city.

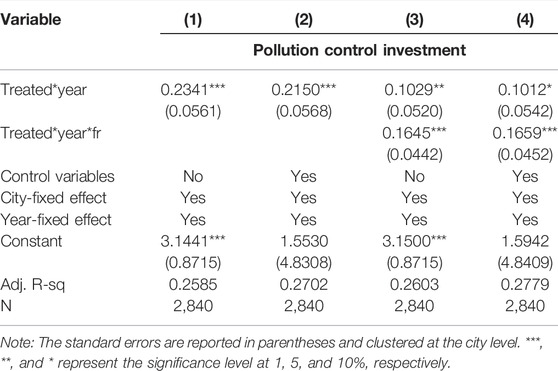

Cost Effect

Table 10 reports the results for cost effect. From columns (1)–(2), it is very clear that the EID policy significantly increases the pollution control cost of regulated cities, since the coefficients of treated*year are significantly positive. And the results still hold when other control variables are included. In addition, from columns (3)–(4), we can see that the coefficients of treated*year*fr are also positive, which suggests that in the cities with a higher degree of decentralization, local governors are more likely to invest more in environmental protection affairs, and this is consistent with our expectation that they care more about the “green achievements” in their jurisdiction for their future promotion.

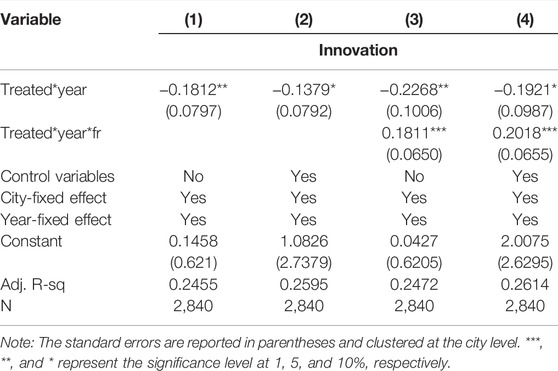

Innovation Effect

Table 11 reports the results for the innovation effect. From columns (1)–(2), we can see that the coefficients of treated*year are significantly negative no matter whether with or without other control variables. It means that EID policy does not stimulate local innovation in the regulated cities compared with other unregulated cities, which could be one of the reasons why EID ultimately exerts a negative impact on local exports. Furthermore, it can be seen from columns (3)–(4) that the coefficients of treated*year*fr are positive, which means that in cities with a higher degree of fiscal decentralization, local governors are likely to improve local innovation. They may directly encourage firms to innovate in advanced discharge treatment technologies and even provides funds for green patents. And at the same time, since local governments invest more money in pollution control and discharge treatment, it may exert a spillover effect on the development of local innovation level. It is consistent with our expectation that local governors in cities with high degree of fiscal decentralization are willing to respond to the calls from the central governments to earnestly implement the environmental policies for long-run development.

In sum, the EID policy does raise related costs for pollution control for local governments in the regulated cities, but it does not activate the innovation effect to offset the negative effect caused by the rising costs, which results in a reduction in local exports. It confirms our Hypothesis 1 that both the cost effect and innovation effect are activated by the EID policy and the inhibitory effect on local exports is the result of their joint efforts.

Furthermore, in cities with a higher degree of decentralization, local governors are more likely to invest more in local pollution control to directly improve local environmental standards, and at the same time, they encourage local firms to innovate in green technologies, which is indirectly conducive to local environments. This verifies our Hypothesis 2 that local governors with higher fiscal power earnestly implement the centrally mandated environmental policy and regard “green achievements” as a priority instead of “grey profits”. However, the benefits brought by the innovation effect cannot offset the negative impact from the rising pollution control costs, so local exports are further hindered in the end.

Conclusion and Policy Implications

In recent years, China has been rewarded with the joy of high-speed growth of economic development by exploiting relatively cheap labor and energy factors for extensive and long lasting economic development. At the same time, China, however, has been left with serious environmental pollution that cannot be ignored any longer. In response, the Chinese government launched a series of environmental protection laws and regulations that show their determination to control pollution problems. Is the newly introduced environmental tool—EID working successfully? What effect does it have on local exports in Chinese cities? How does the local government react towards the centrally mandated EID policy under the background of the financial decentralization system? The EID policy, which began in 2008, provides us with a good opportunity to answer these questions in depth. In this paper, we take the EID policy as a quasi-natural experiment and apply the DID approach to estimate the impact of EID on local exports with the balanced panel data of 284 cities in China from 2004 to 2013. Furthermore, we try to investigate the impact of fiscal decentralization on local governments’ incentive to implement EID. We also carry out a series of heterogeneity tests and robustness tests to confirm the consistency of the estimation results. Finally, we analyze the mechanisms to uncover the reasons behind them.

Our study finds that EID significantly inhibits local exports, and the inhibition effect shows obvious regional and stringency heterogeneity. In the eastern and central regions of China, where the economy is more developed, the inhibitory effect of EID on exports is much more significant. Among the cities that implement the EID, the higher announced “Pollution Information Transparency Index” (PITI) scores generally suggest a stronger inhibitory effect of the EID on exports, indicating that in the cities with stronger environmental regulation stringency, EID policy could squeeze out more highly-polluted local exports. Furthermore, considering the effect of fiscal decentralization, we find that cities with a higher degree of fiscal decentralization often witness a stronger inhibitory effect of EID on exports. That is to say, if the local governors have more power over their fiscal autonomy, their incentive to enforce EID policy will be stronger, presenting the characteristic of “racing to the top”. For these local governors, they will readily implement the EID policy to build a better environment for inflows of high-quality resources for long-term local development. At the same time, “green achievements” are conducive to their future promotion. As for the mechanisms behind, we verify that both cost effect and innovation effect activated by the EID policy are playing the important role. The rising pollution control costs and the restrained innovation result in the decreasing local exports. Furthermore, in those cities with higher fiscal autonomy, local governors do encourage innovation activities all the way. Even more investments in pollution control, however, offset the benefits from the innovation improvements and ultimately strengthen the inhibitory effects on local exports.

Compared with the findings of existing literature, we find that the EID policy exerts an adverse effect on local exports, which is in line with the findings of Fang et al. (2019). While Fang et al. (2019) concentrate on exports at a micro-level and find that the EID policy reduces the export scale of Chinese exporting firms, our study provides new evidence on how the EID policy affects local exports and supports the argument that the environmental policy may harm economic growth in the short term. Besides, we also find that the local governments with stronger fiscal power show a positive attitude to the centrally-mandated environmental policy, reflecting the characteristic of “racing to the top” as stated in Konisky (2007) and Zhang and Zhu (2010). Since there is no research that investigates the relationship between the EID policy and fiscal decentralization so far, our findings fill the research gap and lay a foundation for future research.

In general, the optimal goal of an environmental protection policy is to protect the environment while promoting economic growth. However, in most situations, these two tasks are difficult to achieve simultaneously. Therefore, there exists a suboptimal goal; that is, the implementation of environmental policy could effectively protect the ecological environment but exert a short-term adverse effect on economic development, which is the case in our study. In fact, the economic losses from the reduced exports caused by the centrally-mandated environmental policy are not irreparable. Although the EID policy reduces local exports in the short term, it has been found that it could significantly stimulate innovation at the same time. That is to say, it could enhance export capacity in the long term by promoting export enterprises to improve their innovation ability and improve product quality, so as to expand exports in the end. As a result, a balance between environmental protection and economic development could be achieved in the long term.

Based on the abovementioned conclusions, we put forward the following policy recommendations. First of all, for developing countries such as China, it is particularly important to establish a scientific and timely regulatory system for environmental governance when faced with worsening environmental pollution problems. EID, as a widely adopted approach around the world, has been adjusted and employed in China and has effectively promoted multi-party informed and participation in environmental protection work, exerting a significant effect on pollution reduction and environmental quality improvement. It is suggested to further enhance the degree of environmental information disclosure and make rational use of new technical means, such as differential management, artificial intelligence, and green finance, so as to provide inexhaustible power for protecting the ecological environment, realizing green transformation, and low-carbon development. Secondly, for local governments with varying degrees of fiscal autonomy, they are all advised to earnestly implement the centrally mandated environmental protection policies and create a better environment to attract high-quality resources for long-term local development. They should take into consideration the characteristics of the local economy and try to fully explore the opportunities brought by environmental regulations for industrial upgrading and transformation. Finally, how to keep the balance between environmental regulation and innovation improvement should be a priority for local governors. From our findings, innovation activities are sacrificed for environmental improvement in the short run. However, in the long run, advanced technologies and green innovation are decisive for both the local economy and the local environment. Governors are expected to figure out how to activate the innovation effect when the environmental situation is improving.

Data Availability Statement

Publicly available datasets were analyzed in this study. This data can be found at: https://www.epsnet.com.cn/index.html#/Index.

Author Contributions

Conceptualization, ZF; methodology ZF and ST; software, ZF and ST; validation, ZF; formal analysis, ZF and ZL; resources, ZF and ST; data curation, ZF; writing- original draft preparation, ZF; writing-review and revision on original draft, ZF and ZL; supervision, ZL. All authors have read and agreed to the published version of the manuscript.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1From 2013 to 2014, the number of cities published by the PITI index has increased to 120, but in this paper, we still mainly focus on the initial 113 cities.

2Zonglai Kou and Xueyue Liu. 2017. “FIND Report on City and Industrial Innovation in China (2017)”. Fudan Institute of Industrial Development, School of Economics, Fudan University. Available at: https://max.book118.com/html/2018/0103/147127405.shtm

References

Chen, D. (2020). Trade Barrier Reduction and Environmental Pollution Improvement: New Evidence from Firm-Level Pollution Data in China. Econ. Res. J. 12, 98. [in Chinese].

Chen, J., Gao, M., Ma, K., and Song, M. (2019). Different Effects of Technological Progress on China's Carbon Emissions Based on Sustainable Development. Bus. Strat. Env. 29 (2), 481–492. doi:10.1002/bse.2381

Clarkson, P. M., Li, Y., Pinnuck, M., and Richardson, G. D. (2015). The Valuation Relevance of Greenhouse Gas Emissions under the European Union Carbon Emissions Trading Scheme. Eur. Account. Rev. 24 (3), 551–580. doi:10.1080/09638180.2014.927782

Cui, Y., Zhou, C., and Wang, Z. (2019). Impact of Regional Pollution Control Investment on Enterprises’ Environmental Cost. Public Finance Res. 3, 115. [in Chinese].

Fang, J., Liu, C., and Gao, C. (2019). The Impact of Environmental Regulation on Firm Exports: Evidence from Environmental Information Disclosure Policy in China. Environ. Sci. Pollut. Res. 26 (36), 37101–37113. doi:10.1007/s11356-019-06807-2

Feng, Y., Chen, H., Chen, Z., Wang, Y., and Wei, W. (2021). Has Environmental Information Disclosure Eased the Economic Inhibition of Air Pollution? J. Clean. Prod. 284, 125412. doi:10.1016/j.jclepro.2020.125412

Feng, Y., and He, F. (2020). The Effect of Environmental Information Disclosure on Environmental Quality: Evidence from Chinese Cities. J. Clean. Prod. 276, 124027. doi:10.1016/j.jclepro.2020.124027

Gao, Y., Yao, X., Wang, W., and Liu, X. (2019). Dynamic Effect of Environmental Tax on Export Trade: Based on DSGE Mode. Energy. Environ. 30 (7), 1275–1290. doi:10.1177/0958305x19842380

Gu, X., Han, L., and Zhou, Y. (2016). Difference in Industrial Structure and Effect of ODI on Export: Theory and Evidence from the “China-host Country” Perspective. Econ. Res. J. 51 (04), 102

He, G., Fan, M., and Zhou, M. (2016). The Effect of Air Pollution on Mortality in China: Evidence from the 2008 Beijing Olympic Games. J. Environ. Econ. Manag. 79, 18–39. doi:10.1016/j.jeem.2016.04.004

Hering, L., and Poncet, S. (2014). Environmental Policy and Exports: Evidence from Chinese Cities[J]. J. Environ. Econ. Manag. 68 (2), 296. doi:10.1016/j.jeem.2014.06.005

Huang, S. (2017). A Study of Impacts of Fiscal Decentralization on Smog Pollution [J]. J. World Econ. 40 (02), 127–152. [In Chinese].

Jin, G., and Shen, K. (2018). Polluting Thy Neighbor or Benefiting Thy Neighbor: Enforcement Interaction of Environmental Regulation and Productivity Growth of Chinese Cities [J]. Manag. World 34 (12), 43. [in Chinese].

Konisky, D. M. (2007). Regulatory Competition and Environmental Enforcement: Is There a Race to the Bottom? Am J Political Sci. 51 (4), 853–872. doi:10.1111/j.1540-5907.2007.00285.x

Lei, P., Tian, X., Huang, Q., and He, D. (2017). Firm Size, Government Capacity, and Regional Environmental Regulation: Theoretical Analysis and Empirical Evidence from China. J. Clean. Prod. 164, 524–533. doi:10.1016/j.jclepro.2017.06.166

Li, H., and Zhou, L. (2004). Political Turnover and Economic Performance: the Incentive Role of Personnel Control in China[J]. J. Public Econ. 89 (9), 1743. doi:10.1016/j.jpubeco.2004.06.009

Liu, X., and Zhang, C. (2017). Corporate Governance, Social Responsibility Information Disclosure, and Enterprise Value in China. J. Clean. Prod. 142 (2), 1075–1084. doi:10.1016/j.jclepro.2016.09.102

Liu, Y., Li, Z., and Yin, X. (2018). Environmental Regulation, Technological Innovation and Energy Consumption a Cross-Region Analysis in China. J. Clean. Prod. 203, 885–897. doi:10.1016/j.jclepro.2018.08.277

Lu, J., Li, B., He, L., and Zhang, Y. (2020). Sustainability of Enterprise Export Expansion from the Perspective of Environmental Information Disclosure[J]. J. Clean. Prod., 252.

Lu, J., and Li, H. (2020). The Impact of Government Environmental Information Disclosure on Enterprise Location Choices: Heterogeneity and Threshold Effect test. J. Clean. Prod. 277, 124055. doi:10.1016/j.jclepro.2020.124055

Pan, D., and Fan, W. (2020). Benefits of Environmental Information Disclosure in Managing Water Pollution: Evidence from a Quasi-Natural Experiment in China. Environ. Sci. Pollut. Res. 28, 14764–14781. doi:10.1007/s11356-020-11659-2

Porter, M. E., and Van der Linde, C. (1995). Green and Competitive: Ending the Stalemate[J]. Long. Range Plan. 28 (6), 128

Ren, S., Wei, W., Sun, H., Xu, Q., Hu, Y., and Chen, X. (2019). Can Mandatory Environmental Information Disclosure Achieve a Win-Win for a Firm’s Environmental and Economic Performance? [J]. J. Clean. Prod. 250, 119530. doi:10.1016/j.jclepro.2019.119530

Sheng, D., and Wang, Y. (2012). Infrastructure, Financail Dependence and Regional Export Structure. J. Financial Res. 383 (5), 15. [in Chinese].

Shi, B., Chen, F., and Kang, R. (2019). Environment Information Announcement and Structure Optimization of FDI [J]. China Ind. Econ. (04), 98. [in Chinese].

Shi, X., and Xu, Z. (2018). Environmental Regulation and Firm exports: Evidence from the Eleventh Five-Year Plan in China. J. Environ. Econ. Manag. 89, 187–200. doi:10.1016/j.jeem.2018.03.003

Song, Y., Guo, S., and Zhang, M. (2019). Assessing Customers' Perceived Value of the Anti-Haze Cosmetics under Haze Pollution. Sci. Total Environ. 685, 753–762. doi:10.1016/j.scitotenv.2019.06.254

Wang, X., Shen, X., and Yang, Y. (2020). Does Environmental Information Disclosure Make Firms’ Investments More Efficient? Evidence from Measure 2007 of Chinese A-Listed Companies[J]. Sustainability 12 (5), 1–16. doi:10.3390/su12051895

Xue, G., and Pan, X. (2012). An Empirical Analysis on the Impact of Fiscal Decentralization on Environmental Pollution in China [J]. China Population. Resour. Environ. 022 (1), 77. [in Chinese].

Xue, R., and Su, Q. (2014). Do Environmental Regulations Influence the Comparative Advantage of Polluting Industries? Industrial Econ. Res. 70 (03), 61. [in Chinese].

Yang, Y., Wen, J., and Li, Y. (2020). The Impact of Environmental Information Disclosure on the Firm Value of Listed Manufacturing Firms: Evidence from China. Ijerph 17 (3), 916. doi:10.3390/ijerph17030916

Zhang, H. (2016). Strategic Interaction of Regional Environmental RegulationAn Explanation on the Universality of Incomplete Enforcement of Environmental Regulation [J]. China Ind. Econ. (07), 74. [in Chinese].

Zhang, T., and Xie, L. (2020). The Protected polluters: Empirical Evidence from the National Environmental Information Disclosure Program in China. J. Clean. Prod. 258, 120343. doi:10.1016/j.jclepro.2020.120343

Zhang, Z., and Zhu, P. (2010). Empirical Study on Heterogeneous Dynamic Path of Local Expenditure under Inter-temporal Budget Constraints [J]. Econ. Res. J. 45 (05), 82. [in Chinese].

Zhou, L. (2007). Governing China's Local Officials: An Analysis of Promotion Tournament Model [J]. Econ. Res. J. (07), 36

Zhou, L. (2004). The Incentive and Cooperation of Government Officials in the Political Tournaments: An Interpretation of the Prolonged Local Protectionism and Duplicative Investments in China [J]. Econ. Res. J. (06), 33. [in Chinese].

Zhou, Q., Zhang, X., Shao, Q., and Wang, X. (2019). The Non-Linear Effect of Environmental Regulation on Haze pollution: Empirical Evidence for 277 Chinese Cities During 2002-2010. J. Environ. Manag. 248, 109274. doi:10.1016/j.jenvman.2019.109274

Keywords: environmental information disclosure, fiscal decentralization, local exports, difference-in-difference method, quasi-natural experiment

Citation: Fang Z, Li Z and Tao S (2022) Environmental Information Disclosure, Fiscal Decentralization, and Exports: Evidence From China. Front. Environ. Sci. 10:813786. doi: 10.3389/fenvs.2022.813786

Received: 12 November 2021; Accepted: 21 April 2022;

Published: 26 May 2022.

Edited by:

Faik Bilgili, Erciyes University, TurkeyReviewed by:

Luigi Aldieri, University of Salerno, ItalySa'D Shannak, Hamad bin Khalifa University, Qatar

Copyright © 2022 Fang, Li and Tao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhaohua Li, emhhb2h1YWxpQGh1c3QuZWR1LmNu

Ziwei Fang

Ziwei Fang Zhaohua Li

Zhaohua Li Shuang Tao

Shuang Tao