- Department of Economics, College of Business and Economics, Dankook University, Yongin-si, South Korea

To alleviate the increasingly serious environmental problems, the environmental governance of relevant firms has received widespread attention. In this paper, based on panel data of Chinese listed firms from 2010–2019, we use the dynamic panel model to verify the non-linear relationship between internationalization and green innovation performance. The dynamic panel threshold model is also constructed to estimate the threshold effect of subsidies between internationalization and green innovation performance. The results show that there is a “U” relationship between internationalization and green innovation. Subsidies can help firms cross the inflection point earlier, and internationalization positively affects green innovation output only when the subsidy exceeds the threshold (16.994). Considering the heterogeneity issue, our study finds that the subsidy threshold for internationalization is bigger for state-owned, non-coastal enterprises, and enterprises with environmental information disclosure compared to other enterprises. In addition, when across the subsidy threshold, state-owned, non-coastal enterprises, and enterprises without environmental information disclosure are better able to stimulate green innovation output. This provides evidence and policy directions for other emerging developing countries.

1 Introduction

In the 20 years since China joined the WTO, the economy has developed rapidly and living standards have improved greatly. However, with the development of economic globalization, environmental problems are becoming increasingly prominent. It not only restricts China’s economic sustainable development but also affects the recovery of the world economy. To solve the worsening environmental problems, countries around the world signed The Paris Agreement in 2016, aiming to reduce carbon emissions and achieve the goal of global carbon neutrality. To reduce carbon emissions, governments have introduced several policies and gradually formed a multi-dimensional ecological and environmental management system with enterprises as the main body and governments as the auxiliary. As the main driver of national economic development, the environmental management of manufacturing firms is also attracting attention. At the macro aspect, manufacturing firms need not only government support, but also their own green innovation to enhance environmental governance (Zhuge et al., 2020). In terms of firms’ innovation, in the background of globalization and internationalized R&D, the improvement of firms‘ innovation capability not only depends on domestic R&D capital but also on access to foreign market information and R&D capital. The firms’ internationalization helps to overcome their own limitations (organization, geography), promotes the mobility of staff cross-regional mobility from various countries, and obtain external technologies as much as possible, to achieve their own innovation output efficiently.

Empirical studies have examined various factors influencing innovation performance. Some studies have found that firm age (Amore and Bennedsen, 2016), firm market (Usman et al., 2020), firm size (Boermans and Roelfsema, 2016), and firm growth rate (Li et al., 2017) are drivers of improved innovation performance. Cassiman and Veugelers (2006) argue that the combination of external technology introduction and internal R&D can enhance the firm’s technological performance. Firms can reduce their capital costs through subsidies and are thus more willing to innovate green. Huang et al. (2019) noted that government subsidies increase firms’ willingness to innovate. Based on the LLL framework theory, Keller and Yeaple (2009) analyzed internationalization as enhancing firms’ innovation performance in terms of innovation output. Similarly, many scholars have analyzed the two as a non-linear relationship (Contractor et al., 2003). It is noteworthy that, in the face of growing global environmental problems, firm environment governance has become a primary goal of governments, but few scholars have examined whether corporate internationalization can enhance corporate green innovation output. It can be seen that most existing research has focused on the impact of internationalization on innovation performance (Teece et al., 1997; Kim, 1997), so it is relevant to explore the impact of internationalization on green innovation output.

Subsidies as an important government instrument that influences firms’ internationalization and innovation output, few scholars have made the relationship between government subsidies and internationalization. For example, Jiayun and Yingying (2019) finds that subsidies can facilitate firms’ international trade. However, most studies have mainly explored the impact of subsidies on innovation. Seitz and Watzinger (2017) finds that R&D subsidies can reduce firms’ R&D burden and stimulate R&D investment. However, Wallsten (2000) has a different conclusion, finding that government subsidies have a crowding-out effect on firms’ R&D investment and do not promote firm innovation. In this context, it is worth discussing that the impact of subsidies lies between internationalization and green innovation. Specifically, this paper focuses on whether there are differences in the impact of internationalization on green innovation output at different levels of subsidies.

Therefore, this paper’s main contributions are in the following four aspects: first, existing studies have mainly focused on the impact between internationalization and innovation (Keller and Yeaple, 2009) and has concentrated on developed countries (Chiao and Yang, 2011; Nam and An, 2017). This paper is the first article to study the relationship between the firms internationalization and green innovation performance, providing a theoretical and empirical basis for policy formulation in developing countries. Second, unlike other papers that use a single variable to measure corporate innovation performance (Wallsten, 2000), this paper adopts the entropy weight method (EWM) to establish a firm’s green innovation evaluation system to evaluate the firm’s green innovation performance. Third, while verifying the non-linear relationship between internationalization and green innovation, the effect of subsidies is explored. government subsidies are used as the threshold variable to explore the effect of firm internationalization on green innovation performance under different subsidy levels. Fourth, it is different from other studies that consider heterogeneity in terms of firm size and competitiveness. this paper divides the sample into state-owned enterprises (SOEs) and non-state-owned enterprises (non-SOEs), coastal enterprises (CEs) and non-coastal enterprises (non-CEs), enterprises with environmental information disclosure (EIDEs) and enterprises without environmental information disclosure (non-EIDEs), and explores the impact of firm internationalization on green innovation output in different subsamples. This paper addresses the gaps in existing research by exploring whether firm internationalization affects green innovation performance at different subsidy levels, and provides a basis and suggestions for policy formulation and improvement.

The remainder of the article is organized as follows. Section 2 reviews the relevant empirical studies and discusses the mechanisms between internationalization and green innovation. In Section 3, a theoretical model is constructed. In Section 4, the choice of variables and the use of data are explained. Section 5 describes the estimation results and discussion. Finally, the conclusion and policy implications are reported in section 6.

2 Literature Review and Hypothesis

Studies about internationalization are mainly based on Mathews (2006) LLL framework, springboard theory, and the firm’s resource-based view theory. Mathews (2006) LLL framework and springboard theory (Luo and Tung, 2007) suggest that developing country firms’ internationalization behavior provides access to diverse strategic knowledge and resources when they enter international markets, which is important for enhancing innovation performance. The firm’s resource-based view suggests that a firm’s innovation output depends on the allocation of resources. The effect of different resources differs on a firm’s innovation output. Grimes and Miozzo (2015) showed that firms’ R&D investment abroad is beneficial in enhancing the firm’s innovation and that innovative outputs from R&D facilities established abroad can be passed on to the parent firm. While some other scholars argue that there is a non-linear relationship between internationalization and innovation (Nam and An, 2017). Chiao and Yang (2011) argues that there is an inverted U relationship between internationalization and firm performance. Based on the above theories, we make the following hypotheses.

Hypothesis H1. There Is a Non-linear Relationship Between Firm Internationalization and Green InnovationThe impact of subsidies on R&D performance has also been extensively studied. Based on asymmetric information theory and Keynesianism, the findings on the relationship between subsidies and R&D performance vary. Subsidies can promote innovation by reducing firms’ R&D burden (Yi et al., 2021), transmitting information to private or financing institutions, and facilitating firms to attract social capital (Liu et al., 2019). However, subsidies have a negative impact on innovation output (Yi et al., 2020), Wei and Zuo (2018) found that central government R&D subsidies send negative signals about the quality of R&D projects and worsen subsidized firms’ access to external capital.In addition, subsidies have been little studied for internationalization. Lesser subsidies inhibit firms’ internationalization (Ghouse, 2020), while certain subsidies promote firms towards internationalization (Jiayun and Yingying, 2019). However, few papers have examined the relationship between internationalization, subsidies, and green innovation, so it is worth exploring the relationship between the three. Low-subsidy firms have relatively few external resources and do not have enough cash to invest in R&D programs. High-subsidy firms reduce their R&D burden because of large government subsidies, and in combination with advantages such as talent mobility and technical introduction brought about by internationalization’s positive externalities, increase green R&D output (Gao et al., 2021). Based on the above theories, we make the following hypotheses.

Hypothesis H2. The Impact of Internationalization on Green Innovation Varies Under Different Levels of SubsidiesThere are many studies of innovation based on firm heterogeneity, mostly based on firm size and ownership (Link and Scott, 2018; Li et al., 2021). Given that subsidies and internationalization are unbalanced among different types of firms, this paper divides the entire sample into state-owned and non-state-owned enterprises, coastal and non-coastal enterprises, and enterprises with environmental information disclosure and non-disclosure enterprises. State-owned enterprises have well-established R&D systems and are supported by the government (Usman et al., 2020), which leads to a larger gap between state-owned and non-state-owned enterprises. Compared to coastal enterprises, non-coastal enterprises have a significant geographical disadvantage, which can affect the actual effectiveness of subsidies (Girma et al., 2009). Environmental information disclosure can lead to higher governance costs for firms (Van Leeuwen and Mohnen, 2017; Feng et al., 2021), which in turn may affect firm innovation. Based on the above theories, we make the following hypotheses.

Hypothesis H3. The Impact of Internationalization on Green Innovation Varies Under Different Firm HeterogeneityIn summary, while some research has been carried out in related fields, little attention has been paid to the mechanisms by which internationalization affects green innovation performance. Given the globalization of the economy and the growing environmental concerns, it is worthwhile to consider the impact of internationalization on influencing green innovation performance. Furthermore, considering that the results of internationalization on green innovation performance may also differ at different levels of subsidies, it is necessary to verify the possible threshold effect of subsidies in between two. The logical roadmap is shown in Figure 1.

3 Methodology

3.1 Dynamic Panel Model

Consider the limitations of traditional static methods. Firstly, the endogeneity problem can lead to biased regression results because of some omitted variables (Wang, 2015). Secondly, there is a lagged effect in green innovation performance (Ulucak, 2021), whereby green innovation in the current year may be influenced by green innovation In the previous year. However, traditional static models are unable to analyze this relationship. Therefore, this paper uses both static and dynamic panel models to estimate the regression results.

Different from static panel models, dynamic panel models can provide more information about changes in green innovation performance. According by Arellano and Bond (1991), general method of moments (GMM) estimators use exogenous or endogenous variables with one or more time lags as instrumental variables. Compared to the DIFF-GMM method, which eliminates individual effects and may have weak instrumental variable problems, the SYS-GMM method can overcome these problems, so this paper uses the SYS-GMM method.

3.2 Dynamic Panel Threshold Model

The above analysis can help us better understand the relationship between the two. However, the impact of internationalization on green innovation output may be influenced by other factors leading to biased regression results. Moreover, traditional static and dynamic panel models only capture the average impact between internationalization and green innovation, ignoring possible structural fault lines. In contrast, the panel threshold model based on Hansen (1999) is extended to obtain the dynamic panel threshold model (Caner and Hansen, 2004), which not only considers the dynamic changes in green innovation output and potential structural breaks, but also evades the strong exogeneity assumption in static threshold model. This paper builds a dynamic panel threshold model based on Hansen (1999) static threshold model, combined with Caner and Hansen (2004) approach.

where i and t denote firm and year, GIP represent the green innovation performance, and FI represent the internationalization of the firm. Lns is the logarithmic value of subsidy as the threshold variable,

The forward orthogonal outlier transformations of the other variables are consistent with the error terms. Considering the strong endogeneity of the explanatory variables lagged one period in Equation 2, this paper follows Caner and Hansen (2004) treatment of dynamic panel thresholds that include endogenous explanatory variables. It is estimated in three specific steps.

To estimate this dynamic panel model, we follow a three-stage procedure. First, this study then estimates a reduced-form regression for the endogenous variables

4 Data and Sample

4.1 Dependent Variable

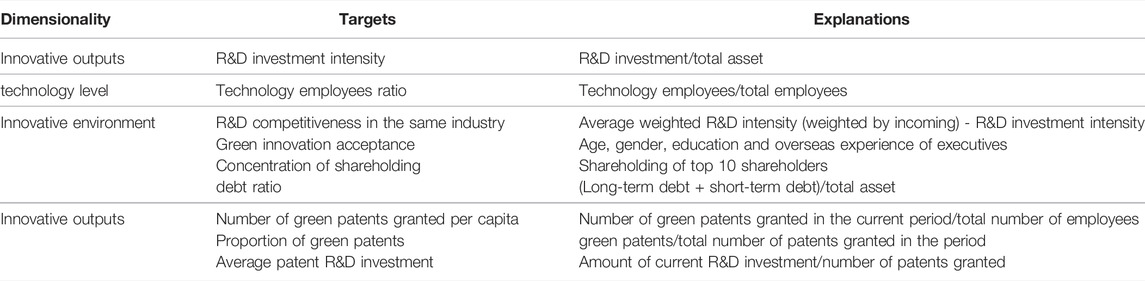

The independent variables in this paper evaluate the green innovation performance through the entropy weight method, which is different from most studies that use the R&D investment intensity and the number of green patents to measure green innovation performance (Wallsten, 2000). This paper draws on the research method (Weng et al., 2020) and uses the entropy weight method to construct a comprehensive evaluation index system of the green innovation performance from four dimensions: innovation input, technology level, enterprise innovation environment and innovation output. 1)In the innovation input dimension, the higher the R&D investment, the higher the green innovation output. 2) In the technology level dimension, the higher the proportion of technical employees, the higher the innovation technology level. 3) In the firm innovation environment dimension, the larger the stock HHI, the more centralized the firm’s control and the easier it is to implement R&D program decisions. The more internationalized the executives, the more biased they are towards green innovation policies (Usman et al., 2020); the smaller the gap between the firm and the average industry R&D investment, and the lower the firm’s debt ratio, the better the innovation environment. 4) In the innovation output dimension, the more patents per capita, the higher the share of green patents, the lower the R&D investment per patent, and the higher the green innovation output. This paper selected nine indicators. The specific indicators are shown in Table 1.

Considering that individual indicators cannot comprehensively evaluate the firm’s Green innovation performance, this paper uses the entropy weighting method to calculate the weights of each indicator. The detailed indicators are shown in Table 1.

1) the standardization of indicators.

2) The normalized values

3) The entropy value

4) The larger the

5) Then calculate the comprehensive evaluation GIP index of green innovation performance. The higher the index is the higher the green innovation performance of the firm is.

4.2 The Main Independent Variables

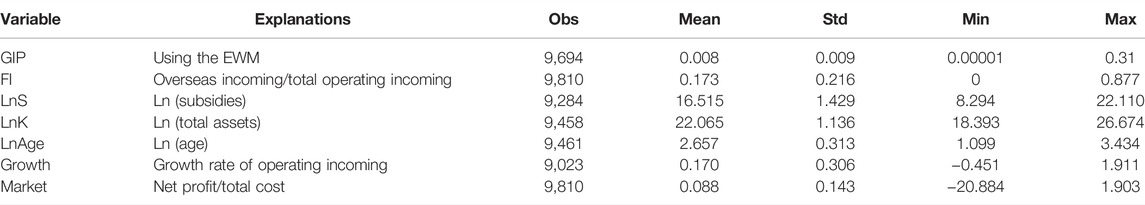

In this study, internationalization and government subsidies are considered to be the main independent variables. The subsidy is the threshold variable and measures the subsidy level of each firm. Internationalization is measured in different standards that most studies used the following criteria: the percentage of overseas assets, the percentage of overseas sales revenue, the percentage of overseas employees. Some scholars have also used the entropy weight index method to measure the degree of internationalization (Sullivan, 1994). Given the limitations of the available data and using the percentage of overseas sales is high validity to measure internationalization (Hitt et al., 1997; Tihanyi et al., 2000). This paper uses the percentage of overseas incoming to measure firm internationalization. Another key independent variable is subsidies. This paper uses the logarithm of government subsidies to measure the level of firm subsidies.

4.3 Control Variables

Given that green innovation performance is also influenced by other factors, based on previous studies (Li et al., 2018), we also introduce four control variables. 1) Firm size: which is measured by the logarithm of our firm’s total assets. 2) Firm age: this variable is calculated by the difference between the year of firm establishment and the year of study. 3) Firm growth rate: The firm growth rate can visually reflect the operational status of the firm, and this paper uses the growth rate of operating incoming to measure the firm growth rate. 4) Degree of market: We use the ratio of net profit to total costs to measure the degree of market.

4.4 Sample

The Chinese government issued new corporate accounting rules in 2006, requiring more detailed disclosure of financial status (e.g. subsidies, R&D investment). Considering the availability and validity of data (Xia et al., 2021; Xu et al., 2021), the study includes manufacturing firms listed in China from 2010–2019. Data are obtained from the China Stock Market and Accounting Research database (CSMAR) and the WIND database. Firms with missing subsidy, R&D investment, and oversea incoming data and firms with consecutive losses were removed, 9,810 firm-year observations were obtained finally. The descriptive statistics of the variables are shown in Table 2.

5 Empirical Results

5.1 Unit Test

Based on the results of the unit root test as shown in Table 3, all variables reject the original hypothesis at a significance level of 1%, indicating that the panel data is a stationary panel.

5.2 The Results of the Static and Dynamic Panel Model

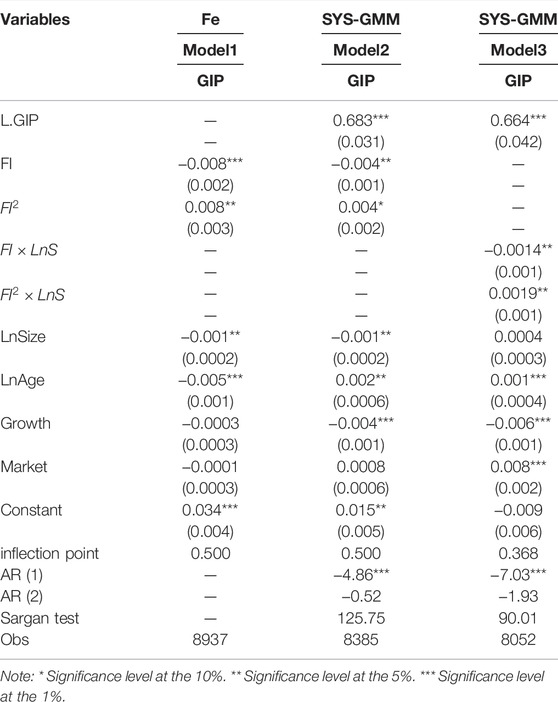

Based on the underlying model, this paper first uses a static panel model to examine the impact of internationalization on green innovation, while a dynamic panel estimation method is used to examine the dynamic impact of internationalization on green innovation output. Considering that internationalization may have strong endogeneity, the lagged first order of internationalization is mainly used as an instrumental variable to address the endogenous, and use the SYS-GMM method to estimate results. First, we used Lind and Mehlum (2010) U-test to verify the non-linear relationship for the proposed variables. The slope of the relationship between internationalization and green innovation was found to exhibit a negative change (-0.0085, p < 0.01) followed by a positive change (0.0062, p < 0.05). The Feller interval of internationalization at the 95% confidence level is (0.384, 0.959), with the extreme point at 0.506, which is just inside the Feller interval. It represents the threshold effect of the effect of internationalization on green innovation, with a threshold value point being 0.506 of internationalization.

The estimation results (Table 4) show that the Hansen test results all accept the original hypothesis that the instrumental variables are valid, indicating that the instrumental variables are reasonably, and the AR (2) test results indicate that there is no second-order serial correlation and that the lagged first-order coefficient of green innovation is 0.683 at 1% significant level (4–2). In terms of the non-linear relationship between internationalization and green innovation performance, the coefficients of internationalization are all significantly negative, while the squared terms are all significantly positive, suggesting a ‘U' shaped relationship between internationalization and green innovation performance, with green innovation performance decreasing and then increasing as internationalization increases. When internationalization falls below a certain threshold (0.500), internationalization has a negative externality effect, which means that the external resources brought by internationalization do not meet the requirements of the firm to invest in its own green innovation programs, and the firm is more interested in maintaining its own operations than in green innovation. When internationalization is above the threshold, internationalization has a positive externality effect, which means that the firm cross-regional exchanges, employee mobility, and the external technologies introduction contribute to the green innovation output. Thus, there is a non-linear “U” shaped relationship between internationalization and green innovation performance, consistent with Hypothesis H1. This compensates for the findings of Caselli and Coleman (2001) and Comin and Hobijn (2004) that when internationalization is low, it is difficult to stimulate green innovation in firms.

To test the effect of internationalization on green innovation under subsidies, we use the cross term

5.3 The Results of the Static and Dynamic Threshold Panel Model

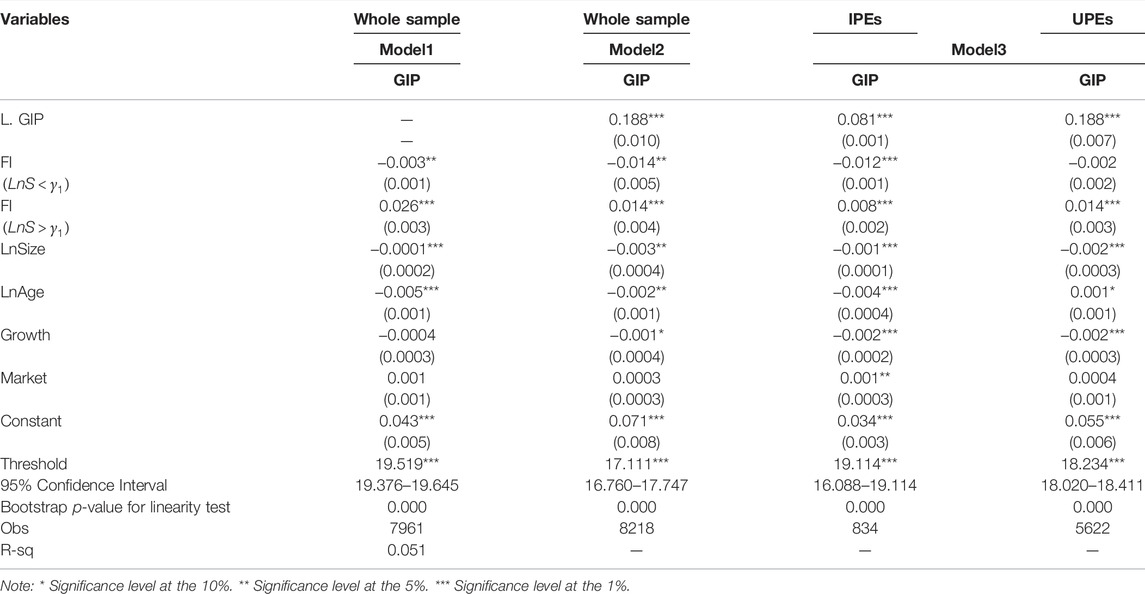

Table 5 shows that there is a “U” shaped relationship between internationalization and green innovation performance, as well as the ability of subsidies to help firms achieve green innovation earlier. To further explore the impact of subsidies on internationalization and green innovation. Table 5 shows the regression results for the threshold variable (subsidies) based on the static and dynamic panel threshold models to further explore the impact of internationalization on green innovation under different subsidies levels. The linearity test (Caner and Hansen, 2004) demonstrates that there is a threshold effect and that the threshold is significant.

Table 5 shows the estimated coefficients of internationalization and green innovation output as the level of subsidies changes. As shown in the static panel threshold model (Table 5), the coefficient of internationalization is -0.003 on green innovation at the 1% significance level when subsidies are below the threshold (19.519). If the subsidy exceeds this threshold, internationalization has a positive effect on green innovation performance with the coefficient increasing from -0.003 to 0.026. The empirical results show that subsidies compensate for firms’ external resources, which in turn promote their green innovation output. The dynamic threshold surface (Table 5) shows that green innovation in the previous period is significantly positive to green innovation output in the current period, indicating a positive externality effect of R&D, i.e. a firm’s existing green innovation contributes positively to ongoing green innovation activities. The regression results of internationalization are consistent with the static threshold model (5–1), consistent with Hypothesis H2. This is in line with Boermans and Roelfsema (2016) and Dang and Motohashi (2015).

Table 5 shows the regression results for enterprises with inventive patent (IPEs) and with utility patent (UPEs). The internationalization effect of IPEs and UPEs are consistent. The threshold for IPEs is much higher at 19.114 than the threshold for UPEs at 18.234. This implies a higher resource requirement for inventive patenting innovations. This is in line with the findings of Dang and Motohashi (2015) and Lei et al. (2012).

5.4 Heterogeneity Analysis

Given the imbalance in subsidies and internationalization in different firms, this paper divides the whole sample into state-owned (SOEs) and non-state-owned enterprises (non-SOEs), and coastal enterprises (CEs), and non-coastal enterprises (non-CEs). If an enterprise is located in a coastal province, it is classified as a coastal enterprise and the others as non-coastal enterprises. The environmental information report is the main instrument of a firms’ environmental monitoring by all parties in society and has an important role in promoting firms to protect environmental protection, which in turn can affect green innovation output, so this paper also explores the impact of environmental information disclosure (Lanjouw and Mody, 1996). If an enterprise discloses environmental information, it is classified as an enterprise with environmental information disclosure (EIDEs) and others as non-disclosing enterprises (non-EIDEs). Table 5 shows the regression results based on the dynamic panel threshold model.

The regression results in Table 6 show that the effect of internationalization on green innovation is consistent across different subsidy levels for both SOEs and non-SOEs. The internationalization of SOEs contributes to the green innovation output than non-SOEs when the subsidy is above the threshold, which is also much larger than the threshold of non-SOEs. This is because SOEs have well-developed R&D systems and encourage more green innovation output (Usman et al., 2020). Due to the larger size of SOEs, the impact of low subsidies on SOEs is relatively small, resulting in a higher threshold value, which is consistent with the findings of Xu et al. (2021).

Table 6 shows the regression results for coastal enterprises and non-coastal enterprises. It is found that the coefficient of internationalization for CEs is smaller than that of non-CEs and the threshold of subsidies for CEs is also much lower than that for non-CEs. six to three shows that the subsidy threshold is lower for non-EIDEs than for EIDEs and the effect of internationalization is greater, implying that EIDEs are forced to be at an R&D disadvantage due to increased costs resulting from environmental information disclosures, in line with the findings of Feng et al. (2021).

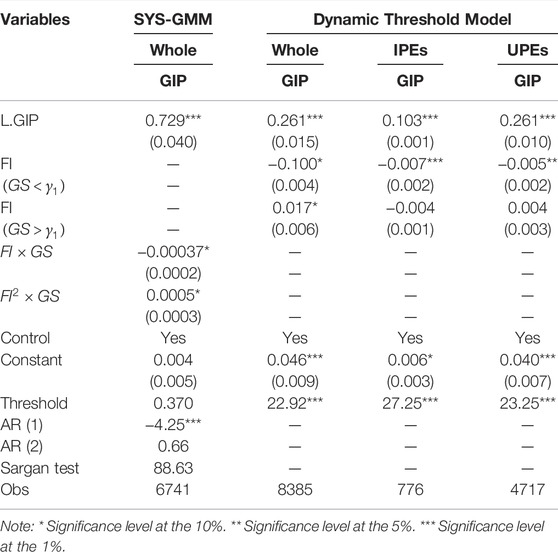

5.5 Robustness Test

For robustness checks, we used alternatives to variables. We choose government stake (the proportion of state-owned shares held by TOP10 shareholders) mentioned by Liu et al. (2021) instead of government subsidies, the stronger the incentive effect from government stake than from subsidies, labeled GS. The regression results (Table 7) remain consistent with the previous analysis and, therefore, it can be confirmed that our test results are robust.

5.6 Discussion

First, apart from contributing to the study of the relationship between internationalization and innovation performance, the findings of this paper’s inquiry differ slightly from previous studies. Specifically, using static and dynamic panel models, this paper finds a non-linear relationship between internationalization and green innovation, with internationalization being difficult to promote firm resource integration and hence green innovation when it is low. When internationalization exceeds a certain threshold (0.500), internationalization has positive externalities, such as cross-regional exchanges, staff communication and knowledge flows, which reduce R&D costs and R&D risks. This compensates for the linear relationship found by Caselli and Coleman (2001) and Comin and Hobijn (2004), and this paper finds a new relationship (non-linear “U” relationship) between the two, enriching the knowledge in the related field.

Another contribution of this paper is the focus on the role of subsidies between internationalization and green innovation. Subsidies have been attracting attention as a government intervention (Huang et al., 2019), yet few studies have considered the role of subsidies between internationalization and green innovation. Therefore, this paper explains the role of subsidies by adding a cross-term with subsidies. It is found that subsidies can help firms to cross the inflection point early and achieve green innovation output. This implies that subsidies can stimulate firms to invest in R&D (Zhang and Xu, 2019), increase expected profits, reduce risk (Huang et al., 2019), consolidate resources within firms. This is in line with the resource-based view theory and keynesian theory. Meanwhile, this paper further quantifies the impact of subsidies, namely, using subsidies as the threshold variable to determine the subsidy threshold. The impact of internationalization on green innovation is significantly negative when the subsidy is less than 16.706 (16.994), while the impact is positive when the subsidy exceeds the threshold. This is in line with Jiayun and Yingying (2019) and Clausen (2009).

Then, we segmented the green innovation types, enterprises with inventive patent and utility patent. Enterprises with inventive patent are found to require significantly more subsidies than enterprises with utility patent, implying that a higher resource requirement for inventive patenting innovations. This is in line with the findings of Dang and Motohashi (2015) and Lei et al. (2012).

Finally Based on the heterogeneity issue, our study finds higher thresholds (subsidies) for SOEs, non-coastal enterprises and enterprises with environmental disclosures compared to other enterprises, implying that the large size of SOEs, non-coastal enterprises geographical disadvantages and environmental disclosure costs lead to high subsidies. This is in line with Usman et al. (2020) and Girma et al. (2009). And after crossing the threshold, the effect of internationalization is greater for SOEs, non-coastal enterprises and enterprises without environmental disclosure. One possible explanation is that SOEs have a well-established R&D system that ensures R&D stability, which is consistent with the findings of Xu et al. (2021). The reason for the low internationalization effect for coastal enterprises is based on the technology gap theory (Fagerberg, 1994; Gerschenkron, 2015). Namely, once a technologically backward catch-ups reaches a certain level of human capital and is able to absorb new technologies, it starts to catch up in terms of technological innovation. In comparison with coastal enterprises, non-coastal enterprises with low levels of R&D will be keen to innovate as catch-ups. Also in line with the findings of Lin and Tang (2013). Finally, enterprises without environmental information disclosure have low environmental information disclosure costs, leading to a greater impact of internationalization on green innovation performance. This is consistent with the findings of Zeng et al. (2010).

6 Conclusion and Policy Implications

6.1 Conclusion

This paper first provides empirical evidence to test a non-linear (“U”) relationship between internationalization and green innovation using Chinese-listed manufacturing companies data from 2010–2019. When internationalization is low, it has a significant negative effect (−0.004) on green innovation. However, internationalization is significantly positive (0.004) on green innovation when internationalization exceeds a threshold. Then, this paper considers the effect of subsidies, and the cross term between internationalization and subsidies shows that subsidies help firms to cross inflection points early. The threshold model captures the threshold value of subsidies, namely, internationalization stimulates green innovation when the subsidy is bigger than 19.519 (17.111). It was found that the impact of internationalization on green innovation is different based on firm heterogeneity. The subsidy threshold is bigger for state-owned enterprises, non-coastal enterprises, and enterprises with environmental information disclosure compared to other firms. And cross the threshold, the effect of internationalization is bigger for state-owned enterprises, non-coastal enterprises, and enterprises without environmental information disclosure. This can be explained by resource-based view theory, Keynesian theory, and technology gap theory.

6.2 Policy Implications

The relevance of our study is clear, as encouraging green innovation in firms is essential in corporate environmental governance and transformation and upgrading. At a practical level, therefore, we make some useful policy recommendations.

First, the government should encourage firms to go global and stimulate their green innovation output. The empirical test results of this study confirm the conjecture of some scholars about the non-linear relationship between internationalization and green product innovation (Nam and An, 2017). There is a U-shaped relationship between internationalization and green product innovation. For most firms, internationalization has a temporary negative impact on green product innovation, but this is only a short-term effect. As the degree of internationalization increases, green innovation outputs become increasingly available.

Secondly, subsidies are important as an intervention tool, and governments should establish and improve subsidy policies to improve the efficiency of firms’ use of external resources. Low subsidies have little impact on innovation, and as they increase, firms can make better use of resources to achieve sustainable output from innovation.

Third, for different types of enterprises, the government should develop appropriate systems to guide their innovation. Specifically, for non-state enterprises, the government should impose relevant policies to encourage them to improve their R&D capabilities, following the principle of “market fairness”. Compared to coastal enterprises, non-coastal enterprises have a distinct geographical disadvantage. The government should not only implement subsidy policies, but also formulate policies to reduce the cost of going global for non-coastal enterprises. For enterprises with environmental information disclosure, higher subsidies reinforce the impact of internationalization on green innovation, which means that environmental information disclosure places a burden on innovation. This requires governments to develop incentives and penalties for enterprises with environmental information disclosure to reduce costs and ease the pressure on firms. In addition, especially in the context of economic globalization and global environmental degradation, the analysis in this paper provides a theoretical basis and policy support for emerging developing countries such as China.

6.3 Limitations

Due to data limitations, this paper only uses data from 2010–2019 to analyze the impact of internationalization on green innovation. Therefore, in future research, we will expand the study from micro to macro data (province, country) to capture the long-term changes among internationalization, subsidies, and green innovation. Secondly, there are many other factors influencing green innovation performance and we will add other control variables to enhance the credibility of our empirical findings.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Materials, further inquiries can be directed to the corresponding author.

Author Contributions

PC contributed to the conception and design of the study. PC organized the database. PC performed the statistical analysis. PC wrote the first draft of the manuscript. PC wrote sections of the manuscript. All authors contributed to manuscript revision, read, and approved the submitted version.

Conflict of Interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Amore, M. D., and Bennedsen, M. (2016). Corporate Governance and green Innovation. J. Environ. Econ. Manag. 75, 54–72. doi:10.1016/j.jeem.2015.11.003

Arellano, M., and Bond, S. (1991). Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 58 (2), 277–297. doi:10.2307/2297968

Boermans, M. A., and Roelfsema, H. (2016). Small Firm Internationalization, Innovation, and Growth. Int. Econ. Econ. Pol. 13 (2), 283–296. doi:10.1007/s10368-014-0310-y

Caner, M., and Hansen, B. E. (2004). Instrumental Variable Estimation of a Threshold Model. Econometric Theor. 20 (5), 813–843. doi:10.1017/s0266466604205011

Caselli, F., and Coleman, W. J. (2001). Cross-country Technology Diffusion: the Case of Computers. Am. Econ. Rev. 91 (2), 328–335. doi:10.1257/aer.91.2.328

Cassiman, B., and Veugelers, R. (2006). In Search of Complementarity in Innovation Strategy: Internal R&D and External Knowledge Acquisition. Manag. Sci. 52 (1), 68–82. doi:10.1287/mnsc.1050.0470

Chao, C. C., Hu, M., Munir, Q., and Li, T. (2017). The Impact of CEO Power on Corporate Capital Structure: New Evidence from Dynamic Panel Threshold Analysis. Int. Rev. Econ. Finance 51, 107–120. doi:10.1016/j.iref.2017.05.010

Chiao, Y. C., and Yang, K. P. (2011). Internationalization, Intangible Assets and Taiwanese SMEs Performance: Evidence of an Asian Newly-Industrialized Economy. Afr. J. Business Manag. 5 (3), 641–655. doi:10.5897/AJBM09.225

Clausen, T. H. (2009). Do subsidies Have Positive Impacts on R&D and Innovation Activities at the Firm Level? Struct. Change Econ. Dyn. 20 (4), 239–253. doi:10.1016/j.strueco.2009.09.004

Comin, D., and Hobijn, B. (2004). Cross-country Technology Adoption: Making the Theories Face the Facts. J. Monetary Econ. 51 (1), 39–83. doi:10.1016/j.jmoneco.2003.07.003

Contractor, F. J., Kundu, S. K., and Hsu, C.-C. (2003). A Three-Stage Theory of International Expansion: the Link between Multinationality and Performance in the Service Sector. J. Int. Bus Stud. 34 (1), 5–18. doi:10.1057/palgrave.jibs.8400003

Dang, J., and Motohashi, K. (2015). Patent Statistics: A Good Indicator for Innovation in China? Patent Subsidy Program Impacts on Patent Quality. China Econ. Rev. 35, 137–155. doi:10.1016/j.chieco.2015.03.012

Diallo, I. (2020). “XTENDOTHRESDPD: Stata Module to Estimate a Dynamic Panel Data Threshold Effects Model with Endogenous Regressors,” in Statistical Software Components S458745 (Boston College Department of Economics). Available at: https://EconPapers.repec.org/RePEc:boc:bocode:s458745 (Accessed April 18, 2020).

Fagerberg, J. (1994). Technology and International Differences in Growth Rates. J. Econ. Lit. 32 (3), 1147–1175.

Feng, Y., Wang, X., and Liang, Z. (2021). How Does Environmental Information Disclosure Affect Economic Development and Haze Pollution in Chinese Cities? the Mediating Role of green Technology Innovation. Sci. Total Environ. 775, 145811. doi:10.1016/j.scitotenv.2021.145811

Gao, Y., Zhang, S., and Liu, X. (2021). Too Much of a Good Thing: The Dual Effect of R&D Subsidy on Firms’ Exploratory Innovation. IEEE Trans. Eng. Manag., 1–13. doi:10.1109/TEM.2021.3100340

Gerschenkron, A. (20151962). Economic Backwardness in Historical Perspective. Cambridge MA: Harvard University Press.

Ghouse, S. M. (2020). Impact of export Barriers on Micro, Small and Medium Enterprises Internationalisation: an Indian Perspective. Ijexportm 3 (4), 370–388. doi:10.1504/ijexportm.2020.109529

Girma, S., Gong, Y., Görg, H., and Yu, Z. (2009). Can Production Subsidies Explain China's Export Performance? Evidence from Firm‐level Data*. Scand. J. Econ. 111 (4), 863–891. doi:10.1111/j.1467-9442.2009.01586.x

Grimes, S., and Miozzo, M. (2015). Big Pharma's Internationalization of R&D to China. Eur. Plann. Stud. 23 (9), 1873–1894. doi:10.1080/09654313.2015.1029442

Hansen, B. E. (1999). Threshold Effects in Non-dynamic Panels: Estimation, Testing, and Inference. J. Econom. 93 (2), 345–368. doi:10.1016/s0304-4076(99)00025-1

Hitt, M. A., Hoskisson, R. E., and Kim, H. (1997). International Diversification: Effects on Innovation and Firm Performance in Product-Diversified Firms. Amj 40, 767–798. doi:10.5465/256948

Huang, Z., Liao, G., and Li, Z. (2019). Loaning Scale and Government Subsidy for Promoting green Innovation. Technol. Forecast. Soc. Change 144, 148–156. doi:10.1016/j.techfore.2019.04.023

Jiayun, X., and Yingying, X. (2019). Do Government Subsidies Affect Enterprises’ Global Value Chain Upgrading? from the Perspective of Export Domestic Value Added Raito. J. Finance Econ. 45 (09), 17–29. doi:10.16538/j.cnki.jfe.2019.09.002

Keller, W., and Yeaple, S. R. (2009). Multinational Enterprises, International Trade, and Productivity Growth: Firm-Level Evidence from the United States. Rev. Econ. Stat. 91 (4), 821–831. doi:10.1162/rest.91.4.821

Kim, D. H. (1998). The Link between Individual and Organizational Learning. The Strateg. Manag. Intellect. capital 41, 62. doi:10.1016/b978-0-7506-9850-4.50006-3

Kremer, S., Bick, A., and Nautz, D. (2013). Inflation and Growth: New Evidence from A Dynamic Panel Threshold Ana1Ysis[J]. Empirical Econ. 44, 1–18. doi:10.1007/s00181-012-0553-9

Lanjouw, J. O., and Mody, A. (1996). Innovation and the International Diffusion of Environmentally Responsive Technology. Res. Pol. 25 (4), 549–571. doi:10.1016/0048-7333(95)00853-5

Lei, Z., Sun, Z., and Wright, B. (2012). Patent Subsidy and Patent Filing in China. Berkeley, mimeo: University of California.

Li, D., Huang, M., Ren, S., Chen, X., and Ning, L. (2018). Environmental Legitimacy, green Innovation, and Corporate Carbon Disclosure: Evidence from CDP China 100. J. Bus Ethics 150 (4), 1089–1104. doi:10.1007/s10551-016-3187-6

Li, D., Zheng, M., Cao, C., Chen, X., Ren, S., and Huang, M. (2017). The Impact of Legitimacy Pressure and Corporate Profitability on green Innovation: Evidence from China Top 100. J. Clean. Prod. 141, 41–49. doi:10.1016/j.jclepro.2016.08.123

Li, T., Li, X., Li, X., and Albitar, K. (2021). Threshold Effects of Financialization on enterprise R & D Innovation: a Comparison Research on Heterogeneity. Quantitative Finance Econ. 5 (3), 496–515. doi:10.3934/qfe.2021022

Lin, F., and Tang, H. C. (2013). Exporting and Innovation: Theory and Firm-Level Evidence from People's Republic of China. Int. J. Appl. Econ. 10, 52–76. http://hdl.handle.net/10419/109611

Lind, J. T., and Mehlum, H. (2010). With or without U? the Appropriate Test for a U-Shaped Relationship*. Oxford Bull. Econ. Stat. 72 (1), 109–118. doi:10.1111/j.1468-0084.2009.00569.x

Link, A. N., and Scott, J. T. (2018). Propensity to Patent and Firm Size for Small R&D-Intensive Firms. Rev. Ind. Organ. 52 (4), 561–587. doi:10.1007/s11151-018-9617-0

Liu, D., Chen, T., Liu, X., and Yu, Y. (2019). Do more Subsidies Promote Greater Innovation? Evidence from the Chinese Electronic Manufacturing Industry. Econ. Model. 80, 441–452. doi:10.1016/j.econmod.2018.11.027

Liu, T., Wang, J., Zhu, Y., and Qu, Z. (2021). Linking Economic Performance and Sustainable Operations of China's Manufacturing Firms: What Role Does the Government Involvement Play? Sustain. Cities Soc. 67, 102717. doi:10.1016/j.scs.2021.102717

Luo, Y., and Tung, R. L. (2007). International Expansion of Emerging Market Enterprises: A Springboard Perspective. J. Int. Business Stud. 38 (4), 481–498. doi:10.1057/palgrave.jibs.8400275

Mathews, J. A. (2006). Dragon Multinationals: New Players in 21st century Globalization. Asia Pac. J Manage 23 (1), 5–27. doi:10.1007/s10490-006-6113-0

Nam, H.-J., and An, Y. (2017). Patent, R&D and Internationalization for Korean Healthcare Industry. Technol. Forecast. Soc. Change 117, 131–137. doi:10.1016/j.techfore.2016.12.008

Seitz, M., and Watzinger, M. (2017). Contract Enforcement and R&D Investment. Res. Pol. 46 (1), 182–195. doi:10.1016/j.respol.2016.09.015

Sullivan, D. (1994). Measuring the Degree of Internationalization of a Firm. J. Int. Bus Stud. 25, 325–342. doi:10.1057/palgrave.jibs.8490203

Teece, D. J., Pisano, G., and Shuen, A. (1997). Dynamic Capabilities and Strategic Management. Strat. Mgmt. J. 18 (7), 509–533. doi:10.1002/(sici)1097-0266(199708)18:7<509::aid-smj882>3.0.co;2-z

Tihanyi, L., Ellstrand, A. E., Daily, C. M., and Dalton, D. R. (2000). Composition of the Top Management Team and Firm International Diversification. J. Manag. 26, 1157–1177. doi:10.1177/014920630002600605

Ulucak, R. (2021). Renewable Energy, Technological Innovation and the Environment: a Novel Dynamic Auto-Regressive Distributive Lag Simulation. Renew. Sustain. Energ. Rev. 150, 111433. doi:10.1016/j.rser.2021.111433

Usman, M., Javed, M., and Yin, J. (2020). Board Internationalization and green Innovation. Econ. Lett. 197, 109625. doi:10.1016/j.econlet.2020.109625

Van Leeuwen, G., and Mohnen, P. (2017). Revisiting the Porter Hypothesis: an Empirical Analysis of green Innovation for the Netherlands. Econ. Innovation New Technol. 26 (1-2), 63–77. doi:10.1080/10438599.2016.1202521

Wallsten, S. J. (2000). The Effects of Government-Industry R&D Programs on Private R&D: The Case of the Small Business Innovation Research Program. RAND J. Econ. 31, 82–100. doi:10.2307/2601030

Wang, Q. (2015). Fixed-effect Panel Threshold Model Using Stata. Stata J. 15 (1), 121–134. doi:10.1177/1536867x1501500108

Wei, J., and Zuo, Y. (2018). The Certification Effect of R&D Subsidies from the central and Local Governments: Evidence from China. R&D Manag. 48 (5), 615–626. doi:10.1111/radm.12333

Weng, Q., Qin, Q., and Li, L. (2020). A Comprehensive Evaluation Paradigm for Regional green Development Based on "Five-Circle Model": A Case Study from Beijing-Tianjin-Hebei. J. Clean. Prod. 277, 124076. doi:10.1016/j.jclepro.2020.124076

Xia, L., Gao, S., Wei, J., and Ding, Q. (2021). Government Subsidy and Corporate green Innovation-Does Board Governance Play a Role? Energy Policy 161, 112720. doi:10.1016/j.enpol.2021.112720

Xu, J., Wang, X., and Liu, F. (2021). Government Subsidies, R&D Investment and Innovation Performance: Analysis from Pharmaceutical Sector in China. Technol. Anal. Strateg. Manag. 33 (5), 535–553. doi:10.1080/09537325.2020.1830055

Yi, J., Murphree, M., Meng, S., and Li, S. (2021). The More the Merrier? Chinese Government R&D Subsidies, Dependence, and Firm Innovation Performance. J. Prod. Innov. Manag. 38 (2), 289–310. doi:10.1111/jpim.12564

Yi, M., Wang, Y., Yan, M., Fu, L., and Zhang, Y. (2020). Government R&D Subsidies, Environmental Regulations, and Their Effect on Green Innovation Efficiency of Manufacturing Industry: Evidence from the Yangtze River Economic Belt of China. Ijerph 17 (4), 1330. doi:10.3390/ijerph17041330

Zeng, S. X., Xu, X. D., Dong, Z. Y., and Tam, V. W. Y. (2010). Towards Corporate Environmental Information Disclosure: an Empirical Study in China. J. Clean. Prod. 18 (12), 1142–1148. doi:10.1016/j.jclepro.2010.04.005

Zhang, X., and Xu, B. (2019). R&D Internationalization and Green Innovation? Evidence from Chinese Resource Enterprises and Environmental Enterprises. Sustainability 11 (24), 7225. doi:10.3390/su11247225

Keywords: internationalization, green innovation performance, subsidy, the dynamic panel threshold model, the non-linear relationship

Citation: Chen P (2022) Subsidized or Not, the Impact of Firm Internationalization on Green Innovation—Based on a Dynamic Panel Threshold Model. Front. Environ. Sci. 10:806999. doi: 10.3389/fenvs.2022.806999

Received: 01 November 2021; Accepted: 09 March 2022;

Published: 04 April 2022.

Edited by:

Thai-Ha Le, Fulbright University Vietnam (FUV), VietnamReviewed by:

Luigi Aldieri, University of Salerno, ItalyJiayu Wang, Hainan University, China

Yuanyuan Hao, Changzhou University, China

Zhehao Huang, Guangzhou University, China

Copyright © 2022 Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Pengyu Chen, cpy702018@163.com

Pengyu Chen

Pengyu Chen