- 1School of Management, Shandong University of Technology, Zibo, China

- 2School of Economics and Management, Shandong Huayu University of Technology, Dezhou, China

- 3Shandong Zibo Shiyan High School, Zibo, China

Introduction: The carbon cap and trade mechanism (CCTM) is forcing companies to reduce carbon emissions. Due to financial and technical constraints, manufacturers responsible for recycling and remanufacturing begin to seek embedded services from energy service companies (ESCOs), marking the emergence of embedded low-carbon service supply chains. The purpose of this paper is to explore the role of embedded low-carbon service in supply chains in lowering manufacturer’s carbon emissions and maintaining economic growth.

Methods: In this paper, a decision model for risk-averse closed-loop supply chain for embedded low-carbon service in uncertain markets is built by using the Stackelberg theory and mean-variance (MV) approach. Equilibrium decisions, the manufacturer’s expected utility growth, and total carbon emission reduction are obtained. Sensitivity analysis is performed for the main parameters.

Results: The results indicate that only when the manufacturer’s risk aversion level and consumers’ low-carbon preference are within the range of 0.35–0.9, can the manufacturer bring in embedded low-carbon service by cooperating with an ESCO through revenue-sharing contracts. When there is a higher carbon price, embedded low-carbon service can further increase the manufacturer’s expected utility, maintain economic growth and reduce carbon emissions.

Discussion: Embedded low-carbon service in supply chains can play a role in lowering manufacturers’ carbon emissions and maintaining economic growth when the manufacturer’s risk aversion level, carbon price, and consumers’ low-carbon preference are high. Theoretically, this study combines closed-loop supply chains (CLSCs) and embedded low-carbon services, enriching supply chain theories. In addition, the findings provide managerial insights for manufacturers, ESCOs, and governments.

1 Introduction

The growing demand for products has caused significant CO2 emissions from production, resulting in global warming (Xu et al., 2016; Ahmed and Sarkar, 2018). To curb CO2 emissions and reverse the trend, governments and institutions with higher environmental awareness have implemented several stringent policies (Cheng et al., 2022). For example, many countries, including China, the EU, the US and Japan, have enacted carbon cap and trade mechanism (CCTM) policies (Toptal and Çetinkaya, 2017; Liu H. et al., 2021). According to the CCTM, there are two main carbon allowances for manufacturers: the government-issued carbon allowances and the additional allowances purchased from the carbon market (Du et al., 2015). In other words, manufacturers can sell their surplus carbon allowances in the carbon market; Or if their carbon allowances are insufficient, they can purchase them from the carbon market to meet the goal.

Meanwhile, consumers’ low-carbon preference is becoming increasingly important. For example, their low-carbon preference has increased product demand (Hadi et al., 2021; Qiao et al., 2021), leading to a growing number of manufacturers engaging in emission reduction for higher revenue. Against such a backdrop, manufacturers must implement their emission reduction initiatives to make green upgrades and develop products with high efficiency and low emissions. That is, they have to green and invest heavily in upgrading their equipment. For example, Wuhan Iron and Steel Group invested more than 200 million yuan in emission reduction technology upgrades. For manufacturers with financial difficulties, seeking embedded low-carbon service from an energy service company (ESCO) is a feasible solution. Embedded low-carbon service refers to the model in which the ESCO as a low-carbon service provider is integrated into a manufacturer’s operation through investment and business embedding to provide low-carbon service (Liao et al., 2022). For example, Siemens Energy cooperated with the Nigeria LNG plant by investing in and implementing emission reduction operations, and both parties shared the benefits generated from low-carbon activities (Liao et al., 2022). Similarly, Honeywell has provided carbon reduction services to Shenzhen Tsingtao Brewery (Ouyang and Fu, 2020).

Furthermore, remanufacturing can make used products usable again, restoring the value of the old products while saving resources (Jung and Hwang, 2011). Therefore, closed-loop supply chains (CLSCs) that perform the functions of recycling and remanufacturing have become a trend (Mogale et al., 2022). In addition, risk is an inherent characteristic of supply chains (Kusi-Sarpong et al., 2021). When the manufacturer shares the earnings of the supply chain with ESCO, carbon reduction risk is also transferred to ESCO. However, faced with uncertain market demand and CCTM, manufacturers still risk financial losses and not achieving optimal emission reductions (Liao et al., 2022). In addition, selecting the right partners and taking advantage of their resources effectively throughout the supply chain also remain challenging for manufacturers (Cheng et al., 2011). Therefore, ESCOs and manufacturers have different risk aversion levels that may cause troubled coordination within low-carbon service supply chains.

To explore the role of embedded low-carbon service in supply chains in lowering manufacturer’s carbon emissions and maintaining economic growth, this paper builds a model of the risk-averse closed-loop supply chain for embedded low-carbon service with the participation of a risk-averse manufacturer that performs recycling and remanufacturing and a risk-averse ESCO that provides low-carbon service. Expected utility and equilibrium decision outcomes of the supply chain led by a manufacturer are discussed, and so are the amount of expected utility growth and total emission reduction for manufacturers choosing embedded low-carbon service. Therefore, the major issues explored in this study are as below: 1) Manufacturers choose embedded low-carbon services to increase emission reduction and expected utility. Can they achieve this purpose through revenue-sharing contracts? If not, under what conditions can they achieve their purposes? 2) How do the manufacturer’s and ESCO’s risk aversion levels, consumers’ low-carbon preference, and the carbon price affect equilibrium decisions and the expected utility of the supply chain?

This study has three main contributions: 1) Based on the Stackelberg game, a decision model of the risk-averse closed-loop supply chain for embedded low-carbon service is constructed. Unlike previous models, it considers the co-existence of embedded low-carbon service and remanufacturing, as well as the factors like the risk aversion level, market uncertainty, carbon price and carbon allowance. Also, the model’s operation rules are discussed, which enriches relevant supply chain theories. 2) By comparing and analyzing the differences between the manufacturer’s expected utility and total emission reduction before and after the introduction of embedded ESCO, the role of embedded low-carbon service in supply chains in lowering the manufacturer’s carbon emissions and maintaining economic growth is explored. 3) By using the mean-variance (MV) approach to describe the risk-averse characteristics, this study can not only solve the problem of de-randomization of embedded low-carbon service in closed-loop supply chains but also analyze the equilibrium decision-making problem in the supply chain through expected utility.

The paper is organized into eight sections. Section 2 will review the relevant literature. Then, the model of the risk-averse closed-loop supply chain for embedded low-carbon service will be introduced in Section 3. In Section 4, relevant game models will be constructed and analyzed. After that, sensitivity analysis and an analysis of the expected utility growth and the total amount of emission reduction will be conducted using numerical simulations in Section 5. Section 6 will analyze the results of the article. Section 7 will present managerial implications and the conclusions and limitations will be presented in Section 8.

2 Literature review

As mentioned above, this study examines the decision-making of a risk-averse ESCO and a risk-averse manufacturer in the closed-loop supply chain for embedded low-carbon service under carbon trading constraints. Therefore, studies on service supply chains, risk aversion and carbon policies are selected for a comprehensive review.

2.1 Service supply chains

Service is becoming increasingly important in global economies, making the concept of the service supply chain (SSC) conspicuous in current operations management (Cheng et al., 2011). According to Peng et al. (2009), research on the SSC could be divided into two directions: 1) SSC as related service activities in traditional supply chains; 2) SSC as an innovation that applies traditional supply chain theories to the service sector. Similarly, Wang et al. (2015) discussed the definitions of the SSC and classified it into service-only supply chains (SOSC) and product service supply chains (PSSC). In SOSC, no physical products are offered. For instance, Ren et al. (2022) studied the quality and pricing issues in IT service supply chains. And Farsi et al. (2020) explored supply chains that offer customized services such as customer maintenance and facility management. By contrast, in PSSC, service coexists with physical products. For instance, Jia et al. (2019) and Niu et al. (2022) analyzed logistics service supply chains that provide logistics and distribution services for products. And Liao et al. (2022) explored low-carbon service supply chains that reduce product carbon emissions.

Scholars have also studied the issue of contract design for low-carbon service supply chains. In examining the cost-sharing decision in low-carbon service supply chains, He et al. (2020) integrated the variable of corporate social responsibility into the research. They not only examined an ESCO but also a service integrator of low-carbon advertising. Shang et al. (2015) argued that issues in the benefits distribution of energy efficiency in embedded low-carbon service programs were a barrier to the rapid development of contracting. Qian and Guo (2014) also studied the design of revenue-sharing contracts between ESCOs and manufacturers and analyzed what revenue-sharing contracts were optimal. In addition, Ouyang and Ju (2017) examined how manufacturers differed in their choice of ESCO partnership models. Ding et al. (2017; 2018) analyzed the behavior of outsourced emission reduction services for coal-fired power plants. Ouyang and Fu (2020) explored how consumers’ low-carbon preference impacted the manufacturer’s choice of ESCOs. Zhang et al. (2020) examined the effect of the revenue-sharing rate on the quality of ESCO’s service. Mao et al. (2022) examined the effect of financing risk in the embedded low-carbon service supply chain. Liao et al. (2022) analyzed an embedded low-carbon service supply chain containing a manufacturer and an ESCO in a certain market context. They explored the issue of contract design with varying ESCO emission reduction efficiency under the information asymmetry between manufacturers and ESCOs.

2.2 Risk aversion

Risk aversion is a strategy used by an enterprise to voluntarily discontinue from or alter the risk of loss of an action to avert potential risks associated with the action. Thus, in the low-carbon service supply chain, the risk aversion level may cause ESCOs and manufacturers to renounce or terminate the implementation of the supply chain. Das et al. (2022) established a two-stage risk-averse closed-loop supply chain. They noted that a risk-averse approach that incorporated the effects of stochastic outcome variability would provide a more robust performance compared to a risk-neutral approach. Qu and Yang (2015) explored the relationship between risk aversion level and social trust in supply chains. Liu et al. (2018) stated that the risk aversion level could impact channel optimization in supply chains. They also explored the effect of supply chain disruption risks on the channels. Luo et al. (2018) studied repurchase agreements in the supply chain considering the risk aversion level. Gupta and Ivanov (2020) examined the role of the risk aversion level on supply chain decisions in the sharing economy. Zhu et al. (2022) studied green investment solutions in a rice supply chain containing risk-averse growers and risk-neutral suppliers.

Many studies have adopted the MV approach regarding the measurement of risk aversion levels. For instance, Choi (2011) used the MV approach for a two-channel risk-averse supply chain and showed that radio frequency identification could add to the profitability of the supply chain. Using the MV approach, Gan et al. (2011) analyzed multiple risk aversion scenarios and proposed corresponding optimal solutions. Shen et al. (2013) explored suppliers’ risk-averse pricing strategies for price reduction in textile and apparel supply chains. Li et al. (2013) examined the supply chain containing a supplier and multiple retailers and analyzed how returns were made within the supply chain when they were all risk-averse. Wang and He (2018) examined the contractual design issue in a low-carbon service supply chain comprised of a supplier, a manufacturer and a low-carbon service provider. Furthermore, they analyzed the effect of risk aversion levels of the manufacturer and supplier on the contract. Goli et al. (2019) used the MV approach to determine the risk level of the product portfolio. Adopting an MV research framework, Wen and Siqin (2020) explored how risk aversion levels and the uncertainty of product quality might influence optimal decisions on sharing economy platforms. Zang et al. (2022) examined the sharing of external costs between risk-averse suppliers and manufacturers in two-stage supply chains with different power structures. They found that under the MV framework, the supplier and manufacturer who were more risk-averse earned less.

2.3 Carbon policies

Many scholars have researched carbon policies concerning low-carbon emissions in supply chains. Jin et al. (2014) examined the three most common carbon policies: carbon taxes, strict carbon caps and the CCTM. And their research implications for companies include redesigning the supply chains and selecting different transport modes (truck, rail or water). Toptal et al. (2014) evaluated the role of multiple carbon policies on the optimal supply chain decision. Wang et al. (2017) analyzed the relationship between supply chain decisions and carbon tax policies. Tirkolaee et al. (2020) explored the optimization of supply chain operations by considering factors, such as carbon emissions and customer satisfaction. Xia et al. (2020) explored the effect of consumers’ low-carbon preference on the carbon emissions of supply chains. Golpîra and Javanmardan (2022) focused on optimizing CLSCs in the context of carbon emissions in their research. Another theme in the current literature is carbon trading. Considering the uncertainty of recycling quality, Zhao et al. (2021) investigated the optimal production decision for CLSC in a carbon market. Wei et al. (2021) evaluated the role of carbon trading in renewable energy investment and marketing activities based on an electricity supply chain. Entezaminia et al. (2021) discussed the joint production and carbon trading policies in supply chain systems under trading supervision. Yang et al. (2021) investigated the non-compliant behaviors of CLSC companies in carbon trading. They found that violation penalties, remanufacturing rates, and carbon emissions can affect all members’ decisions in the CLSC network. Kalantari et al. (2022) explored the effect of policies such as carbon trading and carbon tax on closed-loop supply chains in the scenario of inflation. Using the remanufacturing of spring pallets as an example, Haolan et al. (2022) analyzed the effect of carbon price fluctuations on CLSC under demand uncertainty.

Some scholars have examined the effect of the CCTM on supply chains using the Stackelberg game. The Stackelberg game is a simple game where both leaders and followers make decisions to maximize their respective profits (Meng et al., 2021). Adopting the Stackelberg approach, Du et al. (2015) examined the influence of the CCTM on CLSC. Du et al. (2016) addressed the issue of the manufacturer’s joint multi-product pricing when consumers have low-carbon preference. More specifically, they found conditions under which enterprises can maximize their profit in low-carbon production. With consumers’ low-carbon preference and social preference considered, Xia et al. (2018) examined the influence of carbon reduction and CCTM policies on the supply chain led by the manufacturer. Liu M. et al. (2021) developed a Stackelberg model to explore the best scenario for joint manufacturer and retailer emission reduction under the CCTM. And Qu et al. (2021) adopted the Stackelberg approach to analyze how to optimize the supply chain for emission reduction under the CCTM. In addition, Gong and Zhou (2013) analyzed a model to provide enterprises with optimal emissions trading, technology choices and production strategies under the CCTM. Xu et al. (2017) studied supply chains built upon the CCTM, pointing out that carbon price can significantly affect the optimal decision of supply chains. Drawing on the optimized consensus model and the basic allocation scheme from the closed-loop supply chain trading system that considered income and equity, Xu et al. (2021) proposed a theoretical innovation in their research and designed a flexible cap and trade scheme.

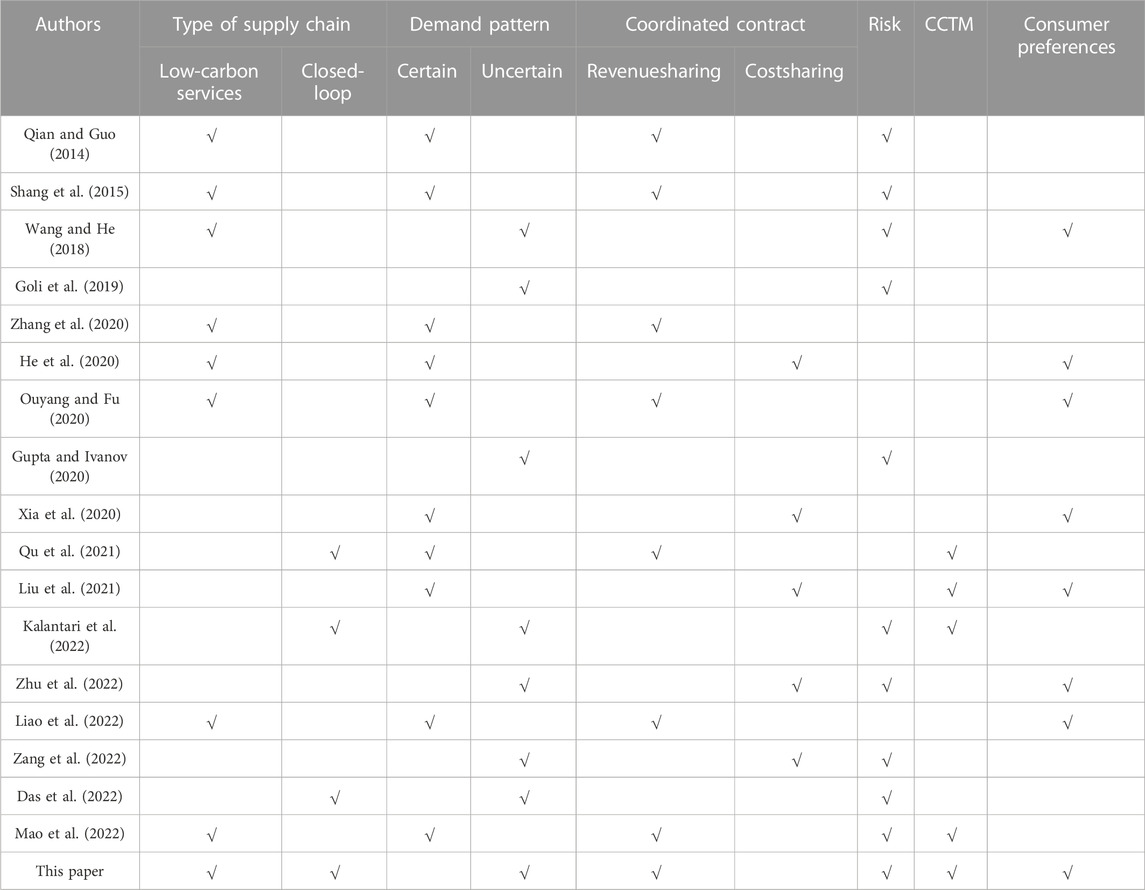

In conclusion, the following research gaps can be identified: 1) Studies related to traditional low-carbon service supply chains focus more on the bargaining power of manufacturers and ESCOs. There lack studies on closed-loop supply chains for embedded low-carbon service in an uncertain market, considering factors like supply chain risks, carbon price, carbon allowances, and product recycling. 2) Studies on closed-loop supply chains for recycling and remanufacturing that use the MV approach to measure supply chain risks and incorporate ESCOs are scarce. 3) Few studies consider the role of the CCTM in the decision-making of the closed-loop supply chain for embedded low-carbon service. Therefore, considering demand uncertainty and the risk aversion level of ESCOs and manufacturers, this paper will build a Stackelberg model of a risk-averse closed-loop supply chain for embedded low-carbon service to explore how embedded low-carbon service in supply chains lowers manufacturer’s carbon emission and maintains economic growth. A comparison of the relevant literature reviewed is shown in Table 1.

3 Model description and parameters

3.1 Model description

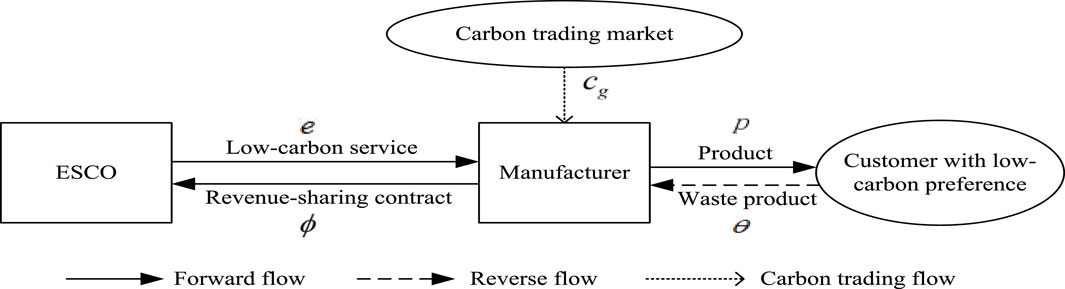

To explore the role of embedded low-carbon service in supply chains in lowering manufacturer’s carbon emissions and maintaining economic growth, this paper examines a closed-loop supply chain for embedded low-carbon service that includes a manufacturer who is responsible for recycling, production and remanufacturing and an ESCO who provides low-carbon service (shown in Figure 1). And both of them have different risk aversion levels facing market demand uncertainty, consumers’ low-carbon preference and the CCTM. Aligned with Liao et al. (2022), the ESCO (

This paper will build a Stackelberg model and construct the expected utility function using the MV approach. The reason for adopting the MV approach is that it can portray the risk aversion level of supply chain participants, which is a risk analysis method widely used in supply chain studies (Zhu et al., 2022). Meanwhile, the market demand in this paper is uncertain and follows a normal distribution. The manufacturer and ESCO will make equilibrium decisions between high returns and low risks.

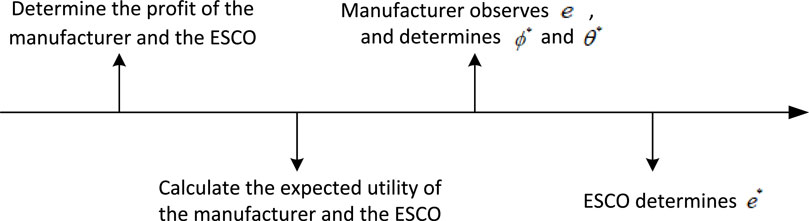

The Stackelberg approach model is a game between leaders and followers. Since it considers the status and information asymmetries that exist between the participants, which is close to reality, it is widely used in pricing and decision-making in the supply chain (Yang et al., 2021). In the Stackelberg game, the leader has a significant advantage in predicting followers’ reactions and making decisions to maximize profits (Meng et al., 2021). In this paper, the game’s leader is the manufacturer, and the ESCO is the follower. Therefore, the sequence of decision-making is as below: firstly, the manufacturer proposes the revenue-sharing and recycling rates to the ESCO. Then the ESCO decides on the sum of carbon reduction in light of revenue maximization. The methodological framework is shown in Figure 2.

3.2 Model variables and parameters

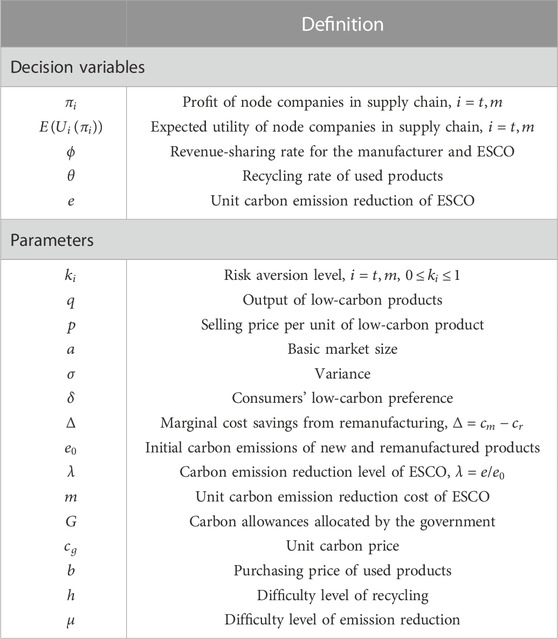

To construct the profit functions for the manufacturer and ESCO, this paper assumes that the model of the closed-loop supply chain for embedded low-carbon service satisfies the following conditions.

1) Both participants in the closed-loop supply chain for embedded low-carbon service are risk-averse. Their risk characteristics are measured by the MV function (Wei and Choi, 2010). The expected utility function is written as

2) As consumers prefer low-carbon products, the low-carbon feature becomes an essential factor influencing market demand. And the market demand

3) It costs a manufacturer

4) The fixed emission reduction cost of an ESCO is written as

Other relevant variables and parameters are described in Table 2.

4 Model construction and analysis

4.1 Model construction

The sequence of the game in the closed-loop supply chain for embedded low-carbon service is as follows: First, the manufacturer proposes to the ESCO

In Equation 1, the first term indicates the earnings allocated to the ESCO from the manufacturer’s sales of low-carbon products; the second term indicates the ESCO’s emission reduction cost; the third term is the fixed cost of the ESCO’s investment in emission reduction technology.

The manufacturer’s profit is expressed below:

In Equation 2, the first term indicates the earnings allocated to the manufacturer from its sales of low-carbon products; the second term is the benefit or cost of the manufacturer’s carbon allowance; the third term refers to the production cost; the fourth term means the cost savings from remanufacturing; the fifth term indicates the total fixed investment cost of recycling.

According to the MV approach, the expected utility functions of the ESCO and the manufacturer are written as below:

The equations are solved using inverse operations. Lemma 1 is the result of the equilibrium decision (details in Appendix A).

Lemma 1 The recycling rate, revenue-sharing rate and unit carbon emission reduction for the equilibrium decision are as follows:

where

4.2 Analysis of model properties

4.2.1 The impact of embedded low-carbon service on the manufacturer

To analyze and compare the changes in the expected utility of manufacturers after introducing embedded ESCOs, a scenario without ESCO involvement needs to be considered. Under this scenario, we assume

Given the manufacturer’s target of maximizing benefits and the fixed recycling rate of used products, Lemma 2 can be obtained (details in Appendix B).

Lemma 2 The manufacturer’s maximum expected utility without introducing an ESCO is as follows:

Proposition 1 As the manufacturer’s risk aversion level and consumers’ low-carbon preference increase, its expected utility growth is a convex function. And the manufacturer’s expected utility growth is positively associated with the carbon price, independent of the risk aversion level of the ESCO.Proposition 1 suggests that as factors such as the manufacturer’s risk aversion level increase, the quantity of growth in the manufacturer’s expected utility falls and then rises. During the falling process, the growth may become negative (see the simulation results in Section 5.2). In other words, although cooperating with an ESCO can achieve the goal of carbon emission reduction, it is at the expense of the manufacturer’s expected utility. Therefore, when considering whether to partner with an embedded ESCO, manufacturers must consider the factors of consumers’ low-carbon preference, their risk aversion levels and the carbon price.

4.2.2 Analysis of factors influencing balanced decision making

Proposition 2 The recycling rate of used products and unit carbon emission reduction are positively associated with the carbon price, consumers’ low-carbon preference and the manufacturer’s risk aversion level. They are independent of the ESCO’s risk aversion level. The opposite conclusion can be reached for the revenue-sharing rate.

Proposition 3 The expected utility of an ESCO is positively associated with the manufacturer’s risk aversion level, consumers’ low-carbon preference and the carbon price. The expected utility of an ESCO is positively correlated with its risk aversion level when manufacturers have a lower risk aversion level. And an opposite conclusion can be made when manufacturers have a higher risk aversion level.

Proposition 4 The manufacturer’s expected utility positively correlates with the carbon price. However, it is negatively correlated with its risk aversion level and is unrelated to the ESCO’s risk aversion level.Propositions 2–4 show the role of the carbon price, risk aversion level, and consumers’ low-carbon preference on the recycling rate of used products, revenue-sharing rate, unit carbon emission reduction and expected utility of the manufacturer and the ESCO. It could be argued that different influencing factors have different mechanisms for controlling the equilibrium solutions of the participants in the closed-loop supply chain for embedded low-carbon service. Therefore, manufacturers and ESCOs need to exchange and communicate promptly and weigh up the benefits and losses when making decisions.

4.2.3 Analysis of factors influencing the total emission reduction

To explore the factors influencing the total amount of emission reduction, it is essential to obtain the total emission reduction

Proposition 5 The total emission reduction of the closed-loop supply chain for embedded low-carbon service is positively associated with the carbon price, manufacturer’s risk aversion level and consumers’ low-carbon preference. But the risk aversion level of ESCOs does not affect the total amount of emission reduction.Proposition 5 suggests that the carbon price, the manufacturer’s risk aversion level and consumers’ low-carbon preference can all raise total emission reductions. However, when they are at a low level, further analysis is needed to determine whether the closed-loop supply chain for embedded low-carbon service model might impinge on the total amount of emission reduction (see the simulation results in Section 5.3).

5 Numerical analysis

This paper uses numerical simulation for the sensitivity analysis of

5.1 Sensitivity analysis

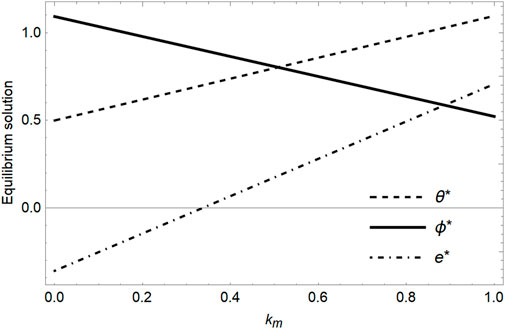

Firstly, the impact of

Based on Figure 3, as manufacturers become increasingly risk-averse, the recycling rate of used products and unit carbon reduction rise, but the revenue-sharing rate declines. Furthermore, when

Secondly, the impact of

According to Figure 4, the manufacturer’s expected utility drops as its risk aversion level rises; when ESCO’s risk aversion level changes, it remains unchanged. When

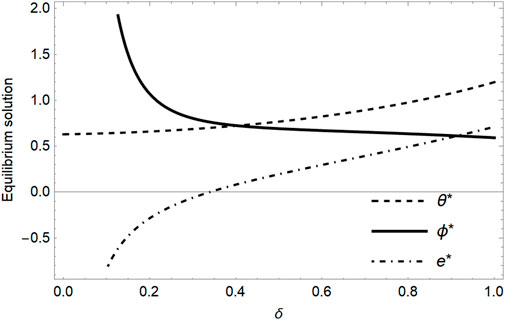

In addition, the impact of

Based on Figure 5, as consumers’ low-carbon preference goes up, the recycling rate of used products and unit carbon reduction increase, but the revenue-sharing rate goes down. However, when

Then, the impact of

According to Figure 6, the expected utility of both the manufacturer and the ESCO grows when consumers’ low-carbon preference and the carbon price rise, suggesting that higher consumers’ low-carbon preference and a higher carbon price prompt manufacturers to reduce their carbon emissions. Meanwhile, when

5.2 Analysis of factors influencing the manufacturer’s expected utility growth

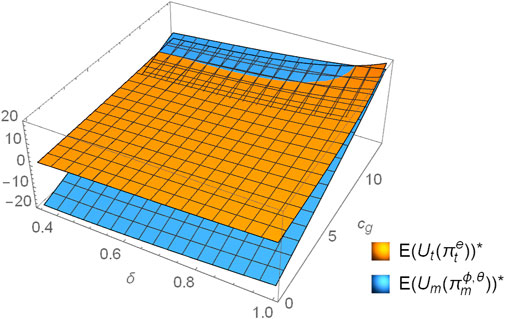

The ESCO’s risk aversion level

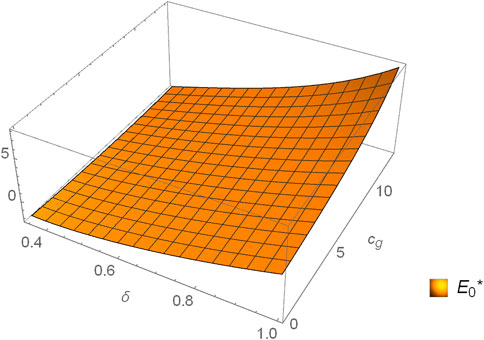

According to Figure 7, when the manufacturer’s risk aversion level rises, its expected utility growth decreases and then increases, and it becomes negative when

After that, the impact of

Based on Figure 8, the manufacturer’s expected utility growth is positively associated with consumers’ low-carbon preference. To be more specific, when

5.3 Analysis of factors influencing the total emission reduction

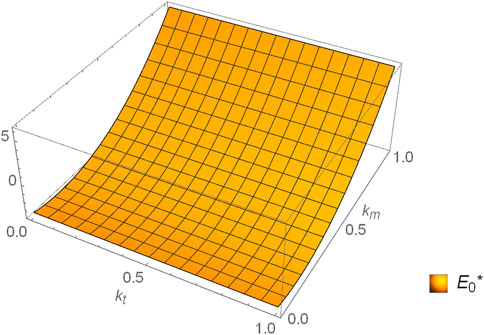

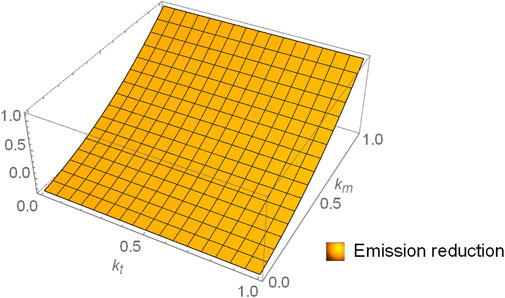

The results obtained from the analysis of the impact of

Based on Figure 9, the ESCO’s risk aversion level doesn’t affect the total amount of emission reduction. However, when the manufacturer’s risk aversion level rises, the total emission reduction increases. When

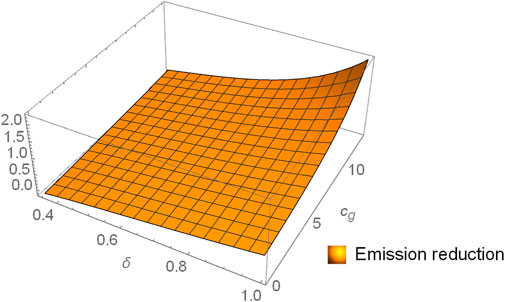

The results of the impact of

According to Figure 10, the total emission reduction rises with the carbon price and consumers’ low-carbon preference. When

6 Discussion

Carbon dioxide emitted through production contributes to climate warming (Xu et al., 2016; Ahmed and Sarkar, 2018). And the CCTM, a robust economic policy, has been implemented by many countries to prompt manufacturing companies to reduce carbon emissions (Yang et al., 2021). Existing studies note that many manufacturers outsource low-carbon projects to ESCOs and the cooperation mechanisms between the two have raised much attention from academia (He et al., 2020; Zhang et al., 2020). Using the MV approach and considering the scenarios for the manufacturers’ recycling and remanufacturing, the paper has built and investigated a Stackelberg model of the risk-averse closed-loop supply chain for embedded low-carbon service under demand uncertainty. It explores the effect of various factors, such as risk aversion levels of the manufacturer and ESCO, the carbon price and consumers’ low-carbon preference, on low-carbon service supply chains. And the role of embedded low-carbon service in supply chains in lowering manufacturer’s carbon emissions and maintaining economic growth is analyzed.

Through sensitivity analysis, the results of the effect of risk aversion level, carbon price and consumers’ low-carbon preference on the embedded low-carbon service supply chain are verified. According to the results, to let embedded low-carbon service supply chain operate, certain conditions should be met: the manufacturer’s risk aversion level and consumers’ low-carbon preference should be within 0.35–0.9, a higher level. Meanwhile, as the carbon price, the manufacturer’s risk aversion level and consumers’ low-carbon preference rise, the recycling rate of used products and the unit carbon emission reduction increase but the revenue-sharing rate decreases. Second, the manufacturer’s expected utility becomes lower when its risk aversion level goes higher. However, when the ESCO’s expected utility is less than 0, its expected utility would increase with its risk aversion level, suggesting that higher consumers’ low-carbon preference and carbon price will lead to the manufacturer’s higher willingness to abate carbon emissions and develop an embedded low-carbon service supply chain. With a greater carbon price and consumers’ low-carbon preference, the expected utility of the manufacturer and the ESCO becomes higher, meaning that greater expected utility can be obtained from low-carbon service supply chains. Thus, the manufacturer and ESCO need to focus on consumers’ low-carbon preference and carbon price, as well as developing and enhancing emission reduction technologies.

The above results can be supported and verified by the existing studies. Firstly, as consumers’ low-carbon preference goes higher, the ESCO enhances its development and investment in emission reduction technology to expand market demand, which is evidenced in the study by Qu et al. (2021). At this point, the manufacturer’s revenue grows and it voluntarily lowers the revenue-sharing rate and concedes part of the benefits to the ESCO to continue reducing emissions. Meanwhile, the manufacturer’s revenue grows, making its investment enthusiasm go up, which in turn improves the recycling rate of used products. Secondly, when the carbon allowances cannot satisfy the manufacturer’s needs, the rise in the carbon price will elevate the manufacturer’s costs, as shown by Xu et al. (2017). At this point, the manufacturer is more willing to encourage the ESCO to invest more and enhance its unit carbon emission reduction. But to do so, the manufacturer needs to reduce the revenue-sharing rate and let the ESCO enjoy more benefits. The rise in the unit carbon emission reduction will lead to higher market demand, benefits and the recycling rate of used products for the manufacturer. Thirdly, the higher the manufacturer’s risk aversion level, the greater the risk it avoids. And the manufacturer will encourage the ESCO to invest more to obtain greater benefits (Zhu et al., 2022). To achieve this, again, the manufacturer needs to reduce its revenue-sharing rate and allows the ESCO to take a larger share of the revenue. When the ESCO acquires a larger share, it will be more enthusiastic about investing and increasing the unit carbon emission reduction, increasing market demand, bringing more benefits to the manufacturer and raising the recycling rate of used products. Finally, according to Zhu et al. (2022) and Zang et al. (2022), though the manufacturer’s risk aversion level can help it avoid risks and reduce potential losses, it might limit its expected utility.

In addition, to explore the way in which embedded low-carbon service in supply chains lowers manufacturer’s carbon emissions and maintains economic growth, this paper compares and analyzes the changes in the manufacturer’s expected utility and the total quantity of emission reduction before and after the introduction of embedded ESCOs. It is found that the rise in the manufacturer’s risk aversion level will lead to a decrease and then an increase in both its expected utility growth and the total amount of emission reduction. When consumers’ low-carbon preference is high, as the carbon price and consumers’ low-carbon preference grow, the manufacturer’s expected utility growth and total carbon emission reduction rise. This is because when the manufacturer’s risk aversion level, the carbon price and consumers’ low-carbon preference increase, the unit carbon emission reduction and market demand rise, leading to growth in total emission reduction. Consumers’ low-carbon preference and the carbon price have significant effects on market demand: when they increase, the manufacturer’s expected utility growth increases. In addition, the manufacturer’s risk aversion level has a more significant effect on the revenue-sharing rate: when the manufacturer’s risk aversion level is low, its expected utility growth decreases. This indicates that when the carbon price, the manufacturer’s risk aversion level and consumers’ low-carbon preference are high, entering into a revenue-sharing contract with an ESCO can be more rewarding to the manufacturer in terms of expected utility and emission reduction. At this point, the manufacturer has no barriers to investment and returns, so it is more likely to choose embedded low-carbon service for carbon emission reduction, which is conducive to investment in carbon emission reduction and technological advancement. This will further increase unit carbon emission reduction, market demand and environmental pollution reduction. Given that manufacturing is the main economic sector and the basis of economic growth (Tirkolaee et al., 2022), technological progress and investment will bring economic growth (Iqbal et al., 2022), and environmental pollution will harm economic growth (Murshed, 2022), so it is reasonable to state that embedded service in supply chains can maintain economic growth.

7 Managerial implications

The research has the following managerial implications.

1) Manufacturers with insufficient financial capacity and technical skills in carbon emission reduction may choose to enter into revenue-sharing contracts with professional ESCOs to form an embedded low-carbon service supply chain. However, the manufacturer’s risk aversion level and consumers’ low-carbon preference may affect the conclusion of revenue-sharing contracts. To be more specific, when their risk aversion level, carbon price and consumers’ low-carbon preference are high, manufacturers may choose to introduce embedded low-carbon service to reduce carbon emissions.

2) ESCOs face the risk of possible losses in the embedded low-carbon service supply chain as they are required to bear the upfront investment in emission reduction. Therefore, they need to improve their risk aversion level and cooperate with manufacturers that can increase their revenue. In addition, they can curtail their investment by appropriately reducing their revenue-sharing rate based on their risk aversion level to improve the sustainability of embedded low-carbon service.

3) The government needs to promote the establishment and implementation of the CCTM and reasonably regulate the carbon price. Meanwhile, since embedded low-carbon service can lower the burden of carbon reduction for manufacturers, the government should encourage financial institutions to provide low-carbon financing services for ESCOs to help them perform embedded low-carbon services. In addition, the government must strengthen environmental education and policy support, actively guide consumers to make low-carbon consumption, and raise consumers’ low-carbon awareness.

8 Conclusion

Under the CCTM policy, manufacturers face significant challenges in reducing carbon emissions. But most manufacturers cannot achieve carbon reduction goals independently due to limited financial and technical strength. Instead, they cooperate with ESCOs and embed them into production and operation to construct a closed-loop supply chain for embedded low-carbon service. However, regarding risks such as demand uncertainty within and outside the supply chain, whether embedded low-carbon service in supply chains can lower manufacturer’s carbon emission and maintain economic growth remain questionable. This study develops a risk-averse closed-loop supply chain model for embedded low-carbon service under demand uncertainty to investigate the mentioned issue. And the results are listed below.

1) The manufacturer’s expected utility growth after introducing an embedded ESCO is mainly influenced by its risk aversion level, consumers’ low-carbon preference and the carbon price. When they are high, introducing an embedded ESCO could increase the manufacturer’s expected utility and maintain economic growth.

2) High carbon price and consumers’ low-carbon preference are forcing manufacturers to reduce carbon emissions, stimulating ESCOs to increase their total emission reduction. Meanwhile, the manufacturer’s risk aversion level significantly impacts the total quantity of emission reduction. When the level is low, the manufacturer’s embedding of an ESCO cannot meet the carbon emission reduction goal. Therefore, only when the manufacturer has a higher risk aversion level should it introduce an embedded ESCO to increase expected utility and reduce carbon emissions.

3) As the manufacturer’s risk aversion level increases, the manufacturer’s expected utility and revenue-sharing rate decrease, and the ESCO’s expected utility, recycling rate and carbon emission reduction increase. By contrast, the increase in the ESCO’s risk aversion level only concerns its expected utility but does not affect other equilibrium decision results. Therefore, it is essential to pay attention to risk management. Only when the manufacturer has a higher risk aversion level can it enter into a revenue-sharing contract with an ESCO to form an embedded low-carbon service supply chain.

Some limitations of this study should also be mentioned. For example, the paper only considers the scenario where market demand is normally distributed. Second, the effect of the recycling quality of used products on the closed-loop supply chain for embedded low-carbon service is not examined. In addition, the situation where manufacturers face multiple competing ESCOs is not considered, which can be a research direction for future studies.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

CS and LC contributed to the conception and design of the study. WY performed the formal analysis. ZZ organized the database and validated it. CS performed the model design and wrote sections of the manuscript. LC performed the analysis, simulation and discussion of the model and completed the first draft of the manuscript. All authors contributed to the manuscript revision, read, and approved the submitted version.

Funding

The authors acknowledge with the National Social Science Fund of China (No. 20BGL017).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ahmed, W., and Sarkar, B. (2018). Impact of carbon emissions in a sustainable supply chain management for a second generation biofuel. J. Clean. Prod. 186, 807–820. doi:10.1016/j.jclepro.2018.02.289

Cheng, F., Yang, S., and Ma, X. (2011). Equilibrium conditions in service supply chain. Procedia Eng. 15, 5100–5104. doi:10.1016/j.proeng.2011.08.946

Cheng, P., Ji, G., Zhang, G., and Shi, Y. (2022). A closed-loop supply chain network considering consumer's low carbon preference and carbon tax under the cap-and-trade regulation. Sustain. Prod. Consum. 29, 614–635. doi:10.1016/j.spc.2021.11.006

Choi, T.-M. (2011). Coordination and risk analysis of VMI supply chains with RFID technology. IEEE Trans. Industrial Inf. 7 (3), 497–504. doi:10.1109/TII.2011.2158830

Das, D., Verma, P., and Tanksale, A. N. (2022). Designing a closed-loop supply chain for reusable packaging materials: A risk-averse two-stage stochastic programming model using CVaR. Comput. Industrial Eng. 167, 108004. doi:10.1016/j.cie.2022.108004

Ding, H., Huang, H., and Tang, O. (2017). Coordination and risk analysis of VMI supply chains with RFID technology. IEEE Trans. Industrial Inf. 7 (3), 497–504. doi:10.1109/TII.2011.2158830

Ding, H., Huang, H., and Tang, O. (2018). Sustainable supply chain collaboration with outsourcing pollutant-reduction service in power industry. J. Clean. Prod. 186, 215–228. doi:10.1016/j.jclepro.2018.03.039

Du, S., Ma, F., Fu, Z., Zhu, L., and Zhang, J. (2015). Game-theoretic analysis for an emission-dependent supply chain in a ‘cap-and-trade’system. Ann. Operations Res. 228 (1), 135–149. doi:10.1007/s10479-011-0964-6

Du, S., Tang, W., and Song, M. (2016). Low-carbon production with low-carbon premium in cap-and-trade regulation. J. Clean. Prod. 134, 652–662. doi:10.1016/j.jclepro.2016.01.012

Entezaminia, A., Gharbi, A., and Ouhimmou, M. (2021). A joint production and carbon trading policy for unreliable manufacturing systems under cap-and-trade regulation. J. Clean. Prod. 293, 125973. doi:10.1016/j.jclepro.2021.125973

Farsi, M., Bailly, A., Bodin, D., Penella, V., Pinault, P.-L., Nghia, E. T. T., et al. (2020). An optimisation framework for improving supply chain performance: Case study of a bespoke service provider. Procedia Manuf. 49, 185–192. doi:10.1016/j.promfg.2020.07.017

Gan, X., Sethi, S. P., and Yan, H. (2011). Addendum to “coordination of supply chains with risk-averse agents” by Gan, sethi, and yan (2004). Supply Chain Coord. under Uncertain., 33–37. doi:10.1007/978-3-642-19257-9_2

Goli, A., Zare, H. K., Tavakkoli-Moghaddam, R., and Sadeghieh, A., School of Industrial Engineering, College of Engineering, University of Tehran, Tehran, Iran (2019). Application of robust optimization for a product portfolio problem using an invasive weed optimization algorithm. Numer. Algebra, Control Optim. 9 (2), 187–209. doi:10.3934/naco.2019014

Golpîra, H., and Javanmardan, A. (2022). Robust optimization of sustainable closed-loop supply chain considering carbon emission schemes. Sustain. Prod. Consum. 30, 640–656. doi:10.1016/j.spc.2021.12.028

Gong, X., and Zhou, S. X. (2013). Optimal production planning with emissions trading. Operations Res. 61 (4), 908–924. doi:10.1287/opre.2013.1189

Gupta, V., and Ivanov, D. (2020). Dual sourcing under supply disruption with risk-averse suppliers in the sharing economy. Int. J. Prod. Res. 58 (1), 291–307. doi:10.1080/00207543.2019.1686189

Hadi, T., Sheikhmohammady, M., Chaharsooghi, S. K., and Hafezalkotob, A. (2021). Competition between regular and closed-loop supply chains under financial intervention of government; a game theory approach. J. Industrial Syst. Eng. 13 (2), 179–199.

Haolan, L., Di, W., Yuhan, W., Zeyu, L., Hongmei, S., Yongyou, N., et al. (2022). Impacts of carbon trading mechanism on closed-loop supply chain: A case study of stringer pallet remanufacturing. Socio-Economic Plan. Sci. 81, 101209. doi:10.1016/j.seps.2021.101209

He, P., He, Y., Shi, C. V., Xu, H., and Zhou, L. (2020). Cost-sharing contract design in a low-carbon service supply chain. Comput. Industrial Eng. 139, 106160. doi:10.1016/j.cie.2019.106160

Iqbal, A., Tang, X., Jahangir, S., and Hussain, S. (2022). The dynamic nexus between air transport, technological innovation, FDI, and economic growth: Evidence from BRICS-MT countries. Environ. Sci. Pollut. Res. 29, 68161–68178. doi:10.1007/s11356-022-20633-z

Jia, J., Chen, S., and Li, Z. (2019). Dynamic pricing and time-to-market strategy in a service supply chain with online direct channels. Comput. Industrial Eng. 127, 901–913. doi:10.1016/j.cie.2018.11.032

Jin, M., Granda-Marulanda, N. A., and Down, I. (2014). The impact of carbon policies on supply chain design and logistics of a major retailer. J. Clean. Prod. 85, 453–461. doi:10.1016/j.jclepro.2013.08.042

Jung, K. S., and Hwang, H. (2011). Competition and cooperation in a remanufacturing system with take-back requirement. J. Intelligent Manuf. 22 (3), 427–433. doi:10.1007/s10845-009-0300-z

Kalantari, S., Kazemipoor, H., Sobhani, F. M., and Molana, S. M. H. (2022). Designing sustainable closed-loop supply chain network with considering spot-to-point inflation and carbon emission policies: A case study. Comput. Industrial Eng. 174, 108748. doi:10.1016/j.cie.2022.108748

Kusi-Sarpong, S., Orji, I. J., Gupta, H., and Kunc, M. (2021). Risks associated with the implementation of big data analytics in sustainable supply chains. Omega 105, 102502. doi:10.1016/j.omega.2021.102502

Li, J., Choi, T.-M., and Cheng, T. E. (2013). Mean variance analysis of fast fashion supply chains with returns policy. IEEE Trans. Syst. Man, Cybern. Syst. 44 (4), 422–434. doi:10.1109/tsmc.2013.2264934

Li, J., Wang, Z., Jiang, B., and Kim, T. (2017). Coordination strategies in a three-echelon reverse supply chain for economic and social benefit. Appl. Math. Model. 49, 599–611. doi:10.1016/j.apm.2017.04.031

Liao, N., Liang, P., and He, Y. (2022). Incentive contract design for embedded low-carbon service supply chain under information asymmetry of carbon abatement efficiency. Energy Strategy Rev. 42, 100884. doi:10.1016/j.esr.2022.100884

Liu, H., Kou, X., Xu, G., Qiu, X., and Liu, H. (2021a). Which emission reduction mode is the best under the carbon cap-and-trade mechanism? J. Clean. Prod. 314, 128053. doi:10.1016/j.jclepro.2021.128053

Liu, M., Li, Z., Anwar, S., and Zhang, Y. (2021b). Supply chain carbon emission reductions and coordination when consumers have a strong preference for low-carbon products. Environ. Sci. Pollut. Res. Int. 28 (16), 19969–19983. doi:10.1007/s11356-020-09608-0

Liu, P. (2019). Pricing policies and coordination of low-carbon supply chain considering targeted advertisement and carbon emission reduction costs in the big data environment. J. Clean. Prod. 210, 343–357. doi:10.1016/j.jclepro.2018.10.328

Liu, Z., Xu, Q., and Yang, K. (2018). Optimal independent pricing strategies of dual-channel supply chain based on risk-aversion attitudes. Asia-Pacific J. Operational Res. 35 (02), 1840004. doi:10.1142/S0217595918400043

Luo, C., Tian, X., Mao, X., and Cai, Q. (2018). Coordinating supply chain with buy-back contracts in the presence of risk aversion. Asia-Pacific J. Operational Res. 35 (02), 1840008. doi:10.1142/S0217595918400080

Mao, H., Guo, Y., Zhang, Y., Zhou, S., and Liu, C. (2022). Low-carbon technology service mode with revenue-sharing contract considering advance funding risk. Environ. Sci. Pollut. Res. 29, 68842–68856. doi:10.1007/s11356-022-20121-4

Meng, Q., Li, M., Liu, W., Li, Z., and Zhang, J. (2021). Pricing policies of dual-channel green supply chain: Considering government subsidies and consumers' dual preferences. Sustain. Prod. Consum. 26, 1021–1030. doi:10.1016/j.spc.2021.01.012

Mogale, D., De, A., Ghadge, A., and Aktas, E. (2022). Multi-objective modelling of sustainable closed-loop supply chain network with price-sensitive demand and consumer’s incentives. Comput. Industrial Eng. 168, 108105. doi:10.1016/j.cie.2022.108105

Murshed, M. (2022). The impacts of fuel exports on sustainable economic growth: The importance of controlling environmental pollution in Saudi Arabia. Energy Rep. 8, 13708–13722. doi:10.1016/j.egyr.2022.09.186

Niu, B., Dai, Z., Liu, Y., and Jin, Y. (2022). The role of physical internet in building trackable and sustainable logistics service supply chains: A game analysis. Int. J. Prod. Econ. 247, 108438. doi:10.1016/j.ijpe.2022.108438

Ouyang, J., and Fu, J. (2020). Optimal strategies of improving energy efficiency for an energy-intensive manufacturer considering consumer environmental awareness. Int. J. Prod. Res. 58 (4), 1017–1033. doi:10.1080/00207543.2019.1607977

Ouyang, J., and Ju, P. (2017). The choice of energy saving modes for an energy-intensive manufacturer under non-coordination and coordination scenarios. Energy 126, 733–745. doi:10.1016/j.energy.2017.03.059

Peng, L., Tong, Z., and Li, Q. (2009). “An analysis of the third party payment system based on service supply chain,” in IEEE International Conference on Information Reuse & Integration, 63–67. doi:10.1109/IRI.2009.5211608

Qian, D., and Guo, J. e. (2014). Research on the energy-saving and revenue sharing strategy of ESCOs under the uncertainty of the value of Energy Performance Contracting Projects. Energy Policy 73, 710–721. doi:10.1016/j.enpol.2014.05.013

Qiao, A., Choi, S., and Pan, Y. (2021). Multi-party coordination in sustainable supply chain under consumer green awareness. Sci. Total Environ. 777, 146043. doi:10.1016/j.scitotenv.2021.146043

Qu, S., Yang, H., and Ji, Y. (2021). Low-carbon supply chain optimization considering warranty period and carbon emission reduction level under cap-and-trade regulation. Environ. Dev. Sustain. 23 (12), 18040–18067. doi:10.1007/s10668-021-01427-8

Qu, W. G., and Yang, Z. (2015). The effect of uncertainty avoidance and social trust on supply chain collaboration. J. Bus. Res. 68 (5), 911–918. doi:10.1016/j.jbusres.2014.09.017

Ren, T., Wang, D., Zeng, N., and Yuan, K. (2022). Effects of fairness concerns on price and quality decisions in IT service supply chain. Comput. Industrial Eng. 168, 108071. doi:10.1016/j.cie.2022.108071

Shang, T., Zhang, K., Liu, P., Chen, Z., Li, X., and Wu, X. (2015). What to allocate and how to allocate?—benefit allocation in shared savings energy performance contracting projects. Energy 91, 60–71. doi:10.1016/j.energy.2015.08.020

Shen, B., Choi, T.-M., Wang, Y., and Lo, C. K. (2013). The coordination of fashion supply chains with a risk-averse supplier under the markdown money policy. IEEE Trans. Syst. Man, Cybern. Syst. 43 (2), 266–276. doi:10.1109/TSMCA.2012.2204739

Tirkolaee, E. B., Goli, A., Faridnia, A., Soltani, M., and Weber, G.-W. (2020). Multi-objective optimization for the reliable pollution-routing problem with cross-dock selection using Pareto-based algorithms. J. Clean. Prod. 276, 122927. doi:10.1016/j.jclepro.2020.122927

Tirkolaee, E. B., Golpîra, H., Javanmardan, A., and Maihami, R. (2022). A socio-economic optimization model for blood supply chain network design during the COVID-19 pandemic: An interactive possibilistic programming approach for a real case study. Socio-Economic Plan. Sci., 101439. doi:10.1016/j.seps.2022.101439

Toptal, A., and Çetinkaya, B. (2017). How supply chain coordination affects the environment: A carbon footprint perspective. Ann. Operations Res. 250 (2), 487–519. doi:10.1007/s10479-015-1858-9

Toptal, A., Özlü, H., and Konur, D. (2014). Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. Int. J. Prod. Res. 52 (1), 243–269. doi:10.1080/00207543.2013.836615

Wang, C., Wang, W., and Huang, R. (2017). Supply chain enterprise operations and government carbon tax decisions considering carbon emissions. J. Clean. Prod. 152, 271–280. doi:10.1016/j.jclepro.2017.03.051

Wang, Q., and He, L. (2018). Managing risk aversion for low-carbon supply chains with emission abatement outsourcing. Int. J. Environ. Res. Public Health 15 (2), 367. doi:10.3390/ijerph15020367

Wang, Y., Wallace, S. W., Shen, B., and Choi, T.-M. (2015). Service supply chain management: A review of operational models. Eur. J. Operational Res. 247 (3), 685–698. doi:10.1016/j.ejor.2015.05.053

Wei, C., Li-Feng, Z., and Hong-Yan, D. (2021). Impact of cap-and-trade mechanisms on investments in renewable energy and marketing effort. Sustain. Prod. Consum. 28, 1333–1342. doi:10.1016/j.spc.2021.08.010

Wei, Y., and Choi, T.-M. (2010). Mean–variance analysis of supply chains under wholesale pricing and profit sharing schemes. Eur. J. Operational Res. 204 (2), 255–262. doi:10.1016/j.ejor.2009.10.016

Wen, X., and Siqin, T. (2020). How do product quality uncertainties affect the sharing economy platforms with risk considerations? A mean-variance analysis. Int. J. Prod. Econ. 224, 107544. doi:10.1016/j.ijpe.2019.107544

Xia, L., Bai, Y., Ghose, S., and Qin, J. (2020). Differential game analysis of carbon emissions reduction and promotion in a sustainable supply chain considering social preferences. Ann. Operations Res. 310, 257–292. doi:10.1007/s10479-020-03838-8

Xia, L., Hao, W., Qin, J., Ji, F., and Yue, X. (2018). Carbon emission reduction and promotion policies considering social preferences and consumers' low-carbon awareness in the cap-and-trade system. J. Clean. Prod. 195, 1105–1124. doi:10.1016/j.jclepro.2018.05.255

Xu, X., Gong, Z., Guo, W., Wu, Z., Herrera-Viedma, E., and Cabrerizo, F. J. (2021). Optimization consensus modeling of a closed-loop carbon quota trading mechanism regarding revenue and fairness. Comput. Industrial Eng. 161, 107611. doi:10.1016/j.cie.2021.107611

Xu, X., Xu, X., and He, P. (2016). Joint production and pricing decisions for multiple products with cap-and-trade and carbon tax regulations. J. Clean. Prod. 112, 4093–4106. doi:10.1016/j.jclepro.2015.08.081

Xu, X., Zhang, W., He, P., and Xu, X. (2017). Production and pricing problems in make-to-order supply chain with cap-and-trade regulation. Omega 66, 248–257. doi:10.1016/j.omega.2015.08.006

Yang, Y., Goodarzi, S., Bozorgi, A., and Fahimnia, B. (2021). Carbon cap-and-trade schemes in closed-loop supply chains: Why firms do not comply? Transp. Res. Part E Logist. Transp. Rev. 156, 102486. doi:10.1016/j.tre.2021.102486

Zang, L., Liu, M., Wang, Z., and Wen, D. (2022). Coordinating a two-stage supply chain with external failure cost-sharing and risk-averse agents. J. Clean. Prod. 334, 130012. doi:10.1016/j.jclepro.2021.130012

Zhang, W., Wang, Z., Yuan, H., and Xu, P. (2020). Investigating the inferior manufacturer’s cooperation with a third party under the energy performance contracting mechanism. J. Clean. Prod. 272, 122530. doi:10.1016/j.jclepro.2020.122530

Zhao, P., Deng, Q., Zhou, J., Han, W., Gong, G., and Jiang, C. (2021). Optimal production decisions for remanufacturing end-of-life products under quality uncertainty and a carbon cap-and-trade policy. Comput. Industrial Eng. 162, 107646. doi:10.1016/j.cie.2021.107646

Appendix A: The proof process of Lemma 1

The ESCO determines the amount of carbon emission reduction of both new and remanufactured products,

The reaction function for unit carbon reduction is

Substitute the reaction functions of

Its Heisei matrix

When

From the systems of equations

Appendix B: The proof process of Lemma 2

The manufacturer determines the recycling rate of used products,

Keywords: embedded low-carbon service supply chain, risk aversion, revenue-sharing contract, carbon cap and trade mechanism, consumers’ low-carbon preference

Citation: Shi C, Chen L, Yu W and Zhang Z (2023) Will the embedded service in supply chains play a role in lowering manufacturer’s carbon emission and maintaining economic growth?. Front. Environ. Sci. 10:1088162. doi: 10.3389/fenvs.2022.1088162

Received: 03 November 2022; Accepted: 30 December 2022;

Published: 12 January 2023.

Edited by:

Guo Wei, University of North Carolina at Pembroke, United StatesReviewed by:

Erfan Babaee Tirkolaee, University of Istinye, TürkiyeSamuel Yousefi, University of British Columbia, Okanagan Campus, Canada

Chuanxu Wang, Shanghai Maritime University, China

Copyright © 2023 Shi, Chen, Yu and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Chengdong Shi, c2NkMDIxMUAxNjMuY29t

Chengdong Shi

Chengdong Shi Lulu Chen1

Lulu Chen1